Abstract

With the expansion of urbanization, we are witnessing the growing uncertainty in municipal food demand leading to an increase in urban waste. With the motive of producing organic fertilizers and conserving the environment, expired food can be collected and recycled. This study examines the hypothesis that leasing recycling facilities from peri-urban areas, due to the ban on reproduction operations in the city centers, can manage the recycling system participants’ relationship and enhance sustainability in urban communities. The problem has been investigated under two separate sources of uncertainty, namely, quality and capacity. In the first scenario, a recycling system consisting of a commercial food service located in urban areas, a food waste collection agency, and a suburban fertilizer factory is optimized, in which the commercial food service leases the fertilizer factory’s facilities for recycling operations. In the second scenario, the two factories’ relationship, in which the first factory can rent the second factory’s facilities in case of capacity shortage, is managed through hybrid contracts and mathematical programming models. The results show that the whole system optimization and Pareto Improvement results for all members are guaranteed under proposed hybrid contracts. These conclusions can help food recycling system managers have a better relationship with other players in their supply chains and enhance their credibility for caring about the environment, social concerns, and government compliance.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

World’s population in urban areas has dramatically increased over the last 50 years (Saborido and Alba 2020). Although urban life is an important subject in economic growth and social modernization (Al-Mulali et al. 2012), it is also a major factor in producing several kinds of pollutants which may arouse a lot of environmental problems such as resource scarcity (Wu and Tan 2012), excessive energy consumption (Lin and Zhu 2021; Chen and Zhou 2021), greenhouse gas emissions (Muhammad et al. 2020), global warming, and climate change. For instance, the increase in the consumption of clean water (Liu et al. 2020; Ma et al. 2022), the increase in emission of carbon dioxide in urban areas, and the increase in the generation of household waste are all considered as some results of dramatic growth in the urbanization (Zhang and Chen 2021).

The subject of municipal household waste, especially food waste, is one of the most significant outcomes of civilization (Sheng et al. 2021), which has caused various environmental problems today (Howe and Wheeler 1999). At present, household waste and especially food waste constitute a major and significant part of solid pollutants and its percentage is increasing annually (Wang et al. 2018b). For example, food is the largest source of solid pollutant waste in the United States, and failure to recycle it may have devastating effects on the environment and social satisfaction (Pai et al. 2019; Balsalobre-Lorente et al. 2022). Unrecycled food waste is a major cause of methane emissions from the surface of landfills, which will eventually lead to contamination of surface water as well as groundwater (Bulak and Kucukvar 2022; Ikhlayel and Nguyen 2017).

Regarding the truth that reducing food waste is the 3rd of 100 solutions to prevent climate change, it seems necessary for city managers and planners to think about municipal waste and ways of recycling it such as producing animal feed or organic fertilizers (Cheng et al. 2021).

Another issue that needs to be addressed is the fact that chemical fertilizers are currently monopolized in the field of agriculture. Although about 50% of agricultural materials use chemical fertilizers, there is a general concern in the agricultural industry to reduce the use of excessive and inappropriate amounts of chemicals in non-organic fertilizers (Fernández-Delgado et al. 2022; Chehade and Dincer 2021). One of the benefits of using natural substances is to regulate the carbon level of the soil which prevents harming plants (Sharma et al. 2019), so it seems necessary to replace chemical and harmful fertilizers with natural and organic substances (Li et al. 2022; Aryal et al., 2021).

Numerous studies (Campuzano and González-Martínez 2017; Fernández-Delgado et al. 2020) can be found in the literature that emphasizes the possibility of producing natural and organic fertilizers from urban food waste. They believe that this urban waste should not be injected directly into the soil due to the toxic particles it may contain, so it must be detoxified through modern technologies so as not to cause any damage to the soil and plants (Bloem et al. 2017). There are also various articles in the literature, such as (Levis et al. 2010; Pai et al. 2019), that discuss appropriate technologies, trained personnel, distinct collection or transportation equipment, modern recycling halls, and up-to-date reproduction facilities with sufficient capacity to produce natural fertilizers from municipal food waste.

This study deals with the issue of urban food recycling systems, and the environmentally friendly transformation of municipal organic waste into natural fertilizers through hybrid contracts such as Quantity Flexibility (QF), Single Cost-Sharing (SCS), Two-Way Cost-Sharing (TWCS), and Option Contract as well as mathematical programming models. Besides, to deal with possible uncertainties, the problem has been investigated in two separate scenarios. In the first scenario, the collected waste quality, and in the second scenario, the recycling capacity is assumed to be uncertain with specific probability distribution functions. In addition, in different countries, there are some governmental laws and regulations prohibiting manufacturing activities in urban areas to prevent air, water, and noise pollution in residential zones. Therefore, in this study, the commercial food service, which is normally supposed to be located in the city centers, is forced to rent reproduction facilities from fertilizer factories in the suburbs.

While recycling food waste is technologically possible and profitable, our observations reveal a large amount of disposal of not-recycled food waste especially in megacities in developing countries. In some cases, using/selling spoiled foods is also reported which is illegal and harmful to human health. While the creation of some food waste is inevitable due to urbanization, it is possible to recycle them to produce organic fertilizers. In this way, we are able to avoid using chemical fertilizers, replace them with organic fertilizers, and make the planet greener. We realized that there are some managerial and planning obstacles in recycling food waste in urban areas; the most important is the issue of coordination between players in the reverse logistics system. This problem motivates us to analyze and optimize the reverse operations of a food waste recycling system. This paper seeks to achieve the following aims:

-

Collecting and recycling municipal food waste, which is increasingly damaging the environment due to the expansion of urbanization.

-

Preventing the sale of expired food in cafes, hotels, fast foods, etc. to control the spread of disease transmission

-

Replacing chemical fertilizers which are harmful to soil and agricultural products with natural and organic fertilizers

-

Creating social satisfaction and following the governmental laws and environmentally friendly restrictions on not carrying out recycling activities in the city by renting remanufacturing facilities from suburbs

-

Helping recycling system managers to create better collaboration between channel participants and increase the whole system’s profitability.

The remaining of the research is organized in this way: in the second part, a research background review is conducted, in the third part, the problem under study is described in all its details, the fourth part is related to mathematical modeling and solving them, and the fifth and sixth sections are devoted to the discussion of numerical results and conclusions, respectively.

Literature review

This research is related to three research areas in the literature, namely game theory and waste recycling, channel optimization using supply contracts, and reverse/closed-loop recycling systems, which will be reviewed in the following.

Game theory and waste recycling

Beheshti et al. (2022) examined a closed-chain system in which a commercial enterprise, through a waste collection agency, collects expired food from agricultural sales centers. In their research, due to governmental restrictions on not carrying out recycling activities in the city, the commercial enterprise is obliged to rent production facilities in suburban areas. They also used a new QF contract to optimize the profits of the entire system and individual components by considering two separate modes for procurement time. Mak et al. (2021) aimed to gather information that might change corporate recycling behavior. By designing a questionnaire and conducting a survey on food waste management from various industries such as hotels, restaurants, and cafes in Hong Kong and Malaysia, they analyzed the issue of changing recycling behavior after clearing the information. Their experiments showed that in Malaysia, the most important factors that affect the recycling behavior of food waste producers are transportation status, infrastructures, and rewards or managerial motivations, respectively. Siddiqui et al. (2021) in their research raised the issue of producing liquid fertilizers and poultry feed from food waste. They collected and tested expired food from relevant agencies such as restaurants, hotels, cafes, and leisure centers. Their research showed that feed containers produced through food waste generally contain 19% protein, with an acceptable range of 15 to 23% in the National Research Council. Zhu et al. (2020) by using mathematical modeling and theory algorithms based on simulated analysis evaluated the interactions and behaviors between food waste recycling channel members through dynamic systems and game theory approaches. To avoid optimistic behavior and unfavorable rules that may arise due to fixed penalties in the organization, they designed and proposed a penalty scheme with random inspection in the form of a three-player game in the field of municipal food waste management. They then tested both fixed and random penalty schemes to find the impact of important factors on members' decisions. Their results emphasize that a random penalty scheme, compared to a fixed penalty scheme, improves both pragmatism and stability in the system.

