Abstract

Knowledge is regarded as a key driver of entrepreneurial activity and economic performance. Nevertheless, empirical evidence suggests that the extent to which knowledge spills over and translates into entrepreneurial activity differs tremendously across different regions. These inconsistent results expose the knowledge spillover mechanism as a concept that is not well understood. This paper is one of the few studies to propose an explanation for the seemingly inconclusive results that we find in the literature by considering the role of infrastructure in knowledge spillovers. Using a dataset of 67 countries, we examine the impact of different types of physical and digital infrastructure on the knowledge spillover mechanism. Our empirical results reveal that the extent to which knowledge translates into entrepreneurial activity largely depends upon the development of specific types of digital and physical infrastructure. This paper provides valuable insights into the knowledge spillover mechanism by identifying certain factors that influence the extent to which knowledge translates into entrepreneurial activity. Furthermore, it has important policy implications for countries to promote entrepreneurial activity and economic performance by developing certain types of physical and digital infrastructure.

Plain English Summary

This study shows that the physical and the digital infrastructure of a country play an important role in knowledge spillover entrepreneurship. We identify certain types of infrastructure that have a pronounced impact on knowledge spillover entrepreneurship. Specifically, we identify the quality of the railroad infrastructure, the quality of electricity supply, and access to fixed broadband internet to be conducive to entrepreneurial activity. Understanding which factors encourage knowledge spillover entrepreneurship is important because knowledge spillover entrepreneurship contributes to the economic performance of a country. Our findings also provide policymakers with suggestions on how to increase the level of knowledge spillover entrepreneurship within their country by highlighting the importance of specific types of physical and digital infrastructure.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

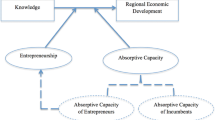

The Knowledge Spillover Theory of Entrepreneurship provides the theoretical foundation for explaining how knowledge translates into entrepreneurial activity and economic performance (Acs et al., 2013; Audretsch, 1995). The theory suggests that the source of entrepreneurial activity originates from knowledge created but not appropriated by incumbent organizations (Acs et al., 2004). By commercializing unexploited knowledge of incumbent organizations, economic agents act as conduits between the R&D activities of incumbents and economic performance (Caiazza et al., 2020). To date, KSTE scholars have already generated a plethora of insights into the knowledge spillover mechanism through which economic agents become key contributors to economic performance (Audretsch & Belitski, 2020; Guerrero & Urbano, 2014).

However, many of these insights remain somewhat ambiguous and expose the knowledge spillover mechanism as a concept that is not well understood. Although knowledge is regarded as a key driver of entrepreneurial activity, empirical evidence suggests that the knowledge spillover mechanism is not always equally successful in translating knowledge into economic outcomes (Audretsch & Keilbach, 2008; Enkel et al., 2009). While the theory has been empirically tested and confirmed – especially in the developed country context, the extent to which knowledge leads to entrepreneurial activity and economic performance differs greatly across countries (Audretsch, 2007; Ejermo et al., 2011).

A central premise of the Knowledge Spillover Theory is that the mobility of knowledge is what allows economic agents to appropriate it. This indicates that encouraging the mobility of knowledge may impact the level of appropriation by economic agents. According to Audretsch et al. (2015), one factor that facilitates the mobility of knowledge is infrastructure which enables the connectivity of people. Increased connectivity may, in turn, spur knowledge diffusion by enabling interactions among economic agents and incumbents. Thus, infrastructure may play a decisive role in spurring knowledge spillovers through increased interactions and by facilitating knowledge sharing which may explain why knowledge spillovers manifest themselves differently in different countries.

The purpose of this paper is to propose an explanation for the seemingly inconclusive results that we find in the literature by considering the role of infrastructure for knowledge spillover entrepreneurship. In particular, we investigate how the physical and the digital infrastructure of countries impact the knowledge spillover mechanism. Using data on 67 countries over the period of 2009 to 2015, we test the moderating effect of different physical and digital types of infrastructure on the link between knowledge and entrepreneurial activity. Our results suggest that infrastructure has a pronounced effect on the knowledge spillover mechanism by enabling knowledge diffusion among economic agents. We further identify specific types of infrastructure that seem to be especially supportive of knowledge spillovers and ultimately knowledge spillover entrepreneurship.

