Abstract

This paper analyzes the R&D profile of Indian drug and pharmaceutical industry during the period 2000–2013, and the factors that influence a pharmaceutical firm’s decision to undertake R&D activities. The study period from 2000 to 2013 has been characterized by a rapid growth in industry’s R&D expenditures, as part of the strategic shift, induced by the Patents (Amendment) Act, 2005. Using the real financial data for the top 91 publicly listed Indian domestic pharmaceutical companies, the study provides new evidence on drivers of R&D intensity in Indian Drugs and Pharmaceutical industry. A panel data random effects Tobit model along with OLS model using firm fixed effects are applied to identify the factors affecting the R&D intensity of the sample firms. Furthermore, McDonald and Moffitt in Rev Econ Stat 62(2):318–321, (1980) procedure is used to decompose Tobit estimates. The empirical findings of the study reveal that firm’s size, past year profitability, past innovative output, leverage ratio; past cash flow; export and import intensities of the firm tend to significantly impact the R&D intensity. While firm size exhibits a non-linear relationship, cash flow, past innovative output shows a positive and significant relationship with R&D intensity. Further, patent count and firm’s overseas presence, considered as additional important determinants of firm-level R&D intensity, influences R&D positively. Lastly, global orientation of Indian pharmaceutical firms has been found to impact R&D activities considerably.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

R&D programs are central to a firm’s competitive advantage as they help to develop superior products/technologies with a well-defined competitive advantage (Lev and Sougiannis 1996; Ettlie 1998; Bhagwat and DeBruine 2011), especially in knowledge intensive areas such as drugs and pharmaceutical (D&P) industry. In this industry, the firms need to continuously innovate by developing and marketing new products, drug delivery systems, and product attributes, based on cutting-edge scientific advances, as part of survival and growth strategies at the national and global levels. Understanding that product life cycles have become shorter and numerous regulatory challenges are emerging faster, this industry spends far more on R&D, relative to its sales revenue, as compared to almost all other industries. For instance, as compared to aerospace, defense, chemical industries, and software and computer services; the drugs and pharmaceutical industry spend 5 times, 4.5 times, and 2.5 times more, respectively (European Commission 2014). The drugs and pharmaceutical industry is seen as analogous to drilling for oil which involves many dry holes and a very few gushers (Office of Technology Assessment, US Congress 1993).

Before discussing the core issue of R&D intensity, it may be noted that the Indian drug and pharmaceutical industry (ID&PI) is the world’s third-largest pharmaceutical industry in terms of volume yet stands ranked at the 13th position in terms of value (Annual Report, Department of Pharmaceuticals, Ministry of Chemistry and Fertilizers 2009–2010). The far lower rank, in terms of value, is reflective of the fact that the Indian pharmaceutical companies are primarily operating in the low priced branded generic product group category with wide heterogeneity in firm sizes and product mix. Interestingly, the emergence of ID&PI in the world pharmaceutical map can be attributed to India’s shift from product to process patent after 1970. This single measure enabled the Indian pharmaceutical companies to replicate the latest drugs introduced in other markets, albeit through different processes, and market them in the domestic and foreign markets at very low prices. This shift to product patent gave such a big fillip to ID&PI that the growth rate of pharmaceutical exports outweighed the growth rate of overall merchandise exports (Nauriyal and Sahoo 2008; Mahajan et al. 2015). There was, however, a remarkable change in the situation after the signing of the TRIPS under the auspices of the WTO when Indian companies, especially bigger ones, started expanding their overseas marketing and distribution networks by trade-supportive infrastructure through mergers and acquisitions (Pradhan 2007). As a consequence, India’s share of the world generic market has much improved from 4.5 % in 2006 to 10.3 % by 2013 which is quite appreciable in view of the stiff competition from international generic manufacturer(s) such as Teva, Mylan, Sandoz, etc. which has a sizeable presence in the US market with deep product pipeline across various therapeutic segments. They also began allocating more resources towards R&D, as part of their survival and growth strategy in the new business milieu.

Against this backdrop, the key objective of this paper is to examine the determinants of R&D intensity in ID&PI for more recent time period i.e., 2000–2013. This study intends to provide new evidence on the factors determining the R&D investment behavior in ID&PI during the longer period of study, a phase portraying the phenomenal increase in R&D expenditure after introduction of the Patents (Amendment) Act, 2005. The study would perhaps be the first one to consider the role of patents and overseas presence of pharmaceutical firm as additional factors, along with size, age, market share, export intensity among others, underlying the dramatic changes in R&D investment behavior of Indian D&P firms.

The rest of the paper is organized as follows. Section 2 discusses R&D scenario in Indian pharmaceutical sector. Section 3 encompasses description of databases, methodology and discussion on conceptual framework. Section 4 focuses on results and discussion, while Sect. 5 sums up findings of the study.

2 R&D scenario in Indian drug and pharmaceutical (ID&PI) industry

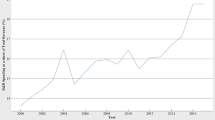

Over the last two decades, the global drug and pharmaceutical industry has experienced a dramatic rise in R&D intensity (R&D expenditure-to-sales revenue ratio). As highlighted by the European Federation of Pharmaceutical Industries and Associations’ Report (2013), top 1500 global pharmaceutical firms have invested around 15 % of sales turnover on R&D related activities in 2011. The R&D spending in the Indian D&P industry has also shown a significant shift. Up until late 2000s, the R&D intensity of Indian D&P firms stood below 0.5 %. Table 1 and Fig. 1 exhibit the trend in this regard. The R&D models of Indian D&P companies range from joint ventures (JVs) to licensing arrangements, besides continuing with high-end generic products (Mazumdar 2012). Interestingly, the top 20 firms have started undertaking in-house R&D, initiated JVs and licensing arrangements, especially after 1995, for the purpose of developing novel products, advanced processes and bio-pharmaceutical products. However, the R&D spending of the Indian companies is not even a pale shade of what is being spent by pharmaceutical MNCs. For instance, while Roche, Novartis, and Merck had spent US$10 billion, US$9.9 billion, and US$7.5 billion, respectively on R&D in 2013; the combined R&D expenditure of 25 leading Indian pharmaceutical companies stood merely at US$0.96 billion. With this magnitude of R&D investment, Indian firms logically had to majorly focus on product improvement in the ever expanding plain generic markets because of acquired competencies in process engineering. Consequently, Indian pharmaceuticals R&D is expected to compete with global industry leaders only in limited range either in process R&D or adding incremental value to the off-patent drugs which stem from the fact that while the Indian firms have developed expertise in the alternative process development and manufacturing of the products, they lack in essential R&D competencies, coupled with professional inexperience, and tenacity for engaging in the whole process of R&D for product innovation.

The most remarkable change, nevertheless, is evident during 2004–2009 when the firms started investing far more resources towards R&D activities, as part of the strategic shift, induced by changing business environment. Some of the firms, especially large-sized, started focusing on Novel Drug Delivery Systems (NDDS),Footnote 1 and expanding production facilities by importing the latest capital goods and seeking technology transfer (Chaturvedi and Chataway 2006). A recent study by Abrol et al. (2011) highlighted that out of the 1159 patents granted to 35 firms from India between 2000 and 2007, product patents constituted only 5 %, dosage forms constituted 44 %, new forms of substance 24 % and processes 18 %. The deceleration in the growth of R&D expenditure, especially after 2006, can be attributed to the failure of out-licensed DRF-2725Footnote 2 and DRF-4148Footnote 3 by Dr. Reddy’s Lab to Novo Nordisk and Novartis in 1998, and that of RBx 2258Footnote 4 by Ranbaxy to Schwarz Pharma in 2002. It has alerted other Indian pharmaceutical firms about the risk involved in innovative R&D. ‘The Perlecan debacle’ wherein the US$52.2 million joint venture of Dr. Reddy’s Lab, Citigroup Venture and ICICI venture in 2005 had collapsed in 2008 due to potential side effects of the molecules identified, further put a lid on such initiatives (Joseph 2011).

