Abstract

Energy price is a key factor in reducing carbon emissions. This paper assesses the relationship between energy prices and carbon emissions from the industrial sector in China. Using panel data covering 31 industrial sectors for the period 2003 to 2015, we calculate the industrial energy price index and then estimate the effects of sector-level energy prices on carbon emissions based on a panel smooth transition regression model. The results show that the nexus between industrial energy prices and carbon emissions is nonlinear overall, and energy prices have a significantly negative effect on carbon emissions, while this negative effect gradually weakens with an increase in energy prices. Moreover, the negative effect of energy prices on carbon emissions is more significant in energy-intensive sectors when energy prices exceed the threshold value. The findings emphasize the importance of energy prices for energy conservation and emission reduction and imply that energy prices can be used as a regulation tool for government industrial energy saving and emission reduction.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The International Energy Agency (IEA) argues that industry was responsible for approximately 38% of global total final energy use in 2018, and the industrial end-use sectors are the largest contributor to the overall growth in final consumption. According to the experience from industrialized countries, carbon dioxide emissions will change as the level of industrialization rises. As the country with the largest energy consumption and carbon emissions worldwide, China maintains the development characteristics of high energy consumption and high emissions in the process of industrialization (Liu et al. 2015; Yan and Fang 2015; Zhang et al. 2016). The proportion of energy consumption in China’s industrial sectors in the country’s total energy consumption increased from 64.68% in 1980 to 77.63% in 2012 and remained at a high proportion of 65.66% in 2017. It can be said that energy consumption is the second largest engine of China’s industrial economic growth, and most industrial sectors have the characteristics of high consumption and strong dependence on energy (Chen 2009; Ouyang and Lin 2015). In 2015, China made a commitment at the United Nations Climate Change conference in Paris to peak carbon emissions and reduce carbon emissions per unit of GDP by 60 to 65% by approximately 2030 compared to the 2005 level. Currently, China has entered a new stage of development, with an energy system dominated by coal and a legacy of serious environmental problems. To achieve its environmental goals, the Chinese government has been concerned chiefly with coordinating and promoting the development of economic growth, society, and environmental quality, and it is urgent and significant for China to reduce industrial carbon emissions.

To meet the challenge of serious ecological and environmental problems, China has implemented a series of principles and policies for energy conservation and emission reduction since 2003 (Price et al. 2010; Yuan et al. 2011; Zhao et al. 2014). A number of polluting industrial enterprises, including large corporations, were closed down, such as local officials forcibly shuttering or destroying factories to reduce pollution to obtain the “APEC Blue” in Beijing. However, some researchers have questioned the validity of top-down and “blunt force” solutions to environmental pollution, especially “one-size-fits-all” solutions for heavy industry enterprises to shut down or suspend production. Such policies may lead to negative effects, including economic losses, unemployment, and unnecessary interruptions in productive activity (Zhao 2019; van der Kamp 2020; Tian et al. 2020). Hence, appropriate policies address the key issue of low-carbon governance among industrial sectors in China.

Many existing studies examine the determinant factors of industrial carbon emissions from the perspective of energy efficiency and technological progress (Wang et al. 2013; Ouyang and Lin 2015). Improving carbon productivity through energy efficiency and green innovation will lead to a higher cost of production, while energy prices may act as a moderator influencing a firm’s behavior of reducing emissions. From the perspective of the production cost, the existing literature finds that energy as a factor of production has a substitution effect with physical capital or human capital, reducing energy consumption and improving energy efficiency to reduce emissions (Birol and Keppler 2000; Fisher-Vanden et al. 2004; Hang and Tu 2007; Gamtessa and Olani 2018; Antonietti and Fontini 2019). Furthermore, changes in energy prices will lead to energy-saving technological innovation and decrease the energy input to reduce carbon emissions (Popp 2001, 2002; Linn 2008). However, energy efficiency improvement may not necessarily reduce energy consumption or even increase energy input, so it will create an increase in carbon emissions. For example, Renou-Maissant (1999) found that energy prices had asymmetric effects on energy intensity in OECD countries due to the composition of the industrial sector and the different prices of various fuels. Hang and Tu (2007) found that the impact of China’s energy prices on energy intensity is asymmetric in the time dimension. Churchill et al. (2019) suggested that improving energy efficiency may negatively influence environment quality through. Meanwhile, if a single fuel price, such as the oil price, is used, there will be a bias in the price estimates. The price difference between different energy types should be considered (Richmond and Kaufmann 2006). Different industries have differences in energy demand, and particularly high energy prices will affect the profits and investment returns of energy-intensive industries, so the impact of these industries’ energy prices on carbon emissions should not be ignored (Lee and Chong 2016; Chai et al. 2009; Zha and Ding 2014; Aldy and Pizer 2015; Gamtessa and Olani 2018; Sato et al. 2019). There, the relationship between energy prices and carbon emission is a prior uncertainty.

It is now very difficult for most countries to obtain effective industrial energy prices. Since several studies have attempted to be concerned about the heterogeneity of energy prices within countries (Ganapati et al. 2016; Sato et al. 2019), they have drawn attention to the lack of assessments on the relationship between industrial activity and pollution due to a lack of sector-level or firm-level data (Dechezleprêtre and Sato 2017). However, few attempts have been made to assess the relationship between sector-specific energy prices and carbon emissions with cross-sectoral differences in the fuel mix.

This paper aims to overcome these limitations and attempts to carry out a useful supplementary study based on existing studies to explore the relationship between sectoral energy prices and carbon productivity using a dataset covering 31 sectors for the period 2003 to 2015. Compared with the existing literature, this paper has the following advantages: (1) this paper constructed the energy price index of China’s industrial sector 2003 to 2015, expanding the energy price index of 31 sectors. (2) In the study of the dynamic relationship between energy prices and carbon emissions, we conducted a relevant analysis at the sectoral level and provide relevant supplements to existing research. (3) This paper adopted a panel smooth transition regression model to capture the heterogeneous relationship between energy prices and carbon productivity in the panel data. (4) Our research links the relationship between energy prices and emission reduction and emphasizes the importance of setting reasonable energy prices for energy conservation and emission reduction.

The remainder of the paper is organized as follows: the “Literature review” section reviews the literature on the energy price-carbon emission nexus. In the “Data and variables” section, the data sources and key variables are introduced and described. The “Estimation and specification tests” section presents the model and tests. The “Results and discussion” section presents the results and discussion and, finally, the conclusions and policy suggestions.

Literature review

To date, many studies have been conducted on the environmental Kuznets curve (EKC) hypothesis, revealing economic growth and environmental degradation with an inverted U-shaped term; in particular, there have been studies on the EKC estimation of carbon dioxide (CO2) emissions, but there is no consensus among the studies of the shape and nature of the EKC (Al-Mulali and Ozturk 2016; Dogan and Seker 2016; Shahbaz and Sinha 2019). Existing studies have attempted to construct a multidimensional framework to discuss the impact of different explanatory variables, including population, energy consumption, oil price, trade, foreign direct investment, urbanization, financial development, and democracy at the national level (Richmond and Kaufmann 2006; Soytas et al. 2007; Jayanthakumaran et al. 2012; Dogan et al. 2019; Usman et al. 2019; Erdogan et al. 2020). Many existing studies have focused on reducing carbon emissions from the industrial sector using index decomposition rather than econometric models. For example, Ang (2004) have adopted index decomposition methods to study the impacts of industrial carbon emissions and provided detailed literature reviews. Due to the lack of data on carbon emissions at the industry and firm levels, researchers have not thoroughly investigated the role played by different factors of carbon emissions (Cole et al. 2005) or the historical determinants of industrial carbon emissions (Agnolucci and Arvanitopoulos 2019).

