Abstract

This paper studies the multi-deteriorating item discrete supply chain to realize considerable savings by aggregating the replenishment. The present integrated replenishment policy has already been widely applied in a variety of industries. This study deals with an integrated multi-deteriorating item replenishment problem with preservation effort and discrete demand rate and discrete order quantity. Most existing studies about preservation effort focused on a single-item replenishment policy. However, integrated replenishment has been extensively applied in many industries to take advantage of economies of scale in preservation. Since it is difficult to solve this problem directly, the necessary and sufficient conditions with these properties are derived; a solution procedure and an algorithm using heuristic approach are developed to obtain the optimal solutions. Numerical examples, comparative analysis and sensitivity analyses are also provided and tested to elucidate the multi-deteriorating item discrete supply chain model with preservation efforts. The results reveal that the extensions of the model provide a wider and reasonable situation in practice, so that the annual channel profit can be maximized.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The company will be probably proud to create a truly efficient leanness company of operations, revamped the processes, reducing overhead and cutting out redundant activities. It should enhance the equality of the products and services, ridding the organization of mistakes and miscommunication and should break down the walls between the units, getting people to work together and share information. Maximum high-tech companies have taken more aggressive approach to restructuring work in cross-company processes. It means reshaping the economics of supply chain for their product using a host of unrelated information systems. For achieving this, it is required to hold cumbersome set of process together, at a great cost.

In multi-echelon supply chain, the company setup is to share information among all the supply chain participants by which the performance of the supply chain can be dramatically enhanced. The suppliers get benefits from this new relationship as well so, the simplicity and security of dealing with one large customer may be attracted rather than a host of small ones. Nowadays, all the companies persistently aimed at greater speed and cost effectiveness the popular grails of supply chain management. Companies’ quests changed with the industrial cycle. When business was booming, executives concentrated on maximizing speed, and when economy headed south, firms desperately tried to maximize the profit. So, supply chain efficiency is necessary to optimize the supply chain’s performance when they maximize their interests. Only agile, adaptable, and aligned supply chains provide companies with sustainable competitive advantage. Today, the industrial environment has become more competitive in the rapidly developing global market. A “Win–Win” supply chain management system should be significant no matter whether the position is on the supply side or buy side. Therefore, integrated supply chain model is introduced to deal with inventory problems in supportive activities between suppliers and retailers.

2 Review of literature

In the real world, procurement and inventory control are truly large scale problems, often involving more than hundreds of items. In a multi-item distribution channel, considerable savings can be realized during the replenishment by coordinating the ordering of several different items. Multi-echelon multi-item replenishment strategies are already widely applied in the real world, for example, the supplying of parts for computers and for automotive assembly Hahm and Yano [17, 18] or refrigerated goods to supermarkets Hammer [19] and Lu [31]. In these industries, a supplier normally produces different products for a single customer and ships to the customer simultaneously in a single truck. In the grocery supply industry or a fast moving consumer goods industry different types of refrigerated goods (General Mills yogurt, Derived Milk products etc.) can be shipped in the same truck to the same supermarket or retail store Hammer [19], Goyal [15], Kao [23], Graves [16], Ben-Khedher and Yano [3], Van Eijis [42], Rempala [36], Chen and Chen [6, 7], Tsao and Sheen [40], Bhattacharya [4], Chen and Chen [8, 9], Elmaghraby and Keskinocak [12], Viswanathan [43,44,45], Lee and Whang [28], Lee [29], Marn and Rosiello [32], Frohlich and Westbrook [13], Fung and Ma [14], Joneja [22], Kaspi and Rosenblatt [24] and Lee and Yao [26] have developed models and algorithms for solving multi-item replenishment problems for different constraints. Miranda and Garrido [33], Shinn [37], Sucky [38], Taylor [39] developed integrated models and Hsu et al. [21] developed the single item model with preservation technology for deteriorating items. Multi-echelon coordination is frequently applied in current business practice it is an essential component in supply chain model. Hence the multi-echelon multi-deteriorated item supply chain is the focus of the present study.