Our study makes important contributions to the KSTE literature. First, we propose an explanation for the inconsistent results in the literature by highlighting the essential role of infrastructure in the knowledge spillover mechanism. We find that the relationship between knowledge and entrepreneurial activity is amplified by the development of a country’s infrastructure. Second, we further distinguish between different types of infrastructure and identify those that have a pronounced impact on knowledge spillover entrepreneurship. Interestingly, our findings suggest that a high-quality digital infrastructure that enables increased knowledge exchange between incumbent organizations and economic agents is especially beneficial in knowledge spillovers.

2 Theoretical framework

2.1 The knowledge spillover theory of entrepreneurship

Entrepreneurship and economics scholars are increasingly interested in understanding the knowledge spillover mechanism that is at the core of the Knowledge Spillover Theory of Entrepreneurship (KSTE) (Audretsch & Belitski, 2013; Audretsch et al., 2021a, 2021b). The KSTE is centered around economic agents who perceive and actualize entrepreneurial opportunities that stem from the exclusive R&D knowledge of incumbent organizations. These economic agents can be internal or external to the incumbent organization, e.g., former employees or external entrepreneurs who ascribe a higher value to the generated knowledge than the incumbent (Acs et al., 2009). By appropriating knowledge that was generated by incumbents, economic agents serve as a knowledge spillover conduit.

According to the logic of the KSTE, increased investments in knowledge by incumbent organizations should lead to increased levels of entrepreneurial activity (Audretsch & Lehmann, 2005; Ghio et al., 2015). Hence, a context that is rich in knowledge provides economic agents with fertile soil to start a business and to ultimately contribute to economic performance. While KSTE scholars have tested and clearly confirmed the knowledge spillover mechanism, empirics are less clear on the strength of its impact. In fact, we can observe differences in the extent to which knowledge is appropriated and translated by economic agents into entrepreneurial activity and economic performance.

Whereas studies set in the USA associate increases in knowledge with increases in entrepreneurial activity and economic performance (Qian, 2017; Tsvetkova & Partridge, 2021), studies in other regions fail to generate the same results. For instance, we can observe these paradoxical results in Sweden and in the European Union, where investments in knowledge did not automatically translate into economic performance in the past years (Audretsch & Keilbach, 2008). Instead, the so-called Swedish and European Union Paradoxe associate higher investments in knowledge with rather low innovation activities and economic performance (Audretsch & Keilbach, 2008; Ejermo et al., 2011). These interesting yet inconclusive findings regarding the role of knowledge in entrepreneurial activity and economic performance motivate our research aim to understand which factors influence the knowledge spillover mechanism and explain the heterogeneous results that we observe.

2.2 Infrastructure and knowledge spillover entrepreneurship

We draw on an associated body of literature that may clarify the ubiquitous confusion that we find in the KSTE literature. The scholarly conversation linking context-specific factors with entrepreneurial activity has grown tremendously over the past decade (Stam, 2014; Welter et al., 2017; Welter et al., 2019), providing a promising avenue for advancing the KSTE literature. While the literature discusses a variety of external factors that enable or disable entrepreneurial activity (Davidsson, 2015), one factor that seems to be particularly relevant is infrastructure. In their seminal piece, Audretsch et al. (2015) provide a fruitful foundation for our analysis by investigating the link between infrastructure and general startup activity in different counties in Germany. The authors conclude that infrastructure and startup activity are positively related and that particular types of infrastructure are especially conducive to startup activity. Building on Audretsch et al. (2015), Bennett (2019) distinguishes between public and private infrastructure investments and their impact on startup activity. The author shows that especially private infrastructure investments are indicative of a higher entry of startups and identifies private infrastructure investments as having an “enabling function” of startup activity (Bennett, 2019; p. 19).