Briški et al (2007) introduced a mathematical approach to analyze the process of material decomposition related to natural municipal solid waste. They managed to get a good estimate of the process performance using their mathematical and experimental approach. In another study, Edwards et al. (2016) introduced a novel mathematical programming approach to predict energy and time consumption of waste collection and recycling. They proved that their urban waste recycling model is more efficient than other models in order to estimate the amount of fuel and the number of needed vehicles. In a recent study, Chauhan et al. (2022) investigated waste recycling concepts in fuzzy environments with the aim of optimizing expected costs and profit for incomplete production processes. They developed sustainable manufacturing systems with fuzzy methods and also showed the credibility of their model with numerical examples. They illustrated that by using their proposed approach and analytical methods, it is possible to increase the profit per unit of time to its highest level.

Regarding the development of game theory, Von Neumann and Morgenstern (1944) spent many years investigating the issue of human decision-making in logical conditions. Finally, they showed in their classic theory that humans take a series of actions to increase their profit for rational decision-making, which led to the formation of game theory (Von Neumann and Morgenstern 1944). In addition, Aumann and Schelling (2005) provided a very useful tool for a better understanding of human behavior by using repeated game theoretical methods and presenting two different strategies. Gul (1997) reviewed John C. Harsanyi, John F. Nash, and Reinhard Selten’s work, which was awarded the Nobel Prize in Economics by the Royal Swedish Academy of Sciences in 1994 for their studies in the field of non-cooperative games. They facilitated science development in the present years by contributing to some fields such as asymmetric information, equilibrium, and credibility, which are considered the most important topics in game theory.

Regarding advances in game theory and its various applications, İzgi and Özkaya (2019) introduced a new method to solve two-player zero-sum matrix games according to the size and norms of the matrix. They also showed how to get a good approximate solution to the problem without solving all the existing equations. In another research, D’Orsogna and Perc (2015) analyzed various methods available in the literature, including game theoretical approaches, to improve the understanding and recognition of crime. They believed that crime statistics can help to produce a suitable strategy for crime modeling and crime prevention. As another application of game theory, Özkaya and İzgi (2021) by using the available approaches in game theory, investigated the effects of home quarantine on the prevalence of the first wave of coronavirus. Similar to other game theoretical research in various areas in the literature, they concentrated on applying game theoretical methods to investigate the effects of home quarantine on the initiation, expansion, and termination of this virus. Perc et al. (2017) studied theoretical and practical research that can bring us a better recognition of cooperation and coordination concepts by using spatial patterns and dynamic visions. Madani (2010) studied the utilization of game theory methods to improve resource preservation such as water. The author proved that the problems related to natural resources such as water always consist of a dynamic structure, by using a set of non-cooperative games. İzgi and Özkaya (2020) examined the problem of decision-making on agricultural insurance. They created a zero-sum matrix game against nature using real data. They first solved this game separately through the max–min and regret criteria in decision theory. Then, by reconsidering this game where mixed strategies are allowed, they solved it with the known methods for solving zero-sum matrix games in the literature.

Optimization mechanisms and supply contracts

Elmaghraby (2000) conducted a general review in the field of sourcing methods with the help of optimization and economics tools. In general, the author showed how market characteristics and supply chain contracts can affect the relationship between buyers and suppliers and lead to the creation of different supplier selection approaches. Henig et al. (1997) optimized supply chain contract terms in the field of inventory planning. First, they modeled inventory control policies with a periodic review approach under their suggested contract, which offered the ordering costs by a multi-interval linear function. Then, they used the Markov Chain method for calculating transportation, shortage, and holding costs as well. Wang (2002) used supply chain contracts as a useful tool for creating coordination and motivating channel members in order to make their decisions similar to an integrated structure. They reviewed a wide range of supply chain structures and provided a general framework for combining different types of supply contracts to offer new hybrid coordination mechanisms. More recently, Li et al. (2016) used a QF contract between a cosmetics manufacturer and a retailer to enhance the system efficiency. They showed that the channel members, under their contract, will achieve the highest possible level of profit. Patra and Jha (2022) tested the effectiveness of a bilateral option contract to control potential risks in a two-tier system. Their network includes a supplier and a humanitarian agency, which has been evaluated using a novel option contract. In their research, they assumed the demand function as a uniform and exponential function and addressed the issue of pre-prepared relief items before the disaster, as well as the exact number of needed relief items after the disaster. Wang et al. (2021) also used an option contract to optimize a production system as well as its manufacturing, ordering, and inventory decisions. They first applied a simple wholesale price contract to have a suitable pattern for comparison, and then incorporated other influential factors such as overconfidence into their model, and re-analyzed the expected profit of the channel members. Finally, by using the option contract, they optimized the whole network by calculating the option and exercise prices. To resolve inconsistencies among a three-tier food network’s members, Pourmohammad-Zia et al. (2021) addressed the issue of channel optimization using customized contracts. Their network consists of three separate members: a farm as a supplier, a food producer as a manufacturer, and a food retailer as a distributor. In their research, to reduce food waste and improve economic, production, and inventory conditions, the manufacturer has used the Vendor Managed Inventory system to control the level of retail orders. In addition, to have more market share and increase the level of sales coverage, the manufacturer has offered a cost-sharing contract as an incentive to share some of the potential risks of the retailer. Besides, to improve the returning used products conditions, Dutta et al. (2016) implemented a buy-back contract from the manufacturer to the retailer. In their proposed buy-back contract, they considered the demand and capacity to be uncertain in a multi-period closed-loop network structure. Bai et al. (2017) implemented a Cap and Trade system in a two-tier sustainable channel, including a manufacturer of degradable products and a retailer in which the demand is considered to be time-dependent. They first analyzed the centralized and decentralized scenarios and then used the revenue-sharing, cost-sharing, and two-part tariff contracts to optimize the member relationships. Their results show that under their proposed contract, the whole channel’s profit and the carbon emission level are both improved. Heydari and Ghasemi (2018) studied a two-tier reverse network including a producer and a collection agency in a situation where the collection agency persuades customers to return their used products by providing an incentive scheme. In their study, both the quality of the returned products and the recycling capacity of the recycler are assumed to be uncertain, and only products that have the minimum required quality are accepted. Finally, they used a modified revenue-sharing contract to optimize the entire network relationships and the channel's overall profitability, and share existing risks fairly between both participants.

Reverse/closed-loop recycling systems

Savaskan et al. (2004) investigated the various forms of supply chain network structures in reverse directions to find the best methods of collecting and recycling used products. They considered three different options for collecting mechanism and calculated the optimal strategies under a Stackelberg game between a manufacturer as the leader and a buyer as the follower. Krikke et al. (2003) presented a mathematical model to improve the decision-making process that fits both product design and transportation structures. They also investigated the effective factors of improving environmental conditions using linear functions based on energy consumption and waste generation. They finally applied and tested their proposed model to design a closed-loop supply chain structure for collecting and recycling refrigerators of a Japanese company. More recently, Wang et al. (2018a) by using an evolutionary and meta-heuristic algorithm based on a modified genetic simulated annealing algorithm investigated the effect of customer satisfaction on the collection of broken bikes in a recycling system in certain areas. Ramezani et al. (2013) studied network design in both forward and reverse directions and modeled and solved the uncertainty of environmental conditions using mathematical multi-objective stochastic models. In the forward direction, they considered three parts: suppliers, factories, and distribution centers, and in the recycling structure, two parts including waste collection agency and disposal centers. Intending to optimize the whole system’s profit, improve the customers’ situations, and raise the products’ quality, they presented their new method for analyzing the transportation status of the channel. They also introduced a risk management plan to create a tradeoff between different goals and showed that eventually a set of optimal Pareto solutions would be obtained. By using two-objective mathematical programming models, Rahimi et al. (2016) analyzed a sustainable recycling system of perishable food waste with a definite expiration date, in which addressing environmental, social, and economic concerns are the main goals of managers. In their two-objective programming model, the first objective function is designed to optimize the distribution and maintenance costs of inventories, and the second objective function is related to the issue of reducing vehicle crashes and decreasing the number of corrupted products. In addition, to reduce the computational complexity, they considered other environmental criteria and the issue of social dissatisfaction factors such as vehicle noise pollution as constraints in their model. By presenting a new method based on mathematical programming models for analyzing the issue of location-allocation in an urban freight recycling system, Ndhaief et al. (2017) examined the status of both forward and reverse logistics structures. With their proposed model, they were finally able to improve the city's logistics situation and save on network operating costs. Chen et al. (2021) innovated in remanufacturing processes by using a closed-loop recycling system including a producer and a seller, in which the producer is allowed to resell the recycled products through the seller. They used two Stackelberg games, once with a producer-led model, once with a seller-led model, and also a Nash game with equal powers for both members, to optimize the players’ decisions. Finally, they presented a cost-sharing contract to optimize the profits of the entire network. By using laboratory and experimental methods, Marcos et al. (2021) analyzed the effect of various uncertainties such as supply, demand, process, and environmental conditions on the recycling of lithium-ion batteries in an electric vehicle closed-loop recycling system.

