Abstract

We investigate whether variations in earnings management in the Asia-Pacific region countries can be explained by the extent of IFRS adoption having regard to the diversity of cultures across countries in the region and the degree of accounting standards enforcement. Across 17 key countries in the region, we find that IFRS convergence is associated with reduced levels of earnings management, particularly in recent years when IFRS has been increasingly adopted by publicly listed firms in the region. Nevertheless, the influence of cultural values and the degree of accounting standards enforcement remain significant and persistent institutional factors explaining international differences in earnings management.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

We examine the significance of institutional factors influencing earnings management behaviour in the Asia-Pacific region, with specific reference to 17 key countries/jurisdictions, that is, Australia, Chile, China, Hong Kong (China), Indonesia, India, Japan, Korea Republic, Malaysia, New Zealand, Pakistan, Peru, Philippines, Russia, Singapore, Thailand, and Chinese Taipei. While International Financial Reporting Standards (IFRS) have been widely implemented in Europe, there has been a much slower and less widespread process of adoption in the Asia-Pacific. Hence, our interest is in explaining the effects of IFRS adoption and the key influential factors operating in the region over time. Our research is conducted in the context of the ongoing convergence of national accounting standards (NAS) towards IFRS. IFRS are claimed to be high quality accounting standards (IFRS-Foundation 2018). Under IFRS principles-based accounting standards, many allowable accounting alternatives have been removed and accounting measurements that better reflect a firm’s economic position and performance are now required (Barth et al. 2008). Accordingly, their use is expected to restrict earnings management behaviour and promote high-quality financial reporting. The purpose of our paper is to assess the extent to which IFRS adoption has made a difference in this respect and to examine whether cultural values and the degree of accounting standards enforcement remain significant and persistent institutional factors explaining international differences in earnings management behaviour.

Earnings management is likely to vary across major countries in the Asia-Pacific for a number of reasons. First, countries in the Asia-Pacific exhibit a wide diversity of institutional settings (Guan et al. 2005) and quality of corporate governance (ACGA 2018). This diversity is likely to influence earnings management practice (e.g., García-Meca and Sánchez-Ballesta 2009; Leuz et al. 2003) and, therefore, the convergence of accounting standards and the quality of financial reporting accordingly.

Second, the extent of IFRS adoption differs widely among countries in the Asia-Pacific and thus likely affects earnings management differently. For example, the use of IFRS as issued by the IASB is still not permitted in some countries, such as Indonesia, India, and Thailand (Deloitte 2018; IFRS 2018), despite many countries’ leaders having emphasised the implementation of IFRS as a desirable set of global accounting standards. Given that a number of studies have documented that financial information under IFRS is of better quality than under NAS (Barth et al. 2008; Byard et al. 2011; Landsman et al. 2012), we expect the earnings management of firms in the Asia-Pacific to vary across countries according to the status of IFRS adoption over time. Firms in countries that mandatorily require IFRS, or are more highly converged with IFRS, are thus expected to have a lower degree of earnings management relative to those that do not permit the use of IFRS or have a lower degree of convergence with IFRS.

Our research also examines whether national culture explains variations in earnings management in the Asia-Pacific region. To date, the studies of earnings management under IFRS have focused largely on accounting standards and other formal institutional factors that likely affect the quality of financial information (e.g., Ball et al. 2000, 2003; Byard et al. 2011; Houqe et al. 2012, 2014; Landsman et al. 2012; Sun et al. 2011) or on regions other than the Asia-Pacific (e.g., Gray et al. 2015; Houqe et al. 2016). Extending these prior studies, our research examines whether informal institutional factors, such as culturally derived accounting values, significantly affect the earnings management behaviour of listed firms in the Asia-Pacific region. Given that prior studies have documented the relationship between cultural values and earnings management (e.g., Braun and Rodriguez 2008; Desender et al. 2011; Guan et al. 2005; Han et al. 2010), we expect that the variation in earnings management behaviour across the Asia-Pacific can be explained to some extent by cultural values. In addition, the Asia-Pacific countries appear to have a high variation in their degrees of accounting standards enforcement (Brown et al. 2014) and a much slower and less widespread process of IFRS adoption. Accordingly, we expect that the variability of earnings management in the Asia-Pacific countries can also be explained to some extent by the degree of accounting standards enforcement.

To investigate whether earnings management varies with the extent of IFRS adoption, we calculate firms’ accrual earnings management behaviour and collect firm level data about IFRS adoption during the period 2001–2016 for 17 major countries/jurisdictions across the Asia-Pacific. The year 2001 represents the base level of accounting standards convergence. The year 2016 represents a more current level of achievement toward the convergence of accounting standards after more than a decade of activity. Multivariate analyses are employed to investigate whether IFRS adoption, cultural values, and the degree of accounting standards enforcement explain variations in the earnings management behaviour of firms across the Asia-Pacific countries as would be expected.

The empirical results of our study make an important contribution to the question as to whether IFRS convergence and adoption is making an impact relative to ongoing cultural influences and the degree of accounting standards enforcement in the Asia-Pacific countries. After more than a decade of the global convergence process taking place, the impact of IFRS adoption is to restrict earnings management behavior. This is consistent with our expectations. Further, the empirical results demonstrate the influence of cultural values and the degree of accounting standards enforcement on international differences in earnings management.

Our study contributes to the policy debate among standard setters concerning the effectiveness of the convergence process towards IFRS. Convergence is a very important issue for Asia-Pacific countries as they must trade-off the potential of an economic integrated market against national autonomy (Apergis and Cooray 2014). Literature that has investigated the impact of IFRS and institutional factors on earnings management in the context of the Asia-Pacific region is very limited. We contribute to this literature by updating the measures used in the culturally derived accounting value of conservatism (Gray 1988). By including the more recent Hofstede culture dimensions of long-term orientation and indulgence in our definition of conservatism, we introduce an updated measure that represents conservatism more effectively than those used in previous studies (e.g., Hope et al. 2008; Salter et al. 2013). In particular, long-term orientation is incorporated because this dimension was set based on recognition of its relevance to Asia (Hofstede and Bond 1988). While the Hofstede dimensions have been criticised by some for their use in cultural studies (Baskerville 2003), they have been widely used and accepted, especially in respect of Asia, in the international business literature (Beugelsdijk et al. 2017; Ronen and Shenkar 2013).

The rest of our paper is organised as follows. In Sect. 2, we present the literature review and hypotheses development. Section 3 demonstrates how the data, sample, and research methodology will be used to investigate the hypotheses. Section 4 presents the empirical results. In Sect. 5, we present a summary and conclusions, including limitations of the study and suggestions for future research.

2 Literature Review and Hypotheses Development

2.1 Global Convergence of Accounting Standards in the Asia-Pacific

The global convergence of accounting standards has reduced the multiplicity of national accounting standards. Prior studies have documented that IFRS restricts earnings management, improves accounting earnings quality, and is useful for investors in making their investment decisions (Barth et al. 2008; Houqe et al. 2012; Landsman et al. 2012). Financial information under IFRS is affected by institutional factors (e.g., Ball et al. 2000) and reporting incentives (e.g., Byard et al. 2011; Christensen et al. 2015). In addition, IFRS is claimed to offer a single set of high quality accounting standards (e.g., Gordon et al. 2008; IFRS-Foundation 2018; SEC 2007). Therefore, their use in the market is expected to not only facilitate comparability, but also provide high quality financial reporting to investors. Theoretically, the higher the quality of financial information the lower the information risk, and hence the lower the cost of equity capital (Easley and O’Hara 2004). Thus, high quality IFRS financial statements encourage capital flows across nations, increase capital market efficiency, and reduce the cost of capital (e.g., Daske et al. 2008; Hail and Leuz 2006).

