Abstract

The rebound effect reflects the difference between the expected energy savings from energy efficiency, and the real ones, considering the former is higher than the latter. In some extreme cases, some scholars consider energy use can even increase after an energy efficiency improvement. This is due to agents’ behavioural responses. After almost four decades of theoretical and empirical studies in the field, there is a strong consensus amongst energy economists that the rebound effect of energy efficiency exists, although its importance is still being discussed. However, there are few empirical studies exploring its potential solutions. In this research, we empirically assess the effects of energy taxation on the rebound effect. Using a dynamic energy-economy computable general equilibrium (CGE) model of the Spanish economy, we test a global energy efficiency increase of 5.00%, and at the same time, different ad valorem tax rates on energy industries. We find that a tax rate of 3.76% would totally counteract the economy-wide rebound effect of 82.82% we estimate for the Spanish economy. This tax rate would still allow some economic benefits provided by the increase of energy productivity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Governments stimulate measures to reduce energy use for several reasons. The most important ones are economic policy objectives, environmental policy and climate change objectives, foreign supply dependence, geostrategic interests, health policies objectives, etc. Leaving particular considerations aside, a sustained reduction of energy use has overall benefits in different areas of a global policy strategy, as energy and its use is central in socio-economic structures.

One of the most extended energy conservation policies is to foster energy efficiency through the implementation of different measures across households, industries and public administrations itself. The main objective of these policies is usually reducing energy consumption, and calculations from engineering models predict the total amount of energy expected to be reduced after a specific efficiency measure applied to a concrete area.

However, beyond the engineering calculations, energy efficiency improvements have secondary effects due to individual and collective behaviours that produce some unexpected outcomes. These effects have been widely studied not only by economists but also by other disciplines. The rebound effect includes all that mechanisms that do not allow to (partially or totally) reduce the energy consumption as it was predicted by engineering calculations (Saunders 1992; Sorrell 2007; Ruzzenenti and Basosi 2008; Font Vivanco et al. 2016a). It was firstly suggested by Jevons (1865), but nobody started to systematically analyse it since the decade of the 1980s of the last century (Brookes 1979; Khazzoom 1980; Lovins et al. 1988). Since then, some theoretical and empirical studies have tried to shed light on the issue, under different analytical frameworks and conditions.

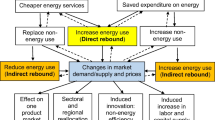

It is commonly accepted amongst energy economists that there are, at least, three different kinds of rebound effects: direct rebound refers to the increase on the demand of the service that has seen improved its own efficiency (Freire-González 2010); indirect rebound refers to the changes in demands of others goods and services from monetary savings derived from cost reductions generated by the more efficient systems (Druckman et al. 2011; Freire-González 2011, 2017); and economy-wide rebound are changes in prices, quantities, supplies and demands across the economic system that lead to new economic equilibriums (Turner 2008; Broberg et al. 2015).

Most of the efforts have been placed in providing empirical evidence (Greening et al. 2000; Sorrell et al. 2009). These studies show that rebound effect exists, but there is no an agreement about its magnitude. Different methods, regions, areas, data, etc. provide different results. However, there are not many studies to provide solutions. There are only few studies that suggest or analyse potential solutions from a theoretical perspective (Freire-González and Puig-Ventosa 2015; van den Bergh 2015; Font Vivanco et al. 2016b). There also are few studies that assess, from an empirical perspective, the efficacy and other effects of the potential solutions proposed by these studies. The potential of energy taxation to limit the rebound effect have been empirically assessed in Saunders (2018). Other studies assess the potential of white certificate schemes, a hybrid instrument combining energy efficiency subsidization and energy taxation. They have found that these certificates limit the rebound effect, compared to pure energy efficiency subsidies (Giraudet and Quirion 2008).

In this research, we empirically assess the efficacy of energy taxation on offsetting the economy-wide rebound effect of energy efficiency improvements. We also explore different potential tax rates and the outcomes, both in economic terms and considering global energy use. Using a dynamic energy-economy computable general equilibrium (CGE) model for the Spanish economy, we test an improvement in energy productivity and, at the same time, different tax rates on energy industries, with values around the percentage increase in energy productivity.