Research gap

It is clear that the two important currents in the literature, namely municipal waste management and channel optimization, have the most correlation with the subject of our research. However, some newly published review papers such as (Nematollahi and Tajbakhsh 2020; Nematollahi et al. 2021) by reviewing 247 recent articles, showed that in the quantitative and mathematical literature on food and agricultural channels, not much research has been done on municipal waste recycling system optimization. Therefore, managing and mathematically analyzing the issue of recollecting and recycling food waste materials in nutritional products industries is a significant gap in the literature that requires getting more attention. Also, Guo et al. (2017) by reviewing most of the articles in the field of channel optimization found that the majority of the researchers are using single contracts in their studies to facilitate the members’ relationships. for instance, a buy-back mechanism between a supplier and a manufacturer, between a manufacturer and a retailer, or between a reproducer and a collection agency, in which one of the participants in the contract usually plays as a leader and the other one as a follower. In fact, in the literature and on the recycling of agricultural and urban food waste, the issue of optimization using hybrid and multiple contracts has received less attention. A hybrid contract means when there is more than one contract between the channel members, for example, if there is both a QF and a revenue-sharing contract between manufacturer and retailer, we call it a hybrid contract. Another type of supply contract is multiple contracts that are concluded between several different members of the network. For example, if a cost-sharing contract is considered among a manufacturer, supplier, and retailer, it is called a multiple contract.

This study intends to address this literature gap on municipal food waste recycling optimization by converting the collected urban waste into organic fertilizers, using mathematical models and novel, hybrid, and multiple contracts under the demand disruption due to Covid-19 and two sources of uncertainty, namely quality and capacity.

Besides, while QF contracts have been used as efficient approaches to optimize the channels in different studies (for example (Heydari et al. 2020)), the majority of these contracts have been developed in the field of commodity production orders and inventory planning decisions. However, in this study, a QF contract has been used to lease facilities and recycling capacity in peri-urban regions to follow government laws prohibiting production activities in urban areas, which is a new work in the literature.

According to Table 1 and in comparison with other papers similar to this study, we can refer to (Li et al. 2021) and (Beheshti et al. 2022). Li et al. (2021) used two capacity reservation and QF contracts to expand the retailer’s capacity, while in this study, two option and QF contracts have been compared to rent recycling capacity from suburban areas. They also considered demand and price to be uncertain in a forward structure, while in this study, quality and capacity are assumed to be uncertain in a reverse flow. Beheshti et al. (2022) also used a novel QF contract, with two modes for lead time, to recycle municipal food waste in a closed-loop recycling system under uncertain quality conditions. But, in this study, the combination of QF with SCS and TWCS contracts has been implemented in a reverse recycling system in which both quality and capacity are considered to be uncertain.

Eventually, our major innovations can be listed below:

-

Managing the channel members’ relationships in a municipal solid waste recovering system under the uncertainty of the capacity, quality, and demand disruption due to the pandemic quarantine regulations

-

Renting recycling facilities and their related technologies from peri-urban areas to comply with governmental rules and prevent the pollution of soil and plants by converting municipal food waste into organic fertilizers

-

Reaching channel optimization using and comparing hybrid and multiple contracts such as option contract, QF contract, SCS contract, TWCS contract, and mathematical programming models

Problem description

Apart from economic issues, another important social responsibility, which should be well considered to have a sustainable society and a favorable environment, is the issue of recycling municipal food waste. Today, the expansion of urbanization, the increasing rate of migration to urban areas, and the spread of various diseases such as Covid-19, have caused an increase in the level of food waste in various communities. Therefore, restaurants, cafes, hotels, and chain stores in urban areas these days are faced with large volumes of expired food due to fluctuations and uncertainties related to demand forecasting. Although these food and agricultural wastes can no longer be used by humans, they can still be considered a suitable source of producing natural fertilizers. While most of the agricultural market is monopolized by chemical fertilizers, organic and natural fertilizers are much more nutritious for the soil and plants. Thus, food channel managers should look for suitable solutions to facilitate the collection and conversion of this expired food into organic and natural fertilizers. This conversion also requires up-to-date technologies, appropriate facilities, and sufficient capacity, but in most modern societies, due to the observance of social satisfaction and the prevention of air pollution and noise pollution, manufacturing operations are restricted in residential parts of the city. Since commercial food services are normally built near the city centers, and recycling activities are prohibited there, they must rent their relevant facilities from factories in the suburbs. This research, by using mathematical programming models and hybrid and multiple supply contracts, deals with the issue of relationship management and channel optimization in renting food waste recycling facilities from outside of the city and converting them into natural fertilizers.

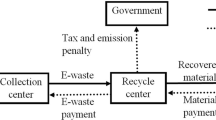

In this paper, two uncertainty factors have been studied in two separate scenarios. The first scenario envisages a three-tier recycling system including a commercial food service near the city center, an out-of-town organic fertilizer factory, and a food waste collection agency. In exchange for a reward, the food waste collection agency receives and inspects municipal food waste from restaurants and chain stores throughout the city. Expired food items that have the necessary quality for recycling are accepted after inspection and sold to the commercial food service. The commercial food service also leases the relevant technologies from the fertilizer factory in suburbs, and finally sells the recycled organic fertilizers to its special customers in the agricultural sector. As the process of equipping the workshop is a time-consuming activity, the fertilizer factory expects the commercial food service to announce its requested capacity previously, but because of the uncertainty of the collected food waste quality, the exact amount of accepted waste is not clear in advance. Therefore, to properly manage the relationship in renting facilities in the first scenario, once a hybrid QF and SCS contract and once again a hybrid QF and TWCS contract have been applied to optimize the channel relationships. According to these combined contracts, the commercial food service first issues an initial order for the fertilizer factory in order for preparing the workshop, and then, when the accurate number of confirmed items is specified, it can modify its initial order up to b% more and a% less, through a secondary order. Also, the commercial food service and the food waste collection agency can share some parts of the disposing and renting costs to optimize the entire system’s profits. Figure 1 shows the material and money flows in the first scenario.

Moreover, in the second scenario, a two-tier recycling system consisting of two fertilizer factories located in suburban areas is considered in such a way that the first factory’s remanufacturing capacity is assumed to be uncertain. In this scenario, the first factory collects and recycles expired food from restaurants and chain stores in exchange for proposing a reward and sells the produced organic fertilizers to the agricultural industries. Since the first factory’s remanufacturing capacity is uncertain, in case of capacity shortage, it can rent some parts of the second factory’s facilities and carry out its process there. In this section, to better manage the renting relationship, once a QF contract and once an option contract has been used to optimize the channel. In the option contract, the first factory reserves some of the second factory’s facilities in exchange for paying the option price through an initial order in advance, and after determining the exact amount of its additional required facilities, it can pay the exercise price and rent its requested capacity up to the ceiling of its initial order. Figure 2 shows the material and money transfer flows in the second scenario. In addition, Table 2 also defines the notations, parameters, and variables used in problem modeling.

