Abstract

Achieving an efficient supply chain is impossible without integrating supply chain processes and extending long-term relationships between its members. Evaluating the process, selecting a set of suppliers, and allocating orders are effective parameters in the coordination among supply chain members. In this study, to achieve an organized process, a two-stage hybrid model is presented to choose efficient suppliers, allocate order, and determine price in a supply chain with regard to coordination among members. First, an integrated Multi-Objective Mixed-Integer Nonlinear Programming (MOMINLP) model is provided to minimize costs and evaluate suppliers simultaneously. The proposed model includes a single-buyer multi-vendor coordination model and Data Envelopment Analysis (DEA). Then, the model is simplified and converted into a quadratic programming model. In the second stage, a model is presented to determine the price agreed upon by the buyer and the selected efficient suppliers using the bargaining game and the Nash equilibrium concept. The purpose of this model is to maximize the parties’ utilities considering the order quantity specified in the first stage. At the end of this paper, the data taken and adapted from the previous researches are applied to show the abilities of the proposed models.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

One of the well-known problems in the field of operations research is the Supply Chain Management (SCM). In SCM, there are various methods to integrate suppliers, manufacturers, distributors, and retailers. In today’s competition in global markets, short life-cycle products and high-expectation customers have persuaded the organizations to focus more on the supply chain. However, an efficient supply chain management entails appropriate planning and coordination among different members of a supply chain. Furthermore, in today’s business environment which is constantly changing due to the variation in customers’ needs, managers have realized that the materials and services received from efficient suppliers have a significant impact on improving the organization capability to satisfy customers requirements and ensure the long-term survival of the company. Since most organizations seek to increase the supply of resources from outside of the organization instead of producing products by themselves, the coordination between the buyer and suppliers is one of the essential relationships among the supply chain members (Yousefi et al. 2017).

On the other hand, production companies are regularly looking for ways to reduce the price, maintain the product quality, increase their market share, and finally, upgrade their competitive position (Demirtas and Üstün 2008). Accordingly, purchasing decisions associated with supplier selection and pricing have become important because they affect organizations’ efficiency through cost, profitability, and flexibility parameters. Therefore, manufacturing companies are seeking to select a set of efficient suppliers to increase their competitiveness throughout the supply chain and determine an agreeable purchasing price (Chen 2011). Applying this strategy is possible only through coordination in the supply chain since the buyer and supplier may decide to maximize profits or minimize costs for their own sake. There might be some contradictions between the supply chain members’ goals, which act as a barrier to meet the overall supply chain goals. For this reason, buyer-vendor inventory models in SCM are considered a special case of bi-level production inventory models.

Choosing an appropriate set of suppliers and setting an agreed-upon purchase price are among the basic strategies followed by each organization. Applying this strategy is possible only by establishing coordination in the supply chain to make the right decision and provide optimal benefits for members. Undoubtedly, decisions are influenced by the cooperative and non-cooperative behaviors among the members of the supply chain. Typically, the contradictions between the goals of the members reduce competitiveness and increase the cost of the supply chain activities. The interaction between two members of the bi-level supply chain, namely buyer and supplier, in determining the price and the amount of the order is required to optimize the supply chain inventory costs.

In this regard, the aim of this study is to provide a two-stage hybrid model to deal with problems including efficient supplier selection, order allocation, and pricing regarding the coordination among supply chain members. In the first stage, a hybrid mathematical model based on the single-buyer multi-vendor coordination model and Data Envelopment Analysis (DEA) model is presented. This model is a bi-objective multi-period order allocation model including cost and efficiency as objective functions. The aim of using the multi-period inventory model is to select the optimal suppliers and allocate orders according to the optimization of supply chain costs. Applying DEA, minimizing supply chain costs, and maximizing the efficiency have been simultaneously considered. Therefore, the output of the model leads to the selection of the efficient suppliers and allocation of the orders according to the cost minimization and efficiency maximization. However, in most previous studies, single-buyer multi-vendor coordination models failed to consider the efficiency of suppliers; thus, the efficiency evaluation has not been performed simultaneously with the allocation of order. Also, to take into account the viewpoint of the Decision Maker (DM), a global criterion method has been used for the allocation of weights to each objective function. For the sake of simplicity, the multi-period coordination model is converted into a quadratic programming model.

In the second stage, the price of the products ordered from the efficient suppliers and the goals of parties are determined using the Nash bargaining game. In fact, the aim of this stage is to determine the price agreed upon in the negotiations between the buyer and the vendor in a competitive environment in which the final price is determined by considering the benefits of the parties. In this state, the benefits of the buyer and selected vendors are maximized, and the concept of cooperation in a competitive environment between suppliers is displayed. Also, this state shows the importance of minimizing the supply chain costs, i.e., minimizing the total costs of the buyer and suppliers. Optimizing these costs is met by reducing the buyer’s costs, matching prices with the buyer available budget, and allocating the part of the unconventional profit of the selected vendors to the buyer. In the pricing stage, in general, and during the bargaining path, in particular, each supplier intends to achieve a larger market share relative to its competitors by offering a discount to the buyer.

The rest of the paper is organized as follows: In Sect. 2, the literature review provides a review of the previous studies on inventory coordination models in the supply chain, supplier selection, and application of the Nash bargaining model in the pricing problem. In Sect. 3, the problem statement and the proposed models are investigated. In the first phase of this section, a Multi-Objective, Mixed-Integer, Non-Linear Programming (MOMINLP) based on single-buyer, multi-vendor, inventory coordination, and DEA models is presented. In the second phase of Sect. 3, the Nash bargaining model is provided for the pricing process based on the outcomes of the first phase and with regard to the interaction between the buyer and selected efficient suppliers. In Sect. 4, to validate the proposed approach, the results of implementing the proposed models in a numerical example are provided and analyzed. Finally, in Sect. 5, the conclusion and suggestions for future research are presented.

2 Literature review

Due to the importance of supply chain management and the coordination among its members in the industrial areas, the supplier selection and pricing problems have become important issues in recent years. Regarding the subject of this study, there are generally two main problems including efficient supplier selection and pricing. Removing the former may lead to efficiency and cost optimization, and solving the latter may create more interaction among supply chain members in the competitive environment. Subsequently, a literature review is presented in three subsections entitled supplier selection problem, buyer-vendor inventory coordination model, and bargaining game.

2.1 Supplier selection problem

The first studies about the supplier selection refer to the 1960 s. In recent years also various types of this problem have been addressed (Yousefi et al. 2017). The existing studies in this filed can be divided into two main categories:

-

1.

Studies that focus on choosing the suppliers’ evaluation criteria and identifying the importance of each criterion.

-

2.

Studies that focus on providing a framework for comparing suppliers based on the selected criteria via quantitative methods.

