Abstract

Regulators of some of the major markets have adopted value at risk (VaR) as the risk measure for structured products. Under the mean-VaR framework, this paper discusses the impact of the underlying’s distribution on structured products. We expand the expected return and the VaR of a structured product with its underlying’s moments (mean, variance, skewness, and kurtosis), so that the impact of the moments can be investigated simultaneously. Results are tested by Monte Carlo and historical simulations. The findings show that for the majority of structured products, underlyings with large positive skewness are preferred. The preferences for the variance and the kurtosis of the underlying are both ambiguous.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Structured products, defined as new investment strategies based on derivatives, have been popular in recent decades among both retail and institutional investors. Their flexible design and the use of derivatives allow them to meet specific investment needs not addressed by traditional financial instruments available in the markets. Typically, the payoff of structured products is dependent on one or more classic assets, for example, stocks or stock indices. For example, one very popular structured product is the discount certificate. Discount certificates offer shares of an underlying at a price below its current market price. The buyer, in return, must be prepared to accept a fixed maximum return (the cap). If at maturity, the underlying price is lower than the cap, buyers receive one share of the underlying per discount certificate. If the underlying price at maturity is higher than or equal to the cap, buyers receive a cash settlement amount equivalent to the cap. A discount certificate is usually constructed from the underlying and short calls. For an overview of structured products, see Blümke (2009).

According to Célérier and Vallée (2013), assets under management (AUM) for retail structured products alone were about 700 billion EUR in Europe in 2011, about 3% of all European financial savings or 12% of mutual funds’ AUM. Due to structured products’ relatively complicated structures and the occasional lack of transparency in regard to their internal mechanisms, understanding their risk has always been an important task for all investors, but especially for retail investors. One example is the case of the Hong Kong-listed company Citic Pacific and its 2 billion USD losses from the accumulator. The accumulator is a structured product that requires an investor to buy a specified amount of a security or currency at a fixed price, settled periodically, subject to certain conditions, as discussed in a report by Santini (2008) from The Wall Street Journal.

In the European Union, a series of directives, regulations, and guidelines (often referred to as “UCITS IV”) have been introduced since 2010 to provide investors with a standardized and trustworthy risk measure for their investment decisions (see European Commission 2010a, b; CESR 2010). Structured products (“structured funds” in the aforementioned documents) are also covered in these regulations. Their method for accessing the risk of structured products is to use Value at Risk (VaR) as the risk measure. The procedure is as follows. First, the past 5-year performances of the underlying are plugged into the payoff function of the structured product to simulate its payoff. The VaR value is the 1% quantile of the structured product’s returns simulated in this way. From this VaR value, a corresponding volatility is calculated, with the assumption of normal distributions. According to this volatility, the structured product is classified into different risk classes, for example, a volatility below 0.5% is risk class 1, a volatility between 0.5 and 2% is risk class 2, and so forth. A similar approach based on VaR has been adopted in Switzerland (see Swiss Structured Products Association 2013).

Some implications of using VaR as the risk measure for structured products are discussed in Cao and Rieger (2013). The authors show that, by specifying an appropriate payoff function, it is possible to design structured products that can theoretically provide arbitrarily large returns while having very low VaRs. Wallmeier (2011) conducts a survey for various risk and return measures of structured products. The author points out the need for improvements over VaR and discusses how the risk and return of structured products should be presented to the investor.

The present paper aims to look at the issue from another perspective. We are not interested in finding the appropriate risk measure for structured products. Instead, seeing that regulators of the major markets have adopted VaR as the risk measure, we will take it as given. We want to discover the implications of this regulation on the underlying selection of structured products. Would, and if so, to what extent does, underlying selection play a role in the “risk” of a structured product? Could some underlyings make “better” products than other? This is relevant to product design from the issuers’ side and to portfolio planning from the investors’ side, as well as to risk classification from the regulators’ side. To the best of our knowledge, this paper is the first one to investigate this question.

To investigate the question more comprehensively, we also need a return measure for structured products. In practice, structured products, like most of the other financial products, are usually marketed with their risk classes together with their (average) past returns. Therefore, mean/expected return is a natural choice of return measure for our discussion. There might be some concerns with this mean-VaR framework; for example, it is not consistent with utility maximization nor is it viable for a general equilibrium model.Footnote 1 Moreover, it could be argued that mean-VaR may not be an appropriate risk-return measure for structured products. However, in this paper, we look at the issue from a practitioner’s perspective. We do not attempt to judge whether VaR (mean-VaR) is good or inappropriate. Neither do we propose a more appropriate risk-return measure for structured products. Given the VaR regulation discussed above and the practical convention of marketing financial products, mean-VaR is a natural consideration for the return and the risk when an investor buys a structured product, as well as when an issuer designs a structured product.Footnote 2 Unsophisticated investors may not be able to employ more advanced risk and return measures and issuers may not have much motivation to provide risk-return values of a product beyond the mean-VaR.

