Abstract

Since globalization has increased both production and population, it has also increased environmental damage. This is why the development of renewable energy sources is crucial to the survival of humanity and the planet itself. Business patterns across the various nations, however, have changed significantly over time. This study examines how environmental taxes and renewable energy electricity affect renewable energy consumption in emerging seven economies by using panel dataset over the period of 1990 to 2020. Control variables include economic growth, carbon emissions, and environmental innovation. The results confirmed the presence of the long-run co-integration association, the existence of slope coefficient heterogeneity, and the dependency of cross sections using several panel data methods. Since the data was not normally distributed, a new technique known as method of moments quantile regression (MMQR) was applied in this study. The projected results contend that the major factors of renewable energy consumption are renewable energy output, environmental taxation, economic growth, and carbon emissions. However, eco-friendly innovations drastically cut back on the need for renewable energy. Bootstrap quantile regression verifies the results’ reliability, and the panel Granger causality test corroborates that the listed factors have a bidirectional causal relationship with renewable energy usage. Furthermore, this research recommends boosting spending on renewable electricity, the environmental tax sector, and ecological innovation in order to expand the use of renewable energy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the last few decades, countries have made policies to improve energy efficiency without slowing down economic growth. This is due to the fact that they have been very worried that the environment is getting worse day by day. The experts believe that rising carbon dioxide (CO2) emissions around the world are the main cause of environmental degradation, global warming, and climate change. Because of economic growth and population growth, the world’s need for energy is growing quickly (Bhowmik and Govind Rajan 2022; Bhowmik et al. 2022a, b). The energy’s mixed efficiency and environmental problems are shifting the focus toward fuels with less carbon (Hashmi et al. 2021). According to the IPCC report (Anser et al. 2021), many international organizations are taking due steps to address global concerns about global warming, climate change, and high CO2 emissions in order to keep the global temperature from rising by more than 1.5 °C. However, typical fossil fuels will be replaced by a renewable energy system that has little or no impact on the environment (Syed et al. 2022). So, in terms of climate risk management, building a low-carbon economy becomes the most important long-term strategy for growth.

The Paris Climate Agreement (COP21) was signed by 195 countries to keep the world average temperature increase less than 2 °C and thereby alleviate environmental and climate problems (Syed and Bouri 2022a, b). It is very necessary to know what causes environmental deterioration for making sound environmental policy (Bhowmik and Govind Rajan 2022; Bhowmik et al. 2022a, b). The introduction of environmental taxes (ET), environment-related technologies, and their effects on renewable energy (RE), which is gaining popularity as a less carbon-intensive and sustainable energy source, is one of the most contentious problems connected to address these environment-related concerns. The rapid growth of once-developing nations now poses a threat to long-term stability. Sustained economic growth is a challenge for developing nations due to rising energy and environmental demands as well as global power imbalances. The environment-friendly methods have positive effects on the world besides adding financial and economic benefits. Transitioning for energy effectiveness and green energy is being helpful in attaining ecological and financial sustainability. Policies and methods to tackle environment and energy difficulties (Bhowmik and Govind Rajan 2022; Bhowmik et al. 2022a, b), as have been underlined in a number of studies, the current body of research. Sustainable economic development also requires government incentives for renewable electricity and energy. Besides, the cost of electricity also has a major bearing on the adoption of non-fossil fuel energy consumption.

Energy utilization, economic progress, and environmental sustainability have all been studied (Liu et al. 2022a). Most analyses have focused on industrialized nations like the USA and Europe (Syed et al. 2021; Syed and Bouri 2022a, b). Earlier studies on the same topic tended to agree that rising economic and energy demand are to be blamed for rising CO2 levels. Numerous studies have highlighted the connection between DGP, non-renewable energy (NRE) sources, and CO2 emissions. It is the topic crucial to understanding and improving the growth patterns of the E7 economies. Natural resource-rich cultures are better able to decrease their reliance on fossil fuels and CO2 emissions. According to M. Li et al. (2022a), it is validated that implementing energy strategies will reduce reliance on NRE sources. The energy mix is still heavily impacted by fossil fuel energy sources. This explains the long-term viability of both RE and NRE sources.

The potential of RE to rebalance the SDGs has been emphasized in recent energy economic literature (Mngumi et al. 2022). Much of this literature has sought to observe the links between the consumption of energy (both renewable and non-renewable), environmental degradation, and economic development. There are two perspectives to look at this work: one way requires dividing this body of work into two sub-genres. In the first approach, we will take a look at the relationship between economic expansion and energy. The second line of inquiry investigates the environmental Kuznets curve (EKC) theory, first articulated by Tang et al. (2022), and its relevance to the link between the ecosystem and economic progress. According to this theory, environmental degradation increases as a country develops but it declines after a certain threshold of per capita income is reached. Generally speaking, as economies grow, environmental quality get worse, and then start improving (Wei et al. 2022). This speculative link has been rigorously evaluated from theoretical perspective and is supported by the vast majority of empirical studies (e.g., Islam et al. 2022; Murshed et al. 2022; Xiang et al. 2022). Over the past few years, scholars have paid a great emphasis on the connections between rising prosperity and rising energy consumption, as well as rising prosperity and ever-increasing environmental degradation. Analyses of the growth-energy nexus and the environment-growth nexus dominate these studies, whereas few studies have attempted to examine both of these connections simultaneously (Bhardwaj et al. 2022; Irfan et al. 2022; Islam et al. 2021). The primary contribution of these studies is to develop a comprehensive framework for analyzing the interplay between CO2 emissions, economic growth, and energy utilization (both renewable and non-renewable). So far, no one has cared to prove that RE can boost economic growth and cut down on CO2 emissions.

Renewable energy technologies can be further divided into two categories: established energy technologies and cutting-edge energy technologies (Y. Wang et al. 2022a, b, c). Z. Liu et al. (2022b, c) contend that in addition to meet the needs of the community and conforming to future and existing civic regulations, renewable resources should also be safe for the environment, they should be made limitless, and inexpensive over long periods of time. The transition to a green economy is essential for both short-term and long-term social and economic gains that can be derived from the renewable distribution that influences rapid green development (Yin et al. 2023). Lin et al. (2020) studied the association between the proliferation of RE and the price of fossil fuels. According to Wang et al. (2022a, b, c), “green paradox theory,” an expensive plan to reduce global warming, may actually increase the use of NRE. In many areas, including energy security, social and economic growth, energy supply, and climate change reduction strategies; sustainable energy solutions are praised but not utilized (Xiao et al. 2022). The health and RE sources of neighboring communities are put in jeopardy by the noise of wind turbines and the potential hazard of solar energy units that reflect sunlight (Si et al. 2022).

The advantages of this study have been divided into three categories. The first original contribution of this study is an explanation of the impact of RE sources, both individually and collectively, on the rate of environmentally sustainable growth in the seven growing economies between 1990 and 2021. Using a sequential empirical strategy, this article explores the link between renewable energy (hydroelectricity) and non-renewable energy (fossil fuel) sources, eco-innovation, GDP (per capita), and environmental taxes. Secondly, this study examines the impact of hydroelectricity usage on environmental sustainability as well as economic growth. If the fact is considered important that the E-7 economies have been selected for this study despite the fact that several of those countries rank among the world’s top polluters and have hydroelectricity’s negligible impact on the environment, the topic’s significance becomes clear. Only two previous studies—one by S. Li et al. (2022b) and another by Li et al., (2023a, b)—have used the method of a “non-linear panel smooth transition vector error correction model” to assess the influence of electricity consumption on economic growth, so the present study makes further valuable additions to the small body of already done work. While Sharif et al. (2022) analyzed overall electricity demand, Irfan et al. (2021) focused on RE sources. In this research, the consumption of hydroelectricity has been taken as the main variable. Here, we employ two distinct methods of analysis—the method of moment quantile regression (MMQR) and the bootstrap quintile regression (BSQR), as they have been validated by previous studies. Finally, the third benefit is that this study answers an important research question that aims to find out how much clean environmental and economic production is boosted by the use of RE. It also tries to seek answer to the question: can the clean environmental and economic development rate of the E-7 countries be increased by using renewable energy sources?

