Abstract

We undertake a systematic literature review and a bibliometric analysis of sustainable finance instruments. We reviewed 303 articles from 119 journals published from 2007 to 2022 listed in the Web of Science database. Our review provides a state-of-art overview of the current evolution of the sustainable finance literature over time and across academic categories and journals. This research aims to identify the primary research stream and evolutionary nuances. Also, we include studies with the first empirical evidence on the effect of the COVID-19 pandemic on the green and social impact financial market. We demonstrate that until 2013 our database interrogation did not detect sustainable finance-related research. Moreover, 241 articles out of our 303 investigate green bonds. This result underlines the scholars’ interest in analysing this innovative financial tool. However, only one article is related to sustainable bonds.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Bibliometric analysis

- Green bonds

- Systematic literature review

- Social impact bonds

- Sustainable bonds

- Sustainable finance

- Prima analysis

JEL Codes

1 Introduction

Nowadays, the world is facing great challenges in social, environmental, and economic areas. Massive financial resources and investments are needed in order to eradicate poverty, combat climate change, reduce economic inequalities, and, most recently, mitigate the threat of pandemics (Levy, 2020; Pizzi et al., 2021; United Nations, 2018). For instance, sustainable finance instruments have become popular across the global market to financially support the green transition, combatting climate change and boosting clean energy while recovering from the ongoing COVID-19 pandemic negative impact.

Green, social impact, and sustainable bonds are these innovative financial tools. The first aims to improve environmental impacts (Tang & Zhang, 2020). However, despite the recent “green bond boom” (Stanley, 2017), there is still no universal definition of this financial security. Green bonds are fixed-income securities issued by capital-raising entities to fund environmental-friendly projects such as renewable energy, sustainable water management, climate change adaptation, and so on (Tang & Zang, 2020). Social impact bonds are a new financial mechanism for delivering pre-defined public services such as food security, affordable housing, access to essential services, and employment generation (OECD, 2016). Finally, sustainable bonds are fixed-income securities that are used to fund projects that have a positive impact on both the environment and society.

Moreover, the literature on sustainable finance has been prolific since issuing the first green bond in 2007 and excessively fragmented. As a result, identifying what and why these instruments differ from traditional finance and investing can be challenging.

In this context, the main objective of this paper is to analyse the literature’s state-of-art and make some order on the ongoing academic works on green, social impact, and sustainable bonds. Furthermore, this study is motivated by the study of Kumar et al. (2022), who suggested enriching the proper understanding of sustainable finance tools. Our study accepts this challenge by studying the entire spectrum of articles on green, social impact, and sustainable bonds. We apply a case study of bibliometric analysis on sustainable finance instruments to explore the evolution of the literature over time, to identify the main authors and journals in the field, the most important papers, and the most studied countries, by doing a keyword analysis, which allows us to detect trending research topics and summarise the paper’s content with just a few words.

Bibliometric analysis is a commonly used and rigorous technique for studying and evaluating large amounts of scientific evidence as it focuses on emerging fields and analyses the nuances of a specific field (Donthu et al., 2021; Goodell et al., 2023; Paul et al., 2020). According to Paul et al. (2020), a bibliometric analysis of themes, theories, or methods synthesises prior studies to strengthen the foundation of knowledge. Mukherjee et al. (2022) posit that bibliometric research provides opportunities to contribute to theory and practice. For instance, our chapter aims to contribute to sustainable finance literature alongside other recent bibliometric studies.

The rest of the paper proceeds as follows: in Sect. 2, we will explore the techniques and methods used to develop our search. More precisely, we will develop a protocol following the PRISMA method (Page et al., 2021) and the subsequent steps to produce the base with which we develop our bibliometric analysis. Then, in Sect. 3, we will show the most important results and discuss them. Finally, in the last section of our study, Sect. 4, we will conclude the research with some final comments.

2 Materials and Methods

The research methodology combines a systematic literature review (SLR) and a bibliometric analysis to understand academic studies clearly. According to the PRISMA Statement, “systematic review is a review of a formulated question that uses systematic and explicit methods to identify, select, and critically appraise relevant research, and to collect and analyse data from the studies that are included in the review” (Moher et al., 2010). This approach is widely used due to the “organised, transparent, and replicable procedures at each step in the process” that ensures quality and replicability of the review (Stechemesser & Guenther, 2012).

