Abstract

This study examined the savings aspect of wealth accumulation by estimating differences in financial risk tolerance and equity ownership among individual investors. Data were obtained from a proprietary dataset that collected over 15,000 risk-tolerance attitude responses between late 2007 and early 2013. Two research methodologies were utilized: cluster analysis and ANCOVA. The cluster analysis identified four investor profiles: (a) young lower-income women, (b) young unmarried men, (c) young college-educated men, and (d) older men with high income and education. Results from the ANCOVA test indicated that each cluster had significantly different levels of equity ownership, controlling for financial risk tolerance. Results provide a framework and methodology for future research on issues related to wealth inequality, investment behavior, and risk attitudes. The ability to group individuals similarly can be an important tool for researchers, policy makers, social activists, financial advisers, financial counselors, and educators when analyzing the household and macroeconomic wealth profile of United States residents.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The issue of wealth inequality continues to be a topic of interest among researchers, policy makers, activists, and those in the print and electronic media. The topic of wealth inequality is one that has global implications (Chang 2014; Schyns 2002). Some have argued that disparities in wealth are a key factor driving ongoing debates about the role of governments and businesses in shaping household level well-being. For example, wealth inequality has been linked with quality of life outcomes (Diener and Diener 1995; Gandelman and Porzecanski 2013; Huang et al. 2016; Ma and Zhang 2014). Chang explained that, as financial institutions have sought to gain more control over local, regional, and global monetary and financial systems, the level of sophistication needed to navigate the financial marketplace has increased. With the development and distribution of more complicated financial products (e.g., securitized debt products and derivatives), and the inherent systemic complexities embedded in the financial system, it has become more difficult for individuals to maintain a consistent level of equality in the marketplace. Furthermore, the development of market and industrial economics has influenced wealth inequality among individuals and within communities (Smith 1991). Consider Stiglitz’s (2012) criticism of the disparity of wealth in the United States. Stiglitz noted that recent wealth inequality has largely been triggered by a wealth friendly financial system that is supported by legislation and international agreements. Specifically, Stiglitz argued that inequality of financial information (i.e., asymmetries of information in the stock market) has led to wealth inequality. It does appear that average consumers are constrained in their ability to obtain and/or process appropriate information about investment risks and returns (FINRA 2016). At the same time, wealthy households—those holding the top 0.1 % of wealth—and financial firms have gained a disproportionate information advantage in obtaining more accurate and diverse data that appear to lead to more financial success (Stiglitz).

According to Saez and Zucman (2014), inequalities in wealth distribution at the household level can be attributed to the top 0.1 % of wealth holders controlling more investment assets. For example, the top 0.1 % of wealth holders living in the United States increased their wealth share from a nominal low of 7 % of U.S. households’ wealth in 1979 to a recent high of 22 %. In terms of income share, before the early millennium global economic recession (i.e., the period between 2000 and 2002), the top 0.1 % income share, excluding capital gains, was between 5.40 % in 1990 and 7.58 % in 1998 (Piketty and Saez 2003, 2014). However, after the series of economic recessions in the early and late 2000s, the income share of the top 0.1 % increased to nearly 11.00 % in 2012. The income share ratio between the top 0.1 % and the bottom 10 % was 50:1 in 1979. The ratio is now closer to 164:1 (Mishel and Bivens 2011). These data suggest that the wealthiest households have gained more opportunities to increase wealth compared to lower wealth holding households. Stiglitz (2012) explained that there is, in effect, a disparity game within the financial system that is caused by inequality of access to the quantity, quality, and timeliness of financial information.

While there are a number of causal factors that help explain the surge in affluence by those on the upper end of the wealth spectrum, two insights are of particular importance when viewed from a personal and household finance perspective. First, income among the top wealth holders has increased much more quickly than it has for others. Second, greater incomes have led to an increasing dispersion in savings rates, with the top wealth holders earning more and saving more. These two factors operate similarly to a feedback circuit. Stiglitz (2012) argued that the current system is closely aligned with the zero-sum gain hypothesis. He noted that the financial markets more closely resemble a negative-sum situation for most consumers. Without sufficient wealth, consumers are locked out of better and faster transmission of information. This, in turn, leads to sub-optimal financial decision making that further suppresses wealth.

