Abstract

This study examines (1) how corporate social responsibility (CSR) or the three pillars of sustainable investing, viz., the environmental (E), social (S), and governance (G) pillars, individually affect innovation performance (IP) and business performance (BP) and (2) how power distance (PD) moderates the impact of the ESG pillars on IP and BP. Our findings of studying 116 multinational enterprises (MNEs) in the technology industry from 2013 to 2018 suggest that not all indicators significantly affect the performance of the MNEs. That is, the G pillar has a positive influence on IP, whereas the E and S pillars are negatively related to BP. Moreover, we find that PD significantly moderates the relationship between two pillars of ESG (E and S) and BP. Specifically, the E and S pillars are negatively related to BP when PD is low, but the relationship is significantly and statistically positive when PD is high. The results can provide technology MNE managers with references for their CSR implementation strategy choices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

People are paying increasing attention to the extent to which corporations improve or harm social welfare. Environmental (E), social (S), and governance (G) dimensions and corporate social responsibility (CSR) are terms used interchangeably to depict corporate efforts in this field (Gillan et al. 2021). CSR is generally considered as a means to incorporate environmental and social components into corporate operations (Baumgartner 2014). Researchers indicated that CSR is crucial to the sustainable development of firms in an evolving environment (Gyves and O'Higgins 2008; Luo and Homburg 2007). Moreover, the relationship between CSR and firm performance (FP) attracted attention from academic researchers owing to the mixed empirical evidence presented in different studies (Wang et al. 2015a, b). Some researchers indicated the positive impact of CSR on FP (Bacinello et al. 2020; Broadstock et al. 2019; Wang et al. 2019), whereas others argued that CSR is adversely related to FP (Di Giuli and Kostovetsky 2014; Filbeck and Gorman 2004; Gallego‐Álvarez et al. 2011). According to previous studies (Cai et al. 2016; Gillan et al. 2021; Liang and Renneboog 2017), economic growth, laws, and culture play a part in such inconsistencies. For example, Wang et al. (2015a, b) confirmed that enterprises in developed economies have a greater CSR–corporate financial performance relationship than firms in emerging ones. The combination of cultural values may be to blame for the inconsistency of the influence of CSR on FP (Cai et al. 2016). Broadstock et al. (2019) modeled the indirect influence of CSR activities on FP by examining their effect on innovative capability. In their research, the authors used a nonparametric frontier analysis methodology on a data collection of 320 Japanese enterprises from 2008 to 2016 (Broadstock et al. 2019). Broadstock et al. (2019) proposed that though some studies generally agree with the observation of the beneficial influence of enterprises’ CSR on their research and development (R&D) activities or capacities for innovation, investigating the CSR or ESG–innovation relationship further for enterprises in additional categories is necessary.

Recently, Tsai et al. (2020) explored the impact of environmental management actions on FP across a range of national culture variables. According to the study, the relationship between environmental management activities and FP is weak in companies in low-power distance (PD) countries (Tsai et al. 2020). Tsai et al. (2020) also recommended that future research can be conducted to investigate the moderating role of economic growth and cultural differences in countries by aggregating empirical evidence linking CSR and FP. Moreover, Luo et al. (2018) determined whether PD functions as a moderating variable and argued that individuals must deal with climate change, and underlying national cultural preferences have an impact on individuals. Therefore, in this study, we explore the moderating effect of PD in the CSR-FP relationship by using the multiple regression approach. We use the PD variable to assess how evenly or unevenly power distribution is in society as well as how easily inequality is expected and accepted. A high score displays that power is concentrated, whereas a low score indicates that power is distributed. Hofstede’s cultural framework was found to be effective in describing cultural background differences between countries (Luo et al. 2018). Thus, in this study, we use the national PD index from Hofstede et al. (2010).

Moreover, when we use different proxies to measure FP, we observe that the relationship between the testing variables and FP differs (Yeh et al. 2010). For example, when Yeh et al. (2010) utilized ROA and ROE as proxies for FP, they noticed that marketing intensity and firm size have a primarily negative effect on business performance (BP), whereas capital structure has a primarily beneficial effect. However, when the authors utilized net profit growth rate as a proxy for FP, they observed that marketing intensity and structure of capital have a considerably favorable influence, whereas firm size has no effect. Researchers formerly applied the ratio of a single input to a single output as an efficiency score to gauge FP (Cui and Mak 2002; Hu et al. 2018; Tsai et al. 2020). This method is straightforward and intuitive but cannot handle numerous inputs or outputs and does not uncover inefficiencies (Wang et al. 2016). Thus, researchers began to use tools that use a frontier analysis approach, such as stochastic frontier analysis (SFA) and data envelopment analysis (DEA), as efficiency computation methodologies improved. The DEA approach can accommodate data from numerous inputs and multiple outputs without requiring a predetermined functional form (Guan and Chen 2012). A series of studies used the DEA method to measure FP (Chen et al. 2006; Hashimoto and Haneda 2008). Compared with the traditional DEA model, the network DEA (NDEA) model not only characterizes the physical relationship between the entire process and its two component processes but also delivers trustworthy results and efficiency measurements (Guan and Chen 2010; Kao 2009; Kao and Hwang 2008). With a multistage measurement perspective, in this study, we establish a structure of two-stage network production process including the first subprocess (innovation performance [IP]) and second subprocess (BP) to obtain the performance scores of multinational enterprises (MNEs).

Given the observed gap in the literature, we investigate the CSR-FP relationship under two types of FP, namely, IP and BP. In addition, we use PD as a moderator to identify the cultural conditions under which the initial relationship may be affected. In the first stage, we assess the performance of MNEs in the technology industry using a directional distance function (DDF)-based model for performance measurement in a two-stage DEA (Wanke et al. 2018). We create the structure of a two-stage network production process to obtain the performance scores of the MNEs. In this study, we focus on MNEs from the technology industry, because the R&D expenditure amount in this industry is the highest among industries. In the second stage, we explore the impact of different CSR indicators on FP (IP and BP) and the moderating effects of PD in the CSR-IP and CSR-BP relationships by using the multiple regression approach.

Our study makes substantial contributions to the existing literature. First, our study explores CSR from three viewpoints: the E pillar, the S pillar, and the G pillar, which enables us to fully measure CSR performance. Second, though several studies were conducted on the CSR-FP relationship, the results of the literature are inconclusive. Our research findings can offer MNE operations additional references for strategic decision-making, especially regarding firms’ CSR implementation strategy choices. Third, though recent studies investigated the moderating effect of different variables on the CSR-FP relationship, the moderating role of PD in the relationship between CSR and IP and BP has yet to be examined. By including interaction terms between CSR and PD, our study provides initial evidence for this aspect, thereby contributing significantly to the literature. Finally, research using DEA to evaluate FP, considering IP and BP as two types of FP, is scant.

Our research findings show that the G pillar has a beneficial impact on the IP of the technology MNEs; however, the E and S pillars have negative impacts. The findings also reveal that PD moderates the link between the two dimensions of CSR (E and S pillars) and BP. Our study is unique in that it shows that when PD is low, the E and S pillars are negatively associated with BP, whereas when PD is high, the correlation is significantly positive. Our findings provide insights into the role of a country’s cultural dimension in employing CSR implementation strategies. As theoretical and practical breakthroughs, the findings of our research are directed at the academic community, practitioners, and policymakers.

The remainder of this paper is laid out as follows. Section 2 presents a brief assessment of the literature on the CSR-FP (IP and BP) relationships and moderating role of PD and develops the hypotheses. Section 3 describes the data and approach used in the analysis, and Sect. 4 reports and explains the obtained results. Finally, Sect. 5 concludes the study by discussing some of its shortcomings and offering suggestions for further research.

2 Hypothesis development

2.1 Link between CSR and firm performance

Previous researchers evaluated the influence of CSR on FP and found that the relationship could be either significantly positive or negative (Bacinello et al. 2020; Di Giuli and Kostovetsky 2014; Jain et al. 2017; Marin et al. 2017). Similarly, Wang et al. (2015a, b) concluded that CSR may be positively or negatively related to firm performance through a meta-analytical review of the recent literature. In the above reviews, the authors did not express an absolute conviction on whether CSR improves firm performance. Measuring issues are worthy of attention. However, in governance studies, FP comprises different organizational outcomes (Miller et al. 2012). Firms may differently emphasize performance measurements (Tsai et al. 2020), and previous studies examined performance from various perspectives (Tsai et al. 2020; Wijesiri et al. 2019). Moreover, scholars measured CSR in various ways (Broadstock et al. 2019; Gillan et al. 2021; Rajesh 2020; Yoon et al. 2018). Yoon et al. (2018) and Rajesh (2020) used ESG scores from the Thomson Reuters database to evaluate companies’ CSR. In this study, we narrow the scope of FP to IP and BP, as measured in Fig. 2, and follow the CSR measurement approach of Rajesh (2020).

