Abstract

This paper aims to capture the effect of environmentally related taxes on environmental quality in Canada while controlling economic growth, financial development, and energy consumption over the period of 1990Q1 to 2020Q4. The present study employs novel econometric approaches, namely, the nonlinear autoregressive distributed lag (N-ARDL) test and the gradual shift causality (GS-C) test. The outcomes of the study reveal that (i) there is long-run cointegration equation between environmental taxes (E-TAX), carbon dioxide emissions (CO2E), economic growth (ECG), financial development (FD), and primary energy consumption (PREC); (ii) E-TAX causes to decrease in environmental degradation in Canada; (iii) PREC and ECG increase (and cause) environmental degradation in Canada; and (iv) financial development also positively affect the environmental sustainability. This effort may also be of great importance for policymakers and decision-makers to better understand the factors of environmental degradation for developing effective tax policies that will alleviate human impacts and contribute to reducing environmental degradation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the world, climate change, carbon dioxide emissions, and improving energy accountability are urgent policy issues that need to be addressed (Adedoyin et al., 2022; Agboola et al., 2022; Wu et al., 2022; Kartal et al., 2023b). It is widely accepted that pollution is primarily caused by carbon dioxide emissions. Globally, environmental practitioners and policymakers are coming to a consensus about the need to set new rules and regulations to tackle climate change’s environmental effects. To the best of my knowledge, despite multiple studies on the effect of taxes on the quality of the environment, there is no research conducted to capture the effect of environmental taxes on the quality of the environment in Canada. Moreover, the present study uses some novel and newly developed approaches, the N-ARDL test and the GS-C test, to capture this linkage for the case of Canada. Finally, the present study aims to provide some suggestions for the governors in Canada based on the empirical outcome of the study.

In the graph, the carbon pricing scenario begins at 727.8 million tonnes of greenhouse gas emissions in 2018, falling to 680.9 million tonnes in 2022. As of 2022, Canada is estimated to emit 770.5 million tonnes of greenhouse gasses without carbon pricing, which is marked by a blue dot. Figure 1 clearly illustrates that carbon pricing leads to a reduction of 90–80 million tonnes of greenhouse gas emissions.

As part of the 2016 Pan-Canadian Framework on Climate Change, Canada implemented a federal carbon price; it continues to negotiate with provinces over its implementation, including legal challenges (Green, 2021). Canada produced 565 million metric tonnes of CO2 in 2018, making it the tenth-largest economy in the world. Carbon capture and storage readiness ranks Canada the highest in the world. A significant part of Canada’s emissions is generated by the transportation sector, which accounted for over 25% of emissions in 2018. A clean fuel standard was developed by the government of Canada to reduce the emissions intensity of transportation fuels in order to meet the government’s Paris Agreement pledge of zero emissions by 2050. The federal government also pledged a CA$170 per tonne CO2 price in 2030. However, no information has been released about the economic impacts other than the claim that there will be no effect on gross domestic product, despite the fact that the organization claims to have done a comprehensive macroeconomic analysis. A targeted reduction of emissions intensity is particularly appropriate for diesel because its emissions intensity is higher than gasoline’s. As global energy markets shift to more sustainable solutions, Canada will benefit from the domestic production of next-generation low-emission diesel. As reported by the study of McKitrick and Aliakbari (2021), the federal carbon tax will, however, result in a 1.8% drop in gross domestic product (GDP) (as seen in Figure 2) and the loss of upwards of 184,000 jobs nationwide. As argued by the federal government, Canadians will “most likely” find themselves better off as a result of the carbon-tax policy since the government will rebate most of the revenues from the tax. Most of the new tax revenues will be offset by the shrinking tax base caused by the increased carbon tax. Government deficits will increase by about $22 billion annually if 90% of carbon tax revenues are rebated to households, and the remainder is spent while other tax rates remain the same (McKitrick and Aliakbari, 2021).

Several researchers have identified four mitigation pathways that policies can target to address freight greenhouse gasses (GHG) emissions: enhance the technological capabilities of vehicles, reduce fuel-related GHGs, decline freight traffic, and promote less emission-intensive modes of transportation (Hammond et al., 2020). However, the impact of environmental taxes on the environment still has not been discussed comprehensively using country-based analysis.

