Abstract

As one of the world’s largest economies, Chinese economy is maintaining the rapid economic development along with the cost of environmental degradation. The role of fiscal policy instruments is still unknown in the Chinese pollution equation. To do this, the present study is an effort to quantify the nexus of fiscal policy instruments and environmental degradation for Chinese economy over 1980 to 2016. The results reveal that fiscal policy instruments significantly increase the environmental degradation in the long run. The GDP and energy consumption of Chinese economy also enhance the environmental degradation respectively. The innovative accounting approach and diagnostics tests also applied to confirm the empirical estimates of study are reliable and valid for policy implications. The outcomes of study reveal that expansionary fiscal policy will lead to environmental degradation. Therefore, the Chinese authorities may consider the usage of advance and eco-friendly production methods to sustain the fast-growing economic growth along with the healthier environment.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In recent decades, environment dynamics, climate changes, and global warming have garnered the attention of researchers around the globe by virtue of the fast-growing population, industrialization, and transportation respectively. The poor environmental protection has raised concerns about the world’s environment (Hafeez et al. 2019c). The environmental degradation has direct linkage with human health, and it also affects the glaciers melting, wildlife, rainfalls, and agriculture (Hafeez et al. 2019c). In simple environmental Kuznets curve (EKC) setting, the energy consumption is one of the essential features of global warming and, hence, pollution (Istaiteyeh 2016; Ozcan and Ari 2017; Hafeez et al. 2019a).

At present, economic development and environmental protection are the two main challenges faced by the world. In the race of economic development, one of the key determinants of environmental degradation, each economy may also consider the environmental aspects (Uddin et al. 2017; Kasman and Duman 2015). For Belt and Road region, Hafeez et al. (2019b) found that foreign direct investment (FDI) and financial development are mitigating the carbon footprint, whereas Salam et al. (2019) suggested that investment and human capital development stimulate the real income and economic development in lower middle income countries. Many researchers in their studies have considered the relation concerning environmental degradation and other economic variables, such as GDP growth, FDI inflows, trade liberalization, development of financial sector, energy consumption, urbanization, tourism, logistics and transportation, and income inequality (Hafeez et al. 2018; Liu Y et al. 2018; Jalil and Feridun 2011; Kalayci and Koksal 2015; Abdouli and Hammami 2017; Cetin and Ecevit 2017;; Rauf et al. 2018; Yasmeen et al. 2018; Hafeez et al. 2019a; Yao et al. 2019; Yasmeen et al. 2019). The aforementioned studies unfold that real income (GDP) is the principal aspect of environmental degradation as real income and energy consumption lead to environmental degradation regarding industrialization (Hafeez et al., 2019a, c; Alam et al. 2014; Istaiteyeh 2016; Ozcan and Ari 2017).

In recent decades, demand for energy has been increased along with economic growth and brought disastrous damages to the environment (Yan and Crookes 2010), as non-renewable energy consumption upsurges the GDP growth, and CO2 emission levels respectively (Zhang et al. 2009). Many studies found that energy consumption mitigates the environment (Cetin and Ecevit 2017; Yasmeen et al. 2018; Hafeez et al. 2019a), while a bidirectional causal link among CO2 emissions and energy consumption is found in Asian and ASEAN countries (Jamel and Derbali, 2016; Lean and Smyth 2010). Iwata et al. (2012) suggested a positive linkage among environmental degradation, energy usage, capital stock, and urbanization respectively.

In contrast, nuclear energy consumption had a negative impact on CO2 emissions in China, Finland, Japan, Korea, and Spain respectively (Zhang and Lin 2012; Alam 2013; Jamel and Maktouf, 2017). As there is a trade-off between economic development and income inequality reduction (Iqbal et al. 2019), it also explored that income inequality and per capita GDP are enhancing the environmental degradation (Alam 2013; Abdouli, Kamoun and Hamdi 2018). In developed countries, due to income equality, there is a greater demand for environmental quality which can be considered a luxury public good (Sekrafi and Sghaier 2018). Zhao et al. (2018) argued that CO2 emission can be mitigated by shifting final energy consumption to electricity for Chinese economy. Moreover, results also revealed that, in current and long-term periods, CO2 reductions can be achieved with increased GDP and decreased carbon intensity which is similar to results of Aung et al. (2017) for Myanmar.

