Abstract

This study aims to examine the association between economic growth and energy consumption (renewable and nonrenewable). The data was collected from 80 developing countries comprising countries from all income over the 1990 to 2020 period. On methodological aspects, this study identifies the diverse impact of variables at different quantiles through novel methods of movement quantile regression (MMQR) approach and long-run coefficient estimations through fully modified ordinary least squares, fixed effects ordinary least squares, and dynamic ordinary least squares. According to the primary findings, the growth hypothesis exists in developing countries as both nonrenewable energy and renewable energy impact economic growth positively in MMQR estimation (for renewable energy at all quintiles and nonrenewable energy at lower quantiles), whereas the feedback hypothesis exists in (Dumitrescu and Hurlin Econ Model 29(4):1450-1460, 2012) Granger causality approach. The findings exposed that the economic renewable and non-renewable energy consumption has a positive impact on economic growth in developing countries. Based on the results, we recommend that developing countries prioritize investments in renewable energy for their production and expansion. Moreover, the provision of tax exemptions, subsidies, and feed-in tariffs are the right policy options towards the encouragement of the renewable energy sector and ultimately for the growth of the developing countries.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Academic research in the domain of energy focuses on the energy consumption-economic growth relationship (Arouri et al., 2012; Gozgor et al. 2018; Khan et al. 2020; Lin & Benjamin 2018; Waheed et al. 2019; Xiang et al. 2021). Four basic hypotheses have been proposed in the literature to explain this association: conservation hypothesis, growth hypothesis, feedback hypothesis, and neutrality hypothesis. The growth hypothesis asserts that increasing consumption of energy drives economic growth. If there had been a one-way causal association between economic growth and energy use in a country, it shows the validity of the growth hypothesis. The conservation hypothesis states that as income rises, so does the energy use. There will be a one-way association between economic growth and energy use for this theory to be valid. According to this hypothesis, conservative energy policy does not impact economic growth (Chien et al. 2021a, b, c, d, e). A two-way causal association between energy use and economic growth validates the feedback hypothesis. According to this argument, economic growth will be slowed because of the conservative energy strategy. It is stressed that this reduction will negatively impact energy consumption. The neutrality hypothesis assumes either no or minimal effect of energy usage on economic growth. The theory asserts that conserving energy does not impact economic growth detrimentally (Baloch et al. 2021; Tuna & Tuna 2019).

The idea of sustainable development motivates scholars to focus on the link of economic growth with energy resources. Many economies have decided to save energy and increase foreign direct investment (FDI) and exports, making energy consumption studies more appealing. However, renewable energy is a crucial factor in such studies. Researchers and scholars have become more interested in studying how renewable energy affects economic growth as sustainable development has grown (Chien et al. 2021a, b, c, d, e; Omri et al. 2015). In recent years, clean energy sources have grown in importance in the global energy consumption mix as a result of the growing detrimental effects of climate change, favorable administration policies, and unpredictable energy prices that encourage renewable energy use. According to the IPCC (Special Report on Climate Change Mitigation and Renewable Energy Resources), the supply of energy services has resulted in significant increases in FDI and improvements in renewable energy could help achieve many important goals of sustainable development, including economic and social development, energy security, access to energy, and reduced health and environmental consequences, in addition to mitigating the consequences of climate change. The use of renewable energy increases economic development while preventing environmental degradation. Nonrenewable energy, on the other side, cannot maintain the quality of the environment in both developed and developing countries (Mohsin et al., 2021a, b). According to forecasts from the IEA (2018), the contribution of renewable in fulfilling the world’s energy needs will expand by 1/5th in the coming 5 years, reaching 12.4% in the year 2023 (Chen et al. 2020; Chien et al. 2021c).

The increasing trend in FDI in the country leads towards the high investment intention and put a positive impact on the economic growth (Chien et al., 2021a, b, c, d, e). Whether and to what extent of FDI, exports and population growth have detrimental impact on economic growth is critical for any country, particularly for developing countries. Although a lot of previous studies investigating the nexus between economic growth and consumption of energy have been conducted, the link between non-renewable and renewable energy and growth for emerging countries has received very little attention (Nawaz, et al. 2021a, b; Ito 2017). In fact, many developing countries have invested in renewable energy sources in the same way they do in the rest of the energy sector. As a result, worldwide investments in renewable resources are on the rise. Most countries that do not have sufficient fossil resources, such as China, India, Japan, and the USA, are attempting to fulfill their energy requirements by importing it from other countries and investing heavily in renewable energy. Investment in renewable energy resources led the way in emerging countries in 2019, leaving developed countries in the dust. As a result, China led the world in annual investment, capacity additions, and output in 2019. China also leads the world in PV solar, solar water heating, and wind energy capacity. Indonesia has bio-diesel potential, Turkey has geothermal energy potential, and Brazil has hydroelectric potential in the top row (Li et al. 2021; Syzdykova et al. 2021). The EIA report discusses the significance of green or alternative energy sources. According to the report, worldwide energy demand will increase by 48% by 2040 (Fu et al. 2021; Liu et al. 2022).

Considering the above facts, the current study explores the association of economic growth with renewable and non-renewable energy usage from 1990 to 2021 for a panel of 80 developing economies belonging to different income groups classified by the World Bank in 2022. The study’s originality arises mainly because the model is rarely used in combination, particularly in the role of economic factors such as FDI, exports, and population growth on economic growth in developing countries. The study’s key distinction identifies its contribution to the existing research on the subject. It uses panel data from 80 developing markets and disaggregated samples of low- and high-income countries. Previous research has either focused on developed countries (Apergis & Payne 2011; Cevik et al. 2021; Nawaz et al. 2021a, b; Salari et al. 2021; Tugcu et al. 2012), but the current study employs panel data comprising of the countries belonging to all four income groups and a wide range of geographical regions around the world and focuses on long-term economic growth. It is significant because the developing countries are working to have transitioned from traditional energy sources, which are primarily based on the fossil fuel use, towards renewable energy resources to contribute to international efforts to protect the environment and promote long-term economic development (Fu et al. 2021; Nawaz et al. 2021a, b). And last and more importantly, the study is novel in terms of its methodological contributions; i.e., the study employs the newly introduced method of movements quantile regression (MMQR) (Machado & Silva 2019) to estimate the said objective, which has various advantages as compared to employing traditional panel data estimation techniques (See Sect. 3 for details).

The current study contributes to the knowledge of existing literature related to renewable energy and economic growth, non-renewable energy and economic growth, FDI and economic growth, exports and economic growth, and population and economic growth. In addition, it is one of the first attempts that examine the joint impact of renewable energy, non-renewable energy, FDI, exports, and population growth on economic growth. In addition, the investigation of renewable energy, non-renewable energy, FDI, exports, and population growth on the economic growth in 80 developing countries is also a significant contribution to the existing literature. The basic purpose of the study is to examine all the developing countries, but due to data availability constraints, only 80 developing countries are examined in this study. In addition, the second purpose of the study is to examine the high economic growth countries among developing countries. Thus, the study selected the 80 countries producing high economic growth. Finally, the current article has also used the MMQR method that is also used by limited studies, and it is a new approach to investigate the association among variables. This technique is considered an effective technique when dealing with potential outliers, which can disrupt the data’s overall distribution. In addition, the MMQR allowed the “conditional heterogeneity of variance effects” to generate and affect outcomes by extracting dependent variables and permitting particular effects on individuals. Moreover, a study conducted by Ozcan and Ozturk (2019) investigated the renewable energy consumption on the economic growth and recommended that the future studies should also explore this area because the energy consumption and economic growth are frequently changing phenomena. In addition, Destek and Sinha (2020) examined the role of renewable and non-renewable energy on economic growth. They suggested that the upcoming articles should add other factors that influence economic growth. The present study fulfils this gap and adds the FDI, exports, and population growth factors to predict economic growth. Finally, a study by Ntanos et al. (2018) conducted a study on renewable energy and economic growth using European countries and recommended that future studies should add developing countries and this study fulfils this gap and examines the renewable energy impact on economic growth using 80 developing countries.