It is not surprising, then, that nearly all investment market participants worry about their ability to save and invest appropriately (Ellis 1995). Implicit within this concern is the notion that households are cautious in the domain of financial decisions. However, keeping one’s wealth in an asset with a low rate of return (i.e., savings account) can be problematic if the goal is to accumulate wealth over a long period of time. Goldsmith (2009) explained the importance of investing from two perspectives. The first is the need to keep pace with inflation. The second is to reduce longevity risk. In other words, personal investments are necessary as a precaution for future financial needs. This implies that most U.S. households should be participating in the investment markets. This is generally true globally as well.

In order to effectively manage the financial well-being of a household, it is important to utilize investment products, tools, and techniques in order to gain financial stability. Financial market participation is a key family resource management strategy. From a personal and household finance perspective, investing is an essential element of any financial plan (Grable et al. 2013). This is where Stiglitz’s (2012) paradox comes into play. On the one hand, households are generally reluctant to take risks in the financial markets. Households may, in fact, be constrained in their ability to participate. On the other hand, it is essential for these households to take financial risk, even in the face of information asymmetry, in order to accumulate wealth over the lifespan.

This paper adds to the wealth inequality discussion by examining one aspect of this paradox. This study examines the savings aspect of wealth accumulation by estimating differences in financial risk tolerance and equity ownership among individual investors. This was accomplished by first clustering individuals into demographic groups and then comparing these groups with respect to risk-tolerance scores and equity ownership patterns. As will be discussed later in the paper, the choice of demographic clusters was driven primarily by literature that indicates distinct saving and investing tendencies based on demographic characteristics. The remainder of this paper is structured to provide (a) a brief review of equity holding patterns in the United States and the theoretical association between financial risk tolerance and equity ownership, (b) a methodological summary, (c) presentation of results, and (d) a discussion of results.

2 Background Review

2.1 Demographics and Equity Ownership

Even though household stock ownership in the United States decreased slightly from 53.2 to 48.8 % between 2007 and 2013 (Egan 2014), a large portion of American households continue to own non-real estate equities (U.S. Census Bureau 2012b). It is important to temper this insight with two caveats. First, equity ownership comes from both direct ownership and holdings of mutual funds, exchange traded funds, and other positions in retirement plans. That is, to some extent, equity ownership may be less of an allocation intention than a byproduct of retirement planning needs. Second, the distribution of equity ownership tends to be skewed quite heavily by age.

Data from the Investment Company Institute (2005, 2008) provide insight into demographic characteristics of equity owners. The median age of those who directly own equities is 53 years. Similarly, the median age of those who own equities in retirement plans is 50 years. Figure 1 illustrates the shift in total equity ownership based on age from 1999 to 2008. As shown, younger individuals in 2008 were less likely to own equities than they were in 1999. It is often assumed that stock losses experienced during the Great Recession influenced young people in a negative way. Additionally, the ownership curve has shifted to the right, indicating that older individuals are now more likely to hold more wealth in equities for a longer period of time.

Source: Investment Company Institute (2008)

Percentage of equity ownership by age over two periods.

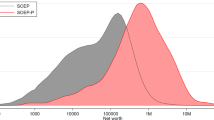

Similar patterns of equity ownership are known to be associated with other demographic factors. For example, men are more likely to report holding equities than women. This seems to be caused by the fact that money behaviors between males and females are different (Furnham et al. 2015). Income is also a strong predictor of equity ownership (U.S. Census Bureau 2012a; Jones 2015). Figure 2 illustrates the association between equity ownership and income. As illustrated, equity ownership is highest among those with incomes ranging from $50,000 to $74,999 and from $75,000 to $99,999. Generally, income level is associated with life cycle transitions. Wealth held in investment assets tends to increase as income grows (Hanna et al. 1995). There is nearly a parallel association between income and likelihood of equity ownership over time. When equity ownership is assessed as a percent of income, the data become even more telling. Whereas only 11.4 % of households in the lowest 20th percentile of income own stocks, 93 % of those in the 90th percentile of income own stocks. There is an almost linear association between income and likelihood of equity ownership (Zumbrun 2014a).

Source: Investment Company Institute (2008)

Percentage of equity ownership by household income (2008).

The association between marital status and education is similar. Over 70 % of those who are married or living with a partner report holding some equities. This figure drops to 10, 6, and 13 % for those who are divorced or separated, widowed, or single, respectively (Investment Company Institute 2008). Similar to the relationship between income and equity ownership, those with higher levels of attained education report holding more equities compared to others.

