Abstract

Cognitive information in real-world decision-making problems is usually associated with all sorts of ambiguities and uncertainties. Fuzzy sets have been proposed as a general workaround for such information representation. Notwithstanding, there are cases in which the fuzzy sets and fuzzy numbers have some degree of uncertainty when available data either come from unreliable sources or refer to events in the future. These situations result in some unreliability of the obtained fuzzy information. For the modeling of the possible future-event effects on the fuzzy information credibility, the present research presents a novel risk-based fuzzy cognitive methodology by investigating all possible cases to risk modeling of fuzzy sets and the governing mathematical equations. The new fuzzy cognitive model is used to develop a multi-criteria decision-making method based on a fuzzy TOPSIS method so-called RFC-TOPSIS, and the proposed approach was tested on a case study of failure modes and effects analysis problem. Based on the results, robust outcomes were obtained when the proposed methodology was used, highlighting the flexibility and the efficiency of the proposed methodology. The present concept can be used to deal with any problems, where membership function is associated with some risks and errors due to risk factors.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Cognitive computation boosts machine reasoning abilities by mimicking the human’s cognition in complex situations where the answers may be ambiguous and uncertain [1]. https://searchenterpriseai.techtarget.com/definition/cognitive-computing. The appropriate expression of cognitive information is essential in cognitive computation [2]. In a typical decision-making process, it is more efficient for the decision-makers to use fuzzy sets for expressing their cognition about the alternatives [3]. When adopting the fuzzy sets, it is important to capture how reliable the available data is, since the classical fuzzy set is unable to model the unreliability of the obtained cognitive information due to different mental factors associated with experts including, age, experience, knowledge background, character, and risk preference as well as other external factors [4,5,6]. Therefore, different innovative extensions of type 1 fuzzy sets has been proposed in the literature, such as interval-valued fuzzy sets (IVFSs) [7], intuitionistic fuzzy sets (IFSs) [8], interval-valued intuitionistic fuzzy sets (IVIFSs) [9], Pythagorean fuzzy sets (PFSs) [10], interval-valued intuitionistic hesitant fuzzy sets (IVIHFSs) [11], Z-numbers [12], hesitant fuzzy sets (HFSs) [13], hesitant fuzzy linguistic term sets (HFLTS) [14], dual hesitant fuzzy sets (DHFSs) [15], interval-valued hesitant fuzzy sets (IVHFSs) [16], probabilistic linguistic term sets (PLTSs) [17], neutrosophic sets (NSs) [18], neutrosophic hesitant fuzzy sets (NHFSs) [19], cognitive cloud model [20], plithogenic sets (PSs) [21], picture fuzzy sets (PFSs) [22], D numbers with linguistic term sets (DLTs) [23], D-intuitionistic hesitant fuzzy sets (DIHFSs) [24], and R-numbers [25]. Associated uncertainty with a fuzzy number is normally represented by either (i) expressing the reliability of the membership function (e.g., Z-numbers) or (ii) expressing the fuzzy number as a range (e.g., IFSs, IVFS, and IVIFSs) [25].

In many decision-making problems which are related to future forecasting, the data to be analyzed are associated with some percent of error, mainly due to predicted/unpredicted effective factors which result in a situation where the knowledge of present cannot be generalized to future in a certain and reliable way [25, 26]. Such sources of error are referred to as risk factors. Indeed, a risk factor affects the evaluated results by deviating them from the main values [27]. This paper aims at presenting a new risk-based fuzzy cognitive model which can be used either explain or justify the errors and risks associated with fuzzy sets in future-based decision-making problems. It is worth noting how different risk and reliability are with regard to information. The information reliability is usually described based on prior performances and knowledge and experts mental factors, whereas risks deal with unseen possible situations [28, 29]. In the meantime, both concepts focus on data accuracy to avoid inappropriate outcomes. In a risk-based fuzzy approach, when the expert’s fuzzy evaluation is obtained, the extra information about his/her risks of the evaluation may be inferred by asking some questions in the form of (1) “how much (percent) the occurrence possibility of your fuzzy prediction might variate (be exposed to risk) due to predicted/unpredicted risk factors” in best (optimistic) and worst (pessimistic) cases?” and (2) “how much these variations are acceptable in your opinion?”. Some risk-based fuzzy cognitive information representations by the experts can be as follows:

“The profit of the project would be high, but the prediction might have 50% risk in the optimistic case (50% more likely to happen) and 40% risk in the pessimistic mode (40% less likely to happen) and 50% risk of the pessimistic scenario can be accepted.”

“The travel time by plane from London to Tehran is about 9 hours, but the prediction might have 10% risk in the pessimistic or optimistic modes (10% more or less likely to happen) and 30% risk of the pessimistic case can be accepted.”

Table 1 describes the cognitive information expression of different extensions of fuzzy sets and the proposed risk-based approach briefly.

The risk of fuzzy information has been modeled by various studies in decision-making problems. For example, Gören and Kulak [30] developed a risk-based fuzzy model for selecting a supplier. In this research, they considered the risk of the evaluation rather than taking it as an attribute. Kulak et al. [31] suggested a risk-based fuzzy axiomatic design (RFAD) in order to select the most appropriate medical imaging systems while considering the risk factors. A risk-based model for the selection of materials of gas turbines using the RFAD method and Shannon entropy was proposed by Hafezalkotob and Hafezalkotob [32]. Maghsoodi et al. [33] presented a multi-criteria decision-making (MCDM) framework based on the RFAD and Shannon entropy to choose the waste oil technology. In this research, different types of risk factors related to the problem were determined using two categories of technological and economic criteria. Seiti et al. [26] presented two pessimistic-optimistic models of risk-taking in fuzzy numbers using the FAD method for selecting a maintenance strategy. In this study, the acceptable risk as a coefficient was used to determine an acceptable percentage of risk in each assessment. In another study, Seiti and Hafezalkotob [34] considered different risk scenarios of fuzzy numbers and developed the R-TOPSIS methodology. The proposed approach was applied for preventive maintenance planning in a rolling mill company. The risk modeling has been also done in the modeling of the risks of beliefs in fuzzy Demeter-Shafer (DS) structure by Seiti et al. [28]. In this paper, an interval-valued DS theory was developed based on the risk of fuzzy information and applied to failure modes and effects analysis (FMEA).

