Abstract

Data envelopment analysis (DEA) models applied to regional innovation systems (RIS) are predominantly focused on evaluating innovation efficiency through a two-stage approach that accommodates sub-processes of production and commercialisation. Focusing on the Portuguese RIS, a three-stage DEA model incorporates a new sub-process characterised by the disclosure of official information on innovation level, thus allowing to internalise the principle of ex ante regulation consecrated by European supranational law in regional innovation policies. The main finding reveals that results of the two-stage DEA differ from those of the three-stage DEA. In particular, the presence of perfect information on innovation level leads to a reduction of the mean innovation efficiency, but also decreases the innovation efficiency gap between peripheral and non-peripheral regions. A discussion related to the need of information disclosure on innovation level is provided to highlight the potential conflict between level and efficiency of innovation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The year 2006 was marked by a shift of paradigm in the conception of regional innovation policies in Portugal. For the first time in the country’s history, the Portuguese National Statistics Institute (INE) publicly released information on the innovation level of Portuguese Level II Nomenclature of Territorial Units for Statistical Purposes (NUTS II). A Synthetic Regional Development Index (ISDR) was created to measure the level of innovation in order to ensure a better policy support. The ISDR is based on a conceptual model characterised by a multidimensional vision of regional development being, thus, structured in three key components: competitiveness, cohesion and environmental quality. Each dimension compiles multiple indicators, which means that ISDR is a composite aggregator index. By the end of 2013, the original version was converted into a second version aimed at providing information on the innovation level of Portuguese NUTS III regions, which has guaranteed the persistence of perfect information on innovation level for a hierarchy of territorial organisation closer to local communities.Footnote 1 The main objective of this study is to evaluate the impact that the disclosure of information regarding innovation level has on the innovation efficiency of Portuguese NUTS III regions.

A regional innovation strategic policy framework defines priorities aimed at building competitive advantages relative to peers. A well-managed process ensures a good matching between research and innovation (R&I) own strengths and business needs to address emerging opportunities and market developments, while avoiding fragmentation and duplication of efforts. According to Foray (2014), smart specialisation strategies shall be developed in a context of synergistic involvement between managing authorities and multiple stakeholders (e.g. universities, industrial and social partners) to ensure that regional targets are successfully achieved. Since this step is subject to several difficulties in real-world practice, enforcement of ex ante regulation provides useful and concrete information on ‘how to act’ and ‘what to put’, thus diminishing the cost of learning and smoothing the inertia associated with decision making. In the absence of ex ante regulation applied to innovation level, firms risk not to deliver a sustainable impact assessment on the local economy, particularly without a well-conceived public policy strategy that provides information on regional assets and potential for businesses. Similarly, households can delay or even block consumption decisions that otherwise would foster regional economic growth. Consequently, linking information disclosure on innovation level with ex ante regulation constitutes a research gap that should be addressed motivated by the fact that regional innovation level is subject to multiple threats and conditionality, so that this regulatory principle constitutes the quickest and most transparent way to clarify doubts to interested parties in addition to promote a better and effective coordination between ex ante regional constraints, ongoing policy actions and ex post investment decisions.

According to Main (1992, p. 102), benchmarking is defined as the ‘art of finding out, in a perfectly legal and above-board way, how others do something better than you do – so you can imitate – and perhaps improve upon – their techniques’.Footnote 2 Hurmenlinna et al. (2002) and Dou (2004) consider that benchmarking through data envelopment analysis (DEA) represents a relevant systematic technique to evaluate regional efficiency by comparing the performance of a given spatial unit with the performance of the ‘best region in class’, thereby allowing to construct a technical efficiency frontier in the innovation production possibilities set (IPPS) of a Regional Innovation System (RIS). Moreover, it corresponds to a non-parametric method because the efficiency frontier is constructed based on real data rather than being estimated. DEA as a measure of efficiency is initially proposed by Farrell (1957). Thenceforth, Charnes et al. (1978) use DEA to assess the efficiency of schools in the United States of America (USA) through a model specification known as CCR. Banker et al. (1984) propose the BCC model that, differently from the CCR model, is characterised by the incorporation of variable returns to scale (VRS) to accommodate observed heterogeneity in the dimensionality of decision making units (DMUs).

A relevant extension to seminal contributions in the context of RIS performance is the multi-stage DEA. This approach consists of a technique whereby the innovation process is perceived as a complex phenomenon being, thus, divided in various sub-processes to provide clairvoyance on input-output relationships of a system. According to Kao (2014) and Carayannis et al. (2015), the innovation process is normally composed by two sub-processes: production and commercialisation. A two-stage DEA model implies that outputs of the production stage correspond to inputs of the commercialisation stage, which justifies the presence of intermediate indicators. In this study, we analyse and compare innovation efficiency scores of Portuguese NUTS III regions considering three different models under the assumption of VRS: one-stage DEA, two-stage DEA and three-stage DEA. The latter option is a novel refinement that consists of incorporating three sub-processes—information, production and commercialisation—whereby perfect information on innovation level of Portuguese NUTS III regions becomes a common knowledge. Hence, this study verifies whether the information release stage has explanatory power on innovation efficiency scores of Portuguese NUTS III regions.

From a technical point of view, this study demonstrates that information can act as a propagation mechanism of efficiency changes in multi-stage systems. According to Kao (2014) ‘most studies in the efficiency evaluation literature focus on a 2-stage approach’ (Carayannis et al. 2015, 254).Footnote 3 This statement suggests that the combination of production and commercialisation constitutes a sufficient condition to explain innovation efficiency trends. By deduction, innovation efficiency scores computed by two-stage DEA are expected to be coincident with innovation efficiency scores computed by DEA containing three or more stages. Hence, if the two-stage DEA model is a sufficient condition for the assessment of regional innovation efficiency, then additional stages are expected to lack a significant effect on the dependent variable. Otherwise, recognising that most studies follow a two-stage DEA model to analyse RIS efficiency would constitute a redundant claim. Consequently, one pretends to provide answers to the following research questions:

-

RQ1: Has the principle of ex ante regulation applied to the innovation level of Portuguese NUTS III regions increased the mean innovation efficiency in Portugal?

-

RQ2: Has the principle of ex ante regulation applied to the innovation level reduced asymmetries between Portuguese NUTS III regions in terms of innovation efficiency?

-

RQ3: Does the additional stage representative of the institutionalisation of the principle of ex ante regulation have explanatory power on the innovation efficiency of Portuguese NUTS III regions?

Main results are summarised as follows. From an economic point of view, one demonstrates that the transition towards a perfect information scenario on innovation level influences both the mean and range of innovation efficiency. In particular, one shows that the introduction of ex ante regulation has a significant and negative effect on innovation efficiency scores of Portuguese NUTS III regions. Moreover, the innovation efficiency gap between peripheral and non-peripheral areas is reduced. Given the policy-oriented nature of this study, useful recommendations are provided to ensure the persistence of best regulatory practices in a context characterised by strategic substitutability between innovation level and innovation efficiency. From a technical point of view, the mathematical treatment applied to the refinement provided by this study confirms that alternative approaches other than optimisation (e.g. probability theory) can be used in multi-stage systems subject to DEA, particularly when these are characterised by imperfect information.

The rest of this study is organised as follows. The “Background Literature” section provides the background literature. The “Mathematical Theory” section exposes the theory underlying multi-stage DEA models. The “Empirical Application” section presents the empirical application. The “Discussion” section discusses the contribution of this study. The “Conclusions” section concludes. Appendices A–C and Supplementary Material complement the analysis carried out in the main text and both can be freely downloaded in the journal’s website or in the following link: https://gitlab.com/vmsrib/information-value-multistage-dea.

