Abstract

In recent years, production optimization becomes one of the key issues in the oil and gas industry. Production optimization is one of the most sophisticated activities from the operational point of view. It is defined based on a set of activities that converts measured and gathered data into optimal managerial decisions. In this study, production optimization of a hydrocarbon field in Iran was performed considering the operational constraints on production and injection using second derivative methods named Davidon-Fletcher-Powell (DFP) and symmetric rank 1 (SR1). The results of simulation and optimization showed that the SR1 method increases net present value about 2.79% compared to base case over a 12-year period. The DFP method can also increase the net present value by 0.54% over a 5-year period, but this method is not suitable for long-term production optimization of the field. Oil and gas cumulative production could increase if the SR1 method is used for a period of at least 12 years compared to the base case, but greater production of the reservoir by using the optimizer will result in a higher pressure drop than the base case. That is why water cumulative production will gradually increase in the last years of reservoir life.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Oilfield development are continually progressing, and new technologies such as chemical flooding are being developed to increase oil production (Taheri-Shakib et al. 2018; Wang et al. 2021). Long-term production from the reservoir leads to gradual pressure drop. The pressure loss as the driving force of the fluid flow in the porous media and the well declines the production rate. After some time, the reservoir pressure will reach to abandon pressure so that no fluid is produced from the reservoir. In recent years, production and injection rate optimization in wells are a subject to delay this phenomenon (Khishvand and Khamehchi 2012).

In general, optimization methods are divided into two categories of direct and indirect methods. Direct methods solve nonlinear programming problems without turning to one or more linear programming problems using direct search methods. While in indirect methods, the problem is solved by examining one or more linear programming problems derived from the initial problem. Linear searching that was developed for the function of one variable commences by specifying an interval containing the optimum point. This interval called the uncertainty range is systematically shortened to acquire relative approximation of optimal response in order to minimize length of interval. The direct methods associated with optimizing multivariable functions are divided into two categories: (a) derivative-free optimization and (b) gradient base methods.

Derivative-free optimization methods such as the cyclic coordinate method (Vassiliadis and Conejeros 2008), Hooke-Jeeves method (Hooke and Jeeves 1961) and Rosenbrock method (Rosenbrock 1963) are based on the absolute search on the response surface; thus, extensive dimension issues require time and cost to reach optimal response. Gradient base methods are an optimal control strategy for finding the settings for production and injection wells in order to maximize some of the economic parameters of the reservoir; thus, production optimization provides us a tool for decision-making about optimal control input. These input parameters can include well injection or production rate, bottom hole pressure, and valve/surface choke settings.

The objective function in production optimizing issues depends on the net present value (Wang et al. 2009; Volcker et al. 2011; Naderi and Khamehchi 2017), recovery factor or production rate (Denney 2003; Lake et al. 2007; Naus et al. 2004), producing gas oil ratio (Razavi and Jalali-Farahani 2008), or allocated gas to each well (Hamedi et al. 2011; Mahdiani and Khamehchi 2015). The number of decision variables that determines the control input dimension depends on the number of wells, production period, and the parameterization of the well settings. Gradient-based optimization methods are usually used in production optimization when gradients are available at an affordable cost (Suwartadi 2012). Earlier, many researchers have optimized the production of a field using derivative-free methods (Conn et al. 2009).

An oil reservoir model is considered as an implicit constraint in terms of optimization approach. The methods that are not derivative-based follow black box optimization methods and do not need much more detail within the simulator. These methods provide only input for the simulator and use the simulator to get results from given input. These algorithms are predominantly iterative and stop after fulfilling stopping criteria and achieving optimal response. However, gradient-based methods use the finite difference method to calculate the value of first derivative. This method causes the simulator calculations to move towards the optimal value. However, this method can be vulnerable to numerical noise and local extrema. Also, the derivative commonly does not exist in simulators, and it must be computed by synchronizing the simulator with one of the numerical software such as MATLAB (Jansen et al. 2009).