Audretsch et al. (2015) ascribe the positive link between infrastructure and entrepreneurial activity to the increased connectivity of economic agents. In fact, the very purpose of infrastructure is to enable the mobility of people and labor (Audretsch & Belitski, 2017; Belitski & Desai, 2016). By facilitating the mobility of a great variety of market participants including individuals, authorities, research institutions, and non-governmental organizations (Stam, 2014), physical infrastructure can provide the basis for interaction and exchange. As the KSTE assumes knowledge to be mobile and moving with its appropriator (economic agent), an infrastructure that facilitates interactions among these “transport mediums” of knowledge may spur knowledge diffusion. Specifically, physical infrastructure provides economic agents with a variety of transportation modes that allow for exchange in different places including but not limited to railway stations and airports as well as during transportation from one location to another. These personal interactions not only enable conversations among economic agents but also allow for the physical exchange of business documents, prototypes or product samples, etc. Hence, as economic agents as “transport mediums” of knowledge move around and exchange with others, knowledge disseminates and spillovers over. Consequently, the physical infrastructure has the potential to increase the mobility of knowledge and to fuel knowledge diffusion among economic agents which is essential to the knowledge spillover mechanism.

In essence, we argue that the presence or absence of a well-developed physical infrastructure can encourage or constrain knowledge diffusion among economic agents. In fact, the development of a country’s physical infrastructure may play a decisive role in the knowledge spillover mechanism and in the emergence of knowledge spillover entrepreneurship. Increased personal interactions allow for knowledge diffusion and may magnify knowledge spillovers to entrepreneurship. Thus, the development of a physical infrastructure should positively impact the extent to which knowledge leads to entrepreneurial activity and economic performance. Therefore, we hypothesize:

-

Hypothesis 1a: The relationship between knowledge and entrepreneurial activity is positively moderated by a country’s physical infrastructure.

According to Audretsch et al. (2015), different types of infrastructure have different effects on entrepreneurial activity. In fact, research on entrepreneurship in cities suggests that physical conditions including transportation infrastructure and cultural amenities, such as green spaces, museums, and theaters, may either encourage or restrain entrepreneurship (Audretsch & Belitski, 2017). Both transportation infrastructure and cultural amenities provide the basis for interactions, potentially facilitating the development of networks among economic agents (Audretsch & Belitski, 2017) and contributing to local economic vibrancy and attractiveness (Feldman, 2014). Hence, there may be certain types of physical infrastructure that amplify knowledge spillovers more than others. Knowledge spillovers rely on the mobility and diffusion of knowledge. Consequently, particular types of a country’s physical infrastructure that foster exchange and knowledge diffusion between economic agents, such as transportation or spaces of interaction including museums and theaters, may be especially important for fostering knowledge spillovers.

For instance, railroad transportation provides economic agents with a variety of opportunities for exchange. Next to presumably shorter interactions during waiting times on railroad platforms, economic agents can exchange with other passengers (economic agents) and transmit knowledge during train rides. These interactions not only are tied to passengers in adjacent seats but also can occur in onboard-catering wagons that provide a place for interaction. Hence, a well-developed railroad infrastructure may have a positive effect on the knowledge spillover mechanism. Another example of a specific type of physical infrastructure that facilitates the mobility of economic agents is road infrastructure. However, unlike traveling via railroad, the use of cars does not allow for close personal interactions and knowledge exchange between travelers beyond their own car. The road infrastructure is designed to transport people via roads to their destination without the possibility to interact beyond stops at gas stations which presumably are too short to exchange knowledge. Hence, as road infrastructure does not provide economic agents with places for longer exchanges, it is rather unlikely to encourage knowledge spillovers to entrepreneurship. Specifically, it presumably is insignificant for the knowledge spillover mechanism. In essence, we argue that those types of physical infrastructure that provide the space and time for interactions and knowledge exchange are conducive to knowledge spillover entrepreneurship. Likewise, those types of physical infrastructure that do not allow for exchange may not be relevant for knowledge spillover entrepreneurship. Therefore, we hypothesize:

-

Hypothesis 1b: Specific types of physical infrastructure have heterogeneous effects on the relationship between knowledge and entrepreneurial activity.

