Abstract

The Green Financial Reform and Innovation Pilot Areas (GFRIPA) policy is a key institutional arrangement that enables China’s green finance to advance from theory to practice. Few studies have quantitatively evaluated the policy’s environmental performance. This study uses a generalized synthetic control method (GSCM) alongside panel data from Chinese prefecture-level cities since 2007 to assess the effects of the GFRIPA policy on energy consumption and pollution emissions and to pinpoint the underlying mechanisms. Results show that establishing the GFRIPA significantly reduces energy consumption and pollution emissions, and that the effect emerges immediately in the policy’s issuance year. Possible mechanisms consist of the increase in urban green innovation, the ease of financing constraints, the optimization of industrial structure, and the enhancement of environmental governance. Heterogeneity analyses reveal that policy effects are more profound in cities with a higher degree of marketization and a higher level of education. The findings provide valuable insights into consistently promoting the GFRIPA policy to meet environmental goals for energy conservation and pollution reduction and ultimately advance green economies in developing nations.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Developing a green financial system is crucial for transforming the mode of economic development and fostering the creation of a resource-efficient and environment-friendly society. It is an inevitable step toward advanced economic development (Ronaldo and Suryanto 2022; Liu and Wang 2023). Green finance is gaining widespread approval as a key tool for advancing modern environmental governance and green development, due to its dual role in market-oriented environmental regulation and resource allocation within the financial sector. In recent years, there has been notable progress in China’s green financial policy framework and institutional system, resulting in impressive development achievements within the green financial market. According to the People’s Bank of China, China’s green loan balance has ranked first in the world in terms of stock size. It reached RMB 20.9 trillion by the end of the third quarter of 2022, marking an increase of 41.4% compared with the corresponding period last year and China has also the second largest green bond market globally. The issuance of green bonds saw a surge of 180% year on year to RMB 600 billion in 2021. Moreover, multi-level green financial products such as green stocks, green funds, green insurance, and carbon finance are continuously burgeoning.

It must be acknowledged that China’s present green finance practices face numerous challenges. The awkward predicament resembles a blockbuster movie with poor box-office returns. The synergy is inadequate between the central government’s green financial initiatives and local economic development. Efficient coordination and beneficial cooperation are also challenging to be achieved between financial institutions and enterprises, resulting in resource waste and inefficient investments. Moreover, the supply and demand of green capital are mismatched, as are the targets of green finance and the assessment indicators used by financial institutions. These issues not only erode financial institutions’ intrinsic motivation to promote green finance, but also frustrate firms’ eagerness to engage in green investments and financing.

For instance, with the full implementation of China’s green credit policy, commercial banks strictly enforce the one-vote veto rule for environmental protection when evaluating credit businesses. This measure helps to cut off funding for high energy-consuming and high-polluting (“two-high”) enterprises, preventing their reckless expansion. However, it can impede enterprises with an eagerness to transform and effective techniques to achieve low-carbon transformation to acquire sufficient financial backing, resulting in delayed or thwarted transformation. Concerning the Chinese economic reality, “two-high” industries play critical roles in local economic growth. Their transformation and development require significant attention (Lin and Zhang 2023). Additionally, green investment schemes’ environmental performance evaluation by financial institutions is problematic. The absence of evaluation criteria and analysis systems for green projects leads to inconsistent evaluation standards of third-party certification agencies. Incomplete information disclosure further exacerbates the lack of cross-sectional comparability of green project information and erodes the credibility of the green market. These issues facilitate greenwashing behaviors of banks and enterprises, posing potential risks of “bad money drives out good.” Therefore, the focus of integrating environmental and financial policies shifts toward effectively utilizing financial markets’ green resource allocation function to realize the economy’s green transformation.

The promotion of green transformation in the economy hinges on revolutionary changes in economic development patterns. China’s rapid economic growth over the past 40 years has yielded notable achievements, positioning it as the world’s second-largest economy. Unfortunately, long-term reliance on unsustainable development modes has led to a surge in energy consumption, as well as an increasingly critical emission issue. According to BP’s World Energy Statistics Yearbook, China constituted 26.5% of global energy consumption in 2021, exhibiting growing energy usage of 7.1% and consistently topping the globe. The dominance of fossil fuels in the energy consumption structure has adverse environmental implications, ranging from heightened natural resource depletion to air pollution and climate change. To achieve green development in China, it is key to boost energy efficiency, regulate pollution emissions, and hasten the process of energy conservation and pollution control.

Supportive policies and strategies drive the development of green finance, serving as crucial institutional innovations and policy tools. These efforts aim to accelerate the creation and enhancement of China’s circular economic development system that is green and low carbon. In June 2017, the State Council Executive Conference decided to build distinctive Green Financial Reform and Innovation Pilot Areas (GFRIPA) in eight regions of five provinces, including Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang. The GFRIPA strategy intends to tap into local government initiative to create an innovative green finance industry, and gradually bolster a consolidated management platform. Green finance in China has entered a new development stage, combining top-down design and bottom-up regional exploration. Has the GFRIPA policy contributed to the green transformation of the regional economy? Can the economic growth pattern be fundamentally reversed to achieve integration between high-quality development and environmental protection? Current research lacks clarity in answering these questions.

Previous studies have mostly evaluated the effect of Chinese green financial policies via the lens of green credits. They find that green credit policies significantly affect macroeconomic transformation, environmental quality improvement, corporate investment and financing, and credit decisions of commercial banks. One view on the macroeconomic level suggests that the green credit is beneficial to green economic growth (Zheng et al. 2022). The effective and acceptable green credit policy incentives, such as government-subsidized interest rates, targeted downgrades, and refinancing, help improve the economic structure (Hu et al. 2020). These incentives mitigate negative impacts on total economic output and employment, resulting in a win–win situation for both the economy and environment (Al Mamun et al. 2022). Another point holds that green credit policies are relatively effective in curbing investment in energy-intensive industries, but unsatisfactory in restructuring industries (Liu et al. 2017). The annual alternation of tight and loose green credit policies leads to fluctuations in green economic growth and unsustainable progress in energy conservation and pollution reduction (Xie and Liu 2019; Lin and Zhou 2022).

The micro-level evidence reveals that green credit policies can improve corporate cash holdings (Yuan and Gao 2022) and hasten the shift of corporate environmental governance from end-of-pipe management to front-end prevention (Sun et al. 2019). The credit-granting process involves an enterprise environmental risk assessment mechanism and strict monitoring of credit allotment to environmentally unfriendly firms (Zhang et al. 2021). This could urge “two-high” enterprises to promote green transition (Lu et al. 2022) and facilitate a push toward corporate emission reduction (Fan et al. 2021). On the other hand, while banks adopt naturally market-oriented mechanisms following the Equator Principles, China’s green credit policy holds banks accountable for environmental hazards. Bank performance may be negatively affected by the environmental access thresholds and the one-size-fits-all approach during implementation (Fan et al. 2021). This results in an asymmetric impact on debt costs among enterprises of varying kinds (Xu and Li 2020) and subsequently affects firm output and investment. Wen et al. (2021) uncover that green credit policies raise funding costs for “two-high” firms and inhibit their R&D investment in green technology. Falmmer (2021) argues that green enterprises might engage in greenwashing by avoiding substantial green innovation following the acquisition of low-cost financing. To determine whether significant reductions in regional energy consumption and pollutant emissions are possible, it necessitates clarifying the role of green financial policies in environmental governance.

Accurately identifying the pure effects of green financial policies is crucial. The GFRIPA policy is another significant step toward developing green finance since the promulgation of the Green Credit Guidelines in 2012. It clearly defines the policy targets and reduces the likelihood of biased estimation results caused by misidentification. This stands in contrast to the vague guidance provided by the Green Credit Guidelines. We use the generalized synthetic control method (GSCM) to assess the effects and mechanisms of the GFRIPA policy on energy consumed and pollution emitted in Chinese prefecture-level cities from 2007 to 2020.