Given that IFRS is claimed to be high quality, a number of studies have examined earnings management behaviour and the quality of financial reporting under IFRS (Barth 2008; Barth et al. 2008; Houqe et al. 2014; Soderstrom and Sun 2007). The quality of financial reporting under IFRS appears to be higher than that under NAS (Barth et al. 2008; Houqe et al. 2012; Landsman et al. 2012), as indicated by less earnings management, timelier loss recognition, and greater value relevance of earnings (Barth et al. 2008). The underlying argument is that high quality IFRS accounting standards are characterised by fewer alternative accounting choices and higher quality accounting measurements. Consequently, IFRS is expected to help managers to more effectively report earnings persistence, to make fewer errors such as in bad debt provisions, and to make higher quality accrual estimations.

As part of ensuring a better quality of financial reporting, IFRS accounting standards have been required (e.g., Australia, South Korea, Hong Kong, New Zealand, and Philippines) or permitted (e.g., Japan) for the preparation of financial statements by some Asia-Pacific countries/jurisdictions, but have not been fully adopted and are not permitted for domestic firms by some other countries (e.g., Indonesia, India, and Thailand). Both Indonesia and India have not adopted IFRS Standards for reporting by domestic companies and have not yet formally committed to adopting IFRS Standards. In Thailand, accounting standards are substantially converged with IFRS Standards, but the financial instruments standards that are part of IFRS Standards have not yet been adopted. Thai Accounting Standards also include several national financial instruments standards that differ from IFRS Standards (Deloitte 2018; IFRS 2018). Although the major economies in the Asia-Pacific region have agreed to promote IFRS as a single set of global accounting standards, the level of adoption or the degree of convergence varies across countries. Given that the variation in Asia-Pacific compliance with IFRS is high, the different levels of use of IFRS by Asia-Pacific firms is likely to lead to a higher variation in earnings management. Thus, we expect that the earnings management of these firms varies and will be associated negatively with the degree of convergence towards IFRS.

Hypothesis 1: Earnings management in the Asia-Pacific region is likely to be negatively associated with the degree of convergence with IFRS.

2.2 Cultural Influences

Guan et al. (2005) examine the impact of cross-country differences in culture on accrual accounting decisions in five Asia-Pacific countries: Australia, Japan, Hong Kong, Malaysia, and Singapore. They find that cultural variables, as defined by Gray (1988), notably ‘conservatism’ and ‘secrecy’ based on the cultural dimensions identified by Hofstede (1980), can explain accounting accruals choices in different countries in their study’s sample. However, Guan et al. (2005) used samples in the period prior to the 2002 formal process of convergence of accounting standards toward IFRS. In more recent studies, focusing on European countries, Gray et al. (2015) and Houqe et al. (2016) find that cultural factors remain influential post-IFRS in explaining differences in the magnitude of earnings management behaviour and earnings quality.

We expect that culture, as an important informal institutional factor (Gray et al. 2015), will continue to influence earnings quality in the context of the current globalisation of accounting standards environment in the Asia-Pacific region. The Asia-Pacific countries have a high degree of cultural diversity relative to other regions such as Europe (e.g., Guan et al. 2005), but at the same time many of them have committed to support IFRS as a single set of global accounting standards (Deloitte 2018). We capture these tendencies in our measure of conservatism versus optimism in a way that draws on a number of cultural dimensions and is thus multi-dimensional. We thereby ensure that our measure is also sensitive to the priorities of firms (including those of ‘family’ firms) across countries in the region that may range from a more conservative focus on the safety of business assets to a more optimistic orientation associated with raising funds in equity capital markets. We do not assume, however, that firms in the Asia-Pacific region are necessarily more conservative. Calculations based on Hofstede (2015), show that countries such as Australia, New Zealand, Philippines, Malaysia, India, and Singapore are likely to be less conservative relative to European countries such as France, Germany, Portugal, and Spain. The Asia-Pacific region presents an interesting and important setting to examine the extent to which IFRS convergence can make a difference in a situation where culture has been shown to be an important influence.

A significant number of studies on the association between earnings management and culture has been documented (e.g., Callen et al. 2011; Desender et al. 2011; Geiger and Smith 2010; Gray et al. 2015; Guan et al. 2005; Han et al. 2010; Nabar and Boonlert-U-Thai 2007). The underlying argument for the link between cultural dimensions and earnings management from these prior studies can be summarised as follows. A negative association between uncertainty avoidance and earnings management is expected because firms tend to manage their earnings by using aggressive accounting techniques. Gray (1988) suggests that strong uncertainty avoidance leads to a preference for conservative measurement practices. Nonetheless, Nabar and Boonlert-U-Thai (2007) argue that strong uncertainty avoidance can give rise to earnings smoothing and earnings signalling when there are pressures for earnings consistency. The association between individualism and earnings management is positive because high individualism societies tend to be self-orientated, autonomous, have low-context communication, and emphasise individual achievement (Hofstede 1983; Nabar and Boonlert-U-Thai 2007). The relationship between power distance and earnings management is positive because information sharing is low in high power distance societies (Gray 1988). In high power distance societies decision structures are centralised and authority held by the top managers (Hofstede 1983). The relationship between masculinity and earnings management is likely to be positive because such societies place a high emphasis on performance. Managers that have ambitious career aspirations and wish to earn high salaries will thus tend to engage in earnings management.

Gray and Vint (1995) present empirical results of the relationship between culture and accounting disclosures across 27 countries. Specifically, they find that this association is more significant for uncertainty avoidance and individualism than for power distance and masculinity. Similarly, based on data from 29 countries, Salter and Niswander (1995) finds that Gray’s (1988) model is statistically significant in explaining actual financial reporting practices but is relatively weak in explaining extant professional and regulatory structures from a cultural base. Their study further finds that the development of financial markets enhances the explanations offered by Gray (1988).

Of course, earnings management has much in common with earnings quality and a number of studies agree that highly managed earnings imply low quality of earnings (e.g., Dechow et al. 2010; DeFond et al. 2007; Kanagaretnam et al. 2011). We focus here on Gray’s accounting value of conservatism, which he defines as “a preference for a cautious approach to measurement so as to cope with the uncertainty of future events as opposed to a more optimistic, laissez-faire, risk-taking approach” (Gray 1988, p. 8). Accordingly, we hypothesise that earnings management is likely to be associated with the culturally derived accounting value of conservatism (optimism). As the direction of the impact of conservatism in the context of overall earnings management remains unclear, for the purposes of our hypothesis we leave the direction of the association unspecified.

Hypothesis 2: Earnings management in the Asia-Pacific region is likely to be associated with the accounting value of conservatism.