Theoretically, underlyings mainly differ from each other in their return distributions. The distribution of a random variable is usually characterized by its moments-mean, variance, skewness, kurtosis, and the like. Therefore, to study the impact of different underlyings on structured products, we need to look at the moments of their return distributions. These moments are the focus of our discussion. In the next sections, we discuss how the underlying’s return distribution, especially its first four moments, can affect the mean-VaR profile of a structured product.

Studies on the preference for skewness and higher moments of the return distribution started with Kraus and Litzenberger (1976), who state that positive skewness is preferred by investors. Their analysis is based on expanding the expected utility with Taylor series to the cubic term. Scott and Horvath (1980) show that the preference direction for positive odd central moments is positive and that for even central moments, it is negative. They expand the expected utility to higher order terms. Now, it is common for this sort of work to employ the expected utility framework. For example, Mitton and Vorkink (2007) explain underdiversification with a mean-variance-skew model. Chang et al. (2013) derive skewness from option prices and investigate the impact of the implied skewness on underyling returns with Capital Asset Pricing Model (CAPM)-like models.

Portfolio choice under VaR or other downside risk measures is another strand of the literature. Basak and Shapiro (2001) discuss the optimal portfolio policy of a utility maximizing investor with the VaR constraint. Alexander and Baptista (2002) compare a mean-VaR model to the mean-variance analysis. Benati (2003) solves the portfolio choice problem with a coherent risk measure constraint by linear programming. The majority of the literature to date focuses on non-derivative financial assets. A portfolio with derivatives has a nonlinear payoff and thus may have different implications for the underlying preference than does a non-derivative asset. El-Jahel et al. (1999) discuss the technical aspects of using VaR as the risk measure for portfolios involving derivatives. Cui et al. (2013) compare different approximation methods of VaR estimation for portfolios with derivatives, where the analysis is mainly based on normal distributed risk factors.

There is not much literature on the implication of VaR or other risk measures for structured products, aside from the aforementioned Cao and Rieger (2013). Although one would intuitively conjecture that the skewness of the underlying might be preferred under the mean-VaR framework, the case is in fact not as straightforward as it appears at first glance. The return distribution of the underlying is distorted now (via the payoff function of the structured product), and it becomes intuitively unclear how this affects the return distribution of the product, based on which the mean return and the VaR is calculated. Therefore, rigorous and analytical discussion is necessary.

This paper makes the following contributions to the literature: (1) we add discussions on the implications of VaR as a risk measure for retail financial products, especially on structured products—which type of underlying is preferred given the risk measure? (2) We add discussions on the risk and the asset allocation of derivatives portfolios—how does the choice of the underlying affect the profile of a structured product?

We expand both the expected return and the VaR of a structured product with its underlying’s first four moments. This allows us to simultaneously discuss the impact of each moment on both the expected return and the VaR. The theoretical results are then tested by Monte Carlo simulation, where we consider a t distribution as the distribution of the underlying’s return. Structured products considered in the simulations are tracker certificates, discount certificates, and capped outperformance certificates. Simulations with real-world data are also carried out on these three structured products. Underlyings are seven major European stock market indices. The results show that under the mean-VaR framework, underlyings with large mean (return) and large positive skewness will be preferred, while the preferences for an underlying’s volatility and kurtosis are ambiguous.

The rest of this paper is organized as follows: Sect. 2 presents the theoretical framework of the analysis and discusses in a theoretical way the impacts of the underlying moments on the expected return and the VaR of a structured product. The theoretical findings are then tested by Monte Carlo simulations and historical simulations in Sect. 3. Section 4 concludes.

2 The theoretical framework and the impacts of the underlying’s moments

Let X be the price of the underlying of a structured product, which is a random variable with the probability density function f(x) and the cumulative distribution function F(x). We normalize \(X^0\), the price of the underlying at time 0, to be 1 and assume that X is non-negative. The payoff (the value) of the structured product is a function \(y: {\mathbb {R}}_+ \rightarrow {\mathbb {R}}_+\) of X. We assume that \(y(\cdot )\) is nondecreasing (see Rieger 2011). The value of the structured product at time 0, \(y^0 = y(X^0)\), is also normalized to 1.

The \((1-\alpha )\)-VaR of the structured product is given by

Among the different ways of defining VaR, we follow the one adopted by the EU regulation (CESR 2010), where VaR is calculated with log-return of the structured product and with the sign changed. To make the following discussions more consistent, we transform the payoff function y(x) to be based on the log-return of X, namely, \(g(\ln (x)) = y(x)\). Then, \(g(\cdot ) = y(e^{(\cdot )})\). In the rest of the paper, we call \(g(\cdot )\) the payoff algorithm of the structured product.

Consider a fixed payoff function of the structured product, the issuer (a bank or another financial institution) of the product wants to discover an underlying, based on which the product delivers a return as high as possible, subject to a given VaR level. Mathematically, this means, given a payoff function y(x) of the structured product, the issuer faces the problem of maximizing its expected return while meeting the VaR constraint at the same time, that is, searching for the mean-VaR frontier, by choosing an appropriate underlying X:

subject to the VaR constraint

Let \(L=\ln (X)\) and \(\mathrm{E}[L] = \mu \). First, we expand the VaR of the product with its underlying’s moments.