The contribution of this paper is threefold. Firstly, it adds to the existing literature on the efficacy of green financial policies through investigating the GFRIPA policy’s effect on energy consumption and pollution emissions. Prior studies have mainly focused on how green credit policies impact corporate cash holdings (Yuan and Gao 2022), corporate investment and financing (Fan et al. 2021), export trade (Gao 2022), environmental quality improvement (Zhang et al. 2021; Su et al. 2022), green innovation (Chen et al. 2022), and green transformation (Lu et al. 2022). Few studies have examined the impact of the GFRIPA policy as a novel green finance reform institution on corporate investment efficiency (Yan et al. 2022), debt financing cost (Shi et al. 2022), and green innovation (Liu and Wang 2023) in pilot areas. Despite potential benefits, there is insufficient debate on whether the GFRIPA policy can efficiently reduce urban energy use and pollution emissions and fundamentally alter the extensive economic growth mode. By exploring this theme, the paper expands the research scope on green finance policies and establish a foundation for deepening the financial sector’s supply-side structural reform in China. It also offers references to policy makers seeking to effectively use financial instruments to conserve energy, cut pollution, and promote urban green development in developing countries.

Secondly, the GSCM is employed to empirically study the energy-saving and pollution-reducing effect of the GFRIPA policy. This approach effectively addresses endogeneity and small treated sample concerns. Prior studies mostly apply the difference-in-differences (DID) technique to evaluate the effect of green credit policies. Due to the unclear policy targets of the Green Credit Guidelines, existing studies have primarily relied on differences in the effects of green credit policies for polluting and clean industries to distinguish the treated and control groups (Lee et al. 2022; Zhao et al. 2023). This identification method is susceptible to subjectivity and potential endogeneity issues. When scrutinizing green credit qualifications, banks often ignore the inadequacy of large state-owned enterprises (SOEs). This leads to some non-high-polluting SOEs being mistakenly classified into the treated group. Moreover, the reliability of the DID method depends on adequate total and treated group sample size. Otherwise, estimator efficiency may be doubted and estimation bias can occur (Conley and Taber 2011). In our study, only 8 cities, accounting for 3.8% of the total number of cities, were piloted in the GFRIPA policy. To address these concerns, we regard the establishment of the GFRIPA as a policy shock and use the GSCM to investigate the effectiveness of the green finance reform in promoting urban energy conservation and reducing pollution.

Thirdly, this study thoroughly sorts out the micro and macro mechanisms underlying the effect of the GFRIPA policy on regional energy consumption and pollution emissions. It is suggested that the policy reduces urban energy consumption and pollution emissions by enhancing green innovation, easing financing constraints, optimizing industrial structure, and strengthening environmental governance. Moreover, following our evaluation of the policy effects in different regions, the government should fully consider regional endowments, factor structures, and comparative advantages of targeted cities while issuing and implementing the GFRIPA policy. The findings provide novel perspectives and empirical evidence that deepen our understandings on how the policy benefits environment, and how to unleash policy potential and expand the pilot areas.

The remainder of this paper is organized as follows. The “Policy background and hypothesis development” section includes background of the policy and hypothesis development. The “Methodology, variables, and data” section introduces GSCM, data, and variable definitions. The “Empirical analysis” section presents empirical studies and robustness tests. The “Mechanism analysis” section reports mechanism analyses. The “Heterogeneity analysis” section discusses heterogeneity and the “Conclusion” section concludes the paper.

Policy background and hypothesis development

Policy background

China has entered a new normal stage in economic development, prioritizing structural optimization and environmental friendliness over sheer economic scale and growth rate. However, China remains the world’s largest consumer of primary energy and has yet to fundamentally alter its way to economic development at the cost of energy consumption and environmental pollution. According to the China Energy Statistics Yearbook, power consumption per GDP in 2016 was 0.621 kWh/$, significantly above the world average of 0.299 kWh/$. The coal-based energy consumption structure not only causes low energy efficiency, but also poses serious challenges to environmental pollution management. Statistics on particulate and SO2 concentration reveal that China is one of the most polluted countries worldwide. To address environmental issues, the Chinese government proposed conserving energy and reducing pollution in the 2006 11th Five-Year Plan. The subsequent 13th Five-Year Plan in 2016 sets dual targets to control total energy consumption and energy consumption per GDP. The 14th Five-Year Plan, which began in 2021, has incorporated policies and actions to tackle climate change. The plan also aims to expedite the green transformation of the development mode by improving the overall resource utilization efficiency, creating a resource recycling system, vigorously developing a green economy, and establishing a green policy system.

The transformation to green economic development necessitates cooperation from the financial sector. Green finance plays a crucial role in supporting the construction of an ecological civilization and in promoting the development of a green economy in China. The proposal to establish national pilot areas for green financial reform and innovation is a critical step toward furthering green financial reform. In August 2016, the People’s Bank of China, the Ministry of Finance, and five other ministries coauthored the “Guidance on Building a Green Financial System.” This marked China as the first developing nation to promote green financial reforms by means of official policy initiatives and government coercion. This guidance specifically proposes encouraging the development of green finance in pilot regions. Local governments are suggested to consider local contexts and address prominent ecological and environmental problems through proactive exploration. In June 2017, the State Council approved the first eight pilot zones for green financial reform and innovation in five provinces. They are Quzhou and Huzhou in Zhejiang, Huadu District of Guangzhou in Guangdong, Gui’an New District in Guizhou, Ganjiang New District in Jiangxi, Hami, Changji, and Karamay in Xinjiang. Lanzhou New District in Gansu and Chongqing City were approved as the pilot zones in December 2019 and August 2022, respectively.

The GFRIPA intends to undertake five main tasks. The first task is to aid financial institutions in establishing green finance departments or sub-branches, and encourage participation in green finance businesses by micro-credit companies and financial leasing companies. It also seeks to attract venture capital, private equity funds, and other national and international capital for green investments. The second task is to incentivize green credit development, and explore mortgage and pledge financing that takes environmental rights and interests such as concessions, project yield rights, and pollution rights as the underlying matter. It also entails hastening green insurance development, and creating novel ecological and environmental liability-based green insurance products; encouraging green enterprises to raise funds through bond issuance and listing, and assisting small and medium-sized enterprises in issuing green collective bonds; and increasing investments in green finance for constructing green buildings and infrastructure in distinctive small- and medium-sized cities and towns. The third task is to roll out pilot markets for trading pollution, water, and energy rights, and build a platform for disseminating information on corporate emissions and environmental violations. It also includes formatting a green credit system, promoting green payment tools like e-money orders and mobile payments, and driving the creation of financial infrastructure based on green ratings and indices. The fourth task is to offer finance, taxation, land, and talent-related policy support for green industries and projects. It also suggests enhancing support for green public welfare projects via local government bonds, and liberalizing market access and public service pricing to improve risk sharing mechanisms of benefit and cost. The fifth task is to build a green financial risk prevention mechanism, perfect the accountability system, establish risk compensation mechanisms for green project investment and financing in accordance with the law, and foster a healthy development model for green finance.

