Abstract

The standard principal-agent model predicts a trade-off in contract design between the protection against risk and incentive motivations. Distinguishing two types of risks, we show that, contrary to this traditional view, the relationship between risk and incentives can be positive. In franchise contracting, this implies that the royalty rate decreases with the risk faced by the franchisee on the local market. Using a unique panel dataset combining French franchise and financial data, we address this issue empirically, alongside performance outcomes. The data support the hypothesis of a negative relationship between risk and the royalty rate, which contradicts the prediction of the standard agency theory. Furthermore, our estimations provide evidence that chain performance increases with an adjusted royalty rate. This paper has important implications for contract design, showing that with increasing local market uncertainty and low-risk aversion, franchisors should reduce the royalty rate.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The aim of the paper is to explain the relationship between risk and incentives and its impact on performance in franchise contracting. The bilateral contract between the franchisor and the franchisee is studied as an incentive device, influencing the performance outcome of the chain. With the franchise contract, the franchisor grants to the franchisee the right to use his brand name, and transfers his know-how (methods, techniques, processes) in exchange for monetary compensation. In the agency-theoretical framework with the franchisor being the principle and the franchisee the agent, the royalty rate is considered as the main monetary provision, and as the “share parameter” determining the partition of residual claimancy rights between the counterparties (Lafontaine and Slade 2001). It is usually expressed as a percentage of the franchisee’s sales.

The relevance of agency theory in franchise contracting is widely accepted, starting from the contributions of Rubin (1978), Mathewson and Winter (1985), and Rey and Tirole (1986). In addition, the empirical literature on franchise data emphasizes the role of the agency-theoretical arguments in explaining the organizational choices in franchise chains (e.g., Blair and Lafonatine 2005; Lafontaine and Slade 2014). Focused on incentive motivations, the principal-agent framework highlights a moral hazard on the franchisee’s side regarding the franchisor’s brand reputation. For this reason, contracts with a low royalty rate play an incentive role, motivating the effort of the franchisee (selling effort, effort in the promotion of the common brand). Then, the franchisor pays itself with other monetary compensations like the upfront fee. In this context, the most incentive contract includes no royalties, and the franchisee is the residual claimant; once the upfront fee is paid, the franchisee captures the totality of the results from its effort.

However, royalties are common in franchise contracts. In agency theory, the presence of royalties in franchise contracts has two justifications. The first one is related to a context of bilateral moral hazard. In this case, the presence of royalties in franchise contracts is justified by the need to provide incentives both for the franchisee and the franchisor. Since the theoretical contributions of Mathewson and Winter (1985) and Bhattacharyya and Lafontaine (1995), this explanation of royalties in franchise contracts has found empirical support in several studies (e.g., Lafontaine 1992; Agrawal and Lal 1995; Brickley 2002; Vazquez 2005; Fadairo 2013; Maruyama and Yamashita 2012). The second explanation, initially proposed in franchising by Martin (1988), concerns the need to insure the franchisee against risk, namely, against hazard on the level of the final demand. In a context of high uncertainty regarding consumer demand, resulting in a high level of risk, the risk-averse franchisee wants to reduce his residual claimancy status. In this situation, a payment mechanism based on royalties, rather than on other devices not related to the final demand, is a way to also involve the franchisor in bearing the risk. Royalties act as an insurance mechanism protecting the franchisee, as the franchisee’s payment to the franchisor takes into account the uncertainty of demand on the local market. In that case, the share contract defined by the royalty rate corresponds to a level of risk sharing.

Therefore, in this agency-theoretical context, the royalty rate is the result of a trade-off in the contract design between the need to provide incentives to the franchisee (which lowers the royalty rate) and the need to protect the franchisee against risk (which raises the royalty rate). This trade-off and inverse relationship between risk and incentives defines the traditional agency-theoretical view regarding the contract design and payment mechanism in a context of moral hazard (e.g., Salanié 2005; Bolton and Dewatripont 2005; Macho-Stadler and Pérez-Castrillo 2001; Blair and Lafontaine 2005).

However, the predicted positive relationship between the level of risk and the royalty rate does not find overall empirical support. Indeed, a large number of empirical studies in organizational economics, accounting and marketing, have found mixed results (Prendergast 2002a). While several works provided evidence for the trade-off (e.g., Joseph and Kalwani 1995; Gosh and John 2000; Wulf 2007; De Varo and Kurtulus 2010), others highlighted a positive relationship between risk and incentives (e.g., Allen and Lueck 1995; Ackerberg and Botticini 2002; Foss and Laursen 2005; Shi 2011). In addition, some studies found no significant relationship between risk and incentives (e.g., Coughlan and Narasimhan 1992; Umanath et al. 1993; Garen 1994; Krafft et al. 2004; Lafontaine and Slade 1997; Lo et al. 2011).

While most of the literature focuses on the standard risk-incentive trade-off, we propose an alternative agency view and provide evidence for a positive relationship between risk and incentives in franchise contracting. Our explanation is based on the theoretical model of Shi (2011). This author differentiates two forms of risk, using the concepts of “non-respondable” versus “respondable” risk. Under non-respondable risk, the agent (franchisee) has no control over events that change his optimal action. In this case, uncertainty refers to output volatility (noise: Baker and Jorgensen 2003). Under respondable risk, the franchisee can react to risk; he has control over events that affect his optimal action. In this case, the franchisee is able to adapt to local market uncertainty by exerting efforts to collect information and make appropriate decisions. While in the standard agency model only non-respondable risk is taken into account regarding the impact on the royalty rate, we argue that both forms of risk must be considered in empirical contract settings.

Our approach is also close to the theoretical contribution of Raith (2008). Dealing with the contractual design, this author develops a moral hazard model to study the optimal incentives, i.e., the payment mechanism. Raith (2008) addresses a different case from the standard principal-agent model, introducing into the analysis post-contractual hidden information. The theoretical model shows that depending on the value of the agent’s specific knowledge, risk and incentives can be positively related. However, in contrast to our analysis, Raith’s analysis does not focus on the risk-incentive relationship, its main goal being to address the performance measurement implications of this private knowledge situation (input measures related to the agent’s actions versus output-based measures).