We organized the rest of the study subsequently: the next second section briefly reviews the relevant existing literature. The third section is about data and employs empirical methodology. Results and discussions are given in the fourth section. Finally, we conclude our study in the fifth section and recommend some worthy policies based on empirical findings.

Existing literature

Many components of sustainable development are seen to work in conjunction with renewable energy (Sari & Soytas 2004; Shair et al. 2021). As a result, sustainable development based on renewable energy sources is at the forefront of international policy. In keeping renewable energy consumption viable and agreeable to other social criteria of development, Bugaje (2006) emphasized considering the following:

-

• Suitable resource management to ensure environmental sustainability.

-

• Because of the disadvantaged rural communities, economic sustainability is achieved through service development and infrastructure that keeps affordability at the forefront.

-

• Ensure the impoverished benefit and the concerns and incomes of the women, legal rights for everyone, and the rights of children are all promoted and valued.

-

• Managerial sustainability is achieved through the insurance of the administrative capacity for the program implementation is available and would be expanded or sustained over time.

The literature on the energy use and GDP or economic growth relationship can be broken down into two categories (Taghizadeh-Hesary & Yoshino 2020; Mohsin et al. 2021a, b; Sun et al. 2020). The first thread analyzes the relationship between economic growth and energy use and validates different hypotheses. Among them, Antonakakis et al. (2017) examined the dynamic association between FDI, economic growth, and use of energy in 106 economies belonging to different income groups over the 1971 to 2011 period by applying the panel vector autoregressive model and its variants and found feedback hypothesis valid to be in these countries. Saidi et al. (2017) studied the causal nexus between economic growth and energy consumption and found bidirectional in 53 global economies from 1990 to 2014. The results of VECM showed that a bidirectional or feedback hypothesis was present between the consumption of energy and economic growth. Similarly, for India, applying a non-linear ARDL bound testing approach observed the feedback hypothesis between energy consumption and economic growth from 1960 to 2015. Coers and Sanders (2013) observed the feedback hypothesis for 30 OECD countries through the VECM approach. Hwang and Yoo (2014) examined the energy consumption-economic growth relationship in Indonesia from 1965 to 2006 through the VECM approach and observed the feedback hypothesis. Kyophilavong et al. (2015) for Thailand, Akkemik and Göksal (2012) for ASEAN, and Belke et al. (2011) for OECD countries validated the feedback hypothesis. In addition, the study by Wang et al. (2018) conducted the study on renewable energy and economic growth and exposed that renewable energy usage has a positive impact on the country's economic growth. Moreover, Chen et al. (2020) and Cevik et al. (2021) also investigated the association between economic growth and renewable energy and revealed that renewable energy usage has a positive linkage with the economic growth of the country.

Conservative hypothesis was observed for Malaysia in the study by Islam et al. (2013) from 1971 to 2009. Similarly, over the 1970 to 2003 period, Lise and Van Montfort (2007) observed a conservative hypothesis between economic growth and energy consumption in Turkey. Some earlier studies observed the growth hypothesis between energy consumption and economic growth like Destek and Sinha (2020) observed in OECD countries; Apergis and Payne (2009) in the Commonwealth of independent states, American countries; Tang et al. (2016) in Vietnam, and some studies found no causal association or neutrality hypothesis between consumption of energy and economic growth including Yildirim et al. (2012) for OECD countries; Azam et al. (2015) for ASEAN countries; T. Chang et al. (2013) for Asian countries; and Jafari et al. (2012) for Indonesia.

The second thread of the existing literature focuses on renewable energy use-economic growth relationships. Like energy consumption, the four hypotheses have been validated by different studies for renewable energy-growth nexus in developing and advanced countries. For instance, Inglesi-Lotz (2016) analyzed the renewable energy effects on growth in 4 OECD economies from 1990 to 2010 through fixed effect estimation and revealed that the use of renewable energy impacted economic development positively, a confirmation of the growth hypothesis. In addition, Yıldırım et al. (2019) conducted a study on the energy consumption and economic growth in BRICS countries and exposed that the energy consumption has a significant impact on the economic growth. Bowden and Payne (2010) studied how consumption of non-renewable and renewable energy, labor, and capital affected GDP in the USA over the 1949 to 2006 period through the multivariate model framework and Toda Yamamoto approach. Their results showed positive uni-directional causality from residential renewable energy and industrial use of non-renewable energy towards economic growth, which supported the growth hypothesis. Pao and Fu (2013) investigated the causal relationship of non-renewable energy consumption and renewable energy consumption with economic growth in Brazil over the 1980 to 2009 period within a production function framework that includes labor and capital. Their findings demonstrated that all variables had a long-term link. Furthermore, Granger causality tests support a one-way causal link of overall renewable energy with economic development supporting the growth hypothesis. While studying 38 countries with higher levels of renewable energy usage over the 1991 to 2012 period, Bhattacharya et al. (2016) analyzed how renewable energy affected economic growth through fully modified ordinary least squares (FMOLS) and dynamic ordinary least squares (DOLS) estimation. The growth hypothesis was found to exist in their study. Moreover, Cevik et al. (2021) conducted a study on renewable and non-renewable energy sources on the economic growth in the USA and exposed that both the energy consumption has a significant and positive role on the economic growth. Omri et al. (2015) studied the relation between non-renewable energy and renewable energy with economic growth in industrialized and underdeveloped countries over the 1990 to 2010 period and found that both kinds of energy exerted a positive influence on economic growth. Similarly, taking South Asian economies as case studies, Rahman and Velayutham (2020) estimated the non-renewable energy, renewable energy, and economic growth relationship from 1990 to 2014. According to the findings of FMOLS and DOLS, nonrenewable and renewable energy positively affected economic growth, confirming the growth hypothesis in South Asian countries. Moreover, Abbasi et al. (2020) conducted a study on the non-renewable energy impact on economic growth and exposed that non-renewable energy usage has a positive impact on the country's economic growth. In addition, a study by Asiedu et al. (2021) also investigated the association among the non-renewable energy usage and economic growth and revealed that the non-renewable energy usage has a positive linkage with the economic growth of the country.