The GFRIPA policy is market-oriented and supplemented by government guidance, with the aim to enhance continuously local green financial construction capacity. Each pilot zone also has its own priorities. Specifically, Quzhou and Huzhou in Zhejiang focus on innovating green finance services for the transformation and upgrading of traditional industries. The Huadu District of Guangzhou in Guangdong is committed to creating a new development model whereby green financial reform and economic growth are mutually supportive. The three Xinjiang cities employ “the Belt and Road” to showcase the building of the Green Silk Road with a demonstration and radiation effect. The Gui’an New District in Guizhou and Ganjiang New District in Jiangxi, both abundant in ecological resources, seek to embrace green finance to avoid “exerting control after pollution.” By the end of 2020, the balance of green loans in these pilot areas reached RMB 236.83 billion, accounting for 15.1% of total loan balances and exceeding the national average 4.3 percentage points. The balance of green bonds grew by 66% compared to the same period last year, amounting to RMB 135.05 billion. Some successful experiences in the reform and innovation of green finance have already been promoted in certain areas. Among these, Huzhou in Zhejiang realized mutual benefits for environmental and economic development through ecologically resourceful transformation, scientific and technological support, and collaboration between central and local policies. The Huadu District of Guangzhou achieved remarkable gains in the development of green financial products and markets. Its trading volume in the environmental equity market has achieved a steady ranking of first place in China, reaching an impressive RMB 3.51 billion.

To sum up, the incentive measures outlined in the GFRIPA policy generate positive outcomes with the synergy of central and local efforts. Guided by the overall development of the GFRIPA program, pilot zones have made great strides in constructing green financial systems, developing product lines, refining organizational structures, establishing service platforms, and enhancing security systems.

Hypothesis development

The GFRIPA policy features both market-oriented and command-and-control environmental regulation. It entails constructing a green financial institutional environment, developing green financing products and services system, and reinforcing guarantees for green financial reform and innovation. These practices would affect credit allotment among enterprises in a region, capital investment direction, and green technological innovation, resulting in a twofold effect on energy consumption and pollution emissions.

The first perspective relates to the construction of a green financial institutional environment. Establishing the GFRIPA helps accomplish the guidance effect of the institutional system and promote corporate environmental awareness and sustainable development notion through a signaling mechanism. Compared with the strong greenness status in developed nations, China’s green development is still in its early stage. Many firms lack awareness of environmental and social responsibilities and a mature system for environmental disclosure (Zhang et al. 2011). The GFRIPA policy aims to build criteria for the green financial system, and coordinate cross-regional, cross-sector, and cross-institutional mechanisms of accountability, checklist, roadmap, and policy evaluation. In this regard, special guidance is released in accordance with actual regional circumstances to create a green financial ecology and improve the assessment on local green enterprises and green projects. According to the institutional theory, institutions can constrain and shape organizational behavior. The GFRIPA policy, as an institutional arrangement that facilitates the green economic transition, is inevitably bound to affect the behaviors of producers. It conveys governmental approval and certification of green producers and releases a strong signal of the insistence on economic green transformation. Specifically, the pilot policy guides producers to build a green production development strategy and take the initiative to cleaner production. Green certification and other similar identities would also force producers to improve production methods and raise energy utilization efficiency.

The second perspective pertains to the development of a diversified green financial market system in the GFRIPA. The differential treatment strategy underlain in this system helps address the externalities associated with environmental projects, alleviate information asymmetry, and internalize negative pollution emission externalities. Specifically, green finance aligns financial activities with producers’ environmental risks and promotes optimal allocation of financial resources in both environmental and economic sectors. The GFRIPA policy defines clearly green financial support priorities and requires financial institutions to establish criteria for identifying greenness and specifying green financial service targets. More credit support should be provided to energy-efficient and eco-friendly enterprises and green projects in fields such as new energy, new materials, green building, and energy-saving renovation of public buildings. This support includes access to loans with reduced interest rates, as well as reduced barriers for bond issuance and listing. Conversely, punitive high-interest loans are offered to “two-high” enterprises and non-green projects in the iron and steel, non-ferrous metals, paper making, printing, and dyeing sectors. This would force these businesses to upgrade their sewage treatment equipment and improve energy usage and pollution management efficiency. To mitigate adverse selection and moral hazard, the authorities also urge green loan recipients to disclose more environmental information. All these initiatives serve to reconcile the conflicting needs of financial resource allocation and environmental project externalities. Due to the optimized resource allocation, they hasten the exit of “two-high” enterprises (Li and Chen 2022) and encourage enterprises to implement strategies for green innovation development (Tan et al. 2022). The established identification criteria promote investment in green projects at the same capital price and enable information-driven reallocation of financial resources (Al Mamun et al. 2022), leading to energy conservation and pollution reduction.

The third perspective involves the financial incentives and supervision measures introduced by the GFRIPA policy. Such safeguards motivate market participants to engage actively in green finance, resulting in positive effects on energy conservation and pollution reduction through notable structural adjustments and comprehensive governance cycles. The conventional financial mode lacks effective appraisal of environmental friendliness and supervision of investment flows, blurring the advantages of green enterprises in the credit market. By building platforms like the information project libraries and introducing diversified participants like third-party certification agencies, the GFRIPA policy can dismantle obstacles to information barriers and improve the efficiency of green investment and financing. The plurality of participants enables strict monitoring and inspection on firms by professional institutions in the areas of production procurement, energy consumption, and pollution emissions. This in turn inspires enterprises to proactively assume environmental responsibilities and dedicate themselves in adopting and developing eco-friendly technologies (Chen et al. 2022; Liu and Wang 2023). Additionally, the policy offers enterprises interest discounts and tax incentives to upgrade their green technological innovation, improve energy input structure, and promote energy conservation and pollution reduction. Based on the above analyses, we propose hypothesis 1 as follows:

-

Hypothesis 1: Implementing the GFRIPA policy contributes to substantial reductions in energy consumption and pollution emissions.

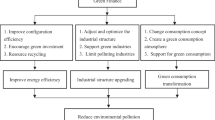

Mechanism analyses on the GFRIPA policy’s energy-saving and pollution-reducing effect

The economic green transformation signifies a revolution that entails the complete greening of corporate production processes at the micro level, as well as the emergence and growth of green industries at the macro level. Green financial reform is a crucial policy tool for contemporary environmental governance and eco-friendly economic transition. It impacts the decision-making of financial institutions and enterprises (Xu and Li 2020; Liu et al. 2019; Wen et al. 2021), alters the energy structure (Ren et al. 2020), and promotes a mutually beneficial outcome for economic growth and environment protection (Sun et al. 2019; Nabeeh et al. 2021). The GFRIPA policy is a significant effort by the Chinese government to advance green financial reform, spearhead the development of green low-carbon industries, and promote environmental protection. The policy has the potential to conserve energy and reduce pollution emissions through four outlined mechanisms below.

Green innovation mechanism

Green innovation is what propels economic green transformation, energy efficiency improvement (Okushima and Tamura 2010), and the achievement of energy conservation and pollution reduction goals. High uncertainty and environmental externalities are main barriers to corporate green innovation (Tang et al. 2020). Due to market failure in the R&D market, it is challenging to obtain a socially optimal level of clean technological R&D through market incentives alone (Popp 2002). This highlights the importance of government incentives. To begin with, establishing the GFRIPA reinforces market expectations for green transformation and sends a signal to increase firms’ pollution-control expenses and production costs. This channels resources to eco-friendly businesses and projects and promotes corporate green innovation to increase competitive advantages, offsetting the costs of environmental regulations (Porter and Van der Linde 1995). Second, the GFRIPA policy helps coordinate the conflict between corporate social responsibility and profit maximization under the traditional financial framework. It also reallocates financial resources by developing a scarcity environmental product market that offers firms more market information on technological advancements (Goulder and Parry 2008). This will lessen the uncertainty in green innovation and inspire corporate green innovation. Third, the policy includes special funds and financial subsidies for energy conservation and pollution control in pilot areas. Funding supports and direct incentives may attract companies to conduct green technological R&D and renovation. When green innovation and a green economy thrive, a positive feedback mechanism arising from the positive externalities of green industries will emerge within the GFRIPA policy. This will enable the coexistence of economic interests and environmental effects, leading to a win–win situation for energy conservation and pollution reduction. Hypothesis 2 is thus proposed as:

-

Hypothesis 2: Establishing the GFRIPA encourages green innovation to promote urban energy conservation and pollution reduction. Specifically, green innovation increases with the implementation of the GFRIPA policy. This reduces in turn urban energy consumption and pollution emissions.

