Abstract

The role which finance and related innovations can play in promoting environmental sustainability, is a recent area where research has started to emerge. The present study aims to understand the research trends and emerging research areas at the intersection of finance, innovation and sustainability. The research is a quantitative investigation of the intellectual framework of this field. It adopts a bibliometric analysis approach to a systematic literature review. Out of 1246 documents retrieved from Scopus database, 132 documents were selected for analysis after screening. Biblioshiny package of R studio and VosViewer software were used to conduct the analyses and visualizations. The results from co-occurrence analysis revealed four major themes on which the research is being conducted in the field, the first theme was related to financial innovations and sustainability, the second theme was on innovation, sustainability and financial performance, the third theme was related to sustainable development, green innovation and environmental regulations, while the fourth theme presented a focus on financial development and technological innovation. The recent research topics in this field were green innovation, green finance and financial development. While the emerging topics were related to sustainable finance, green bonds, and ESG. This review is unique as it systematically and quantitatively reviews the intersection of three emerging, pertinent and closely related areas of sustainability, innovation and finance. The study puts forth research trends, research gaps and future research directions for the field.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Businesses must continuously establish new strategies from the moment they are founded in order to succeed, keep operating, and simultaneously develop and grow (Sonmez Cakir and Adiguzel 2022). They must always be one step ahead of their rivals since they operate in a highly competitive environment. This scenario has demonstrated that innovation is not a choice but a need for businesses. For a long time, innovation has been essential to the success of businesses. Companies who have successfully innovated throughout history have often been acknowledged with success, revenues, and marketing capabilities (Maier et al. 2020). Consequently, continuous innovation is now essential for gaining a competitive edge(Chesbrough 2012). However, innovation when taken as a whole, is a crucial component that helps businesses to endure, grow, and achieve success in the future (Sonmez Cakir and Adiguzel 2022). Surprisingly, numerous businesses were used to strategies and tactics that imposed their rush for competitiveness while omitting essential environmental concerns (Aboelmaged and Hashem 2019). Presently, academics, businesspeople, and policymakers have been paying more and more attention to sustainable development (SD) and this importance of innovations in greening has been discussed as one of the major topics in the SD discourse (Silvestre and Ţîrcă, 2019). Moreover, innovations are essential components of sustainability implementation since they continuously alter our external environment and way of life and these components can be used by enterprises, distribution networks, organizations, societies, geographies, and nations (Silvestre 2015b). In reality, the finding provides evidence that innovation-centered strategies should be used to address sustainability (Silvestre 2015a). The leap of growth towards a more sustainable era, however, appears to be infuriatingly sluggish in practise, and there are pressing calls for more investments and creativities from institutions, educational institutions, and policy makers to implement innovative multidisciplinary approaches to address our current and pressing sustainability challenges.

As per the formative explanation of sustainable development by Brundland Commission's (Keeble 1988) the social, economic, and environmental aspects of sustainability are interdependent. Considering the "triple bottom line," it is suggested that when making corporate and policy decisions, equal weight should be given to the financial, environmental, and social components. Businesses are forced to operate in a tough, intense, and simultaneously dynamic aggressive environment and conditions due to the scenario caused by globalisation and the global competitive climate. Businesses sustainability performance is demonstrated by their capacity to address the requirements of the stakeholders they contact with and communicate with without running the danger of alienating their prospective future stakeholders (Dyllick and Hockerts 2002). Numerous research examining the connection between innovation and performance give innovation a favorable evaluation, leading to increased organizational performance. In this context, the present study intends to conduct extensive review of the past studies conducted on sustainability-innovation integration in the area of finance and likely influence of application of innovation is enhancing the sustainable financial performance. To achieve this, the methodology adopted by us is a performance analysis and science mapping collectively known as bibliometric analysis.

The current study contributes in three ways: First, undertaking thorough examination of the past studies and attempted to conduct an in-depth literature mapping and suggesting probable research area where more work can be undertaken. Second, this review study will add to the body of academic literature on the key topics and understudied problems due to the paucity of research on innovation-sustainability integration in finance. Third, A cluster analysis was carried out to find structural trends in the innovation-sustainability literature in varied disciplines. Using this approach, the writers were able to identify recurrent patterns in the literature, which also assisted them in formulating important questions for more research. With this backdrop, the following research questions are attempted to be answered with the help of present study:

-

1.

What are the publication trends in the area of innovation and sustainability in finance?

-

2.

Who are the most influential articles, sources, authors, affiliations and countries on innovation and sustainability integration with finance?

-

3.

What are the latest themes and trends in finance-related innovation and sustainability assimilation?

-

4.

What are the most promising areas of finance where both innovation and sustainability can be applied?

To address sustainability issues, businesses, investors, financial institutions, governments, and other parties have been pushing sustainable finance and investment (SFI) projects. The SF area has benefited by the development of related studies by academics. Their research has mostly concentrated on evaluating the financial success of businesses that are devoted to sustainability. The area of SF has a much greater reach and encompasses a wider variety of participants beyond firms and investors; they need to be reflected by the study, even if these studies have helped to expand the field. In addition, SFI research has grown in a fragmented way (Fabregat-Aibar et al. 2019), making it challenging to define the field's scope and distinguish it from conventional finance and investment.

A review of the literature would help to overcome these problems. So far, no one has made an attempt to do this, and because of the growing importance of the scope of innovation in every field, it is imperative to conduct this study.

1.1 Background on sustainable finance and innovation

At the nexus of finance and the SDGs, sustainable finance has become a crucial idea. In 2020, the capital markets raised more than $400 billion in fresh funding, of which $357.5 billion came from sustainability bonds and $76.5 billion from green bonds (Refinitiv 2020; United Nations 2020). However, the concept of sustainable finance is broad and embraces a wide range of sustainable means of achieving financial and investment objectives. The European Commission (2021) defines sustainable finance as an evolving process of considering environmental, social, and governance (ESG) factors in financial and investment decisions. This definition, which is restricted to ESG elements, is, nevertheless, rather specific. This necessitates the use of a larger, all-encompassing definition of sustainability. In this regard, Kumar et al. (2021) suggest that sustainable finance should include all practices and elements that make financial systems sustainable and contribute to sustainability. This definition complements the many objectives set by various stakeholders, such as the SDGs of the United Nations and the ESG of the European Commission.

On the other hand, according to Posner and Mangelsdorf (2017), innovation is the idea of "creating new value" by either developing new technologies, processes, business models, or institutions, or by repurposing already existing technologies and mechanisms. Early-stage grant-based research, late-stage demonstration support, or assistance for innovative business models have been the main focuses of climate financing for innovation (e.g., the Global Innovation Lab for Climate financing-The Lab 2020). The recent study by Ren et al. (2023a) conducted a review study covering the integration of sustainable finance and blockchain technology. The study helps to understand the mode, process, and mechanism of their integration, this research provides a multi-level and all-encompassing comprehensive bibliometric technique (Co-occurrence Analysis method, Natural Language Processing method, and Exploratory Factor Analysis method).