What is the contribution of our paper? First, this study contributes to the literature on the relationship between risk and the provision of incentives in different contractual agreements (e.g., Prendergast 2002a, 2002b; Wulf 2007; Misra et al. 2005; De Varo and Kurtulus 2010) by offering an application of the “respondable risk” model of Shi (2011) in franchise contracting. Based on data from the French franchise sector, we provide evidence that the royalty rate is negatively related to risk, operationalized by the risk of business failure. Second, this is one of the few studies that empirically investigates the performance effect of the royalty rate (e.g., Combs et al. 2011; Shane et al. 2006; Kosová and Lafontaine 2010; El Akremi et al. 2015). Few studies have highlighted the positive influence of the royalty rate on chain performance. Kosová and Lafontaine (2010) found some evidence of a positive relationship between royalty rate and franchising growth, and between royalty rate and total growth. Similarly, Polo-Redondo, Polo-Redondo and Lucia Palacios (2011), and Kacker et al. (2016) provided evidence of a positive relationship between royalty rates and performance, measured in terms of firm/network size. Our work makes a notable contribution by showing that a royalty rate adjusted to risk and incentive issues impacts positively on chain performance, using a different measure of firm performance, i.e., the market share.

The article is organized as follows. Sections 2 and 3 present the theoretical framework and develop the hypotheses. Specifications regarding the data and the study variables are provided in Sect. 4. Section 5 focuses on the empirical determinants of the royalty rate. Section 6 examines the impact of the royalty rate on chain performance. Section 7 offers concluding comments.

2 Impact of the risk-incentive relationship on the royalty rate

We address the impact of risk faced by the franchisee (i.e., outlet risk) on the contractual design, i.e., on the level of the royalty rate, taking into account incentives issues. Calling into question the standard agency risk-incentive trade-off, we argue that risk and incentives can be positively related, depending on the context. In that case, a more risky environment requires a more incentivizing contract, which involves a lower royalty rate. The impact of risk on the royalty rate is then negative, contrary to the traditional agency-theoretical result.

We propose two explanations for why a negative relationship between risk and royalties may emerge in franchise contracting. First, according to the respondable risk approach (Shi 2011), uncertainty increases franchisees’ effort level to collect local market information. Second, within the endogenous matching approach (Serfes 2005), uncertainty is negatively correlated with the franchisees’ risk aversion. Both effects increase the likelihood of a negative risk-royalty relationship. Due to missing data on franchisees’ attitude toward risk, we do not empirically test the endogenous matching approach developed in the online-only appendix. In the following, the respondable risk approach is discussed in detail.

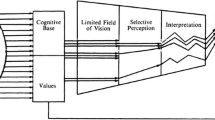

Consistent with Shi (2011), we argue that uncertainty is associated with the two forms of risk: respondable and non-respondable risk (see Fig. 1). Under non-respondable risk (see I in Fig. 1), the franchisee has no control over events that change his optimal course of action. This case of non-fundamental uncertainty refers to transitory random noise (i.e., cash flow risk; He et al. 2014; Fung 2013), and corresponds to the standard agency setting (Rantakari 2008). Higher uncertainty results in output volatility and higher risk costs for the franchisor, in order to protect the risk-averse franchisee from bearing higher risk by offering a lower-powered incentives contract, i.e., a higher royalty rate. Then, the payment mechanism is mainly output based, acting as an insurance mechanism for the franchisee.

Under respondable risk (see II in Fig. 1), the franchisee can respond to risk and has control over events that change her/his optimal actions (Shi 2011; Antel and Demski 1988). In this case, uncertainty refers to the unobserved profitability (i.e., profitability uncertainty; He et al. 2014). In this fundamental uncertainty situation, the franchisee as entrepreneur exercises “responsible control” because “profit arises out of the inherent, absolute unpredictability” (Knight 1921, pp. 278, 311; Rao 1971). The everyday proximity with final consumers results in private information—like in Raith’s (2008) framework—for the franchisee versus the franchisor regarding the local market. For this reason, the franchisee, compared to the franchisor, is the agent who can address respondable risk. The franchisee is better positioned to respond to uncertainty by exerting efforts to collect information and make appropriate decisions in the local market. Since franchisees’ efforts to collect information are more valuable in a riskier environment, they become more responsive to incentives as fundamental uncertainty increases. For instance, in franchise settings characterized by a high level of local market uncertainty, the franchisor understands less which tasks should be performed and how they should be performed in the local markets. In this case, the franchisees have valuable local market information, which can be exploited by delegating decision authority to the franchisees (Prendergast 2002a; Nagar 2002). The franchisor supports the franchisee’s higher efforts to collect information by increasing incentives, and thus lowering the royalty rate.

We can conclude that uncertainty has two opposing effects on the royalty rate: the royalty rate as increasing the effect of uncertainty due to higher risk costs and the royalty rate as decreasing the effect of uncertainty due to the information-induced effort-return effect. If the local market uncertainty is high and the franchisees are less risk averse, the information-induced effort-return effect is likely to dominate the risk-cost effect of uncertainty on the royalty rate. In this situation, the royalty rate will decrease with increasing uncertainty to provide stronger incentives.

We complete our analysis with Table 1, which illustrates the responsible risk approach to the relationship between risk and royalties under given risk aversion levels. We differentiate uncertainty between non-respondable and respondable risk; in addition, we distinguish between risk-neutral and risk-averse franchisees in order to show how franchisee’s risk aversion influences the result. (1) Under non-respondable risk and risk-neutral franchisees, the risk-cost effect (RCE) and the effort-return effect (ERE) are zero; hence, the royalty rate and risk are not related. (2) Under non-respondable risk and risk-averse franchisees, which describes the standard agency setting, RCE is positive and ERE is zero; in this case, the royalty rate and risk are positively related. (3) Under respondable risk and risk-neutral franchisees, RCE is zero and ERE is positive; hence, the royalty rate and risk are negatively related. (4) Under respondable risk and risk-averse franchisees, RCE and ERE are positive, resulting in a negative relationship between the royalty rate and risk, if ERE dominates RCE. This is more likely to be the case, the higher the local market uncertainty and the lower the franchisees’ risk aversion are. Consequently, we can conclude that in empirical entrepreneurial settings (i.e., under high local market uncertainty and low-risk aversion), risk and royalties will be negatively related in franchise contracting.

We investigate in the online appendix the case where uncertainty influences the degree of risk aversion of the franchisees, using the endogenous matching approach. In this appendix, we develop a simple agency model of franchise contracting, studying the endogenous matching between the franchisor’s risk characteristics and franchisees’ degree of risk aversion. Our theoretical model demonstrates that the negative risk-royalty prediction holds when relaxing the assumption of a given level of risk aversion (i.e., risk aversion of the franchisees not related to the uncertainty level on the market). Moreover, our respondable risk approach is only valid as long as more uncertainty is not related to more risk-averse franchisees. Therefore, it is important to know that the endogenous matching approach predicts the reverse relationship; i.e., more uncertainty attracts less-risk-averse franchisees. Indeed, in this complementary appendix, we formally demonstrate that less-risk-averse franchisees characterized by a strong entrepreneurial orientation choose more risky local market environments as well as contracts with lower royalty rates.