Financing constraint mechanism

The realization of energy conservation and pollution reduction depends greatly on significant environmental investment and capital redistribution among enterprises and industries. Rajan and Zingales (1998) have found that financing constraints confronting firms are significantly influenced by regional financial development in addition to their own internal factors. The GFRIPA policy has the potential to enrich the green financial product system and advance green financial institutions and platform organizations in quantity and quality. Green financing will be then more sufficiently supplied in the pilot areas. Moreover, the diversified green financial market system and the collaboration mode of “professional institutions + governments + financial institutions” brought by the policy can largely ease information asymmetry between banks and enterprises. This enables reduced transaction costs in the financial market and decreased risks for green financial institutions. For example, Ganjiang New District in Jiangxi has developed standardized green Public–Private-Partnership (PPP) projects to support the development of clean energy and rail transportation. This incentive has prompted financial institutions to offer financing modes like intellectual property pledge, energy performance contracting, and green asset securitization, thereby expanding corporate financing channels. In the context of ever-more strict and improved modern environmental governance, reduced financing costs encourage firms to invest more in environmental pollution control. This in turn enhances the efficient use of environmental resource. Studies indicate that green finance policies have significantly increased the exit risk of high-polluting firms, while simultaneously boosting incumbent firms’ market share (Li and Chen 2022). Green credits improve environmental quality by influencing firm financing and investment (Zhang et al. 2021; Lu et al. 2022). Therefore, we propose hypothesis 3:

-

Hypothesis 3: Establishing the GFRIPA alleviates corporate financing constraints to promote urban energy conservation and pollution reduction. Specifically, financing constraints eases with the implementation of the GFRIPA policy. This reduces in turn urban energy consumption and pollution emissions.

Industry structure mechanism

As backbone of an economic system, industries affect both the utilization and efficiency of production factors, as well as the resulting pollution emissions’ scope and type (Chen et al. 2021a). The GFRIPA policy plays a key role in promoting an optimized industrial structure and fostering resource-saving and eco-friendly development patterns. At the micro level, the policy will affect resource allocation and induce structural adjustments in credit flow. This will subsequently impact how the industry structure evolves. Given the strong support for green finance, financial institutions may use green regulations and the profit-seeking principle to restrict funding to businesses and projects that violate industrial policies and environmental rules. This action helps to curb the unregulated expansion of “two-high” firms (Liu et al. 2017). Conversely, enterprises and projects that meet green financial requirements can access low-interest loans. This policy tilt encourages more firms to engage in green projects, upgrade their current technologies, and conduct green technological innovation. The resulting industry structure is more environmentally sustainable (Hu et al. 2020). At the macro level, the policy can break institutional barriers that hinder green development, expand the range of financial services, and promote the flow and coordinated allocation of factors such as knowledge, technologies, talents, and funds. It also facilitates industrial restructuring and cleanliness through the novelty policy implementation mode of “government guidance and market dominance.” Consequently, the following hypothesis is proposed:

-

Hypothesis 4: Establishing the GFRIPA optimizes the industry structure to promote urban energy conservation and pollution reduction. Specifically, the industry structure optimizes with the implementation of the GFRIPA policy. This reduces in turn urban energy consumption and pollution emissions.

Environmental governance mechanism

The success of environmental governance requires a large amount of green investment that generates strong positive externalities. Nevertheless, these externalities cannot be fully internalized as environmental investments are challenging to convert into immediate economic benefits. Governments’ intervention is necessitated to adjust green investments to a socially optimal level. Since the implementation of the GFRIPA policy, local governments in pilot zones have introduced subsequently various special policies on green finance as well as fiscal and taxation policies. These policies aim to foster investment in green infrastructure and promote ecologically sustainable development. The strengthening of environment governance will raise fiscal spending on green infrastructure and directly enhance the overall governance efficacy in regional energy conservation and pollution reduction. Moreover, preferential measures such as one-time bonus and financial subsidies will induce the lowland effect. This effect has the potential to change investor preferences, increase an economy’s environmental capital stock, drive innovation in production paradigms, and eventually curb energy consumption and pollution emissions. In line of this logic, we propose hypothesis 5:

-

Hypothesis 5: Establishing the GFRIPA enhances regional environmental governance to promote urban energy conservation and pollution reduction. Specifically, environmental governance strengthens with the implementation of the GFRIPA policy. This reduces in turn urban energy consumption and pollution emissions.

All in all, Fig. 1 displays the theoretical framework of this paper.

Methodology, variables, and data

Generalized synthetic control method

It is crucial to find an appropriate method to evaluate the effect of the GFRIPA policy regarding energy conservation and pollution reduction. Prior studies have frequently employed the DID technique to appraise policy effects. This method relies on the parallel trend assumption that the outcomes of both the treated and control groups would have run parallel in the absence of policy intervention. To ensure the validity of the estimated coefficients, it also requires the total sample size, as well as the observations of the treated group exposed to exogenous policy shocks to be substantially large (Conley and Taber 2011). Nevertheless, unobserved time-varying confounders may cause the parallel trend assumption to fail (Xu 2017). The fact that the GFRIPA policy involves only eight pilot cities, accounting for 3.8% of all cities, also poses a challenge.

Abadie and Gardeazabal (2003) propose a synthetic control method (SCM) within a counterfactual estimation framework to address the issues above. The method creates a synthetic control group to serve as the counterfactual for the treated group by optimizing weights assigned to cities in the control group and employing pretreatment periods as criteria to underlie sound matches. Although it could offer explicitly objective weights to the control cities and compare transparently between the treated and synthetic control groups, the SCM applies solely to the case of a single treated city, and the provided uncertainty estimates are not easily interpretable. Since the GFRIPA policy covers eight treated cities, we draw on Xu (2017) to combine the SCM with the interactive fixed effects (IFE) model and use the generalized synthetic control method (GSCM) to assess the energy-saving and pollution-reducing effect of the GFRIPA policy. According to Bai (2009), IFE models feature an interaction term between time-varying coefficients (labeled as latent factors) and unit-specific intercepts (labeled as factor loadings), of which the DID model is a special case. Gobillon and Magnac (2016) highlight the superiority of IFE models over the SCM in DID settings when no common support is shared in factor loadings of the treated and control groups.

Theoretically, the GSCM is in the spirit of the SCM since it is essentially a reweighting scheme that regards pre-treatment treated outcomes as benchmarks for assigning optimal weights to control cities and predicts treated counterfactuals by analyzing cross-sectional correlations between the treated and control groups (Xu 2017). The method differs from the SCM by conducting dimension reduction before reweighting and allowing for the smoothing of weights assigned to control units. It is also a bias correction technique for IFE models when treatment effects are heterogeneous across units. By treating counterfactuals of treated cities as missing data, the method draws on the IFE model to conduct out-of-sample predictions for post-treatment treated outcomes. Overall, the GSCM generalizes the SCM to cases of multiple treated objects. It avoids repeated searches for matches of control units for each treated one by one and improves algorithm efficiency by obtaining treated counterfactuals in a single run of the IFE model. Table 1 visually compares the DID method, the SCM, and the GSCM for policy effect assessment.

Detailed GSCM settings are as follows. Assume that there exists N sample regions in the whole sample period T, among which Ntr regions are approved to implement the GFRIPA policy in the period T0, while the remaining Nco regions do not introduce the policy. The observable outcome variable yit for any region i in period t is written as an IFE model:

where Dit identifies whether a region i has been approved to implement the GFRIPA policy in period t, and takes the value 1 if the answer is yes and 0 otherwise. δit denotes the heterogeneous treatment effect of the policy. xit is a p × 1 dimensional observable control variable set, and β is the pertinent p × 1 dimensional parameters. ft is an r × 1 dimensional unobservable time-varying common factor vector, and λi is the corresponding 1 × r dimensional unknown factor loading vector. \({\varepsilon }_{it}\) is a random error term with zero mean.