It is not an extravagance to suggest that this study is the first of its kind to answer important questions about the factors influencing renewable energy and this work has significant implications for the field to further develop and prosper, even in the times when the E7 economies are fighting for greater environmental sustainability, and the authorities are concerned about the growth of RE. To that end, the empirical results of this analysis will aid the E7 economies in developing and enacting appropriate policies for the development and improvement of renewable energy sources. The estimated findings of this research would be useful not only for the E7 economies but also for other developing economies, considering the fact that scant amount of information is available on the factors and causes impacting the adoption of renewable energy sources. Therefore, this research paves the way for academics to focus on the factors that affect RE, and find the ways results of this research be expanded to apply to economies still in their early stages? This study uses the latest econometric methods, which are more efficient and robust than typical regression methods, applied to conduct empirical testing.

This is how the rest of the manuscript is structured. The “Literature review” section will look at the empirical research that is available. The research’s data and methods are discussed in the “Data and methodology” section. Findings and comments are detailed in the “Results and discussion” section, while findings and policy implications are documented in the “Conclusion and policy implications” section.

Literature review

Due to the correlation between economic expansion and rising energy requirements, modern manufacturing processes rely significantly on fossil fuels. Since we are heading in the direction where a hybrid energy system is a viable method to tackle environmental degradation issues, RE sources have developed as a substitute for conventional energy sources (Xu et al. 2021). We look at the literature on environmental improvements and laws with the current state of renewable energy in mind.

Renewable energy consumption—environmental taxes nexus

Environmental taxes are a form of pricing policy that aims to improve the environment while stimulating economic development (Khan et al. 2021). Carbon emissions may be reduced by 28% in severely polluted economies if environmental levies and environmental technology are implemented. According to research by (Sharif et al. 2020b, 2019), carbon taxes have beneficial effects both on the environment and the economy. As shown by analyses conducted by Godil et al. (2020), who used the computable general equilibrium (CGE) approach to analyze environmental policies and took a balanced stance towards economic growth and ecological reforms. To lower carbon emissions and improve energy efficiency, Irfan et al. (2021) investigated the environmental tax as an energy policy instrument. The study’s authors used a dynamic general equilibrium to show that environmental levies had varying effects across different economic sectors.

According to an assessment of GHG legislation and emission trading schemes in six major economies conducted by Mishra et al. (2020), emission trading programs help reduce carbon emissions by an average of 1.58% per year. Environmental taxes, according to Wan et al. (2022), reduce carbon emissions in Greece. They also argued that a better environmental outcome might be feasible, particularly in the EU countries, if various tax rates are set for different economic sectors. According to Jian and Afshan (2022), only the highest level of environmental tax can help cut CO2 emissions in the majority of the nations in South America. According to the findings of Sharif et al. (2020a, b, 2017), a carbon tax of £50 per metric ton would lead to a 37% decrease in Scotland’s CO2 emissions. Using the social accounting matrix, Suki et al. (2020) show that a US$5 carbon tax per ton results in an 1800-g reduction in greenhouse gas emissions. Despite the fact that there are many ways in which CO2 can boost GDP, there are still examples where it can have a detrimental influence in the long run (Sharif et al. 2022).

Renewable energy consumption—economic growth nexus

Several scholars have struggled to address the causality between energy usage and economic expansion. The correlation between primary energy use from various sources and GDP for Bulgaria, Hungary, Romania, Poland, and Turkey from 1980 to 2012/2013 is confirmed. For instance, by the research of Deng et al. (2022), who looked at the connection between economic development and energy use in India between 1950 and 1996, it is found that it is both bidirectional and same-directional process. In his research on four countries—India, Indonesia, Thailand, and the Philippines—Husnain et al. (2022) demonstrate that the correlation between income and energy use is not coincidental. Povitkina et al. (2021) make a similar observation, demonstrating that a country’s economic growth affects the rate at which its petroleum consumption increases. Energy consumption and CO2 emissions do not lead to economic development, as shown by other experts Huang et al. (2022) using different methods. These experts recommend that the government should follow energy conservation strategies and carbon decline policies because they do not impede a country’s economic development. Their findings provide crucial evidence for international efforts to cut energy consumption.

The benefits and downsides of various RE sources are discussed in greater detail by other researchers too (Khurshid and Khan 2021). A huge initial investment required to turn geothermal energy into a sustainable system is the primary argument against it. This means that it is only an option for wealthy countries. However, nations like Turkey, which have an abundance of geothermal sources, cannot afford to stop using polluting energy sources (such as coal) or invest in developing methods to harness the renewable energy source due to their quickly expanding populations and economies (Nosheen et al. 2021). After showing a two-way causal association between RE and economic growth for the period 1980–2016, De Santis et al. (2021) argue that Turkey’s sustainable development requires both increased production of RE and reduced consumption of conventional forms of energy. A multi-criteria study of Italy’s scenario suggests that replacing the current method for generating hot water and heat with solar thermal panels and heat pumps will significantly reduce the country’s final energy consumption (Zhang et al. 2021).

Role of renewable energy electricity, carbon emissions, environmental taxes, and eco-innovation

The theory of ERT anticipates that environmental taxation supports the execution of eco-friendly means that minimize the use of NRE resources, and this theory has been the topic of heated dispute among scholars concerned with environmental sustainability (Ma et al. 2022). Furthermore, several studies incorporate economic growth and other crucial aspects to study the effect of green policies and ERT on carbon emissions (Hussain et al. 2023). Previous studies have shown that the ERT has a deleterious effect on carbon emissions (Weimin et al. 2022).

The effects of the environmental tax (ET) on CO2 emissions in OECD countries, along with other renowned factors like financial development and renewable energy, are examined (Ahmed et al. 2022a, b, c). Experiment results, using the GMM and quantile regression models, confirm that ET have a negative impact on ecological degradation. Another study that looked at the influence of environmental taxes on carbon emissions was undertaken in Vietnam (Li et al. 2023a). Multiple factors, such as environmental taxation and carbon dioxide emissions from 2001 to 2018, were analyzed using multivariate regression. The findings state that carbon emissions have decreased dramatically due to the increase in environmental tax collection.

Firdaus et al. (2022) studied the connection between RE, economic development, and carbon emissions in the context of four Nordic nations (Denmark, Norway, Finland, and Sweden). The empirical outcomes showed that the quality of the ecosystem in the nations examined improved as an outcome of the use of RE and technical innovation. The association between fossil fuel subsidies and greenhouse gas emissions was studied by Ahmed et al. (2022a, b, c) for MENA countries. The research found that it was possible that a reduction in gasoline and diesel product subsidies of 20 US cents per liter would significantly cut CO2 emissions. Evidence from Samour et al. (2022) shows that the usage of oil and coal, as well as the agricultural sector, is the primary source of GHG emissions in China and India, whereas RE sources improve environmental quality.

Ahmed et al. (2022a, b, c) recently presented evidence for the effectiveness of environmental policies and eco-innovations in reducing CO2 emissions in OECD nations. The authors proposed innovations, laws, and greener investments to achieve greener and cleaner environment goals based on the stochastic influences of regression on population, prosperity, and technology (STIRPAT) method. Following the footsteps of this research, Hunjra et al. (2022) looked at the renewable energy-carbon nexus in the context of 107 nations as a worldwide sample. Researchers used panel co-integration and causality analysis to look at the effects of renewable energy at various phases. The research concluded that high- and low-income nations alike would benefit from switching to RE sources. The association between renewable energy electricity (REE), NRE, economic growth, and carbon emissions is hotly debated, as evidenced by the aforementioned studies. There is a gap in the literature about the relationship between rising RE electricity, environmental taxes, and eco-innovation and the resulting effect on REC and the ecosystem. Secondly, the literature has overlooked the fact that RE has a moderating effect on economic expansion. To fill in the gaps relating to knowledge and information, the present research seeks to examine how factors such as environmental taxation, eco-innovation, and economic progress impact REC.