Subscripts S, T, f, and o represent SCS and TWCS contracts in the first scenario, QF, and option contracts in the second scenario, respectively. Besides, Superscripts D, C, and H also refer to decentralized, centralized, and coordinated schemes, respectively.

The following assumptions are also considered in modeling the problem mathematically:

-

Logically \(m\ge {d}_{S}\), otherwise, collecting the food waste in the first scenario and under the SCS contract will not be justified for the food waste collection agency.

-

Logically \(V\ge m+L\), otherwise, recycling food waste in the first scenario will not be justified for commercial food service.

-

Logically \(L\ge t\), otherwise, the first factory under the QF contract in the second scenario will not do any recycling activity in its workshops.

-

Logically \(V\ge {d}_{f}+L\), otherwise, recycling food waste in the second scenario and under the QF contract will not be justified for the first factory.

-

Logically \(e\ge t\), otherwise, the first factory under the option contract in the second scenario will not do any recycling activity in its workshops.

-

Logically \(V\ge {d}_{o}+e\), otherwise, recycling of food waste in the second scenario and under the option contract will not be justified for the first factory.

Modeling and solution method

The issue has been investigated under two separate scenarios. In the first scenario, it is assumed that the collected municipal food waste quality is uncertain, and the food waste collection agency, after inspection, will accept \(\theta\) percent of the waste (\(\theta\) has a uniform distribution function between 0 and 1). However, in the second scenario, it is assumed that the organic fertilizer factory recycling capacity (i.e., \({C}_{p}\)), is uncertain, and if this plant runs out of capacity, it can rent the remanufacturing facilities from other factories (\({C}_{p}\) also have a uniform distribution function between 0 and U). Figure 3 illustrates the modeling and problem-solving process under both the investigated scenarios.

First scenario: uncertainty in the collected municipal food waste quality

Initially, the proposed reward is considered to be predetermined through an agreement between the commercial food service and store managers previously, and a hybrid QF and SCS contract is used to optimize the channel. In addition, the decision-making on the proposed reward is then placed under the authority and control of the collection agency, and eventually, a hybrid QF and TWCS contract has been implemented to manage the system relationships.

Hybrid QF and SCS contract

According to the QF contract, and the range in which \(\theta {R}_{S}\) is located, the profit function of the commercial food service will be a piecewise function as below:

If \(0\le \theta {R}_{S}\le \left(1-a\right){q}_{S}\), the commercial food service purchases \(\theta {R}_{S}\) items of accepted waste and makes a net profit equal to \(V\theta {R}_{S}-m\theta {R}_{S}-L\left(1-a\right){q}_{S}\) by converting them into organic fertilizer. If \(\left(1-a\right){q}_{S}\le \theta {R}_{S}\le \left(1+b\right){q}_{S}\), the commercial food service rents \(\theta {R}_{S}\) capacity units and earns \(V\theta {R}_{S}-m\theta {R}_{S}-L\theta {R}_{S}\) through recycling activities in fertilizer factory. Eventually, if \(\left(1+b\right){q}_{S}\le \theta {R}_{S}\), the commercial food service can only rent \(\left(1+b\right){q}_{S}\) capacity units. Therefore, it purchases merely \(\left(1+b\right){q}_{S}\) accepted items from the collection agency and receives \(V\left(1+b\right){q}_{S}-m\left(1+b\right){q}_{S}-L\left(1+b\right){q}_{S}\).

The mathematical expectation of the commercial food service’s profit function is calculated through Eq. (2).

The food waste collection agency’s function under the QF contract in the first scenario is also developed according to Eq. (3)

If \(0\le \theta {R}_{S}\le \left(1+b\right){q}_{S}\) the commercial food service purchases entire \(\theta {R}_{S}\) accepted items and the food waste collection agency's profit will be equal to \(m\theta {R}_{S}-{d}_{S}\theta {R}_{S}\). If \(\left(1+b\right){q}_{S}\le \theta {R}_{S}\), the commercial food service purchases merely \(\left(1+b\right){q}_{S}\) units of collected items and the food waste collection agency must also pay for the disposal fee of confirmed but not recovered materials.

At last, the mathematical expectation of the food waste collection agency’s profit function is calculated through Eq. (4).

The calculated profit functions are eventually simplified as below:

Finally, by adding Eq. (5) and (6), the mathematical expectation of the whole recycling system profit function can be obtained through Eq. (7).

Proposition 1:

The mathematical expectation of the commercial food service’s profit is a concave function in initial order and its optimal value under the decentralized scheme is:

For all proofs see Appendix.

Proposition 2:

The mathematical expectation of the entire recycling system’s profit is a concave function in initial order and its optimal value under the centralized scheme is:

Corollary 1:

By comparing Eq. (8) and Eq. (9) and also considering the aforementioned assumptions, it is concluded that \({q}_{S}^{C*}>{q}_{S}^{D*}\). That is, the optimum quantity of the initial order under the centralized scheme is greater.

Corollary 2:

The commercial food service is interested in ordering smaller amounts for \({q}_{S}\) because if \(\theta {R}_{S}<\left(1-a\right){q}_{S}\), it has to pay for the additional capacity.

Corollary 3:

The food waste collection agency would prefer the commercial food service order larger amounts for \({q}_{S}\) because if \(\theta {R}_{S}\) becomes greater than \(\left(1+b\right){q}_{S}\), it has to pay for the disposal costs.

Corollary 4:

By placing the values obtained from Eq. (8) and Eq. (9) in Eq. (5), Eq. (6), and Eq. (7), and comparing them with each other, it becomes clear that:

Although \({q}_{S}^{C*}\) is more profitable than \({q}_{S}^{D*}\) for the food waste collection agency and the whole recycling system, it causes the commercial food service to lose some parts of its profit. Therefore, since deciding on the amount of initial order is under the authority of commercial food service, it will choose \({q}_{S}^{D*}\) in favor of itself.

Therefore, the food waste collection agency, to create coordination in the channel, offers the commercial food service to order \({q}_{S}^{C*}\) instead of \({q}_{S}^{D*}\), and if \(\theta {R}_{S}\) becomes less than\(\left(1-a\right){q}_{S}\), it will pay \(\%{\beta }_{S}\) of the extra rental costs. In this contract, which is called SCS and is widely used in the literature (Zang et al. 2022), the food waste collection agency and the commercial food service share some parts of the costs and their potential risks between themselves to optimize the entire system’s profit. According to this contract, \(m\) also changes to\({m}_{S}\), and its value must be calculated in such a way that none of the channel members will lose in comparison with the decentralized scheme.

The commercial food service and the food waste collection agency’s expected profit functions under the proposed SCS mechanism are expressed as:

After some simplification the profit functions will be as follows:

The entire recycling system’s profit function also remains unchanged.

Proposition 3:

The mathematical expectation of the commercial food service’s profit under the SCS contract is a concave function in initial order and its optimal value from the commercial food service’s point of view is:

Proposition 4:

Under the SCS contract, the commercial food service's decision about \({q}_{S}\) is the same as the centralized scheme if and only if:

Corollary 5:

Based on Proposition 4, a closed-form relation between the two contract parameters, namely \({\beta }_{S}\) and \({m}_{S}\) is obtained. Now we need to get the value of \({\beta }_{S}\) in such a way that none of the members of the system will lose in comparison with the decentralized scheme. Then the appropriate value of \({m}_{S}\) can be obtained by using Eq. (15).

