Abstract

This paper investigates a generalized lead time distribution with a variable backordering rate in a two-echelon supply chain system. The vendor produces a single product and delivers to the buyer in equal sized batches. The delivery lead time follows a generalized stochastic variable. Shortages are allowed to occur and backordered partially. The backorder rate depends on the demand on stock-out period. Based on this notion, we formulate a mixed integer non-linear cost function which needs to be minimized with respect to reorder point, number of deliveries and lot size from the vendor to the buyer, to operate cooperatively in the integrated model. Analytically we proved the convexity of the generalized lead time distribution cost function with respect to the control parameters. Further, the uniqueness of optimality has been proved. To validate the proposed model, uniform, exponential and normal distributed lead times are presented in numerical example section. Sensitivity analysis also performed to the values of the parameters.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper develops a two-echelon integrated inventory control with the general distribution of the procurement lead time of a lot size, and variable backorder rate. In this section, we present some of previous works regarding this work.

Today’s highly competitive market conditions, the integrated strategy plays a vital role in the supply chain network. Goyal (1977) firstly introduce the single vendor single supplier integrated system. This paper observes that the total cost of the integrated approach is less than the sum of the total cost of the individuals. After this work, till now many researchers incorporate this integrated strategy into their literature (e.g., Ben-Daya and Raouf 1994; Cárdenas-Barrón et al. 2012, 2011; Chung and Wee 2008; Huang 2004; Lee et al. 2007, 2017; Lin 2009; Ouyang et al. 2007; Pan and Yang 2002; Sajadieh et al. 2010; Wangsa and Wee 2017; Wu et al. 2007; Yang 2010).

In all supply chain systems, the lead time is an important factor and many inventory control model involves the deterministic lead times. Controllable lead time is one of the deterministic lead time strategies which is incorporated by many authors (e.g., Ben-Daya and Raouf 1994; Lee et al. 2007; Lin 2009; Ouyang et al. 2007; Pan and Yang 2002; Wu et al. 2007) and it is first introduced by Tersine (1982). According to Tersine model, the lead time may be consisting of many segments like, setup order time, delivery time, distributor lead time etc. These segments can be shortened by additional cost called crashing cost.

A common assumption of aforesaid literature is either deterministic lead time or known variable lead time. In practice, there might be plenty of environmental causes which may influence the delivery lead time, for example, transportation time, late production and so forth, and this outcome the lead time to be uncertain. Liberatore (1977) is the first author addressed an inventory modeling involving stochastic lead times. An inventory model developed by Sphicas and Nasri (1984), deals with constant demand and stochastic lead times. Yano (1987) determined the optimal lead times for two-echelon system, with the aim of minimizing the sum of inventory holding costs and tardiness costs. Nasri et al. (1990) developed inventory control with stochastic lead time and the authors incorporate the investment strategy to minimize the set-up cost. Specifically, the set-up cost reduces as exponential function of investment. Fujiwara and Sedarage (1997) developed an Economic Order Quantity (EOQ) problem for single-item, where the production of an item required number of parts and the lead time is assumed to be a stochastic variable. The problem determines when to order in each part and finds the EOQ, hence the total cost per unit time of the system is minimized. He et al. (2005) presented a probabilistic, finite lead time inventory model with backordering. A generalized EOQ model with backorder is developed and uniformly distributed lead time was employed as a particular case. Paknejad et al. (2005) modified the stochastic lead time inventory model which allows a defectiveness in the system, for that the extra holding cost incurred for the defective items until those items are returned to the vendor. Also the paper deals with the investment to improve the quality. Jokar and Sajadieh (2008) proposed a multi-sourcing inventory model with the stochastic lead time. The authors incorporate more than one suppliers and splitting orders between them to lessen the lead time risk in the unstable environments. The aim of the study is to finding optimal number of suppliers and comparing the results to sole-sourcing model.

