Abstract

This paper addresses the issue of model selection in the beta regression model focused on small samples. The Akaike information criterion (AIC) is a model selection criterion widely used in practical applications. The AIC is an estimator of the expected log-likelihood value, and measures the discrepancy between the true model and the estimated model. In small samples, the AIC is biased and tends to select overparameterized models. To circumvent that problem, we propose two new selection criteria, namely: the bootstrapped likelihood quasi-CV and its 632QCV variant. We use Monte Carlo simulation to compare the finite sample performances of the two proposed criteria to those of the AIC and its variations that use the bootstrapped log-likelihood in the class of varying dispersion beta regressions. The numerical evidence shows that the proposed model selection criteria perform well in small samples. We also present and discuss and empirical application.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In regression analysis, practitioners are usually interested in selecting the model that yields the best fit from a broad class of candidate models. Thus, model selection is of paramount importance in regression analysis. Model selection is usually based on model selection criteria or information criteria. The Akaike information criterion (AIC) (Akaike 1973) is the most well-known and commonly used model selection criterion. Several alternative criteria have been developed in the literature, such as the SIC (Schwarz 1978), HQ (Hannan and Quinn 1979) and AICc (Hurvich and Tsai 1989).

The AIC was proposed for estimating (minus two times) the expected log-likelihood. Using Taylor series expansion and the asymptotic normality of the maximum likelihood estimator Akaike showed that the maximized log-likelihood function is a positively biased estimator for the expected log-likelihood. After computing such bias, the author derived the AIC as an asymptotically approximated correction for the expected log-likelihood. In small samples, however, the AIC is biased and tends to select models that are overparameterized (Hurvich and Tsai 1989).

Several variants of the AIC have been proposed in the literature. The first correction of the AIC, the AICc, was proposed in Sugiura (1978) for linear regression models. Later, Hurvich and Tsai (1989) expanded the applicability of the AICc to cover nonlinear regression and autoregressive models. They showed that the AICc is asymptotically equivalent to the AIC, but usually delivers more accurate model selection in finite samples. Analytical corrections to the AIC, such as AICc, can be nonetheless difficult to obtain in some classes of models (Shibata 1997). The analytical difficulties stem from distributional and asymptotic results, as well as from certain restrictive assumptions. To circumvent analytical difficulties and to obtain more accurate corrections in small samples, bootstrap (Efron 1979) variants of the AIC were considered in the literature. They have been introduced and explored in different classes of models. See, for instance, Cavanaugh and Shumway (1997), Ishiguro and Sakamoto (1991), Ishiguro et al. (1997), Seghouane (2010), Shang and Cavanaugh (2008) and Shibata (1997), who introduced the criteria known as WIC, AICb, EIC, among other denominations. Such bootstrap extensions typically outperform the AIC in finite samples. In addition, as noted by Shibata (1997), they can be easily computed.

Both the AIC and its bootstrap variants aim at estimating the expected log-likelihood using a bias correction for the maximized log-likelihood. In this paper, we follow the approach introduced by Pan (1999) and propose an estimator for the expected log-likelihood that does not require a bias adjustment term. In particular, nonparametric bootstrap and cross-validation (CV) are jointly used in a criterion called bootstrapped likelihood CV (BCV). Using the parametric bootstrap and a quasi-CV method, we define a new AIC variant. It uses the bootstrapped likelihood quasi-CV (BQCV). We also propose a slight modification known as 632QCV.

Model selection criteria based on the bootstrapped log-likelihood have been explored and successfully applied to autoregressive models (Ishiguro et al. 1997), state-space models (Bengtsson and Cavanaugh 2006; Cavanaugh and Shumway 1997), mixed models (Shang and Cavanaugh 2008), linear regression models (Pan 1999; Seghouane 2010) and logistic and Cox regression models (Pan 1999). In this paper, we investigate model selection via bootstrap log-likelihood in the class of beta regression models. Such models were introduced by Ferrari and Cribari-Neto (2004) and are tailored for modeling responses that assume values in the standard unit interval, \((0,1)\), such as rates and proportions. We consider the class of varying dispersion beta regressions, as described in Simas et al. (2010), Ferrari and Pinheiro (2011) and Cribari-Neto and Souza (2012). It generalizes the fixed dispersion beta regression model proposed by Ferrari and Cribari-Neto (2004). The model has two submodels, one for the mean and another one for the dispersion.

The chief goal of our paper is twofold. First, we propose new model selection criteria for beta regressions and then we numerically investigate their finite sample performances in small samples. We also provide simulation results on alternative model selection strategies. The numerical evidence shows that the criteria we propose typically yield reliable model selection in the class of beta regression models. Even though our focus lies in beta regression modeling, the two model selection criteria we propose can be used in other classes of regression models.

This paper is organized as follows. In the next section, we introduce the AIC and its bootstrap extensions. We also propose two new model selection criteria. Section 3 introduces the class of beta regression models. In Sect. 4, we present Monte Carlo simulation results on model selection in fixed and varying beta regression models. An empirical application is presented and discussed in Sect. 5. Finally, some concluding remarks are offered in Sect. 6.

2 Akaike information criterion and bootstrap variations

The distance measure between two densities can be measured using the Kullback–Leibler (KL) information (Kullback 1968), also known as entropy or discrepancy (Cavanaugh 1997). The KL information can be used to select an estimated model which is closest to the true model. The AIC was derived by Akaike (1973) by minimizing the KL information. In what follows, we shall follow Bengtsson and Cavanaugh (2006) to formalize the notion of selecting a model from a class of candidate models.