For presentation convenience, we rewrite Eq. (1) as the following vector form:

Then, the data generation process for the outcome variable of the control group can be expressed as:

where \({Y}_{co}=({Y}_{1},{Y}_{2},...,{Y}_{{N}_{co}})\) and \({\varepsilon }_{co}=({\varepsilon }_{1},{\varepsilon }_{2},...,{\varepsilon }_{{N}_{co}})\) are T × Nco dimensional matrices; \({X}_{co}\) is a T × Nco × p dimensional matrix; and \({\Lambda }_{co}=({\lambda }_{1},{\lambda }_{2},...,{\lambda }_{{N}_{co}})\) is a Nco × r dimensional matrix.

Theoretically, for any period t ∈ [T0, T] and for Dit ∈ {0, 1}, the outcome variable has two possibilities for region i, i.e., \({y}_{it}(1)={\delta }_{it}+{{x}_{it}}^{\prime}\beta +{{\lambda }_{i}}^{\prime}{f}_{t}+{\varepsilon }_{it}\) and \({y}_{it}(0)={{x}_{it}}^{\prime}\beta +{{\lambda }_{i}}^{\prime}{f}_{t}+{\varepsilon }_{it}\). Then, the policy effect of establishing GFRIPA in region i at period t is:

The problem with Eq. (4) is that we can only observe yit(1) when region i has been implementing the GFRIPA policy at t > T0, but not yit(0) for the counterfactual case where region i is assumed to have not been approved to implement the GFRIPA policy at t > T0. In the GSCM, Xu (2017) suggests the following steps to acquire a proper estimate of yit(0).

First, it embeds a leave-one-out cross-validation method to compute the mean square prediction error (MSPE) for different numbers of factors. The optimal factor number \({r}^{*}\) in ft is then identified by minimizing the previously calculated MSPE.

Second, the control group data is employed to estimate the IFE model. Latent factors are derived through minimizing the objective function (5).

Based on the estimated parameters \(\widehat{\beta }\) and \({\widehat{F}}^{0}\) from Eq. (5), the treated group data is employed to estimate factor loadings \({\widehat{\lambda }}_{i}\) for each treated region by minimizing MSPE of the treated group before implementing the GFRIPA policy. If we use the superscript 0 to indicate the periods before the implementation of the GFRIPA policy, \({\widehat{\lambda }}_{i}\) is presented as follows.

Then, the outcome variable of the counterfactual synthetic control group after policy implementation can be calculated as:

Finally, we take \({\widehat{y}}_{it}(0)\) as an unbiased estimator for \({y}_{it}(0)\) and get the policy effect for the treated region i at period t through Eq. (4). The average treatment effect on the treated (ATT), i.e., the policy effect, for each period t can be expressed as:

where a boostrap technique is employed to estimate the standard error of \({\widehat{ATT}}_{t}\). The overall ATT is obtained through \(\widehat{ATT}=\sum_{t>{T}_{0}}{\widehat{ATT}}_{t}\).

Variable definition

The dependent variables

This paper regards the energy consumption intensity and pollution emission intensity to be the dependent variables. Energy consumption intensity is a widely used indicator, which assesses an economy’s overall energy utilization efficiency and provides information on the resource and environmental costs related to economic development. A reduction in energy consumption intensity indicates the energy-saving effect to be explored in our study. We measure energy consumption intensity (Engy) by the natural logarithm of total energy consumption per RMB 10,000 of GDP. China’s coal-based energy consumption structure and thermal power-reliant traditional industrial development mode determine that its air pollution is SO2-dominant soot-type pollution (Chen et al. 2021a). SO2 is also an air pollutant felt most directly by the public. China has included SO2 reduction as its key aim of pollution control strategies since 1998. So, a reduction in SO2 emission intensity indicates the pollution-reducing effect to be examined in our study. We select the natural logarithm of SO2 emission per industrial output to proxy for pollution emission intensity (PoluEmisn).

The main independent variable

This paper considers the green financial reform proxied by the GFRIPA policy as the main independent variable. We denote it by D = treat × after, where treat is a grouping dummy identifying whether a city belongs to the treated group. The treated group entails the eight aforementioned regions in Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang. If the answer is yes, 1 is assigned to treat; otherwise, 0 is assigned. Given that Lanzhou New District in Gansu province and Chongqing are approved as the GFRIPA in December 2019 and August 2022, respectively, these two pilot cities are not included in the treated group in our study. after is a time dummy identifying whether a year falls within the policy implementation period. If a specified year is after 2017, 1 is assigned to after; otherwise, 0 is assigned.

Mechanism variables

Theoretical analyses suggest four mechanism variables in this paper. Among them, we refer to Yang et al. (2021) and determine green innovation (GrnInov) by the ratio of urban green patent applications to overall patent applications. Financing constraints (FC) are measured by the firm size-weighted SA index of a city’s A-share listed companies, where the SA index is calculated following Hadlock and Pierce (2010), and the greater the index, the more severe the financing constraints confronting a specified city. As with Chen et al. (2021b), industry structure (IndStru) is measured by the natural logarithm of the ratio of the tertiary industry’s output value to the secondary industry’s in a city. Following Chang et al. (2019), environmental governance (EnvirGov) is defined as the proportion of urban government investment expenditure on pollution control to GDP.

Control variables

Following the existing literature, we control for control variables that may affect energy consumption and pollution emissions. These variables include the level of economic development (lngdp), measured by the natural logarithm of a city’s GDP; population density (lnpopint), measured by the natural logarithm of population size per administrative district area; urbanization level (urban), measured by the ratio of urban population to total population; openness (open), measured by the ratio of foreign direct investment to GDP; green coverage (greening), measured by the proportion of green area to the built-up area; transportation facilities (lnfras), measured by the natural logarithm of the ratio of road passenger traffic to total population; the level of industrial development (lnind), measured by the natural logarithm of the industrial added value; and consumption level (consum), measured by the total retail sales of consumer goods as an percentage in GDP.

Data description

This paper selects panel data of 209 prefecture-level cities in China from 2007 to 2020 to investigate how and through what mechanisms the green financial reform impacts energy consumption and pollution emissions. The reason for choosing such a sample period lies in that governments of all levels began to thoroughly disclose energy consumption per RMB 10,000 of GDP in 2007 and that the statistical yearbooks were updated to 2020. Moreover, the concept of green finance was formally introduced into China in 2007 and the GFRIPA policy was officially issued in 2017. This indicates that our research sample covers information on the whole stages of introduction, testing, and promotion of green finance.Footnote 1 Such a comprehensive data helps unify the assessment of the GFRIPA policy under a uniform green finance concept and confirms the representative of our research theme. All the original data used in the paper is from China Statistical Yearbook, China City Statistical Yearbook, China Energy Statistical Yearbook, provincial and city statistical yearbooks, and local government statistical bureaus. The descriptive statistics of variables are listed in Table 2.

Empirical analysis

Baseline results

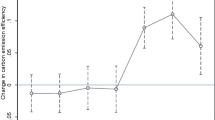

Panel a of Fig. 2 depicts how energy consumption and pollution emission intensities evolve in the treated and counterfactual groups. It shows that before the GFRIPA policy was issued in 2017, the counterfactual group closely matches the treated group in energy consumption and pollution emission intensities. This is also verified by the insignificant pre-treatment ATT estimates in panel b of Fig. 2.