Some of the studies found a feedback hypothesis between economic growth and the use of clean or nonrenewable energy. Among these studies, Apergis et al. (2010) estimated the causal relationship between economic growth, renewable, and nuclear energy consumption and over the 1984–2007 period in a panel of 19 emerging and developed economies. Their findings also reveal that nuclear energy usage had a detrimental influence on economic growth, but renewable energy consumption had a beneficial effect. Short-run causality test evident that feedback hypothesis between use of nuclear and renewable energy and growth was present. Asiedu et al. (2021) studied the association between renewable and non-renewable energy consumption and economic growth in European economies over the period 1990 to 2018. Granger causality analysis found a feedback hypothesis between economic growth and non-renewable and renewable energy (Soava et al., 2018), which scrutinized the data for European countries from 1995 to 2015 period to study the renewable energy growth nexus. According to the findings of FMOLS estimations, the growth hypothesis and Granger causality results feedback hypothesis existed in these economies. Saint Akadiri, Alola, Akadiri, and Alola (2019) applied ARDL model to the data of European countries’ panel spanning over 1995 to 2015 period to examine renewable energy growth hypothesis, and results of panel Granger causality indicated that bidirectional or feedback hypothesis existed in these economies. The feedback hypothesis was concluded by Kahia et al. (2016) in MENA countries and Long et al. (2015) for China. Moreover, Nawaz et al. (2021a, b) investigated the impact of renewable energy on economic growth and exposed that when the country produces more products, they consume more renewable energy; thus, the high renewable energy is an indication of high economic growth. In addition, Yao et al. (2019) also examined the renewable energy role on economic growth and indicated that the high renewable energy usage produces high production in the country, which means high consumption of renewable energy indicates high economic growth.

In continuation, some of the studies found a conservative hypothesis between the consumption of energy of both types and economic growth. Caraiani et al. (2015) studied renewable energy-economic growth nexus in 5 European economies over the 1980 to 2013 period, and the findings from the Engle-Granger causality method indicated the presence of the conservation hypothesis. Similarly, analyzing the data for Turkey by applying the Toda-Yamamoto approach and ARDL analysis (Ocal & Aslan, 2013) found that the conservation hypothesis is present between renewable energy use and growth. Destek and Aslan (2017) analyzed the performance of renewable and non-renewable energy on development in 17 developing economies over the 1980–2012 period and provided the evidence for different hypotheses for different economies, including conservative hypotheses for Peru, Portugal, and Egypt. Applying the vector auto-correction mechanism (VECM), Aneja et al. (2017) studied the relationship between economic growth and consumption of both energy types. It concluded the presence of a conservative hypothesis. In contrast, Payne (2011) analyzed the biomass energy-economic growth relationship in the USA within the multivariate framework of Toda Yamamoto and observed no causal association or neutrality hypothesis between biomass energy and economic growth. Alper and Oguz (2016) investigated the causality among renewable energy, labor, and capital for EU member economies from 1990 to 2009 through ARDL and found that the neutrality hypothesis was present for Cyprus, Hungary, Estonia, Slovenia, and Poland. Menegaki (2011) found the neutrality hypothesis existed for European countries (Salim & Rafiq 2012) for Africa and (Yildirim et al., 2012) for the USA.

In addition, Adedoyin et al. (2020a, b) present their arguments about the relationship between FDI, ICTs, air transportation, and energy and economic growth relevant to industry 4.0. The evidence for presenting study hypotheses was collected from the United States (US) from 1981 to 2017. The study implies that FDI has a positive relationship with economic growth. In economies where foreign investment increases, the economic practices can be run through industry 4.0 technologies that require a significant investment. So, economic growth accelerates. Raza et al. (2021) investigate the relationship between FDI and economic growth. The study sample comprised OECD countries for the period spanning from 1996 to 2013. The authors employed the fixed effect model and the generalized method of moments (GMM) estimator to analyze and find a positive relationship between FDI and economic growth. Kalaitzi and Cleeve (2018) identify the relationship between exports and economic growth. The information for exports and economic growth and their relationship was collected from UAE from 1981 to 2012. Unit root tests, the Johansen cointegration test, the multivariate Granger causality test, and a modified Wald test were employed to test the relationship. The research presented the outcome that exports positively impact economic growth, and there is a bidirectional causality relationship. Furuoka (2018) examines the relationship of exports with the country’s economic growth. A survey was conducted to Sub-Saharan Africa for the empirical analysis of the concerned factor relationship. An innovative econometric methodology was employed with the Fourier ADF, causality tests, and a rolling causality test method. The results showed a significant positive relationship between exports and economic growth.

A study was conducted by Azam et al. (2020) to test the validity of Malthusian and Kremer’s theories with the analysis of the relationship between population growth and economic growth in the developing economy of India. The autoregressive distributed lag approach was applied to test the data about the impacts of population growth on economic growth collected from India from 1980 to 2018. This empirical research confirms Malthusian and Kremer’s theories, meaning a significant positive relationship between population growth and economic growth in both short and long-term periods. Kuhe (2019) investigates the connection between population growth and economic growth. The study reveals that Nigeria was selected as a case study to analyze population growth and economic growth relationship, and time-series data was used from 1960 to 2015. A unit root test Dickey-Fuller generalized least squares, error correction mode, Engle-Granger cointegration test, fully modified least squares, and VAR Granger causality test were employed. This research found a positive relation between population growth and economic growth.

Research gap

The inconsistent results show that no clear conclusion exists on the renewable energy economic growth nexus. The findings are contradictory because of the difference in periods, techniques, and settings. Some articles employ traditional panel data approaches to study the renewable energy-growth nexus, i.e., various ordinary least squares, i.e., FMOLS, DOLS, Pedroni, and Kao Panel co-integration test and various types of time series estimations. To our knowledge, none of the recent studies about energy and particularly renewable energy growth nexus can be found that estimated this relationship by employing panel quantile regression techniques. Thus, to fill in the research gap, our study uses MMQR regression for the empirical estimation to conclude renewable energy and economic growth relationship because they outperform traditional approaches addressing distributional heterogeneity. Furthermore, according to Sharif et al. (2020), a quantile regression method can provide fascinating results concerning the relationship between two variables that are not normally revealed by OLS regression analysis.

Data and econometric methodology

In accordance with the research goal, GDP is the dependent variable and renewable energy is the primary explanatory variable that is taken in the model. Nonrenewable energy FDI, exports, and population growth have been taken as the control variables in the model. A balanced panel data set of 80 developing countries have been collected from the World Development Indicators (WDI). The basic purpose of the study is to examine all the developing countries, but due to data availability constraints, only 80 developing countries are examined in this study. Moreover, the current study has developed the groups of countries according to their income, i.e., lower middle income, low income, middle-, and high-income developing economies to eliminate the different economic condition effects on the results. In addition, the data is extracted over the period 1990 to 2020 because the researchers want to examine the latest years to expand the scope and significance of the study (a list of countries has been provided in the Appendix). Countries belonging to all income groups are selected to reveal the true picture of the issue in all groups of the developing countries. Economic growth is measured by GDP constant US$ (2015), FDI measured as the net inflows (% of GDP), exports is measured as the exports of goods and services (% of GDP), and population growth is measured as the annual percentage growth. The consumption of fossil fuels measures non-renewable energy as a per cent of the total energy consumption, and renewable energy consumption as the per cent of the consumption of total energy is the measure of renewable energy consumption in our study. This study has examined only five factors such as renewable energy consumption, non-renewable energy consumption, FDI, exports, and population growth because the basic motive of the study is to examine the renewable energy role in the economic growth and the relevant factors such as non-renewable energy consumption and production are also added in the study. The functional model of the study is specified as

where REN denotes renewable energy consumption, NREN stands for non-renewable energy consumption, FDI denotes foreign direct investment, EXP stands for exports, and PG denotes population growth.