In the first category, the most significant criteria for the evaluation of suppliers include harmonization with organizational goals, alignment with organizational strategies, reliability over time, and the possibility of rapid and accurate feedback. Several comprehensive studies have been conducted on designing and defining suppliers’ evaluation criteria (Dickson 1966; Chen 2011). The second category includes techniques for solving the supplier selection problem. In recent years, various analytical methods have been proposed to solve the supplier selection problem. Single and combined models are two most widely used models to this end (Chen 2011). Further examination of the previous studies reveals that researchers have shifted from the single models to the integrated or hybrid ones. According to Chen (2011), single models are divided into three subcategories including mathematical models, analytical models (such as cluster analysis, multiple regression, discriminant analysis, conjoint analysis, and principal component analysis), and artificial intelligence (such as neural networks, software agent, case-based reasoning, expert system, and fuzzy inference). Most widely used methods for the supplier selection include analytic hierarchy process (Deng et al. 2014), analytic network process (Zhang et al. 2015), mixed integer linear programming (Bohner and Minner 2017), mixed integer nonlinear programming (Mendoza and Ventura 2013), multi-objective programming (Rezaei et al. 2016; Yousefi et al. 2017), goal programming (Choudhary and Shankar 2014), fuzzy sets (Ordoobadi 2009), and data envelopment analysis (Azadi et al. 2015). Due to the weaknesses of these methods, researchers were focused on integrated or hybrid approaches. Some of the hybrid models based on the combination of mathematical programming models include fuzzy multi-objective programming (Wu et al. 2010; Aghai et al. 2014), intuitionistic fuzzy multi-attribute linear programming (Wan and Li 2013), multi-objective multi-choice goal programming (Jadidi et al. 2015), multi-objective data envelopment analysis (Rezaee et al. 2017), multi-objective mixed integer nonlinear programming (Moheb-Alizadeh and Handfield 2017), and hybrid goal programming and dynamic data envelopment analysis framework (Tavana et al. 2017).

Among the combined models based on multi-criteria decision-making techniques, the following models can be mentioned: mixed integer linear programming with fuzzy TOPSIS (Kilic 2013), fuzzy goal programming with fuzzy analytic hierarchy process (Kar 2014), multi-objective programming with fuzzy analytic hierarchy process (Azadnia et al. 2015), multi-objective linear programming with MULTIMOORA (Çebi and Otay 2016), fuzzy multi-objective linear programming with fuzzy analytic hierarchy process (Kumar et al. 2017), analytic network process with grey relational analysis (Hashemi et al. 2015), analytical hierarchy process with TOPSIS (Jain et al. 2016) and integrated fuzzy VIKOR and fuzzy TOPSIS (Banaeian et al. 2018).

2.2 Buyer-vendor inventory coordination models

One of the main issues in the supplier selection problem is inventory management which can be studied via mathematical programming. Inventory is usually considered one of the current assets of an organization, and its levels directly affect income and operating costs. Therefore, the interaction between the buyer and the vendor is important. Buyer-vendor inventory coordination models can be provided as two-stage inventory models that can fairly assign the net income to the parties based on the discount policies (Goyal and Gupta 1989).

Goyal (1977) was one of the first researchers who provided the buyer-vendor coordination models. He considered a system of a single-buyer single-vendor under the assumption of infinite production rate for the vendor to minimize the buyer’s and vendor’s costs. In the latest studies, researchers such as Chan et al. (2010), Kamali et al. (2011), Hammami et al. (2014), Giri and Bardhan (2015), Hariga et al. (2016), and Yousefi et al. (2017) analyzed the types of vender-buyer coordination problems in the supply chain with different assumptions and objective functions. In recent decades, a high percentage of studies have mostly focused on supplier selection and order allocation problems based on the inventory coordination models. Xiang et al. (2014) studied the order allocation problem by considering multiple manufacturers versus multiple suppliers. To this end, they considered two order allocation strategies, namely production capacity-based strategy and the production load equilibrium-based strategy. Hosseininasab and Ahamdi (2015) proposed a two-phase supplier selection procedure based on the supplier eligibility. The first phase included supplier evaluation, and the second one included multi-objective portfolio optimization. They studied the long-term trend of value, stability, and relationship of candidate suppliers. Adeinat and Ventura (2015) proposed a mathematical model with the single retailer and multiple potential suppliers to find the optimal pricing and replenishment policy. After solving the model and providing optimal solutions, they applied the Karush–Kuhn–Tucker conditions to investigate the impact of supplier’s capacity on the optimal solutions.

Çebi and Otay (2016) developed a two-stage fuzzy approach for supplier selection and order allocation problems by considering the satisfying quantity discounts, lead-time, and capacity and demand constraints. They used the fuzzy MULTIMOORA to evaluate and select suppliers with regard to subjective measures. Then, they used the fuzzy goal programming to determine the amount of order allocated to the selected suppliers. PrasannaVenkatesan and Goh (2016) used a multi-objective mixed-integer linear programming to find the optimal suppliers selection and order quantity allocation under disruption risk. In their study, supplier evaluation and order allocation were conducted using the hybrid fuzzy analytic hierarchy process, fuzzy PROMETHEE, and multi-objective particle swarm optimization. Mokhtari and Rezvan (2017) evaluated the production-inventory problem in green supply chain and provided a single-supplier multi-buyer multi-product model. They used a non-linear programming model to formulate the problem and an analytical approach to optimally solve the respective problem. Venegas and Ventura (2018) studied supply chain coordination mechanism and proposed the single-buyer single-vendor supply chain for order allocation by considering price-sensitive demand and quantity discounts in the cooperative and non-cooperative game environments.

2.3 Negotiation and bargaining

The application of cooperative games in supply chain management has turned into a natural choice. In fact, as the partnership improves the efficiency of the supply chain, the cooperative game has found an essential role in the supply chain. The ability to combine game theory with other approaches has led to a plethora of studies in the field of supply chain design and coordination. One of these studies proposed coordination of cooperative advertising models in a one-manufacturer two-retailer supply chain system (Wang et al. 2011). Another research includes the simultaneous cooperative and non-cooperative advertising along with pricing decisions in a supply chain consisting of one manufacturer and one retailer (Aust and Buscher 2012). During recent years, the increased bargaining and negotiation between supply chain members have been extensively drawn the attention. Likewise, Nagarajan and Sošic (2008) studied the cooperative game theory in the bargaining problem in supply chain management. They emphasized two aspects of cooperative games including profit allocation and stability. On the other hand, due to the highly competitive environment, bargaining has turned into one of the crucial elements in the transactions. Perhaps, the first known instance of using bargaining in the supply chain has been presented by Kohli and Park (1989). In another study, Sucky (2005) focused on supply chain management from the inventory management point of view. Then, Sucky (2006) proposed the bargaining model with the consideration of discount policies for a single supplier-single buyer problem. Ye and Xu (2010) discussed coordination in a decentralized supply chain consisting of a vendor and a buyer. They presented two inventory models including the decentralized supply chain based on the Stackelberg game and the concentrated supply chain based on the Nash bargaining. He and Zhao (2012) used the Nash bargaining problem for coordination in multi-echelon supply chain under uncertainty conditions. Chern et al. (2014) examined the relationship between the buyers and the suppliers using the non-cooperative Nash equilibrium. They considered an allowable delay, positive impact on the demand, negative impact on the cost, and risk in the supply chain.

In this study, a two-stage model is presented to select efficient suppliers, allocate orders, and determine price considering coordination between supply chain members. In the first stage, a hybrid model based on the buyer-vendor coordination model and DEA is provided. It may consider the qualitative and quantitative measures for selecting efficient suppliers as well as allocating orders according to the cost optimization. Also, in the second stage, a mathematical model is presented based on the Nash bargaining game to finalize order price.