Interestingly, the R&D efforts of the Indian pharmaceutical companies have been found to have concentrated in chronic diseases such as cancer and diabetes, instead of tropical diseases viz., malaria, tuberculosis, etc. which afflict majority of the population in India and other developing economies (Joseph 2011). The deviation of Indian firms from tropical diseases to lifestyle related and other chronic diseases can be explained by ‘invest where the present and future profits rest’ axiom. For instance, the fast rise of the middle income group in India, Africa, Asia and the fast graying population in the West warrants more R&D focus on life style related diseases as the paying capacity of the ailing users of these medicines is much higher as compared to those largely affected by tropical diseases. The business firms shall invest where the profit is. The raging debate on the ‘Utility Models’, wherein the incremental value addition to off-patent drugs promise more profit than and much less R&D cost, is a case in point. The investment priorities of Indian firms suggest that they are willing to put their money where growth opportunities are far higher, suggesting thereby that the global integration of ID&PI has initiated them into the partnership of an inequitable model of international R&D and production. It was further reported that the Hatch-Waxman Act of 1984 still continues to be “the most important stimulus for domestic pharmaceutical firms to invest in the process of learning, competence building and innovation making activity” (Abrol et al. 2011). It may be pointed out here that Hatch-Waxman Act provided for filing of the Abbreviated New Drug Application (ANDAFootnote 5), which allowed approval of generic drug products, by a shorter and less expensive route by establishing bio-equivalence of their products with the innovator drug. They are not required to report preclinical (animal) and clinical (human) data to establish safety and effectiveness, as is the case with the innovator drug. The significant increase in the ANDA approvals for Indian companies, especially for Lupin, Sun Pharmaceuticals, DRL, Cadila, Glenmark, Torrent, Ipca and Aurobindo, along with much more commitment of resources to R&D activities with them demonstrates the impact of Hatch-Waxman Act. Similarly, India stands at the top in terms of drug master filings (DMFsFootnote 6) Type II (Drug substance, its intermediate and material used in the manufacturing) by sharing around 36 of the global DMFs filed during 2009–2013 (Table 2), up from 14 percent in 2000.

The classifications of the pharmaceutical firms, according to ownership types, size, age, and other parameters also make for interesting reading, and are summed up in Table 3. There has been a tremendous rise in the number of domestic firms from 41 in 1996 to 141 by 2011, which have become R&D active. This probably indicated confidence of Indian firms in their innovative and financial capabilities to carry out independent R&D. Surprisingly, the share of domestic firms in R&D activity had started registering a downturn after 2006. There could be three possible reasons behind this trend. First, post-2006 period has witnessed noticeable incidents of M&As taking place to the effect that even big R&D active firms like Ranbaxy was taken over by Daiichi-Sankyo and then finally acquired by Sun Pharmaceuticals, Matrix Labs by Mylan, Shantha Pharmaceuticals by Sanofi-Aventis, and Piramal by Abott Pharma, etc. Second, the setback received by Dr. Reddy’s Lab and Ranbaxy due to the failure of their out-licensed molecules to pass to even phase II clinical trials, made the companies rethink about their R&D strategies. Most of the firms, thus, preferred the course of contract/collaborative routes, instead of initiating independent research. Third, foreign subsidiaries had also started strategizing in order to capitalize on the fast rise in the demand for generic segment, which had more ‘gushers’ than ‘dry holes’. During 1996–2006, while only some of the foreign firms (like Merck, Pfizer, and GlaxoSmithKline, etc.) were R&D active, other leading firms (like Stride Acrolabs, Sanofi and AstraZeneca, etc.) have also started shifting part of their R&D operations to captive research centres in low-cost India. The MNCs R&D efforts were essentially focused on developing facilities basically for phase III clinical trials and other such modules that only integrate Indian talent and facilities into foreign pharmaceutical firms’ global objectives, rather than the development of drug from the basic stages through bio-technological or chemical processes (Abrol et al. 2011). The product patent regime initiated in 2005 further accelerated this process.

The size-wise classification reveals that large sized companies were far more R&D active in 2014, although the share of small companies has also been impressive. It was probably for the fact that while the large companies could afford the resources and R&D initiatives, small companies had also been forced to undertake R&D in order to stay in the competition. It may be noted that in case of both large and small sized companies, the focus of R&D differed, although all of them worked in the domain of the process than the product R&D. For instance, while in case of large sized companies, it had mainly been on advanced processes, bio-pharmaceuticals and novel products (Mazumdar 2012), it had been marginal improvements in case of small companies. Interestingly, most of the R&D had been undertaken by the firms, which earn a large part of their revenue from exports. This sounds quite logical in view of the fact that most of the R&D efforts of the Indian pharmaceutical companies are directed ‘towards developing processes and products to get regulatory approvals for entry and growth in patent-expired generic markets in developed countries (Chaudhuri et al. 2010). The major highlights of these R&D efforts comprise: product development of formulations, development of processes for manufacturing Active Pharmaceutical ingredients (APIs), process validation, bio-equivalence testing and generation of other data required for DMFs and ANDAs for getting international regulatory approvals especially keeping in view the regulated markets (Chaudhuri et al. 2010). Given that R&D efforts are geared towards meeting specific requirements of the overseas markets, it is logical to presume that the firms which are exporting a sizable chunk of their output are likely to be far more R&D intensive as compared to their counterparts which are either do not have much presence in the overseas markets or are not exporting directly.

Table 3 also indicates that the firms established after 1990 were far more R&D active as compared to the firms established earlier. Thus, both innovative attitude and export orientation appeared to have led to increased R&D.

It may be pointed out here that the nature of the Indian pharmaceutical R&D is very different from the MNCs, as the former had largely focused on the out-licensing of most of the new chemical entities (NCEsFootnote 7) identified through their R&D efforts to MNCs for their poor capacity to bear the high costs and risks associated with clinical trials. The evidence of this trend comes from the actions of Ranbaxy (out-licensing of compound RBx 22584, for the treatment of benign prostate hyperplasia to Schwarz Pharma), DRL (out-licensing of anti-diabetic molecules such as DRF5 2593, DRF 2725 and DRF 4148 to Novartis for pre-clinical and clinical development) and few other Indian pharmaceutical firms. Nevertheless, it would be interesting to examine the determinants of R&D in the ID&PI, as R&D activities are still considered to be the domain of bigger companies which could commit financial resources and manpower on long-term basis. In this regard, it may be mentioned that given the legacy of Indian pharma firms, there is less likelihood of Indian companies going the MNCs’ way, at least for next 5 years, primarily for two reasons. The first is: they still have large potential in the market to churn it for the branded generic drugs as the governments all over the world are encouraging this segment to contain the rising health care costs. The second: their low confidence, low-risk taking aptitude and capacity, and more importantly much less financial capabilities deter them to invest heavily in new drug discovery. The safest bid appears to be to take advantage of low cost and replication of large number of drugs that have already gone off-patent and are subject to rising demand with rapidly changing life styles. The present work also differs from the earlier study (Pradhan 2003, 2010) in respect of sample covered, functional specification of the model and coverage of independent variables. Present study consider a latest time period which allows examining the impact of various factors on R&D intensity post product patent regime. Pradhan (2010) only analysed R&D determinants of Small and Medium Enterprises (SMEs) while present study takes a wider and heterogeneous panel of Indian pharmaceutical firms. Our study also attempts to analyse the impact of two novel variables namely, innovative output and overseas presence.

3 Database and methodology

3.1 Database

Our sample consists of the top (the largest on the basis of sales revenue) 91 Indian drug and pharmaceutical companies listed on the Bombay Stock Exchange (BSE) over the period 2000–2013. The data on firm’s financial variables have been obtained from the Prowess Database of Centre for Monitoring Indian Economy (CMIE). This database provides firm-level data on various financial parameters of all the listed firms in India. This sample is a highly representative sample of R&D intensive pharmaceutical companies, as selected firms demonstrate continuous R&D spending, and their share of R&D expenditure in pharmaceutical industry ranges from 68.1 % in 2000–2001 to 82.95 % in 2012–2013 (see Table 4). The Patent Cooperation Treaty (PCT) applications count data for the sample firms has been obtained from the PATENTSCOPE Database of World Intellectual Property Organization (WIPO). The final dataset forms an unbalanced panel for the above mentioned period.

The previous studies have suggested using R&D intensity in order to avoid any size bias (Grabowski and Vernon 2000; Pradhan 2003; Mahlich and Roediger-Schluga 2006). It suggests that normalization of R&D expenditure provides benefits in cross-sectional or panel studies as it tends to reduce heteroscedasticity, and therefore, the R&D intensity in this study has been measured as the ratio of R&D expenditure to sales.