Carbon taxes can encourage conservation, substitution, and innovation to reduce carbon emissions. Australians, Swedes, and Albertans have proposed or implemented this measure around the world. It appears, however, that a carbon tax may harm the growth of the economy. Thus, a carbon tax should be systematically studied to determine an effective and economically feasible strategy for reducing GHG emissions (Bhat and Mishran, 2020; Liu et al., 2018; Vera and Sauma, 2015).

According to Haites et al. (2018), carbon pricing policies perform well in terms of emissions reductions, cost-effectiveness, and economic efficiency. The authors examine whether and how tax rates have changed over time and how taxes and emissions trading systems have reduced emissions. The study provides useful information on the effectiveness of carbon pricing schemes and the impact of various policies on carbon emissions (or their lack thereof). The authors note, however, that carbon pricing cannot be separated from other climate mitigation policies (Haites, 2018). Based on emissions reductions and cost-effectiveness, Haites (2018) reviews carbon pricing policies. Carbon taxes in European nations have led to small reductions, up to 6.5% over the past few years, according to Haites (2018). Yet countries that are also part of the EU-ETS (European Union Emissions Trading System) whose emissions are not taxed reduced emissions more quickly than those whose emissions are taxed. Non-ETS emissions may have been reduced more by other policies than carbon taxes, according to a study by Haites (2018).

The cross-sectional dataset of effective energy tax rates of Organisation for Economic Co-operation and Development (OECD) countries is used by Sen and Vollebergh (2018) to estimate the long-run impact of a broad-based carbon tax on energy consumption. The outcomes of Sen and Vollebergh (2018) reveal that higher energy taxes decline environmental pollution in OECD countries. Hassan et al. (2020) also focus on the case of OECD countries and conclude that taxes related to the environment could promote economic growth if GDP per capita is high. Loganathan et al. (2020) aim to capture the impact of productivity and green taxation on the quality of the environment in Malaysia. They conclude that green taxation contributes to environmental sustainability positively. Ghazouani et al. (2021) argued that promoting cleaner energy sources and environmental taxes can be effective ways to reduce pollution. Moreover, as underlined by Ghazouani et al. (2021), economists and environmental scientists recommend the use of environmental-related taxes and carbon and energy taxes to achieve zero carbon emissions.

As far as I observed in the existing literature, no study has examined the effect of environmental taxes on environmental degradation in Canada by using single-country data and the asymmetric and Fourier-based approach. Therefore, the study fills a literature gap. Accordingly, analyzing the effect of environmental taxes on the quality of the environment may reduce omitted variable bias in the econometric model. Finally, it is also important that policymakers and decision-makers understand environmental degradation factors to develop effective tax policies that will reduce human impacts and contribute to reducing environmental degradation while maintaining economic growth and alleviating human impacts.

Data and methodology

This section describes the variables used in the estimated models and explains how the models were constructed. Based on the main aim of this present study, the BDS test, ADF unit root test, N-ARDL test, and GS-C test are employed. As advised by Liu et al. (2023b), Cheng et al. (2021), and Shahbaz et al. (2019), a quadratic match-sum approach is used in this study to simulate an annual-to-quarter-frequency transformation of time series variables in order to prevent potential problems arising from a small sample size. Moreover, for the N-ARDL and GS-C tests, the E-TAX, CO2E, ECG, FD, and PREC can be either stationary at the level or stationary at the first difference. Therefore, the integration of the order of the time series is not problematic as long as they do not have I(2) behavior. For the main aim of the present study, Eq. 1 is estimated in this study.

Equation (1) highlights that CO2 emissions are determined by a combination of variables such as E-TAX, ECG, FD, and PREC. This model is converted into their regression form for empirical analysis, as follows:

where CO2E, E-TAX, ECG, FD, and PREC stand for production-based CO2 emissions, environmentally related taxes % of GDP, economic growth, financial development, and primary energy consumption, respectively. It is worth mentioning that all variables, except E-TAX, are in log form in this study. Figure 3 illustrates the analysis flow of the present study, while Figure 4 shows the box plots of the LCO2E, E-TAX, LECG, LPREC, and LFD variables. In addition, the descriptive statistics of the variables are reported in Table 1. Based on the Kurtosis test, as reported in Table 1, the study determined whether the variable was light-tailed or heavy-tailed. All of the indicators are platykurtic since they have values less than 3. Skewedness statistics in Table 1 show that LCO2E, LECG, LPREC, and LFD distributions are slightly right-skewed, whereas E-TAX distributions are left-skewed. The findings from the Jarque–Bera show that only LPREC is normally distributed within all variables. Figure 4 also reports the box plot of the time series variables.