Literature gap

Several gaps in the literature are reflected by the literature review that we will describe in the preceding sections. To begin with, there is a lack of information about the factors that influence the use of RE, as no prior research has ever attempted to determine the factors that can increase REC. These factors include the use of renewable energy electricity and eco-innovation in the context of the E7 nations, Secondly, there is a gap in the literature about the association between environmental taxes and the generation of electricity by RE sources. However, from the perspective of SDG 10, enabling the E7 states to fulfill the SDG agenda by 2030 requires focus on the lopsided distribution of RE productivity throughout the E7 nations. This work attempts to fill these knowledge gaps by developing a novel indicator of inequality in renewable energy productivity expressed as a Theil Index, and apply it to the problem in identifying the factors that contribute to this vitally important kind of inequality.

Data and methodology

This research primarily explores the links between REC, REE, eco-innovation, environmental taxes, CO2 emissions, and economic growth in seven emerging countries (Mexico, Indonesia, China, Russia, Turkey, India, and Brazil) from 1990 to 2020. Table 1 provides detailed descriptions and suggested measurements for the model variables that have been proposed. Total final energy consumption in kilowatt-hours (kWh) and kWh consumption from renewable energy sources (REC) are two ways to quantify a country's reliance on renewable energy in a given year. To calculate the REC in kilotons of oil equivalence, multiply the total energy consumption in kilograms by the REC, as a percentage of the total energy consumption, and then divide it by 100. Renewable energy electricity (REE) is the percentage of total power generation that comes from renewable sources. All of the information about REE comes from the World Development Indicators. CO2 emissions are measured in million metric tons, and gross domestic product (GDP) is calculated in constant 2015 US dollars. Data for the analysis of the abovementioned variables can be collected from the World Development Indicators (WDI) and British petroleum database. GDP is used as a proxy for economic growth while it is the total output of a country in a given year.

Model specification

The following overarching model was developed for this research, with REC as the dependent variable:

Consider the following as an example of how the model, we just talked about, can be written in regression form:

Here, the following Eq. (1) demonstrates that GDP, REE, ET, EI, and CO2 emissions are the functions of REC. However, Eq. (2) demonstrates that both the antecedent variables and the ET are important determinants of REC. The “i” and “t” represent the cross-sections and the time period, respectively; “ε” stands for random error.

Estimation strategy

Descriptive and normality statistics

Before performing an empirical estimation, this report’s descriptive statistics will be useful in describing the analyzed data. Data can be summarized by looking at the mean, median, range, minimum, and maximum estimations. Moreover, the standard deviation, defined as a variance between each observation and the mean value, is calculated to show the range of values for the variable under consideration. In addition, this investigation employs two metrics—kurtosis and skewness—to evaluate the normalcy of the data. The normality test developed by Hadri (2000) is presented in its conventional form, but it is augmented by the following measures to assess whether or not the data are normally distributed:

Skewness (S), number of observations (N), and excess kurtosis (K) are defined by the corresponding equation. In comparison with performing a skewness analysis and a kurtosis analysis independently, this test is more efficient because it performs both of these analyses simultaneously. In a J.B. test, the null hypothesis stresses that both assessments are zero, as it would be expected from a normally distributed dataset. If the data pan out as expected, the hypothesis will be rejected because it will show that the variables follow an atypical distribution.

Testing slope heterogeneity and CD

This research examines panel data characteristics, including slope coefficient heterogeneity (SCH) and cross-sectional dependence (CD), after collecting descriptive and normality estimates. Between 1760 and 1840, globalization and trade exploded; it allowed some countries to specialize in specific goods while let a few other countries to concentrate on other certain other matters. As a result of this specialization, a few economies are reliant on those of others for their continued prosperity. Because of this reliance, many nations have chosen policies that may eventually cause their economies resemble with those of other nations. It has created the complex econometric problem of slope homogeneity. As discussed by Shah (2020), the results of panel data forecasts may be incorrect and deceptive if the slope homogeneity issue occurs. The SCH test (Juhl and Lugovskyy 2014) is used in this investigation. Efficiently providing both the corrected SCH and the non-corrected SCH makes this test useful, as shown by the following equation form, derived from research in Pesaran (2008):

where \({\widehat{\Delta }}_{SCH}\) stands for the homogeneity of the slope coefficient in Eq. (4) and “ASCH” stands for the homogeneity of the slope coefficient after the amendment made in Eq. (5).

Slope coefficients are supposed to be standardized under the null hypothesis until the point where projections become statistically unimportant.

Ignoring the CD of the panel, like the preceding specification, may lead to conflicting empirical results (Hunjra et al. 2022). This research has used the CD test (Pesaran 2015) to establish whether or not the economies of the E7 are dependent over time and space. Through analysis of Pesaran (2015), we may derive the standard equation for CD, which is as follows:

The test’s null hypothesis expresses that the cross sections are not reliant on each other across the board. But empirically significant estimates are enough to rule out the null hypothesis (H0) and point to CD in the panel.

Stationary testing

Identifying the panel’s stationary case follows the calculation of CSD. In order to ascertain whether or not a panel’s data series are stationary, we can use the CADF test statistics presented below.

The CSD’s existence is assumed by the CADF, a type of IPS unit root test. By averaging the unit-root data from the CADF and CIPS tests for each country and cross section, we can get the measurements of this test for the entire panel. CIPS (cross-sectionally augmented IPS) tests (Phillips and Perron 1988) were also used in the investigation. CIPS is equipped to handle the CSD, resulting in more trustworthy and precise outcomes. It is defined as:

where, as shown, it is a typical cross section, and it is written:

CIPS test results are presented as

Co-integration testing

In this paper, we employ the error correction model (ECM) (Engle and Granger 2015) to study the presence of long-run co-integration across variables in a panel consisting of the economies of the Eurozone’s Group of Seven. Effective estimates for dealing with CD and intercept heterogeneity are provided by this test, which combines panel and group mean statistics. Both sets of numbers are evaluated using the following tried-and-true methods:

\({G}_{\tau }=\frac{1}{N}\sum_{i=1}^{N}\frac{{\widehat{\alpha }}_{i}}{S.E{\widehat{\alpha }}_{i}},\) and \({G}_{a}=\frac{1}{N}\sum_{i=1}^{N}\frac{T{\widehat{\alpha }}_{i}}{{\widehat{\alpha }}_{i}(1)},\) shows the mean group statistics, while \({P}_{\tau }=\frac{\widehat{\alpha }}{S.E\left(\widehat{\alpha }\right)},\) and \({P}_{a}=T.\) \(\widehat{\alpha }\) shows the panel statistics.

Method of moments quantile regression (MMQR)

It is important to note that all the aforementioned methods generate linear correlations between model variables by averaging the relevant variables, completely disregarding the conditional data distribution in the process. Contrarily, quantile regressions for panel datasets use the quantiles of the variables to probe for relationships (Martínez-Avila et al. 2022). Coefficients calculated from quantiles of the dependent variable are presented for evaluation by Khanfar et al. (2021), and these coefficients are modified by the means of the numerous explanatory factors. Despite the fact that conditional measures may be shown to have minimal or no influence, this method nevertheless seems to be helpful dealing with probable outliers, which can dislocate the data’s whole distribution. Furthermore, while computing, it may happen that conventional quantile regressions are unable to move across cross sections at different quantile levels. It leads to an inaccurate distribution of the dependent variable (Magiri et al. 2022). The current work also uses a recent estimation approach proposed by Machado and Santos Silva (2019) which is known as the “method of moments quantile regression” (MMQR). Due to its inability to ascertain the heterogeneity that remains unnoticed in each cross section of the panel data, quantile regression is, as previously indicated, the least stable to outliers. Moreover, it is interesting to note that MMQR seems to perform well with distributions that deviate from the normality assumption. Its main advantage is that it may be used in non-linear models and is significantly easier to compute, especially while dealing with several endogenous variables. By isolating dependent variables and allowing specific impacts on people, the MMQR enabled the “conditioned heterogeneity of variance effects” to generate and influence outcomes. Typical quantile regressions, such as those found in Ahmad et al. (2021), lack this quality because their computation consists solely of shifting averages. Furthermore, when data is classified on the basis of some individual-specific effects, MMQR is deemed more applicable in such context as the ones where variables have endogeneity qualities. In the event where the model is non-linear, this method is effective (Wu et al. 2022). In comparison to other non-linear estimate methods, such as the non-linear autoregressive distributed lag (NARDL) model, which typically describes non-linear features with exogenous boundaries by not choosing the benchmark standards; MMQR performs better since it may incorporate a non-linear model. This method also permits asymmetry with respect to location, as the parameters of variables are position-dependent under the distribution conditions. These results suggest that the MMQR is more legitimate and robust than previous methods especially when it comes to the formation of asymmetrical non-linear links and connections (Khee Pek 2021). The MMQR also successfully overcomes the difficulties of endogeneity and heterogeneity (Rehman et al. 2022). Since the MMQR approach yields non-crossing regression quantile estimates, it is also quite easy to implement. As such, the conditional quantiles QY (τ|X) are estimated to provide a framework for the location-scale variation.