The coordination among channel members is important for enhancing a channel’s competitiveness. It has been investigated that a company can increase its market share by aligning itself with its channel partners Narayanan and Raman [34]. However, companies in the same channel often do not act in ways that maximize the channel profit, so the whole supply chain performs inadequately. A company often thinks that whatever policy which maximizes its own profit and it will also maximize the channel profit Lee [27]. Recently Khouja [25] framed an integrated three-stage supply chain with multiple vendors and buyers. Hsu and Wee [20] discussed horizontal suppliers’ coordination issue under uncertain deliveries. Chen and Chen [7] discussed the effects of joint replenishment and channel coordination for managing multiple deteriorating items. Li and Wang [30] briefed a complete literature review of supply chain system coordination. Prasad et al. [35] proposed and validated a model on decentralized production–distribution planning in multi-echelon supply chain network using intelligent agents. Banu and Mondal [2] considered an integrated inventory model that deals with one manufacturer and one retailer. The manufacturer provides warranty period for the finished product to ensure product reliability. The objective of this study is to analyze the effect of the credit period offered by the manufacturer which is functionally depended on warranty period of the product. The objective is to maximize the integrated model by optimizing product warranty, customers’ credit period and cycle length.

The present study will be devoted to the issue of channel coordination of multi-items as a coordination mechanism. The goal of this paper is to develop a procedure to find the retail price, annual replenishment frequency and preservation effort factor that maximizes the annual profit consisting of setup costs, inventory holding cost, and preservation effort cost for both the perspective of the individual like retailer, manufacturer and the perspective of the channel.

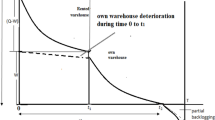

The remainder of this paper as follows. In Sect. 2, the assumptions and notations used in this study are described. In Sect. 3 the mathematical models both for decentralized policy and centralized policy are developed, under decentralized policy two different policies are developed like non cooperative replenishment with individual items and with joint items respectively and under centralized policy two another policies are developed like cooperative replenishment with individual items and with joint items respectively. A discussion of the mathematical properties of the models and a solution procedure with algorithm are given in Sect. 4. Finally, a numerical analysis is presented with some comparative analysis and sensitivity analyses with testing have been performed in Sect. 5. Conclusions are drawn in Sect. 6. The major assumptions used in the above reviewed research articles are summarized in Table 1. Figure 1 depicts the environment of the multi-item integrated discrete supply chain with preservation efforts.

3 Assumptions and notations

Table 2 describes the summary of notations in detail.

The mathematical model is developed under the following assumptions:

This paper deals with a multi-echelon supply chain, consisting of one supplier, one manufacturer and one buyer (retailer), who stocks and sells multiple \(\left( k \right)\) items for the end customers. These multi-deteriorated items have short life-times and are subject to linear decaying with preservation efforts per unit time. The inventory level of the raw materials and finished products are always greater than the demand rate. The demand rate for each item is assumed to be linear price-dependent function over the selling period. The supplier adopts a lot-for-lot strategy. It means the quantity ordered by the supplier equals the demand quantity placed by the retailer.

-

1.

The demand for item \(i\) is represented by a linear decreasing function of the retail price.

-

2.

The deterioration rates of the raw materials and finished items are linear decreasing function of preservation efforts.

-

3.

The supplier provides a credit period \(t\) to the retailer; a capital opportunity cost due to the period incurs. On the other hand, the retailer gains a capital opportunity benefit due to this period.

-

4.

The preservation effort cost under policy \(j\), \(PrE_{j} \left( {\tau_{i} ,D_{i} } \right) = \mathop \sum \nolimits_{i = 1}^{k} b\left( {\tau_{i} } \right)^{2} D_{i} \left( {p_{j,i} } \right)\) where, \(\tau_{i} > 0\), b is a constant and \(\tau_{i}\) is a preservation effort factor.

4 Mathematical model

In this section, the model is formulated from the perspectives of the retailer and supplier and channel.

4.1 The decentralized policy

In the decentralized production and replenishment decision-making policy, each individual within the supply chain aims at optimizing its own profit function with preservation effort effects, and without consideration being given to its counterpart’s reaction or resulting profit. The retailer makes a replenishment decision based on an EOQ policy that includes inventory-holding cost, major and minor setup costs and preservation effort cost. The major setup cost may represent a fixed transportation cost, regardless of its composition, and the minor setup cost may represent item-specific warehousing, material handling, and order processing costs, for each specific deteriorated item included in the order. The individual replenishment policy (policy I), and then the joint replenishment policy (policy II) are presented for the multi-item problem.