The model in its econometric form is expressed as follows:

Heterogeneous panel estimation techniques

The present study applies three different types of methodologies established for panel research designs with heterogeneity to achieve consistent and reliable results, namely, the FE-OLS (fixed effects ordinary least squares), DOLS (dynamic ordinary least squares), and the FMOLS (fully modified ordinary least squares). The purpose of using different approaches is to draw comparisons and ensure internal consistency that can be attained when all three approaches reveal identical results. The FE-OLS estimation technique is based on Driscoll and Kraay’s standard errors that can produce accurate results when auto-correlation lasts for a fixed time and has cross-section dependency (CSD) of a specific level (Adebayo et al. 2022). Since the cross-sectional units present in the panel series differ in terms of their mean and co-integration equilibrium, Pedroni (2004) proposed the FM-OLS, which consists of an intercept for each cross-section individual and maintains a “heterogeneous correlation in error-terms” for each cross-section in the panel dataset. Furthermore, the DOLS technique proposed by Kao and Chiang (2001) is an enhanced approach for panel estimations. Panel DOLS executes significantly under the designs of short-run dynamic and can achieve an outstanding improvement in estimation accuracy over that of single-equation DOLS with even a modest number of cross-sectional units. It is a better estimation technique than FMOLS and FE-OLS, which are based on Monte-Carlo simulations in small panels. The FMOLS method provides consistent evaluations for small sample size and also provides a check for robustness of the results. In order to attain asymptotic competences, this method modifies least squares to explain effects of serial correlation and test for the endogeneity that result from the co-integrating relationships existence. Furthermore, D-OLS can deal effectively with endogeneity by extending differentials between lead and lagged data (Fareed et al. 2022).

Methods of moment quantile regression

It must be emphasized that the methodologies mentioned above compute linear correlations between model variables using variables mean, and therefore ignoring the conditional data distribution. The methods of quantile regressions for panel datasets, on the other hand, investigate associations by moving through different quantiles of the variables (Sarkodie & Strezov, 2019). Koenker and Hallock (2001) proposed the procedure of evaluating the coefficients computed from the quantiles asymmetries of the dependent variable and are simultaneously affected by the mean of the various explanatory variables. This strategy appears to be as effective when dealing with potential outliers, which can disrupt the data’s overall distribution (An et al. 2021), whilst this technique has the capability of producing consistent results even while conditional measures are determined to have minor or limited effects (Binder & Coad 2011). In addition, traditional quantile regressions cannot move across cross-sections at various levels of quantiles when computing, which results in an incorrect distribution of the dependent variable (Ike et al. 2020). Furthermore, the current work employs a novel estimate method known as “the method of moments quantile regression” (MMQR), which was proposed by Machado and Silva (2019). Quantile regression, as previously stated, is the least stable to outliers due to its inability to determine the heterogeneity that remains unobserved in all cross-sections of the panel data. In addition, it is notable that MMQR appears to work well with non-normal distributions. In contrast, it has the benefit of being applicable to non-linear models and being computationally much simpler, especially in models with multiple endogenous variables. The MMQR allowed the “conditional heterogeneity of variance effects” to generate and affect outcomes by extracting dependent variables and permitting particular effects on individuals. Typical quantile regressions by Koenker (2004) do not have this property because they compute by simply moving the averages around. Furthermore, when the data is categorized on the foundation of some individual-specific effects, MMQR is said to be more appropriate in the setting where variables have endogeneity qualities. This approach is efficient in case of non-linearity of the model (Aziz et al. 2020). Because MMQR can include a nonlinear model, it outperforms other nonlinear estimation techniques, such as the non-linear autoregressive distributed lag (NARDL) model that often explains non-linear properties exogenous parameters by not selecting the benchmark standards. Furthermore, because the parameters of variables are sensitive to their position within the distribution conditions, this methodology allows for asymmetry depending on location. Based on these findings, the MMQR appears to be more legitimate and robust, particularly in terms of the formation of asymmetrical nonlinear links and connections (Elbatanony et al., 2021), as well as addressing the challenges of heterogeneity and endogeneity (An et al. 2021); the result generated by MMQR, which provides structure quantiles, is intuitive and non-crossing. The current article has taken the 10% quantile because Eq. (3) describes the quantile evaluations that are conditional on a scale for a specific location \(Q_y(\delta!\ddot X{'}\mathrm i\mathrm t)\)

In the above equation, þ (ƛi + Ƶ΄it \(\psi\) > 0) = 1 is probability and (ἀ, F, ƛ, J)΄ are calculated on the bases of the parameters. (ἀi, ƛi), = 1 to N represents the distinct individual fixed effects, and Ƶ is the k vector of specified modules of Ẍ. Evident alterations/variations with j are as below:

Beyond time-period (t) and individuals (i), Ṻit and Ẍ΄it are identically scattered. Ṻit is momentum conditions (standardized) orthogonal to Ẍ΄it. Alternatively, we can write Eq. (3) as follows;

In Eq. (5), the vector of the descriptive variable is represented by Ẍ΄it, i.e., GDP, REN, NREN FDI, EXP, and PG. Qy (d| Ẍ΄it) is the distribution at Ẏit quantile, and PG is a constraint on the independent variable's position. Ẍ΄it. ἀi (\({{\delta}}\)) ≡ ἀi + ƛi q (\({{\delta}}\)), which is a scalar that shows \({{\delta}}\boldsymbol{^{\prime}}\) fixed effects of quantiles in separate i. q(\({\varvec{\delta}}\)) shows sample individual quantiles which are obtained by resolving the optimization;

ἠ0 (Ȑ) = (\(\delta -\) 1) ȐȊ (Ȑ less than 0) + TȐȊ (Ȑ greater than 0) denotes the estimated operator.

Empirical findings and discussions

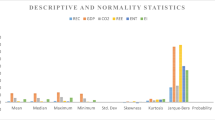

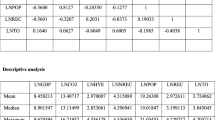

Table 1 reports the descriptive statistics analysis of all the series. The mean values of GDP, REN, NREN, and FDI are 617,008, 31.66, 64.96, and 80.744, respectively. The descriptive statistics also report all variables’ median, minimum, and maximum values.

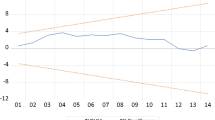

It is necessary to confirm certain characteristics of time series and cross-sectional variables before predicting long-run coefficients. For this purpose, the second generation CIPS test proposed by Pesaran (2007) have been applied. Unit root tests at a 1% significance level reveal that GDP, FDI, REN, EXP, PG, and NREN have the order of integration at level, i.e., I (1), as shown in Tables 2 and 3.

Table 3 presents the CD test findings, which reveal that at a 1% significance level, all series are substantially dependent across cross-sections.

Pedroni (2004) and Westerlund (2007) bootstrap cointegration tests strongly reject the null hypothesis (H0) of no cointegration, as seen in Tables 4 and 5, indicating strong favor for the existence of cointegration. This indicates that variables of the model are long-run cointegrated. So, we estimate long-run coefficients after confirming the long-run cointegration relationship.