2.1.1 CSR and IP

Numerous studies showed the connection between CSR and IP, demonstrating that CSR can directly affect IP (Costa et al. 2015; Ratajczak and Szutowski 2016; Wu et al. 2018). Anser et al. (2018) found a relationship between firms’ innovation and CSR and indicated that IP directly affects the execution of CSR activities. Ruggiero and Cupertino (2018) showed that CSR and financial performance can enhance IP, and CSR can assist companies in surviving market competition. However, not all CSR activities add value, and many increase costs (Hillman and Keim 2001). Gallego‐Álvarez et al. (2011) indicated that CSR negatively impacts the intensity of innovation. Although they may be positively valued by various stakeholders, other stockholders may observe a reduction in the value of their stocks. Accordingly, firms may not be particularly concerned about sustainable business innovation (Gallego‐Álvarez et al. 2011). Moreover, resources spent on environmental investments may displace other innovation investments (Hottenrott and Rexhäuser 2015) because of a firm’s resource limitations. Seeking a desirable theory is difficult, and empirical evidence on the CSR-IP relationship is lacking (Ratajczak and Szutowski 2016). Theoretical explanations on the CSR-innovation relationship as well as on the direction of the relationship should be explored.

Carrión-Flores and Innes (2010) examined a group of 127 manufacturing industries from 1989 to 2004 and found that environmental IP is induced by strict pollution targets. Therefore, in this study, we hypothesize the following:

Hypothesis 1a (H1a)

The environmental pillar is associated with IP.

Bocquet et al. (2013) confirmed that CSR may create barriers against innovation or innovative products and processes, which depend on the intensity of a company’s CSR adoption. Shapiro et al. (2015) focused on China’s innovation outputs and implied that corporate governance may be a significant determinant of innovative activity for small and mid-size enterprises (SMEs), but only to a limited extent. In addition, the authors recommended future studies focus on comprehending why differences in effects exist contingent on the innovation measure (Shapiro et al. 2015). We thus hypothesize the following:

Hypothesis 1b (H1b)

The governance pillar is associated with IP.

Wang et al. (2019) used panel data to investigate the social performance-IP relationship in a sample of Chinese enterprises in high-polluting sectors from 2011 to 2016 and indicated the significant relationship between social performance and IP. Therefore, we hypothesize the following:

Hypothesis 1c (H1c)

The social pillar is associated with IP.

2.1.2 CSR and BP

Doh et al. (2010) argued that demonstrating CSR does not produce a positive market reaction. Becchetti et al. (2012) presented negative abnormal returns around dates when CSR-related events occurred. Di Giuli and Kostovetsky (2014) utilized panel data from 2003 to 2009 and suggested that a negative relationship exists between CSR and FP. Subsequently, Fatemi et al. (2015) confirmed this negative relationship through simulation analyses. Buchanan et al. (2018) observed the adverse and significant coefficient estimate of an interaction term between their ESG assessment, crisis factors, and Tobin’s q following the establishment of binary classification of high versus low ESG performance depending on whether or not firms reveal.

Jain et al. (2017) indicated that firms’ low performance levels are related to high combined ESG scores. Recently, Qureshi and Ahsan (2022) found that firms in high-PD countries have low environmental performance, and the environmental performance and firm value have a negative relationship. The authors observed that in cultures with a high PD, investors punish companies that disclose improved environmental performance. Therefore, we hypothesize the following:

Hypothesis 2a (H2a)

The environmental pillar is associated with BP.

Gillan et al. (2010) showed that as enterprises improve during their sample period, their ESG scores and institutional ownership decrease. Masulis and Reza (2015) suggested that corporate donations raise chief executive officer interests while also implying the misallocation of corporate resources, which can decrease firm value. Substantial evidence, primarily from developed countries, shows that corporate governance and ownership have an effect on innovation outcomes (Shapiro et al. 2015). Therefore, we hypothesize the following:

Hypothesis 2b (H2b)

The governance pillar is associated with BP.

Investors may also force companies to enhance their sustainability performance (Dyck et al. 2019). Aupperle et al. (1985) showed that social responsibility is not related to profitability. Specifically, the authors found that different social orientation levels are uncorrelated with performance differences. Brower et al. (2017) proved that firms’ prior corporate social performance reputation exerts an effect on not only the firms’ future social performance but also their financial performance. Margolis and Walsh (2003) conducted a literature review to find proof of the general influence of corporate social performance on financial performance. The authors claimed that the results presented in the studies are inconclusive, because half of the accessed studies show the significantly positive impact of corporate social performance on financial performance. Therefore, we hypothesize the following:

Hypothesis 2c (H2c)

The social pillar is associated with BP.

2.2 Moderating effect of PD

Whether management decisions about corporate responsibility have an impact on BP and firm value, as well as whether decisions on ESG or CSR are driven by performance or valuations, is one of the most hotly contested topics in the literature on ESG or CSR of all kinds (Gillan et al. 2021). Despite the positive effect of CSR on FP (Bacinello et al. 2020), certain CSR disadvantages exist (Gallego‐Álvarez et al. 2011). The interaction of cultural values may be to blame for the inconsistent impact of CSR (Cai et al. 2016). Cultural values can exert an indirect effect on economic performance as well as a direct influence on people's expectations and preferences, which in turn shape their behaviors and decisions (Guiso et al. 2006). In particular, PD is one of the dimensions of cultural values that affect CSR and FP (Chen et al. 2022; Lu and Wang 2021). The idea of PD is viewed as a moderator in many studies (Ahmad and Gao 2018; Hober et al. 2021; Luo et al. 2018). However, research on the impact of PD on the CSR-FP relationship is still limited. In this section, we present our hypotheses on the boundary conditions of the effect of CSR using PD as a moderator. Firms in high-PD countries are more advantageous than their counterparts in low-PD countries in achieving innovation by promoting their successful execution of innovative activities and enhancing their BP (Nakata and Sivakumar 1996; Rauch et al. 2013). The degree to which one acknowledges the validity of unequally dispersed power in organizations and institutions is referred to as PD (Hofstede 1984). Countries with a low PD are likely to allow less power inequality and rarely tolerate for environmental or social unfairness (Park et al. 2007; Williams and Zinkin 2008). PD is important owing to its influence on not only country-level performance (van Everdingen and Waarts 2003) but also firm-level performance (Ringov and Zollo 2007; Tsai et al. 2020).

Lenssen et al. (2007) examined the influence of national culture on corporate social performance and showed that PD and masculinity have a significant effect on the perceived quality of corporate behavior. Meanwhile, Kaasa (2016) found a negative link between R&D investments and PD. Previous studies indicated that staff can be pressured to give innovative ideas for managing the environment and green innovation improvement (Dangelico 2015; Wolf 2013). Employees with a high PD orientation are likely to obey the demand to contribute ideas merely because they feel compelled to do so. Employees with a low PD orientation may prioritize other tasks over idea contests, making them less likely to submit ideas (Hober et al. 2021). Innovation is discouraged in high-PD societies, because leaders in such societies tend to be authoritarian, and subordinates do not expect to be involved in decision-making but rather anticipate commands from their superiors (Husted 2005). As a result, firms’ ability to develop is limited, even in environmental innovation (Shane 1993). The previous authors (Nakata and Sivakumar 1996; Rauch et al. 2013) showed that firms in high-PD countries are more advantageous in achieving innovation by promoting their successful execution of innovative activities and enhancing their BP. Therefore, we hypothesize the following:

Hypothesis 3a (H3a)

PD has a moderating role in the E pillar-IP relationship.

Many studies highlighted managers’ essential function and status as a centralized pivot for informational roles and decisional roles, including strategy and resource management. The extent of a manager’s domination in innovative processes as well as the impact of such domination on business innovation and development received little scholarly attention (Harel et al. 2020). In a study using the meta-analysis method, Xue et al. (2019) emphasized the moderating role of PD on the business model innovation-FP relationship. In their research, Hu and Judge (2017) observed the interaction impact of team PD values on team processes and performance. Under the moderating effect of PD, Naz et al. (2020) explored pharmacists’ perspectives on organizational learning and innovation for perceived organizational performance and found that PD moderates the relationship. Lin et al. (2020) investigated the mechanisms through which human resource management practices enhance corporate innovation as well as how this relationship varies between cultures. According to the authors, employee-oriented human resource management practices have a stronger significantly positive effect in high-PD countries than in low-PD countries. In the context of the performance of multinational R&D teams, Lee et al. (2021) discovered that team-level cultural distance (PD is one of nine cultural value dimension indicators) can moderate the detrimental effects of knowledge centralization on performance. Therefore, we hypothesize the following:

Hypothesis 3b (H3b)

PD has a moderating role in the G pillar-IP relationship.