However, after 2017, the treated group lies constantly below the counterfactual groups concerning both the energy consumption intensity and pollution emission intensity. This is also confirmed by the significantly negative ATT estimates at a 5% confidence level. It is estimated that the GFRIPA policy’s overall ATT is − 0.1189 for the energy consumption intensity and − 0.0487 for pollution emission intensity, with the respective p values of 0.0027 and 0.0088. These findings indicate that establishing the GFRIPA can effectively conserve energy and reduce pollution emissions. Hypothesis 1 is accordingly proved.

Additionally, the GFRIPA policy’s energy-saving and pollution-reducing effects feature a significant “ahead-of-policy” feature. This is underlain by the evidence that the ATT estimates emerge significantly different from 0 at a 5% confidence level in 2017 when the proposal to build the GFRIPA was formally released. The result is practically intuitive. In order to qualify as a pilot zone constructer, local governments typically engage in pre-planning activities to develop green financial systems, product systems, and service platforms. Such measures transmit governments’ green development strategy signals to the market and catalyze economic agents’ awareness of environmental protection and sustainable development. More resources would be then directed toward green enterprises and green projects. The urban energy-saving and pollution-reducing benefits are activated upon official designation of the specified region as a pilot area.

Robustness tests

Placebo test

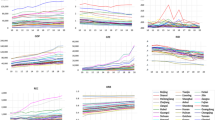

To address the possibility that the GFRIPA policy’s energy-saving and pollution-reducing effect is driven by random factors, this paper creates a fake policy variable through a random sampling and reuses the GSCM to conduct a placebo test. The sampling procedure involves randomly grouping cities into the treated and control groups 500 times and randomly designating a year within 2014–2016 as the policy issuance year 500 times. We then re-employ the GSCM to estimate the ATT of the fake policy. Figure 3 displays the kernel density distribution of the fake policy’s overall ATT estimation. The fake policy’s ATT estimates are primarily distributed around 0, and the actual policy’s ATT estimates gotten from the baseline analysis are outliers.

Permutation test

Another concern argues that other unobserved factors may contribute to energy conservation and pollution reduction. To ensure the validity of the policy effect, we reference the permutation test proposed in Abadie et al. (2010) and examine whether comparable results would arise when the pilot zones were selected out of the original control group. The procedure entails assuming sequentially all areas in the control group enacted the GFRIPA policy in 2017, creating a counterfactual group for each hypothetical treated group, estimating the pertinent policy effect for each assumed case with the GSCM, and contrasting the policy effects between the hypothetical scenarios and the actual GFRIPA policy. As it is unfeasible to enumerate all \({C}_{209-8}^{8}=\text{ 5.7383}\times {10}^{13}\) cases of the hypothesized pilot zones, we employ a random sampling generator and get 500 hypothesized cases for investigation. The GSCM requires that the counterfactual group fit well with the treated group in pre-treatment outcomes. So, if the two groups were poorly fitted in energy consumption intensity and pollution emission intensity before 2017, the prediction of post-treatment outcomes would be incredible. Following Abadie et al. (2010), we use the root mean squared error (RMSE) of the pre-intervention periods and eliminate hypothetical cases with a larger RMSE than that of the actual policy case. This results in a respective exclusion of 66 and 16 investigation cases for permutation tests related to energy consumption intensity and pollution emission intensity. Figure 4 reports the ATT estimates (presented as dashed curves) for the remaining hypothetical cases, together with the actual ATT estimators (shown in a solid curve). There were no evident ATT discrepancies between the hypothetical scenarios and the actual GFRIPA policy case before 2017, whereas the discrepancies escalated after 2017. Since then, the actual ATT for the GFRIPA policy has been distributed far below the ATTs of the hypothetical cases. The possibilities to choose a randomly designated group of pilot zones with a greater policy effect than the actual GFRIPA policy effect in terms of energy savings and pollution reduction can be estimated as 0.23% (= 1/434) and 0.21% (= 1/484), respectively. These findings confirm the significance and validity of the baseline results.

Exclusion of interference from other policies

Given that the policy effect may be interfered by other green initiatives, we collect some important policies and events which may impact economic agents’ environmental behaviors and examine whether the GFRIPA policy’s energy-saving and pollution-reducing effect survives after controlling for these policies. One key policy is the pilot project introduced in 2008 to build innovative cities. It aims to achieve an organic integration of environmental protection and innovation-driven development (Li et al. 2021; Yu et al. 2022; Yang et al. 2022). Another initiative involves the pilot policy formally released by China’s Ministry of Housing and Urban–Rural Development in 2012 to construct smart cities. It identifies the intensive, green, low-carbon, and intelligent development characteristics as the intrinsic requirements of smart cities to achieve sustainable urban development (Cui and Cao 2022; Song et al. 2022). Apart from the aforementioned policies, the Chinese government has also strengthened emphasis on environmental protection in the past decade through practices such as linking credit grants with environmental risks and issuing guidance on green credits. The variables of innovative city policy, smart city policy, and government concerns are thus successively added into the baseline model to address potential policy interference. Figure 5 presents the ATT estimates. It is evident that even after controlling for other policies’ interference, we still observe significantly negative estimated ATT estimates at the 1% or 5% confidence level.

Alternative measurement for indicators

To address possible concerns caused by different indicator measurement ways, we re-examine the policy effect by defining the energy consumption intensity and pollution emission intensity as the natural logarithm of energy consumption per capita and the natural logarithm of SO2 emissions per capita, respectively. The ATT estimates are reported in Fig. 6, where we find insignificant zero-centered ATT estimates before 2017 and significantly negative ATT estimates since 2017. As calculated, the policy’s overall ATT for energy consumption intensity and pollution emission intensity is − 0.2322 and − 0.1021, with the respective p values of 0.0027 and 0.0127.

Summary of robustness tests

To sum up, the results of the robustness tests are quantitatively similar to the baseline results. The non-randomness, validity, and robustness of the baseline findings are confirmed through a placebo test, permutation test, exclusion of interference from other policies, and alternative measures for energy consumption and pollution emissions.

Mechanism analysis

This section applies a mediation model to empirically test possible mechanisms through which the GFRIPA policy contributes to energy conservation and pollution reduction.

Green innovation mechanism

Table 3 reports the estimated results of the green innovation mechanism, where columns (1) to (3) are estimates without control variables, and columns (4) to (6) are estimates with control variables. The coefficients for D in columns (1) and (4) are significantly positive at a 5% confidence level, while the coefficients for GrnInov in the remaining columns are significantly negative at a 1% or 5% confidence level. These results indicate that no matter whether the control variables are controlled for, implementing the GFRIPA policy can raise urban green innovation, which promotes in turn the exertion of urban energy-saving and pollution-reducing effects.

This is practically intuitive. Green innovation generally features environmental protection technological advancement, which is crucial to conserving energy and lowering pollution emissions. By creating a market for trading scarce environmental products and directing financial resources to green firms and green projects, the GFRIPA policy incentivizes companies to engage more in green technological innovation. This accelerates the exhibition of the energy-saving and pollution-reducing effect.

Financing constraints mechanism

Table 4 reports the estimated results of financing constraints mechanism. We find from columns (1) and (4) that the coefficients for D are significantly negative at a 1% confidence level, indicating that the GFRIPA policy helps to alleviate financing constraints. In columns (2), (3), (5), and (6), the coefficients for FC are significantly positive at a 10% or 5% confidence level, suggesting that financing constraints alleviation is beneficial to the intensity decrease in energy use and pollution emissions. That is, the GFRIPA policy promotes energy conservation and pollution reduction by easing financing constraints.