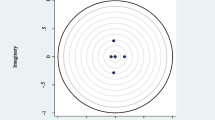

After calculating the main descriptive statistics of the time series variables (as reported in Table 1), the present study employed the BDS test of Broock et al. (1996) to check the nonlinearity attributes of LCO2E, E-TAX, LECG, LPREC, and LFD variables. As a next step, the order of the integration of the time series variables is captured by the ADF unit root test with a breakpoint. In addition to the ADF unit root test, this study used Enders and Lee’s (2012) ADF unit root test. Since the Fourier ADF unit root test uses a limited number of parameters, it avoids the problem of losing power that occurs when using too many dummy variables (Ozgur, Yilanci, & Kongkuah, 2022; Pata et al., 2022; Kirikkaleli et al., 2023a; Kirikkaleli et al., 2023b; Kartal et al., 2023a).

As a main estimator, the present study employs the N-ARDL approach of Shin et al. (2014) in order to identify the long-term and asymmetric impact of E-TAX on LCO2E while taking into account LECG, LPREC, and LFD variables over the period of 1990–2020 for the case of Canada. It is widely accepted that obtaining nonlinearity behavior and mix integration order for the time series variables is likely to increase the possibility of biased estimation results with linear models. Therefore, the present study used the N-ARDL approach developed by Shin et al. (2014). As with the ARDL model, the NARDL model is flexible since all variables do not have to have the same order of integration (Liu et al., 2023a; Meng et al., 2023; Abosedra et al., 2023). Therefore, the test provides superior outcomes relative to the traditional linear ARDL estimator (Lau et al., 2023). The N-ARDL approach allows the present study to detect the long-run effects of both negative and positive shocks in E-TAX, LECG, LPREC, and LFD to the LCO2E variable.

The traditional Toda and Yamamoto (TY) causality test was developed by Toda and Yamamoto (1995) in order to capture causal linkage among the time series variable. The test could be applied without detecting the integration order of the time series variables. More recently, the TY causality test was improved by Nazlioglu et al. (2016) by taking into account the Fourier function. The developed version of the TY causality test is called “gradual shift causality” since the test allows gradual shifts in the estimated model. As mentioned by Nazlioglu et al. (2016), “this approach is capable of capturing gradual or smooth shifts and does not require prior knowledge regarding the number, dates, and form of structural breaks.”

Empirical findings

This empirical research examines the long-run and causal effect of the E-TAX variable on LCO2E in Canada while controlling some important determinates of LCO2E, namely, LECG, LPREC, and LFD variables in Canada for 1990–2020. To achieve the stated objectives, as an initial test, the BDS test is performed to capture whether the time series variables have nonlinear behavior over the selected time period for the case of Canada. The outcome of the BDS test is reported in Table 2, which clearly reveals the validity of the nonlinear characteristics of the LCO2E, E-TAX, LECG, LPREC, and LFD variables, implying that performing linear and traditional approaches might create biased outcomes. Therefore, the present study used N-ARDL and GS-C tests in order to capture the long-run and causal effect of the E-TAX variable on LCO2E in Canada.

As a next step, the integration of the order of the time series variables is captured using the Fourier ADF unit root test and ADF unit root test with breakpoint. The outcomes are reported in Table 3. As clearly seen, the F-stats of the time series variables are not significant at a 5% significance level. Therefore, the decisions are made using the ADF unit root test with a breakpoint to identify the integration of order of the LCO2E, E-TAX, LECG, LPREC, and LFD variables. The outcome of the unit root test exposes that while LCO2E, E-TAX, and LPREC seem stationary at the first difference, LECG and LFD appear stationary at the level, implying that the integration of order of the LCO2E, E-TAX, and LPREC variables are one (I-1), whereas LECG and LFD have an I-0 behavior. Since the variables are mixed ordered and have nonlinear behavior over the selected time period for the case of Canada, the present study performed N-ARDL and GS-C tests.