Suppose the \(n\)-dimensional vector \(Y\) is sampled from an unknown density \(f(Y|\theta _{k_0})\), where \(\theta _{k_0}\) is a \(k_0\)-vector of parameters. The respective parametric family of densities is denoted by \(\mathcal {F}(k_i)=\left\{ f(Y|\theta _{k_i})|\theta _{k_i}\in \Theta _{k_i}\right\} \), where \(\Theta _{k_i}\) is the \(k_i\)-dimensional parametric space. Let \(\hat{\theta }_{k_i}\) be the maximum likelihood estimate of \(\theta _{k_i}\). It is obtained by maximizing \(f(Y|\theta _{k_i})\) in \(\Theta _{k_i}\), i.e., \(f(Y|\hat{\theta }_{k_i})\) is the maximized likelihood function.

Using the AIC, it is possible to select the model that best approximates \(f(Y|\theta _{k_0})\) from the class of families \(\mathcal {F}=\{\mathcal {F}(k_1), \mathcal {F}(k_2), \ldots \), \( \mathcal {F}(k_L)\}\). For notation simplicity, we will not consider different families in the class \(\mathcal {F}\) which have the same dimension. We say that \(f(Y|\hat{\theta }_k)\) is correctly specified if \(f(Y|\theta _{k_0})\in \ \mathcal {F}(k)\), where \(\mathcal {F}(k)\) is the smallest dimensional family that contains \(f(Y|\theta _{k_0})\). We say that \(f(Y|\hat{\theta }_k)\) is overspecified if \(f(Y|\theta _{k_0})\in \mathcal {F}(k)\), but families of smaller dimension also contain \(f(Y|\theta _{k_0})\). On the other hand, \(f(Y|\hat{\theta }_k)\) is underspecified if \(f(Y|\theta _{k_0})\notin \mathcal {F}(k)\).

The KL measure can be used to determine which fitted model (i.e., which model in the collection \(f(Y|\hat{\theta }_{k_1}), f(Y|\hat{\theta }_{k_2}), \ldots , f(Y|\hat{\theta }_{k_L})\)) is closest to \(f(Y|\theta _{k_0})\). The KL distance between the true model \(f(Y|\theta _{k_0})\) and the candidate model \(f(Y|\theta _k)\) is given by

where \(\mathrm{E}_0(\cdot )\) denotes expectation under \(f(Y|\theta _{k_0})\). Let

It is possible to show that \(2d(\theta _{k_0},\theta _k) = \delta (\theta _{k_0},\theta _k) - \delta (\theta _{k_0},\theta _{k_0})\). Since \(\delta (\theta _{k_0},\theta _{k_0})\) does not depend on \(\theta _k\) minimizing \(2d(\theta _{k_0},\theta _k)\) or \(d(\theta _{k_0},\theta _k)\) is equivalent to minimizing the discrepancy \(\delta (\theta _{k_0},\theta _k)\). Therefore, the model \(f(Y|\theta _{k})\) that minimizes minus two times the expected log-likelihood, \(\delta (\theta _{k_0},\theta _k)\), is the closest model to the true model according to the Kullback–Leibler information.

Notice that,

measures the distance between the true model and the estimated candidate model. However, it is not possible to evaluate \(\delta (\theta _{k_0},\hat{\theta }_k)\), since it requires knowledge of density \(f(Y|\theta _{k_0})\). Akaike (1973) used \(-2\log f(Y|\hat{\theta }_k)\) as an estimator for \(\delta (\theta _{k_0},\hat{\theta }_k)\). Its bias

can be asymptotically approximated by \(-2k\), where \(k\) is the dimension of \(\theta _k\).

Thus, the expected value of Akaike’s criterion,

is asymptotically equal to the expected value of \(\delta (\theta _{k_0},\hat{\theta }_k)\), which is given by

Notice that, \(-2\log f(Y|\hat{\theta }_k)\) is a biased estimator of minus two times the expected log-likelihood and the penalizing term of the AIC, \(2k\), is an adjustment term for the bias given in (2).

Since the AIC is based on a large sample approximation, it may perform poorly in small samples (Bengtsson and Cavanaugh 2006). Several variants of the AIC were developed aiming at delivering more accurate model selection in small samples. Sugiura (1978) developed the AICc, which in class of linear regression models is an unbiased estimator of \(\Delta (\theta _{k_0},k)\), that is, \(\mathrm{E}_0\left\{ \mathrm{AICc}\right\} =\Delta (\theta _{k_0},k)\). Based on the results obtained by Sugiura (1978), Hurvich and Tsai (1989) extended the use of the AICc to cover nonlinear regression and for autoregressive models. The authors showed that the AICc is asymptotically equivalent to the AIC, i.e., \(\mathrm{E}_0\left( \mathrm{AICc}\right) + o(1)=\Delta (\theta _{k_0},k)\), and typically outperforms the AIC in small samples.

According to Cavanaugh (1997), the advantage of AICc over the AIC is that the former estimates the expected discrepancy more accurately than the latter. On the other hand, a clear advantage of the AIC over the AICc is that the AIC is universally applicable, regardless of the class of models, whereas the AICc derivation is model dependent.

