Abstract

Multichannel retailers dominate today’s retail landscape. Practitioners and researchers are particularly interested in understanding how the multichannel strategy helps establishing and developing relationships with customers. Our findings, from 302 customers of multichannel financial services firms, show that frontline employees’ customer facilitation behaviors (traditional channel) have a stronger impact on satisfaction than e-psychological benefits (derived from the company’s Web site), while their positive influence on trust is not significantly different. Implications for theory and practice are discussed.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

One of the most dramatic trends in the retail environment has been the proliferation of channels through which customers can interact with firms (Neslin et al. 2006). Multichannel retailing is the set of activities involved in selling merchandise (tangible products) or services to consumers through more than one channel (Levy and Weitz 2009). Despite the explosion of multichannel retailing in practice, “the academic literature has yet to develop a broad theory of how channels work together” (Avery et al. 2012, p. 98). Research on multichannel customer management provides significant insights on issues like channel selection and motivations (Blázquez 2014; Kumar and Venkatesan 2005; Kollmann et al. 2012; Kushwaha and Shankar 2008; Montoya-Weiss et al. 2003; Valentini et al. 2011), channel migration (Ansari et al. 2008; Gensler et al. 2004; Knox 2005; Thomas and Sullivan 2005; Venkatesan et al. 2007; Verhoef et al. 2007), and the comparison between multichannel and single-channel customers (Kumar and Venkatesan 2005; Kushwaha and Shankar 2013; Wallace et al. 2004).

Importantly, the multichannel literature has placed special emphasis on rational, functional issues such as price level (Montoya-Weiss et al. 2003; Kauffman et al. 2009; Verhoef et al. 2007), convenience (Madlberger 2006), availability (Bendoly et al. 2005), promotions (Verhoef et al. 2007), usefulness of information (Choi and Park 2006), and the shopping environment (Park and Lennon 2006). Also, much research on multichannel customer behavior has been conducted with multichannel customers of tangible products (Ansari et al. 2008; Bendoly et al. 2005; Blázquez 2014; Gensler et al. 2004; Kauffman et al. 2009; Kumar and Venkatesan 2005; Park and Lennon 2006; Valentini et al. 2011; Wallace et al. 2004) and is based on objective data such as customers’ purchase histories (e.g., Avery et al. 2012; Ansari et al. 2008; Dholakia et al. 2005; Joo and Park 2008; Kushwaha and Shankar 2013; Verhoef and Donkers 2005; Venkatesan et al. 2007). Clearly sales are important, but given today’s emphasis on relationship marketing, practitioners, and researchers are particularly interested in understanding how the multichannel strategy helps establishing and developing relationships with customers (Neslin and Shankar 2009).

In this article, we examine the influence of customers’ perceptions of employees’ customer facilitation behaviors (customer-oriented behaviors that go beyond the call of duty through the traditional channel) and e-psychological benefits (customers’ positive feelings and comfort that lead them to be relaxed while using the online channel) on customer’s satisfaction and trust in the multichannel service firm. We extend the current published literature in many ways. First, the multichannel customer literature has generally ignored how more judgmental and less objective issues (e.g., customer facilitation behaviors and e-psychological benefits) influence the development of the customer–firm relationship. Yet, there is preliminary evidence provided by single-channel studies which indicates that these psychological elements are inherent in most consumer purchasing decisions. For example, findings from Fernández-Sabiote and Román (2005) show that employees’ customer facilitation behaviors are positively correlated to customers’ satisfaction and word of mouth. Our research, therefore, aims to contribute to the literature by examining the role of psychological factors in the relationship building process in a multichannel context. In the online channel, Klaus (2013) recently found that the psychological factors experienced by customers play an important role in overcoming their resilience to using online channels due to the lack of familiarity with the brand, the channel, or the absence of a physical presence linked to the Web site.

Second, only recently scholars have paid attention to relational outcomes in the context of multichannel service retailing (Harris et al. 2006; Hsieh et al. 2012; Larivière et al. 2011; Seck and Philippe 2013; Van Birgelen et al. 2006). This stream of research has been focused on satisfaction and/or loyalty to the firm. We add to these studies by considering customer trust in the service firm. The trust that customers have in service organizations is a key concern for marketers and customer relationship managers (Eisingerich and Bell 2008).

Third, most consumer studies on multichannel contexts tend to study direct effects and explain consumers’ expectations and their motivations for channel preference (e.g., Montoya-Weiss et al. 2003). We build on the service literature to select need for interaction with a service employee (a consumer’s trait) and service complexity (a characteristic of the buying process) as moderating variables. Furthermore, prior research has shown that these variables play a key role in explaining customers’ channel selection, but have an unknown effect on multichannel consumer behavior (e.g., Meuter et al. 2005). Importantly, several studies have found that the need for interaction with service employees is positively related to the need to avoid machines (e.g., Forman and Sriram 1991; Prendergast and Marr 1994) and service complexity is likewise related to consumers’ willingness to receive service employees’ advice and help (Simon and Usunier 2007).

Finally, unlike the majority of previous studies, we focus on service rather than merchandise retailing because services are intangible in nature and consequently multichannel customers are more likely to experience higher levels of perceived risk and uncertainty (Fernández Sabiote and Román 2012). This is particularly the case in the online service channel, due to the lack of human (face-to-face) contact with front-line employees (Venkatesh et al. 2003). Service firms have traditionally used frontline employees to reduce such uncertainties and develop and enhance relationships with customers (i.e., Gwinner et al. 1998). Thus, understanding the factors that lead to higher levels of satisfaction and trust is of special interest to both multichannel service retailers and service marketing scholars.

In what follows, we provide a review of the literature and outline our conceptual framework. Hypotheses are then presented and tested. Finally, implications of the study are discussed.

2 Literature review and research model

Traditionally, the personal face-to-face interaction between the customer and the contact employee is at the heart of most service experiences. During this face-to-face interaction, frontline employees are likely to practice customer facilitation behaviors. Similar to service quality, these are customer-oriented behaviors aimed to enhance the customer service experience. Yet, unlike service-oriented behaviors such as responsiveness, which involves “timeliness of service” (Parasuraman et al. 1985, p. 47), facilitation behaviors are discretionary actions that go beyond the employee’s formal job requirements (Fernández-Sabiote and Román 2005). For example, these behaviors include giving customers alternative solutions even though it means more work for the employees. Therefore, these are voluntary initiatives that take place when employees “go the extra mile during the employee–customer interface” (Maxham et al. 2008, p. 150). In other words, facilitation behaviors can be considered as extra-role (i.e., not required) performances employees engage in that benefit the firm in some way, whereas providing prompt service can be considered as in-role performances since they are typically core job responsibilities encompassed in an employee’s formal job description (Borman and Motowidlo 1993).