2.3 Degree of Accounting Standards Enforcement

Differences in accounting standards among countries create differences in the financial information reported, thereby increasing barriers to capital investment. The need to protect shareholders by ensuring better financial reporting processes is driven by the potential behaviour of insiders (managers and controlling shareholders) to use a firm’s profits to benefit themselves at the expense of the suppliers of capital (creditors, minority shareholders) (Fama 1980; Fama and Jensen 1983; Jensen and Meckling 1976). Regulations, including accounting standards and their enforcement, ensure a more effective financial reporting process by limiting insiders’ ability to manipulate reported firm performance and reduces the information asymmetry between insiders and outsiders (Healy et al. 1999; Healy and Palepu 2001; La Porta et al. 2000).

Prior earnings literature that has examined international effects provides evidence that besides accounting standards, features of the financial reporting system, such as legal system, shareholder protection, regulatory enforcement, the legal environment, and managerial incentives, also explain the variation in earnings management across countries (e.g., Ball et al. 2003; Barth 2008; Christensen et al. 2016). Ball et al. (2003) provide evidence that for the East Asian countries, which are considered to have high quality common law, accounting standards show lower quality of financial reporting compared to code law countries. The authors argue that institutional structures in those countries give preparers incentives to provide financial reports that are of low quality. Importantly, Leuz et al. (2003), Lang et al. (2006), DeFond et al. (2007), and Houqe et al. (2012) have documented that earnings management varies according to the level of investor protection.

Using anti-director rights and law enforcement measures as per La Porta et al. (1998) to capture the variation in investor protection across countries, prior studies find that variations in the level of investor protection across countries are associated with earnings management (DeFond et al. 2007; Lang et al. 2006; Leuz et al. 2003). These studies provide consistent evidence that stronger investor protection countries have less earnings management and more informative earnings than weaker investor protection countries. The variation in institutional factors is also reflected in the degree of accounting standards enforcement in the Asia-Pacific countries (Brown et al. 2014). For example, in the context of the Asia-Pacific countries, Australia, Hong Kong, Malaysia, Singapore, and New Zealand are likely to have greater investor protection relative to the rest of the Asia-Pacific countries such as Indonesia, Japan, Korea Republic, and Pakistan (Brown et al. 2014). Consistent with the prior literature, if earnings management across countries varies according to the level of institutional factors, then we expect that the earnings management in the Asia-Pacific region will vary according to the degree of enforcement.

Hypothesis 3: Earnings management in the Asia-Pacific is likely to be negatively associated with the degree of accounting standards enforcement.

3 Methodology and Data

3.1 Sample and Data

The period from 2001 to 2016 is considered appropriate for our study to examine the extent to which the convergence of accounting standards towards IFRS, in the context of culturally derived accounting values and varying degrees of enforcement, has contributed to the quality of financial information. We chose 2001 as it is one year before accounting standards began to converge in 2002, as formalised by the IASB and accepted by the European Union. The year 2016 represents recent data availability and current evidence of achievement towards the global convergence of accounting standards. We divide the sample into two periods (2001‒2008 and 2009‒2016). By examining the effect of convergence of accounting standards and other factors on earnings management during these two periods, we can observe more clearly whether factors influencing earnings management have changed during more than a decade (2001‒2016) of the convergence process taking place.

The sample for our study consists of listed firms in Australia, Chile, China, Hong Kong (China), Indonesia, India, Japan, Korea Republic, Malaysia, New Zealand, Pakistan, Peru, Philippines, Russia, Singapore, Thailand, and Chinese Taipei. These 17 countries/jurisdictions are economically significant in the Asia-Pacific region. They have been involved in the agreement on the globalisation of accounting standards as a response to the global economic crisis in 2008‒2009 and a commitment to promote global financial stability. Following the 2009 G20 countries’ agreement on the globalisation of accounting standards, the seven G20 countries in the Asia-Pacific region (Australia, China, India, Indonesia, Japan, Russia, and South Korea) committed to eliminate material differences between their NAS and IFRS. The other countries/jurisdictions in the region (Hong Kong (China), Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, and Chinese Taipei) have required the use of IFRS either fully or partially for their publicly listed firms (Deloitte 2018). Thus, they are expected to have made some progress in converging their NAS to IFRS in recent times.

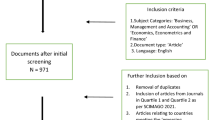

The sample is selected based on the following criteria: (1) firms are publicly listed in the years 2001 and 2016; (2) data to determine country level variables, that is, culture and degree of accounting standards enforcement (auditors’ working environment and the degree of accounting enforcement activity) (Brown et al. 2014) must be available; (3) data to calculate earnings quality must be available; (4) data to calculate control variables must be available; (5) all variables (except for dummy and country level institutional variables) are winsorised at the first and 99th percentiles to mitigate the effects of outliers. Table 1 presents the outcomes of applying the sample selection criteria, reported by country and firm year. Among 46 countries/jurisdictions in the Asia-Pacific region (DKIAPCSS 2018), the Hofstede culture dimensions are available for 19 countries. Among these 19, the degree of accounting enforcement data are not available for two countries (i.e., Bangladesh and Vietnam). Thus, we use 17 countries, as presented in the first column of Table 1, for our analyses. The bottom row indicates that the total number of publicly listed firms per year ranges from 7628 in 2001 to 15,464 in 2016. The total number of publicly listed firms per country, presented in the last column, ranges from 1473 for New Zealand to 42,090 for Japan. A large quantity of data is not available for calculating Chinese Taipei’s earnings management in 2001 and 2002 and South Korea’s earnings management in 2011. From a total of 1044 Chinese Taipei firms in 2002, the data are reduced to 225 after five sample selection criteria are applied, much lower compared to the following years. From a total of 1080 Korean firms in 2011, the data are reduced to 577 after five sample selection criteria are applied, much lower compared to the following years. The total number of observations from these 17 countries/jurisdictions and 16 year sample are 198,433.

We rely on the Compustat Global data from the WRDS database to source earnings management data and other firm’s specific variables. Data for cultural values are obtained from Hofstede’s cultural dimensions from their website. For the formal institutional factors variable, we employ the degree of audit and accounting standards enforcement as presented by Brown et al. (2014). Market Capitalisation per Gross Domestic Product data is obtained from the website of the World Development Indicators and the Federal Reserve Bank of St. Louis. Data for Corporate Governance Quality used in the additional analyses are obtained from the ACGA website (ACGA 2018). The measurement of the key variables is further explained in the next section.

3.2 Testing Hypotheses and Variables Measurement

3.2.1 Model

To investigate our hypotheses, an Ordinary Least Square regression with industry and time fixed effects model is employed. The model is presented in Eq. (1). The dependent variable is earnings management (EMj,t) as measured by three indicators of accrual earnings management (EM1j,t, EM2j,t, EM3j,t). The test variables in the model are firm-level IFRS adoption (IFRSj,t), new conservatism (NCON,t) using updated indicators, and degree of accounting standards enforcement (ENFORCN,t). Firm size (SIZEj,t), leverage (LEVj,t), growth (GWTHj,t), liquidity risk (LRj,t), business risk (BRj,t), debt issuance (DISSUEj,t), sales turnover (TURNj,t), market capitalisation (MCN,t), and dual listing (DLj,t) are included in the model as control variables. All of these variables are firm-specific measures, except for culture (NCON,t), degree of enforcement (ENFORCN,t), and market capitalisation (MCN,t).