For Brazilian economy, Zambrano‐Monserrate and Fernandez (2017) argued the existence of EKC and long-run relationship between economic growth and environmental degradation. On the other hand, Liu Y et al. (2018, studied the effects of three types of environmental regulation on energy consumption for Chinese economy. They found a significant relationship between cost and economical environmental regulation, whereas the concept of green paradox exists in other two regulations, i.e., legal and supervised. The rebound effect of energy is higher than the usage of energy which is made possible through technological innovation in indirect path. The environmental performance links positively with sociopolitical and economic factors such as international trade (das Neves Almeida and García-Sánchez 2017). In import-export-oriented countries, an increase in production has negative effect on environmental performance (das Neves Almeida and García-Sánchez 2017; Goulder 2013).

China adopts a proactive fiscal policy, which will get under consideration of four sectors, lowering the taxes and fees, to improve weak links, and trying to boost up the consumption level for the sake of enhancement in the livelihood. China is also announcing and focusing on policies to improve the real economy and technology. China’s fiscal revenues rose up to 4% (1.11 trillion RMB) yearly in August 2018 and lowered its fiscal deficit target: 2.6% of GDP for 2018 which is 0.4% less than 2017. To overcome the pollution problem, Chinese government along with academics is trying to reduce CO2 emission and increase productivity. In USA, the government spending has an adverse effect on the environment (Halkos and Paizanos 2016). The temporal trend in carbon dioxide emission, government revenue, and government expenditures is shown in Figs. 1 and 2. According to the National Energy Administration, China’s total energy consumption has been raised by 3.3% year on year in 2018. Electricity usage has been raised by 8.5% last year (World Bank 2017). A hasty rise in energy consumption, containing increased residential electricity usage, resulted as the biggest contributor in CO2 emissions. China’s current gross domestic product is 12.238 trillion USD (World Bank 2017).

The research related to financial development EKC reveals that the monetary policy may not only affect GDP growth but also indirectly figures out the money supply, and effects of environment degradation through energy consumption policies (Kaushal and Pathak 2015; Jalil and Feridun 2011). Fiscal policy is also a significant policy instrument like the monetary policy to manage the demand side of economy through government spending and taxation because the government spent a larger portion of GDP in most countries worldwide through fiscal policy (Halkos and Paizanos 2013). On the other hand, fiscal policy instruments, taxes and government expenditures, are directly linked with GDP growth, production level, energy usage, and environmental quality respectively. Thus, it also is an interesting dimension to research the nexus of environmental degradation and fiscal policy instruments. The improvements in fiscal deficit enhance the capital accumulation level, economic activities, and energy demand within economy (Balcilar et al. 2016; Dongyan 2009). Therefore, the tax policies can improve energy efficiency and tax incentives have a positive effect on environmental quality (Liu et al. 2017; Balcilar et al. 2016; Dongyan 2009). Fiscal policy can increase the revenues by imposing environmental taxes, and also affects the environment and energy sector due to inelastic nature of energy products (Rausch 2013).

It is noteworthy to mention the mechanisms through which fiscal spending affects the environmental pollution. The impact of fiscal spending on environmental pollution may differ according to the source of pollution, i.e., whether pollution is production or consumption generated (McAusland 2008). For production-generated pollution, Lopez et al. (2011) recognize the different mechanisms through which the level of government expenditure may affect environmental quality. Considering consumption-generated pollution, fiscal spending on sectors like health and education increases consumers’ current and future income and may in turn lead to deterioration of environmental quality, constituting the income channel. On the other hand, higher levels of government expenditure aid the establishment, enforcement, and efficiency of environmental regulations which in turn may lead to the development of institutions that enhance environmental quality. As a consequence, the total effect on consumption pollution depends on the relative magnitude of the income and environmental regulation effects.

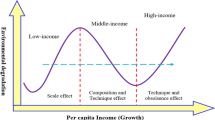

The mechanisms of fiscal policy instruments are stated as income effect, composition effect, and technique effect respectively: (i) income effect: higher income levels, which are usually associated with increased government expenditure, enhance the demand for improved environmental quality; (ii) composition effect: increased fiscal spending fosters human capital intensive activities which are less detrimental to the environment compared with activities that are physical capital intensive. Furthermore, Ahmed et al. (2019a, b) also argued that economic development and energy consumption do not mitigate the ecological footprints in case study of Malaysian economy; (iii) technique effect: this channel also tends to reduce environmental pollution which improved labor efficiency associated with higher levels of government spending on the health and education sectors.