With the development of index methods, some scholars have found that energy intensity, scale effect, and substitution effects are key factors of carbon reduction for industrial sectors. The results suggest that improving energy efficiency and promoting structure would be effective means of controlling carbon emissions (see Liu et al. 2015; Shao et al. 2016). Moreover, researchers have other methods to simulate the impacts of environmental and energy policy (see Schumacher and Sands 2007) and have analyzed how energy prices influence the steel industry based on computable general equilibrium (CGE). Edelenbosch et al. (2017) found that reducing carbon emissions depends on the energy intensity decline and conversion potential between energy consumption types through a scenario simulation of demand policy. The combination of improving energy efficiency and changes in economic structure has offset more than half of the impacts on the final energy use of increased economic activity in the industry and service sectors in IEA countries and other major economies (Cornillie and Fankhauser 2004; IEA 2018). However, improving energy efficiency has often been assumed to be one of the most cost-effective ways of reducing CO2 emissions, increasing the security of the energy supply, and improving industry competitiveness. Energy prices can be used as a measure of how environmental policy affects green innovation to promote carbon productivity (Ley et al. 2013; Aghion et al. 2016).

Thus far, research on energy prices has been extensive. First, energy prices, as a key price factor, has an influence on macroeconomic activity, such as the unemployment rate, energy demand, exchange rate, and international trade, due to the different fluctuations resulting from the price of other goods (Hamilton 1996; Hooker 1996; Beckmann and Czudaj 2013). It is impossible to depend only on income to improve environmental quality (Richmond and Kaufmann 2006). A few studies have examined the impact of oil price shocks on the macro economy and greenhouse gas emissions (Vielle and Viguier 2007) and regulating the energy price to play a role in energy saving and emission reduction (Löschel and Schymura 2013; Nie and Yang 2016). Through the consumption quantity, energy prices enhance energy efficiency to reduce carbon emissions (Al-Mulali and Ozturk 2016), and technological progress is a function of energy prices (Abadie and Chamorro 2008; Aghion et al. 2016). Second, the price of specific energy types and heterogeneous industries is related to industrial structure, such as the asymmetric impact of oil prices on different sectors due to energy demand elasticity and the transition of alternative input elements (Hamilton 1988; Lee and Ni 2002; Kilian 2008; Wang et al. 2009; Hamilton 2010; Ganapati et al. 2016). Third, energy prices can induce energy-saving innovation. Popp (2001, 2002) and Linn (2008) found that two-thirds of the initial change in industrial energy consumption after a price change is due to price-induced substitution, while the remaining one-third is due to induced innovation. Existing research focuses on the relationship between energy prices and energy intensity and has not reached a completely unified conclusion. For example, Hang and Tu (2007) mentioned that increasing the energy price could improve energy efficiency as an effective and productive policy tool, but Chai et al. (2009) and Zhang and Xu (2012) suggested that the role of energy prices is limited in industrial energy consumption and can change the way of economic development by improving energy efficiency. Metcalf (2008) argued that the decrease in energy intensity in the USA was caused by the change in industry structure rather than energy price-induced innovation. Furthermore, a firm will choose the most effective capital because there is no way to replace the existing capital and energy in the short term. In the long run, the energy consumption of a firm is related to the energy price, and the firm can adopt energy-saving capital (Atkeson and Kehoe 1999; Newell et al. 2006; Steinbuks and Neuhoff 2014). The empirical studies on the nexus of energy price and carbon emissions have mostly been conducted at the national level (McCollum et al. 2016) and drawn attention to the shortage of assessments on the relationship between industrial activity and pollution and the lack of sector-level or firm-level data (Dechezleprêtre and Sato 2017). However, scholars have noted the significant role of energy prices, such as the nexus of energy and employment (Kahn and Mansur 2013; Marin and Vona 2019), the impact of energy prices on trade (Sato and Dechezleprêtre 2015), and the choice of investment location (Kahn and Mansur 2013; Panhans et al. 2017; Saussay and Sato 2018). As sector-specific energy prices reduce the measurement errors associated with cross-sectoral differences in the fuel mix, they are expected to considerably improve the estimation in cross-country analyses (Marin and Vona 2019; Sato et al. 2019). Ganapati et al. (2016) analyzed how energy prices influence the outcome price, production cost, and profit, showing that raising the energy cost may increase the marginal cost and goods price but decrease the price makeup. While energy costs account for only a small portion of total production costs in most manufacturing sectors, especially labor prices in China, which are more sensitive than energy prices (Ouyang and Sun 2015), energy prices are still one of the important factors affecting the competitiveness of energy-intensive industries (IEA (International Energy Agency) 2013; Sato and Dechezleprêtre 2015).

It is easy to see that the existing literatures have paid some attention to the role of energy prices in reducing carbon emission on the national or regional levels, but still have short of the empirical research. Hence, this paper first constructs a comprehensive dataset of industrial energy price indices at sector levels covering 31 industry sectors in China for the period 2003 to 2015. Furthermore, this paper employs the panel smooth transition model to evaluate the effect of industrial energy price index on carbon emission reduction, and then examines the heterogeneous relationship for two diverse groups of energy-intensive industries. Our conclusions offer useful policy suggestions for decision-makers to facilitate the energy price reform and industrial carbon emission.

Data and variables

Data

The study includes 31 selected industrial sectors during 2003–2015, and the data are from China’s statistical yearbook, China’s industrial statistical yearbook, China’s energy statistics yearbook, and Chinese environmental statistics yearbook (see Table 1 for sources and definitions). We describe the data sources and processing steps for different variables below.

The change in carbon productivity is the key indicator for assigning share reduction because carbon productivity involves the concept of efficiency, combining economic conditions and environmental performance (Kaya and Yokoburi 1997; Meng and Niu 2012). Referring to Tone (2001), we calculate the carbon productivity using the slacks-based measure (SBM) model that considers carbon emission as the undesirable output. See the evaluation model of carbon productivity in Appendix A and the indicators in the attached Table 9.

Existing research focuses on national-level or specific energy prices such as oil prices (Gonseth et al. 2015), and not every country publishes industry-level energy prices. The problem created as a result is that specific energy prices do not faithfully reflect the industry’s energy price costs, and the endogenous nature of the industry’s energy price heterogeneity in the macro system generates endogeneity, which reflects the industry’s real price costs when implementing emission reductions. Therefore, it is necessary to construct an industry-level energy price index. Sato et al. (2019) discussed in detail the existing research on the construction of industry-level price index, and they constructed an index in which the weights are fixed over time, called the fixed weights energy price index (FEPI).Footnote 1 Using logarithmic transformation can isolate time constants, and fixed effects can be prevented by controlling the industry sector energy types in price setting errors and types of secondary energy choices and avoid some part of the endogeneity problem as well as some measurement error when combined with fixed effects in panel data. FEPI can capture intertemporal changes in energy prices between departments without substitution effects as the price index in the panel data, while FEPI can control the unobserved characteristics, so it can be a standalone variable (Sato et al. 2019). In this paper, we adopt the producer price index of coal industrial products, petroleum industrial products, and electric industrial products, and we calculate the comprehensive energy price according to the energy consumption ratio of different industries at different times. Referring to Sato et al.’s (2019), the formula for FEPI is used as follows:

where \( {F}_{it}^j \) is the input of fuel quantity in sector i at time t, using the standard coal as a unit. \( {P}_{it}^j \) represents the real price of fuel j in the total manufacturing industry of country t in 1990. \( {w}_{it}^j \) represents the intertemporal fixed price coefficient of fuel price. Then, the equation becomes linear using geometrically averaged prices of various fuels.

Due to the industry’s carbon emissions, it is not only related to the input energy factors but also related to the industry’s economic characteristics and environmental governance. Therefore, to avoid missing variables, this paper also adds some control variables, such as the industry’s environmental regulation index (LER), the industry’s scale (LSIZE), the industry’s foreign investment level (LFDI), the nature of property rights (LIN_P), and their interactions, referring to Yuan et al. (2017) and Ouyang et al. (2020). The method of the environmental regulation index refers to Levinson’s (1999) to replace the environmental regulation intensity with pollutant emissions and collects three indicators of wastewater, waste gas, and solid waste to reflect the enterprise’s sewage discharge and environmental regulation intensity. By standardizing the treatment of pollutants and weighting the industrial output value, it is possible to objectively reflect the intensity of environmental regulations in the industrial sectors of various provinces, as seen in Appendix B. In summary, the descriptive statistics of the variables are shown in Table 1.