The \((1-\alpha )\)-VaR of y(x) is given by

Assume y is strictly increasing in the neighborhood of \(q_{X,\alpha }\), the \(\alpha \)-quantile of X, then Eq. (4) is equivalent to

because \(\ln (x)\) is strictly increasing.

Let the \(\alpha \)-quantile of L be \(q_{\alpha }\) (i.e., \(\mathrm{P}\left( L \le q_\alpha \right) = \mathrm{P}\left( \ln (X) \le q_\alpha \right) =\alpha \)), then

\(VaR_\alpha \) is apparently decreasing in \(q_{\alpha }\).

Based on the Cornish–Fisher expansion (Cornish and Fisher 1937; Fisher and Cornish 1960; Hill and Davis 1968), the \(\alpha \)-quantile of a non-normal random variable can be approximated with its first four moments and the standard normal quantile:

where \(\mu \), \(\sigma \), \(\gamma _1\), \(\gamma _2\), and \(q_{\alpha }\) are expectation, standard deviation, skewness, excess kurtosis, and \(\alpha \)-quantile of \(\ln (X)\), respectively. \(p_\alpha \) is \(\alpha \)-quantile of a standard normal distribution. Then, the \((1-\alpha )\)-VaR of the structured product y(X) is given by

There has been some concern as to the validity and the accuracy of the Cornish–Fisher expansion and there are other quantile approximation methods (see Wallace 1958). We had two reasons for choosing the Cornish–Fisher expansion to approximate the quantile of the underlying’s log-return. First, because it is one of the earliest methods for quantile approximation, it is also one of the most well-known methods (e.g., Gabrielsen et al. 2012 employ the Cornish–Fisher expansion to forecast VaR with time-varying moments). Second, this paper aims to study the direction of the impacts of underlying moments on the risk-return profile of structured products. Our primary concern is the sign before each moment in Eq. (8). The accuracy of the approximation is thus relatively secondary.

Next, we expand the expected return of the product. Let us further assume that the payoff function of the structured product is a piecewise linear function with the form:

where \(a_i \ge 0\), \(b_i \in {\mathbb {R}}\), for \(i=1,2,\ldots ,m\). \(\bigcup _{i=1}^{n} A_i = {\mathbb {R}}_+\) and at least for one j, \(a_j > 0\).

The vast majority of structured products will have payoff functions of this form. In fact, almost all the official categories of structured products currently listed by the European Structured Investment Products Association (2012) have payoff functions in form of Eq. (9). One exception is twin-win certificates, which have a decreasing payoff part, that is, \(a_i<0\) for some i, and this part is defined only on a finite interval of X.

Rewrite Eq. (9) with the payoff algorithm g and \(\ln (X)\):

The expected return of y(X) is then given by

Because \(a_i\), \(b_i\), \(\text {P}(B_i)\), and \(\int \nolimits _{B_i} e^{L}\mathrm{d}\text {P}\) are all non-negative, there exist \(\bar{a} \in [\min (a_i), \max (a_i)]\) and \(\bar{b} \in [\min (b_i), \max (b_i)]\), such that

and

Thus, Eq. (12) can be written as

namely,

Let us expand \(e^L\) at \(\mu \) (the expectation of L) with a Taylor series:

Take the expectation of both sides of Eq. (17):

where \(\sigma ^2\) is the variance and \(\mu _i\) is the ith central moment of L, respectively.

Namely

where \(\gamma _1\) and \(\gamma _2\) are the skewness and the excess kurtosis of L, respectively. Let \(\gamma _1 \ge -\frac{3}{\sigma }\), then, c.p., \(\text {E}[e^L] \) is increasing in \(\mu \) in Eq. (19). For example, if \(\sigma = 0.3\), \(\gamma _1 \ge -\frac{3}{\sigma }\) means that the skewness of L is no smaller than \(-10\).

Equation (16) becomes then

with positive \(\bar{a}\) and \(\bar{b}\).

Via Eq. (20), we can expand the expected return of a structured product with its underlying’s moments.

By considering Eqs. (20) and (8) together, we can discover the impacts of each moment of the underlying on the expected return and the VaR of a structured product simultaneously. Before we proceed, let us summarize the important assumptions we have made

-

(A1) the payoff function \(y(\cdot )\) follows the form of Eq. (9);

-

(A2) the payoff function \(y(\cdot )\) is strictly increasing in the neighborhood of \(q_{X,\alpha }\), the \(\alpha \)-quantile of X;

-

(A3) the skewness \(\gamma _1\) of the underlying log-return \(\ln (X)\) is no smaller than \(-\frac{3}{\sigma }\), where \(\sigma \) is the underlying volatility.

Proposition 2.1

If the underlying’s log-return \(\ln (X)\) follows a normal distribution (i.e., X is log-normal distributed), and the payoff function y(X) of the structured product satisfies (A1) and (A2), then under the mean-VaR framework, underlyings with large expected log-return are preferred; the preference for its variance is ambiguous.