Table 4 reports both N-ARDL bounds and N-ARDL long-run results. As clearly seen in Table 5, the outcomes of N-ARDL show that the null hypothesis that there was no cointegration equation between LCO2E, E-TAX, LECG, LPREC, and LFD can be rejected for the case of Canada. The result shows that there is a long-run linkage between environmental taxes and environmental quality while controlling the main determinants of LCO2E in Canada. In addition to this, Table 5 also reports that positive and negative shocks in E-TAX decline the environmental degradation in Canada. In the long run, green growth, as a result of rising environmentally related taxes, tends to degrade pollution by reducing environmental degradation in Canada. E-TAX plays a vital role in executing sustainable development. Therefore, it can manage the development of economics and sustainability of the environment. It is therefore important for environmentally friendly countries to achieve these objectives through green growth. This outcome supports the environmentally friendly taxes–led–environmental sustainability hypothesis and also can be supportive evidence for the early empirical outcome of Chien et al. (2021) and Zahan and Chuanmin (2021). Actually, it is interesting to have a finding that negative shocks in E-TAX also decrease environmental degradation in Canada. This finding supports that paying environmentally related taxes indicates obtaining greener technology, and this situation leads to a better environment in Canada. This outcome also reveals that serious environmental tax legislation in Canada will allow firms to switch to cleaner production techniques. Additionally, the study argues that investing tax funds in initiatives promoting sustainable technologies will aid countries in meeting SDG-7 and SDG-13. For ecological stability, environmental taxes must be based on the polluter-pays principle. It is also important to fund renewable technology development in Canada with tax revenue from environmental taxes.

The outcomes of N-ARDL also reveal that positive and negative shocks in ECG cause an increase in CO2E, whereas positive and negative shocks in FD contribute to environmental sustainability positively. Finally, as expected, positive shocks in PREC increase CO2E. The stability of the N-ARDL estimators is confirmed by B-P-G heteroskedasticity approach (reported in Table 5), Ramsey reset approach (reported in Table 5), Cusum and Cusumsq (as illustrated in Figs. 5 and 6, respectively).

As a final step, the present study employed the GS causality test to capture the possible causal effect of E-TAX, LECG, LPREC, and LFD on LCO2E in Canada. The outcome of the GS-C test is shown in Table 5. As expected, changes in E-TAX significantly lead to changes in LCO2E in Canada, implying that environmentally related taxes are an important factor in predicting production-based CO2 emissions. In addition, at a 10% significance level, LFD and LECG cause LCO2E, showing how economic growth and financial development are important in order to estimate production-based CO2 emissions in Canada.

Conclusion

To combat the environmental effects of climate change, environmental practitioners and policymakers around the world have come to a consensus about the need to set new rules and regulations. Based on the author’s knowledge, despite numerous studies examining the effect of taxes on the environment, no research has been conducted to examine the effect of environmental taxes in Canada. Therefore, the paper fills this gap in the literature. Based on this aim, this paper captures the long-run and causal impact of environmentally related taxes on environmental quality in Canada while controlling economic growth, financial development, and energy consumption over the period of 1990Q1 to 2020Q4. The present study employs novel econometric approaches, namely, N-ARDL and GS-C tests.

The outcome of novel econometric approaches reveal that (i) E-TAX, CO2E, ECG, FD, and PREC are cointegrated in Canada over a selected time period; (ii) Canadian environmental degradation decreases due to rising environmentally related taxes; (iii) PREC and ECG increase (and cause) CO2E in Canada; (iv) the development of the financial sector also has a positive effect on the sustainability of the environment.