Further, the remainder of the study is organized as follows: Sect. 2 presents the methodology adopted in the study, Sect. 3 discusses the results obtained followed by Sect. 4 presents the concluding remarks and finally Sect. 5 discussion implications of research and future research directions.

2 Data sources and methodology

We employ bibliometric analysis to comprehend the pattern, perceptions, conceptual framework, and paradigm-shifting findings in the area of "Innovation and sustainability in finance". In general, as argued by Donthu et al. (2021a, b), Mukherjee et al. (2021) bibliometric analysis is a recognized scientific method for examining a literature corpus in which statistical approach are used to examine scholarly data (such as publication and citation statistics). The method is a well-known technique for doing scientific research with applicability in many fields, including business (Donthu et al. 2021a, b; Kumar et al. 2021). There are numerous ways to review the literature (Paul et al. 2021) but the bibliometric method is the most unbiased because it relies on analytical techniques and a review protocol (Kumar et al. 2022). The other review methods, such as critical, either lack review protocols or are constrained to subjective interpretations because they lack objective analysis techniques (e.g., thematic analysis) (Donthu et al. 2021a, b). The current study specifically follows the Donthu et al. (2021a) four-step bibliometric analysis process, which entails establishing the goals and scope of the study, selecting the techniques for analysis, gathering the data for analysis, conducting the analysis, and summarizing the results as depicted in Fig. 1.

2.1 Goal and scope of the study

The goal of the current study is to provide insight into the bibliometric and conceptual framework of the existing literature on the application of innovation and sustainability in finance. The intellectual structure relates to the primary issues and themes of research in the field under examination (Kumar et al. 2022), whereas the bibliometric structure encompasses publishing productivity. Given the depth of research in sustainability and finance and innovation and finance, the study's potential reach is rather broad.

2.2 Procedures for analysis

The study conducts the bibliometric analysis for mapping the extensive literature on innovation and sustainability pertaining to the area of finance. To unpack the key topics and themes in the research field, the study, in specific, undertakes a performance analysis using a wide selection of bibliometric measures, including citations, cite score, impact factor, publication count, and h-index, as well as keyword co-occurrence analysis and bibliographic coupling.

2.3 Data for analysis

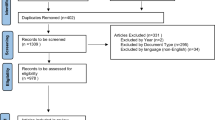

To locate the articles and the bibliometric and bibliographic information related to them for analysis, 35 publications based on innovation and sustainability and its application in finance were examined to create a scientifically produced search string. The essential search string exercise was completed using the framework of the scientific field that (Kumar et al. 2022) had suggested. The data has been extracted in the month of January 2023. The string yielded 2356 documents which were quite large in numbers. As recommended by Ronda-Pupo (2017), the documents were further filtered on the basis of English language, document type, keywords and time frame. After doing proper filtering, the resultant documents came out to be 1456. The brief characteristics of the sample data is presented in Table 1. After going through cursory overview, we came across some articles which were not relevant for our study, as our research is strictly confined to application of innovation and sustainability in the area of finance. In accordance with the technique of Kumar et al. (2022) the Scopus database was chosen for data collection, and we carried out a "subject" search using a "search string" that included the title, abstract, keywords, and author keywords. The Scopus database was chosen since it is the largest scientific database for papers based on peer-review (Donthu et al. 2021a, b; Paul et al. 2021). Further, the authors use a two-step process to choose the publications that are pertinent to the study. First, all authors have gone through the initial screening of the title and abstract of the all the outcome articles. Documents which are specifically pertaining to the application of innovation and sustainability in the area of finance are selected for final analysis. The articles were excluded at this step as they were not link the convergence of innovation and sustainability in finance. Second, one of the co-authors have removed the duplicates and missing information data after the first step. The final number of documents after the screening and exclusion came out to be 132. Hence, we conducted our analysis on 132 set of documents. The complete selection process of the documents is presented in Fig. 2.

Selection criteria of documents. Source: author’s own conceptualization. Note: Records inclusion criteria: Language: English, Document type: article and review, Year: 2012 to 2022, publication stage: final, subject area: business, management and accounting, economics and econometrics and social sciences

3 Results

The analysis of the present study is conducted in two folds: first, the performance analysis has been done to have an insight about the trends in publications and influential analysis in the area of innovation and sustainability integration with finance. Influential analysis reveals the most prolific authors who have worked in the area based on the total citations garnered, h-index, average citations. Moreover, the analysis also includes most influential sources and affiliations published the study in this area. Consequently, analysis also revealed the collaboration network in terms of countries and authors. The detailed performance analysis has been discussed below:

3.1 Performance analysis: trends in Innovation, Sustainability & Finance Research

To answer RQ1- What are the publication trends in the area of innovation and sustainability in finance- the study looks at the overall number of publications in the area by year. Scopus database is from where the bibliometric information used in the analysis was gathered. Bibliometric data is a type of big data that includes details on scientific publications, like Information on publications (such the title, abstract, keywords, and year) and citations (like the author, the document, and the number of journal citations) (Donthu et al. 2021a, b).

Figure 3 displays the quantity of articles on innovation and sustainability integration for finance. The fact that all studies in this area are specifically produced between 2013 and 2020, with the majority coming between 2020 and 2022, which illustrates the fact that it is an emerging field of study that has only lately begun to gain popularity. In fact, innovation and sustainability are two defining concepts in the area of business and management. The concepts like sustainable innovation, eco-innovation, green innovation and its integration with various disciplines for instance finance have gained much popularity since 2017 after the 2015 Paris agreement when economies have started joining hands to together to take a pledge for contributing towards carbon neutrality. As the United Nations Development Program (UNDP) supported the financial sustainability process of capital markets and introduced the financial category law of sustainable development goal (Nedopil Wang et al. 2022) and future researchers will concentrate more on the subject of fusing new technology with sustainable development as the concept of "green finance" gains more prominence (Ren et al. 2023b). Since initial research studies concentrated on each concept separately, it is not unexpected that study on their integration just reached academia in 2018. This indicates that the integration of innovation and sustainability is truly crucial for every discipline.

3.2 Most influential articles

To answer RQ2-i.e., what are the most influential articles on innovation and sustainability integration with finance? For the 132 articles under consideration, the study uses the citation network to conduct a performance analysis. There are a handful of indicators to gauge a publication's impact, but the most prominent one is citations (Ding and Cronin 2011), which gauge a publication's impact by counting how often it is referenced in other publications (Donthu et al. 2021a, b). Moreover, Tables 2, 3, 4 and 5 presents the top 10 globally cited documents and locally cited documents respectively. Biblioshiny package from R and VOSviewer have been used to examine the most cited documents and citation network. The citation network of publications is represented in Fig. 4. As per Table 2, which list out the top 10 globally cited documents, the work conducted by Aguilera-Caracuel and Ortiz-de-Mandojana (2013) on “Green Innovation and Financial Performance: An Institutional Approach” has received maximum citations (242) followed by Ahmad et al. (2021) on “Modelling the dynamic linkages between eco-innovation, urbanization, economic growth and ecological footprints for G7 countries: Does financial globalization matter?” and Falcone (2020) on “Environmental regulation and green investments: the role of green finance” has received 151 and 60 citations respectively.