Sajadieh and Akbari Jokar (2009) presented a single-vendor single-buyer integrated inventory system for a stochastic lead time. The authors assumed that the lead time follows a uniform distribution. Also, the authors assumed to allow shortages with completely backorder. Sajadieh et al. (2009) developed exponentially distributed stochastic lead time inventory model with shortages and completely backorder. Normally distributed lead time inventory model is investigated by Hoque (2013), the model allows shortages. If the batch Q arrives late at the time t, then the vendor kept the Qt inventory in his warehouse. This extra inventory induces the extra holding cost at the vendor side. Hoque (2013) had taken this extra holding cost into his model. Shu et al. (2015) extends Sajadieh et al. (2009) model by incorporating the transportation cost of lot size which is increasing function of q. Lin (2016) also extends Sajadieh et al. (2009) by allowing shortages and those shortages are partially backordered. Also, Lin (2016) using investment function to reduce the mean value of lead time. The paper by Hossain et al. (2017) is the first literature which considers the general distributions of stochastic lead times and the vendor may have the penalty cost for the delayed delivery. To illustrate the model, the authors used different distributions such as uniform, normal and exponential distributions in the numerical section.

A comparison of our model with these literatures is given in Table 1. The remainder of the paper is arranged as follows. In the next section we put forward Notations and Assumptions. In Sect. 3 we deal the mathematical model with general distribution of lead time, and algorithm of obtaining the minimum cost. Numerical computations for different distributions and parametric sensitivity analysis are carried out in Sect. 4. Conclusions are made in the last section.

2 Notations and assumptions

We adopt the following notations and assumptions to develop the mathematical model.

2.1 Notations

- D :

-

demand rate (units/unit time)

- A :

-

buyer’s ordering cost per order

- B :

-

vendor’s setup cost per setup

- \(h_b\) :

-

buyer’s holding cost per unit per unit time

- \(h_v\) :

-

vendor’s holding cost per unit per unit time

- l :

-

length of the lead time (a random variable)

- f(l):

-

probability density function of l

- \(\pi\) :

-

buyer’s shortage cost per unit per unit time

- \(\pi _0\) :

-

marginal profit (i.e., cost of lost demand) per unit per unit time

- a :

-

upper limit of lead time (unit time)

- b :

-

lower limit of lead time (unit time)

- Q :

-

buyer’s order quantity (units per order) (a decision variable)

- r :

-

reorder level (units) (a decision variable)

- \(\beta\) :

-

fraction of shortage will be backordered \((0\le \beta \le 1)\) (a decision variable)

- \({\mathbb {E}}(\cdot )\) :

-

mathematical expectation

2.2 Assumptions

-

1.

A two-echelon integrated inventory model is developed with single-vendor and single-buyer for a single-item.

-

2.

Demand rate is constant and production rate is infinite.

-

3.

The buyer follows a classical (Q, r) system, i.e., the inventory is continuously reviewed and the order Q is placed when the inventory level reaches the reorder point r.

-

4.

The vendor’s rate of production is assumed to be infinite.

-

5.

The lead time of the buyer’s order is a random variable.

-

6.

Shortages are allowed at the buyer side and a fraction (\(\beta\)) of shortages is backordered. The backordering parameter \(\beta\) is assumed to inversely proportional to the amount of shortages.

3 Mathematical model

In this section the mathematical model of integrated inventory system is developed. Based on an agreement between the two entities, the buyer orders Q units to the vendor and in order to reduce the setup cost, the vendor produces nQ items and transfers Q items for n times. The vendor produces the items with infinite production rate and production time is assumed to be zero (e.g., Sajadieh et al. 2009; Lin 2016; Hossain et al. 2017). Since the delivery lead time is probabilistic in nature which follows a known randomness with the probability function f(l) within certain range (a, b).