Due to strict environmental tax laws in Canada, businesses will be able to shift production to cleaner methods based on the empirical findings of this study. The paper concludes that redistributing tax revenue to sustainable technology programs would enable nations to achieve the United Nations Sustainable Development Goals 7 and 13. Polluter-pay principles must be adhered to when it comes to environmental taxes so that ecological sustainability can be ensured in Canada. Furthermore, tax revenues received from environmental taxes in Canada should support research and development of renewable technologies. It is imperative that environmental taxes be based on the polluter-pays principle in order to maintain ecological stability. Green growth tends to degrade pollution in the long run by reducing environmental degradation in Canada due to rising taxes related to the environment. In addition, environmental taxes should be used to fund the development of renewable technologies in Canada. As a result, in the case of Canada, sustainable development relies heavily on E-TAX.

Data availability

The data that support the findings of this study are available from the OECD, EIA, Global Carbon Project, and World Bank.

Abbreviations

- CO2E:

-

Carbon dioxide emissions

- ECG:

-

Economic growth

- EIA:

-

Energy Information Administration

- E-TAX:

-

Environmental taxes

- EU-ETS:

-

European Union Emissions Trading System

- FD:

-

Financial development

- GS-C:

-

Gradual shift causality

- GHG:

-

Greenhouse gasses

- GDP:

-

Gross domestic product

- N-ARDL:

-

Nonlinear autoregressive distributed lag

- OECD:

-

Organisation for Economic Co-operation and Development

- PREC:

-

Primary energy consumption

- SDG:

-

Sustainable Development Goal

- TY:

-

Toda and Yamamoto

References

Abosedra S, Fakih A, Ghosh S, Kanjilal K (2023) Financial development and business cycle volatility nexus in the UAE: evidence from nonlinear regime-shift and asymmetric tests. Int J Financ Econ 28(3):2729–2741

Adedoyin FF, Bekun FV, Eluwole KK, Adams S (2022) Modelling the nexus between financial development, FDI, and CO2 emission: does institutional quality matter? Energies 15(20):7464

Agboola PO, Bekun FV, Agozie DQ, Gyamfi BA (2022) Environmental sustainability and ecological balance dilemma: accounting for the role of institutional quality. Environ Sci Pollut Res 29(49):74554–74568

Bhat AA, Mishra PP (2020) Evaluating the performance of carbon tax on green technology: evidence from India. Environ Sci Pollut Res 27:2226–2237

Broock WA, Scheinkman JA, Dechert WD, LeBaron B (1996) A test for independence based on the correlation dimension. Econ Rev 15(3):197–235

Cheng G, Zhao C, Iqbal N, Gülmez Ö, Işik H, Kirikkaleli D (2021) Does energy productivity and public-private investment in energy achieve carbon neutrality target of China? J Environ Manag 298:113464

Chien F, Sadiq M, Nawaz MA, Hussain MS, Tran TD, Le Thanh T (2021) A step toward reducing air pollution in top Asian economies: the role of green energy, eco-innovation, and environmental taxes. J Environ Manag 297:113420

Enders W, Lee J (2012) A unit root test using a Fourier series to approximate smooth breaks. Oxf Bull Econ Stat 74(4):574–599

Ghazouani A, Jebli MB, Shahzad U (2021) Impacts of environmental taxes and technologies on greenhouse gas emissions: contextual evidence from leading emitter European countries. Environ Sci Pollut Res 28:22758–22767

Green JF (2021) Does carbon pricing reduce emissions? A review of ex-post analyses. Environ Res Lett 16(4):043004

Haites E (2018) Carbon taxes and greenhouse gas emissions trading systems: what have we learned? Clim Pol 18(8):955–966

Haites E, Maosheng D, Gallagher KS, Mascher S, Narassimhan E (2018) Experience with carbon taxes and greenhouse gas emissions trading system. Duke Environ Law Policy Forum 29:109–182

Hammond W, Axsen J, Kjeang E (2020) How to slash greenhouse gas emissions in the freight sector: policy insights from a technology-adoption model of Canada. Energy Policy 137:111093

Hassan M, Oueslati W, Rousselière D (2020) Environmental taxes, reforms and economic growth: an empirical analysis of panel data. Econ Syst 44(3):100806

Kartal MT, Kirikkaleli D, Kılıç Depren S (2023a) Investigating political stability effect on the environment in the Netherlands by Fourier-based approaches. International Journal of Sustainable Development & World Ecology:1–12