However, it is critical to stress that our framework suffers from a CSD problem. Therefore, the panel estimation approach should incorporate efficient procedures in the presence of CSD to eliminate the distortions in size that may occur. To comply, our study uses a variety of heterogeneous panel estimate approaches (DOLS, FMOLS, FE-OLS, and MMQR) to address these concerns effectively. Table 6 summarizes the results of the FE-OLS, D-OLS, and FMOLS estimation procedures before going on to MMQR. In all three specifications, the significance, magnitude, and sign of coefficients are essentially or substantially the same. It supports the accuracy of the three models’ estimates. All the variables are statistically significant at a 1% level and affect our dependent variable either positively or negatively. Table 6 reveals that renewable energy boosts economic growth by 2.08 units in FMOLS, 1.35 units in D-OLS, and 2.07 units in FE-OLS. In contrast, nonrenewable energy consumption increases economic growth by 1.87 units in FMOLS, 1.76 units in DOLS, and 1.83 units in FE-OLS. This result validates the growth hypothesis, suggesting that a one-way association runs from energy use to economic growth is present in developing countries. It reveals that energy consumption (both nonrenewable and renewable) has an important role in economic growth in both direct and indirect ways by complementing the labor and capital in production processes. The results for both country and panel level studies (i.e., Saidi & Omri 2020; Destek & Sinha 2020; Chang & Fang 2022; Adedoyin et al. 2020a, b) are in line with our study for renewable energy and the findings of Okumus et al. (2021); Tugcu et al. (2012); Pegkas (2020); and Asif et al. (2021) for nonrenewable energy but the findings of Asiedu et al. (2021) and Abbasi et al. (2020) are in sharp contrast with our results. Therefore, the conclusions obtained to confirm the positive impact of the decisions that follow an increase in renewable energy consumption on economic growth. Many relevant programs and future decisions can be implemented. However, FDI leads to an increase in economic growth in all three model specifications. A unit increase in FDI leads to 0.982 units increase in FMOLS, 0.55 units in DOLS, and 0.436 in FE-OLS. In addition, a unit increase in EXP leads to 0.764 units increase in FMOLS, 1.902 units in DOLS, and 0.910 in FE-OLS. Finally, a unit increase in PG leads to 1.012 units increase in FMOLS, 0.281 units in DOLS, and 1.019 in FE-OLS. This is consistent with the notion that pollution can reduce output directly by lowering the productivity of man-made labor and capital. Hence, pollution acts like a negative externality. Consistent with the findings of previous studies (Borhan et al. 2012; Abdollahi 2020), there are lost working days due to health issues; the quality of industrial apparatuses deteriorates due to air pollution.

After estimating the long-run coefficient by FMOLS, FE-OLS, and DOLS techniques, now we proceed toward MMQR estimations. The estimated findings are reported in Table 7.

First of all, renewable energy is found to significantly affect GDP at all quantiles, i.e., (0.10–0.90), similar to the previous estimations. It indicates that a rise in the consumption of renewable energy helps countries grow substantially. However, the coefficient for nonrenewable energy is statistically significant and positive at lower quantiles ranging over (0.10–0.30) only, and at medium to higher quantiles ranging from 0.40 to 0.90, it becomes negative and insignificant. A possible reason for this result is that in many low-income economies, energy consumption is low compared to developed economies. These economies mostly rely on agriculture and do not mainly rely on energy resources for production activities (Asif et al. 2021). And last, unlike FMOLS, FE-OLS, and DOLS, FDI, EXP, and GDP are found to exert an insignificant impact on GDP in developing economies at all quantiles (0.10–0.90). The long-run co-integration connection indicates the presence of at least uni-directional granger causality. Therefore, towards the end of our empirical estimation, the Dumitrescu and Hurlin (2012) test for panel causality was employed to estimate the causal association among the study variables. Table 8 below provides us with the short-run findings of the panel causality test. A bidirectional causality between economic growth and renewable energy use and economic growth and nonrenewable energy use is evident from the results that confirm the feedback hypothesis between energy and economic growth. However, unidirectional causality between GDP and FDI, GDP and EXP, and GDP and PG are observed in the causality analysis.

Discussions

The results of the current article indicated that renewable energy usage has a positive impact on economic growth because high energy consumption results in increased production, which increases economic growth. This outcome is similar to the Ntanos et al. (2018) who also investigated that renewable energy usage has played a positive role in economic growth because it enhances the country’s production. This result is also matched with Ozcan and Ozturk (2019) who examined that the high usage of renewable energy increases production in the country that enhances economic growth. In addition, the results also indicated that non-renewable energy usage has a positive impact on economic growth because the high energy consumption results in high production that increases economic growth. This finding is in line with Long et al. (2015), who also investigated that non-renewable energy usage has played a positive role in economic growth because it enhances production. Moreover, this output is similar to Asiedu et al. (2021) who also examined that the high usage of non-renewable energy results in increased production that enhances economic growth. Finally, the results also revealed that the increased FDI has a positive impact on the country’s economy because the high FDI enhance the country capacity to produce and has a positive impact on economic growth. This output is matched with Ito (2017) who also investigated that the high FDI affect the country’s economic grooming. In addition, this result is also similar to the Nawaz et al. (2021a, b), who also revealed that the high FDI reduces the country’s economic growth.

The results indicated that FDI has a positive impact on economic growth. These results are in line with Sultanuzzaman et al. (2018), which show that the countries where policies are made and implemented to encourage foreign entities to invest enjoy progress in all the economic sectors related to human capital development and capital formation. So, it creates physical and human resources for the economy and let it get a high rate of growth. These results are also supported by Erdoğan et al. (2020), which indicates that FDI increase contributes to the financial resources of the companies within the country. With the increased financial resources, firm management improves, and business operations can be carried on effectively. Hence, individual firms’ economic performance contributes to the country’s economic growth. The results revealed that exports have a positive impact on economic growth. These results agree with Iqbal et al. (2022), which highlight that by encouraging exports from the country, improvement is brought in the productivity of factors of production. Thus, economic growth is accelerated with the improvement in the production performance of individual businesses. These results are also supported by Gizaw et al. (2022), which examine that with the rise in exports, the government and individual businesses can generate earnings in the foreign exchange, which they could use for the improvement of business practices. Hence, the increase in exports increases the country’s economic growth.

The results indicated that population growth has a positive impact on economic growth. These results match with Nkalu et al. (2019), which proclaim that human capital improvement depends on the country’s population growth. When the population growth is high, the country makes rapid economic growth. These results are also supported by Regmi and Rehman (2021), which stress the same notion that in the country where the population growth is high, the economic activities are greater in number, and there is fluency in the undertaking of these practices. So, the country is likely to progress in the overall production of goods and services. That is why the increase in production enhances economic growth.

Conclusion

In the current energy economics literature, the efficiency of renewable energy in balancing economic growth and environmental quality is becoming a hot topic. Therefore, the present study presented an analysis of the impact of renewable and nonrenewable energy on economic growth. Our study is based on 80 developing economies belonging to all four income groups, i.e., lower middle income, low income, middle-, and high-income developing economies. Panel data from 1990 to 2020 has been analyzed through FMOLS, DOLS, and FE-OLS estimations. Heterogeneous linear estimate approaches show variability in coefficient magnitude while remaining close to the size determined by the various specifications. To comply, we use the MMQR method to assess the diverse effects of the independent variable across a wide quantile range in the conditional allocation of GDP. Results show that using both types of energy positively affects economic growth in FMOLS, DOLS, FE-OLS, and MMQR. A positive effect of FDI on GDP has been observed in three estimations. The growth hypothesis exists at all quantiles in terms of renewable energy consumption and only at lower quantiles (0.10–0.30) for the consumption of non-renewable energy in developing countries. Thus, the current article concluded that the developing countries had used both renewable and non-renewable energy, which is the reason for their positive impact on economic growth. In addition, this study also concluded that the developing countries also produce high FDI, which is the reason for the positive impact on the economic growth.