The probability P {\({\delta }_{I}\) + \({Z}_{it}^{^{\prime}}\Upsilon >0\}\) = 1. (α, \({\beta }^{^{\prime}}\), and \({\delta }_{^{\prime}} {\Upsilon }^{^{\prime}}{)}^{^{\prime}}{)}^{^{\prime}}\) are the parameters to be assessed. The isolated i fixed effects are nominated by (αi, δi), i = 1,…, n, and k-vector of documented elements of X is denoted by Z, which are differentiable conversions with element known by:

It is time-independent, uniformly distributed, and may be applied to any fixed Xit. Orthogonal to Xit and adjusted to meet the moment criteria in Khurana et al., (2021), which do not need stringent exogeneity, Uit is distributed independently and similarly among persons (i) and throughout time (t). Given the above, the following follows logically from Eq. (13).

Economic growth, REC, TI, and GL are all independent variables in Eq. 13 and vector of independent variables represented by\({X}_{it}\). The quantile distribution of the dependent variable \({Y}_{it}\) (CO2 emissions) is shown as \({Q}_{y}\left(\tau |{X}_{it}\right)\), while it is dependent on the value of independent variables. An individual’s quantile-fixed effect is represented by the scalar coefficient, \({X}_{it}^{^{\prime}}\).–αi \(\left(\tau \right)\) ≡ αi + \({\delta }_{i}\) q \(\left(\tau \right)\). Unlike other least-square fixed effects, the individual effect does not signify a change in the intercept. The conditional distribution of the endogenous variable is allowed to shift between quantiles due to the temporal invariance of the parameters and their varying effects. In order to determine the τ-th quantile of a sample, we must first optimize the following: The τ-th sample quantile is represented by Y (\(q(\tau )\).

where \({\rho }_{\tau }(A)\) = \(\left(\tau -1\right)\text{ AI}\{{\text{A}}\le 0\}+\text{TAI }\{{\text{A}}>0\}\) denotes the check function.

Granger panel causality and robustness

In this work, the BSQR is employed to verify the MMQR method’s empirical findings and add a layer of robustness. If one is interested in analyzing confidence intervals and tests of significance, BSQR is a substitution method that can help. This specification’s benefit is that it dispenses with the need for a parametric assumption of an asymptotically normal sample distribution in order to gather quantitative data. To be more precise, the BSQR (Dumitrescu and Hurlin 2012) employs computational resources to assess the empirical sampling distribution of the estimating model, which in turn provides beneficial estimating strategies and shows empirical results.

The MMQR and BSQR techniques may be able to estimate outcomes for each regressor at a specific scale and location, but they cannot identify the causal association between variables. Granger panel causality heterogeneity test (Dumitrescu and Hurlin 2012) has been used in this study to determine the path of causality. When compared to other methods, this test is superior in its ability to identify TN panels with imbalances. The problems of slope heterogeneity and CD, in panel data, are also discussed (Li et al. 2023b).

Results and discussion

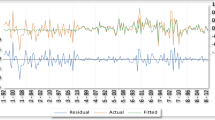

The empirical outcomes assessed using the aforementioned methods are shown below. Table 2 and Fig. 1 display some descriptive statistics from this study. According to the descriptive statistics, the mean, median, and range values for all of the variables are all positive. It demonstrates the upward trending nature of the variables under study. With respect to the latter, the extremes of each variable are both positive and significantly different from one another. Since volatility in a time series may be measured by taking the standard deviation, this study does just that. Since the standard deviation is positive for all variables, the estimated outcomes suggest that all variables are unstable. In addition, the study assesses the skewness and kurtosis normality requirements, both of which produce estimated values outside of their respective critical ranges of 0 and 3, respectively. Therefore, the variables are not assumed to follow a normal distribution in this analysis. This research has used the normality test, which takes into account both excess kurtosis and skewness concurrently to examine the topic of data normality in depth (Hadri 2000). According to the data presented in the study, all of the variables have statistically significant values at the 1% level. As an outcome, we can conclude that the variables adhere to the asymmetric distribution and reject the null hypothesis of regularly distributed data.

The SCH and CD tests are analyzed in this work after the descriptive and normality estimates are presented. Tables 3 and 4 provide the estimated outcomes for the aforementioned parameters. By using the SCH test, we discover that the results are highly significant even at the 1% level of significance. To conclude, it can be said that the slope coefficients are not homogeneous; we must therefore reject the null hypothesis of slope homogeneity. In contrast, the outcome of the CD test yielded estimates that are statistically significant across the board. Since cross-sectional reliance is the norm for E7 economies, we must also reject the null hypothesis of cross-sectional independence. Further evidence of the potential for a shock in one nation to affect variables in other countries is provided by the existence of CD.

CD and unit root tests

Some commonplace preparatory tests are run to determine the time-series features of the variables before estimating the unknown parameters. As a first step, we investigate whether or not the panel exhibits cross-sectional dependence (CD). Estimated coefficients may be skewed if the data is dependent over time. Panel data efficiency advantages may be severely attenuated if CD, which may occur as an outcome of unnoticed common factors, is disregarded. Therefore, this issue must be taken into account if accurate coefficient estimations are to be generated. To evaluate panel CDs, we use the CD test proposed by Pesaran et al., (2004). Table 4 shows that all quantitative indicators, with the exception of oil output, show substantial cross-sectional dependence among countries. For this reason, we need to incorporate procedures that are robust to the impacts of cross-sectional dependency into our unit root and co-integration tests and panel estimate methods in order to decrease the probability of any size distortions.

When we use standard first-generation unit root testing (see Table 5), it is possible to obtain skewed estimates because the diagnostic tests confirm the heterogeneity of slopes and panel CD. The panel data issues were addressed by Tzankova (2020). By using the CIPS unit root test, the empirical findings are presented in Table 5. Only one variable, residual end-effect (REE), is statistically significant at I (0). It means that the presence of a unit root has been rejected. The statistical numbers for REC, GDP, CO2, ENT, and EI are all below their critical values, so they are marked non-stationary. Owing to this, I(1) is where all of these variables are examined because it has statistical values greater than their critical values. The present analysis is able to examine the long-run co-integration connection between the variables because all of them reject the null hypothesis of unit root presence and are thus considered stationary.

We use the panel co-integration test (Pedroni 2004) and the bootstrapped panel co-integration test (Westerlund and Edgerton 2007) to find whether or not there is a genuine long-run link between the variables. In the spirit of Engle and Granger’s 2-step technique, Pedroni presents a complete framework for assessing panel co-integration. In order to account for the variation, Pedroni’s method first eliminates potentially confounding short-run factors, and then deterministic tendencies that are unique to each individual. Pedroni generates seven alternative test statistics from estimated residuals; these can be “pooled” by “within-dimension” tests, which assume a single process, or “grouped” or “between-dimension” tests, that assume many processes acting independently of one another. Westerlund and Edgerton (2007) suggests a method according to which four more tests are conducted under the premise that co-integration does not exist. Due to the structural rather than residual character of the dynamics being tested, the test loosens the imposition of common factor limits on the tests based on residual dynamics. The need for structural dynamics arises from the fact that residual-based co-integration tests might lose a lot of their efficacy if common factor limitations do not hold (Charfeddine and Kahia 2019). By removing this constraint, it is no longer necessary for long- and short-term adjustment processes to be identical. By employing the bootstrapping method, we are able to reduce the impact of cross-sectional dependence on our key values, and thereby ensure their reliability.