If the first derivative is available in the optimization problem, then it must be decided to use one of the conventional gradient-based methods. The most common methods in this area are the steepest gradient (Fliege and Svaiter 2000), conjugate gradient (Birgin and Martínez 2001), and quasi-Newton (Savioli and Bidner 1994). These methods all use first-order derivatives and quasi-newton methods to estimate the Hessian matrix. In terms of convergence rate toward optimal response, quasi-Newton methods are faster than first-derivative base methods and the Newton method.

Second-order derivative-based optimization methods often use two major strategies: (a) line-search; (b) trust-region. So far, derivative-based methods have used line-search strategy, and implementation of the trust-region strategy in the simulator environment is not feasible in order to calculate the first-order derivative (Biegler 2010).

Decision parameters in a production optimization problem often have operational constraints. Well flow rates, wellhead, and bottom-hole pressure have their own limitations. However, if the produced fluid is assumed incompressible, the total amount of injected and produced fluid should be equal. There are many non-linear constraints such as water production rates in wells that are complex (Naderi and Khamehchi 2016). The presence of nonlinear constraints in the production optimization problem disrupts applicability of adjoint method to calculate the first derivative, which can be considered either by limiting the simulator or by using methods such as the Lagrange algorithm (Chen 2011).

In this study, two methods of Davidon-Fletcher-Powell (DFP) and symmetric rank 1 (SR1) were used to optimize the production in one of Iran’s fields. These two methods are among the quasi-Newton methods. With the synchronization of the Eclipse simulation software with MATLAB software, Jacobian matrix is calculated using the adjoint method. Then, Hessian matrix is estimated, and the objective function is calculated based on decision parameters. Net present value was selected as objective function in this study, and operational constraints were applied to each decision parameters in the simulator environment.

Field specifications

The oil field is located in Abadan plain, west of Karun River and 45 km from north of Khorramshahr. Square structure is a symmetric anticline with a length of 24 km and a width of 10 km and has a north–south orientation. This field consists of three reservoirs in different formations. So far, 33 wells have been drilling and the status of the wells is as follows: 19 active production wells, 4 injection wells, and 1 active water injection wells. Surface equipment have capability to produce 165,000 barrels of oil per day and 350 million cubic feet of gas per day. Wells produce under the constant bottom hole production rate constraint. After reducing the bottom-hole pressure below the constraint limit, the constant-rate production converts to constant-pressure production. Table 1 shows the fluid properties in one producing well. The reservoir’s general information such as reservoir pressure and temperature, water cut, gas oil ratio, and drainage area are presented in Table 2. The well and reservoir model were finally constructed using the Ellipse simulator software.

Methodology

Production optimization is one of the most complex activities from the operational point of view, due to its various physical properties, tool errors, and the lack of measurements of future times which is also affected by uncertainty. Optimization is defined as finding the best available value from an objective function in a given domain of variables. The net present value (NPV) was selected as the objective function in this study. Equation (1) is applicable to calculating NPV. Our goal is to determine the decision factors of the problem. The net present value (in the presence of optimizer) is greater that the net present value in the base case.

To calculate net present value, parameters such as capital expenditures (CAPEX), operating costs (OPEX), water management costs per well (cw), gas injection rate per injection well (cginj), interest rate (i), gas (pg), and oil (po) price gas (cg), and oil (co) production costs are effective in the market. These parameters are decision factors. According to Eq. (2), the parameter u is known as the control parameter and is a function of the produced fluid flow rate from each well and the injection fluid flow rate per well.

Our goal is to maximize the NPV objective function, but in this relatively large oil field, there is no explicit relationship between the net present value function and the flow rate of the 19 production and 3 injection wells. In other words, the NPV cannot be expressed in terms of the parameter u. In this optimization problem, in addition to the objective function, several operational constraints are also applied in order to achieve optimal production under ideal conditions. The cumulative oil production from production wells, according to the capacity of the wellhead equipment should not exceed 160,000 barrels a day (Eq. 4). Also, due to the amount of produced gas and available natural gas reserves as well as capacity of wellhead equipment like wellhead compressor to compress injected gas, the amount of injectable gas should not exceed 280 million cubic feet per day (Eq. 5).