2.1 Bootstrap extensions of AIC

Bootstrap extensions of AIC (EIC) are criteria that use bootstrap estimators for the bias term \(B\) given in (2). They typically include a bias estimate which is more accurate than \(-2k\) in small samples, thus leading to more reliable model selection. In what follows, we shall use five different bootstrap estimators, \(B_i\) (\(i=1,\ldots ,5\)) for \(B\). The bias estimator \(B_i\) defines five bootstrap extensions of AIC which we denote by \(\mathrm{EIC}i\), \(i=1,\ldots ,5\). The bootstrap variants of the AIC that we shall use for model selection in the class of beta regressions have the following form:

Let \(Y^*\) be a bootstrap sample (generated either parametrically or nonparametrically) and let \(\mathrm{E}_*\) denote the expected value with respect to distribution of \(Y^*\). Consider \(W\) bootstrap samples \(Y^*(i)\) and the corresponding estimates of \(\hat{\theta }_k\): \(\left\{ \hat{\theta }^*_k(i)\right\} \), \(i=1,\,2,\,\ldots ,\,W\). Here, each estimate \(\hat{\theta }^*_k(i)\) is the value of \(\theta _k\) that maximizes the likelihood function \(f(Y^*(i)|\theta _k)\).

Ishiguro et al. (1997) proposed a bootstrap extension of the AIC known as the EIC. It is a particular case of the WIC Ishiguro and Sakamoto (1991) obtained considering independent and identically distributed (i.i.d.) observations. We shall refer to such a criterion as \(\mathrm{EIC1}\). It estimates the bias in (2) as

A different bootstrap-based criterion was proposed in Cavanaugh and Shumway (1997) for the selection of state-space models; we shall refer to it as \(\mathrm{EIC2}\). The criterion estimates the bias in (2) as

We note that \(\mathrm{EIC1}\) and \(\mathrm{EIC2}\) are called AICb1 and AICb2, respectively, in Shang and Cavanaugh (2008) in the context of mixed models selection based on the parametric bootstrap.

Shibata (1997) showed that \(B_1\) and \(B_2\) are asymptotically equivalent and proposed the following three bootstrap estimators of (2):

We shall refer to the corresponding criteria as \(\mathrm{EIC3}\), \(\mathrm{EIC4}\) and \(\mathrm{EIC5}\).

Seghouane (2010) proposed corrected versions of the AIC for the linear regression model as asymptotic approximations to \(\mathrm{EIC1}\), \(\mathrm{EIC2}\), \(\mathrm{EIC3}\), \(\mathrm{EIC4}\) and \(\mathrm{EIC5}\) obtained using the parametric bootstrap.

2.2 Bootstrapped likelihood and cross-validation

The model selection criteria described so far aim at estimating the expected log-likelihood using a bias correction for the maximized log-likelihood function. Pan (1999), however, tried to obtain an estimator for the expected log-likelihood that does not require a bias adjustment. It uses cross-validation (CV) and bootstrap.

CV is widely used for estimating the error rate of prediction models (Efron 1983; Efron and Tibshirani 1997). In the context of model selection, according to Davies et al. (2005), the first CV-based criterion was the PRESS (Allen 1974). Bootstrap-based model selection was introduced by Efron (1986). Breiman and Spector (1992) and Hjorth (1994) discuss the use of CV and bootstrap in model selection.

According to Efron (1983) and Efron and Tibshirani (1997), CV typically reduces bias, but leads to variance inflation. Such variability can be reduced using the bootstrap method. In the context of model selection of models, Pan (1999) introduced a method that combines nonparametric bootstrap and CV: the bootstrapped likelihood CV (BCV). BCV yields an estimator of (1) that does not entail bias correction. For a sample \(Y\) of size \(n\), the BCV is defined by

where \(Y^*\) is the bootstrap sample generated nonparametrically, \(Y^-\! = Y\!-\!Y^*\), that is, \(Y=Y^- \!\cup Y^*\) and \(Y^- \! \cap Y^* \!= \emptyset \), and \(m^*\!>0\) is the number of elements of \(Y^-\). Thus, no observation of \(Y\) is used twice: each observation either belongs to \(Y^*\) or to \(Y^-\).

Following Efron (1983), Pan (1999) argues that the BCV can overestimate (1) and, on the other hand, \(-2\log f(Y|\hat{\theta }_k)\) may underestimate it. Thus, following the 632+ rule Efron and Tibshirani (1997), Pan (1999) introduces the 632CV criterion as

2.3 Proposed bootstrapped likelihood quasi-CV

We shall now introduce two new model selection criteria of models that incorporate corrections for small samples. Like the BCV, these criteria provide direct estimators for the expected log-likelihood.

Let \(F\) be the distribution function of the observed sample \(Y=(y_1,\dots ,y_n)\) and let \(\hat{F}\) be the estimated distribution function, i.e., \(\hat{F}\) is the distribution function \(F\) evaluated at the estimative \(\hat{\theta }\). We define

Suppose, we have \(W\) pseudo-samples \(Y^*_p\) obtained from \(\hat{F}\) and let \(\{\hat{\theta }^{p*}_k(i),\, i=1,2,\ldots ,W\}\) denote the set of \(W\) bootstrap replications of \(\hat{\theta }_k\). We define the bootstrapped likelihood quasi-CV (BQCV) criterion as follows:

where \(\mathrm{E}_{p*}\) is the expected value with respect to the distribution of \(Y^*_p\).

It follows from the strong law of large numbers that

where \(\xrightarrow {a.s.}\) denotes almost sure convergence.

The computation of BQCV can be performed as follows:

-

1.

Estimate \(\theta \) using the sample \(Y=(y_1,\ldots ,y_n)\);

-

2.

Generate \(W\) pseudo-samples \(Y^*_p\) from \(\hat{F}\);

-

3.

For each \(Y^*_p(i)\), \(i=1,\ldots ,W\), compute \(\hat{\theta }^{p*}_k(i)\) and \(-2\log f(Y|\hat{\theta }_k^{p*}(i))\);

-

4.

Using the \(W\) replications of \(-2\log f(Y|\hat{\theta }_k^{p*})\) compute

Based on pilot simulations, we recommend using \(W=200\).