Aguilera-Caracuel and Ortiz-de-Mandojana (2013) attempted to investigate the probable relationship between green innovation and financial performance. Authors found that green innovative firms are located in contexts with stricter environmental regulations and higher environmental normative levels. This is done using an institutional approach and a sample of 88 green innovative firms and 70 matched pairs (green innovative and non-green innovative firms). Moreover, authors observed that green innovative enterprises do not show increased financial performance when compared to non-green innovative firms. We discover that, when focused on green innovative enterprises, the level of green innovation is correlated favourably with firm profitability. Ahmad et al. (2021) in their study intends to examine how the ecological footprints of the G7 countries have changed as a result of financial globalisation, urbanisation, eco-innovation, and economic growth. The overall results demonstrate that urbanisation promotes environmental deterioration by increasing ecological footprints, while financial globalisation and eco-innovation lower ecological footprints. Additionally, it is discovered that the relationship between ecological footprints and economic growth is inverted U-shaped. Falcone (2020) in their study comprehensively discussed how green investments is affected by regulatory environment.

Further, Tables 3, 4 and 5 lists the top 10 locally cited documents. The study conducted by Tolliver et al. (2021) titled “Green Innovation and Finance in Asia” received maximum local citations 4 followed by Aguilera-Caracuel and Ortiz-de-Mandojana (2013) titled “Green Innovation and Financial Performance: An Institutional Approach” and Menne et al. (2022) titled “Optimizing the Financial Performance of SMEs Based on Sharia Economy: Perspective of Economic Business Sustainability and Open Innovation” who gained 4 and 2 citations respectively. Tolliver et al. (2021) in their article shed light on integration of green innovation in finance. Authors examined the status of green innovation and finance as measures sustainable economic growth in emerging economies of Asia. To perform this, the study contrasts current trends in China, Japan, South Korea, and India, and it also gives an overview of developments at the national and corporate levels. In particular, green patent registration patterns are considered to be essential parts of green technologies that influence sustainable development. In order to shed light on the factors influencing many green innovations that promote sustainable growth, environmental, social, and governance (ESG) disclosure at the firm level is also examined, in addition to the extremely prevalent green bond and green foreign direct investment (FDI) finance pathways. Menne et al. (2022) in their study assessed the impact of open innovation on SME based on Shariah economy. In order to better understand the financial performance of SMEs from a sharia economic perspective, this study scrutinized how using sharia fintech affects their ability to perform financially and sustain their operations. It will also strengthen their human resource capacity, business diversification, productivity, and product marketing. The study's findings demonstrate that human resource capability and company diversity have a 41.8 percent impact on the financial success of SMEs.

Further, Fig. 4 presents the Citation network for publications in area of innovation and sustainability in finance. The network clearly indicates that study by Aguilera-Caracuel and Ortiz-de-Mandojana (2013) has garnered maximum number of citations follwed by Tolliver et al. (2021). Both the studies have been conducted on green innovation and financial performance wherby former have stressed out in Asian region. The highest citations indicates the relevance and significance of the theme.

3.2.1 Top cited documents

The top cited articles based on global and local citations are presented in Tables 2, 3, 4 and 5 respectively. The number of times an article is cited by other papers in the field of finance sustainable finance and innovation research is known as a local citation. The number of times an article, maybe outside the field of sustainable finance and innovation in finance, is cited by papers in that field is referred to as the global citation rate. Among the top cited are Aguilera-Caracuel and Ortiz-de-Mandojana (2013) and Ahmad et al. (2021) with 242 and 151 global citations. Further, Tolliver et al. (2021) and Aguilera-Caracuel and Ortiz-de-Mandojana (2013) garnered maximum local citations 4.

Study by Aguilera-Caracuel and Ortiz-de-Mandojana (2013) focused on green innovation and financial performance focusing on institutional approach. Author(s) find that green innovative firms are in contexts with stricter environmental regulations and higher environmental normative levels, using an institutional approach and a sample of 88 green innovative firms and 70 matched pairs (green innovative and non-green innovative firms). In contrary, however, that green innovative enterprises do not show greater financial success when compared to non-green innovative firms. Ahmed et al. (2021) in their study intends to examine how the ecological footprints of the G7 nations have changed as a result of financial globalisation, urbanisation, eco-innovation, and economic growth. To determine the environmental effects of these factors, recent econometric techniques that are resilient to handling cross-sectionally dependent panel datasets are used with yearly frequency data ranging from 1980 to 2016. The overall results demonstrate that urbanisation promotes environmental deterioration by increasing ecological footprints, whereas financial globalisation and eco-innovation minimise ecological footprints.

3.3 Most relevant sources

This section (Table 2) covers the sources that published studies concerning innovation and sustainability in integration in finance. It becomes crucial to look at the journals of the researcher's area of interest when conducting a literature review (Saini et al. 2022). Figure 5 presents the most relevant journals who published in the area of innovation and sustainability in finance. This area is crucial for tracking and assessing how publications from different journals are distributed. Sustainability from MDPI is the most popular journal with total production of 14 documents in this domain, followed by Journal of cleaner of production (Elsevier) with 10 documents and Economic Research-Ekonomska Istrazivanja (Taylor & Francis) with 7 documents.

3.4 Most influential authors

To answer third part of RQ3: Who are the most influential articles, sources, authors, affiliations and countries on innovation and sustainability integration with finance, the visualization from VOSviewer concerning author collaboration has been executed. By identifying cooperation characteristics with the subject area and the degree of their link, this graphic showed a network of author collaboration. Of the 13,637 authors, 31 meet the threshold with minimum citations kept at 4, only 813 authors found some association. Different colors red, green, blue, purple, yellow, sky blue and orange presents different clusters. In terms of total citations, Khan, Z from Higher Colleges of Technology, United Arab Emirates is at the top with TC 153 followed by Liu, C from Economics and Management School, Wuhan University, China and Xiang Z from Economics and Management School, Wuhan University, China. As per the network diagram, there are seven clusters on which author’s work can be segregated (Fig. 6).

3.5 Most relevant countries and affiliation

To answer the fourth part of RQ3: Who are the most influential articles, sources, authors, affiliations and countries on innovation and sustainability integration with finance, the performance analysis on the basis numerous indicators have been carried out. This includes a country-based co-authorship study, the visualizing network for which is shown in Fig. 6. The geographical map of nations that publish studies on innovation and sustainability integration in the area of finance is also shown in Fig. 7. Map clearly indicates that China tops the chart with maximum number of publications (114), followed by Indonesia 29, Pakistan 21, United kingdom 17 and Netherlands 15. Detailed figure about the countries production in the area is shown in Table 6 presents the publications on the basis of affiliation while Table 7 presents the country wise publication. Additionally, Fig. 8a and b presents the country collaboration network executed with the help of Biblioshiny. This map illustrates the concentration of collaborative research on innovation and sustainability integration in the field of finance. Wuhan University, China is the highest producer of the research in this area (Fig. 9).