For underlyings with zero skewness, we have the following proposition.

Proposition 2.2

If the underlying’s log-return \(\ln (X)\) is distributed with zero skewness (e.g., symmetrically distributed), and the payoff function y(X) of the structured product satisfies (A1) and (A2), then under the mean-VaR framework, underlyings with large expected log-return will be preferred; the preferences for the variance and the kurtosis are both ambiguous.

Finally, let us discuss the general case of the underlying distribution.

Proposition 2.3

If the payoff function y(X) of the structured product satisfies (A1) and (A2) and the underlying satisfies (A3), then under the mean-VaR framework, underlyings with large expected log-return will be preferred. Large positive skewness is also preferred. Preference for the underlying variance is ambiguous; preference for the underlying kurtosis is conflicting.

Proofs for propositions 2.1–2.3 can be found in the Appendix. Let us summarize the above propositions. If the payoff function y(X) of the structured product satisfies Eq. (9), then, other moments being fixed, its expected return is increasing in the expectation, in the variance, in the skewness, and in the kurtosis of the underlying’s log-return. Its VaR is increasing in the kurtosis and decreasing in the expectation of the underlying’s log-return. The impacts of the variance and the skewness are in general ambiguous. In other words, under the mean-VaR framework:

-

1.

Expectation \(\mu \)

Other moments being fixed, large expected log-return of the underlying is always preferred.

-

2.

Variance \(\sigma ^2\)

Preferences for the variance of the underlying’s log-return is ambiguous.

-

3.

Skewness \(\gamma _1\)

Large positive skewness is preferred.

-

4.

Kurtosis \(\gamma _2\)

Preference for the kurtosis of the underlying’s log-return is always ambiguous. Large kurtosis increases both the expected return and the VaR of the product.

The results of this section confirm the importance of the underlying’s volatility risk and kurtosis risk. For the underlying’s mean and skewness, it is straightforward: one just chooses the underlying with high expected return and with high probability of above-expected return, thus optimizing both the expected return and the VaR of the structured product. However, underlyings with large volatility/large kurtosis will, on the one hand, increase the expected return of the structured product, but, on the other hand, they will also increase the VaR (the risk) of this product. Ignoring the kurtosis of the underlying whose log-return is leptokurticly distributed will lead to underestimations for the VaR of the structured product.

Our results also suggest that mean-variance efficient underlyings, which are often thought to characterize the market portfolio, are not necessarily the optimal underlyings for structured products. At a given expected return level of the underlying, small variance of the underlying will lead to small VaR but also small expected return of the structured product.Footnote 3

3 Simulation

3.1 Monte Carlo simulation

With real-world data, it is not always possible to compare one moment of the underlying while controlling for its other moments. Monte Carlo simulations are more feasible for testing the theoretical results in the previous section. To this end, random numbers are generated from a given distribution. These random numbers as log-returns of the underlying are used to calculate the underlying prices at the maturity of the structured product, and consequently, the payoffs of the structured product can be simulated. Based on the simulated payoffs, we will have the simulated expected return (the mean of the simulated return) and the VaR of the product. The distribution used is a t distribution. The structured products considered are tracker certificates, discount certificates, and capped outperformance certificates. Tracker certificates are one of the simplest structured products, discount certificates are one of the most popular structured products, and capped outperformance certificates are the most complex of the three products. Detailed introductions to the t distribution used for the simulation and the three structured products are presented in the Appendix.

Top Simulated mean return (left) and VaR (right) of tracker certificates with t-distributed (6 degrees of freedom) underlying log-return. The x-axis is the mean of the simulated underlying log-return. The y-axis is the volatility of the simulated underlying log-return. Simulation run 100,000 times. Bottom Simulated mean return (left) and VaR (right) of tracker certificates with t-distributed underlying log-return. The x-axis is the excess kurtosis of the simulated underlying log-return. The solid line, the dashed line, the dotted line, and the “-.” line stand for a volatility of 30, 32.5, 35, and 37.5%, respectively. Simulation run 1,000,000 times

Next, we simulate the underlying performance at the maturity of the structured product with a t distribution and plug it into the payoff functions of the three structured products. In each case, the annual risk-free interest rate is assumed to be \(0.6\%\). The maturity of all products is assumed to be 1 year. The confidence level for the VaR is set at 99% (\(\alpha = 0.01\)), the same as the CESR (2010). Option prices are obtained from Black–Scholes formula. The underlying price at time 0 is assumed to be 1000. The cap of the discount certificate is 1500, 1.5 times the initial underlying price.

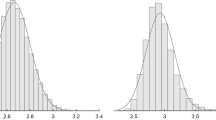

Figures 1, 2, and 3 present the simulation results. The upper parts of the figures plot the mean return and the VaR of the structured products against the mean and the volatility of the simulated underlying log-return, respectively. The t distribution has 6 degrees of freedom, corresponding to a kurtosis of 3. The parameter \(\mu \) ranges from \(-0.2\) to 0.2; \(\sigma \) is from 0.05 to 0.35. The simulation is run 100,000 times. All three products reveal similar shapes. Product returns are increasing in \(\mu \) and in \(\sigma \). Products’ VaRs are decreasing in \(\mu \) and increasing in \(\sigma \).