The produced oil flow rate in each well (qoi) should not exceed 15,240 barrels per day (Eq. 6). The fraction of produced water per well (WCTi) should be less than 50%; otherwise, due to the impossibility of managing water production at the surface, the well will be closed (Eq. 7). The produced gas oil ratio in each well (GORi) should not exceed 15,000 cubic feet per barrel of oil produced since there is no possibility of separating gas from oil in the separators (relationship 8). Finally, the pressure limit is also considered to be the pressure applied to each well. The bottom hole pressure (BHPi) should be more than 100 psi; otherwise, the well will be closed because the fluid will not have the energy required for production (Eq. 9). The optimization problem will be as follows:

Considering the implementation of the well and reservoir model in the Eclipse simulator, cumulative oil production, cumulative water production, and cumulative gas production and the gas injection rate will be achieved in each simulation runtime. The existing constraints on equipment are also applied to the simulator. The value of the net present at each step can be obtained using Eq. (1). This value is NPV0, which is derived from the history of the reservoir and previous production conditions. The following algorithm is used to obtain the optimal NPV point by Davidon-Fletcher-Powell (DFP) method:

-

1.

One point using the production history of each well is considered as the initial assumption of the control parameter u. The NPV at this point is obtained using Eq. (1) and called NPV0.

-

2.

The converging parameter (ε) value is selected as the stopping criteria. If the norm of gradient matrix value is less than the converging parameter in each step, the algorithm stops, and the resulting response is optimized.

-

3.

Consider the K (iteration number) as 0 and the matrix V0 equal to the identity matrix. The initial assumption of the Hessian matrix must always be a positive definite matrix.

-

4.

The Jacobian matrix value is calculated using the Eq. (10) at the NPVk point.

where uk is equal to the control matrix consisting of the production flow rate of the production wells and the injection rate of injection wells in the repetition k. The parameter sk is called the perturbation size, whose value varies from 0.9 to 1.1 in optimization problems.

-

5.

Stopping criteria is checked after calculating the Jacobian matrix. If it does not, the next step will be done.

-

6.

The search direction parameter is computed from Eq. (11):

where V is the inverse Hessian matrix.

-

7.

Linear optimization is performed to find the best value for the step length parameter (αk) in each step. Since the dimensions of the optimization problem are large, linear optimization is neglected to find this parameter and two values of 1 and 0.5 are embedded in the problem. The reason is that linear optimization will significantly increase the volume of the computations.

-

8.

The current point is updated using Equation (12).

This equation is the same as the Newton–Raphson method.

-

9.

The values of sk and yk are obtained in accordance with Eqs. (13) and (14), using the search direction and the gradient difference at two calculated points.

By calculating the two parameters Ak and Bk and replacing in Eq. (17), the inverse of the Hessian matrix will be updated using the Davidon-Fletcher-Powell (DFP) method.

-

10.

By placing the value of k=k+1, back to the beginning of the algorithm, and the calculations are repeated. If the stopping criteria algorithm is met, the algorithm is stopped, and the result will be the optimal response.

The DFP method is also part of the rank-2 method for estimating the Hessian matrix, since according to Eq (17), the Hessian matrix is updated using two terms named Ak and Bk in each replication. The symmetric rank-1 update (SR1) is also part of the quasi-Newton method for estimating the Hessian matrix. To optimize the NPV objective function by the SR1 method, the algorithm provided for the DFP method is strictly followed; only the Eq. (18) must be used to update the Hessian matrix:

The SR1 method is part of the rank-1 method for estimating Hessian matrix. Since, according to Eq. (18), the Hessian matrix is updated only by adding a term. If the initial assumption for the Hessian matrix is positive definite, the Hessian matrix estimation by the DFP method will definitely be positive definite. However, in the SR1 method, only the Hessian matrix estimate is positive definite only if condition (19) is satisfied:

In this study, both DFP and SR1 methods were implemented in the MATLAB. Then, by synchronizing the Ellipse simulator and MATLAB software, the optimal result of the objective function is obtained using two methods quasi-Newton rank 1 (SR1) and quasi-Newton rank 2 (DFP).