4.1.1 Policy-I: Non-cooperative replenishment for individual items

Under the individual replenishment of deteriorated multi-item, the decision problem facing the retailer with preservation effort effects is to determine the retail price, replenishment cycle and preservation effort for each individual deteriorated item. The change in inventory level for each item is due to the combined effects and preservation effort effects of deterioration over the replenishment cycle, and the model can be framed by the following differential equation.

After solving Eq. (1) and using the boundary condition the value of \(I_{r,i} \left( t \right)\) is:

Purchasing Cost (PC):

where, \(c_{r,i}\) is the per unit purchasing cost of item i of the retailer and \(I_{r,i} \left( 0 \right)\,is\,the\,initial\,inventory\,level\,of\,item\,i\) or the inventory level at the beginning of the replenishment cycle and it is also equivalent to the ordering quantity.

We have, \(I_{r,i} \left( t \right) = \frac{{D_{i} }}{{\theta_{i} }}\left[ {e^{{\theta_{i} \left( {T_{I,i} - t} \right)}} - 1} \right],\,for\,0 \le t \le T_{I,i}\), putting \(t = 0\,in\,I_{r,i} \left( t \right)\) it can be obtained:

So the total purchasing cost of all items is:

Holding Cost (HC):

where, \(h_{r,i}\) is the per unit inventory holding cost of item i and \(I_{r,i} (t)\) is the inventory level of item i at timet.

So, the total inventory holding cost of all items is:

Major Setup Cost (MaSC):

Minor Setup Cost (MSC):

Preservation Effort Cost (PrEC):

Sales Revenue (SR):

The exponential term \(e^{{\theta_{i} T_{I,i} }}\) can be approximated by using the Taylor series expansion, \(e^{{\theta_{i} T_{I,i} }} = 1 + \theta_{i} T_{I,i} + \frac{{\left( {\theta_{i} T_{I,i} } \right)^{2} }}{2!} + \frac{{\left( {\theta_{i} T_{I,i} } \right)^{3} }}{3!} + \cdots\), for a reasonable deterioration rate of a perishable product like diary items, medicinal product and agricultural items whose lifetime is commonly less than 1 month then the third or higher order terms of the Taylor series expansion can be neglected. So the total purchasing cost of all items, \(PC\) and the total inventory holding cost, \(HC\) is given by:

The retailer’s profit function per unit time; \(\pi_{I,r}\) is given by:

4.1.1.1 Optimization

The retailer determines the retail price for each item, individual replenishment cycle of each finished item and preservation effort factor of each item, so as to maximize his profit. We utilize the following propositions to discuss the condition for an optimal solution from the individual non-cooperative policy.

Proposition 1

The retailer’s profit function per unit time; \(\pi_{I,r}\) is concave in \(p_{I,i}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the demand function. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

Hence, the second order derivative of \(\pi_{I,r}\) should be negative for concavity property.

It implies that the retailer’s total profit per unit time is concave. □

Proposition 2

The retailer’s profit function per unit time; \(\pi_{I,r}\) is concave in \(T_{I,i}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and time. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

The optimal value of \(T_{I,i} (T_{I,i}^{*} )\) is obtained and the second order derivative of \(\pi_{I,r}\) should be negative for concavity property.

Hence, the retailer’s total profit per unit time is concave. □

Proposition 3

The retailer’s profit function per unit time; \(\pi_{I,r}\) is concave in \(\tau_{i}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the preservation effort. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

The optimal value of \(\tau_{i} (\tau_{i}^{*} )\) is obtained and the second order derivative of \(\pi_{I,r}\) should be negative for concavity property.

Hence, the retailer’s total profit per unit time is concave.

The upstream manufacturer has adopted a make –to-order policy, i.e. a lot-for-lot production policy, the production is the same quantity as demanded by the downstream player of supply chain i.e. retailer. Here for each production run, a major setup cost is incurred due to such factors as changeover costs, and a minor setup cost was incurred for each additional item being produced in the line. For the manufacturer the preservation effort cost was not required for market demand but he incurred additional inventory holding and ordering costs for the raw materials required to produce the finished goods.