Policy implications

Overall, our findings suggest that developing-country policymakers should prioritize investments in the renewable energy industry, which helps increase energy self-sufficiency and produce long-term employment and economic growth. Countries need to accept economic and technical support from wealthy countries to achieve this goal. On the other hand, governments in developing countries are required not only to construct renewable energy systems but also to expand them (such as wind, solar, small-scale biomass, and hydro plants) according to climatic and geographical conditions. However, fossil fuel taxes and incentives are also being used to boost the renewable energy sector (tax exemption, subsidies, feed-in tariffs). Currently, the most important policies for promoting renewable energy are subsidies for manufacturing and importing alternative sources of energy, provision of loans at lower rate of interest to start and adopt this technology, and permitting the exchange of agreements to produce electricity from these sources. Fixing tariffs and ensuring price assurances for clean and green power generation are also important aspects of these strategies. The current article also recommended to the regulators that they should establish policies related to reducing FDI and exports that significantly impacted the country’s economic growth. The study also suggested that the authorities should focus on renewable energy consumption to reduce non-renewable energy consumption, which leads to high economic growth.

Data availability

The data that support the findings of this study are attached.

References

Abbasi K, Jiao Z, Shahbaz M, Khan A (2020) Asymmetric impact of renewable and non-renewable energy on economic growth in Pakistan: new evidence from a nonlinear analysis. Energy Explor Exploit 38(5):1946–1967

Abdollahi H (2020) Investigating energy use, environment pollution, and economic growth in developing countries. Environ Clim Technol 24(1):275–293

Adebayo TS, Akadiri SS, Adedapo AT, Usman N (2022) Does interaction between technological innovation and natural resource rent impact environmental degradation in newly industrialized countries? New evidence from method of moments quantile regression. Environ Sci Pollut Res 29(2):3162–3169

Adedoyin FF, Bekun FV, Alola AA (2020a) Growth impact of transition from non-renewable to renewable energy in the EU: the role of research and development expenditure. Renew Energy 159:1139–1145

Adedoyin FF, Bekun FV, Driha OM, Balsalobre-Lorente D (2020b) The effects of air transportation, energy, ICT and FDI on economic growth in the industry 4.0 era: Evidence from the United States. Technol Forecast Soc Chang 160:1202–1218. https://doi.org/10.1016/j.techfore.2020.120297

Akkemik KA, Göksal K (2012) Energy consumption-GDP nexus: heterogeneous panel causality analysis. Energy Econ 34(4):865–873

Alper A, Oguz O (2016) The role of renewable energy consumption in economic growth: evidence from asymmetric causality. Renew Sustain Energy Rev 60:953–959

An H, Razzaq A, Haseeb M, Mihardjo LW (2021) The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the Belt and Road host countries: new evidence from Method of Moments Quantile Regression. Environ Sci Pollut Res 28(5):5254–5270

Aneja R, Banday UJ, Hasnat T, Koçoglu M (2017) Renewable and non-renewable energy consumption and economic growth: empirical evidence from panel error correction model. Jindal J Bus Res 6(1):76–85

Antonakakis N, Chatziantoniou I, Filis G (2017) Energy consumption, CO2 emissions, and economic growth: An ethical dilemma. Renew Sustain Energy Rev 68:808–824

Apergis N, Payne JE (2009) Energy consumption and economic growth: evidence from the Commonwealth of Independent States. Energy Econ 31(5):641–647

Apergis N, Payne JE (2011) On the causal dynamics between renewable and non-renewable energy consumption and economic growth in developed and developing countries. Energy Syst 2(3):299–312

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69(11):2255–2260

Arouri MEH, Youssef AB, M’henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy 45:342–349

Asiedu BA, Hassan AA, Bein MA (2021) Renewable energy, non-renewable energy, and economic growth: evidence from 26 European countries. Environ Sci Pollut Res 28(9):11119–11128

Asif M, Bashir S, Khan S (2021) Impact of non-renewable and renewable energy consumption on economic growth: evidence from income and regional groups of countries. Environ Sci Pollut Res 28(29):38764–38773

Azam M, Khan AQ, Bakhtyar B, Emirullah C (2015) The causal relationship between energy consumption and economic growth in the ASEAN-5 countries. Renew Sustain Energy Rev 47:732–745

Azam M, Khan HN, Khan F (2020) Testing Malthusian’s and Kremer’s population theories in developing economy. Int J Soc Econ 47(4):523–538. https://doi.org/10.1108/IJSE-08-2019-0496

Aziz N, Mihardjo LW, Sharif A, Jermsittiparsert K (2020) The role of tourism and renewable energy in testing the environmental Kuznets curve in the BRICS countries: fresh evidence from methods of moments quantile regression. Environ Sci Pollut Res 27(31):39427–39441

Baloch ZA, Tan Q, Kamran HW, Nawaz MA, Albashar G, Hameed J (2021) A multi-perspective assessment approach of renewable energy production: policy perspective analysis. Environ Dev Sustain 1-29. https://doi.org/10.1007/s10668-021-01524-8

Belke A, Dobnik F, Dreger C (2011) Energy consumption and economic growth: new insights into the cointegration relationship. Energy Econ 33(5):782–789

Bhattacharya M, Paramati SR, Ozturk I, Bhattacharya S (2016) The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl Energy 162:733–741

Binder M, Coad A (2011) From average Joe’s happiness to miserable Jane and cheerful John: using quantile regressions to analyze the full subjective well-being distribution. J Econ Behav Organ 79(3):275–290

Borhan H, Ahmed EM, Hitam M (2012) The impact of CO2 on economic growth in ASEAN 8. Procedia Soc Behav Sci 35:389–397

Bowden N, Payne JE (2010) Sectoral analysis of the causal relationship between renewable and non-renewable energy consumption and real output in the US. Energy Sources Part B 5(4):400–408

Bugaje IM (2006) Renewable energy for sustainable development in Africa: a review. Renew Sustain Energy Rev 10(6):603–612

Caraiani C, Lungu CI, Dascălu C (2015) Energy consumption and GDP causality: a three-step analysis for emerging European countries. Renew Sustain Energy Rev 44:198–210

Cevik EI, Yıldırım DÇ, Dibooglu S (2021) Renewable and non-renewable energy consumption and economic growth in the US: a Markov-switching VAR analysis. Energy Environ 32(3):519–541

Chang C-L, Fang M (2022) Renewable energy-led growth hypothesis: new insights from BRICS and N-11 economies. Renew Energy

Chang T, Chu H-P, Chen W-Y (2013) Energy consumption and economic growth in 12 Asian countries: panel data analysis. Appl Econ Lett 20(3):282–287

Chen C, Pinar M, Stengos T (2020) Renewable energy consumption and economic growth nexus: Evidence from a threshold model. Energy Policy 139:111295

Chien F, Hsu C-C, Zhang Y, Vu HM, Nawaz MA (2021a) Unlocking the role of energy poverty and its impacts on financial growth of household: is there any economic concern. Environ Sci Pollut Res 1-14. https://doi.org/10.1007/s11356-021-16649-6

Chien F, Kamran HW, Nawaz MA, Thach NN, Long PD, Baloch ZA (2021b) Assessing the prioritization of barriers toward green innovation: small and medium enterprises Nexus. Environ Dev Sustain 1-31. https://doi.org/10.1007/s10668-021-01513-x

Chien F, Pantamee AA, Hussain MS, Chupradit S, Nawaz MA, Mohsin M (2021c) Nexus between financial innovation and bankruptcy: evidence from information, communication and technology (ict) sector. Singap Econ Rev 1–22