Online consumers have traditionally sought highly rational or functional benefits such as convenience and accessibility (i.e., Fenech and O’Cass 2001; Gerrard and Cunningham 2003; Ko et al. 2005; Lai and Li 2005) and economy and efficiency (i.e., Fenech and O’Cass 2001; Gerrard and Cunningham 2003; Lai and Li 2005; Suh and Han 2002). Similarly to the evolution of the studies in the offline context, consumer research in the online context is evolving from a focus on the cognitive aspects of decision making to include intrinsic aspects, such as hedonic value (e.g., Cheng et al. 2009; Fiore et al. 2005; Liao et al. 2011; Wang et al. 2013), emotional value (Cheng et al. 2009; Gentile et al. 2007), or confidence benefits (e.g., Colgate et al. 2005; Su et al. 2009). In this sense, research has shown that consumers may also experience less rational, and more emotional and psychological benefits, such as entertainment, reduced anxiety and comfort during online navigation (Colgate et al. 2005; Ko et al. 2005; Su et al. 2009; Klaus 2013). For example, in a context of retail banking, Colgate et al.’s (2005) results show the prevalence of confidence benefits over the other relational benefits. Cheng et al. (2009), who measured emotional value, proved how the capacity to stimulate positive feelings and emotions in Internet affects order placement. Findings from Liao et al. (2011) reveal that perceived playfulness has a more significant effect on online purchase intention than more rational factors such as usefulness (Liao et al. 2011).

In an attempt to consider all these less rational, and more emotional and psychological benefits, some scholars have used the term “psychological factors” that customers experience while using a Web site (Constantinides 2004; Klaus 2013). Constantinides (2004) argues that psychological factors play a crucial role in helping online customers unfamiliar with the vendor or unfamiliar with online transactions to overcome fears of fraud of the Web site. In this vein, findings from Klaus (2013) show that psychological factors help overcome customer’s resilience to using online channels. These psychological factors do not explicitly include hedonic-oriented benefits such as perceived playfulness or gamification. Building on this stream of research, e-psychological benefits in our study refer to customers’ positive feelings and comfort that lead them to be relaxed while using the online channel.

Our construct, e-psychological benefits is related, yet different to perceived ease of use. Perceived ease of use refers to “the degree to which an individual believes that using a particular system would be free of real and mental efforts” (Davis 1989, p. 323). The Technology Acceptance Model (TAM) postulates that perceived usefulness and ease of use determine the user’s attitude toward a technology, behavioral intentions, and eventually the actual use of technology. Previous studies have found that perceived ease of use leads to consumers’ intentions to use e-commerce (Cha 2011; Fetscherin and Lattermann 2008). Unlike the origins of TAM, derived mainly to explain the adoption of an information system, e-psychological benefits is a construct to be applied in the context of online retailing. In this context, not only perceived ease of use, but also fraudulent practices, security/privacy issues, and misrepresentation of information are likely to influence consumers’ positive feelings and comfort while using a Web site (Román 2007; Riquelme and Román 2014). That is to say, perceived ease of use can be one of the antecedents of e-psychological benefits, but not the only one.

Customer satisfaction is conceptualized as a cumulative, global evaluation based on experience with the firm over time (Homburg et al. 2005). According to the expectancy-disconfirmation paradigm (Oliver 1980), customers judge satisfaction by comparing previously held expectations with perceived product or service performance. Next to satisfaction, trust has been put forward as a precondition for patronage behavior and the development of long-term customer relationships (Ribbink et al. 2004). Trust in the firm occurs when the customer believes and feels that the service company “can be relied upon to behave in such a manner that the long-term interests of the customer will be served” (Crosby et al. 1990, p. 70). Thus, in this model trust is a consequence of satisfaction. Need for interaction with a service employee is defined by Dabholkar and Bagozzi (2002) as the “importance of human interaction to the customer in service encounters” (p. 188). Finally, complexity has been identified as a factor that influences consumer channel choice (e.g., Black et al. 2002; Simon and Usunier 2007). Service complexity depends not only on the number and intricacy of steps required to perform the service, but also on the service divergence, that is, the degree of freedom allowed in or inherent to a particular sequence of the process (Shostack 1987).

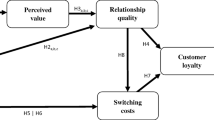

Our hypotheses are represented in Fig. 1. In particular, we propose that customer facilitation behaviors and e-psychological benefits positively influence satisfaction with and trust in the multichannel service firm (Hypotheses 1–3). Additionally, Fig. 1 proposes a more general, encompassing theoretical model: the aforementioned direct effects on satisfaction are moderated by customers’ need for interaction and service complexity (Hypotheses 4–8).

Our model integrates the well-known disconfirmation paradigm and the cognitive fit theory. Cognitive fit theory holds that an individual’s performance in solving a decision-making problem (e.g., buying a product) will depend on the fit between the way in which information for solving the problem is presented (e.g., product array in bricks-and-mortar store versus comparative table in Web site) and the nature of that problem (e.g., getting a feel for the product versus getting concrete information about its price and features). In other words, “the fit between the requirements of a specific activity in which a person is involved and the means through which this activity might be accomplished determines that person’s attitudes and behaviors toward the activity” (van Birgelen et al. 2006, p. 368).

Although this theory was originally developed in decision science, van Birgelen et al. (2006) extended it to multichannel service environments. These authors define the goodness of fit between multiple service channels as the “level of compatibility between customer evaluative judgments of the performance of each channel used” (p. 368), and they identify two possible evaluations: compatible (channels are perceived as similar) and complementary (one channel adds value to another channel).

3 Hypotheses development

Customers approach a service interaction with preformed expectations (Mohr and Bitner 1995). That is, customers will consider the behavior of the service employees as satisfactory if it meets or exceeds their expectations. If customers’ expectations are supported and reinforced, then it will positively affect their overall satisfaction with the service company. If not, the customers’ overall satisfaction will likely be negative. As argued earlier, this notion is consistent with a “disconfirmation of expectations” model in which a customer is satisfied if performance exceeds expectations and dissatisfied if performance falls short of expectations (Oliver 1980).

Customer facilitation behaviors (i.e., “willing to help” behaviors) go beyond the prescribed job requirements, and consequently customers are not likely to expect them. In fact, as Bitner et al. (1990) noted “customers remember with considerable frequency those occasions when they receive special treatment by the service employee” (p. 80). Therefore, it is plausible to hypothesize that customer facilitation behaviors increase satisfaction. Stated formally:

H1a

Customer facilitation behaviors have a positive effect on satisfaction with the firm.

Service employees with whom the customer interacts are able to confirm and build trust in the organization (e.g., Gremler et al. 2001; Zeithaml and Bitner 2000). We expect that customer facilitation actions on the part of the service representative, such as showing a genuine concern for the customer’s well-being will facilitate the communication of service-related information, thereby increasing consumers’ understanding of how the service operates. Importantly, in traditional face-to-face interactions, the detection of genuine behaviors relies, among other things, on recognizing subtle changes in the service employee’s nonverbal behaviors, such as eye contact and body movements. In particular, these expressive non-verbal behaviors are harder to suppress and to fake in comparison with verbal behaviors and/or written communications (DePaulo 1992). Overall, these qualities should reduce interpersonal barriers and raise comfort levels (Petty and Cacioppo 1986), thereby alleviating perceptions of “riskiness” and contributing toward the establishment of trust in the service representatives. Principally, frontline service employees “are the organization in the customer’s eyes” (Zeithaml and Bitner 2000, p. 287), and the service employee and the service company are often indistinguishable in the mind of the customer (Crosby et al. 1990). Therefore, we expect that employees’ customer facilitation behaviors will increase trust in the service company. Stated formally:

H1b

Customer facilitation behaviors have a positive effect on trust in the firm.