The case study of Spain is interesting to know how taxes can counteract the rebound effect in the context of the European Union, were countries are supposed to have a high level of fiscal sovereignty but monetary policies determined by the European Central Bank. Spain is a high-income developed country with some specificities, but not a leading economy in this context. As the rebound effect is expected to be higher in developing countries than in industrialized ones (Sorrell 2007), Spain can be a good case study to understand how energy taxes can work to mitigate the economy-wide round effect in the European context and to obtain insights for other industrialized countries with similar economic and trade structures, as well as energy use.

Methodology

The methodology used in this study comprises two steps: (1) development of the dynamic energy-economy CGE model and (2) scenario development to test different possibilities, which includes (i) changes in energy productivity and (ii) changes in energy tax rates. Both types of scenarios are combined as detailed below.

The dynamic energy-economy CGE model

Economic model

Early versions of the economic model are in Ho and Jorgenson (2007) and in Cao et al. (2013). However, the version used in this research has experienced many changes and adaptations since its first developments. Technical details and the equations of the economic model can be found in Freire-González and Ho (2018) and in Freire-González and Ho (2019). This model is adequate to generate new insights on the rebound effect, as well as tax policies to avoid it. It has been previously used and initially developed to assess environmental taxes, so taxes are exogenous in a way that different combinations of fiscal policies can be tested. Cobb-Douglass production functions are developed to specifically differentiate between energy inputs and the rest of the productive inputs (materials, labor, land and capital). This allows to introduce productivity gains as an exogenous variable following Turner (2008), as detailed in the “Changes in energy productivity” section.

In summary, four agents are represented in the system: households, enterprises, government and rest of the world. Behavioural equations represent all the economic transactions between them. Households provide labor and use the incomes received to buy commodities, to pay taxes and save part of them. They also receive dividends from enterprises, and transfers from the government and from the rest of the world. Enterprises use production factors and intermediate commodities to produce goods and services. They also deliver dividends to households, pay taxes to government, receive and transfers from the government and have transactions with the rest of the world, saving part of their incomes. Government pays and receives incomes through taxes, subsidies and other transfers, but it also purchases commodities and invests. The rest of world imports goods and services, buy commodities (exports), makes foreign investments and receive and transfer incomes.

Production functions combine five factors of production to carry out their activities: labor, capital, land, energy and other intermediates. They are specified as Cobb-Douglas functions, using input-output technical coefficients of the use matrix as the share of the different factors of production. Labor supply depends on the level of unemployment. Capital grows with new investments and declines with depreciation. Land is fixed exogenously for agriculture, forestry and fishing industries. From the dynamic perspective, it is a Solow model, and savings drive the economic growth. Growth also depends on population growth and technical change.

Energy model

The energy industries identified in the model are as follows: extraction of coal and lignite peat; extraction of crude petroleum and services related to crude oil extraction; extraction of natural gas; mining of uranium and thorium ores; production of coke; refinement of petroleum and nuclear fuel, production of electricity by coal; production of electricity by gas; production of electricity by nuclear; production of electricity by hydro; production of electricity by wind; production of electricity by petroleum and other oil derivatives; production of electricity by biomass and waste; production of electricity by solar; production of other electricity; transmission services of electricity; distribution and trade services of electricity and production and distribution of gas.

We include an energy submodel into the dynamic CGE system. In our model, there is a detail on 101 commodities produced by the 101 detailed industries, including the different forms of energy generated by coal, oil, gas and renewable electricity sources. We define energy use assuming that all the energy used by the economic system is provided by the industries defined above, and considering exports and imports:

where Et is the total use of energy, QCi is the domestic energy commodity i (which can be coal, oil, natural gas or renewables), Xi are energy exports, Mi are energy imports, and δi and δmi are the internal energy use coefficient and the imports energy use coefficient, representing the energy use per monetary unit of each variable. Specifically, the units of the energy coefficients are in megajoules/euros. Energy is in tones (for oil and gas), in cubic meters (for natural gas) and in kilowatt hours (for renewables). It has been obtained from the International Energy Agency (IEA). Then, we have applied conventional conversion factors for each energy source to obtain megajoules. In Eq. (2), we define the domestic commodity in real terms.

where VQCit represents the domestic commodity in nominal terms, and PCit is the price of domestic commodities. Variations in the price of different forms of energy, in imports or in exports of energy, change the total energy supply. They would also be affected by changes in quantities and prices in other nondirectly related industries.