We can summarize the analytical framework of our empirical test as follows: based on the respondable risk approach and under the assumption of given risk aversion, we argue that, contrary to the standard agency-theoretic prediction, risk and royalties are negatively related when the risk-cost increasing effect of uncertainty is smaller than the information-induced effort-return effect of uncertainty on the royalty rate. Within this approach, uncertainty positively influences the effort-return effect due to franchisees’ information collection and corresponding decision-making, and hence negatively influences royalties. On the other hand, uncertainty positively influences the risk-cost effect under given risk aversion and hence positively influences royalties. Consequently, the likelihood of a negative relationship between risk and royalties increases with uncertainty due to the increase in the information-induced effort-return effect in riskier local market environments. Hence, the higher the local market uncertainty is, the higher the likelihood of a negative relationship between risk and royalties is. From this result, we derive the following testable hypothesis:

Hypothesis 1

Under given risk aversion of the franchisees, higher local market risk is associated with a lower royalty rate.

3 Performance outcome

Few empirical studies have addressed the impact of contractual terms on chain performance (an exception is Combs et al. 2011). Shane et al. (2006) study the impact of strategic decisions on the chain performance and their evolution over time, measured as increase in the network size. The royalty rate is taken into account as one of the pricing policy decisions. The authors provide evidence that the size of a franchise system is negatively related to its royalty rate, and that, as the system ages, the relationship between the network size and the royalty rate becomes more negative (Shane et al. 2006). In the study of Kosová and Lafontaine (2010), the royalty rate is a control variable in econometric models for the growth and survival of franchised chains, with the age and size of the chain being the core explanatory variables. Based on US panel data, they do not find evidence for any influence of the royalty rate on chain performance, which is measured in terms of franchising growth and exit from franchising. Recently, based on US retail and service chain data, El Akremi et al. (2015) find that upfront fees, level of internationalization, chain age, training, and experience before franchising have a positive impact on performance of franchise chains. However, the influence of the royalty rate on sales (as a performance measure) is negative.

In this study, we apply a new methodology to test the performance impact of the royalty rate. We use market share as the performance indicator, in addition to other financial indicators for robustness checks. Based on the above reasoning regarding the risk-incentive relationship in franchising, we argue that the royalty rate is a strategic variable enabling the franchisor to deal with the risk and incentives issues. For this reason, a royalty rate adjusted to risk and to the provision of incentives should result in higher performance at the network level. We formulate the following hypothesis:

Hypothesis 2

Franchise chain performance increases with a royalty rate adjusted to risk and incentives issues.

4 Data and measurement

To perform the empirical tests, we use contractual data from franchised networks, the variable of interest being the royalty rate clause. In addition, we make the choice to measure the performance outcome and the risk level context using financial data. For this reason, we use two complementary and distinct data sources, one for the franchise contractual data, and the other for the financial data. Our final dataset is a panel covering the period 1996 to 2000. Although it was not possible to access information regarding the most recent period, our dataset is of great interest, matching franchise and financial data originating from two highly credible institutions. We hereafter present in detail the data sources, the treatment procedure for missing values, the sample, and the royalty rate contractual provision.

4.1 Data sources

Our two sources are the French Federation of Franchising (FFF) and the French financial dataset DIANE. The FFF is the most credible French institution producing specific information on franchise chains. The institution publishes surveys and annual reports regarding chains located in France, with the main characteristics of the firm, and the features of the franchise contracts. FFF data have previously been used by Barthélemy (2011) in a cross-sectional analysis, while we deal here with panel data. Our second data source, DIANE, is the reference dataset for the financial analysis of companies in France. DIANE covers the majority of French firms, which are required to file their annual accounts with the registrars of commercial courts. This private dataset is managed by the Bureau Van Dijk, specialized in the commercialization of global financial and business information. The panel data structure of DIANE allowed us to track the evolution of the franchisor situations over time. Thus, our dataset is unique and specifically fitted for the issue addressed in this paper. Owing to the focus of DIANE, our dataset relates to French networks.

4.2 Missing values

A few values are missing at random (MAR) in the data. Depending on the variable, the percentage of missing data varies between 0.0 and 15%. Considering these low percentages, the sample size would be adequate without completing the data. However, to avoid any bias, we made the choice to complete the data using the multiple imputation method.Footnote 1 Multiple imputation method uses Monte Carlo simulations to replace missing data from a number (m > 1) of simulations. In each simulation, the complete data matrix is analyzed using conventional statistical methods. Finally, the method combines the results to generate robust estimators, their standard errors, and their confidence intervals. Thus, the multiple imputation method replaces missing values at random and does not generate bias in the allocation of imputed values. This method is appropriate when missingness is well predicted from observed variables, which is the case with a MAR mechanism.

Descriptive statistics show that after the missing value treatment, the means, variances, asymmetry, and kurtosis remain almost the same. Thus, the treated sample is not distant from the baseline characteristics of the original sample. Finally, we perform a two-sample t test with equal variances, confirming that there is no significant difference between the two samples (sample including missing values versus sample with imputed data). The completed sample is balanced, with information for each individual each year.

4.3 Sample and main variable of interest

Our sample consists of 184 French networks in a wide range of business sectors, presented in Table 2. The sector shares in the sample highlight the importance of four activities: services to company and persons, home equipment, clothes, and supermarkets.

In Fig. 2, we present the sector-based trend in our main variable of interest, the royalty rate, over the period of 1996–2000. Table 3 gives more details on the average royalty rates. The mean royalty rate is 4.3%, with a standard error of 3.2.

4.4 Measurement

4.4.1 Dependent variables

The dependent variables are as follows:

-

Royalty rate, ri: this variable is the percentage of the franchisee’s sales (turnover) accruing to the franchisor.

-

Performance variables: our main performance indicator is the market share (Market share, Pi) defined as follows: this variable is measured as the turnover of the franchisor divided by the sector turnover. The market share is often considered as the key indicator of the competitiveness of an offer. It is relevant to our study, measuring the competitiveness of the franchise concept in addition with the organizational choices of the chain. This indicator is not related to the size of the company (here to the size of the network), and reflects the loyalty of customers to a business concept, its position of strength vis-à-vis its competitors, as well as its attractiveness. Moreover, this performance indicator is specifically appropriate to our study as we deal with the impact of the contractual choices as regards risk on the local market. It is thus pertinent to get the result in terms of market share.