To the best of our knowledge, there is no empirical research that relates e-psychological benefits to other variables such as satisfaction and trust. In both cases, it can be argued that there are theoretical arguments for a positive relationship. First, customers’ feelings of comfort and reduced anxiety are expected to enhance customer satisfaction since these e-psychological benefits provide the framework necessary to improve the performance of customer’s online activities. Furthermore, previous evidence from studies that have analyzed constructs closely related to e-psychological benefits, such as confidence benefits (Su et al. 2009) and peace of mind (Maklan and Klaus 2011), shows that they play a role increasing customer satisfaction in the online context. Consequently,

H2a

E-psychological benefits have a positive effect on satisfaction with the firm.

Also, e-psychological benefits can increase trust in the firm. Multichannel customers using the firm’s Web site experience less anxiety and perceived risk due to these e-psychological benefits (Su et al. 2009). In this sense, e-psychological benefits are likely to diminish the uncertainty linked with transactions. Therefore, we propose the following hypothesis:

H2b

E-psychological benefits have a positive effect on trust in the firm.

The relationship between satisfaction and trust has received considerable theoretical and empirical support (e.g., Garbarino and Johnson 1999; Geyskens et al. 1999). From a theoretical perspective, a highly satisfying experience with the service organization may not only reassure the customer that his or her trust in the service is well placed, but also enhance it (Singh and Sirdeshmukh 2000). Although Johnson and Grayson (2005) found only partial support for the relationship between satisfaction and trust, recent findings from the services marketing literature reveal that satisfaction positively influences trust (e.g., Fernández-Sabiote and Román 2009; Wiertz et al. 2004). Since it is directly linked to meeting expectations, satisfaction over time reinforces the perceived reliability of the firm and contributes to trust (Singh and Sirdeshmukh 2000). There is a long-term orientation in the variable of trust, since it is also conceptualized as “a cumulative process that develops over the course of repeated, successful interactions” (Nicholson et al. 2001, p. 4). That is, as Geyskens et al. (1999, p. 227) point out “satisfaction (which develops in the short run and is a report of past interactions) positively influences trust (which takes relatively longer to develop and has a more expectational quality to it)”. Accordingly, we hypothesize that

H3

Customer’s satisfaction with the company has a positive effect on customer’s trust in the company.

4 Moderating effects on satisfaction

In what follows, the moderating effects of the customer’s need for interaction and service complexity (Hypotheses 4–8) on the influence of customer facilitation behaviors and e-psychological benefits on satisfaction are discussed. The lack of theoretical arguments prevents us from formulating moderating effects when trust is the dependent variable.

4.1 Customer’s need for interaction

This factor has been identified as a key element in self-service technologies (SST) adoption (Dabholkar and Bagozzi 2002; Dabholkar 1996). If consumers have a high need for interaction, they may avoid self-service, especially when it is technology based, but if they have a low need for interaction, they are likely to seek such options.

Multichannel customers may not be extreme in their preferences since they do not avoid either frontline employees or the “independence” provided by the Web site. However, based on the cognitive fit theory, we expect need for interaction to play a moderating role on the satisfaction building process through each channel. A multichannel customer with low need for interaction will have a stronger intrinsic motivation to use the online channel compared to a consumer with higher need for interaction. Such a consumer would not be greatly concerned whether SST are easy to use or reliable and would want to use them anyway. The fit between the need for interaction (higher need in an offline context) and the experience of customer facilitation in the offline context determines a more positive attitude toward this experience which, in turn, will have a stronger effect on satisfaction. In fact, multichannel customers with a high need for interaction are likely to have a more positive attitude toward service employees (Dabholkar and Bagozzi 2002; Meuter et al. 2000), evaluating their performance more positively. This strengthening effect is suggested by Perea y Monsuwé et al. (2004). Therefore, we expect that when such customer is exposed to customer facilitation behaviors, he or she will be more satisfied than a customer with a lower need for interaction. Stated formally,

H4a

The positive effect of customer facilitation behaviors on satisfaction is stronger for those customers with higher need for interaction.

Meanwhile, consumers with a higher need for interaction may feel less comfortable using the online channel, as compared to consumers with a lower need for interaction. When customers with a higher need for interaction experience e-psychological benefits, their preference for the employee may reduce the impact of e-psychological benefits on satisfaction. The fit between the need for interaction (lower need in an online context) and the experience of e-psychological benefits in the online context determines a more positive attitude toward this experience, which in turn, will have a stronger effect on satisfaction. Empirical evidence by Susskind (2004) reveals that customers with a high need for interpersonal interaction are likely to have feelings of uncertainty or unease about using the Internet for shopping-related activities. Therefore, multichannel customers with a lower need for interaction are likely to have a more positive attitude toward the online medium experience, evaluating more positively its non functional benefits, both emotional and comfort benefits. Therefore, we expect that the impact of e-psychological benefits on satisfaction will be lower for customers with a higher need for interaction.

H4b

The positive effect of e-psychological benefits on satisfaction is stronger for those customers with lower need for interaction.

4.2 Service complexity

Service complexity is expected to have a moderating effect in the influence of customer facilitation behaviors on satisfaction, because lower service complexity is likely to accentuate the role of customer facilitation behaviors (Devlin 1998; Garry 2008). Two lines of reasoning may hold. First, based on the cognitive fit theory, there is no better fit between a higher level of complexity and the experience of customer facilitation in the offline context than a lower level of complexity and the experience of customer facilitation, since in both cases the customer requirements are the same. It is the employee who makes the effort. In a simple service context, satisfaction of the customer is derived from other factors as well, such as the physical evidence or other customers’ behaviors. The product itself is not of utmost concern to the customer, and the personal interaction, and hence customer facilitation behaviors, are likely to become an important factor in driving customers’ satisfaction. However, customers demanding complex services are likely to pay more attention to the product itself rather than to other peripheral factors (such as the interaction component) because of its high relevance in building satisfaction (Garry 2008). Second, based on the elaboration likelihood model (ELM) (see Petty and Cacioppo 1986), in a simple service context the customer will have a lower motivation to devote a big amount of cognitive resources to form a judgment (Yoon et al. 2010). Under such conditions, a peripheral route of information processing is commonly used. Consequently, customers will rely on simple cues or some simple inference in evaluating the service such as customer facilitation behaviors. Meanwhile, central route processing will occur when customers use complex services since the customer will be motivated to process information, elaborating on relevant issues or attributes (Prenshaw et al. 2006). Therefore, we propose that

H5

The positive effect of customer facilitation behaviors on satisfaction is stronger when customers only use simple services as compared to those customers who use complex services.