Luo et al. (2018) demonstrated that increasing PD reduces corporate carbon transparency and also discovered that PD modifies the link between carbon performance and carbon transparency in addition to having a direct impact on it. Luo et al. (2018) found that carbon disclosure and carbon performance are unlikely correlated, which shows that disclosure is motivated by legitimation concerns. A smaller concentration of power encourages social responsibility and lowers carbon opaqueness (Luo et al. 2018). Roy and Mukherjee (2022) asserted that corporate ESG disclosures are likely to be poor in countries with a high PD. Therefore, we hypothesize the following:

Hypothesis 3c (H3c)

PD has a moderating role in the S pillar-IP relationship.

There have been many studies showing that environmental and social performance have impacts on BP. However, these relationships are not consistent across different studies. This difference is due to the influence of PD in different cultures. Low-PD cultures have been found to be associated with more responsibilities in social and environmental aspects as compared to high-PD cultures (Park et al. 2007). Also, enterprises in low-PD nations perform better environmentally and share more CSR information (Lu and Wang 2021). There will be a greater tendency to punish irresponsible corporate behavior in nations with low PD cultures than in nations with high PD cultures (Williams and Zinkin 2008). Pressure from stakeholders may result in a consistent CSR-oriented system in the business environment (Kowalczyk and Kucharska 2020). Companies should work harder to advance a CSR paradigm shift that includes a well-established CSR-oriented culture to outperform their rivals over the long term (Yu and Choi 2016). Organizations can increase their teams' environmental behaviors by using environmentally focused transformational leadership, especially when there is a high PD (Peng et al. 2020). Tsai et al. (2020) highlighted the influence of environmental management practices on FP under various dimensions of national culture. According to the research (Tsai et al. 2020), the environmental management practices-FP relationship is stronger in firms in national cultural backgrounds with a high PD than in national cultural backgrounds with a low PD. Therefore, we hypothesize the following:

Hypothesis 4a (H4a)

PD has a moderating role in the E pillar-BP relationship.

Corporate governance performance is linked to improved environmental performance and increased disclosure of CSR-related data. The moderating role of PD in the links between perceived organizational support and job results was investigated by Farh et al. (2007). The authors discovered that PD changed the connections between perceived organizational support and work results, with these connections being higher for individuals with low (versus high) PD scores. Humphries and Whelan (2017) showed that corporate governance best practices specified in country-specific rules are influenced by the national culture, as defined by Hofstede’s cultural dimensions. In addition, the authors observed that the PD dimension is related to one or more corporate governance structure aspects. According to Ortas and Gallego-Álvarez (2020), businesses operating in nations with high levels of PD experience less of a negative impact from governance performance on their tax-aggressiveness. This result confirmed that in high PD nations, it is accepted that businesses that have more influence will utilize it to increase their wealth through more aggressive tax policies. Therefore, we hypothesize the following:

Hypothesis 4b (H4b)

PD has a moderating role in the G pillar-BP relationship.

Ringov and Zollo (2007) found that PD has a considerable negative impact on corporate social and environmental performance. Furthermore, Dyck et al. (2019) revealed the significance of cultural background. Specifically, foreign institutional investors based in countries with strong environmental and social commitments exert the most influence on a company’s environmental and social performance. The authors revealed that a society’s social norms seep into firms via the portfolio investment channel and provided new evidence on how culture influences economic decision-making. Dyck et al. (2019) also discovered that enterprises’ environmental and social performance increase when investors come from countries where the importance of environmental and social concerns is generally recognized. Corporate social performance encourages a fair value allocation among all stakeholders, which is in line with the egalitarian principles prevalent in low PD cultures. As a result, corporate social performance is more in line with low PD values than high PD values. Corporate social performance, on the other hand, is less compatible with high PD cultures, where people are willing to tolerate the privileges of a select few and the disparities between people (Hofstede 2001; Pérez-Cornejo et al. 2021). Nations with low PD cultures are more likely to penalize irresponsible firm behaviors as compared to those with high PD cultures (Pérez-Cornejo et al. 2021; Williams and Zinkin 2008). Therefore, we hypothesize the following:

Hypothesis 4c (H4c)

PD has a moderating role on the S pillar-BP relationship.

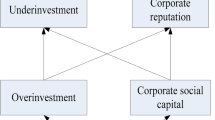

Figure 1 presents the hypothesized model for the present study, specifically, (1) the effect of the CSR indicators on the two types of FP (IP and BP) and (2) the moderating role of PD in the CSR indicators-IP and CSR indicators-BP relationships.

3 Research design

3.1 Data description and sample selection

In this study, we examine the performance of MNEs from a list of the world’s largest public companies in the technology industry (Forbes 2019) for the period of 2013–2018. We consider the latest 6 years because technological knowledge depreciates rapidly owing to technological obsolescence, forgetting, and organizational member turnovers (Nooteboom et al. 2007). As a result, if technological information is not employed within a short- to medium-term period, most of its economic worth and competitive advantage will be lost (Ardito et al. 2020). In addition, Broadstock et al. (2019) suggested that the use of conditional time-dependent estimators will enable the uncovering of the potential dynamic nonlinear effect of the indicators of CSR on FP. During the sample period, 166 MNEs are included in the list. We extract data on the financial indicators and ESG scores from the Thomson Reuters database to gauge IP and BP and CSR. Moreover, we collect information on the number of granted patents and patent applications from the Lens database. We exclude 49 MNEs with missing data on their R&D expenses, patents, and ESG scores. The sample includes 116 MNEs and 696 firm-year observations. Although the DEA method relies on very few assumptions, it is sensitive to extreme values, or outliers (Banker and Chang 2006). Outliers can alter the efficient frontier; hence, checking for the presence of atypical decision-making units (DMUs) is crucial (Bellini 2012). Therefore, we employ an approach provided by Khezrimotlagh et al. (2020) to detect outliers that will require the least amount of user judgment. The process for detecting the outliers is described below.

Step 1 We run the DDF two-stage NDEA model to measure the initial IP and BP scores (N = 696; the first level of the context-dependent approach, such as level 1). We identify the presence of outliers using context-dependent DEA.

Step 2 Similarly, we run the DDF two-stage NDEA model to measure the second IP and BP scores (N = 673; level 2). We compare the sorted scores from level 1 and level 2 using the Kolmogorov–Smirnov two-sample test. The Kolmogorov–Smirnov two-sample test is significant (p-value < 0.01), which indicates that the distribution in level 1 and level 2 is different. Next, we continue to level 3.

Step 3 We run the DDF two-stage NDEA model to measure the third IP and BP scores (N = 663; level 3). We compare the sorted scores from level 2 and level 3 using the Kolmogorov–Smirnov two-sample test. The Kolmogorov–Smirnov two-sample test is significant (p-value < 0.01), which indicates that the distribution in level 2 and level 3 is different. Next, we continue to level 4.

Step 4 We run the DDF two-stage NDEA model to measure the fourth IP and BP scores (N = 650; level 4). We compare the sorted scores from level 3 and level 4 using the Kolmogorov–Smirnov two-sample test. The Kolmogorov–Smirnov two-sample test is not significant (p-value > 0.1), which indicates that the distribution in level 3 and level 4 is similar. We stop the process. Level 3 is the final sample (N = 663).

After excluding 33 observations, we obtain a final sample with 663 observations. The descriptive statistics of the indicators of the 663 observations are shown in Table 1. The indicators have a positive correlation (Table 2), which follows the isotonic condition we use to evaluate the efficiency level. From Table 1, we see that all the indicators have a non-normal distribution (a significant Kolmogorov–Smirnov test result). This outcome shows that the DEA approach is a powerful and useful research method because it does not require the assumption of normality for the data (Lin et al. 2019).

3.2 CSR measurement

In this study, we utilize the ESG scores from Thomson Reuters to measure CSR performance (Rajesh 2020; Yoon et al. 2018). There are different measures for each group of the Thomson Reuters ESG scores. The quantity of measurements for each category indicates how significant the associated category is. Table 3 displays the numbers and weights.

3.3 IP and BP measurement

DEA is a nonparametric mathematical method for measuring the performance of a group of equivalent DMUs using multiple inputs and multiple outputs (Charnes et al. 1978). For a company operating in a multidimensional setting, aggregating a set of financial ratios can be complicated and requires imagination and experience (Fang et al. 2013; Yang and Morita 2013; Yeh 1996). Another superiority of DEA is that it does not request any distributional assumptions. However, traditional DEA treats a system as a whole unit in evaluating performance and does not consider the operation of individual processes. Therefore, the administrator has information on the relative efficiency of the system but is ignorant of the processes that regularly drive inefficiency. The impact of a component on the system thus acquired can be deceptive (Kao and Hwang 2011). Kao and Hwang (2008) concluded that system efficiency is the product of the two stages. With comprehensive information, the decision maker can appropriately enhance the performance of a DMU. From these perspectives, we consider FP as the product of two stages, namely, IP and BP, which we explain in the next section.