To perform robustness checks, we use two additional performance indicators, defined hereafter:

-

Intangible assets: this variable is measured as the total intangible assets of the franchisor divided by the total fixed assets.

-

Net cash to turnover: this variable is a liquidity indicator measured as the net cash of the franchisor; that is, the cash and cash equivalents, or the most liquid assets of the company, minus the bank overdrafts, divided by the turnover.Footnote 2

4.4.2 Independent variables

In the econometric model for the royalty rate, the core explanatory variable is the risk of business failure as proxy for local market risk. Previous studies in the empirical franchise literature use a variety of proxies for local market risk (Lafontaine and Bhattacharyya 1995; Lafontaine and Slade 2014). The risk of business failure is an imperfect proxy for local market risk. However, we can assume that it is closely related with local market uncertainty. High local market uncertainty at the outlet level may increase the risk of business failure for the chain.

Risk of business failure, ρi: risk is not easy to measure; this is the reason why this issue has rarely been directly addressed in the empirical literature on franchise data. Apart from Martin (1988), who proxies the level of risk in distribution networks with the proportion of company-owned outlets (PCO),Footnote 3 the franchise literature more closely related to risk deals with survival versus failure rates. Indeed, many studies on franchise data focus on this matter, for example, Castrogiovanni et al. (1993) who define a failure as closure of a unit within a franchise chain. More often, the failure rate is calculated as a ratio between unit closures and the total number of units for a given network and over a defined reporting period (Michael and Combs 2008). In some empirical analyses, survival (or failure) is defined as a dummy variable, equal to 1 if the firm remains in franchising after a period of time.

A main interest of the DIANE dataset is to provide a relevant measure of risk with the Conan-Holder score. This scoring measures the risk of business failure in each network. We aimed at using accounting and financial measures, based on official data, to get a reliable indicator of the risk born by the chain franchisees. This is a well-known and accepted indicator of risk in the financial and accounting context. The relevance of this indicator is explained by its scoring nature, matching and balancing several aspects of the firm’s accounting position to define the level of vulnerability of the firm—in other words, the risk of business failure. The Conan-Holder score is based on the observation of statistical series, and measures the probability of failure. This probabilistic definition is very relevant regarding the issue of risk. To the best of our knowledge, the Conan-Holder score has not previously been used in the franchise literature. It is calculated with five financial ratios, as follows:

The Conan-Holder score is interpreted as follows:

ρi < 4: high risk level.

4 ≤ ρi < 9: medium risk level.

ρi ≥ 9: low risk level.

To complete our empirical tests and provide robustness checks, we define an alternative measure of risk, based on the aforementioned background literature on failure in franchising. Thus, our second measure of risk is the variation rate of outlets in the network, defined as follows:

where the number of units includes franchised units and company-owned units.

4.4.3 Control variables

Several control variables are included in this study:

-

Upfront fee, Fi: this variable is defined as the fixed amount paid by the franchisee when entering the network. In the franchise literature, the upfront fee is often considered as related to the royalty rate. More precisely, since Rubin (1978), both payment mechanisms are usually regarded as inversely related. The upfront fee is defined as a rent extraction mechanism, i.e., as a tool used by the franchisor to extract additional profits from the franchisee once the level of the royalty rate is defined. Indeed, the upfront fee is independent of incentives issues and thus appears to be complementary to the royalty rate.

However, the empirical results do not clearly support the hypothesis of a negative relationship between the upfront fee and the royalty rate. Thus, although Vazquez (2005) provides evidence for a significant negative relationship between the two provisions, based on Spanish data, previous results on US data show that the two monetary devices are not always related (Lafontaine 1992; Lafontaine and Shaw 1999). We use this variable to control for the influence of alternative payment mechanisms of the franchisor, not related to the franchisee’s output. In this context, the royalty rate is studied as part of a whole payment mechanism from the franchisee to the franchisor.

-

Franchisees’ contribution, αi: this variable is measured as the number of franchisees in each network divided by the total number of outlets (franchised and company-owned) in the sector. This variable captures the franchisees’ contribution to the network compared to the other chains in the same business sector. It is thus a way to proxy the franchisee efforts in a specific network. In accordance with the standard principal-agent model, this effort is expected to be negatively related to the level of the royalty rate.

-

Proportion of company-owned units, pci: this variable is measured as the number of company-owned units in the network divided by the total number of outlets in the network. The proportion of company-owned units can be studied as a proxy for the reputation of the network, in other words, for the brand name value (Lafontaine and Shaw 2005). In this case, this variable is related to the moral hazard on the franchisor’s side (Scott 1995), and allows us to control for its influence in the estimations.

-

Age of the network, ai: this variable refers to the difference between the year of creation of the franchise and the present year in the panel data. In addition to the proportion of company-owned units, this variable can also be used as a proxy for the reputation of the network.

-

The economic sector: this dummy variable controls for the influence of operating in the service sector versus the retail sector.

4.5 Summary statistics

Table 4 reports the means, standard deviation, and correlations between the dependent, independent, and control variables. In addition to Table 4, the following comments can be provided regarding the royalty rate variable. In almost 50% of the cases, the standard deviation of the royalty rate is different to 0.

5 Empirical determinants of the royalty rate

5.1 Methodology: random versus fixed effect model and checks for potential endogeneity

The methodology with panel data requires us first to compare the random effect model and the fixed effect model, since both address the problem of the unobserved heterogeneity, by specifying an error term constant over time for each unit (fixed effect model), or randomly distributed over time for each unit (random effect model). It is interesting to note that with short-period panels, as with the sample, the random effect model may produce better estimators than the fixed effect model (Heckman 1981). In addition, the random effect model is consistent in the presence of time-invariant variables (Greene 2000). This is not the case with the fixed effect model. Indeed, time-invariant variables can be perfectly collinear with the fixed effect model, whereas most of the contract variables are by nature almost time-invariant.

The Hausman test confirms our intuition (Hausman 1978), and shows that the random effect model is more appropriate to the data (χ 2 = 1.75, p = 0.6257). Additional checks are performed, which confirm the choice for the random effect model. We use the Lagrange multiplier test (Breusch and Pagan 1980) to see if the variance across the chains is zero. This test supports the random effect model, since it provides evidence of significant differences across the networks (χ 2 = 270.75, p = 0.000).