Customers using complex services online face a different situation. They make a greater cognitive effort (central route processing) compared to those who only use simple services online (peripheral route processing) since they have to invest time and effort to get the service (Simon and Usunier 2007). Previous research in the online context suggests the predictive value of a cue such as e-psychological benefits (e.g., Colgate et al. 2005; Klaus 2013). Therefore, e-psychological benefits can be considered as highly relevant in this context. Additionally, customers using complex services online make a more intense use of the online channel than those who use it only for simple services. The former are not only aware of the level of performance the Web site can achieve, but they also feel more confident in the use of the Web site by developing the knowledge to use complex services online. In fact, those customers who use the online channel to get both simple and complex services are likely to score differently in their feelings of self-efficacy, control, confidence and perceived risk (Durkin 2007). Then, customers with self-efficacy are more likely to maximize value and take full advantage of service benefits (van Beuningen et al. 2009). That is, there is a match between the requirements of the activity in which the customer is involved (getting a complex service online) and the means through which this activity is accomplished (through the Web site with greater e-psychological benefits), which ultimately determines a better attitude toward the activity. In this sense, environmental psychology has shown that those who perceive they have more control tend to feel and behave more positively (Proshansky et al. 1974). Since a higher level of knowledge about the firm’s Web site leads to customer feelings of greater confidence and less perceived risk, when the customer experiences e-psychological benefits, his or her positive feelings of confidence will result in a stronger effect of e-psychological benefits on satisfaction with the firm compared to those who use the Web site only for simple services. These arguments lead to the following hypotheses:

H6

The positive effect of e-psychological benefits on satisfaction is stronger when customers use complex services compared to those customers who only use simple services.

In what follows, we build on cognitive fit theory (cf., van Birgelen et al. 2006) to elaborate on how the use of complex services in the online channel and the offline channel influences the effects of customer facilitation behaviors and e-psychological benefits, respectively, on satisfaction.

We expect that the positive effect of employees’ customer facilitation behaviors on satisfaction will be similar for customers who use the online channel to get complex services and those who use it only for simple ones. Two lines of reasoning may hold. First, although customers using complex services online invest more time and effort to deliver the service themselves than those using the online channel only for simple services, when it comes to experiencing the service offline, there are no such differences in the effort needed by the customers to get the service delivered by the employees. Even if those who use complex services online perceive the online channel as an effective substitute for the offline channel, employees’ customer facilitation behaviors are more likely to be fully perceived in face-to-face interactions. Thus, the fact that a customer is able to get a complex service online will not weaken the effect that an employee performing an extra-role behavior (i.e., facilitation behaviors) has on his/her satisfaction. A second, more fundamental argument follows from the cognitive fit theory. Van Birgelen et al. (2006) report a complementary cognitive channel fit between the Internet and a service employee. The online channel’s lower potential for providing immediate feedback and reacting swiftly to specific desires can be offset by the offline channel, whereas the offline channel’s limited ability to deliver repetitive and consistent service can be compensated for by the online channel (Maruping and Agarwal 2004). This cognitive fit is likely to manifest itself as a complementary evaluative effect on satisfaction no matter which kind of online service is demanded (complex or simple). Therefore, we propose that

H7

The positive effect of customer facilitation behaviors on satisfaction will be similar for customers who only use simple services online and those who use complex services online.

Based on van Birgelen et al.’s results, it is plausible to expect that multichannel customers who use complex services offline are more likely to perceive the online channel as a complementary channel while those using the traditional channel only to get simple services may perceive the online channel as an effective substitute for the offline channel (i.e., channels are perceived as similar). In fact, the online channel reduces the relative value that customers derive from simple services delivered through the offline channel (van Birgelen et al. 2006). Compatibility will occur since customers using simple services offline will perceive that the functionalities of the offline channel are similar to those of the online channel. Since there is a channel fit for customers using simple services offline, they are more likely to have a more positive attitude toward the online activity. Therefore, e-psychological benefits are likely to have a stronger influence on satisfaction building for them than for those customers who use complex services offline. Consequently, we posit that

H8

The positive effect of e-psychological benefits on satisfaction is stronger when customers only use simple services in the offline context as compared to those customers who use complex services offline.

5 Methodology

5.1 Data collection procedure and sample

The financial sector was chosen as the context of the study since it has been and is one of the most affected by the spread of new technologies such as the Internet (Gounaris and Koritos 2008). Nowadays, financial services’ customers are encouraged to use firms’ Web sites as an alternative channel. However, this sector has traditionally relied on frontline employees to build customer–firm relationships. Additionally, the financial sector offers services that differ in complexity level, a characteristic necessary to test our model.

In-depth interviews were first carried out with four multichannel consumers of financial services as well as a pretest with a convenience sample of 45 financial services consumers in order to get a better understanding of the research variables, assess the survey format and refine and adapt items to suit them to the specific context of our study. Then, we hired a marketing research firm to assist with the data collection through telephone interviews. The survey was administered to a sample of adults selected randomly from all regions of Spain. As in previous research (e.g., Ganesh et al. 2000; van Birgelen et al. 2006), respondents were screened for their level of experience with the bank’s service channels. Only respondents with sufficient experience with both channels (having used the online and the offline channel at least once with the same bank services provider in the current year) were included in the sample. The final sample consisted of 302 financial services customers of 43 banks. The average respondent was 42.3 years of age, 49 % of the respondents were male, the sample was well educated with 71 % of the respondents having a university level or equivalent, and 24.8 % were entrepreneurs. 61.3 % of the respondents were customers of more than one bank, and they had been working with their main bank an average of 12.6 years.

5.2 Measures

Existing scales were adapted to the context of the study. Participants indicated their (dis)agreement with a set of statements using 10-point Likert-like questions, with end points ranging from “1 = totally disagree” to “10 = totally agree”. Perceived customer facilitation behavior was measured with a five-item scale from Fernández-Sabiote and Román (2005). E-psychological benefits were measured with three indicators adapted from Sánchez et al. (2006). Overall satisfaction with the firm was measured using Brady and Cronin’s (2001) scale. Trust in the firm was assessed using a four-item scale adapted from Verhoef et al. (2002) and Roberts et al. (2003). Need for interaction was measured using three items from Dabholkar’s (1996) scale. The satisfaction, trust and need for interaction scales have been successfully used in the Spanish context by Fernández-Sabiote and Román (2009) and Riquelme and Román (2014), respectively.

In relation to service complexity measurement, sixteen service activities were identified both through a review of the literature and feedback from 10 multichannel banking customers who were considered as judges. These judges categorized the services as complex or non-complex using a sumscore decision rule. Services were categorized as complex (e.g., management of mortgages and other loans, management of investment funds, etc.) or simple (e.g., checking balances, bank transfers and other payments, mobile refill, etc.) irrespective of the channel used to get them. Then, service complexity (online and offline) was operationalized with two new variables as a result of the aggregation of the online and offline complex services demanded by the customer. More specifically, if the sum was higher than or equal to 1 then the customer was considered to use complex services.

We calculated Cronbach’s alpha to ensure that each scale exhibited a satisfactory level of internal consistency. Next, the multi-item scales were evaluated through confirmatory factor analysisFootnote 1 using the maximum likelihood procedure in Lisrel 8.80. Following the procedures suggested by Anderson and Gerbing (1988), none of the items were deleted. As shown in Table 1, the multi-item scales showed acceptable convergent and discriminant validity.Footnote 2

6 Results

The results of the structural equation analysis represent an acceptable fit of the data (\(\chi_{(84)}^{2}\) = 158.08; χ 2/df = 1.88; RMSEA = .054; CFI = .99; GFI = .93; SMSR = .05; NNFI = .99). As shown in Table 2, all of our core hypotheses were supported. The model explained 35 % of the variance in satisfaction, and 74 % of the variance in trust. Additionally, the indirect effects of perceived customer facilitation behaviors and e-psychological benefits on trust via satisfaction were examined. Results showed a significant effect in both cases (t value = 6.65 and 3.39, respectively).