Data

The main source of data is a social accounting matrix (SAM) for the Spanish economy developed. This is the data that mainly feed the economic part of the model. It is a square matrix which represents all the economic flows between economic agents in a specific period of time. The core of the SAM we have built comes from the National Statistics Institute of Spain (INE) and Exiobase (Tukker et al. 2013; Wood et al. 2015). From the former, we obtained supply and use tables, and from the latter, we were able to disaggregate the energy industries into 16 economic industries to obtain more detail. Exiobase is a multiregional input-output framework with environmental extensions for 2007 in its second version. It also includes interindustry detail of energy use. We finally developed the SAM with 101 industries and 101 commodities.

The rest of the economic flows included in the SAM have been completed with information from the INE, the Bank of Spain and other sources from the Spanish government, including the Ministry of Industry and the Ministry of Treasury and Public Administrations. From these sources, we obtained data on different taxes, financial flows, the government accounts, enterprises accounts and on the rest of the world sector. The stock of capital and depreciation rates by industry were obtained from the EU KLEMS project on growth and productivity (Jäger 2016).

Scenario development

Changes in energy productivity

The energy efficiency improvement is considered exogenous in this research, so there are no costs from the implementation of measures or policies that would lead to an increase in energy efficiency. This is a specific kind of efficiency improvement, but we have considered this is the best one to avoid heterogeneity problems within costs of different measures. Many efficiency improvements come with a cost. Some studies (Allan et al. 2007; Peng et al. 2019; Broberg et al. 2015) show that when considering the cost of energy-efficiency improvements, the rebound effect is lower.

In order to test energy efficiency improvements, we assume that resource efficiency equals to resource productivity, so an improvement in energy efficiency is equal to an improvement in the productivity of energy, and at the same, this equals to a reduction in the cost of energy. This affects all the other economic sectors, as they use energy to produce commodities. So, the first direct effect of efficiency is a reduction of the production costs of all goods and services that use energy as a productive input. Considering that energy is a widely common used production factor across the economy, the effects are expected to be wide. This reduction in the cost of energy triggers an increase of the own demand of energy, but also of the rest of the goods and services, that are now cheaper, boosting the use of energy again. There are also changes in income allocation and trade, and a new general equilibrium arises in the economic system, leading to a global energy use, different than the one initially expected.

We describe industry production behaviour as Cobb-Douglass production functions with constant returns to scale. Energy productivity improvements are introduced into the system as shown in Eq. (3).

where QIjt represents the total production of industry j at period t; g is technical progress; K is capital; L is labor; T is land, E is energy and M are materials. The share of each production factor is represented by different ∝. From this equation, we can draw the dual cost function in Eq. (4).

where Pjt is the effective production cost of sector j at period t, gt is the technical progress, PKt is the price of capital, PLt is the price of labor, PTt is the price of land, PEt is the price of energy and PMt is the price of materials. Then, we include six new parameters, one per each production factor, which reflect assumptions about the annual average growth in factor productivity (ϕF) (Grepperud and Rasmussen 2004). See Eq. (5).

Energy productivity improvements are introduced by increasing the value of ϕE in Eq. (5). An increase of this parameter reduces the production costs of industries. Those industries that are more energy-intensive are more directly affected by this change.

Then, we estimate the economy-wide energy rebound effect by using Turner’s approach (Turner 2008). In Eq. (6), we assume that a change in energy efficiency have an impact on the price of energy measured in efficiency units.

where \( {\dot{p}}_{\varepsilon } \) is the price variation of energy in efficiency units, \( {\dot{p}}_E \) is the price variation of energy, and ρ is the rate of energy augmenting technical progress. The relationship between the price variation of energy in efficiency units and the energy use measured in efficiency units (\( \dot{\varepsilon} \)) is shown in Eq. (7).

where ϑ is the general equilibrium price elasticity of the demand for energy. The relationship between energy in natural units (\( \dot{E} \)) and energy use in efficiency units (\( \dot{\varepsilon} \)) can be stated as it is in Eq. (8).