3.2 Methodology

3.2.1 Random effects panel Tobit model

The study employs a random effects panel Tobit model to investigate the factors explaining the R&D intensity (RDI) of sampled firms in the Indian D&P industry. Note here that use of Tobit model is an appropriate method since dependent variable R&D intensity is limited for two ground realities. First, all the firms are not indulging in R&D activity in all the years, because their generic drug manufacturing facilities do not have any requirement for R&D. Second, all the firms have not reported their R&D expenditure, since as per the existing regulations, firms have to report only those expenditures which are at least one percent of their turnover. Some of the notable studies that applied the Tobit analysis for determining firm level R&D intensity include Mairesse and Robin (2008) for France, Baum et al. (2013) for United Kingdom and Kwon and Inui (2013) for Japan.

The use of random effects (RE) panel Tobit model was preferred over the fixed effects because the likelihood estimator for fixed effects in case of a non-linear model such as Tobit is considered biased and inconsistent (Greene 2004; Hsiao 2003). The Tobit model is specified in terms of latent dependent variable \( RDI_{it}^{*} \) as

The RDI it is supposed to be observed only if \( RDI_{it}^{*} > 0 \) and it is not observed if \( RDI_{it}^{*} \le 0 \) such that

and \( E\left[{RDI_{it}} \right] = E\left[{RDI_{it}^{*}/RDI_{it}^{*} > 0} \right]. \)

Here, X it is a vector of observed variables that are expected to affect R&D intensity of firm i, β coefficient is a weighted average of effect of an increase in an explanatory variable on the probability of performing the R&D activity and the effect on the expected value of R&D intensity above the limit zero, and μ it is an error term, capturing the unobserved factors that affect R&D intensity. The error term μ it is assumed to be independent of X it and is independent and identically distributed (i.i.d.) over time and across firms in case of random effect Tobit model. In general, the common error term μ it could be freely correlated over time. Here, we consider the error components model which splits the error term μ it into a time-invariant individual random-effect (α i ) and thus measures unobserved individual heterogeneity, and a time-varying idiosyncratic random error (ε it ) which depicts the unobserved time variant shocks to R&D intensity, and is independent of the exogenous variables and α i .

The joint density for the ith observation RDI i = (RDI i1,…,RDI iT) can be written as

where \( \phi_{it} = \phi \left((RDI_{it}^{*} - \alpha_{i} - X_{it}^{\prime}\beta) \sigma_{\varepsilon} \right), \varPhi_{it} = \varPhi \left((\alpha_{i} + X_{it}^{\prime}\beta)\sigma_{\varepsilon} \right) \), and \( \phi (.)\,{\text{and}}\,\varPhi (. ) \) denote the standard normal probability distribution function and cumulative distribution function, respectively.

Under the assumption that \( \alpha_{i} \sim N[0,\sigma_{\alpha}^{2}] \), the random-effects MLE of \( \beta,\sigma_{\varepsilon}^{2} \) and \( \sigma_{\alpha}^{2} \) maximizes the log-likelihood \( \sum_{i = 1}^{N} \ln f(RDI_{i}/X_{i},\beta,\sigma_{\upsilon}^{2},\sigma_{\alpha}^{2}),{\text{where}} \)

Maximizing (3) w.r.t. unknown parameters i.e., β, \( \sigma_{\varepsilon}^{2} \) and \( \sigma_{\alpha}^{2} \) yields consistent and asymptotically normally distributed estimators. The log-likelihood function in the Eq. (3) does not subside to a sum as it would in the case of cross section or time-series Tobit model. In the present study, STATA 13.0 has been used for estimation purposes. STATA uses the advantage of the Gauss–Hermite quadrature for the likelihood calculations of random-effects Tobit model. Further, bootstrapped standard errors, which are heteroscedasticity corrected standard errors and deals with the problem of non-normality of data, are estimated for the specified model.

3.2.2 Decomposition of marginal effects

The computed Tobit estimates cannot be directly interpreted without decomposing its marginal effects. McDonald and Moffitt (1980) proposed the decomposition of Tobit estimates into two types of effects: (1) the change in the probability of indulging in R&D activity (2) the change in the changes in the noncensored values of RDI. Thus, the total change in RDI it can be disaggregated as:

The relative magnitudes of these two effects are important indicators with substantive economic implications but researchers commonly assume that the Tobit β coefficients measure the correct regression coefficients for observations above the limit but it is an erroneous and Tobit coefficient cannot be interpreted directly. Consequently, the relationship between the expected value of all observations, \( E[RDI_{it}] \), the expected value conditional upon being above the limit, \( E[RDI_{it}^{*}] \) and the probability of being above the limit, F(z), is \( E\left[{RDI_{it}^{*}} \right] = F(z)E\left[{RDI_{it}^{*}} \right] \). Following the theoretical and empirical literature on the determinants of R&D intensity at the firm level for Indian D&P industry may depend upon a number of factors (X) as discussed in the next sub-section.

3.2.3 Model specification

This sub-section identifies the factors that induce a firm to undertake R&D investments. The R&D being firm’s internal decision, firm’s own characteristics like size, age, competencies, external technology purchase, market share, export orientation, raw material and intermediary product imports, foreign ownership, business group affiliation and profitability might influence the decision. The existing literature suggests that the market value of a firm is related positively to R&D investments on account of growth opportunities that are expected to create (Eberhart et al. 2004; Chan et al. 2001; Lev and Sougiannis 1996). Given that product life cycle in the pharmaceutical industry has shrunk considerably on account of intense and dynamic nature of R&D activities of various competitors; R&D decisions, commitment of huge investment of time and resources has become tricky issue. It may also be noted that the shift from ‘chemistry’ to ‘molecular biology’ which has increased capital equipment and training costs, and technological complexities in the drug development, have raised the average R&D costs tremendously. The costs are further exacerbated by the time consuming drug approval processes in order to ensure drug safety and efficacy (Austin 2006), as part of increased international regulatory harmonization, and failure of a very large number of drug projects at phase I trial itself (Food and Drug Administration 2004). Rising R&D costs coupled with an effective reduction in the effective patent life of an innovation has further complicated this business. However, there is an urgent need for R&D in this industry for the drug resistance diseases and the emergence of the new strains of viruses/bacteria requiring development of new pharmaceutical products and drug delivery systems.

As pointed out earlier, a significant portion of the Indian pharmaceutical firms does not undertake R&D, as they operate in the branded generic market with surety of business. It would, therefore, be interesting to find out what motivates some of the firms to undertake R&D which is considered to have non-linear payoffs (Tsai 2001). The fact that R&D is generally undertaken by bigger Indian pharmaceutical firms indicate towards the possibility that they face more uncertainties, as compared to smaller firms which are exclusively generic market players. The R&D is measured here as the R&D intensity which refers to how much a company will commit their funds to R&D relative to their sales revenue. All the variables that are expected to influence the firm’s decision to undertake R&D are listed in Table 5.

The description of each independent variable is given below:

3.2.3.1 Firm’s size

The literature spells an ambiguity in the relationship between innovativeness and size. It is hypothesized that large firms are more innovative, especially in sectors with high concentration and barriers to entry (Blundell et al. 1999), while small firms are more innovative in sectors with low concentration in newly emerging technologies (Acs and Audretsch 1987). The positive relationship between size and R&D is also supported by evidences of M&As taking place in the drug and pharmaceutical industry across the world. Small size firm, with no market power in hand, may not be able to fund the R&D activities for the fact that R&D infrastructural development entails high fixed and recurring costs. It may further be noted that due to the expensive nature of R&D in the drug and pharmaceutical industry, the size of the firm becomes extremely important because smaller firms may find it difficult to invest in the development of innovative products where there is a greater risk of several competing drugs cropping up simultaneously (Matraves 1999). Some of the empirical studies that have reported a positive impact of firm’s size on its R&D initiatives include Kumar and Saqib (1996), Siddharthan (1988), Nath (1993), Pradhan (2003), Abdelmoula and Etienne (2010), Cohen (2010), etc.

Studies have also found a U-shaped relationship between firm’s size and innovation in the case of the long tailed structure of Indian industry and reported a positive relationship between R&D intensity and firm’s size only up to a certain size and after that no effect was observed (Nath 1993; Kumar and Siddharthan 1994). However, the recent evidences reported inverted U shape relationship between firm size and R&D investment (Bhat and Narayanan 2011). Given the fact that the marginal costs of incremental R&D investments in regard to larger size companies are likely to be relatively lower, it is expected that R&D spending will be more viable to them. It has also been reported that firm size also impacts the thrust and direction of R&D (Mazumdar 2012). Thus, previous empirical work does not provide any comprehensive evidence regarding the clear cut indication of the relationship between firm size and R&D intensity. We hypothesize that the large size firms may allocate a greater proportion of their sales revenue to R&D. The variable ‘firm size’ is reflected by total assets. Total assets of the firm are measured in million INR. Specifically, log of firm size (LFSZ) and demeaned squared values of log of firm size (FSZSQ) are included in the estimation of the model.

