Abstract

Despite the growing interest in researches on the impact of technological development on carbon emissions, the effect of technological innovation on the other indicators of environmental degradation is of little interest. In order to close this gap, the aim of this study is to determine the effects of technological innovation on both carbon emission and ecological footprint for big emerging markets (BEM) countries. In doing so, the environmental impacts of the financialization process are also explored, in line with the fact that these countries face constraints in financing technological developments. In this context, the effects of technological development, financialization, renewable energy consumption, and non-renewable energy consumption on environmental degradation are examined through the second-generation panel data methods for the period 1995–2016. The findings indicate that technological innovation is effective in reducing carbon emissions, but does not have a significant impact on the ecological footprint, namely a 1% increase in technological innovations reduces carbon emission by 0.082–0.088%. Moreover, it is found that financialization harms environmental quality for both indicators of the environment because a 1% increase in financialization increases carbon emissions by 0.203–0.222% and increases ecological footprint by 0.069–0.071%.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In recent years, due to the serious effects of the economic policies on the environment, there are intensive discussions on the concepts pointing to environmental destruction such as global warming and climate change. Accordingly, the environmental Kuznets curve (hereafter, EKC) hypothesis that deals with the effects of economic growth on environmental destruction has become a popular research subject. The hypothesis is basically derived from the inverted U-shaped relationship between economic growth and income inequality expressed in the study of Kuznets (1955), but Grossman and Krueger (1991) and Shafik and Bandyopadhyay (1992) pioneered the adaptation of this hypothesis to environmental destruction. EKC hypothesis briefly states that in the first phase of economic growth, environmental degradation increases due to the increase in income level, and environmental destruction decreases after exceeding a certain threshold in income level (Dinda 2004). According to Grossman and Krueger (1991), it is possible to divide the impact of the economic activities on environmental destruction into three groups as scale effect, composition effect, and technology effect. The scale effect is an effect explaining the increase in the environmental degradation caused by the economic activities carried out by using fossil fuels depending on the increase in commercial activities in the period when the national economies started to grow. However, in the later stages, environmental destruction decreases due to the changes in the commercial policies of the countries in which the economic growth process continues, especially due to the specialization in certain areas where the level of pollution is less (composition effect) and due to the improvement in technology and increasing competitive advantage (technological effect).

Despite the only cause of environmental destruction or environmental quality has been hypothesized as economic growth, it has been determined by country experiences that just economic enrichment is not enough to reach the final stage of the hypothesis. Therefore, the researchers strived to explain the difference in the effects of enrichment on the environment by focusing on the indicators triggered by economic growth and the indicators triggering economic growth. In this context, some recent studies explained mentioned differences by financialization (Shahbaz et al. 2018a, 2020; Ahmad et al. 2018; Khan et al. 2019; Destek and Sarkodie 2019; Nasir et al. 2019; Zafar et al. 2019; Destek 2019a; Liu and Song 2020), globalization (Rafindadi and Usman 2019; Ahmed et al. 2019; Destek 2019b; Balsalobre-Lorente et al. 2020; Bilgili et al. 2020; Destek and Sinha 2020), urbanization (Salahuddin et al. 2019; Wang and Su 2019; Ulucak and Khan 2020), industrialization (Asumadu-Sarkodie and Owusu 2017; Liu and Bae 2018; Dong et al. 2019; Wang et al. 2020), energy portfolio (Destek et al. 2018; Bekun et al. 2019; Alola et al. 2019; Sharif et al. 2020; Destek and Aslan 2020; Erdogan et al. 2020), human capital (Ahmed and Wang 2019; Chen et al. 2019; Sarkodie et al. 2020; Zafar et al. 2020), and technological innovation (Yu and Du 2019; Hashmi and Alam 2019; Sinha et al. 2020; Khan and Ulucak 2020) levels of the countries.

In spite of the fact that all the mentioned factors have direct or indirect effects on the environment, environmental regulations and technological progress are accepted as the most important prerequisite for reaching the final stage of the EKC hypothesis (Yin et al. 2015). In addition to its direct effects, it is stated that technological innovation manages the relations among the determinants of environmental quality and also that innovation-supported commercial activities also serve environmental quality (Torras and Boyce 1998). In particular, the effective support of innovative activities specific to the energy sector decreases environmental damage by increasing renewable energy use and energy efficiency (Vukina et al. 1999). However, access to high-cost environmental technologies is not possible especially in developing countries due to the fund constraint. In this context, low-income developing countries are still obliged to have a production structure based on fossil energy sources, while high-income developing countries (emerging economies) can obtain the necessary funds for environmental technologies through the financial system. Therefore, although the financialization process appears to indirectly contribute to environmental quality, there are also debates that it increases environmental degradation.

Many scenarios with opposite views regarding the environmental effects of the financialization process come to the fore. In the optimistic scenario, it is stated that the technologies that provide savings in energy use and help reduce environmental pollution will be easier and lower cost. In addition, according to this view, the environmental dominance of firms, which are managed with a more effective financial system, leads to a reduction in the environmental destruction of these firms (Claessens and Feijen 2007; Tamazian et al. 2009). According to the opposite view, the impact of financial development on environmental destruction arises for various reasons. The first of these is to attract foreign direct investments to the country at the expense of environmental destruction to support financial development and economic growth. Secondly, the widespread use of financial instruments increases the power of consumers to purchase products such as automobiles, refrigerators, and air conditioners. It causes more environmental degradation by purchasing such products. Finally, it is an increase in energy consumption and therefore environmental damage due to frequent use of new projects and new investment channels in order to reduce financing costs, diversify financing channels, and distribute business risk (Zhang 2011). Apart from all these arguments, some empirical studies suggest that there is no relationship between financial development and carbon emissions (Shahbaz et al. 2018b). Therefore, the following research questions need to be answered: (i) Is technological progress an environmental blessing or a curse? (ii) Does the expansion and deepening of the financial system fund long-term profitable environmental projects or pursue short-term profit?