Further, to answer the last part of RQ3, affiliation analysis has been conducted to explore the most productive/ prolific institutions who are publishing studies in the area of innovation and sustainability in the area of finance. Figure 10 presents the distribution of studies amongst the publishing institutions worldwide. It is clear from the result that Wuhan University has produced maximum publications (15) which is based in China, followed by Stockholm Environment Institute and University Borsowa with 6 and 5 publications respectively (Table 7).

3.6 Co-word analysis

To answer the RQ4- What are the latest themes and trends in finance-related innovation and sustainability assimilation? the study performs keyword co-occurrence analysis of author keywords listed in the 132 articles in the review dataset. The keywords that authors specify in an article, signify the contextual breadth of that publication, and their co-occurrence reflects the subject trends dominant in the study field (Kumar et al. 2022). Most frequently occurred keywords, cumulative occurrences are listed in Table 8, which clearly indicates that green innovation is frequently occurred keyword. The word cloud and cumulative occurences are presented in, Figs. 10 and 11 respectively.

The top 20 keywords based on their occurrence are presented in Table 10. Green innovation is the most prominent keyword in the list with 20 occurrences, followed by innovation (18), sustainable development (18), sustainability (15), financial performance (12), financial development (9), green finance (9) and eco-innovation (7).

The Fig. 10 depicts cumulative occurrence of author’s keywords, which is an indicator of progression of themes over time or word dynamics. It can be observed that the studies on sustainable finance and innovation were existing but very few, however, it is after 2016 that the interest in these areas started picking up. This is the time around which an emphasis on sustainability in businesses started gaining traction owing to the emphasis on sustainability and innovation by United Nations, as they put forth sustainable development goals or SDGs in 2015 (Sustainable Development Goals | United Nations Development Programme, n.d.). This increasing trend in such research gained further traction in 2019 and beyond, which is the time when the world was battling with Covid-19 pandemic when businesses and researchers were showing interest in areas such as innovation and sustainability to combat the crisis. Themes such as Green innovation and Green finance have been observed to be some of the most recent research themes, while terms such as Eco-innovation, financial innovation, and financial development are some of the other recent themes with increasing research interest in the field. Themes of sustainability and sustainable development have seen a continuous rise in research interest in this field.

The co-word network analysis based on author’s keywords, revealed six clusters or themes on which the research is being conducted. The six themes were as follows- cluster 1: Green innovation and finance for sustainable development, cluster 2: Innovation and sustainability in finance, cluster 3: financial performance, environmental policy and sustainability, cluster 4: financial development, technological innovations and sustainability, followed by cluster 5: sustainable finance and green bonds, and cluster 6: financial globalization and ecological footprint.

3.6.1 Strategic map based on authors’ keywords

A strategic map as depicted in the following Fig. 12, can be used to examine how a study field has changed over time (Cobo et al. 2011). The quadrant 1 in the map represents motor themes, which depict themes which have been researched well and are central to the field under study. The primary themes under quadrant 1 related to the theme of innovation and climate change and includes topics such as financial innovation, technological innovation and climate change. The other theme which lies at the intersection of quadrant 1 and quadrant 2 include topics such as sustainable development, sustainable innovation and financial constraints. The second quadrant represents niche themes or isolated themes, on which research is being conducted. These topics are well connected with each other but are not well connected with other themes in the field. Such niche themes include aspects such as covid-19, big data, and policy in relation to finance, innovation and sustainability issues. The third quadrant represents basic or traversal themes, in which the research on topics within themes are well connected with each other, however, are not well connected externally. The themes in this quadrant were primarily related to green innovation, financial performance and environmental regulation. Other major theme was related to financial development, economic growth and environmental sustainability. The last or the fourth quadrant, holds much significance as it depicts emerging or declining themes. It can be used to predict the future direction of the research in the field. This quadrant includes themes related to sustainable finance, green bonds and ESGs. Research is gaining momentum in these areas and can be further examined and strengthened. Other topics in the cluster which lies at the intersection of quadrant 3 and 4, include areas such as innovation, sustainability and financing aspects such as crowdfunding.

The topic dendrogram based on author’s keywords, reveal two major themes on which the research is being conducted. The first theme as depicted in red color in Fig. 13 reveal topics or keywords more related to environmental concerns such as carbon emissions, together with innovation and finance. The second major theme which can be further segregated in sub-clusters, include topics related to different aspects of finance such as financial resources, investment, green credits, financial systems etc., financial development, and economic growth together with aspects such as innovation, technology adoption, sustainability, sustainable development, green innovation, eco innovation, environmental technology, green technology, and patents and inventions to name a few (Fig. 13).

3.7 Co-citations analysis

Co-citation analysis is a science mapping technique that assumes that publications that are frequently referenced together have comparable subject content. The analysis can be used to show how a study field is conceptualized. When two publications appear together in the reference list of another publication, they are linked in a co-citation network and business scholars can advantage from co-citation analysis by learning about theme clusters in addition to locating the most important publications (Donthu et al. 2021a, b). The listed papers serve as the foundation for these thematic groups. The co-citation network diagram of authors is presented in Fig. 14. Of 13,637 authors, 31 meet the threshold with minimum citation kept at 4, total authors connected came out to be 813. In all 6 clusters have been identified depicted by different colors. Further, the co-citation network diagram of sources is presented in Fig. 15. Of 3948 sources, 41 meet the threshold with minimum citations kept at 4, number of sources came out to be 339. In all 6 clusters have been identified depicted by different colors.

3.8 Bibliographic coupling

An approach for science mapping known as bibliographic coupling works under the premise that two publications with comparable references also have similar content (Kessler 1963). Bibliographic coupling is appropriate for business researchers who want to learn about a variety of topics and their most recent developments (Donthu et al. 2021a, b). This analysis focuses on classifying articles into thematic clusters groups with similar references, and it performs better when applied to a certain time period (Zupic and Čater 2015). Here, the thematic clusters are formed based on the publications cited. Consequently, Bibliographic coupling can increase visibility for specialist and contemporary articles (Donthu et al. 2021a, b).

Henceforth, to answer the RQ 3- What are the latest themes and trends in finance-related innovation and sustainability assimilation, bibliographic coupling and cluster analysis is done for 132 articles. Four primary thematic clusters are formed as a result of the application of bibliographic coupling to the review dataset. The bibliographic coupling map in Fig. 16 displays the topic clusters, highlighting each cluster in a different hue. Cluster 1 is presented by red colour followed by cluster 2 by green, cluster 3 blue and cluster 4 yellow.

3.9 Cluster Analysis

3.9.1 Cluster 1: Sustainable innovation and financial performance

The top 10 cited documents in cluster 1 are presented in Table 9 below. This cluster discusses the effect of sustainability-innovation integration on the financial performance of the organizations. The concepts namely sustainable supply chain finance, green innovation, management accounting information system, big data analytics has been highlighted in this cluster.