3.2.3.2 Market share

The relationship of R&D and market power of a firm dates back to Schumpeter’s theory of innovation (Schumpeter 1942), which holds that the large firms do enjoy more autonomy and power in the market, and can provide economies of scale in production and innovation. The literature suggests that market power may have more to do with the firm’s share, as the high market share is largely an offshoot of high customer awareness and market penetration (Bloom and Kotler 1975; Scott 1984; Hussinger 2008; Raymond et al. 2010). Thus, market share of the firm can be taken as a viable proxy for market power. The market share of the firm is calculated as the share of the firm’s sales in total industrial sales. Studies that have reported market share of the firm as a major determinant of firm level R&D expenditure includes Bhat and Narayanan (2006) and Sanguinetti (2005). In the drug and pharmaceutical industry, a larger market share implies that the firm maintains a large marketing and distribution network in a vast geographical area, and is undertaking production and marketing of products in a wide range of therapeutic areas. In this industry, the firms not only compete with respect to prices, products, and therapeutic segments, but also in advertising and R&D expenditures. A rise in market share precedes the goodwill and branding is created through advertising and market spending. Thus, in this study, we assume the relationship between firm’s R&D spending and market share to be positive. This study includes market share (MSH) of the firm and its demeaned quadratic term (MSHSQ) as explanatory variables to explore the direction and magnitude of the relationship between market share and R&D intensity of the Indian drug and pharmaceutical firms.

3.2.3.3 Firm age

Following Lall (1986), firm age could be used as a plausible proxy for accumulated technological expertise and knowhow as an outcome of its past R&D and production experiences applied towards skills and technological up gradation. Further, established and credible firms are likely to have a better R&D infrastructure and may attract highly skilled and talented R&D staff. Earlier studies have also reported that firm age has a significant impact on the decision to engage in R&D activities for the fact that they have higher probabilities of possessing skills and channels to commercially harness their innovations (Abdelmoula and Etienne 2010; Pradhan 2007; Lall 1986). In the drug and pharmaceutical industry, old and established firms may have resources, motivation and compulsions to innovate unlike other industries where innovations may be a driving point to establish a new firm. Hence, it is expected that firm age (FAGE), ceteris paribus, is likely to induce a positive and significant impact on the R&D investment intensity. Firm age is calculated in years as the difference between the year of incorporation and the last year of the study i.e., 2012. It is hypothesized that firm age is positively associated with the R&D intensity.

3.2.3.4 Profit of firm at time t−1

Past profits serve as an investible fund for R&D activities. Existing literature indicates that past years’ profitability affects the R&D expenditure of a pharmaceutical firm positively for the fact that increased profit raise firm’s capacity to commit additional resources to R&D expenditure and also internally generated cash is relatively inexpensive as source of investment capital, as compared to other alternatives such as commercial borrowings, bonds etc. (Malmberg 2008, Congressional Budget Office Study 2006). Some studies suggest that only realized profitability, which increases the level of a firm’s internal funds, determines firm’s R&D investment (Scherer 2011; Scherer 2001; Grabowski and Vernon 2000; Abbott and Vernon 2007). Past year’s lagged profitability therefore, was found to be exercising significant impact on R&D expenditure and R&D related investment decisions (Simanjuntak and Tjandrawinata 2011). However, two distinct channels have been proposed in the earlier literature: first, current profits serve as a source of R&D funding (Scherer 2007, 2011), and second expectations of future profit opportunities can have influence on R&D investment. The linkage from profits to R&D expenditure was reported to be direct since it concerns yearly budget decisions and can be captured by the yearly variations. Thus, in order to capture the effect of past profits on the R&D expenditure, Return on Assets (ROA) of past year is taken as a proxy for profits, is included in the model. It is hypothesized that past profits have a positive impact on the firm’s R&D intensity.

3.2.3.5 Export intensity

The R&D investment of a firm may also be determined by its export intensity because of the transferability of the R&D costs across domestic and foreign markets (Davies and Rondi 1996). A number of studies have investigated the link between export behavior and the firm’s propensity and, its’ ability to conduct R&D and indicated that exporting firms are likely to be more innovative (Vernon 1966; Pradhan 2003; Salmon and Shaver 2005; Sun 2010; Abdelmoula and Etienne 2010). Existing literature also suggest a two-way relationship between these two variables. Increased firm level R&D activity of the Indian pharmaceutical industry was responsible in a major way for the observed increase in export intensity (Goldar 2013). Export intensity reflects international competitive structure of a firm which affects R&D investment on process and product development because of the need for product adaption (Kumar and Pradhan 2003). Openness allows firms to be benefited from economies of scale and increase return on R&D investment (Zimmerman 1987). In the Indian context, the overseas markets are far more rapidly expanding due to promotion of generics on account of steep rise in the health costs and a fast ageing population in the West. Presently, Indian pharmaceutical exports are destined to around 175 countries, with heavy concentration in highly regulated Western markets, which emphasize so much on maintaining good manufacturing practices and meeting quality standards at par with the global norms. Exports comprising over 63 % of the bulk drugs and intermediaries and 37 % of the formulations in 2010 (Kallumal and Bugalya 2012), certainly provide these firms with an attractive opportunity to spread out their R&D costs. The notion that only bigger Indian pharmaceutical firms undertake R&D because they face far more uncertainties in their international businesses, may also be analyzed by considering export intensity as an explanatory variable.

3.2.3.6 Import intensity

The literature suggests that the imports of intermediate inputs and capital goods also help in determining R&D intensity by creating a knowledge spillover effect on the importing firm through absorption of imported knowledge/equipment/technology. It has been reported that imported inputs and capital goods create a positive impact on overall growth, productivity and in-house R&D of the firm (Sharma and Mishra 2011; Amiti and Konings 2005). Although some studies have empirically explored this relationship for the Indian pharmaceutical industry and found a positive and significant impact of imported inputs on the R&D intensity at the firm level (Kumar and Pradhan 2003; Basant and Fikkert 1996), yet what constitutes pharmaceutical imports may help to identify the mechanism through which it happens. For instance, around 90 % of the imports in this industry constitute bulk drugs and intermediaries (Kallumal and Bugalya 2012) which serve the basis for formulations preparations. Thus import constitutes primary/intermediary materials needed for the manufacturing of the end products. In such a case, the increasing import intensity, at least in the case of drug and pharmaceutical industry, may reduce the need to carry out R&D, especially if the firm is operating in the domain of branded generic drugs. Given the fact that the import of capital equipment is an infrequent phenomenon, it is also unlikely to exercise any significant impact on the R&D decision making and actually implementing the decisions to that effect. Nevertheless, basing upon prior art, it is hypothesized that import intensity may have a positive impact on R&D intensity.

3.2.3.7 Past innovative output

The past innovative output, which can largely be termed as intangible asset accumulation is expected to determine R&D intensity as it not only suggests the innovation orientation of the firm but the environment for its appropriability i.e., strong patent protection. Further, the possibility of a firm to continue with the innovations rises once the company is already into it and is operating in a sturdy competitive business environment. For a research-intensive industry, effective IPRs protection is critical for funding huge amount of R&D expenditure as the industry is highly R&D intensive and patents of chemical compounds play a crucial role in terms of encouraging developments of new drugs (Tyagi et al. 2014; Brekke and Straume 2009; Correa 2004). It may, nevertheless, be pointed out that the mere acquisition of the patents does not reflect the innovativeness of the firm, as an overwhelming proportion of the patents granted in any year never turn into commercial applications (Pakes 1986; Pakes and Schankerman 1984). Thus, the ‘development’ constituent, signifying the application part of the R&D activity (Arora and Ceccagnoli 2006; Barge-Gil and López 2011; Asheim and Coenen 2005), appears to be largely missing. Quite possibly, intellectual property is created to cash upon fringe benefits than materializing real applications. Another major limitation of the patent data arises from the fact that they fail to capture the wide heterogeneity in terms of their technological and economic values (Griliches et al. 1987). This limitation could have been overcome by considering citations of the patents, but for the estimation difficulties and data constraints on ‘citation stock’, especially for the very recent innovations, it could not be done.

So, as a proxy for innovative output, past PCT applications of a given firm registered in PATENTSCOPE which is a database of World Intellectual Property Organization (WIPO), are used in the model. Patents registered only with PATENTSCOPE, are used in order to avoid the possibility of double counting as the firms may get same patents registered with other national patent offices. It is hypothesized that a larger number of patents encourage the firm to undertake further R&D so as to maintain the competitive edge. One period past patent count has been taken as a proxy for past innovative output.