Results and discussion

There are numerous quasi-Newton-based (QNM) methods such as DFP (Davidon-Fletcher-Powell) and SR1 (symmetric rank 1) used to optimize twice-differentiable functions. The difference between them are the exact methods that they use to approximate the inverse Hessian matrix (H-1) that is used in the full Newton’s method. The primary benefits of QNMs stem from the fact that they do not need to iteratively calculate the inverse Hessian, thus the different types of QNMs are highly dependent on what approximation is used. The most simplistic approximation uses the same value of the inverse Hessian for each iteration. Obviously, this is not ideal, but is illustrative none the less. QNMs could be computationally cheap and fast computable. There is no need for second derivative to solve linear system of equations. They also have more convergence steps and less precise convergence path (Liu et al. 2019; Liu and Chen 1999).

Synchronizing two MATLAB and Eclipse software, and implementing DFP and SR1 methods in the MATLAB, production optimization of the oilfield with the aim of maximizing the net present value objective function is performed. The amount of produced fluids is measured each time the reservoir simulator run, and the objective function is calculated using Eq. (1). The optimal cash flow was calculated using the two methods over a 17 years period (from 2018 to 2035), and was drawn in the presence of the base case and in the absence of optimizer, the results of which are shown in Fig. 1. Quasi-Newton methods are generally a class of optimization methods that are used in non-linear programming when full Newton’s methods are either too time consuming or difficult to use (Liu et al. 2019). The lack of precision in the Hessian calculation leads to slower convergence in terms of steps. Because of this, quasi-Newton methods can be slower (and thus worse) than using the full Newton’s method. This occurs for simple problems where the extra computation time to actually compute the Hessian inverse is low (Naderi et al. 2020).

According to Fig. 1, the cash flow graph from the SR1 method until the year 2030 shows a positive balance and the values calculated are above the base case diagram. From the year 2030 onward, the chart is downtrend and cannot converge to more than the base case. Thus, SR1 will show its best performance by 2030. The net present value associated with the SR1 method is reported in Table 3. According to these results, the SR1 method by 2030 would increase about 2.8% of the total net present value compared to base case, which is about $ 1.2 billion. Therefore, until 2030, the SR1 method will significantly increase the profitability of the project. Now, if the data from 2030 to 2035 are also considered in the calculations, it is observed that for a total of 17 years, the SR1 method lost its efficiency, and the calculated net present value is reduced by about 5% compared to the base case, which is estimated about $3 billion. Therefore, this method will not be responsive in the long term.

According to Fig. 1, the DFP method until time step 4 (2022) is able to predict optimal values for the field cash flow. Then, at time step 5, this method cannot converge to the optimal field cash flow. As a result, its ability to optimize relative to the SR1 method is more limited. According to previous studies, the ability of the second derivative methods is completely problem-dependent and will be determined only after optimization. The calculated parameters of the DFP method are given in Table 4. This method is able to increase the net present value of the field by up to $ 112 million over a period of 5 years (about 0.6% increase compared to base case); therefore, it is suitable for short-term optimization in short term.

The producing wells are producing based on constant pressure. Therefore, the production flow rate from any well (19 active production wells in this field) is controlled using surface choke. As shown in Fig. 1, the cash flow calculated by the SR1 method over the 12-year period and the DFP method over the 5-year period were greater than the base case resulting from the simulation. One of the main factors affecting the value of the objective function is the net present value is the amount of cumulative oil produced from active wells in the field. Oil, given its daily price, appears in the NPV formula (Eq. 1).