The lower parts of Figs. 1, 2, and 3 plot the mean return and the VaR of the structured products against the excess kurtosis \(\gamma _2\) of the simulated underlying log-return, respectively. We consider different underlying volatilities (30, 32.5, 35, and 37.5%). \(\mu \) is 0.1; \(\eta \) ranges from 5 to 8. For all products, both the return and the VaR reveal slightly upward trends with an increasing kurtosis. In addition, at a fixed kurtosis, larger volatility increases both the product return and VaR.

The results also confirm Proposition 2.2 that for an underlying, whose log-return is distributed with zero skewness, a large \(\mu \) is always preferred and the impacts of volatility and kurtosis are each conflicting: they both increase the product return and the VaR at the same time.

Top Simulated mean return (left) and VaR (right) of discount certificates with t-distributed (6 degrees of freedom) underlying log-return. The x-axis is the mean of the simulated underlying log-return. The y-axis is the volatility of the simulated underlying log-return. Simulation run 100,000 times. Bottom Simulated mean return (left) and VaR (right) of discount certificates with t-distributed underlying log-return. The x-axis is the excess kurtosis of the simulated underlying log-return. The solid line, the dashed line, the dotted line, and the “-.” line stand for a volatility of 30, 32.5, 35, and 37.5%, respectively. Simulation run 1,000,000 times

Top Simulated mean return (left) and VaR (right) of capped outperformance certificates with t-distributed (6 degrees of freedom) underlying log-return. The x-axis is the mean of the simulated underlying log-return. The y-axis is the volatility of the simulated underlying log-return. Simulation run 100,000 times. Bottom Simulated mean return (left) and VaR (right) of capped outperformance certificates with t-distributed underlying log-return. The x-axis is the excess kurtosis of the simulated underlying log-return. The solid line, the dashed line, the dotted line, and the “-.” line stand for a volatility of 30, 32.5, 35, and 37.5%, respectively. Simulation run 1,000,000 times

3.2 Historical simulation

We also checked our theoretical findings with real-world data. We consider seven major stock market indices in the eurozone and simulate the performances of the three above-mentioned structured products with weekly historical stock indices from 2008 to 2014, see Table 1 for the descriptive statistics of the stock market indices we used. The maturities of the products are again assumed to be 1 year. Option prices are obtained with the Black–Scholes formula. For the risk-free interest rate, we take the average 12 month Euribor of the same year as the construction date. For the volatility, we calculate the realized volatility of each index over the next 52 weeks after the construction date. The VaR level is again 99%. The cap of the discount certificate is 1.5 times the index levels on the construction date.

We construct the three structured products for 1 day in every week from 3 March 2008 to 25 February 2013. Then, we plug the index levels 52 weeks later from this day into the payoff function of the products to obtain the products’ returns. Based on these historically simulated returns, we calculate the VaR of the products. The average return and the VaR of each of the three products for the seven European stock indices are presented in Table 2. Products written on different underlyings exhibit different risk-return profiles, as measured by average return and VaR. In this case, it is impossible to perfectly compare the results between different underlyings, because we cannot compare one moment while controlling for the other three moments. However, we can still make the following observations.

First, Germany’s DAX appears to be the best performing underlying for all three structured products. Products written on DAX always have the highest average return and the lowest VaR. In contrast, Italy’s FTSE MIB delivers much worse results. For all the three products, FTSE MIB always has lower average returns but higher VaRs than products written on DAX. This can be explained by the fact that DAX in this period has substantially the highest mean of the log-return among the seven underlyings, while FTSE MIB has the lowest mean.

Second, let us look at Austria (ATX) and Finland (OMX Helsinki 25). The mean of their log-returns differ substantially. However, the differences between their volatilities and between their skewness are small. The difference between their kurtosis is relatively small, too, compared to that between their means. Finland’s stock index, which has a higher mean than Austria’s, delivers better risk-return profiles for structured products than Austria’s stock index does. This again confirms the positive impact from the mean of the underlying log-return.

Third, for Austria (ATX) and France (CAC 40), the mean of their indices is very close to each other and the skewness of CAC 40 is higher than that of ATX. According to our theoretical results, products based on CAC 40 should have (slightly) better risk-return profiles than products based on ATX. This can be confirmed by the historically simulated results in Table 2, where products written on CAC 40 have similar or a little higher average returns, but lower VaRs than products written on ATX. Although differences between their volatilities and between their kurtosis are not small, these two moments’ impacts on the risk-return profiles of structured products are ambiguous, thus in accord with our theoretical findings.