3.2.3.8 Overseas presence

The overseas presence of a firm, which could be either through greenfield investment or mergers and acquisitions or both, is expected to boost its R&D spending in order to adapt its products to the local demand. The prior art has found strong evidence of rise in R&D spending after the firm expanded overseas for the fact that such firms would be able to “garner better financial performance only if they increase their spending on intangibles after increasing their international presence” (Mitchell et al. 1993). Impact of firm’s overseas presence on R&D intensity is estimated by using the dichotomous variable, i.e., attributing the value of 1 for overseas presence, and 0 otherwise. However, to which extent, overseas presence impact the R&D intensity is far from conclusive evidences.

3.2.3.9 Leverage ratio

Financing of R&D investment depends upon firm’s financial resources and its’ profit generation. Debt can reduce the free cash flow difficulty indicated by Jensen (1986) that managers tend to go for empire building, but can also cause the overhang problem discussed in Myers (1997) that Companies with soaring debt face more difficulty to generate funds for new growth opportunities. R&D investment is part of firm’s survival strategy and it is often associated with lower leverage (Bradley et al. 1984; Titman and Wessels 1988; Chang and Song 2014). Lee and Choi (2015) found that debt has a negative impact over R&D investment of Korean Pharmaceutical firms as firms facing a financial risk are less interested in R&D investment due to financing cost and credit rating. Brown et al. (2009) state that young technology intensive firms may prefer equity financing for investing in R&D. Moreover gestation period of R&D investment is longer in pharmaceutical sector as compared to other technology intensive sectors such as information technology and automobiles. Returns are highly risky and unpredictable since molecules keep on failing in the pipe line. Hence, it is expected that financial leverage of the firm may impact R&D intensity of a pharmaceutical firm. Debt to equity ratio (LEV) taken as a proxy for financial leverage, is included in the model.

3.2.3.10 Cash flow

The relationship of R&D and cash flow originates from seminal work of Arrow (1962), which holds that high-risk prone and uncertain investment in technological innovation may come across the issue of grave “moral hazard” problem. R&D managers may prefer internal financing over external finances due to the limitations of insurance opportunities in such highly uncertain investment. The literature suggests that by preferring internal financing, the management intends to secure the interest of existing shareholders in presence of information asymmetry (Myers and Majluf 1984; Lee and Choi 2015). Studies on firm level investment behavior validates the hypothesis that the cost of internal funds is lesser than new debt and equity financing due to the higher cost of external fund (Grabowski and Vernon 2000). Researchers have found a positive relationship between cash flow and R&D investment in the case of pharmaceutical industry since R&D investment is highly risky, uncertain and returns can be expected after a long gestation period (Grabowski and Vernon 2000; Vernon 2005; Simanjuntak and Raymond 2005; Malmberg 2008; Lee and Choi 2015). Thus, in this study, we assume the relationship between firm’s R&D spending and past year cash flow (LCFS) to be positive.

3.2.4 Estimation procedure

Descriptive statistics of all variables have been presented in Table 8. As could be discerned from the descriptive statistics, there is a wide heterogeneity among the sample units with respect to almost all the variables.

Before proceeding to the estimation of econometric models, it would be pertinent to check for the non-stationarity of the panel of 1098 firm-year observations, and the results are presented in Table 9. As revealed, the Phillips–Perron test statistics and Augmented Dickey Fuller estimates reject the null hypothesis of absolute non-stationarity of data for all variables.

Further, variance inflating factors (VIF) have been computed for detecting multicollinearity in the data variables. All the variables except firm size, cash flow and market share have been found to be non-collinear with VIFs below 2 (see Table 10). To resolve the problem of collinearity between the firm size and market share and their quadratic terms, these quadratic terms have been taken after demeaning the firm size and market share, and squaring the demeaned value, respectively. The demeaning normalizes the data, and makes firm size, market share and their respective squared terms orthogonal (Majumdar 1998). High VIF values are found for firm size, cash flow and market share variables, when all the variables were tested together, so VIF have been re-estimated after dropping collinear variables. It can be seen here that all VIFs are below 4 and are nowhere near to the rule of thumb for models 1–4, so the presence of strong collinearity is not detected.

Next, two alternative econometric models have been estimated to investigate the determinants of R&D intensity. Model 1 excludes MSH and MSHSQ variables and model 2 drops LFSZ and FSZSQ variables. The estimation of these different models was necessitated by high degree of multicollinearity among the independent variables.

Both the models are specified as below:

Both the above stated models have been estimated using random-effects panel Tobit model. Following Goldar (2013), the models have been estimated after introducing the yearly time dummies to allow the intercept to vary over the time. Table 6 depicts estimated coefficients of all the estimated variables for RE Tobit estimation while Table 7 shows regressions coefficients for OLS estimation. Two types of marginal effects, in McDonald- Moffitt Decomposition framework, which are directly and effectively interpretable, have been presented in Tables 6. The reported Chi square statistics for all models depict that the estimated models are statistically significant.

4 Empirical results

The empirical results are presented in Table 6. The significance and performance of individual independent variables are discussed below.

The relationship between firm size and R&D activity is observed to be nonlinear for the sample firms. LFSZ is negatively related to R&D intensity and significant at 5 %. This finding is contrary to earlier studies which suggested that the size of the firm is directly related to R&D intensity as larger firms have scale-economy advantages and greater resources to invest in R&D (Kumar and Saquib 1996; Pradhan 2003). Other things being equal, an increase in firm size decreases R&D intensity as well as probability to be engaged in R&D activity. The quadratic term of firm size i.e., FSZSQ appeared to have made positive yet insignificant impact on firm level R&D intensity. The increase in the R&D intensity with firm size suggests that firms are investing more across different therapeutic classes in order to diversify their R&D portfolios. For instance, the R&D portfolio of some of the largest selling firms of ID&PI such as Cipla Ltd. which is involved in investing R&D across more than 10 therapeutic classes ranging from basic categories pediatrics and tropical diseases to highly specialized classes like oncology and HIV-AIDS. Similarly, Ranbaxy Ltd., Sun Pharmaceuticals, Lupin Ltd. and Cadila Healthcare, etc. have also invested in R&D across several therapeutic areas. The results further indicate that marketing and advertising gets far more allocation of resources, as compared to R&D, only up to a threshold level of a firm’s size. After crossing that threshold, it is R&D which gets more attention and allocation of resources.

MSH and its quadratic term MSHSQ are positively related to R&D spending decision for Indian pharmaceutical firms, but the relationship is an insignificant one. This unexpected result is consistent with the other study which found only significant relationship between market share and R&D when market share is measured as number of employees rather than sales revenue (Sanyal and Vancauteren 2014). Earlier studies also conclude that R&D intensity can be expected to increase with market share, but level off and may fall when a firm captures the whole market as monopolist (Nord 2011).

Firm age is insignificantly and positively related to RDI in all models. This finding is consistent with the theory that age contributes to accumulate learning which reflects in increased R&D intensity for the probability that older firms in the industry may have the competitive advantages of technological learning and experience in doing R&D, as compared to new entrants. However, this relationship is insignificant, so firm age is not of much importance while determining firm’s R&D investment decision.

ROA lagged by 1 year bears a strongly positive and significant impact on a firm’s decision to undertake R&D. It appears that the internal resource generation of a firm significantly increases both the probability of R&D activity and R&D intensity of Indian pharmaceutical companies, as also reported by earlier research studies (Pradhan 2003, 2010). The appropriateness from the success of R&D investment generally encourages firms to conduct R&D activities. The rise in profit via realized huge revenues provides a stimulus to managers who expect rising profits from R&D investment to expand their R&D activities (Lee and Hwang 2003).

The role of export intensity is found to be significantly favorable for the sample firms in all models. From McDonald–Moffitt decomposition of marginal effects, it can be seen that an increase in export intensity of firms impacts R&D active firms more than the firms which may have the probability to go for R&D investment. This finding is consistent with earlier findings that exporting firms learn to be more innovative and efficient as they have information inflow from their foreign activities (Pradhan 2003; Salmon and Shaver 2005; Silva et al. 2013). It has also been reported that the exploration and diversification of global markets significantly increase the need for technological inputs of the enterprise resulting in the intensity of investments in R&D (Kumar and Saqib 1996). Thus, the exporting Indian pharmaceutical firms are exposed to knowledge inputs about diseases and drug efficacy which are not available to firms whose operations are confined to the domestic market. Therefore, competing in the foreign market allows exporting pharmaceutical firms to connect to global patients’ base and technological information.