To accept the first hypothesis, the coefficient estimate of IFRS adoption (α1) from Eq. (1) must be significantly negative. Regarding the second hypothesis NCON,t, the sign of the cultural value coefficient estimate (α2) must be significantly positive or negative. Lastly, to accept the third hypothesis ENFORCN,t, coefficient estimate (α3) must be significantly negative.

3.2.2 Measurement of Earnings Management

We use discretionary (abnormal) accruals to measure the extent of earnings management (Dechow et al. 1995; DeFond 2010; Jones 1991; Lo 2008). Because earnings management can use income-increasing or income-decreasing accruals, we adopt the magnitude of absolute discretionary accruals as the proxy of earnings discretion behaviour (e.g., Gray et al. 2015; Wang 2006). A higher magnitude of absolute discretionary accruals indicates a greater level of earnings discretion, or lower earnings quality. Discretionary accruals are defined as total accruals minus estimated normal accruals. Following prior studies, we use the performance-matched modified Jones model to estimate normal accruals (e.g., Gray et al. 2015; Kim et al. 2017; Kothari et al. 2005), as presented in Eq. (2).

TAj,t is total accruals scaled by lagged total assets for firm j in year t, and total accruals is the difference between income before extraordinary items and operating cash flows. Assetsj,t−1 is the year-end total assets for firm j in year t − 1. ∆REVj,t is the change in sales from year t − 1 to year t, scaled by Assetsj,t−1. PPEj,t is gross property, plant, and equipment, scaled by Assetsj,t−1. ROAj,t−1 is return on assets for firm j in year t − 1.

We estimate coefficients from cross-sectional industry regressions by country groups for each year. Following Gray et al. (2015), we require a minimum of 20 observations for each country-year group. To improve the robustness of our results, we also use another two specifications of the performance-matched modified Jones model to estimate normal accruals by considering change in accounts receivable (Eq. 3) and using ROA year t − 1 (Eq. 4):

-

1.

EM2 is calculated by total accruals minus estimated normal accruals from Eq. 3:

$$TA_{j,t} = \alpha_{0} + \alpha_{1} \left( {1/Assets_{j,t - 1} } \right) + \alpha_{2} \left( {\Delta REV_{j,t} - \, \Delta REC_{j,t} } \right) + \alpha_{3} PPE_{j,t} + \alpha_{4} ROA_{j,t} + \, e_{j,t} .$$(3) -

2.

EM3 is calculated by total accruals minus estimated normal accruals from Eq. 4:

$$TA_{j,t} = \alpha_{0} + \alpha_{ 1} \left( {1/Assets_{j, \, t - 1} } \right) + \alpha_{ 2} \left( {\Delta REV_{j,t} - \, \Delta REC_{j,t} } \right) + \alpha_{ 3} PPE_{j,t} + \alpha_{ 4} ROA_{j, \, t - 1} + \, e_{it} .$$(4)

∆RECj,t is the change in accounts receivable from year t − 1 to year t, scaled by Assetsj,t−1.

3.2.3 Measurement of Degree of Convergence with IFRS

Prior studies have used different methods and sources of data to measure the convergence of accounting standards (Chen et al. 2014; Ding et al. 2005, 2007; Fontes et al. 2005; Qu and Zhang 2010). They investigate convergence of accounting standards using a single country over time (Fontes et al. 2005) or a worldwide sample (Chen et al. 2014; Ding et al. 2005, 2007). In cross-country studies, Ding et al. (2005, 2007), and Chen et al. (2014) employ the measurement of absence and divergence to determine the convergence of accounting standards in 52 countries (Ding et al. 2005) and in 30 countries (Chen et al. 2014; Ding et al. 2007). Different from the measurement approach used in these prior studies, our study applies the adoption of IFRS at the firm level. We use a dummy variable, one for firms that have fully adopted IFRS and zero for firms that have not fully adopted IFRS. We consider that this firm-level dummy is a better fit for our study because we apply a firm-level model and because earnings management measured as in our study is also measured at the firm level.

3.2.4 Measurement of Cultural Values

A large number of prior studies have employed Hofstede’s cultural dimensions and documented that such measures can explain accounting systems and financial reporting behaviour (e.g., Braun and Rodriguez 2008; Desender et al. 2011; Gray et al. 2015; Guan et al. 2005; Han et al. 2010). While the Hofstede dimensions have been criticised by some for their use in cultural studies (Baskerville 2003), they have been widely used and accepted in the international business literature (Beugelsdijk et al. 2017; Ronen and Shenkar 2013). Since the accounting values identified by Gray (1988) have been empirically shown to have a relationship with Hofstede’s culture dimensions, we employ the quantitative accounting value measures based on the calculations used by Hope et al. (2008) and Salter et al. (2013). Hope et al. (2008) and Salter et al. (2013) define and calculate Conservatism‒Optimism (CO) as the uncertainty avoidance score minus the sum of the individualism and masculinity scores. For our test purposes, however, we update the definition of CO by including the recent Hofstede culture dimensions of long-term orientation and indulgence. Thus, our new CO measure (NCO) is more multi-dimensional, and calculated as uncertainty avoidance plus long-term orientation score minus the sum of the individualism, masculinity, and indulgence scores. Long-term orientation can be seen to reinforce uncertainty avoidance while indulgence can be associated with individualism and masculinity (Hofstede 2015). Long-term orientation is also incorporated because this dimension was set based on recognition of its relevance to Asia (Hofstede and Bond 1988). Further, Beugelsdijk et al. (2017) suggest that integrating and adding updated cultural dimensions to existing frameworks can further strengthen Hofstede-inspired research.

3.2.5 Measurement of Degree of Accounting Standards Enforcement

Brown et al. (2014) recommend the use of indices that measure the degree of enforcement of financial reporting practices. Following Brown et al. (2014)’s recommendation, we employ measures of the quality of the audit working environment and the degree of accounting standards enforcement activity as proxies for the degree of accounting standards enforcement. These indices capture country differences in the environment in which auditors perform their role and the activities of national enforcement bodies in relation to promoting compliance with accounting standards (Brown et al. 2014). The indices comprise:

-

(a)

an audit index being an aggregate of the following nine components: (1) licence; (2) additional requirements; (3) professional development; (4) quality assurance program; (5) oversight body; (6) sanctions; (7) rotation; (8) level audit fees; and 9) level litigation risk, with index score maximum is 32;

-

(b)

an enforcement index being an aggregate of the following six components: (1) regulatory body; (2) sets standards; (3) reviews financial statements; (4) reports surveillance program; (5) taken enforcement action; and (6) level of resourcing, with an index score at a maximum of 24. Combined audit and enforcement indices have the maximum score of 56.