The algorithm outlined above is not a genuine cross-validation scheme, hence the name quasi-CV. It is not a genuine cross-validation scheme because it does not partition the sample \(Y\), but instead it treats the samples \(Y^*_p\) and \(Y\) as partitions of the same data set. In each bootstrap replication, we use a procedure which is similar to the twofold CV. Here, the training sample is the pseudo-sample of the parametric bootstrap scheme, \(Y^*_p\), and the validation sample is the observed sample, \(Y\).

Following the approach used by Pan (1999) for obtaining the 632CV, we propose another model selection criterion, which we call 632QCV. It is a variant of the BQCV and is given by

3 The beta regression model

Many studies in different fields examine how a set of covariates is related to a response variable that assumes values in continuous interval, \((0,1)\), such as rates and proportions; see, e.g., Brehm and Gates (1993); Hancox et al. (2010); Kieschnick and McCullough (2003); Ferrari and Cribari-Neto (2004); Smithson and Verkuilen (2006); Zucco (2008); Verhaelen et al. (2013), and Whiteman et al. (2014). Such modeling can be done using the class of beta regression models, which was introduced by Ferrari and Cribari-Neto (2004). It assumes that the response variable (\(y\)) follows the beta law. The beta distribution is quite flexible since its density can assume a number of different shapes depending on the parameter values. The beta density can be indexed by mean (\(\mu \)) and dispersion (\(\sigma \)) parameters when written as

where \(0<y<1\), \(0<\mu <1\), \(0<\sigma <1\), \(\Gamma {(\cdot )}\) is the gamma function and \(V(\mu )=\mu (1-\mu )\) is the variance function. The mean and the variance of \(y\) are, respectively, by \(\mathrm{E}(y)=\mu \) and \(\mathrm{var}(y)=V(\mu )\sigma ^2\).

Let \(Y=(y_1,\ldots ,y_n)\) be a vector of independent random variables, where \(y_t\), \(t=1,\ldots ,n\), has density (3) with mean \(\mu _t\) and unknown dispersion \(\sigma _t\). The varying dispersion beta regression model can be written as

where \({\beta }=(\beta _1,\ldots ,\beta _r)^{\top }\) and \({\gamma }=(\gamma _1,\ldots ,\gamma _s)^{\top }\) are vectors of unknown parameters and \(x_t=(x_{t1},\ldots ,x_{tr})^{\top }\) and \(z_t=(z_{t1},\ldots ,z_{ts})^{\top }\) are observations on \(r\) and \(s\) independent variables, \(r+s=k<n\). In what follows, we denote the matrix of regressors used in the mean submodel by \(X\), i.e., \(X\) is the \(n\times r\) matrix whose \(t\)th line is \(x_t\). Likewise, \(Z\) is the matrix of regressors used in the dispersion submodel. When intercepts are included in the mean and dispersion submodels, \(x_{t1}=z_{t1}=1\), for \(t=1,\ldots ,n\). In addition, \(g(\cdot )\) and \(h(\cdot )\) are strictly monotonic and twice differentiable link functions with domain in \((0,1)\) and image in IR. In the parameterization we use, the same link functions can be used in the mean and dispersion submodels. Commonly used link functions are logit, probit, log–log, complementary log–log and Cauchy. A detailed discussion of link functions can be found in McCullagh and Nelder (1989) and Koenker and Yoon (2009). Finally, we note that the constant dispersion beta regression model is obtained by setting \(s=1\), \(z_{t1}=1\) and \(h(\cdot )\) is the identity function.

Joint estimation of \({\beta }\) and \({\gamma }\) can be performed by maximum likelihood. Let \(\theta _k = (\beta _1, \ldots , \beta _r, \gamma _1, \ldots , \gamma _s)^{\top }\) and let be \(Y\) an \(n\)-vector of independent beta random variables. The log-likelihood function is

where

The score function is obtained by differentiating the log-likelihood function with respect to the unknown parameters. Closed-form expressions for the score function and Fisher’s information matrix are given in Appendix A.

Let \(U_{\!\beta }({\beta },{\gamma })\) and \(U_{\!\gamma }({\beta },{\gamma })\) be the score functions for \({\beta }\) and \({\gamma }\), respectively. The maximum likelihood estimators are obtained by solving

The solution to such a system of equations does not have a closed form. Hence, maximum likelihood estimates are usually obtained by numerically maximizing the log-likelihood function.

A global goodness-of-fit measure can be obtained by transforming the likelihood ratio as Nagelkerke (1991)

where \(L_\mathrm{null}\) is the maximized likelihood function of the model without regressors and \(L_\mathrm{fit}\) is the maximized likelihood function of the fitted regression model. An alternative measure is the square of the correlation coefficient between \(g( {y})\) and \(\widehat{ {\eta }}=X\widehat{ {\beta }}\), where \(\widehat{ {\beta }}\) denotes the maximum likelihood estimator of \({\beta }\). Such a measure, which we denote by \(R^2_{FC}\), was proposed by Ferrari and Cribari-Neto (2004) for constant dispersion beta regressions.

4 Numerical evaluation

In this section, we investigate the performances of the AIC and its bootstrap variations in small samples when used in the selection of beta regression models. All simulations were performed using the Ox matrix programming language (Doornik 2007). All log-likelihood maximizations were numerically carried out using the quasi-Newton nonlinear optimization algorithm known as BFGS with analytic first derivatives.Footnote 1

We consider beta regression models with mean submodel as given in (4) and dispersion submodel as given in (5). We used \(1000\) Monte Carlo replications and, for each sample, \(W=200\) bootstrapped log-likelihoods were computed. We experimented with larger values of \(W\) but noticed that they only yielded negligible improvements in the model selection criteria performances. For the bootstrap extensions of AIC, we investigated the use of the parametric bootstrap, \(\mathrm{EIC}i_{p}\), as well as the use of the nonparametric bootstrap, \(\mathrm{EIC}i_{np}\). We also considered alternative model selection criteria in the Monte Carlo simulations: AICc (Hurvich and Tsai 1989), SIC (Schwarz 1978), SICc (McQuarrie 1999), HQ (Hannan and Quinn 1979) and HQc (McQuarrie and Tsai 1998).Footnote 2 The covariates values were obtained as random \(\mathcal {U}(0,1)\) draws; they were kept constant throughout the experiment. The logit link function was used in both submodels.