Many researchers investigated the relationship of environmental degradation with financial indicators, but incorporation of fiscal variables is still missing for China in the exiting literature. About 1/5 of urban Chinese breathe in heavily polluted air, and 1/3 of total cities in China meet China’s own pollution standards (World Bank 2017). Therefore, this study incorporates and unfolds the impact of fiscal policy instruments, taxes and government expenditures, on environmental degradation for Chinese economy, while Halkos and Paizanos (2016) found that fiscal aggregates have significant effect on CO2 emission in USA.

Model specification and data

The aspiration of study is to incorporate and investigate the impact of fiscal policy instruments on environmental degradation for Chinese economy. The treatment of the fiscal policy is to make the macroeconomic variables stable in different phases of business cycle. To sustain the environmental degradation, the government spending is a noteworthy factor of environmental degradation (Islam and Lopez 2015; Galinato and Islam, 2014; Lopez and Palacios, 2014; Lopez et al. 2011). Liu et al. (2017) studied Chinese transportation sector and unfold that government can improve environmental quality by giving tax incentives and energy efficiency. Energy consumption is a primal feature to enhance the environmental degradation (Halkos and Paizanos 2016; Hafeez et al. 2019a; Jamel and Maktouf 2017; Al-Mulali et al. 2015). As Hafeez et al. (2019c) suggested that GDP has indirect relationship with environmental quality by energy consumption channels, fiscal policy tools, taxes and revenue, have a direct effect on environmental quality via real income and energy consumption channels (Halkos and Paizanos 2016; Jamel and Maktouf 2017; Katircioglu and Katircioglu 2018). The economy size is measured through GDP (Yao et al. 2019; Yasmeen et al. 2019).

According to the US Environmental Protection Agency, carbon emissions, in the form of CO2, make up more than 80% of the greenhouse gases emitted in the USA. The CO2 emissions raise global temperatures by trapping solar energy in the atmosphere. Hafeez et al. (2018) figured out that CO2 emission has higher ambient half-life as compared with other air pollutants. According to United Nations Framework Convention on Climate Change (UNFCC), CO2 emission is creating problems on global scale. Under the light of aforementioned arguments and by following the recent literature, the environmental degradation is measured through per capita CO2 emission (Hafeez et al. 2019a, b, c; Liu J et al. 2018; Hafeez et al. 2018; Jamel & Maktouf 2018; Al-Mulali et al. 2015).

Thus, to examine the effects of fiscal policy instruments on environmental degradation, this study considers the following proposed two econometric models:

In Eqs. 1 and 2, “t”, Log, CO2, EC, and GDP are time span (1980–2018), natural log, carbon dioxide emissions, energy consumption, and gross domestic product respectively, whereas FP1, and FP2 are the fiscal policy instruments, government expenditures and total revenue, respectively. The parameters from β2to β4 in Eq. 1 and β5to β7 in Eq. 2 are the long-run estimates of energy consumption, government expenditures, gross domestic product, and energy consumption, total revenue, and gross domestic product respectively. While, ɛ1t, and ɛ2t represent the error term in Eq. 1 and 2 respectively. The detail of under-considered variables is presented in Table 1. The dataset on CO2 emission and energy use is extracted from World Development Indicator (WDI), while the dataset on GDP, government revenues and expenditure, is retrieved from the National Bureau of Statistics of China (NBSC).

WDI World Development Indicator, NBSC National Bureau of Statistics of China

Econometric strategy

Autoregressive distributive lag model (ARDL) bounding testing approach proposed by Pesaran et al. (2001) is a study used to compute the long-run and short-run dynamics. It has some authentic features as compared with Engle and Granger (1987), and Johansen (1988) co-integration tests respectively. Firstly, ARDL is more appropriate to indorse co-integration between the variables for small data set (Ahmed et al. 2019a, b). Secondly, it is equally useful to estimate the parameters whether the regressors are integrated at level or at first difference (Charfeddine et al. 2018). It also utilizes the simple linear transformation to compute short- and long-run dynamics along suitable lag length and free from autocorrelation and endogeneity issues (Ahmed et al. 2019a, b; Charfeddine et al. 2018). The unrestricted models are given as follow:

ARDL equation for governmental expenditure model

where Δ indicates the difference operator and Ƥ is the lag length whereas t is the number of years. From coefficient λ1 to λ4 are error correction dynamics and from α0 to α3 are the coefficient which shows the long-run relation between the series. Null hypothesis suggests that there is no co-integration between variable which is (H0:λ1 ≠ λ2 ≠ λ3 ≠ λ4 = 0). For this purpose, we use F-statistics, irrespective of what the series is integrated of I(0) or I(1).

