Abstract

The environmental protection tax (EPT) is an important environmental policy in China. However, it remains unclear whether the EPT has reduced environmental pollution effectively since its implementation in 2018. Based on the panel data of 229 prefecture-level cities in China during 2015–2019 and the difference-in-differences (DID) model, this study empirically assesses the causal effect of the EPT on environmental pollution. It is found that the EPT has a significantly negative effect on industrial sulfur dioxide (SO2) and industrial soot (dust) emissions but has no significant impact on industrial wastewater emissions. The mechanism analysis reveals that the EPT has the tax enforcement effect and energy efficiency effect, that is, the EPT reduces pollution emissions through increasing actual tax burden and improving the efficiency of energy utilization. However, the innovation effect is weak, which is only effective in reducing industrial SO2 emissions. Finally, we compare how different types of cities responded to the EPT. The results show that the EPT has limited effect on environmental pollution in large cities and southern China.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Developing countries, including China, have long faced the dilemma of how to balance economic growth and environmental protection. Due to the advantages of labor and resources, China has created a great economic growth miracle over the past 40 years of reform and opening up (Wu et al. 2019). However, rapid economic growth has also led to serious environmental pollution issues (Zhu et al. 2019). According to the Environmental Performance Index 2022 (EPI) jointly released by Columbia University and Yale University, China’s EPI ranked 160 out of 180 countries in the world.Footnote 1 The excessive environmental pollution has been a growing threat to China’s sustainable development (Yang et al. 2019). The average value of welfare loss from air pollution in China accounts for 5.765% of GDP during 1990–2017.Footnote 2

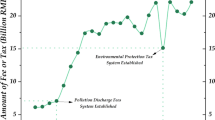

To effectively address the environmental problems, the Chinese government has launched a series of environmental regulation, including the environmental protection tax (EPT). The EPT is levied on producers who directly emits pollutants into the environment. Four categories of pollutants are taxable, including air pollutants, water pollutants, solid waste, and noise, with a total of 117 pollution factors. Actually, the EPT originate from the pollutant discharge fee, which began to implemented in the 1980s. However, due to the low charging standards and a lack of compulsory enforcement, the pollutant discharge fee did poorly in alleviating the deterioration of environment (Li et al. 2021). Therefore, the Chinese government actively promotes conversion of the pollutant discharge fee to the EPT, attempting to stimulate companies to reduce pollution emissions and protect the environment through strict taxation. Finally, the Chinese government levy the EPT in 2018, replacing the pollutant discharge fee that had been in place for nearly 40 years. Compared to the pollutant discharge fee, the EPT has stricter tax enforcement and higher tax rates, which could increase the motivation for enterprises to reduce pollution emissions. However, as a market-based environmental regulation, the EPT only charges a price on the pollutants emitted by polluters and cannot impose restriction on the amount of emission. If the marginal benefits of pollutant emissions are higher than the marginal costs, companies would rather pay the EPT than reduce pollution emissions. Hence, whether the EPT could realize the goal of controlling environmental pollution is still controversial.

Actually, the impact of environmental regulation on environmental pollution is not a new topic, but there is a great divergence in conclusions (Shi et al. 2019; Lai et al. 2020; Wu and Gao 2021; Alola and Nwulu 2022). Scholars generally believe that environmental regulation could play an important role in controlling environmental pollution (Wang et al. 2018; Orset 2019; Mardones and Mena 2020; Wang and Li 2021), as environment regulation could stimulate enterprises to increase environmental investment and conduct technological innovation (He et al. 2021; Prest and Krupnick 2021). However, some scholars argue that environmental regulation could not control environmental pollution effectively (Yuan et al. 2017; Hao et al. 2018), owing to the existence of institutional defects (Wu and Tal 2018) and the conflict between environment protection targets and fiscal targets (Tobin and Cho 2010). In a more complicated result, some literature even finds that the impact of environmental regulation on pollution emissions varies across pollutants and regions (Lin and Li 2011; Mardones and Cabello 2019; Zhang et al. 2019).

As for the EPT, a market-based environmental regulation, a growing number of studies have investigated its impact, such as its impact on enterprises’ environmental investments (Liu et al. 2022), enterprises’ technological innovation (Wang and Yu 2021; Jiang et al. 2023), the green transformation of heavy polluters (Liang et al. 2022), and corporate performance (Long et al. 2022). Only a few studies attempt to evaluate the tax’s impact on environmental pollution (Li et al. 2021; Li 2022), and there is room for improvement. On the one hand, lack the assessment of the impact of the EPT on water pollution. The EPT is levied on both air pollutant and water pollutants. Curbing severe water pollution is also the goal of the EPT. But existing studies only discuss its impact from the perspective of air pollutants. Its impact on water pollution has been ignored. On the other hand, probably due to the lack of relevant data, the underlying mechanisms and heterogeneity have rarely been analyzed (Li et al. 2021).

To narrow the aforementioned research gaps, this study utilizes the implementation of the EPT law as a quasi-natural experiment and employs a DID model to identify the causal effect of the EPT on environmental pollution. Based on the panel data of 229 prefecture-level cities in China during 2015–2019, we find that the EPT has a significantly negative effect on industrial sulfur dioxide (SO2) and industrial soot (dust) emissions but has no significant impact on industrial wastewater emissions. The mechanism analysis indicates that the EPT could reduce environmental pollution through enhancing tax enforcement and energy efficiency. The mediating effect of technological innovation is only effective in controlling industrial SO2 emissions. Finally, the heterogeneity analysis shows that the EPT has a significantly negative impact on environmental pollution in small cities and northern China but exerts little impact in large cities and southern China.

Our study contributes to the existing literature in several aspects. First, we empirically investigate the environmental effect of the EPT, a market-based environmental regulation. The empirical results verify the effectiveness of the EPT in controlling environmental pollution, which not only provides empirical evidence from the largest developing countries for related studies, but also highlights the importance of carrying out stringent environmental regulation to improve the environmental welfare for population in developing countries. Second, we enrich the study of the EPT. Unlike existing studies that focus only on the impact of the EPT on air pollution, our study focuses on both its impact on air pollution and water pollution, which is of great importance for Chinese government to comprehensively evaluate the EPT’s impact on environment and further improve the EPT in the future. In addition, we analyze the mechanisms through which the EPT affect environmental pollution and its heterogeneous effects on environmental pollution in cities with different sizes and locations, which is rarely studied in existing studies (Li et al. 2021). Third, the results of this study could contribute to understanding the mechanisms by which environmental regulation achieves economic dividends. The mechanism analysis reveals that the EPT has a significantly positive impact on regional technology innovation and energy efficiency. Although the EPT may lead to higher production costs and lower profits for firms in the short time, the positive effect on facilitating technology innovation and energy efficiency may bring about additional productivity gains in the long run.