Reviewing the literature, a few noteworthy research gaps are as follows:

The risk modeling was investigated only in MCDM problems, and by modeling variations of fuzzy numbers x scale, and no comprehensive model has been proposed for risk modeling of fuzzy membership functions.

The risks were investigated for classic trapezoidal and triangular fuzzy numbers, and no study has been performed to consider the risk of generalized fuzzy numbers (GFNs) owing to risk factors.

To fill these gaps, the novelties of the proposed risk-based fuzzy cognitive model are briefly as follows: (I) the proposed model extends the fuzzy sets risk modeling by allocating a confidence interval to a fuzzy membership function owing to possible risks by considering the risk as the presence of factors affecting the membership function, (II) risk modeling of a trapezoidal GFN is investigated through modeling the variations of its membership functions, (III) the proposed methodology is adopted to extend a Risk-based Fuzzy Cognitive Technique for Order of Preference by Similarity to Ideal Solution (RFC-TOPSIS) and applied to FMEA problem. Before proceeding to the introduction of the cognitive model, various risk configurations including the optimistic and pessimistic modes and acceptable risks are analytically described and their relationships discussed.

The rest of this manuscript is organized as follows. “Preliminaries” provides a brief discussion on type I and type II fuzzy sets and fuzzy numbers. “Risk Modeling of Fuzzy Sets and Generalized Trapezoidal Fuzzy Numbers” presents new developments in the research on risk modeling of fuzzy sets and generalized trapezoidal fuzzy numbers. “The Proposed Risk-Based Fuzzy Cognitive Model” introduces the concept of the proposed cognitive model and the RFC-TOPSIS method. In “Illustrative Example and Comparisons”, an example of FMEA using the proposed RFC-TOPSIS methodology is provided to elucidate its applicability in a real problem. “Results” describes the main findings of the proposed models. Finally, “Conclusion” delineates conclusion and future research directions.

Preliminaries

This section briefly discusses type I (T1) and type II (T2) fuzzy sets and numbers. The discussion is a basic requirement for the risk-based fuzzy cognitive model.

Type I Fuzzy Sets

Definition 1

A fuzzy set A in a universe of discourse X is characterized by a membership function μA, which takes the values ranging from 0 to 1, so we have [35]

The value of μA at x ∈ X represents the degree to which x is a member of A.

Definition 2

Operations between fuzzy sets A = {(x, μA(x)} and B = {x, μB(x)} are listed in the following [36].

Definition 3

A triangular fuzzy number (TFN) \( \tilde{a} \) on ℝ has its membership function \( {\upmu}_{\tilde{\boldsymbol{a}}}(x):\mathbb{R}\to \left[0,1\right] \) which is defined as follows [25]:

where a1 and a3 are the lower and upper bounds of the fuzzy number \( \tilde{A} \), respectively, and a2 describes the modal value. The TFN can be expressed as \( \tilde{a}=\left({a}_1,{a}_2,{a}_3\right) \)

Definition 4

Defuzzification is the process of converting the outcomes of fuzzy systems into a real crisp number [37]. There are various defuzzification techniques such as the center of area (COA) [38] and center of gravity (COG) [39]. Using the COA method, a defuzzified value of a TFN \( \tilde{a}=\left({a}_1,{a}_2,{a}_3\right) \) is obtained by employing Eq. (4) [25].

Definition 5

A generalized trapezoidal fuzzy number (GTrFN) can be expressed by \( \tilde{A}=\left({a}_1,{a}_2,{a}_3,{a}_4;{\mu}_{\tilde{LA}},{\mu}_{\tilde{RA}}\right) \), where a1, a2, a3, a4 are real values and \( {\mu}_{\tilde{LA}} \) and \( {\mu}_{\tilde{RA}} \) are so-called left and right heights of GTrFN \( \tilde{A} \). If \( {\mu}_{\tilde{LA}}={\mu}_{\tilde{RA}} \) = 1, then \( \tilde{A} \) becomes a traditional TrFN and can be represented as \( \tilde{A}=\left({a}_1,{a}_2,{a}_3,{a}_4\right) \) [40]. In fact, defining the left and right membership degrees gives much more flexibility to express uncertainty, since the possibilities of a2 and a3 and the points between them could not necessarily be identical. According to Jiang et al. [40], GTrFN \( \tilde{A} \) has its membership function \( {\mu}_{\tilde{A}} \) defined as follows:

where g1(x),g2(x) and g3(x) are interdependent linear functions and g1 : [a1, a2] → [0, 1], g2 : [a2, a3] → [0, 1] and g3 : [a3, a4] → [0, 1].

Type II fuzzy sets

The type II fuzzy set (T2 FS) is an extension to T1 FS. A T2 FS can be defined in different ways, which are presented in the following.

Definition 5

A T2 FS \( \tilde{A} \) in the universe of discourse X can be defined through a T2 membership function as expressed in the following [41]:

In which x and u are the primary and secondary variables of \( \tilde{A} \), respectively, and the T2 membership function of \( \tilde{A} \) is denoted by \( {\mu}_{\tilde{A}}\left(x,u\right) \).

Definition 6

The primary membership of \( \tilde{A} \) can be described by applying Eq. (7) [41].