Background Literature

For the sake of brevity, a detailed review on DEA literature is available for consultation in Appendix C. In what follows, we circumscribe ourselves on clarifying the most relevant contributions that support the analysis, which consists of applying DEA to evaluate the performance of Portuguese NUTS III regions.

Two main reasons justify the development of this study. First, the prevalence of a dichotomy between the impact of ex ante regulation on innovation level and the impact of ex ante regulation on innovation efficiency given that, despite the impact of ex ante regulation on innovation level corresponds to a direct effect, the effect of ex ante regulation on innovation efficiency turns out to be indirect.Footnote 4 This issue is important for policy making because, if such a dichotomy exists, then a trade-off in public policy can be identified.Footnote 5 Second, only a few studies analysed RIS performance to date. This scarcity is particularly identified in empirical studies applying DEA models to evaluate the innovation efficiency of regions. Kao (2014) provides a review focused on multi-stage DEA to reveal that the literature is characterised by a debate on how the innovation efficiency should be computed (e.g. additive versus geometric decomposition) and to show a concern on whether VRS or constant returns to scale (CRS) should be imposed. The author confirms that the decomposition of innovation in two or more sub-processes ensures better insights, particularly after the contribution of Rho and An (2007) where the authors demonstrate that the one-stage DEA model may imply inaccurate evaluation of efficiency. Li et al. (2012) also clarify that the standard DEA approach cannot offer the ability to identify the source of technical inefficiency.

Moreover, at least four debilities associated with the multi-stage DEA approach applied to RIS performance can be highlighted. First, initial contributions merely consider RIS as a single system (Zabala-Iturriagagoitia et al. 2007, 2008; Sharma and Thomas 2008; Matei and Aldea 2012; Foddi and Usai 2013). Second, although frequently combined with the multi-level environment, the multi-stage approach has been adopted in a reduced number of studies (Chen and Guan 2012; Kaihua and Mingting 2014; Carayannis et al. 2015, 2016). Furthermore, past studies differ by the set of inputs, outputs and scope of application. Third, despite the growth of smart specialisation strategies across European regions (Foray 2014), past studies disregard the administrative figure of NUTS III units as the hierarchical level of reference in territorial organisation for the evaluation of regional innovation efficiency and territorial innovation policies, which contradicts the recommendation provided by European Commission (2014). Consequently, in addition to the restrictive number of studies, previous research also neglects the critical threshold above which local dynamics are unlikely to be captured by DEA models focused on the evaluation of RIS performance. Finally, the practice of adopting a two-stage DEA approach to compute innovation efficiency seems to have been widely accepted and rapidly disseminated. As such, the present study analyses whether this standardised practice has empirical support.

Although there are some studies interconnecting innovation level and innovation efficiency in the regional context (e.g. Cooke et al. 1997; Fritsch and Franke 2004; Tödtling and Trippl 2005; Boschma 2015), their focus is restricted to theoretical explanations, which means that little attention has been given to modelling and measuring the impact of a public disclosure of innovation level on innovation efficiency. Moreover, the relation between innovation level and innovation efficiency at the regional level is usually taken as a given. In contrast, such a relation is endogenously determined in this study due to the incorporation of the information release stage.

Mathematical Theory

Let us detail the theory underlying multi-stage DEA models. Figure 1 clarifies the conceptual background, which is based on the premise that a given process is split into multiple sub-processes.

Following Kao and Hwang (2008), Wang and Chin (2010), Carayannis et al. (2015) and Carayannis et al. (2016), n DMUs are evaluated under a multi-stage approach. Each DMUj transforms m inputs xij, i = {1, …, m} into D2 intermediate outputs\( {\mathbf{z}}_{dj}^2 \), d = {1, …, D2}, in the second stage which become intermediate inputs of the third stage. These are then transformed into D3 intermediate outputs\( {\mathbf{z}}_{dj}^3 \), d = {1, …, D3}, in the third stage and so on until the last stage is reached, where one obtains s outputs yrj, r = {1, …, s}. Based on the previous notation, a multi-stage DEA model is mathematically expressed as follows:

where \( {\theta}_0^1 \), \( {\theta}_0^2 \) and \( {\theta}_0^M \) are efficiency scores of the first, second and Mth stage, respectively. One should also clarify that, under the case of output-oriented DEA with multiple stages, efficiency scores in all stages are input-based except in the last one, which is output-based (Carayannis et al. 2015, 2016).

To satisfy the research objective, one should confront two-stage DEA outcomes with those of the three-stage DEA model. This requires to internalise that the innovation process is not only characterised by production and commercialisation but also by an information release sub-process. Based on data availability, this case study holds a timing structure where outputs of the production (information) sub-process are used as inputs of the information (commercialisation) sub-process, respectively. Therefore, the multi-stage system is said to be characterised by partial ex ante regulation. From a regulatory standpoint, a three-stage DEA model allows to infer whether the release of official information on innovation level has influential power on innovation efficiency. The main theoretical result is summarised as follows.

Proposition 1 (impact of the principle of ex ante regulation in a multi-stage system). Let M − 1 represent the system absent of a stage that includes the ex ante regulation principle and let M represent the system where a representative stage of the ex ante regulation principle is incorporated. Regardless of the timing structure of the game (i.e. independently of the time period where the information release stage is introduced), the equilibrium is characterised as follows:

-

(I)

If \( {\overline{\theta}}_j^{M-1}<{\overline{\theta}}_j^M \), then applying the principle of ex ante regulation to the multi-stage system has a positive effect on the mean efficiency score.

-

(II)

If\( {\overline{\theta}}_j^{M-1}={\overline{\theta}}_j^M \), then applying the principle of ex ante regulation to the multi-stage system has a neutral effect on the mean efficiency score.

-

(III)

If\( {\overline{\theta}}_j^{M-1}>{\overline{\theta}}_j^M \), then applying the principle of ex ante regulation to the multi-stage system has a negative impact on the mean efficiency score.

Proof. Appendix B.

Empirical Application

Innovation efficiency scores of Portuguese NUTS III regions are evaluated. These consist of 25 units, 23 of which belong to the mainland and 2 correspond to archipelagos of Madeira and Açores. Assuming VRS, the innovation process is decomposed in:

-

(i)

One stage or sub-process: it corresponds to the seminal BCC model.

-

(ii)

Two stages or sub-processes: production and commercialisation.

-

(iii)

Three stages or sub-processes: production, information and commercialisation.

Data

Three different multi-stage models are analysed. First, the one-stage or single system DEA model is considered. At the NUTS III level {X11, …, X14} are used as inputs, while {Y11, …, Y13} are used as outputs, thus, 7 variables are considered in total, which satisfies the rule of thumb n ≥ max {m × s, 3(m + s)} proposed by Cooper et al. (2004).Footnote 6 Second, a two-stage DEA model is developed. Initial (intermediate) inputs correspond to 2011 (2014) data, while outputs correspond to 2015 data, respectively. Hence, we consider a three-year lag structure for the transformation of initial inputs into intermediate measures and a one-year lag structure for the transformation of intermediate inputs into outputs. The selection of variables is inspired in Chen and Guan (2012), Kaihua and Mingting (2014), Carayannis et al. (2015) and Carayannis et al. (2016). As clarified in Table 1, this model includes 4 initial inputs, 4 intermediate indicators and 3 outputs at the NUTS III level.Footnote 7

A three-stage DEA model is also constructed. This extension assumes that the release of official information on innovation level may have explanatory power on innovation efficiency. In particular, information regarding components of the ISDR (i.e. cohesion, competitiveness and environmental quality) is internalised. The year 2013 corresponds to the period where market agents have access to the official information on innovation level. Hence, we consider a 2-year lag structure for the transformation of initial inputs into the first group of intermediate variables, a one-year lag structure for the transformation of the first intermediate measures into the second group of intermediate variables and a 1-year lag structure for converting the second intermediate measures into outputs. Summary statistics are exposed in Table 2.