3.1 Buyer’s total cost

The buyer’s total cost consisting of ordering cost, holding cost and shortage cost (if shortage occur) per unit time. The order Q units are placed when the inventory level drops to the reorder level r. Since the delivery lead time is a probabilistic, the order may arrive early or late with respect to the mean lead time \({\mathbb {E}}(l)=\frac{r}{D}\). The time is a continuous variable, for that, we develop this model by considering the stochastic lead time follows a continuous random variable. The upper bound and the lower bound of the lead time are b and a respectively, i.e., \(-\infty \le a\le l\le b\le +\infty\) which is the general range of the lead time considered in this paper. Since ordering cost per order is A, the ordering cost per unit time is \(\frac{DA}{Q}\). If the order arrives earlier with respect to the mean lead time \(\frac{r}{D}\), i.e., \(l\le \frac{r}{D}\), then the time-weighted inventory (area bounded by red color in Fig. 1) is \(\frac{1}{2}Dl^2+l(r-Dl)=l(r-\frac{Dl}{2})\). Therefore the expected holding cost per unit time is \(h_b(D/Q){\mathbb {E}}\left[ \left( r-\frac{Dl}{2}\right) lI_{(a\le l\le \min (b,r/D))}\right]\), where \(I_B\) is the indicator function, i.e., \(I_B:=I_B(\omega )=\left\{ \begin{array}{ll} 1,&{}{\text {if}}\; \omega \in B\\ 0, &{} {\text {if}}\; \omega \notin B. \end{array}\right.\) Suppose the order arrives late with respect to the mean lead time \(\frac{r}{D}\), i.e., \(l>\frac{r}{D}\), then the time weighted inventory (area bounded by red color in Fig. 2) is \(\frac{r^2}{2D}\). Therefore the expected holding cost per unit time is \(\frac{D}{Q}{\mathbb {E}}\left[ \frac{r^2}{2D}I_{\min (b,r/D)<l\le b}\right]\). Similarly, the shortage area (area bounded by black color in Fig. 2) is \(\frac{1}{2D}(Dl-r)^2\). Thus the expected number of backorder per cycle is \(\beta {\mathbb {E}}\left[ \frac{1}{2D}(Dl-r)^2I_{\min (b,r/D)<l\le b}\right]\) and the expected shortage cost per unit time is \((\pi +\pi _0(1-\beta ))\frac{D}{Q}{\mathbb {E}}\left[ \frac{1}{2D} (Dl-r)^2I_{\min (b,r/D)<l\le b}\right]\)\(=\frac{(\pi +\pi _0(1-\beta ))}{2Q}{\mathbb {E}}\left[ (Dl-r)^2I_{\min (b,r/D)<l\le b}\right]\). Since the backordering ratio is assumed to inversely proportional to the amount of shortage, we get

where \(\rho >0\). In both the cases, \(l\le \frac{r}{D}\) and \(l>\frac{r}{D}\), the maximum inventory level after the arrival is \(Q+r-Dl\). Thus the time weighted inventory (area bounded by blue color) after the arrival is \(\frac{(Q-Dl)^2}{2D}+\frac{r(Q-Dl)}{D}\). The expected total cost is \(\frac{D}{Q}h_b\frac{1}{2D}{\mathbb {E}}\left[ (Q-Dl)^2I_{(a\le l \le b)}\right] +\frac{D}{Q}h_b\frac{r}{D}{\mathbb {E}}\left[ (Q-Dl)I_{(a\le l\le b)}\right]=\frac{h_b}{2Q}{\mathbb {E}}\left[ (Q-Dl)^2I_{(a\le l \le b)}\right] +\frac{h_br}{Q}{\mathbb {E}}\left[ (Q-Dl)I_{(a\le l\le b)}\right]\). Therefore the expected total cost of the buyer is

Total cost with respect to r of Example 4.1 when \(n=1\)

Total cost with respect to r of Example 4.2 when \(n=1\)