The rest of this study is arranged as follows. The “Research hypothesis” section discusses the research hypothesis. The “Methodology and data” section introduces the methodology and data. The empirical results and relevant discussion are shown in the “Results and discussion” section. The “Heterogeneity analysis” section contains the heterogeneity analysis. The final section is the “Conclusion and policy implications”.

Research hypothesis

The EPT and environmental pollution

Pigou (1932) proposed that levying environmental taxes on polluters is an effective measure to solve the problem of negative externalities caused by environmental pollution. The essence of environmental taxes is to internalize the external costs of environmental pollution into the costs of polluters’ production, so as to stimulate enterprises to reduce pollution emissions and protect environment (Liu et al. 2022). However, due to the non-exclusive nature of the environment as a public good, companies would not be motivated to reduce pollution emissions unless the tax rate is higher than their marginal abatement cost (Arwin and Daigee 2011). Otherwise, companies prefer to pay environmental taxes instead of taking measures to reduce pollution emissions.

The Chinese government implemented the pollutant discharge fee in 1982, which is the predecessor of the EPT. However, the pollutant discharge fee was not effective in promoting pollution reduction due to low fees, corruption issues, and loose regulations (Maung et al. 2016; Li et al. 2021). To deal with these issues, the government issued the EPT law in 2016 and began to levy the EPT on January 1, 2018, changing the pollutant discharge fee into the EPT. Compared to the pollutant discharge fee, the EPT has been incorporated into the national legal system, which is stricter and mandatory. The problems of fee negotiation, interest exchanges, and missing payments are effectively eliminated, which will increase the actual tax burden of pollution emissions. In addition, 12 provincesFootnote 3 have set the tax rate of the EPT exceeding the pollutant discharge fee, which will also put extra pressure on enterprises to reduce pollution emissions. Thus, we propose the following hypothesis.

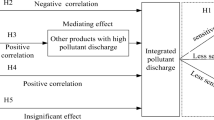

H1. The EPT has a significantly negative effect on environmental pollution.

Tax enforcement effect

Tax enforcement is an important external force that supervises companies and influences corporate behavior (Wang et al. 2023). For example, the tax authorities could audit companies’ accounting books, and supervise the company to prevent any actions that harms tax revenue. Stricter tax enforcement will raise the actual tax burden on enterprises (Sun 2022).

The EPT could reduce environmental pollution by stricter tax enforcement. For one thing, the implementation of the EPT will discourage enterprises’ tax avoidance activities. Compared to the pollutant discharge fee, the EPT is incorporated into the national legal system. Polluters who refuse to pay or avoid paying the EPT will be fined up to five times the amount payable, and even be prosecuted for criminal responsibility in serious cases. In such a situation, the benefit–cost ratio of tax avoidance activities becomes lower and enterprises’ incentive to avoid taxation decreases (Tang and Yang 2023). For another thing, with the strengthening of environmental authorities’ supervision of pollution emissions, data falsification will gradually decrease. The data on pollution emissions reported by enterprises will be more accurate. As a result, the actual levy rate of the EPT will be higher than that of the pollutant discharge fee, which to some extent will raise the tax burden on enterprises. In a word, stricter tax enforcement brought by the EPT could effectively reduce tax avoidance activities and the falsification of pollution emissions data, leading to an increase in the actual cost of pollution emissions and stimulating enterprises to reduce pollution emissions. Accordingly, we propose the hypothesis as follows.

H2. The EPT reduces environmental pollution through the mediating effect of tax enforcement.

Innovation effect

According to the Porter hypothesis, environmental regulation could stimulate firms to develop technological innovation, resulting in an innovation compensation effect (Porter 1991; Porter and van der Linde 1995). In other words, the benefits brought by technological innovation could offset the environmental compliance costs.

As a market-based environmental regulation, the EPT may promote pollution reduction by technological innovation. On the one hand, compared to the pollutant discharge fee, the EPT has higher tax rates, which will increase enterprises’ environmental compliance costs and put external pressure on enterprises to reduce emissions. The theory of enterprise competitiveness indicates that the external pressure could motivate firms to conquer organizational sluggishness and exert a considerable impact in driving firms to engage in technological innovation (Ambec and Barla 2002). On the other hand, the implementation of the EPT could reduce the risk of environmental investment and influence enterprises’ expectations. The EPT law is the first tax law in the history of China aimed at environmental protection (Yang and Tang 2023), which indicates that the government has placed a high priority on environmental protection. It will make enterprises realize the fact that environmental protection is a long-term task that enterprises have to face. Therefore, enterprises have to enhance their environmental investment and carry out technological innovation to reduce pollution emissions for long-term benefits. Moreover, enterprises with pollutant emission concentrations below the legal limit will receive tax breaks, which will also motivate enterprises to conduct technological innovation to reduce pollution emissions. Based on the analysis, we propose the hypothesis as follows.

H3. The EPT reduces environmental pollution through the mediating effect of technological innovation.

Energy efficiency effect

Improving energy efficiency has become an important measure for enterprises to reduce environmental pollution with the constant increase in energy demand (de Miguel et al. 2015). The higher the energy efficiency, the less amount of pollutant would be emitted per unit of output.

The EPT could stimulate enterprises to improve energy efficiency, thereby reducing pollution emissions. On the one hand, the EPT could help optimize the energy structure (Gao et al. 2022). It is notable that the standardization and strictness of the EPT could restrict companies, especially those in high-polluting industries, from over-investing in expanding production capacity (Yu et al. 2021). As a result, the energy consumption of companies will be declined, especially coal, leading to the optimization of energy structure and a reduction of pollution emissions. On the other hand, the EPT could stimulate enterprises to reduce energy waste. The implementation of the EPT brings higher cost pressure to enterprises. Under such pressure, enterprises have the motivation to strengthen the supervision of production process, taking full use of energy to save costs (Cao et al. 2022). Hence, the EPT could stimulate enterprises to optimize the energy structure and reduce energy waste, leading to improved energy efficiency and reduced pollution emissions. According to the analysis, we propose the hypothesis as follows.