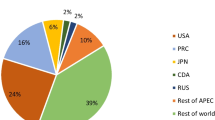

Based on the above debates, this study aims to examine the impact of technological innovation and financialization on environmental degradation in big emerging markets (BEM) countries: Argentina, Brazil, China, India, Indonesia, Mexico, Poland, S. Africa, S. Korea, and Turkey. For this purpose, the impact of technological development, financial development, renewable energy consumption, and non-renewable energy consumption on environmental degradation is analyzed with second-generation panel data methodologies for the period from 1995 to 2016. In doing so, to compare the atmospheric and total environmental effect of explanatory variables, both carbon emissions and ecological footprint are used as environmental degradation indicators. The reason for using the ecological footprint of Wackernagel and Rees (1996) is that the ecological footprint is seen as a more appropriate measure representing environmental degradation than other environmental indicators (Wackernagel and Rees 1996) because it simultaneously measures grazing land, fishing grounds, forest land, settled land, and carbon footprint (Lin et al. 2016). Moreover, the reason why this country group is preferred in the study is that BEM countries have a more developed financial system and higher technology investments than other developing countries. In addition, according to the recent report of Muntean et al. (2018), BEM 10 countries are responsible for 45.71% of global carbon emissions in 2017. Therefore, identifying the triggers of the carbon emissions of these countries and finding solutions to this will also play an important role in reducing global carbon emissions.

The contributions of the study to existing literature are fourfold: (i) this is the first study to examine the determinants of environmental degradation in BEM countries. (ii) The study uses environment-related technologies as an indicator of technological innovation to clearly observe the environmental efficiency of technological development. (iii) The study also uses the Financial Development Index as an indicator of financial development instead of private credits that are widely used in the literature because the Financial Development Index includes many sub-indices about the financial system. (iv) The study compares the effects of explanatory variables on carbon emissions and ecological footprint instead of focusing only on atmospheric pollution. (v) Unlike previous studies, the study uses second-generation panel data methodologies to take into account the possible cross-sectional dependence among observed countries.

The paper is organized as follows: the “Literature review” section reviews and summarizes the previous studies. The “Data and methodology” section describes the empirical models, data, and methodology. The “Empirical results” section presents and discusses the empirical results. Finally, the “Conclusions and policy implications” section concludes the study with policy implications.

Literature review

Since the main purpose of this study is to observe the impact of technological innovation and financialization on environmental degradation, we categorize the section into two parts as financialization and environment nexus and technological innovation and environment nexus. In the first part, we focus on the environmental impact of financialization and the second part includes the previous studies on the environmental impact of technological innovation.

Financialization and environment

It is seen that studies investigating the effect of financialization on environmental quality have obtained different findings. In general, the main view that financialization increases environmental quality is stated that in parallel with the improvement in economic growth with financialization, energy will be used efficiently and the possibility of accessing new technologies that increase environmental quality will increase; thus, environmental pollution will decrease (Islam et al. 2013). On the other hand, the opposite view argues that the economic growth provided by the increase in financialization may cause more industrial pollution and environmental degradation (Jensen 1996). As one of the pioneering studies on financialization and environmental degradation nexus, Tamazian et al. (2009) analyzed the relationship between financial development, economic growth, and carbon emissions in BRIC countries between 1992 and 2004 with the standard reduced-form modeling approach. In the study, the ratio of deposit money bank assets to GDP, the capital account convertibility, and financial liberalization are used as indicators of financial development. In conclusion, it is stated that especially the developments in the capital market and the banking sector and the FDI inflows in these sectors are effective in reducing environmental degradation. Similar to the findings of this study, Jalil and Feridun (2011) also found that financial development reduces carbon emissions and stated that the reduction of carbon emissions in China is the possible result of the establishment of new environmental facilities that are realized with the capital accumulation provided by financial development and provide waste disposal. In addition, the study also argued that the financialization process required for reducing environmental pollution should be continued by supporting the problematic loans with various privatization reforms. Shahbaz et al. (2013a) reach a similar result for Malaysia and attributed this finding to that financial development in Malaysia providing the financing required for environmental development projects at a lower cost and the environmental projects carried out with financial development to achieve significant efficiency in fossil fuel consumption throughout the country. Shahbaz et al. (2013b) also validated the environmental pollution reducing effect of financial development in South Africa.