However, not only the physical infrastructure of a country may facilitate the mobility of knowledge among incumbents and economic agents, but also does the development of the digital infrastructure of a country. While physical interactions, such as meeting at different types of company events or industry conferences, are essential for knowledge diffusion, digitalization has provided incumbent organizations and economic agents with new opportunities to share and appropriate knowledge. Distinguishing between the physical and the digital infrastructure of a country is important, as the underlying knowledge-sharing mechanisms seem to be inherently different and may, therefore, influence the extent to which knowledge leads to entrepreneurial activity and economic performance in different ways. In fact, the development of digital infrastructure has increased greatly over the past two decades and, hence, is relatively new in comparison to traditional types of physical infrastructure.

In their seminal piece on digital technologies and entrepreneurship, von Briel et al. (2018) conceptualize digital technologies as external enablers of venture creation. In fact, digitalization has allowed for the emergence of various digital channels which enable knowledge sharing among incumbent organizations and economic agents. Contrary to knowledge sharing through physical interactions, digital channels allow instant knowledge sharing not only between a limited number of incumbents and economic agents but also among every individual that has access to these channels. Hence, digital channels are not subject to physical boundaries but rather enable economic agents to engage with a variety of market participants and access large amounts of data, for instance, through websites, social media, or blogs (Autio et al., 2018; Goswami et al., 2018; Thompson et al., 2018). In addition, a well-developed digital infrastructure provides economic agents with opportunities to quickly test ideas, build prototypes, and collect customer feedback (Belitski et al., 2023), all of which generate knowledge that is essential to the launch of a new venture. Hence, the development of a digital infrastructure should amplify knowledge spillovers. Therefore, we hypothesize:

-

Hypothesis 2a: The relationship between knowledge and entrepreneurial activity is positively moderated by a country’s digital infrastructure.

While the digital infrastructure provides economic agents with extensive opportunities to connect with one another (Belitski et al., 2023), there may be specific types of a country’s digital infrastructure that encourage knowledge spillovers more than other types. Some types may be more conducive to facilitating the mobility of knowledge and ultimately knowledge diffusion among incumbents and economic agents. In fact, a survey commissioned by Google (Digitally Driven, 2021) illustrates that the value of digital tools for firm performance differs depending on the digital tool in use. In this regard, broadband infrastructure is presumably more relevant for knowledge spillover entrepreneurship as it provides economic agents with access to large amounts of information. In addition, it facilitates interactions between economic agents and allows access to and sharing of knowledge in the form of files, documents, prototypes, etc. In contrast, other types of digital infrastructure that do not entail the benefits of interaction or sharing of knowledge may be less conducive to knowledge spillover entrepreneurship. Therefore, we expect the extent to which specific types of digital infrastructure impact the knowledge spillover mechanism to differ. We hypothesize:

-

Hypothesis 2b: Specific types of digital infrastructure have heterogeneous effects on the relationship between knowledge and entrepreneurial activity.

In essence, we suggest that infrastructure is an overlooked area in the KSTE literature which needs to be examined, as it may help us explain the inconsistent results that we observe in the literature. Investigating both the development of the physical and the digital infrastructure is especially important because of two reasons. First, a central premise of the KSTE is the geographical proximity of economic agents to public and private research institutions. Hence, engagement and exchange between economic agents and incumbent organizations require a well-developed physical infrastructure. Second, over the past years, digitalization has accelerated tremendously, enabling knowledge sharing via various digital channels. We argue that these new knowledge-sharing channels need to be taken into account when examining the knowledge spillover mechanism, as they represent a major source of knowledge, whose adoption was immensely accelerated by the COVID pandemic.

3 Data and methodology

To examine the role of infrastructure in knowledge spillovers to entrepreneurship, we use country-level data from different sources including the Global Entrepreneurship Monitor (GEM), the World Bank, and the World Economic Forum. The GEM project collects comprehensive data on entrepreneurial activity across countries and is commonly used in country-level research (Anokhin & Wincent, 2012; Koellinger, 2008). In line with previous research on the KSTE (De Clercq et al., 2008; González-Pernía et al., 2015), we complement the GEM data with macroeconomic data from the World Bank database as supplied by the UNESCO Institute for Statistics (2023). Lastly, we use data from the Global Competitiveness Report of the World Economic Forum. The World Economic Forum administers an Executive Opinion Survey each year that collects data on the opinion of executives around the world toward the business environment they operate (Schwab & Sala-i-Martín, 2015). For instance, the survey asks participants to assess the quality of infrastructure in their country. The World Economic Forum further complements the Executive Opinion Survey with data on the technological readiness of countries from the International Telecommunications Union. Table 1 provides a short description of each variable including its data source.