3.2.6 Control Variables

Prior studies document that larger firms are more likely to disclose more information than smaller firms because information disclosed by a small firm is worth more than that disclosed by a large firm (Atiase 1985; Bamber 1987). We therefore include firm size as a control variable that affects earnings quality. Higher leverage indicates a firm is closer to a debt covenant restriction. Managers in more highly leveraged firms could be increasing income or manipulating the financial statements to avoid violating a covenant (Watts and Zimmerman 1986). Leverage is measured by the debt to equity ratio (total debt to total assets). A negative relationship between growth and earnings quality is suggested by some researchers (Dechow and Ge 2006; Dechow et al. 2010; McVay et al. 2006; Richardson et al. 2005). Nissim and Penman (2001) and Lee et al. (2006) have documented that in terms of sales growth or net operating asset growth, high growth firms have lower earnings persistence. Our study also includes two elements of risk disclosure information (e.g., Hodder et al. 2001; Lipe 1998) as control variables. They are liquidity risk as measured by the liquidity ratio and business risk as measured by operating cash flow (Houqe et al. 2012). Following prior studies, Debt issuance (DISSUEj,t), Turnover (TURNj,t,) (e.g., Christensen et al. 2015), market capitalisation (MCN,t), and dual listing firms (DLj,t,) are also included.

Table 2 presents a summary of the variable definitions and measurements used in our study.

4 Empirical Results

4.1 Descriptive Statistics

Table 3 presents descriptive statistics for all variables employed for investigating hypotheses 1–3. A total of 198,433 firms-years observations during 2001 to 2016 are employed to test the hypotheses. It shows that the minimum value, 10th and 25th percentile of all three proxies of earnings management (EM1, EM2, and EM3) are the same. The maximum, mean, median, standard deviation, and the remaining percentile) are slightly different, suggesting that they are consistent with and comparable to prior studies (e.g., Gray et al. 2015). About 23.9% of 198,433 observations have fully adopted IFRS. There is less IFRS adoption in the earlier years than in later, as indicated by the median value of 0.000. As documented in prior research (e.g., Guan et al. 2005), countries in the Asia-Pacific exhibit a wide diversity of institutional settings. In our study, NCO in the Asia-Pacific region also shows a wide variation, ranging from − 1.500 to 0.990. Similarly, the Asia-Pacific region has a wide range of accounting standards enforcement with a minimum score of 6 and maximum score of 52, given that the maximum score in Brown et al. (2014) of the ENFORC index is 56. Overall, the firm specific variables indicate higher variation, particularly for size, leverage, liquidity risk, and market capitalisation.

The Pearson correlations among independent variables in the models of Eq. (1) are presented in Table 4, which shows that most of the variables of interest are significantly correlated at the 1% level. However, they also have low correlations and thus face no potential problems to influence our results. NCO is positively correlated with SIZE, LEV, BR, and TURN and negatively correlated with all other variables at the 1% level of significance. Interestingly, the negative correlation between NCO and ENFORC suggests that firms from countries with lower conservatism values are likely to have a stronger degree of accounting standards enforcement. This relationship has also been found to apply in the European region context (Gray et al. 2015). Table 4 also shows that the IFRS variable is significantly correlated but has low correlations with all other variables. They are significantly correlated at the 1% level of significance with a positive sign for ENFORC, LR, DISSUE, MC, and DL and with a negative sign for all other variables. For the remaining (control) variables, except for LEV and GWTH, there are low and significant correlations among variables consistent with the literature.

4.2 Main Results

We examine whether variations in earnings management in the major countries in the Asia-Pacific region can be explained by the extent of IFRS adoption (IFRS) having regard to the diversity of cultures (NCO) across countries in the region and the degree of accounting standards enforcement (ENFORC) over the years 2001–2016. In particular, our interest is to provide empirical evidence of the impact of convergence towards IFRS and of other key influential factors. The multiple regression results are presented in Table 5.

4.2.1 The Effect of Accounting Standards Convergence on Earnings Management

Our study’s first hypothesis focuses on examining the association between IFRS and EM. Given that in the earlier years of our study period there were not many companies using IFRS (still applying NAS) and the NAS of the seven G20 Asia-Pacific countries had not yet converged to IFRS, no association, or a positive association, between IFRS and EM is expected because a lower quality of accounting standards is likely to open up greater opportunities to manage accruals and smooth earnings (higher earnings management). Prior studies suggest that financial reporting under IFRS is likely to result in higher accounting quality compared to firms applying NAS (Barth 2008; Barth et al. 2008; Soderstrom and Sun 2007) and also to improvements in the financial analyst information environment (Byard et al. 2011). Correspondingly, we expect a negative and significant association between IFRS and EM from the regression results using the sample that includes firms that have adopted IFRS in more recent years. In fact, many firms in the Asia-Pacific countries have fully adopted IFRS, especially in respect of Australia, New Zealand, Singapore, Philippines, Malaysia, and South Korea.

Table 5 presents the regression results for the association between IFRS and EMs (EM1, EM2, and EM3). Panels A and B present the results using the sample period 2001‒2008 with 83,688 observations and 2009‒2016 with 114,745 observations, respectively. We note that the number of firms that have adopted IFRS increased sharply from 2009 onwards. By separating this sample, we expect that IFRS will be negatively associated with EM in the sample period after 2009 but will have no association or a negative association in the sample period before 2009. As expected, for the sample period 2001‒2008, the results show no significant association between IFRS and EM. This result reflects the early period of the convergence of accounting standards where more firms still use NAS. The regression results presented in Table 5, panel B confirm our expectation of a negative association between IFRS and EM for the sample period 2009‒2016, which is at the 1% level of significance. The significant negative association can be interpreted as meaning that a higher level of convergence to IFRS is associated with restricted or lower earnings management. These results support H1 that IFRS has a significant negative association with EM in the context of the Asia-Pacific region. We interpret these results as an indication that IFRS convergence has made a major difference over the period 2009‒2016. These results complement prior studies in the context of the European region (Gray et al. 2015; Houqe et al. 2016) and cross-listed firms (Sun et al. 2011).

4.2.2 The Effect of Culture on Earnings Management

We expect that conservatism, a preference for a more cautious approach to earnings measurement so as to account for the uncertainty of future events, is associated with earnings management (Braun and Rodriguez 2008; Gray 1988). As presented in Table 5, panel A, the regression results indicate that NCO is negatively associated with accrual earnings management (EM1, EM2, and EM3) at the 1% level of significance, that is, higher levels of conservatism are associated with lower levels of earnings management. This significant negative association is consistent across the regression results using the subsample 2001‒2008 (Table 5, panel A) and 2009‒2016 (Table 5, panel B). Despite the same direction of negative association between NCO and earnings management, the coefficient parameters in the sample period 2009‒2016 (EM1, EM2, and EM3 = − 0.004) are greater than those in the sample period 2001‒2008 (EM1, EM2, and EM3 = − 0.001). These results imply that the ability of the cultural accounting value of conservatism to explain variations in earnings management is greater during the period 2009‒2016 than during the earlier period 2001‒2008.