Definition 7

An interval T2 trapezoidal fuzzy number (IT2 TrFN), \( {\tilde{\tilde{A}}}_i \), is written as \( {\tilde{\tilde{A}}}_i=\left({\tilde{A}}_i^U;{\tilde{A}}_i^L\right)=\left(\left({a}_{i1}^U,{a}_{i2}^U,{a}_{i3}^U,{a}_{i4}^U;{H}_1\left({\tilde{A}}_i^U\right),{H}_2\left({\tilde{A}}_i^U\right)\right),\left({a}_{i1}^L,{a}_{i2}^L,{a}_{i3}^L,{a}_{i4}^L;{H}_1\left({\tilde{A}}_i^L\right),{H}_2\left({\tilde{A}}_i^L\right)\right)\right), \) where \( {\tilde{A}}_i^U \) and \( {\tilde{A}}_i^L \) are T1 trapezoidal fuzzy numbers, \( {H}_j\left({\tilde{A}}_i^U\right) \) denotes the membership value of \( {a}_{ij}^U \) in the trapezoidal fuzzy number \( \left({\tilde{A}}_i^U\right),1\le j\le 4,{H}_j\left({\tilde{A}}_i^L\right) \) is the membership value of \( {a}_{ij}^L \) determined based on the lower trapezoidal membership function \( {\tilde{A}}_i^L,1\le j\le 4 \),\( {H}_1\left({\tilde{A}}_i^U\right)\in \left[0,1\right],{H}_2\left({\tilde{A}}_i^U\right)\in \left[0,1\right],{H}_1\left({\tilde{A}}_i^L\right)\in \left[0,1\right],{H}_2\left({\tilde{A}}_i^L\right)\in \left[0,1\right] \), and 1 ≤ i ≤ n [42]. The IT2 TrFNs \( {\tilde{\tilde{A}}}_1 \) and \( {\tilde{\tilde{A}}}_2 \) follow the mathematical operations given below [42]:

Definition 8

An IT2 TrFN \( {\tilde{\tilde{A}}}_i \) can be defuzzified as follows [42]:

where \( DTraT\left({\tilde{\tilde{A}}}_i\right) \) is the defuzzified valued of \( {\tilde{\tilde{A}}}_i \). If \( {\tilde{A}}_i^U={\tilde{A}}_i^L, \) then \( {\tilde{\tilde{A}}}_i \) becomes GTrFN, i.e., \( {\tilde{A}}_i=\left({a}_{i1},{a}_{i2},{a}_{i3},{a}_{i4};{H}_1\left({\tilde{A}}_i\right),{H}_2\left({\tilde{A}}_i\right)\right) \), which can be defuzzified as follows:

Risk Modeling of Fuzzy Sets and Generalized Trapezoidal Fuzzy Numbers

In this section, risk modeling of fuzzy sets and GTrFNs is examined considering various configurations that may arise, such as negative risk, positive risk, acceptable negative risk, and acceptable positive risk. Fuzzy set risk modeling is discussed in “Fuzzy Set Risk Modeling” while the modeling based on GTrFNs comes in “Generalized Trapezoidal Fuzzy Number Risk Modeling,” with other schemes of risk modeling based on fuzzy sets and fuzzy numbers are given in “Other Configurations of Fuzzy Sets and Generalized Trapezoidal Fuzzy Number Risk Modeling.”

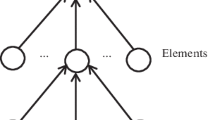

Fuzzy Set Risk Modeling

This section investigates different schemes of risk modeling based on fuzzy sets. For this purpose, three cases are considered: pessimistic, optimistic, and pessimistic-optimistic. Either of the cases may occur depending on the nature of the involved risk factors and decision variables [18]. In a pessimistic case, the risk tends to worsen the existing information, while an optimistic case implies that the risk enhances the fuzzy information and the pessimistic-optimistic mode is the general form of fuzzy set risk modeling which is a combination of the two former cases.

Pessimistic Approach

Assuming that the risk may only worsen the values of the fuzzy set membership functions or only the pessimistic values are considered by the decision-maker, in this case, one may end up with a pessimistic interval of fuzzy sets. The effect of these factors is termed negative risk in this paper and denoted by r−. Let \( A=\left\{x,{\mu}_{\tilde{A}}(x)| x\epsilon\ X\right\} \) be a fuzzy set of X, a pessimistic set of A can then be formulated as follows by considering risk r− for the membership function \( {\mu}_{\tilde{A}}(x) \):

where \( {\tilde{A}}_P(x) \) represents the pessimistic set of X elements considering r−.

Generally, one may consider separate risks for the membership degree of each individual element values, xi ∈ X. For example, given that the risks ri− refer to the membership degree of the ith element, i.e., \( {\mu}_{\tilde{A}}\left({x}_i\right) \), the intended relationship can be written as follows.

In order to achieve further clarity, we take into account only a similar risk value for all the membership degrees of a specific fuzzy set, so we referred to all risks with no indices. See Example 1.

Optimistic Mode

Now consider a case where effective factors can only improve the membership grades. We consider these values as usually dependent on the degree to which the decision-maker is the optimist. In this mode, the associated risk with the factors contributing to better solutions is called the positive risk (denoted by r+) and the optimistic interval of the membership function is obtained as follows:

where \( {\tilde{A}}_O(x) \) is the set of optimistic values of primary fuzzy set A.

Pessimistic-Optimistic Approach

In this approach, risk factors are assumed to affect the membership function both pessimistically (r−) and optimistically (r+). Accordingly, the solution interval for the membership function will be developed as in Eq. (32) where \( {\tilde{A}}_{P-O}(x) \) represents the pessimistic-optimistic interval of the fuzzy set A.

One may consider a special case with identical r+ and r− values, implying that chances that the effective factors may improve or worsen the results are equal. Given that the optimistic and pessimistic approaches represent special cases of the optimistic-pessimistic approach with zero r− or r+ values, respectively, the rest of this research keeps focusing on this general approach (i.e. optimistic-pessimistic) only.