The following subsection describes the protocol performed according to the PRISMA Statement.

2.1 The Protocol

The systematic methodology allows for carefully identifying and synthesising the current literature on the topic with reproducible criteria and limits biases and random errors (Delle Foglie & Keshminder, 2022).

The first methodological step is defining the research questions the literature review is based on. These are:

- Q1::

-

How far did the economic literature on green, social impact, and sustainable bonds investigate these new financial instruments?

- Q2::

-

What are the major research trends in academia about them?

- Q3::

-

What are the future research directions on green, social impact, and sustainable bonds?

Following the PRISMA procedure, the next step is to select the bibliographic database. Between the two databases most used, Scopus and Web of Science, we selected the latter as it provides a list of high-quality peer-reviewed articles and is widely used (Araclil et al., 2021; Khan et al., 2020; Liu et al., 2015; Waltman, 2016). Therefore, this database suits the requirements of our bibliographic analysis (Paltrinieri et al., 2019; Khan et al., 2020; Khan et al., 2022). The research is limited to English-, French-, Italian-, and Spanish-written articles published in peer-reviewed journals. The choice to include only scientific works guarantees the reproducibility and completeness of the literature sample (Cortellini & Panetta, 2021). We consider papers published between 01/01/2007 and 31/12/2022. The starting period is chosen according to the European Investments Bank’s (EIB) first-world green bond issuance (2007), while 2022 is the last complete year available. In 2022, we also included early-access articles published at the beginning of 2023.

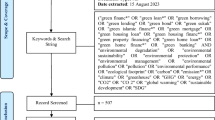

The data query is based on a combination of the following authors’ keywords (AK): AK = (green bond*) AND/OR (social bond*)Footnote 1 AND/OR (sustainable bond*). To exclude any articles that are not referred to economics, we focus on papers about the following subject areas: “Business”, “Business finance”, “Economics”, “Environmental studies”, “Ethics”, and “Management”.

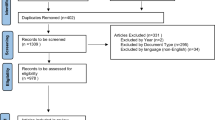

The academic records identified through database interrogations resulted in a total of 502. To obtain a refined sample, after reading the title and abstract of each article, we excluded not relevant and off-topic papers (185 documents) and duplication (4 documents). To establish the “no relevance”, we included only papers that: (1) debate on the development and use of green, social impact, or sustainable bonds, (2) case studies (real or proposal) on green, social impact, and sustainable bonds, and (3) qualitative, quantitative, or comparative studies. Finally, we double-checked the sample verifying the full-text availability via academic databases and removed ten papers, leaving 303 articles in the final sample. The steps conducted during the sample construction are provided in Fig. 1.

In addition, the bibliometric analysis is conducted through Bibliometrix, an R-tool for comprehensive science mapping analysis (Aria & Cuccurullo, 2017). This second approach is complementary to PRISMA in order to organise the performance analysis better. In the next section, we will show some results.

3 Results and Discussion

Bibliometric reviews analyse literature using statistical methods, software, or graphical interfaces that is, in our case, via Biblioshiny of Bibliometrix package of R (Aria & Cuccurullo, 2017; Delle Foglie & Keshminder, 2022).

Green, social impact, and sustainable bonds are new and rising topics in the economic and financial literature. Nevertheless, the interest of scholars is noticeable (Fig. 2).

As we can observe, our final sample of 303 documents was published between 2013 and 2023 from 119 different journals with an annual growth rate of almost 26%. The latest data shows the academic community’s interest in investigating these new sustainable finance instruments. This trend is also detectable in the significant number of authors (660) who worked on the publications under review.

According to the aims of this paper, after completing the analysis of all the documents included in the sample through Bibliometrix, we can develop a “taxonomy of green, social impact, and sustainable bonds’ research” starting from the thematic map reported in Fig. 3.

After reading all article’s abstracts, introductions, results and discussion, and conclusion sections, the selected academic works are grouped into different categories related to the subject the authors analysed, as shown in Table 1.

Concerning our sample, green bonds are a major topic in academia (colour red in Fig. 3), followed by social impact bonds (colour green) and sustainable bonds (colour brown). This trend is also confirmed by the evolution of the sustainable finance worldwide market, where the issuance of green bonds prevails, as Fig. 4 shows.