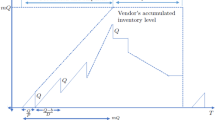

3.2 Vendor’s total cost

The vendor produces nQ items and delivers them for n times of Q batches. The vendor’s inventory level is depicted in Fig. 3. So the vendor’s average holding cost is \(\frac{h_v(n-1)Q}{2}\) and the setup cost per unit time is \(\frac{B}{nQ/D}\). Due to late delivery, the extra inventory is kept in the vendor’s warehouse as in Hoque (2013). The late delivery happens when \(l>\frac{r}{D}\), and the order Q arrives by the late time \(l-\frac{r}{D}\). Therefore the vendor keeps those extra \(Q\left( l-\frac{r}{D}\right)\) inventory per cycle and the extra inventory cost per unit time is \(h_v\frac{D}{Q}Q\left( l-\frac{r}{D}\right) =h_v(Dl-r)\). Expected total cost of the vendor is

3.3 Integrated total cost

Suppose the vendor and the buyer decided to cooperate and agree to follow the integrated approach then the expected total cost of the system will be the sum of vendor total cost and buyer total cost. i.e.,

The above equation can be written as

subject to, n integer, \(q>0\), \(r>0\), \(0\le \beta \le 1\).

Now the problem is to find the EOQ, reorder level r, number of shipments n and backordering rate \(\beta\) that minimize the expected total cost in Eq. (5). Next we discuss total cost of earlier delivery and late delivery in two cases. Then we use the classical optimization techniques to minimize Eq. (5) with respect to Q, r, n and \(\beta\). With the help of MATLAB, we iteratively solve simultaneous equations which are obtained from differentiating Eq. (5) with respect to Q and r. To prove the convexity of \(ETC_i,\ i=1,2\) over n we assumed that n is a continuous variable.

Case 1

If \(b\le r/D\): Then Eq. (5) will becomes

Here \(\frac{\partial ^2}{\partial n^2}ETC_1=\frac{2DB}{Qn^3}>0\ \ \forall\ \ n>0\). This shows that \(ETC_1\) is convex in n for given Q and r. \(\frac{\partial ^2}{\partial Q^2}ETC_1=\frac{2D}{Q^3}\left( A+\frac{B}{n}\right) >0\), \(\frac{\partial ^2}{\partial r^2}ETC_1=0\). This shows that \(ETC_1\) is convex in Q and r for given n. On setting \(\frac{\partial ETC_1}{\partial Q}=0\) and solving this with respect to Q, we get

Again \(\frac{\partial ETC_1}{\partial r}=h_b\int \limits _a^bf(l){\mathrm {d}}l\) which is a constant function; leads the fact that the optimal solution of r is the expected value of the reorder point. i.e., \(r^*=D{\mathbb {E}}(l)\).

Case 2

If \(b> r/D\): Then Eq. (5) will become

As in the previous case \(\frac{\partial ^2}{\partial n^2}ETC_2=\frac{2DB}{Qn^3}>0\ \ \forall\ \ n>0\). This shows that \(ETC_2\) is convex in n for given Q and r. Putting \(\frac{\partial }{\partial Q}ETC_2=0\).

and solving with respect to Q we get

Now differentiating Eq. (8) over r using the Leibniz rule, we get

Putting \(\frac{\partial }{\partial r}ETC_2=0\), we get

Now taking second derivative of Eq. (8) over Q we get

Since \(1-\beta \ge 0\) and \(Dl-r>0\), the above expression is positive for all \(Q>0\). This shows that \(ETC_2\) is convex in Q. Now taking second derivative of Eq. (8) over r we get