By defining an interval in a simple form, as it is evident from the Eq. (19), it is implicitly assumed that all of the points due to risks are identical when their possibility degrees are not considered. In the presence of risk, the existing and evaluated membership degree has the highest degree of possibility. Trying to describe the interval based on this assumption, one can employ the triangular fuzzy numbers as a measure of the possibility degree of each point. Representing the optimistic-pessimistic interval via a TFN gives

where \( {\tilde{A}}_{P- OT}(x) \) is the triangular fuzzy-valued pessimistic-optimistic set of A. See Example 2.

Generalized Trapezoidal Fuzzy Number Risk Modeling

This section presents a discussion on risk modeling of GTrFNs under various scenarios. Similar to “Fuzzy Set Risk Modeling,” three scenarios are considered herein: pessimistic, optimistic, and pessimistic-optimistic modes.

Modeling the Pessimistic Interval of Generalized Trapezoidal Fuzzy Numbers

As explained in the previous sections, one may take the negative risk for membership degrees of GTrFNs. Let \( \tilde{A}=\left({a}_1,{a}_2,{a}_3,{a}_4;{\mu}_{\tilde{LA}},{\mu}_{\tilde{RA}}\right) \) be an arbitrary GTrFN. Given that \( {\mu}_{\tilde{LA}}\ne {\mu}_{\tilde{RA}} \), different risks can be defined for left- and right-hand-side membership degrees, i.e., rL− for \( {\mu}_{\tilde{LA}} \) and rR− for \( {\mu}_{\tilde{RA}} \), respectively. Therefore, denoted by \( {\tilde{A}}_P \), a T2 fuzzy pessimistic interval for A considering rL− and rR− can be formulated as

where \( {\tilde{A}}^P \) refers to the pessimistic form of A with negative risks. Figure 1 demonstrates \( {\tilde{\tilde{A}}}_P \).

Modeling the Type II Fuzzy Optimistic Interval of Generalized Trapezoidal Fuzzy Numbers

Following an opposite approach to that followed in the previous section, an optimistic interval of membership degrees can be obtained for GTrFN \( \tilde{A} \) by considering positive risks rL+ and rR+ for \( {\mu}_{\tilde{LA}} \) and \( {\mu}_{\tilde{RA}} \), respectively, as follows:

where \( {\tilde{A}}^O \) and\( {\tilde{\tilde{A}}}^O \) are the optimistic modes of \( \tilde{A} \) and optimistic T2 fuzzy interval, respectively. \( {\tilde{\tilde{A}}}^O \) is depicted in Fig. 2.

Modeling the Pessimistic-Optimistic Interval of Generalized Trapezoidal Fuzzy Numbers

Based on what was mentioned previously, a fuzzy number may be associated with both optimistic and pessimistic risks at the same time. In this case, for GTrFN \( \tilde{A} \), a T2 pessimistic-optimistic interval, can be defined as follows:

where \( {\tilde{\tilde{A}}}^{P-O} \) shows the pessimistic-optimistic mode of \( \tilde{A} \) which is shown in Fig. 3.

Based on the reasoning explained in “Fuzzy Set Risk Modeling,” it makes more sense to describe the intervals using a TFN rather than a simple interval. Given GTrFN \( \tilde{A}=\left({a}_1,{a}_2,{a}_3,{a}_4;{\mu}_{\tilde{LA}},{\mu}_{\tilde{RA}}\right) \), the TFN-based pessimistic-optimistic interval of Eq. (27) (herein designated as \( {\tilde{\tilde{A}}}^{P- OT} \)) is defined as follows:

Other Configurations of Fuzzy Sets and Generalized Trapezoidal Fuzzy Number Risk Modeling

When it comes to the risk of a membership function, there are chances that cases other than those discussed in the previous sections arise due to the nature of risk itself; an example of this scenario is the acceptable risk by decision-makers. Hence, here, all other modes in fuzzy sets and numbers are discussed and obtained relations of “Fuzzy Set Risk Modeling” and “Generalized Trapezoidal Fuzzy Number Risk Modeling” are modified based on it.

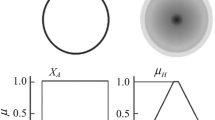

Acceptable (Tolerable) Risk

Figure 3 implies that, with increasing the risk, an extended range of membership degree is considered, implying further uncertainty and lower value of available information. As a common practice in most decision-making problems, the decision-maker tends to accept a certain level of risk up to which he/she can tolerate the risk. Being dependent on the risk-taking behavior of the decision-maker and the specific problem at hand, this behavior is generally referred to as the risk appetite of the decision-maker [26]. Denoting the acceptable risk by AR, positive and negative degrees of risk-taking can be indicated by AR+ and AR−, respectively. Accordingly, Eqs. (19) and (24) will be modified as follows.

where 0 < rR−, rL− < 1 and rR+, rL+ > 0.

The AR is expressed as a number between 0 and 1. Figure 4 indicates how different are pessimistic-optimistic intervals with and without considering AR for an arbitrary membership degree μ.

All of the possible scenarios regarding the risk modeling of a membership function are presented in Fig. 5.

The Proposed Risk-Based Fuzzy Cognitive Model

In fuzzy decision-making problems, the accuracy of the results highly depends on the information quality, which consists of completeness, accuracy, consistency, and the credibility of information. As discussed previously, unforeseen risk factors tend to deviate fuzzy information from the actual data. Different approaches to risk modeling in fuzzy sets and systems were discussed in “Risk Modeling of Fuzzy Sets” and “Generalized Fuzzy Numbers.” The present section sets out a risk-based fuzzy cognitive approach to be applied on fuzzy sets and GTrFNs in the pessimistic-optimistic scheme based on all risk configurations, e.g., positive, negative, and acceptable risks. This new concept is deemed useful for the decision-making problems where the membership degrees are associated with risks and errors. “Definitions and Operations” presents new algebraic operations for our new model based on T1 and T2 FSs. In order to demonstrate the capabilities of the proposed concept, an MCDM framework based on the combination of the FTOPSIS method and this new concept is developed in “RFC-TOPSIS Method.”