These data support the working assumption of many financial experts; namely, equity ownership can be attributed to, in large part, demographic factors. For example, among financial service professionals, it is often assumed that households headed by older males will be more likely to hold a higher proportion of financial assets in equities. Similarly, younger female headed households are thought to hold more conservative investment assets, such as cash equivalent products and bonds. While it is true that these, and other similar assumptions, are a part of the common lexicon of the financial advice business, it is also important to note that the data behind these assumptions may also provide insight into the wealth inequality paradox.

2.2 Risk Tolerance and Equity Ownership

Financial risk tolerance, which is defined as a person’s willingness to engage in a financial behavior in which the outcomes are both unknown and potentially negative, plays a key role in shaping asset allocation decisions. Theoretically, the relationship between financial risk tolerance and equity ownership is causally positive. In other words, it is reasonable to hypothesize that a person’s willingness to engage in a risky investing behavior precedes an actual asset allocation decision. Because individuals tend to be relatively risk averse, on average, only those who exhibit some degree of tolerance for financial ambiguity and volatility should be investing in equities, or at a minimum, a greater proportion of their portfolio in equities (Corter and Chen 2006).

Numerous studies have been conducted over the past two decades designed to evaluate the association between financial risk attitudes and demographic factors. Similar to the demography of equity ownership, distinct patterns of risk tolerance consistently appear in the literature. For example, men tend to exhibit a greater willingness to take financial risk (Gilliam et al. 2010). Further, education and income are known to be positively associated with risk tolerance (Hallahan et al. 2004). It is not surprising, then, that these same variables tend to be related with equity ownership decisions and the accumulation of wealth. Age and marital status are among the two most commonly used demographic factors used to describe financial risk tolerance.

Interestingly, the literature regarding the robustness of these factors in describing risk tolerance has been inconsistent. Some, for example, have noted that age is negatively related with risk attitudes (e.g., Deakin et al. 2004; Finke and Huston 2003; Rolison et al. 2014), whereas others have reported a positive association between these two variables (e.g., Sulaiman 2012). In terms of marital status, there are some reports that singles are more risk tolerant because they have less to lose by accepting volatility in their portfolio (e.g., Hallahan et al. 2004; Yao and Hanna 2004). There is, however, other documentation suggesting that married persons are more risk tolerant because of their ability to diversify risk across more than one person in a household (e.g., Watson and McNaughton 2007).

2.3 The Association between Risk Tolerance and Equity Ownership

The demography of equity ownership and financial risk tolerance intersect at the point of wealth creation. Conceptually, the profile of those who hold equities in their portfolio, as a means of generating excess risk-adjusted returns, should exhibit risk-tolerance characteristics that are different from those who either do not hold equity positions or have low equity exposure. This may help explain, to some extent, the apparent gap in wealth in the United States. Zumbrun (2014a) reported data from the Survey of Consumer Finances that showed direct and indirect holdings of equities are positively and linearly associated with income. Interestingly, a similar pattern of association is often observed with risk-tolerance attitudes and income. The same holds true for relationships between and among other personal characteristics (e.g., gender, age, education, and marital status) and equity ownership and financial risk tolerance.

Zumbrun (2014b) noted a disturbing, but not surprising, fact; namely, over 5 million households sold their equity holdings between 2010 and 2013, even in the midst of the market rebound. The resulting sales led to a nearly 4.5 % decline in equity holdings among American households. This decline in stock ownership was seen across the demographic spectrum, with one major exception: households in the top 10 % of wealth increased their equity exposure at this time. Zumbrun went on to report that households with the highest levels of education were among those who purchased more equities over this time period. He concluded that, while factors such as long-term unemployment and declines in real estate values did, and continue to have, undeniable effects on wealth creation and stability, growing wealth inequality can also be explained, in large part, by investing behavior.

It is worth noting that much of the data linking wealth disparity to equity ownership (i.e., certain households’ propensity to accept volatility in return for higher returns to wealth) has failed to account for the role financial risk tolerance plays in shaping behavior. This study is among just a handful of empirical analyses designed to evaluate the savings aspect of wealth accumulation by estimating differences in financial risk tolerance and equity ownership among individual investors using demographic clusters. As will be discussed below, it turns out that the same demographic factors that describe equity ownership also work well in describing the willingness of individual investors to engage in financial risk-taking behavior.