provided \(-\rho \beta \int \limits _{r/D}^b(Dl-r)^2f(l){\mathrm {d}}l+\frac{D}{\beta ^4}>0\). This shows that \(ETC_2\) is convex provided \(\frac{D}{\beta ^4}>\rho \beta \int \limits _{r/D}^b(Dl-r)^2f(l){\mathrm {d}}l\). The cost function in Eq. (8) is non-linear and it is difficult to find the closed form to get the optimality. So we follow an iterative algorithm. Since the number of deliveries is a positive integer and we already proved that the convex nature of the cost function in n for both the cases. At first, the solution process can be started by setting \(n=1\). Then we need to find which case will be suitable for the problem. So first we start with Case 2. To find the extreme points Q and r from Eqs. (11) and (13) respectively, but Q and r are interlinked with each other. So we start the algorithm with \(n=1\) and \(Q=\sqrt{\frac{2DA}{h_v+h_b}}\) (simple EOQ formula) and finding r from Eq. (13). Then substitute r value obtained from the previous step into Eq. (11). Repeat this process until no change occur in the values of Q and r. Now we can say which case is suitable for the problem using the value of r. i.e., if \(r/D\ge b\) then this problem is suitable for Case 1 otherwise the problem is suitable for Case 2.

In our proposed model, if l follows a uniform distribution and the late delivery holding cost is not incorporated then, our model becomes the model proposed by Sajadieh and Akbari Jokar (2009). If l follows an exponential distribution then this model will be same as Sajadieh et al. (2009) model. We cannot compare our proposed model numerically to Hossain et al. (2017) model, because in Hossain model the late delivery cost is assumed in terms of time (\(c_p\) per unit time), whereas here we consider the extra holding cost at the vendor side due to the late delivery. Anyhow, our proposed model is general one when compare to Hossain in the sense of variable backorder, since Hossain assumed that, the shortages are completely backorder. If \(\beta =1\) then our proposed model will become Hossain model. In our proposed model, if \(\beta\) is any constant lies between 0 and 1, then it will become model of Lin (2016) for without investment case.

The algorithmic solution procedure can therefore be stated as follows.

3.4 Algorithm

-

1.

Set \(n=1\).

-

2.

Find r by solving Eq. (13) with respect to r using \(Q=\sqrt{\frac{2DA}{h_v+h_b}}\).

-

3.

Put Q in Eq. (13) and solve for r.

-

4.

Using this r, find Q from Eq. (11). Repeat this process until no change occur in the values of Q and r. This \((Q^*,r^*)\) is the optimal solution for given n. Find \(ETC_2\) using \((Q^*,r^*,n)\).

-

5.

Put \(n=n+1\) and go to step 1.

-

6.

Find \(n^*\) such that it satisfy \(ETC_2(Q^*,r^*,n^*-1)> ETC_2(Q^*,r^*,n^*)\le ETC_2(Q^*,r^*,n^*+1)\).

-

7.

This \((Q^*,r^*,n^*)\) is the optimal solution of the system. Substitute \(r^*\) value in Eq. (1) and find \(\beta ^*\). \(ETC_2(Q^*,r^*,n^*,\beta ^*)\) is the minimum total cost of the proposed model.

4 Numerical example

To illustrate the aforementioned searching procedure, we study a numerical example. All the numerical parameters are taken from Hossain et al. (2017), and we add \(\pi _0\), \(\rho\) as additional parameters.