3.1 Variables

Knowledge spillover entrepreneurship is characterized by its innovative nature and its contribution to economic performance (Audretsch et al., 2008). In accordance with previous research on the KSTE (Kirschning & Mrożewski, 2023), we measure knowledge spillover entrepreneurship using GEM data on improvement-driven opportunity-motivated entrepreneurial activity, hereafter referred to as opportunity-driven entrepreneurship (OTEA). Opportunity-driven entrepreneurs are defined as the fraction of those that are involved in entrepreneurial activity that claim to be driven by opportunity (Global Entrepreneurship Monitor, 2023). Opportunity-driven entrepreneurship represents an appropriate proxy for knowledge spillover entrepreneurship as it is associated with country-level innovation (Mrożewski & Kratzer, 2017) and economic impact (Block et al., 2015).

One essential component of the knowledge spillover process is the amount of knowledge that is available as provided by universities and research institutions. We include the variable expenditures on research and development (R&D), expressed as a percent of GDPFootnote 1(ERD), to approximate the potential supply of knowledge within a country. The measure comprises capital and current expenditures of business enterprises, governmental institutions and higher education, and private non-profit organizations (World Bank, 2022). It is frequently used in the KSTE literature as a proxy for knowledge stock (Acs et al., 2012; Audretsch & Vivarelli, 1996; Iftikhar et al., 2022).

To approximate the infrastructural development of a country, we use measures of different types of a country’s infrastructure, as rated by business executives that took part in the Executive Opinion Survey of the World Economic Forum. Consistent with existing entrepreneurship literature, we acknowledge that different types of infrastructure may have different effects on entrepreneurial activity (Audretsch et al., 2015; Valliere & Peterson, 2009). In fact, we further distinguish between specific types of physical infrastructure and digital infrastructure that allow knowledge exchange. We operationalize the physical infrastructure of a country through multiple variables of the Global Competitiveness Report. Experts were asked to assess the quality of the different types of physical infrastructure on a scale from one to seven (Schwab & Sala-i-Martín, 2015). We include the quality of the railroad infrastructure (QRR), the quality of roads (QRO), and the quality of air transportation infrastructure (QAT).

Next to the physical infrastructure of a country, we consider the digital infrastructure as an important element in the exchange and mobilization of knowledge stock and, thus, essential to the knowledge spillover mechanism. We measure the digital infrastructure using data on the technological development of a country as provided by the World Economic Forum. Firstly, we employ a measure of the quality of electricity supply (QES) which again was assessed by business executives as part of the Executive Opinion Survey. Secondly, we include variables that reflect the provision of broadband services within a country. In particular, we examine fixed broadband internet subscriptions (FBIS), measured per 100 population, and mobile telephone subscriptions (MTS), measured per 100 population.Footnote 2 Data on both fixed broadband subscriptions and mobile telephone subscriptions was collected by the International Telecommunications Union and accessed through the Global Competitiveness Report of the World Economic Forum.

According to Chowdhury et al. (2019), the institutional environment of a country affects the emergence of entrepreneurial activity. Therefore, it is also likely to impact the knowledge spillover process. In fact, Acs et al. (2004) summarize this phenomenon under the concept of the knowledge filter and argue that the institutional setting, e.g., legal regulations or restrictions, may prevent or encourage knowledge spillover entrepreneurship. Therefore, we control for the institutional environment of a country, using the annual percentage growth rate of Gross Domestic Product (GDPG) (Acs et al., 2009). Furthermore, we control for the log of the population (POP), as knowledge spillover entrepreneurship may, to some extent, depend on a country’s population size. Log of the population (POP) is a frequently used control variable in country-level entrepreneurship research (Anokhin & Wincent, 2012; Boudreaux & Nikolaev, 2019).