Finished product:

The profit function per unit time of the manufacturer can be obtained by a procedure similar to the one developed for the retailer, can be expressed as follows:

Summing up the Eqs. (2) and (5) yield the profit model for the supply chain under policy I:

□

4.1.2 Policy-II: Non-cooperative replenishment for joint items

Under the joint replenishment policy, the retailer determines a common replenishment cycle \(T_{II}^{*}\) for the simultaneous replenishment of all multi-items, the retail price \(p_{II,i}^{*}\) for each item and the preservation effort factor \(\tau_{i}^{*}\) for each item with an aim at maximizing its profit. In this policy, the revenue and the associated costs considered by the retailer are similar to the individual replenishment, except for the number of major replenishment setups that are reduced to one over the cycle. The total profit per unit time of the retailer \(\pi_{II,r}\) is

4.1.2.1 Optimization

The retailer determines the retail price for each item, common replenishment cycle of each finished item and publicity effort factor of each item, so as to maximize his profit. We utilize the following propositions to discuss the condition for an optimal solution from the joint non-cooperative policy.

Proposition 1

The retailer’s profit function per unit time; \(\pi_{II,r}\) is concave in \(p_{II,i}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the demand function. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

The second order derivative of \(\pi_{II,r}\) should be negative for concavity property.

The retailer’s total profit per unit time is concave. □

Proposition 2

The retailer’s profit function per unit time; \(\pi_{II,r}\) is concave in \(T_{II}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the time. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

The optimal value of \(T_{II} (T_{II}^{*} )\) is obtained and the second order derivative of \(\pi_{II,r}\) should be negative for concavity property.

Hence, the retailer’s total profit per unit time is concave. □

Proposition 3

The retailer’s profit function per unit time; \(\pi_{II,r}\) is concave in \(\tau_{i}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the preservation effort. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

The optimal value of \(\tau_{i} (\tau_{i}^{*} )\) is obtained and the second order derivative of \(\pi_{II,r}\) should be negative for concavity property.

Hence, the retailer’s total profit per unit time is concave.

Accordingly, the total profits per unit time for the manufacturer and for the system are

and Summing up the Eqs. (7) and (8) yield the profit model for the supply chain under policy I:

□

4.2 The centralized policy

In contrast to the decentralized decision process, the centralized policy simultaneously determines the retail price, the replenishment cycle and preservation effort by considering the total profit incurred by the retailer and the manufacturer, so that the system is maximized. The individual replenishment policy (policy III) and then the joint replenishment policy (policy IV) are framed for the problem.

4.2.1 Policy-III: Cooperative replenishment for individual items

In this policy, the retail price, replenishment cycle and preservation effort for each item are determined jointly by the individuals in supply chain. The system profit of policy III is:

Proposition 1

The system profit function per unit time; \(\pi_{III}\) is concave in \(p_{III,i}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the demand function. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

So, the optimal value of \(p_{III,i} (p_{III,i}^{*} )\) is obtained and the second order derivative of \(\pi_{III}\) should be negative for concavity property.

Hence the system profit per unit time is concave in \(p_{III,i}\). □

Proposition 2

The system profit function per unit time; \(\pi_{III}\) is concave in \(T_{III,i}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the time. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

The optimal value of \(T_{III,i} (T_{III,i}^{*} )\) is obtained and the second order derivative of \(\pi_{III}\) should be negative for concavity property.

Hence, the system profit per unit time is concave in \(T_{III,i}\). □

Proposition 3

The system profit function per unit time; \(\pi_{III}\) is concave in \(\tau_{i}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the preservation effort. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

The optimal value of \(\tau_{i} (\tau_{i}^{*} )\) is obtained and the second order derivative of \(\pi_{III}\) should be negative for concavity property.

Hence, the system profit per unit time; \(\pi_{III}\) is concave in \(\tau_{i}\). □

4.2.2 Policy-IV: Cooperative replenishment for joint items

If both cooperation and joint replenishment are employed, the decision facing the retailer and the manufacturer is to jointly determine a common replenishment cycle, the retail price for each item and the preservation effort for each item. The system profit per unit time is:

After simplifying:

Proposition 1

The system profit function per unit time; \(\pi_{IV}\) is concave in \(p_{IV,i}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the demand function. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

So, the optimal value of \(p_{IV,i} (p_{IV,i}^{*} )\) is obtained and the second order derivative of \(\pi_{IV}\) should be negative for concavity property.