We decompose FP into two stages: IP and BP using a DDF-based model for efficiency measurement in the two-stage NDEA (Wanke et al. 2018). According to previous studies (Yang and Okada 2019), a high R&D investment can transform innovation performance into tangible assets through patents to improve FP. That is, firms utilize their innovative ability to generate sales. We propose two different stages for examining the internal structure, that is, the IP stage and the BP stage (Fig. 2). We design the former stage to determine the IP and the latter stage to realize the BP of the MNEs in the technology industry. We utilize R&D expense as an input to first achieve patent application and granted patent as intermediate outputs, which are next included with operating expenses, total assets, and total employees as inputs to finally achieve two ultimate outputs, viz. revenue and market value. Table 4 summarizes the variables, which are selected by also following prior studies.

We utilize the multivariate measurement method, which concurrently measures various FP indicators to overcome the single-dimension limitation of the traditional methodology. We use the two-stage network DDF (Wanke et al. 2018) to measure the structures of the internal network production to realize the changes in IP and BP (Picazo-Tadeo et al. 2012; Riccardi et al. 2012; Shao et al. 2019; Zhou et al. 2012). We present the linear programming problems below.

We consider a set of \(n\) firms \((k = 1, \ldots ,m)\). For a DMU k, we use \(m\) inputs \((x_{ak} ,a = 1, \ldots ,m)\) to produce \(z_{bk}\) \((b = 1, \ldots ,l)\) intermediate outputs in the first stage and \(z_{bk}\) plus a new set of factors \(z_{ck}\) \((c = 1, \ldots ,g)\) to produce \(h\) outputs in the second stage \((y_{dk} ,d = 1, \ldots ,h)\). We assume that the production possibility set of the inputs and outputs is convex. We define the two-stage network DDF as follows:

We define the technology set as follows:

\(T\left( {{\mathbf{x}},{\mathbf{z}},{\mathbf{y}}} \right)\):\({\mathbf{x}}_{ak}\) can produce the \(z_{bk}\) intermediate outputs in the first process, and \(z_{bk}\) and \(z_{ck}\) can produce the final \({\mathbf{y}}_{dk}\) in the second process. According to Fried et al. (2008), the direction vector \({\mathbf{g}} = \left( {{\mathbf{g}}_{{\mathbf{x}}} ,{\mathbf{g}}_{{\mathbf{y}}} } \right)\) should be selected by the investigator before measuring the DDF. We consider the direction to be \({\mathbf{g}} = \left( {{\mathbf{g}}_{{\mathbf{x}}} {\mathbf{ = x,g}}_{{\mathbf{y}}} {\mathbf{ = y}}} \right)\) in this study (Chiu et al. 2012; Chung et al. 1997). Consequently, the inefficiency measure of the target company in the technology set under convex constraints can be provided by the following linear programs.

where \(\lambda_{ko}^{{}}\) and \(\mu_{ko}^{{}}\) symbolize the intensity variables corresponding to the first and second processes of an observed company, respectively. For an observed company, the optimal solution \(\lambda_{ko}^{*}\) shows whether company \(k\) serves as a role model to the observed company in the first stage. The optimal solution \(\mu_{ko}^{*}\) has the same definition in the second stage. Consequently, the production efficiency of the first stage is \(IP_{o}^{{}} = 1 - \delta_{o}^{{}}\), which is the IP, where IP is between 0 and 1. The efficiency of the second stage in the set is defined as \(BP_{o}^{{}} = {1 \mathord{\left/ {\vphantom {1 {\left( {1 + \beta_{o}^{{}} } \right)}}} \right. \kern-\nulldelimiterspace} {\left( {1 + \beta_{o}^{{}} } \right)}}\), which is the BP, where BP is between 0 and 1. The variables indicate that the target company is efficient in the first and second stages if \(IP_{o}^{{}}\) and \(BP_{o}^{{}}\) are equal to unity.

3.4 PD measurement

We apply Hofstede et al. (2010)’s national PD values, which are established from six main cultural dimensions influencing people’s behavioral patterns: individualism, PD, uncertainty avoidance, masculinity, long-term orientation, and indulgence. The PD variable evaluates how equal or unequal the power distribution is within a social community and how readily inequality is accepted. A large number indicates that the power is focused, whereas a small number indicates that the power is scattered.

3.5 Control variables

Following previous studies (Bong Choi and Williams 2013; Cui and Mak 2002; Lu et al. 2014; Mahajan et al. 2018; Surroca and Tribó 2008; Wang et al. 2019; Wu et al. 2020), we employ control variables to filter their influence on IP and BP. The control variables include firm size (SIZE) (Wu et al. 2020; Yang et al. 2020), R&D intensity (RDI) (Carrión-Flores and Innes 2010; Yang et al. 2020), return on assets (ROA) (Wu et al. 2020), and leverage (LEV) (Wu et al. 2020).

3.6 Truncated regression model

As the efficiency score ranges from 0 to 1, conducting an ordinary least squares (OLS) regression in the second stage may result in biased estimated coefficients. Direct regression analysis is invalid, as Simar and Wilson (2007) pointed out, owing to the unknown serial connection among the efficiency ratings. Simar and Wilson (2011) indicated that the use of OLS in the second-stage estimation is consistent only if highly strange and uncommon assumptions are made about the data-generating process, which limits its usefulness. In other words, a truncated regression can ensure consistency in the second-stage estimation. Therefore, we conduct Simar and Wilson’s truncated regression with a bootstrapping technique to determine if the independent variables have an impact on the performance of the MNEs (Simar and Wilson 2007, 2011).

We assume and test the following specifications.

where \(\alpha\) is the intercept, \(\varepsilon_{j}\) is the error term, and \(X_{j}\) represents a vector of the observation-specific variables of firm \(j\) that are expected to be related to the firm’s efficiency scores, \(IP_{j}\), and \(BP_{j}\). To confirm the fitness of the truncated regression model presented below, we execute a simulation test with a total of 2000 experimental observations, following previous studies (Lu et al. 2014; Simar and Wilson 2007, 2011).

where \(IP_{it}\) IP derived using a DDF two-stage NDEA model, \(BP_{it}\) BP derived using a DDF two-stage NDEA model, \(EP_{it}\) EP, which is an indicator of CSR, \(SP_{it}\) SP, which is an indicator of CSR, \(GP_{it}\) GP, which is an indicator of CSR, \(PD_{it}\) PD dimension, \(SIZE_{it}\) natural logarithm of total assets, \(RDI_{it}\) Ratio of R&D expense to total assets, \(ROA_{it}\) Ratio of net income to revenues, \(LEV_{it}\) Ratio of total debt to total assets.

4 Results and discussion

4.1 Results

Table 5 presents the results of the descriptive statistics, including the mean, minimum, maximum, and standard deviation, of the dependent and independent variables. The results show that the average IP and BP of the MNEs in the technology industry is 0.199 and 0.827, respectively. The ESG scores over the sample period indicate that the average value of EP, GP, and SP is 69.538, 63.221, and 67.119, respectively. Among the three CSR dimensions, EP seems to have the highest score, followed by SP. The standard deviation of the three CSR dimensions, that is, EP (21.473), GP (20.832), and SP (19.527), is relatively large, which indicates that the ESG scores of the MNEs in the technology industry differ significantly. From the descriptive statistics of the control variables, we can see that the average SIZE is USD 16.341 thousand in natural logged terms (equivalent to USD 29 billion), whereas the average firm RDI is 0.073. The minimum ROA value (− 25.138) is negative, which shows that some of the MNEs occasionally experienced financial losses, which could impact their sustainable strategies. Meanwhile, the mean LEV is approximately 0.207.

Moving further, first, as the variance inflation factors (VIFs) scores less than 10, multicollinearity is not a problem in our study (Cohen et al. 2013). Second, Table 6 shows the correlation matrix of the independent variables. As indicated in Tables 7 and 8, we perform a series of OLS and truncated regression analyses to test whether the CSR dimensions impact IP and BP and whether PD moderates the relationship between the variables.Footnote 1 The truncated regression results are reported in the second to fifth columns, whereas the OLS regression results are reported in the sixth to ninth columns. The results of the two approaches are nearly similar in the impact direction.

As shown in model 1 (Table 7), we enter the three independent variables (EP, GP, and SP), moderator (PD), and four control variables (SIZE, RDI, ROA, and LEV) into the regression. The results we obtain using the truncated regression reveal that RDI and ROA are significantly and negatively related to IP. In addition, PD has a positive significant effect on IP beyond that of the control variables and independent variables (β = 0.00477, p < 0.01). In terms of the main testing variables, GP has a significantly positive impact on IP (β = 0.00115, p < 0.05); thus, H1b is supported, but H1a and H1c are not supported. In models 2, 3, and 4, we add the interaction terms between EP, GP, and SP and PD to the regression. As shown in Table 8, the interaction terms are not significantly related to IP (p > 0.1), thereby disconfirming H3a, H3b, and H3c. The results indicate that PD does not moderate the relationship between the CSR dimensions and IP.