One concludes that data vary greatly from area to area (e.g. indicator Z11 at the NUTS III level ranges between 48 and 27,791 with a standard deviation equal to 7318.623). Consequently, the scale effect on innovation efficiency scores (i.e. the dimensionality of DMUs) must be taken into account, which implies that VRS should be imposed in all output-oriented DEA models. The ex ante adoption of VRS has been considered in previous studies (Shi et al. 2017) not only because the BCC model is more flexible (Bowlin 1998) but also due to evidence that such a consideration can be particularly relevant when spatial units have different sizes (Lobo et al. 2016) and present heterogeneous characteristics (Horta et al. 2016) as it seems to be the case of Portuguese NUTS III regions.

Finally, some raw data contain non-positive values. According to Cook and Zhu (2008), one can deal with non-positive data only under the assumption of VRS due to the translation invariance property. The idea of considering the use of the additive method stems from the fact that the VRS frontier does not change if we translate the negative input and output data into positive values (Ali and Seiford 1990). As such, the additive method is applied to indicators holding non-positive values (Pastor 1996).

Results

Global Overview

Total innovation efficiency and innovation efficiency scores by sub-process are summarised in Table 3.

From a technical standpoint, the discriminating power of the one-stage DEA model is low due to the reduced number of inputs and outputs compared to the number of DMUs; thus, 48% of the Portuguese NUTS III regions are at the efficiency frontier. This percentage is reduced to 40% when the innovation process is segmented in two sub-processes. Nevertheless, results suggest that both approaches overestimate innovation efficiency scores and, consequently, these may not be adequate to identify truly efficient regions.

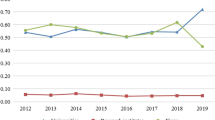

Though, Table 3 reveals that only 24% of the Portuguese NUTS III regions (Alto Tâmega, Oeste, Àrea Metropolitana (AM) Lisboa, Alentejo Litoral, Alto Alentejo and Região Autónoma (RA) Madeira) are at the efficiency frontier once including the information release stage. To provide clairvoyance on this outcome, which essentially reveals that innovation efficiency scores under a two-stage DEA model may not collapse with innovation efficiency scores under a three-stage DEA model, one should present a graphical illustration to identify main changes in innovation efficiency when there is a transition from the two-stage DEA model to the three-stage DEA model in addition to show descriptive statistics. Based on insights provided by proposition 1, Fig. 2 clarifies Portuguese NUTS III regions that benefit from the inclusion of the information release stage.

The establishment of ex ante regulation on innovation level implies a heterogeneous impact among Portuguese NUTS III regions. In particular, innovation efficiency scores of NUTS III regions belonging to the interior north and central regions of the country are improved, while the opposite is applied to innovation efficiency scores of NUTS III regions belonging to the northern coast and southern interior regions of the country as well as in Açores. A neutral effect is observed on innovation efficiency scores of NUTS III regions belonging to the southern coast of mainland Portugal as well as in Madeira.

Table 4 clarifies descriptive statistics related to innovation efficiency, which allows to infer the following generalised statement. Two main consequences result from the application of ex ante regulation in Portuguese NUTS III regions: reduction of the mean innovation efficiency and reduction of the innovation efficiency gap between peripheral and non-peripheral areas.

Economic Intuition

Impact on the Mean Innovation Efficiency Score in Portugal

Firstly, it is convenient to clarify the meaning of the finding related to RQ1. If the information release stage is not included, we would be artificially leveraging the country’s mean innovation efficiency. In other words, we would be signalling that Portugal is more efficient than it actually is. Secondly, the economic intuition behind this result can now be explained. The institutionalisation of the ex ante regulation principle in 2013 leads to the proliferation of perfect information with respect to innovation level of Portuguese NUTS III regions, which may or not improve innovation level depending on their specific characteristics. Ceteris paribus, Portuguese NUTS III regions holding a higher (lower) propensity to innovate tend to be endowed with a greater (fewer) amount of inputs and outputs, respectively. According to INE (2018), more (less) innovative NUTS III regions are predominantly concentrated in the coastal and south (northern and central interior) regions of the country, which are represented by the light grey (black) colour in Fig. 2, respectively. Consequently, the reduction of the mean innovation efficiency can be explained by the fact that innovation level and innovation efficiency are characterised by strategic substitutability, which means that the efficiency loss observed in Portuguese NUTS III regions with a higher level of innovation dominates the efficiency gain observed in Portuguese NUTS III regions with a lower level of innovation.Footnote 8

Impact on the Innovation Efficiency Gap Between Portuguese NUTS III Regions

Firstly, it is convenient to clarify the meaning of the finding related to RQ2. If the information release stage is not included, we would be artificially leveraging (reducing) the innovation efficiency score of Portuguese NUTS III regions represented by the light grey (black) colour in Fig. 2, respectively. In other words, we would be widening the gap between innovation efficiency scores of Portuguese NUTS III regions belonging to coastal or southern regions of the country relative to innovation efficiency scores of Portuguese NUTS III regions belonging to the interior north and centre regions of the country. Secondly, the economic intuition behind this result can now be explained. When market agents have total access to information on innovation level due to the application of ex ante regulation within the national jurisdiction, they are able to identify (i) regions more endowed with essential inputs that do not necessarily produce a substantial amount of output, (ii) regions more endowed with essential inputs that produce a substantial amount of output, (iii) regions less endowed with essential inputs that produce a substantial amount of output, and (iv) regions less endowed with essential inputs that do not necessarily produce a substantial amount of output.

Ceteris paribus, stakeholders (citizens and/or consumers) have the incentive to invest (live, work and/or consume) in regions of the type (ii) and (iii), respectively. This is because the development of new products, services or processes is dependent on the allocation of inputs (e.g. in the form of investment and/or consumption realisation) to regions characterised by a high level of output materialisation. The information release stage has the ability to influence any subsequent sub-process in multi-stage systems applied to the innovation process. Knowing that the new stage is introduced after production but before commercialisation, it follows that only the latter sub-process is expected to be subject to efficiency changes. Note, however, that this argumentation does not explain the reason for observing territorial convergence in terms of innovation efficiency.

The reduction of the innovation efficiency gap between peripheral and non-peripheral Portuguese NUTS III regions can be justified by three potential reasons. Firstly, exclusively due to the fact that innovative regions typically characterised by the presence of churn (i.e. entry of resources from other territorial areas) have a greater endowment of inputs, but the increase in terms of output materialisation is too weak. Since these regions are unable to produce a sufficiently high level of additional outputs, the reduction of innovation efficiency is inevitable. Secondly, exclusively due to the fact that non-innovative regions typically characterised by the absence of churn (i.e. exit of resources to other spatial units) have a reduced endowment of inputs, but the decrease in terms of output materialisation is even lower. Since these regions are subject to severe reduction of the amount of outputs relative to that observed in the amount of inputs, a higher innovation efficiency score is observed. Lastly, entry and exit of resources can simultaneously occur such that both dynamics can explain the territorial convergence in innovation efficiency.