Proposition 5:

The maximum value of \({\beta }_{S}\) under the SCS mechanism for which the commercial food service is convinced to accept the proposed contract is obtained as follows:

Proposition 6:

The minimum value of \({\beta }_{S}\) under the SCS mechanism for which the food waste collection agency is convinced to accept the proposed contract is obtained as follows:

Corollary 6:

If \({\beta }_{S}\) is set in the range of \(\left[{\beta }_{S}^{\mathrm{min}},{\beta }_{S}^{\mathrm{max}}\right]\), the system will be properly optimized by using the proposed contract. The exact value of \({\beta }_{S}\) can be also determined according to the bargaining power between the commercial food service and the food waste collection agency. Besides, after determining the exact value of \({\beta }_{S}\), the amount of \({m}_{S}\) can be obtained through Eq. (15).

Hybrid QF and TWCS contract

In this section, it is assumed that the proposed reward \(\left({d}_{T}\right)\) is under the authority and control of the food waste collection agency and is not known from the beginning. In addition, the collected food waste \(\left({R}_{T}\right)\) needs to be computed again according to the new value for \(\left({d}_{T}\right)\).

Like (Govindan and Popiuc 2014; Heydari and Ghasemi 2018), spoiled food that is collected corresponding to the specified amount of reward is:

By substituting \({R}_{S}\) of Eqs. (5), (6), and (7) with \({R}_{T}\) from Eq. (18), the mathematical expectation of the commercial food service, the food waste collection agency, and the entire system’s profit functions will be as follows:

In this section, the commercial food service and the food waste collection agency have equal power. Therefore, they decide on their optimal strategies through a Nash game approach at the same time.

Proposition 7:

The commercial food service and the food waste collection agency’s profit functions in the decentralized scheme are concave in \({q}_{T}\) and \({d}_{T}\) respectively.

Because of the concavity of both functions, optimal amounts of \({q}_{T}^{D}\) and \({d}_{T}^{D}\) will be calculated through solving Eq. (22) and Eq. (23) concurrently which are separately gained from the first-order optimality condition on Eq. (19) with respect to \({q}_{T}\) and Eq. (20) with respect to \({d}_{T}\).

Therefore, both members of the system in the decentralized scheme announce their optimal strategies as follows and at the same time.

Moreover, we then obtain the optimal values of the decision variables according to the centralized scheme in which the whole system is assumed to be under the control of one decision-maker.

Proposition 8:

The entire recycling system’s profit is a concave function with respect to \({q}_{T}\) and \({d}_{T}\) jointly. Therefore, the optimal amount of the initial order and the proposed reward from the entire channel point of view will be as follows:

Corollary 7:

According to the aforementioned assumptions, it is clear that \({q}_{T}^{C*}\) is greater than \({q}_{T}^{D*}\) and also \({d}_{T}^{C*}\) is greater than \({d}_{T}^{D*}\). Besides, the whole recycling system’s interest in the centralized scheme will increase compared to the decentralized one. Therefore, by providing a suitable contract, the commercial food service can encourage the food waste collection agency to consider a larger amount of reward, and the food waste collection agency can also use an incentive plan to encourage the commercial food service to place a larger initial order.

Therefore, similar to (Wang et al. 2020), a TWCS contract has been applied in this section. It means that the commercial food service pays \(\lambda \%\) of the disposal costs, and the food waste collection agency pays \({\beta }_{T}\%\) of the additional capacity hiring costs. Thus, the food waste collection agency and the commercial food service are encouraged to consider larger reward and initial order, respectively. According to this contract, \(m\) also changes to \({m}_{T}\) again, and its value must be calculated in such a way that none of the recycling system members will lose in comparison with the decentralized scheme.

The commercial food service and The food waste collection agency’s expected profit functions under the proposed TWCS mechanism are expressed as:

After some simplification the profit functions will be as follows:

The entire recycling system’s profit function also remains unchanged.

Proposition 9:

The commercial food service and the food waste collection agency’s profit functions under the TWCS contract are concave in \({q}_{T}\) and \({d}_{T}\) respectively.

Because of the concavity of both functions, optimal amounts of \({q}_{T}^{H}\) and \({d}_{T}^{H}\) will be calculated through solving Eq. (32) and Eq. (33) concurrently which are separately gained from the first derivative of Eq. (30) with respect to \({q}_{T}\) and the first derivative of Eq. (31) with respect to \({d}_{T}\).

Therefore, both members of the system under the TWCS mechanism announce their optimal strategies as follows and at the same time.

Next, the values of the proposed contract terms, i.e. \({\beta }_{T}\), \(\lambda\) and \({m}_{T}\), must be calculated in such a way that the profit of none of the system participants becomes less than their decentralized scheme. Finally, similar to (Heydari and Mosanna 2018), a mathematical nonlinear model is used to optimize the whole system’s interest through calculating the optimal values of contract parameters according to the existing constraints.

s.t.

where Eq. (36) intends to optimize the whole system’s interest as an objective function. Equations (37) and (38) respectively ensure that the commercial food service and the food waste collection agency’s profits under the proposed contract are at least equal to their decentralized schemes plus \(\alpha \%\) of the added profit to the whole system. In other words, these constraints guarantee enough motivation for the commercial food service and the food waste collection agency to accept the proposed contract. Constraint (39) also certifies that the optimal solution values are gained reasonably.

Second scenario: uncertainty in the recycling capacity

In this scenario, where the first factory’s recycling capacity is uncertain, according to an agreement, it can rent some parts of the second factory’s facilities in necessary situations. In this section, first the option contract and then the QF contract are implemented and finally compared for renting the recycling capacity.

Option contract

In this section, an option contract has been applied to optimize and manage the facility renting relationships between the two factories. Under this contract, the proposed reward and the initial order are considered as the first factory’s decision variables and the option price as the second factory’s decision variable. In addition, a Stackelberg two-player game approach has also been used to solve the problem.

Under the option contract, the first factory’s function is calculated according to Eq. (40)

The expected value of the first factory’s profit under the option contract, by considering the continuous uniform probability distribution function between \(\left(0,U\right)\) for \({C}_{p}\), is simplified as follows:

Also, the profit function of the second factory, under the option contract is:

The expected value of the second factory’s profit by considering the continuous uniform probability distribution function between \(\left(0,U\right)\) for \({C}_{p}\), is simplified as follows:

By substituting the relation \({R}_{o}=\frac{{d}_{o}}{{d}_{\mathrm{max}}}Q\) in Eq. (41) and Eq. (43), the expected value of the first and second profit functions are rewritten as:

Finally, the mathematical expectation of the entire system’s profit function is obtained as the summation of Eq. (44) and Eq. (45):

The first factory decides on the reward and the initial rental capacity, and the second factory decides on the option price, and the decisions of both members of the system also affect each other's profit functions. So here we face a two-player game in which the second factory will play the role of leader and the first factory will play the role of follower. To solve this model, a Stackelberg method has been applied, which means that the leader, i.e., the second factory, decides on the option price and then the first factory, by knowing the second factory’s policy, decides on the rental capacity and the reward. Of course, this process is done in a backward procedure.

Proposition 10:

The first factory’s profit under the option contract is a concave function with respect to initial order and proposed reward jointly, and its best responses will be as:

Proposition 11:

After placing Eq. (47) and Eq. (48) in Eq. (45), the second factory’s expected profit function becomes concave in o and the optimal value of the option price is obtained as follows:

Proposition 12:

After revealing the second factory’s final and optimal decision about the option price, the first factory’s best responses will also be determined accurately and the optimal values of \({d}_{o}\) and \({q}_{o}\) will be calculated as follows:

QF contract

In this part, the first factory decides on the initial order and then the second factory adjusts A and B to create coordination in the channel so that the first factory’s decision becomes similar to a situation in which the whole system’s interest is maximized.

The first factory’s profit function in the second scenario and under the QF contract is formulated as follows:

The expected value of the first factory’s profit, by considering the continuous uniform probability distribution function between \(\left(0,U\right)\) for \({C}_{p}\), is simplified as follows:

Also, the second factory’s profit function in this section is formulated as follows:

The expected value of the second factory’s profit function, by considering the continuous uniform probability distribution function between \(\left(0,U\right)\) for \({C}_{p}\), is simplified as follows:

By placing the relation \({R}_{f}=\frac{{d}_{f}}{{d}_{\mathrm{max}}}Q\) in Eq. (53) and Eq. (55), the first and second factories’ expected profit functions are rewritten as follows:

Finally, the mathematical expectation of the entire system’s profit function is calculated by summing Eq. (56) and Eq. (57) as Eq. (58).