The empirical ECM test results are presented in Table 6. This study suggests that there is no long-run equilibrium association by assuming that the error correction term is equal to zero. In light of the data, the p values for the means of the groups (Gt and Ga) and the panels (Pt and Pa) are both extremely small. Because the error correction is not zero, the co-integration association between the variables must exist, and the null hypothesis of the test must be rejected.

Following confirmation of the co-integration of the variables of interest, this analysis assesses long-run elasticities. Moment quantile regression, a new technique that is useful for handling non-linear data, has been used in this work to account for the uneven distribution of the independent variables. Table 7 presents empirical outcomes from this method. The results show that all the variables have positive influences across all quantiles, with the exception of the TIN. From the lowest (Q 25th) to the highest (Q 90th) quantile, REC increases by 4.555–4.454 percentage points for each unit rise in GDP, REE, CO2, and ENT, and by 0.514–0.627% for each unit increase in ENT. But energy is the key factor which makes businesses successful and helps economies expand. One thing is certain, if traditional fossil fuels are used at their current rate of use, they will run out quickly. Largest energy users are the industrial and residential sector that are trying to make the transition from outdated energy resources and apparatus to RE acceptance as their incomes rise. Thus, affluence plays a progressive role in the uptake and REC. The positive correlation between economic expansion and the use of renewable energy sources is empirically authenticated by the results of this study. The outcomes are also consistent with the results of Sardianou et al. (2021). In addition to the obvious benefits that accrue from a flourishing economy, a rise in income also has a multiplier effect on the spread of renewable energy projects, which in turn increases the generation and distribution of green power. Therefore, the increased amount of renewable supply promotes the demand for and use of renewable energy. Renewable power production may enhance economic growth, which boosts investment, that leads to encouraging REC (Abbasi et al. 2022). This phenomenon is also supported by empirical research (Sadiq et al. 2022). In a similar way, more economic activity is to be blamed for increased CO2 emissions. Increased economic and financial activity is tied to industrial trade, which, on the one hand, helps generate revenue but, on the other, causes environmental deterioration due to increased consumption of fossil fuels. So, new research suggests that technical advancement might greatly encourage renewable energy usage, and uncouple economic growth from carbon emissions (Li et al. 2023b). The positive correlation between these factors holds true in emerging economies, which are at the beginning of a period of rapid economic expansion. Industrial development leading to increased incomes boosts the adoption and use of RE. It already has been established that as people’s standards of living improve, the economy shifts towards a greener, more energy-efficient model of production and consumption. This model in turn reduces the rise in CO2 emissions. Now emerging economies are also increasingly using energy-efficient resources and technology due to strict ecological procedures, manufacturing growth, stronger economic growth, and rising ecological deterioration. Sustainable policy initiatives (Ehigiamusoe et al. 2022) include the steps that slow down or reverse environmental deterioration, boost the use of RE, and keep the economy and industry growing. Technology advancement is the only factor on the list with a negative impact on REC. The last three quintiles see a decrease in REC of 0.50–0.766% for every percentage point rise. The main reason why TIN has a negative effect on REC now is that emerging economies are concerned with the long-term viability of their rapid economic expansion. Thus, the inventions are more important for the economy's continued viability than the planets. Current analyses are in favor of technical innovation's role in promoting and utilizing RE alongside economic growth; therefore, it is important to invest in the development of environmentally linked technological innovation. The significant outcomes of scale and location provide additional support for the estimated outcomes, which are determined to be highly significant at the 1%, 5%, and 10% levels, respectively. In addition, the long-term elasticities of all relevant variables are displayed.

This research examined the model’s robustness after the long-run elasticities were estimated using the innovative MMQR method. Empirical results are presented in Table 8; the current study used BSQR to get them. The estimated results confirm the positive influence of GDP, REO, CO2, and ENT and the negative influence of EI on REC. Thus, it validates the model’s robustness. It was found that the track of impact continued to be same across quintiles of the BSQR and MMQR, even though the size of the influence varied. Statistical significance for the empirical estimates is obtained at the 1%, 5%, and 10% levels for all quantiles.

Despite the fact that both the MMQR and BSQR methods offer highly accurate estimates at the individual quantile levels, the causal association between the variables is hard to be seen in these specifications. Accordingly, the Granger causality between the variables is examined by using the Granger panel causality heterogeneous test. Table 9 displays the anticipated findings from the aforementioned analysis. The data suggests a two-way causal link among GDP-REC, CO2-REC, REE-REC, and EI-REC. All of the explanatory variables were shown to be viable factors of renewable energy; hence, the null hypothesis was rejected. As a result, there is the possibility of a spillover effect in either the dependent or explanatory variable at any policy level. Accordingly, effective policy measures are necessary to increase the usage of RE sources without dampening economic expansion.

Conclusion and policy implications

Today’s economies, whether they are developing or industrialized, have the challenge of addressing rising environmental degradation without compromising their own growth or productivity. According to a significant body of research, our dependence on conventional NRE for energy is largely to be blamed for the deterioration of our planet. Scholars and policymakers have recognized the need to find solutions to these problems, and they have placed a premium on the research and development of RE sources. That is why the current study examines the factors influencing the adoption of RE sources by developing countries. This paper examines the role that numerous energies and environmental, financial, and technical issues play in the adoption of RE sources. This study uses panel data methodologies, which verify the variety of CD and slope coefficients, because it is concerned with data from the E7 economies. The results also show that every variable is co-integrated. This study uses the unique MMQR approach to account for the uneven distribution of data and finds that the main drivers of REC in the region are increasing power generation from renewable sources, energy effectiveness, economic development, and carbon emissions. When it comes to providing an all-encompassing picture of the relationship between variables at quantile distributions, MMQR is clearly superior to traditional panel quantile regression. This method delivers accurate estimates and is very robust against outliers. Quantiles, locations, and scales all affect how large these variables actually are. These factors are connected in some way, as rising prosperity encourages more money to be put into RE and energy efficiency. REC increases in various fields, which in turn helps the environment and the economy. Emerging economies, on the other hand, focus their technical innovation on economic sustainability at the expense of environmental recovery. As a result, TI reduces demand for renewable energy in these countries.

Our study emphases on the effects of environmental taxes on GHG emissions under ecological policy measures during the period of January 1990–January 2021 in seven emerging economies. Environmental taxes (ENT) are the most important factor, however they are only moderately significant and highly sensitive to definition and approach. Long term, the results indicate that a rise in energy taxes and imports may be a role in lowering emissions of greenhouse gases. However, this leverage could not be generalized, and other tools also should be identified and employed, as environmental taxes produce varying results in different nations (as observed in several research cited in our paper).

Policy implications

It is advocated that more effective steps should be taken by government representatives and legislators in these developing nations to inspire the development and consumption of RE across all economic activities, particularly in renewable energy power. This article also helps regulators design new policies that cut back on NRE use and boost renewable energy use in an effort to slow environmental deterioration. Increasing energy consumption is a byproduct of rapid economic expansion; this article advises policymakers that they may best serve the public interest by fueling their expansion with sustainable sources of power, and by minimizing their impact on the natural world. The effective and economic growth of the renewable energy sector should be a primary focus of policymakers. Therefore, E7 countries should compare the upfront cost of renewable energy against the cost of reducing carbon emissions. The widespread usage of renewable energy sources lays the foundation of a low-carbon economy and sustained economic expansion. The E7 countries need to establish laws and policies to educate the public on the importance of environmental taxes and eco-innovation. Although it is obvious that policy should encourage the use of RE sources in the energy supply, the continued use of non-renewable or fossil resources presents a significant barrier to this goal. Therefore, avoiding these obstructions is of paramount importance, and investing in only eco-friendly technologies makes it possible. This focus should be maintained across all stages of production, especially in the industrial sector, and be made appealing by subsidies and tax breaks. Further, in order to accomplish a continuous decrease in emissions, E7 officials must create and apply growth-centered programs and agendas. For instance, when their economies grow, these nations will be better able to fund clean energy research, adopt stringent environmental rules, and educate their citizens about the need to protect the planet. Fostering technological advancements and facilitating the exchange of knowledge among the E7 countries is also crucial to improving the efficiency of renewable energy. This will increase economic output along with reducing CO2 emissions in these nations.