For an energy efficiency gain that affects all uses of energy across the economic system, the change in energy demand can be obtained by substituting Eqs. (6) and (8) into (7). See Eq. (9).

The economy-wide rebound effect (RE) can be expressed in percentage terms as:

There is an additional consideration that need to be taken into account when estimating the economy-wide rebound effect. It is related to the boundaries of the analysis. Energy efficiency is only improved for a subset of its total uses in this study, specifically for production uses, and from them, only domestically supplied energy (not for imports). In this case, from Turner (2008), rebound effect has to be estimated as shown in Eqs. (11) and (12).

where T, I and D subscripts mean total, industry and domestic supplied energy, respectively.

In our empirical tests, we have applied an average annual improvement of 5.00% in energy efficiency, or energy productivity. Then, we have assessed the dynamic effects on different macroeconomic and energy indicators and combined it with changes in energy taxation as detailed in the next section. The efficiency improvement considered means to set a ϕE value of 1.05.

Changes in energy tax rates

At the same time, we introduce an energy productivity improvement into the model, and we add an ad valorem tax to the total production of the different energy industries: all forms of energy extraction, production and distribution. This is a “rebound tax”, as the main objective is to minimize the rebound effect and should be planned at the same time policy-makers plan an energy efficiency strategy, in order to implement them simultaneously.

Another possibility that would have the same macroeconomic effects from our modelling point of view is to increase a preexisting tax that is currently being applied to the production of different energy industries. This could be an easiest way to manage it from a legal or administrative point of view, but implementation issues are out of the scope of this research.

Our model and SAM have detail on different taxes, specifically tax on capital; tax on labour; property tax; tax on dividends; value-added tax (VAT) on products; excise duties on alcohol, tobacco, hydrocarbons, electricity and retail hydrocarbons; sales tax; other taxes on production; social security contributions; and import taxes (or tariffs). We obtained the information to add them from the General Intervention Board of the State Administration (IGAE) of Spain.

We apply five different scenarios related to tax rates. The first one implies a tax rate of 1% to all the energy sectors; the second, 2%; the third, 3%; the fourth, 4%; and the fifth, 5%. These scenarios are combined with the 5% increase in energy productivity, in order to provide results.

As the aim of this research is just to show to under certain conditions some level of taxation could avoid the rebound. Ad valorem tax rates are defined through a scenario-based approach. In our simulations, government revenues from these simulated taxes are used for higher government purchases. Beyond these scenarios, we have also run the models with many other tax rates and productivity improvements in order to find other interesting results like the tax at which the rebound effect is zero, and the tax at which the GDP variation is zero, as we describe below in the results section.

Results

Some interesting results arise from the analysis. The first general result is that applying a 5.00% general improvement of energy productivity, we obtain an economy-wide rebound effect of 82.82% for Spain. So, after the efficiency improvement, only a 17.18% of the expected savings become effective. Although it is quite a high rebound effect, backfire is not reached (rebound > than 100%), so there are still some energy savings.

Figure 1 shows the economy-wide rebound effect under different tax rates, after an energy productivity improvement of 5.00%. We observe a reduction of the rebound effect as the tax rate grows, and it totally disappears at the tax rate of 3.76%. This rate is lower than the increase of the energy productivity. Tax rates higher than this value turn rebound effect negative, that is, the energy savings are higher than initially expected.

The relevant indicator for this research is energy use (initial and final), as the research is focused on mitigating the rebound effect, with no other academic or policy considerations. However, we provide other macroeconomic indicators. To understand the cost of taxing energy industries after the energy productivity improvement, we have plotted Fig. 2. It shows that under all analysed tax rates, there is an increase of GDP after an energy productivity improvement of 5.00%. GDP increase is zero when the tax rate of the new tax is 27%. It is interesting to point out that, even in the case that rebound effect is totally counteracted (rebound equal to zero), there is a GDP improvement in relation to the base case. With a policy that increases energy productivity by 5.00%, and a at the same time, taxing energy industries at 3.76%, we reduce energy consumption as initially expected and still obtain an annual average GDP increase of 0.57%. This would allow a double benefit: policies that combine energy productivity improvements with energy taxation can save energy and improve economic welfare. This result is obtained without considering other revenue recycling possibilities, but just by spending the revenues from this new tax in the same way that government usually spends other revenues. Some studies show that the economic output would be even better if revenues are used to cut other preexisting taxes (Freire-González 2018).