We choose to estimate the random effect model using the feasible generalized least squares method (FGLS). This method assumes that the covariance structure of the composite errors is unknown (Cheng et al. 2015). In addition, it is useful to estimate the full variance-covariance matrix (Aysun et al. 2014). Finally, the FGLS estimator is asymptotically normal, even under weak conditions, that is, even if the errors do not follow a normal distribution (Greene 2000). Two stages are required. First, a covariance matrix is built with the residuals of an OLS or another estimation. In the second stage, the FGLS is calculated, and replaces the value of the unknown covariance matrix for its estimation. Using the FGLS method, we perform a likelihood ratio test regarding heteroskedasticity at the panel level. The results (χ 2 = 1143.25, p = 0.000) confirm that the data in the sample do not have a common disturbance variance, thereby providing another support for the random effect model. Given that we use a 5-year panel, we assume there is no serious problem of autocorrelation.

We check for potential problems of endogeneity, using again the Hausman test. Two regressors may indeed raise endogeneity problems, because they are managerial variables deriving from the franchisor’s choices: the franchisees’ contribution in the network and the upfront fee. We compare an instrumental model with the previous results in two stages, including the lagged variable as an instrument. The resultsFootnote 4 show that there is no problem of endogeneity.

5.2 Econometric model and estimation results

We study the empirical influence of risk on the royalty rate (related to hypothesis 1), controlling for several potential determinants, with the following econometric model:

where R it is the royalty rate, μ is the constant term, f it is the upfront fee, e it is the franchisee contribution, ρ it is the risk of business failure, a it is the age of the network, u i is the random disturbance that characterizes the ith observation (constant over time), and ϵ it is the error term.

This model can be re-written as follows:

where X 1 is the matrix of explanatory variables and θ 1 is the vector of parameters containing the regression coefficients.

The estimation results are presented in Table 5. A first comment concerns the good global significance of the econometric models, as highlighted by the Wald χ 2 tests. To perform robustness checks, we estimate additional models with the alternative measure of risk (models 5 and 6) and without the variable for franchisees’ contribution (models 3, 4, 6). The results are robust, since they are qualitatively identical in all the models, including the models with time dummies. The significant and negative influence of the risk variable on the royalty rate suggests that, consistent with the trade-off view, the royalty rate decreases with the risk of business failure, thus providing support for hypothesis 1.

Finally, the results regarding the control variable upfront fee are contrary to the agency-theoretical argument concerning rent extraction by the franchisor (Mathewson and Winter 1985; Lal 1990); the two monetary provisions appear as complementary incentive devices. This result is compatible with the property rights view (Windsperger 2001; Kacker and Sadeh 2015) and the screening theory (Dnes 1992). The property rights theory argues that upfront fees increase with the franchisor’s intangible brand name assets, and a stronger brand name requires more franchisor’s investments during the contract period, resulting in higher royalties. The screening theory argues that high upfront fees are more likely to attract franchisees with high entrepreneurial capabilities. If the screening effect dominates the rent extraction effect, royalties and upfront fees can be positively related. Furthermore, the positive sign of the age variable can be interpreted as a reputation effect, which is consistent with the explanation in terms of moral hazard on the franchisor’s side; the higher the network reputation is, the higher the royalty rate required to motivate the franchisor to preserve this asset is.

6 Empirical impact on the chain performance

Within a comparative approach, we use two distinct royalty rate variables to test hypothesis 2 (i.e., to study the impact of the royalty rate on the chain performance): the observed royalty rate, enclosed in the dataset, versus the predicted royalty rate deriving from model (1). The latter refers to the correctly risk- and incentive-adjusted royalty rate.

6.1 Methodology for the observed royalty rate: specification tests and econometric model

The Hausman test regarding the influence of the observed royalty rate on the network market share shows that the random effect model is more appropriate than the fixed effect model (χ 2=3.96, p = 0.1383). This result is confirmed with the Lagrange multiplier test (χ 2= 674.08, p = 0.000), which reveals significant differences across the chains, thus supporting the random effect model. For robustness checks, we take into account two additional performance indicators (intangible assets and net cash). The tests confirm the results obtained with the market share indicator in favor of the random effect model.

Finally, the likelihood ratio heteroskedasticity test is performed. The results confirm the choice for the random effect model: χ 2=4670.03, p = 0.000 with the market share indicator; χ 2=864.91, p = 0.000 with the intangible assets indicator; and χ 2= 4256.30, p = 0.000 with the net cash indicator.

In the equation for the performance, two regressors can be suspected of endogeneity because they result from the franchisor’s choice: the royalty rate and the proportion of company-owned units in the network. The results of the Hausman tests performed regarding potential problems of endogeneity show that, whatever the performance indicator taken into account, there is no problem of endogeneity regarding these two variables.

The econometric model is as follows:

where P it is the market share, φ is the constant term, r it is the observed royalty rate, pc i is the proportion of company-owned units, s i is the sector (retail and services), v i is the random disturbance that characterizes the ith observation (constant over time), and ψ it is the error term.

6.2 Methodology for the adjusted royalty rate: specification tests and econometric model

The econometric work regarding the adjusted royalty rate is also based on the random effect model. To take into account the predictions from model (1), we use the two-step methodology developed by Murphy and Topel. Murphy and Topel formally established an econometric model in two steps that contains an unobservable variable, which is replaced by the predicted values from another model. Similar methodologies using seemingly unrelated regressions are not adequate here because of the features of the panel, where N(the number of chains) is big whereas T (the number of years) is small.

The method is as follows: in the first stage, the unobservable variable (here r it ) is estimated as a function of a matrix of variables X 1(n × q) , and θ 1(q × 1), that is, the covariance matrix, and the parameters of vectors that also contain the coefficient β 1, respectively. In the second stage, the dependent variable (here P it ) is estimated as a function of X 2(n × p), which also contains the values predicted from the first stage and θ 2(p × 1). Since (\( \widehat{\theta} \)1) is the estimation of (θ 1), the covariance matrix is corrected in order to have asymptotically correct standard errors.

According to Hardin (2002), Greene (2000)), and Hole (2006), the Murphy and Topel variance estimation for θ 2 is as follows:

where V 1(q × q) and V 2(p × p) are the asymptotic variance matrices of θ 1 and θ 2, respectively, and C and R are the matrices given by

respectively; f i1 and f i2 represent the observable i’s contribution to the likelihood function of each stage.

Due to the difficulty of performing a test for endogeneity concerning the predicted royalty rate in the equation for the performance, we proceed as follows: first, we test for the potential problem of endogeneity between the performance and the explanatory variables of the royalty rate, and then, we assume that if the explanatory variables of the royalty rate do not raise an endogeneity problem with the performance, this is also the case with the predicted royalty rate. From the results of the Hausman tests, it is reasonable to assume that there is no endogeneity problem in the second stage of the Murphy and Topel estimation.