Example 4.1

First assume that the lead time is uniformly distributed with the limits 0 to 35 days, i.e., \(l\sim U(0,35)\) days with other parameters \(D=1000\) units per unit time, \(B=400\) per setup, \(h_v=4\) per unit per unit time, \(A=25\) per order, \(h_b=5\) per unit per unit time, \(\pi =30\) per unit, \(\pi _0=50\) per unit and \(\rho =0.4\). According to algorithmic procedure, fix \(n=1\), and find \(Q=\sqrt{\frac{2DA}{h_v+h_b}}=74.54\). Now substitute Q in Eq. (13) and getting \(r=59.83\). Evaluate Q from Eq. (11) using \(r=59.83\). By using this Q, determine the value of r from Eq. (13). Repeat this process until no change occur in the values of Q and r, we get \(Q=421.01\) and \(r=33.51\). From this value of r we can find the backorder ratio \(\beta =0.8556\). This \((Q^*,r^*,\beta ^*)=(421.01,33.51,0.8556)\) is the optimal solution for given \(n=1\) and the total cost \(ETC_2(Q^*,r^*,\beta ^*)=ETC_2(421.01,33.51,0.8556)=2114.03\). Now put \(n=2\) repeat the same aforesaid procedure we get the optimal solutions \((Q^*,r^*,\beta ^*)=(228.57,43.36,0.9084)\), and the corresponding total cost \(ETC_2(Q^*,r^*,\beta ^*)=ETC_2(228.57,43.36,0.9084,2091.72)=2091.72\). Note that \(ETC_2\) for \(n=1\) is greater than \(ETC_2\) for \(n=2\). This assures \(n=1\) cannot be optimal, and now to check whether \(n=2\) is optimum or not, thus we need \(ETC_2\) for \(n=3\). Now fix \(n=3\) and we get the optimal solutions \((Q^*,r^*,\beta ^*)=(159.47,48.92,0.9328)\) and the corresponding total cost \(ETC_2=2194.04\). Therefore the optimal solutions are \((Q^*,r^*,\beta ^*,n^*)=(228.57,43.36,0.9084,2)\) and the minimum total cost is 2091.72. Also note that \(r^*/D=43.36/1000=0.0434\) years = 15.83 days, which is less than \(b=35\) days. Hence, this problem is suit for Case 2. For different values of \(\rho\), the optimal values are given below in Table 2. From Table 2, we observe that for any amount of shortages, for \(\rho =0\) and \(\rho =\infty\) we get \(\beta =1\) (completely backordered) and \(\beta =0\) (completely lost) respectively as per Eq. (1). The graphical representation of the total cost with respect to r is depicted in Fig. 4 for \(n=1\). This shows that the total cost is convex in r.

Example 4.2

Now assume that, if the lead time follows an exponential distribution with mean 18.25 days, which remains the limits 0 to \(\infty\) days, i.e., \(l\sim {\hbox {Exp}}(1/18.25)\), and other parameters are \(D=1000\), \(B=50\), \(h_v=1\), \(A=40\), \(h_b=4\), \(\pi =6\), \(\pi _0=10\) and \(\rho =0.4\). Here \(b=\infty\), and for all value of \(r^*\), \(r^*/D<b\). So, this example fit for Case 2. Using the algorithmic procedure, for \(n=1\) we get \(ETC_2(Q^*,r^*,\beta ^*)=ETC_2(247.61,10.93,0.5544)=874.35\), for \(n=2\), we get \(ETC_2(Q^*,r^*,\beta ^*)=ETC_2(190.96,20.02,0.5988)=868.36\) and for \(n=3\) we get \(ETC_2(Q^*,r^*,\beta ^*)=ETC_2(162.74,25.71,0.6258)=909.15\). Therefore the optimal solution of the system is \((Q^*,r^*,\beta ^*,n^*)=(190.96,20.02,0.5988,2)\) and the minimum total cost is 868.36. Sensitivity analysis on \(\rho\) is employed in Table 3. The graphical representation of the total cost with respect to r is depicted in Fig. 5 when \(n=1\).

Example 4.3

Finally, assume that if the lead time is normally distributed. Hoque (2013) states that, “probability of arrival of a batch earlier or late appears to be smaller than the probability of arrival of a batch in the mean lead time. Thus normal distribution of lead time seems to be a better fit to the problem”. Also he states that, in the exponential distribution, the probability of earlier arrival is higher than the probability of late arrival. Now, assume that the mean of the lead time is 35 days and the standard deviation is 4 days, which remains the limits 0 to \(\infty\) days, i.e., \(l\sim N(35,4^2)\). Other parameters are \(D=120{,}000\), \(B=1000\), \(h_v=1\), \(A=400\), \(h_b=1.25\), \(\pi =1.5\), \(\pi _0=3\) and \(\rho =0.4\). Like previous example, \(b=\infty\), here also \(r/D<b\) for all \(r>0\). Therefore the problem fits for Case 2. By algorithm we get the optimal solutions as \((Q^*,r^*,\beta ^*,n^*)=(16{,}767.17,10{,}513.42,0.1937,1)\) and the minimum total cost is 20,881.49. Sensitivity analysis on \(\rho\) is employed in Table 4.