The slopes of the rebound effect and the GDP variation curves give some margin to policy action. While rebound declines fast with energy tax rates, GDP improvement declines slowly. This means that policy actions involving some kind of energy taxation after improvements in productivity of energy will always be positive in environmental and economic terms at low tax rates. We have tested higher productivity improvements, and the patterns remain with the model we developed: same slopes and proportional effects with proportional tax rates.

Beyond the global economic effects, it is interesting to show the results of different taxes on different industries, after an energy productivity improvement combined with energy taxation. We have grouped all the economic sectors into two groups, energy industries (includes the 16 energy industries of our economic model) and other industries (the other 85 industries), and we have obtained the average variation of production and prices of them in relation to the base case. Figure 3 shows the average variation of production and prices of both groups, with the energy productivity improvement of 5.00% in two situations: (1) without any additional measure, and (2) under an ad valorem tax of 3.76% on all energy sectors (that one that totally counteracts the rebound effect). As we have the dynamic effects, we plot year 1 and year 20 to also observe the long-term effects.

Globally, the productivity improvement benefits all industries if no additional measures are carried out, as we observe higher production and lower prices. If we tax energy sectors at 3.76%, counteracting the rebound effect, energy sectors globally reduce their production and increase prices. However, the other industries still improve. The elasticity of substitution between inputs is equal to 1, due to the Cobb-Douglass production functions specified in the model. However, the effect of the simulated tax of 3.76% on energy sectors comes a combination of the behavioural responses of these specifications (with the fixed-proportions shares from input-output tables) and the increase of the energy productivity we forced in simulations. In the long term (year 20), there are also effects on capital accumulation for different industries, leading to further changes in prices and quantities.

There is another study that empirically finds energy taxes to mitigate the rebound effect (Saunders 2018), based on the methodology detailed in Saunders (2013) to estimate the rebound effect. He estimates aggregate production functions for 30 sectors in the USA, using econometric methods and historical data. In this study, the required energy tax to counteract the rebound effect is substantial and different for each sector facing different rebounds. In his study, most sectors should implement a tax between 0 and 50%, but some sectors with high rebound effects need extreme tax rates (350%). Beyond the differences on the methodology (we use CGE modelling), the case study (the US versus Spain), the period and other assumptions taken into consideration, there are also differences between both studies in the scope and approaches followed, as we use a scenario-based procedure. Further research should try different specifications and models to extract more robust conclusions on the optimal energy tax rates needed to mitigate the rebound and its comparison with other potential solutions.

Conclusions

This research represents a first empirical attempt to the assess how energy taxation could be an effective policy to offset the rebound effect of energy efficiency. Results from tests conducted in an energy-economy dynamic CGE model suggest that energy taxation not only could work in compensating the rebound effect, but there would still be a long-term positive outcome in terms of economic output, as GDP increases in relation to the base case when implementing taxes on energy industries. This is because energy productivity improvements have deeper effects on economic structure than the potential negative economic effects of taxation. Actually, combining energy efficiency with taxation at a similar tax rates only have negative effects on energy industries, not for the rest of the industries of the economic system.

That is, policy-makers can obtain a double benefit by imposing a proper tax after an energy productivity improvement, by reducing energy consumption as initially expected and, at the same time, improving the economy. One powerful way to use the results of this research would be to complementing specific policies of energy efficiency with energy taxation measures. Even without perfect information about the productivity improvement reached, it is better to implement energy taxation, with tax rates around the value of the efficiency improvement. These rates can actually be smaller than the percentage of efficiency improvement to counteract the rebound effect, and still have economic improvement. Regarding the implementation of the proposed measures in this study, it can be difficult to track the specific energy productivity improvements and tax them optimally to counteract the rebound effect, so it could work better as a complementary measure to energy efficiency policies, plans or strategies.