Study limitations and suggestions

Although a wide range of topics has been covered, this investigation of what influences people to use renewable energy sources is particularly thorough. In spite of this, there are a few areas which need further investigation and the authors of the study have pointed them out as well. For instance, future studies must empirically assess how a variety of environmental, economic and financial issues influence renewable energy. International trade, foreign direct investment, financial development, ecological procedures, etc. are all examples of areas where this research might be expanded to better understand the elements that could boost renewable energy consumption. Moreover, developed-world economies, such as the G20 and G7, and time-series data can be included in this analysis to better inform policy decisions. Besides, alternative panel data methods, such as the cross-sectional ARDL model, can also be used in future research to look into both the short-run and long-run estimates in a single stream.

Data availability

The data can be available on request.

References

Abbasi KR, Hussain K, Haddad AM, Salman A, Ozturk I (2022) The role of financial development and technological innovation towards sustainable development in Pakistan: Fresh insights from consumption and territory-based emissions. Technol Forecast Soc Change 176:121444. https://doi.org/10.1016/J.TECHFORE.2021.121444

Ahmad M, Jan I, Jabeen G, Alvarado R (2021) Does energy-industry investment drive economic performance in regional China: implications for sustainable development. Sustain Prod Consum 27:176–192. https://doi.org/10.1016/j.spc.2020.10.033

Ahmed N, Hamid Z, Mahboob F, Rehman KU, e Ali MS, Senkus P, Wysokińska-Senkus A, Siemiński P, Skrzypek A (2022a) Causal linkage among agricultural insurance, air pollution, and agricultural green total factor productivity in United States: pairwise Granger causality approach. Agriculture 12:1320. https://doi.org/10.3390/AGRICULTURE12091320

Ahmed N, Mahboob F, Hamid Z, Sheikh AA, e Ali MS, Glabiszewski W, Wysokińska-Senkus A, Senkus P, Cyfert S (2022b) Nexus between nuclear energy consumption and carbon footprint in Asia Pacific region: policy toward environmental sustainability. Energies 15:6956. https://doi.org/10.3390/EN15196956

Ahmed N, Sheikh AA, Mahboob F, de Ali MS, Jasińska E, Jasiński M, Leonowicz Z, Burgio A (2022c) Energy diversification: a friend or foe to economic growth in Nordic countries? A novel energy diversification approach. Energies 15:5422. https://doi.org/10.3390/EN15155422

Anser MK, Syed QR, Apergis N (2021) Does geopolitical risk escalate CO2 emissions? Evidence from the BRICS countries. Environ Sci Pollut Res 28:48011–48021. https://doi.org/10.1007/S11356-021-14032-Z/TABLES/8

Bhardwaj M, Kumar P, Kumar S, Dagar V, Kumar A (2022) A district-level analysis for measuring the effects of climate change on production of agricultural crops, i.e., wheat and paddy: evidence from India. Environ Sci Pollut Res 29:31861–31885. https://doi.org/10.1007/S11356-021-17994-2/METRICS

Bhowmik S, Govind Rajan A (2022) Chemical vapor deposition of 2D materials: a review of modeling, simulation, and machine learning studies. iScience 25:103832. https://doi.org/10.1016/J.ISCI.2022.103832

Bhowmik R, Rahut DB, Syed QR (2022a) Investigating the impact of climate change mitigation technology on the transport sector CO2 emissions: evidence from panel quantile regression. Front Environ Sci 10:709. https://doi.org/10.3389/FENVS.2022.916356/BIBTEX

Bhowmik R, Syed QR, Apergis N, Alola AA, Gai Z (2022b) Applying a dynamic ARDL approach to the Environmental Phillips Curve (EPC) hypothesis amid monetary, fiscal, and trade policy uncertainty in the USA. Environ Sci Pollut Res 29:14914–14928. https://doi.org/10.1007/s11356-021-16716-y

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213. https://doi.org/10.1016/j.renene.2019.01.010

De Santis R, Esposito P, Lasinio CJ (2021) Environmental regulation and productivity growth: Main policy challenges. Int Econ 165:264–277. https://doi.org/10.1016/j.inteco.2021.01.002

Deng Z, Liu J, Sohail S (2022) Green economy design in BRICS: dynamic relationship between financial inflow, renewable energy consumption, and environmental quality. Environ Sci Pollut Res 29:22505–22514. https://doi.org/10.1007/S11356-021-17376-8/METRICS

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29:1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Ehigiamusoe KU, Lean HH, Babalola SJ, Poon WC (2022) The roles of financial development and urbanization in degrading environment in Africa: Unravelling non-linear and moderating impacts. Energy Rep 8:1665–1677. https://doi.org/10.1016/j.egyr.2021.12.048

Engle RF, Granger CWJ (2015) Co-integration and error correction: representation, estimation, and testing. Appl Econom 39:107–135. https://doi.org/10.2307/1913236

Firdaus R, Xue Y, Gang L, e Ali MS (2022) Artificial intelligence and human psychology in online transaction fraud. Front Psychol 13:3558. https://doi.org/10.3389/FPSYG.2022.947234/BIBTEX

Godil DI, Sharif A, Rafique S, Jermsittiparsert K (2020) The asymmetric effect of tourism, financial development, and globalization on ecological footprint in Turkey. Environ Sci Pollut Res 27:40109–40120. https://doi.org/10.1007/S11356-020-09937-0/METRICS

Hadri K (2000) Testing for stationarity in heterogeneous panel data. Econom J 3:148–161. https://doi.org/10.1111/1368-423x.00043

Hashmi SM, Bhowmik R, Inglesi-Lotz R, Syed QR (2021) Investigating the environmental Kuznets curve hypothesis amidst geopolitical risk: global evidence using bootstrap ARDL approach. Environ Sci Pollut Res 29(16):24049–24062. https://doi.org/10.1007/S11356-021-17488-1

Huang H, Chau KY, Iqbal W, Fatima A (2022) Assessing the role of financing in sustainable business environment. Environ Sci Pollut Res 29:7889–7906. https://doi.org/10.1007/s11356-021-16118-0

Hunjra AI, Azam M, Bruna MG, Taskin D (2022) Role of financial development for sustainable economic development in low middle income countries. Financ Res Lett 47:102793. https://doi.org/10.1016/J.FRL.2022.102793

ul Husnain MI, Syed QR, Bashir A, Khan MA (2022) Do geopolitical risk and energy consumption contribute to environmental degradation? Evidence from E7 countries. Environ Sci Pollut Res 29:41640–41652. https://doi.org/10.1007/S11356-021-17606-Z/TABLES/10

Hussain M, Rasool SF, Xuetong W et al (2023) Investigating the nexus between critical success factors, supportive leadership, and entrepreneurial success: evidence from the renewable energy projects. Environ Sci Pollut Res Int. https://doi.org/10.1007/S11356-023-25743-W

Irfan M, Ahmad M, Fareed Z et al (2021) On the indirect environmental outcomes of COVID-19: short-term revival with futuristic long-term implications. https://doi.org/10.1080/09603123.2021.1874888

Irfan M, Elavarasan RM, Ahmad M, Mohsin M, Dagar V, Hao Y (2022) Prioritizing and overcoming biomass energy barriers: application of AHP and G-TOPSIS approaches. Technol Forecast Soc Change 177:121524. https://doi.org/10.1016/j.techfore.2022.121524