This may be in that the GFRIPA policy expands urban supply of green financing services. In addition to addressing the information asymmetry between banks and companies, the multi-dimensional information platform built by the GFRIPA also lowers financial market frictions, boosts investor confidence, decreases financing costs for local companies, and brings new incentives to corporate green investments in pollution control. With the ongoing improvement of modern environmental governance system, enterprise financing costs reduction would enhance the use of excess funds in technological R&D, production equipment upgrading, and environment-friendly projects investment, and form a positive feedback mechanism for energy-saving and pollution-reducing effect.

Industry structure mechanism

Table 5 reports the estimated results of industry structure mechanism. As can be seen, the coefficients for D in columns (1) and (4) are significantly positive at a 5% confidence level, while the coefficients for IndStru in the remaining columns are significantly negative. This indicates that no matter whether the control variables are controlled for, industry structure optimization is a key mediation of the GFRIPA policy’s efforts to curb both energy consumption and pollution emissions.

Intuitively, the industry structure largely determines the pattern of energy consumption and the type of pollution emissions in the operation of the regional economy. By altering the flow of credit resources and limiting polluting companies’ access to credit, the GFRIPA policy drives such industries to change and promotes a greener, cleaner, and more ecologically and environmentally friendly regional industry structure. All these practices lead to the reduction in the intensity of energy use and pollution emissions.

Environmental governance mechanism

Table 6 reports the estimated results of environmental governance mechanism, where we observe that the GFRIPA policy-induced enhancement of environmental governance leads to energy conservation and pollution reduction. Specifically, we know from columns (1) and (4) that the coefficients for D are significantly positive at a 1% confidence level, implying that the policy raises local governments’ attention on the environment and their investment in environmental governance. The remaining columns demonstrate that the coefficients for EnvirGov are significantly negative, indicating that strengthening environmental governance is conducive to the intensity reduction of energy consumption and pollution emission of the treated group.

Environmental resource is a non-exclusive but competitive public good with significant externalities that require government regulation. As market mechanisms alone cannot fully internalize externalities, government intervention is needed to accomplish energy conservation and pollution reduction targets. The GFRIPA policy provides a supervision and guarantee mechanism for the green transformation of the economy. This entails offering enterprises financial subsidies, vigorously developing green infrastructure, and encouraging participation of multiple entities. It also establishes a thorough governance cycle and thereby creates healthy external conditions for energy saving and pollution reducing in cities.

Summary of mechanism analysis

To sum up, implementing the GFRIPA policy contributes significantly to urban energy conservation and pollution reduction. This policy-induced energy-saving and pollution-reducing effect is achieved through the policy’s prominent role in increasing urban green innovation, easing financing constraints, optimizing industrial structure, and enhancing environmental governance.

Heterogeneity analysis

In this section, we further investigate whether the GFRIPA policy’s energy-saving and pollution-reducing effect is heterogeneous among cities with distinct marketization degree and education level.

Marketization level

Pilot cities vary greatly in the marketization process. Since marketization is key for the policy to function effectively, we divide cities into high and low marketization regions to examine the heterogeneous policy effects. The marketization index in Wang et al. (2021) is used to quantify marketization degree.

Figure 7 illustrates that the GFRIPA policy’s energy-saving and pollution-reducing effect are noticeable in cities with a high degree of marketization, and this effect emerges in the year the policy is enacted. Although the GFRIPA policy can somewhat reduce energy consumption and pollution emissions in cities in the treated group that are less market-oriented, the energy-saving and pollution-reducing effect is not satisfactory. It is estimated that the overall ATT of the treated group with high marketization is − 0.1326 for the energy consumption intensity and − 0.0771 for pollution emission intensity, with p values of 0.0080 and 0.0050. On the other hand, the corresponding overall ATTs for the low marketization group are − 0.0818 and − 0.0108, and insignificant at p values of 0.3395 and 0.5931, respectively.

The findings are intuitive. A non-mature market in cities with low marketization is often indicated by the obvious government involvement in the banking and business sectors, along with the relatively low participation of market mechanisms in the dominant resource allocation. This presents a challenge for the government to identify corporate green investments and offer enterprises green financial supports. The distortion of capital allocation across firms caused by low marketization may disincentivize firms to treat pollution and promote green innovation and transformation, ultimately weakening the GFRIPA policy’s environmental governance effect.

Education level

Financial literacy and environmental consciousness of the population are directly associated with their education levels. This part examines whether policy effects differ across education levels. We measure the urban education level as a proportion of educational expenditure to general public budget, and group cities based on the median education level.

Figure 8 reflects that the overall ATT of the treated group with higher levels of education is − 0.1535 for energy consumption intensity and − 0.1068 for pollution emission intensity. Both values are statistically significant at the 1% level. The overall ATT values for the treated group with lower levels of education are − 0.0220 for energy consumption intensity and − 0.0208 for pollution emission intensity, but they are statistically insignificant. These findings reveal that compared to cities with a low education level, cities with a high education level witness a better policy effect in terms of energy conservation and pollution reduction.

A potential explanation resides in that people in highly educated cities tend to be more environmentally conscious and are consequently more likely to pay for environmental governance. Their enhanced financial knowledge and investment experiences could also stimulate their participation in green financial activities. This may extend to purchasing green financial products and prioritizing attention to business environmental disclosures. Firms in this situation may take the initiative to invest in environmental social responsibility and show a stronger inclination toward green innovation to bolster their reputation. Another reason refers to the stock of human capital and knowledge, which plays a vital role in the development of a green economy. High human capital, brought on by high education levels, can elevate factor efficiency, spur new green technologies, and propel green development in cities. Thus, the GFRIPA policy’s energy-saving and pollution-reducing effect can be more prominent in cities with higher levels of education and more advanced human capital.

Conclusion

China’s economic development is changing from a crude mode that prioritizes economic scale and growth rate to a connotative one that emphasizes structural optimization and environmental friendliness. The GFRIPA policy, a representative regional green financial reform policy, provides a new perspective on how to address the issues of energy consumption and pollution emissions. This paper regards the GFRIPA policy launched in China in 2017 as a quasi-natural experiment and employs the GSCM to assess the green financial reform’s energy-saving and pollution-reducing effect, as well as the pertinent mediating mechanisms, with Chinese prefecture-level panel data from 2007 to 2020. The results show that the GFRIPA policy significantly reduces the intensity of energy consumption and pollution emissions in the treated cities and that this effect has an “ahead-of-policy” feature that manifests itself in the year the policy is issued. Mechanism analyses indicate that the policy promotes cities to meet the policy goals of energy conservation and pollution reduction through improving green innovation, easing financing constraints, optimizing industrial structure, and strengthening environmental governance. Heterogeneity discussion implies that the GFRIPA policy has a stronger energy-saving and pollution-reducing effect in cities with a higher marketization degree and education level.

The above findings have important policy implications for China to further upgrade its green finance policy and fully exploit the energy-saving and pollution-reducing benefits of green finance.

First, an institutional long-term mechanism for supporting green economic development should be established to enhance the GFRIPA policy’s energy-saving and pollution-reducing effect. Government guidance and financial market foundation are two crucial elements to guarantee the role of the green financial reform policy in conserving energy and lowering pollution. As China’s green finance market expands, the government should continuously improve the protection system for implementing green financial system, define responsibility boundary between the government and market in policy implementation, speed up the transition of government environmental policies from the command-and-control type to the market-incentive type, and create a much thorough market-oriented condition for the green financial system’s effective operation.

Second, the officials should base on experiences of the current pilot cities to expedite the policy’s rollout across the nation while considering disparities among cities in institutional environments and resource endowments. The heterogeneity results in this paper suggest that local governments should actively learn from pilot cities’ successful experiences and introduce corresponding policy toolkits that take into account the actual situation of local marketization degree and education level. Specific policies include deepening local governments’ reform of administration simplification and power delegation, combination of decentralization with control, and improvement of service awareness and functions, activating the enthusiasm of various market entities, and encouraging market-dominant resource allocation. Instead of slavishly replicating the growth trajectory of a pilot city, local governments should scale back their direct economic intervention, boost supportive infrastructure construction, intermediary organizations and service institutions development, and professional personnel training, and gradually promote the green finance reform.