3 Methodology

3.1 Data and Measures

This study employed a two stage analysis: cluster analysis and analysis of covariance (ANCOVA). First, the study divided investors into taxonomies of similarity using a cluster analysis technique. Following the cluster analysis, an ANCOVA procedure was used to describe asset holdings and financial risk tolerance among the clusters. Data for this study were obtained from a proprietary dataset. Data were collected online at Rutgers University (http://njaes.rutgers.edu:8080/money/riskquiz/) from over 15,000 investor respondents over the period 2007 to 2013 using an online investment risk-tolerance survey. The survey was open to anyone with access to the internet and was free to use. Those who answered the questions received a no-cost portfolio allocation recommendation.

Clusters were created using five demographic characteristics and two response pattern variables: (1) age, (2) marital status, (3) education, (4) gender, (5) income, (6) investment decision style, and (7) season (i.e., time of the year) of response. Age was coded using seven categorical variables: 1 = under age 25, 2 = 25 to 34, 3 = 35 to 44, 4 = 45 to 54, 5 = 55 to 64, 6 = 65 to 74, and 7 = over 75. Marital status was coded 1 = never married, 2 = living with a significant other, 3 = married, 4 = separated/divorced, 5 = widowed, and 6 = shared living arrangement. Education was measured using a series of dummy variables: (a) some high school or less (yes = 1), (b) high school (yes = 1), (c) some college (yes = 1), (d) Associate’s degree (yes = 1), (e) Bachelor’s degree (yes = 1), and (f) graduate degree (yes = 1). Gender was coded 1 = female. Similar to education, income was measured using a series of dichotomous variables: 1 = less than $25,000, 2 = $25,000 to $49,999, 3 = $50,000 to $74,999, 4 = $75,000 to $99,999, and 5 = $100,000 or more (Table 1).

Investment decision style was a dichotomously coded variable that asked respondents to indicate if they made their own investment decisions or if they relied on the advice of someone else before making an investment decision. The season of response variable was used as a proxy for the time of year that respondents accessed the survey. The four seasons were divided using traditional meteorologist seasons: (a) spring, including March, April, and May; (b) summer, including June, July, and August; (c) fall, including September, October, and November; and (d) winter, including December, January, and February. It was hypothesized that the seasonality of responses might have corresponded to respondents’ engagement in the investment planning process through learning about or gaining information regarding household financial topics. For example, those who accessed financial information earlier in the year may have done so as a way to preplan for retirement savings or income tax liabilities, whereas those who accessed the same information later may have been engaged in an evaluation of their portfolio holding returns. Descriptive data for each the variables are shown in Table 2.

As part of the survey, respondents were asked to indicate the percent of their current portfolio held in equities (not including their primary residence), cash, and bonds, as well as other investment assets. An equity to fixed-income variable was created by dividing equity holdings by the combination of cash and bonds held by a respondent. This percentage figure was used as the outcome measure in the analyses. The mean and standard deviation for the equity to fixed-income ratio was 1.34 and 5.33, respectively.

Additionally, each respondent’s financial risk tolerance was controlled in the analysis. Risk scores were obtained in the survey by having respondents complete a 13-item risk-tolerance quiz (Grable and Lytton 1999). Scores on the quiz were summed according to standards recommended by Grable and Lytton. The mean risk-tolerance score was 27 (range of 13 to 47) (SD = 5.50). The scale’s Cronbach’s alpha was α = .77. Table 3 provides additional alpha and mean risk-tolerance statistics.

3.2 Statistical Procedures

This study used a hierarchical cluster analysis procedure (i.e., Ward’s linkage method) via Stata 12.0 to estimate groupings. Cluster membership was based on the following criteria: respondent demographic characteristics, investment decision style, and season of response. Once the clusters were established, an ANCOVA analysis procedure was used to determine if cluster status was related to asset holdings and financial risk tolerance. Results from these tests are reported below.

4 Results

Four clusters emerged from the hierarchical cluster model analysis. Table 1 provides a narrative description of each cluster. Each cluster was unique in its respondent membership. It is important to remember that the cluster analysis technique may have excluded some groups. In this study, for example, older women were not grouped together or in a cluster. This type of exclusion can happen when a specific group is spread out among all of the clusters. For the purposes of this study, each cluster can be described as follows:

-

Cluster A represented young, relatively low income females who rely on others for investment advice.