3 Problem statement and proposed models

In this study, a bi-level supply chain consisting of the single manufacturer (buyer) and multiple vendors (suppliers) is considered with the aim of selecting an appropriate set of efficient suppliers and determining the price agreed upon by the parties. First, a strategic plan is made by the buyer to determine the objective of the annual demand considering the market studies and market conditions in the future. Then, the buyer seeks to identify available suppliers in the market, especially those having previous cooperative experience with the buyer. Subsequently, the identified suppliers are analyzed using the proposed hybrid model to ensure maximized efficiency and minimized costs. This model seeks to select suppliers which optimize the cost of the supply chain. The selected suppliers must be able to supply products based on the relevant evaluation criteria. After selecting the needed suppliers to meet the buyer’s demand based on the objectives and constraints, the price negotiation and bargaining are done (the price that maximizes the profits for the vendor and the losses for the buyer) to simultaneously maximize the utilities of the vendors and buyer and ultimately to reduce the cost of buyer’s purchase. In fact, at this stage, the bargaining model is implemented simultaneously for the buyer and vendors. Hence, the suppliers attempt to balance their prices and conclude a contract by observing each other’s suggested price. By implementing this model subject to the buyer’s budget constraints and the parties’ utilities, the buyer will be able to obtain the appropriate price and the vendor will be able to obtain profit. Figure 1 shows the manner of buyer-vendor interaction in the problem under scrutiny. Figure 1 illustrates the process of evaluating and selecting the suppliers as well as allocating the orders in the first stage and the process of pricing via bargaining game in the second stage.

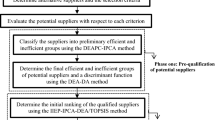

According to the proposed model, in the first stage, the MOMINLP model is provided. It considers the single-buyer multi-vendor coordination model to select efficient suppliers, calculate the optimal order quantity, minimize the total supply chain cost, and maximize efficiency. This hybrid model simultaneously performs the supplier selection and order allocation. In the second stage, the bargaining model between the buyer’s price and the selected suppliers’ price is presented. The steps related to this two-stage approach are specified in Fig. 2. The assumptions, indices, parameters, and decision variables of the proposed models are listed in Table 1. Also, the objective functions and constraints of the relevant sub-sections are expressed.

3.1 Hybrid model for efficient supplier selection and order allocation

This section presents a model based on the buyer-vendor coordination and DEA models. This model considers the efficiency of vendors or suppliers (as decision-making units). Therefore, this model intends to select the maximum N efficient suppliers among N candidate suppliers and to specify the amount of order allocation for the selected suppliers. This process tries to cover the buyer demand by these suppliers by taking into account the efficiency and costs of the inventory system. In this section, the DEA model (Klimberg and Ratick 2008) is used for the supplier(s) evaluation and selection. By combining the buyer-vendor coordination and the DEA models, a hybrid model for supplier selection and order allocation is yielded.

It should be mentioned that for calculating the efficiency of potential suppliers, the criteria (inputs and outputs) of Decision Making Units (DMUs) should be considered. These criteria are divided into two classes including desirable and undesirable. Undesirable criteria include costs, defect rate, and delays in delivery that are intended to be decreased by the management. Therefore, these parameters are considered inputs in the DEA model. Desirable criteria are profitability, quality, and reliability of delivery that are intended to be increased by the management. These are considered outputs in the DEA model. Indeed, the proposed hybrid model includes two objective functions: Z1 for minimizing the annual costs of the supply chain, and Z2 for maximizing the efficiency of the selected suppliers.

-

A.

The Total Cost of the Supply Chain (Z1)

The first objective function is the Supply Chain Annual Cost (SCAC), which is equal to the sum of the Buyer’s Annual Cost (BAC) and the Suppliers’ Annual Cost (SSAC). In this section, each of these costs is calculated separately.

3.1.1 Buyer’s annual costs

The buyer’s annual costs in the bi-level supply chain include the Annual Purchasing Cost (APC), the Annual Ordering Cost (AOC), and the Annual Inventory Holding Cost (AIHC) for the buyer. The APC depends on the price per unit. Since the number of periods in the time horizon is equal to D/Q, the APC is formulated as in relation (1).

In Eq. (1), APC is equal to the sum of purchasing costs for the selected suppliers based on the purchased quantity in different periods. Also, Eq. (2) represents the annual ordering costs in the supply chain.

It is clear from Eq. (2) that if the buyer decides to order from supplier k, a fixed ordering cost corresponding to this supplier occurs in each period. It should be noted that for calculating the inventory holding cost, it is required to calculate the average inventory per unit time. The average inventory per unit time is obtained by taking the average inventory per period and dividing it by the length of the period (T). According to Fig. 3, during the order cycle period, the inventory of buyer from supplier k will go steadily from qk to zero, and the length of the order period is Q/D. The average buyer inventory (Ik) received from supplier k is calculated as \(I_{k} = \frac{{\frac{1}{2} \times q_{k} \times T_{k} }}{T} = \frac{{\frac{1}{2} \times q_{k} \times \frac{{q_{k} }}{D}}}{{\frac{Q}{D}}} = \frac{{q_{k}^{2} }}{2Q}\).

According to the buyer’s inventory holding cost per unit time, the AIHCk for the orders received from the supplier k is equal to \(AIHC_{k} = h_{b} \,I_{k} = \frac{{h_{b} }}{2Q}q_{k}^{2}\). As a result, the AIHC for the orders that the buyer receives from all suppliers can be written as in relation (3).

Equation (4) calculates the buyer’s annual cost as follows:

3.1.2 Suppliers’ annual cost

The Suppliers’ Annual Cost (SSAC) includes the Annual Cost of Production (ACP), the Setup Annual Cost (SAC), and the Annual Cost of Inventory Holding (ACIH). The ACP and SAC are given by Eqs. (5) and (6), respectively.

In Eq. (5), the ACP is equal to the sum of costs required for each product in different periods. Also, it is clear from Eq. (6) that if the selected suppliers provide the same product, a fixed setup cost of production corresponding to these suppliers occurs. The calculation of suppliers’ annual cost of inventory holding is similar to that of the buyer’s annual inventory holding cost (see Eq. 7). Therefore, the average inventory of the supplier k is calculated as \(I_{k} = \frac{{\frac{1}{2} \times q_{k} \times T_{k} }}{T} = \frac{{\frac{1}{2} \times q_{k} \times \frac{{q_{k} }}{{P_{k} }}}}{{\frac{Q}{D}}} = \frac{{Dq_{k}^{2} }}{{2P_{k} Q}}\).

The suppliers’ annual cost is calculated by Eq. (8).

The total supply chain annual cost is SCAC = BAC + SSAC. Hence, the first objective function of the hybrid model (includes the buyer’s annual cost and suppliers’ annual cost) is formulated as in relation (9).

-

B.

The Total Efficiency of Suppliers (Z2)

In this section, the DEA model is applied to measure the suppliers’ efficiency. In this regard, it is combined with the buyer-vendor coordination model. Also, the efficiency of each supplier is calculated for each product. Considering the related constraints, the mentioned objective function (see Eq. 10) seeks to select the suppliers that maximize the overall suppliers’ efficiency.

-

C.

The Final Objective Function (Z)

As it is obvious, the objective functions Z1 and Z2 act against one another. In other words, the optimization of each function leads to a deviation from the optimal point of the other function. Therefore, a method that can simultaneously optimize each of the mentioned objective function is required (Miettinen 1999). In this case, the Global Criterion Method (GCM) was used to find a point in which the sum of the relative deviations of all objective functions from their optimal values (Z *i ) can be minimized. Therefore, the final objective function by using the GCM is expressed as in relation (11).

In this method, different weights can be assigned to the objective functions to consider the decision makers’ (DMs) opinion. In this Equation, wi is the objective function’s weight defined by DM, and the sum of all weights is equal to 1 (\(\sum\nolimits_{i = 1}^{2} {w_{i} } = 1\)).