It is generally agreed that researchers should compare the fit of rival models to that of the focal, proposed model. A new model (rival model) in which satisfaction fully mediates the relationship between the independent variables and trust is proposed. As shown in Table 2, when the partially mediated model is compared with the fully mediated model (rival model) the increase of the Chi square is significant (\(\Delta \chi_{(2)}^{2}\) = 15.46, p < .001), indicating a partial mediating effect on the customer facilitation-trust and e-psychological benefits-trust relationships.

To test whether customer facilitation behaviors have a stronger effect on satisfaction and trust than e-psychological benefits, we estimated a series of constrained and unconstrained models. An unconstrained model freely estimates the effects of each predictor on the outcome variable. The constrained model constrains the effects of two predictors on an outcome variable to be equal. The χ 2 difference between the unconstrained and constrained models tests the difference in relative strength between two predictors (Bollen 1989). The unconstrained model results are shown in Table 2 (\(\chi_{(84)}^{2}\) = 158.08). The influence of customer facilitation behaviors on satisfaction and trust was 0.49 and 0.14, respectively, whereas the influence of e-psychological benefits on satisfaction and trust was 0.21 and 0.10, respectively. First, we compared the effects of facilitation behaviors and e-psychological benefits on satisfaction. The resulting constrained model \(\chi_{(85)}^{2}\) was 163.23 and the difference in χ 2 between the unconstrained and constrained models was significant (Δχ 2 = 5.15, p < 0.025). Meanwhile, when comparing the effect of customer facilitation behaviors and e-psychological benefits on trust, the constrained model (\(\chi_{(85)}^{2}\) = 158.17) was not significantly different from the unconstrained model’s χ 2 (Δχ 2 = 0.09, p > 0.10). In short, the effect of customer facilitation behaviors on satisfaction was significantly stronger than the effect of e-psychological benefits, but customer facilitation behaviors and e-psychological benefits did not significantly differ in their effect on trust.

6.1 Test of the moderating hypotheses

Next we tested moderating effects (H4–H8) through multi-group LISREL analyses. For consumer’s need for interaction the sample was median split in two subgroups respectively to ensure within-group homogeneity and between-group heterogeneity (cf. Stone and Hollenbeck 1989). For complexity of the service, the sample was split into consumers with experience versus without experience with complex services in the offline channel, and consumers with experience versus those without experience with complex services in the online channel. This allowed us to evaluate our hypotheses by comparing the path coefficients of the two subsamples. Formally, we calculated two models: One base model where the structural path of interest (e.g., from customer facilitation to satisfaction; Hypothesis 1a) is freely estimated and one alternative model, where the path is fixed (static). If a significant χ 2 change is observed in comparing the models, we conclude a significant moderation effect exists.

The results of the multi-group LISREL analyses are shown in Table 3. First, contrary to what it was expected, the positive influence of customer facilitation on satisfaction is stronger for customers with lower need for interaction (γ = 0.53, t = 5.91) than for those with a higher need for interaction (γ = 0.36, t = 4.59). Meanwhile, the positive influence of e-psychological benefits on satisfaction is weaker among customers with higher need for interaction (γ = 0.15, t = 1.95) than those with a lower need for interaction (γ = 0.35, t = 3.95). Thus H4a is rejected while H4b is supported.

In relation to services complexity, results show how the effect of perceived customer facilitation behavior on satisfaction (H5) is stronger for customers who do not use complex services in the offline channel (γ = 0.62, t = 6.33) versus those who use complex services (γ = 0.43, t = 5.75). However, H7 results show how this effect is not stronger for customers who only use the online channel for simple services (use complex services online: γ = 0.54, t = 6.59; do not use complex services online γ = 0.47, t = 5.49). Meanwhile, in H8, the effect of e-psychological benefits on satisfaction is stronger for customers that do not use complex services in the offline channel (γ = 0.63, t = 5.52) than for those who use complex services offline (γ = 0.11, t = 1.83); and, as suggested in H6, for customers who use complex services online (γ = 0.49, t = 4.66) versus those who use the online channel for simple services (γ = 0.13, t = 1.95). Therefore, all our hypotheses are supported except H4a.

7 Discussion and implications

Several interesting patterns can be observed in our findings. First, customer facilitation behaviors have a stronger impact on satisfaction than e-psychological benefits, while their influence on trust is not significantly different. While previous studies may have related similar antecedents with satisfaction and trust (e.g., Fernández-Sabiote and Román 2005; Gremler et al. 2001), this is, to our knowledge, the first which actually compares these effects in a multichannel context. Second, results from examining the direct and indirect effects indicate that both customer facilitation behaviors and e-psychological benefits affect trust via satisfaction (t = 6.65 and t = 3.39, respectively).

Regarding the moderating effects, contrary to what was hypothesized, the effect of customer facilitation behavior on satisfaction was stronger for customers with lower need for interaction than for those with higher need for interaction. In retrospect, this result may be explained by the expectation-performance theory. That is, a multichannel customer with a high need for interaction is likely to have higher expectations of what he or she is going to get from the firm’s personnel compared to the firm’s Web site. Therefore, it will be more difficult to overcome his/her expectations, compared to another customer who has lower need for interaction, and is less motivated to interact with frontline employees. The latter will be more independent, willing to do things by him/herself and may even anticipate low value from interaction with employees. Based on the expectation-performance theory, if a customer with low need for interaction is exposed to customer facilitation behaviors, he/she may be more satisfied than another customer with a higher need for interaction, since the latter will have higher expectations. In contrast, for the online channel, the positive influence of e-psychological benefits on satisfaction is stronger for customers with lower need for interaction than those with a higher need for interaction.

Finally, the moderating effects of complexity are of particular interest. All the hypotheses (H5, H6, H7 and H8) are supported, which indicates that: (a) the effects of customer facilitation behaviors and e-psychological benefits on satisfaction are higher for customers who do not use complex services (in either the offline or the online channel); (b) customers who use complex services offline give less relevance to peripheral elements in their satisfaction judgments; (c) the existence of a fit effect between channels, since the type of service used in the offline channel impacts on the influence of the online channel’s benefits (the alternative channel) on satisfaction; and (d) there is a complementary evaluative effect in the offline channel for customers using both complex and only using simple services online.

7.1 Research implications

Modeling multichannel customer behavior is in an early stage of research and numerous possibilities still exist for inspecting and expanding the knowledge in this area. Past research has mainly focused on rational, more functional issues such as price level or promotions. Furthermore, while some studies have shown that there are drawbacks associated with the multichannel delivery of services, such as channel cannibalization (van Birgelen et al. 2006), others have provided empirical evidence for the positive effects of a multichannel strategy (Verhoef et al. 2007).

The current study adds to the existing literature by exploring the role of more psychological non-core dimensions of multichannel service provision in their contribution to the customer–firm relationship. More specifically, we examined the direct and indirect effects of perceived customer facilitation behaviors and e-psychological benefits on customer satisfaction with the firm and trust in the firm. This is, to the best of our knowledge, the first time that trust is examined as a relational outcome in a multichannel service context. Extant research in services marketing has underscored the importance of trust and its implications for driving long-lasting customer relationship (Eisingerich and Bell 2008). Our results offer important insights for theory since both channels positively influenced satisfaction and trust in the service provider. Interestingly, despite the improvements over the years in the delivery of online services, our findings highlight the key role of interpersonal interactions between customers and employees in service encounters, yet our findings suggest that e-psychological benefits can be as strong as employees’ customer facilitation in building trust in the service firm.