Proposition 13:

The expected profit function of the first factory is concave respect to the \({q}_{f}\) under the QF contract in the second scenario, and the optimal value of \({q}_{f}\) from the first factory’s perspective is obtained as follows:

Proposition 14:

The profit of the whole system has also a concave function with respect to the initial order under the QF contract in the second scenario, and its optimal amount from the whole system point of view is obtained as follows:

Corollary 8:

To optimize the whole system's profit, the second factory must appropriately adjust the relationship between A and B so that the decision of the first factory becomes similar to \({q}_{f}^{C*}\).

Proposition 15:

If the second factory regulates the relationship between A and B as the following equation, the entire recycling system is well optimized.

Discussion and computational results

In this subsection, we will make mathematical calculations and experiments to analyze the efficacy and usefulness of our developed contracts. Table 3 shows all notations employed in our mathematical structures along with their estimated values. The values of these parameters have been predicted through conducting interviews with managers and senior experts of Kaleh-Solico companies.

Table 4 shows the optimal values of the decision variable and SCS contract parameter. Also, if we consider \({\beta }_{S}\) equal to the mean of its upper and lower limits (\({\beta }_{S}=\frac{{\beta }_{S}^{\mathrm{min}}+{\beta }_{S}^{\mathrm{max}}}{2}\)), the values of the expected profit functions can be reached in Table 5.

As you can see in the above tables, in contrast with the decentralized scheme the initial order optimal value rises in the centralized structure. Besides, although the food waste collection agency and the entire system’s profits increase in the centralized scheme, the commercial food service’s interest falls off. This causes the commercial food service not to accept the decision-making similar to a centralized scheme; But with the proposed SCS contract, the commercial food service’s initial order and the entire system’s expected profit become the same as their centralized scheme. Now, if we consider \({\beta }_{S}\) between the \(\left[{\beta }_{S}^{\mathrm{min}},{\beta }_{S}^{\mathrm{max}}\right]\), the commercial food service and the food waste collection agency will both have higher expected profits than their decentralized structure. Therefore, during this contract, the whole channel will be well optimized and the Pareto Improvement conditions will be achieved for all members.

According to Table 6, with increasing \({\beta }_{S}\), the expected profit of the commercial food service decreases, and for \({\beta }_{S}={\beta }_{S}^{\mathrm{max}}\), it reaches its minimum value (i.e., 29,493.75, the expected profit of its decentralized scenario). Therefore, by further increasing it, the commercial food service will not accept the proposed contract. Besides, by decreasing the value of \({\beta }_{S}\), the food waste collection agency’s expected profit decreases, and for \({\beta }_{S}={\beta }_{S}^{\mathrm{min}}\) it reaches its lowest value (i.e. 23,435.15625, the expected profit of its decentralized scheme). This time, if \({\beta }_{S}\) decreases further, the food waste collection agency will no longer accept the proposed contract. Ultimately, the choice of the exact value for \({\beta }_{S}\) will depend on the bargaining power between the commercial food service and the food waste collection agency.

Moreover, Table 7 shows decision variables, proposed TWCS contract parameters, and the expected profit functions’ values, respectively.

As you can see in the above table, both the initial order and proposed reward are higher in the centralized scheme. Also, while the commercial food service and the entire system’s interests increase in the centralized structure, the expected profit of the food waste collection agency decreases. This causes the food waste collection agency to reject the decision-making similar to a centralized system; However, due to the proposed TWCS contract, the initial order, as well as the proposed reward, become as close as possible to the optimal values of the centralized scheme and the total recycling system’s profit increases almost to near the expected profit of the centralized structure; Finally, it can be seen that the commercial food service and the food waste collection agency will both gain higher profits than their decentralized scheme (Pareto Improvement).

According to Table 8, the optimal decisions i.e. the initial order and also the proposed reward, by increasing the amount of \(\alpha\), change increasingly and decreasingly respectively. Although these changes will lead to more expected profit for the commercial food service, they ultimately reduce the whole system and the food waste collection agency’s interests.

Moreover, the decision variables, contract terms, and profit functions’ optimal amounts under the option contract for different values of e and under the QF contract for different values of L in the second scenario are given in Tables 9 and 10, respectively. Figure 4 also graphically shows these changes in profit functions under both contracts simultaneously.

According to the above tables and figures, both the option and QF contracts’ expected profits for the first factory are declining by increasing in e and L, and have a close profitability level so that both can be used with almost equal efficiency. But in any case, it can be said that for \(\left(L\le 145,e\le 95\right)\) and also for \(\left(L\ge 285,e\ge 235\right)\), the option contract is a little more profitable for the first factory but for \(\left(145\le L\le 285,95\le e\le 235\right)\) the first factory prefers the QF contract instead of the option contract. Moreover, the second factory’s profit for the option contract is a descending function with respect to e and for the QF contract is an ascending function relative to L. Therefore, it can be said that for \(\left(L\le 240,e\le 190\right)\), the second factory prefers the option contract and for \(\left(L\ge 240,e\ge 190\right)\), it prefers QF contract. In addition, the total system’s profit for the option contract is also a downward function with respect to e, and for QF contract is a fixed-function in terms of L. So, for \(\left(L\le 230,e\le 180\right)\) option contract and for \(\left(L\ge 230,e\ge 180\right)\) QF contract will have more productivity for the entire recycling system.

Comparison of results with previous research

Heydari and bakhshi (2022) examined the effect of using two types of coordination mechanisms, i.e., conventional contract and option contract on fulfilling market demands and providing appropriate delivery service in companion with a 3PL retailer. They realized that when demand uncertainty is low, the option contract can be more beneficial and when the demand uncertainty rises, the conventional contract would work more efficiently. However, in the current study, we have compared the effectiveness of using an option contract with a QF contract to create coordination between two factories which were producing organic fertilizers. Our results showed that on one hand, the option contract could do better when the unit cost of leasing recycling capacity is greater than the exercise price and on the other hand, the QF contract may make higher profits for both members when the exercise price is greater than the unit cost of leasing recycling capacity.

Yang et al. (2017) studied two supply chains facing a competitive environment to gain more market share under a cap and trade system. They proved that a single revenue-sharing contract not only provides a win–win situation for both participants but also makes more profit for the entire network. However, we showed that a two-way cost/revenue sharing contract may even bring more profits for all of the involved participants than a single cost/revenue sharing contract, as proved by (Wang et al. 2020). Besides, in our work, it has been illustrated that a two-way cost/revenue sharing contract can ensure Pareto-Improvement conditions for all of the channel members, which is also compatible with the results gained by Beheshti et al. (2022).

Practical implementation and managerial insights

Based on the obtained results, commercial food service managers are suggested to get together with waste collection companies and select the initial order amount by mutual negotiations with them. It is also suitable for commercial food service managers to collaborate with organic fertilizer factories, specifically when faced with large amounts of food waste (for example, in times of crises such as Covid-19). On the other hand, greater participation in environmentally friendly exercises may also be a decisive and influential element in enhancing the company's prestige and increasing the demand for its products. Whole system decision-makers are also advised to allow the food waste collection companies to decide on the proposed reward themselves because it will further increase the expected profit of the channel as well as the expected profit of the other members. Food recovering system managers are also offered not to insist on achieving extra added revenue, because insisting on a larger share of the total surplus profit may create worse conditions for all participants.

In summary, the proposed models developed in this study, as a managerial insight, may support recycling system administrators and decision-makers to:

-

Come up with the best way of working with food collection and inspection companies to save time, money, and energy and enter into a win–win relationship with them.

-

Achieve a suitable approach for collecting and recycling waste, to prevent diseases caused by the consumption of expired and wasted foodstuffs.