Third, in order to further extend the GFRIPA policy’s energy-saving and pollution-reducing effect, the government needs to promote green innovation initiatives, create diversified financing channels, and induce more market entities into the green financial system that aims at improving energy efficiency, altering energy structure, and governing environmental pollution. Local governments can develop green financial policies that encourage the creation of environmentally friendly financial products, generate a more simplified financing mechanism, and address the issue of green investment caused by financial constraints. Moreover, it is necessary to strengthen the departmental and regional coordination mechanism that is compatible with green development. The accountability system and long-term mechanism of supervision for ecological environmental protection should also be improved to create good external conditions for the regional energy-saving and pollution-reducing effect through increasing the communication and cooperation with green financial intermediary service institutions.

Data availability

Data for this original research work will be available by the corresponding author upon reasonable request.

Notes

China began to develop green finance nationwide in 2007. This practice was influenced by both domestic and international factors at that time. Concerning the international development of green finance, the European Investment Bank (EIB) issued the world’s first green bond in 2007. This aroused the Chinese government’s comprehensive recognition of the significance of adopting green practices in finance. So, concerning domestic situation, in July 2007, the Ministry of Ecology and Environment of China, the People’s Bank of China, and the China Banking Regulatory Commission jointly issued a brand-new credit notice—“Opinions on the Implementation of Environmental Protection Policies and Regulations for the Prevention of Credit Risks.” This marked the entry of green credit, an important tool of green finance, into China’s main battlefield of pollution management.

References

Abadie A, Gardeazabal J (2003) The economic costs of conflict: a case study of the Basque Country. Am Econ Rev 93(1):113–132. https://doi.org/10.1257/000282803321455188

Abadie A, Diamond A, Hainmueller J (2010) Synthetic control methods for comparative case studies: estimating the effect of California’s tobacco control program. J Am Stat Assoc 105(490):493–505. https://doi.org/10.1198/jasa.2009.ap08746

Al Mamun M, Boubaker S, Nguyen DK (2022) Green finance and decarbonization: evidence from around the world. Financ Res Lett 46:102807. https://doi.org/10.1016/j.frl.2022.102807

Bai J (2009) Panel data models with interactive fixed effects. Econometrica 77(4):1229–1279. https://doi.org/10.3982/ecta6135

Chang C-P, Dong M, Liu J (2019) Environmental governance and environmental performance. ADBI Working Paper 936. Tokyo: Asian Development Bank Institute. https://doi.org/10.2139/ssrn.3470015

Chen L, Li K, Chen S, Tang L (2021a) Industrial activity, energy structure, and environmental pollution in China. Energy Econ 104:105633. https://doi.org/10.1016/j.eneco.2021.105633

Chen Y, Cheng L, Lee C-C, Wang C (2021b) The impact of regional banks on environmental pollution: evidence from China’s city commercial banks. Energy Econ 102:105492. https://doi.org/10.1016/j.eneco.2021.105492

Chen Z, Zhang Y, Wang H, Ouyang X, Xie Y (2022) Can green credit policy promote low-carbon technology innovation? J Clean Prod 359(7):132061. https://doi.org/10.1016/j.jclepro.2022.132061

Conley TG, Taber CR (2011) Inference with “difference in differences” with a small number of policy changes. Rev Econ Stat 93(1):113–125. https://doi.org/10.1162/REST_a_00049

Cui H, Cao Y (2022) Do smart cities have lower particulate matter 2.5 (PM2.5)? Evidence from China. Sustainable Cities and Society 86:104082. https://doi.org/10.1016/j.scs.2022.104082

Demirgüç-Kunt A, Maksimovic V (1998) Law, finance, and firm growth. J Financ 53(6):2107–2137. https://doi.org/10.1111/0022-1082.00084

Falmmer C (2021) Corporate green bonds. J Financ Econ 142(2):499–516. https://doi.org/10.1016/j.jfineco.2021.01.010

Fan H, Peng Y, Wang H et al (2021) Greening through finance? J Dev Econ 152:102683. https://doi.org/10.1016/j.jdeveco.2021.102683

Gao Y (2022) Green credit policy and trade credit: evidence from a quasi-natural experiment. Financ Res Lett 50(12):103301. https://doi.org/10.1016/j.frl.2022.103301

Gobillon L, Magnac T (2016) Regional policy evaluation: Interactive fixed effects and synthetic controls. Review of Economics and Statistics 98(3):535–551. https://doi.org/10.1162/REST_a_00537

Goulder LH, Parry I (2008) Instrument choice in environmental policy. Rev Environ Econ Policy. https://doi.org/10.2139/ssrn.1117566

Hadlock CJ, Pierce JR (2010) New evidence on measuring financial constraints: moving beyond the KZ index. Rev Financ Stud 23(5):1909–1940. https://doi.org/10.1093/rfs/hhq009

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res 27(10):10506–10519. https://doi.org/10.1007/s11356-020-07717-4

Lee C, Chang Y, Wang E (2022) Crossing the rivers by feeling the stones: the effect of China’s green credit policy on manufacturing firms’ carbon emission intensity. Energy Econ 116(12):106413. https://doi.org/10.1016/j.eneco.2022.106413

Li R, Chen Y (2022) The influence of a green credit policy on the transformation and upgrading of heavily polluting enterprises: a diversification perspective. Econ Anal Policy 74(6):539–552. https://doi.org/10.1016/j.eap.2022.03.009

Li Y, Zhang J, Yang X et al (2021) The impact of innovative city construction on ecological efficiency: a quasi-natural experiment from China. Sustain Prod Consum 28:1724–1735. https://doi.org/10.1016/j.spc.2021.09.012

Lin B, Zhang A (2023) Can government environmental regulation promote low-carbon development in heavy polluting industries? Evidence from China’s new environmental protection law. Environ Impact Assess Rev 99(3):106991. https://doi.org/10.1016/j.eiar.2022.106991

Lin B, Zhou Y (2022) Measuring the green economic growth in China: influencing factors and policy perspectives. Energy 241(2):122518. https://doi.org/10.1016/j.energy.2021.122518

Liu S, Wang Y (2023) Green innovation effect of pilot zones for green finance reform: evidence of quasi natural experiment. Technol Forecast Soc Chang 186(1):122079. https://doi.org/10.1016/j.techfore.2022.122079

Liu J-Y, Xia Y, Fan Y et al (2017) Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J Clean Prod 163:293–302. https://doi.org/10.1016/j.jclepro.2015.10.111

Liu X, Wang E, Cai D (2019) Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Financ Res Lett 29:129–135. https://doi.org/10.1016/j.frl.2019.03.014

Lu Y, Gao Y, Zhang Y et al (2022) Can the green finance policy force the green transformation of high-polluting enterprises? A quasi-natural experiment based on “Green Credit Guidelines.” Energy Economics 114:106265. https://doi.org/10.1016/j.eneco.2022.106265

Nabeeh NA, Abdel-Basset M, Soliman G (2021) A model for evaluating green credit rating and its impact on sustainability performance. J Clean Prod 280:124299. https://doi.org/10.1016/j.jclepro.2020.124299

Okushima S, Tamura M (2010) What causes the change in energy demand in the economy?: The role of technological change. Energy Econ 32:S41–S46. https://doi.org/10.1016/j.eneco.2009.03.011

Popp D (2002) Induced innovation and energy prices. Am Econ Rev 92(1):160–180. https://doi.org/10.1257/000282802760015658

Porter ME, Van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(4):97–118. https://doi.org/10.1257/jep.9.4.97

Rajan R, Zingales L (1998) Financial development and growth. Am Econ Rev 88(3):559–586