Our study also contributes to the literature by examining the moderating role of customer’s need for interaction and service complexity on the effect of facilitation behaviors and e-psychological benefits on satisfaction. Importantly, researchers have long argued that “hypothesizing direct effects may be somewhat redundant and obvious” (Dabholkar and Bagozzi 2002, p. 185), and it is much more meaningful to investigate the moderating effects of consumer traits and/or characteristics of the buying process (e.g., Baron and Kenny 1986; James and Brett 1984).

7.2 Managerial implications

This study has relevant implications for the management of multichannel customers. Recent findings stress the importance of synchronizing services channels to reduce channel conflicts and to enhance the overall channel system performance (Falk et al. 2007; Neslin et al. 2006). Moreover, it has been suggested to shift customers to the online channel (Falk et al. 2007). For managers to optimize service firms’ efforts and outcomes, they must know which components are most desirable and valued by multichannel customers, and which contribute to desirable organizational ends. Our results show how both channels have a positive impact on the customer–firm relationship. However, the offline channel, through customer facilitation behaviors, has a stronger impact on satisfaction than the online channel through e-psychological benefits. This suggests that managers should carefully consider decisions on substituting human labor in face-to-face settings with technology when designing and coordinating multichannel strategies.

On the one hand, promoting customer facilitation behaviors between customers and frontline employees is a feasible approach to generate satisfaction and trust in the firm. In this sense, employees’ empowerment can affect their tendency to perform such behaviors. Empowerment allows for quicker responses to customer needs and problems, more warmth and enthusiasm when employees interact with customers, and more employee-generated ideas for improving customer service. Additionally, when a firm places high value on developing long-term relationships with employees, it will be more likely to foster the commitment and trust necessary for customer facilitation behaviors.

On the other hand, enhancing customers’ perception of e-psychological benefits is another feasible and easy way to promote satisfaction and trust in the firm. In doing so, we recommend the following activities for management. First, communicating e-psychological benefits through advertising and other forms of communication to customers will make these benefits more evident. Second, investing in enhancing customers’ ability to use the firm’s Web site. For example, through the development of tutorials, and rewarding those customers who follow these activities, it will increase not only the use of the firm’s Web site but also customers’ satisfaction and trust in the firm. It is important not to make customers feel they are being forced into using a particular channel, but that they are being offered multiple options.

7.3 Limitations and directions for future research

Our findings must be interpreted in light of our study’s limitations, which also point to potential directions for future research. First, the survey was limited to multichannel retailing in the context of financial services. While this context is appropriate for this investigation, generalizability of the findings to other service industries may be restricted. Future research could replicate our results in another setting, using similar channels, or further develop our insights by including other channels (e.g., telephone). Second, our study demonstrates connections between the service provided through the offline channel and the online channel. However, more research is needed for managers to understand the effect of alternative channels on channel evaluations. Our study was conducted with consumers with sufficient experience with both channels (having used the online and the offline channel at least once with the same bank services provider in the current year). Additional research could examine the role of different levels of experience with the channels in our hypothesized framework. Finally, future studies should incorporate longitudinal measurement to address the dynamics of customers’ multichannel use. We could investigate our model in different time periods and make comparisons.

Overall, this study improves our understanding of consumers’ use of multichannel services, particularly in relation to how more psychological benefits derived from face-to-face interactions as well as interactions with the company’s Web site influence satisfaction and trust in the service provider.

Notes

Since data were collected cross-sectionally using self-report measures, the potential for common methods variance exists. Following Podsakoff et al. (2003, p. 889), we tested for this bias using Harman’s one-factor approach. In particular, we subjected all the measures to a confirmatory factor analysis, and found that the one-factor model demonstrated a poor fit to the data [χ 2(135) = 2428.44; p = .0; GFI = .53; CFI = .81; RMSEA = .24; RMSR = .16; TLI (NNFI) = .78]. As a result, common methods bias was ruled out as a potential threat to the subsequent hypothesis testing.

Convergent validity was assessed by verifying the significance of the t values associated with the parameter estimates. All t values were positive and significant (p < .01). Discriminant validity was tested by comparing the average variance extracted by each construct to the shared variance between the construct and all other variables. For each comparison, the explained variance exceeded shared variance.

References

Anderson JC, Gerbing DW (1988) Structural equation modeling in practice: a review and recommended two step approach. Psychol Bull 103(3):411–423

Ansari A, Mela CF, Neslin SA (2008) Customer channel migration. J Mark Res 45(1):60–76

Avery J, Steenburgh TJ, Deighton J, Caravella M (2012) Adding bricks to clicks: predicting the patterns of cross-channel elasticities over time. J Mark 76(3):96–111

Bagozzi RP, Yi Y (1988) On the evaluation of structural equation models. J Aca Mark Sci 16(1):74–94

Baron RM, Kenny DA (1986) The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Personal Soc Psychol 5l(6):1173–1182

Bendoly E, Blocher JD, Bretthauer KM, Krishnan S, Venkataramanan MA (2005) Online/in-store integration and customer retention. J Serv Res 7(4):313–327

Bitner MJ, Booms BH, Tetreault MS (1990) The service encounter: diagnosing favorable and unfavorable incidents. J Mark 54(1):71–84

Black NJ, Lockett A, Ennew C, Winklhofer H, McKechnie S (2002) Modelling consumer choice of distribution channel: an illustration from financial services. Int J Bank Mark 20:161–173

Blázquez M (2014) Fashion shopping in multichannel retail. The role of technology in enhancing the customer experience. Int J Electron Commer 18(4):97–116

Bollen KA (1989) Structural equations with latent variables. Wiley, New York

Borman WC, Motowidlo SJ (1993) Expanding the criterion domain to include elements of contextual performance. In: Schmitt N, Borman WC (eds) Personnel selection in organizations. Jossey-Bass, San Francisco, pp 71–98

Brady MK, Cronin JJJ (2001) Some new thoughts on conceptualizing perceived service quality: a hierarchical approach. J Mark 65(3):34–49

Cha J (2011) Exploring the internet as a unique shopping channel to sell both real and virtual items: a comparison of factors affecting purchase intention and consumer characteristics. J Electron Commer Res 12(2):115–132

Cheng JM-S, Wang ES-T, Lin JY-C, Vivek SD (2009) Why do customers utilize the internet as a retailing platform? A view form consumer perceived value. Asian Pac J Mark Log 21(1):144–160

Choi J, Park J (2006) Multichannel retailing in Korea: effects of shopping orientations and information seeking patterns on channel choice behavior. Int J Retail Distrib Manag 34(8):577–596

Colgate M, Buchanan-Oliver M, Elmsly R (2005) Relationship benefits in an internet environment. Manag Serv Qual 15(5):426–436

Constantinides E (2004) Influencing the online customer’s behavior: the Web experience. Internet Res 14(2):111–126

Crosby LA, Evans KR, Cowles D (1990) Relationship quality in services selling: an interpersonal influence perspective. J Mark 54(3):68–81

Dabholkar PA (1996) Consumer evaluations of new technology-based self-service options: an investigation of alternative models of service quality. Int J Res Mark 13:29–51