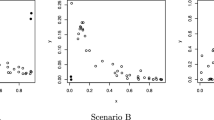

Performance evaluation of the different criteria is done as in Hannan and Quinn (1979), Hurvich and Tsai (1989), Shao (1996), McQuarrie et al. (1997), McQuarrie and Tsai (1998), Pan (1999), Shi and Tsai (2002), Davies et al. (2005), Shang and Cavanaugh (2008), Hu and Shao (2008), Liang and Zou (2008), and Seghouane (2010). For each criterion, we present the frequency of correct order selection (\(=\!k_0\)), as well as the frequencies of underspecified (\(<\!k_0\)) and overspecified (\(>\!k_0\)) selected models.

The following data generating processes were used:

The first two models, (6) and (7), entail large dispersion whereas the remaining two models, (8) and (9), have small dispersion. Considering the parameters values, we note that the regression models in (6) and (8) are easily identifiable whereas the models in (7) and (9) are weakly identifiable. In the weak identifiability scenario, variations in the covariates have different impacts on the mean response. The terminology “easily identified models” is used here in the same sense as in McQuarrie and Tsai (1998), Caby (2000) and Frazer et al. (2009). We emphasize that such a concept of model identifiability differs from the usual concept which relates to the model parameters uniqueness (Paulino and Pereira 1994; Rothenberg 1971). The numerical results for models with large and small dispersion are similar and, for that reason, we only present results for models with small dispersion, (8) and (9).

In all cases, the correct model order dimension is \(k_0=6\): there are three parameters in the mean submodel and three parameters in the regression structure for the dispersion. The sample sizes are \(n=25, 30, 40, 50\) and five candidate covariates are considered for both submodels. The candidate models are sequentially nested for the mean submodel, that is, the candidate model with \(r\) parameters in the mean regression structure consists of the submodel with the \(1,2,\dots ,r\) first parameters. The dispersion submodels are also sequentially nested. Thus, for each value of \(r\) we vary \(s\) from \(1\) to \(6\), totaling \(6 \times 6 = 36\) candidate models.

Since the true model belongs to the set of candidate models, the evaluation of the different selection criteria is done by counting the number of times that each criterion selects the correct model order (\(k_0\), \(r_0\) or \(s_0\)). Three different approaches were considered. First, we used the different model selection criteria to jointly select the mean and dispersion regressors; the results are given in Tables 5 and 2. Afterwards, for a correctly specified dispersion submodel, we used the model selection criteria to select the regressors in the mean submodel; the results are given in Tables 1 and 4. Finally, for a correctly specified mean submodel, we performed model selection on the dispersion submodel; the results are presented in Tables 5 and 6. In all tables, the best results are highlighted.

The figures in Table 1 show that the proposed criteria yield reliable joint selection of mean and dispersion regressors in easily identifiable models. We note that for \(n=25\) and \(n=30\), 632QCV was the best performing criterion. For \(n=40\) and \(n=50\), BQCV was the best performer. Among the extensions (EIC’s) of the AIC, the criterion that stands out is the EIC3 in their two versions, both with parametric and with nonparametric bootstrap. In this scenario, the AICc stands out when compared to alternative criteria that do not make use of bootstrapped log-likelihood. It is noteworthy the poor performance of the BCV, 632CV and EIC’s criteria. When the sample size increases, the performances of the nonparametric EIC’s improve, becoming similar. The same does not hold, however, for the parametric EIC’s: \( \mathrm{EIC1}_p \) and \(\mathrm{EIC4}_p\) perform poorly in all sample sizes.

Under weak identifiability, the good performances of the BQCV and 632QCV criteria become even more evident; see Table 2. The 632QCV criterion was the best performer for \(n=25, 30, 40\). For \(n=50\), BQCV outperformed the competition. It is noteworthy that for \(n=25, 30\), the 632QCV criterion outperformed all nonbootstrap-based criteria by at least 200 %. The EIC3 performs well relative to the other bootstrap extensions when regressors are jointly selected for both submodels in a weakly identifiable model. We also note the weak performances of the BCV and 632CV criteria. The AICc clearly outperforms the AIC. For instance, the AIC selected an overspecified model in 614 replications whereas that happened only 147 times when the AICc was used.

We shall now focus on selecting regressors for the mean submodel. Here, the dispersion submodel is correctly specified and the interest lies in identifying which covariates must be included in the mean submodel. The results for a weakly identifiable model are displayed in Table 3. They again show the good finite sample performances of our two model selection criteria. For \(n=25,30\), the 632QCV criterion was the best performer. For \(n=40\), the best performer was BQCV, and for \(n=50\), the \(\mathrm{EIC2}_p\) criterion outperformed the competition. Once again, the best performing AIC extension was EIC3 and the BCV and 632CV criteria performed poorly. The figures in Table 3 also show that the AICc and the HQc are the best performers among the criteria that do not use bootstrapped log-likelihood.