Estimation and specification tests

China’s industrial sectors are divided into mining, manufacturing, electricity, gas, and water production, so the share of energy consumption is heterogeneous. Since 2012, the electricity and heat production sector has surpassed the manufacturing sector and been the top carbon emitter among all industrial sectors (Wang et al. 2017). Moreover, it is generally assumed that each unit of the panel model is homogenous and cannot capture the heterogeneity of cross-sectional units. In our paper, due to the substitution between energy and other input factors, energy prices can affect capital productivity, green technology adoption, and, in turn, the demand for energy consumption (Dıaz et al. 2004; Linn 2009; Gamtessa and Olani 2018). Although Hansen (1999) proposed the panel threshold regression model (PRT), which can separate different cross-sections of individuals into different systems for estimation, the energy price data in our paper are not discrete and jumping but continuous and gradually changing. Hence, this study proposes using the panel smooth transition regression (PSTR) from González et al. (2005) instead of the traditional panel data fixed effect and random effect models to effectively depict the heterogeneity of the model parameters between the cross-sectional units and to allow the model parameters to be smoothly transformed with the transformed variables. The PSTR model has been applied widely in previous studies; for example, it has been applied in some studies on the relationship between pollution and economic growth (Aslanidis and Xepapadeas 2008), between inflation and growth (Seleteng et al. 2013), and between temperature and electricity consumption (Bessec and Fouquau 2008). Other studies focus on the impact of prices on exports (Allegret et al. 2014) and exchange rate behavior (Béreau et al. 2012). Empirical studies suggest that the PSTR model is intended for characterizing heterogeneous panels, allowing the regression coefficients to vary both across individuals and over time (González et al. 2005).

In terms of heterogeneity in the PSTR model, it is assumed that coefficients are bounded continuous functions of an observable variable, called the transition variable. Thus, they fluctuate between a limited number of “extreme regimes” (often two). The PSTR model can be interpreted as a linear heterogeneous panel model with coefficients that vary across individuals and over time, which generalizes the PTR model by allowing the regression coefficients to change smoothly when moving from one extreme regime or state to another (González et al. 2005). As the transition variable is possibly individual-specific and time-varying, the regression coefficients are allowed to be different for each of the individuals in the panel and to change over time. Hence, there are three steps to apply the PSTR model: (i) model specification, (ii) parameter estimation, and (iii) model evaluation. The first step is to test the linearity of the PSTR model to circumvent the identification problem. Then, the second step is to determine the number of location parameters. Finally, we can estimate the PSTR model and analyze the results.

The PSTR model

The general PSTR model with m extreme regimes is defined as shown in Formula (2):

where 1 ≤ i ≤ N, 1 ≤ t ≤ T, N represents different sectors, and T denotes the time. uit is the fixed individual effect, and εit is the error. The transition function \( {g}_m\left({q}_{it}^{(m)};{\gamma}_m,{c}_m\right) \) is the continuous function, including the threshold variable\( {q}_{it}^{(m)} \). According to González et al. (2005), we transform the transition function to the logistic function form as follows:

where γ is the slope coefficient of the transition function and determines the smoothness of the transitions. cm is the location parameter or threshold parameter, which determines the thread value between zones. m is the number of location parameters. In general, when m = 1 or m = 2, the form is quadric and logistic. Moreover, the transition function is gm = 1 when qit ≥ cm. However, the transition function is gm = 0 when qit < cm. In particular, when the slope coefficient γ → 0, the transition function is gm = 0.5 , which implies that the function is a linear fixed effect function. Generally, it is sufficient to consider m = 1 or m = 2, as these values allow for commonly encountered types of variation in the parameters (González et al. 2005). Hence, when the observed values are in a low-zone system, β0 explains only the relationship between its variables. When the observed values are in the high-zone system, the relationship between the variables is explained by β0 + β1.

In our context, we analyze the nonlinear link between energy prices and carbon productivity. The transition variable is assumed to be the log of the energy price index in sector i in year t. The basic PSTR model with two extreme regimes is defined as

where the explained indicator LCP is the log of carbon productivity in sector i in year t. For 1 ≤ i ≤ N, 1 ≤ t ≤ T, N represents different sectors, and T denotes the time. LEI is energy intensity, Zit represents the control variables, including environmental regulation (LER), production size (LSIZE), ownership structure (LIN_P), and the cross variables (LFDI_ER, LSIZE_ER, and LIN_P_ER). uit is the fixed individual effect, and εit is the error. The transition function g(qit; γ, c) is a continuous function of the observable variable LEIit, which is normalized to be bounded between zero and one, and LEIit determines the value of g(LEIit; γ, c). According to González et al. (2005), the transition function is always formulated in logistic function form as follows:

where γ is the slope coefficient of the transition function and determines the smoothness of the transitions. cm is the location parameter or threshold parameter, which determines the thread value between zones. m is the number of location parameters. When the threshold variable qit is different from xit, the elasticity of carbon productivity with respect to the energy price index xit for the ith sectors at time t is defined by the weighted average of β0 and β1 in the extreme regimes, as follows:

Note that it is significant for interpreting the sign of these parameters but not the values of parameters with extreme situations.

Model specification test

Before estimating the panel data model, we must consider whether it is correct according to the linearity test. According to González et al. (2005), the rejection of the null hypothesis (H0 : γ = 0) indicates that the model has nonlinear effects, and a panel smoothing transformation regression estimation can be used. Because the model includes undefined parameters γ and c, it is impossible to perform a nonlinear verification of the model directly. It is deduced by first-order Taylor expansion at γ = 0, so Formula (2) can be written as follows:

where \( {\mathrm{u}}_{it}^{\ast }={u}_{it}+{R}_m{\beta}_1{x}_{it} \), Rm represents the rest of the Taylor expansion. The null hypothesis for the linearity test of the model is H0 : γ = 0, which means that \( {\mathrm{H}}_0^{\ast }:{\beta}_1^{\ast }={\beta}_2^{\ast }=\dots ={\beta}_m^{\ast }=0 \). Therefore, the location of parameter m must be identified before the nonlinearity of Formula (2). To determine the value of m, the linear fixed effect model and the linear auxiliary regression model are estimated, as well as the square sum of the residual squares. The SSR0 and SSR1 are calculated using the original hypothesis (linear model hypothesis) and the alternative hypothesis (the panel smooth transformation regression model), and then, we use the residual sum of squares and the measurement by building the following Lagrange Multiplier test statistic (LM test)

where k is the number of exogenous variables, Formulas (3) and (4) are the LM statistics and obey the asymptotic distribution χ2(mk) and F(mk, TN − N − mk), respectively. Moreover, Colletaz and Hurlin (2006) noted that pseudo-LRT is the statistic with a distribution of χ2(mk):

Results and discussion

Statistics

Summary statistics are provided in Table 2.

Results of unit root tests

The characteristics of panel data are a combined time series and use cross-sectional data. To avoid false regressions and ensure the validity of the estimated results, it is necessary to perform unit root tests to check the stationarity properties of the variables. The statistical methods of the Levin et al. (2002, LLC) test proposes a panel unit root test for the null hypothesis of unit root against a homogeneous stationary hypothesis, and the Fisher-ADF and PP-Fisher test tests both allow for individual unit root processes (Choi 2001). All three panel unit root tests examine the null hypothesis of a unit root with the alternative hypothesis of the absence of a unit root. Table 3 shows that the variables reject the null hypothesis significantly at a statistical significance level of 1% (the variable LFDI rejects the null hypothesis significantly at a statistical significance level of 5%), which means that the variables are stationary.