Aguilera-Caracuel and Ortiz-de-Mandojana (2013) in their study discusses varied dimension of green innovation vis-à-vis energy efficient, waster recycling and pollution reduction. Authors in their study examined the potential effect of green innovation on financial performance of innovative and non-innovative firms. Moreover, Tseng et al. (2019a) developed a fuzzy interpretive model to analyse cost and benefits of sustainable supply chain finance in textile industry. After applying the model, authors concluded that most critical factors determining the performance are attributed to financial attributes and value innovation.

Although, the nexus between green innovation and financial performance is actively studied. But, then the concrete benefits is sparsely present in the academic literature. Przychodzen et al. (2020) explored the probable effect on the financial performance of Standard & Poor’s 500 organizations over the long period. Besides, Forcadell et al. (2019) examined the influence of innovation sustainability in banking industry.

3.9.2 Cluster 2: Green innovation and regulations

The top 10 cited documents in cluster 2 is presented in Table 10. The documents in cluster 3 emphasises on regulatory aspects of green innovation in finance. Study conducted by Falcone (2020) discussed the environmental regulation in green investments. The purpose of this study is to better organise the scant existing literature on the linkages between the financial system and business commitment to environmental goals. Further, Tolliver et al. (2021) assessed the literature on green innovation and finance as measures of advancements towards sustainable economic growth in significant economies across Asia. In addition to comparing current patterns in China, Japan, South Korea, and India, this article provides an outline of recent changes at the national and corporate levels. In particular, green patent registration trends are considered to be essential parts of green technologies that influence sustainable development. Along with the growingly popular green bond and green foreign direct investment (FDI) finance mechanisms, firm-level environmental, social, and governance (ESG) transparency is also examined in order to shed light on the inputs driving many green innovations that are supportive of sustainable growth. Rustiarini et al. (2022) in their study tried to identified determinants and implications when applying green innovation in SMEs. As a mediator in the relationship between intellectual capital, sustainability performance, and financial performance, green innovation was also examined in this study. This study demonstrated how intellectual capital improved financial performance, SME sustainability, and green innovation. The relationship between intellectual capital, sustainability performance, and financial success was also thought to be mediated through green innovation. Thus, the adoption of green innovation allows SMEs to realize their economic benefits while simultaneously directing businesspeople to fulfil their social and environmental obligations.

3.9.3 Cluster 3: Green financing and productivity

Top 10 cited documents in cluster 3 is presented in Table 11. The documents in cluster 3 focusses more on contribution of innovation in financial sector towards mitigating climate related risk. Studies in this cluster studied the nexus between green financial innovation and carbon neutrality. Moreover, studies also stressed on the probable relationship between green finance and climate risk mitigation. Zhang and Vigne (2021) in their study uses green total factor productivity to measure the economic and environmental efficiency and found that innovation efficiency has a positive impact on total productivity. Further, Zhang et al. (2022) examined the role of green finance for mitigating the climate change repercussions. In this work, authors used a quantile regression model to quantify the effect of green finance and digital finance on ecological sustainability using data from the G-20 economies from 2008 to 2018. According to the findings of the panel quantile regression, Carbon dioxide emissions are decreased by investments in green finance, renewable energy, and technical innovation, whereas they are increased by factors like economic development, energy consumption, trade, and foreign direct investment. This report makes several recommendations for how policymakers may advance digital finance, boost the influence of green finance, and establish a market for carbon pricing to support sustainable development. The role and institutional framework of climate finance are discussed in the article by Ryan Hogarth (2012) from the standpoint of innovation systems. It looks at the obstacles that prohibit emerging economies from converting to low-carbon and climate-resilient economies as well as the solutions required to get over those obstacles. It concludes that the absence of incentives is not nearly as ubiquitous as the obstacles to innovation and economic development. further, this study makes an argument regarding the institutional framework of climate finance that it should go through national funding organisations and that the United Nations Framework Convention on Climate Change should adopt crediting mechanisms for sectoral no-lose targets or nationally appropriate mitigation actions.

3.9.4 Cluster 4: Financing and green innovations

The documents in cluster 4: financing and green innovations are listed in below table 12. This cluster consists of documents focusing on financing patterns and constraints for green and sustainable innovations. Study conducted by Xiang et al. (2020) looks into their environmental disclosure and evaluates how it affects their green innovation initiatives as well as the mechanisms that drive it. The three dimensions of environmental investment and management, environmental supervision and agency certification, and environmental performance and governance are measured using text analysis. Further, the Poisson regression model for panel data reveals that throughout the past ten years, substantially polluting listed companies in China have been significantly incentivized to use green innovations. This finding is consistent with a few robustness checks. Moreover, another study by Xiang et al. (2022) highlighted the issue of financing corporate green innovations. This study discusses how the funding structure's impact on innovation input, with a scant mention of its impact on the output and standard of green innovation. Furthermore, this study examines how government support for corporations affects their use of green innovation and considers how it might affect other forms of funding, which offers ideas and recommendations for building a national system of scientific innovation and creating pertinent industrial policies.

4 Discussion and concluding remarks

The results from the bibliometric analysis helped in addressing the research questions which motivated the study. RQ1 was related to identifying publication trends in the area of innovation and sustainability in finance. The results from productivity analysis revealed that there has been an increasing trend in publications. The studies in the field saw a considerable increase from the year 2013, while the majority coming between 2020 and 2022. This illustrates the fact that it is an emerging field of study that has only lately begun to gain popularity. Innovation has been reported to be positively correlated to sustainability performance (Kuzma et al., 2020), however, this interaction has not been much explored in the context of Finance especially financial performance. In fact, innovation and sustainability are two defining concepts in the area of business and management. The concepts like sustainable innovation, eco-innovation, green innovation and its integration with various disciplines for instance finance have gained much popularity since 2017 after the 2015 Paris agreement when economies have started joining hands to together to take a pledge for contributing towards carbon neutrality. As the United Nations Development Program (UNDP) supported the financial sustainability process of capital markets and introduced the financial category law of sustainable development goal (Nedopil Wang et al. 20222022), RQ2 which aimed at identifying most t influential articles in the field, as a result of performance analysis using citation analysis, revealed that most influential articles have been focused around the themes of Green innovation, eco-innovation, and green finance in relation to other variables such as financial performance, urbanisation, economic growth, ecological footprints, and the interaction of Environmental regulation and green investments, respectively. The top 3 most influential articles have been “Green Innovation and Financial Performance: An Institutional Approach” by Aguilera-Caracuel and Ortiz-de-Mandojana (2013) has received maximum citations (242) followed by Ahmad et al. (2021) on “Modelling the dynamic linkages between eco-innovation, urbanization, economic growth and ecological footprints for G7 countries: Does financial globalization matter?” and (Falcone 2020) on “Environmental regulation and green investments: the role of green finance” has received 151 and 60 citations respectively. So, as to address RQ3, the most influential sources, authors, affiliations and countries were identified. While the he most influential sources were recognised to be the journal Sustainability (Switzerland), followed by Journal of Cleaner Production, and Corporate Social Responsibility & Environmental Management at the second and third rank based on h-index, as well as total number of citations and publications. The theme of the present research and the aim and scope of the journals are well aligned, however the journals do not have specific focus on the field of Finance. The most influential author in the field has been Khan Z, affiliated to Higher Colleges of Technology, United Arab Emirates with the highest total number of citations, followed by Liu C, Xiang X, and Yang M, sharing the second rank in terms of total citations and having the same affiliation to Economics and Management School, Wuhan University, China. China also stands out as the leading country in terms of total number of publications as well as the total link strength indicating high collaborative research with other regions. Countries such as Indonesia, Pakistan, United Kingdom and Netherlands follow China in such research. This indicates that not only are businesses in China focusing on Intelligent Manufacturing (World Economic Forum 2022) based with a specific focus on ESG, but academic research is focusing on promoting such sustainability and innovation orientation across different functions of business such as Finance. In terms of most relevant affiliation, Wuhan University, China, stands out with maximum number of publications. Stockholm environmental Institute, headquartered in Sweden, and Bosowa University, Indonesia follow China and share the second spot for most relevant affiliations.