-

Cluster B was representative of relatively young unmarried men who rely on others for investment advice regardless income.

-

Cluster C was structured around younger men with a college education; those in Cluster C were more likely to make their own investment decisions.

-

Cluster D represented what financial advisers might call a typical investor; that is, Cluster D included older men with high incomes and more education; those in Cluster D were also more likely to make their own investment decisions.

Table 2 shows the coding of each variable used in the analysis and the resulting descriptive statistics for each variable. In addition, categorical comparisons of the four clusters are presented. The four clusters were found to be statistically significantly different on the seven clustering variables. Table 3 provides information regarding the mean risk-tolerance scores and alpha estimates for each cluster.

Based on the structural patterns in Table 2, an ANCOVA procedure was used to determine if cluster status was related to asset holdings. The dependent variable in the ANCOVA was the ratio of equity holdings to fixed-income and cash holdings. The ANCOVA function was:

where Y denotes the percent of respondents’ portfolios held in equities; β0 is the mean value of the percent of the portfolio held in equities; α i denotes the different equity ratio holdings among the four clusters; and β1 is the covariate variable coefficient (i.e., risk tolerance (X ij )). Table 4 and Fig. 1 present the ANCOVA results.

As shown in Fig. 3, when controlling for financial risk tolerance, each cluster exhibited a significantly different equity ratio, F (3,14992) = 160.06, p < .001. A slight drop was noted from Cluster A to Cluster B, but as expected, those in Clusters C and D were found to hold a higher proportion of their investment wealth in equities. The covariate, financial risk tolerance, was also found to be positive associated with the equity ratio, F (1,14992) = 164.13, p < .001.

5 Discussion

Results from this study provide some support for the notion that equity ownership can be described, in part, by the demographic profile of investors. Those who held the highest ratio of equities to fixed-income assets (i.e., cash and bonds) in this study shared the following characteristics: (1) older than age 40, (2) married, (3) high educational background, (4) male, (5) high income, (6) personal decision making style, and (7) a propensity to access investment and financial information earlier in the year, a potential indicator of investment pre-planning. Five aspects of these findings are of particular importance.

First, the finding that the proportion of equities held by a respondent was higher among those who made their own investment decisions implies that equity ownership may be linked to investor confidence and experience. Corter and Chen (2006) made a similar conclusion when they noted that experienced investors are more likely to hold risky portfolios. Those in this study who relied on someone else for investment advice held more in cash and bonds than those who managed their own investments. Of course, this result may be an artifact of the sample frame, but it is worth noting that those in Cluster D—the highest equity ratio group—did not exhibit the highest mean risk score. In fact, those in Cluster D shared a risk profile similar to respondents grouped in Cluster B, which was a low equity ratio group (see Table 3). This hints at the importance of an individual’s decision-making preference as a key factor in shaping equity ownership behavior and the dangers that can result from stereotyping investors solely according to their demographic characteristics.

Second, the seasonality results are interesting. The finding that those in Clusters C and D—the high equity ratio groups—accessed the survey more times in the winter months may indicate a pattern of sophistication among equity investors. For example, these investors, who also make their own investment decisions, may be evaluating their financial situation more intently during the winter months in preparation for tax planning, investment tax loss harvesting, charitable gifting, required minimum distribution (RMD) withdrawals, and portfolio rebalancing (Lakonishok and Smidt 1986). Additionally, the winter months tend to be colder, which may prompt people to stay indoors. This may, in turn, provide individuals an opportunity to devote more time to managing their household finances. It is also possible that the seasonality finding is primarily spurious and not related to equity ownership at all. The role of seasonality patterns as a factor that may influence investment selection and/or financial planning behavior is worth further study.

Third, findings from this analysis indicate that the ownership of equities, cash, and bonds differs based on a number of personal characteristics. This insight is not new; rather, this study adds support to the concept that, in addition to advice and experience, certain demographic factors, such education, play a key role in shaping asset ownership decisions. Education, for example, appears to be more important than traditional grouping variables, such as gender and income. For instance, the conventional wisdom that being male and having more income leads to higher equity ownership is probably over stated. Consider Clusters B and D. These groups were dominated by men with high income. Yet, the difference in equity ownership between these groups was extremely large. The key differences between the groups appears to be decision style, experience (proxied by age), and education. Seasonality issues were also present. These findings support Zumbrun’s (2014a) assertion that wealth accumulation is driven in large part by education and similar factors. It is not surprising that education is linked to wealth inequality. As shown in this study, education is a key determinant of equity ownership.