H4. The EPT reduces environmental pollution through the mediating effect of energy efficiency.

Methodology and data

Model

The DID model

This paper adopts the DID model to investigate the impact of the EPT on environmental pollution. The EPT law was initiated nationwide in 2018, so we cannot classify the treatment group and control group by whether a city has enforced the EPT. As an alternative identification strategy, we note that although all cities have enforced the EPT in 2018, the effect of the EPT varies across cities due to the differences in tax rates. As we mentioned earlier, cities in 12 provinces such as Beijing, Hebei, and Henan have set the tax rate of the EPT higher than the pollutant discharge fee. The increased tax rate made them largely affected by the EPT. While cities in the other provinces set the tax rate of the EPT equal to the pollutant discharge fee, the unchanged tax rate made them experience less change when implementing the EPT (Long et al. 2022). Based on this judgement, we refer to previous studies (Gao et al. 2022; Long et al. 2022; Yang and Tang 2023), treating the implementation of the EPT law as a quasi-natural experiment, with cities with increased tax rate as the treatment group and cities with unchanged tax rate as the control group. Accordingly, we construct the DID model as follows to investigate the impact of the EPT on environmental pollution:

where t and i represent the year and the city, respectively. \({Pollute}_{it}\) is the environmental pollution of city i in year t. \({Treat}_{i}\) is a city dummy variable and \({Time}_{t}\) is a time dummy variable. The interaction term, \({Treat}_{i} \times {Time}_{t}\), is the key explanatory variable, meaning that whether the city increased its environmental tax rate after the implementation of the EPT law. \(\beta\) captures the effect of the EPT on environmental pollution. \({X}_{it}\) is a set of control variables that may influence cities’ environmental pollution. \({\eta }_{i}\) is the city fixed effect and \({\delta }_{t}\) is the year fixed effect. \({\varepsilon }_{it}\) represents the random error term.

The mediating effect model

To identify the mechanism through which the EPT influences environmental pollution, we utilize the mediating effect model proposed by Baron and Kenny (1986) for testing. Specifically, the following models are constructed. Equation (3) is utilized to evaluate the impact of the EPT on the mediating variables (including tax enforcement, technological innovation, and energy efficiency). Furthermore, we employ Eq. (4) to evaluate the impact of mediating variables on environmental pollution.

where \({M}_{it}\) is the mediating variable, including tax enforcement (TE), technological innovation (Rd), and energy efficiency (EI). The meaning of the other symbols is the same as those in Eq. (1). In the first stage, estimate the significance of \(\beta\) in Eq. (2). If \(\beta\) is insignificant, it means that the EPT has no significant effect on environmental pollution, and stop the test for mediating effect. In the second stage, estimate the statistical significance of \({\alpha }_{1}\) in Eq. (3) and \({\gamma }_{2}\) in Eq. (4), respectively. If \({\alpha }_{1}\) and \({\gamma }_{2}\) are both significant, it suggests that a mediating effect exists. On this basis, if \({\gamma }_{1}\) in Eq. (4) is statistically insignificant, a complete mediating effect exists; if \({\gamma }_{1}\) is significant and larger than \(\beta\) in Eq. (2), a partial mediating effect exists. Finally, if either \({\alpha }_{1}\) or \({\gamma }_{2}\) is statistically insignificant, we should conduct the Sobel test to judge whether a mediating effect exists.

Variable

Dependent variable

Environmental pollution (Pollute it)

Existing studies generally use the emissions of specific pollutants as a proxy for environmental pollution. In this study, we use industrial SO2 emissions per unit GDP (SO2) and industrial soot (dust) emissions per unit GDP (Dust) to measure air pollution and industrial wastewater emissions per unit GDP (Water) to measure water pollution (Yu et al. 2019).

Key independent variable

The EPT policy variable (Treat i×Time t)

\({Treat}_{i}\) is a city dummy variable that is equal to 1 if city \(i\) raised the environmental tax rate in 2018; otherwise, it equals to 0. \({Time}_{t}\) is a time dummy variable that is equal to 1 during 2018–2019 and 0 during 2015–2017. The interaction term, \({Treat}_{i} \times {Time}_{t}\), is the explanatory variable that tests whether the EPT will affect environmental pollution.

Control variables

With reference to previous studies (Yu et al. 2019; Song et al. 2020), this study also controls a series of variables that affect cities’ environmental pollution, including the level of economic development (PGDP), industrial structure (Indus), population density (Popden), and foreign direct investment (FDI). The definitions and units of variables are shown in Table 1. The Environmental Kuznets Curve hypothesis indicates that an inverted U-shaped relationship exists between environmental pollution and the level of economic development (Dinda 2004). Therefore, the squared term of the level of economic development (PGDP2) is also taken into account. Regional real GDP is deflated by the regional GDP index, and we take 2015 as the base year.

Mediating variables

Tax enforcement (TE)

Strict tax enforcement will increase the cost of production and guide firms to control pollution emissions (Liu et al. 2023). Referring to Yang and Tang (2023), tax enforcement is expressed as the difference between the actual tax burden minus the expected tax burden. We construct the following model to estimate TE.

where \({T}_{it}\) is the tax revenue of city i in year t. \({GDP}_{it}\) represents the gross regional product of city i in year t. The meanings of Ind1 and Ind2 are the proportions of first and secondary industry value added to GDP, respectively. \(Pre\frac{{T}_{it}}{{GDP}_{it}}\) represents the expected tax burden. Frist, regress Eq. (5) to estimate the expected tax burden, which is the residual of Eq. (5). Then, calculate tax enforcement using Eq. (6). A higher value of TE means stricter tax enforcement.

Technological innovation (Rd)

Technological innovation is a key driving force in reducing pollution emissions. In this study, R&D intensity, the ratio of R&D input to GDP, is employed to measure technological innovation (Cheng et al. 2017).

Energy efficiency (EI)

Energy intensity could accurately reflect the energy consumed to obtain unit GDP. Energy intensity, the energy consumption per unit of GDP, is used to measure energy efficiency (Cirone and Urpelainen 2013; Pan et al. 2021). Referring to Shi and Li (2020) and Gao et al. (2022), the energy consumption of cities is obtained by decomposing provincial energy consumption data based on prefecture-level cities’ nighttime lighting data.