Table 4 contains the frequencies of correct model selection for the mean submodel when the model is weakly identifiable. The criteria that stands out are the same of the previous settings. For \(n=25,30,40\) (\(n=50\)), 632QCV (BQCV) was the best performer. The \( \mathrm{EIC5}_p \) criterion tends to select models that are overspecified in small samples; see also Table 2.

In our third and final approach, the mean submodel is correctly specified and the interest lies in selecting covariates for the dispersion submodel. The results are presented in Table 5. They show that the 632QCV criterion performs well when the model is easily identifiable; indeed, it was the best performer in all sample sizes. The 632QCV criterion was the only bootstrap AIC variant that outperformed all nonbootstrap-based criteria when \(n=25\). For the remaining sample sizes, only BQCV and \(\mathrm{EIC3}_p\) outperformed the criteria that do not employ bootstrapped log-likelihood. Table 6 presents results for a weakly identifiable model. This was the only scenario in which 632QCV was not the best performing model selection criterion for \(n=25,30\); it still performs well, nonetheless. For larger sample sizes, \(n=40,50\), the proposed criterion was the best performer. For \(n=25\) (\(n=50\)), model selection based on the HQ (\(\mathrm{EIC3}_p\)) criterion was the most accurate.

The simulation results presented above lead to important conclusions on beta regression model selection. Such conclusions can be summarized as follows:

-

The model selection criteria proposed in this paper generally work very well and lead to accurate model selection. The 632QCV criterion performed better as the sample size was small and the BQCV performed better in larger samples.

-

Among the criteria that do not use the bootstrapped log-likelihood, the AICc and the HQc criteria were the best performers. The AICc stood out when the sample size was small and the HQc performed better in larger samples.

-

Among the AIC extensions (EIC’s), the EIC3 was the criterion that delivered most accurate model selection. Its nonparametric bootstrap implementation (\( \mathrm{EIC3}_{np} \)) displayed the best performances in small samples and \(\mathrm{EIC3}_p\) performed best in larger sample sizes.

-

The finite sample performances of the different information criteria are considerably superior when such criteria are used to select regressors for the mean submodel rather than to pursue dispersion submodel selection; compare the results in Tables 3 and Table 5, and also the results in Tables 4 and 6.

-

The criteria that employ bootstrapped log-likelihood for beta regression model selection clearly outperform the competitors.

We emphasize that the two model selection criteria we propose can be used in other classes of regression models based on likelihood inferences, such as generalized linear models (McCullagh and Nelder 1989) and count data models (Winkelmann 2008). Numerical evaluation of their finite sample performances in different contexts will be done in future research.

5 Application

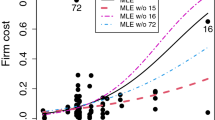

We use the data given in Griffiths et al. (1993) (Griffiths et al. 1993, Table 15.4) on food expenditure, income and number of people in 38 households of a major city in the United States. These data were modeled by Ferrari and Cribari-Neto (2004), who used a constant dispersion beta regression. We performed model selection using the two-step model selection scheme proposed in Bayer and Cribari-Neto (2015) coupled with the BQCV and 632QCV criteria proposed in this paper. In this scheme, the dispersion is taken to be constant and the mean submodel covariates are selected; next, using the selected mean submodel, model selection is carried out in the dispersion submodel. As shown in Bayer and Cribari-Neto (2015), this selection scheme tends typically outperforms the joint selection of regressors for the mean and dispersion submodels at a much lower computational cost. An implementation of such a model selection procedure in R language (R Core Team 2014) with the proposed BQCV and 632QCV criteria and two-step scheme is available at http://www.ufsm.br/bayer/auto-beta-reg.zip. The file contains computer code for model selection in beta regressions and also the dataset used in this empirical application.

Following Ferrari and Cribari-Neto (2004), we model the proportion of food expenditure \((y)\) as a function of income \((x_2)\) and of the number of people \((x_3)\) in each household. We use the logit link function for the mean and dispersion submodels. The following covariates are also considered for inclusion in both submodels: the interaction between income and the number of people (\(x_4 = x_2 \times x_3\)), \(x_5 = x_2^2\) and \(x_6 = x_3^2\).

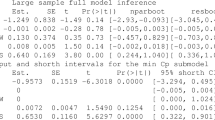

Assuming constant dispersion, the selected mean submodel, both by BQCV and by 632QCV, uses \(x_3\) and \(x_4\) as covariates. Assuming that this is the correct submodel for mean, we now select the regressors to be included in the dispersion submodel. The dispersion submodel selected by the BQCV and 632QCV criteria only includes one covariate, namely: \(x_3\). The parameter estimates of the selected model are presented in the Table 7.

We note that the parameter estimates show that there is a positive relation between the mean response and the number of people in each household, as well as a negative relationship with the interaction variable (\(x_4\)). There is also a positive relationship between the number of people in each household and the response dispersion. The varying dispersion beta regression model we selected and fitted has a pseudo-\(R^2\) considerably larger than that of the constant dispersion model used by Ferrari and Cribari-Neto (2004): \(R^2_{ML}=0.5448\) versus \(R^2_{ML}=0.4088\).

6 Conclusions

In this paper, we considered the issue of beta regression model selection in small samples. We proposed two new model selection criteria for the class of varying dispersion beta regression models. The new criteria were obtained as bootstrap variations of the AIC and provide direct estimators for the expected log-likelihood. The proposed criteria are based on the bootstrap method and on a procedure called quasi-CV. They are then called bootstrapped likelihood quasi-CV (BQCV) and 632QCV. In addition to the proposed criteria, we investigated other criteria corrected for small samples. We did an extensive literature review and identified different bootstrap variations of the AIC that have been proposed for other classes of models. The finite sample performances of the proposed criteria relative to alternative model selection schemes were numerically evaluated in the context of varying dispersion beta regression modeling. The Monte Carlo evidence we presented favors the criteria we proposed: they typically lead to more accurate model selection than alternative criteria. We thus suggest the use of BQCV and 632QCV for beta regression model selection. An empirical application was also presented and discussed.