By using this method, if the DM allocates a higher weight to a function, the final solution will be closer to the optimal value of that function. In Eq. (11), the optimal values of all functions (Z *i ) are calculated independently. In this step, the objective functions which must be maximized are normalized according to \(\frac{{Z_{i}^{*} - Z_{i} }}{{Z_{i}^{*} }}\). Also, the objective functions which must be minimized are normalized according to \(\frac{{Z_{i} - Z_{i}^{*} }}{{Z_{i}^{*} }}\). The constraints of the hybrid model (Z) include Eqs. (12–26). Equation (12) shows that the annual production quantity of suppliers (\(\frac{D}{Q}\sum\nolimits_{k = 1}^{n} {q_{k} }\)) must be equal to the buyer’s annual demand rate.

According to (13), the annual order quantity of the supplier i (D × qk)/Q should be equal to or less than the supplier’s annual production rate. This constraint prevents the disproportionate allocation of orders to the suppliers.

Equation (14) shows that whenever a supplier is selected, the amount of commodity which has been allocated is not zero. Also, whenever there is no commodity to be assigned, extra suppliers would not be selected.

Equation (15) indicates that the weighted sum of the inputs for each supplier is equal to a binary number. This equation should be considered for all suppliers.

Equation (16) shows the amount of inefficiency of each supplier considering the weighted sum of the outputs. This equation should be considered for all suppliers.

Equation (17) states that the weighted sum of the outputs should be less than that of the corresponding inputs.

Equation (18) guarantees the maximum number of suppliers that could be selected, is N.

This constraint is effective when the optimization of the objective functions is possible with fewer suppliers. In another situation and based on the management’s policy which considers order allocation to all of the candidate suppliers, this equation can only be used with an equal sign. This situation shows that N different suppliers are selected by the buyer. In this case, the optimization may not be applied. The reason is that if it is possible to provide the demand with N−1 suppliers, this constraint (with an equal sign) may cause an extra supplier selection with a very small amount of allocated order. Consequently, it may impose additional costs on the buyer because of the high purchase cost. Also, Eqs. (19) and (20) indicate that the weights of inputs and outputs are non-negative values.

Equation (21) assures that weighted outputs are less than or equal to 1.

Equations (22)–(26) are utilized to define the type of variable. \(y_{k}\) is the binary variable and \(q_{k}\), \(e_{k}\), \(U_{kj}\), \(V_{ki}\), Q are the positive real variables.

Finally, the hybrid mathematical model for the supplier selection and order allocation is expressed as follows:

The first objective function (Z1) is a fractional nonlinear model. Fractional state of this model is the reason for its complexity of solving. Accordingly, the model has to be firstly simplified. To this end, Eq. (12) should be replaced in Z1 as follows:

Suppose \(\left( {\sum\nolimits_{k = 1}^{n} {q_{k} } } \right)^{ - 1} = t\) and \(tq_{k} = q_{k}^{/}\). Then, Eq. (12) is converted into Eq. (27):

With changing variable (\(ty_{k} = b_{k}\)), the objective function Z1 is rewritten as follows:

Equations (29–31) as the constraints created due to the change of variables are also added to the model:

Also, \(\sum\nolimits_{k = 1}^{n} {q_{k}^{/} } = 1\) replaces \(Q = \sum\nolimits_{k}^{n} {q_{k} }\) and Eqs. (32) and (33) replace Eqs. (13) and (14). Therefore, we have:

It should be noted that, for suitable \(\varepsilon\), equation \(\frac{{q_{k}^{/} }}{t} \ge \varepsilon y_{k}\) is converted into \(q_{k}^{/} \ge \varepsilon y_{k}\). One important matter in minimizing Z1 by the fractional programming is that the value of variable t must be greater than zero. But, if variable t is equal to zero, the solutions obtained from Model (34) are similar to those obtained for the former problem (Dantzig 1998):

This model includes all the constraints explained earlier (shown by AX ≤ B). Also, the new constraint Z1 = Z P1 is added to this model. The upper bound of t is used as the input parameter to prevent the repetition. Finally, the final hybrid model is expressed as follows:

In the above model, the objective function in the final state (quadratic programming) intends to select the appropriate suppliers (regarding cost and efficiency) and allocate orders to these efficient suppliers. It should be noted that the sum of the weights assigned to Z1 and Z2 is equal to 1. As can be seen, Eqs. (15–26) which were introduced in the initial state of the hybrid model are used in the final model. Also, Eqs. (12), (13), and (14) have been replaced by Eqs. (27), (32), and (33). In addition, Eqs. (29–31) have been added to the proposed model’s constraints considering the linearization of \(ty_{k} = b_{k}\).

Equation (28) or Z1 is a nonlinear function. Therefore, there is no guarantee that algorithms used for solving nonlinear programming lead to an optimal solution. The specified solution for the multi-objective problem has to satisfy four Karush–Kuhn–Tucker conditions. Indeed, in the optimization of the convex problems, if one solution satisfies Karush–Kuhn–Tucker conditions, the local optimal solution will be the global optimum. On the other hand, the objective function is a quadratic function (with the goal of minimization), and the related feasible region is convex. Hence, the obtained solution is the global optimal solution. At the end of the first stage, the corresponding flowchart for providing the overall structure of the proposed approach has been shown in Fig. 4.

3.2 Bargaining model for pricing

In this section, the second model is presented using the Nash bargaining game. In the second stage, the buyer is confronted with a list of different suppliers. Logically, the buyer wants to obtain an appropriate purchase price from each supplier. In fact, the buyer wants to obtain a suitable purchase price that does not exceed its annual budget. The matters of crucial importance to vendor or supplier include current cost, subjective utility, competitive environment, other vendors’ prices, tendency to conclude a contract, and selling. The purpose of the Nash bargaining is to maximize the utilities of the players to achieve an equilibrium point and optimize the related decisions. Therefore, the supplier reduces its pre-defined price, and the buyer tries to compensate the existing weaknesses and maximize other benefits. Naturally, the players that engage in a bargaining (buyer and suppliers) want to reach an agreement, but when the price is too high, it is a sheer profit for the supplier, and when the price is too low, it is a sheer profit for the buyer. Buyer and suppliers have opposite interests in determining the price, but they are motivated to make a transaction. Therefore, considering the indices, parameters, and variables (see Table 1), the objective function and constraints of the Nash bargaining model between the buyer and multiple vendors are expressed as follows:

The objective function Z3 intends to maximize the utilities of the players. This objective function tries to make more benefit for the buyer. On the other hand, it wants to increase the profit of the kth selected supplier from the lower bound of its expected profit. The supplier tends to lower the price at the beginning of the evaluation phase and lose its profit because there is an intensely competitive environment hence all the suppliers tend to have a contract with the buyer. Price reduction continues to such an extent that the suppliers do not lose their minimum profit. In the case of an agreement, Eq. (36) determines the amount of the buyer cost.