Fourth, this paper adds to the literature by including financial risk tolerance as a variable that influences someone’s investment asset allocation decisions. Not surprisingly, risk scores matched the equity holding results. That is, risk tolerance and equity ownership were positively associated among the clusters. The implication of this finding is potentially significant. As Zumbrun (2014a, b) pointed out, recent changes in wealth inequality in the United States correspond to nationwide equity holding data. He reported that equity ownership among the majority of U.S. households declined from 2010 through 2013, but among those holding the most wealth, equity ownership increased. Results from this study bolster this insight by suggesting that a key factor driving allocation decisions is the risk tolerance of the household. Figure 4 illustrates the likely relationship between risk tolerance, equity ownership, and wealth accumulation over the lifespan.

Fifth, this study has implications for financial educators by providing insight into the characteristics of people who make their own investment decisions and those who rely on others for advice. The latter tend to be young, single, and have less education than those who invest on their own. There is a need to develop demographically appropriate programs and methodologies (e.g., texts, phone apps, YouTube videos) that help these individuals choose advisors, avoid scams, and increase their investment knowledge and confidence.

If the relationships in Fig. 4 are correct, the policy implications for those interested in reducing wealth inequality are significant. While it is difficult to shape help-seeking behavior, it is possible to stimulate increased interest in financial and investing topics through formal (e.g., classes) and informal (e.g., social media) education and financial coaching (Ali et al. 2015; Easterbrook et al. 2015). Ali et al., for example, found that financial literacy and financial education tends to be positively associated with a person’s willingness to seek help from financial services professionals. This increased help-seeking may promote a greater willingness to engage in risky financial behavior among some households. Easterbrook et al. confirmed the education effect on social behavior among individuals living in the United Kingdom. Although the study by Easterbrook et al. did not focus directly on the education effect and household financial behavior, their findings did suggest that household interactions in the investment markets can be guided by education.

Education, as such, may be effective if directed at shaping attitudes and behaviors towards the necessity of risk-taking as a component of creating and maintaining lifetime wealth. There is evidence to suggest that those with the highest risk-tolerance attitudes (e.g., those who grew up with family members who were interested in personal finance or those who became experienced investors over time) accumulate more lifetime wealth. Without directed education about the benefits of owning risky assets and information about the role of risk tolerance in shaping behavior, the current state of wealth inequality may be difficult to change without large income and wealth redistribution policies.

In terms of wealth distribution policies, two elements are of importance (Hirschauer et al. 2015). First, any new policy should improve access to market information for households. Second, governmental policies should attempt to improve the market power of individuals and households vis-a-vis financial institutions. Efforts to create financial equilibrium by improving household financial well-being may be a way to reduce wealth inequality in the future. Of particular importance is the role of financial education and financial coaching focused on improving financial capabilities related to risk assessment and risk taking (Thiry 2015). With appropriate financial education and coaching, guided by policies designed to balance access to information, individuals and households might improve their financial well-being through more efficient allocation of household resources.

In summary, this study provides a framework and methodology for future research devoted to building taxonomies of equity ownership. The ability to group individuals similarly can be an important tool for researchers, policy makers, social activists, financial advisers, financial counselors, and educators when describing the household and macroeconomic wealth profile of those living in the United States. In addition to being a practical analytical tool, cluster analysis can also help provide insights into wealth inequalities. As shown in this study, equity ownership appears to be directly associated with the way wealth is skewed in the United States. While it is important to note possible limitations associated with this study, such as the open access data collection process, lack of qualitative data regarding investing intentions, and missing objective wealth measures, findings are still noteworthy in showing a potential positive relationship among investment risk tolerance, equity ownership, and greater lifetime wealth accumulation. These factors are likely useful in helping describe some of the wealth inequality seen today.