The firms with higher import intensity remain negative yet significantly related to R&D intensity. Import intensity negatively impacts both the probability of R&D activity and R&D intensity of firms in the ID&PI. Generally, imported raw materials and intermediaries help in expanding the scale, breadth, and penetration of export markets (Feng et al. 2012). Since export orientation appears to have significantly and positively impacted the R&D intensity, it is reasonable to assume that higher import intensity may also exercise positive impact on this variable via export intensity. It appears that the firms, which are extensively importing, have lower technological and financial capabilities, and therefore, rely more on imports, the bulk of which comprise Active Pharmaceutical Ingredients (APIs) and other intermediaries for meeting their upgradation requirements. Imports of technology and capital equipment are very low and irregular events.

Past innovative output influences R&D intensity positively and significantly in Models 1 and appears as a prominent factor affecting both R&D intensity and probability to be engaged in R&D activity. This finding of positive relationship of past innovation and R&D investment decision is also consistent with a study of firm level R&D behavior in the Netherlands’ pharmaceutical industry (Sanyal and Vancauteren 2014). Persistence of innovation is evident from the result. It supports the view that a firm having had initiated the R&D, generally intends to and actually continue with it probably for the fact that they realize commercial benefits of innovations. In the case of Indian firms, sale of newly discovered molecules, incremental value addition to existing products, and efforts to meet the FDA, and other norms of regulated markets, etc. keep pushing them in the arena of research. Once a firm has secured intellectual property rights, it may have the incentive to further invest in order to commercialize the protected invention/innovation.

Overseas presence dummy exhibits a positive and significant relationship with RDI in Models 2. It implies that the firms, which have an active overseas presence, increased their R&D spending. The R&D probability of firms is also increased as evidenced from McDonald–Moffitt decomposition. Globally active firms invest in higher R&D to incessantly advance their competitiveness and credibility in the global pharma landscape. It also indicates towards R&D, undertaken by Indian firms, moving more towards competing with the industry leaders, but in limited range either, in process R&D or adding incremental value to the off-patent drugs. Knowledge spillover from the overseas exposure also incentivizes such firms to invest in further knowledge creation.

A negative and significant relationship between R&D investment and leverage ratio is found in the Indian pharmaceutical firms. This finding is consistent with existing studies on the relationship R&D investment and financial structure variables (Bradley et al. 1984; Titman and Wessels 1988; Baysinger and Hoskisson 1989; Hsieh et al. 2003; Chang and Song 2014). The firms with lower debt tend to be more innovative (Jordan et al. 1998; O’brien 2003). Pharmaceutical R&D investment faces high degree of risk and uncertainty along with a long gestation period, so equity financing is preferred over debt because debt increasing financing costs. Apart from problem of financing costs, potential loan defaults also contribute in decline of firm-level pharmaceutical R&D investment (Lee and Choi 2015).

Past year cash flow is found positively and significantly associated with R&D investment, as consistent with extant literature. Firm’s internal funding sources are considered as an important determinant of R&D and the positive sign adds up to the evidence to the effect that cash flow has positive impact on the R&D expenditure. This finding implies that due to high adjustment costs of R&D investment, internal finances are very important for firm to invest in R&D activities. High cost of external debt and difficulty in availing external debt for R&D investment due to high risks and uncertainties involved, also incentivize the mangers to prefer internal funds to external debts. This finding is in conformity with the findings of earlier studies (Mulkay et al. 2001; Bougheas et al. 2003; Bloch 2005; Hall and Lerner 2009; Pindado et al. 2010).

The empirical analysis undertaken in this paper indicates that firm’s size; past profits; past innovative capacity; export and import intensities; stronger patent regime and past cash flow are important determinants of pharmaceutical R&D.

4.1 Year effects

For the regression results presented in Table 6 (I) and the coefficients of the yearly dummies for the model 1 and 2 are reported in Table 6 (II). The year 2000–2001 has been taken as the base year. The estimated coefficients indicate that the yearly effects caused R&D Intensity to go up from 2002–2003 to 2004–2005, after which a see-saw kind of pattern is conspicuous. It appears that ‘yearly effects’ explain a significant part of the increase in R&D intensity during the years 2005–2006, 2006–2007, 2008–2009, 2011–2012 and 2012–2013. It appears that time period started playing a significant role post TRIPS act, 2005.

4.2 Robustness checks

Following the RE Tobit estimation, an additional robustness check is also conducted to test the validity of our estimation strategy. In order to investigate, whether or not the estimation is sensitive to autocorrelation and heteroscedasticity, both the models 3 and 4 are estimated by applying firm fixed effects. This model is employed to remove the potential misspecifications and omitted variable bias. Standard errors were clustered at firm level. Results from fixed effects estimations are presented in Table 7.

Model 3 and model 4 have been employed to run the fixed effects:

Table 7 depicts that estimated coefficients of fixed effects OLS model are similar in direction and significance with RE Tobit model, though their magnitude vary, however the data used in present study forms an unbalanced panel and RE Tobit model is relevant and significant for our analysis.

5 Conclusions and policy implications

This paper contributes to the empirical literature by improving our understanding of R&D determinants in the context of the Indian drug and pharmaceutical industry. The study employs a random-effects panel Tobit model to investigate the factors explaining the R&D intensity (RDI) of the top 91 domestic firms in the Indian D&P industry. The study period spans from 2000 to 2013. The empirical results reveal that firm’s size, export intensity; past R&D output, past year profitability; import intensity and leverage ratio are important variables that influence firm’s R&D activities, although they differ in terms of direction of influence and strength. The firm’s size is found to have negatively impacted R&D intensity which appears to be in sharp contrast to Schumpeterian wisdom. The R&D activity of the Indian pharmaceutical firms appears to be systematically affected by the imports of technology/capital goods and export orientation as both variables turned out to be significant determinants of in-house R&D. Past year profit seemed to have acted as a facilitating cash fund to invest in R&D and also as an incentive to increase R&D while higher leverage ratio appear to discourage managers to invest in R&D. Past innovative capacity has also demonstrated to have worked in favour of Indian pharmaceutical firms. On the ground, Indian pharmaceutical firms have been either been selling their patented molecules to big MNCs or undertaking contract research for them. These motives have also appeared to have worked behind increased investment in R&D.

The analysis has a number of important applications. In particular, it provides new insights by estimating the impact of firm’s overseas presence, past innovation count, and stronger patent regime dummy on firm’s R&D investment behaviour. By using the recent dataset, this study analyses the broader time period after the introduction of the product patent regime, and captures the shift in the R&D scenario. It presents a conceptual framework to analyze the effects of the proposed managerial policy actions on the R&D investment decision. Large size does not necessarily give competitive advantage to a firm for conducting R&D. It would follow from this that firms may start up new small R&D subsidiaries to focus on drug discovery and development. Smaller firms may start taking up generic R&D as it do not require a huge fixed R&D cost and smaller firms may be successful from the point of view of increasing R&D intensity. Information asymmetry resulted in liquidity being a more significant determinant factor than the stability of pharmaceutical firms. The research also highlights the major role that the firm’s own innovative output plays in the pharmaceutical R&D investment. It may follow from this that acquiring patent rights may produce high returns in terms of strengthening R&D capabilities. Besides owning patent rights, export orientation and overseas presence of the Indian pharmaceutical firms also facilitate R&D intensity through knowledge spillover. Therefore, a liberal foreign trade policy towards facilitating pharmaceutical exporters would help in enhancing the R&D capabilities which will lead towards increased R&D expenditure. Future research could focus on some approaches which are not considered in this study. First, the additional variables, including the impact of mergers and acquisitions and the type of R&D activities taken by the firm may be considered in analyzing the R&D investment behaviour. Second, bivariate causal relationships between R&D and past profitability, and R&D and exports may also be examined. Future studies may also analyze the differences in strategic and marketing approaches of R&D active and non R&D active firms in Indian pharmaceutical sector.

Notes

It aims to provide a therapeutic amount of drug to the appropriate site in the body to accomplish promptly and then maintain the desired drug concentration. This drug delivery system improves drug potency, control drug release to give a sustained therapeutic effect, provide greater safety.

DRF-2725 (NN622) was a peroxisome proliferator-activated receptor alpha and gamma agonist which, according to Dr Reddy's, has shown potential to regulate these parameters and thereby blood glucose and diabetic dysplasia. This molecule failed after it has been out-licensed.

