Abstract

In contrast to the previous literature, this paper examines the optimal second-best environmental tax rate in the presence of pre-existing distortions by taxing emissions rather than commodities. First, by extending the general equilibrium model in the literature, we find that the “Ramsey” formula is different from the traditional one. Both the magnitude of the optimal emission tax rate and the welfare effects of the green tax reform depend on the stage of labor supply curve in which the labor tax is. Second, we analyze other tax systems that are not mentioned in the literature. In a tax system with an environmental tax and an abatement subsidy, the welfare effects of increasing or decreasing the two policy instruments at the same time will be negative.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It has been suggested by Pigou (1920) that when externalities are present in an economy, a direct tax on waste can internalize external social damage and correct inefficiencies in the competitive allocation of resources. The optimal environmental tax rate is set to be equal to the marginal environmental damage, which is the well-known Pigovian principle.

However, many analyses, either partial equilibrium or general equilibrium, focus on how the optimal environmental tax rate deviates from the Pigovian principle in a second-best setting. On the one hand, partial equilibrium analyses where such deviation takes place include those of Lee and Misiolek (1986) and Oates (1993). In taking the non-environmental benefit generated by pollution taxation into consideration, Lee and Misiolek (1986) found that the efficient tax rate may be higher or lower than the Pigovian tax rate depending on the tax elasticity of emission demand. Oates (1993) found that the optimal environmental tax rate must diverge from the Pigovian rate by an amount equal to the reduced excess burden from other taxes under an optimal taxation model.

On the other hand, Sandmo (1975) first used a general equilibrium model to integrate the theory of optimal taxation with the analysis of the use of indirect taxation to counter negative external effects and found that the optimal tax rate on the externality-creating commodity was a weighted average of the Ramsey component (the inverse elasticity) and the Pigovian component (the marginal environmental damage). Bovenberg and van der Ploeg (1994) integrated environmental externalities and the optimal provision of the public good in terms of the natural environment, and also concluded that the optimal dirty tax rate was the weighted sum of an externality correction term and a revenue-raising term. Bovenberg and de Mooij (1994) further argued that the second-best optimal environmental tax rate was lower than the marginal pollution damage if the interaction effect between environmental taxes and pre-existing taxes in the green tax reform was considered. Since then, this result, which contrasts with the intuition whereby the second-best optimal environmental tax rate is higher than the marginal pollution damage, has been widely discussed. See the summary by Goodstein (2003).

There are four problems with the literature on the general equilibrium analysis of optimal environmental taxation. First, the literature uses an obsolete tax base for environmental tax in its models. The environmental tax base used is the dirty commodity that produces pollution. This method of taxing dirty commodities follows Pigou’s tradition (1920) of taxing quantities of production. We surmise that the reason behind Pigou’s choice of taxing dirty commodities was that there were no abatement technologies or abatement activities available in the 1920s and the only way to reduce emissions at that time was to reduce the production of dirty commodities. Thus, the relationship between dirty commodities and emissions was fixed at one to one. However, due to the progress in abatement technologies, this fixed relationship has changed since the 1960s. Nowadays, emissions can be reduced not only by reducing the production of dirty commodities, but also by investing in abatement activities. Thus, the present literature in environmental economics usually models the size of the externalities as a function of the quantities of dirty commodities and the inputs in pollution abatement, and uses emissions as the tax base for the environmental taxes.Footnote 1 Second, pollution abatement activities are usually ignored in the literature simply for the same reason. Third, most countries subsidize their pollution abatement activities, for instance by providing investment tax credits for firms’ abatement investment expenditures in order to stimulate investment on abatement activities and thereby foster economic growth. Fourth, the prior literature reveals the interests in this problem, but only in numerical models. Each study (Goulder et al. 1997, 1999) has a numerically solved model with abatement spending to simulate the effect of a tax on emissions, whereas their analytical model does not have abatement spending and still focuses on the effect of a tax on the polluting goods. It is for these reasons that a model that takes into consideration the taxing of emissions as well as abatement activities may be more realistic and may also be more meaningful.