Opposite to the above studies, some studies found the environmental degradation increasing effect of financial development. For instance, Zhang (2011) analyzed the impact of financial development on carbon emission for China between 1980 and 2009 by using the variance decomposition method and reached the finding that financial development, especially the effect of financial intermediation transactions, increases carbon emissions. This is mainly attributed to the deficiencies in adapting the direction of the use of FDI movements entering China to encourage low-carbon development and the development of financial intermediation activities in China, which lead to a significant increase in carbon emissions. Shahbaz et al. (2015) also concluded that financial development increases environmental destruction and explained the reason of this finding that the lack of obstacles and sanctions in promoting and increasing energy use to ensure unsustainable high economic growth, as in many developing countries such as India. Similarly, Shahbaz et al. (2016) for Pakistan and Baloch et al. (2019) obtained for 59 Belt and Road countries. The findings obtained in these studies are attributed to the financial developments in the banking sector; the fact that the financial resource distribution mechanism of the banking sector in selected countries is not monitored after the resource allocation, the companies that use their funds in practices lacking environmental control are punished by various methods such as interest rate increases or tax increases.

There are also some studies that found an indirect effect of financialization instead of the direct effect such as Al-Mulali and Sab (2012) observed the relationship between financial development, energy consumption, carbon emission, and economic growth in Sub-Saharan African countries for the period of 1980–2008, and concluded that increased energy use due to economic growth and financial development significantly increases carbon emissions. Boutabba (2014) discussed the relationship between carbon emissions, financial development, economic growth, energy consumption, and openness in India between 1971 and 2008 using with ARDL bound test. According to the findings, the increase in financial development increases the environmental degradation by increasing the energy use.

Based on the parabolic function of the EKC hypothesis, Moghadam and Lotfalipour (2014) examined the possible parabolic impact of financial development on environmental pollution between 1970 and 2011 using the ARDL method and found that there is a positive relationship between financial development and carbon emissions, but this relationship evolved negatively after achieving a certain level of financial development; therefore, the study argued that there is an inverted U-shaped relationship between these twin variables. According to the study, this situation is a result of the investments supported by financial development that only focus on the size of industrial activities in Iran and the developments that will increase environmental protection in the sector are ignored. Furthermore, some studies argue that there is no statistical relationship between financialization and environmental degradation. Ozturk and Acaravci (2013) examined the nexus between financial development, trade openness, energy consumption, and carbon emissions in Turkey for the years of 1960–2007 and the findings show that financial development has no effect on carbon emissions.

Similar to our study, there are also some studies that employ the second-generation panel data methodologies to check the financialization-environment nexus. For instance, Wang et al. (2019) utilized methods that allow cross-section dependency while examining the relationship between financialization and environment for OECD countries. According to this study, financial development plays an important role in reducing CO2 emissions by funding companies to acquire environmentally friendly technologies in the production process. Similar findings were obtained from the studies of Dogan and Seker (2016) for the top renewable energy generator countries and Awan et al. (2020) for the Middle East and North African countries. On the contrary, Bayar and Maxim (2020) predicted that for post-transition European economies, funds other than energy-saving technological developments or financial developments that are directed towards production channels only increase environmental degradation.

Technological innovation and environment

Similar to the studies on the relationship between financialization and environment, it is seen that mixed results are obtained from the studies examining the effects of technological innovation on the environment, depending on the used methodology, observed country/country group, or considered period. But still, as hypothesized, empirical findings often appear to be that technological innovation contributes to environmental quality. For instance, Ali et al. (2016) examined the relationship between technological innovation and carbon emission in Malaysia and the finding about pollution reducing effect of technology was attributed to the fact that technological developments in Malaysia were based on green and environmentally friendly technology. Ibrahiem (2020) investigated the nexus for the Egyptian economy which emphasized that low- and zero-carbon energy supply is important in the application of technologies, especially in energy-intensive sectors such as the cement sector. Ahmed et al. (2016) also found the evidence that technological progress reduces carbon emission. Moreover, Hang and Yuan-Sheng (2011) considered the possible parabolic relationship between the mentioned variables and found that the effect of technological development on carbon emission is positive in the first stage and negative in the later stages in China. In other words, it is found that there is an inverted U-shaped relationship between both variables. This situation is attributed to the increase in investment and higher emissions due to the emergence of more technological innovations in the first phase of industrialization in the country’s economy. In the later stages of industrialization, the positive impact of technology has been explained by the change in consumption patterns from the energy-intensive manufacturing sector to the more environmentally friendly service sector and the emergence of alternative energy sources.

It is surprisingly seen that most of the studies focusing on only the causal nexus between technological innovation and the environment found that there is no significant relationship between the variables. For instance, Fei et al. (2014) examined the relationship between renewable energy, economic growth, carbon emissions, and technological innovation in Norway and New Zealand for the period 1971–2010 with the Granger causality test. According to the results, while it is concluded that there is a bidirectional causality between carbon emission and technological innovation for Norway, it is estimated that there is no causal relationship between these variables in New Zealand. Irandoust (2016) searched the relationship between technological innovation, renewable energy, and carbon emissions in Denmark, Finland, Norway, and Sweden for the period from 1975 to 2012. The study used the R&D expenditures in the energy sector as an indicator of technological innovation with employing the causality test of Toda and Yamamoto (1995) and concluded that there is a unidirectional causality from technological innovation to renewable energy, but there is no significant causal relationship between carbon emission and technological innovation. Fan and Hossain (2018) analyzed the relationship between trade openness, technological innovation, and carbon emissions for the period of 1974–2016 in China and India with the Toda-Yamamoto causality test. According to the findings, while there is a bidirectional causal relationship between twin variables in China, there is a unidirectional causality from technological development to carbon emission in India. The difference of the findings between China and India is attributed to India’s being far behind the world standards in terms of preparation for technological development. Yii and Geetha (2017) investigated the relationship between technological innovation and carbon emissions in Malaysia for the period of 1971–2013 with the VECM Granger causality test. The findings have revealed that there is no relationship between technological innovation and carbon emissions. Samargandi (2017) tested the relationship between sectoral value added, technological development, and carbon emissions between 1970 and 2014 in Saudi Arabia with the ARDL bound test and concluded that technological development does not have a significant effect on carbon emissions. This situation is attributed to the fact that 100% fossil fuel is still used as the primary energy source in the country; the petroleum supply with low prices is abundant and therefore innovative activities that enable the use of clean energy resources are ignored.