DRF- 4148 was a anti-diabetic compound, which was out-licensed to Novartis in 2001. It also failed during further development.

RBX 2258 (pamirosin) was being developed for the treatment of benign prostate hyperplasia by Ranbaxy. Ranbaxy later out-licensed it to the German firm Schwarz Pharma which stopped Phase II trials of RBX 2258.

ANDA is an application for a U.S. generic drug approval for an existing licensed medication or approved drug.

DMF is a submission to the Food and Drug Administration, that may be used to provide confidential detailed information about facilities, processes, or articles used in the manufacturing, processing, packaging, and storing of one or more human drugs.

It is a molecule developed by the innovator company in the early drug discovery stage, which after undergoing clinical trials could translate into a drug that could be a cure for some disease.

References

Abbott TA, Vernon JA (2007) The cost of US pharmaceutical price regulation: a financial simulation model of R&D decisions. Manag Decis Econ 28:293–330

Abdelmoula M, Etienne JM (2010) Determination of R&D investment in French firms: a two-part hierarchical model with correlated random effects. Econ Innov New Technol 19(1):53–70

Abrol D, Prajapati P, Singh N (2011) Globalization of the Indian pharmaceutical industry: implications for innovation. Int J Inst Econ 3(2):327–365

Acs ZJ, Audretsch DB (1987) Innovation, market structure, and firm size. Rev Econ Stat 69(4):567–574

Amiti M, Konings J (2005) Trade liberalization, intermediate inputs, and productivity: evidence from Indonesia. Am Econ Rev 97(5):1611–1616

Arora A, Ceccagnoli M (2006) Patent protection, complementary assets, and firms' incentives for technology licensing. Manag Science 52(2):293–308

Arrow K (1962) Economic welfare and the allocation of resources for invention. In: The rate and direction of inventive activity: economic and social factors. Princeton University Press, New Jersy, USA, pp 609–626

Asheim BT, Coenen L (2005) Knowledge bases and regional innovation systems: comparing nordic clusters. Res Policy 34(8):1173–1190

Austin DH (2006) Research and development in the pharmaceutical industry. Congressional Budget Office, USA

Barge-Gil A, López A (2011) R versus D: estimating the differentiated effect of research and development on innovation results. MPRA Paper: 29083, Munich Personal RePEc Archive, Germany. RePEc:pra:mprapa:41270. Accessed Aug 2013

Basant R, Fikkert B (1996) The effects of R&D, foreign technology purchase, and domestic and international spillovers on productivity in Indian firms. Rev Econ Stat 78(2):187–199

Baum CF, Caglayan M, Talavera O (2013) R&D expenditures and geographical sales diversification. Rev Int Econ 8(1):459–474

Baysinger B, Hoskisson RE (1989) Diversification strategy and R&D intensity in multiproduct firms. Acad Manag J 32(2):310–332

Bhagwat Y, DeBruine M (2011) R&D and advertising efficiencies in the pharmaceutical industry. Int J Appl Econ 8(1):55–65

Bhat S, Narayanan K (2006) Technological Strategies and Exports: A study of Indian Basic Chemical Industry. http://hdl.handle.net/1853/35996. Accessed July 2014

Bhat S, Narayanan K (2011) Technology sourcing and outward FDI: comparison of chemicals and IT industries in India. Trans Corp Rev 3(2):50–64

Bloch C (2005) R&D investment and internal finance: the cash flow effect. Econ Innov New Technol 14:213–223

Bloom PN, Kotler P (1975) Strategies for high market-share firms. Harv Bus Rev 53(6):63–72

Blundell R, Griffith R, Reenen JV (1999) Market share, market value and innovation in a panel of british manufacturing firms. Rev Econ Stud 66(3):529–554

Bougheas S, Görg H, Strobl E (2003) Is R&D financially constrained? Theory and evidence from Irish manufacturing. Rev Ind Organ 22:159–174

Bradley M, Gregg AJ, Kim E (1984) On the existence of an optimal capital structure: theory and evidence. J Finance 39(3):857–878

Brekke KR, Straume OR (2009) Pharmaceutical patents: incentives for research and development or marketing? South Econ J 76:351–374

Brown JR, Fazzari SM, Petersen BC (2009) Financing innovation and growth: cash flow, external equity, and the 1990s R&D boom. J Finance 64(1):151–185

Chan LKC, Lakonishok J, Sougiannis T (2001) The stock market valuation of research and development expenditures. J Finance 56(6):2431–2457

Chang H, Song FM (2014) R&D investment and capital structure. http://www.efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEETINGS/2014Rome/papers/EFMA2014_0145_fullpaper.pdf

Chaturvedi K, Chataway J (2006) Strategic integration of knowledge in Indian pharmaceutical firms: creating competencies for innovation. Int J Bus Innvov Res 1(1):27–50

Chaudhuri S, Park C, Gopakumar KM (2010) Five years into the product patent regime: India’s response. United Nations Development Program, New York

Cohen WM (2010) Fifty years of empirical studies of innovative activity and performance, In: Hall B, Rosenberg N (ed) Handbook of the economics of innovation, 1st edn. Elsevier, North-Holland, pp 129–213

Congressional Budget Office (2006) Research and development in the pharmaceutical industry. USA. https://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/76xx/doc7615/10-02-drugr-d.pdf. Accessed July 2011

Correa CM (2004) Ownership of knowledge: the role of patents in pharmaceutical R&D. World Health Organ 8(10):784–787

Davies SW, Rondi L (1996) Intra-EU multinationality of industries. In: Davies SW, Lyons BR (eds) European union structure, strategy and the competitive mechanism. Oxford University Press, Oxford

Department of Pharmaceuticals (2010) Annual report-2009–10. Ministry of Chemistry and Fertilizers, Government of India

Eberhart AC, Maxwell WF, Sidique AR (2004) An examination of long-term abnormal stock returns and operating performance following R&D increases. J Finance 59(2):623–650

Ettlie JE (1998) R&D and global manufacturing performance. Manag Sci 44(1):1–11

European Commission (2014) The 2014 EU industrial R&D investment scoreboard: 60–62. http://iri.jrc. ec.europa.eu/scoreboard14.html

European Federation of Pharmaceutical Industries and Associations (EFPIA) (2013) The pharmaceutical industry in figures. Brussels, Belgium. http://www.efpia.eu/uploads/Figures_Key_Data_2013.pdf. Accessed July 2013

Feng L, Li Z, Swenson DL (2012) The connection between imported intermediate inputs and exports: evidence from Chinese firms. IAW Discussion Papers 86. Tübingen Germany. ftp://ftp.repec.org/opt/ReDIF/RePEc/iaw/pdf/iaw_dp_86.pdf, Accessed 18 May 2015

Food and Drug Administration (2004) Innovation or stagnation: challenge and opportunity on the critical path to new medical products. Government of USA

Greene W (2004) The behaviour of the maximum likelihood estimator of limited dependent variable models in the presence of fixed effects. Econ J 7(1):98–119

Goldar B (2013) R&D intensity and exports: a study of Indian pharmaceutical firms. Innov Dev 3(2):151–167

Grabowski H, Vernon JA (2000) The determinants of pharmaceutical research and development expenditures. J Evol Econ 10:201–205

Griliches Z, Pakes A, Hall BH (1987) The value of patents as indicators of inventive activity. In: Dasgupta P, Stoneman P (eds) Economic Policy and Technological Performance. Cambridge University Press, Cambridge, pp 97–124

BH Hall, Lerner J (2009) The financing of R&D and innovation, Working Paper 15325 http://www.nber.org/papers/w15325, National Bureau of Economic Research 1050, Cambridge, MA 02138

Hsiao C (2003) Analysis of panel data. Cambridge University Press, Cambridge

Hsieh PH, Mishra CS, Gobeli DH (2003) The return on R&D versus capital expenditures in pharmaceutical and chemical industries. Eng Manag 50(2):141–150

Hussinger K (2008) R&D and subsidies at the firm level: an application of parametric and semiparametric two-step selection models. J Appl Econom 23(6):729–747

Jensen MC (1986) Agency cost of free cash flow, corporate finance, and takeovers. Corporate finance, and takeovers. Am Econ Rev 76(2):323–329

Jordan J, Lowe J, Taylor P (1998) Strategy and financial policy in UK small firms. J Bus Finance Account 25(1–2):1–27

Joseph RK (2011) The R&D scenario in Indian pharmaceutical industry. Research and information system for developing countries, New Delhi. http://ris.org.in/images/RIS_images/pdf/dp176_pap.pdf. Accessed May 2011