Notes

For details on the BFGS algorithm, see Press et al. (1992).

The use of these criteria in beta regression models is done in an ad hoc manner.

References

Akaike H (1973) Information theory and an extension of the maximum likelihood principle. In: Petrov BN, Csaki F (eds) Proceedings of the second international symposium on information theory, pp 267–281

Allen D (1974) The relationship between variable selection and data augmentation and a method for prediction. Technometrics 16:125–127

Bayer FM, Cribari-Neto F (2015) Model selection criteria in beta regression with varying dispersion. Commun Stat Simul Comp. doi:10.1080/03610918.2014.977918

Bengtsson T, Cavanaugh J (2006) An improved Akaike information criterion for state-space model selection. Comput Stat Data Anal 50(10):2635–2654

Brehm J, Gates S (1993) Donut shops and speed traps: evaluating models of supervision on police behavior. Am J Polit Sci 37(2):555–581

Breiman L, Spector P (1992) Submodel selection and evaluation in regression: the X-random case. Int Stati Rev 60:291–319

Caby E (2000) Review: regression and time series model selection. Technometrics 42(2):214–216

Cavanaugh J (1997) Unifying the derivations for the Akaike and corrected Akaike information criteria. Statist Probab Lett 33(2):201–208

Cavanaugh JE, Shumway RH (1997) A bootstrap variant of AIC for state-space model selection. Stat Sin 7:473–496

Cribari-Neto F, Souza T (2012) Testing inference in variable dispersion beta regressions. J Statist Comput Simul 82(12)

Davies S, Neath A, Cavanaugh J (2005) Cross validation model selection criteria for linear regression based on the Kullback–Leibler discrepancy. Stat Methodol 2(4):249–266

Doornik J (2007) An object-oriented matrix language Ox 5. Timberlake Consultants Press, London. http://www.doornik.com/

Efron B (1979) Bootstrap methods: another look at the jackknife. Ann Stat 7(1):1–26

Efron B (1983) Estimating the error rate of a prediction rule: improvement on cross-validation. J Am Stat Assoc 78(382):316–331

Efron B (1986) How biased is the apparent error rate of a prediction rule? J Am Stat Assoc 81(393):461–470

Efron B, Tibshirani R (1997) Improvements on cross-validation: the 632+ bootstrap method. J Am Stat Assoc 92(438):548–560

Ferrari SLP, Cribari-Neto F (2004) Beta regression for modelling rates and proportions. J Appl Stat 31(7):799–815

Ferrari SLP, Pinheiro EC (2011) Improved likelihood inference in beta regression. J Stat Comput Simul 81(4):431–443

Frazer LN, Genz AS, Fletcher CH (2009) Toward parsimony in shoreline change prediction (i): basis function methods. J Coastal Res 25(2):366–379

Griffiths WE, Hill RC, Judge GG (1993) Learning and practicing econometrics. Wiley, New York

Hancox D, Hoskin CJ, Wilson RS (2010) Evening up the score: sexual selection favours both alternatives in the colour-polymorphic ornate rainbowfish. Anim Behav 80(5):845–851

Hannan EJ, Quinn BG (1979) The determination of the order of an autoregression. J Roy Stat Soc Ser B 41(2):190–195

Hjorth JSU (1994) Computer intensive statistical methods: validation, model selection and Bootstrap. Chapman and Hall

Hu B, Shao J (2008) Generalized linear model selection using \(\text{ R }^2\). J Stat Plan Inf 138(12):3705–3712

Hurvich CM, Tsai CL (1989) Regression and time series model selection in small samples. Biometrika 76(2):297–307

Ishiguro M, Sakamoto Y (1991) WIC: an estimation-free information criterion., Research memorandumInstitute of Statistical Mathematics, Tokyo

Ishiguro M, Sakamoto Y, Kitagawa G (1997) Bootstrapping log likelihood and EIC, an extension of AIC. Ann Inst Stat Math 49(3):411–434

Kieschnick R, McCullough BD (2003) Regression analysis of variates observed on (0, 1): percentages, proportions and fractions. Stat Modell 3(3):193–213

Koenker R, Yoon J (2009) Parametric links for binary choice models: a fisherian-bayesian colloquy. J Econ 152(2):120–130

Kullback S (1968) Information theory and statistics. Dover

Liang H, Zou G (2008) Improved aic selection strategy for survival analysis. Comput Stat Data Anal 52:2538–2548

McCullagh P, Nelder J (1989) Generalized linear models, 2nd edn. Chapman and Hall

McQuarrie A, Shumway R, Tsai CL (1997) The model selection criterion AICu. Statist Probab Lett 34(3):285–292

McQuarrie A, Tsai CL (1998) Regression and time series model selection. World Scientific, Singapure

McQuarrie A (1999) A small-sample correction for the Schwarz SIC model selection criterion. Statist Probab Lett 44(1):79–86

Nagelkerke NJD (1991) A note on a general definition of the coefficient of determination. Biometrika 78(3):691–692

Pan W (1999) Bootstrapping likelihood for model selection with small samples. J Comput Graph Stat 8(4):687–698

Paulino CDM, Pereira CAB (1994) On identifiability of parametric statistical models. J Ital Stat Soc 3(1):125–151

Press W, Teukolsky S, Vetterling W, Flannery B (1992) Numerical recipes in C: the art of scientific computing, 2nd edn. Cambridge University Press