Moreover, there are also studies analyzing the relationship between technological development and the environment by considering cross-sectional dependency. For some recent studies, Khattak et al. (2020) analyzed the impact of technological innovation, economic growth, and renewable energy use on carbon emissions in the BRICS countries for the period of 1980–2016. Findings have shown that innovation activities have failed to reduce carbon emission for BRICS countries except Brazil. Similarly, Ali et al. (2020) concluded that innovation activities in 33 selected European Union countries reduced carbon emissions. This finding is attributed to the diffusion of technological developments that provide energy efficiency.

Data and methodology

Data

Following the above debate, the annual data from 1995 to 2016 is observed to examine the impact of technological innovation and financialization on environmental degradation based on the IPAT environmental model of Ehrlich and Holdren (1971) which is a widely used theoretical model by environmental economists. The IPAT environmental model can be summarized as follows:

where I shows the environmental impact, P means population, A indicates economic activities, and T implies technological level. In the following years, Dietz and Rosa (1994, 1997) transformed this basic model into a stochastic model and obtained the STIRPAT (Stochastic Impacts by Regression on Population, Affluence and Technology) model. While creating the empirical model, we follow the STIRPAT model, but we excluded the population variable from the model by using countable variables in the per capita form. In this direction, our empirical model is as follows;

where ED is environmental degradation and proxied by two different indicators such as carbon dioxide emission (CO) and ecological footprint (EF), R is renewable energy consumption, NR is non-renewable energy consumption, TEC is technological innovation, and FIN indicates financialization. In the empirical procedure, CO is measured in per capita carbon emissions in metric tons, EF is used as per capita ecological footprint in gha, R (NR) is used as per capita renewable (non-renewable) energy consumption in kwh, TEC is measured as a patent number in environmental-related technologies, and FIN is used as the Financial Development Index.

In regard to the source of the dataset, CO data is obtained from Gilfillan et al. (2019), UNFCCC (2019), and BP (2019), and EF data is obtained from Global Footprint Network. R and NR data are obtained from Energy Information Administration, TEC data is retrieved from OECD statistics, and FIN data is obtained from the Financial Development Index of the International Monetary Fund. In empirical analysis, to avoid scaling differences and to normalize the series, all variables are used in natural logarithmic form.

Methodology

Preliminary tests

In the panel data procedure, it is necessary to choose the right estimator to obtain consistent and reliable results for policy recommendations. Based on the fact that the effects of the 2008 global financial crisis spread across almost all countries, it is anticipated that estimators (called as first-generation estimators), which do not take into account inter-country dependency, are not expected to yield reliable results. Accordingly, when using panel data techniques, it is most likely necessary to test the interdependence between countries, in other words, the cross-sectional dependence (hereafter, CSD). In this study, the CSD issue is investigated by the CD test developed by Pesaran (2004). Then, it is also necessary to observe the stationarity process, which is important in all econometric predictions. Therefore, the CIPS unit root test developed by Pesaran (2007) is used in the study since the unit root test to be used should be a test that also allows CSD. At the end of the preliminary tests, the test of whether the long-term relationship between the variables is valid affects the choice of the estimator to be used. Accordingly, the validity of the mentioned relationship is investigated through the ECM-based cointegration test developed by Westerlund (2007).

Panel long-run estimators

After validating the cross-sectional dependent cointegration among variables, the coefficient of cointegrated regressor should be searched with an estimation technique that allows cross-sectional dependence. Thus, we conduct CUP-FM (continuously updated and fully modified) and CUP-BC (continuously updated and bias-corrected) estimators developed by Bai et al. (2009). These estimators augment the basic panel regression model and assume cross-sectional dependence and error term (εit) (e.g., Bai and Kao 2006) as follows:

where Ft, \( {\lambda}_i^{\prime } \) and μit indicate the vector of common factors, corresponding factor loadings, and the idiosyncratic component of the error term, respectively. The computation process of CUP-FM is based on repeatedly estimating coefficients and long-run co-variance matrix until reaching the convergence as follows:

where \( {\hat{y}}_{it}^{+}={y}_{it}-\left({\hat{\lambda}}_i^{\prime }{\hat{\Omega}}_{F\varepsilon i}+{\hat{\Omega}}_{\mu \varepsilon i}\right){\hat{\Omega}}_{\varepsilon i}^{-1}\Delta {x}_{it} \), \( {\hat{\Omega}}_{F\varepsilon i} \), and \( {\hat{\Omega}}_{\mu \varepsilon i} \) are estimated long-run co-variance matrices and \( {\hat{\varDelta}}_{F\varepsilon i}^{+} \) and \( {\hat{\Omega}}_{\mu \varepsilon i} \) are estimated one-sided long-run co-variance.