3.2 Methodology

To test our three hypotheses, we conduct moderated ordinary least squares (OLS) regression analyses. Our dataset comprises 67 countries and covers the period from 2009 to 2015. We opted for a country-level research design as differences in the development level of infrastructure are especially prominent across countries. In fact, a report by the International Monetary Fund (Abiad et al., 2014) reveals a large variation in the availability of infrastructure per capita. While differences appear to be particularly large between developing countries and developed countries, Abiad et al. (2014) also identify infrastructure discrepancies across a variety of developed countries, e.g., the USA vs. Sweden. These substantial differences across countries render our country-level focus a particularly interesting unit of analysis.

To address causality issues associated with OLS regression analyses, we use lagged independent variables. The time lag further matches the spillover logic of the KSTE which assumes that knowledge spillovers do not occur immediately, but that knowledge takes time to be commercialized (Ghio et al., 2015). In line with previous studies on the knowledge spillover mechanism (Audretsch & Belitski, 2020; Iftikhar et al., 2022; Qian & Acs, 2013), we opted for a one-year time lag which reflects the relationship between knowledge generation and diffusion in one period and entrepreneurial activity in the subsequent year. Our dataset only consists of countries with at least two observations for each variable which we aggregate. Table 2 reports the descriptive statistics and the correlation matrix. The correlation coefficients between the independent variables of the six models are well within the limits. Next to the correlation coefficients, we investigate the Variance Inflation Factors (VIF) for each variable which are all below the conventional threshold of 4, the highest being 3.1 for our fixed broadband internet subscriptions variable.

4 Empirical results and discussion

The purpose of this paper is to propose an explanation for the seemingly ambiguous results that we find in the KSTE literature. Although there is a common understanding that knowledge promotes entrepreneurial activity and economic performance, empirical evidence shows that the extent to which knowledge spills over from incumbent organizations to economic agents is not equally observable across different countries (Audretsch & Keilbach, 2008). Table 3 summarizes the empirical results of our regression analyses, testing the moderating role of various types of physical and digital infrastructure in knowledge spillovers from incumbent organizations to economic agents. Models 1–3 test hypothesis 1a and hypothesis 1b which suggest that the relationship between knowledge and entrepreneurial activity is positively moderated by a country’s physical infrastructure (H1a) and that specific types of physical infrastructure are of different importance in knowledge spillovers (H1b). Hypothesis 2a and hypothesis 2b which propose that the relationship between knowledge and entrepreneurial activity is positively moderated by a country’s digital infrastructure (H2a) and that specific types of digital infrastructure are of different importance in knowledge spillovers (H2b) are tested in models 4–6.

The results for model 1 show that the quality of the railroad infrastructure (QRR) significantly moderates the knowledge spillover relationship between incumbent organizations and entrepreneurial activity. The positive interaction term (β 0.240; p < 0.05) is significant at the 5% level, suggesting that knowledge spillovers are strengthened through a higher-quality railroad infrastructure. The positive effect of a country’s railroad infrastructure on knowledge spillovers may be ascribed to the facilitation of interactions between people through increased transportation of economic agents by rail. The KSTE assumes knowledge to be mobile. Hence, an infrastructure that facilitates the connectivity of people and, thereby, the mobility of knowledge encourages knowledge spillovers. This finding is in line with Audretsch et al. (2015) who also find that investments in the railway infrastructure are conducive to startup activity. Our findings are also consistent with Woolley (2014), who argued that interaction is a key driver of new venture creation, which in our case manifests itself vicariously in the importance of a country’s quality of the railroad infrastructure in knowledge spillovers.

Model 2 and model 3 test the impact of the quality of roads (QRO) and the quality of air transportation infrastructure (QAT) on knowledge spillovers, respectively, and yield insignificant results, indicating that there is no empirical evidence confirming that increasing the quality of roads and air transportation promotes knowledge spillovers. It comes as no surprise that the quality of roads may not encourage knowledge spillovers. In fact, there has been an ongoing scholarly debate on the impact of highway infrastructure on economic activity. While some studies find positive effects of highway infrastructure on entrepreneurial activity, other studies report negative effects (Bennett, 2019; Chandra & Thompson, 2000). On the one hand, these contrary effects can be ascribed to the enabling role of highway infrastructure such that an increase in quality reduces transportation costs and allows increased mobility (Chandra & Thompson, 2000). On the other hand, some industries may be affected by the relocation of economic activity to another area (Chandra & Thompson, 2000). An alternative explanation for the insignificance of road quality in knowledge spillovers may be the fact that mobility via cars is decentralized. In contrast to railway mobility, mobility via cars allows economic agents to travel without the need to interact with one another beyond stops at gas stations. Hence, individuals who travel by car circumvent interactions and knowledge diffusion which are essential to knowledge spillovers.