In Table 5, we tabulate optimal solutions for different distribution and for different parameters. From Tables 2, 3, 4 and 5, it can be observed that, increasing the value of \(\rho\) will result in a decrease in the order quantity and reorder level. This will happen because if \(\rho\) increases will make the backorder ratio decreases to zero, thus the system will become completely lost case. So that to avoid the shortages, the reorder will increase. Also, increasing shortage and \(\rho\) will lead to the increasing the total cost. Most of all cases the increasing the shortage and \(\rho\) will not affect the number of shipments.

5 Conclusion

This article presents an integrated single buyer single vendor inventory control problem for generalized lead time distribution. The demand rate was assumed to be deterministic (constant), and the lead time was probabilistic variable with a known probability distribution. Unlike the existing vendor-buyer integrated models, the presented model assumed that the lead time to be a generalized stochastic variable. Furthermore the shortages are allowed and it will be backordered, and it depends on the amount of shortages. Previous works on the stochastic lead time, are focused only on completely backorder case, whereas this proposed model dealt with the partial backorder case. Also in this model, the extra holding cost due to late delivery was incorporated in the vendor side which is one of the practical aspect, where the vendor takes the full responsibility of goods in a good manner until they are delivered to the customer. We formulated the cost function as a nonlinear mixed integer problem to determine the EOQ, reorder level, backorder rate and the number of shipments. The convexity of total cost with respect to the Q, n and r are also provided and this revealed that the solution is a global minimum. This convexity holds for any probability distribution of lead time. We presented a step by step algorithmic procedure to find the optimal solutions. Numerical examples were also given, for different distributions such as uniform, normal, exponential and different parameters. Sensitivity analysis also provided for different value of \(\rho\).

The model can be further extended to multi-item inventory problems. Another extension that the authors are working on is to consider the stochastic demand together the stochastic lead time. It will be more relevant to the real market.

References

Ben-Daya M, Raouf A (1994) Inventory models involving lead time as a decision variable. J Oper Res Soc 45(5):579–582

Cárdenas-Barrón LE, Wee HM, Blos MF (2011) Solving the vendor–buyer integrated inventory system with arithmetic–geometric inequality. Math Comput Model 53(5–6):991–997

Cárdenas-Barrón LE, Teng JT, Treviño-Garza G, Wee HM, Lou KR (2012) An improved algorithm and solution on an integrated production-inventory model in a three-layer supply chain. Int J Prod Econ 136(2):384–388

Chung CJ, Wee HM (2008) An integrated production-inventory deteriorating model for pricing policy considering imperfect production, inspection planning and warranty-period- and stock-level-dependant demand. Int J Syst Sci 39(8):823–837

Fujiwara O, Sedarage D (1997) An optimal \((Q, r)\) policy for a multipart assembly system under stochastic part procurement lead times. Eur J Oper Res 100(3):550–556

Goyal SK (1977) An integrated inventory model for a single supplier-single customer problem. Int J Prod Res 15(1):107–111

He XJ, Kim JG, Hayya JC (2005) The cost of lead time variability: the case of the exponential distribution. Int J Prod Econ 97(2):130–142

Hossain MSJ, Ohaiba MM, Sarker BR (2017) An optimal vendor–buyer cooperative policy under generalized lead-time distribution with penalty cost for delivery lateness. Int J Prod Econ 188:50–62

Hoque MA (2013) A vendor–buyer integrated production-inventory model with normal distribution of lead time. Int J Prod Econ 144(2):409–417

Huang CK (2004) An optimal policy for a single-vendor single-buyer integrated production inventory problem with process unreliability consideration. Int J Prod Econ 91(1):91–98