Kallumal M, Bugalya K (2012) Trends in India’s trade in pharmaceutical sector: some insights. Centre for WTO Studies, Indian Institute of Foreign Trade, New Delhi. http://wtocentre.iift.ac.in/workingpaper/Working%20Paper2.pdf, Accessed June 2013

Kumar N, Budhwaar V (2015) Dynamics of drug master filings at United States Food and Drug Administration. World J Pharm Pharm Sci 4(4):424–435

Kumar N, Pradhan JP (2003) Export competitiveness in the knowledge-based Industries: a firm-level analysis of Indian manufacturing. RIS discussion paper no. 43, Research and Information System for Developing Countries, New Delhi

Kumar N, Saqib M (1996) Firm size, opportunities for adaptation and in-house R&D activity in developing countries: the case of Indian manufacturing. Res Policy 25(5):713–722

Kumar N, Siddharthan NS (1994) Technology, firm size and export behavior in developing countries: the case of Indian enterprises. J Dev Stud 31(2):289–309

Kwon HU, Inui T (2013) What determines R&D intensity? Evidence from Japanese manufacturing firms. http://home.sogang.ac.kr/sites/sgrime/journal/Lists/b6/Attachments/671/JOME_V42_1_2.pdf. Accessed Jan 2014

Lall S (1986) Technological development and export performance in LDCs: leading engineering and chemical firms in India. Rev World Econ 122(1):80–92

Lee M, Choi M (2015) The determinants of research and development investment in the pharmaceutical industry: focus on financial structures. Osong Public Health Res Perspect 6(5):302–309

Lee MH, Hwang IJ (2003) Determinants of corporate R&D investment: an empirical study comparing Korea’s IT industry with its non-IT industry. ETRI J 25(4):258–265

Lev B, Sougiannis T (1996) The capitalization, amortization and value-relevance of R&D. J Account Econ 21:107–138

Mahajan V, Nauriyal DK, Singh SP (2015) Trade performance and revealed comparative advantage of Indian pharmaceutical industry in new IPR regime. Int J Pharm Healthc Mark 9(1):56–73

Mahlich JC, Roediger-Schluga T (2006) The determinants of pharmaceutical R&D expenditures: evidence from Japan. Rev Ind Organ 28(2):145–164

Mairesse J, Robin S (2008) Innovation and productivity: a firm-level analysis for French manufacturing and services using CIS3 and CIS4 data (1998–2000 and 2002–2004). Paper presented at the DRUID conference, in Copenhagen, Denmark. http://www2.druid.dk/conferences/viewpaper.php?id=3604&cf=29. Accessed Aug 2012

Majumdar SK (1998) Assessing comparative efficiency of the state-owned mixed and private sectors in Indian industry. Public Choice 96(1–2):1–24

Malmberg C (2008) R&D and financial systems: the determinants of R&D expenditures in the Swedish pharmaceutical industry. CIRCLE Electronic Working Paper Series. http://www2.druid.dk/conferences/viewabstract.php?id=2999&cf=29. Accessed Aug 2011

Matraves C (1999) Market structure, R&D and advertising in the pharmaceutical industry. J Ind Econ 47(2):169- 194

Mazumdar M (2012) Performance of pharmaceutical companies in India: a critical analysis of industrial structure, firm specific resources, and emerging strategies. Springer, Berlin

McDonald JF, Moffitt RA (1980) The uses of Tobit analysis. Rev Econ Stat 62(2):318–321

Mitchell W, Shaver JM, Yeung B (1993) Performance following changes of international presence in domestic and transition industries. J Int Bus Stud 24(4):647–669

Mulkay B, Hall BH, Mairesse J (2001) Investment and R&D in France and in the United States. In: Herrmann H, Strauch R (eds) Investing today for the world tomorrow. Springer, New York

Myers S (1997) Determinants of corporate borrowing. J Fin Econ 5:147–175

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Fin Econ 13(2):187–221

Nath P (1993) Firm size and in-house R & D: the Indian experience revisited. Dev Econ 31(3):329–344

Nauriyal DK, Sahoo D (2008) The new IPR regime and Indian drug and pharmaceutical industry: an empirical analysis. Paper Presented in EPIP Conference, Berne, Switzerland. http://www.epip.eu/conferences/epip03/papers/Nauriyal_EPIP%20Conference%202008.pdf. Accessed July 2011

Nord LJ (2011) R&D investment link to profitability: a pharmaceutical industry evaluation. Undergrad Econ Rev 8(1):Article 6. http://digitalcommons.iwu.edu/uer/vol8/iss1/6

O’brien JP (2003) The capital structure implications of pursuing a strategy of innovation. Strateg Manag J 24(5):415–431

Office of Technology Assessment (1993) Pharmaceutical R&D: costs, risks and rewards. Government printing office, Washington DC, USA. http://govinfo.library.unt.edu/ota/Ota_1/DATA/1993/9336.PDF. Accessed Aug 2011

Pakes A (1986) Patents as options: some estimates of the value of holding European patent stocks. Econometrica 54(4):755–784

Pakes A, Schankerman M (1984) The Rate of obsolescence of patents, research gestation lags, and the private rate of return to research resources. In: Griliches Z (ed) R&D, patents, and productivity. University of Chicago Press, Chicago, pp 73–88

Pindado J, De Queiroz V, De La Torre C (2010) How do firm characteristics influence the relationship between R&D and firm value? Financ Manag 39(2):757–782

Pradhan JP (2003) Liberalization, firm size and R&D performance: a firm level study of Indian pharmaceutical industry. Munich Personal RePEc Archive, Germany. http://mpra.ub.uni-muenchen.de/17079/1/MPRA_paper_17079.pdf. Accessed August 2012

Pradhan JP (2007) Trends and patterns of overseas acquisitions by Indian multinationals. Munich Personal RePEc Archive, Germany. http://mpra.ub.uni-muenchen.de/id/eprint/12404.pdf. Accessed Aug 2012

Pradhan JP (2010) R&D strategy of small and medium enterprises in India: trends and determinants. Munich Personal RePEc Archive, Germany. http://mpra.ub.uni-muenchen.de/id/eprint/20951.pdf. Accessed July 2012

Raymond W, Mohnen P, Palm F, der Loeff SS (2010) Persistence of innovation in Dutch manufacturing: is it spurious? Rev Econ Stat 92(3):495–504

Salmon RM, Shaver JM (2005) Learning by exporting: new insights from examining firm innovation. J Econ Manag Strategy 14(2):431–460

Sanguinetti P (2005) Innovation and R&D expenditures in Argentina: evidence from a firm level survey. Universidad Torcuato Di Tella, Department of Economics, Buenas Aires. http://www.crei.cat/activities/sc_conferences/23/papers/sanguinetti.pdf. Accessed July 2012

Sanyal S, Vancauteren M (2014) R&D and its determinants: a study of the pharmaceutical firms in the Netherlands. http://cit2014.sciencesconf.org/conference/cit2014/pages/Full_Paper_Shreosi_Sanyal.pdf

Scherer FM (2001) The link between gross profitability and pharmaceutical R&D spending. Health Aff 20(5):216–220

Scherer FM (2007) Pharmaceutical innovation. KSG working paper RWP07-004. Harvard University. http://ssrn.com/abstract=902395 or http://dx.doi.org/10.2139/ssrn.902395. Accessed July 2012

Scherer, FM (2011) R&D costs and productivity in biopharmaceuticals. Working Paper RWP11-046. John F. Kennedy School of Government, Harvard University. http://dash.harvard.edu/bitstream/handle/1/5688848/RWP11-046_Scherer.pdf?sequence=1. Accessed June 2013

Schumpeter JA (1942) Capitalism, socialism, and democracy. Harper and Brothers Publishers, New York

Scott J (1984) Firm versus industry variability in R&D intensity. In: Griliches Z (ed) R & D, patents, and productivity. University of Chicago Press, Chicago, pp 233–248

Sharma C, Mishra RK (2011) Does export and productivity growth linkage exist? Evidence from the Indian manufacturing industry. Int Rev Appl Econ 25(6):633–652

Siddharthan NS (1988) In-house R&D, imported technology, and firm size: lessons from Indian experience. Dev Econ 26(3):212–221

Silva A, Afonso O, Africano A (2013) Economic performance and international trade engagement: the case of Portuguese manufacturing firms. Int Econ Econ Policy 10(4):521–547

Simanjuntak DG, Raymond RT (2005) M&A of generic pharmaceutical companies increases productivity. http://ssrn.com/abstract=1946761. doi:10.2139/ssrn.194676