Definitions and Operations

For an arbitrary fuzzy set {〈x, μ〉}, the corresponding risk-based fuzzy cognitive model (RFC(x)) on X is defined based on a pessimistic-optimistic membership function, \( {\tilde{\mu}}_{\mathrm{RFC}} \), considering the entire set of risks, R, i.e., negative and positive risks and acceptable negative and positive risks:

where

and μRFC1 : X → [0, 1], μRFC1 : X → [0, 1], and μRFC3 : X → [0, 1].

The same algebraic operations as those applied to fuzzy sets (e.g., union, intersection) can be developed for the proposed model. For the proposed risk-based fuzzy cognitive sets associated with A and B (designated as \( {\mathrm{RFC}}_A(x)=\left\{\left\langle x,{\tilde{\mu}}_{\mathrm{RFC}A}\right\rangle \right\} \), and\( {\mathrm{RFC}}_B(x)=\left\{\left\langle x,{\tilde{\mu}}_{\mathrm{RFC}B}\right\rangle \right\} \), respectively), some of the main operations can be defined as follows.

Union:

-

Intersection:

-

Complement:

-

⊕−Sum:

-

⊗−Sum

All of the above-mentioned operations can be easily proven based on the operations applicable to basic fuzzy sets and TFNs. See also Example 4.

Proposed Model of Generalized Trapezoidal Fuzzy Numbers

The risk-based fuzzy cognitive form of an arbitrary GTrFN \( \tilde{A}=\left({a}_1,{a}_2,{a}_3,{a}_4;{\mu}_{\tilde{LA}},{\mu}_{\tilde{RA}}\right) \) is a T2 fuzzy number designated as \( {R}_S\ \left(\tilde{A}\right) \). \( {R}_S\ \left(\tilde{A}\right) \) can be defined based on the governing equations and parameters of the proposed risk-based approach, such as rL−, rR−, rL+, rR+, AR− , and AR+, respectively. Mathematically, \( {R}_S\left(\tilde{A}\right) \) is written as

where

and

Suppose \( {R}_S\left(\tilde{A}\right)=\left({a}_1,{a}_2,{a}_3,{a}_4;{{\tilde{\mu}}^L}_{SA},{{\tilde{\mu}}^R}_{SA}\right) \) and \( {R}_S\left(\tilde{B}\right)=\left({b}_1,{b}_2,{b}_3,{b}_4;{{\tilde{\mu}}^L}_{SB},{{\tilde{\mu}}^R}_{SB}\right) \), then employing algebraic operators of T2 FSs and TFNs, one can obtain

\( {R}_S\left(\tilde{A}\right) \) can be defuzzified through Eqs. (44) and (45). The first round of defuzzification of \( {R}_S\left(\tilde{A}\right) \) using Eq. (15) gives

However, given that the obtained value is still fuzzy in nature, a second defuzzification round may be practiced on the basis of the COA method (Eq. (4)) to come with the final crisp value:

Other operations (e.g., aggregation and normalization) can also be defined on this basis easily.

RFC-TOPSIS Method

As of current, a variety of FTOPSIS methods have been proposed [43, 44] for multi-attribute decision-making problems. The present study lays out a novel FTOPSIS method, namely, risk-based fuzzy cognitive TOPSIS model (RFC-FTOPSIS). The following are different steps of this new methodology.

Step 1. Forming the fuzzy decision and weight matrices

In this step, m alternatives with respect to n criteria are evaluated and the decision matrix based on GTrFNs and the fuzzy criteria weights are determined, which are denoted as \( {\tilde{D}}_k \) and \( \tilde{W} \), respectively.

where \( {{\tilde{s}}^k}_{ij} \) is the fuzzy evaluation of the ith alternative respect to the jth attribute by kth expert and \( {{\tilde{s}}^k}_{ij}=\left({s}_{1 ij},{s}_{2 ij},{s}_{3 ij},{s}_{4 ij};{\mu}_{Lij},{\mu}_{Rij}\right) \).

Step 2. Determining the risk matrix

In the second step, for evaluating the risk factors, the positive and negative risk matrices of m alternatives with respect to n criteria are determined based on each decision-maker’s opinions.

where Rk denotes the risk matrix of the kth decision-maker and Rk+ and R−k are the positive and negative risk matrices, respectively. In the above relations, r−ijk and r−ijk are negative and positive risks related to μLij, μRij in assessing the ith alternative with respect to the jth criterion by the kth decision-maker.

Step 3. Determining AR matrix

Now, focusing on experts’ opinions and organizational goals, the AR matrix of the n criteria is specified. In this case, AR+ and AR− refer to the positive and negative AR matrices, respectively

Step 4. Defining the risk-based fuzzy cognitive decision matrix (RSk)

In a fourth step, a risk-based fuzzy cognitive decision matrix is formed. Given the GTrFN \( {{\tilde{s}}^k}_{ij} \) in Eq. (46), risk matrix Eq. (48), and acceptable risk matrices Eq. (51), the risk-based GTrFNs, i.e., \( {R_S}^k\left({\tilde{s}}_{ij}\right) \), and the corresponding matrix, RSk, can be obtained as follows:

Step 5. Aggregating the decision matrix RSk

Subsequently, RSk should be aggregated to give RST as follows:

where \( {R_S}^T={\left[{R_S}^T\left({\tilde{s}}_{ij}\right)\right]}_{m\times n} \) and \( {R_S}^T\left({\tilde{s}}_{ij}\right) \) denotes the aggregated risk-based GTrFN \( {\tilde{s}}_{ij} \).

Step 6. Weighting the decision matrix

Now, the weighted aggregated matrix is obtained (RSW) by employing Eqs. (56) and (57).

in which \( {R_S}^W\left({\tilde{s}}_{ij}\right) \) is weighted aggregated risk-based GTrFN \( {\tilde{s}}_{ij} \).