The econometric model is as follows:

where γ is the constant term, \( {\widehat{R}}_{it} \)is the adjusted royalty rate (predicted from model 1), ϖ i is the random disturbance that characterizes the ith observation (constant over time), and ξ it is the error term.

This model can be re-written as follows:

where X 2 is the matrix of explanatory variables and θ 2 is the vector of parameters containing the regression coefficients.

One of the columns in X 2 contains the predicted values from model 1.

6.3 Estimation results

The final empirical results are reported in Table 6, and concern the influence of the observed royalty rate (models 7, 8, 12, 14) and the adjusted royalty rate (models 9, 10, 11, 13, 15) on chain performance.Footnote 5 The main results use the network market share as the performance indicator (models 7–11). For robustness checks, we perform estimations with alternative performance criteria (models 12–15).

Here again, the good global significance of the models has to be mentioned. The key result from this set of estimations is the positive and clearly significant influence of the adjusted royalty rate on chain performance, whereas the observed royalty rate has no significant effect. This result is robust, whatever the performance indicator and the measure of risk, and is consistent with hypothesis 2.

7 Discussion and conclusions

The aim of the paper is to explain the relationship between risk and incentives and its impact on performance in franchise contracting. Consistent with the respondable risk approach of Shi (2011), we argue that franchisees have an important information-acquisition role in facing uncertainty. Indeed, the franchisee can exert effort to acquire local market information and then make corresponding local market decisions. Franchisee effort is more valuable and creates a higher residual income under higher uncertainty, i.e., when respondable risk is greater. On the other hand, risk-averse franchisees must be protected from bearing higher risk. The relation between royalties and (respondable) risk thus depends on the effort-return effect in relation to the risk-cost effect of uncertainty. The higher the uncertainty under a given franchisees’ risk aversion is, the higher the likelihood of a negative risk-royalty relationship is.

Using French franchise and financial panel data, we test the hypothesis of a risk-royalty rate trade-off. The results of our empirical investigation suggest that the contractual choices, more precisely here the level of the royalty rate, are motivated by incentives issues, and that a higher level of risk results in more incentive contracts. Thus, contrary to the standard agency framework, the hypothesis of a negative relationship between risk and royalties finds support here. In addition, we provide evidence for a positive effect of a risk-incentive adjusted royalty rate on chain performance. Specifically, the results show that a royalty rate adjusted to provide more incentives when the risk increases leads to higher performance.

Finally, considering these empirical results, we ask what are the franchise firm-specific reasons for a negative risk-royalty relationship. These refer to two important factors in franchise contracting: degree of local market uncertainty and franchisee’s degree of risk aversion. First, franchising is used as an inter-organizational governance form when the franchisor has less access to the relevant local market information and the franchisees as residual claimants can provide this access. Since the importance of the entrepreneurial role of the franchisees varies with uncertainty in the local market, the effort-return effect due to the acquisition of local market information increases with uncertainty. Second, a stronger entrepreneurial orientation of the franchisees is compatible with a lower degree of risk aversion. Less risk-averse franchisees need less compensation for bearing higher risk, resulting in lower risk costs for the franchisor. Consequently, both effects increase the likelihood that risk and the royalty rate are negatively related.

The paper makes the following important contributions. First, this paper contributes to the franchise literature by proposing a new explanation for the mixed empirical evidence on the risk-royalty rate relationship in franchise contracting (e.g., Lafontaine and Bhattacharyya 1995; Lafontaine and Slade 2014). Our explanation is based on the reasoning that uncertainty has two opposing effects on the risk-incentive relationship: a risk-cost effect and an information-induced effort return effect. If the latter dominates, risk and the royalty rates are negatively related, which is more likely under higher local market uncertainty. Second, this study contributes to the literature on the trade-off between risk and incentives in different contractual relationships (e.g., Prendergast 2002a, 2002b) by arguing that the relationship between risk and incentives depends on the strength of the risk-cost effect compared to the information-induced effort-return effect of uncertainty on incentives. Since most of the previous studies focus on the standard risk-incentive trade-off, they cannot provide an explanation of the mixed empirical results. However, few recent studies (Prendergast 2002a; Shi 2011; Fung 2013; He et al. 2014) provide important arguments for a positive relationship between risk and incentives. Prendergast (2002a) and Fung (2013) focus on the delegation effect of higher uncertainty that may cancel out the risk-incentive trade-off due to higher risk costs. Shi (2011) explains the information-induced effort-return effect of uncertainty that positively impacts incentives, and He et al. (2014) distinguish two forms of uncertainty (profitability uncertainty and cash flow risk) and explain the positive risk-incentive relationship with the learning-by-doing effect of high uncertainty. This study adds to the above contracting literature by including, in addition to the risk-cost effect, the information-induced effort-return effect of uncertainty (based on the respondable risk approach of Shi 2011). An extension of our approach is proposed in the online appendix, developing new theoretical results regarding the endogenous matching effect of uncertainty to explain the risk-incentive relationship in franchise contracting. Third, the study contributes to the literature on the performance consequences of contract provisions in franchising (e.g., Combs et al. 2011). To the best of our knowledge, this is the first study that provides evidence that chain performance increases with an adjusted royalty rate.

This paper has also important implications for the franchisor/franchise manager. Indeed, the results offer some recommendations for designing a franchise contract. First, if the local market uncertainty is high and the franchisees are less risk averse, the negative information-induced effort-return effect is likely to dominate the positive risk-cost effect of uncertainty on the royalty rate. Therefore, the franchisor should reduce the royalty rate with increasing local market uncertainty in order to provide stronger entrepreneurial incentives. Second, the franchisor can positively influence chain performance by designing a franchise contract with a risk-incentive adjusted royalty.

Several limitations have to be mentioned. First, one major measurement problem refers to the risk of business failure as proxy for local market risk. We acknowledge that this proxy for outlet risk is imperfect, but we expect that it is closely related to local market risk associated with profitability uncertainty and output volatility. However, since local market risk data are not available, as mentioned in several previous studies (e.g., Lafontaine and Bhattacharyya 1995; Lafontaine and Slade 2014; He et al. 2014), we employed risk of business failure as an imperfect proxy to operationalize risk. Future studies have to collect data and use measures that differentiate between respondable and non-respondable risk. Second, the empirical investigation is limited by the size of the data, with the analysis being based on a 5-year panel sample. This analysis could be complemented with a longer panel in order to highlight fixed effects, thereby avoiding the potential problem regarding the collinearity between the time-invariant variables and fixed effects. Third, the econometric estimations distinguish only two sectors, retail versus service. A more detailed analysis taking into account further sectors could provide important results for theory and practice. Since we expect that the degree of uncertainty and risk aversion are sector-dependent (Foss and Laursen 2005), we may obtain different results for the risk-royalty rate relationship and hence different implications for the franchisor’s contract design decision.