The previous economic argumentation does not mean that investors and consumers neglect regions with a higher innovation efficiency due to the reduced endowment of inputs, but rather that they seek to migrate to regions characterised by production and/or commercialisation activities holding a high level of output materialisation. In this sense, results clearly indicate that INE acts as intermediate platform to help on the mitigation of asymmetric information problems affecting investment and/or consumption decisions by providing verification and trust to the market in the form of certified information. In actual regulatory practice, the reduction of information asymmetries can accommodate several forms (e.g. acknowledgment, validation of information, legal confirmation). Any action on this domain is said to be unambiguously positive regardless whether innovation level and innovation efficiency are strategic substitutes or not given that the establishment of ex ante regulation at the regional level constitutes a sufficient and necessary condition for the proliferation of market transparency and perfect competition. Therefore, despite not being unique, this principle is a relevant factor on the allocation of innovation efficiency throughout the Portuguese territory.

Technical Findings

Previous conclusions are reinforced through the observation of Fig. 3.

Under the one-stage DEA model, 72% of DMUs are above the efficiency score 0.8. This percentage decreases to 52% (48%) under the two-stage (three-stage) DEA model, respectively. Consequently, the three-stage DEA model removes a fraction of DMUs from the percentile closest to the innovation efficiency frontier. Under the one-stage DEA model, 20% of DMUs are between efficiency scores 0.3 and 0.8. This percentage increases to 32% (36%) under the two-stage (three-stage) DEA model, respectively. Consequently, the three-stage DEA model increases the concentration of DMUs in intermediate classes of innovation efficiency. Lastly, the observation of DMUs positioned below the efficiency score 0.3 is only verified under the application of two-stage and three-stage DEA models.

In relation to RQ3, one concludes that the analysis does not validate the claim that innovation efficiency scores obtained under a two-stage DEA model coincide with those obtained under a three-stage DEA model, which suggests that the information release stage has explanatory power on innovation efficiency. Note, however, that this conclusion is only applied to the case where the new stage is characterised by the disclosure of official information on innovation level. This result should not be immediately generalised since the goal of this study is precisely to show the importance of this specific stage for the assessment of RIS efficiency through DEA and, thus, indirectly highlight the relevance of recent efforts developed by the European Commission to ensure the persistence of best regulatory practices. Recent European history is marked by attempts to institutionalise several regulatory principles within national jurisdictions to reduce systemic risks and increase internal confidence (European Commission 2010). Moreover, the European Commission tendered a study to review different methods for estimating costs and benefits to ensure a higher degree of internal consolidation, which suggests a strong commitment of the supranational authority to improve the ex ante assessment of costs and benefits of regulation applied to a panoply of areas, including regional innovation (European Commission 2012).

Finally, differences in estimated innovation efficiency scores may not imply a loss of correlation among innovation efficiency scores derived from alternative DEA models. Correlation coefficients are exposed in Table 5, which are based on innovation efficiency scores of Portuguese NUTS III regions clarified in Table 3.

Table 3 shows that the three-stage DEA model provides largely different innovation efficiency scores compared to those of alternative DEA models. However, results exposed in Table 5 indicate that innovation efficiency scores under the three-stage DEA model have a significantly strong correlation with those under the alternative DEA models. Since the correlation is sufficiently high while innovation efficiency scores are quite different between the three-stage DEA model and alternative DEA models, one concludes that the stability of innovation efficiency scores is sensitive to the type of stage being introduced in a multi-stage system.

Robustness

There are two ways to confirm that previous findings are assertive, which intuitively reflects the need to validate that the release of information on innovation level has a significant effect on innovation efficiency scores of Portuguese NUTS III regions. Before providing econometric details, it is firstly convenient to explain the most important aspect that should be kept in mind. While the two-stage DEA model is said to be unrestricted, the three-stage DEA must be understood as a restricted model. This is because the information release stage is already embedded in innovation efficiency scores obtained with a three-stage DEA model, while the opposite holds for innovation efficiency scores obtained with a two-stage DEA model. Consequently, innovation efficiency scores computed by three-stage DEA are already influenced by the innovation level of Portuguese NUTS III regions, while innovation efficiency scores computed by two-stage DEA are expected to be negatively affected by a covariate capable of capturing the innovation level of Portuguese NUTS III regions (see Table 4).

Restricted and Unrestricted Models: Regressing Efficiency on Environmental Variables

The first option consists of being strictly focused on the two-stage DEA (i.e. unrestricted) model to confirm the statistical significance of a covariate that captures the dissemination of information on innovation level of Portuguese NUTS III regions and the respective impact on innovation efficiency scores. Additionally, we can also verify which covariates are statistical significant from a given set of independent variables. These shall be considered determinants of the innovation efficiency of Portuguese NUTS III regions. Examples of DEA applications on RIS performance include Chen and Guan (2012), Carayannis et al. (2015) and Carayannis et al. (2016). However, only the study of Fritsch and Slavtchev (2011) considers a two-step approach to estimate determinants of innovation efficiency based on cross-sectional data. To satisfy this purpose, Fritsch and Slavtchev (2011) adopt a stochastic frontier analysis (SFA) rather than multiple specifications for DEA, which is precisely the kind of procedure developed here.

Since innovation efficiency scores vary between 0 and 1, bilateral limits exist on the dependent variable. A Tobit regression is then the adequate model to evaluate the distribution of a dependent variable with this type of characteristic (Tobin 1958). Although this approach allows to obtain outcomes from which policy guidelines can be inferred, readers should be aware that alternative options exist for this second step of the two-stage DEA.Footnote 9 Dependent and independent variables considered for the Tobit regression are shown in Table 6. With the exception of percentages and indexes, covariates are transformed into logarithmic format in order to compare estimated coefficients since these can be interpreted as elasticities (Wooldridge 2013). Summary statistics are clarified in Table 7, while the correlation matrix is exposed in Table 8.

After estimating innovation efficiency scores of Portuguese NUTS III regions through a two-stage DEA in a first step, the set of final values is used as dependent variable of a regression analysis aimed at satisfying a twofold objective. One pretends to investigate whether the global ISDR, which is the representative covariate of regional innovation level, is statistically significant. If that is the case, then innovation efficiency scores of Portuguese NUTS III regions depend on the information disclosure of innovation levels. The sign of the estimated coefficient is expected to be negative since the mean efficiency score decreases with the transition to the three-stage DEA model (see Table 4). Moreover, although not being the main scope of research, this extension allows to identify determinants of the innovation efficiency of Portuguese NUTS III regions. Results are reported in Table 9.

Let us focus on outcomes related to the case where innovation efficiency (TO) corresponds to the dependent variable. First, global ISDR is statistically significant in all specifications, which suggests that the release of information on innovation level has explanatory power on the innovation efficiency of Portuguese NUTS III regions. As expected, innovation efficiency scores are negatively affected by the global ISDR. Second, mobility of labour force and effectiveness of anti-monopoly policies are statistically significant; thus, both correspond to determinants of regional performance.

Focus now on outcomes related to the case where production efficiency (PR) corresponds to the dependent variable. First, global ISDR never holds statistical significance, which suggests that the release of official information on innovation level does not influence production efficiency scores. Second, only the mobility of labour force is significant being, thus the unique determinant of production efficiency.

Let us also reflect on outcomes related to the case where commercialisation efficiency (CO) corresponds to the dependent variable. First, global ISDR is statistically significant after the inclusion of labour mobility, which suggests that the release of official information on innovation level has explanatory power on commercialisation efficiency scores. In particular, the dependent variable is negatively affected by the global ISDR. Second, mobility of labour force and effectiveness of anti-monopoly policies are significant, thus, both correspond to determinants of commercialisation efficiency.