The variable Uk in Eq. (37) is the profit that the kth selected supplier earns from selling a specified amount of product in the first stage and the mutual understanding to coordinate on price in the second stage. Equation (38) shows that the mutual understanding making the coordination on price is subject to this prerequisite that the buyer’s cost fails to exceed its annual budget. Equation (39) guarantees reducing the price by the kth selected supplier continues to such an extent that it does not go beyond the lowest expected price of the supplier. Also, Eq. (40) specifies that the utility of a buyer should be at least equal to the total utility of the suppliers. Equation (41) states that Ub is always a positive value because buying a product has some costs unless the price is zero. Equation (42) shows that the minimum profit of a supplier is more than zero; therefore, the variable Uk is naturally positive. Equation (43) expresses that the price is always more than zero as otherwise there was no need for the bargaining process. In the following, the bargaining power of the suppliers and buyer is provided. This power can be determined according to many parameters such as work experience or previous cooperation with buyers, market share, financial status, production capacity, and order volume. Hence, when two players hold a negotiation, the player with high bargaining power earns more utility relative to the player with low bargaining power. As a general result, the high bargaining power leads to more profit, and the low bargaining power results in low profit. Therefore, the objective function in Eq. (35) can change to Eq. (44) to consider the bargaining power of different players. Considering the bargaining power of the players, the proposed model can be rewritten as follows:

In Eq. (44), wb and wk refers represent the bargaining power of buyer and kth selected supplier, respectively. Equation (45) guarantees that the total power of the players is equal to a constant value (C=1 is used as a standard value). Since the proposed model holds true under the Nash bargaining game conditions, there is an allocation utility with a unique solution, called the Nash equilibrium. The Nash conditions (Nash Jr 1950) in the bargaining model should be checked to recognize the correctness of this matter. Careful consideration of the model sheds light on the symmetry condition because a change in the arrangement of the players and cooperative level fails to lead to a change in the solution. The following two lemmas are used for the proof of two conditions (compact and convex feasible regions):

Lemma 1

The feasible region of the proposed bargaining model is compact.

Proof

It is clear that the feasible region of the presented model is bounded and closed. Consequently, the feasible region is compact.□

Lemma 2

The feasible region of the proposed bargaining model is convex.

Proof

All the constraints of the model are linear and convex. Therefore, the feasible region is convex.□

4 A numerical example and results analysis

In this section, the performance of the proposed models is investigated based on the data collected from other related studies. This study is done by analyzing the data obtained from different scenarios from the view of management. The weights assigned to the cost and efficiency functions determine the difference between these two concepts. It should be noted that the proposed models are implemented using Lingo 14.0. It is supposed that there are 10 candidate suppliers, and the buyer wants to select at least 5 suppliers based on the annual demand (200,000 per year). In the supplier(s) selection process, not only the supply of the demand, but also the efficiency of the supplier(s) to optimize the cost of the supply chain is taken into account. After selecting the required number of suppliers, the buyer negotiates with the selected suppliers to determine the final purchase price through bargaining. To this end, Nash bargaining game is performed to achieve the price that maximizes the utility of the parties.

For evaluating and selecting the suppliers based on DEA model as well as having a reliable model, the number of the potential suppliers (n), the number of inputs (m), and the number of outputs (s) should follow n ≥ 3 (m + s) (Friedman and Sinuany-Stern 1998). Therefore, one input and two outputs are considered for measuring the efficiency of the suppliers. The total cost of the shipments (TC) is used as input, while service-quality experience (EXP) and service-quality credence (CRE) are defined as intangible outputs. The data associated with the buyer and suppliers have been presented in Tables 2 and 3. Data were taken from Kamali et al. (2011). Also, following Talluri and Baker (2002), the values of the input and outputs for each candidate supplier are shown in Table 4.

The results of the implementation of the first model are shown in Tables 5 and 6. Table 5 shows the absolute optimal values of the total cost of the supply chain and the total efficiency of the selected suppliers, which optimize each objective function independently.

As seen in Table 5, according to the independent optimization of Z1 (cost) and its optimal value (2,800,966), suppliers 1, 6, 7, and 9 have been selected. On the other, according to the independent optimization of Z2 (efficiency) and its optimal value (9.683425), suppliers 1, 3, 4, and 6 have been selected. It implies that the behavior of the objective functions is not similar, and each of them leads to the selection of different suppliers. According to the most previous studies, if management only seeks the suppliers that minimize the inventory cost of the supply chain, it uses the results of Z1. However, it is not possible to formulate the supplier selection problem by considering all the evaluation criteria. It is better to use the concept of efficiency to overcome this limitation. By using the DEA (Z2) and defining appropriate criteria, the efficiency score can be defined for each supplier. Therefore, to create an optimal and efficient supply chain, selecting low cost and efficient suppliers is needed. As discussed in Sect. 3.1, for the simultaneous consideration of cost and efficiency functions, the weighted global criterion method in which different weights are assigned to each objective function by the decision maker has been used. In the following, the solution of the hybrid model under different scenarios for the selection of weights (w1, w2) is global optimum (see Tables 6 and 7). Tables 6 and 7 present the values of periodical and annual orders from the selected suppliers, respectively.

According to Tables 6 and 7, the selected suppliers are the same in the first and second scenarios, which is consistent with the result of the independent optimization of Z1. But due to the weight reduction of Z1 in the second scenario (from 1 to 0.75) compared to the first one, the model tends to supply the buyer from the selected suppliers with more order quantity rather than those with higher efficiency. Also, the selected suppliers in the third to fifth scenarios are the same as those in the independent optimization of Z2. By increasing the weight of Z2, the results of these scenarios are moving toward the allocation of orders to efficient suppliers. In the scenario (w1, w2) = (0, 1), the importance of minimizing supply chain cost is equal to zero. Hence, the problem is caused by the fact that only the efficient suppliers are selected. Also, the fewer periodical orders and the optimal number of periods are maximized. This may cause an increment in ordering and cost setting. It is because of the mere importance of efficiency and inventory management. By taking into account the management opinion about the weights of efficiency and cost, a suitable balance should be made. Overall, using the proposed hybrid model, the decision maker can consider different opinions about the objective functions. If the management focuses on cost, the results obtained from integrating the objective functions will be closer to the results obtained from the optimization of the cost function. On the other hand, if more attention is dedicated to efficiency and high-quality products, the obtained results will be closer to the results obtained from the optimization of the efficiency function. In fact, it can be said that the integrated model intends to make a balance between efficiency and cost functions. Briefly, suppliers’ selection is done according to the following conditions:

-

The annual demand of the buyer has to be supplied.

-

The cost of the inventory system has to be minimized.

-

The efficiency of the selected suppliers has to be maximized as much as possible.

-

The production capacity of each supplier has not to be exceeded.

-

The selection of additional suppliers and imposition of extra costs on the buyer have to be avoided.

-

The management’s viewpoints on assigning weights to the objective functions have to be met.

Considering the first condition and according to (46) and (47), it can be said that q /k is a percentage of buyer’s demand which is covered by supplier k to provide the total demand.

The results depict that the suppliers’ selection and products allocation based on the production capacity of suppliers continue until the demand is supplied. Therefore, periodical allocation of the product to the selected supplier is done based on the maximum production capacity as a percentage of the annual demand. Then, the periodical product allocation is done for the next supplier. As a result, the overall level of the product allocation to the selected suppliers will be equal to the annual demand, and finally, the total demand will be supplied.

For example, according to Table 7 and (w1, w2) = (0.5, 0.5), it can be said that the proposed model will supply the annual demand of the buyer based on the supplier production capacity and optimize the objective function by selecting suppliers 1, 3, 4, and 6. Supplier 4 is selected to supply the rest of the buyer’s demand. It covers 57,500 units of the demand, and its production capacity is 63,000 units. However, if the production capacity is ignored in the selection, the final selection is made between suppliers 9 and 10 with the production capacity of 66,500 and 61,000, respectively. Indeed, simultaneous consideration of the supplier’s cost and efficiency sheds light on the undesirability of these suppliers. The difference in costs and the reason for selection are shown by primary analysis of the differences in holding costs (see Table 3). Also, the difference in efficiency shows the difference between the input of the DEA model and the cost of supplier transportation (see Table 4).