The latest research themes were identified through bibliographic coupling while emerging research trends were identified through co-word analysis. This analysis helped in addressing RQ4. The results from co-word analysis revealed that Green Innovation has been the most frequently used keyword. It was observed that the studies on sustainable finance and innovation were existing but very few, however, it is after 2016 that the interest in these areas started picking up. This is the time around which an emphasis on sustainability in businesses started gaining traction owing to the emphasis on sustainability and innovation by United Nations, as they put forth sustainable development goals or SDGs in 2015 (Sustainable Development Goals United Nations Development Programme, n.d.). This increasing trend in such research gained further traction in 2019 and beyond, which is the time when the world was battling with Covid- 19 pandemic when businesses and researchers were showing interest in areas such as innovation and sustainability to combat the crisis. Themes such as Green innovation and Green finance have been observed to be some of the most recent research themes, while terms such as Eco- innovation, financial innovation, and financial development are some of the other recent themes with increasing research interest in the field. Themes of sustainability and sustainable development have seen a continuous rise in research interest in this field. Through strategic mapping of keywords the emerging themes were identified. The identified emerging themes were sustainable finance, green bonds and ESGs.

5 Research implications and future research directions

By objectively recording the intellectual structure, the volume, and the knowledge-development trajectories, the research's primary goal was to find areas of convergence and potential future interdisciplinary research projects between innovation and sustainability. In order to achieve these goals, we utilised a bibliometric study to examine 132 papers that were published in journals that were indexed by Scopus. In this section of the paper, we discussed the various prospective themes and gaps in the area of innovation and sustainability in finance and suggest future research directions.

5.1 Implication of the study

The identification of the evolution of the number of published articles is related to the first research question that this study attempts to answer. It wasn't until 2015 that interest in this subject really took off, as seen by a significant rise in publications. The enhanced mediatization of the overall negative development the earth experiences and the recent publishing of the SDGs by the United Nations may be to blame for the increased interest. The fact that all studies in this area are specifically produced between 2013 and 2020, with the majority coming between 2020 and 2022, which illustrates the fact that it is an emerging field of study that has only lately begun to gain popularity.

Further, authors conducted the influential analysis to analyse the impact of studies in this area. The citation network of documents revealed that study by Aguilera-Caracuel and Ortiz-de-Mandojana (2013) garnered maximum number of citations globally. In terms of sources, sustainability (MDPI) is the most influential journal followed by Journal of cleaner production (Elsevier) and Economic Research. In terms of authors, Khan Z is the most cited author. Country wise analysis revealed that China is the most productive and cited country in the area of innovation and sustainability integration in finance.

Next science mapping was conducted to analyse the intensity of the research in this area. Initially, co-word analysis was done, and co-word network diagram produced most researched theme. Keywords such as sustainability, innovation and financial performance were most explored. Moreover, thematic map were drawn and it depicted the most research theme and less explored theme. Many probable themes were identified which can be further act as future research directions. Finally, co-citation analysis and bibliographic coupling was conducted to find out hidden insights of research in the area of innovation and sustainability in the area of finance. The bibliographic coupling identified four cluster in this area which are extensively discussed in the above section.

Hence, with this backdrop, the implication of this study is threefold: first, there have been exponential growth in the area of innovation and sustainability research post 2016 however there is no literature found linking with finance. Second, most of the studies are conducted by developed economies as depicted by most productive countries dataset. Third, on the basis of word dynamics, keywords such as financial innovation, technological innovation and climate change have been largely explored implying the attractiveness of the area amongst the researchers as well as the policy makers. Fourth, four clusters have been identified using bibliographic coupling where documents were focussed on regulatory aspects in the area of innovation and sustainability, sustainable innovation and financial performance, sustainable financial innovation and climate change.

5.2 Gaps

On the basis of the extensive review of study, performance analysis and science mapping, various gaps have been identified in this area which may provide future research directions to researchers. The research gaps identified from the study are listed as under: first, concentrated research, which implies that the studies conducted in this area are concentrated more on developed economies. The wealthy nations are more interested in this topic than the undeveloped nations, who could be most affected by the results of the adoption of the SDGs but have so far shown less interest. Innovation influences many aspects of human life, both generally and in the context of sustainable development, and should therefore be given more consideration (Vatananan-Thesenvitz et al. 2019). Second, sparse literature on sustainability innovation in the area of finance, which infers that there are very limited financial aspects on which research has been conducted integrating with the sustainability and innovation. Studies concerning COVID-19 and innovation sustainability has been less explored.

6 Limitations

Science mapping was employed in this review to help us better grasp the literature base. First, it's important to emphasize that science mapping can be utilized as a supplement to established review techniques rather than as a replacement. The sole emphasis on SCOPUS-indexed papers leads to a third constraint. Compared to other databases like Web of Science, the SCOPUS database provides a wider variety of papers, although it does not contain all publications in a certain field (Vatananan-Thesenvitz et al. 2019).

References

Aboelmaged M, Hashem G (2019) Absorptive capacity and green innovation adoption in SMEs: the mediating effects of sustainable organisational capabilities. J Clean Prod 220:853–863. https://doi.org/10.1016/j.jclepro.2019.02.150

Aguilera-Caracuel J, Ortiz-de-Mandojana N (2013) Green innovation and financial performance: an institutional approach. Organ Environ 26(4):365–385. https://doi.org/10.1177/1086026613507931

Ahmad M, Jiang P, Murshed M, Shehzad K, Akram R, Cui L, Khan Z (2021) Modelling the dynamic linkages between eco-innovation, urbanization, economic growth and ecological footprints for G7 countries: does financial globalization matter? Sustain Cities Soc 70(March):102881. https://doi.org/10.1016/j.scs.2021.102881

Ali Q, Salman A, Yaacob H, Zaini Z, Abdullah R (2020) Does big data analytics enhance sustainability and financial performance? The case of ASEAN banks. J Asian Finance Econ Bus 7(7):1–13. https://doi.org/10.13106/jafeb.2020.vol7.no7.001

Alonso-Martínez D, González-Álvarez N, Nieto M (2019) The influence of financial performance on corporate social innovation. Corp Soc Responsib Environ Manag 26(4):859–871. https://doi.org/10.1002/csr.1726