Last but not least, two comments are in order. Firstly, despite the proliferation of market transparency on innovation level does not influence the production sub-process, it holds the ability to negatively modify commercialisation efficiency patterns in Portugal. This result, which is justified by the fact that the information release stage is imposed after the production stage but before the commercialisation stage, implies that the timing structure of sub-processes in multi-stage systems matters. In this case study, the information release stage is important to reduce the obfuscation of consumers, while it does not affect the behaviour of producers since these are already informed and installed in the majority of innovative regions when the information about innovation level becomes part of the public domain. Consequently, the global ISDR seems to accommodate a high opportunity cost that should not be neglected by specialists.

Secondly, knowing that model M5 is considered the optimal choice to assess determinants of innovation efficiency due to the fact that it holds the highest log pseudo-likelihood value, it follows that covariates global ISDR, anti-monopoly policies and labour mobility are statistically significant. The first one has a negative impact on the dependent variable (i.e. an increase in 1 percentage point (p.p.) implies a reduction of approximately 4.5 p.p. in innovation efficiency). The second and third ones have a positive impact on the dependent variable (i.e. when anti-monopoly policies increase by 1 p.p., innovation efficiency scores increase nearby 2.3 p.p., while an increase of 1 p.p. in non-permanent contracts leads to an increment of innovation efficiency scores in 1.2 p.p.). Therefore, a common denominator between statistically significant covariates is their elastic relation with the dependent variable.

Statistical Tests

The second option consists of simultaneously considering the three-stage DEA (i.e. restricted) model and the two-stage DEA (i.e. unrestricted) model to perform the log-likelihood ratio (LR) test to check for differences between both nested multi-stage nonparametric models (Bogetoft and Otto 2010). Again, model M5 corresponds to the optimal choice since it holds the highest log pseudo-likelihood value. The LR test (−1.25, p > 0.05) indicates that the null hypothesis cannot be rejected at the 0.05 critical level of statistical significance. Indeed, the test statistic is below the criticalchi-square statistic of 3.84 or, similarly, the observed p value exceeds the 5% confidence level. As such, the LR test suggests that the inclusion of the information release stage is not redundant, thereby allowing to confirm that this new stage has the ability to modify innovation efficiency scores of Portuguese NUTS III regions.

Discussion

Based on the main result of this study, this section pretends to reflect on two issues. Firstly, on the identification of a potentially relevant market characteristic for the formulation of optimal RIS policies. Secondly, on the dilemma between imperfect information and perfect information as a means of dealing with the trade-off between innovation efficiency and innovation level.

Identification of the Relevant Market Characteristic for the Formulation of RIS Policies

RIS literature is predominantly focused on discussing whether RIS policies should support bottom-up or top-down innovation processes. One of the main controversies relies on understanding whether the actor (i.e. the organisation level, which presupposes following a bottom-up principle) (Nilsson and Moodysson 2014; Zukauskaite et al. 2017) or the system (i.e. the local government, which presupposes following a top-down principle) (Sotarauta et al. 2017; Miörner and Trippl 2017; Njøs and Fosse 2018) should receive more financial, technical and non-technical support from public policies (Uyarra 2010) because, from a historical perspective, these cannot be simultaneously focused on both levels of actuation due to capacity constraints (Nauwelaers and Wintjes 2002). Similar reasoning is shared by recent debates on the balance between actors and system in the formulation and execution of RIS policies (Isaksen and Jakobsen 2016), regional development (Zukauskaite et al. 2017) and regional structural change (Isaksen et al. 2018), which suggests the persistence of strategic substitutability between both types of support measures.

Although important, the above discussion does not seem to capture the key determinant identified in this study for the formulation of RIS policies. Overall, three main reasons justify the necessity of revealing information on innovation level. First, economic realities currently move faster than political and theoretical ones. It seems clear the need to accept that economic interdependences require a faster and more coherent reaction from social agents, political planners and theoreticians. Second, the recent economic crisis that affected Europe had a strong impact on least favoured regions and exposed several concerns on the practical implementation of RIS policies, but not necessarily on conceptual explanations and theoretical definitions.Footnote 10 Third, information asymmetry is the main source of market failures in the economy (Akerlof 1970; Holmstrom and Tirole 1989), and this characteristic has a significant impact on the formulation of RIS policies and actual regulatory practice.

Role of the Information Value on the Formulation of RIS Policies and Market Dynamics

In the analysis of information, ex ante and ex post asymmetries are often discussed. Ex ante asymmetric information can be explained through adverse selection either in relation to the quality of goods in the product market or in relation to innovation efficiency scores in the context of RIS. Adverse selection is a situation where a member knows something about its own characteristics that the other part is unware. Adverse selection is often referred to as an ex ante hidden information problem where, for instance, the local population may know more about the endowment of inputs in the region compared to investors. Solutions available to correct market failures associated with adverse selection include reputation (i.e. higher innovative regions can build a reputation so as to ensure a degree of differentiation from peers), standardisation or specialisation (i.e. to mitigate the problem of building a reputation, regions can standardise the development of high quality inputs) and warranties.Footnote 11

In turn, ex post asymmetric information can be explained through moral hazard in signed contracts (e.g. hiring workers without effective knowledge of their level of effort). Moral hazard are ‘situations where one side of the market does not observe the actions of the other being, sometimes, referred to as a hidden action problem’ (Varian 1990, p. 589). The standard effect is the increased probability of undesired outcomes for one of the parties involved in the innovation process. Available solutions to correct market failures related to moral hazard include the adoption of deductibles (i.e. co-payments) depending on whether moral hazard increases the risk of a loss, respectively. Moreover, a governmental intervention through either taxes or subsidies may ensure proper incentives to reduce risks or improve the care taken by individuals (Rees 1989; Hillier 1997). Note that the applicability of DEA models to evaluate RIS performance has been undertaken relying on the critical assumption that economic agents are fully informed on innovation level, which can only occur if markets are characterised by perfect information (Stiglitz 1993). In a seminal contribution, Stigler (1961, p. 213) recognises that ‘information is a valuable resource: knowledge is power’. In this sense, access to information has the advantage of establishing welfare maximising actions in multiple domains. The uncertainty is reduced when information is viewed as a valuable economic factor, which has a positive influence on the aggregate utility level (Nicholson 1998). While several remedies exist for information asymmetries such as contingent contracts (e.g. liability contracts, warranties, signalling, certification and monitoring), most are generally not satisfactory (Nayyar 1990). Moreover, in case of inappropriate qualitative information released into the market, several distortions can emerge, namely a non-monotonic relation between innovation efficiency and innovation level.

In light of the previous argumentation, one may claim that the main concern that should be at the heart of the RIS debate is whether to disseminate reliable information on innovation level since this appears to constitute a critical step to enhance the effectiveness of smart specialisation strategies. Decisions on this domain are expected to have a substantial impact on the allocation of investment and resources, efficiency and level of innovations, economic growth rates and/or sustainable development of regions.

That being said, this study addresses strategic actions to correct associated market failures (e.g. negative externalities due to agglomeration effects), which should be implemented if and only if information disclosure on innovation level is deemed necessary. In case of strategic substitutability between innovation level and innovation efficiency, two cases are expected to prevail: on the one hand, if the goal of the policy maker is to promote convergence in innovation efficiency between peripheral and non-peripheral areas, then the release of official information on innovation level is desirable. However, the innovation level gap between peripheral and non-peripheral areas is expected to increase due to the movement of resources in favour of innovative regions; on the other hand, if the goal of the policy maker is to promote convergence in innovation level between peripheral and non-peripheral areas, then the release of official information on innovation level is ill-advised. Notwithstanding, the innovation efficiency gap between peripheral and non-peripheral areas is expected to increase.