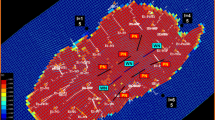

Figure 2 shows the trend of changes in cumulative oil production over the period of 12 years from 2018 to 2030, calculated from the SR1 method, as compared to the base case of the simulation. The optimum cumulative oil production was calculated only over 5 years using the DFP method, because in the long-term this method does not converge to optimal response. As can be seen, during the 12-year period, the amount of cumulative oil production using the SR1 method is more than the base case calculated by the simulator. According to this figure, at the beginning of 2018, 558,849,660 barrels of oil from the field have been cumulatively produced from all wells.

Now, if the control parameters set by optimizer (SR1 method) are used over the next 12 years, the amount of cumulative oil production will reach one billion and twenty million barrels (from the beginning of the production life of the field) at the end of 2030, while at The normal and non-optimal mode will be around 1 billion barrels, which is about 20 million barrels less than optimized state (2.48% increase in the amount of oil produced by the use of the optimizer). If the DFP method is used, the amount of cumulative oil production will increase by about 500,000 barrels over a period of 5 years. However, by the end of 2022, the amount of oil produced from wells will be reduced. These methods are not perfect, however, and can have some drawbacks depending on the exact type of quasi-Newton method used and the problem to which it is applied. Despite this, quasi-Newton methods are generally worth using with the exception of small-scale problems.

Figure 3 shows the amount of cumulative gas production in the nineteen wells studied. Produced gas is important from two respects. First, gas in Eq. (1) has an economic value and an increase in gas production in a field will increase the net present value. Secondly, the studied field has three injection wells. These wells are used to inject gas into the reservoir and consequently to increase production (recovery methods). Considering these issues, Fig. 3 shows that, in the lifetime of the field production by 2030, the application of optimal parameters in the production of the reservoir by the SR1 method would increase the cumulative gas production to two billion and two hundred and seventy million (103 ft3). In non-optimal condition, the amount of cumulative gas production from the reservoir will be equal to two billion and two hundred and fifty-seven (103 ft3) by 2030. Therefore, using the SR1 method in optimized mode, the amount of cumulative gas produced would be about 20 billion cubic feet more than the non-optimal state (about 0.95% cumulative production increase).

However, it should be noted in Fig. 3 that after 2027 (around time step 10), cumulative gas production is gradually declining using the optimizer condition and will approach to the amount of cumulative gas production in a non-optimal state. Table 5 shows the exact amounts of cumulative gas production optimized using the SR1 and non-optimal state. The above claim is clearly specified in the table data. Also, the process of producing gas is not strongly ascending. In some time-steps, ascending and descending trend is also observed. In the DFP method, there was little change in the amount of cumulative production by 2022, thus neglected to be drawn.

More specifically, these methods are used to find the global minimum of a function f(x) that is twice-differentiable. There are distinct advantages to using quasi-Newton methods over the full Newton’s method for expansive and complex non-linear problems (Naderi et al. 2020). Figure 4 shows cumulative water production in the 12-year period for a base case and optimal state. As can be seen, by applying the optimizer in model in 2018, the amount of cumulative water production increases simultaneously with the increase in oil production. However, after some time step, the cumulative water production diagram shows a smooth and straight-line process. After time strep 4 thereafter, the cumulative water production has been re-emerging, which is observed to the end of the studied interval (2030). It seems that at time step 4, an increase in oil production (in the presence of the optimizer) has led to a higher pressure drop on the system, resulting in the influx of water from the porous space inside the reservoir and the appearance of more amounts of water at the surface.

The cumulative water production graph in the base case is a relatively linear with a positive gradient, which is increasing over time with a smooth slope. Applying the optimizer has caused the amount of cumulative water production to increase over time than the base case. Therefore, it can be concluded that the presence of optimizer, despite the significant increase in oil and gas production, has negative aspects, such as increasing water cut, which will impose additional costs on the system. However, additional costs due to water production are considered in Eq. (1) (to calculate net present value).