ARDL Equation for governmental revenue model

If the value of F-statistic is greater than the upper bound value, then it is evident that there is a co-integration among variables. In this case, the F-statistic lies below the lower bound value; therefore, we fail to reject the null hypothesis. If the value of F-statistic lies in between the upper and lower bound, we cannot decide whether their co-integration exists or not; these critical values are selected for the study proposed by (Pesaran et al., 2001).

An error correction model (ECM) has been specified below for both the models:

Empirical analysis and results

The aspiration of study is to examine the linkage of fiscal policy instruments on the environmental degradation in the case of China. The estimated outcomes are presented into government expenditures and total revenue models respectively. Table 2 represents the results of unit root tests, Phillips-Perron (PP) and augmented Dicky-Fuller (ADF); it concluded that all under-considered variables are stationarity at 1st difference. None of under-considered variables is stationarity at 2nd difference. Thus, the is no problem to proceed the application of ARDL to estimate short- and long-run estimates. Before the estimation of short- and long-run estimates, there is need to check the existence of co-integration between the variables. Thus, the bound testing approach is adopted based on Wald test to compute F-statistics value to test the co-integration null hypothesis; there is no co-integration between the variables. The bound testing results are represented in Table 3.

The results from bound testing reject the co-integration null hypothesis for all estimated fiscal policy instruments models, government expenditures (LCO2/[LEC,LE,LGDP], LEC/[LCO2,LE,LGDP], LE/[LEC,LCO2,LGDP], LGDP/[LEC,LE,LCO2]) and total revenue (LCO2/[LEC,LR,LGDP],LEC/[LCO2,LR,LGDP],LR/[LEC,LCO2,LGDP],LGDP/[LEC,LR,LCO2]).

Asterisk and double asterisks are indications of rejection of null hypothesis at least at 5% and 10% level of significance

Optimal lag length is determined by AIC. For critical values, see (Narayan, 2005).

Triple, double, and single asterisks indicated level of rejection at 1%, 5%, and 10% respectively

After the confirmation of co-integration, the next step is to compute the estimates of long and short through ARDL. The results from ADRL for fiscal policy instruments models are reported in Table 4. All the coefficients have a significant and have expected effect on the CO2 emission at 0.05% significance level. In both fiscal policy instruments models, the positive sign of the GDP’s coefficient in both short- and long-run indicates the increment in environmental degradation with increase in economy volume, as the economic growth triggers the carbon footprints to upsurge for Malaysian economy (Ahmed et al. 2019a, b). China is still in work very keenly to improve its environment as it is achieving the environmental objective without bargaining its growth objectives. As China is in its evolving stage, so the interpretation drawn advises that government should focus to lift up the economy and GDP which will help to increase the environmental quality. Rauf et al. (2018) also suggested that economic expansion of One Belt and Road Initiative (BRI) region proposed by China will create energy demand and, hence, environmental degradation.

Asterisk and double asterisks indicated level of rejection at 1% and 5% level of significance respectively

The coefficient of energy consumption has significantly positive impact on environmental degradation in the long run, as the results show that 1% increment in energy use will lead to 0.68% increase in environmental degradation. China, second largest economy of world, has higher rate of energy consumption in household and industries. China is trying to use hybrid and electric high-speed trains, vehicles, and motorbikes. Thus, increase in energy demand for electricity is also very high for transportation and production of energy in China mainly depends upon conventional methods like fossil fuels (Bento and Moutinho 2016). Due to this, energy is one of vital drivers of environmental degradation along with more elastic energy consumption with respect to CO2 emission. Hafeez et al. (2019a) suggested that energy demand is direct cause to increase the environmental problems as well as environmental degradation though CO2 emission. Yasmeen et al. (2019) also argue that energy consumption is increasing eight air pollution indicators.

For fiscal policy instruments, the coefficient of log government expenditure is also statistically positive and significant in the long run which tells us that, as the government increases its expenditures, it will lead to environmental degradation. The value of the coefficient is 0.21 in the long run, which shows that, if 1% of government expenditure changes, it will be the reason for a 0.21% increase in environmental degradation but, in the short run, the results are different as the value of the coefficient in the short run is − 0.2 which shows that, if the government increases its expenditure by 1%, it will lead to a fall in the environmental degradation by 0.2%. These results show that government expenditure affects environmental quality quickly. However, long-term policies are required according to government expenditures.

While the coefficient of log government revenue shows that the collection of revenue has a negative effect on environmental degradation in the short run, in the long run, it will have a positive effect on environmental degradation. The coefficient value of energy consumption from government revenue is also significant and has positive impact on environmental degradation. It states that an increase in energy consumption by 1% will lead to destroying the environmental quality by 0.52%.