In this sense, the observed heterogeneity in the formulation and implementation of RIS policies in Portugal can be explained in light of a public policy trade-off, whereby a policy maker either prioritises the efficiency of innovation relative to the level of innovation or vice-versa. As such, from a social welfare standpoint, strategic actions aimed at ensuring the proliferation of full transparency and perfect competition shall be considered positive by assumption. However, if these merely promote agglomeration effects on a restrictive number of regions that are already per se the most innovative ones, then caution is advised on the type of information disclosed to the market. Lastly, the main result in the “Empirical Application” section indicates that including the information release stage in DEA constitutes a necessary and sufficient condition to change innovation efficiency scores. This finding contradicts the dogma according to which innovation efficiency scores under a two-stage DEA model are coincident with those obtained under a DEA model composed by three or more stages.

Role of the Information Value on Multiple Elements of Different Helix Models

Ultimately, information asymmetries may imply that the best allocation of scarce resources can only be achieved through a public intervention, which suggests that strengthening interactive and collaborative networks between different elements of the double, triple, quadruple and quintuple helix models (i.e. industry, governments, academia, civil society and natural environment) can be socially desirable.

Governments are responsible for putting infrastructure in place to reduce transaction costs associated with the provision of inputs, goods and services in any geographical region. Governments either can take risks not assumed by the private sector or can create adequate regulations to ensure that every citizen makes good use and gets universal access to innovation outputs. Nevertheless, any type of public intervention is considered as a successful case if expected outcomes are effectively met. While the private sector has limitations due to the need to keep profits high, the governmental performance can also be disappointing. The major challenge is to promptly define the type of intervention that ensures the attainability of predefined targets. More than merely signalling the innovation level of a region, social planners have the responsibility to provide valuable information to effectively decrease information asymmetries between abstract (i.e. national) contexts and community-specific (i.e. local) realities.

Industry stakeholders analyse a considerable set of regional attributes before making investment decisions. According to Nayyar (1990), three types of quality standards are used to find them: search quality (i.e. attributes that can be determined prior to investment), experience quality (i.e. attributes that are determined after the investment realisation) and credence quality (i.e. intangible attributes that may be unable to evaluate even after R&D investment). Their mix moderates the role of information on the behaviour of investors. The availability of official information before investment realisation is considerably more important in the case of innovation products and services, which are high on experience and credence qualities since respective outputs are more difficult to assess. Indeed, the endowment and quality of inputs is expected to be directly proportional to the severity of consequences suffered from using inputs of less than anticipated endowment and quality (Nayyar 1990). Investors also seek information about existing training and human capacity of regions, either prior to investment realisation or by experience after being installed. However, search for information is frequently limited by costs. To dissuade this bias, investors can obtain valuable information through the word-of-mouth at the prospect stage (Nayyar 1990).

On this domain, one should highlight the importance of civil society and natural environment (Carayannis et al. 2016). Accordingly, the reputation of a region may be interpreted as a contract whereby concerns of local agents (e.g. consultancy staff) relative to future path developments are implicitly enforced. The information absorbed by investors is expected to determine the efficacy of reputation as a remedy to solve information asymmetries. The suggestion provided in this study is to complement such a local transmission by a reputation mechanism based on the release of official information on innovation level. Although being subject to the constraint of transferability, this strategic action developed by INE holds the characteristic of a public good. Once acquired by interested parties, it can be used perpetually and renewed periodically. It should be cautioned, however, that lapses in the determination of innovation efficiency scores can have a side effect contrary to the one desired. Indeed, as acknowledged in Riordan and Williamson (1985), bureaucratic distortions should not be jeopardised. Ultimately, social planners should balance the negative—internal—cost with the benefit from imposing the ex ante information principle in the domain of regional innovation policies.

Conclusions

This study provides a contribution for the literature focused on the measurement of regional performance by providing insights from the field of Industrial Economics. From a technical point of view, one improves the state-of-the-art of DEA studies applied to RIS performance by introducing a stage that discloses official information on innovation level. Innovation efficiency scores change when this new sub-process is included due to the promotion of market transparency through the elimination of information asymmetries on innovation level. More importantly, results from the empirical application indicate that the institutionalisation of the ex ante regulation principle in Portuguese NUTS III regions reduces the mean innovation efficiency. However, convergence between the innovation efficiency of peripheral and non-peripheral regions is also observed during the period 2011–2015.

These consequences reflect that the introduction of a sub-process aimed at releasing information on innovation level holds the ability to influence the dynamics of innovation efficiency. A lower mean innovation efficiency can be justified by the greater degree of transparency on innovation level. Within a context of global competition, Portuguese NUTS III regions are currently viewed as interesting investment opportunities, which has fostered a greater endowment of inputs that clearly surpasses the increase of outputs. In light of this study, the international recognition of Portuguese NUTS III regions can be attributed to the perfect information environment promoted by the public release of ISDR. A reduced innovation efficiency gap between peripheral and non-peripheral Portuguese NUTS III regions reflects that the net value added of territorial innovation (i.e. value resulting from the increase of inputs deducted by the increase of outputs) is greater in core regions. Consequently, ex ante regulation principle seems to have been fostering a stronger concentration of resources (i.e. inputs and outputs) in core regions. Lastly, one should highlight that a normative reflection on trade-offs between regional innovation asymmetries and sustainable development is out of the scope of this study, which is strictly based on a positive economic analysis.

Results also show that the disclosure of information on innovation level does not have explanatory power on production efficiency since evidence of significant effects is only found for the commercialisation sub-process. This is justified by the fact that the information release stage is introduced after the production sub-process, but before the commercialisation sub-process (i.e. partial ex ante regulation). Depending on data availability, an interesting task left for future research is to understand the effect of ex ante regulation when the information release stage is introduced before the production sub-process (i.e. full ex ante regulation scenario) and after the commercialisation sub-process (i.e. full ex post regulation scenario).

Another important conclusion is the confirmation of strategic substitutability between innovation level and innovation efficiency in Portuguese NUTS III regions, which suggests the persistence of a trade-off in public policy. When DEA is output-oriented, a region highly innovative may not be placed at the efficiency frontier due to the excessive endowment of inputs, which may not be compensated by sufficiently high amount of outputs. This reinforces the importance of multi-stage DEA approaches in the context of RIS performance given that the ability of not observing a given jurisdiction as a black box makes the evaluation of innovation efficiency more reliable. Nevertheless, readers should keep in mind that innovation efficiency scores are sensitive to the econometric approach, models and choice of variables made by the expert regardless of the sophistication brought by the new contribution. As such, this study has limitations and respective results should be viewed with caution.

Knowing that information asymmetry is recognised as the main source of market failures in the economy (Holmstrom and Tirole 1989), the analysis suggests that the main debate of RIS literature should not be restricted to the type of policies that one pretends to stimulate, but should also accommodate a discussion on the necessity of making information on innovation level publicly available to interested parties through permanent monitoring and/or mandatory access. Lastly, measures to dissuade market failures associated with the trade-off between innovation level and innovation efficiency should be indicated. One the one hand, one way to overcome it is to anticipate the public announcement of innovation level (e.g. from t + 2 to t + 1), which means that a given jurisdiction may have the incentive to take the political option of becoming first-mover by continuously monitoring the innovation level so as to ensure a quicker assessment of innovation efficiency scores.Footnote 12 If properly implemented in Portuguese NUTS III regions, a Stackelberg advantage may be conquered relative to other European peers, which facilitates the conversion of strategic substitutability into strategic complementarity due to the attraction of new exogenous resources (e.g. foreign direct investment). On the other hand, the creation of conditions for the valorisation of endogenous resources is also advised. However, this option is economically viable as long as it does not constitute a non-credible threat in the sense of Kreps and Wilson (1982), which is equivalent to say that productivity gains associated with the additional investment spent in local resources should dominate potential adverse effects.