As it was mentioned, Tables 6 and 7 present the results of allocating periodical orders and annual orders to the supplier with a suitable efficiency that finally leads to the optimization of supply chain cost. This is the end of the first stage. It is assumed that the buyer could decrease the purchase price suggested by the supplier based on factors such as other suppliers’ price, the amount of order allocated to them, and the suppliers’ willingness to cooperate. Afterward, the second stage starts. By analyzing the first stage, the third scenario (w1, w2) = (0.5, 0.5) will be selected randomly for the second stage, and it can be used for every weighted set. According to the cost of the first stage of the third scenario, it is clear that the cost imposed on the buyer is equal to 1,875,016 monetary units. As it was mentioned in Sect. 3.2, the buyer may fail to have enough budget, or as it is suggested, the costs can be reduced by leading the buyer to the second stage.

It should be noted that the cost may affect the optimization of the objective functions, and it is likely to supply the buyer’s demand only by paying this cost. In this section, the possibility of price reduction by the suppliers due to the competitive environment is investigated as well. Hence, with the budget equal to 1,750,000 monetary units, the buyer starts bargaining as the second stage. This bargaining is done with the assumption of equality of power between the buyer and suppliers. The first stage provides the data required for the second stage. As a result, q *k and q /*k are the same with the optimal values of qk and q /k in the previous stage, respectively. Also, index k that is allocated in the first stage includes values of 1 to N for the selected suppliers. Thus, the selected suppliers have been numbered as shown in Table 8.

In addition to the data used in the first stage, the minimum profit of the supplier (Gk) is used in the second stage, calculated by Eq. (48). In this equation, ARSk presents the annual sales revenue of the kth supplier based on the initial price, SAPk refers to the annual profit of the kth supplier based on the initial price, and SSAC denotes the annual cost of the kth supplier.

Equation (48) which gives the annual profit of the kth supplier is calculated according to the difference between the annual sales revenue of the kth supplier and the costs of production, setup, and holding. Therefore, to calculate the optimal profit of the kth supplier, it is enough to calculate the profit based on the initial price and its discount. It is equal to a percentage of the profit of the initial price (Xk) that the supplier or vendor loses to earn other profits (see Eq. 49 for more information).

Minimum sales price per unit in Table 9 can be calculated by Equation: \(\frac{{c_{k} \times G_{k} }}{{SAP_{k} }}\). In fact, it is a price that vendor or supplier uses to earn more profit in the competitive environment. According to Table 9, it can be seen that before the negotiation, Supplier 3 has the highest amount of profit among the selected suppliers. For this reason, the minimum sales price per unit for this supplier is higher than other suppliers. In this section, according to the data presented in Tables 8 and 9, the price bargaining model between buyer and suppliers (vendors) has been implemented, and the results obtained are listed in Table 10. The respective table also depicts the final prices of the bargaining model. The change in initial prices by the supplier can itself cause a change in the profits and costs. These changes are positive for the buyer thanks to the bargaining. These changes lead to a decrease in the annual purchasing cost and the total cost of the buyer. Suppliers have to reduce their prices and get closer to the final price of the product. Therefore, the supplier loses some part of its profit, whereas the chance of cooperating with buyer and selling product will increase. The definitions of price indices in Table 10 along with some new parameters are presented as follows:

-

ARSk: The annual revenue of selling kth supplier based on initial price.

-

ARSk*: The annual revenue of selling kth supplier based on secondary price.

-

∆ARSk: The change in the annual revenue of the kth supplier.

-

%∆ARSk: The percent of changes in annual revenue of kth supplier in relation to revenue of initial price.

-

SAPk: The annual profit of kth supplier based on initial price or Uk.

-

SAPk*: The annual profit of kth supplier based on secondary price or Uk*.

-

∆SAPk: The change in the annual profit of the kth supplier.

-

%∆SAPk: The percent of changes in annual profit of kth supplier according to the initial price.

-

SPUk: The profit for per unit of kth supplier based on initial price.

-

SPUk: The profit for per unit of kth supplier based on secondary price.

-

∆SPUk: The change in profit per unit of kth supplier.

-

%∆SPUk: The percent of change in profit per unit of kth supplier according to profit per unit of initial price.

-

APCk: The annual purchase cost of the buyer for the kth supplier based on initial price.

-

APCk*: The annual purchase cost of the buyer for the kth supplier based on secondary price.

-

∆APCk: The change of the annual purchase cost of the buyer for kth supplier.

-

%∆APCk: The percent of change in the annual purchase cost of the buyer for kth supplier according to the annual purchase cost of the buyer based on the initial price.

By solving the Nash bargaining model with the objective of maximizing the buyer’s and suppliers’ utility functions, the final price of the orders is calculated. These prices are based on the agreement between the selected suppliers and buyer, the budget of the buyer, and the minimum expected profit of the suppliers. In general, the suppliers with minimum utility usually lose profit expected to be earned from the initial price. The decrease is in a way that the profit of the secondary price (agreed) for the suppliers is higher than or equal to their minimum expected utility and lower than or equal to their initial price. In other words, \(G_{k} \le SAP_{k}^{*} \le SAP_{k}\). According to the final price agreed upon by the buyer and Supplier 1, this supplier has a higher annual profit reduction than other suppliers (see Table 10). Supplier 1 has defined the minimum sales price per unit of product with more changes in the initial price (changes equal to − 1.8 monetary unit for each product). Also, it has created more performance freedom for the buyer compared to the other selected suppliers. Similarly, the final price agreed upon by the buyer and Supplier 1 (i.e., 8.045521) has led to the highest reduction in the final revenue and profit of the supplier (− 10.60% and − 19.53%, respectively) compared to the revenue and profit expected to be earned from the initial price. Also, due to the volume of the order allocated to Supplier 1 and the final price (resulting from bargaining), Supplier 1 has lost more profit per unit of product due to the willingness to cooperate with the buyer. In addition, the selected suppliers have lost an average of 14.74% of each unit profit for their products in the bargaining as the discount offered to the buyer; however, they have earned other privileges such as the chance of cooperation with the buyer and selling of their products. Thus, during the bargaining process, the buyer can achieve the best possible price.

It should be explained that the lower the budget of the buyer in hand, the more difficult the agreement. It means that even if the secondary price gets closer to the minimum expected price of the supplier or to its minimum expected profit, the agreement fails to be done unless the buyer has enough budget. The buyer’s budget should be determined logically and based on the prices and demands of each period. As a result, with a low budget of the buyer, the model goes toward minimum prices and the minimum expected profit for the supplier. Analyzing Table 11 shows that the agreed price is placed along the interval of minimum sales price per unit and the initial price.

According to indices ∆Ck (changes in the price of the kth supplier in the competitive environment) and Ck% (percent of changes in the price of the kth supplier in the competitive environment based on initial price), all the suppliers try to minimize their prices to get a higher share in the market and create a long experience of cooperation with buyer. Such a cost reduction is because the buyer has a budget less than the cost obtained from the simultaneous optimization of supply chain cost and efficiency. This pricing is done due to both the buyer’s low budget and the discount offered by the supplier considering the competitive market. Finally, the buyer and suppliers both benefit by the transaction, and the Nash objective function reaches the maximum. According to Table 10, it can be concluded that each supplier initially aims to make a high percentage of profit according to its initial price (xk), but then it decides to reduce the initial price to get closer to the buyer’s condition, and finally it reduces its revenue and profit to cooperate with the buyer. The amount of xk is determined by the mindset of the supplier. In other words, each supplier offers a discount in competition with other suppliers. This mindset can be determined based on the following criteria: the operating costs, the amount of sale, the production capacity, the market share, the type of market and its competitiveness, and the breakdown point. According to Table 11 and the final price obtained by bargaining between buyer and suppliers, Supplier 1 and Supplier 2 have offered the highest (10.60%) and the lowest (1.35%) price reductions compared to their initial price, respectively.