There are also some reasons for using the CUP-FM and CUP-BC estimators in this study. First, similar to our preferred cointegration test, these estimators are also consistent tests in the case of exogenous explanatory variables. In addition, these estimators can be used for the variables that are integrated from different orders. Moreover, since the CUP-FM estimator is a test developed based on the fully modified OLS estimator which uses the Bartlett-Kernel procedure, it can also be used especially in possible autocorrelation and heteroskedasticity situations (Kiefer and Vogelsang 2002). Finally, both estimators are robust in case of endogeneity (Bai et al. 2009).

Empirical results

The results of preliminary tests

In the first step of empirical analysis, we employ some preliminary tests (i.e., CSD, unit root, and cointegration) to prefer the most suitable estimator for our empirical models. In doing so, first, the possible CSD among BEM countries are examined with CD test and the findings are presented in Table 1. Based on the results, the null hypothesis if there is no CSD is clearly rejected; therefore, the importance of considering the impact of globalization on our indicators is validated.

Based on the confirmation of CSD, since the stationarity process of variables should be searched with a unit root test that allows CSD, we employ the CIPS unit root test of Pesaran (2007). The results from Table 1 show that the unit root process can not be rejected in the level form of variables. However, all variables have become stationary in the first differenced form thence the evidence that all variables are integrated of order one is confirmed.

In the final step of preliminary analysis, the existence of a long-run relationship between variables for both models is investigated with the ECM-based panel cointegration test of Westerlund (2007) and the findings are shown in Table 2. In the first model, the null of no cointegration is rejected by Gτ, Pτ, and Pα statistics. In case of the second model, the null is also rejected by Gτ and Pτ statistics. Therefore, we confirm the validity of the cointegration relationship between variables for both models and this result allows us to search the cointegrating coefficients of explanatory variables on environmental degradation.

Determinants of environmental degradation

As financialization, technological innovation, renewable energy consumption, and non-renewable energy consumption are cointegrated with the environmental degradation indicators, the long-run impact of these variables on different degradation proxies is observed with CUP-FM and CUP-BC estimation techniques that allow CSD. First, we examine the determinants of carbon emissions (CO) and present the findings in Table 3. At a first glance, both estimation results show that increasing renewable energy consumption reduces carbon emissions while non-renewable energy consumption increases it. In addition, the hypothesis that technological development is efficient on carbon mitigation is confirmed. However, it is surprisingly found that financialization harms the atmospheric quality in BEM countries.

In the case of ecological footprint, the findings from Table 4 reveal that renewable energy consumption also reduces the ecological footprint as it reduces the carbon emissions. However, unlike carbon emission function, the ecological footprint increasing role of non-renewable energy use is not observed. Similarly, it is also found that technological innovation does not significantly affect ecological footprint. However, the hypothesis that financialization harms environmental quality is also supported because financial development increases ecological footprint.

Overall, our findings reveal that renewable energy consumption reduces environmental degradation for both environmental indicators and the finding is consistent with the findings of Alola et al. (2019) and Sharif et al. (2020). The environmental degradation reducing the effect of renewable energy consumption means that the renewable energy consumption level of selected countries has reached to an adequate level to combat with environmental destruction. In addition, we found that non-renewable energy consumption increases carbon emissions but does not affect ecological footprint. The degradation increasing effect of non-renewable energy use is also validated by the studies of Bekun et al. (2019), Destek and Aslan (2020), and Erdogan et al. (2020). This finding is an expected situation because fossil energy sources are accepted as the most pollutant energy sources. When the environmental effects of technological innovation are evaluated in line with the main purpose of the study, it is seen that technological progress reduces carbon emission in line with the studies of Ahmed et al. (2016) and Ibrahiem (2020). However, it has been observed that technological progress does not have a significant impact on the ecological footprint. This indicates that technological research focuses only on targets that increase atmospheric quality in selected countries. Finally, it is found that financialization accelerates deterioration in all environmental indicators. The environmental degradation increasing effect of financial development is also confirmed by Ali et al. (2019). This finding emphasizes that the countries observed have failed in terms of regulation policies that will encourage the financial system to provide funding for environmentally friendly technologies.

We also use the two-way fixed-effect model for robustness check and present the findings in Table 5. As seen, the findings from the two-way fixed-effect model are consistent with the continuously updated estimators. Namely, the results validated the evidence that increasing renewable energy consumption and technological innovation reduces the carbon emissions while non-renewable energy consumption and financialization increase it. In addition, for the ecological footprint model, increasing renewable energy reduces ecological footprint while financialization increases the degradation level of countries. Similar to the findings from CUP estimators, these findings also confirmed that non-renewable energy use and technological innovation do not have any significant impact on ecological footprint.

Conclusions and policy implications

This study explores the impact of technological innovation on environmental degradation by controlling the financialization, renewable energy consumption, and non-renewable energy consumption in big emerging markets (BEM) countries. In addition, to compare how the atmospheric pollution and total environmental degradation are affected by technological innovation, both carbon emissions and ecological footprint are used as an indicator of environment. In doing so, the period from 1995 to 2016 is analyzed with second-generation panel data methodologies. In detail, the stationary properties of variables are examined with CIPS unit root test, the existence of a long-run relationship between variables is searched with ECM-based panel cointegration test, and the long-run impacts of the regressors are probed with Cup-FM and Cup-BC estimation techniques.