Dabholkar PA, Bagozzi RP (2002) An attitudinal model of technology-based self-service: moderating effects of consumer traits and situational factors. J Acad Mark Sci 30(3):184–201

Davis FD (1989) Perceived usefulness, perceived ease of use and user acceptance of information technology. MIS Q 13(3):319–339

DePaulo BM (1992) Nonverbal behavior and self-presentation. Psychol Bull 111(2):203–243

Devlin JF (1998) Adding value to service offerings: the case of UK retail financial services. Eur J Mark 32(11/12):1091–1109

Dholakia RR, Zhao M, Dholakia N (2005) Multichannel retailing: a case of study of early experiences. J Interact Mark 19(2):63–74

Durkin M (2007) On the role of bank staff in online customer purchase. Mark Intell Plan 25(1):82–97

Eisingerich AB, Bell SJ (2008) Perceived service quality and customer trust: Does enhancing customers’ service knowledge matter? J Serv Res 10:256–268

Falk T, Schepers J, Hammerschmidt M, Bauer HH (2007) Identifying cross-channel dissynergies for multichannel service providers. J Serv Res 10(2):143–160

Fenech T, O’Cass A (2001) Internet users’ adoption of Web retailing: user and product dimensions. J Prod Brand Manag 10(6/7):361–381

Fernández Sabiote E, Román S (2012) Adding clicks to bricks: a study of the consequences on customer loyalty in a service context. Electron Commer Res Appl 11(1):36–48

Fernández-Sabiote E, Román S (2005) Organizational citizenship behaviour from the service customer’s perspective. Int J Mark Res 47(3):317–336

Fernández-Sabiote E, Román S (2009) The influence of social regard on the customer-service firm relationship: the moderating role of length of relationship. J Bus Psychol 24(4):441–453

Fetscherin M, Lattermann C (2008) User acceptance of virtual worlds. J Electron Commer Res 9(3):231–242

Fiore AM, Jin H-J, Kim J (2005) For fun and profit: hedonic value from image interactivity and responses toward and online store. Psychol Mark 22(8):669–694

Forman AM, Sriram V (1991) The depersonalization of retailing: its impact on the “lonely” consumer. J Retail 67(2):226–243

Ganesh J, Arnold MJ, Reynolds KE (2000) Understanding the customer base of service providers: an examination of the differences between switchers and stayers. J Mark 64(3):65–87

Garbarino E, Johnson MS (1999) The different roles of satisfaction, trust, and commitment in customer relationships. J Mark 63(2):70–87

Garry T (2008) Affect and the role of corporate customer expertise within legal services. J Serv Mark 22(4):292–302

Gensler S, Dekimpe MG, Skiera B (2004) Evaluating channel performance in multi-channel environments. J Retail Consum Serv 14:17–23

Gentile C, Spiller N, Noci G (2007) How to sustain the customer experience: an overview of experience components that co-create value with the customer. Eur Manag J 25(5):395–410

Gerrard P, Cunningham BJ (2003) The diffusion of Internet banking among Singapore consumers. Int J Bank Mark 21(1):16–28

Geyskens I, Steenkamp JBEM, Kumar N (1999) A meta-analysis of satisfaction in marketing channel relationships. J Mark Res 36(2):223–238

Gounaris S, Koritos C (2008) Investigating the drivers of internet banking adoption decision: a comparison of three alternative frameworks. Int J Bank Mark 26(5):282–304

Gremler DD, Gwinner KP, Brown SW (2001) Generating positive word-of-mouth communication through customer-employee relationships. Int J Serv Ind Manag 12(1):44–59

Gwinner KP, Gremler DD, Bitner MJ (1998) Relational benefits in services industries: the customer’s perspective. J Acad Mark Sci 26(2):101–114

Harris KE, Grewal D, Mohr LA, Bernhardt KL (2006) Consumer responses to service recovery strategies: the moderating role of online versus offline environment. J Bus Res 59:425–431

Homburg C, Koschate N, Hoyer WD (2005) Do satisfied customers really pay more? A study of the relationship between customer satisfaction and willingness to pay. J Mark 69:84–96

Hsieh Y-C, Roan J, Pant A, Hsieh J-K, Chen W-Y, Lee M, Chiu H-C (2012) All for one but does one strategy work for all? Building consumer loyalty in multi-channel distribution. Manag Serv Qual 22(3):310–335

James LR, Brett JM (1984) Mediators, moderators, and tests for mediation. J Appl Psychol 69(2):307–321

Johnson D, Grayson K (2005) Cognitive and affective trust in service relationships. J Bus Res 58(4):500–507

Joo Y-H, Park MHJ (2008) Information search and purchase channel choice across in-home shopping retail formats. Acad Mark Stud J 12(2):49–61

Kauffman RJ, Lee D, Yoo JLB (2009) Analyzing a hybrid firm’s pricing strategy in electronic commerce when channel migration occurs (January 12). Available at SSRN: http://ssrn.com/abstract=1339875. doi:10.2139/ssrn.1339875

Klaus P (2013) The case of Amazon.com: towards a conceptual framework of online customer service experience (OCSE) using the emerging consensus technique (ECT). J Serv Mark 27(6):443–457

Knox G (2005) Modeling and managing customers in a multichannel setting. Working Paper, University of Tilburg, Tilburg

Ko H, Cho CH, Roberts (2005) Internet uses and gratifications. A structural equation model of interactive advertising. J Advert 34(2):57–70

Kollmann T, Kuckertz A, Kayser I (2012) Cannibalization or synergy? Consumers’ channel selection in online–offline multichannel systems. J Retail Consum Serv 19(2):186–194

Kumar V, Venkatesan R (2005) Who are multichannel shoppers and how do they perform? Correlates of multichannel shopping behavior. J Interact Mark 19(2):44–61

Kushwaha TL, Shankar V (2008) Single channel vs. multichannel retail customers: correlates and consequences. Working Paper, Texas A&M University, College Station

Kushwaha TL, Shankar V (2013) Are multichannel customers really more valuable? The moderating role of product category characteristics. J Mark 77(4):67–85

Lai VS, Li H (2005) Technology acceptance model for internet banking: an invariance analysis. Inf Manag 42:373–386

Larivière B, Aksoy L, Keiningham TL (2011) Does satisfaction matter more if a multichannel customer is also a multicompany customer? J Serv Manag 22(1):39–66

Levy M, Weitz B (2009) Retailing management, 7th edn. McGraw-Hill, New York

Liao C, To PL, Liu CC, Kuo PY, Chuang SH (2011) Factors influencing the intended use of web portals. Online Inf Rev 35(2):237–254

Madlberger M (2006) Exogenous and endogenous antecedents of online shopping in a multichannel environment: evidence from a catalog retailer in the German-speaking world. J Electron Commer Organ 4(4):29–51

Maklan S, Klaus P (2011) Customer experience: are we measuring the right things. Int J Mark Res 53(6):771–792

Maruping LM, Agarwal R (2004) Managing team interpersonal processes through technology: a task-technology fit perspective. J Appl Psychol 89:975–990

Maxham JG III, Netemeyer TG, Lichtenstein DR (2008) The retail value chain: linking employee perceptions to employee performance, customer evaluations, and store performance. Mark Sci 27(2):147–167