This paper contributes to the analytical literature in two respects. First, we extend earlier analytical work on optimal environmental taxation in a general equilibrium model by taxing emissions. Second, in our model we consider the abatement activities that are devoted to reducing emissions. In addition, these abatement activities are assumed to be subsidized. The purpose of this paper is to examine the optimal second-best emission tax rate as well as the welfare effects under the condition of tax revenue neutrality in tax systems. Contrary to the previous literature, we first find that when the tax base consists of emissions, the “Ramsey” formula is different from the traditional one. Second, contrary to Bovenberg and de Mooij (1994), the optimal second-best environmental tax rate will be lower than the first-best Pigovian tax rate when the labor tax rate is low, and will be higher than the first-best Pigovian tax rate when the labor tax rate is very high under the homogeneous and separable utility function.

In Sect. 2, we present our model. In Sect. 3, we analyze the optimal second-best emission tax rate and the welfare effects of the green tax reform in the two tax systems. Section 4 concludes the paper.

2 Model

Following Bovenberg and de Mooij (1994), there are N identical households in a closed economy. These identical households own resources that are labors to produce goods or keep some of them as leisure. A linear technology produces a private clean good C, a private dirty good D, a public good G and an abatement facility A, with labor L being the only one input. The production of D results in emissions E. We normalize units so that the marginal rate of transformation is 1. The notation used is similar to that of Bovenberg and de Mooij (1994).

The utility of a representative household depends on the consumption of the private commodities C and D, leisure V, a public good G and environmental quality, which is represented by the total emissions of the economy E. The utility function u(C, D, V, G, E) is continuous and quasi-concave. The resource constraint is normalized to one, and so V + L = 1. Total emissions E is a function of D and A:

The budget constraint of the representative household is

where τ e is the emission tax rate, s A is the subsidy rate of abatement activities, and τ L is the tax rate on labor income.

The representative household maximizes utility with respect to C, D, A and V, but takes G and E as given. E is a kind of public externality. The maximization yields the indirect utility function

The government maximizes welfare by maximizing the representative household’s indirect utility function v. The government must balance its revenue constraint:

3 Analysis

In this section, we analyze the optimal emission rate and welfare effects in the presence of pre-existing distortions. Because the objective that we are interested in is the optimal emission tax rate, we discuss two tax systems. One tax system contains an environmental tax and a labor tax without considering the subsidy on abatement activities (Sect. 3.1). The other tax system includes an environmental tax and the subsidy on abatement activities without considering a labor tax (Sect. 3.2). These two specific scenarios are utilized because demand functions are homogeneous of degree zero in prices when households don’t receive additional lump sum income. So we can normalize one price at unity without losing generality. See Schob (1997), Dixit and Munk (1977) and Auerbach (1985). Thus, there are actually three policy devices in Sects. 3.1 and 3.2. In Sect. 3.1 we normalize the price of subsidy activities to unity, and in Sect. 3.2 we normalize the price of labor to unity.

3.1 A tax system with an environmental tax and a labor tax

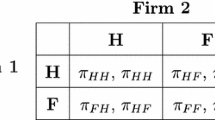

This case extends the basic model of general equilibrium in the literature, such as in Sandmo (1975), Bovenberg and de Mooij (1994), and Bovenberg and van der Ploeg (1994), by taxing emissions. In this case, we set the subsidy rate of abatement facilities to zero, and the government sets τ e and τ L to maximize

where μ is the marginal utility of public expenditure.The first-order conditions are

Equations 7 and 8 mean that the marginal utility from one more unit of tax equals its marginal cost. By Roy’s identity, Eqs. 7 and 8 become

where λ is the marginal utility of private income. Using Slutsky equations (∂I/∂τ e = δ Ie − e(∂I/∂Y) and ∂I/∂τ L = − δ IL − L(∂I/∂Y) with I = A, D, L, and the substitution effect, δ IJ , J = e, L, which is the change in demand when the price of e (L) changes holding expenditure fixed, we write the two first-order conditions in the following matrix form:

where Y is total household income and δ IJ is an element of the Slutsky matrix.

Then we use Cramer’s rule to solve τ e and τ L .Footnote 2

where \( \rho = {\frac{\lambda }{\mu }} + {\frac{N}{\mu }}\frac{\partial u}{\partial E}\left( {{\frac{\partial e}{\partial D}}\frac{\partial D}{\partial Y} + {\frac{\partial e}{\partial A}}\frac{\partial A}{\partial Y}} \right) + \tau_{e} \left( {{\frac{\partial e}{\partial D}}\frac{\partial D}{\partial Y} + {\frac{\partial e}{\partial A}}\frac{\partial A}{\partial Y}} \right) + \tau_{L} {\frac{\partial L}{\partial Y}} \), the net social marginal utility of the private income of the representative household that is measured in terms of public expenditure.Footnote 3

According to Eq. 12, the optimal tax rate on emissions is composed of two terms. The first term is the Ramsey component with its denominator weighted by the impact of the dirty good and abatement inputs on emissions. The other term is the marginal environmental damage weighted by the inverse of the marginal cost of public funds λ/μ. Thus, we find that when the tax base consists of emissions, the “Ramsey” formula in the previous literature is different from the traditional one.