R Core Team (2014) R: a language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. http://www.R-project.org/

Rothenberg TJ (1971) Identification in parametric models. Econometrica 39(3):577–591

Schwarz G (1978) Estimating the dimension of a model. Ann Stat 6(2):461–464

Seghouane AK (2010) Asymptotic bootstrap corrections of AIC for linear regression models. Signal Process 90:217–224

Shang J, Cavanaugh J (2008) Bootstrap variants of the Akaike information criterion for mixed model selection. Comput Stat Data Anal 52(4):2004–2021

Shao J (1996) Bootstrap model selection. J Am Stat Assoc 91(434):655–665

Shi P, Tsai CL (2002) Regression model selection: a residual likelihood approach. J Roy Stat Soc Ser B 64(2):237–252

Shibata R (1997) Bootstrap estimate of Kullback–Leibler information for model selection. Stat Sin 7:375–394

Simas AB, Barreto-Souza W, Rocha AV (2010) Improved estimators for a general class of beta regression models. Comput Stat Data Anal 54(2):348–366

Smithson M, Verkuilen J (2006) A better lemon squeezer? Maximum-likelihood regression with beta-distributed dependent variables. Psychol Methods 11(1):54–71

Sugiura N (1978) Further analysts of the data by Akaike’s information criterion and the finite corrections—further analysts of the data by Akaike’s. Commun Stat Theor M 7(1):13–26

Verhaelen K, Bouwknegt M, Carratalà A, Lodder-Verschoor F, Diez-Valcarce M, Rodríguez-Lázaro D, de Roda Husman AM, Rutjes SA (2013) Virus transfer proportions between gloved fingertips, soft berries, and lettuce, and associated health risks. Int J Food Microbiol 166(3):419–425

Whiteman A, Young DE, He X, Chen TC, Wagenaar RC, Stern C, Schon K (2014) Interaction between serum BDNF and aerobic fitness predicts recognition memory in healthy young adults. Behav Brain Res 259(1):302–312

Winkelmann R (2008) Econometric analysis of count data, 5th edn. Springer, p 320

Zucco C (2008) The president’s “new” constituency: Lula and the pragmatic vote in Brazil’s 2006 presidential elections. J Lat Am Stud 40(1):29–49

Acknowledgments

We gratefully acknowledge partial financial support from CAPES, CNPq, and FAPERGS. We also thank two referees for comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix A: score function and information matrix of the beta regression model with varying dispersion

Appendix A: score function and information matrix of the beta regression model with varying dispersion

This appendix presents the score function and Fisher’s information matrix for the varying dispersion beta regression model described in Sect. 3.

The score function is obtained by differentiating the log-likelihood function with respect to the unknown parameters. The score function of \(\log f(Y|\theta _{k})\) with respect to \({\beta }\) is given by

where \(\Phi \!= \!\text {diag}\! \left\{ \frac{1\!-\! \sigma ^2_1}{\sigma ^2_1},\ldots ,\frac{1\!-\sigma ^2_n}{\sigma ^2_n} \right\} \), \(T \!=\! \text {diag}\left\{ \frac{1}{g^{\prime }(\mu _1)},\ldots ,\frac{1}{g^{\prime }(\mu _n)}\right\} \), \({y}^{*}\!=\!(y^{*}_1,\ldots ,y^{*}_n)^{\top }\), \({\mu }^{*}\!=\!(\mu ^{*}_1,\ldots ,\mu ^{*}_n)^{\top }\), \(y^{*}_t \! = \log \left( \frac{y_t}{1-y_t} \right) \), \(\mu ^{*}_t= \psi \left( \mu _t\left( \frac{1-\sigma ^2_t}{\sigma ^2_t}\right) \right) - \psi \left( (1-\mu _t)\left( \frac{1-\sigma ^2_t}{\sigma ^2_t}\right) \right) \) and \(\psi (\cdot )\) is the digamma function, i.e., \(\psi (u)\!=\frac{\partial \log \Gamma (u)}{\partial u}\), for \(u>0\). The score function of \(\log f(Y|\theta _{k})\) with respect to \({\gamma }\) is

where \(H\! = \!\text {diag} \!\left\{ \! \frac{1}{h^{\prime }(\sigma _1)}, \ldots , \frac{1}{h^{\prime }(\sigma _n)} \!\right\} \) and \({a}= ( a_1,\) \( \ldots ,a_n)^{\top }\), the \(t\)th element of \(a\) being \(a_t = -\frac{2}{\sigma ^3_t} \left\{ \mu _t \left( y^*_t - \mu ^*_t \right) + \log (1-y_t) - \psi \left( (1-\mu _t)(1-\sigma ^2_t)/\sigma ^2_t \right) + \psi \right. \left. \left( (1-\sigma ^2_t) / \sigma ^2_t \right) \right\} \).

Fisher’s information matrix for \({\beta }\) and \({\gamma }\) is given by

where \(K_{({\beta },{\beta })} = X^{\top }\Phi WX \), \(K_{({\beta },{\gamma })} = (K_{({\gamma },{\beta })})^{\top }=X^{\top }CTHZ\) and \(K_{({\gamma },{\gamma })}=Z^{\top }DZ\). Also, we have \(W = \text {diag}\{w_1,\ldots ,w_n\}\), \(C = \text {diag}\{c_1,\ldots ,c_n\}\) and \(D = \text {diag}\{d_1,\ldots ,d_n\}\), where

Rights and permissions

About this article

Cite this article

Bayer, F.M., Cribari-Neto, F. Bootstrap-based model selection criteria for beta regressions. TEST 24, 776–795 (2015). https://doi.org/10.1007/s11749-015-0434-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11749-015-0434-6