Gray (1988) suggests that a country that places a high value on conservatism will have a higher uncertainty avoidance score and lower individualism and masculinity scores using Hofstede’s cultural values. Further, prior research suggest that Hofstede’s cultural values of uncertainty avoidance, individualism, and masculinity are related to earnings management (e.g., Nabar and Boonlert-U-Thai 2007). Given that Hofstede’s cultural values are related to conservatism and earnings management (e.g., Braun and Rodriguez 2008), it is plausible that over time a change in one of these cultural values is reflected in the shifting association between conservatism and earnings management. However, our results show that NCO is consistently and negatively associated with EM. Higher uncertainty avoidance leads to a preference for more conservative accounting (Gray 1988). Accordingly, higher uncertainty avoidance managers are more likely to follow regulations and traditional practices and make less room for professional judgment, promoting lower levels of earnings management.

4.2.3 The Effect of Degree of Accounting Standards Enforcement on Earnings Management

Table 5 shows that the degree of accounting standards enforcement (ENFORC) is negatively associated with earnings management (EM1, EM2, EM3) at the 1% level of significance. The effect of ENFORC on earnings management remains similar over time, as shown in the results of regression using our 2001‒2008 and 2009‒2016 subsample as shown in Table 5. The coefficient parameter is similar for the 2001‒2008 subsample (− 0.030) and for the subsample 2009‒2014 (= 0.035). These results imply that the current convergence of accounting standards in the Asia-Pacific does not change the way the degree of enforcement affects earnings management. We find consistently similar results that ENFORC is negatively associated with EM at the 1% level of significance for both sub-samples. These results support H3, suggesting that the variability of earnings management in the Asia-Pacific countries can be explained by the degree of accounting standards enforcement both before and after the sharply increasing use of IFRS taking place from 2009. The role of ENFORC in explaining the variation in earnings management of firms in the Asia-Pacific region has not changed much following the adoption of IFRS by publicly listed firms and the convergence of NAS and IFRS. The higher the degree of accounting standards enforcement, the lower the earnings management. These results are consistent with prior studies in Europe (e.g., Armstrong et al. 2010; Gray et al. 2009, 2015; Henry et al. 2009), firms cross-listed across countries (Lang et al. 2006; Sun et al. 2011), and in other countries around the world (e.g., Braun and Rodriguez 2008; Desender et al. 2011; Han et al. 2010; Hope 2003).

4.3 Additional Analyses

Prior studies suggest that earnings management is associated with the quality of corporate governance (CGQ) (García-Meca and Sánchez-Ballesta 2009). To control for this variable, we include the variable CGQ in the model for the period 2009‒2016 so as to assess the effect of more recent developments. Data for CGQ is obtained from survey reports produced by the Asian Corporate Governance Association (ACGA 2018) assessing the quality of corporate governance in the Asian region. Unfortunately, the available data is limited to data for ten countries/jurisdictions (China, Hong Kong (China), India, Indonesia, Korea, Malaysia, Philippines, Singapore, Thailand, and Chinese Taipei). The data has been collected periodically since 2003 but bi-annually since 2010 by ACGA from a survey of its member country associations. ACGA computes country scores based on evaluating country performance using its survey. Table 6 shows the regression results using the model that includes the control variable of CGQ as reported by ACGA (ACGA 2018). The results indicate that CGQ is positively associated with earnings management as opposed to our expectation of a negative association between the two variables. A plausible interpretation of these results is that the CGQ measure represents the perceived overall level of commitment to corporate governance norms rather than specific factors relating to earnings management, that is, adoption of IFRS and strong accounting standards enforcement, which our findings show are key factors limiting earnings management practices along with a more conservative culture. Higher quality corporate governance norms in themselves seem unlikely to impact earnings management behaviour.

5 Conclusions

We investigated whether variations in earnings management in the Asia-Pacific region countries can be explained by the extent of IFRS adoption having regard to the diversity of cultures and the degree of accounting standards enforcement across countries in the Asia-Pacific region. We developed hypotheses relating to the impact of IFRS adoption on earnings management, as well as the persistence of culture on accounting behaviour and the impact of accounting standards enforcement at national level. In order to test our hypotheses, we calculated firms’ earnings management behaviour based on the accrual earnings management literature, IFRS adoption at the firm level, updated accounting values relating to conservatism, and the degree of accounting standards enforcement in each country of the Asia-Pacific region in our sample. We sampled firms listed on the capital markets in Asia-Pacific countries during the sample period of 2001–2016. After applying the necessary information availability criteria, the number of observations was reduced to 198,433.

Multivariate analyses were employed to assess whether IFRS adoption has made a difference as would be expected and included the application of variables representing cultural values and the degree of accounting standards enforcement. Firm and country level variables that have been documented by prior studies to have an impact on earnings management were also used as control variables including firm size, leverage, growth, liquidity risk, business risk, debt issuance, sales turnover, market capitalisation, and dual listing. In additional analyses, we also included an indicator of country level corporate governance as another institutional level control.

The empirical results of our study contribute to the question as to whether IFRS adoption in the Asia-Pacific region has made a difference over time given the context of key institutional differences relating to cultural influences and the degree of accounting standards enforcement. After more than a decade of the global convergence process taking place in the Asia-Pacific region, the impact of IFRS convergence on earnings management has been stronger in recent years in terms of restricting earnings management, which is consistent with our expectations. Our results also indicate a significant negative association between earnings management and the cultural value of conservatism during the entire period from 2001 to 2016, indicating the persistent influence of cultural values on accounting practice. Overall, these results thus provide support for our study’s first and second hypotheses. Regarding accounting standards enforcement, our study finds consistently similar results that ENFORC is negatively associated with earnings management. These results support our third hypothesis that the variability of earnings management in the Asia-Pacific countries can be explained by the degree of accounting standards enforcement both before and after the substantial adoption of IFRS.

Countries in the Asia-Pacific region are economically significant and are important for promoting global financial stability. Seven countries in the Asia-Pacific region (Australia, China, India, Indonesia, Japan, Russia, and South Korea) are part of the G20 group of countries and involve agreement on the globalisation of accounting standards. They are committed to eliminate material differences between their NAS and IFRS. The other countries (Hong Kong (China), Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, and Chinese Taipei) have required the use of IFRS either fully or partially for their publicly listed firms (Deloitte 2018). IFRSs are still not permitted in some countries, such as Indonesia, India, and Thailand (Deloitte 2018; IFRS 2018). Given these important roles of the Asia-Pacific countries in promoting global financial stability but still having variation in progress toward converging NAS to IFRS, our findings present significant implications for regulators and investors in the region. Our study’s findings also complement and extend prior studies in the context of the European region (Gray et al. 2015; Houqe et al. 2016)

Our study contributes most importantly to the policy debate among standard setters concerning the effectiveness of the global convergence process towards IFRS. While IFRS is making a difference in the Asia-Pacific, it is crucial to note that the role of cultural values, specifically conservatism, and the degree of accounting standards enforcement remain significant and persistent institutional factors influencing international differences in earnings quality. Our findings suggest that traditional accounting approaches tend to continue to be significant in the Asia-Pacific region despite the growing internationalisation of capital markets. While the scope of our study is limited to key countries in the Asia-Pacific region, further research could usefully explore other regions of the world beyond Europe, especially the differing standard setting contexts of countries in, for example, the regions of Africa and Latin America.

References

ACGA. (2018). The Report on the Quality of Corporate Governance in Asian Market. Asian Corporate Governance Association (ACGA) and CLSA Asia-Pacific. https://www.acga-asia.org/cgwatch-detail.php?id=10. Retrieved 8 July 2018.