Kartal MT, Pata UK, Kılıç Depren S, Erdogan S (2023b) Time, frequency, and quantile-based impacts of disaggregated electricity generation on carbon neutrality: evidence from leading European Union countries. International Journal of Sustainable Development & World Ecology:1–19

Kirikkaleli D, Castanho RA, Özbay RD, Genc SY, Ahmed Z (2023a) Does resource efficiency matter for environmental quality in Canada? Frontiers in Environmental Science 11:1276632

Kirikkaleli D, Sofuoğlu E, Ojekemi O (2023b) Does patents on environmental technologies matter for the ecological footprint in the USA? Evidence from the novel Fourier ARDL approach. Geosci Front 101564

Lau CK, Patel G, Mahalik MK, Sahoo BK, Gozgor G (2023) Effectiveness of fiscal and monetary policies in promoting environmental quality: evidence from five large emerging economies. Emerg Mark Financ Trade:1–13

Liu L, Huang CZ, Huang G, Baetz B, Pittendrigh SM (2018) How a carbon tax will affect an emission-intensive economy: a case study of the Province of Saskatchewan, Canada. Energy 159:817–826

Liu L, Pang L, Wu H, Hafeez M, Salahodjaev R (2023a) Does environmental policy stringency influence CO2 emissions in the Asia Pacific region? A nonlinear perspective. Air Qual Atmos Health:1–10

Liu B, Hu R, Ullah S (2023b) Energy technology innovation through the lens of the financial deepening: financial institutions and markets perspective. Environ Sci Pollut Res:1–10

Loganathan N, Mursitama TN, Pillai LLK, Khan A, Taha R (2020) The effects of total factor of productivity, natural resources and green taxation on CO2 emissions in Malaysia. Environ Sci Pollut Res 27:45121–45132

McKitrick, R., & Aliakbari, E. (2021). Estimated impacts of a $170 carbon tax in Canada.

Meng Q, Zhang JW, Wang Y, Chang HL, Su CW (2023) Green household technology and its impacts on environmental sustainability in China. Sustainability 15(17):12919

Nazlioglu S, Gormus NA, Soytas U (2016) Oil prices and real estate investment trusts (REITs): gradual-shift causality and volatility transmission analysis. Energy Econ 60:168–175

Ozgur O, Yilanci V, Kongkuah M (2022) Nuclear energy consumption and CO2 emissions in India: evidence from Fourier ARDL bounds test approach. Nucl Eng Technol 54(5):1657–1663

Pata UK, Yilanci V, Zhang Q, Shah SAR (2022) Does financial development promote renewable energy consumption in the USA? Evidence from the Fourier-wavelet quantile causality test. Renew Energy 196:432–443

Sen S, Vollebergh H (2018) The effectiveness of taxing the carbon content of energy consumption. J Environ Econ Manag 92:74–99

Shahbaz M, Gozgor G, Hammoudeh S (2019) Human capital and export diversification as new determinants of energy demand in the United States. Energy Econ 78:335–349

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Horrace W, Sickles R (eds) The Festschrift in Honor of Peter Schmidt: Econometric Methods and Applications. Springer, New York, pp 281–314

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1-2):225–250

Vera S, Sauma E (2015) Does a carbon tax make sense in countries with still a high potential for energy efficiency? Comparison between the reducing-emissions effects of carbon tax and energy efficiency measures in the Chilean case. Energy 88:478–488

Wu W, Li X, Lu Z, Gozgor G, Wu K (2022) Energy subsidies and carbon emission efficiency in Chinese regions: the role of the FDI competition in local governments. Energy Sources, Part B: Economics, Planning, and Policy 17(1):2094035

Zahan I, Chuanmin S (2021) Towards a green economic policy framework in China: role of green investment in fostering clean energy consumption and environmental sustainability. Environ Sci Pollut Res 28:43618–43628

Author information

Authors and Affiliations

Contributions

The manuscript is written by DK.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

I confirmed that this manuscript has not been published elsewhere and is not under consideration by another journal. Ethical approval and informed consent are not applicable for this study.

Consent for publication

Not applicable.

Competing interests

The author declares no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kirikkaleli, . Environmental taxes and environmental quality in Canada. Environ Sci Pollut Res 30, 117862–117870 (2023). https://doi.org/10.1007/s11356-023-30616-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-30616-3