Next to the quality of roads, the quality of air transportation also yields insignificant empirical results. An explanation for the insignificance of the quality of air transportation infrastructure may be that the air transportation infrastructure is rather important for the mobility of people across different countries rather than within countries. Therefore, it may not promote knowledge spillover entrepreneurship within the boundaries of one country but rather between countries which cannot be measured with our dataset. Overall, these results testing the impact of different types of physical infrastructure in knowledge spillovers lend support for Hypothesis 1a while indicating that there are heterogeneous effects of different types of physical infrastructure on the knowledge spillover mechanism (H1b). In essence, our results regarding the role of the physical infrastructure in knowledge spillovers suggest that especially the railroad infrastructure promotes knowledge diffusion between incumbent organizations and economic agents by enabling the connectivity of people and, thereby, the mobility of knowledge.

As indicated above, models 4–6 investigate the role of the digital infrastructure in knowledge spillovers. In particular, model 4 and model 5 provide empirical evidence that increasing the quality of electricity supply (QES) and the number of fixed broadband internet subscriptions (FBIS) has a positive impact on the relationship between knowledge and entrepreneurial activity. The statistically significant interaction terms for model 4 (β 0.258; p < 0.05) and model 5 (β 0.319; p < 0.05) indicate that knowledge spillovers are strengthened in countries with higher-quality electricity supply and increased access to fixed broadband internet. The importance of the quality of electricity supply in knowledge spillovers may be explained by the fact that quality electricity supply is necessary for economic agents to be able to access the internet with a stable connection. Thus, a high-quality electricity supply enables incumbent organizations and economic agents to access and convey knowledge through various digital channels, thereby fuelling knowledge spillovers. Likewise, fixed broadband internet is also conducive to knowledge spillovers, again indicating that increased access to the internet fosters knowledge diffusion. This finding is in line with Heger et al. (2011) who label broadband as a type of venture promoter.

In contrast, mobile telephone subscriptions (MTS) seem not to be as important in knowledge spillovers as the other two types of digital infrastructure, which can be concluded from the insignificant interaction term. One reason as to why mobile telephone subscriptions are not relevant in knowledge spillovers may lie in the user behavior of mobile telephone subscribers. In fact, mobile telephone services are commonly used with the smartphone. Although mobile phones enable interactions between market participants, spillover effects require the transmission of complex technical knowledge which may prove rather difficult through a mobile phone. In fact, one may argue that complex technical knowledge requires economic agents to put in effort and time to apprehend it rather than accessing it on the go with a small (mobile) display which is the case when using mobile telephone services with the smartphone. Likewise, viewing large files that convey complex knowledge (e.g., business documents, files or prototypes) on the smartphone may lack usability and seems to be rather done on a computer. This may explain why mobile telephone subscriptions exhibit an insignificant effect on knowledge spillovers. Overall, these empirical results lend support to Hypothesis 2a, suggesting that different kinds of digital infrastructure have heterogeneous effects on the knowledge spillover mechanism (H2b). In particular, our results imply that the quality of electricity supply and fixed broadband internet subscriptions promote knowledge spillovers to entrepreneurship. We test this finding by repeating our analysis with a measure from the World Bank that reflects the percentage of individuals using the internet (IUI). The empirical results reveal a positive and significant interaction term (β 0.273; p < 0.05), confirming the positive effect of internet usage on knowledge spillovers.Footnote 3

To confirm the robustness of our findings, we conducted additional analyses. First, we recalculated our models using an alternate measure of knowledge. KSTE scholars operationalize knowledge through a variety of measures. While expenditures on research and development is probably one of the most frequently used ones, there are other measures that represent good proxies for the amount of knowledge that is available within a country. In line with the KSTE literature (Audretsch et al., 2008, 2021a, 2021b), we perform our analyses with the knowledge measure researchers working in R&D (RES) from the World Bank. The results confirm our initial findings, revealing positive and statistically significant interaction terms for the quality of the railroad infrastructure (QRR), the quality of electricity supply (QES), and the number of fixed broadband internet subscriptions (FBIS). Empirical results are shown in Table 5.