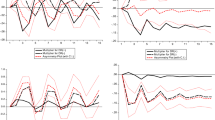

The ECM (error correction model) shows that Chinese economy is converging towards long-run equilibrium from short run in case of any shock occurred in economy with 51% and 69.76% of speed of convergence in government expenditure and revenue models respectively. We also performed some diagnostic test as shown in Table 3. The probability values of diagnostic tests show that there is no problem of serial correlation, multicollinearity in the model as the probability value of LM test is greater than 0.05 which means there is no serial correlation and the estimated models are stable and reliable. To check the structural invariance, endogeneity, and estimates’ stability in both short and long run, the tests of cumulative sum of squares of recursive residuals (CUSUMSQ) and cumulative sum of recursive residuals (CUSUM) also have been applied for both the estimated models. The red lines in Figs. 3, 4, 5, and 6 show the 5% level of significance.

Innovative accounting approach

To check the estimates’ reliability, variance decomposition analysis has been conducted through innovative accounting approach for both fiscal policy instruments model. The results from innovative accounting approach are stated in in Tables 5 and 6 respectively. In government expenditure model, the energy consumption described a small amount of the difference of carbon emissions 1.5% in the short term say in 3 years, and in time of 5 years, energy consumption explained 1.7% variance and in 10 years 41% of the variance of CO2 emission. Similarly, the gross domestic product contributes about 8.09% in 3-year horizon, in 5 years 23% share in the carbon emission, and 19.3% share in 10 years because of shocks on economic growth.

Similarly, the share of government expenditure in the variance of carbon emission is 1.5% in the 3-year horizon, 6.4% in 5 years, and 17.2% in 10 years respectively. About 25% of variance in public expenditures is due to the shock in CO2 emission in the 3-year horizon, while in 5-year horizon CO2 emission explains 19.6% of the disparity in government expenditures and, in year 10, 10% variation is due to carbon emissions. Energy consumption’s share is 44% in the 3rd year horizon, while in the 10-year horizon the contribution is 60%. Variation due to economic growth in government expenditure is 0.66% in 5th year; 0.73% is in 10th-year horizon.

Now move on to explain the discrepancy of energy consumption due to other considered variables of the study. CO2 emissions explained the variation of 36 and 13% in GDP growth in year 5 and year 10, respectively. The contribution of government expenditure in the variation of energy consumption is 10% in the 5th year and 17.6% in year 10. GDP also plays its role in the variation of energy consumption as 15.4% and 15% in year 5 and 10 respectively. The estimates ensured the trustworthiness of the connecting link among GDP growth and the other under-considered variables of the study. The contribution of carbon emissions in economic growth is 36.5% in year 5, and 29.7% in year 10. Ten percent variations in year 5 are due to government expenditures, and 6.1% in year 10 and 0.9% in year 5 are due to energy consumption, and 1.4% in year 10 is 1.4%. The result of innovation accounting approach supports the reliability of the findings of the study.

In government revenue model, the energy consumption explained the difference of CO2 emission in 1.3% in 5 years, and energy consumption explained 5% variance in 10 years. Similarly, the gross domestic product adds about 5.2% in 3-year horizon, in 5 years and 10.3% variations in CO2 emissions in 10 years is because of shocks on economic growth. In the same way, the share of government revenue in the variance of carbon emission is 8% in the 3-year horizon and 48% in 10 years. Now describe the variance of energy use due to other regressors of the model 2. The contribution of government revenue in the variation of energy consumption is 11.7% in 5th year and 38.9% in year 10. Gross domestic product also plays its role in the variation of energy consumption as 2.4% and 6.5% in the years 5 and 10 respectively.

The outcomes ensured the trustworthiness of the pivotal relationship between GDP growth and the variables used in the study. 1.5% variations in year 5 and 4.3% in year 10 are due to government revenue. The variation due to energy consumption in GDP is 3.6% in year 5 and 5% in year 10. The relation between the government revenues and other regressors of the model 2. About 16.7% variance in government revenues is due to the shudder in carbon emission in the 5-year horizon, while in 10-year horizon carbon emission explains 16.3%. Energy consumption’s share is 16.8% in the 5-year horizon, while in the 10-year horizon the contribution is 17.9%. Variation due to economic growth in government revenues is 24.1% in 5th year and 20.9% in the 10th-year horizon.

To check the robustness of the study, the impulse response functions are also computed to check how the dependent variable CO2 react to one standard deviation shock given to the independent variables, GDP, energy consumption, government expenditures, and government revenues respectively (Fig. 7). The impulse response of one standard deviation shock to energy consumption will lead CO2 emissions upwards; then, it will bring it down for a short period and then after 5 years, it will again lead it to a higher level very quickly. In the response to one standard deviation shock to GDP, CO2 will go up, but after reaching a threshold level in the future, it will come down which is a sign of EKC that, as GDP increases, CO2 will increase but after a certain level, the environmental quality will improve. To check how much CO2 respond to government expenditures, we make a graph for impulse response to government expenditures; as we can see, one standard deviation shock to LE initially does not affect CO2 but later on it will push upwards which is a sign that government should think about its spending very carefully because with the same pattern going on government expenditure will lead to environmental degradation. Government revenues initially decrease the environmental degradation; later on, government revenue will push CO2 upwards; it means the government can control environmental quality by the strict fiscal policy if they make an affecting fiscal policy after thinking environmental protection.

Conclusion and policy recommendations

China is moving towards economic development and has become the second largest economy of world. Therefore, the Chinese government is taking steps to ensure the coherence and trying to maintain the balance concerning environment and economic development; to do so, it is really a matter of thinking and a matter to identify the relation of economic growth and environmental conditions in the case of China. The study results are of great interest for both scholars and policy-makers because this study is adding a contribution to the related to fiscal policy instruments which are directly effecting the environmental degradation. The level of CO2 emissions in China expressively converges as contributed by fiscal policy indicators to long-term equilibrium paths. The long-term effects of fiscal policy tools on environment in China are unfortunately positive. It reflects that China fiscal policy is not successfully embraced in dropping pollution levels up till now. The results of the study reasonably disclose that environmental protection policies need to be balanced with fiscal policies in China, though it is investigated that fiscal policy does not have a strong effect on environmental quality.

The main motive of the fiscal policy instruments is to promote real economy rather than environmental quality. The computed results reveal that the fiscal policy instruments, government expenditure and revenue, are statistically increasing the Chinese environmental degradation in the long run. It also indicates that sustainable environment quality can be achieved through consistent fiscal policy.

In both estimated models, the energy consumption is increasing the CO2 emission in Chinese economy. As the increasing demand of energy for consumption causes an increase in demand for energy production. China is rich in renewable energy resources, e.g., the solar, biodiesel, wind, geothermal, biomass waste for the production of energy still to fulfill the demand for energy consumption government rely on fossil fuels, and burning fossil fuels cause environmental degradation. Consequently, the findings of present recommend that fiscal policy may devise to have a continued and eco-friendly policies to improve air quality. Chinese authorities are extensively adapting fiscal policies to manage economic growth; such policies are required in energy sector that can improve the environmental quality such as regulations for energy production sector, industrial sector, and agriculture sector, and moreover government investment and encouragement of private sector for participation in renewable energy system through tax and subsidy programs. Such improvements in fiscal policies will lead to better effect on environmental quality.

Government needs to pay attention to the awareness programs as most of the people do not know the devastating impact of different things which leads to environmental degradation, and citizen’s understanding about the serious problem like environmental degradation can play a pivotal role in cultivating the environmental quality. By awareness, one can motivate people to use those methods and tools which are environmental friendly in transportations, production methods, household electricity consumption, and energy efficiency. The Chinese government should focus on green energy use in transportation like advanced euro technology which is completely environment-friendly.

References

Abdouli M, Hammami S (2017) Investigating the causality links between environmental quality, foreign direct investment and economic growth in MENA countries. Int Bus Rev 26:264–278

Abdouli M, Kamoun O, Hamdi B (2018) The impact of economic growth, population density, and FDI inflows on CO 2 emissions in BRICTS countries: Does the Kuznets curve exist? Empir Econ 54(4):1717–1742

Ahmed Z, Wang Z, Mahmood F et al (2019a) Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05224-9

Ahmed Z, Wang Z, Mahmood F, Hafeez M, Ali N (2019b) Does globalization increase the ecological footprint? Empirical evidence from Malaysia. Environ Sci Pollut Res:1–18

Alam A (2013) Nuclear energy, CO2 emissions and economic growth the case of developing and developed countries. J Econ Stud 40(6):822–834

Alam A, Azam M, Bin Abdullah A, Malik IA, Khan A, Hamzah TAAT et al (2014) Environmental quality indicators and financial development in Malaysia: unity in diversity. Environ Sci Pollut Res 22:8392–8404

Al-Mulali U, Saboori B, Ozturk I (2015) Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy 76:123–131. https://doi.org/10.1016/j.enpol.2014.11.019

Aung TS, Saboori B, Rasoulinezhad E (2017) Economic growth and environmental pollution in Myanmar: an analysis of environmental Kuznets curve. Environ Sci Pollut Res 24(25):20487–20501

Balcilar M, Ciftcioglu S, Gungor H (2016) The effects of financial development on Investment in Turkey. Singap Econ Rev 61(4):1650002. https://doi.org/10.1142/S0217590816500028

Bento JPC, Moutinho V (2016) CO2 emissions, non-renewable and renewable electricity production, economic growth, and international trade in Italy. Renew Sust Energ Rev 55:142–155

Cetin M, Ecevit E (2017) The impact of financial development on carbon emissions under the structural breaks: empirical evidence from Turkish economy. Int J Econ Perspect 11(1):64–78

Charfeddine L, Al-malk AY, Al K (2018) Is it possible to improve environmental quality without reducing economic growth: evidence from the Qatar economy. Renew Sust Energ Rev 82:25–39. https://doi.org/10.1016/j.rser.2017.09.001

das Neves Almeida TA, García-Sánchez IM (2017) Sociopolitical and economic elements to explain the environmental performance of countries. Environ Sci Pollut Res 24(3):3006–3026

Dongyan L (2009) Fiscal and tax policy support for energy efficiency retrofit for existing residential buildings in China’s northern heating region. Energy Policy 37(6):2113–2118. https://doi.org/10.1016/j.enpol.2008.11.036

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 251–276

Galinato GI, Islam F (2014) The challenge of addressing consumption pollutants with fiscal policy Working Paper Series WP. Washington State University

Goulder LH (2013) Climate change policy’s interactions with the tax system. Energy Econ 40:S3–S11

Hafeez M, Chunhui Y, Strohmaier D, Ahmed M, Jie L (2018) Does finance affect environmental degradation: evidence from One Belt and One Road Initiative region? Environ Sci Pollut Res:1–14

Hafeez M, Yuan C, Khelfaoui I, A Sultan Musaad O, Waqas Akbar M, Jie L (2019a) Evaluating the energy consumption inequalities in the One Belt and One Road Region: Implications for the Environment. Energies 12(7):1358

Hafeez M, Yuan C, Shahzad K, Aziz B, Iqbal K, Raza S (2019b) An empirical evaluation of financial development-carbon footprint nexus in One Belt and Road region. Environ Sci Pollut Res:1–11

Hafeez M, Yuan C, Yuan Q, Zhuo Z, Stromaier D (2019c) A global prospective of environmental degradations: economy and finance. Environ Sci Pollut Res:1–18

Halkos GE, Paizanos EΑ (2013) The effect of government expenditure on the environment: An empirical investigation. Ecol Econ 91:48–56

Halkos GE, Paizanos EA (2016) The effects of fiscal policy on CO2 emissions: evidence from the U.S.A. Energy Policy 88:317–328

Iqbal K, Peng H, Hafeez M, Ahmad K, Tang L (2019) Corruption, income inequality and decline in South Asia. Hum Syst Manag 38(3):235–241

Islam F, Lopez R (2015) Government spending and air pollution in the U.S. Int. Rev. Env. Resour. Econ. 8(2):139–189

Istaiteyeh RMS (2016) Causality analysis between electricity consumption and real GDP: evidence from Jordan. Int J Econ Perspect 10(4):526–540

Iwata H, Okada K, Samreth S (2012) Empirical study on the determinants of CO2 emissions: evidence from OECD countries. Appl Econ 44:3513–3519

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291. https://doi.org/10.1016/j.eneco.2010.10.003

Jamel L, Derbali A (2016) Do energy consumption and economic growth lead to environmental degradation? Evidence from Asian economies. Cogent Economics & Finance 4(1):1170653

Jamel L, Maktouf S (2017) The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Economics & Finance 5(1):1341456

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12(2-3):231–254

Kalayci S, Koksal C (2015) The relationship between China’s airway freight in terms of carbon-dioxide emission and export volume. Int J Econ Perspect 9(4):60–68

Kasman A, Duman YS (2015) CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: a panel data analysis. Econ Model 44:97–103

Katircioglu S, Katircioglu S (2018) Testing the role of fiscal policy in the environmental degradation: the case of Turkey. Environ Sci Pollut Res 25(6):5616–5630

Kaushal LA, Pathak N (2015) The causal relationship among economic growth, financial development and trade openess in Indian economy. Int J Econ Perspect 9(2):5–22

Lean HH, Smyth R (2010) CO2 emissions, electricity consumption and output in ASEAN. Appl Energy 87(6):1858–1864

Liu Y, Han L, Yin Z, Luo K (2017) A competitive carbon emissions scheme with hybrid fiscal incentives: the evidence from a taxi industry. Energy Policy 102:414–422. https://doi.org/10.1016/j.enpol.2016.12.038

Liu J, Yuan C, Hafeez M, Yuan Q (2018) The relationship between environment and logistics performance: evidence from Asian countries. J Clean Prod 204:282–291

Liu Y, Li Z, Yin X (2018) The effects of three types of environmental regulation on energy consumption—evidence from China. Environ Sci Pollut Res 25(27):27334–27351

Lopez R, Palacios A (2014) Why has Europe become environmentally cleaner? Decomposing the roles of fiscal, trade and environmental policies. Environ Resour Econ 58(1):91–108

Lopez R, Galinato GI, Islam F (2011) Fiscal spending and the environment: theory and empirics. J Environ Econ Manag 62:180–198

McAusland C (2008) Trade, politics, and the environment: Tailpipe vs. smokestack. J Environ Econ Manag 55(1):52–71

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37(17):1979–1990

Ozcan B, Ari A (2017) Nuclear energy-economic growth nexus in OECD countries: a panel data analysis. Int J Econ Perspect 11(1):138–154

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Rauf A, Liu X, Amin W, Ozturk I, Rehman OU, Hafeez M (2018) Testing EKC hypothesis with energy and sustainable development challenges: a fresh evidence from Belt and Road Initiative economies. Environ Sci Pollut Res 25:1–15

Rausch S (2013) Fiscal consolidation and climate policy: an overlapping generation’s perspective. Energy Econ 40:S134–S148. https://doi.org/10.1016/j.eneco.2013.09.009

Salam S, Hafeez M, Mahmood MT, Akbar K (2019) The dynamic relation between technology adoption, technology innovation, human capital and economy: comparison of lower-middle-income countries. Interdiscip Descr Complex Syst: INDECS 17(1-B):146–161

Sekrafi H, Sghaier A (2018) Examining the relationship between corruption, economic growth, environmental degradation, and energy consumption: a panel analysis in MENA region. J Knowl Econ 9(3):963–979

Uddin GA, Salahuddin M, Alam K, Gow J (2017) Ecological footprint and real income: panel data evidence from the 27 highest emitting countries. Ecol Indic 77:166–175. https://doi.org/10.1016/j.ecolind.2017.01.003

World Bank (2017) World development indicators. Retrieved from: http://www.worldbank.org. Accessed March, 2019

Yan X, Crookes RJ (2010) Energy demand and emissions from road transportation vehicles in China. Prog Energy Combust Sci 36(6):651–676

Yao X, Yasmeen R, Li Y, Hafeez M, Padda IUH (2019) Free trade agreements and environment for sustainable development: a gravity model analysis. Sustainability 11(3):597. https://doi.org/10.3390/su11030597

Yasmeen R, Li Y, Hafeez M, Ahmad H (2018) The trade-environment nexus in light of governance: a global potential. Environ Sci Pollut Res 25:34360–34379

Yasmeen R, Li Y, Hafeez M (2019) Tracing the trade–pollution nexus in global value chains: evidence from air pollution indicators. Environ Sci Pollut Res 26:5221–5233

Zambrano‐Monserrate MA, Fernandez MA (2017) An environmental Kuznets curve for N2O emissions in Germany: an ARDL approach. In: Natural Resources Forum, vol 41, No. 2 Blackwell Publishing Ltd, Oxford, pp 119–127

Zhang C, Lin Y (2012) Panel estimation for urbanization, energy consumption and CO2 emissions: a regional analysis in China. Energy Policy 49:488–498. https://doi.org/10.1016/j.enpol.2012.06.048

Zhang M, Mu H, Ning Y, Song Y (2009) Decomposition of energy-related CO2 emission over 1991–2006 in China. Ecol Econ 68(7):2122–2128

Zhao W, Cao Y, Miao B, Wang K, Wei YM (2018) Impacts of shifting China’s final energy consumption to electricity on CO2 emission reduction. Energy Econ 71:359–369

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yuelan, P., Akbar, M.W., Hafeez, M. et al. The nexus of fiscal policy instruments and environmental degradation in China. Environ Sci Pollut Res 26, 28919–28932 (2019). https://doi.org/10.1007/s11356-019-06071-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-06071-4