Anser MK, Khan MA, Nassani AA, Aldakhil AM, Hinh Voo X, Zaman K (2021) Relationship of environment with technological innovation, carbon pricing, renewable energy, and global food production. Econ Innov New Technol 30(8):807–842. https://doi.org/10.1080/10438599.2020.1787000

Benites L, Ruff C, Ruiz M, Matheu A, Inca M, Juica P (2020) Análisis de los factores de competitividad para la productividad sostenible de las PYMES en Trujillo (Perú). Revista De Metodos Cuantitativos Para La Economia y La Empresa 29(29):208–236

Bhutta AI, Ullah MR, Sultan J, Riaz A, Sheikh MF (2022) Impact of green energy production, green innovation, financial development on environment quality: A role of country governance in Pakistan. Int J Energy Econ Policy 12(1):316–326. https://doi.org/10.32479/ijeep.11986

Chesbrough H (2012) Open innovation: where we’ve been and where we’re going. Res Technol Manag 55(4):20–27. https://doi.org/10.5437/08956308X5504085

Cobo MJ, López‐Herrera AG, Herrera‐Viedma E, Herrera F (2011) Science mapping software tools: review, analysis, and cooperative study among tools. J Am Soc Inf Sci Technol 62(7):1382–1402

Ding Y, Cronin B (2011) Popular and/or prestigious? Measures of scholarly esteem. Inf Process Manag 47(1):80–96. https://doi.org/10.1016/j.ipm.2010.01.002

Donthu N, Kumar S, Mukherjee D, Pandey N, Lim WM (2021a) How to conduct a bibliometric analysis: an overview and guidelines. J Bus Res 133(March):285–296. https://doi.org/10.1016/j.jbusres.2021.04.070

Donthu N, Kumar S, Pandey N, Pandey N, Mishra A (2021b) Mapping the electronic word-of-mouth (eWOM) research: A systematic review and bibliometric analysis. J Bus Res 135(February):758–773. https://doi.org/10.1016/j.jbusres.2021.07.015

Dyllick T, Hockerts K (2002) 5. Beyond the business case for corporate sustainability—Dyllick—2002—Business Strategy and the Environment—Wiley Online Library. Bus Strategy Environ 11(2):130–141

Erkmen T, Günsel A, Altindağ E (2020) The role of innovative climate in the relationship between sustainable IT capability and firm performance. Sustainability (switzerland). https://doi.org/10.3390/SU12104058

European Commission (2021) Sustainable Finance, Retrieved from https://commission.europa.eu/businesseconomy-euro/banking-and-finance/sustainable-finance_en

Falcone PM (2020) Environmental regulation and green investments: the role of green finance. Int J Green Econ 14(2):159–173

Forcadell FJ, Aracil E, Úbeda F (2019) The influence of innovation on corporate sustainability in the international banking industry. Sustainability (switzerland) 11(11):12–15. https://doi.org/10.3390/su11113210

González-Ruiz JD, Botero-Botero S, Duque-Grisales E (2018) Financial eco-innovation as a mechanism for fostering the development of sustainable infrastructure systems. Sustainability (switzerland). https://doi.org/10.3390/su10124463

Huang Y, Chen C, Lei L, Zhang Y (2022) Impacts of green finance on green innovation: a spatial and nonlinear perspective. J Clean Prod 365:132548

Keeble BR (1988) The Brundtland report: “our common future.” Med War 4(1):17–25. https://doi.org/10.1080/07488008808408783

Kessler MM (1963) Bibliographic coupling between scientific papers’ received. Journal Assoc Inf Sci Technol 14(1):10–25

Kumar S, Lim WM, Sivarajah U, Kaur J (2022) Artificial intelligence and blockchain integration in business: trends from a bibliometric-content analysis. Inf Syst Front. https://doi.org/10.1007/s10796-022-10279-0

Kumar, S., Lim, W. M., Pandey, N., & Christopher Westland, J. (2021). 20 years of Electronic Commerce Research. In Electronic Commerce Research (Vol. 21, Issue 1). Springer US. https://doi.org/10.1007/s10660-021-09464-1

Kuzma E, Padilha LS, Sehnem S, Julkovski DJ, Roman DJ (2020) The relationship between innovation and sustainability: a meta-analytic study. J Cleaner Prod 259:120745

Liu X, Razzaq A, Shahzad M, Irfan M (2022) Technological changes, financial development and ecological consequences: a comparative study of developed and developing economies. Technol Forecast Soc Change 184(12):122004. https://doi.org/10.1016/j.techfore.2022.122004

Maier D, Maier A, Aşchilean I, Anastasiu L, Gavriş O (2020) The relationship between innovation and sustainability: a bibliometric review of the literature. Sustainability (switzerland) 12:10. https://doi.org/10.3390/SU12104083

Maltais A, Nykvist B (2021) Understanding the role of green bonds in advancing sustainability. J Sustain Finance Invest 11(3):233–252. https://doi.org/10.1080/20430795.2020.1724864

Menne F, Surya B, Yusuf M, Suriani S, Ruslan M, Iskandar I (2022) Optimizing the financial performance of SMEs based on sharia economy: perspective of economic business sustainability and open innovation. J Open Innov Technol Market Complex. https://doi.org/10.3390/joitmc8010018

Messabia N, Fomi PR, Kooli C (2022) Managing restaurants during the COVID-19 crisis: innovating to survive and prosper. J Innovation Knowl 7(4):100234

Moro-Visconti R, Rambaud SC, Pascual JL (2020) Sustainability in FinTechs: An explanation through business model scalability and market valuation. Sustainability (switzerland) 12(24):1–24. https://doi.org/10.3390/su122410316

Mukherjee D, Kumar S, Donthu N, Pandey N (2021) Research published in management international review from 2006 to 2020: a bibliometric analysis and future directions. In: Management international review, vol 61, issue 5. Springer, Berlin. https://doi.org/10.1007/s11575-021-00454-x

Nedopil Wang C, Lund Larsen M, Wang Y (2022) Addressing the missing linkage in sustainable finance: the ‘SDG Finance Taxonomy.’ J Sustain Finance Invest 12(2):630–637. https://doi.org/10.1080/20430795.2020.1796101

Niemann CC, Dickel P, Eckardt G (2020) The interplay of corporate entrepreneurship, environmental orientation, and performance in clean-tech firms—a double-edged sword. Bus Strateg Environ 29(1):180–196. https://doi.org/10.1002/bse.2357

Paul J, Lim WM, O’Cass A, Hao AW, Bresciani S (2021) Scientific procedures and rationales for systematic literature reviews (SPAR-4-SLR). Int J Consumer Stud. https://doi.org/10.1111/ijcs.12695

Polzin F, Sanders M, Täube F (2017) A diverse and resilient financial system for investments in the energy transition. Curr Opin Environ Sustain 28:24–32. https://doi.org/10.1016/j.cosust.2017.07.004

Posner B, Mangelsdorf ME (2017) Twelve essential innovation insights. MIT Sloan Manag Rev Fall 2017