Results of the linear and no remaining heterogeneity tests

To ensure the robustness of the results, this paper tested the linearity using the three statistics LM, LMF , and LRT (H0 : γ = 0) in Eqs. (8)–(9). If the statistical results reject the null hypothesis H0 : r = 0 , the relationship between the energy price index and carbon productivity is nonlinear, and it is further appropriate to use the nonlinear panel smooth transition function model. Furthermore, the three test statistics are used to determine the optimal number of transformation functions of the PSTR model. When the number of location parameters is m = 1 and m = 2, respectively, LM,LMF,and LRT, the three statistics, reject the null hypothesis H0 : γ = 0 at the 1% level. This finding shows that the relationship between energy prices and carbon productivity is nonlinear, so it is appropriate to use the nonlinear panel smooth transition function model. Furthermore, it is necessary to examine the nonlinear relationship between energy prices and carbon productivity. When the number of location parameters is m = 1 and m = 2, the three statistics LM, LMF,and LRT show that we cannot reject the null hypothesis when the transformation function is H0 : γ = 1.Therefore, the optimal number of transition functions r∗ = 1 can be determined.

Since there are unrecognized parameters in the PSTR model, we can use the methods of the two-parameter grid search and NLS to calculate parameters γ and c. The results are shown in Table 4.

Energy price threshold and transition parameter

This paper applies the sequence of tests discussed at the end of the “Results of unit root tests” section to determine the order m of the logistic transition functions. According to the location parameter (m) and the r (m) values, we can estimate the parameters of the PSTR model and the parameter and sum of the squared residuals. Then, using the AIC and BIC information, each threshold variable model is evaluated. Moreover, the rules of the AIC and BIC with the area that contains the PSTR model fully reflect the heterogeneity of the cross-section and time (Colletaz and Hurlin 2006). From what has been discussed above, we place the number of location parameters in the nonlinear conversion function in Table 5.

Measured by three kinds of statistical tests in the null hypothesis test, if the null hypothesis is rejected, a further nonlinear inspection is required to define the number of panel smooth transition functions to determine whether the existing conversion function is sufficient to describe the nonlinear characteristics of the model. Then, the nonlinear relationship of the model is tested using the threshold variable (LEP). However, the results reject the null hypothesis, which requires a further nonlinear inspection to determine the number of panel smooth transition functions to examine whether the existing conversion function is sufficient to describe the nonlinear characteristics of the model. To identify the number of transition functions, we plug γ = 1 into Formula (2), convert the function\( {g}_m\left({q}_{it}^{(m)};{\gamma}_m,{c}_m\right) \), and implement the first-order Taylor expansion at γ = 2 as follows:

Estimation results of the PSTR

When determining the optimal number of model conversion functions and the number of location parameters, we must estimate the PSTR model (1) by using NLS based on a grid-search procedure. Table 6 reports the estimation results. When β1 > 0, β0 < eit < β0 + β1, it means that coefficients eit will increase as the energy price index (LEPit) increases. Otherwise, when β1 < 0,β0 > eit > β0 + β1, coefficients eit will decrease as the energy price index (LEPit) decreases.

In the existing research, it is generally believed that the increase in energy prices will cause the production cost of enterprises to increase and reduce the use of energy to achieve the effect of emission reduction (Newell et al. 1999). Because the existing literature involves theoretical model building under the condition of complete and incomplete competition, assuming that enterprise production is completely elastic, the volatility of energy prices can change consumer demand, but these assumptions do not completely conform to the real economy and will overestimate the role of energy prices in energy conservation and emissions reduction policy (Ganapati et al. 2016). It can be found from the regression results in Table 6 that when it is significantly less than the threshold value of 7.107, the energy price has a significant positive relationship with the increase in carbon productivity. When the energy price reaches the threshold of 7.107, the conversion function g(.) = 0, and then the influence coefficient of the energy price on carbon productivity is 0.012 (0.012–0.007* 0 = 0.012). When the energy price rises to more than 7.107, the conversion function g(.) = 1, and the effect coefficient of the energy price on carbon productivity decreases to 0.005 (0.012–0.007*1 = 0.005), and the weakening effect is statistically significant. It can be seen from the results that when the energy price rises, the carbon productivity of the industry is improved, possibly because the rising energy price increases the production cost. Some industries reduce the consumption of fossil energy by replacing the input of non-energy elements, thus reducing carbon emissions. The industry can also improve carbon productivity by improving energy efficiency—that is, the coefficient is called when energy prices rise within a certain range, and the increase in carbon productivity of the industrial sector is suppressed but is not statistically significant, and improvements in energy efficiency can significantly increase carbon productivity, perhaps because some industries are energy intensive, such as the power production industry, and the power input required by this industry is dependent on petrochemical energy consumption. Zha and Ding (2014) found that the power sector is the least sensitive to energy prices due to its relatively stable energy demand.

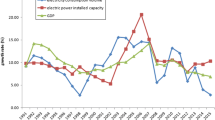

However, when the energy price rises to a certain stage, the effect of the energy price on reducing carbon emissions will weaken, which means that carbon emissions cannot be reduced by raising energy prices. Furthermore, the reported model’s slope coefficient in Table 6 is relatively small, which means that the changing trend of the transformation function is relatively smooth, with 66 observation values less than 7.107 accounting for 16.38% of all observed data, putting it in low-zone system. There are 337 observed values greater than 7.107, accounting for 83.62% of all observed data, and they are in the high-zone system. Each point in Fig. 1 represents the corresponding observation values, and it can be seen that some of the observed values are between the high- and low-zone systems, which also verifies that the method adopted in this paper is reasonable.

Discussion

There exists heterogeneity of energy input in different sectors, such as cement and steel belonging to nonmetallic mineral products and the black metal smelting and rolling processing industries being energy-intensive and highly polluting industries, but the tobacco and wood processing industries feature low consumption and low emissions. Therefore, the sensitivity of industry production to energy prices will vary. Therefore, we divided the 31 sectors into two groups based on carbon emissions, referring to Zha and Ding (2014).

As shown in Table 7, the grouping samples have both rejected the null hypothesis significantly (H0 : r = 0), implying that a nonlinear relationship exists. For the significant heterogeneity in the subsample, the PSTR model is fit to analyze the nonlinear effect of energy prices on carbon productivity. Similarly, due to rejecting the null hypothesis H0 : r = 0 but accepting the null hypothesis H0 : r = 1, we can obtain the optimal number of transition functions as r∗ = 1. Moreover, as Table 6 shows, the statistical test results in the subsample are consistent. The AIC and BIC values are relatively small when m = 1 is adopted, so m∗ = 1 is the optimal position parameter of the sample number. Above all, the optimal number of PSTR models in the subsample is r∗ = 1, and the optimal location parameter is m∗ = 1. The grouping samples both reject the null hypothesis significantly (H0 : r = 0), implying that a nonlinear relationship exists. For the significant heterogeneity in the subsample, the PSTR model is fit to analyze the nonlinear effect of energy prices on carbon productivity. Similarly, due to rejecting the null hypothesis H0 : r = 0 but accepting the null hypothesis H0 : r = 1, we can obtain the optimal number of transition functions as r∗ = 1.

As Table 8 shows, the statistical test results in the subsample are consistent. The AIC and BIC values are relatively small when m = 1 is adopted, so m∗ = 1 is the optimal position parameter of the sample number. Above all, the optimal number of PSTR models in the subsample is r∗ = 1, and the optimal location parameter is m∗ = 1.