Meuter ML, Ostrom AL, Roundtree RI, Bitner MJ (2000) Self-service technologies: understanding customer satisfaction with technology-based service encounters. J Mark 64(3):50–64

Meuter ML, Bitner MJ, Ostrom AL, Brown SW (2005) Choosing among alternative service delivery modes: an investigation of customer trial of self-service technologies. J Mark 69(2):61–83

Mohr LB, Bitner MJ (1995) The role of employee effort in satisfaction with service transactions. J Bus Res 32:149–177

Montoya-Weiss MM, Voss GB, Grewal D (2003) Determinants of online channel use and overall satisfaction with a relational, multichannel service provider. J Acad Mark Sci 31(4):448–458

Neslin SA, Shankar V (2009) Key issues in multichannel customer management: current knowledge and future directions. J Interact Mark 23:70–81

Neslin SA, Grewal D, Leghorn R, Shankar V, Teerling ML, Thomas JS, Verhoef PC (2006) Challenges and opportunities in multichannel customer management. J Serv Res 9(2):95–112

Nicholson CY, Compeau LD, Sethi R (2001) The role of interpersonal liking in building trust in long-term channel relationships. J Acad Mark Sci 29(1):3–15

Oliver RL (1980) A cognitive model of the antecedents and consequences of satisfaction decisions. J Mark Res 17(4):460–469

Parasuraman A, Zeithaml VA, Berry LL (1985) A conceptual model of services quality and its implication for future research. J Mark 49(4):41–50

Park J, Lennon SJ (2006) Psychological and environmental antecedents of impulse buying tendency in the multichannel shopping context. J Consum Mark 23(2):58–68

Perea y Monsuwé T, Dellaert BGC, de Ruyter K (2004) What drives consumers to shop online? A literature review. Int J Serv Ind Manag 15(1):102–121

Petty RE, Cacioppo JT (1986) The elaboration likelihood model of persuasion. In: Berkowitz L (ed) Advances in experimental social psychology, vol 19. Academic Press, New York, pp 123–205

Podsakoff PM, MacKenzie SB, Lee JY, Podsakoff NP (2003) Common method biases in behavioral research: a critical review of the literature and recommended remedies. J Appl Psychol 88(5):879–903

Prendergast GP, Marr NE (1994) Disenchantment discontinuance in the diffusion of technologies in the service industry: a case study in retail banking. J Int Consum Mark 7(2):25–40

Prenshaw PJ, Kovar SE, Burke KG (2006) The impact of involvement on satisfaction. J Serv Mark 20(7):439–452

Proshansky HM, Ittelson WH, Rivlin LG (1974) Freedom of choice and behavior in a physical setting. In: Proshansky HM, Ittelson WH, Rivlin LG (eds) Environmental psychology. Holt, Rineheart & Winston, New York, pp 170–181

Ribbink D, van Riel ACR, Liljander V, Streukens S (2004) Comfort your online customer: quality, trust and loyalty on the internet. Manag Serv Qual 14(6):446–456

Riquelme IP, Román S (2014) The relationships among consumers’ ethical ideology, risk aversion and ethically-based distrust of online retailers and the moderating role of consumers’ need for personal interaction. Ethics Inf Technol 16(2):135–155

Roberts K, Varki S, Brodie R (2003) Measuring the quality of relationships in consumer services: an empirical study. Eur J Mark 37(1/2):169–196

Román S (2007) The ethics of online retailing: a scale development and validation from the consumers’ perspective. J Bus Ethics 72(2):131–148

Sánchez J, Callarisa L, Rodríguez RM, Moliner MA (2006) Perceived value of the purchase of a tourism product. Tour Manag 27(3):394–409

Seck AM, Philippe J (2013) Service encounter in multi-channel distribution context: virtual and face-to-face interactions and consumer satisfaction. Serv Ind J 33(6):565–579

Shostack GL (1987) Service positioning through structural change. J Mark 51(1):34–43

Simon F, Usunier JC (2007) Cognitive, demographic, and situational determinants of service customer preference for personnel-in-contact over self-service technology. Int J Res Mark 24:163–173

Singh J, Sirdeshmukh D (2000) Agency and trust mechanisms in consumer satisfaction and loyalty judgements. J Acad Mark Sci 28(1):150–167

Stone EF, Hollenbeck JR (1989) Clarifying some controversial issues surrounding statistical procedures for detecting moderator variables: empirical evidence and related matters. J Appl Psychol 74(21):3–10

Su Q, Li L, Cui YW (2009) Analysing relational benefits in e-business environment from behavioural perspective. Syst Res Behav Sci 26(2):129–142

Suh B, Han I (2002) Effect of trust on customer acceptance of Internet Banking. Electron Commer Res Appl 1:247–263

Susskind AM (2004) Electronic commerce and World Wide Web apprehensiveness: an examination of consumers’ perceptions of the World Wide Web. J Comput Mediat Commun 9(3):00. doi:10.1111/j.1083-6101.2004.tb00287.x

Thomas JS, Sullivan UY (2005) Managing marketing communications with multichannel customers. J Mark 69(4):239–251

Valentini S, Montiguti E, Neslin SA (2011) Decision process evolution in customer channel choice. J Mark 75(6):72–86

van Beuningen J, de Ruyter K, Wetzels M, Streukens S (2009) Customer self-efficacy in technology-based self service. J Serv Res 11(4):407–428

van Birgelen M, de Jong A, de Ruyer K (2006) Multi-channel service retailing: the effects of channel performance satisfaction on behavioral intentions. J Retail 82(4):367–377

Venkatesan R, Kumar V, Ravishanker N (2007) Multichannel shopping: causes and consequences. J Mark 71(2):114–132

Venkatesh V, Morris MG, Davis GB, Davis FD (2003) User acceptance of information technology: toward a unified view. MIS Q 27(3):425–478

Verhoef PC, Donkers B (2005) The effect of acquisition channels on customer loyalty and cross-buying. J Interact Mark 19(2):31–43

Verhoef PC, Franses PH, Hoekstra JC (2002) The effect of relational constructs on customer referrals and number of services purchased from a multiservice provider: Does age of relationship matter? J Acad Mark Sci 30(3):2002–2216

Verhoef PC, Neslin SA, Vroomen B (2007) Multichannel customer management: understanding the research-shopper phenomenon. Int J Res Mark 24:129–148

Wallace DW, Giese JL, Johnson JL (2004) Customer retailer loyalty in the context of multiple channel strategies. J Retail 80:249–263

Wang Y, Chan SF, Yang Z (2013) Customers’ perceived benefits of interacting in a virtual brand community in China. J Electron Commer Res 14(1):49–66

Wiertz C, de Ruyter K, Keen C, Streukens S (2004) Cooperating for service excellence in multichannel service systems: an empirical assessment. J Bus Res 57(4):424–436

Yoon S, Lee S, Choi YK (2010) Different routes to judgment formation. Commun Bus 1:50–70

Zeithaml VA, Bitner MJ (2000) Services marketing: integrating customer focus across the firm, 2nd edn. McGraw Hill, New York

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fernández-Sabiote, E., Román, S. The multichannel customer’s service experience: building satisfaction and trust. Serv Bus 10, 423–445 (2016). https://doi.org/10.1007/s11628-015-0276-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11628-015-0276-z