3.1 Publication Years

Until 2013, our database interrogation did not detect sustainable finance-related research (grey line). However, the first green bonds (green line) and social impact bonds (yellow line) were already issued (green bonds in 2007 and social impact bonds in 2010).

The following years registered a considerable increase in publication and scholars’ interest (Fig. 5 and Table 2), particularly after the Paris Agreement in 2015, with which world leaders pledged to be socially responsible and set the 17 Sustainable Development Goals (SDGs) to be achieved by 2030. Further, around 2018, Greta Thunberg, a young girl from Sweden, started a school strike for climate, asking for urgent actions on the climate crisis.

The number of papers grew significantly for both green and social impact bonds starting in 2019, with the emergence of the global pandemic, increased climate awareness, and growing demand for social services. Publications related to sustainable bonds (blue line) are identified starting from 2020.

With the beginning of the post-pandemic era and the issuance of the first recovery funds, the number of papers published related to green, social impact, and sustainable bonds reached its peak. However, in 2022 there was a turnaround for social impact bonds article production that began to decrease considerably, while the articles related to green bonds continued to grow.

Overall, the annual growth rate of production is 25.89%.

3.2 Author(s)’ Analysis

Table 3 collects the ten most productive authors. M.A. Naeem is the author with the highest number of papers published on sustainable finance-related instruments (n.7), followed by Y. Li (n.6) and D. Park (n.5).

In general, as we can observe from Table 3, the number of papers published per author is not high, even if the literature on sustainable finance is vast. This evidence can be explained by the high number of authors that keeps investigating sustainable finance. Furthermore, the green and social impact bond markets are still in their infancy. Most of the authors analysed have commonly expressed that the major limitation in investigating these innovative financial instruments is the absence of a standard definition and the difficulty in the data collection. Related to this last point, social impact bonds are less reviewed than green bonds due to the difficulty of collecting data. In fact, among the ten most productive authors, no one has studied social impact bonds.

In the end, we focus on some metrics, more precisely on an author-level metric, the h-index that measures both the productivity and citation impact of the publications (Bornmann & Daniel, 2007). B. Lin is the author with the highest h-index value, followed by D. Park and A. K. Tiwari.

3.3 The Most Important Articles

We identify the most trending ten articles based on the number of citations reported in Table 4. O. D. Zerbib (2019) has been cited 268 times during the period analysed, followed by J. C. Reboredo (2018) and D. Y. Tang (2020). These ten influential papers are a great start to have an overview of green bonds since the authors are the most prominent in the research field. The ten papers are cited on average 35 times per year, with the highest rate of 57.67 and the lowest of 11.55 times. The lowest value is slightly under the all-document average citation per document, which is 19.79 times.

3.4 Keywords Analysis

The total number of authors’ keywords is 957. Table 5 and Fig. 6 illustrates the results of the 50 keywords most used and their frequency. This kind of analysis allows us to detect trending research topics and summarise the paper’s content with just a few words.

Many terms are related to green bonds and climate change. This result is not surprising because most papers under analysis have examined this innovative instrument.

The other most frequent words are related to social impact bonds, such as “impact investing”, “payment by results”, “public–private partnership”, and “social investment”.

Other prominent terms refer to “corporate social responsibility”, “ESG factors”, “sustainable development goals”, “COVID-19 pandemic”, and “financial markets”. In fact, concerning the market analysis, we find several keywords such as “financial analysis”, “yield spread”, “bond yield”, “liquidity”, “credit rating”, “portfolio diversification”, “greenwashing”, and “equity and other prices”. All these terms are referred to the analysis of green bonds.

This analysis highlights how scholars and practitioners investigate green and social impact bonds. Concerning the former, the authors investigate their financial performance. Concerning the latter, the authors examine the issuance methodology of social impact bonds and their application sector.

3.4.1 Source Analysis

We identified top ten prominent journals based on the (1) number of papers, (2) number of citations, and (3) number of citations per year. The top journals are listed in Table 6.

Sustainability is the journal most chosen by the authors interested in sustainable finance and its instruments, followed by the Finance Research Letters.

Following a fundamental premise and motivation of bibliometric studies according to which citations reflect the impact, we agree with Goodell et al. (2023) that impact measures quality. For this reason, it is interesting to observe that seven out of ten journals are ranked Q1 following the Journal Impact Factor (JIF)Footnote 2 quartile performed by Clarivate. It means that sustainable finance, green, social impact, and sustainable bonds are not only prominent research topics for scholars but also that the scientific community and journals are concerned about these novel themes.