Two groups, on with high energy intensity and one with low energy intensity, correspond to models I and II, respectively, and the results are shown in Table 8. For the low-energy-intensity group, when the price is significantly less than the threshold value of 6.874, the energy price has a significant negative correlation with the increase in carbon productivity. When the energy price reaches the threshold value of 6.874, the conversion function g(.) = 0, and the influence coefficient of the energy price on carbon productivity is − 0.017 (−0.017 + 0.02 × 0 = − 0.017). When the energy price rises to more than 6.874, the conversion function g(.) = 1, and the coefficient of the energy price on carbon emissions increases to 0.003 (−0.017 + 0.02 × 1 = − 0.003). The relation between energy price and carbon productivity becomes positive. Zha and Zhou (2014) analyzed the substitution relationship between energy and non-energy elements in China’s industrial sectors and found that most of the industrial sectors had a substitution relationship between energy and capital. These low-energy-intensity industries, such as the textile and garment industries, water production, and supply industries, are labor-intensive and capital-intensive industries, respectively. Energy factors account for a relatively small proportion of input factors and are not highly sensitive to energy prices. Even when energy prices are high, capital-intensive industries, for example, will introduce energy-saving equipment, which reduces carbon emissions by improving energy efficiency rather than reducing energy input. However, the introduction of energy-saving equipment will increase the production cost of the enterprise so that when the energy price exceeds a certain threshold, the enterprise will consider measuring the cost of input factors. Higher energy prices within a certain range, such as capital-intensive enterprise energy-saving facilities, may occur through reform to improve the efficiency of energy consumption rather than increasing energy consumption, resulting in a loss of carbon productivity. However, when the energy price exceeds the threshold value, the improvement of the energy efficiency of enterprises will cost a great deal of money. Enterprises will adjust the proportion of input factors, and normal production can be guaranteed by increasing the input of labor alternative energy.

For the samples in the high-energy-intensity emission group, the influence coefficient of energy prices on carbon productivity is negative but not significant when the energy price is less than the threshold value of 7.794. When the energy price reaches the threshold value of 7.794, the conversion function g (…) = 0, and the influence coefficient of the energy price on carbon emission growth is − 0.002 but not significant. When the energy price is greater than 7.794, the conversion function g(.) = 1, and the effect coefficient of energy prices on carbon emissions increases to (−0.002 + 0.005 × 1 = 0.003). The effect of energy prices on carbon productivity increases. Compared to its high sensitivity to energy prices, the energy price threshold is lower (6.874 < 7.794) because most energy-intensive industries have a high degree of dependence on fossil fuel. Just below the threshold of rising energy prices, the role of energy prices is not significant. However, when the energy price exceeds the threshold value, the influence of the rising energy price on the carbon industry is significant, and enterprises can improve their energy efficiency to reduce carbon emissions. This finding is consistent with Kander and Schön (2007), who found that only when energy prices rise to a certain level will enterprises increase capital investment to reduce energy consumption. The enterprises will consider which option is more reasonable between the cost of rising energy and clean energy alternative investment. From the perspective of social externalities, if the benefit of emission reduction cannot be achieved through energy prices, the government may shut down some energy-consuming and high-emission enterprises to achieve the goal of energy conservation and emission reduction. However, this approach cannot achieve the sustainability goal of energy conservation and emission reduction in the industrial sector.

Figure 2 depicts the conversion function of the high-energy-intensity group, among which there are 66 observations for the high-zone system, accounting for 21.63% of the high-energy-intensity group. The lower area of the observed value is 142, accounting for 78.37% of the high-energy-intensity group. Even if prices are greater than the threshold value or have a positive relation with rising energy prices and carbon productivity, the slope coefficient (γ = 5.151) shows that high energy prices significantly influence carbon emissions. A firm will enter the high-energy-intensity group after it reaches the threshold of the low area. High-energy-intensity industry enterprises, due to cost drivers, must improve energy efficiency by investing in clean energy to meet the power demands of the enterprise. Further validation of high energy prices has a role in reducing carbon emissions in high-energy-intensity sectors.

Similarly, Fig. 3 describes the energy price conversion function of the low-carbon-emission group. For the low-carbon-emission industries, 166 observations are in the high zone, accounting for 85.13% of the observed data. Additionally, 29 observations are in a low area, accounting for 14.87% of the sample observations from the slope coefficient (γ = 1516.7). Sectors in the low-energy-intensity group are mostly in the high area, meaning that the sectors cannot make adjustments to higher energy prices in a timely manner when energy prices do not exceed the threshold value, rather than causing enterprises’ energy consumption to have the rebound effect, thus increasing carbon emissions. However, after reaching the ultrahigh threshold, these sectors have reduced carbon emissions by decreasing the proportion of energy inputs.

Conclusion

From the industry perspective, this article discusses the influence of energy prices on carbon emissions based on data from 2003 to 2015 revealing China’s energy price influence on carbon emission according to the energy intensity level of the high and low groups. The results show that there is a nonlinear relationship between energy prices and carbon productivity. On the whole, the energy price can play a regulatory role in energy conservation and emission reduction, but when the price is higher than a certain threshold, the regulatory role will be weakened. Moreover, given that firms are divided into two groups according to energy intensity, high-energy-intensity industries are more sensitive to energy prices and reduce carbon emissions by improving energy efficiency and alternative factors. Industries with low energy intensity are sensitive to price adjustments, so increasing prices will definitely reduce carbon emissions by improving energy efficiency. Overall, our findings imply that high energy prices can be regarded as a signal of strict regulation, while low energy prices are a sign of relatively weak regulation, which is consistent with the research of Marin and Vona (2019). In particular, the measures should focus on the energy-intensive sectors. Unreasonable energy prices actually distort the cost of energy use, which is not conducive to energy saving and emission reduction in high-energy-intensity sectors.

This paper emphasizes the importance of energy prices for industrial energy conservation and emission reduction and provides evidence for the government to formulate fair and reasonable environmental governance policies and energy price reforms. At this stage, to ensure air quality, some energy-intensive factories, such as iron and steel plants, will be temporarily shut down, which will not bring about long-term sustainable environmental governance and industrial energy consumption transformation. Energy prices can be used as a regulatory tool for environmental governance, but the premise is the rationality of energy prices; otherwise, the phenomenon of high carbon emissions and high energy consumption cannot be effectively controlled. China’s energy conservation and emission reduction work is a systematic task. Therefore, while the government implements environmental governance and the market-oriented reforms of energy prices, the government needs to consider the allocation of energy prices in different industries and the relationship between different types of energy prices.

Notes

Sato et al. (2019) established variable weighted energy prices and fixed weighted energy prices for 12 industrial sectors in 48 countries, including China’s industrial sectors.

References

Abadie LM, Chamorro JM (2008) European CO2 prices and carbon capture investments. Energy Econ 30:2992–3015. https://doi.org/10.1016/j.eneco.2008.03.008

Aghion P, Dechezleprêtre A, Hemous D, Martin R, Van Reenen J (2016) Carbon taxes, path dependency, and directed technical change: evidence from the auto industry. J Political Econ 124:1–51. https://doi.org/10.1086/684581

Agnolucci P, Arvanitopoulos T (2019) Industrial characteristics and air emissions: long-term determinants in the UK manufacturing sector. Energy Econ 78:546–566. https://doi.org/10.1016/j.eneco.2018.12.005

Aldy JE, Pizer WA (2015) The competitiveness impacts of climate change mitigation policies. J Assoc Environ Resour Econ 2:565–595. https://doi.org/10.1086/683305

Allegret J-P, Couharde C, Coulibaly D, Mignon V (2014) Current accounts and oil price fluctuations in oil-exporting countries: the role of financial development. J Int Money Finance 47:185–201. https://doi.org/10.1016/j.jimonfin.2014.06.002

Al-Mulali U, Ozturk I (2016) The investigation of environmental Kuznets curve hypothesis in the advanced economies: the role of energy prices. Renew Sust Energ Rev 54:1622–1631. https://doi.org/10.1016/j.rser.2015.10.131

Ang BW (2004) Decomposition analysis for policymaking in energy. Energy Policy 32:1131–1139. https://doi.org/10.1016/s0301-4215(03)00076-4

Antonietti R, Fontini F (2019) Does energy price affect energy efficiency? Cross-country panel evidence. Energy Policy 129:896–906. https://doi.org/10.1016/j.enpol.2019.02.069