Date description

Constrained by data availability, we drop the cities with serious data missing. Finally, this study obtains a balanced panel data of 229 prefecture-level cities in China during the period of 2015–2019. The data of provincial energy consumption is collected from the China Energy Statistical Yearbook (2016–2020). The nighttime lighting data is gained from the National Oceanic and Atmospheric Administration (NOAA), which is widely used in the field of economics to simulate variables (Shi and Li 2020). Other variables are collected from the China City Statistical Yearbook (2016–2020) and the statistical yearbooks of prefecture-level cities (2016–2020). To address the heteroscedasticity of the model, variables are in logarithmic form. The definitions and descriptive statistics of the variables are shown in Table 1.

Results and discussion

Analysis of baseline regression results

We employ the DID model to assess the net effect of the EPT on environmental pollution by Eq. (1). According to Columns (1)–(4) of Table 2, the impact of the EPT on industrial SO2 and soot (dust) emissions is significant and negative no matter whether the control variables are added. The industrial SO2 and soot (dust) emissions of cities in the treatment group decrease by 17.1% and 17.2%, respectively, compared to those in the control group. This suggests that the EPT has raised the tax burden on enterprises in the short term, which stimulates them to reduce pollution emissions. The possible reasons are as follows. The EPT has more strict supervision and enforcement than the pollutant discharge fee, which will reduce the issues of fee negotiation, interest exchanges, and missing payments during the collection and management process, and thus increase enterprises’ actual tax burden and result in the significant decrease in pollution emissions.

The results in Columns (5) and (6) indicate that the EPT has no significant impact on industrial wastewater emissions and could not impel cities to reduce industrial wastewater emissions. Two possible reasons are as follows. First, the taxable object of industrial wastewater is not comprehensive. Wastewater pollutants such as total nitrogen, dimethyl amide and dioxin, which are discharged in high quantities, are not included in the scope of the EPT. Second, the environmental tax rate for water pollutants is low. According to the EPT law, the range of the tax rate for water pollutants is between 1.4 and 14 yuan per pollution equivalent. The lowest tax rate is implemented in 14 provinces. Therefore, the EPT could reduce industrial SO2 and soot (dust) emissions, but exerts no significant impact on industrial wastewater emissions.

Parallel trend test

Satisfying the hypothesis of parallel trend is a precondition for utilizing the DID model, which means that the explained variable of the treatment group and the control group should have the same time trend before the implementation of the policy (Acemoglu and Angrist 2001; Zhang et al. 2021). Otherwise, the conclusion we obtain from the DID model will be biased. Referring to Du et al. (2022), we construct the model as follows to test whether the hypothesis of parallel trend is satisfied.

where \({Time}_{t}\) is the indicator variable. \({Time}_{t}\) equals 1 if it is in year t; otherwise, it equals 0. The meaning of the other symbols is the same as those in Eq. (1). We take 2015 as the base year. Figure 1 shows the time trend of the regression coefficients of \({Treat}_{i} \times {Time}_{t}\) under the 95% confidence interval. The coefficients of \({Treat}_{i} \times {Time}_{t}\) do not significantly differ from 0 before the implementation of the EPT, indicating that there is no significant difference in the change trend of environmental pollution between the treatment group and the control group before the implementation of the EPT. Indeed, the coefficients of \({Treat}_{i} \times {Time}_{t}\) are significant for LnSO2 from 2018 and for LnDust from 2019, which means the hypothesis of parallel trend is satisfied and again verifies that the EPT could significantly reduce environmental pollution.

Mechanism analysis

In this part, we try to verify whether the EPT reduces environmental pollution through tax enforcement, technological innovation and energy efficiency. Based on Eqs. (2)–(4), the mediating effect of these three variables are tested, and the regression results are presented in Table 3.

Mediating effect of tax enforcement

The result in Column (1) of Table 3 shows that the coefficient of Treat × Time is significantly positive, indicating that the EPT is conducive to enhancing tax enforcement. According to Columns (2) and (3), the increase in tax enforcement will lead to a significant decrease in environmental pollution, with 1% increase in tax enforcement decreasing cities’ industrial SO2 and soot (dust) emissions by 5.785% and 6.175%, respectively. Moreover, the coefficients of Treat × Time are significantly negative and slightly larger than those in Table 2, indicating that a partial mediating effect exists and H2 is verified.

The results indicate that the EPT could make the tax enforcement stricter, reducing tax avoidance activities and the falsification of pollution emissions data. The stricter tax enforcement could effectively enhance enterprises’ actual tax burden and stimulate them to reduce pollution emissions. Therefore, tax enforcement plays a mediating role in the effect of the EPT on environmental pollution.

Mediating effect of technological innovation

As shown in Column (4) of Table 3, the EPT is conducive to technological innovation, suggesting that cities with increased tax rates have raised their R&D intensity by 13.2% after the implementation of the EPT compared to cities with unchanged tax rates. The results in Columns (5) and (6) show that only the coefficient of Treat × Time in Column (5) is significantly negative, indicating that the mediating effect is only significant for reducing industrial SO2 emissions. In summary, the EPT could reduce industrial SO2 emissions by stimulating enterprises to increase their R&D investments, but it could not affect industrial soot (dust) emissions through this mechanism.

Possible explanations are as follows. First, technological innovation has the characteristic of lagging (Long et al. 2022), which makes it unable to take effect in a short time. Second, the environmental tax rate for SO2 is 1.2–12 yuan per 0.95 kg, while that for soot (dust) is 1.2–12 yuan per 2.18 (4) kg. A higher tax rate per kilogram for SO2 may lead to more R&D investment for SO2 emission reduction.

Mediating effect of energy efficiency

The result in Column (7) of Table 3 shows that the EPT is conducive to enhancing energy efficiency; indeed, energy efficiency in the treatment group increased by 5.8% after the implementation of the EPT compared to that in the control group. According to Columns (8) and (9), the increase in energy efficiency will lead to a significant decrease in environmental pollution, with 1% increase in energy efficiency decreasing industrial SO2 and soot (dust) emissions by 0.272% and 0.412%, respectively. Moreover, the coefficients of Treat × Time are significantly negative and slightly larger than those in Table 2, indicating that a partial mediating effect exists and H4 is verified.