As this is still an unexplored field, there is plenty of work to do in this area. Further research needs to analyse the best way to implement this new form of taxation from a legal and an administrative point of view. As well as the design and implementation issues necessary for it to succeed, whether is better the creation of a “rebound tax” or complementing other preexisting taxes. Further research also needs to explore these conclusions under different socio-economic frameworks.

The implementation of these complementary policies (resource efficiency plus taxation) can adopt different forms in practice but should go hand by hand if energy efficiency measures, or resource productivity policies in general, have the objective of reducing resources use. Other energy pricing policies, such as cap-and-trade systems could have a similar impact but need to be further explored in other empirical studies. A combination of different systems could also work. This research shows that complex policies, involving the combination of different kinds of measures, are necessary to deal with complex problems like the secondary effects of resource efficiency and the rebound effect. Further research should also explore how different tax rates should be chosen, from theoretical point of view, in order to avoid the rebound effect in different contexts.

As we state, the article is focused on the rebound effect of energy efficiency. This field analyses and measures how energy efficiency does not reduce energy use as expected. We focus on this, obviating policy considerations. The objective of this research is just to avoid the rebound effect of energy. We understand that including other policy consideration would move away from the contributions in the specific field. There are many policy objectives with different focus. A climate change policy would focus on CO2 emissions, partially benefiting from these results, but an energy security policy would focus on maximizing energy use reduction (this research would be very useful). A policy exclusively focused on economic growth could even focus on not counteracting the rebound effect. Further research can also focus on these issues, i.e. how and which policy objectives can use this research.

References

Allan, G., Hanley, N., McGregor, P., Swales, K., & Turner, K. (2007). The impact of increased efficiency in the industrial use of energy: A computable general equilibrium analysis for the United Kingdom. Energy Economics, 29(4), 779–798.

Broberg, T., Berg, C., & Samakovlis, E. (2015). The economy-wide rebound effect from improved energy efficiency in Swedish industries–A general equilibrium analysis. Energy Policy, 83, 26–37.

Brookes, L. G. (1979). A low energy strategy for the UK, at G. Leach et al.: a Review and Reply. Atom, 269, 3–8.

Cao, J., Ho, S., & Jorgenson, D. W. (2013). The economics of environmental policies in China. In C. P. Nielsen & M. S. Ho (Eds.), Clearer skies over China. Cambridge: MIT press.

Druckman, A., Chitnis, M., Sorrell, S., & Jackson, T. (2011). Missing carbon reductions? Exploring rebound and backfire effects in UK households. Energy Policy, 39(6), 3572–3581.

Font Vivanco, D., McDowall, W., Freire-González, J., Kemp, R., & van der Voet, E. (2016a). The foundations of the environmental rebound effect and its contribution towards a general framework. Ecological Economics, 125, 60–69.

Font Vivanco, D., Kemp, R., & van der Voet, E. (2016b). How to deal with the rebound effect? A policy-oriented approach. Energy Policy, 94, 114–125.

Freire-González, J. (2010). Empirical evidence of direct rebound effect in Catalonia. Energy Policy, 38(5), 2309–2314.

Freire-González, J. (2011). Methods to empirically estimate direct and indirect rebound effect of energy-saving technological changes in households. Ecological Modelling, 223(1), 32–40.

Freire-González, J. (2017). A new way to estimate the direct and indirect rebound effect and other rebound indicators. Energy, 128, 394–402.

Freire-González, J. (2018). Environmental taxation and the double dividend hypothesis in CGE modelling literature: a critical review. Journal of Policy Modeling, 40(1), 194–223.

Freire-González, J., & Ho, M. S. (2018). Environmental fiscal reform and the double dividend: Evidence from a dynamic general equilibrium model. Sustainability, 10(2), 501.

Freire-González, J., & Ho, M. S. (2019). Carbon taxes and the double dividend hypothesis in a recursive-dynamic CGE model for Spain. Economic Systems Research, 31(2), 267–284.

Freire-González, J., & Puig-Ventosa, I. (2015). Energy efficiency policies and the Jevons paradox. International Journal of Energy Economics and Policy, 5(1), 69.

Giraudet, L. G., & Quirion, P. (2008). Efficiency and distributional impacts of tradable white certificates compared to taxes, subsidies and regulations. Revue d'économie politique, 118(6), 885–914.

