Abstract

The purpose of this paper is to contribute to the literature on stock markets and energy prices by studying the impact of oil price changes in the stock market returns of five developed countries (USA, Germany, France, Italy, and Japan) and five emerging countries (Tunisia, Argentina, Thailand, Brazil, and Jordan). A panel data approach is employed for the period covering January 2004 to December 2014. The methodology used in this paper is an international multi-factor model which allows for both unconditional and conditional risk factors to investigate the impact of the effects of the oil price risk and market risk of the stock market returns depending on whether the returns for each risk factor are increasing or decreasing. In the long-term, the oil price beta is significant for five developing markets only when the oil prices are up and they have not much effect on the emerging market for both up and down markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Although there is a rich literature on the relationship between energy price and the macroeconomic aggregates, the analysis of the relationship between oil price and the financial markets fell into a second position. One of the reasons appearing in this context is that the researchers have often considered the hypothesis of the financial market efficiency. This hypothesis assumes that the price of financial assets includes all the available information, including public and exogenous information related to the oil price within this framework, the oil price-related information is directly incorporated in the price of the financial assets.

The extent in which the stock markets are affected by the oil price can be explained by referring to the theory of the equity value where the share price is obtained by discounting the expected future cash flows at a rate demanded by investors. Business cash flows and discount rates reflect the economic conditions (inflation, interest rates, production cost, income, economic growth and financial market confidence, etc.) which can be influenced by the oil shocks (Apergis and Miller 2009;Park and Ratti 2008. As a result, stock prices may significantly react to structures in the evolution of oil price.

In recent decades, many researchers have shown that oil price shocks have significant effects on the macroeconomic variables in most developed countries (Cunado and Gracia 2005; Balaz and Londarev 2006; Gronwald 2008; Cologni and Manera 2008; Kilian 2008; Lardic and Mignon 2006, 2008). However, much remains unknown about the response of oil price risk in other emerging countries which have not been studied and where the creation of stock markets, such as Brazil, Argentina Tunisia, Jordan, and Thailand, is relatively recent. These countries are chosen in our study because they are different from those of other emerging countries, especially the Gulf Cooperation Council (GCC) ones in that they are oil net importers.

In addition, the main purpose of this paper is to study the long-term dynamic interactions between oil prices and stock returns in five emerging markets (Brazil, Argentina, Tunisia, Jordan, and Thailand) and compare their results with those of developed countries such as (Germany, USA, Italy, France, and Japan), using a multi-factor approach that allows for both conditional and unconditional developed by Basher and Sadorsky (2006). Our study is among the very few ones dealing with a panel data set of developed and emerging markets. The investigation of the comparative analysis is based on the knowledge of the structure of the economy of these countries and the absence of the literature review. On the other hand, the determination of a comparative analysis between emerging and developed countries is interesting for several reasons:

First, the emerging countries are not major players in the global market supply compared to the oil-producing ones since their stock markets are likely to be less sensitive to oil price variations than those of the developed countries.

Second, the emerging markets are different from the developed ones in that they are less integrated into the global financial market and are extremely less susceptible to regional political events.

As a consequence, studying the influence of oil price shocks on the profitability of financial assets in two very different regions enables both investors and authorities to understand the evolution the stock markets depending on the evolution of oil prices.

Our main results are as follows. First, we noted a neutral relationship in the long term in the up and down oil market between the beta of the oil market and the excess returns in the emerging countries, Second, and unlike the emerging countries, the developed countries exhibit a significant long-run relationship when oil markets are up.

Literature Review

The risk-return relationship in the stock market and the reaction of the stocks to a variety of risk factors has been studied by many authors. There are two theories to estimate the relationship between risks and returns; these are the Capital Asset Pricing Model (CAPM) and the Arbitrage pricing Model (APT). In both models, the expected returns are linearly related to risk factors and risk premiums.

The literature that used a model to a single factor can be classified into two groups: Studies that use unconditional single-factor models based on Sharpe (1964), Lintner (1965), Black (1972), and Fama and MacBeth (1973); and studies that use conditional single-factor models based on Pettengill et al. (1995). On the other hand, studies that expand the set of risk factors to examine the effect of the macroeconomic variables (as systematic risk factors) on the stock returns use an unconditional multi-factor model such as the APT developed by Ross (1976).

In the first instance, the CAPM model is used to verify the impact of non-diversifiable risk (also known as systematic risk or market risk) on the stock market returns. This model was introduced by Treynor (1961, 1962) and Sharpe (1964), who built by Markowitz (1952), developed further by Lintner (1965), Mossin (1966), and Black (1972); and extended by Fama and MacBeth (1973). This model is a three-step portfolio approach which is a single-factor model that based on only one risk factor, the market risk, and does not take other risk factors. The stock risk is one of the systematic risk factors in the stock market, which is cannot be eliminated by diversification. Ross (1976) tried to verify that market risk is not the only element that could measure the systematic risk of the stock returns. He developed the CAPM and created a multi-factor asset pricing model, Arbitrage Pricing Theory (APT), as an alternative to the CAPM.