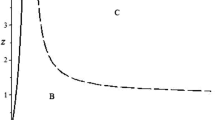

What we wish to know is whether the optimal second-best environmental tax rate is lower or higher than the first-best Pigovian tax. In order to simplify the expression, we consider the special case where the utility function is homogeneous and separable between private goods, the public good and emissions.Footnote 4 By this simplification, the term δ LL e + δ Le L becomes 0 (see the Appendix), and the optimal tax rate on emissions is the one and only term, the Pigovian component. As the marginal environmental damage equals the Pigovian tax rate τ P , we substitute the result \( \tau_{e} = {\frac{\lambda }{\mu }}\tau_{P} \) into the first-order condition for the labor tax and obtain the result where the marginal cost of public funds (λ/μ) equals \( \left( {1 + {\frac{{\tau_{L} }}{L}}\frac{\partial L}{{\partial \tau_{L} }}} \right) \). So the magnitude of the optimal emission tax rate depends on ∂L/∂τ L . Because the labor supply curve is upward sloping and then backward bending, the optimal second-best environmental tax rate may be lower or higher than the first-best Pigovian tax rate. Thus, we conclude that the optimal second-best environmental tax rate will be lower than the first-best Pigovian tax rate when τ L is low and will be higher than the first-best Pigovian tax rate when τ L is very high.

Then we consider the welfare effects of the green tax reform. This means that the government reduces the labor tax rate while at the same time increasing the emission tax rate under the revenue neutral condition. It is assumed that the initial tax rate on emissions is the Pigovian tax rate. By total differentiating the welfare function (Eq. 4) and the government’s revenue constraint (Eq. 5) with the revenue neutral condition (dG = 0), we obtain:

From Eq. 14, whether the welfare improves or not depends on how the quantity of labor supplied responds to the marginal increase in τ e and τ L . We have discussed the direct-effect term ∂L/∂τ L in the last paragraph. As to the indirect-effect term ∂L/∂τ e , Bovenberg and de Mooij (1994) suggested that the sign of this term is negative. However, Gustafson and Hadley (1989), West and Williams (2007) and Goodstein (2002) argued that ∂L/∂τ e may be positive. We know that generally the direct effect will be much more significant than the indirect effect. Thus, the welfare will rather depend on the change in labor supply from the channel τ L than from the channel τ e in most cases. So the result is consistent with that in the previous paragraph, the welfare will improve if the labor supply is in the stage where it is backward bending.

3.2 A tax system with an environmental tax and an abatement-subsidy

In this case, we set the labor tax rate to zero and focus on the case where there is an emission tax and there are subsidies on abatement activities. Using the same procedures as in Sect. 3.1, we obtain the optimal second-best environmental tax rate and the rate of the subsidy on abatement inputs as shown in Eqs. 15 and 16:

where \( \gamma = {\frac{{\tilde{\lambda }}}{\mu }} + {\frac{N}{\mu }}\frac{\partial u}{\partial E}\left( {{\frac{\partial e}{\partial D}}\frac{\partial D}{\partial Y} + {\frac{\partial e}{\partial A}}\frac{\partial A}{\partial Y}} \right) + \tau_{e} \left( {{\frac{\partial e}{\partial D}}\frac{\partial D}{\partial Y} + {\frac{\partial e}{\partial A}}\frac{\partial A}{\partial Y}} \right) - s_{A} {\frac{\partial A}{\partial Y}} \), \( \tilde{\lambda } \) is the marginal utility of income in this case.

We also find that the optimal tax rate consists of two terms, one being the Ramsey component with its denominator weighted by the influence of the dirty good on emissions and the other the marginal environmental damage weighted by the inverse of the marginal cost of public funds \( \tilde{\lambda }/\mu \). Thus, when the tax base consists of emissions, the “Ramsey” formula is also different from the traditional one.