Greening, L. A., Greene, D. L., & Difiglio, C. (2000). Energy efficiency and consumption—the rebound effect—a survey. Energy policy, 28(6-7), 389–401.

Grepperud, S., & Rasmussen, I. (2004). A general equilibrium assessment of rebound effects. Energy economics, 26(2), 261–282.

Ho, M. S., & Jorgenson, D. (2007). Policies to control air pollution damages. In M. S. Ho & C. P. Nielsen (Eds.), Clearing the air: The health and economic damages of air pollution in China (pp. 331–372). Cambridge: MIT Press.

Jäger, K. (2016). EU KLEMS growth and productivity accounts 2016 release, statistical module. Description of methodology and country notes for Spain.

Jevons, W. S. (1865). The coal question. London: Macmillan and Co.

Khazzoom, J. D. (1980). Economic implications of mandated efficiency standards for household appliances. Energy Journal, 1, 21–39.

Lovins, A. B., Henly, J., Ruderman, H., & Levine, M. D. (1988). Energy saving resulting from the adoption of more efficient appliances: another view; a follow-up. The Energy Journal, 92, 155.

Peng, J. T., Wang, Y., Zhang, X., He, Y., Taketani, M., Shi, R., & Zhu, X. D. (2019). Economic and welfare influences of an energy excise tax in Jiangsu province of China: A computable general equilibrium approach. Journal of Cleaner Production, 211, 1403–1411.

Ruzzenenti, F., & Basosi, R. (2008). The rebound effect: An evolutionary perspective. Ecological Economics, 67, 526–537.

Saunders, H. D. (1992). The Khazzoom-Brookes postulate & neoclassical growth. The Energy Journal, 13(4), 131–148.

Saunders, H. D. (2013). Historical evidence for energy efficiency rebound in 30 US sectors and a toolkit for rebound analysts. Technological Forecasting and Social Change, 80(7), 1317–1330.

Saunders, H. D. (2018). Mitigating rebound with energy taxes, the selected works of Harry D. Saunders. Bepress.

Sorrell, S. (2007). The rebound effect: an assessment of the evidence for economy-wide energy savings from improved energy efficiency. London: UK Energy Research Centre.

Sorrell, S., Dimitropoulos, J., & Sommerville, M. (2009). Empirical estimates of the direct rebound effect: A review. Energy policy, 37(4), 1356–1371.

Tukker, A., de Koning, A., Wood, R., Hawkins, T., Lutter, S., Acosta, J., Rueda Cantuche, J. M., Bouwmeester, M., Oosterhaven, J., Drosdowski, T., & Kuenen, J. (2013). EXIOPOL - Development and illustrative analyses of a detailed global MR EE SUT/IOT. Economic Systems Research, 25(1), 50–70.

Turner, K. (2008). A computable general equilibrium analysis of the relative price sensitivity required to induce rebound effects in response to an improvement in energy efficiency in the UK economy. Discussion paper. SIRE-DP-2008-20. University of Strathclyde.

van den Bergh, J. C. (2015). Pricing would limit carbon rebound. Nature, 526(7572), 195–195.

Wood, R., Stadler, K., Bulavskaya, T., Lutter, S., Giljum, S., de Koning, A., Kuenen, J., Schütz, H., Acosta-Fernández, J., Usubiaga, A., Simas, M., Ivanova, O., Weinzettel, J., Schmidt, J. H., Merciai, S., & Tukker, A. (2015). Global sustainability accounting: Developing Exiobase for multi-regional footprint analysis. Sustainability, 7(1), 138–163.

Funding

This project received funding from the European Union’s Horizon 2020 Research and Innovation Program under the Marie Sklodowska-Curie grant agreement, No. 654189. It also received the support of the Beatriu de Pinós postdoctoral programme of the Government of Catalonia’s Secretariat for Universities and Research of the Ministry of Economy and Knowledge.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Freire-González, J. Energy taxation policies can counteract the rebound effect: analysis within a general equilibrium framework. Energy Efficiency 13, 69–78 (2020). https://doi.org/10.1007/s12053-019-09830-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-019-09830-x