The results indicate that the EPT could stimulate enterprises to optimize the energy consumption structure and reduce energy waste, significantly improving the efficiency of energy utilization. The increased energy efficiency will lead to a significant decrease in pollution emissions. The mediating effect of energy efficiency is verified.

Robustness test

To ensure the robustness of the aforementioned findings, we employ four methods to perform robustness tests: test for expectation effect, placebo test, excluding the effects of other environmental policies and using alternative measurements of environmental pollution.

Test for expectation effect

The EPT law was issued in 2016. Before the EPT officially takes effect in 2018, enterprises may take action in advance based on expectations, such as increasing environmental investment and improving production processes, to mitigate its effect. Those actions taken by enterprises may make the treatment and control groups not comparable ex ante and bias our estimates. However, Fig. 1 shows that the coefficients of Treat × Time are not significant before the implementation of the EPT, which excludes the expectation effect to some extent. Nevertheless, to ensure the robustness of the results, we refer to Lu and Yu (2015) and Yao et al. (2023) to further test whether the expectation effect exists. Specifically, control Treat × Time2016 and Treat × Time2017 on the basis of Eq. (1), where Time2016 and Time2017 are dummy variables for 2016 and 2017, respectively.

The results are shown in Table 4. The coefficients of Treat × Time2016 and Treat × Time2017 are found to be statistically insignificant, indicating that there is no expectation effect. Moreover, the coefficients of Treat × Time are still negative and statistically significant in Columns (1) and (2), indicating that environmental pollution reduction is indeed brought by the implementation of the EPT.

Placebo test

To exclude the influence of other unobservable and omitted factors, we conduct a placebo test by assigning the treatment group and the control group artificially (Cai et al. 2016). With such an artificial shock, since the cities in the placebo treatment group did not raise their environmental tax rates in reality, environmental pollution in these cities should theoretically not be reduced significantly. In other words, the coefficient of Treat × Time should be insignificant and close to zero.

Specifically, 91 cities were randomly selected from 229 cities as the placebo treatment group, which were assumed to increase their environmental tax rates in 2018, and the other cities were selected as the placebo control group. Subsequently, use Eq. (1) to regress. Repeat the above random sampling and regression 500 times, and we can obtain 500 placebo regression coefficients and their p-values. According to Fig. 2, we can find that the coefficients are clustered around 0 and most of p-values exceed 0.1, indicating that the above regression results are scarcely obtained by coincidence. Hence, there is no placebo effect, which further confirms the robustness of the results.

Excluding the effects of other environmental policies

When assessing the effect of the EPT on environmental pollution, it will unavoidably be influenced by other environmental policies. To ensure the robustness of the results, we need to exclude the effects of the environmental policies implemented during the sample period. First of all, the government launched the Three-year Action Plan for Winning the Blue Sky Defense Battle (BSDB) in July 2018. The BSDB policy aimed at reducing air pollution and cities such as Beijing, Tianjin, and Tangshan were selected as key governance area. To exclude its impact, we refer to Liu and Wang (2023) and add the dummy variable, \({BSDB}_{it}\), to Eq. (1). Specifically, the \({BSDB}_{it}\) is equal to 1 when city i is the key governance area and the time t is after 2018; otherwise, the \({BSDB}_{it}\) is 0. Secondly, we attempt to exclude the impact of the low-carbon city pilot (LCCP) policy and the carbon emission trading (CET) policy, which have been implemented since 2010 and 2011, respectively. Referring to Liu and Xiao (2022), we drop low-carbon pilot cities and CET pilot cities from the sample, respectively. Then, use Eq. (1) to regress.

Table 5 exhibits the regression results. The coefficients of Treat × Time in Columns (1), (2), (4), (5), (7), and (8) are still negative and significant, but those in Columns (3), (6), and (9) are negative and not significant. The results suggest that the EPT could reduce industrial SO2 and soot (dust) emissions but exerts no significant influence on industrial wastewater emissions, which is consistent with the benchmark regression results and verifies the robustness of the results.

Alternative measurement of environmental pollution

In addition to the emissions of specific pollutants per unit GDP we used in this paper, the total emissions of specific pollutants (Cheng et al. 2019) and the emissions of specific pollutants per capita (Ayamba et al. 2019) are also measurements of environmental pollution. To verify the robustness of the benchmark regression results, we introduce these two alternative indicators as proxies for environmental pollution. The total emissions of specific pollutants are denoted as LnTSO2, LnTDust, and LnTWater, and the emissions of specific pollutants per capita are denoted as LnPSO2, LnPDust, and LnPWater.

The regression results in Table 6 show that the EPT could significantly reduce the emissions of industrial SO2 and soot (dust) but has no significant impact on industrial wastewater emissions. Therefore, the results are robust even when altering the measurement of environmental pollution.

Heterogeneity analysis

Heterogeneity in city size

Cities of different sizes vary greatly in terms of population size, economic conditions, and technological innovation capabilities. Large cities tend to have good economic conditions and massive innovative companies, which make them the leaders in the field of technology (Yang et al. 2021). These endowment conditions may affect pollution reduction. Therefore, the effect of the EPT on environmental pollution may vary in cities of different sizes. In view of this, we divide the sample into large cities and small cities. Specifically, a city whose residents exceeds one million is a large city; if not, it is a small city (Chen et al. 2022).

Table 7 exhibits the regression results. The coefficients of Treat × Time in Columns (2) and (4) are both significantly negative, while those in Columns (1) and (3) are negative but not significant, indicating that the EPT has promoted small cities to reduce air pollution emissions but has no significant effect on large cities’ air pollution emissions. A possible explanation is that large cities have achieved higher standards of pollution reduction. Owing to the good economic conditions and the agglomeration of enterprises, large cities have more advanced technology in reducing pollution emissions. The cost pressure brought by the EPT is not sufficient enough to stimulate enterprises in large cities to reduce pollution emissions. As for industrial wastewater emissions, the coefficients of the Treat × Time in Columns (5) and (6) are insignificant, indicating that the EPT could not reduce industrial wastewater emissions in either large cities or small cities, which is consistent with the results of the benchmark regression.

Heterogeneity in city location

Cities in different regions have huge differences in natural conditions and industrial structure. Northern China relays on the coal-based heating system in winter, which will consume a large amount of coal and cause severe air pollution (Almond et al. 2009). In addition, the industrial system in northern China characterizes a heavy chemical industry with high pollution emissions (Huang et al. 2021). Therefore, the role of the EPT in environmental pollution in different regions may be different. This study divides the sample into two sub-samples for testing: northern China and southern China. The division is according to the geographical boundary of Qinling Mountain and Huaihe River. Table 8 exhibits the regression results.