It is hoped that this study will spur similar research using different diverse populations from various countries. This study focused specifically on those living in the United States. Therefore, the findings may not be globally generalizable. For instance, in some countries where economic status is growing, development of financial services may be a key solution for poverty-reduction (Abosedra and Shahbaz 2016) and reduced income inequality (Shahbaz et al. 2015). Whereas in developed countries complicated financial systems may overwhelm individuals’ capabilities to control wealth decisions, the development of financial service platforms in emerging economies may provide a mechanism to overcome some financial challenges. Future research is needed to test this hypothesis by comparing wealth inequality using various populations, controlling for education and risk tolerance. Outcomes from such work will improve the understanding of the association between the development of financial services and wealth accumulation.

References

Abosedra, S., & Shahbaz, M. (2016). Modeling causality between financial deepening and poverty reduction in Egypt. Social Indicators Research, 126, 955–969.

Ali, A., Rahman, M. A., & Bakar, A. (2015). Financial satisfaction and the influence of financial literacy in Malaysia. Social Indicators Research, 120, 137–156. doi:10.1007/s11205-014-0583-0.

Chang, H. (2014). Economics: The user’s guide. New York, NY: Bloomsbury Press.

Corter, J. E., & Chen, Y.-J. (2006). Do investment risk tolerance attitudes predict portfolio risk? Journal of Business and Psychology, 20, 369–381.

Deakin, J., Aitken, M., Robbins, T., & Sahakian, B. J. (2004). Risk taking during decision-making in normal volunteers changes with age. Journal of the International Neuropsychological Society, 10, 590–598. doi:10.1017/S1355617704104104.

Diener, E., & Diener, C. (1995). The wealth of nations revisited: Income and quality of life. Social Indicators Research, 36, 275–286.

Easterbrook, M. J., Kuppens, T., & Manstead, A. R. (2015). The education effect: Higher educational qualifications are robustly associated with beneficial personal and socio-political outcomes. Social Indicators Research,. doi:10.1007/s11205-015-0946-1.

Egan, M. (2014). Stockswatch: More US families own cats than stocks. CNN. Retrieved from http://money.cnn.com/2014/09/09/investing/stock-market-investing-us-families/.

Ellis, C. D. (1995). The loser’s game. Financial Analysts Journal, 51, 95–100.

Finke, M. S., & Huston, S. J. (2003). The brighter side of financial risk: Financial risk tolerance and wealth. Journal of Family and Economic Issues, 24, 233–256.

FINRA. (2016). U.S. survey data at a glance. Retrieved from FINRA Investor Education Foundation website: http://www.usfinancialcapability.org/results.php?region=US.

Furnham, A., von Stumm, S., & Fenton-O’Creevy, M. (2015). Sex differences in money pathology in the general population. Social Indicators Research, 123, 701–711.

Gandelman, N., & Porzecanski, R. (2013). Happiness inequality: How much is reasonable? Social Indicators Research, 110, 257–269. doi:10.1007/s11205-011-9929-z.

Gilliam, J., Chatterjee, S., & Grable, J. (2010). Measuring the perception of financial risk tolerance: A tale of two measures. Journal of Financial Counseling and Planning, 21(2), 30–43.

Goldsmith, E. B. (2009). Consumer economics: Issues and behaviors. Upper Saddle River, NJ: Pearson/Prentice Hall.

Grable, J. E., Klock, D. D., & Lytton, R. H. (2013). The case approach to financial planning: Bridging the gap between theory and practice (2nd ed.). Erlanger, KY: The National Underwriter Company.

Grable, J. E., & Lytton, R. H. (1999). Financial risk tolerance revisited: The development of a risk assessment instrument. Financial Services Review, 8, 163–181.

Hallahan, T. A., Faff, R. W., & McKenzie, M. D. (2004). An empirical investigation of personal financial risk tolerance. Financial Services Review, 13, 57–78.

Hanna, S., Chang, Y. R., & Fan, J. X. (1995). Optimal life-cycle savings. Financial Counseling and Planning, 5(1), 1–15.

Hirschauer, N., Lehberger, M., & Musshoff, O. (2015). Happiness and utility in economic thought—Or: What can we learn from happiness research for public policy analysis and public policy making? Social Indicators Research, 121, 647–674. doi:10.1007/s11205-014-0654-2.

Huang, J., Wu, S., & Deng, S. (2016). Relative income, relative assets, and happiness in urban China. Social Indicators Research, 126, 971–985.

Investment Company Institute. (2005). Equity ownership in America, 2005. Washington, DC: Investment Company Institute and the Securities Industry and Financial Markets Association.