3.4.2 Country Analysis

Table 7 illustrates the ten countries most and least cited in the papers. China and the USA are the most cited, Qatar, Sri Lanka, and Norway the least.

This data can be explained because these countries issue most green and social impact bonds. Furthermore, China’s market analysis is gaining much interest because it represents a developing country’s green bond explosion.

However, if we put together the number of times European countries (Spain, Italy, Netherlands, France, Sweden, Romania, Denmark, and Norway) have been mentioned (1,628 times), we would far outnumber the USA (763 times) and China (1,024 times). This is because Europe still dominates the market even if the green, social impact, and sustainable bond market is spreading and the number of actors and liquidity is increasing worldwide.

4 Conclusion

This study reviewed the sustainable finance-related literature. Using a bibliometric approach, we analysed 303 articles published in 2007–2022 from Web of Science databases. Through our analysis, we noted that the extant literature deeply focused on the green bond market, whereas only limited studies have investigated social impact or sustainable bonds.

We show that the peak in article production for both green and social impact bonds was reached in 2021, although in 2022 the number of papers related to social impact bonds significantly decreased. This can be explained by the difficulty in collecting data for this last type of bonds. In addition, we highlighted that the top 10 contributions are unsurprisingly related to green bonds. However, they can be a great starting point for an overview of the green bonds market since the authors are the most prominent in the research field. Moreover, we demonstrate that seven out of 10 of the most productive journals are ranked Q1. As for the top three countries most mentioned, we find China, the USA, and Spain.

Our chapter can be used as a guide for future scholars and practitioners in advancing theory and having a general overview of sustainable finance related to literature evolution.

Overall, while we highlight the specific findings of this particular bibliometric study, our focus is to reiterate the need for future studies related to social impact and sustainable bonds.

Notes

- 1.

We selected a wider category to include studies related to social bonds and social impact bonds.

- 2.

A journal’s quartile ranking is determined by comparing a journal to others in its JCR category based on Impact Factor score. If a journal falls in Q1, it means that the journal performs better than at least 75% of journals in that category, based on its Impact Factor score (Clarivate, 2023. Available https://clarivate.libguides.com/jcr#:~:text=JIF%20Percentile%3A,granular%20view%20than%20quartiles%20do.).

References

Aracil, E., Nájera-Sánchez, J., & Forcadell, F. J. (2021). Sustainable banking: A literature review and integrative framework. Finance Research Letters, 42, no 101932. https://doi.org/10.1016/j.frl.2021.101932

Aria, M., & Cuccurullo, C. (2017). Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. https://doi.org/10.1016/j.joi.2017.08.007

Bornmann, L., & Daniel, H. D. (2007). What do we know about the h index? Journal of the American Society for Information Science and Technology, 58(9), 1381–1385. https://doi.org/10.1002/asi.20609

Clarivate Analytics (2023, April 7). Journal Citation Reports: Learn the Basics. Clarivate Analytics. https://clarivate.libguides.com/jcr#:~:text=JIF%20Percentile%3A,granular%20view%20than%20quartiles%20do

Cortellini, G., & Panetta, I. C. (2021). Green bond: A systematic literature review for future research agendas. Journal of Risk and Financial Management, 14(12), no. 589, https://doi.org/10.3390/jrfm14120589

Delle Foglie, A., & Keshminder, J. S. (2022). Challenges and opportunities of SRI sukuk toward financial system sustainability: A bibliometric and systematic literature review. International Journal of Emerging Markets. EarlyCite. https://doi.org/10.1108/IJOEM-04-2022-0601

Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. https://doi.org/10.1016/j.jbusres.2021.04.070

Goodell, J. W., Oriani, M. E., Paltrinieri, A., & Patel, R. (2023). The importance of ABS 2 journals in finance scholarship: Evidence from a bibliometric case study. Finance Research Letters, article in press, 103828. https://doi.org/10.1016/j.frl.2023.103828

Khan, A., Hassan, M. K., Paltrinieri, A., Dreassi, A., & Bahoo, S. (2020). A bibliometric review of takaful literature. International Review of Economics & Finance, 69, 389–405. https://doi.org/10.1016/j.iref.2020.05.013