Notes

See Appendix A.3 for details.

See Appendix A.4 for details.

Ceteris paribus, the principle of ex-ante regulation encourages an increase in innovation level of regions endowed with adequate local conditions for the proliferation of innovative activities due to the provision of a relevant condition (i.e. perfect information) for strengthening the collaboration between actors (e.g. firms, institutions, intermediary agencies), while promoting a decrease in innovation level of regions absent of adequate local conditions for the proliferation of innovative activities due to the disclosure of local incapacities for strengthening the collaborative network.

See Appendix A.5 for details.

Where n represents the number of DMUs, m represents the number of inputs and s represents the number of outputs.

See Appendix A.6 for details.

The dichotomy between innovation level and innovation efficiency within the Portuguese territory is empirically confirmed in the second step of DEA exposed in Subsection 4.3.

Similar to the present analysis, some previous studies consider a two-step DEA approach. The second step consists of an econometric analysis to examine the effect of environmental factors on innovation efficiency scores (Nasierowski and Arcelus 2003; Cullmann et al. 2011; Guan and Chen 2012; Chen and Guan 2012; Afzal 2014). Among these studies, Tobit has been the mostly widely used approach. However, Afzal (2014) and Matei and Aldea (2012) employed bootstrapping in the context of National Innovation Systems since this option ensures bias corrected estimations. As a robustness check, we also perform bootstrapping by resorting to the Stata command SIMARWILSON to conclude that the qualitative nature of results remains unchanged. Super-efficiency, which can produce a ranking of observations that compose the sample, has also been considered in Pan et al. (2010), Guan and Chen (2012) and Chen and Guan (2012).

The European Union (EU) has a relevant role in mobilising local resources and concentrating economic, social, cultural and innovative activities aimed at promoting regional growth and sustainable development. The main struggle relies on two dimensions: competitiveness (i.e. efficient use of factors and resources) and convergence (i.e. reduction of discrepancies between regions). Nowadays, about 33% of the total budget for cohesion and regional policy is allocated to convergence objectives. The main instrument used is structural funds, namely the European Regional Development Fund (ERDF), Cohesion Fund (CF) and Social Fund (SF). The absorptive capacity at the firm level is evaluated periodically within each national jurisdiction in order to identify whether convergence is ongoing and whether efficiency targets are being satisfied, while bearing in mind three priorities: (i) smart growth (by strengthening knowledge and innovation); (ii) sustainable growth (by ensuring efficient and competitive use of scarce resources); and (iii) growth based on social inclusion (by developing inhabitants’ knowledge and competences, promoting full employment of the labour force and alleviating poverty) (Eurostat 2017). This means that, despite the heterogeneity of RIS environments across Europe, different RIS policies combined with local-based smart specialisation strategies are defined to achieve common targets, namely a balanced view in diminishing disparities between and within regions, ensuring solidarity among European Member States, and strengthening the process of convergence. In this sense, it is clear that the theoretical goal of achieving common targets in the context of territorial heterogeneity is behind any doubt. However, the practical implementation of smart specialisation strategies can be subject to criticism.

As recognised in Pindyck and Rubinfeld (1989), higher innovative regions can overcome asymmetric information problems by signalling innovation level through extensive guarantees or warranty.

By definition, permanent monitoring occurs when the timeline converges to t or, similarly, when there is no time gap between the year in which the ISDR becomes public and the year to which the ISDR refer to. This is a reasonable consideration based on the existing technology (e.g. artificial intelligence).

References

Afzal, M. N. I. (2014). An empirical investigation of the national innovation system (NIS) using data envelopment analysis (DEA) and the TOBIT model. International Review of Applied Economics, 28(4), 507–523.

Ali, A. I., & Seiford, L. M. (1990). Translation invariance in data envelopment analysis. Operations Research Letters, 9(6), 403–405.

Akerlof, G. A. (1970). The market for lemons: Quality uncertainty and the market mechanism. Quarterly Journal of Economics, 84, 488–500.

Banker, R. D., Charnes, A., & Cooper, W. W. (1984). Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science, 30, 1078–1092.

Bogetoft, P., & Otto, L. (2010). Benchmarking with DEA, SFA and R. New York, NY: Springer.

Boschma, R. (2015). Towards an evolutionary perspective on regional resilience. Regional Studies, 49(5), 733–751.

Bowlin, W. F. (1998). Measuring performance: An introduction to data envelopment analysis (DEA). Journal of Cost Analysis, 15(2), 3–27.

Carayannis, E. G., Goletsis, Y., & Grigoroudis, E. (2015). Multi-level multi stage efficiency measurement: The case of innovation systems. Operational Research, 15, 253–274.

Carayannis, E. G., Goletsis, Y., & Grigoroudis, E. (2016). A multilevel and multistage efficiency evaluation of innovation systems: A multi-objective DEA approach. Expert Systems with Applications, 62, 63–80.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2, 429–444.

Chen, K., & Guan, J. (2012). Measuring the efficiency of China’s regional innovation systems: Application of network data envelopment analysis (DEA). Regional Studies, 46, 355–377.

Cook, W. D., & Zhu, J. (2008). Data envelopment analysis: Modeling operational processes and measuring productivity. USA: CreateSpace.

Cooke, P., Uranga, M. G., & Etxebarria, G. (1997). Regional innovation systems: Institutional and organisational dimensions. Research Policy, 26(4–5), 475–491.

Cooper, W. W., Li, S. L., Seiford, L. M., & Zhu, J. (2004). Sensitivity analysis in DEA. In Handbook on data envelopment analysis (pp. 75–97). Boston: Kluwer.

Cullmann, A., Schmidt-Ehmcke, J., & Zloczysti, P. (2011). R&D efficiency and barriers to entry: A two stage semi-parametric DEA approach. Oxford Economic Papers, 64(1), 176–196.

Dou, H. J. M. (2004). Benchmarking R&D and companies through patent analysis using free databases and special software: A tool to improve innovative thinking. World Patent Information, 26, 297–309.

European Commission (2010) Commission recommendation of 20 September 2010 on regulated access to next generation access (NGA) networks. Retrieved from here.

European Commission (2012) EU regulatory fitness. Retrieved from here.

European Commission (2014). Commission Regulation (EU) No 868/2014 of 8 August 2014 amending the annexes to Regulation (EC) No 1059/2003 of the European Parliament and of the council on the establishment of a common classification of territorial units for statistics (NUTS). Retrieved from here.

Eurostat (2017). Smarter, greener, more inclusive? Indicators to support the Europe 2020 strategy — 2017 Edition. Retrieved from here.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society A, 120, 253–281.

Foddi, M., & Usai, S. (2013). Regional knowledge performance in Europe. Growth and Change, 44(2), 258–286.

Foray, D. (2014). Smart specialisation: Opportunities and challenges for regional innovation policy. London, LO: Routledge.

Fritsch, M., & Franke, G. (2004). Innovation, regional knowledge spillovers and R&D cooperation. Research Policy, 33(2), 245–255.

Fritsch, M., & Slavtchev, V. (2011). Determinants of the efficiency of regional innovation systems. Regional Studies, 45, 905–918.