At the beginning of 2018 (early stage optimization by SR1), the cumulative water production from the beginning of the production life of the reservoir was about one million and six hundred thousand barrels. This value reached to more than four million barrels at the end of the 12-year period by applying optimizer that has been doubled compared with the base case over the same period. Data related to the amount of cumulative water production from wells from the beginning of production life up to 2030 are presented in Table 6. Also, the time step zero refers to the cumulative water production from the beginning of the production life of the reservoir (opening of wells) by the beginning of 2018 (the beginning of optimization).

As mentioned earlier, wells are producing with a constant rate. If the pressure greatly drops, the scenario will be changed and production will be carried out under constant pressure. According to the fundamental relationships governing in porous media, the pressure difference and the production flow rate have a positive relationship, so that the higher the production flow, the greater the loss of pressure inside the porous space and, as a result, depletion of reservoir energy in long-term. In the presence of an optimizer such as the SR1 method, it is expected that during the 12-year period, the amount of oil and gas produced from the reservoir will increase. Increasing water production is the first effect of increasing fluid production from porous media in the long term. The second effect of increasing production is the reduction of reservoir pressure and, consequently, earlier reservoir abandon pressure. This issue is critical because in the presence of the optimizer, we will be able to produce oil faster and less cost in long term.

Figure 5 shows the changes in pressure over the 12-year period (from 2018 to 2030) in the reservoir. The figure is composed of two graphs, both of which start at the base pressure of 6982 psi. This pressure was recorded at the beginning of 2018. The blue graph shows the square points of the pressure drop over the production time in the presence of the SR1 optimizer. In the 12-year period, the pressure dropped to 1284 psi and reaches 5698 psi at the end of the surveyed period (2030). The red graph with round points also shows the pressure drop in the absence of the optimizer and under the base case. This graph has a downward trend like the blue graph, but its gradient is lower than the blue graph. In the base case, the pressure at the end of the studied period (2030) reaches to 5844 psi. It is clear that the pressure drop in the base case is lower than the previous one, and the reservoir still maintains its energy.

Correlating the Figs. 4 and 5 that up to time step 4, the pressure drop in the presence of the optimizer and the base case is not significant (about 60 psi). For this reason, cumulative water production, is slightly different (about 200,000 barrels). After the time step 4, the pressure drop has become more intense in the presence of the optimizer, which has led to an increase in the amount of water cut in the surface. The recorded pressure values at the end of each time step in the base case and in the presence of the optimizer are reported in Table 7.

Conclusions

In this paper, two methods of SR1 and DFP, both components of second derivative optimization methods were used. The SR1 method increases about 2.79% of the net present value compared to the base state over a 12-year period. By continuing to optimize by 2035 (a period of 17 years), this method loses its efficiency in convergence towards optimal response.

In DFP, it was able to increase the net present value of the field by 0.54% during the 5-year period, but this method is not suitable for long-term optimization of the production of the field.

The amount of cumulative production of oil and gas would increase if using the SR1 method over a period of 12 years compared to the base case, but it should be assumed that greater production of the reservoir by using the optimizer would result in a higher pressure drop than the base case. As a result, cumulative water production will gradually increase in the final years.

References

Biegler, L. T., 2010. Nonlinear programming: concepts, algorithms, and applications to chemical processes. Vol. 10 ed. s.l.:Siam.

Birgin EG, Martínez JM (2001) A spectral conjugate gradient method for unconstrained optimization. Appl Math Optim 43(2):117–128

Chen, C., 2011. Adjoint-gradient-based production optimization with the augmented Lagrangian method, s.l.: (Doctoral dissertation, University of Tulsa).

Conn AR, Scheinberg K, Vicente LN (2009). Introduction to derivative-free optimization.. Vol. 8 ed. s.l.:Siam.