4 Conclusion

In this paper, we investigate the impacts of underlyings on the expected return and the VaR of structured products-in other words, the preferences for the underlying’s moments under the mean-VaR framework. Although one would intuitively expect that the skewness might be preferred under the mean-VaR framework, the case is in fact not as straightforward as it appears at first glance. We are now dealing with a distorted return distribution (via the payoff function) and a rigorous and analytical investigation is necessary. We expand the expected return of a structured product with a Taylor series and expand the VaR of the product with the Cornish–Fisher approach. This allows us to study the impacts of an underlying’s first four moments on the expected return and the VaR of a product simultaneously. Theoretical results are derived for cases, where the underlying’s log-return follows a normal distribution, a zero-skewness distribution, and a general distribution with nonzero skewness and nonzero excess kurtosis.

Under the mean-VaR framework, the findings show that for the majority of structured products, other moments being fixed, underlyings with large expected log-return are always preferred. Preference for the volatility of the underlying is ambiguous. Large positive skewness is also preferred. The impacts of its kurtosis on the expected return and the VaR of the product are conflicting-large kurtosis increases both the expected return and the VaR (risk) at the same time.

The results confirm the importance of an underlying’s volatility risk and kurtosis risk. For underlyings’ mean and skewness, it is straightforward: one just picks the underlying with high expected return and with high probability of above-expected return, thus optimizing both the expected return and the VaR of the structured product. However, underlyings with large volatility/large kurtosis will, on the one hand, increase the expected return of the structured product, and, on the other hand, they will also increase the VaR (the risk) of this product. Ignoring the kurtosis of the underlying, whose log-return is leptokurticly distributed will lead to underestimations for the VaR of the structured product.

The results also indicate that mean-variance efficient underlyings, which are often thought to characterize the market portfolio, are not necessarily the optimal underlyings for structured products. At a given expected return level of the underlying, small variance of the underlying will lead to small VaR but also small expected return of the structured product. More thorough discussion is needed in this direction and future research could investigate the relation between the mean-variance efficient underlyings and the mean-VaR efficient structured products.

The theoretical results are tested with Monte Carlo simulations. We consider the case of a t distribution. Structured products used in the simulation are tracker certificates, discount certificates, and capped outperformance certificates. Simulation results are not at odds with the theoretical finding. Simulations with real-world historical data are also conducted. We consider seven major European stock market indices as the underlyings. The simulation results can also be explained by our theoretical finding.

A limitation of the paper is that the discussions are based on one-period models. Although it is true that buyers of structured products usually implement a buy-and-hold strategy and there is basically no trading before maturity, this one-period framework is not capable of considering path-dependent products, for example, products with a barrier option component. Further study can extend the framework of the paper to a multi-period one.

Notes

It can easily be verified that two structured products with the same VaR do not necessarily have the same expected return.

A thorough discussion of the mean-variance efficient underlyings and the mean-VaR efficient structured products is beyond the scope of this paper.

References

Alexander, G.J., Baptista, A.M.: Economic implications of using a mean-var model for portfolio selection: a comparison with mean-variance analysis. J. Econ. Dyn. Control 26(7–8), 1159–1193 (2002)

Basak, S., Shapiro, A.: Value-at-risk-based risk management: optimal policies and asset prices. Rev. Financ. Stud. 14(2), 371–405 (2001)

Benati, S.: The optimal portfolio problem with coherent risk measure constraints. Eur. J. Oper. Res. 150(3), 572–584 (2003)

Blümke, A.: How to Invest in Structured Products. Wiley, Amsterdam (2009)

Cao, J., Rieger, M.O.: Risk classes for structured products: mathematical aspects and their implications on behavioral investors. Ann. Financ. 9(2), 167–183 (2013)

Célérier, C., Vallée, B.: What Drives Financial Complexity? A Look into the Retail Market for Structured Products, Research Paper. HEC, Paris (2013)

CESR: CESR’s Guidelines on the Methodology for the Calculation of the Synthetic Risk and Reward Indicator in the Key Investor Information Document. Committee of European Securities Regulators. CESR/10-673 (2010)

Chang, B.Y., Christoffersen, P., Jacobs, K.: Market skewness risk and the cross section of stock returns. J. Financ. Econ. 107(1), 46–68 (2013)

Consigli, G.: Tail estimation and mean-var portfolio selection in markets subject to financial instability. J. Bank. Financ. 26(7), 1355–1382 (2002)

Cornish, E.A., Fisher, R.A.: Moments and cumulants in the specification of distribution. Revue de l’Institut International de Statistique 5, 307–322 (1937)

Cui, X., Zhu, S., Sun, X., Li, D.: Nonlinear portfolio selection using approximate parametric value-at-risk. J. Bank. Financ. 37(6), 2124–2139 (2013)

El-Jahel, L., Perraudin, W., Sellin, P.: Value at risk for derivatives. J. Deriv. 6(3), 7–26 (1999)

European Commission: Commission directive 2010/43/eu. Off. J. Eur. Union L. 176, 42–61 (2010a)

European Commission: Commission regulation (eu) no 583/2010. Off. J. Eur. Union L. 176, 1–15 (2010b)

European Structured Investment Products Association: Eusipa derivative map. https://doi.org/www..eusipa.org/images/grafiken/european_map_web.pdf. Published: May. 2012, Accessed 15 Jan 2014

Fisher, R.A., Cornish, E.A.: The percentile points of distributions having known cumulants. Technometrics 2(2), 209–225 (1960)