Khan, A., Goodell, J. W., Hassan, M. K., & Paltrinieri, A. (2022). A bibliometric review of finance bibliometric papers. Finance Research Letters, 47, nª 102520. https://doi.org/10.1016/j.frl.2021.102520

Kumar, S., Sharma, D., Rao, S., Lim, W. M., & Mangla, S. K. (2022). Past, present, and future of sustainable finance: Insights from big data analytics through machine learning of scholarly research. Annals of Operations Research: 1–44. https://doi.org/10.1007/s10479-021-04410-8

Levy, D. L. (2020). COVID-19 and global governance. Journal of Management Studies, 58(2), 562–566. https://doi.org/10.1111/joms.12654

Liu, Z., Yin, Y., Liu, W., & Dunford, M. (2015). Visualizing the intellectual structure and evolution of innovation systems research: A bibliometric analysis. Scientometrics, 103(1), 135–158. https://doi.org/10.1007/s11192-014-1517-y

Moher, D., Liberati, A., Tetzlaff, J., & Altman, D. G. (2010). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. International Journal of Surgery, 8(5), 336–341. https://doi.org/10.1016/j.ijsu.2010.02.007

Mukherjee, D., Lim, J. W., Kumar, S., & Donthu, N. (2022). Guidelines for advancing theory and practice through bibliometric research. Journal of Business Research, 148, 101–115. https://doi.org/10.1016/j.jbusres.2022.04.042

Organisation for Economic Co-operation and Development (OECD). (2016). Social impact investment: Building the evidence base. OECD.

Page, M. J., McKenzie, J. E., Bossuyt, P. M., Bourtron, I., Hoffmann, T. C., Mulrow, C. D., Shamseer, L., Tetzlaff, J. M., Akl, E. A., Brennan, S. E. & Moher, D. (2021). The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. International of Clinical Epidemology, 134, 178–189. https://doi.org/10.1016/j.jclinepi.2021.03.001

Paltrinieri, A., Hassan, M. K., Bahoo, S., & Khan, A. (2019). A bibliometric review of sukuk literature. International Review of Economics & Finance, In press. https://doi.org/10.1016/j.iref.2019.04.004

Paul, J., & Criado, A. R. (2020). The art of writing literature review: What do we know and what do we need to know? International Business Review, 29(4), nº 101717. https://doi.org/10.1016/j.ibusrev.2020.101717

Pizzi, S., Rosati, F., & Venturelli, A. (2021). The determinants of business contribution to the 2030 agenda: Introducing the SDG reporting score. Business Strategy and the Environment, 30(1), 404–421. https://doi.org/10.1002/bse.2628

Stanley M. (2017). Behind the green bond boom. Retrieved Jun 19, 2022, from https://www.morganstanley.com/ideas/green-bond-boom

Stechemesser, K., & Guenther, E. (2012). Carbon accounting: A systematic literature review. Journal of Cleaner Production, 36, 17–38. https://doi.org/10.1016/j.jclepro.2012.02.021

Tang, D. Y., & Zhang, Y. P. (2020). Do shareholders benefit from green bonds? Journal of Corporate Finance, 61,. https://doi.org/10.1016/j.jcorpfin.2018.12.001

United Nations. (2018). The sustainable development goals report 2018. Nova York.

Waltman, L. (2016). A review of the literature on citation impact indicators. Journal of Informetrics, 10(2), 365–391. https://doi.org/10.1016/j.joi.2016.02.007

Funding

We have received no funding to conduct this research.

Author information

Authors and Affiliations

Contributions

Author Statement

The authors assert that this paper is a product of genuine collaboration and is not published or under consideration elsewhere.

Corresponding author

Editor information

Editors and Affiliations

Ethics declarations

Declaration of Competing Interest

We confirm that we do not have any conflict of interest.

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Dahbi, F., Carrasco, I., Petracci, B. (2024). A Bibliometric Analysis of Sustainable Finance. In: La Torre, M., Leo, S. (eds) Contemporary Issues in Sustainable Finance. Palgrave Studies in Impact Finance. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-031-45222-2_5

Download citation

DOI: https://doi.org/10.1007/978-3-031-45222-2_5

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-031-45221-5

Online ISBN: 978-3-031-45222-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)