Then we are interested in whether the optimal second-best environmental tax rate is lower or higher than the first-best Pigovian tax and the welfare effects if the government increases or decreases s A and τ e at the same time under the revenue neutral condition. By assuming the separability and homogeneity of the utility function, we cannot make out whether the optimal second-best environmental tax rate will be lower or higher than the first-best Pigovian tax in Eq. 15. However, we can determine whether or not the welfare improves by totally differentiating the welfare function (Eq. 4) and government revenue constraint (Eq. 5) by the revenue neutral condition (dG = 0) in order to arrive at Eq. 17:

There are two terms on the right-hand side of Eq. 17, namely, the effects arising from the change in the emission tax rate and the abatement-subsidy rate. First, we know that ∂A/∂τ e is positive because of the substitution effect, that is, marginally increasing the emission tax rate will cause emissions to decrease and therefore A should be invested to achieve this. Thus, the sign of the first term of Eq. 17 is negative.

Second, with respect to the square brackets that house the changes in s A , there are two terms. Obviously, \( s_{A} {\frac{\partial A}{{\partial s_{A} }}} \) is positive. The brackets \( \left( {{\frac{\partial e}{\partial A}}\frac{\partial A}{{\partial s_{A} }} + {\frac{\partial e}{\partial D}}\frac{\partial D}{{\partial s_{A} }}} \right) \) comprise the total effect of the abatement-subsidy rate on emissions through A and D. We know that \( {\frac{\partial e}{\partial A}}\frac{\partial A}{{\partial s_{A} }} \) will be negative. However, the effects of \( \left( {{\frac{\partial e}{\partial D}}\frac{\partial D}{{\partial s_{A} }}} \right) \) will be different both in the short run and in the long run (Baumol and Oates 1975, 1979; Xepapadeas 1997). In the short run, the increase in the subsidy rate will induce the household to further reduce its emissions. However, in the long run, the total emissions will be increased because the subsidy will make the inputs of the dirty commodities cheaper, and the sector of the dirty goods industry will expand because of higher profitability. According to Baumol and Oates (1975), the effect of a subsidy on emissions through D will dominate the effect through A, and so the effect of the subsidy on emissions will be negative in the long run.

Due to the first term in the square brackets being only the short-term effect, the effect of the subsidy on emissions will be larger than this. Thus, we believe that the sign of the square brackets will be negative in the long run. Finally, the overall welfare effects if the government increases or decreases s A and τ e at the same time under the revenue neutral condition will be negative. By this result we can infer that the optimal second-best environmental tax rate will be lower than the first-best Pigovian tax rate.

The policy implication is that the subsidy on abatement will not only decrease the welfare, but will also be environmentally harmful. We find that the subsidy on abatement whose initial intention was to reduce emissions will instead give rise to more emissions in the long run.

4 Conclusion

In all of the previous literature on the general equilibrium analysis of optimal environmental taxation, a dirty commodity has been used as the tax base of the environmental tax. This construct of the model is based on the assumption that dirty commodities and emissions exhibit a simple linear relationship. Although this linear relationship may have been true in the early days when no abatement technologies were available, this linear relationship does not hold anymore because many abatement technologies and activities have in recent times been employed to abate emissions. Therefore, we argue that emissions instead of dirty commodities should be used as the tax base of the environmental tax in the general equilibrium analysis of optimal environmental taxation.

This paper contributes to the literature by taxing emissions rather than dirty commodities to analyze the optimal second-best environmental tax rate. In addition, we take into account the policy of subsidizing abatement activities that is commonly found in many countries. Furthermore, we examine the welfare effects under the tax revenue neutrality condition in the tax systems.

In the first place, we extend the basic general equilibrium model in the previous literature by taxing emissions. In contrast to the results in the literature, we first find that the second-best optimal environmental tax rate based on the “Ramsey” formula is different from the traditional one. The “Ramsey” formula holds only when the tax base is a dirty commodity. Second, the optimal second-best emission tax rate will be lower than the first-best Pigovian tax rate when the labor tax rate is low and will be higher than the first-best Pigovian tax rate when the labor tax rate is very high. This result is different from that of Bovenberg and de Mooij (1994).