Aslanidis N, Xepapadeas A (2008) Regime switching and the shape of the emission–income relationship. Econ Model 25:731–739. https://doi.org/10.1016/j.econmod.2007.11.002

Atkeson A, Kehoe PJ (1999) Models of energy use: putty-putty versus putty-clay. Am Econ Rev 89:1028–1043. https://doi.org/10.1257/aer.89.4.1028

Beckmann J, Czudaj R (2013) Oil prices and effective dollar exchange rates. Int Rev Econ Finance 27:621–636. https://doi.org/10.1016/j.iref.2012.12.002

Béreau S, Villavicencio AL, Mignon V (2012) Currency misalignments and growth: a new look using nonlinear panel data methods. Appl Econ 44:3503–3511. https://doi.org/10.1080/00036846.2011.577022

Bessec M, Fouquau J (2008) The non-linear link between electricity consumption and temperature in Europe: a threshold panel approach. Energy Econ 30:2705–2721. https://doi.org/10.1016/j.eneco.2008.02.003

Birol F, Keppler JH (2000) Prices, technology development and the rebound effect. Energy Policy 28:457–469. https://doi.org/10.1016/s0301-4215(00)00020-3

Chai J, Guo JE, Wang SY, Lai KK (2009) Why does energy intensity fluctuate in China? Energy Policy 37:5717–5731. https://doi.org/10.1016/j.enpol.2009.08.037

Chen S (2009) Engine or drag: can high energy consumption and CO2 emission drive the sustainable development of Chinese industry? Front Econ China 4:548–571. https://doi.org/10.1007/s11459-009-0029-9

Choi I (2001) Unit root tests for panel data. J Int Money Financ 20(2):249–272. https://doi.org/10.1016/S0261-5606(00)00048-6

Churchill SA, Inekwe J, Smyth R, Zhang X (2019) R&D intensity and carbon emissions in the G7: 1870–2014. Energy Econ 80:30–37. https://doi.org/10.1016/j.eneco.2018.12.020

Cole MA, Elliott RJR, Shimamoto K (2005) Industrial characteristics, environmental regulations and air pollution: an analysis of the UK manufacturing sector. J Environ Econ Manag 50:121–143. https://doi.org/10.1016/j.jeem.2004.08.001

Colletaz G, Hurlin C (2006) Threshold effects of the public capital productivity: an international panel smooth transition approach, working papers halshs-00008056, HAL. https://EconPapers.repec.org/RePEc:hal:wpaper:halshs-00008056.2006.01.20

Cornillie J, Fankhauser S (2004) The energy intensity of transition countries. Energy Econ 26:283–295. https://doi.org/10.1016/j.eneco.2004.04.015

Dechezleprêtre A, Sato M (2017) The impacts of environmental regulations on competitiveness. Rev Environ Econ Policy 11:183–206. https://doi.org/10.1093/reep/rex013

Dıaz A, Puch LA, Guilló MD (2004) Costly capital reallocation and energy use. Rev Econ Dyn 7(2):494–518. https://doi.org/10.1016/j.red.2003.09.005

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energ Rev 60:1074–1085. https://doi.org/10.1016/j.rser.2016.02.006

Dogan E, Taspinar N, Gokmenoglu KK (2019) Determinants of ecological footprint in MINT countries. Energy Environ 30:1065–1086. https://doi.org/10.1177/0958305x19834279

Edelenbosch OY, Kermeli K, Crijns-Graus W, Worrell E, Bibas R, Fais B, Fujimori S, Kyle P, Sano F, van Vuuren DP (2017) Comparing projections of industrial energy demand and greenhouse gas emissions in long-term energy models. Energy 122:701–710. https://doi.org/10.1016/j.energy.2017.01.017

Erdogan S, Okumus I, Guzel AE (2020) Revisiting the environmental kuznets curve hypothesis in OECD countries: the role of renewable, non-renewable energy, and oil prices. Environ Sci Pollut Res 27:1–9. https://doi.org/10.1007/s11356-020-08520-x

Fisher-Vanden K, Jefferson GH, Liu H, Tao Q (2004) What is driving China’s decline in energy intensity? Resour Energy Econ 26:77–97. https://doi.org/10.1016/j.reseneeco.2003.07.002

Gamtessa S, Olani AB (2018) Energy price, energy efficiency, and capital productivity: empirical investigations and policy implications. Energy Econ 72:650–666. https://doi.org/10.1016/j.eneco.2018.04.020

Ganapati S, Shapiro JS, Walker R (2016) Energy prices, pass-through, and incidence in US manufacturing. US Census Bureau Center for economic studies paper no. CES-WP-16-27. https://doi.org/10.2139/ssrn.2783473

Gonseth C, Cadot O, Mathys NA, Thalmann P (2015) Energy-tax changes and competitiveness: the role of adaptive capacity. Energy Econ 48:127–135. https://doi.org/10.1016/j.eneco.2014.12.010

González A, Teräsvirta T, Van Dijk D (2005) Panel smooth transition model and an application to investment under credit constraints. Working paper. Stockholm School of Economics, Stockholm, Sweden

Hamilton JD (1988) Are the macroeconomic effects of oil-price changes symmetric? Carnegie-Rochester Conf Ser Public Policy 28:369–378. https://doi.org/10.1016/0167-2231(88)90031-0

Hamilton JD (1996) This is what happened to the oil price-macroeconomy relationship. J Monet Econ 38:215–220. https://doi.org/10.1016/s0304-3932(96)01282-2

Hamilton JD (2010) Nonlinearities and the macroeconomic effects of oil prices. Macroecon Dyn 15:364–378. https://doi.org/10.1017/s1365100511000307

Hang L, Tu M (2007) The impacts of energy prices on energy intensity: evidence from China. Energy Policy 35:2978–2988. https://doi.org/10.1016/j.enpol.2006.10.022

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econ 93(2):345–368. https://doi.org/10.1016/S0304-4076(99)00025-1

Hooker MA (1996) What happened to the oil price-macroeconomy relationship? J Monet Econ 38:195–213. https://doi.org/10.1016/s0304-3932(96)01281-0

IEA (2018) World energy outlook 2018 – executive summary. International Energy Agency, France

IEA (International Energy Agency) (2013) World energy outlook 2013. Paris: International Energy Agency. France

IPCC (2006) Greenhouse gas inventory: IPCC guidelines for National Greenhouse gas Inventories. United Kingdom Meteorological Office, BracknellReturn to ref 2006 in article

Jayanthakumaran K, Verma R, Liu Y (2012) CO2 emissions, energy consumption, trade and income: a comparative analysis of China and India. Energy Policy 42:450–460. https://doi.org/10.1016/j.enpol.2011.12.010

Kahn ME, Mansur ET (2013) Do local energy prices and regulation affect the geographic concentration of employment? J Public Econ 101:105–114. https://doi.org/10.1016/j.jpubeco.2013.03.002

Kander A, Schön L (2007) The energy-capital relation—Sweden 1870–2000. Struct Change Econ Dyn 18:291–305. https://doi.org/10.1016/j.strueco.2007.02.002

Kaya Y, Yokoburi K (1997) Environment, energy, and economy: strategies for sustainability. United Nations University Press, Tokyo

Kilian L (2008) The economic effects of energy price shocks. J Econ Lit 46(4):871–909. https://doi.org/10.1257/jel.46.4.871

Lee S, Chong WO (2016) Causal relationships of energy consumption, price, and CO2 emissions in the US building sector. Resour Conserv Recycl 107:220–226. https://doi.org/10.1016/j.resconrec.2016.01.003

Lee K, Ni S (2002) On the dynamic effects of oil price shocks: a study using industry level data. J Monet Econ 49:823–852. https://doi.org/10.1016/s0304-3932(02)00114-9

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econ 108(1):1–24. https://doi.org/10.1016/S0304-4076(01)00098-7

Levinson A (1999) Grandfather regulations, new source bias, and state air toxics regulations. Ecol Econ 28(2):299–311. https://doi.org/10.1016/S0921-8009(98)00045-7