-

Enter into optimal negotiations and conclude contracts with factories that convert food waste into organic fertilizers, to improve the environmental conditions and eliminate the problems related to the chemical fertilizers

-

Achieve the best approach for renting recycling facilities from suburban areas to avoid governmental fines for banning productive and reproductive activities in urban areas and gaining social satisfaction.

-

Enter into negotiations with parallel factories and use the best contract for renting their facilities, in case of lack of reproductive capacity.

-

Effectively decide on the proposed reward value to be paid to customers such as hotels and cafes to create appropriate competition with parallel rivals.

Future research

The models analyzed in this study can still be developed in several ways, which can help to bring the models closer to real-world conditions. for example:

-

A capacity ceiling can be set for the production factories so that these plants can only use their remaining capacity (not leased) to carry out their recycling operations.

-

The two-channel system i.e. traditional one (through the food waste collection agency) or the modern one (via the Internet) can be considered for food waste collection, and the competition between the two channels can also be examined.

-

The government can be included in the model as a decision-maker to determine the percentage of reproductive activities or the amount of capacity that each factory can access for its recycling activities inside and outside the city.

-

The different phases of the problem can be interrelated so that the output of each phase will be the input of the next phase and finally the results of all phases can be analyzed collectively.

Conclusion

This study deals with the issue of optimization in a recycling urban waste system, under the uncertainty of collected waste and reproductive capacity in which there are restrictions on manufacturing and remanufacturing activities (for example, limitations such as the prohibition of reproductive activities to recycle urban food waste and convert it into organic fertilizers). In the first scenario of this study, the optimization of a system consisting of a commercial food service, a food waste collection agency, and a fertilizer factory is investigated, in which a hybrid contract (QF and SCS) is used to manage the relationships between members. In this section, to optimize the channel, the initial order is calculated as a commercial food service's decision variable, but the proposed reward is supposed to have a predetermined amount. The system is then re-evaluated, by another hybrid contract (QF and TWCS) and a mathematical nonlinear model to optimize and manage the participant’s connection. Besides, in the second scenario, the two factories’ relationship is managed under the uncertainty of the first factory’s reproductive capacity. In this section, the initial order and the proposed reward that affects the amount of the collected waste and the overall profit of the system are considered model decision variables. This case has also been evaluated and optimized using two contracts (QF and option). Different models of the problem have been studied under three schemes: decentralized, centralized, and under the proposed contracts. Numerical examples show that under the SCS contract, the profitability of the channel reaches its highest possible value (equal to the centralized scheme). Moreover, under the TWCS contract, the profits of all members, as well as the whole system’s interest, outweigh their decentralized scheme that shows Pareto Improvement results for all participants. Moreover, it can be seen that the QF contract in the second scenario works better in some periods and the option contract also works better in some other periods for different amounts of the rental fee, i.e., L and e.

Data availability

All data generated or analyzed during this study are included in this published article and its supplementary information files.

References

Al-Mulali U, Sab CNBC, Fereidouni HG (2012) Exploring the bi-directional long run relationship between urbanization, energy consumption, and carbon dioxide emission. Energy 46(1):156–167

Aryal JP, Sapkota TB, Krupnik TJ, Rahut DB, Jat ML, Stirling CM (2021) Factors affecting farmers’ use of organic and inorganic fertilizers in South Asia. Environ Sci Pollut Res 28(37):51480–51496

Aumann’s R, Schelling’s T (2005) Contributions to game theory: analyses of conflict and cooperation. Information on the Bank of Sweden Prize Economic Sciences in Memory of Alfred Nobel, Stockholm.

Bai Q, Chen M, Xu L (2017) Revenue and promotional cost-sharing contract versus two-part tariff contract in coordinating sustainable supply chain systems with deteriorating items. Int J Prod Econ 187:85–101

Balsalobre-Lorente D, Driha OM, Halkos G, Mishra S (2022) Influence of growth and urbanization on CO2 emissions: The moderating effect of foreign direct investment on energy use in BRICS. Sustainable Dev 30(1):227–240

Beheshti S, Heydari J, Sazvar Z (2022) Food waste recycling closed loop supply chain optimization through renting waste recycling facilities. Sustainable Cities Soc 78:103644

Bloem E, Albihn A, Elving J et al (2017) Contamination of organic nutrient sources with potentially toxic elements, antibiotics and pathogen microorganisms in relation to P fertilizer potential and treatment options for the production of sustainable fertilizers: a review. Sci Total Environ 607:225–242

Briški F, Vuković M, Papa K, Gomzi Z, Domanovac T (2007) Modelling of composting of food waste in a column reactor. Chem Pap 61(1):24–29

Bulak ME, Kucukvar M (2022) How ecoefficient is European food consumption? A frontier-based multiregional input-output analysis. Sustainable Dev 30(5):817–832

Campuzano R, González-Martínez S (2017) Influence of process parameters on the extraction of soluble substances from OFMSW and methane production. Waste Manage 62:61–68

Chauhan A, Sharma NK, Tayal S, Kumar V, Kumar M (2022) A sustainable production model for waste management with uncertain scrap and recycled material. J Mater Cycles Waste Manage 24:1797–1817

Chehade G, Dincer I (2021) Progress in green ammonia production as potential carbon-free fuel. Fuel 299:120845

Chen H, Dong Z, Li G, He K (2021) Remanufacturing process innovation in closed-loop supply chain under cost-sharing mechanism and different power structures. Comput Ind Eng 162:107743

Chen Z, Zhou M (2021) Urbanization and energy intensity: Evidence from the institutional threshold effect. Environ Sci Pollut Res 28(9):11142–11157

Cheng Z, Yu L, Li H, Xu X, Yang Z (2021) Use of housefly (Musca domestica L.) larvae to bioconversion food waste for animal nutrition and organic fertilizer. Environ Sci Pollut Res 28(35):48921–48928.

D’Orsogna MR, Perc M (2015) Statistical physics of crime: A review. Phys Life Rev 12:1–21

Dutta P, Das D, Schultmann F, Fröhling M (2016) Design and planning of a closed-loop supply chain with three way recovery and buy-back offer. J Cleaner Prod 135:604–619

Edwards J, Othman M, Burn S, Crossin E (2016) Energy and time modelling of kerbside waste collection: Changes incurred when adding source separated food waste. Waste Manage 56:454–465

Elmaghraby WJ (2000) Supply contract competition and sourcing policies. Manuf Serv Oper Manage 2(4):350–371

Fernández-Delgado M, del Amo-Mateos E, Lucas S, García-Cubero MT, Coca M (2020) Recovery of organic carbon from municipal mixed waste compost for the production of fertilizers. J Cleaner Prod 265:121805

Fernández-Delgado M, del Amo-Mateos E, Lucas S, García-Cubero MT, Coca M (2022) Liquid fertilizer production from organic waste by conventional and microwave-assisted extraction technologies: Techno-economic and environmental assessment. Sci Total Environ 806:150904

Govindan K, Popiuc MN (2014) Reverse supply chain coordination by revenue sharing contract: A case for the personal computers industry. Eur J Oper Res 233(2):326–336

Gul F (1997) A Nobel Prize for game theorists: the contributions of Harsanyi. Nash and Selten J Econ Perspect 11(3):159–174

Guo S, Shen B, Choi TM, Jung S (2017) A review on supply chain contracts in reverse logistics: Supply chain structures and channel leaderships. J Cleaner Prod 144:387–402

Henig M, Gerchak Y, Ernst R, Pyke DF (1997) An inventory model embedded in designing a supply contract. Manage Sci 43(2):184–189

Heydari J, Bakhshi A (2022) Contracts between an e-retailer and a third party logistics provider to expand home delivery capacity. Comput Ind Eng 163:107763

Heydari J, Ghasemi M (2018) A revenue sharing contract for reverse supply chain coordination under stochastic quality of returned products and uncertain remanufacturing capacity. J Cleaner Prod 197:607–615