As seen in Table 10, the values are shown with a minus sign. The negative sign in Table 12 depicts a decrease in the cost of the buyer. The respective table also shows the cost of the buyer for supplier k and the lost revenue of supplier k. In other words, \(\Delta APC_{k} = \Delta ARS_{k}\) and \(\% APC_{k} = \% ARS_{k}\).

According to Table 12, purchasing costs of the buyer have reduced by 125974 compared to the initial state, because the selected suppliers have ignored a percentage of their profits. Generally, the final price for the purchase is defined based on the following conditions:

-

Maximizing the total profit of the supply chain.

-

Considering the buyer’s total available budget.

-

Fulfilling the minimum expected profit of the selected suppliers.

5 Summary and conclusion

Nowadays, due to the rapid changes in the customers’ needs in the competitive market, coordination among the supply chain members is one of the most important matters for the effective management of the modern supply chain network. It also helps to achieve high-quality products and customers’ satisfaction. As a result, incorrect decisions about supplier selection and order allocation will lead to negative consequences for companies, such as losses in revenue and market share. Also, the proper evaluation and selection of suppliers have potential effects on improving the performance of organizations as a competitive strategy. Therefore, this study investigated the efficient supplier selection and pricing problems based on the relationship between the buyer and suppliers to present an overview of the supply chain processes. For the first time, a hybrid model has been presented which simultaneously considers efficiency concept, minimizes the supply chain costs, and seeks to select the efficient supplier and allocate the orders during a specified planning period in a multi-period environment and mono-product with certain demand (the proposed model in the first stage). The aim of this model is to select the suppliers that maximize the efficiency and minimize the total cost. This model considers the efficiency concept in the supplier evaluation process and allocates orders to efficient suppliers simultaneously. In fact, unlike most previous models, the proposed hybrid model considers the suppliers’ efficiency along with optimizes the supply chain costs and allows the decision maker to use more criteria for the suppliers’ evaluation depending on each industry. In other words, the second objective function of the hybrid model (efficiency optimization) can simultaneously consider various evaluation criteria (e.g., quality, delivery rate, experience, customer satisfaction, service level, and environmental issues) along with the cost. In fact, it allows the buyer to change the supplier selection criteria and add or remove them in different conditions.

The results of implementing the proposed hybrid model in the first stage indicate that the selected suppliers are different according to the independent optimization of each objective function. Such variation occurs due to the nature of each objective function. However, Tables 6 and 7 (derived from the implementation of the hybrid model in a numerical example) indicate that simultaneous optimization of these functions may enable the decision maker to select different suppliers depending on the condition and allocate order according to the weights of these functions (in the global criteria method). For example, if a buyer in a specific period has a lower budget compared to other periods, the model assigns a higher weight to the cost function. Accordingly, suppliers failing to have the required efficiency are likely to be selected regarding the function at issue. On the other, if the buyer intends to provide high-quality products and achieve customer satisfaction, the model assigns a high weight to the efficiency function. In this state, suppliers with the raw material that enable the buyer to deliver a final high-quality product to the customer are likely to be selected, but as cost optimization is not made, the buyer may endure significant costs. In general, if the decision maker focuses more on reducing the supply chain cost, the hybrid model results will be close to those obtained from the independent optimization of the first objective function. On the other, if the decision maker focuses more on increasing the efficiency of the selected suppliers, the results of the hybrid model will be close to those obtained from the independent optimization of the second objective function.

As stated, an efficient supply chain network requires cooperation between suppliers and buyers. One of the important tools for the supply chain coordination and benefits increasing is pricing. Thus, in the second phase of the proposed approach, the buyer and selected suppliers (output of the first stage) negotiate to determine a price agreed upon via Nash bargaining game to optimize supply chain costs in the competitive environment. The final price of each product unit is obtained by implementing the Nash bargaining model between the buyer and the selected suppliers. Analyzing Table 11 shows that the agreed price is placed along the interval of the minimum selling price per unit and initial price. According to the agreed price, the utility of the negotiation’s sides is increased, and a win-win situation is established between the players. Despite losing part of the profit, each supplier achieves its own utility. In fact, the selected suppliers try to ensure their sales and continue their cooperation with the buyer. On the other hand, the buyer reduces purchasing costs because of the suppliers’ discount policy. Such a condition occurs due to the competitive environment between suppliers and their willingness to attract the buyer’s attention. Hence, the selected suppliers lose an average of 14.74% for unit-profit in the negotiation process with the buyer. Instead, they earn additional privileges such as the chance of cooperation with the buyer and the assurance of the selling. Furthermore, the purchase costs of the buyer have been decreased to 125,974 monetary units compared to the initial state, because the selected suppliers have ignored some parts of their profits.

Despite its noticeable advantages, the proposed approach has also some limitations, such as ignoring the demand uncertainty for dealing with inadequate data from the market environment, which can be studied using uncertainty approaches such as the fuzzy theory. Also, the proposed models are presented based on the single-buyer multi-vendor coordination model (bi-level supply chain) in the single-product mode; however, this model can be developed to multi-buyer multi-vendor multi-product mode for better adaptation with the real-world complex problems. In addition, it is recommended to convert the proposed two-stage approach into a single-stage model in which the supplier selection, order allocation, and order price are done simultaneously.

References

Adeinat H, Ventura JA (2015) Determining the retailer’s replenishment policy considering multiple capacitated suppliers and price-sensitive demand. Eur J Oper Res 247(1):83–92

Aghai S, Mollaverdi N, Sabbagh MS (2014) A fuzzy multi-objective programming model for supplier selection with volume discount and risk criteria. Int J Adv Manuf Technol 71(5–8):1483–1492

Aust G, Buscher U (2012) Vertical cooperative advertising and pricing decisions in a manufacturer–retailer supply chain: a game-theoretic approach. Eur J Oper Res 223(2):473–482

Azadi M, Jafarian M, Saen RF, Mirhedayatian SM (2015) A new fuzzy DEA model for evaluation of efficiency and effectiveness of suppliers in sustainable supply chain management context. Comput Oper Res 54:274–285

Azadnia AH, Saman MZM, Wong KY (2015) Sustainable supplier selection and order lot-sizing: an integrated multi-objective decision-making process. Int J Prod Res 53(2):383–408

Banaeian N, Mobli H, Fahimnia B, Nielsen IE, Omid M (2018) Green supplier selection using fuzzy group decision making methods: a case study from the agri-food industry. Comput Oper Res 89:337–347

Bohner C, Minner S (2017) Supplier selection under failure risk, quantity and business volume discounts. Comput Ind Eng 104:145–155

Çebi F, Otay İ (2016) A two-stage fuzzy approach for supplier evaluation and order allocation problem with quantity discounts and lead time. Inf Sci 339:143–157

Chan CK, Lee YCE, Goyal SK (2010) A delayed payment method in co-ordinating a single-vendor multi-buyer supply chain. Int J Prod Econ 127(1):95–102

Chen YJ (2011) Structured methodology for supplier selection and evaluation in a supply chain. Inf Sci 181(9):1651–1670

Chern MS, Chan YL, Teng JT, Goyal SK (2014) Nash equilibrium solution in a vendor–buyer supply chain model with permissible delay in payments. Comput Ind Eng 70:116–123

Choudhary D, Shankar R (2014) A goal programming model for joint decision making of inventory lot-size, supplier selection and carrier selection. Comput Ind Eng 71:1–9