The results of the empirical analysis can be summarized as follows: (i) increasing renewable energy consumption reduces both carbon emissions and ecological footprint. (ii) Increasing non-renewable energy consumption increases carbon emissions while it does not significantly affect the ecological footprint. (iii) Technological innovation reduces carbon emissions while it does not significantly affect ecological footprint. (iv) Financialization increases both carbon emissions and ecological footprint. Based on these findings, the first one indicates that renewable energy share in the total energy portfolio of these countries has reached the level that reduces environmental degradation. Therefore, it can be said that continuing green energy policies to increase the mentioned rate plays a key role in success for combating environmental destruction. In addition, the second finding implies that non-renewable energy consumption is a factor that mainly increases atmospheric pollution but has an almost insignificant effect on total environmental degradation. In this context, the conversion to renewable energy should be accelerated in order to reduce atmospheric pollution. Thirdly, it is surprisingly seen that technological innovations act mainly with the focus of reducing atmospheric pollution. On the other hand, it seems there is no technological progress to reduce damage on cropland, grazing land, fishing grounds, build-up lands, and forest land. Therefore, the innovative researches should also be directed to create improvements in ecological footprint indicators. The fourth and most negative picture clearly reveals the fact that the financial system accelerates environmental degradation. This is largely due to the fact that emerging economies are in need of funds provided by the financial system in their development strategies and that they are limited in terms of environmentally friendly regulation policies. However, it is observed that the development policy, which is pursued solely based on economic enrichment, is an important obstacle to reaching other sustainable development targets. Moreover, the problems that will arise as a result of environmental degradation eliminate the economic gains in the long term. Accordingly, it will be a more rational policy to regulate the financialization process to provide funding projects especially for environmentally friendly technological progress. When the findings are evaluated on financialization, technological innovation, and environmental transfer mechanism, it is concluded that technological innovation activities that reduce environmental pollution do not benefit the financial sector, contrary to expectations. That is to say, technological development in these countries reduces environmental degradation, but the financing opportunities provided by the financialization process to environmental technologies are insufficient. In fact, the financial sector provides more funds for areas that increase environmental pollution in big emerging economies.

Considering the rapidly increasing production levels and emissions of BEM countries, it is of great importance that developed countries with higher technology levels compared to BEM countries share environment-friendly technologies with BEM countries in terms of global emission reduction. In addition, considering the rapid industrialization and innovation processes, other countries should take measures to restrict the import of high-emission industrial products rather than low-cost goods imports in their trade with BEM countries.

Finally, we should note about the limitations of this study to create a roadmap for future studies. Although this study provides information about the effects of technological development and financialization on overall environmental degradation, identifying the impact on disaggregated environmental indicators will allow more detailed policy recommendations, namely, determining the effects of technological innovation and financialization on cropland, grazing land, fishing grounds, forest land, built-up land along with carbon footprint can be compared by using subcomponents of the ecological footprint as dependent variables instead of total ecological footprint.

Data availability

The datasets analyzed during the current study are available from the corresponding author on reasonable request.

References

Ahmad M, Khan Z, Ur Rahman Z, Khan S (2018) Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) model. Carbon Management 9(6):631–644

Ahmed Z, Wang Z (2019) Investigating the impact of human capital on the ecological footprint in India: an empirical analysis. Environ Sci Pollut Res 26(26):26782–26796

Ahmed A, Uddin GS, Sohag K (2016) Biomass energy, technological progress and the environmental Kuznets curve: evidence from selected European countries. Biomass Bioenergy 90:202–208

Ahmed Z, Wang Z, Mahmood F, Hafeez M, Ali N (2019) Does globalization increase the ecological footprint? Empirical evidence from Malaysia. Environ Sci Pollut Res 26(18):18565–18582

Ali W, Abdullah A, Azam M (2016) The dynamic linkage between technological innovation and carbon dioxide emissions in Malaysia: an autoregressive distributed lagged bound approach. Int J Energy Econ Policy 6(3):389–400

Ali HS, Law SH, Lin WL, Yusop Z, Chin L, Bare UAA (2019) Financial development and carbon dioxide emissions in Nigeria: evidence from the ARDL bounds approach. GeoJournal 84(3):641–655

Ali M, Raza SA, Khamis B (2020) Environmental degradation, economic growth, and energy innovation: evidence from European countries. Environ Sci Pollut Res Int

Al-Mulali U, Sab CNBC (2012) The impact of energy consumption and CO2 emission on the economic growth and financial development in the Sub Saharan African countries. Energy 39(1):180–186

Alola AA, Bekun FV, Sarkodie SA (2019) Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci Total Environ 685:702–709

Asumadu-Sarkodie S, Owusu PA (2017) The causal effect of carbon dioxide emissions, electricity consumption, economic growth, and industrialization in Sierra Leone. Energy Sources, Part B: Economics, Planning, and Policy 12(1):32–39

Awan AM, Azam M, Saeed IU, Bakhtyar B (2020) Does globalization and financial sector development affect environmental quality? A panel data investigation for the Middle East and North African countries. Environ Sci Pollut Res:1–14

Bai J, Kao C (2006) On the estimation and inference of a panel cointegration model with cross-sectional dependence. Contributions to economic analysis 274:3–30

Bai J, Kao C, Ng S (2009) Panel cointegration with global stochastic trends. J Econ 149(1):82–99

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ Sci Pollut Res 26(6):6199–6208

Balsalobre-Lorente D, Driha OM, Shahbaz M, Sinha A (2020) The effects of tourism and globalization over environmental degradation in developed countries. Environ Sci Pollut Res 27(7):7130–7144