Ley MC, Stucki T, Woerter M (2013) The impact of energy prices on green innovation. KOF working papers no. 340. https://doi.org/10.2139/ssrn.2306534

Linn J (2008) Energy prices and the adoption of energy-saving technology. Econ J 118:1986–2012. https://doi.org/10.1111/j.1468-0297.2008.02199.x

Linn J (2009) Why do energy prices matter? The role of interindustry linkages in US manufacturing. Econ Inq 47:549–567. https://doi.org/10.1111/j.1465-7295.2008.00168.x

Liu N, Ma Z, Kang J (2015) Changes in carbon intensity in China’s industrial sector: decomposition and attribution analysis. Energy Policy 87:28–38. https://doi.org/10.1016/j.enpol.2015.08.035

Löschel A, Schymura M (2013) Modeling technological change in economic models of climate change: a survey. ZEW-Centre for european economic research discussion paper (13-007). https://doi.org/10.2139/ssrn.2217490

Marin G, Vona F (2019) Climate policies and skill-biased employment dynamics: evidence from EU countries. J Environ Econ Manag 98:102253. https://doi.org/10.1016/j.jeem.2019.102253

McCollum DL, Jewell J, Krey V, Bazilian M, Fay M, Riahi K (2016) Quantifying uncertainties influencing the long-term impacts of oil prices on energy markets and carbon emissions. Nat Energy 1:16077. https://doi.org/10.1038/nenergy.2016.77

Meng M, Niu D (2012) Three-dimensional decomposition models for carbon productivity. Energy 46:179–187. https://doi.org/10.1016/j.energy.2012.08.038

Metcalf GE (2008) An empirical analysis of energy intensity and its determinants at the state level. Energy J 29:1–26. https://doi.org/10.5547/issn0195-6574-ej-vol29-no3-1

Newell RG, Jaffe AB, Stavins RN (1999) The induced innovation hypothesis and energy-saving technological change. Q J Econ 114:941–975. https://doi.org/10.1162/003355399556188

Newell RG, Jaffe AB, Stavins RN (2006) The effects of economic and policy incentives on carbon mitigation technologies. Energy Econ 28:563–578. https://doi.org/10.1016/j.eneco.2006.07.004

Nie PY, Yang YC (2016) Effects of energy price fluctuations on industries with energy inputs: an application to China. Appl Energy 165:329–334. https://doi.org/10.1016/j.apenergy.2015.12.076

Ouyang X, Lin B (2015) An analysis of the driving forces of energy-related carbon dioxide emissions in China’s industrial sector. Renew Sust Energ Rev 45:838–849. https://doi.org/10.1016/j.rser.2015.02.030

Ouyang X, Sun C (2015) Energy savings potential in China’s industrial sector: from the perspectives of factor price distortion and allocative inefficiency. Energy Econ 48:117–126. https://doi.org/10.1016/j.eneco.2014.11.020

Ouyang X, Li Q, Du K (2020) How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Policy 139:111310. https://doi.org/10.1016/j.enpol.2020.111310

Panhans M, Lavric L, Hanley N (2017) The effects of electricity costs on firm re-location decisions: insights for the pollution havens hypothesis? Environ Resour Econ 68:893–914. https://doi.org/10.1007/s10640-016-0051-1

Popp DC (2001) The effect of new technology on energy consumption. Resour Energy Econ 23:215–239. https://doi.org/10.1016/s0928-7655(00)00045-2

Popp DC (2002) Induced innovation and energy prices. Am Econ Rev 92:160–180. https://doi.org/10.1257/000282802760015658

Price L, Wang X, Yun J (2010) The challenge of reducing energy consumption of the Top-1000 largest industrial enterprises in China. Energy Policy 38:6485–6498. https://doi.org/10.1016/j.enpol.2009.02.036

Renou-Maissant P (1999) Interfuel competition in the industrial sector of seven OECD countries. Energy Policy 27(2):99–110. https://doi.org/10.1016/S0301-4215(99)00006-3

Richmond AK, Kaufmann RK (2006) Energy prices and turning points: the relationship between income and energy use/carbon emissions. Energy J 27:157–180. https://doi.org/10.5547/issn0195-6574-ej-vol27-no4-7

Sato M, Dechezleprêtre A (2015) Asymmetric industrial energy prices and international trade. Energy Econ 52:130–S141. https://doi.org/10.1016/j.eneco.2015.08.020

Sato M, Singer G, Dussaux D, Lovo S (2019) International and sectoral variation in industrial energy prices 1995–2015. Energy Econ 78:235–258. https://doi.org/10.1016/j.eneco.2018.11.008

Saussay A, Sato M (2018) The impacts of energy prices on industrial foreign investment location: evidence from global firm level data. FAERE working paper, 2018.21. https://doi.org/10.17524/repec.v12i4

Schumacher K, Sands RD (2007) Where are the industrial technologies in energy–economy models? An innovative CGE approach for steel production in Germany. Energy Econ 29:799–825. https://doi.org/10.1016/j.eneco.2006.12.007

Seleteng M, Bittencourt M, van Eyden R (2013) Non-linearities in inflation–growth nexus in the SADC region: a panel smooth transition regression approach. Econ Model 30:149–156. https://doi.org/10.1016/j.econmod.2012.09.028

Shahbaz M, Sinha A (2019) Environmental Kuznets curve for CO2 emissions: a literature survey. J Econ Stud 46:106–168. https://doi.org/10.1108/jes-09-2017-0249

Shao S, Yang L, Gan C, Cao J, Geng Y, Guan D (2016) Using an extended LMDI model to explore techno-economic drivers of energy-related industrial CO2 emission changes: a case study for Shanghai (China). Renew Sust Energ Rev 55:516–536. https://doi.org/10.1016/j.rser.2015.10.081

Soytas U, Sari R, Ewing BT (2007) Energy consumption, income, and carbon emissions in the United States. Ecol Econ 62:482–489. https://doi.org/10.1016/j.ecolecon.2006.07.009

Steinbuks J, Neuhoff K (2014) Assessing energy price induced improvements in efficiency of capital in OECD manufacturing industries. J Environ Econ Manag 68:340–356. https://doi.org/10.1016/j.jeem.2014.07.003

Tian Z, Tian Y, Chen Y, Shao S (2020) The economic consequences of environmental regulation in China: from a perspective of the environmental protection admonishing talk policy. Business Strategy and the Environment 29(4):1723–1733. https://doi.org/10.1002/bse.2464

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. Eur J Oper Res 130:498–509. https://doi.org/10.1016/s0377-2217(99)00407-5

Usman O, Iorember PT, Olanipekun IO (2019) Revisiting the environmental Kuznets curve (EKC) hypothesis in India: the effects of energy consumption and democracy. Environ Sci Pollut Res 26:13390–13400. https://doi.org/10.1007/s11356-019-04696-z

van der Kamp DS (2020) Blunt force regulation and bureaucratic control: Understanding China’s war on pollution. Governance:1–19. https://doi.org/10.1111/gove.12485

Vielle M, Viguier L (2007) On the climate change effects of high oil prices. Energy Policy 35:844–849. https://doi.org/10.1016/j.enpol.2006.03.022

Wang Q, Qiu HN, Kuang Y (2009) Market-driven energy pricing necessary to ensure China’s power supply. Energy Policy 37:2498–2504. https://doi.org/10.1016/j.enpol.2009.03.008

Wang Y, Zhu Q, Geng Y (2013) Trajectory and driving factors for GHG emissions in the Chinese cement industry. J Clean Prod 53:252–260. https://doi.org/10.1016/j.jclepro.2013.04.001

Wang Y, Lai N, Mao G, Zuo J, Crittenden J, Jin Y, Moreno-Cruz J (2017) Air pollutant emissions from economic sectors in China: a linkage analysis. Ecol Indic 77:250–260. https://doi.org/10.1016/j.ecolind.2017.02.016