Similarly, as shown in Table 8, we enter the three independent variables (EP, GP, and SP), moderator (PD), and four control variables (SIZE, RDI, ROA, and LEV) into the regression (model 9). The results we acquire using the truncated regression indicate that SIZE and ROA are significantly and positively related to BP. Moreover, PD has a positive significant effect on BP beyond that of the control variables and independent variables (β = 0.00157, p < 0.01). In terms of the main testing variables, EP has a significantly negative impact on BP (β = − 0.00066, p < 0.1); thus, H2a is supported, but H2b and H2c are not supported. In models 10, 11, and 12, we add the interaction terms between EP, GP, and SP and PD to the regression. As shown in Table 9, the interaction terms EP × PD and SP × PD are significantly related to BP (β = 0.00007, p < 0.01 and β = 0.00007, p < 0.01), thereby supporting H4a and H4c. However, GP × PD is not significant (β = 0.00003, p > 0.1), thereby disconfirming H4b. The results indicate that PD significantly moderates the relationship between the two CSR dimensions (EP and SP) and IP. By contrast, PD has no moderating effect on the GP-BP relationship. Figures 3 and 4 are produced from the slope and intercept data in the truncated regression output. The two figures illustrate that when PD is relatively high (i.e., high PD), EP and SP are positively related to BP. By contrast, when PD is relatively low (i.e., low PD), EP and SP are negatively related to BP.

Across developed and developing countries, the state is the primary driver of CSR (Zhao 2012). Depending on the economic development, the expected level of CSR practices of firms may differ (Tsai et al. 2020). As a result, investigating whether the CSR–FP link differs across different business, industry, or country groups is crucial (Yoon et al. 2018). To better understand the results, we conduct an analysis by country. Interestingly, as shown in Table 9, EP and SP are negatively significant to the BP of the MNEs from Bermuda, Canada, Finland, Switzerland, Germany, the Netherlands, Sweden, and the United Kingdom, which are the top countries in the environmental regulatory regime (Esty and Porter 2001). The pressure of regional economies affecting FP can explain this outcome (Wang et al. 2019). Conversely, the CSR dimensions are positively significant to the BP of the MNEs from China and India (Table 9).

4.2 Discussion

The purpose of this study is to investigate how CSR dimensions influence firm-level IP and BP in the technology industry. In addition, we argue that PD moderates the CSR-FP relationship.

The regression results of the control variables show that the determinants of IP and BP vary significantly. Large MNEs are likely to achieve superior business results, whereas the relationship between firm size and IP is not statistically significant. In addition, our results suggest that MNEs with high RDI will likely demonstrate poor IP, but RDI has no impact on BP. Previous empirical research on the RDI-FP relationship also found evidence of the positive-to-insignificant or negative impact of RDI on FP. The extent of innovation may not consistently follow a linear path, because after a certain point, a large market size may reduce efficiency (Mahajan et al. 2018). The direction of the relationship between a firm’s RDI and performance differs when we consider FP from different perspectives. For example, Leung and Sharma (2021) indicated that RDI harms financial performance in the short-term (profitability) and has a positive effect on financial performance in the long-term (firm value) but no significant impact on export performance. Although ROA has a significant impact on IP and BP, the effect behaves quite differently. For IP, the result indicates that MNEs with considerable ROA tend to have a low level of IP. Conversely, the result shows that MNEs with substantial ROA are likely to demonstrate improved BP. This result is consistent with that of Yang et al. (2020), which indicated that for technology-intensive industries, short-term financial performance measured by ROA is negatively correlated with the quality of innovation. However, this result may be different in other industries or in the long term (Wang et al. 2019; Yang et al. 2020).Footnote 2

In terms of the main effect of the dimensions of CSR on IP, we show that GP is positively significant to the IP of the technology MNEs. Our findings are consistent with those of Broadstock et al. (2019) and Wang et al. (2019), which showed that the ESG/CSR adoption criteria have a beneficial influence on firms’ ability to innovate, thereby indicating that ESG/CSR practices improve firms’ ability to innovate. Our findings also confirm those of Shapiro et al. (2015), who showed that corporate governance positively and significantly affects IP by using two measures of innovation, namely, invention patents, and new product sales. Our findings can assist technology MNEs in implementing innovative methods to gain considerable CSR advantages and achieve sustainable development.

In terms of the main effect of the dimensions of CSR on BP, we find that EP and SP are negatively and significantly related to BP. Our results consistently confirm the findings of Di Giuli and Kostovetsky (2014), which indicated that an increase in CSR performance is negatively related to future stock returns and firm ROA reductions. Thus, the authors proposed that any returns to stakeholders from social responsibility come at the direct expense of firm value. CSR strategies have different outcomes, and the results rely on their implementation. By contrast, Broadstock et al. (2019) confirmed that CSR policy adoption will preliminarily improve firms’ innovative ability and eventually positively impact their performance. Based on this conclusion, we determine that the findings of Broadstock et al. (2019) are generally inconsistent with our results. However, in our study, we observe the moderating effect of PD on the relationship between CSR and BP, whereby when PD is relatively high (i.e., high PD), EP and SP are positively related to BP. By contrast, when PD is relatively low (i.e., low PD), EP and SP are negatively related to BP.

Moreover, our findings show that in countries with a high environmental regulatory regime index, implementing CSR will reduce the BP of MNEs. Our study results are consistent with those of Lanoie et al. (2008), which demonstrated that long-term productivity drops in polluting industries following a rise in the stringency of environmental regulations, which could be due to the large investments frequently required to satisfy legislation in such areas.

5 Conclusion

The objective of this study is to logically elucidate and empirically measure the impact of CSR on IP and BP, overcoming the conflicting, and often contradicting, results obtained by previous studies. We present a fine-grained assessment of the impact of CSR on IP and BP. Following prior research, we highlight the significantly positive relationship between the G pillar and IP. In addition, we find evidence of the favorable influence on BP from the high level of CSR in countries with a high PD, whereas the CSR-BP relationship is negative in countries with a low PD. Furthermore, when we perform an analysis by country, we observe that the CSR-BP relationship of the MNEs in countries with a low PD and high environmental regulatory regime index ranking, such as Bermuda, Canada, Finland, Germany, Switzerland, the Netherlands, Sweden, and the United Kingdom, is negative. Conversely, the CSR-BP relationship of the MNEs in countries with a high PD and low environmental regulatory regime index ranking, such as China and India, is positive.

5.1 Managerial implications

From the perspective of IP, our regression results indicate that the implementation of CSR will improve the IP of the technology MNEs. We encourage managers and entrepreneurs interested in CSR to discover why following CSR practices that boost IP is beneficial for technology MNEs. Technology MNEs must consider the influence factors of IP from the perspective of the MNEs’ proactive motivation. Conveying IP information can assist in gaining considerable investor support, thereby enhancing the profitability of MNEs (Wang et al. 2019).

From the perspective of BP, our findings may result from the fact that not all CSR activities create value for a company. We offer probable explanations for the variation in the outcomes of various investigations (Bacinello et al. 2020; Broadstock et al. 2019; Di Giuli and Kostovetsky 2014; Gallego‐Álvarez et al. 2011). Our regression results imply that managers of technology MNEs should pay increased attention to CSR adoption management to improve BP and consider the cultural dimension, namely, PD. Moreover, we find that CSR has a positive relationship with BP in economies with a low environmental regulatory regime index ranking and national cultural backgrounds with a high PD. Our findings imply that the above implication is especially relevant to MNEs operating in nations with such specialized contexts.

5.2 Limitations and future research

Concerning limitations and future research directions, we present several ways in which our work may be extended. First, our research does not include the MNEs from the list of the world’s largest public companies in the technology industry (Forbes 2019) lacking ESG scores. Some of the MNEs have only 2 years of ESG score data, but in our study, we explore the MNEs using a 6-year period. Future studies may explore MNEs by adding more MNEs to the sample. Second, we consider PD as a moderating variable affecting the CSR-FP relationship, separated into IP and BP. We recommend future research to explore whether other dimensions of national culture will have a significant effect on the CSR-FP relationship. Third, different types of FP will produce different results (Bocquet et al. 2017). In our study, we measure FP by narrowing the scope of FP to IP and BP. Future research may explore the sustainable performance of MNEs by considering CO2 as an undesired output when measuring performance. Finally, using data from technology MNEs, we investigate the moderating roles of PD on the CSR-IP and CSR-BP relationships in large firms. We are aware of a few studies on SMEs, but future studies on SMEs are necessary.