It is found that the coefficients of the Treat × Time in Columns (1) and (3) are significantly negative, but those in Columns (2) and (4) are not significant, indicating that the EPT is effective in reducing industrial SO2 and industrial soot (dust) emissions in northern China and has weak impact on industrial SO2 and industrial soot (dust) emissions in southern China. Meanwhile, the insignificant coefficients of the Treat × Time in Columns (5) and (6) indicate that the EPT has no impact on industrial wastewater emissions in either northern or southern China, which is consistent with the results of the baseline regression. Industrial structure may be the main reason for the difference in the effect of the EPT on air pollutant emissions in northern China and southern China. Secondary industry with high pollution emission intensity in northern China takes a relatively high share compared to that in southern China (Zhang et al. 2021). The implementation of the EPT will put higher cost pressure on enterprises in northern China and thus has a significant marginal effect.

Conclusions and policy implication

Developing countries, including China, face a trade-off between economic growth and environmental protection. Based on the panel data of 229 prefecture-level cities in China during 2015–2019 and the DID model, this study empirically evaluate the effect and mechanism of the EPT, a market-based environmental regulation, on environmental pollution. Heterogeneity analysis is also performed to explore whether the impact of environmental regulation on environmental pollution varies across city types.

The main findings are as follows: (1) the EPT has a significantly negative effect on industrial SO2 and industrial soot (dust) emissions but has no significant impact on industrial wastewater emissions. This finding still holds after a series of robustness tests. (2) The mechanism analysis suggests that the EPT promotes environmental pollution reduction by tax enforcement effect and energy efficiency effect, increasing enterprises’ actual tax burden and stimulating enterprises to enhancing energy efficiency. However, the innovation effect is weak, which is only effective in reducing industrial SO2 emissions. (3) The heterogeneity analysis indicates that the EPT exerts a significantly negative effect on environmental pollution in small cities and northern China, while the effect is weak in large cities and southern China.

According to the aforementioned results, the policy implications are as follow. First, the provisions of the EPT law on taxable water pollutants needs urgent improvement. On the one hand, water pollutants such as total nitrogen, dimethyl amide, and dioxin should be included in the scope of the EPT. On the other hand, the tax rate for water pollutants should be raised. Second, strengthen support for enterprises’ technological innovation. Technological innovation is a mediating mechanism for the EPT to promote industrial SO2 reduction. The governments should pay more attention to motivating companies to carry out technological innovation, such as providing subsidies and special funding support for corporate R&D activities. Third, implement the EPT flexibly according to local conditions. The effect of the EPT varies across cities with different sizes and location. Currently, the impact of the EPT is limited in large cities and southern China. Governments in these cities could implement the EPT strictly and raise the environmental tax rate appropriately to make the EPT work. Fourth, implement the EPT strictly and improve it continuously to promote it to play a greater role in pollution control. The EPT is an important environmental policy in China and our paper confirm its effectiveness in controlling environmental pollution. We should implement the EPT strictly and improve it continuously in the future. For example, lower the criterion for tax relief from pollutant concentration 30% below the emission standard to 10% below the emission standard. Strengthen the collaboration between taxation department and ecological environment department, and promote the construction of pollution emission data sharing platform.

There are still some limitations that may be the directions for future research. On the one hand, based on city-level data, this study empirically evaluates the impact of the EPT on cities’ pollution emission. However, the EPT is levied on enterprises that directly discharge pollutants into the environment, and the impact of the EPT on corporate pollution emission is also worth studying. On the other hand, the long-term impact of the EPT on pollution emissions may also be the direction for future research. Due to the availability of data, this study only evaluates the short-term impact of the EPT. However, the long-term impact of the EPT is also worth studying, as in the long run firms could adjust production scale and structure, and the investment in research and development may start to take effect, which may lead to changes in the magnitude and mechanism of the impact of the EPT on environmental pollution.

Data availability

Data and materials are available from the corresponding author on reasonable request.

Notes

Data source: https://stats.oecd.org/

12 provinces include Beijing, Hebei, Henan, Shandong, Shanxi, Hunan, Jiangsu, Chongqing, Sichuan, Guizhou, Guangxi, and Hainan provinces.

References

Acemoglu D, Angrist J (2001) Consequences of employment protection? The case of the Americans with disabilities act. J Polit Econ 109(5):915–957. https://doi.org/10.1086/322836

Almond D, Chen Y, Greenstone M, Li H (2009) Winter heating or clean air? Unintended impacts of China’s Huai river policy. Am Econ Rev 99:184–190. https://doi.org/10.1257/aer.99.2.184

Alola A, Nwulu N (2022) Do energy-pollution-resource-transport taxes yield double dividend for Nordic economies? Energy 25:124275. https://doi.org/10.1016/j.energy.2022.124275

Ambec S, Barla P (2002) Theoretical foundation of the Porter hypothesis. Econ Lett 75(3):355–360. https://doi.org/10.1016/s0165-1765(02)00005-8

Arwin P, Daigee S (2011) Optimal emission tax with pre-existing distortions. Environ Econ Pol Stud 13:79–88. https://doi.org/10.1007/s10018-010-0005-8

Ayamba E, Haibo C, Ibn Musah A, Ruth A, Osei-Agyemang A (2019) An empirical model on the impact of foreign direct investment on China’s environmental pollution: analysis based on simultaneous equations. Environ Sci Pollut Res 26:16239–16248. https://doi.org/10.1007/s11356-019-04991-9

Baron R, Kenny D (1986) The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173. https://doi.org/10.1037/0022-3514.51.6.1173

Cai X, Lu Y, Wu M, Yu L (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123:73–85. https://doi.org/10.1016/j.jdeveco.2016.08.003

Cao Y, Tang Y, Xing H (2022) Has the “Environmental Protection Fee-to-Tax” improved the total factors productivity of heavily polluting enterprises? J Audit Econ 37(05):95–106 (in Chinese)

Chen C, Li Y, Lv N, Zhang W, Sun Y (2022) Can government low-carbon regulation stimulate urban green innovation? Quasi-experimental evidence from China’s low-carbon city pilot policy. Appl Econ 54(57):6559–6579. https://doi.org/10.1080/00036846.2022.2072466