In the second place, we further discuss other tax systems that are not discussed in the literature. In the tax system with an environmental tax and an abatement subsidy, the welfare effects of increasing or decreasing the emission tax rate and the subsidy rate of abatement activities at the same time will be negative. This indicates that the optimal second-best environmental tax rate will be lower than the first-best Pigovian tax rate. The policy implication is that the subsidy on abatement will not only decrease the welfare, but will also be environmentally harmful.

Notes

If some types of emissions are difficult to monitor and tax directly, the tax bases of the environmental tax could be the dirty commodities. For example, agricultural chemicals instead of water pollution emissions are taxed in some countries.

It is net because it measures both the gain in social welfare and the tax payment due to an increase in income (Diamond, 1975).

The separability of utility function means the marginal utility of private goods, public good and emissions is independent of each other. For example, u(C, D, V, A, G, E) = f(C, D, V, A) + g(G) − h(E), U C,G = 0.

References

Auerbach AJ (1985) The theory of excess burden and optimal taxation. Handbook of Public Economics I, pp 61–127

Baumol WJ, Oates WE (1975) The theory of environmental policy, 1st edn. Cambridge University Press, New York

Baumol WJ, Oates WE (1979) Economics, environmental policy, and the quality of life. Prentice-Hall, Englewood Cliffs

Bovenberg AL, de Mooij RA (1994) Environmental levies and distortionary taxation. Am Econ Rev 94:1085–1089

Bovenberg AL, van der Ploeg F (1994) Environmental policy, public finance and the labor market in a second-best world. J Public Econ 55(3):349–390

Diamond PA (1975) A many-person Ramsey tax rule. J Public Econ 4:227–244

Dixit AL, Munk KJ (1977) Welfare effects of tax and price changes: a correction. J Public Econ 8:103–107

Fullerton D, Wolverton A (2005) The two-part instrument in a second-best world. J Public Econ 89:1961–1975

Goodstein E (2002) Labor supply and the double-dividend. Ecol Econ 42:101–106

Goodstein E (2003) The death of the Pigovian tax? Policy implications from the double-dividend debate. Land Econ 79:402–414

Goulder LH, Parry IWH, Burtraw D (1997) Revenue-raising versus other approaches to environmental protection: the critical significance of preexisting tax distortions. Rand J Econ 28:708–731

Goulder LH, Parry IWH, Williams RC III, Burtraw D (1999) The cost-effectiveness of alternative instruments for environmental protection in a second-best setting. J Public Econ 72:329–360

Gustafson E, Hadley L (1989) Labor supply and money illusion: a dynamic simultaneous equation model. Q Rev Econ Bus 29(4):63–75

Lee DR, Misiolek WS (1986) Substituting pollution taxation for general taxation: some implications for efficiency in pollution taxation. J Environ Econ Manag 13:338–347

Oates WE (1993) Pollution charges as a source of public revenues. In: Giersch H (ed) Economic progress and environmental concerns. Springer, Berlin

Pigou A (1920) The economics of welfare. MacMillan, London

Sandmo A (1974) A note on the structure of optimal taxation. Am Econ Rev 64:701–706

Sandmo A (1975) Optimal taxation in the presence of externalities. Swed J Econ 77(1):86–98

Schob R (1997) Environmental taxes and pre-existing distortions: the normalization trap. Int Tax Public Finance 4:167–176

West SE, Williams RC III (2007) Optimal taxation and cross-price effects on labor supply: estimates of the optimal gas tax. J Public Econ 91:593–617

Xepapadeas A (1997) Advanced principles in environmental policy. Edward Elgar, UK

Acknowledgments

The authors would like to thank Academia Sinica, Taipei, Taiwan, for its generous financial support for the research through the Academia Sinica Fellowships for Doctoral Candidates in the Humanities and Social Sciences.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

The homogeneity assumption of the utility function implies that \( \sum\nolimits_{k} {\delta_{ik} } p_{k} = 0 \). i.e.,

By substituting (18) into the numerator of Eq. (13)

From Sandmo (1974), separability implies that δ VC = βVC and δ VD = βVD where β is a function of arguments in the utility function. So we find:

Substituting (20)–(22) into (19) gives (23).

By factoring out δ Le on the right-hand side of (23) and using the household budget constraint (23) equals zero.

About this article

Cite this article

Pang, A., Shaw, D. Optimal emission tax with pre-existing distortions. Environ Econ Policy Stud 13, 79–88 (2011). https://doi.org/10.1007/s10018-010-0005-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-010-0005-8