Investment Company Institute. (2008). Equity and bond ownership in America, 2008. Washington, DC: Investment Company Institute and the Securities Industry and Financial Markets Association.

Jones, C. I. (2015). Pareto and Piketty: The macroeconomics of top income and wealth inequality. Journal of Economic Perspectives, 29, 29–46.

Lakonishok, J., & Smidt, S. (1986). Volume for winners and losers: Taxation and other motives for stock trading. The Journal of Finance, 41, 951–974.

Ma, Y. Z., & Zhang, Y. (2014). Resolution of the happiness-income paradox. Social Indicators Research, 119(2), 705–721. doi:10.1007/s11205-013-0502-9.

Mishel, L., & Bivens, J. (2011). Occupy Wall Streeters are right about skewed economic rewards in the United States (Briefing Paper 331). Retrieved from Economic Policy Institute website: www.epi.org/files/2011/BriefingPaper331.pdf.

Piketty, T., & Saez, E. (2003). Income inequality in the United States, 1913–1998. Quarterly Journal of Economics, 118, 1–39.

Piketty, T., & Saez, E. (2014). Income inequality in the United State, 1913–1998 (Tables and figures updated to 2013). Unpublished raw data, Retrieved from University of California, Berkeley, Center for Equitable Growth website: https://eml.berkeley.edu/~saez/TabFig2013prel.xls.

Rolison, J. J., Hanoch, Y., Wood, S., & Liu, P. (2014). Risk-taking differences across the adult life span: A question of age and domain. Journals of Gerontology. Series B, Psychological Sciences and Social Sciences, 69, 870–880.

Saez, E., & Zucman, G. (2014). Wealth inequality in the United States since 1913: Evidence from capitalized income tax data. NBEER Working Paper 20625. Retrieved from: http://goodtimesweb.org/industrial-policy/2014/SaezZucman2014.pdf.

Schyns, P. (2002). Wealth of nations, individual income and life satisfaction in 42 countries: A multilevel approach. Social Indicators Research, 60, 5–40.

Shahbaz, M., Loganathan, N., Tiwari, A. K., & Sherafatian-Jahromi, R. (2015). Financial development and income inequality: Is there any financial Kuznets Curve in Iran? Social Indicators Research, 124, 357–382.

Smith, C. L. (1991). Measures and meaning in comparisons of wealth equality. Social Indicators Research, 24, 367–392.

Stiglitz, J. E. (2012). The price of inequality. New York: W.W. Norton & Co.

Sulaiman, E. K. (2012). An empirical analysis of financial risk tolerance and demographic features of individual investors. Procedia Economics and Finance, 2, 109–115.

Thiry, G. (2015). Beyond GDP: Conceptual grounds of quantification. The case of the Index of Economic Well-Being (IEWB). Social Indicators Research, 121, 313–343. doi:10.1007/s11205-014-0650-6.

U.S. Census Bureau. (2012a). Table 56—Marital status of the population by sex, race, and Hispanic origin: 1990 to 2010. Retrieved from www.census.gov/compendia/statab/2012/tables/12s0056.pdf.

U.S. Census Bureau. (2012b). Table 1211—Stock ownership by age of head of family and family income: 2001 to 2007. Retrieved from https://www.census.gov/compendia/statab/2012/tables/12s1211.pdf.

Watson, J., & McNaughton, M. (2007). Gender differences in risk aversion and expected retirement benefits. Financial Analysts Journal, 63, 52–62.

Yao, R., & Hanna, S. D. (2004). The effect of gender and marital status on financial risk tolerance. Consumer Interests Annual, 50, 123–124.

Zumbrun, J. (2014a, October 27). Who owns stocks? It’s not just the rich. The Wall Street Journal, Real Time Economics Blog. Retrieved from http://blogs.wsj.com/economics/2014/10/27/who-owns-stocks-its-not-just-the-rich/.

Zumbrun, J. (2014b, October 26). Bad stock-market timing fueled wealth disparity. The Wall Street Journal. Retrieved from www.wsj.com/articles/bad-stock-market-timing-fueled-wealth-disparity-1414355341.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Heo, W., Grable, J.E. & O’Neill, B. Wealth Accumulation Inequality: Does Investment Risk Tolerance and Equity Ownership Drive Wealth Accumulation?. Soc Indic Res 133, 209–225 (2017). https://doi.org/10.1007/s11205-016-1359-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-016-1359-5