Islam MM, Khan MK, Tareque M, Jehan N, Dagar V (2021) Impact of globalization, foreign direct investment, and energy consumption on CO2 emissions in Bangladesh: does institutional quality matter? Environ Sci Pollut Res 28(35):48851–48871. https://doi.org/10.1007/S11356-021-13441-4

Islam MM, Ali MI, Ceh B, Singh S, Khan MK, Dagar V (2022) Renewable and non-renewable energy consumption driven sustainable development in ASEAN countries: do financial development and institutional quality matter? Environ Sci Pollut Res 29:34231–34247. https://doi.org/10.1007/S11356-021-18488-X/METRICS

Jian X, Afshan S (2022) Dynamic effect of green financing and green technology innovation on carbon neutrality in G10 countries: fresh insights from CS-ARDL approach. http://www.tandfonline.com/action/authorSubmission?journalCode=rero20&page=instructions. https://doi.org/10.1080/1331677X.2022.2130389

Juhl T, Lugovskyy O (2014) A Test for Slope Heterogeneity in Fixed Effects Models. https://doi.org/10.1080/07474938.2013.806708

Khan SAR, Yu Z, Sharif A (2021) No silver bullet for de-carbonization: preparing for tomorrow, today. Resour Policy 71:101942. https://doi.org/10.1016/j.resourpol.2020.101942

Khanfar AAA, Iranmanesh M, Ghobakhloo M et al (2021) Applications of blockchain technology in sustainable manufacturing and supply chain management: A systematic review. Sustain 13. https://doi.org/10.3390/su13147870

Khee Pek C (2021) Agricultural Multifunctionality for Sustainable Development in Malaysia: a Contingent Valuation Method Approach. Malaysian J Sustain Agric 6:01–06. https://doi.org/10.26480/mysj.01.2022.01.06

Khurana S, Haleem A, Luthra S, Mannan B (2021) Evaluating critical factors to implement sustainable oriented innovation practices: an analysis of micro, small, and medium manufacturing enterprises. J Clean Prod 285:125377. https://doi.org/10.1016/j.jclepro.2020.125377

Khurshid A, Khan K (2021) How COVID-19 shock will drive the economy and climate? A data-driven approach to model and forecast. Environ Sci Pollut Res 28:2948–2958. https://doi.org/10.1007/s11356-020-09734-9

Li M, Yao-Ping Peng M, Nazar R, NgoziAdeleye B, Shang M, Waqas M (2022a) How does energy efficiency mitigate carbon emissions without reducing economic growth in post COVID-19 era. Front Energy Res 10:1–14. https://doi.org/10.3389/fenrg.2022.832189

Li S, Ye C, Ding Y, Song Y (2022b) Reliability Assessment of Renewable Power Systems Considering Thermally-Induced Incidents of Large-Scale Battery Energy Storage. IEEE Trans Power Syst. https://doi.org/10.1109/TPWRS.2022.3200952

Li C, Asim S, Khalid W, Ali MSE (2023a) What influences the climate entrepreneurship? Chinese-based evidence. Front Environ Sci 10:2560. https://doi.org/10.3389/FENVS.2022.1051992/BIBTEX

Li X, Wang H, Yang C (2023b) Driving mechanism of digital economy based on regulation algorithm for development of low-carbon industries. Sustain Energy Technol Assessments 55:102909. https://doi.org/10.1016/J.SETA.2022.102909

Lin Y, Wang Y, Fu XM (2020) Since January 2020 Elsevier has created a COVID-19 resource centre with free information in English and Mandarin on the novel coronavirus COVID- 19. The COVID-19 resource centre is hosted on Elsevier Connect, the company ’ s public news and information

Liu L, Li Z, Fu X, Liu X, Li Z, Zheng W (2022a) Impact of Power on Uneven Development: Evaluating Built-Up Area Changes in Chengdu Based on NPP-VIIRS Images (2015–2019). Land 11:489. https://doi.org/10.3390/LAND11040489

Liu S, Durani F, Syed QR, Haseeb M, Shamim J, Li Z (2022b) Exploring the dynamic relationship between energy efficiency, trade, economic growth, and CO2 emissions: evidence from novel Fourier ARDL approach. Front Environ Sci 10:971. https://doi.org/10.3389/FENVS.2022.945091/BIBTEX

Liu Z, Wang Y, Feng J (2022c) Vehicle-type strategies for manufacturer’s car sharing. Kybernetes ahead-of-print.https://doi.org/10.1108/K-11-2021-1095/FULL/XML

Ma X, Akhtar R, Akhtar A, Hashim RA, Sibt-e-Ali M (2022) Mediation effect of environmental performance in the relationship between green supply chain management practices, institutional pressures, and financial performance. Front Environ Sci 10:1196. https://doi.org/10.3389/FENVS.2022.972555/BIBTEX

Machado JAF, Santos Silva JMC (2019) Quantiles via moments. J Econom 213:145–173. https://doi.org/10.1016/J.JECONOM.2019.04.009

Magiri R, Gaundan S, Singh S, Pal S, Bakare A, Choongo K, Zindove T, Okello W, Mutwiri G, Iji PA (2022) The role of agricultural institutions in providing support towards sustainable rural development in south pacific island countries. J Agric Sci 14:104. https://doi.org/10.5539/JAS.V14N2P104

Martínez-Avila O, Llenas L, Ponsá S (2022) Sustainable polyhydroxyalkanoates production via solid-state fermentation: influence of the operational parameters and scaling up of the process. Food Bioprod Process 132:13–22. https://doi.org/10.1016/J.FBP.2021.12.002

Mishra S, Sinha A, Sharif A, Suki NM (2020) Dynamic linkages between tourism, transportation, growth and carbon emission in the USA: evidence from partial and multiple wavelet coherence. Curr Issues Tour 23:2733–2755. https://doi.org/10.1080/13683500.2019.1667965

Mngumi F, Shaorong S, Shair F, Waqas M (2022) Does green finance mitigate the effects of climate variability: role of renewable energy investment and infrastructure. Environ Sci Pollut Res 1:1–13. https://doi.org/10.1007/s11356-022-19839-y

Murshed M, Rashid S, Ulucak R, Dagar V, Rehman A, Alvarado R, Nathaniel SP (2022) Mitigating energy production-based carbon dioxide emissions in Argentina: the roles of renewable energy and economic globalization. Environ Sci Pollut Res 29:16939–16958. https://doi.org/10.1007/s11356-021-16867-y

Nosheen M, Iqbal J, Abbasi MA (2021) Do technological innovations promote green growth in the European Union? Environ Sci Pollut Res 28:21717–21729. https://doi.org/10.1007/S11356-020-11926-2/TABLES/15

Pedroni P (2004) Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom Theory 20:597–625. https://doi.org/10.1017/S0266466604203073

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Econom Rev 34:1089–1117. https://doi.org/10.1080/07474938.2014.956623

Pesaran MH (2008) Testing slope homogeneity in large panels [WWW Document]. URL https://www.sciencedirect.com/science/article/pii/S0304407607001224. Accessed 17 Sep 2022

Pesaran MH, Schuermann T, Weiner SM (2004) Modeling regional interdependences using a global error-correcting macroeconometric model. J Bus Econ Stat 22:129–162. https://doi.org/10.1198/073500104000000019

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346. https://doi.org/10.1093/BIOMET/75.2.335

Povitkina M, CarlssonJagers S, Matti S, Martinsson J (2021) Why are carbon taxes unfair? Disentangling public perceptions of fairness. Glob Environ Chang 70:102356. https://doi.org/10.1016/j.gloenvcha.2021.102356

Rehman A, Ma H, Ozturk I, Ulucak R (2022) Sustainable development and pollution: the effects of CO2 emission on population growth, food production, economic development, and energy consumption in Pakistan. Environ Sci Pollut Res 29:17319–17330. https://doi.org/10.1007/S11356-021-16998-2/METRICS

Sadiq M, Shinwari R, Usman M, Ozturk I, Maghyereh AI (2022) Linking nuclear energy, human development and carbon emission in BRICS region: Do external debt and financial globalization protect the environment? Nucl Eng Technol 54:3299–3309. https://doi.org/10.1016/J.NET.2022.03.024