Gabrielsen, A., Zagaglia, P., Kirchner, A., Liu, Z.: Forecasting value-at-risk with time-varying variance, skewness and kurtosis in an exponential weighted moving average framework. Working Paper, Dipartimento Scienze Economiche, Universita’ di Bologna (2012)

Hill, G.W., Davis, A.W.: Generalized asymptotic expansions of cornish-fisher type. Ann. Math. Stat. 39(4), 1264–1273 (1968)

Kraus, A., Litzenberger, R.H.: Skewness preference and the valuation of risk assets. J. Financ. 31(4), 1085–1100 (1976)

Mitton, T., Vorkink, K.: Equilibrium underdiversification and the preference for skewness. Rev. Financ. Stud. 20(4), 1255–1288 (2007)

Rieger, M.O.: Co-monotonicity of optimal investments and the design of structured financial products. Financ. Stoch. 15(1), 27–55 (2011)

Santini, L.: Citic pacific sees $2 billion bad-bet hit. Wall Str. J. https://doi.org/online.wsj.com/article/SB122460075958054287.html, Published: 22 Oct. 2008, Accessed: 11 June 2013

Scott, R.C., Horvath, P.A.: On the direction of preference for moments of higher order than the variance. J. Financ. 15(4), 915–919 (1980)

Swiss Structured Products Association: Information about the SSPA risk figure. https://doi.org/www..svsp-verband.ch/download/risikokennzahl/Informationen_SVSP_Risikokennzahl_2013-02-01_EN.pdf, Published: 31 Jan. 2013, Accessed: 22 Jan 2014

Tsao, C.: Portfolio selection based on the mean-var efficient frontier. Quant. Financ. 10(8), 931–945 (2010)

Wallace, D.L.: Asymptotic approximations to distributions. Ann. Math. Stat. 29, 635–654 (1958)

Wallmeier, M.: Beyond payoff diagrams: how to present risk and return characteristics of structured products. Financ. Mark. Portf. Manag. 25(3), 313–338 (2011)

Acknowledgements

The author thanks Markus Schmid (the editor), the anonymous referee, Marc Oliver Rieger, Vincent Xiang (discussant), Mohammad M. Mousavi (discussant), conference participants at the 2nd International Conference on Future and Other Derivative Markets (Beijing), the 1st Paris Financial Management Conference, and the 6th IFABS Conference (Lisbon), as well as seminar participants at Xiamen University.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 2.1

When \(\ln (X)\) follows a normal distribution, that is, \(\ln (X) \sim \mathrm{N}(\mu , \sigma ^2)\):

where \(p_\alpha \) denotes the \(\alpha \)-quantile of a standard normal distribution. Equation (6) becomes

Since the level \(\alpha \) for VaR is always at the left tail of the distribution (e.g., \(\alpha \) is 1% in the EU regulation CESR 2010), \(p_\alpha \) in Eq. (22) is negative. \(VaR_\alpha \) is thus decreasing in \(\mu \) and increasing in \(\sigma \).

Furthermore, Eq. (20) becomes

because \(\gamma _1 = 0\) and \(\gamma _2 = 0\) for normal distributed \(\ln (X)\).

Observe Eqs. (22) and (23) together, because we have \(\bar{a} \ge 0\), the first term \(\bar{a}e^\mu \), the second term \(\frac{\bar{a}e^\mu }{2!}\sigma ^2\), and the third term \(\frac{3\bar{a}e^\mu }{4!}\sigma ^4\) in Eq. (23) are all increasing in \(\mu \). Larger \(\mu \) will thus increase \(\mu _y\), the expected return of the product. \(\mu _y\) is obviously increasing in \(\sigma ^2\), too. Larger underlying variance will increase expected return of the product; it will however, increase the VaR of the product in Eq. (22) at the same time.

Proof of Proposition 2.2

In this case, Eq. (20) becomes

In addition, Eq. (8) becomes

The term \(p_\alpha + \frac{p_\alpha ^3-3p_\alpha }{24}\gamma _2\) and the term \(\frac{p_\alpha ^3-3p_\alpha }{24}\) in Eq. (25) are both negative, because \(p_\alpha \) is negative and \(\gamma _2\) is non-negative. Consequently, the \((1-\alpha )\)-VaR of the structured product \(VaR_\alpha \) will be decreasing in \(\mu \), increasing in \(\sigma \) and in \(\gamma _2\).

The expected return \(\mu _y\) of the product is obviously increasing in \(\mu \). \(\mu _y\) will also be increasing in \(\sigma ^2\) and in \(\gamma _2\), since \(\gamma _2 \ge 0\). Because \(VaR_\alpha \) is decreasing in \(\mu \) and increasing in \(\sigma \) and in \(\gamma _2\), only large expectation from the underlying’s log-return is preferred. The preferences for the variance and the kurtosis of the underlying in this case are both conflicting: larger variance (kurtosis) increases the expected return of the product, but also increases the VaR at the same time.

Proof of Proposition 2.3

Let us directly look at Eqs. (20) and (8).