Heydari J, Govindan K, Ebrahimi-Nasab HR, Taleizadeh AA (2020) Coordination by quantity flexibility contract in a two-echelon supply chain system: effect of outsourcing decisions. Int J Prod Econ 225:107586

Heydari J, Mosanna Z (2018) Coordination of a sustainable supply chain contributing in a cause-related marketing campaign. J Cleaner Prod 200:524–532

Howe J, Wheeler P (1999) Urban food growing: The experience of two UK cities. Sustainable Dev 7(1):13–24

Ikhlayel M, Nguyen LH (2017) Integrated approaches to water resource and solid waste management for sustainable development. Sustainable Dev 25(6):467–481

İzgi B, Özkaya M (2019) A new perspective to the solution and creation of zero sum matrix game with matrix norms. Appl Math Comput 341:148–159

İzgi B, Özkaya M (2020) The Demonstration of Necessity of Agricultural Insurance by the Game Theory: Matrix Norm Approach. Afyon Kocatepe Univ J Sci Eng 20(5):824–831

Krikke H, Bloemhof-Ruwaard J, Van Wassenhove LN (2003) Concurrent product and closed-loop supply chain design with an application to refrigerators. Int J Prod Res 41(16):3689–3719

Levis JW, Barlaz MA, Themelis NJ, Ulloa P (2010) Assessment of the state of food waste treatment in the United States and Canada. Waste Manage 30(8–9):1486–1494

Li H, Hu Z, Wan Q, Mu B, Li G, Yang Y (2022) Integrated Application of Inorganic and Organic Fertilizer Enhances Soil Organo-Mineral Associations and Nutrients in Tea Garden Soil. Agron 12(6):1330

Li J, Luo X, Wang Q, Zhou W (2021) Supply chain coordination through capacity reservation contract and quantity flexibility contract. Omega 99:102195

Li X, Lian Z, Choong KK, Liu X (2016) A quantity-flexibility contract with coordination. Int J Prod Econ 179:273–284

Lin B, Zhu J (2021) Impact of China’s new-type urbanization on energy intensity: A city-level analysis. Energy Econ 99:105292

Liu J, Zhao D, Mao G, Cui W, Chen H, Yang H (2020) Environmental sustainability of water footprint in mainland China. Geogr Sustainability 1(1):8–17

Ma X, Li N, Yang H, Li Y (2022) Exploring the relationship between urbanization and water environment based on coupling analysis in Nanjing. East China Environ Sci Pollut Res 29(3):4654–4667

Madani K (2010) Game theory and water resources. J Hydrol 381(3–4):225–238

Mak TM, Iris KM, Xiong X et al (2021) A cross-region analysis of commercial food waste recycling behaviour. Chemosphere 274:129750

Marcos JT, Scheller C, Godina R, Spengler TS, Carvalho H (2021) Sources of uncertainty in the closed-loop supply chain of lithium-ion batteries for electric vehicles. Cleaner Logistics and Supply Chain 1:100006

Modak NM, Panda S, Sana SS (2016) Two-echelon supply chain coordination among manufacturer and duopolies retailers with recycling facility. Int J Adv Manuf Technol 87(5):1531–1546

Muhammad S, Long X, Salman M, Dauda L (2020) Effect of urbanization and international trade on CO2 emissions across 65 belt and road initiative countries. Energy 196:117102

Ndhaief N, Bistorin O, Rezg N (2017) A modelling approach for city locating logistic platforms based on combined forward and reverse flows. IFAC-PapersOnLine 50(1):11701–11706

Nematollahi M, Tajbakhsh A (2020) Past, present and prospective themes of sustainable agricultural supply chains: A content analysis. J Cleaner Prod 271:122201

Nematollahi M, Tajbakhsh A, Sedghy BM (2021) The reflection of competition and coordination on organic agribusiness supply chains. Transp Res Part E Logist Transp Rev 154:102462

Özkaya M, Izgi B (2021) Effects of the quarantine on the individuals’ risk of Covid-19 infection: Game theoretical approach. Alexandria Eng J 60(4):4157–4165

Pai S, Ai N, Zheng J (2019) Decentralized community composting feasibility analysis for residential food waste: A Chicago case study. Sustainable Cities Soc 50:101683

Patra TDP, Jha JK (2022) Bidirectional option contract for prepositioning of relief supplies under demand uncertainty. Comput Ind Eng 163:107861

Perc M, Jordan JJ, Rand DG, Wang Z, Boccaletti S, Szolnoki A (2017) Statistical physics of human cooperation. Phys Rep 687:1–51

Pourmohammad-Zia N, Karimi B, Rezaei J (2021) Food supply chain coordination for growing items: A trade-off between market coverage and cost-efficiency. Int J Prod Econ 242:108289

Rahimi M, Baboli A, Rekik Y (2016) Sustainable inventory routing problem for perishable products by considering reverse logistic. IFAC-Papersonline 49(12):949–954

Ramezani M, Bashiri M, Tavakkoli-Moghaddam R (2013) A new multi-objective stochastic model for a forward/reverse logistic network design with responsiveness and quality level. Appl Math Modell 37(1–2):328–344

Saborido R, Alba E (2020) Software systems from smart city vendors. Cities 101:102690

Savaskan RC, Bhattacharya S, Van Wassenhove LN (2004) Closed-loop supply chain models with product remanufacturing. Manage Sci 50(2):239–252

Sharma HK, Xu C, Qin W (2019) Biological pretreatment of lignocellulosic biomass for biofuels and bioproducts: an overview. Waste Biomass Valorization 10(2):235–251

Sheng C, Zhang D, Wang G, Huang Y (2021) Research on risk mechanism of China’s carbon financial market development from the perspective of ecological civilization. J Comput Appl Math 381:112990

Siddiqui Z, Hagare D, Jayasena V, Swick R, Rahman MM, Boyle N, Ghodrat M (2021) Recycling of food waste to produce chicken feed and liquid fertiliser. Waste Manage 131:386–393

Von Neumann J, Morgenstern O (1944) Theory of games and economic behavior. Princeton University Press, Princeton

Wang CX (2002) A general framework of supply chain contract models. Supply Chain Management: an International Journal 7(5):302–310

Wang L, Wu Y, Hu S (2021) Make-to-order supply chain coordination through option contract with random yields and overconfidence. Int J Prod Econ 242:108299

Wang X, Zhao M, He H (2018a) Reverse logistic network optimization research for sharing bikes. Procedia Comput Sci 126:1693–1703

Wang Z, Dong X, Yin J (2018b) Antecedents of urban residents’ separate collection intentions for household solid waste and their willingness to pay: Evidence from China. J Cleaner Prod 173:256–264

Wang Z, Brownlee AE, Wu Q (2020) Production and joint emission reduction decisions based on two-way cost-sharing contract under cap-and-trade regulation. Comput Ind Eng 146:106549

Wu P, Tan M (2012) Challenges for sustainable urbanization: a case study of water shortage and water environment changes in Shandong, China. Procedia Environ Sci 13:919–927

Yang L, Zhang Q, Ji J (2017) Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int J Prod Econ 191:286–297

Zang L, Liu M, Wang Z, Wen D (2022) Coordinating a two-stage supply chain with external failure cost-sharing and risk-averse agents. J Cleaner Prod 334:130012

Zhang D, Chen Y (2021) Evaluation on urban environmental sustainability and coupling coordination among its dimensions: A case study of Shandong Province. China Sustainable Cities Soc 75:103351

Zhu C, Fan R, Luo M, Lin J, Zhang Y (2020) Urban food waste management with multi-agent participation: A combination of evolutionary game and system dynamics approach. J Cleaner Prod 275:123937

Author information

Authors and Affiliations

Contributions

Saeed Beheshti and Jafar Heydari contributed to the study conception and design. Material preparation, data collection, and analysis were performed by Saeed Beheshti and Jafar Heydari. The first draft of the manuscript was written by Saeed Beheshti, then Saeed Beheshti and Jafar Heydari commented on previous versions of the manuscript. Saeed Beheshti and Jafar Heydari read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ta Yeong Wu

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions