Abstract

Regulated water industries need to improve their technical efficiency and allocate their resources efficiently. This is the case of the water industry in England and Wales which was privatized in 1989, and the method of price cap regulation was implemented. This study uses an input distance function system approach to estimate the technical efficiency and distortions in the choice of input mixes for the English and Welsh water and sewerage companies (WaSCs) over the years 1991–2016. The results indicated that an average WaSC was 75.3% technically efficient which means that inputs could be reduced by 24.7% keeping the level of output constant. On average, the input mix was considered to be allocated inefficiently as there was an over-utilization of capital and other inputs relative to employment. Moreover, the low degree of substitutability among inputs implied that reducing allocative inefficiency could be costly. The findings of our study is of interest to policy makers who want to implement effective policies to improve efficiency in the water industry.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

There are several reasons for promoting the participation of the private sector in the water industry such as the need to attract private funding to improve the infrastructure, reduce inefficiencies, and enhance quality of service (Craig 2009). A recent study by Marques and Simões (2020) concluded that Portuguese private water utilities present better performance than public water utilities. In this context, an interesting case study is the English and Welsh water and sewerage industry which was privatized in 1989. Since then, several capital investment programs have been carried out to reduce water losses and to improve the quality of service, drinking water quality, and environmental standards (McEldowney 2014). The method of regulation imposed for the water and sewerage companies (WaSCs) and water only companies (WoCs) was in the form of price caps which is a highly powered incentive scheme. To evaluate whether the regulated water companies have improved their efficiency or not, we need to look into technical and allocative efficiency (Woodbury and Dollery 2004). The former refers to the ability of a firm (water company in this study) to reduce its inputs for a given level of output, whereas the latter comes from the misallocation of resources, e.g., over-use of capital, employment, or other operating inputs (Sauer and Frohberg 2007). A water company that is technically efficient may be allocatively inefficient due to the misuse in the choice of inputs, and vice versa.

Water companies need well-designed incentives that will aid them to allocate resources efficiently. Moreover, water companies need to invest in capital so that the drinking water is delivered to end users and wastewater is treated and discharged without polluting the environment or re-used for other purposes (Ryan et al. 2019). They also need to invest in new technologies that can allow them to reduce costs and pass any cost savings to customers in terms of lower prices. At the same time, water companies need to hire employees and train them to improve their skills. The quality of the above choices may have an impact on water companies’ technical efficiency (Li and Phillips 2017). Thus, knowing how the water company can reduce its inputs and allocate resources more efficiently, the regulator can promote a higher level of efficiency and ensure the required financial support for carrying out the programs.

Literature reviews by Worthington (2014) and Cetrulo et al. (2019) evidenced that past research evaluating technical efficiency of water companies is vast. In the framework of the English and Welsh water and sewerage industry, several studies assessed the technical efficiency of water companies and the impact of regulation on their performance. Bottasso and Conti (2003, 2009) used econometric techniques to underline the positive impact of the tight 1999 price review on water companies’ efficiency. Saal et al. (2007), Molinos-Senante et al. (2017), and Molinos-Senante and Maziotis (2019) also used econometric methods to show that after 2000, the English and Welsh water companies achieved considerable efficiency gains and moved closer to the efficient frontier. This is was also confirmed by other studies like Portela et al. (2011) who used parametric techniques like data envelopment analysis (DEA). Another study by Molinos-Senante et al. (2014) demonstrated that the 2004 price review was not very effective in stimulating efficiency gains. Maziotis et al. (2016) showed that quality of service improved during the years 2001–2004 whereas it considerably got worse during the years 2005–2008.

Few studies investigated the impact of resource mix efficiency in the English and Welsh water industry. Saal and Parker (2001) used index number techniques to calculate labor productivity. In a profit decomposition context, Maziotis et al. (2014) used index numbers and DEA techniques to show that there was an evidence of efficient allocation of resources after 2000 by substituting labor with capital. We note that the previous studies did not directly estimate allocative efficiency. This was done by Erbetta and Cave (2007) who employed DEA techniques to estimate technical and allocative distortions in the English water industry during the years 1993–2005. The results showed that initially there was an over-utilization of labor and under-utilization of capital which led to allocative inefficiency. These allocative distortions were reduced gradually. However, none of the above studies used econometric techniques to study the existence of allocative inefficiency in the English and Welsh water industry.

Within this in mind, the main objective of the study is to estimate the technical efficiency and allocative distortions in the choice of input mixes in the English and Welsh water and sewerage industry using an input distance function system approach. An important advantage of using an econometric approach, instead of non-parametric techniques such as index numbers and DEA, is the inclusion of several environmental variables in the efficiency assessment (Carvalho et al. 2012; Marques et al. 2014; Pinto et al. 2017). We use an input distance function approach as it does not require the use of market prices and allows the accommodation of several inputs and outputs. We estimate technical efficiency and allocative distortions among inputs by using a system of equations, the input distance function, and its related cost share equations, because it makes the estimates more efficient as we add equations but do not increase the number of parameters (Triebs et al. 2016; Molinos-Senante and Maziotis 2017). This approach has been proposed by Fare and Grosskopf (1990) and Grosskopf and Hayes (1993) and applied to several sectors such as hospital, manufacturing, airports, water, and sewerage industry (Berg and Marques 2011), but not to the English and Welsh water companies, to the best of our knowledge. Finally, we also calculate Morishima elasticities of substitution among inputs to see the degree of their substitutability which can help us determine if the cost of reducing allocative inefficiency is high or not. The results of our study can help policy makers to design and implement effective policies to enhance efficiency in the water industry.

This study contributes to the current strand of literature in several aspects. First, to the best of our knowledge, there are no previous studies estimating the technical efficiency and allocative distortions in the choice of input mixes for English and Welsh water companies. Second, allocative distortions were estimated using an input distance function system approach which has been scarcely applied to evaluate the performance of water companies. Finally, the assessment conducted in this study involves a large period (1991–2016). Hence, we innovate in the field of water companies’ performance with the estimation of efficiency and allocative distortions of English and Welsh water companies over 1991–2016 using an input distance function system approach.

Methodology

This section presents the parametric approach to estimate technical and allocative distortions among different pairs of inputs to determine the presence of allocative inefficiency. Technical efficiency refers to the situation where a water company needs to reduce its inputs for a given level of output whereas allocative efficiency stands for changes in the resource mix given the price of inputs. The approach followed in this study is based on specifying an input distance function system approach as proposed by Fare and Grosskopf (1990) and Grosskopf and Hayes (1993), applied later by Erbetta and Petraglia (2011) in the manufacturing sector and extended by others in several sectors such as hospitals and airports (see for instance, Rodrıguez-Alvarez et al. 2004; Hidalgo-Gallego et al. 2017).

We use an input distance function instead of a cost function as it does not require information on prices for inputs (for more details, see for instance Coelli and Perelman 2000). Using a shadow cost function, we assume that water companies minimize their shadow cost, C, using a vector of shadow input prices, ws, to produce a given level of output, y (Erbetta and Petraglia 2011):

where L(y) is the set of inputs to produce a given level of output y. Any deviation of shadow input prices from the actual input prices leads to allocative distortions. Fare and Grosskopf (1990) used an input distance function approach to represent technology and then calculate allocative distortions. The input distance function takes the following form:

For x ∈ L(y), DI(y, x) ≥ 1, with x being technically efficient but not necessarily allocatively efficient if DI(y, x) = 1.

Using then the dual Shepherd’s lemma (1953), we can calculate shadow price ratios for inputs using the two first partial derivatives of the input distance function with respect to any inputs i and j as follows (Rodrıguez-Alvarez et al. 2004):

The comparison between the ratios of shadow input prices and actual input prices can be used to assess the existence of input misallocation (allocative efficiency). This can be done using the following equation:

If γij = 1, then the resource mix is allocatively efficient; if γij > 1, then input i is under-utilized relative to input j and if γij < 1, then input i is over-utilized relative to input j (Erbetta and Petraglia 2011). To estimate the allocative distortions or input misallocations, γij, we follow Erbetta and Petraglia’s (2011) approach and use a translog input distance function and its cost share equations:

The cost share equations are as follows:

where σsDs are firm-specific dummies that represent firm heterogeneity (one firm-specific dummy is dropped to avoid any multicollinearity problems (Kumbhakar et al. 2015)); s and t denote firm and time, respectively; m and n denote outputs and inputs, respectively. We also include a set of control variables, χk, that may affect the technology (Saal et al. 2007); and εst is random error with zero mean and constant variance. We also impose the restrictions for homogeneity of degree 1 in inputs and symmetry in the estimation:

Then, the index of allocative distortions, γij, in Eq. (4) is calculated for each water company using Eq. (8):

In Eq. (8), γij can be seen as a ratio of the optimal input cost shares compared with the ratio of the actual input cost shares based on the fact that the first partial derivative of the log-distance function with respect to the log of input i represents the i-th input optimal cost share (Erbetta and Petraglia 2011).

The input distance function is estimated jointly with N-1 cost share equations; Eqs. (5) and (6) via iterated seemingly unrelated regression (SUR) (Zellner 1962). One share equation is dropped in order not to have any singularity problems. SUR estimation is used as the additional structure imposed by the share equations makes the estimates more efficient as we add equations but do not increase the number of parameters (Triebs et al. 2016). The input distance function system of Eqs. (5) and (6) allows us to estimate technical efficiency for each firm (water company) at any time. Technical efficiency is calculated based on the predicted value of the log-distance function and by adding the absolute value of the most negative residual (Grosskopf et al. 2001; Abrate and Erbetta 2010):

As Abrate and Erbetta (2010) noted, the above approach to estimate technical efficiency is deterministic and is equivalent to corrected ordinary least squares (COLS).

After the calculation of allocative distortions among the different pairs of inputs, we check if the technology allows for substitution among inputs. If there is an inefficient allocation of inputs, then, the cost of reducing allocative inefficiency may be costly if the inputs are poor substitutes (Rodrıguez-Alvarez et al. 2004). Thus, we use the Morishima elasticities of substitution to determine the degree of substitutability among inputs which are defined using the following equation:

where Dj(y, x) and Di(y, x) are the shadow prices (or marginal products) of inputs j and i, respectively. The ratio of the input shadow prices (or marginal products) gives the marginal rate of technical substitution (MRTS). In other words, it shows how one input can change with respect to the other input for a given level of output, i.e., the slope of the isoquant. The second-order effects of input i and j are used to calculate the curvature of the isoquant. Dij shows the change in the marginal product of input i when there is a change in input j, whereas Dii shows the change in the marginal product of input i when there is a change in input i. Thus, Eij are cross-shadow price elasticities implying whether the net input pairs are substitutes or complements and Eii are own shadow price elasticities (Rodrıguez-Alvarez et al. 2004). Low values of the Morishima elasticity of substitution, i.e., less than 1, indicate that the two inputs are poor substitutes, whereas higher values of the Morishima elasticity suggest higher substitutability between inputs (Rodrıguez-Alvarez et al. 2004).

Data and sample selection

The data used in this study refer to the ten English and Welsh WaSCs who were privatized as natural monopolies in 1989 and provide both water and sewerage services. The source of the data is the “June reports for WaSCs in England and Wales” and water companies’ annual performance reports over the period 1991–2016. In accordance with past practice (see for instance, Molinos-Senante and Maziotis 2017), two outputs and three inputs were selected. Outputs were the volumes of water delivered (Ml/year) to capture water services and the number of equivalent population served to capture sewerage services. The three inputs were capital, labor, and other costs. Capital is proxied using a physical measure of network, the modern equivalent asset value (MEA) defined as the current cost estimates of the replacement costs of the existing capital stock (Maziotis et al. 2015). Following past studies (e.g., Molinos-Senante and Maziotis 2017), we calculate capital costs as the sum of the opportunity cost of invested capital and capital depreciation relative to MEA asset values, and the price of physical capital was derived as the user cost of capital divided by the MEA measure of physical capital stocks (for more details, see Saal et al. 2007). Labor input was proxied by sthe number of full time employees, and the price of labor was calculated as the ratio of labor input to employees’ wages. Other costs were defined as the difference between operating costs and labor costs and the price of other costs was defined by the UK price index of materials and fuel purchased in purification and distribution of water. We use labor input as the normalized variable.

Previous studies stated that they may be other variables that have an effect on technology and efficiency (e.g., Carvalho and Marques 2011; Carvalho et al. 2012; Pinto et al. 2017). Thus, we included the following environmental variables in our analysis: (1) water population density defined as the ratio of water population to water area served; (2) sewerage population density denoted as the ratio of sewerage population to wastewater area served; (3) percentage of water losses; (4) percentage of water taken from boreholes; and (5) trade effluent intensity defined as the ratio of trade effluent to resident sewerage population (Saal et al. 2007). Table 1 reports the descriptive statistics for the variables used in our study.

Results and discussion

Input distance function and cost share estimations

The results from the estimation of the system of Eqs. (5)–(6) using iterated SUR are reported in Table 2. Following standard practice, all variables were divided by their average value so that the estimated first-order parameters can be directly interpreted as elasticities evaluated at the sample mean (Molinos-Senante et al. 2017). The results indicate that the input distance function is well-behaved fulfilling the regularity conditions for all observations.

As expected, the estimated parameters for water delivered and equivalent population served are negative and statistically significant, which suggests that the distance function is non-increasing in outputs. A 10% increase in the volumes of water delivered and in the number of equivalent population served might lead to an increase of 2.38% and 2.45% of all inputs, respectively. The capital input cost share and the cost share of other inputs are 57.0% and 29.6%, respectively. This result demonstrates the highly capital-intensive nature of the English and Welsh water and sewerage industry.

The estimated coefficients of the inputs are positive, as expected, and statistically significant. The labor input cost share is recovered from the homogeneity property and is at the level of 13.5%. The negative and statistically significant second-order parameters of the water and sewerage output suggest that these elasticities increased at an increasing rate. The interaction term between water delivered and equivalent population is positive and statistically significant which means that cost complementarities between these outputs might exist. As capital and other inputs increase, their elasticity increased as well. Technical change as captured by the time coefficient is negative and statistically significant which means that on average, the industry showed technical regress. The coefficient of sewerage population density is positive and statistically significant. This means that more densely populated areas might require lower costs for wastewater collection and treatment infrastructure (Carvalho and Marques 2011; Molinos-Senante et al. 2017). The coefficient of water leakage is also positive which means that water companies who invest in technologies that predict leakages might reduce their inputs in the long run. Finally, effluent from large users tended to have lower input requirements (Saal et al. 2007) as indicated by the positive and statistically significant coefficient.

Technical efficiency and allocative distortions

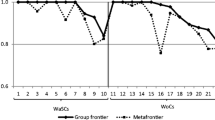

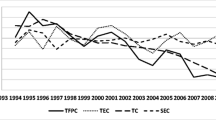

The estimates of technical efficiency and allocative distortions for each pair of inputs: capital, other inputs, and labor, are reported in Fig. 1. The sample is split into several sub-periods as we want to link the results with the regulatory cycle of the English and Welsh water industry. Looking at the technical efficiency estimates, it is concluded that an average WaSC was 75.3% technically efficient which means that inputs could be reduced by 24.7% keeping the level of output constant. It is shown that average WaSC’s technical efficiency increased from 0.709 during the years 1991–1995 to 0.735 over the period 2011–2016. Similar levels of technical efficiency were reported by Villegas et al. (2019) who studied the efficiency of WaSCs in the provision of drinking water (excluding sewerage activities) over the years 2001–2016 using non-parametric techniques.

Looking at the allocative distortions in the use of inputs, it is shown that on average, capital and other inputs were over-utilized with respect to labor input over time. Consequently, labor was under-utilized relative to capital and other inputs. A high misallocation of labor was revealed in the English and Welsh water and sewerage industry over time. Moreover, the mix of capital and other inputs was also not efficient as there was an under-utilization of these inputs. Overall, the results indicate that in general, the input mix was inefficient and that WaSCs could improve their cost performance by moving to a more efficient allocation of resources. This could be achieved by making savings on capital and other inputs and a simultaneous increase in employment.

The first years after the water and sewerage industry privatization led to an average technical efficiency of 70.9% implying that the water companies needed to further reduce their inputs by 29.1% for a given level of output. As far as the resource mix allocation was concerned, the results showed an initial over-utilization of labor and other inputs and an under-utilization of capital. This is consistent with previous studies by Erbetta and Cave (2007) and Saal and Parker (2001) who showed that the reorganization of workforce seemed to be necessary during the first years of privatization.

The 1994 price review had a positive impact on technical efficiency of the water companies as it increased by 7.7%, from 0.709 during 1991–1995 to 0.760 during 1996–2000. On average, WaSCs could reduce their inputs by 24% while maintaining the same magnitude of output. This result is consistent with previous studies by Molinos-Senante et al. (2017) and Molinos-Senante and Maziotis (2018) who showed that the 1994 price review allowed companies to improve their efficiency with less efficient companies moving closer to the frontier. The results regarding input allocation indicate that there was an over-utilization of capital relative to labor and other inputs. This result which corroborates Saal and Parker’s (2001) study is explained by the fact that the water companies needed to carry out substantial capital programs to improve the network, quality of service, drinking water quality, and environmental standards.

The tightened 1999 price review further stimulated technical efficiency as an average WaSC needed to reduce its inputs by almost 21% to improve its efficiency. This is also found in the input allocation where although an over-utilization of capital existed relative to the other two inputs, the allocative distortions value moved closer to one. This finding is consistent with Erbetta and Cave (2007) who also reported the positive impact of the 1999 price review on companies’ allocative efficiency. Maziotis et al. (2014) also showed that the English and Welsh water and sewerage industry started to move to a better allocation of resources by substituting labor with capital. Studies by Maziotis et al. (2015) and Molinos-Senante et al. (2017) showed that over time, capital investment programs carried out since privatization considerably improved the water quality and environmental standards and the network quality.

The 2004 price review did not encourage water companies to be more efficient as there was a decrease in their technical efficiency. This result is consistent with Portela et al. (2011) and Villegas et al. (2019) who showed a downward trend in efficiency gains during the years 2006–2010. The price review seemed to have increased the distortion in the allocation of inputs between capital and the other two inputs where an over-utilization of capital was apparent. The 2009 and the first 2 years of the 2014 price review did not stimulate technical efficiency as there was a reduction in technical efficiency of 4%, from 0.765 during 2006–2010 to 0.735 during 2011–2016. This price review might have led the industry to under-utilize their resources so allocative inefficiency increased. The results from the allocative distortions suggest that the input mix was not efficient, so a further allocation of resources is required to reduce costs. We use the Morishima elasticities of substitution to determine if the inputs are good or poor substitutes and therefore conclude if it would be costly or not to improve allocative efficiency. The results are depicted in Table 3.

It is shown that own price elasticities of demand for capital, other inputs, and labor are negative as expected. The estimated Morishima elasticities are positive among the different pairs of capital, labor, and other inputs. This implies that the inputs were substitutes but their small value suggests that they were poor substitutes. There is limited possibility to substitute capital with labor and other inputs as the value is close to zero. There are higher possibilities to substitute labor with capital and labor as indicated by the slightly higher value of Morishima elasticity between labor and capital and between labor and other inputs. The Morishima elasticities suggest that substitution among labor and capital and other inputs was almost 0.24 times easier than switching from capital input or operating expenses into labor. These findings imply that reducing allocative inefficiency might be costly.

Article 9 of the European Water Framework Directive (2000/60/EC) introduced the principle of cost recovery for water services. It involves that main water uses, including households, must adequately contribute to the recovery of cost of water services. At the same time, water and sanitation tariffs should be affordable for all. Hence, water companies need to understand if the current resources are allocated efficiently so that they can reduce their costs in the future. In this context, the methodology used in this study is very useful for water companies and regulators as it quantifies allocative distortions in the choice of input mixes.

Moreover, about 35% of the total drinking water supplied (45 billion of m3) is lost annually through leakage, and in some low-income countries, water leakage is 50–60% of water supplied (Kanakoudis et al. 2013). Hence, a main challenge of water companies is to reduce water losses which are even more relevant in the current context of climate change where 1.6 billion people face economic water shortage (FAO 2013). The assessment conducted in this study illustrates that investing in technologies to predict leakage might reduce the costs of water companies in the long run. This information is very relevant for not only English and Welsh water companies but worldwide because it evidences that investing in repairing or renovating water networks can be costly in the short run but economically and environmentally beneficial in the long term.

Results showed that the water companies were both technically and allocatively inefficient. It was found that the companies needed to reduce their costs for a given level of output. It was also reported that over time, there was an overutilization of capital and other inputs relative to employment. From a policy perspective, this means that the water companies need to manage better their daily operations so that they can be more technically efficient. This can be done by hiring skilled employees who can help running the business more efficiently. Since privatization, the English and Welsh water companies have carried out substantially capital investment programs to improve the network and quality of service to customers. It appears that good service quality and high efficiency can be achieved by using less capital and more labor than what the current input choice is.

Conclusions

The water industry in England and Wales was privatized in 1989, and since then, they have carried out several capital investment programs to improve the network, environmental standards, and quality of service to customers. Thus, the evaluation of WaSCs’ performance in terms of their technical and allocative efficiency, i.e., the reduction in inputs given the level of output and the allocation of resources given their prices, can provide useful information for water companies and regulator.

In this study, we used an input distance function system approach to estimate the technical efficiency and allocative distortions in the mix of inputs for several WaSCs over the period 1991–2016. The main findings can be summarized as follows. First, the estimated results highlighted the highly capital-intensive nature of the English and Welsh water and sewerage industry. There were several operational characteristics that impacted water companies’ input requirements and efficiency such as sewerage population density, trade effluent intensity, and water leakage. Average WaSC was found to be almost 75% technically efficient which implies that it might need to reduce its inputs by almost 25% to maintain the same level of output. The 1994 and 1999 price reviews had a positive impact on water companies’ technical efficiency, whereas the other price reviews did not seem to further stimulate WaSCs’ efficiency. Moreover, the results from the allocative distortions in the mix of inputs suggest that capital and other inputs were over-utilized regarding labor over the whole period. The 1999 price review seemed to have a positive impact on WaSCs’ allocation of resources; however, the next price reviews seemed to have negatively impacted companies’ resources mix. Our findings suggest that average WaSCs could allocate their resources more efficiently by making savings on capital and other inputs and by increasing employment at the same time. However, the poor substitutability among inputs suggests that reducing allocative inefficiency could be costly. Finally, as further research, we plan to estimate the cost of allocative inefficiency by estimating a cost function system approach.

The results of our study can be of great interest for policy makers for the following reasons. First, it provides information on how efficient water companies are which can be further used by regulators to determine a cost (revenue) allowance as part of the price review process. It also allows regulated companies to identify factors that may increase companies’ efficiency such as investments in technologies to identify and repair water leakages. Moreover, it aids regulated water companies to evaluate if the allocation of their resources has been efficient over time. It can help them to see if and where there has been an over or under-utilization among inputs such as capital, labor, and other inputs. Finally, it may allow WaSCs to improve their efficiency by making changes in the mix of their inputs such as substituting capital and other inputs with labor. Any changes in the current mix of inputs should be carefully evaluated as they might be costly.

References

Abrate G, Erbetta F (2010) Efficiency and patterns of service mix in airport companies: an input distance function approach. Transportation Research Part E: Logistics and Transportation Review 46(5):693–708

Berg S, Marques R (2011) Quantitative studies of water and sanitation utilities: a benchmarking literature survey. Water Policy 13(5):591–606

Bottasso, A., Conti, M. (2003). Cost inefficiency in the English and Welsh water industry: an heteroskedastic stochastic cost frontier approach. DIEM Universita` di Genova, mimeo

Bottasso A, Conti M (2009) Price cap regulation and the ratchet effect: a generalised index approach. J Prod Anal 32(3):191–201

Carvalho P, Marques RC (2011) The influence of the operational environment on the efficiency of water utilities. J Environ Manag 92:2698–2707

Carvalho P, Marques RC, Berg S (2012) A meta-regression analysis of benchmarking studies on water utilities market structure. Util Policy 21:40–49

Cetrulo TB, Marques RC, Malheiros TF (2019) An analytical review of the efficiency of water and sanitation utilities in developing countries. Water Res 161:372–380

Coelli T, Perelman S (2000) Technical efficiency of European railways: a distance function approach. Appl Econ 32(15):1967–1976

Craig A (2009) Water privatization trends in the United States: human rights, national security, and public stewardship. Law Policy Review 33(3):785–849

Erbetta F, Cave M (2007) Regulation and efficiency incentives: evidence from the England and Wales water and sewerage industry. Rev Netw Econ 6(4):425–452

Erbetta F, Petraglia C (2011) Drivers of regional efficiency differentials in Italy: technical inefficiency or allocative distortions? Growth Chang 42(3):351–375

FAO (2013) Coping with water scarcity: an action framework for agriculture and food security. Available at: http://www.fao.org/3/i3015e/i3015e.pdf. Accessed 25 June 2020

Fare R, Grosskopf S (1990) A distance function approach to price efficiency. J Public Econ 43(1):123–126

Grosskopf S, Hayes K (1993) Local public sector bureaucrats and their input choices. J Urban Econ 33:151–166

Grosskopf S, Hayes KJ, Taylor LL, Weber WL (2001) On the determinants of school district efficiency: competition and monitoring. J Urban Econ 49(3):453–478

Hidalgo-Gallego, S., Martínez-San Román, V., Núñez-Sánchez, R. (2017). Estimation of allocative efficiency in airports for a pre-privatization period. In The Economics of Airport Operations. Edited by Bitzan J.D. and Peoples J.H. Advances in Airline Economics Book Series 6, Emerald Publishing Limited

Kanakoudis V, Tsitsifli S, Samaras P, Zouboulis A (2013) Assessing the performance of urban water networks across the EU Mediterranean area: the paradox of high NRW levels and absence of respective reduction measures. Water Policy 13(4):939–950

Kumbhakar SC, Wang H-J, Horncastle A (2015) A practitioner’s guide to stochastic frontier analysis using STATA. Cambridge University Press

Li F, Phillips MA (2017) The influence of the regulatory environment on Chinese urban water utilities. Water Resour Manag 31(1):205–218

Marques RC, Simões P (2020) Revisiting the comparison of public and private water service provision: an empirical study in Portugal. Water (Switzerland) 12(5):1477

Marques RC, Berg S, Yane S (2014) Nonparametric benchmarking of Japanese water utilities: institutional and environmental factors affecting efficiency. J Water Resour Plan Manag 140(5):562–571

Maziotis A, Saal DS, Thanassoulis E, Molinos-Senante M (2014) Profit change and its drivers in the English and Welsh water industry: is output quality important? Water Policy 18(4):1–18

Maziotis A, Saal DS, Thanassoulis E, Molinos-Senante M (2015) Profit, productivity and price performance changes in the water and sewerage industry: an empirical application for England and Wales. Clean Techn Environ Policy 17(4):1005–1018

Maziotis A, Molinos-Senante M, Sala-Garrido R (2016) Assessing the impact of quality of service on the productivity of water industry: a Malmquist-Luenberger approach for England and Wales. Water Resour Manag 31:2407–2427

McEldowney J (2014) Water privatisation and regulation: the UK experience. Water Resources in the Built Environment: Management Issues and Solutions 9780470670910:23–32

Molinos-Senante M, Maziotis A (2017) Estimating economies of scale and scope in the English and Welsh water industry using flexible technology. J Water Resour Plan Manag 143(10):04017060

Molinos-Senante M, Maziotis A (2018) Assessing the influence of exogenous and quality of service variables on water companies’ performance using a true-fixed stochastic frontier approach. Urban Water J 15(7):682–691

Molinos-Senante M, Maziotis A (2019) Cost efficiency of English and Welsh water companies: a meta-stochastic frontier analysis. Water Resources 33:3041–3055

Molinos-Senante M, Maziotis A, Sala-Garrido R (2014) The Luenberger productivity indicator in the water industry: an empirical analysis for England and Wales. Util Policy 30:18–28

Molinos-Senante M, Porcher S, Maziotis A (2017) Impact of regulation on English and Welsh water-only companies: an input distance function approach. Environ Sci Pollut Res 24(20):16994–17005

Pinto FS, Simoes P, Marques RC (2017) Water services performance: do operational environment and quality factors count? Urban Water J 14(8):773–781

Portela MCAS, Thanassoulis E, Horncastle A, Maugg T (2011) Productivity change in the water industry in England and Wales: application of the meta-Malmquist index. J Oper Res Soc 62(12):2173–2188

Rodrıguez-Alvarez A, Fernandez-Blanco V, Lovell CK (2004) Allocative inefficiency and its cost: the case of Spanish public hospitals. Int J Prod Econ 92(2):99–111

Ryan JAC, Ives MC, Dunham IM (2019) The impact of cost of capital reductions on regulated water utilities in England and Wales: an analysis of isomorphism and stakeholder outcomes. J Manag Gov 23(1):259–287

Saal DS, Parker D (2001) Productivity and price performance in the privatized water and sewerage companies in England and Wales. J Regul Econ 20(1):61–90

Saal DS, Parker D, Weyman-Jones T (2007) Determining the contribution of technical change, efficiency change and scale change to productivity growth in the privatized English and Welsh water and sewerage industry: 1985–2000. J Prod Anal 28(1–2):127–139

Sauer J, Frohberg K (2007) Allocative efficiency of rural water supply - a globally flexible SGM cost frontier. J Prod Anal 27(1):31–40

Triebs TP, Saal DS, Arocena P, Kumbhakar SC (2016) Estimating economies of scale and scope with flexible technology. J Prod Anal 45(2):173–186

Villegas A, Molinos-Senante M, Maziotis A (2019) Impact of environmental variables on the efficiency of water companies: a double bootstrap approach. Environ Sci Pollut Res 26(30):31014–31025

Woodbury K, Dollery B (2004) Efficiency measurement in Australian local government: the case of New South Wales municipal water services. Rev Policy Res 21(5):615–636

Worthington AC (2014) A review of frontier approaches to efficiency and productivity measurement in urban water utilities. Urban Water J 11(1):55–73

Zellner A (1962) An efficient method of estimating seemingly unrelated regressions and tests for aggregation bias. J Am Stat Assoc 57(298):348–368

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Molinos-Senante, M., Maziotis, A. & Villegas, A. Estimating technical efficiency and allocative distortions of water companies: evidence from the English and Welsh water and sewerage industry. Environ Sci Pollut Res 27, 35174–35183 (2020). https://doi.org/10.1007/s11356-020-09850-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-09850-6