In the second instance, and according to Chen et al. (1986), the APT models a linear relationship between an asset’s expected return, market risk, and other external risk factors such as macroeconomic factors which can have an impact on the asset returns. The APT model explored a set of economic state variables, for instance market returns and oil prices as systematic risk factors. This model analyzed the relationship between these risk factors and the US stock returns and found a strong relationship between them. Their results showed that the returns are exposed to the systematic economic news.

In the third instance, Pettengill et al. (1995) showed that when the realized returns are used instead of the expected returns to estimate the CAPM, the effect of the risk parameters beta in the returns must be conditional on the relationship between the realized market returns and the risk-free rate. They therefore introduced a conditional relationship between parameter beta and the realized returns as an alternative approach to the one used by Fama and MacBeth (1973). They determined whether the direction of the market is “up” or “down” based on the relationship between the realized market returns and the risk free rate, and separated the “up” market from the “down” market to create a conditional relationship between the risk factors and the realized returns. Whether the market is up or down depends on the effect of the risk factors in the realized returns. Whether the market is up or down depends on the risk-free rate, if it is positive or negative. When the excess market returns are positive, the stock market is “up” and when the excess market returns are negative, the stock market is “down”. If the excess market returns (or premium) are positive, the relationship between beta and the returns will be positive. Moreover, if the excess market returns are negative, the investor will hold the risk-free asset, which has a low beta, and the relationship between beta and the return will be negative. Thus, while the relationship between the expected returns and risk is always positive. Thus, while the relationship between the expected returns and risk is always positive, the one between the realized returns and risk can either be positive or negative depending on the market excess returns.

Empirically, several studies have been developed to analyze the impact of oil prices on the stock returns in the developed countries. Today, emerging countries have become more dependent on the volatility of oil prices. In fact, most studies have been carried out in Russia, Brazil, South Africa, Asian countries (China, India), and the GCC. The findings of these studies showed that these emerging countries are likely to be more affected by the volatility of oil prices than the developed countries. According to official statistics by the International Monetary Fund, economic growth in the emerging economies outpaced growth in the developed ones during the Subprime crisis.

The GDP of the developed countries in 2009 decreased by 3.6 %, while that of the emerging countries increased by 1.7 %. Moreover, some other forecasts indicate that emerging economies accounted for about 50 % of World GDP in 2050 (Chen and Chen 2007). On the other hand, in the emerging countries, particularly in India, China, Brazil, and Russia, the world oil demand increased annually on an average of 1153 million barrels per day during the 2001–2010 period. However, there is still much to be done about the other emerging countries such as Jordan, Tunisia, Thailand, and Argentina. Hence the objective of this research is to study the impact of oil price beta on the stock market returns in these countries, then compare them with those of the developed ones, such as the USA, Germany, France, Italy, and Japan. To answer this question, we state the following hypothesis:

H1/Equity returns in emerging countries (Brazil, Argentina, and Thailand) are influenced by oil prices at the same level of than developed countries (USA, Japan, Germany, France, and Italy).

Methodology and Data

Data

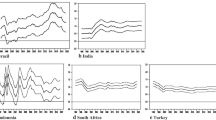

In this study, we examine the effect of oil price volatility on the stock market returns during the period between January 2004 and December 2014. The starting date of the sample period is determined by the availability of monthly stock market returns.

The data of this present study consist of monthly closing per country and the Morgan Stanley Capital International (MSCI) World Index. The countries included in the study are five emerging markets and five developed countries. The data are similar to those used by Harvey and Zhou (1993). For the emerging countries, we retained Argentina, Brazil, Jordan, Tunisia, and Thailand and for the developed countries we retained USA, Germany, France, Japan, and Italy. Finally, we use the spot monthly crude oil prices of the West Texas Intermediate (WTI) in dollars per barrel. All of the data are in the US dollar (Table 1).

The vulnerability of a country to a rise in oil prices depends on oil importers. According to this table, the USA is the largest importer of oil. In fact, in 2014, it was found to be the largest consumer of oil. It differs from the other OCDE members whose consumption deceased for nearly 10 years under the concomitant effect of the economic downturn and energy efficiency policies.

The Japanese economy is heavily industrialized and relies heavily on oil as an energy source. As a consequence, it is the second largest oil importer after the USA with about 5.3 % of the total consumption of the world’s oil. According to the 2009 International Energy Agency report, the oil imports stood at 3.408 mbd. The growth of oil import is no longer supported by the developed countries, said the Organization for Economic Co-operation and Development (OECD), but supported by emerging countries like Brazil and Thailand. According to the scenario of the International Energy Agency (IEA), the annual rate of imported oil in Thailand was on average 793,900 (thousand bpd) in 2011, while the same rate for Tunisia and Jordan was only 68,320 and 3680 (thousand barrels per day). Thailand was more dependent on changes in oil prices with net imports of 793,900 in 2011.