Finally, this study has important consequences for future research on risk and incentives in contract relations. Empirical studies have to consider that the agents are characterized by different degrees of entrepreneurial orientation (i.e., effort level and risk aversion). Therefore, it is problematic to compare the incentive contracts of entrepreneurs, such as franchisees, characterized by a strong entrepreneurial orientation, with the performance-based contracts of employees (executives, managers, sales agents), characterized by a lower level of entrepreneurial orientation (e.g., Pendergast 2002a; Wulf 2007). When uncertainty and entrepreneurial orientation (i.e., high information-induced effort level and low-risk aversion) are positively related, we expect that the likelihood of a positive risk-incentive relationship will increase from sales force workers to division managers, to executives, and to franchisees as entrepreneurs (Wright 2004). Hence, the contract design will vary with the “relative significance of entrepreneurial functions” (Rao 1971, p. 593). Within franchising, it might be possible that local market uncertainty is different in product franchising compared to services. Assuming higher uncertainty in the service franchising sector, franchisees in the service sector will show a stronger entrepreneurial orientation characterized by a lower degree of risk aversion and a higher information-contingent effort level than franchisees in product franchising. This may result in a less negative risk-royalty relationship in product franchising compared to services.

Summary statistics and correlationsFootnote 6

Notes

A good discussion on the interest of this method is offered by Rubin (1996).

A high liquidity indicator means that the company does not suffer liquidity risk. However, it can also suggest that the firm does not invest enough.

Considering that low PCOs are associated with less risk in company-owned outlets and with more risk in franchised outlets.

The results of all the specification tests are available upon request.

Note that the result of the comparison of estimations based on the observed royalty rate and estimations based on the predicted royalty rate is intuitively the same as deviations from the predicted royalty rate. For technical reasons, we do not directly include the deviations from the predicted royalty rate as regressor. The Topel and Murphy methodology indeed requires performing the second step with the prediction (from the first step), not with a deviation.

The upfont fee is divided by 10,000

References

Ackerberg, D. A., & Botticini, M. (2002). Endogenous matching and the empirical determinants of contract form. Journal of Political Economy, 110, 564–591.

Agrawal, D., & Lal, R. (1995). Contractual arrangements in franchising: an empirical investigation. Journal of Marketing Research, 32, 213–221.

Allen, D. & Lueck, D. (1995). Risk preferences and the economics of contracts. The American Economic Review, 85(2), 447–451.

Antel, R., & Demski, J. S. (1988). The controllability principle in responsibility accounting. The Accounting Review 63, 700 – 718

Aysun U., Bouvet F. Hofler R. (2014). An alternative measure of structural unemployment, economic modelling http://www.Sciencedirect.Com/science/journal/02649993, 38, 592–603.

Baker, G. P., & Jorgensen, B. (2003). Volatility, noise and incentives, mimeo. Harvard University and Columbia University.

Barthélemy, J. (2011). Agency and institutional influences on franchising decisions. Journal of Business Venturing, 26, 93–103.

Bhattacharyya, S., & Lafontaine, F. (1995). Double-sided moral hazard and the nature of share contracts. RAND Journal of Economics, 26, 761–781.

Blair, R., & Lafontaine, F. (2005). The economics of franchising. Cambridge: Cambridge University Press.

Bolton, P., Dewatripont, M. (2005). Contract theory. MIT Press.

Breusch, T., & Pagan, A. (1980). The Lagrange multiplier test and its applications to model specification in econometrics. Review of Economic Studies, 47, 239–253.

Brickley, J. (2002). Royalty rates and upfront fees in share contracts: evidence from franchising. Journal of Law, Economics and Organization, 18, 511–535.

Castrogiovanni, G. J., Justis, R. T., & Julian, S. D. (1993). Franchise failure rates: an assessment of magnitude and influencing factors. Journal of Small Business Management, 31(2), 105–114.

Cheng, T., Ing, C., & Yu, S. (2015). Toward optimal model averaging in regression models with time series errors. Journal of Econometrics, 189, 321–334.

Combs, J., Ketchen, D., Shook, C. L., & Short, J. C. (2011). Antecedents and consequencies of franchising: past accomplishments and future challenges. Journal of Management, 37, 99–126.

Coughlan, A. T., & Narasimhan, C. (1992). An empirical analysis of sales-force compensation plans. Journal of Business, 65, 93–121.

De Varo, J., & Kurtulus, F. (2010). An empirical analysis of risk, incentives and the delegation of worker authority. Industrial and Labor Relations Review, 64, 641–661.

Dnes, A. W. (1992). ‘Unfair’ contractual practices and hostages in franchise contracts. Journal of Institutional and Theoretical Economics, 148, 484–504.

El Akremi, A., Perrigot, R., & Piot-Lepetit, I. (2015). Examining the driver of franchised chains performance through the lens of the dynamic capabilities approach. Journal of Small Business Management, 53, 145–165.

Fadairo, M. (2013). Why include royalties in distribution contracts? Evidence from France. International Journal of Retail and Distribution Management, 41, 566–583.

Foss, N., & Laursen, K. (2005). Performance pay, delegation, and multitasking under uncertainty and innovativeness: an empirical investigation. Journal of Economic Behavior and Organization, 58, 246–276.

Fung, M. K. (2013). A trade-off between non-fundamental risk and incentives. Review of Quantitative Finance and Accounting, 41, 29–51.

Garen, J. E. (1994). Executive compensation and principal-agent theory. Journal of Political Economy, 102, 1175–1199.

Ghosh, M., & John, G. (2000). Experimental evidence for agency models of salesforce compensation. Marketing Science, 19, 348–365.

Greene, W. (2000). Econometric analysis. Prentice-Hall International, 3th edition.

Hardin, J. (2002). The robust variance estimator for two-stage models. Stata Journal, 2, 253–266.

Hausman, J. (1978). Specification tests in econometrics. Econometrica, 46, 1251–1271.

Heckman, J. (1981). The incidental parameters problem and the problem of initial conditions in estimating a discrete time-discrete data stochastic process. In Structural analysis of discrete data with econometric applications (pp. 179–195). Cambridge, MA: MIT Press.