Chien F, Sadiq M, Kamran HW, Nawaz MA, Hussain MS, Raza M (2021d) Co-movement of energy prices and stock market return: environmental wavelet nexus of COVID-19 pandemic from the USA, Europe, and China. Environ Sci Pollution Res 1-15. https://doi.org/10.1007/s11356-021-12938-2

Chien F, Sadiq M, Nawaz MA, Hussain MS, Tran TD, Le Thanh T (2021e) A step toward reducing air pollution in top Asian economies: the role of green energy, eco-innovation, and environmental taxes. J Environ Manage 297. https://doi.org/10.1016/j.jenvman.2021e.113420

Coers R, Sanders M (2013) The energy–GDP nexus; addressing an old question with new methods. Energy Econ 36:708–715

Destek MA, Aslan A (2017) Renewable and non-renewable energy consumption and economic growth in emerging economies: evidence from bootstrap panel causality. Renew Energy 111:757–763

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic co-operation and development countries. J Clean Prod 242:118–228

Dumitrescu E-I, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460

Elbatanony M, Attiaoui I, Ali IMA, Nasser N, Tarchoun M (2021) The environmental impact of remittance inflows in developing countries: evidence from method of moments quantile regression. Environ Sci Pollut Res 28(35):48222–48235

Erdoğan S, Yıldırım DÇ, Gedikli A (2020) Natural resource abundance, financial development and economic growth: an investigation on Next-11 countries. Resour Policy 65:1015–1029. https://doi.org/10.1016/j.resourpol.2019.101559

Fareed Z, Rehman MA, Adebayo TS, Wang Y, Ahmad M, Shahzad F (2022) Financial inclusion and the environmental deterioration in Eurozone: the moderating role of innovation activity. Technol Soc 1–14

Fu Q, Álvarez-Otero S, Sial MS, Comite U, Zheng P, Samad S, Oláh J (2021) Impact of renewable energy on economic growth and CO2 emissions—evidence from BRICS countries. Processes 9(8):1281

Furuoka F (2018) Exports and economic growth in Sub-Saharan Africa: new insights from innovative econometric methods. J Int Trade Econ Dev 27(7):830–855. https://doi.org/10.1080/09638199.2018.1455890

Gizaw N, Abafita J, Merra TM (2022) Impact of coffee exports on economic growth in Ethiopia; An empirical investigation. Cogent Econ Finance 10(1):2041260. https://doi.org/10.1080/23322039.2022.2041260

Gozgor G, Lau CKM, Lu Z (2018) Energy consumption and economic growth: new evidence from the OECD countries. Energy 153:27–34

Hwang J-H, Yoo S-H (2014) Energy consumption, CO2 emissions, and economic growth: evidence from Indonesia. Qual Quant 48(1):63–73

IEA (2018) RENEWABLES. from https://www.iea.org/fuels-and-technologies/renewables

Ike GN, Usman O, Sarkodie SA (2020) Testing the role of oil production in the environmental Kuznets curve of oil producing countries: new insights from Method of Moments Quantile Regression. Sci Total Environ 711:135–148

Inglesi-Lotz R (2016) The impact of renewable energy consumption to economic growth: a panel data application. Energy Econ 53:58–63

Iqbal A, Tang X, Rasool SF (2022) Investigating the nexus between CO2 emissions, renewable energy consumption, FDI, exports and economic growth: evidence from BRICS countries. Environ Dev Sustain 9:1–30. https://doi.org/10.1007/s10668-022-02128-6

Islam F, Shahbaz M, Ahmed AU, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model 30:435–441

Ito K (2017) CO2 emissions, renewable and non-renewable energy consumption, and economic growth: evidence from panel data for developing countries. Int Econ 151:1–6

Jafari Y, Othman J, Nor AHSM (2012) Energy consumption, economic growth and environmental pollutants in Indonesia. J Policy Model 34(6):879–889

Kahia M, Aïssa MSB, Charfeddine L (2016) Impact of renewable and non-renewable energy consumption on economic growth: new evidence from the MENA Net Oil Exporting Countries (NOECs). Energy 116:102–115

Kalaitzi AS, Cleeve E (2018) Export-led growth in the UAE: multivariate causality between primary exports, manufactured exports and economic growth. Eurasian Bus Rev 8(3):341–365. https://doi.org/10.1007/s40821-017-0089-1

Kao C, Chiang M-H (2001) On the estimation and inference of a cointegrated regression in panel data Nonstationary panels, panel cointegration, and dynamic panels: Emerald Group Publishing Limited

Khan MK, Khan MI, Rehan M (2020) The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financial Innov 6(1):1–13

Koenker R (2004) Quantile regression for longitudinal data. J Multivar Anal 91(1):74–89

Koenker R, Hallock KF (2001) Quantile regression. J Econ Perspect 15(4):143–156

Kuhe DA (2019) The impact of population growth on economic growth and development in Nigeria: an econometric analysis. Mediterr J Basic Appl Sci 3(3):100–111

Kyophilavong P, Shahbaz M, Anwar S, Masood S (2015) The energy-growth nexus in Thailand: does trade openness boost up energy consumption? Renew Sustain Energy Rev 46:265–274

Li W, Chien F, Hsu C-C, Zhang Y, Nawaz MA, Iqbal S, Mohsin M (2021) Nexus between energy poverty and energy efficiency: estimating the long-run dynamics. Resour Policy 72. https://doi.org/10.1016/j.resourpol.2021.102063

Lin B, Benjamin IN (2018) Causal relationships between energy consumption, foreign direct investment and economic growth for MINT: Evidence from panel dynamic ordinary least square models. J Clean Prod 197:708–720

Lise W, Van Montfort K (2007) Energy consumption and GDP in Turkey: Is there a co-integration relationship? Energy Econ 29(6):1166–1178

Liu Z, Lan J, Chien F, Sadiq M, Nawaz MA (2022) Role of tourism development in environmental degradation: a step towards emission reduction. J Environ Manage 303. https://doi.org/10.1016/j.jenvman.2021.114078

Long X, Naminse EY, Du J, Zhuang J (2015) Nonrenewable energy, renewable energy, carbon dioxide emissions and economic growth in China from 1952 to 2012. Renew Sustain Energy Rev 52:680–688

Machado JA, Silva JS (2019) Quantiles via moments. J Econom 213(1):145–173

Menegaki AN (2011) Growth and renewable energy in Europe: a random effect model with evidence for neutrality hypothesis. Energy Econ 33(2):257–263

Mohsin M, Hanif I, Taghizadeh-Hesary F, Abbas Q, Iqbal W (2021a) Nexus between energy efficiency and electricity reforms: a DEA-based way forward for clean power development. Energy Policy 149:112052

Mohsin M, Kamran HW, Nawaz MA, Hussain MS, Dahri AS (2021b) Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies. J Environ Manage 284:111999

Nawaz MA, Hussain MS, Kamran HW, Ehsanullah S, Maheen R, Shair F (2021a) Trilemma association of energy consumption, carbon emission, and economic growth of BRICS and OECD regions: quantile regression estimation. Environ Sci Pollut Res 28(13):16014–16028

Nawaz MA, Seshadri U, Kumar P, Aqdas R, Patwary AK, Riaz M (2021b) Nexus between green finance and climate change mitigation in N-11 and BRICS countries: empirical estimation through difference in differences (DID) approach. Environ Sci Pollut Res 28(6):6504–6519. https://doi.org/10.1007/s11356-020-10920-y