Samour A, Baskaya MM, Tursoy T (2022) The impact of financial development and FDI on renewable energy in the UAE: a path towards sustainable development. Sustain 14:1208. https://doi.org/10.3390/su14031208

Sardianou E, Stauropoulou A, Evangelinos K, Nikolaou I (2021) A materiality analysis framework to assess sustainable development goals of banking sector through sustainability reports. Sustain Prod Consum 27:1775–1793. https://doi.org/10.1016/j.spc.2021.04.020

Sharif A, Afshan S, Chrea S, Amel A, Khan SAR (2020a) The role of tourism, transportation and globalization in testing environmental Kuznets curve in Malaysia: new insights from quantile ARDL approach. Environ Sci Pollut Res 27:25494–25509. https://doi.org/10.1007/S11356-020-08782-5/METRICS

Sharif A, Godil DI, Xu B, Sinha A, Rehman Khan SA, Jermsittiparsert K (2020) Revisiting the role of tourism and globalization in environmental degradation in China: Fresh insights from the quantile ARDL approach. J Clean Prod 272:122906. https://doi.org/10.1016/j.jclepro.2020.122906

Sharif A, Raza SA, Ozturk I, Afshan S (2019) The dynamic relationship of renewable and nonrenewable energy consumption with carbon emission: A global study with the application of heterogeneous panel estimations. Renew Energy 133:685–691. https://doi.org/10.1016/j.renene.2018.10.052

Sharif A, Saha S, Loganathan N (2017) Does tourism sustain economic growth? Wavelet-based evidence from the United States. Tour Anal 22:467–482. https://doi.org/10.3727/108354217X15023805452022

Sharif A, Saqib N, Dong K, Khan SAR (2022) Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: the moderating role of social globalisation. Sustain Dev 30:1934–1946. https://doi.org/10.1002/SD.2360

Si W, Lin W, Xu D, Luo Y, Han N (2022) Evaluation method of a new power system construction based on improved LSTM neural network. J Comput Methods Sci Eng 22:1819–1832. https://doi.org/10.3233/JCM-226445

Suki NM, Sharif A, Afshan S, Suki NM (2020) Revisiting the Environmental Kuznets Curve in Malaysia: the role of globalization in sustainable environment. J Clean Prod 264. https://doi.org/10.1016/j.jclepro.2020.121669

Syed QR, Bhowmik R, Adedoyin FF, Alola AA, Khalid N (2022) Do economic policy uncertainty and geopolitical risk surge CO2 emissions? New insights from panel quantile regression approach. Environ Sci Pollut Res 29:27845–27861. https://doi.org/10.1007/S11356-021-17707-9/FIGURES/10

Syed QR, Bouri E (2022a) Spillovers from global economic policy uncertainty and oil price volatility to the volatility of stock markets of oil importers and exporters. Environ Sci Pollut Res 29:15603–15613. https://doi.org/10.1007/S11356-021-16722-0/TABLES/6

Syed QR, Bouri E (2022) Impact of economic policy uncertainty on CO2 emissions in the US: Evidence from bootstrap ARDL approach. J Public Aff 22:e2595. https://doi.org/10.1002/PA.2595

Syed QR, Bouri E, Zafar RF, Adekoya OB (2021) Does geopolitical risk mitigate inbound tourism? Evidence from panel quantile regression. J. Public Aff 22:e2784. https://doi.org/10.1002/PA.2784

Tang YM, Chau KY, Fatima A, Waqas M (2022) Industry 4.0 technology and circular economy practices: business management strategies for environmental sustainability. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-19081-6

Tzankova Z (2020) Public policy spillovers from private energy governance: new opportunities for the political acceleration of renewable energy transitions. Energy Res Soc Sci 67:101504. https://doi.org/10.1016/j.erss.2020.101504

Wan Q, Miao X, Afshan S (2022) Dynamic effects of natural resource abundance, green financing, and government environmental concerns toward the sustainable environment in China. Resour Policy 79:102954. https://doi.org/10.1016/J.RESOURPOL.2022.102954

Wang P, Yu P, Huang L, Zhang Y (2022) An integrated technical, economic, and environmental framework for evaluating the rooftop photovoltaic potential of old residential buildings. J Environ Manage 317:115296. https://doi.org/10.1016/J.JENVMAN.2022.115296

Wang P, Yu P, Lu J, Zhang Y (2022) The mediation effect of land surface temperature in the relationship between land use-cover change and energy consumption under seasonal variations. J Clean Prod 340:130804. https://doi.org/10.1016/J.JCLEPRO.2022.130804

Wang Y, Wen X, Gu B, Gao F (2022) Power scheduling optimization method of wind-hydrogen integrated energy system based on the improved AUKF algorithm. Math 10:4207. https://doi.org/10.3390/MATH10224207

Wei R, Ayub B, Dagar V (2022) Environmental benefits from carbon tax in the Chinese carbon market: a roadmap to energy efficiency in the post-COVID-19 era. Front Energy Res 10:1–11. https://doi.org/10.3389/fenrg.2022.832578

Weimin Z, Sibt-e-Ali M, Tariq M, Dagar V, Khan MK (2022) Globalization toward environmental sustainability and electricity consumption to environmental degradation: does EKC inverted U-shaped hypothesis exist between squared economic growth and CO2 emissions in top globalized economies. Environ Sci Pollut Res 29:59974–59984. https://doi.org/10.1007/S11356-022-20192-3/METRICS

Westerlund J, Edgerton DL (2007) A panel bootstrap cointegration test. Econ Lett 97:185–190. https://doi.org/10.1016/j.econlet.2007.03.003

Wu B, Monfort A, Jin C, Shen X (2022) Substantial response or impression management? Compliance strategies for sustainable development responsibility in family firms. Technol Forecast Soc Change 174:121214. https://doi.org/10.1016/j.techfore.2021.121214

Xiang H, Chau KY, Iqbal W, Irfan M, Dagar V (2022) Determinants of social commerce usage and online impulse purchase: implications for business and digital revolution. Front Psychol 13:837042. https://doi.org/10.3389/fpsyg.2022.837042

Xiao H, Bao S, Li X, Tang H, Wu G, Zhou J (2022) The decision making method of financial institutions in industrial cluster upgrading based on interval-valued intuitionistic trapezoidal fuzzy number game matrix. J Comput Methods Sci Eng 22:997–1009. https://doi.org/10.3233/JCM-225986

Xu B, Sharif A, Shahbaz M, Dong K (2021) Have electric vehicles effectively addressed CO2 emissions? Analysis of eight leading countries using quantile-on-quantile regression approach. Sustain Prod Consum.https://doi.org/10.1016/j.spc.2021.03.002

Yin X, Ye C, Ding Y, Song Y (2023) Exploiting Internet data centers as energy prosumers in integrated electricity-heat system. IEEE Trans Smart Grid 14:167–182. https://doi.org/10.1109/TSG.2022.3197613

Zhang Y, Abbas M, Koura YH, Su Y, Iqbal W (2021) The impact trilemma of energy prices, taxation, and population on industrial and residential greenhouse gas emissions in Europe. Environ Sci Pollut Res 28:6913–6928. https://doi.org/10.1007/s11356-020-10618-1

Author information

Authors and Affiliations

Contributions

Waqar Ameer: conceptualization, data curation, methodology; Muhammad Sibt e Ali: writing—original draft, data curation; Fatima Farooq: visualization, supervision, editing; Bakhtawar Ayub: writing—review and editing; Muhammad Waqas: software, editing, supervision.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

The authors have declared that they have no known competing financial interests or personal relationships that seem to affect the work reported in this article. It is declared that researchers have no human participants, human data or human tissues.

Consent for publication

N/A.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Arshian Sharif

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ameer, W., Ali, M.S.e., Farooq, F. et al. Renewable energy electricity, environmental taxes, and sustainable development: empirical evidence from E7 economies. Environ Sci Pollut Res 31, 46178–46193 (2024). https://doi.org/10.1007/s11356-023-26930-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-26930-5