Notes

Our baseline model includes PD; untabulated results indicate that the sign and significance of the coefficients in the model remain the same when we exclude PD.

Our results remain robust and qualitatively the same when we add other control variables, such as the ratio of the book value of property, plant, and equipment to total assets; the natural logarithm of capital expenditure; and the ratio of R&D expense to total assets.

References

Ahmad I, Gao Y (2018) Ethical leadership and work engagement. Manag Decis 56(9):1991–2005. https://doi.org/10.1108/MD-02-2017-0107

Anser MK, Zhang Z, Kanwal L (2018) Moderating effect of innovation on corporate social responsibility and firm performance in realm of sustainable development. Corp Soc Responsib Environ Manag 25(5):799–806. https://doi.org/10.1002/csr.1495

Ardito L, Ernst H, Messeni Petruzzelli A (2020) The interplay between technology characteristics, R&D internationalisation, and new product introduction: empirical evidence from the energy conservation sector. Technovation 96–97:102144. https://doi.org/10.1016/j.technovation.2020.102144

Aupperle KE, Carroll AB, Hatfield JD (1985) An empirical examination of the relationship between corporate social responsibility and profitability. Acad Manag J 28(2):446–463. https://doi.org/10.5465/256210

Bacinello E, Tontini G, Alberton A (2020) Influence of maturity on corporate social responsibility and sustainable innovation in business performance. Corp Soc Responsib Environ Manag 27(2):749–759. https://doi.org/10.1002/csr.1841

Banker RD, Chang H (2006) The super-efficiency procedure for outlier identification, not for ranking efficient units. Eur J Oper Res 175(2):1311–1320. https://doi.org/10.1016/j.ejor.2005.06.028

Baumgartner RJ (2014) Managing corporate sustainability and CSR: a conceptual framework combining values, strategies and instruments contributing to sustainable development. Corp Soc Responsib Environ Manag 21(5):258–271. https://doi.org/10.1002/csr.1336

Becchetti L, Ciciretti R, Hasan I, Kobeissi N (2012) Corporate social responsibility and shareholder’s value. J Bus Res 65(11):1628–1635. https://doi.org/10.1016/j.jbusres.2011.10.022

Bellini T (2012) Forward search outlier detection in data envelopment analysis. Eur J Oper Res 216(1):200–207. https://doi.org/10.1016/j.ejor.2011.07.023

Bocquet R, Le Bas C, Mothe C, Poussing N (2013) Are firms with different CSR profiles equally innovative? Empirical analysis with survey data. Eur Manag J 31(6):642–654. https://doi.org/10.1016/j.emj.2012.07.001

Bocquet R, Le Bas C, Mothe C, Poussing N (2017) CSR, innovation, and firm performance in sluggish growth contexts: a firm-level empirical analysis. J Bus Ethics 146(1):241–254. https://doi.org/10.1007/s10551-015-2959-8

Bong Choi S, Williams C (2013) Innovation and firm performance in Korea and China: a cross-context test of mainstream theories. Technol Anal Strateg Manag 25(4):423–444. https://doi.org/10.1080/09537325.2013.774346

Broadstock DC, Matousek R, Meyer M, Tzeremes NG (2019) Does corporate social responsibility impact firms’ innovation capacity? The Indirect Link between Environmental & Social Governance Implementation and Innovation Performance. J Bus Res. https://doi.org/10.1016/j.jbusres.2019.07.014

Brower J, Kashmiri S, Mahajan V (2017) Signaling virtue: Does firm corporate social performance trajectory moderate the social performance–financial performance relationship? J Bus Res 81:86–95. https://doi.org/10.1016/j.jbusres.2017.08.013

Buchanan B, Cao CX, Chen C (2018) Corporate social responsibility, firm value, and influential institutional ownership. J Corp Finan 52:73–95. https://doi.org/10.1016/j.jcorpfin.2018.07.004

Cai Y, Pan CH, Statman M (2016) Why do countries matter so much in corporate social performance? J Corp Finan 41:591–609. https://doi.org/10.1016/j.jcorpfin.2016.09.004

Carrión-Flores CE, Innes R (2010) Environmental innovation and environmental performance. J Environ Econ Manag 59(1):27–42. https://doi.org/10.1016/j.jeem.2009.05.003

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2(6):429–444

Chen C-J, Wu H-L, Lin B-W (2006) Evaluating the development of high-tech industries: Taiwan’s science park. Technol Forecast Soc Change 73(4):452–465. https://doi.org/10.1016/j.techfore.2005.04.003

Chen C-J, Ruey-Shan G, Wang S-H, Lin Y-H (2022) Power distance diversification, ownership structure, and business group performance. J Bus Res 151:70–85. https://doi.org/10.1016/j.jbusres.2022.06.041

Chiu C-R, Liou J-L, Wu P-I, Fang C-L (2012) Decomposition of the environmental inefficiency of the meta-frontier with undesirable output. Energy Econ 34(5):1392–1399. https://doi.org/10.1016/j.eneco.2012.06.003

Chung YH, Färe R, Grosskopf S (1997) Productivity and undesirable outputs: a directional distance function approach. J Environ Manage 51(3):229–240

Cohen J, Cohen P, West SG, Aiken LS (2013) Applied multiple regression/correlation analysis for the behavioral sciences. Routledge

Costa C, Lages LF, Hortinha P (2015) The bright and dark side of CSR in export markets: its impact on innovation and performance. Int Bus Rev 24(5):749–757. https://doi.org/10.1016/j.ibusrev.2015.01.008

Cui H, Mak YT (2002) The relationship between managerial ownership and firm performance in high R&D firms. J Corp Finan 8(4):313–336. https://doi.org/10.1016/S0929-1199(01)00047-5

Dangelico RM (2015) Improving firm environmental performance and reputation: the role of employee green teams. Bus Strateg Environ 24(8):735–749. https://doi.org/10.1002/bse.1842

Di Giuli A, Kostovetsky L (2014) Are red or blue companies more likely to go green? Politics and corporate social responsibility. J Financ Econ 111(1):158–180. https://doi.org/10.1016/j.jfineco.2013.10.002

Doh JP, Howton SD, Howton SW, Siegel DS (2010) Does the market respond to an endorsement of social responsibility? The role of institutions, information, and legitimacy. J Manag 36(6):1461–1485

Dyck A, Lins KV, Roth L, Wagner HF (2019) Do institutional investors drive corporate social responsibility? International evidence. J Financ Econ 131(3):693–714. https://doi.org/10.1016/j.jfineco.2018.08.013

Esty DC, Porter M (2001) Ranking national environmental regulation and performance: A leading indicator of future competitiveness? Glob Comp Repo 2002:78–100

Fang H-H, Lee H-S, Hwang S-N, Chung C-C (2013) A slacks-based measure of super-efficiency in data envelopment analysis: an alternative approach. Omega 41(4):731–734. https://doi.org/10.1016/j.omega.2012.10.004

Farh J-L, Hackett RD, Liang J (2007) Individual-level cultural values as moderators of perceived organizational support-employee outcome relationships in China: comparing the effects of power distance and traditionality. Acad Manag J 50(3):715–729. https://doi.org/10.5465/amj.2007.25530866

Fatemi A, Fooladi I, Tehranian H (2015) Valuation effects of corporate social responsibility. J Bank Finance 59:182–192. https://doi.org/10.1016/j.jbankfin.2015.04.028

Filbeck G, Gorman RF (2004) The relationship between the environmental and financial performance of public utilities. Environ Resource Econ 29(2):137–157. https://doi.org/10.1023/B:EARE.0000044602.86367.ff

Fried HO, Lovell CK, Schmidt SS (2008) The measurement of productive efficiency productivity growth. Oxford University Press Inc, New York, p 10016

Gallego-Álvarez I, Manuel Prado-Lorenzo J, García-Sánchez IM (2011) Corporate social responsibility and innovation: a resource-based theory. Manag Decis 49(10):1709–1727. https://doi.org/10.1108/00251741111183843

Gillan SL, Koch A, Starks LT (2021) Firms and social responsibility: a review of ESG and CSR research in corporate finance. J Corp Finan 66:101889. https://doi.org/10.1016/j.jcorpfin.2021.101889

Guan J, Chen K (2010) Measuring the innovation production process: a cross-region empirical study of China’s high-tech innovations. Technovation 30(5):348–358. https://doi.org/10.1016/j.technovation.2010.02.001

Guan J, Chen K (2012) Modeling the relative efficiency of national innovation systems. Res Policy 41(1):102–115. https://doi.org/10.1016/j.respol.2011.07.001

Guiso L, Sapienza P, Zingales L (2006) Does culture affect economic outcomes? J Econ Perspect 20(2):23–48. https://doi.org/10.1257/jep.20.2.23