Apergis, N., & Cooray, A. (2014). Tax revenues convergence across ASEAN, Pacific and Oceania countries: Evidence from club convergence. Journal of Multinational Financial Management, 27(8), 11–21.

Armstrong, C. S., Barth, M. E., Jagolinzer, A. D., & Riedl, E. J. (2010). Market reaction to the adoption of IFRS in Europe. Accounting Review, 85(1), 31–61.

Atiase, R. K. (1985). Predisclosure information, firm capitalization, and security price behavior around earnings announcements. Journal of Accounting Research, 23(1), 21–36.

Ball, R., Kothari, S. P., & Robin, A. (2000). The effect of international institutional factors on properties of accounting earnings. Journal of Accounting and Economics, 29(1), 1–51.

Ball, R., Robin, A., & Wu, J. S. (2003). Incentives versus standards: Properties of accounting income in four East Asian countries. Journal of Accounting and Economics, 36(1–3), 235–270.

Bamber, L. S. (1987). Unexpected earnings, firm size, and trading volume around quarterly earnings announcements. Accounting Review, 62(3), 510.

Barth, M. E. (2008). Global financial reporting: Implications for U.S. academics. Accounting Review, 83(5), 1159–1179.

Barth, M. E., Landsman, W. R., & Lang, M. H. (2008). International accounting standards and accounting quality. Journal of Accounting Research, 46(3), 467–498.

Baskerville, R. F. (2003). Hofstede never studied culture. Accounting, Organizations and Society, 28(1), 1–14.

Beugelsdijk, S., Kostova, T., & Roth, K. (2017). An overview of Hofstede-inspired country-level culture research in international business since 2006. Journal of International Business Studies, 48(1), 30–47.

Braun, G. P., & Rodriguez, R. P., Jr. (2008). Earnings management and accounting values: A test of Gray (1988). Journal of International Accounting Research, 7(2), 1–23.

Brown, P., Preiato, J., & Tarca, A. (2014). Measuring country differences in enforcement of accounting standards: An audit and enforcement proxy. Journal of Business Finance and Accounting, 41(1–2), 1–52.

Byard, D., Li, Y., & Yu, Y. (2011). The effect of mandatory IFRS adoption on financial analysts’ information environment. Journal of Accounting Research, 49(1), 69–96.

Callen, J. L., Morel, M., & Richardson, G. (2011). Do culture and religion mitigate earnings management? Evidence from a cross-country analysis. International Journal of Disclosure and Governance, 8(2), 103–121.

Chen, C. J. P., Ding, Y., & Xu, B. (2014). Convergence of accounting standards and foreign direct investment. The International Journal of Accounting, 49(1), 53–86.

Christensen, H. B., Hail, L., & Leuz, C. (2016). Capital-market effects of securities regulation: Prior conditions, implementation, and enforcement. The Review of Financial Studies, 29(11), 2885–2924.

Christensen, H. B., Lee, E., Walker, M., & Zeng, C. (2015). Incentives or standards: What determines accounting quality changes around IFRS Adoption? European Accounting Review, 24(1), 31–61.

Daske, H., Hail, L., Leuz, C., & Verdi, R. (2008). Mandatory IFRS reporting around the world: Early evidence on the economic consequences. Journal of Accounting Research, 46(5), 1085–1142.

Dechow, P., & Ge, W. (2006). The persistence of earnings and cash flows and the role of special items: Implications for the accrual anomaly (Article). Review of Accounting Studies, 11(2–3), 253–296.

Dechow, P., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics, 50(2–3), 344–401.

Dechow, P. M., Sloan, R. G., & Sweeney, A. R. (1995). Detecting earnings management. Accounting Review, 70(2), 193–225.

DeFond, M. L. (2010). Earnings quality research: Advances, challenges and future research. Journal of Accounting and Economics, 50(2–3), 402–409.

DeFond, M., Hung, M., & Trezevant, R. (2007). Investor protection and the information content of annual earnings announcements: International evidence. Journal of Accounting and Economics, 43(1), 37–67.

Deloitte (2018). The use of IFRSs by jurisdiction. http://www.iasplus.com/country/useias.htm. Retrieved 11 Aug 2018.

Desender, K. A., Castro, C. E., & León, S. A. E. (2011). Earnings management and cultural values. American Journal of Economics and Sociology, 70(3), 639–670.

Ding, Y., Hope, O.-K., Jeanjean, T., & Stolowy, H. (2007). Differences between domestic accounting standards and IAS: Measurement, determinants and implications. Journal of Accounting and Public Policy, 26(1), 1–38.

Ding, Y., Jeanjean, T., & Stolowy, H. (2005). Why do national GAAP differ from IAS? The role of culture. The International Journal of Accounting, 40(4), 325–350.

DKIAPCSS. (2018). Countries of the Asia-Pacific Region. The Daniel K. Inouye Asia-Pacific Center for Security Studies. https://apcss.org/about-2/ap-countries/. Retrieved 1 Aug 2018.

Easley, D., & O’Hara, M. (2004). Information and the cost of capital. Journal of Finance, 59(4), 1553–1583.

Fama, E. F. (1980). Agency problems and the theory of the firm. Journal of Political Economy, 88(2), 288–307.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. Journal of Law and Economics, Corporations and Private Property: A Conference Sponsored by the Hoover Institution, 26(2), 301–325.

Fontes, A., Rodrigues, L. L., & Craig, R. (2005). Measuring convergence of National Accounting Standards with International Financial Reporting Standards. Accounting Forum, 29(4), 415–436.

García-Meca, E., & Sánchez-Ballesta, J. P. (2009). Corporate governance and earnings management: A meta-analysis. Corporate Governance: An International Review, 17(5), 594–610.

Geiger, M., & Smith, J. (2010). The effect of institutional and cultural factors on the perceptions of earnings management. Journal of International Accounting Research, 9(2), 21–43.

Gordon, E. A., Jorgensen, B. N., & Linthicum, C. L. (2008). Could IFRS replace U.S. GAAP? A comparison of earnings attributes and informativeness in the U.S. Market. http://ssrn.com/Abstract=1132908.

Gray, S. J. (1988). Towards a theory of cultural influence on the development of accounting systems internationally. Abacus, 24(1), 1–15.

Gray, S., Kang, T., Lin, Z., & Tang, Q. (2015). Earnings management in Europe post IFRS: Do cultural influences persist? Management International Review, 55(6), 1–30.

Gray, S. J., Linthicum, C. L., & Street, D. L. (2009). Have ‘European’ and US GAAP measures of income and equity converged under IFRS? Evidence from European companies listed in the US. Accounting and Business Research, 39(5), 431–447.

Gray, S. J., & Vint, H. M. (1995). The impact of culture on accounting disclosures: Some international evidence. Asia-Pacific Journal of Accounting, 2(1), 33–43.

Guan, L., Pourjalali, H., Sengupta, P., & Teruya, J. (2005). Effect of cultural environment on earnings manipulation: A five Asia-Pacific country analysis. Multinational Business Review, 13(2), 23–41.