Step 7. Normalizing the weighted decision matrix

In this step, the matrix elements should be normalized. If \( {R_S}^W\left({\tilde{s}}_{ij}\right)=\left({s}_{1 ij},{s}_{2 ij},{s}_{3 ij},{s}_{4 ij};{\tilde{\mu}}_{LSij},{\tilde{\mu}}_{RSij}\right) \), the normalized matrix is defined using Eq. (58).

where RSN denotes the normalized matrix and \( {R_S}^N\left({\tilde{s}}_{ij}\right) \) is the normalized value of \( {R_S}^W\left({\tilde{s}}_{ij}\right) \) which is obtained as follows:

-

Step 8. Defuzzifying the normalized decision matrix

Now to convert RSN to simple fuzzy decision matrix, each \( {R_S}^N\left({\tilde{s}}_{ij}\right) \) should be one time defuzzified. This can be done using Eq. (44), and then we have

and

In these relations, D1(RSN) is the defuzzified matrix and \( {D}_1\left({R_S}^N\left({\tilde{s}}_{ij}\right)\right) \) is a one-time defuzzified value of \( {R_S}^N\left({\tilde{s}}_{ij}\right) \).

Step 9. Specifying the FPISs and FNISs

In this step, for each attribute the fuzzy positive ideal solutions (FPISs) A+ and fuzzy negative ideal solutions (FNISs) A− should be obtained by employing Eqs. (62) and (65):

where by considering \( {D}_1\left({R_S}^N\left({\tilde{s}}_{ij}\right)\right)=\left({a}_{1 ij},{a}_{2 ij},{a}_{3 ij}\right) \), we have

Step 10. Determining distance of each choice from FPISs and FNISs

The distances between each choice from each FPIS and each FNIS are denoted by \( {d}_i^{+} \) and \( {d}_i^{-} \), respectively, and can be calculated by using Eq. (64):

in which the distance between two TFNs \( \tilde{A}=\left({a}_{11},{a}_{12},{a}_{13}\right) \) and \( \tilde{B}=\left({a}_{21},{a}_{22},{a}_{23}\right) \) can be described via Eq. (65) [23]:

Step 10. Computing the closeness coefficient

Eventually, the following equation provides the closeness coefficient (CCi) for the ith option:

Step 11. Ranking the alternatives

In this step, the alternatives are ranked descending according to CCi. The steps of the proposed RFC-TOPSIS method are depicted in Fig. 6.

Illustrative Example and Comparisons

In this section, to demonstrate capabilities of the proposed RFC-TOPSIS method in solving decision-making problems under risk and uncertainty, a case study of FMEA is presented with the results of different scenarios compared.

Case Study (FMEA Analysis)

As a popular industrial analysis technique, FMEA works by ranking potential failure modes based on so-called Risk Priority Number (RPN) measure. The RPN is evaluated by multiplying the risk factors, i.e., occurrence (O), severity (S), and detection (D) [45]. Given that this analysis is frequently performed prior to actually designing the process or the product, the risk factors are extremely difficult to predict accurately [17]. The proposed RFC-TOPSIS model was evaluated on an ocean-fishing vessel as a case study. For this purpose, FMEA was performed on structure, propulsion, electrical, and auxiliary systems of the vessel. Possible failure of each of these systems may end up with injuries and/or other negative impacts. For each failure mode, the entire spectrum of signals and warnings were investigated. Table 2 presents GTrFN-based assessments for different failure modes with respect to different risk factors by one expert. Being doubtful due to information deficiency, the expert assigned two values (i.e., positive and negative risks) to each risk factor. The acceptable negative and positive risks of each criterion were determined based on the organizational goals and expert opinions (Table 2).

As a first step, Eqs. (36) and (37) were employed to calculate the risk-based fuzzy cognitive form of each evaluation (Table 3). Next, the evaluations were subjected to defuzzification via Eq. (44) and a simple fuzzy decision matrix was built based on TFNs (Table 4). Subsequently, CCi values were obtained by calculating the distance from FPISs and FNISs, respectively. Results of the ranking procedure are presented in Table 5. Moreover, in order to show the effectiveness of the proposed model to capture various scenarios of the problem, four other cases are investigated as follows:

Case 1: Only optimistic mode (positive risk) is considered.

Case 2: Only pessimistic mode (negative risk) is considered.

Case 3: AR is equal to zero.

Case 4: The problem is risk-free.

Table 5 and Fig. 7 present the results of the four above-described cases, indicating discrepancies resulting from different risk configurations in the problem.

Results

Generally speaking, in future-based problems, predicted input data for processing are sometimes associated with risks and errors. Although such data can be adequately expressed using fuzzy sets and numbers, risks of this information can be considered as a confidence factor. By reviewing the results, it can be seen that the slight different outcomes were obtained from the presented case study when the RFC-TOPSIS methodology was applied, highlighting flexibility and efficiency of the methodology when it comes to risk-related problems. Considering the risk for evaluating the RPN, as compared to the risk-free case, has led to change in the results, e.g., the criticality of F3 decreases from rank 1 in the risk-free case to rank 2. It could be noted that considering the risk results in a more precise, reliable, and robust manner results in the risk-free case and it is obvious that it does not add the processing load considerably.

By reviewing the closeness coefficient values of different scenarios, it is inferred that by assuming the identical values of FPISs and FNISs in each scenario, the closeness coefficient of the proposed model is always between optimistic and pessimistic cases and lower than the free-risk mode, i.e., we have

Finally, ranking results show a higher impact of optimistic risk on results than other cases, since the failure modes have become more critical.