Gyves S, O’Higgins E (2008) Corporate social responsibility: An avenue for sustainable benefit for society and the firm? Soc Bus Rev 3(3):207–223. https://doi.org/10.1108/17465680810907297

Harel R, Schwartz D, Kaufmann D (2020) The relationship between innovation promotion processes and small business success: the role of managers’ dominance. RMS. https://doi.org/10.1007/s11846-020-00409-w

Hashimoto A, Haneda S (2008) Measuring the change in R&D efficiency of the Japanese pharmaceutical industry. Res Policy 37(10):1829–1836. https://doi.org/10.1016/j.respol.2008.08.004

Hillman AJ, Keim GD (2001) Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strateg Manag J 22(2):125–139. https://doi.org/10.1002/1097-0266(200101)22:2%3c125::AID-SMJ150%3e3.0.CO;2-H

Hober B, Schaarschmidt M, von Korflesch H (2021) Internal idea contests: work environment perceptions and the moderating role of power distance. J Innov Knowl 6(1):1–10. https://doi.org/10.1016/j.jik.2019.11.003

Hofstede G (1984) Culture’s consequences: international differences in work-related values, vol 5. Sage

Hofstede G (2001) Culture’s consequences: comparing values, behaviors, institutions and organizations across nations. Sage publications

Hofstede G, Hofstede GJ, Minkov M (2010) Cultures and organizations: software of the mind, 3rd edn. McGraw-Hill, New York

Hottenrott H, Rexhäuser S (2015) Policy-induced environmental technology and inventive efforts: Is there a crowding out? Ind Innov 22(5):375–401. https://doi.org/10.1080/13662716.2015.1064255

Hu J, Judge TA (2017) Leader–team complementarity: Exploring the interactive effects of leader personality traits and team power distance values on team processes and performance. J Appl Psychol 102(6):935–955. https://doi.org/10.1037/apl0000203

Hu J, Wang S, Xie F (2018) Environmental responsibility, market valuation, and firm characteristics: evidence from China. Corp Soc Responsib Environ Manag 25(6):1376–1387. https://doi.org/10.1002/csr.1646

Humphries SA, Whelan C (2017) National culture and corporate governance codes. Corp Govern Int J Bus Soc 17(1):152–163. https://doi.org/10.1108/CG-06-2016-0127

Husted BW (2005) Culture and ecology: a cross-national study of the determinants of environmental sustainability. MIR Manag Int Rev 45(3):349–371

Jain T, Aguilera RV, Jamali D (2017) Corporate stakeholder orientation in an emerging country context: a longitudinal cross industry analysis. J Bus Ethics 143(4):701–719. https://doi.org/10.1007/s10551-016-3074-1

Kao C (2009) Efficiency decomposition in network data envelopment analysis: a relational model. Eur J Oper Res 192(3):949–962. https://doi.org/10.1016/j.ejor.2007.10.008

Kao C, Hwang S-N (2008) Efficiency decomposition in two-stage data envelopment analysis: an application to non-life insurance companies in Taiwan. Eur J Oper Res 185(1):418–429. https://doi.org/10.1016/j.ejor.2006.11.041

Kao C, Hwang S-N (2011) Decomposition of technical and scale efficiencies in two-stage production systems. Eur J Oper Res 211(3):515–519. https://doi.org/10.1016/j.ejor.2011.01.010

Khezrimotlagh D, Cook WD, Zhu J (2020) A nonparametric framework to detect outliers in estimating production frontiers. Eur J Oper Res 286(1):375–388. https://doi.org/10.1016/j.ejor.2020.03.014

Kowalczyk R, Kucharska W (2020) Corporate social responsibility practices incomes and outcomes: Stakeholders’ pressure, culture, employee commitment, corporate reputation, and brand performance: a Polish-German cross-country study. Corp Soc Respon Environ Manag 27(2):595–615. https://doi.org/10.1002/csr.1823

Lanoie P, Patry M, Lajeunesse R (2008) Environmental regulation and productivity: testing the porter hypothesis. J Prod Anal 30(2):121–128. https://doi.org/10.1007/s11123-008-0108-4

Lee JY, Choi BC, Ghauri PN, Park BI (2021) Knowledge centralization and international R&D team performance: unpacking the moderating roles of team-specific characteristics. J Bus Res 128:627–640. https://doi.org/10.1016/j.jbusres.2020.06.052

Leung TY, Sharma P (2021) Differences in the impact of R&D intensity and R&D internationalization on firm performance: mediating role of innovation performance. J Bus Res 131:81–91. https://doi.org/10.1016/j.jbusres.2021.03.060

Liang HAO, Renneboog LUC (2017) On the foundations of corporate social responsibility. J Financ 72(2):853–910. https://doi.org/10.1111/jofi.12487

Lin F, Lin S-W, Lu W-M (2019) Dynamic eco-efficiency evaluation of the semiconductor industry: a sustainable development perspective. Environ Monit Assess 191(7):435

Lin C-H, Sanders K, Sun J-M, Shipton H, Mooi EA (2020) HRM and innovation: the mediating role of market-sensing capability and the moderating role of national power distance. Int J Hum Resour Manag 31(22):2840–2865. https://doi.org/10.1080/09585192.2018.1474938

Lu J, Wang J (2021) Corporate governance, law, culture, environmental performance and CSR disclosure: a global perspective. J Int Finan Markets Inst Money 70:101264. https://doi.org/10.1016/j.intfin.2020.101264

Lu W-M, Wang W-K, Kweh QL (2014) Intellectual capital and performance in the Chinese life insurance industry. Omega 42(1):65–74. https://doi.org/10.1016/j.omega.2013.03.002

Luo X, Homburg C (2007) Neglected outcomes of customer satisfaction. J Mark 71(2):133–149. https://doi.org/10.1509/jmkg.71.2.133

Luo L, Tang Q, Peng J (2018) The direct and moderating effects of power distance on carbon transparency: an international investigation of cultural value and corporate social responsibility. Bus Strateg Environ 27(8):1546–1557. https://doi.org/10.1002/bse.2213

Mahajan V, Nauriyal DK, Singh SP (2018) Efficiency and its determinants: panel data evidence from the indian pharmaceutical industry. Margin J Appl Econ Res 12(1):19–40. https://doi.org/10.1177/0973801017738416

Margolis JD, Walsh JP (2003) Misery loves companies: rethinking social initiatives by business. Adm Sci Q 48(2):268–305. https://doi.org/10.2307/3556659

Marin L, Martín PJ, Rubio A (2017) Doing good and different! The mediation effect of innovation and investment on the influence of CSR on competitiveness. Corp Soc Responsib Environ Manag 24(2):159–171. https://doi.org/10.1002/csr.1412

Masulis RW, Reza SW (2015) Agency problems of corporate philanthropy. Rev Financ Stud 28(2):592–636. https://doi.org/10.1093/rfs/hhu082

Miller CC, Washburn NT, Glick WH (2012) PERSPECTIVE—the myth of firm performance. Organ Sci 24(3):948–964. https://doi.org/10.1287/orsc.1120.0762

Nakata C, Sivakumar K (1996) National culture and new product development: an integrative review. J Mark 60(1):61–72

Nooteboom B, Van Haverbeke W, Duysters G, Gilsing V, van den Oord A (2007) Optimal cognitive distance and absorptive capacity. Res Policy 36(7):1016–1034. https://doi.org/10.1016/j.respol.2007.04.003

Ortas E, Gallego-Álvarez I (2020) Bridging the gap between corporate social responsibility performance and tax aggressiveness. Acc Audit Acc J 33(4):825–855. https://doi.org/10.1108/AAAJ-03-2017-2896

Park H, Russell C, Lee J (2007) National culture and environmental sustainability: a cross-national analysis. J Econ Finance 31(1):104–121. https://doi.org/10.1007/BF02751516

Peng J, Chen X, Zou Y, Nie Q (2020) Environmentally specific transformational leadership and team pro-environmental behaviors: the roles of pro-environmental goal clarity, pro-environmental harmonious passion, and power distance. Hum Relat 74(11):1864–1888. https://doi.org/10.1177/0018726720942306

Pérez-Cornejo C, de Quevedo-Puente E, Delgado-García J-B (2021) The role of national culture as a lens for stakeholder evaluation of corporate social performance and its effect on corporate reputation. BRQ Bus Res Q. https://doi.org/10.1177/23409444211007487

Picazo-Tadeo AJ, Beltrán-Esteve M, Gómez-Limón JA (2012) Assessing eco-efficiency with directional distance functions. Eur J Oper Res 220(3):798–809. https://doi.org/10.1016/j.ejor.2012.02.025

Qureshi MA, Ahsan T (2022) Do investors penalize the firms disclosing higher environmental performance? A cross cultural evidence. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-19716-8