Cheng Z, Li L, Liu J (2019) The effect of information technological on environmental pollution in China. Environ Sci Pollut Res 26(32):33109–33124. https://doi.org/10.3390/ijerph17186477

Cheng Z, Li L, Liu J (2017) The emissions reduction effect and technical progress effect of environmental regulation policy tools. J Clean Prod 149:191–205. https://doi.org/10.1016/j.jclepro.2017.02.105

Cirone A, Urpelainen J (2013) Political market failure? The effect of government unity on energy technology policy in industrialized democracies. Technovation 33(10–11):333–344. https://doi.org/10.1016/j.technovation.2013.06.001

de Miguel C, Labandeira X, Löschel A (2015) Frontiers in the economics of energy efficiency. Energy Econ 52:S1–S4. https://doi.org/10.1016/j.eneco.2015.11.012

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49(4):431–455. https://doi.org/10.1016/j.ecolecon.2004.02.011

Du Z, Xu C, Lin B (2022) Does the Emission Trading Scheme achieve the dual dividend of reducing pollution and improving energy efficiency? Micro evidence from China. J Environ Manag 323:116202. https://doi.org/10.1016/j.jenvman.2022.116202

Gao X, Liu N, Hua Y (2022) Environmental Protection Tax Law on the synergy of pollution reduction and carbon reduction in China: evidence from a panel data of 107 cities. Sustain Prod Consump 33:425–437. https://doi.org/10.1016/j.spc.2022.07.006

Hao Y, Deng Y, Lu Z, Chen H (2018) Is environmental regulation effective in China? Evidence from city-level panel data. J Clean Prod 188:966–976. https://doi.org/10.1016/j.jclepro.2018.04.003

He P, Sun Y, Niu H, Long C, Li S (2021) The long and short-term effects of environmental tax on energy efficiency: perspective of OECD energy tax and vehicle traffic tax. Econ Model 97:307–325. https://doi.org/10.1016/j.econmod.2020.04.003

Huang H, Mo R, Chen X (2021) New patterns in China’s regional green development: an interval Malmquist-Luenberger productivity analysis. Struct Change Econ Dyn 58:161–173. https://doi.org/10.1016/j.strueco.2021.05.011

Jiang Z, Xu C, Zhou J (2023) Government environmental protection subsidies, environmental tax collection, and green innovation: evidence from listed enterprises in China. Environ Sci Pollut Res 30:4627–4641. https://doi.org/10.1007/s11356-022-22538-3

Lai X, Liu Z, Luo S (2020) Assessment on the effectiveness of environmental regulation in China—evidence from a panel data analysis. Environ Sci Pollut Res 27(30):37363–37376. https://doi.org/10.1007/s11356-020-08583-w

Li P, Lin Z, Du H, Feng T, Zuo J (2021) Do environmental taxes reduce air pollution? Evidence from fossil-fuel power plants in China. J Environ Manag 295:113112. https://doi.org/10.1016/j.jenvman.2021.113112

Li Z (2022) Can environmental tax curb air pollution: evidence from China. Appl Econ Lett 1–4. https://doi.org/10.1080/13504851.2022.2061703

Liang H, Wang Z, Niu R (2022) Does environmental regulations promote the green transformation of high polluters?. Appl Econ Lett 1–5. https://doi.org/10.1080/13504851.2022.2030034

Lin B, Li X (2011) The effect of carbon tax on per capita CO2 emissions. Energy Policy 39(9):5137–5146. https://doi.org/10.1016/j.enpol.2011.05.050

Liu G, Yang Z, Zhang F, Zhang N (2022) Environmental tax reform and environmental investment: a quasi-natural experiment based on China’s Environmental Protection Tax Law. Energy Econ 109:106000. https://doi.org/10.1016/j.eneco.2022.106000

Liu J, Xiao Y (2022) China’s environmental protection tax and green innovation: incentive effect or crowding-out effect? Econ Res J 57(01):72–88 (in Chinese)

Liu K, Wang X (2023) Does environmental regulation policy contribute to healthy China initiative? Evidence from Two Control Zone policy. Nankai Econ Stud 05:186–208. https://doi.org/10.14116/j.nkes.2023.05.011

Liu Z, Tang Y, Wilson J, Tao X, Lv B, Wang Z, Xu Y, Zhang Z, Zhang Y, Zhao W (2023) Influence of government attention on environmental quality: an analysis of 30 provinces in China. Environ Impact Assess Rev 100:107084. https://doi.org/10.1016/j.eiar.2023.107084

Long F, Lin F, Ge C (2022) Impact of China’s environmental protection tax on corporate performance: empirical data from heavily polluting industries. Environ Impact Assess Rev 97:106892. https://doi.org/10.1016/j.eiar.2022.106892

Lu Y, Yu L (2015) Trade liberalization and markup dispersion: evidence from China’s WTO accession. Am Econ J-Appl Econ 7(4):221–253. https://doi.org/10.1257/app.20140350

Mardones C, Cabello M (2019) Effectiveness of local air pollution and GHG taxes: the case of Chilean industrial sources. Energy Econ 83:491–500. https://doi.org/10.1016/j.eneco.2019.08.007

Mardones C, Mena C (2020) Economic, environmental, and distributive analysis of the taxes to global and local air pollutants in Chile. J Clean Prod 259:120893. https://doi.org/10.1016/j.jclepro.2020.120893

Maung M, Wilson C, Tang X (2016) Political connections and industrial pollution: evidence based on state ownership and environmental levies in China. J Bus Ethics 138(4):649–659. https://doi.org/10.1007/s10551-015-2771-5

Orset C (2019) How do travellers respond to health and environmental policies to reduce air pollution? Ecol Econ 156:68–82. https://doi.org/10.1016/j.ecolecon.2018.08.016

Pan X, Wei Z, Han B, Shahbaz M (2021) The heterogeneous impacts of interregional green technology spillover on energy intensity in China. Energy Econ 96:105133. https://doi.org/10.1016/j.eneco.2021.105133

Pigou A (1932) The economics of welfare, 4th edn. Macmillan, London, UK

Porter M (1991) America’s green strategy. Sci Am 26(4):168

Porter M, van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(4):97–118. https://doi.org/10.1257/jep.9.4.97