Denney D (2003) Optimizing production operations. J Petrol Technol 55(03):59–60

Fliege J, Svaiter BF (2000) Steepest descent methods for multicriteria optimization. Math Meth Operations Res 51(3):479–494

Hamedi H, Rashidi F, Khamehchi E (2011) A novel approach to the gas-lift allocation optimization problem. Petrol Sci Technol 29(4):418–427

Hooke R, Jeeves TA (1961) Direct search solution of numerical and statistical problems. J ACM (JACM) 8(2):212–229

Jansen JD, Brouwer R, Douma SG (2009) Closed loop reservoir management.. s.l., In SPE reservoir simulation symposium. Society of Petroleum Engineers.

Khishvand M, Khamehchi E (2012) Nonlinear risk optimization approach to gas lift allocation optimization. Ind Eng Chem Res 51(6):2637–2643

Lake LW et al. (2007) Optimization of oil production based on a capacitance model of production and injection rates. s.l., In Hydrocarbon economics and evaluation symposium. Society of Petroleum Engineers.

Liu Y, Chen G (1999) Optimal parameters design of oilfield surface pipeline systems using fuzzy models. Inf Sci 120(1-4):13–21

Liu Y, Chen S, Guan B, Xu P (2019) Layout optimization of large-scale oil–gas gathering system based on combined optimization strategy. Neurocomputing 332:159–183

Mahdiani MR, Khamehchi E (2015) Stabilizing gas lift optimization with different amounts of available lift gas. J Natural Gas Sci Eng 26:18–27

Naderi M, Khamehchi E (2016) Nonlinear risk optimization approach to water drive gas reservoir production optimization using DOE and artificial intelligence. J Natural Gas Sci Eng 31:575–584

Naderi M, Khamehchi E (2017) Well placement optimization using metaheuristic bat algorithm. J Petrol Sci Eng 150:348–354

Naderi M, Khamehchi E, Karimi B (2020) A rigorous approach to uncertain production optimization using a hybrid algorithm: combination of a meta-heuristic and a Quasi-Newton method. J Petrol Sci Eng 195:107924

Naus MM, Delle N, Jansen J-D (2004) Optimization of commingled production using infinitely variable inflow control valves. s.l., In SPE Annual Technical Conference and Exhibition. Society of Petroleum Engineers.

Razavi F, Jalali-Farahani F (2008) Ant colony optimization: a leading algorithm in future optimization of petroleum engineering processes. Artificial Intell Soft Comput–ICAISC 2008:469–478

Rosenbrock HH (1963) Some general implicit processes for the numerical solution of differential equations. Comput J 5(4):329–330

Savioli GB, Bidner MS (1994) Comparison of optimization techniques for automatic history matching. J Petrol Sci Eng 12(1):25–35

Suwartadi E (2012) Gradient-based methods for production optimization of oil reservoirs, s.l.: s.n.

Taheri-Shakib J, Rajabi-Kochi M, Kazemzadeh E, Naderi H, Salimidelshad Y, Esfahani MR (2018) A comprehensive study of asphaltene fractionation based on adsorption onto calcite, dolomite and sandstone. J Petrol Sci Eng 171:863–878

Vassiliadis VS, Conejeros R (2008) Cyclic coordinate method cyclic coordinate method. Springer, Boston, MA., pp. 595-596.

Volcker, C., Jørgensen, J. B. & Stenby, E. H., 2011. Oil reservoir production optimization using optimal control. In CDC-ECE 7937-7943.

Wang C, Li G, Reynolds AC (2009) Production optimization in closed-loop reservoir management. SPE J 14(03):506–523

Wang Z, Liu X, Luo H, Peng B, Sun X, Liu Y, Rui Z (2021) Foaming properties and foam structure of produced liquid in alkali/surfactant/polymer flooding production. J Energy Resour Technol 143(10):103005

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interests

Additional information

Responsible Editor: Santanu Banerjee

Rights and permissions

About this article

Cite this article

Rajabi-Kochi, M., Khamehchi, E. A modified optimization procedure for production and injection scheduling in an oil field using second derivative methods. Arab J Geosci 14, 1609 (2021). https://doi.org/10.1007/s12517-021-08048-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12517-021-08048-5