Rajesh R (2020) Exploring the sustainability performances of firms using environmental, social, and governance scores. J Clean Prod 247:119600. https://doi.org/10.1016/j.jclepro.2019.119600

Ratajczak P, Szutowski D (2016) Exploring the relationship between CSR and innovation. Sustain Acc Manag Policy J 7(2):295–318. https://doi.org/10.1108/SAMPJ-07-2015-0058

Rauch A, Frese M, Wang Z-M, Unger J, Lozada M, Kupcha V, Spirina T (2013) National culture and cultural orientations of owners affecting the innovation–growth relationship in five countries. Entrep Reg Dev 25(9–10):732–755. https://doi.org/10.1080/08985626.2013.862972

Riccardi R, Oggioni G, Toninelli R (2012) Efficiency analysis of world cement industry in presence of undesirable output: application of data envelopment analysis and directional distance function. Energy Policy 44:140–152. https://doi.org/10.1016/j.enpol.2012.01.030

Ringov D, Zollo M (2007) The impact of national culture on corporate social performance. Corp Govern Int J Bus Soc 7(4):476–485. https://doi.org/10.1108/14720700710820551

Roy A, Mukherjee P (2022) Does national culture influence corporate ESG disclosures? Evidence from cross-country study. Vision. https://doi.org/10.1177/09722629221074914

Ruggiero P, Cupertino S (2018) CSR strategic approach, financial resources and corporate social performance: the mediating effect of innovation. Sustainability 10(10):3611

Shane S (1993) Cultural influences on national rates of innovation. J Bus Ventur 8(1):59–73. https://doi.org/10.1016/0883-9026(93)90011-S

Shao L, Yu X, Feng C (2019) Evaluating the eco-efficiency of China’s industrial sectors: a two-stage network data envelopment analysis. J Environ Manage 247:551–560. https://doi.org/10.1016/j.jenvman.2019.06.099

Shapiro D, Tang Y, Wang M, Zhang W (2015) The effects of corporate governance and ownership on the innovation performance of Chinese SMEs. J Chin Econ Bus Stud 13(4):311–335. https://doi.org/10.1080/14765284.2015.1090267

Simar L, Wilson PW (2007) Estimation and inference in two-stage, semi-parametric models of production processes. J Econom 136(1):31–64. https://doi.org/10.1016/j.jeconom.2005.07.009

Simar L, Wilson PW (2011) Two-stage DEA: caveat emptor. J Prod Anal 36(2):205. https://doi.org/10.1007/s11123-011-0230-6

Surroca J, Tribó JA (2008) Managerial entrenchment and corporate social performance. J Bus Financ Acc 35(5–6):748–789. https://doi.org/10.1111/j.1468-5957.2008.02090.x

Tsai K-H, Huang C-T, Chen Z-H (2020) Understanding variation in the relationship between environmental management practices and firm performance across studies: a meta-analytic review. Bus Strateg Environ 29(2):547–565. https://doi.org/10.1002/bse.2386

van Everdingen YM, Waarts E (2003) The effect of national culture on the adoption of innovations. Mark Lett 14(3):217–232. https://doi.org/10.1023/A:1027452919403

Wang DH-M, Chen P-H, Yu TH-K, Hsiao C-Y (2015a) The effects of corporate social responsibility on brand equity and firm performance. J Bus Res 68(11):2232–2236. https://doi.org/10.1016/j.jbusres.2015.06.003

Wang Q, Dou J, Jia S (2015b) A meta-analytic review of corporate social responsibility and corporate financial performance: the moderating effect of contextual factors. Bus Soc 55(8):1083–1121. https://doi.org/10.1177/0007650315584317

Wang Q, Hang Y, Sun L, Zhao Z (2016) Two-stage innovation efficiency of new energy enterprises in China: a non-radial DEA approach. Technol Forecast Soc Chang 112:254–261. https://doi.org/10.1016/j.techfore.2016.04.019

Wang W, Zhao X-Z, Chen F-W, Wu C-H, Tsai S, Wang J (2019) The effect of corporate social responsibility and public attention on innovation performance: evidence from high-polluting industries. Int J Environ Res Public Health 16(20):3939

Wanke PF, Hadi-Vencheh A, Forghani A (2018) A DDF based model for efficiency evaluation in two-stage DEA. Optim Lett 12(5):1029–1044. https://doi.org/10.1007/s11590-017-1162-5

Wijesiri M, Martínez-Campillo A, Wanke P (2019) Is there a trade-off between social and financial performance of public commercial banks in India? A multi-activity DEA model with shared inputs and undesirable outputs. RMS 13(2):417–442. https://doi.org/10.1007/s11846-017-0255-y

Williams G, Zinkin J (2008) The effect of culture on consumers’ willingness to punish irresponsible corporate behaviour: applying Hofstede’s typology to the punishment aspect of corporate social responsibility. Bus Ethics Eur Rev 17(2):210–226. https://doi.org/10.1111/j.1467-8608.2008.00532.x

Wolf R (2013) Management relations in the work culture in Japan as compared to that of the West. Innov J Bus Manag Decis 2(5):116–122

Wu W, Liu Y, Chin T, Zhu W (2018) Will green CSR enhance innovation? A perspective of public visibility and firm transparency. Int J Environ Res Public Health 15(2):268

Wu W, Liang Z, Zhang Q (2020) Effects of corporate environmental responsibility strength and concern on innovation performance: the moderating role of firm visibility. Corp Soc Responsib Environ Manag 27(3):1487–1497. https://doi.org/10.1002/csr.1902

Yang X, Morita H (2013) Efficiency improvement from multiple perspectives: an application to Japanese banking industry. Omega 41(3):501–509. https://doi.org/10.1016/j.omega.2012.06.007

Yang AS, Okada H (2019) Corporate innovations as institutional anomie: patent activities and financial performance of the international aerospace industry. Financ Res Lett 28:328–336. https://doi.org/10.1016/j.frl.2018.06.001

Yang J, Ying L, Gao M (2020) The influence of intelligent manufacturing on financial performance and innovation performance: the case of China. Enterp Inf Syst 14(6):812–832. https://doi.org/10.1080/17517575.2020.1746407

Yeh Q-J (1996) The application of data envelopment analysis in conjunction with financial ratios for bank performance evaluation. J Oper Res Soc 47(8):980–988. https://doi.org/10.1057/jors.1996.125

Yeh M-L, Chu H-P, Sher PJ, Chiu Y-C (2010) R&D intensity, firm performance and the identification of the threshold: fresh evidence from the panel threshold regression model. Appl Econ 42(3):389–401. https://doi.org/10.1080/00036840701604487

Yoon B, Lee JH, Byun R (2018) Does ESG performance enhance firm value? Evidence from Korea. Sustainability 10(10):3635

Yu Y, Choi Y (2016) Stakeholder pressure and CSR adoption: the mediating role of organizational culture for Chinese companies. Soc Sci J 53(2):226–235. https://doi.org/10.1016/j.soscij.2014.07.006

Zhao M (2012) CSR-based political legitimacy strategy: managing the state by doing good in China and Russia. J Bus Ethics 111(4):439–460. https://doi.org/10.1007/s10551-012-1209-6

Zhou P, Ang BW, Wang H (2012) Energy and CO2 emission performance in electricity generation: a non-radial directional distance function approach. Eur J Oper Res 221(3):625–635. https://doi.org/10.1016/j.ejor.2012.04.022

Forbes (2019) The world’s largest public companies. https://www.forbes.com/global2000/list/

Gillan S, Hartzell JC, Koch A, Starks LT (2010) Firms’ environmental, social and governance (ESG) choices, performance and managerial motivation. Unpublished working paper

Kaasa A (2016). Culture as a possible factor of innovation: evidence from the European Union and neighboring countries. In: Re-thinking DIVERSITY, Springer, pp 83–107

Lenssen G, Perrini F, Tencati A, Lacy P, Ringov D, Zollo M (2007) The impact of national culture on corporate social performance. Corporate Governance: The international journal of business in society

Naz K, Sarmad M, Ikram A, Rasheed I, Khan MJ (2020) Investigating pharmacists’ perceived organizational performance through learning and innovation under the moderating role of power distance. 24(07)

Xue S-J, Hou J, Gao P-B (2019) Business model innovation and firm performance: a meta-analysis. In: Paper presented at the 6th International Conference on Management Science and Management Innovation (MSMI 2019)

Funding

The funding was provided by Ministry of Science and Technology (Grant No. 110-2410-H-034 -021 -MY3).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Le, MH., Lu, WM. & Kweh, Q.L. The moderating effects of power distance on corporate social responsibility and multinational enterprises performance. Rev Manag Sci 17, 2503–2533 (2023). https://doi.org/10.1007/s11846-022-00591-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-022-00591-z

Keywords

- Corporate social responsibility

- Innovation performance

- Business performance

- Network DEA

- Multinational enterprises

- Power distance