Prest B, Krupnick A (2021) How clean is “refined coal”? An empirical assessment of a billion-dollar tax credit. Energy Econ 97:105023. https://doi.org/10.1016/j.eneco.2020.105023

Shi D, Li S (2020) Emissions trading system and energy use efficiency——measurements and empirical evidence for cities at and above the prefecture level. China Ind Econ 9:5–23. https://doi.org/10.19581/j.cnki.ciejournal.2020.09.001. (in Chinese)

Shi H, Qiao Y, Shao X, Wang P (2019) The effect of pollutant charges on economic and environmental performances: evidence from Shandong province in China. J Clean Prod 232:250–256. https://doi.org/10.1016/j.jclepro.2019.05.272

Song Y, Yang T, Li Z, Zhang X, Zhang M (2020) Research on the direct and indirect effects of environmental regulation on environmental pollution: empirical evidence from 253 prefecture-level cities in China. J Clean Prod 269:122425. https://doi.org/10.1016/j.jclepro.2020.122425

Sun Y (2022) Tax incentives, tax enforcement, and enterprise R&D investment: evidence from Chinese A-share listed. Front Psychol 13:953313. https://doi.org/10.3389/fpsyg.2022.953313

Tang W, Yang X (2023) Is environmental tax legislation effective for pollution abatement in emerging economies? Evidence from China. Front Environ Sci 10. https://doi.org/10.3389/fenvs.2022.1113383

Tobin I, Cho W (2010) Performance tools and their impact on pollution reduction: an assessment of environmental taxation and R&D. Int Rev Public Adm 15(3):53–65. https://doi.org/10.1080/12294659.2011.10805179

Wang B, Liu B, Niu H, Liu J, Yao S (2018) Impact of energy taxation on economy, environmental and public health quality. J Environ Manag 206:85–92. https://doi.org/10.1016/j.jenvman.2017.10.030

Wang H, Li J (2021) Dual effects of environmental regulation on PM2.5 pollution: evidence from 280 cities in China. Environ Sci Pollut Res 28(34):47213–47226. https://doi.org/10.1007/s11356-021-14011-4

Wang J, Ke D, Lai X (2023) Tax enforcement and corporate social responsibility: evidence from a natural experiment in China. Emerg Mark Financ Trade 59(2):542–560. https://doi.org/10.1080/1540496X.2022.2097066

Wang Y, Yu L (2021) Can the current environmental tax rate promote green technology innovation? - evidence from China’s resource-based industries. J Clean Prod 278:123443. https://doi.org/10.1016/j.jclepro.2020.123443

Wu H, Hao Y, Weng J (2019) How does energy consumption affect China’s urbanization? New evidence from dynamic threshold panel models. Energy Policy 127:24–38. https://doi.org/10.1016/j.enpol.2018.11.057

Wu J, Tal A (2018) From pollution charge to environmental protection tax: a comparative analysis of the potential and limitations of China’s new environmental policy initiative. J Comp Policy Anal 20(2):223–236. https://doi.org/10.1080/13876988.2017.1361597

Wu X, Gao M (2021) Effects of different environmental regulations and their heterogeneity on air pollution control in China. J Regul Econ 60(2–3):140–166. https://doi.org/10.1007/s11149-021-09436-1

Yang Q, Gao D, Song D, Li Y (2021) Environmental regulation, pollution reduction and green innovation: the case of the Chinese Water Ecological Civilization City Pilot policy. Econ Syst 45(4):100911. https://doi.org/10.1016/j.ecosys.2021.100911

Yang S, Fang D, Chen B (2019) Human health impact and economic effect for PM2.5 exposure in typical cities. Appl Energy 249:316–325. https://doi.org/10.1016/j.apenergy.2019.04.173

Yang X, Tang W (2023) Additional social welfare of environmental regulation: the effect of environmental taxes on income inequality. J Environ Manag 330:117095. https://doi.org/10.1016/j.jenvman.2022.117095

Yao W, Zhang Y, Ma J, Cui G (2023) Does environmental regulation affect capital-labor ratio of manufacturing enterprises: evidence from China. Int Rev Financ Anal 86:102485. https://doi.org/10.1016/j.irfa.2023.102485

Yu L, Sun F, Bi Q, Liu Q (2021) Will the tax reform of environmental protection fees help improve the capacity utilization of enterprises-quasi natural experimental evidence from the implementation of the environmental protection tax law. J Shanghai Univ Financ Econ 23:32–47 (in Chinese)

Yu Y, Yang X, Li K (2019) Effects of the terms and characteristics of cadres on environmental pollution: evidence from 230 cities in China. J Environ Manag 232:179–187. https://doi.org/10.1016/j.jenvman.2018.11.002

Yuan B, Ren S, Chen X (2017) Can environmental regulation promote the coordinated development of economy and environment in China’s manufacturing industry?–a panel data analysis of 28 sub-sectors. J Clean Prod 149:11–24. https://doi.org/10.1016/j.jclepro.2017.02.065

Zhang K, Xu D, Li S (2019) The impact of environmental regulation on environmental pollution in China: an empirical study based on the synergistic effect of industrial agglomeration. Environ Sci Pollut Res 26(25):25775–25788. https://doi.org/10.1007/s11356-019-05854-z

Zhang S, Wang Y, Hao Y, Liu Z (2021) Shooting two hawks with one arrow: could China’s emission trading scheme promote green development efficiency and regional carbon equality? Energy Econ 101:10541. https://doi.org/10.1016/j.eneco.2021.105412

Zhu L, Hao Y, Lu Z, Wu H, Ran Q (2019) Do economic activities cause air pollution? Evidence from China’s major cities. Sustain Cities Soc 49:101593. https://doi.org/10.1016/j.scs.2019.101593

Funding

This work was supported by the major project of the China National Social Science Foundation (grant number: 20&ZD092).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection, and analysis were performed by Qiuyue Yin. The first draft of the manuscript was written by Qiuyue Yin. Review and editing are performed by Yongsheng Lin, Bo Yuan, and Zhanfeng Dong. Supervision and project administration are performed by Zhanfeng Dong. All authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yin, Q., Lin, Y., Yuan, B. et al. Does the environmental protection tax reduce environmental pollution? Evidence from a quasi-natural experiment in China. Environ Sci Pollut Res 30, 106198–106213 (2023). https://doi.org/10.1007/s11356-023-29898-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-29898-4