Dantzig GB (1998) Linear programming and extensions. Princeton University Press, Princeton

Demirtas EA, Üstün Ö (2008) An integrated multiobjective decision making process for supplier selection and order allocation. Omega 36(1):76–90

Deng X, Hu Y, Deng Y, Mahadevan S (2014) Supplier selection using AHP methodology extended by D numbers. Exp Syst Appl 41(1):156–167

Dickson GW (1966) An analysis of vendor selection systems and decisions. J Purch 2(1):5–17

Friedman L, Sinuany-Stern Z (1998) Combining ranking scales and selecting variables in the DEA context: the case of industrial branches. Comput Oper Res 25(9):781–791

Giri BC, Bardhan S (2015) A vendor–buyer JELS model with stock-dependent demand and consigned inventory under buyer’s space constraint. Oper Res Int J 15(1):79–93

Goyal SK (1977) An integrated inventory model for a single supplier-single customer problem. Int J Prod Res 15(1):107–111

Goyal SK, Gupta YP (1989) Integrated inventory models: the buyer-vendor coordination. Eur J Oper Res 41(3):261–269

Hammami R, Temponi C, Frein Y (2014) A scenario-based stochastic model for supplier selection in global context with multiple buyers, currency fluctuation uncertainties, and price discounts. Eur J Oper Res 233(1):159–170

Hariga M, Glock CH, Kim T (2016) Integrated product and container inventory model for a single-vendor single-buyer supply chain with owned and rented returnable transport items. Int J Prod Res 54(7):1964–1979

Hashemi SH, Karimi A, Tavana M (2015) An integrated green supplier selection approach with analytic network process and improved Grey relational analysis. Int J Prod Econ 159:178–191

He Y, Zhao X (2012) Coordination in multi-echelon supply chain under supply and demand uncertainty. Int J Prod Econ 139(1):106–115

Hosseininasab A, Ahmadi A (2015) Selecting a supplier portfolio with value, development, and risk consideration. Eur J Oper Res 245(1):146–156

Jadidi O, Cavalieri S, Zolfaghari S (2015) An improved multi-choice goal programming approach for supplier selection problems. Appl Math Model 39(14):4213–4222

Jain V, Sangaiah AK, Sakhuja S, Thoduka N, Aggarwal R (2016) Supplier selection using fuzzy AHP and TOPSIS: a case study in the Indian automotive industry. Neural Comput Appl. https://doi.org/10.1007/s00521-016-2533-z

Kamali A, Fatemi Ghomi SMT, Jolai F (2011) A multi-objective quantity discount and joint optimization model for coordination of a single-buyer multi-vendor supply chain. Comput Math Appl 62(8):3251–3269

Kar AK (2014) Revisiting the supplier selection problem: an integrated approach for group decision support. Exp Syst Appl 41(6):2762–2771

Kilic HS (2013) An integrated approach for supplier selection in multi-item/multi-supplier environment. Appl Math Model 37(14):7752–7763

Klimberg RK, Ratick SJ (2008) Modeling data envelopment analysis (DEA) efficient location/allocation decisions. Comput Oper Res 35(2):457–474

Kohli R, Park H (1989) A cooperative game theory model of quantity discounts. Manag Sci 35(6):693–707

Kumar D, Rahman Z, Chan FT (2017) A fuzzy AHP and fuzzy multi-objective linear programming model for order allocation in a sustainable supply chain: a case study. Int J Comput Integr Manuf 30(6):535–551

Mendoza A, Ventura JA (2013) Modeling actual transportation costs in supplier selection and order quantity allocation decisions. Oper Res Int Journal 13(1):5–25

Miettinen K (1999) Nonlinear multiobjective optimization, vol 12. Springer, Berlin

Moheb-Alizadeh H, Handfield R (2017) An integrated chance-constrained stochastic model for efficient and sustainable supplier selection and order allocation. Int J Prod Res. https://doi.org/10.1080/00207543.2017.1413258

Mokhtari H, Rezvan MT (2017) A single-supplier, multi-buyer, multi-product VMI production-inventory system under partial backordering. Oper Res. https://doi.org/10.1007/s12351-017-0311-z

Nagarajan M, Sošić G (2008) Game-theoretic analysis of cooperation among supply chain agents: review and extensions. Eur J Oper Res 187(3):719–745

Nash JF Jr (1950) The bargaining problem. Econ: J Econ Soc 155–162

Ordoobadi SM (2009) Development of a supplier selection model using fuzzy logic. Supply Chain Manag: Int J 14(4):314–327

PrasannaVenkatesan S, Goh M (2016) Multi-objective supplier selection and order allocation under disruption risk. Trans Re Part E: Log Trans Rev 95:124–142

Rezaee MJ, Yousefi S, Hayati J (2017) A multi-objective model for closed-loop supply chain optimization and efficient supplier selection in a competitive environment considering quantity discount policy. J Ind Eng Int 13(2):199–213

Rezaei J, Davoodi M, Tavasszy L, Davarynejad M (2016) A multi-objective model for lot-sizing with supplier selection for an assembly system. Int J Log Res Appl 19(2):125–142

Wan SP, Li DF (2013) Fuzzy LINMAP approach to heterogeneous MADM considering comparisons of alternatives with hesitation degrees. Omega 41(6):925–940

Sucky E (2005) Inventory management in supply chains: a bargaining problem. Int J Prod Econ 93:253–262

Sucky E (2006) A bargaining model with asymmetric information for a single supplier–single buyer problem. Eur J Oper Res 171(2):516–535

Talluri S, Baker RC (2002) A multi-phase mathematical programming approach for effective supply chain design. Eur J Oper Res 141(3):544–558

Tavana M, Shabanpour H, Yousefi S, Saen RF (2017) A hybrid goal programming and dynamic data envelopment analysis framework for sustainable supplier evaluation. Neural Comput Appl 28(12):3683–3696

Venegas BB, Ventura JA (2018) A two-stage supply chain coordination mechanism considering price sensitive demand and quantity discounts. Eur J Oper Res 264(2):524–533

Wang SD, Zhou YW, Min J, Zhong YG (2011) Coordination of cooperative advertising models in a one-manufacturer two-retailer supply chain system. Comput Ind Eng 61(4):1053–1071

Wu DD, Zhang Y, Wu D, Olson DL (2010) Fuzzy multi-objective programming for supplier selection and risk modeling: a possibility approach. Eur J Oper Res 200(3):774–787

Xiang W, Song F, Ye F (2014) Order allocation for multiple supply-demand networks within a cluster. J Intell Manuf 25:1367–1376

Ye F, Xu X (2010) Cost allocation model for optimizing supply chain inventory with controllable lead time. Comput Ind Eng 59(1):93–99

Yousefi S, Mahmoudzadeh H, Jahangoshai Rezaee M (2017) Using supply chain visibility and cost for supplier selection: a mathematical model. Int J Manag Sci Eng Manag 12(3):196–205

Zhang X, Deng Y, Chan FT, Mahadevan S (2015) A fuzzy extended analytic network process-based approach for global supplier selection. Appl Intell 43(4):760–772

Acknowledgements

The authors are also indebted to the anonymous reviewers who have provided professional aspects and constructive feedbacks. They help us to improve the paper according to the useful and valuable comments and suggestions on the technical and structural aspects of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yousefi, S., Jahangoshai Rezaee, M. & Solimanpur, M. Supplier selection and order allocation using two-stage hybrid supply chain model and game-based order price. Oper Res Int J 21, 553–588 (2021). https://doi.org/10.1007/s12351-019-00456-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-019-00456-6