Conclusion

Fuzzy sets can well represent the ambiguities and uncertainties of human cognitive information; however, in some decision-making problems, particularly those focusing on future events, usually, some percentage of risk and error exists about the predicted fuzzy data, which cannot be modeled by classical fuzzy sets. Therefore, the present research developed a new risk-based fuzzy cognitive model for describing the risk associated with the fuzzy sets and generalized fuzzy numbers. Moreover, such concepts as risk appetite (risk-taking degree) were considered to model the proposed methodology in a better and more realistic manner. Considering the novelties of this new concept, one may refer to the definition of positive and negative risks and the pessimistic and optimistic intervals of a membership function in the form of TFNs. Since the proposed model can be used to address various risk scenarios, it gives to organizations and decision-makers flexibility to define various parameters like the acceptable degree of positive/negative risk in real applications. Finally, a new approach called RFC-TOPSIS methodology was developed for solving MCDM problems, followed by presenting a case study of FMEA to demonstrate the efficiency of the proposed methodology. Based on the results of this study, the proposed methodology is highly recommended for problems requiring high levels of precision, such as safety or environment-related problems where a wrong decision is likely to end up with serious consequences. In addition, it can be used in decision problems in which data are related to the future along with risk and ambiguity including project management, portfolio selection, and climate changes.

As is discussed in “Introduction,” the mental factors of experts affect the reliability of the obtained information, since the risk values themselves are extracted by the experts, and there are differences in their risk perceptions (i.e., the higher risk values are reported by pessimist experts and the lower values by optimistic experts); it is recommended to employ consensus-reaching models in group decision problems to reduce the effects of miscognition through social influence [46]. Additionally, in this study, crisp values were obtained directly by the experts, which is not always a true assumption. The precise value of negative and positive risks of future predictions are not always in hand, so it can be expressed by using fuzzy information, which can be mentioned as a future direction of this study. Moreover, the risk-based fuzzy cognitive model was employed only for T1 fuzzy information that can be applied to other fuzzy models (e.g., intuitionistic fuzzy sets, hesitant fuzzy sets, and interval-valued fuzzy sets) and another future research work for modeling risks of aforementioned uncertainties.

References

Sun G, Guan X, Yi X, Zhou Z. Improvements on correlation coefficients of hesitant fuzzy sets and their applications. Cogn Comput. 2019;11(4):529–44 1-16.

Liu P, Zhang X. A novel picture fuzzy linguistic aggregation operator and its application to group decision-making. Cogn Comput. 2018;10(2):242–59.

Tao Z, Han B, Chen H. On intuitionistic fuzzy copula aggregation operators in multiple-attribute decision making. Cogn Comput. 2018;10(4):610–24.

Ma Z, Zhu J, Ponnambalam K, Chen Y, Zhang S. Group decision-making with linguistic cognition from a reliability perspective. Cogn Comput. 2019;11(2):172–92 1-21.

Wang JQ, Cao YX, Zhang HY. Multi-criteria decision-making method based on distance measure and choquet integral for linguistic Z-numbers. Cogn Comput. 2017;9(6):827–42.

Ye J. Multiple attribute decision-making methods based on the expected value and the similarity measure of hesitant neutrosophic linguistic numbers. Cogn Comput. 2018;10(3):454–63.

Turksen IB. Interval valued fuzzy sets based on normal forms. Fuzzy Sets Syst. 1986;20(2):191–210.

Atanassov KT (2012) On intuitionistic fuzzy sets theory (Vol. 283). Springer.

Atanassov K, Gargov G. Interval-valued intuitionistic fuzzy sets. Fuzzy Sets Syst. 1989;31(3):343–9.

Xiao F, Ding W. Divergence measure of Pythagorean fuzzy sets and its application in medical diagnosis. Appl Soft Comput. 2019.

Zhai Y, Xu Z, Liao H. Measures of probabilistic interval-valued intuitionistic hesitant fuzzy sets and the application in reducing excessive medical examinations. IEEE Trans Fuzzy Syst. 2017;26(3):1651–70.

Zadeh LA. A note on Z-numbers. Inf Sci. 2011;181(14):2923–32.

Rodríguez RM, Bedregal B, Bustince H, Dong YC, Farhadinia B, Kahraman C, et al. A position and perspective analysis of hesitant fuzzy sets on information fusion in decision making. Towards high quality progress. Information Fusion. 2016;29:89–97.

Ji P, Zhang HY, Wang JQ. A projection-based outranking method with multi-hesitant fuzzy linguistic term sets for hotel location selection. Cogn Comput. 2018;10:737–51.

Zhu B, Xu Z, Xia M. Dual hesitant fuzzy sets. J Appl Math. 2012;2012:13.

Farhadinia B. Information measures for hesitant fuzzy sets and interval-valued hesitant fuzzy sets. Inf Sci. 2013;240:129–44.

Pang Q, Wang H, Xu Z. Probabilistic linguistic term sets in multi-attribute group decision making. Inf Sci. 2016;369:128–43.

Ye J. Similarity measures between interval neutrosophic sets and their applications in multicriteria decision-making. J Intell Fuzzy Syst. 2014;26(1):165–72.

Şahin R, Liu P. The correlation coefficient of single-valued neutrosophic hesitant fuzzy sets and its applications in decision making. Neural Comput & Applic. 2017;28(6):1387–95.

Song W, Zhu J. A multistage risk decision making method for normal cloud model considering behavior characteristics. Appl Soft Comput. 2019;78:393–406.

Smarandache F. Plithogenic set, an extension of crisp, fuzzy, intuitionistic fuzzy, and neutrosophic sets–revisited. Neutrosophic Sets and Systems. 2018;21:153–66.

Cuong, B. C., & Kreinovich, V. (2013). Picture Fuzzy Sets-a new concept for computational intelligence problems. In Information and Communication Technologies (WICT), 2013 Third World Congress on (pp. 1-6). IEEE.

Xiao F. A novel multi-criteria decision making method for assessing health-care waste treatment technologies based on D numbers. Eng Appl Artif Intell. 2018;71:216–25.

Li X, Chen X. D-intuitionistic hesitant fuzzy sets and their application in multiple attribute decision making. Cogn Comput. 2018;10(3):496–505.