Hence, the system profit per unit time is concave in \(p_{IV,i}\). □

Proposition 2

The system profit function per unit time; \(\pi_{IV}\) is concave in \(T_{IV}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the time. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

The optimal value of \(T_{IV} (T_{IV}^{*} )\) is obtained and the second order derivative of \(\pi_{IV}\) should be negative for concavity property.

Hence, the system profit per unit time is concave in \(T_{IV}\). □

Proposition 3

The system profit function per unit time; \(\pi_{IV}\) is concave in \(\tau_{i}\).

Proof

The optimal property of the profit function strongly depends on the value of the parameters and the preservation effort. The concavity property of an optimization is differentiating with respect to the decision parameter, equating to zero and putting the value of the parameter in the second order differentiation then test for optimality i.e. negative for maximization.

The optimal value of \(\tau_{i} (\tau_{i}^{*} )\) is obtained and the second order derivative of \(\pi_{IV}\) should be negative for concave property.

Hence, the system profit per unit time; \(\pi_{IV}\) is concave in \(\tau_{i}\). □

5 Algorithm

Table 3 shows the solution procedure of the four integrated supply chain models.

6 Numerical analysis

The multi-echelon supply chain profit models can be applied in solving multi-item problems using the arbitrary number of items, to illustrate the effect of the models three items are taken into consideration in the supply chain. The four different policies with preservation effort effects and without preservation effort effects incorporated with the proposed mixed integer heuristic approach are implemented on a personal computer using Lingo 14.0.

In this section, some managerial insight by considering the following interesting issues:

-

The supplier’s and retailer’s profit (attained from the individual and channel perspectives) are compared and the mixed integer channel coordination are shown.

-

The impact of preservation efforts for deteriorating items under four different policies is shown.

We consider ten different items that need to be replenished jointly, namely items 1-3. Using the data of Table 4 the model is illustrated. Figure 2 shows 2-Dimension plot of retail price and demand function of product 1, 2 and 3 respectively. Figure 3 shows 3-Dimension mesh plot of retail price, preservation effort and preservation effort cost of product 1, 2 and 3 respectively. Figure 4 shows the three dimensional mesh plotting of price, replenishment time and total profit of product 1, 2 and 3 for policy I, II, III and IV respectively. Table 5 shows the optimal values of different models and comparative analysis of different models with different cases are shown in Table 6.

6.1 Interpretation

From the Table 6 for the channel perspective point of view, it is observed that from all the policies the profit of cooperative model with joint items (policy IV) has a maximum value whereas the profit of cooperative model with individual item (policy III) has the minimum value. Similarly, for the preservative effort point of view it is investigated that policy IV has a maximum value whereas policy III has a minimum value. So, it is concluded that channel perspective annual profit for joint items with preservative effort is maximum than any other annual profit of channel for multi-item and multi-echelon supply chain model but the channel perspective model of cooperative replenishment for joint items with mixed integer and preservation effort is 48114.94 which is very much approaching to the profit of policy IV model i.e. 48115.04. Figure 5 shows the profits of the players like retailers and manufacturers with four different policies like I, II, III and IV under the cases like with preservation efforts, without preservation efforts, mixed integer of demand rate and order quantity and preservation efforts, mixed integer of demand rate and preservation efforts and mixed integer of demand rate and without preservation efforts. It is observed that the retailer as an individual player has more profit as compared to manufacturer. This suggests that the retailer will like be the leading player of the business connections of supply chain. To increase manufacturer profit, the strategy of profit sharing for deteriorated items will be profitable to both the players which results the better profit of the integrated supply chain. Figure 6 shows the profits of the four different policies like I, II, III and IV with different cases like with preservation efforts, without preservation efforts, mixed integer of demand rate and order quantity and preservation efforts, mixed integer of demand rate and preservation efforts and mixed integer of demand rate and without preservation efforts. It is observed that the policy IV has maximum profit as compared to other three policies except the third case. It suggests that cooperative policy for joint deteriorating items gives more profit in discrete demand rate supply chain.