Hole, D. (2006). Calculating Murphy-Topel variance estimates in stata: a simplified procedure. The Stata Journal, 6, 521–529.

He, Z., Li, S., Wei, B., & You, J. (2014). Uncertainty, risk, and incentives: theory and evidence. Management Science, 60, 206–226.

Joseph, K., & Kalwani, M. U. (1995). The impact of environmental uncertainty on the design of sales force compensation plans. Marketing Letters, 6, 183–197.

Kacker, M., Sadeh, F. (2015). The relationship between royalty rates and franchise fees: a meta-analysis, EMNet Conference 2015, Cape Town, South Africa, December 3–5.

Kacker, M., Dant, R. P., Emerson, J., & Coughlan, A. T. (2016). How firm strategies impact size of partner-based retail networks: evidence from franchising. Journal of Small Business Management, 54(2), 506–531.

Knight, F. H. (1921). Risk, uncertainty, and profit. Boston: Houghton Mifflin.

Kosová, R., & Lafontaine, F. (2010). Survival and growth in retail and service industries: evidence from franchised chains. Journal of Industrial Economics, 58(3), 542–578.

Krafft, M., Albers, S., & Lal, R. (2004). Relative explanatory power of agency theory and transaction cost analysis in German sales forces. International Journal of Research in Marketing, 21, 265–283.

Lal, R. (1990). Improving channel coordination through franchising. Marketing Science, 9, 299–318.

Lafontaine, F. (1992). Agency theory and franchising some empirical results. RAND Journal of Economics, 23, 263–283.

Lafontaine, F., & Bhattacharyya, S. (1995). The role of risk in franchising. Journal of Corporate Finance, 2, 39–74.

Lafontaine, F., & Slade, M. (1997). Retail contracting: theory and practice. Journal of Industrial Economics, 45, 1–15.

Lafontaine, F., & Shaw, K. (1999). The dynamics of franchise contracting: evidence from panel data. Journal of Political Economy, 107, 1041–1080.

Lafontaine, F., & Shaw, K. (2005). Targeting managerial control: evidence from franchising. RAND Journal of Economics, 36, 131–150.

Lafontaine, F., & Slade, M. (2001). Incentive contracting and the franchise decision. In Advances in Business Application of Game Theory: Kluwer Academic Press.

Lafontaine, F., & Slade, M. (2014). Incentive and strategic contracting: implications for the franchise decision. In K. Chatterjee & W. Samuelson (Eds.), Game theory and business applications. New York: Springer.

Lo, D. H.-F., Ghosh, M., & Lafontaine, F. (2011). The incentive and selection roles of salesforce compensation contracts. Journal of Marketing Research, 48, 781–798.

Macho-Stadler, I., & Pérez-Castrillo, D. (2001). An introduction to the economics of information: incentives and contracts. Oxford University Press.

Martin, R. E. (1988). Franchising and risk management. American Economic Review, 78(5), 954–968.

Maruyama, M., & Yamashita, Y. (2012). Franchise fees and royalties: theory and empirical results. Review of Industrial Organization, 40, 167–189.

Mathewson, F., & Winter, R. (1985). The economics of franchise contracts. Journal of Law and Economics, 28, 503–526.

Michael, S. C., & Combs, J. G. (2008). Entrepreneurial failure: the case of franchisees. Journal of Small Business Management, 46(1), 73–90.

Misra, S., Coughlan, A. T., & Narasimhan, C. (2005). Salesforce compensation: an analytical and empirical examination of the agency theoretical approach. Quantitative Marketing and Economics, 3, 5–39.

Nagar, V. (2002). Delegation and incentive compensation. The Accounting Review, 77, 379–395.

Polo-Redondo, B.-J., & Lucia Palacios, L. (2011). Determinants of firm size in the franchise distribution system: empirical evidence from the Spanish market. European Journal of Marketing, 45(1/2), 170–190.

Prendergast, C. (2002a). The tenuous trade-off between risk and incentives. Journal of Political Economy, 110, 1071–1102.

Prendergast, C. (2002b). Uncertainty and incentives. Journal of Political Economy, 20, 115–137.

Raith, M. (2008). Specific knowledge and performance measurement. The Rand Journal of Economics, 39(4), 1059–1079.

Rantakari, H. V. (2008). On the role of uncertainty in the risk-incentives trade-off. The B.E. Journal of Theoretical Economics, 8, 1–23.

Rao, H. H. (1971). Uncertainty, entrepreneurship, and sharecropping in India. Journal of Political Economy, 79, 578–595.

Rey, P., & Tirole, J. (1986). The logic of vertical restraints. American Economic Review, 76, 921–939.

Rubin, P. (1978). The theory of the firm and the structure of the franchise contract. Journal of Law and Economics, 21(1), 223–233.

Rubin, D. (1996). Multiple imputation after 18+ years. Journal of the American Statistical Association, 91, 473–489.

Salanié, B. (2005). The economics of contracts. MIT Press.

Scott, F. (1995). Franchising vs. company ownership as a decision variable of the firm. Review of Industrial Organization, 10, 69–81.

Serfes, K. (2005). Risk sharing vs. incentives: contract design under two-sided heterogeneity. Economics Letters, 88, 343–349.

Shane, S., Shankar, V., & Aravindakshan, A. (2006). The effects of new franchisor partnering strategies on franchise system size. Management Science, 52, 773–787.

Shi, L. (2011). Respondable risk and incentives for CEOs: the role of information-collection and decision-making. Journal of Corporate Finance., 17, 189–205.

Umanath, N. S., Ray, M. R., & Campbell, T. L. (1993). The impact of perceived environmental uncertainty and perceived agent effectiveness on the composition of compensation contracts. Management Science, 39, 32–45.

Vazquez, L. (2005). Up-front franchise fees and ongoing variable payments as substitutes: an agency perspective. Review of Industrial Organization, 26, 445–460.

Windsperger, J. (2001). The fee structure of franchising: a property rights view. Economics Letters, 73, 219–226.

Wright, J. (2004). The risk and incentives trade-off in the presence of heterogeneous managers. Journal of Econmics, 83, 209–223.

Wulf, J. (2007). Authority, risk, and performance incentives: evidence from division manager positions inside firms. Journal of Industrial Economics, 55, 169–196.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

ESM 1

(PDF 145 kb)

Rights and permissions

About this article

Cite this article

Lanchimba, C., Windsperger, J. & Fadairo, M. Entrepreneurial orientation, risk and incentives: the case of franchising. Small Bus Econ 50, 163–180 (2018). https://doi.org/10.1007/s11187-017-9885-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-017-9885-3