Methodology

In order to investigate the relationship between oil price risk and the emerging and developing stock market based on Basher and Sadorsky (2006), a CAPM model that allows for conditional and unconditional risk factors is employed for returns.

The First Step: the Estimated Coefficients Beta

In the first step, we estimate the beta coefficients (the market beta and the oil price beta) on the risk factors for each country using the rolling regression method. In particular, we estimate Eq. (1) using a rolling fixed window length of 600 trading days (approximately 5 years of monthly trading data).

The model takes the following form:

The monthly return R it is measured by:

Where i is the country, t is the time, R it is the return of the stock market i on time t, α is a constant, R m,t is the excess market return, R o,t is the oil price return,ε it is the error term, and β it is the reaction of return stock market i to risk factor x at time t. Obviously, β 1it and β 2it are estimated coefficients denoting the market beta and the oil price beta.

The Second Step: the OLS Regression

In the second step, a pooled data set consists of the stock returns and the risk factor betas for each country from Eq. (1) using panel data estimation.

Model 1: Relationship between stock returns and risk factors (market beta and oil price beta)

The unconditional model:

Equation 3 is an unconditional relationship between return and risk factors (market beta and oil price beta).

Where β it is the coefficient estimated from the first step for each country in time t.

The conditional model:

Where D1 is a dummy variable equal to 1 when excess market returns are positive (up market) and 0 otherwise (down market). The other dummy variables are similarly defined for each risk factor.

D2 is a dummy variable that is equal to 1 when oil price returns are positive and 0 otherwise. A priori, it is expected that γ1 '(γ1 ' ') andγ2 ' (γ2 '') each has positive (negative) signs. The symmetry between the up and down markets can be tested for the hypothesis that γ1 '+γ1 ' '= 0 versus the alternative, γ1 '+γ1 ' ≠ 0. In a similar manner, the symmetry between the up and down oil price changes can be tested from the hypothesis that γ2 '+γ2 ' ' = 0 versus the alternative, γ2 '+γ2 ' ≠ 0.

Model 2: The relationship between stock returns and risk factors (market beta, oil price beta, and total risk)

The unconditional and conditional relationship between stock returns and risk incorporating total risk, respectively, is given by Eqs. (4) and (5).

The unconditional model:

Where β it is the coefficient estimated from the first step for each country in time.

μ2 is country i’s total risk. Total risk represents a combination of systematic risk and the unsystematic risk. In your paper, the total risk is measured using the standard deviation of stock market returns.

The conditional model:

Model 3: The relationship between stock returns and risk factors (market beta, oil price beta, and skewness)

The unconditional model:

Where μ3 is country i’s relative skewness coefficients risk factors.

The conditional model:

Model 4: The relationship between stock returns and risk factors (market beta, oil price beta, and kurtosis)

The unconditional model:

Where μ4 is, country i’s relative kurtosis coefficients risk factors.

The conditional model:

Empirical Results

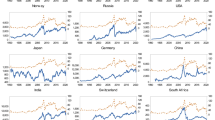

Table 2 provides descriptive statistics of the variables used. For developed countries, Germany and France have the highest mean returns averaging at 0.0046 and 0.0017, respectively. Italy has the smallest average daily returns of −0.0013. Regarding volatility, the higher values occur in Italy (0.0676) and Germany (0.0691).The lowest standard deviation, in contrast, occurs for the USA stock returns (0.0446) and for Japan stock returns (0.0486). Regarding skewness, we can see that the coefficient of skewness is negative in all cases, which means that the distributions are skewed to the left. The kurtosis is greater than 3 in all cases, implying that all performance series are leptokurtic.

For the emerging economies, the lowest dividend yield is attributed to the Brazil with an average of 0.0003, while most the highest means returns is recorded in Argentina with 0.0118. In terms of the standard deviation, the lower value is observed on the Jordan stock exchange of 0.0546 while the highest is observed on the stock exchange of Argentina with a standard deviation of 0.1186.

This high volatility in the emerging countries may be explained by the limited number of listed companies, a limited number of investors, various economic, and non-transparency of information. From Table 3, it can be noted that the skewness coefficient is negative in most cases except in the case of Jordan, that is to say the distribution of returns is asymmetric shifted left. This indicates that the market activity in these markets has more negative than positive impacts during the period analyzed. The kurtosis is greater than 3 in all cases; this means that all series are leptokurtic performance, Harvey (1995) showed that the distribution of emerging market returns is not normal with a negative skewness and kurtosis a greater than 3, which means a higher risk of loss in terms of the probability value.

MSCI World Market Index | Spot West Texas Intermediate (WTI) | |

Mean | 0.0040617 | 0.0020427 |

Max | 0.103504 | 0.076672 |

Min | −0.2112785 | −0.1514388 |

Std-Dev | 0.0454403 | 0.0357448 |

Skewness | −1.232526 | −1.439618 |

Kurtosis | 6.645888 | 6.974916 |

Jarque-Bera | 31.40 | 36.40 |

Prob | 0.000 | 0.000 |

ADF Unit root test | ||

t-Statistic | −9.162943 | −6.809817 |

Test critical values: 5 % | −2.883579 | 0.0000 |

PP Unit root test | ||

t-Statistic | −9.301461 | −6.832121 |

Test critical values: 5 % | −2.883579 | −2.883579 |

The global market performance with the lowest standard deviation 0.045 illustrates the benefits of portfolio diversification. It is important to note that the period of our study is very volatile in the global stock market due to the Asian crisis of 1997–1998, the bursting of a speculative bubble in the US housing market in 2000, the introduction of the euro in 1999, the financial crisis in 2008, and the Arab revolution in 2011.

WTI brut oil price is characterized by positive average returns of 0.0020427 and a standard deviation of 0.0357448 which means that there is an upward trend in oil prices during the last decade.

The Jarque-Bera test statistics rejects the null hypothesis of normality in all the countries and oil price at 1 % significance level. This non-normality is also evident from the skewness and kurtosis coefficients. In order to determine the order of integration of the variables, the Phillips-Perron and Dickey-Fuller tests are used to check the existence of unit roots. The results for both tests show that all the oil and financial series levels are non-stationary, and are also stationary in the first differences at the 5 % level.

Table 4 reports the correlation matrix between risk factors. The correlation statistics indicate a positive relation between the developed countries’ stock returns and the MSCI World except for Germany (−0.031), which is consistent with CAPM theory. In addition, the stock returns in the USA show the highest correlation 0.067 with the changes in oil prices. This could be due to the fact that the USA is one of the largest world oil consumers. These correlations are positive for most developed countries, suggesting that oil price increases over the last decade were seen as indications of higher expected economic growth and corporate earnings in the developed market. This implies that equity returns in the developed countries and changes in oil prices move in the same direction and interpret new information in the same way between oil price changes and stock returns.

The correlation between equity returns in the emerging countries and oil prices has different degrees; Argentina, Brazil, Jordan, and Tunisia are positively correlated with changes in oil prices. This means that their equity returns do not vary in the same direction with oil prices. The analysis of the correlation matrix between the stock markets in Thailand and the change in oil prices are not high of −0.107. This suggests that there are international diversification strategies of portfolios of significant interest in terms of risk reduction. The highest correlation is 0.199 in Brazil. This means that diversification of this market allows of significant gains for the international investors and help to reduce the total risk of their portfolios.

Regarding the correlation with the market risk, we noticed that Thailand has a very high positive correlation of −0.011 with the market risk, while the negative correlation and the lowest is recorded in Thailand with a value of −0.157.

The Results of the Estimation

We estimate four unconditional and four conditional models. Model 1 investigates the relationship between the returns and all the systematic risk factors (market risk, oil price risk). Models 2 and 3 add skewness and kurtosis, respectively, as risk factors, respectively, to model 1. Model 4 evaluates the relationship between all the risk factors and returns. We estimate four models for both unconditional and conditional cases. The results of this OLS method are displayed in Tables 5 and 6.

The results of Hausman test for the unconditional and conditional models, respectively, for the five emerging countries (Brazil, Argentina, Thailand, Tunisia, and Jordan) allowed us to conclude that the individual effect is fixed and not random with a probability = 0.000 < 0.01. The F-statistic of the regression is not significant except for model 4. A low goodness of fit (R-squared) mean there are other macroeconomic factor which can influence the emerging stock returns.

The results from all of unconditional models show that the estimated coefficient on the market beta is negative and statistically insignificant. These results are in agreement with the paper by Pettengill et al. (1995), Isakov (1999), Fletcher (2000), Hodoshima et al. (2000), and Tang and Shum (2003). The estimated coefficient on the oil prices risk factor is positively related to returns, but the relationship is insignificant in all unconditional models indicating that at a monthly frequency, oil price risk factor is not an important driver of excess stock market returns in emerging markets. These results from beta oil prices are not similar to the study of Basher and Sadorsky (2006) in establishing a positive and significant relationship between returns and oil beta in emergent markets. By contrast, the estimated coefficient for the total risk and skewness to the risk-return relationship of the emerging markets is statistically insignificant (Table 3). However, the estimated coefficient for the kurtosis is an insignificant factor with a negative coefficient of −0.147185.

The results of models 2 and 4 (Table 6) show the conditional version of each model. Some of the down and up market beta shows an insignificant correlation with the emerging excess market returns except for model 4. However, conditional oil betas show almost a non significant correlation with the emerging excess market returns except for model 2. The result on market betas is not similar to that of Hodoshima et al (2000) who found that model fits are better in the down markets than in the up markets.

Hausman test is used to select either fixed or random effects models (Greene 2008). The results of Hausman test for the unconditional and conditional models, respectively, for the five developed countries (USA, Germany, Italy, France and Japan) made us to conclude that the individual effect is fixed and not random with a probability =0.000 < 0.01. The R-square was about 0.028 which implied that oil price and other variables accounted for about 28 % of variation in stock prices. F-statistic showed that the model used in this study was relevant and significant at 1 % level except for model 1.

According to the results of our conditional models, the risk-return relationship is the same in the up markets, and both of them are positive and statistically significant at a 5 % level but are negative and insignificant in the down market. This result shows that developed markets with higher risk receive higher returns compared to markets with lower risk.

This result is consistent with that of Pettengill et al (1995), Isakov (1999), Fletcher (2000), Basher and Sadorsky (2006), and Tang and Shum (2003) who found a positive relationship in the down market. However, this result is inconsistent with the studies of Sinaee and Moradi (2010), who found a positive relationship between market risk and returns in both the up and down markets during the period 2003 to 2005.

The results about the oil price risk factor are mixed. The oil price risk factor is statistically insignificant and positive in the unconditional models estimated with monthly data except for model 2. This coefficient is also positive and significant in all the conditional models in the up markets, but is negative and significant in the down markets except for model 3. In contrast, when oil prices are up, the relationship between oil price beta and returns are found positive (in three out of the six models studied). This result is found in previous studies, such as those of Jones and Kaul (1996), Sadorsky (1999), Huang et al. (1996), El-Sharif et al. (2005), and Naifar and Dohaiman (2013). Since oil constitutes a substantial input for many industries, its price increase leads to economic crises by creating significant cost-push inflation, and consequently reduce stock returns.

Model 4 presents the results of adding skewness and kurtosis to the risk-return relationship. The unconditional model shows that skewness is negatively related to returns, and the relationship is significant. The conditional model also shows a weak relationship where the estimated coefficients of skewness are statistically negative and insignificant for both up and down markets. The overwhelming rejection of skewness indicates that it does not play a significant role in the development market monthly asset returns. This result is inconsistent with that of Tang and Shum (2003) who documented that skewness is a significant factor for conditional returns in up and down markets.

However, the results of the unconditional model show that the coefficient of kurtosis is positive and significant at a 10 %. In contrast, the results of the conditional model show that kurtosis is positively related to realize returns in the up and down markets, but the estimated coefficient is not significant. These results are similar to those of Tang and Shum (2003) who found that kurtosis does not play a significant role in the pricing asset returns.

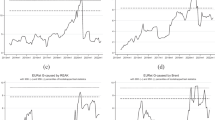

We implement five different types of panel root tests: the Lintner (1965) test (LLC), the Breitung (2000) test, the Im et al. (2002) test (IPS), and the Fisher-type ADF and Phillips-Perron (PP) tests. The results are based on the inclusion of an intercept and trend. The results of panel unit root tests in level and one order of differentiation are reported in Table 7.

For the oil beta and the market beta, Levin, Lin and Chu, Im, Pesaran and Shin W-stat, ADF–Fisher Chi-square, and PP–Fisher Chi-square suggest no unit roots but again the other tests fail to reject the null hypothesis in the levels. However, the emergent stock returns and the developed stock returns are I (0). On the other hand, significant evidence of non-stationary is suggested by five different types of panel root test.

Generally, based on the results of these panel unit root tests, it is clear that all our variables contain a unit root in level and become stationary after first differencing. Thus, all our variables are indeed I (1), which indicates that the series in the panel are integrated of order 1.

We then implemented the panel cointegration tests proposed by Pedroni (2004) to test for the existence of a long-run cointegrating relationship between the average returns and the two beta variables. This is a residual-based test for the null of a cointegration in heterogeneous panels. This is a residual-based for the null of a cointegration in heterogeneous panels. Two series of statistics are considered in the context of the Pedroni test (Table 8). The first set of three statistics is based on pooling the residuals along the within dimension of the panel, while the second set of statistics is based on pooling the residuals along the between dimension of the panel. It allows for a heterogeneous autocorrelation parameter across the members.

The results show that the null hypothesis of no cointegration is rejected by Panel v-Statistic, Panel PP-Statistic, Panel ADF-Statistic, Group PP-Statistic, and Group ADF-Statistic for the developed stock returns.

However, for the emergent stock returns, the two types of homogenous and heterogeneous panel cointegration except Panel v-Statistic, Panel rho-Statistic, and Group rho-Statistic reveal that the null hypothesis of no cointegration is rejected at a threshold meaning 1 % during the period 2004–2014.

From the obtained results, five out of the seven proposed statistics conclude in favor of the existence of cointegration for emerging and developed stock returns. Therefore, these panel cointegration tests point out to the existence of a long run relationship between the oil beta and the emerging and developed stock returns.

Given that our variables are cointegrated, the next step is the estimation of the long-run relationship. The OLS estimator is a biased and inconsistent estimator when applied to cointegrated panels. Therefore, Pedroni (2000, 2001, 2004) suggests the estimation of the long-run relationship using the FMOLS approach. This last not only generates consistent estimates of the β parameters in small samples but also controls for the likely endogeneity of the regressors and serial correlation.

For the emerging countries, the R-squared of the conditional and unconditional models is not significant. On the other hand, the results in Table 10 for the developed countries show that R-square was about 0.01. In the conditional model, in all cases the R-square have increased. Compared to the unconditional model, the influence of oil price fluctuations is lower when using conditional model. Next to goodness of fit, it is important to test for autocorrelation. In the last line in Tables 9 and 10, the result of the Durbin-Watson test is presented. The Durbin-Watson test statistic is equal to 1.5 in all cases, indicating no autocorrelation because this value is very close to 2.

First, we present the long-term relationship estimates for the emerging countries (Table 9). The results show that oil price estimates are not significant in the conditional and unconditional models. The estimated coefficients for the market beta are insignificant in the conditional and unconditional models. The total risk estimating the conditional relationship in the model 2 provides negative and statistically significant coefficients of 10 % with a coefficient of −0.0253, in the up markets.

Secondly, we also examine the nature of the long-term relationship between oil prices and equity returns in the developed countries (Tables 9 and 10). In the unconditional relationship, the estimated coefficients for the market beta are positive and significant except for model 1, while the estimated coefficients for the beta oil are positive and not significant except for model 2. This result is not consistent with that of Asteriou and Bashmakova (2013) who found a long-term negative coefficient for 10 Central and Eastern Europe. In the conditional model, the market beta is insignificant when the stock market returns are rising, whereas the oil price beta coefficient is positive and significant when the yields are rising. This suggests that equity returns in the developed countries are sensitive to the volatility of oil prices when the movement direction is positive.

The sensitivity of the stock markets to the market risk, to the risk of oil prices, and to the total risk is studied in model 2. The results indicate that there is no long-term relationship between the stock market returns and the total risk in the conditional model. This result is consistent with the results of Asteriou and Bashmakova (2013).

The long-term relationship between the stock market returns, the market risk, the oil price risk, and asymmetry as an additional risk measurement are studied in model 3. The estimation results show no significant reaction between the stock returns and the asymmetries in the conditional model. This result is consistent with those of Asteriou and Bashmakova (2013). As for the flattening, the estimated model 4 gives positive and not significant coefficients in the conditional model.

Conclusion and Policy Implications

There is a growing body of literature per country and per region on the relationship between the stock market return and oil price volatility. In this regard, most studies have focused on the most advanced emerging countries (India, China, Brazil, Mexico, and Russia). Very few studies have focused on other countries at the beginning of their emergence (Jordan, Tunisia, Thailand, and Argentina).

The purpose of this article is to study the relationship between the stock markets returns and oil price volatility for two different regions according to their degree of growth by using an international multi-factor model that allows for conditional and unconditional risk factors. Our paper is a particularly comparative analysis between five developed economies (USA, France, Japan, Germany, and Italy) and five emerging countries (an Asian (Thailand), two Latin American (Argentina, Brazil), an African (Tunisia), and a Middle Eastern (Jordan)).

This idea is an important and an interesting contribution to the study because the weight of the emerging countries in global GDP increased from 27.4 % in 1992 to over than 40 % in 2011 and reached more than 45 % in 2007 according to the IMF.

For the emerging countries, the results appear to be robust, and our FMOLS estimation reveals that the oil price beta does not cause an impact on the stock returns of the five emerging markets. Our estimates are consistent with the empirical literature (see, e.g., Huang et al. 1996; Henriques and Sadorsky 2008; Apergis and Miller 2009; Sukcharoen et al. 2014). In addition, this result means that the information contained in the oil price indexes cannot improve the forecast of the equity market index in these countries. This can be achieved by developing rational asset allocation strategies between the five emerging equity markets and by utilizing oil as a defensive hedging strategy in case of equity market turmoil. Another plausible explanation is that the emerging stock market indices are dominated by non-oil industries such as telecommunications and construction which are less dependent on oil.

These empirical results, findings have practical implications and relevancy for both institutional investors and retailers operating in these five countries, in particular, and for policymakers, in general. Indeed, recent financial liberalization agendas put into practice by these five emerging states were successful in making their domestic economies grow faster along with more trading activities in their distinctive stock markets. It is in the best interest of the five states to speed-up their financial reform measures, including privatization programs and enhancing prudential regulations and policies, so as to make their five equity markets more perceptible and efficient in processing and divulging information. This ramification of these results for decision-makers is that crossing-out of restrictions and barriers to the influx of foreign capital to emerging equity markets is expected to improve and enhance growth and liquidity in these financial markets. This is because more liquid capital markets offer lower borrowing costs of emerging entities aspiring to raise equity funds domestically. Moreover, international financial institutions will be willing to diversify their portfolios by tapping the five emerging financial markets in order to diversify across countries with a wide range of risk/return alternatives.

However, some other conclusions suggest that both positive and negative effects of crude oil on the stock market returns may not easily be transmitted to stock prices as in the case of the developed countries. This is justified by the lack of liquidity in the emerging stock markets, which represents a hurdle to risk transmission from oil to local stocks.

Unlike the emerging countries, the developed countries exhibit a significant long-run relationship when oil markets are up, this result will be of interest for empirical models of forecasting and for theoretical models that require as a pre-requisite a cointegrating relationship between oil price and the stock market. In addition, this result may be explained by the highest economic growth in these countries that are characterized by the presence of some oil and gas listed firms consuming an important quantity of energy and may thus be heavily dependent on oil production and supply. More precisely, unfavorable changes in oil prices would reduce their economic performance, leading to lower their diversification benefits because of less cash-flow generated by firms’ activities.

From an investment point of view, this result shows that the oil market and the stock markets in developed countries are more integrated than in the emerging countries. This implies that the expected benefits of investment strategy between the developed countries and oil stocks are low. Thus, investors in the developed countries should seek other foreign countries for new investment opportunities in order to build efficient portfolios. In addition, the significant relationship between the oil prices and the stock prices implies some degree of predictability in the stock markets of the developed countries. As a consequence, effective speculation and arbitrage strategies can be developed in light of our empirical results.

Nevertheless, our study has some limitations related mainly to the data and the used estimation model. First, according to Sadorsky (1999), the CAPM model does not highlight the dynamic relationship between oil prices and stock market returns. This limit was incorporated by Haung et al. (2005) who used a multivariate model to test the impact of oil price volatility on the stock market returns.

Second, we use daily data instead of weekly data. According to several authors, such as Mohamed El Hedi Arouri and Christophe Rault (2012), the weekly data may adequately capture the interaction between oil and stock prices in the region.

Third, by using a group of five emerging countries and five developed countries, a recent paper argues that there is a relationship between oil prices and the stock returns. This suggests that this relationship is not always clear. An analysis by country of this link would be informative to examine the robustness of the findings.

References

Apergis, N., & Miller, S. M. (2009). Do structural oil-market shocks affect stock prices? Energy Economics, 31, 569–575.

Asteriou, D., & Bashmakova, Y. (2013). Assessing the impact of oil returns on emerging stock markets: a panel data approach for ten Central and Eastern European Countries. Energy Economics, 38, 204–211.

Arouri, M. E. H., & Rault, C. (2012). Oil prices and stock markets in GCC countries: Empirical evidence from panel analysis. International Journal of Finance and Economics, in press.

Balaz, P., & Londarev, A. (2006). Oil and its position in the process of globalization of the world economy. Politicka Economie, 54, 508–528.

Basher, S. A., & Sadorsky, P. (2006). Oil price risk and emerging stock markets. Global Finance Journal, 17, 224–251.

Black, F. (1972). Capital market equilibrium with restricted borrowing. The Journal of Business, 45, 444–454.

Breitung, J. (2000). The local power of some unit root tests for panel data. In B. Baltagi (Ed.), Advances in econometrics: non stationary panels, panel cointegration, and dynamic panels (Vol. vol, 15, pp. 161–178). Amsterdam: JAI Press.

Chen, N. F., Roll, R., & Ross, S. A. (1986). Economic forces and the stock market. Journal of Business, 59, 383–403.

Chen, S. S., & Chen, H. C. (2007). Oil prices and real exchange rates. Energy Econ. 29, 390--404.

Cologni, A., & Manera, M. (2008). Oil prices, inflation and interest rates in a structural cointegrated VAR model for the G-7 countries. Energy Economics, 30, 856–88.

Cunado, J., & Gracia, F. P. (2005). Oil prices, economic activity, and inflation: evidence for some Asian countries. Energy Economics, 25, 137–154.

El-Sharif, I., Brown, D., Burton, B., Nixon, B., & Russell, A. (2005). Evidence on the nature and extent of the relationship between oil prices and equity values in the UK. Energy Economics, 27, 819–830.

Fama, E. F., & MacBeth, J. D. (1973). Risk, return, and equilibrium: empirical tests. Journal of Political Economy, 81, 607–636.

Fletcher, J. (2000). On the conditional relationship between beta and return in international stock returns. International Review of Financial Analysis, 9, 235–245.

Greene, W. H., (2008). Econometric analysis. 6th Edn.: Pearson Prentice Hall.

Gronwald, M. (2008). Large oil shocks and the US economy: infrequent incidents with large effects. Energy Journal, 29, 151–71.

Harvey, C. R. (1995). The risk exposure of emerging equity markets. World Bank Economic Review, 9(1), 19–50.

Harvey, C. R., & Zhou, G. (1993). International asset pricing with alternative distributional specifications. Journal of Empirical Finance, 1, 107–131.

Henriques, I., & Sadorsky, P. (2008). Oil prices and the stock prices of alternative energy companies. Energy Economics, 30, 998–1010.

Hodoshima, J., Garza-Gomez, X., & Kunimura, M. (2000). Cross-sectional regression analysis of return and beta in Japan. Journal of Economics and Business, 52, 515–533.

Huang, B., Hwang, M. J., & Hsiao-Ping, P. (2005). The asymmetry of the impact of oil price shocks on economic activities: An application of the multivariate threshold model. Energy Economics, 27(3), 455--476.

Huang, R. D., Masulis, R. W., & Stoll, H. R. (1996). Energy shocks and financial markets. Journal of Futures Markets, 16, 1–27.

Im, K. S., Pesaran, M. H., & Shin, Y. (2002). Testing for unit roots in heterogenous panels. University of Cambridge: Discussion Paper.

Isakov, D. (1999). Is beta still alive? Conclusive evidence from the Swiss stock market. The European Journal of Finance, 5, 202–212.

Jones, C. M., & Kaul, G. (1996). Oil and the stock markets. J. Financ. LI (2).

Kilian, L. (2008). The economic effects of energy price shocks. Journal of Economic Literature, 46, 871–909.

Lardic, S., & Mignon, V. (2006). Oil prices and economic activity: an asymmetric cointegration approach. Energy Economics, 34, 3910–3915.

Lardic, S., & Mignon, V. (2008). Oil prices and economic activity: an asymmetric cointegration approach. Energy Economics, 30, 847–855.

Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics, 47, 13–37.

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7, 77–91.

Mossin, J., (1966) Equilibrium in a capital asset model. Econometrica, 35(4), 768–783

Naifar, N., & Dohaiman, M. S. (2013). Nonlinear analysis among crude oil prices, stock markets’ return and macroeconomic variables. International Review of Economics and Finance, 27, 416–431.

Park, J., & Ratti, R. A. (2008). Oil price shocks and stock markets in the US and 13 European countries. Energy Economics, 30, 2587–2608.

Pedroni, P. (2000). Fully modified OLS for heterogeneous cointegrated panels. Advance Economic, 15, 93–130.

Pedroni, P. (2001). Purchasing power parity tests in cointegrated panels. The Review of Economics and Statistics, 83, 727–731.

Pedroni, P. (2004). Panel cointegration: asymptotic and finite sample properties of pooled time series tests, with an application to the PPP hypothesis. Economic Theory, 20, 597–625.

Pettengill, G., Sundaram, S., & Mathur, I. (1995). The conditional relation between beta and return. Journal of Financial and Quantitative Analysis, 30, 101–116.

Ross, S. A. (1976). The arbitrage theory of capital asset pricing. Journal of Economic Theory, 13, 341–360.

Sadorsky, P. (1999). Oil price shocks and stock market activity. Energy Economics, 2, 449–469.

Sharpe, W. F. (1964). Capital asset prices: a theory of market equilibrium under conditions of risk. Journal of Finance, 19, 425–442.

Sinaee, H., & Moradi, H. (2010). Risk-Return Relationship in Iran Stock Market. International Research Journal of Finance and Economics, ISSN 1450--2887 Issue 41.

Sukcharoen, K., Zohrabyan, T., Leatham, D., & Wu, X. (2014). Interdependence of oil prices and stock market indices: a copula approach. Energy Economics, 44, 331–339.

Tang, G. Y. N., & Shum, W. C. (2003). The conditional relationship between beta and returns: recent evidence from international stock markets. International Business Review, 12, 109–126.

Treynor, JL. (1961) Market value, time, and risk. Rough Draft, 95–209. Unpublished manuscript.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Algia, H., Abdelfatteh, B. The Conditional Relationship between Oil Price Risk and Return Stock Market: a Comparative Study of Advanced and Emerging Countries. J Knowl Econ 9, 1321–1347 (2018). https://doi.org/10.1007/s13132-016-0421-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-016-0421-5