Przychodzen W, Leyva-de la Hiz DI, Przychodzen J (2020) First-mover advantages in green innovation—Opportunities and threats for financial performance: a longitudinal analysis. Corp Soc Responsib Environ Manag 27(1):339–357. https://doi.org/10.1002/csr.1809

Quatrini S (2021) Challenges and opportunities to scale up sustainable finance after the COVID-19 crisis: lessons and promising innovations from science and practice. Ecosyst Serv 48:101240. https://doi.org/10.1016/j.ecoser.2020.101240

Refinitiv (2020) Sustainable finance review. Refinitiv. Available at https://www.refinitiv.com/content/dam/marketing/en_us/documents/reports/sustainable-finance-review-first-nine-months-2020-hsbc.pdf

Ren YS, Ma CQ, Chen XQ, Lei YT, Wang YR (2023) Sustainable finance and blockchain: a systematic review and research agenda. Res Int Bus Finance 64(February 2022):101871. https://doi.org/10.1016/j.ribaf.2022.101871

Ren YS, Ma CQ, Chen XQ, Lei YT, Wang YR (2023) Sustainable finance and blockchain: A systematic review and research agenda. Res Int Bus Finance 101871

Ronda-Pupo GA (2017) The effect of document types and sizes on the scaling relationship between citations and co-authorship patterns in management journals. Scientometrics 110(3):1191–1207. https://doi.org/10.1007/s11192-016-2231-8

Rustiarini NW, Bhegawati DAS, Mendra NPY (2022) Does green innovation improve SME performance? Economies. https://doi.org/10.3390/economies10120316

Ryan Hogarth J (2012) The role of climate finance in innovation systems. J Sustain Finance Invest 2(3–4):257–274. https://doi.org/10.1080/20430795.2012.742637

Saha T, Sinha A, Abbas S (2022) Green financing of eco-innovations: is the gender inclusivity taken care of? Econ Res Ekonomska Istrazivanja 35(1):5514–5535. https://doi.org/10.1080/1331677X.2022.2029715

Saini N, Singhania M, Yadav MP, Hasan M, Abedin MZ (2022) Non-financial disclosures and sustainable development: a scientometric analysis. J Cleaner Prod 381(P1):135173. https://doi.org/10.1016/j.jclepro.2022.135173

Silvestre BS (2015a) A hard nut to crack! Implementing supply chain sustainability in an emerging economy. J Clean Prod 96:171–181. https://doi.org/10.1016/j.jclepro.2014.01.009

Silvestre BS (2015b) Sustainable supply chain management in emerging economies: environmental turbulence, institutional voids and sustainability trajectories. Int J Prod Econ 167:156–169. https://doi.org/10.1016/j.ijpe.2015.05.025

Silvestre BS, Ţîrcă DM (2019) Innovations for sustainable development: moving toward a sustainable future. J Clean Prod 208:325–332. https://doi.org/10.1016/j.jclepro.2018.09.244

Sonmez Cakir F, Adiguzel Z (2022) Effects of innovative finance, strategy, organization and performance: a case study of company. Int J Innov Sci. https://doi.org/10.1108/IJIS-08-2021-0146

Tarkhanova EA (2018) Innovations and sustainability in the financial and banking sectors. Terra Economicus 16(2):75–82. https://doi.org/10.23683/2073-6606-2018-16-2-75-82

The Lab (2020) The global innovation lab for climate finance. https://www.climatefinancelab.org/.

Tolliver C, Fujii H, Keeley AR, Managi S (2021) Green Innovation and Finance in Asia. Asian Econ Policy Rev 16(1):67–87. https://doi.org/10.1111/aepr.12320

Tseng ML, Lim MK, Wu KJ (2019a) Improving the benefits and costs on sustainable supply chain finance under uncertainty. Int J Prod Econ 218(18):308–321. https://doi.org/10.1016/j.ijpe.2019.06.017

Tseng ML, Islam MS, Karia N, Fauzi FA, Afrin S (2019b) A literature review on green supply chain management: trends and future challenges. Resour Conserv Recycl 141:145–162

Tuhkanen H, Vulturius G (2022) Are green bonds funding the transition? Investigating the link between companies’ climate targets and green debt financing. J Sustain Finance Invest 12(4):1194–1216. https://doi.org/10.1080/20430795.2020.1857634

United Nations. (2020). The sustainable development agenda. Available at https://www.un.org/ sustainabledevelopment/development-agenda/.

Vatananan-Thesenvitz R, Schaller AA, Shannon R (2019) A bibliometric review of the knowledge base for innovation in sustainable development. Sustainability 11(20):5783

Vercelli A (2013) Financialization in a long-run perspective: an evolutionary approach. Int J Polit Econ 42(4):19–46

Wang H, Qi S, Zhou C, Zhou J, Huang X (2022) Green credit policy, government behavior and green innovation quality of enterprises. J Clean Prod 331:129834

Xiang X, Liu C, Yang M, Zhao X (2020) Confession or justification: The effects of environmental disclosure on corporate green innovation in China. Corp Soc Responsib Environ Manag 27(6):2735–2750. https://doi.org/10.1002/csr.1998

Xiang X, Liu C, Yang M (2022) Who is financing corporate green innovation? Int Rev Econ Finance 78(December 2021):321–337. https://doi.org/10.1016/j.iref.2021.12.011

Yaoteng Z, Xin L (2022) Research on green innovation countermeasures of supporting the circular economy to green finance under big data. J Enterp Inf Manag 35(4–5):1305–1322. https://doi.org/10.1108/JEIM-01-2021-0039

Yongabo P, Göransson B (2022) Constructing the national innovation system in Rwanda: efforts and challenges. Innov Dev 12(1):155–176. https://doi.org/10.1080/2157930X.2020.1846886

Zhang D, Vigne SA (2021) How does innovation efficiency contribute to green productivity? A financial constraint perspective. J Cleaner Product 280:124000. https://doi.org/10.1016/j.jclepro.2020.124000

Zhang D, Mohsin M, Taghizadeh-Hesary F (2022) Does green finance counteract the climate change mitigation: asymmetric effect of renewable energy investment and R&D. Energy Econ 113(12):106183. https://doi.org/10.1016/j.eneco.2022.106183

Ziolo M, Bak I, Cheba K (2021) The role of sustainable finance in achieving sustainable development goals: does it work? Technol Econ Dev Econ 27(1):45–70. https://doi.org/10.3846/tede.2020.13863

Zupic I, Čater T (2015) Bibliometric methods in management and organization. Organ Res Methods 18(3):429–472. https://doi.org/10.1177/1094428114562629

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no potential conflict of interest.

Research involving human participants and/or animals

This research donot involve any human participants and/or Animals.

Informed consent

The research study donot require any consent from outside parties.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Fatima, S., Tandon, P. & Singh, A.B. Current state and future directions of sustainability and innovation in finance: a bibliometric review. Int J Syst Assur Eng Manag 15, 1591–1614 (2024). https://doi.org/10.1007/s13198-023-02041-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-023-02041-9