Bayar Y, Maxim A (2020) Financial development and CO2 emissions in post-transition European Union countries. Sustainability 12(7):2640

Bekun FV, Alola AA, Sarkodie SA (2019) Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Bilgili F, Ulucak R, Koçak E, İlkay SÇ (2020) Does globalization matter for environmental sustainability? Empirical investigation for Turkey by Markov regime switching models. Environ Sci Pollut Res 27(1):1087–1100

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

BP (2019) British petroleum statistical review of world energy. London: British Petroleum Corporate Communications Services

Chen S, Saud S, Saleem N, Bari MW (2019) Nexus between financial development, energy consumption, income level, and ecological footprint in CEE countries: do human capital and biocapacity matter? Environ Sci Pollut Res 26(31):31856–31872

Claessens S, Feijen E (2007) Financial sector development and the millennium development goals. The World Bank

Destek MA (2019a) Financial development and environmental degradation in emerging economies. In: Energy and Environmental Strategies in the Era of Globalization. Springer, Cham, pp 115–132

Destek MA (2019b) Investigation on the role of economic, social, and political globalization on environment: evidence from CEECs. Environ Sci Pollut Res:1–14

Destek MA, Aslan A (2020) Disaggregated renewable energy consumptio and environmental pollution nexus in G-7 countries. Renew Energy 151:1298–1306

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic co-operation and development countries. J Clean Prod 242:118537

Destek MA, Ulucak R, Dogan E (2018) Analyzing the environmental Kuznets curve for the EU countries: the role of ecological footprint. Environ Sci Pollut Res 25(29):29387–29396

Dietz T, Rosa EA (1994) Rethinking the environmental impacts of population, affluence and technology. Hum Ecol Rev 1(2):277–300

Dietz T, Rosa EA (1997) Environmental impacts of population and consumption. Environmentally significant consumption: Research directions:92–99

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49(4):431–455

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energ Rev 60:1074–1085

Dong F, Wang Y, Su B, Hua Y, Zhang Y (2019) The process of peak CO2 emissions in developed economies: a perspective of industrialization and urbanization. Resour Conserv Recycl 141:61–75

Ehrlich PR, Holdren JP (1971) Impact of population growth. Science 171(3977):1212–1217

Erdogan S, Okumus I, Guzel AE (2020) Revisiting the environmental Kuznets curve hypothesis in OECD countries: the role of renewable, non-renewable energy, and oil prices. Environ Sci Pollut Res:1–9

Fan H, Hossain MI (2018) Technological innovation, trade openness, CO2 emission and economic growth: comparative analysis between China and India. Int J Energy Econ Policy 8(6):240

Fei Q, Rasiah R, Shen LJ (2014) The clean energy-growth nexus with CO2 emissions and technological innovation in Norway and New Zealand. Energy & environment 25(8):1323–1344

Gilfillan D, Marland G, Boden T, Andres R (2019) Global, regional, and national fossil-fuel CO2 emissions. Available at https://energy.appstate.edu/CDIAC

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. National Bureau of Economic Research (no. w3914)

Hang G, Yuan-Sheng J (2011) The relationship between CO2 emissions, economic scale, technology, income and population in China. Procedia Environ Sci 11:1183–1188

Hashmi R, Alam K (2019) Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: a panel investigation. J Clean Prod 231:1100–1109

Ibrahiem DM (2020) Do technological innovations and financial development improve environmental quality in Egypt? Environ Sci Pollut Res:1–13

Irandoust M (2016) The renewable energy-growth nexus with carbon emissions and technological innovation: evidence from the Nordic countries. Ecol Indic 69(118):125

Islam F, Shahbaz M, Ahmed AU, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model 30:435–441

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Jensen AL (1996) Beverton and Holt life history invariants result from optimal trade-off of reproduction and survival. Can J Fish Aquat Sci 53(4):820–822

Khan D, Ulucak R (2020) How do environmental technologies affect green growth? Evidence from BRICS economies. Sci Total Environ 136504

Khan MTI, Yaseen MR, Ali Q (2019) Nexus between financial development, tourism, renewable energy, and greenhouse gas emission in high-income countries: a continent-wise analysis. Energy Econ 83:293–310

Khattak SI, Ahmad M, Khan ZU, Khan A (2020) Exploring the impact of innovation, renewable energy consumption, and income on CO2 emissions: new evidence from the BRICS economies. Environ Sci Pollut Res:1–16

Kiefer NM, Vogelsang TJ (2002) Heteroskedasticity-autocorrelation robust standard errors using the Bartlett kernel without truncation. Econometrica 70(5):2093–2095

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

Lin B, Omoju OE, Nwakeze NM, Okonkwo JU, Megbowon ET (2016) Is the environmental Kuznets curve hypothesis a sound basis for environmental policy in Africa? J Clean Prod 133:712–724

Liu X, Bae J (2018) Urbanization and industrialization impact of CO2 emissions in China. J Clean Prod 172:178–186

Liu H, Song Y (2020) Financial development and carbon emissions in China since the recent world financial crisis: evidence from a spatial-temporal analysis and a spatial Durbin model. Sci Total Environ 715:136771

Moghadam HE, Lotfalipour MR (2014) Impact of financial development on the environmental quality in Iran. Chinese Business Review 13(9):537–551

Muntean M, Guizzardi D, Schaaf E, Crippa M, Solazzo E, Olivier J, Vignati E (2018) Fossil CO2 emissions of all world countries. Publications Office of the European Union, Luxembourg