Yan X, Fang YP (2015) CO2 emissions and mitigation potential of the Chinese manufacturing industry. J Clean Prod 103:759–773. https://doi.org/10.1016/j.jclepro.2015.01.051

Yuan J, Kang J, Yu C, Hu Z (2011) Energy conservation and emissions reduction in China—progress and prospective. Renew Sust Energ Rev 15:4334–4347. https://doi.org/10.1016/j.rser.2011.07.117

Yuan B, Ren S, Chen X (2017) Can environmental regulation promote the coordinated development of economy and environment in China’s manufacturing industry?–a panel data analysis of 28 sub-sectors. J Clean Prod 149:11–24. https://doi.org/10.1016/j.jclepro.2017.02.065

Zha D, Ding N (2014) Elasticities of substitution between energy and non-energy inputs in China power sector. Econ Model 38:564–571. https://doi.org/10.1016/j.econmod.2014.02.006

Zha D, Zhou D (2014) The elasticity of substitution and the way of nesting CES production function with emphasis on energy input. Appl Energy 130:793–798. https://doi.org/10.1016/j.apenergy.2014.01.093

Zhang C, Xu J (2012) Retesting the causality between energy consumption and GDP in China: evidence from sectoral and regional analyses using dynamic panel data. Energy Econ 34:1782–1789. https://doi.org/10.1016/j.eneco.2012.07.012

Zhang X, Karplus VJ, Qi T, Zhang D, He J (2016) Carbon emissions in China: how far can new efforts bend the curve? Energy Econ 54:388–395. https://doi.org/10.1016/j.eneco.2015.12.002

Zhao, L. (2019). Lessons from “APEC blue” about air pollution control in China. Chinese Research Perspectives on the Environment, volume 9. Brill, 2019. 24–35. https://doi.org/10.1163/9789004401570_003

Zhao X, Li H, Wu L, Qi Y (2014) Implementation of energy-saving policies in China: how local governments assisted industrial enterprises in achieving energy-saving targets. Energy Policy 66:170–184. https://doi.org/10.1016/j.enpol.2013.10.063

Zhu PF, Zhang ZY, Jiang GL (2011) Empirical study of the relationship between FDI and environmental regulation: an intergovernmental competition perspective. Econ Res J 6:133–145 (In Chinese)

Acknowledgments

We would like to thank two anonymous reviewers for useful comments and feedback. We also thank Professor Wang Zanxin from Yunnan University for the helpful comments. Furthermore, we would like to thank the editor and two referees for helpful comments, which greatly improved the manuscript. All remaining errors and omissions are our own.

Funding

This paper was funded by the National Nature Science Foundation of China (71963034), the project of philosophy and social and science of Yunnan Province (QN2019006), and the project of Yunnan University on development economics and innovation hub (C176240103).

Author information

Authors and Affiliations

Contributions

For research articles with two authors, data curation, Y.T.; methodology, Y.T.; writing–original, draft, Y.T. and X.Y.; writing–review and editing, Y.T.; project administration, X.Y.; funding acquisition, X.Y.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflicts of interest.

Additional information

Responsible editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1. The method of calculating carbon productivity

We adopt carbon productivity as an indicator of carbon emissions in our paper. Using the data from 2003 to 2015 for China’s industrial sectors, we will employ here the input-oriented SBM model under variable returns to scale (VRS), referring to Tone (2001). The directivity distance function is defined as.

where (xt, i, yt, i, bt, i) represents the input and output vector for industry i. And (gx, gy, gb) is the direction vectors of bad output and input expansion, and (\( {\mathrm{s}}_i^x,{\mathrm{s}}_m^y,{\mathrm{s}}_i^b \)) represent the relaxation vectors of expectation input and bad output, respectively. When both are greater than zero, the actual input and pollution are greater than the boundary input and output, but the actual output is less than the boundary output. These basic data for calculating carbon productivity are from the Chinese statistical yearbook (2003–2016), the Chinese industrial statistical yearbook (2003–2016), and the Chinese energy statistics yearbook (2003–2016). Moreover, the average number of workers presents the indicator of human capital, and obtaining physical capital is calculated by the perpetual inventory method. The key to the calculation is to determine the capital stock in the base period and the depreciation index of fixed asset investment. At present, the country does not publish the officially calculated capital stock of subindustries, so it takes some time to calculate this indicator. For the estimation of the economic indicators of different sectors in different periods, the most significant problem is that the classification of industries in different time periods needs to be adjusted, which is explained in the processing of energy consumption indicators in this paper. Second, using the perpetual inventory method needed to base the estimation and allowing for depreciation, capital investment, and the stock price index of investment in fixed assets—due to the selection in this paper of the other indicators in 1990 as the base—we constructed our calculation based on the industrial divisions, which will be added to obtain the data based on 1990 as the base of the capital stock per year.

Appendix 2. The method of calculating environment regulation

Due to the heterogeneity between different sectors, the emission intensity of different pollutants is different. Based on the availability of data, this paper selects three indicators to measure the intensity of environmental governance: the rate of wastewater discharge reaching the standard, the rate of sulfur dioxide removal, and the comprehensive utilization rate of solid waste. The specific methods are as follows: linear standardization is carried out according to the range of 0–1 for the wastewater discharge standard rate, the sulfur dioxide removal rate, and the comprehensive utilization rate of solid waste, which can eliminate the unmeasurable indexes using the mathematical transformation of relevant indexes.

In the specific context of environmental regulation policy, enterprises will set targets to reduce pollutant emissions. Thus, many researchers use quantitative indicators to measure the intensity of environmental regulation directly and choose indicators related to pollutants in the industrial sector. There are three main types of pollutants discharged by enterprises: wastewater, waste gas, and solid waste. A single type of pollutant emission cannot refer to the status of industrial enterprises and cannot fully reflect the intensity of environmental regulation. Therefore, the measurement of environmental regulation variables in existing studies is mostly a comprehensive indicator. Zhu et al. (2011) standardized industrial wastewater discharge, industrial solid waste discharge, and SO2 emissions and then weighted the calculations to obtain environmental regulations. This study refers to Levinson’s (1999) measurement method to replace the environmental regulation intensity with pollutant emissions and collects three indicators—wastewater, waste gas, and solid waste—to reflect the enterprise’s sewage discharge and environmental regulation intensity. By standardizing the treatment of pollutants and weighting the industrial output value, it is possible to objectively reflect the intensity of environmental regulations in the industrial sectors of various provinces. The specific treatment is as follows: firstly, the linear standardization of unit pollution emissions in various industries is as follows.

where \( {\mathrm{UE}}_{ij}^s \)is the standardized value of the pollutant emission per unit output value of j pollutant in the i industry; max(UEij) and min(UEj) are the maximum and minimum values of each index in all industries, respectively; and UEij is the original value.

Then, we calculate the adjustment coefficient of each index (Wj), following Ouyang et al. (2020):

where Eij is pollution discharge of the jth pollutant in sector i;\( \frac{E_{ij}}{\sum \limits_{i=1}^m{E}_{ij}} \) is the proportion of the jth pollutant emission and the ith sector in all industry sectors; OUTPUTi is the output value of sector i; \( \frac{{\mathrm{OUTPUT}}_i}{\sum_{i=1}^m{\mathrm{OUTPUT}}_i} \)is the proportion of sector i’s output value to all industrial sectors; after conversion, the ratio of the pollutant emission per unit output value of j pollutant in the ith industry (UEij) to the average level of the output value of the jth pollutant (UEij). After obtaining the weighted weights of the indicators for each year, the average value is further estimated. Then, through the standardized values and average weights of individual indicators, the environmental regulation of each indicator and the overall environmental regulation are calculated

Rights and permissions

About this article

Cite this article

Tian, Y., Yang, X. Asymmetric effects of industrial energy prices on carbon productivity. Environ Sci Pollut Res 27, 42133–42149 (2020). https://doi.org/10.1007/s11356-020-10204-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-10204-5