Nkalu CN, Edeme RK, Nchege J, Arazu OW (2019) Rural-urban population growth, economic growth and urban agglomeration in sub-Saharan Africa: what does Williamson-Kuznets hypothesis say? J Asian Afr Stud 54(8):1247–1261. https://doi.org/10.1177/0021909619865997

Ntanos S, Skordoulis M, Kyriakopoulos G, Arabatzis G, Chalikias M, Galatsidas S, . . . Katsarou A (2018) Renewable energy and economic growth: Evidence from European countries. Sustainability, 10(8):2626-2639

Ocal O, Aslan A (2013) Renewable energy consumption–economic growth nexus in Turkey. Renew Sustain Energy Rev 28:494–499

Okumus I, Guzel AE, Destek MA (2021) Renewable, non-renewable energy consumption and economic growth nexus in G7: fresh evidence from CS-ARDL. Environ Sci Pollut Res 28(40):56595–56605

Omri A, Mabrouk NB, Sassi-Tmar A (2015) Modeling the causal linkages between nuclear energy, renewable energy and economic growth in developed and developing countries. Renew Sustain Energy Rev 42:1012–1022

Ozcan B, Ozturk I (2019) Renewable energy consumption-economic growth nexus in emerging countries: a bootstrap panel causality test. Renew Sustain Energy Rev 104:30–37

Pao H-T, Fu H-C (2013) The causal relationship between energy resources and economic growth in Brazil. Energy Policy 61:793–801

Payne J (2011) On biomass energy consumption and real output in the US. Energy Sources Part B 6(1):47–52

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economet Theor 20(3):597–625

Pegkas P (2020) The impact of renewable and non-renewable energy consumption on economic growth: the case of Greece. Int J Sustain Energ 39(4):380–395

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22(2):265–312

Rahman MM, Velayutham E (2020) Renewable and non-renewable energy consumption-economic growth nexus: new evidence from South Asia. Renew Energy 147:399–408

Raza SA, Shah N, Arif I (2021) Relationship between FDI and economic growth in the presence of good governance system: evidence from OECD Countries. Glob Bus Rev 22(6):1471–1489

Regmi K, Rehman A (2021) Do carbon emissions impact Nepal’s population growth, energy utilization, and economic progress? Evidence from long-and short-run analyses. Environ Sci Pollut Res 28(39):55465–55475. https://doi.org/10.1007/s11356-021-14546-6

Saidi K, Omri A (2020) The impact of renewable energy on carbon emissions and economic growth in 15 major renewable energy-consuming countries. Environ Res 186:109567

Saidi K, Rahman MM, Amamri M (2017) The causal nexus between economic growth and energy consumption: New evidence from global panel of 53 countries. Sustain Cities Soc 33:45–56

Saint Akadiri S, Alola AA, Akadiri AC, Alola UV (2019) Renewable energy consumption in EU-28 countries: policy toward pollution mitigation and economic sustainability. Energy Policy 132:803–810

Salari M, Kelly I, Doytch N, Javid RJ (2021) Economic growth and renewable and non-renewable energy consumption: evidence from the US states. Renew Energy 178:50–65

Salim RA, Rafiq S (2012) Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Econ 34(4):1051–1057

Sari R, Soytas U (2004) Disaggregate energy consumption, employment and income in Turkey. Energy Econ 26(3):335–344

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Shair F, Shaorong S, Kamran HW, Hussain MS, Nawaz MA (2021) Assessing the efficiency and total factor productivity growth of the banking industry: do environmental concerns matters? Environ Sci Pollut Res 28(16):20822–20838

Sharif A, Mishra S, Sinha A, Jiao Z, Shahbaz M, Afshan S (2020) The renewable energy consumption-environmental degradation nexus in Top-10 polluted countries: fresh insights from quantile-on-quantile regression approach. Renew Energy 150:670–690

Soava G, Mehedintu A, Sterpu M, Raduteanu M (2018) Impact of renewable energy consumption on economic growth: evidence from European Union countries. Technol Econ Dev Econ 24(3):914–932

Sultanuzzaman MR, Fan H, Akash M, Wang B, Shakij USM (2018) The role of FDI inflows and export on economic growth in Sri Lanka: an ARDL approach. Cogent Econ Finance 6(1):151–164. https://doi.org/10.1080/23322039.2018.1518116

Sun H, Awan RU, Nawaz MA, Mohsin M, Rasheed AK, Iqbal N (2020) Assessing the socio-economic viability of solar commercialization and electrification in south Asian countries. Environ Dev Sustain 1-23. https://doi.org/10.1007/s10668-020-01038-9

Syzdykova A, Abubakirova A, Erdal FB, Saparova A, Zhetibayev Z (2021) Analysis of the relationship between renewable energy and economic growth in selected developing countries. Int J Energy Econ Policy 11(1):110

Taghizadeh-Hesary F, Yoshino N (2020) Sustainable solutions for green financing and investment in renewable energy projects. Energies 13(4):788

Tang CF, Tan BW, Ozturk I (2016) Energy consumption and economic growth in Vietnam. Renew Sustain Energy Rev 54:1506–1514

Tugcu CT, Ozturk I, Aslan A (2012) Renewable and non-renewable energy consumption and economic growth relationship revisited: evidence from G7 countries. Energy Econ 34(6):1942–1950

Tuna G, Tuna VE (2019) The asymmetric causal relationship between renewable and NON-RENEWABLE energy consumption and economic growth in the ASEAN-5 countries. Resour Policy 62:114–124

Waheed R, Sarwar S, Wei C (2019) The survey of economic growth, energy consumption and carbon emission. Energy Rep 5:1103–1115

Wang Z, Zhang B, Wang B (2018) Renewable energy consumption, economic growth and human development index in Pakistan: evidence form simultaneous equation model. J Clean Prod 184:1081–1090

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):709–748

Xiang H, Ch P, Nawaz MA, Chupradit S, Fatima A, Sadiq M (2021) Integration and economic viability of fueling the future with green hydrogen: an integration of its determinants from renewable economics. Int J Hydrogen Energy 46(77):38145–38162. https://doi.org/10.1016/j.ijhydene.2021.09.067

Yao S, Zhang S, Zhang X (2019) Renewable energy, carbon emission and economic growth: a revised environmental Kuznets Curve perspective. J Clean Prod 235:1338–1352

Yıldırım DÇ, Yıldırım S, Demirtas I (2019) Investigating energy consumption and economic growth for BRICS-T countries. World J Sci Technol Sustain Dev 16(4):184–195. https://doi.org/10.1108/WJSTSD-12-2018-0063

Yildirim E, Saraç Ş, Aslan A (2012) Energy consumption and economic growth in the USA: Evidence from renewable energy. Renew Sustain Energy Rev 16(9):6770–6774

Funding

This paper is funded by Van Lang University, Vietnam.

Author information

Authors and Affiliations

Contributions

Vu Minh Hieu: writing — original draft, writing — review and editing, supervision. Nguyen Hong Mai: conceptualization, data curation, methodology, visualization.

Corresponding author

Ethics declarations

Ethical approval

The authors declare that they have no known competing financial interests or personal relationships that seem to affect the work reported in this article.

Consent to participate

We declare that we have no human participants, human data, or human tissues.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Table

9.

Rights and permissions

About this article

Cite this article

Hieu, V.M., Mai, N.H. Impact of renewable energy on economic growth? Novel evidence from developing countries through MMQR estimations. Environ Sci Pollut Res 30, 578–593 (2023). https://doi.org/10.1007/s11356-022-21956-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21956-7