Seiti H, Hafezalkotob A, Martínez L. R-numbers, a new risk modeling associated with fuzzy numbers and its application to decision making. Inf Sci. 2019;483:206–31.

Seiti H, Hafezalkotob A, Fattahi R. Extending a pessimistic–optimistic fuzzy information axiom based approach considering acceptable risk: application in the selection of maintenance strategy. Appl Soft Comput. 2018;67:895–909.

Seiti H, Tagipour R, Hafezalkotob A, Asgari F. Maintenance strategy selection with risky evaluations using RAHP. J Multi-Criteria Decis Anal. 2017;24(5-6):257–74.

Seiti H, Hafezalkotob A, Najafi SE, Khalaj M. A risk-based fuzzy evidential framework for FMEA analysis under uncertainty: an interval-valued DS approach. J Intell Fuzzy Syst. 2018;35(2):1419–30 (Preprint), 1-12.

Seiti H, Hafezalkotob A. Developing pessimistic–optimistic risk-based methods for multi-sensor fusion: an interval-valued evidence theory approach. Appl Soft Comput. 2018;72:609–23.

Gören HG, Kulak O. A new fuzzy multi-criteria decision making approach: extended hierarchical fuzzy axiomatic design approach with risk factors. In: Decision Support Systems III-Impact of Decision Support Systems for Global Environments. Cham: Springer; 2014. p. 141–56.

Kulak O, Goren HG, Supciller AA. A new multi criteria decision making approach for medical imaging systems considering risk factors. Appl Soft Comput. 2015;35:931–41.

Hafezalkotob A, Hafezalkotob A. Risk-based material selection process supported on information theory: a case study on industrial gas turbine. Appl Soft Comput. 2017;52:1116–29.

Ijadi Maghsoodi A, Hafezalkotob A, Azizi Ari I, Ijadi Maghsoodi S, Hafezalkotob A. Selection of waste lubricant oil regenerative technology using entropy-weighted risk-based fuzzy axiomatic design approach. Informatica. 2018;29(1):41–74.

Seiti H, Hafezalkotob A. Developing the R-TOPSIS methodology for risk-based preventive maintenance planning: a case study in rolling mill company. Comput Ind Eng. 2019;128:622–36.

Bede B. Mathematics of fuzzy sets and fuzzy logic. Berlin, Heidelberg: Springer-Verlag; 2013.

Shokeen J, & Rana C (2017). Fuzzy sets, advanced fuzzy sets and hybrids. In 2017 International Conference on Energy, Communication, Data Analytics and Soft Computing (ICECDS) (pp. 2538-2542). IEEE.

Fuchs E, & Masoum MA (2011). Power quality in power systems and electrical machines. Academic press.

Patel AV, Mohan BM. Some numerical aspects of center of area defuzzification method. Fuzzy Sets Syst. 2002;132(3):401–9.

Van Broekhoven E, De Baets B. Fast and accurate center of gravity defuzzification of fuzzy system outputs defined on trapezoidal fuzzy partitions. Fuzzy Sets Syst. 2006;157(7):904–18.

Jiang W, Luo Y, Qin XY, Zhan J. An improved method to rank generalized fuzzy numbers with different left heights and right heights. J Intell Fuzzy Syst. 2015;28(5):2343–55.

Mendel JM, Rajati MR, Sussner P. On clarifying some definitions and notations used for type-2 fuzzy sets as well as some recommended changes. Inf Sci. 2016;340:337–45.

Kahraman C, Öztayşi B, Sarı İU, Turanoğlu E. Fuzzy analytic hierarchy process with interval type-2 fuzzy sets. Knowl-Based Syst. 2014;59:48–57.

Joshi D, Kumar S. Interval-valued intuitionistic hesitant fuzzy Choquet integral based TOPSIS method for multi-criteria group decision making. Eur J Oper Res. 2016;248(1):183–91.

Zhang X, Xu Z. Soft computing based on maximizing consensus and fuzzy TOPSIS approach to interval-valued intuitionistic fuzzy group decision making. Appl Soft Comput. 2015;26:42–56.

Seiti HR, Behnampour A, Imani DM, Houshmand M. Failure modes and effects analysis under fuzzy environment using fuzzy axiomatic design approach. Int J Research Ind Eng. 2017;6(1):51–68.

Capuano N, Chiclana F, Fujita H, Herrera-Viedma E, Loia V. Fuzzy group decision making with incomplete information guided by social influence. IEEE Trans Fuzzy Syst. 2018;26(3):1704–18.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Ethical Approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

-

Example 1. Letting the risks associated with membership function and set elements of a reference set X and the fuzzy set \( \tilde{A} \) as rμ− = 0.3 and rx− = 0.2,respectively, the pessimistic set \( {\tilde{A}}_{Pb} \) can be obtained as follows.

-

Example 2. Taking the X and fuzzy set \( \tilde{A} \) of Example 1 and assuming the risks of membership function as r− = 0.3 and r+ = 0.2, the pessimistic-optimistic set \( {\tilde{A}}_{P- OT}(x) \) can be written as follows.

-

Example 3. Suppose GTrFN \( \tilde{A}=\left(1,2,3,4;\mathrm{0.4,0.6}\right) \) and rL− = 0.2, rR− = 0.3, rL+ = 0.3 and rR+ = 0.2 , \( {\tilde{\tilde{A}}}^{P- OT} \) is determined as follows:

-

Example 4. By letting ={1}, A = {(1,0.2)}, B = {(1,0.5)}, RA = {0.3, 0.4, 0.2, 0.1}, and RB = {0.2, 0.1, 0.2, 0.1},then we have

Rights and permissions

About this article

Cite this article

Seiti, H., Hafezalkotob, A. A New Risk-Based Fuzzy Cognitive Model and Its Application to Decision-Making. Cogn Comput 12, 309–326 (2020). https://doi.org/10.1007/s12559-019-09701-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12559-019-09701-8