Hail, L., & Leuz, C. (2006). International differences in the cost of equity capital: Do legal institutions and securities regulation matter? Journal of Accounting Research, 44(3), 485–531.

Han, S., Kang, T., Salter, S., & Yoo, Y. K. (2010). A cross-country study on the effects of national culture on earnings management. Journal of International Business Studies, 41(1), 123–141.

Healy, P. M., Hutton, A. P., & Palepu, K. G. (1999). Stock performance and intermediation changes surrounding sustained increases in disclosure. Contemporary Accounting Research, 16(3), 485–520.

Healy, P. M., & Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31(1–3), 405–440.

Henry, E., Lin, S., & Ya-Wen, Y. (2009). The European-U.S. “GAAP gap”: IFRS to U.S. GAAP Form 20-F reconciliations. Accounting Horizons, 23(2), 121–150.

Hodder, L., Koonce, L., & McAnally, M. L. (2001). SEC market risk disclosures: Implications for judgment and decision making. Accounting Horizons, 15(1), 49–70.

Hofstede, G. (1980). Culture’s consequences. Thousand Oaks: Sage Publications.

Hofstede, G. (1983). National cultures in four dimensions: A research-based theory of cultural differences among nations. International Studies of Management and Organization, 13(1–2), 46–74.

Hofstede, G. (2015). The Hofstede Center: Strategy, Culture, Change. http://geert-hofstede.com/countries.html. Retrieved 12 Dec 2015.

Hofstede, G., & Bond, M. H. (1988). The Confucius connection: From cultural roots to economic growth. Organizational Dynamics, 16(4), 5–21.

Hope, O.-K. (2003). Disclosure practices, enforcement of accounting standards, and analysts’ forecast accuracy: An international study. Journal of Accounting Research, 41(2), 235–272.

Hope, O.-K., Kang, T., Thomas, W., & Yoo, Y. K. (2008). Culture and auditor choice: A test of the secrecy hypothesis. Journal of Accounting and Public Policy, 27(5), 357–373.

Houqe, M. N., Easton, S., & van Zijl, T. (2014). Does mandatory IFRS adoption improve information quality in low investor protection countries? Journal of International Accounting, Auditing and Taxation, 23(2), 87–97.

Houqe, M. N., Monem, R. M., Tareq, M., & van Zijl, T. (2016). Secrecy and the impact of mandatory IFRS adoption on earnings quality in Europe. Pacific-Basin Finance Journal, 40, 476–490.

Houqe, M. N., van Zijl, T., Dunstan, K., & Karim, A. (2012). The effect of IFRS adoption and investor protection on earnings quality around the world. The International Journal of Accounting, 47(3), 333–355.

IFRS. (2018). Who uses IFRS Standards? https://www.ifrs.org/use-around-the-world/use-of-ifrs-standards-by-jurisdiction/. Retrieved 1 Aug 2018.

IFRS-Foundation. (2018). Why global accounting standards. http://www.ifrs.org/use-around-the-world/why-global-accounting-standards/. Retrieved 1 Jan 2018.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Jones, J. J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193–228.

Kanagaretnam, K., Lim, C. Y., & Lobo, G. J. (2011). Effects of national culture on earnings quality of banks. Journal of International Business Studies, 42(6), 853–874.

Kim, J., Kim, Y., & Zhou, J. (2017). Languages and earnings management. Journal of Accounting and Economics, 63(2), 288–306.

Kothari, S. P., Leone, A. J., & Wasley, C. E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163–197.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (1998). Law and finance. The Journal of Political Economy, 106(6), 1113.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (2000). Investor protection and corporate governance. Journal of Financial Economics, 58(1–2), 3–27.

Landsman, W. R., Maydew, E. L., & Thornock, J. R. (2012). The information content of annual earnings announcements and mandatory adoption of IFRS. Journal of Accounting and Economics, 53(1), 34–54.

Lang, M., Raedy, J. S., & Wilson, W. (2006). Earnings management and cross listing: Are reconciled earnings comparable to US earnings? Journal of Accounting and Economics, 42(1–2), 255–283.

Lee, C.-W., Li, L., & Yue, H. (2006). Performance, growth and earnings management. Review of Accounting Studies, 11(2–3), 305–334.

Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings management and investor protection: An international comparison. Journal of Financial Economics, 69(3), 505–527.

Lipe, M. G. (1998). Individual investors’ risk judgments and investment decisions: The impact of accounting and market data. Accounting, Organizations and Society, 23(7), 625–640.

Lo, K. (2008). Earnings management and earnings quality. Journal of Accounting and Economics, 45(2–3), 350–357.

McVay, S., Nagar, V., & Tang, V. (2006). Trading incentives to meet the analyst forecast. Review of Accounting Studies, 11(4), 575–598.

Nabar, S., & Boonlert-U-Thai, K. K. (2007). Earnings management, investor protection, and national culture. Journal of International Accounting Research, 6(2), 35–54.

Nissim, D., & Penman, S. H. (2001). Ratio analysis and equity valuation: From research to practice. Review of Accounting Studies, 6(1), 109–154.

Qu, X., & Zhang, G. (2010). Measuring the convergence of national accounting standards with international financial reporting standards: The application of fuzzy clustering analysis. The International Journal of Accounting, 45(3), 334–355.

Richardson, S. A., Sloan, R. G., Soliman, M. T., & Tuna, I. (2005). Accrual reliability, earnings persistence and stock prices. Journal of Accounting and Economics, 39(3), 437–485.

Ronen, S., & Shenkar, O. (2013). Mapping world cultures: Cluster formation, sources and implications. Journal of International Business Studies, 44(9), 867–897.

Salter, S. B. P., Kang, T. A. P., Gotti, G. A. P., & Doupnik, T. S. P. (2013). The role of social values, accounting values and institutions in determining accounting conservatism. Management International Review, 53(4), 607–632.

Salter, S. B., & Niswander, F. (1995). Cultural influence on the development of accounting systems internationally: A test of Gray’s [1988] theory. Journal of International Business Studies, 26(2), 379–397.

SEC. (2007). Acceptance from foreign private issuers of financial statements prepared in accordance with International Financial Reporting Standards without reconciliation to U.S. GAAP. Release 33-8879, December 21, Washington DC.

Soderstrom, N. S., & Sun, K. J. (2007). IFRS adoption and accounting quality: A review. European Accounting Review, 16(4), 675–702.

Sun, J., Cahan, S. F., & Emanuel, D. (2011). How would the mandatory adoption of IFRS affect the earnings quality of U.S. firms? Evidence from cross-listed firms in the U.S. Accounting Horizons, 25(4), 837–860.

Wang, D. (2006). Founding family ownership and earnings quality. Journal of Accounting Research, 44(3), 619–656.

Watts, R. L., & Zimmerman, J. L. (1986). Positive accounting theory. New Jersey: Prentice-Hall Career and Technology.

Worldbank. (2017). Market capitalization of listed domestic companies (% of GDP). World Federation of Exchanges database.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wijayana, S., Gray, S.J. Institutional Factors and Earnings Management in the Asia-Pacific: Is IFRS Adoption Making a Difference?. Manag Int Rev 59, 307–334 (2019). https://doi.org/10.1007/s11575-018-0371-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-018-0371-1