Jokar MRA, Sajadieh MS (2008) Determining optimal number of suppliers in a multiple sourcing model under stochastic lead times. J Ind Syst Eng 2(1):16–27

Lee WC, Wu JW, Lei CL (2007) Optimal inventory policy involving back-order discounts and variable lead time demand. Int J Adv Manuf Technol 34(9):958–967

Lee W, Wang SP, Chen WC (2017) Forward and backward stocking policies for a two-level supply chain with consignment stock agreement and stock-dependent demand. Eur J Oper Res 256(3):830–840

Liberatore MJ (1977) Planning horizons for a stochastic lead-time inventory model. Oper Res 25(6):977–988

Lin YJ (2009) An integrated vendor–buyer inventory model with backorder price discount and effective investment to reduce ordering cost. Comput Ind Eng 56(4):1597–1606

Lin HJ (2016) Investing in lead-time variability reduction in a collaborative vendor–buyer supply chain model with stochastic lead time. Comput Oper Res 72:43–49

Nasri F, Affisco JF, Javad Paknejad M (1990) Setup cost reduction in an inventory model with finite-range stochastic lead times. Int J Prod Res 28(1):199–212

Ouyang LY, Wu KS, Ho CH (2007) An integrated vendor–buyer inventory model with quality improvement and lead time reduction. Int J Prod Econ 108(1):349–358

Paknejad J, Nasri F, Affisco JF (2005) Quality improvement in an inventory model with finite-range stochastic lead times. Adv Decis Sci 2005(3):177–189

Pan JCH, Yang JS (2002) A study of an integrated inventory with controllable lead time. Int J Prod Res 40(5):1263–1273

Sajadieh MS, Akbari Jokar MR (2009) An integrated vendor–buyer cooperative model under stochastic supply lead-time. Int J Adv Manuf Technol 41(9):1043–1050

Sajadieh MS, Jokar MRA, Modarres M (2009) Developing a coordinated vendor–buyer model in two-stage supply chains with stochastic lead-times. Comput Oper Res 36(8):2484–2489

Sajadieh MS, Thorstenson A, Jokar MRA (2010) An integrated vendor–buyer model with stock-dependent demand. Transp Res Part E Logist Transp Rev 46(6):963–974

Shu MH, Huang JC, Fu YC (2015) A production-delivery lot sizing policy with stochastic delivery time and in consideration of transportation cost. Appl Math Model 39(10):2981–2993

Sphicas GP, Nasri F (1984) An inventory model with finite-range stochastic lead times. Nav Res Logist 31(4):609–616

Tersine RJ (1982) Principles of inventory and materials management. North Holland, Amsterdam

Wangsa ID, Wee HM (2017) Impact of lead time reduction and fuel consumption on a two-echelon supply chain inventory with a subsidised price and pick-up policy. Int J Integr Supply Manag 11(2–3):264–289

Wu JW, Lee WC, Tsai HY (2007) Computational algorithmic procedure of optimal inventory policy involving a negative exponential crashing cost and variable lead time demand. Appl Math Comput 184(2):798–808

Yang MF (2010) Supply chain integrated inventory model with present value and dependent crashing cost is polynomial. Math Comput Model 51(5):802–809

Yano CA (1987) Stochastic leadtimes in two-level assembly systems. IIE Trans 19(4):371–378

Acknowledgements

The work of the authors are supported by Department of Science and Technology-Science and Engineering Research Board (DST-SERB), Government of India, New Delhi, under the Grant Number DST-SERB/SR/S4/MS: 814/13-Dated 24.04.2014.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ganesh Kumar, M., Uthayakumar, R. A two-echelon integrated inventory model under generalized lead time distribution with variable backordering rate. Int J Syst Assur Eng Manag 10, 552–562 (2019). https://doi.org/10.1007/s13198-019-00769-x

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-019-00769-x