Nasir MA, Huynh TLD, Tram HTX (2019) Role of financial development, economic growth & foreign direct investment in driving climate change: a case of emerging ASEAN. J Environ Manag 242:131–141

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Pesaran HM (2004) General diagnostic tests for cross-sectional dependence in panels. University of Cambridge, Cambridge Working Papers in Economics, p 435

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Rafindadi AA, Usman O (2019) Globalization, energy use, and environmental degradation in South Africa: startling empirical evidence from the Maki-cointegration test. J Environ Manag 244:265–275

Salahuddin M, Ali MI, Vink N, Gow J (2019) The effects of urbanization and globalization on CO 2 emissions: evidence from the Sub-Saharan Africa (SSA) countries. Environ Sci Pollut Res 26(3):2699–2709

Samargandi N (2017) Sector value addition, technology and CO2 emissions in Saudi Arabia. Renew Sust Energ Rev 78:868–877

Sarkodie SA, Adams S, Owusu PA, Leirvik T, Ozturk I (2020) Mitigating degradation and emissions in China: the role of environmental sustainability, human capital and renewable energy. Sci Total Environ 137530

Shafik N, Bandyopadhyay S (1992) Economic growth and environmental quality: time-series and cross-country evidence. World Development Report Working Paper WPS 904, The World Bank, Washington, DC

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013a) Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ Model 35:145–152

Shahbaz M, Tiwari AK, Nasir M (2013b) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shahbaz M, Mallick H, Mahalik MK, Loganathan N (2015) Does globalization impede environmental quality in India? Ecol Indic 52:379–393

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Shahbaz M, Destek MA, Polemis ML (2018a) Do foreign capital and financial development affect clean energy consumption and carbon emissions? Evidence from BRICS and Next-11 countries. SPOUDAI-Journal of Economics and Business 68(4):20–50

Shahbaz M, Nasir MA, Roubaud D (2018b) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857

Shahbaz M, Haouas I, Sohag K, Ozturk I (2020) The financial development-environmental degradation nexus in the United Arab Emirates: the importance of growth, globalization and structural breaks. Environ Sci Pollut Res:1–15

Sharif A, Baris-Tuzemen O, Uzuner G, Ozturk I, Sinha A (2020) Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: evidence from Quantile ARDL approach. Sustain Cities Soc 102138

Sinha A, Sengupta T, Alvarado R (2020) Interplay between technological innovation and environmental quality: formulating the SDG policies for next 11 economies. J Clean Prod 242:118549

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1–2):225–250

Torras M, Boyce JK (1998) Income, inequality, and pollution: a reassessment of the environmental Kuznets curve. Ecol Econ 25(2):147–160

Ulucak R, Khan SUD (2020) Determinants of the ecological footprint: role of renewable energy, natural resources, and urbanization. Sustain Cities Soc 54:101996

UNFCCC (2019) United nations climate change database

Vukina T, Beghin JC, Solakoglu EG (1999) Transition to markets and the environment: effects of the change in the composition of manufacturing output. Environ Dev Econ 4(582):598

Wackernagel M, Rees W (1996) Our ecological footprint: reducing human impact on the earth, vol 9. New society publishers

Wang Q, Su M (2019) The effects of urbanization and industrialization on decoupling economic growth from carbon emission–a case study of China. Sustain Cities Soc 51:101758

Wang Z, Rasool Y, Asghar MM, Wang B (2019) Dynamic linkages among CO 2 emissions, human development, financial development, and globalization: empirical evidence based on PMG long-run panel estimation. Environ Sci Pollut Res 26(36):36248–36263

Wang Z, Rasool Y, Zhang B, Ahmed Z, Wang B (2020) Dynamic linkage among industrialisation, urbanisation, and CO2 emissions in APEC realms: evidence based on DSUR estimation. Struct Chang Econ Dyn 52:382–389

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

Yii KJ, Geetha C (2017) The nexus between technology innovation and CO2 emissions in Malaysia: evidence from granger causality test. Energy Procedia 105:3118–3124

Yin J, Zheng M, Chen J (2015) The effects of environmental regulation and technical progress on CO2 Kuznets curve: an evidence from China. Energy Policy 77:97–108

Yu Y, Du Y (2019) Impact of technological innovation on CO2 emissions and emissions trend prediction on ‘New Normal’economy in China. Atmospheric Pollution Research 10(1):152–161

Zafar MW, Zaidi SAH, Sinha A, Gedikli A, Hou F (2019) The role of stock market and banking sector development, and renewable energy consumption in carbon emissions: insights from G-7 and N-11 countries. Res Policy 62:427–436

Zafar MW, Shahbaz M, Sinha A, Sengupta T, Qin Q (2020) How renewable energy consumption contribute to environmental quality? The role of education in OECD countries. J Clean Prod 122149

Zhang YJ (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Author information

Authors and Affiliations

Contributions

MAD initiated and designed the study. MM reviewed the literature and collected the dataset. MAD carried out the empirical analysis. MAD and MM have jointly interpreted the empirical findings, and revised and completed the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical approval and consent to participate

Not applicable

Consent to publish

Not applicable

Competing interests

The authors declare that they have no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Destek, M.A., Manga, M. Technological innovation, financialization, and ecological footprint: evidence from BEM economies. Environ Sci Pollut Res 28, 21991–22001 (2021). https://doi.org/10.1007/s11356-020-11845-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-11845-2