6.2 Sensitivity analysis

It is interesting to investigate the influence of the significant parameters,

\(b,\alpha_{1i} ,\beta_{1i} ,\alpha_{2i} ,\beta_{2i} , \alpha_{i} , \beta_{i} , A_{r} , a_{r,i} ,h_{r,i} , c_{r,i} , \mu_{i} , u_{i} ,A_{m} ,a_{m,i} , a_{mr,i} , h_{m,i} , h_{mr,i}\,and\,c_{mr,i}\) on policy IV profit model. The computational results of Table 7 are summarized in Table 8. Figure 7 shows the changes in common replenishment cycle T with variations in supply chain parameters and it is observed that the common replenishment cycle T is highly sensitive to the parameters \(\alpha_{2i} , A_{r} ,h_{r,i}\,and\,a_{mr,i}\). Figure 8 shows the changes in preservation effort cost with variations in supply chain parameters and it is observed that the preservation effort cost is highly sensitive to the parameters \(b,\alpha_{1i} ,\beta_{1i} , \alpha_{i} ,h_{r,i} , c_{r,i} ,A_{m}\,and\,h_{m,i}\). Figure 9 shows the changes in total profit per unit time under policy IV with variations in supply chain parameters and it is observed that the total profit per unit time under policy IV is highly sensitive to the parameters \(\alpha_{1i}\,and\,\beta_{1i}\).

6.3 Sensitivity analysis through ANOVA testing

The sensitivity of the system profit per unit time with publicity effort with respect to the important parameters like \(A_{m}\) and \(A_{r}\) has been presented using the Analysis of Variance (ANOVA) method. The main conclusions drawn from the sensitivity analysis are as follows:

-

\(H_{01} :\) Null Hypothesis: the optimal joint replenishment profit with preservation effort under co-operative policy is insignificant for different values of \(A_{m }\,and\,A_{r}\).

-

\(H_{11} :\) Alternative Hypothesis: the optimal joint replenishment profit with preservation effort under co-operative policy is differs significantly for different values of \(A_{m }\,and\,A_{r}\).

The ANOVA in Table 9 is constructed for the data values of Table 10, it is seen that the p-values of \(F_{0.05;5,25}\) and \(F_{0.05;5,25}\) (i.e. F-distribution at 5% level), are less than 0.05 respectively. So, the null hypothesis is rejected. Hence the system profit per unit time with preservation effort is significantly differ for different values of \(A_{m }\,and\,A_{r}\).

The sensitivity of the system profit per unit time without preservation effort with respect to the important parameters like \(A_{m}\) and \(A_{r}\) has been presented using the Analysis of Variance (ANOVA) method. The main conclusions drawn from the sensitivity analysis are as follows:

-

\(H_{01} :\) Null Hypothesis: the optimal joint replenishment profit without preservation effort under co-operative policy is insignificant for different values of \(A_{m }\,and\,A_{r}\).

-

\(H_{11} :\) Alternative Hypothesis: the optimal joint replenishment profit without preservation effort under co-operative policy is differs significantly for different values of \(A_{m }\,and\,A_{r}\).

The ANOVA in Table 11 is constructed for the data values of Table 12, it is seen that the p-values of \(F_{0.05;5,25}\) and \(F_{0.05;5,25}\) (i.e. F-distribution at 5% level), are less than 0.05 respectively. So, the null hypothesis is rejected. Hence the system profit per unit time with preservation effort is significantly differ for different values of \(A_{m }\,and\,A_{r}\).

7 Conclusion

This study considers four profit optimization models, with discrete demand rate, discrete order quantity and preservation efforts for economies of scale, on the individual and joint items. We explore the preservation efforts benefits the retailer’s cooperative replenishment with joint items model but for the channel perspective model preservation efforts play economies of scale where discrete (integer) demand rates benefit the retailers for multi-item integrated mixed integer supply chain model. Numerical analysis is conducted to clarify managerial insights about the impact of preservation efforts, mixed integer modeling on the decisions and profits of both the parties. From sensitivity analysis it is tested that the system profit per unit time with and without preservation efforts is significant for different values of \(A_{m }\,and\,A_{r}\). The major parameters, \(\alpha_{i},\,\beta_{i},\,A_{r},\,h_{r,i},\,\mu_{i},\,u_{i},\,A_{m},\,a_{m,i},\,h_{m,i}\,and\,c_{mr,i}\) on cooperative replenishment for joint items model are highly sensitive for channel profit so for choosing the values of these parameters at managerial level is a very crucial decision for optimizing profit. This work can be extended in several ways like deterioration, backlogging, forward financing, partially forward financing, two components demand etc. for further research work.

References

Abad, P.L., Jaggi, C.K.: A joint approach for setting unit price and the length of the credit period for a seller when end demand is price sensitive. Int. J. Prod. Econ. 83, 115–122 (2003)

Banu, A., Mondal, S.K.: An integrated inventory model with warranty dependent credit period under two policies of a manufacturer. J. Oper. Res. Soc. India 55, 677 (2018). https://doi.org/10.1007/s12597-018-0345-x

Ben-Khedher, N., Yano, C.A.: The multi-item joint replenishment problem with transportation and container effects. Transp. Sci. 28(1), 37–54 (1994)

Bhattacharya, D.K.: On multi-item inventory. Eur. J. Oper. Res. 162, 786–791 (2005)

Chang, H.J., Hung, C.H., Dye, C.Y.: An inventory model for deteriorating items with linear demand under condition of permissible delay in payments. Prod. Plan. Control 12, 274–282 (2001)

Chen, J.M., Chen, T.H.: The multi-item replenishment problem in a two-echelon supply chain: the effect of centralization versus decentralization. Comput. Oper. Res. 32, 3191–3207 (2005)

Chen, J.M., Chen, T.H.: Effects of joint replenishment and channel coordination for managing multiple deteriorating products in a supply chain. J. Oper. Res. Soc. 56(10), 1224–1234 (2005)

Chen, J.M., Chen, T.H.: The profit maximization model for a multi-item distribution channel. Transp. Res. Part-E Logist Transp. Rev. 43, 338–354 (2007)

Chen, T.H., Chen, J.M.: Optimizing supply chain collaboration based on joint replenishment and channel coordination. Transp. Res. Part E Logist. Transp. Rev. 41(4), 261–285 (2005)

Chung, K.J.: A theorem on determination of economic order quantity under conditions of permissible in payments. Comput. Oper. Res. 25(1), 49–52 (1998)

Cohen, M.A.: Joint pricing and ordering policy for exponentially decaying inventory with known demand. Naval Res. Logist. Q. 24, 257–268 (1977)

Elmaghraby, W., Keskinocak, P.: Dynamic pricing in the presence of inventory considerations: research overview, current practices, and future directions. Manag. Sci. 49, 1287–3091 (2003)

Frohlich, M.T., Westbrook, R.: Demand chain management in manufacturing and services: web-based integration, drivers and performance. J. Oper. Manag. 20, 729–745 (2002)

Fung, R.Y.K., Ma, X.: A new method for joint replenishment problems. J. Oper. Res. Soc. 52(3), 358–362 (2001)

Goyal, S.K.: Economic policy for jointly replenished items. Int. J. Prod. Res. 26(7), 1237–1240 (1988)

Graves, S.C.: On the deterministic demand multi-product single-machine lot scheduling problem. Manag. Sci. 25(3), 276–280 (1979)

Hahm, J., Yano, C.A.: The economic lot and delivery scheduling problem: the common cycle case. IIE Trans. 27, 113–125 (1995)

Hahm, J., Yano, C.A.: The economic lot and delivery scheduling problem: models for nested schedules. IIIE Trans. 27, 126–139 (1995)

Hammer, M.: The superefficient company. Harv. Bus. Rev. 79, 82–91 (2001)

Hsu, P.H., Wee, H.M.: Horizontal suppliers coordination with uncertain suppliers deliveries. Int. J. Oper. Res. 2(2), 17–30 (2005)

Hsu, P.H., Wee, H.M., Teng, H.M.: Preservation technology investment for deteriorating inventory. Int. J. Prod. Econ. 124, 388–394 (2010)

Joneja, D.: The joint replenishment problem: new heuristics and worst case performance bounds. Oper. Res. 38(4), 711–723 (1990)

Kao, E.P.C.: A multi-product dynamic lot-size model with individual and joint set-up costs. Oper. Res. 27(2), 279–289 (1979)

Kaspi, M., Rosenblatt, M.J.: The effectiveness of heuristic algorithms for multi-item inventory systems with joint replenishment costs. Int. J. Prod. Res. 23(1), 109–116 (1985)

Khouja, M.: Optimizing inventory decisions in a multi-stage multi-customer supply chain. Transp. Res. Part E Logist. Transp. Rev. 39(3), 193–208 (2003)

Lee, F.C., Yao, M.J.: A global optimum search algorithm for the joint replenishment problem under power-of-two policy. Comput. Oper. Res. 30(9), 1319–1333 (2003)

Lee, H.L.: The triple-a supply chain. Harv. Bus. Rev. 82(10), 102–112 (2004)

Lee, H.L., Whang, S.: Demand chain excellence. Supply Chain Manag. Rev. 44(3), 40–46 (2001)

Lee, W.: A joint economic lot size model for raw material ordering, manufacturing setup, and finished goods delivering. Omega 33(2), 163–174 (2005)

Li, X., Wang, Q.: Coordination mechanisms of supply chain systems. Eur. J. Oper. Res. 179(1), 1–16 (2007)

Lu, L.: A one-vendor multi-buyer integrated inventory model. Eur. J. Oper. Res. 81(2), 312–323 (1995)

Marn, M.V., Rosiello, R.L.: Managing price gaining profits. Harv. Bus. Rev. 70(5), 84–94 (1992)

Miranda, P.A., Garrido, R.A.: Incorporating inventory control decisions into a strategic distribution network design model with stochastic demand. Transp. Res. Part E Logist. Transp. Rev. 40(3), 183–207 (2004)

Narayanan, V.G., Raman, A.: Aligning incentives in supply chains. Harv. Bus. Rev. 82(11), 94–102 (2004)

Prasad, T.V.S.R.K., Srinivas, K., Srinivas, C.: Decentralized production–distribution planning in multi-echelon supply chain network using intelligent agents. J. Oper. Res. Soc. India 54, 217 (2017). https://doi.org/10.1007/s12597-016-0277-2

Rempala, R.: Joint replenishment multiproduct inventory problem with continuous and discrete demands. Int. J. Prod. Econ. 81–82, 495–511 (2003)

Shinn, S.W.: Determining optimal retail price and lot size under day-term supplier credit. Comput. Ind. Eng. 33(3–4), 717–720 (1997)

Sucky, E.: Coordinated order and production policies in supply chains. OR Spectrum 26, 493–520 (2004)

Taylor, T.A.: Supply chain coordination under channel rebates with sales effort effects. Manag. Sci. 48(8), 992–1007 (2002)

Tsao, Y.C., Sheen, G.J.: A multi-item supply chain with credit periods and weight freight cost discounts. Int. J. Prod. Econ. 135, 106–115 (2012)

Tsao, Y.C., Sheen, G.J.: Joint pricing and replenishment decisions for deteriorating items with lot-size and time dependent purchasing cost under credit period. Int. J. Syst. Sci. 38(7), 549–561 (2007)

Van Eijis, M.J.G.: Multi-item inventory systems with joint ordering and transportation decisions. Int. J. Prod. Econ. 35, 285–292 (1994)

Viswanathan, S.: Note: periodic review policies for joint replenishment inventory systems. Manag. Sci. 43(10), 1447–1454 (1997)

Viswanathan, S.: On optimal algorithms for the joint replenishment problem. J. Oper. Res. Soc. 53, 1286–1290 (2002)

Viswanathan, S., Piplani, R.: Coordinating supply chain inventories through common replenishment epochs. Eur. J. Oper. Res. 129(2), 277–286 (2001)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Padmabati Gahan: Mentor.

Rights and permissions

About this article

Cite this article

Pattnaik, M., Gahan, P. Preservation effort effects on retailers and manufacturers in integrated multi-deteriorating item discrete supply chain model. OPSEARCH 58, 276–329 (2021). https://doi.org/10.1007/s12597-020-00477-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12597-020-00477-2