\(VaR_\alpha \) is clearly decreasing in \(\mu \). The impact of \(\sigma \) is ambiguous, because the term

can be both positive and negative, depending on the combination of \(\gamma _1\) and \(\gamma _2\).

As for \(\gamma _1\), Eq. (26) is a quadratic function of \(\gamma _1\). The minimum is achieved at \(\gamma _1 = \frac{3p_{\alpha }^2-3}{2p_{\alpha }^3-5p_{\alpha }}\), which is negative for \(p_{\alpha } < -1.581\) (\(\alpha < 0.057\)), a typical level for VaR. Thus, when \(\gamma _1 \le \frac{3p_{\alpha }^2-3}{2p_{\alpha }^3-5p_{\alpha }}\), the VaR is increasing in \(\gamma _1\); when \(\gamma _1 > \frac{3p_{\alpha }^2-3}{2p_{\alpha }^3-5p_{\alpha }}\), the VaR is decreasing in \(\gamma _1\). When \(\alpha = 0.01\) (CESR 2010), \(\frac{3p_{\alpha }^2-3}{2p_{\alpha }^3-5p_{\alpha }} = -0.977\). If the skewness is smaller than \(-0.977\), the VaR will be increasing in the skewness; if the skewness is larger than \(-0.977\), the VaR will be decreasing in the skewness. In general, it is safe to say that large positive skewness will reduce the VaR.

As for \(\gamma _2\), it is obvious that \(VaR_\alpha \) is increasing in \(\gamma _2\). Because \(\sigma > 0\) and the term \(\frac{p_\alpha ^3-3p_\alpha }{24}<0\) for \(\alpha <0.042\) (\(p_\alpha <-1.732\)), which is typical for VaR.

In Eq. (20), the impact of \(\mu \) on \(\mu _y\) is obviously positive. \(\mu _y\) is increasing both in \(\gamma _1\) and in \(\gamma _2\). Because \(\sigma >0\), \(\mu _y\) is also increasing in \(\sigma \).

Putting VaR together: Keeping other moments fixed, underlyings with large expected log-return will be preferred. Large positive skewness will be preferred, too. The impact of underlying variance is ambiguous. Increasing the underlying kurtosis will increase the expected return of the product but, however, increase the VaR of the structured product, too.

t Distribution If a random variable T follows a t distribution with \(\eta \) degrees of freedom, then its probability density function is given by

where \(\Gamma \) is the gamma function. When \(\eta > 4\), the expectation, the variance, the skewness, and the excess kurtosis of T are 0, \(\frac{\eta }{\eta - 2}\), 0, and \(\frac{6}{\eta - 4}\), respectively. A transformed version of the t distribution is often used. If L follows a transformed t distribution with \(\eta \) degrees of freedom, a location parameter \(\mu \), and a scale parameter \(\sigma \), then

where T has a probability density function of Eq. (27). In comparison to a normal distribution, L in Eq. (28) will have positive excess kurtosis and can better capture the “fat tails” of the financial asset’s return.

Tracker certificates Tracker certificates are one of the market participation products investigated in this paper. They simply track the performance of the underlying assets. Holding a tracker certificate has basically the same payoff as holding the underlying itself. We use this product in the simulation as an example of products with very simple payoff functions. They are usually constructed with zero-strike calls (LEPO). For more detail on tracker certificates, see Blümke (2009). The payoff function of a tracker certificate is simply \(y(X) = X\), and thus, its payoff algorithm is \(g(L) = g(\ln (X)) = e^{\ln (X)} = e^L\).

Discount certificates Discount certificates are a yield enhancement product. As discussed in the beginning of this paper, they offer the buyer, on the one hand, shares of an underlying at a price lower than its current price. On the other hand, however, the buyer has to accept a fixed maximum return (the cap). At maturity, if the underlying price is lower than the cap, the buyer receives one share of the underlying per discount certificate; otherwise, the buyer receives a cash settlement equivalent to the cap. Discount certificates are usually constructed by holding the underlying and selling call options with strike being the cap. The payoff function of a discount certificate can be described by

where K is the cap. Its payoff algorithm is thus

Capped outperformance certificates Capped outperformance certificates (also called turbo certificates), another type of participation products, allow for a disproportionate participation in the gains of the underlying at any level above the strike price. In return, the buyer’s profit is limited (capped) on the upside. They are usually constructed with the underlying, a long at-the-money call and two short out-of-the-money calls. Their payoff function can be described by

for \(K_2>K_1\), where \(K_1\) is the strike of the first long call, which is usually set to be the spot price of the underlying, \(K_2\) is the strike of the two short calls determined by the premium paid for the first call. The payoff algorithm of a capped outperformance certificate is thus given by

because we have normalized the spot price to be 1, \(K_1 = X^0 = 1\).

Rights and permissions

About this article

Cite this article

Cao, J. How does the underlying affect the risk-return profiles of structured products?. Financ Mark Portf Manag 31, 27–47 (2017). https://doi.org/10.1007/s11408-016-0281-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-016-0281-9