Guan, J., & Chen, K. (2012). Modeling the relative efficiency of national innovation systems. Research Policy, 41(1), 102–115.

Hillier, B. (1997). The economics of asymmetric information. Hampshire, HA: Macmillian Press.

Holmstrom, B. R., & Tirole, J. (1989). The theory of the firm. In Handbook of industrial organization (pp. 61–133). Massachusetts, MA: MIT University Press.

Horta, I. M., Camanho, A. S., & Dias, T. G. (2016). Residential building resource consumption: A comparison of Portuguese municipalities' performance. Cities, 50, 54–61.

Hurmenlinna, P., Peltola, S., Tuimala, J., & Virolainen, V. M. (2002). Attaining world-class R&D by benchmarking buyer–supplier relationships. International Journal of Production Economics, 80, 39–47.

Instituto Nacional de Estatística (INE) (2018). Indice Sintético de Desenvolvimento Regional: 2018. Retrieved from here.

Isaksen, A., & Jakobsen, S. (2016). New path development between innovation systems and individual actors. European Planning Studies, 25(3), 355–370.

Isaksen, A., Tödtling, F., & Trippl, M. (2018). Innovation policies for regional structural change: Combining actor-based and system-based strategies. In A. Isaksen, F. Tödtling, & M. Trippl (Eds.), New avenues for regional innovation systems-theoretical advances, empirical cases and policy lessons (pp. 221–238). Cham, CH: Springer.

Kaihua, C., & Mingting, K. (2014). Staged efficiency and its determinants of regional innovation systems: A two-step analytical procedure. Annuals of Regional Science, 52, 627–657.

Kao, C., & Hwang, S.-N. (2008). Efficiency decomposition in two-stage data envelopment analysis: An application to non-life insurance companies in Taiwan. European Journal of Operational Research, 185(1), 418–429.

Kao, C. (2014). Network data envelopment analysis: A review. European Journal of Operational Research, 239(1), 1–16.

Li, Y., Chen, Y., Liang, L., & Xie, J. (2012). DEA models for extended two-stage network structures. Omega, 40, 611–618.

Lobo, M. S. D. C., Rodrigues, H. D. C., André, E. C. G., Azeredo, J. A. D., & Lins, M. P. E. (2016). Dynamic network data envelopment analysis for university hospitals evaluation. Revista de Saúde Pública, 50, 22.

Kreps, D. M., & Wilson, R. (1982). Sequential equilibria. Econometrica, 50(4), 863–894.

Main, J. (1992). How to steal the best ideas around. Fortune, 126(8), 102–106.

Matei, M. M., & Aldea, A. (2012). Ranking National Innovation Systems According to their technical efficiency. Procedia - Social and Behavioral Sciences, 62, 968–974.

Miörner, J., & Trippl, M. (2017). Paving the way for new regional industrial paths: Actors and modes of change in Scania’s games industry. European Planning Studies, 25(3), 481–497.

Nasierowski, W., & Arcelus, F. J. (2003). On the efficiency of national innovation systems. Socio-Economic Planning Sciences, 37(3), 215–234.

Nauwelaers, C., & Wintjes, R. (2002). Innovating SMEs and regions: The need for policy intelligence and interactive policies. Technology Analysis & Strategic Management, 14(2), 201–215.

Nayyar, P. R. (1990). Information asymmetries: A source of competitive advantage for diversified service firms. Strategic Management Journal, 11, 513–519.

Nicholson, W. (1998). Microeconomic theory: Basic principles and extensions. Florida: Dryden Press.

Nilsson, M., & Moodysson, J. (2014). Regional innovation policy and coordination: Illustrations from southern Sweden. Science and Public Policy, 42(2), 147–161.

Njøs, R., & Fosse, J. K. (2018). Linking the bottom-up and top-down evolution of regional innovation systems to policy: Organizations, support structures and learning processes. Industry and Innovation, 1, 1–20.

Pan, T. W., Hung, S. W., & Lu, W. M. (2010). DEA performance measurement of the national innovation system in Asia and Europe. Asia-Pacific Journal of Operational Research, 27(3), 369–392.

Pastor, J. T. (1996). Translation invariance in data envelopment analysis: A generalization. Annals of Operations Research, 66(2), 91–102.

Pindyck, R. S., & Rubinfeld, D. I. (1989). Microeconomics. New York: Macmillian.

Rees, R. (1989). Uncertainty, information and insurance. In J. D. Hey (Ed.), Current issues in microeconomics. HA Macmillian: Hampshire.

Rho, S., & An, J. (2007). Evaluating the efficiency of a two-stage production process using data envelopment analysis. International Transactions in Operational Research, 14, 395–410.

Riordan, M. H., & Williamson, O. E. (1985). Asset specificity and economic organization. International Journal of Industrial Organization, 3, 365–378.

Sharma, S., & Thomas, V. (2008). Inter-country R&D efficiency analysis: An application of data envelopment analysis. Scientometrics, 76, 483–501.

Shi, X., Li, Y., Emrouznejad, A., Xie, J., & Liang, L. (2017). Estimation of potential gains from bank mergers: A novel two-stage cost efficiency DEA model. Journal of the Operational Research Society, 68(9), 1045–1055.

Sotarauta, M., Beer, A., & Gibney, J. (2017). Making sense of leadership in urban and regional development. Regional Studies, 51(2), 187–193.

Stigler, G. J. (1961). The economics of information. Journal of Political Economy, 69, 213–225.

Stiglitz, J. E. (1993). Economics. New York: W. W. Norton & Company.

Tobin, J. (1958). Estimation of relationships for limited dependent variables. Econometrica, 26, 24–36.

Tödtling, F., & Trippl, M. (2005). One size fits all? Towards a differentiated regional innovation policy approach. Research Policy, 34(8), 1203–1219.

Uyarra, E. (2010). What is evolutionary about ‘regional systems of innovation’? Implications for regional policy. Journal of Evolutionary Economics, 20(1), 115–139.

Varian, H. R. (1990). Intermediate microeconomics: A modern approach. New York: W. W. Norton & Company.

Wang, Y. M., & Chin, K. S. (2010). Some alternative DEA models for two-stage process. Expert Systems with Applications, 37, 8799–8808.

Wooldridge, J. M. (2013). Introductory econometrics: A modern approach. Mason: Cengage Learning.

Zabala-Iturriagagoitia, J. M., Voigt, P., Gutiérrez-Gracia, A., & Jiménez-Sáez, F. (2007). Regional innovation systems: How to assess performance. Regional Studies, 41, 661–672.

Zabala-Iturriagagoitia, J. M., Gutiérrez-Gracia, A., & Jiménez-Sáez, F. (2008). Benchmarking innovation in the Valencian community. European Urban and Regional Studies, 15(4), 333–347.

Zukauskaite, E., Trippl, M., & Plechero, M. (2017). Institutional thickness revisited. Economic Geography, 93(4), 325–345.

Acknowledgments

Ribeiro is based at the Faculty of Economics of the University of Porto. Varum and Daniel are both based at the Department of Economics (DEGEIT), University of Aveiro. Authors appreciate suggestions and comments of the Editor-in-Chief Elias G. Carayannis and three anonymous referees, which were important to improve the quality of this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

ESM 1

(PDF 692 kb)

Rights and permissions

About this article

Cite this article

Ribeiro, V.M., Varum, C. & Daniel, A.D. Introducing microeconomic foundation in data envelopment analysis: effects of the ex ante regulation principle on regional performance. J Knowl Econ 12, 1215–1244 (2021). https://doi.org/10.1007/s13132-020-00661-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-020-00661-1