Second, we repeat our analysis with different control variables to account for variations in knowledge spillover entrepreneurship that cannot be attributed to our independent variables. In fact, the uneven distribution of the population within a country may similarly result in the uneven development of infrastructure (Audretsch & Belitski, 2017). To address this potential impact on knowledge spillover entrepreneurship, we perform our analysis with the control variables urban population as a percentage of the total population (URBN) and population density (POPDENS) measured as the population per land area from the World Bank. Similarly, we account for variation in countries’ total land areas and the potentially uneven distribution of infrastructure which may be especially prominent in larger countries. Specifically, we recalculate our models with the control variables log of country area (CSIZE) measured as total land in square kilometers and log of the population (POP). The results remain robust. Tables 5 and 6 present the respective results.

Furthermore, we run additional analyses controlling for the sectoral structure within a country where we distinguish between manufacturing value added as a percentage of GDP (SECT_MAN), services value added as a percentage of GDP (SECT_SERV), and agriculture (including fishing and forestry) value added as a percentage of GDP (SECT_AGR). Lastly, we control for the availability of human capital within a country, drawing on data from the World Bank on government expenditure on education as a percentage of GDP (HUMCAP). Our results remain robust to any of these changes in control variables and are shown in Table 7.

The findings of our study now raise the question of whether the physical and the digital infrastructure of a country complement or substitute each other. While our empirical results do not allow for a definite answer, we presume complementarity/substitution of the physical and the digital infrastructure to be context-dependent. Specifically, we view these two types of infrastructure to be complements in times of business as usual and substitutes in times of (global) crises, such as the COVID pandemic. The COVID pandemic put the use of physical infrastructure and, hence, physical interactions between economic agents to a halt, forcing economic agents to rely on digital channels to communicate and share knowledge. This substitution effect, for instance, manifested in a steep decline in the use of transportation and a sharp increase in remote work (Bruhn et al., 2023; Nundy et al., 2021), moving interactions between economic agents online.

However, in times of business as usual, it is unlikely that the increased connectedness through digital infrastructure has the potential to fully substitute the advantages of physical infrastructure, allowing for in-person meetings. In fact, recent research has found evidence that shifting away from in-person interactions might affect the innovation processes negatively. While certain activities that pertain to the later stages of the innovation process (e.g., idea selection) can be done online without efficiency losses, other elements, particularly at the early stages of the process (e.g., idea generation), are more effective when conducted in person (Brucks & Levav, 2022). These dynamics might be particularly true in knowledge and technology transfer contexts, as tacit knowledge and technology are best explained and demonstrated in person (Hovhannisyan & Keller, 2015). Taking this into account, we argue that both physical and digital infrastructure complement each other in encouraging knowledge spillover entrepreneurship in times of business as usual. Contrarily, in times of crisis, one type of infrastructure may prove more important and substitute the other to some extent.

5 Conclusion

The KSTE literature has provided important insights into the role of entrepreneurial activity as a knowledge spillover conduit. While knowledge is unquestionably a driver of innovation and economic performance, empirical results are inconsistent and differ in the extent to which knowledge promotes entrepreneurial activity and economic performance. Contrary to the logic of the KSTE, the Swedish and the European Union Paradoxe associate increases in knowledge with low innovation activities and economic performance. This paper seeks to understand why knowledge spillovers manifest themselves differently in different countries. Our results shed light on the inconsistent KSTE literature by emphasizing the role of infrastructure in the knowledge spillover mechanism.

We investigate both the physical and the digital infrastructure across countries and show that certain types of physical and digital infrastructure are of different importance in knowledge spillovers. In particular, our findings suggest that especially the quality of the railroad infrastructure, the quality of electricity supply, and access to fixed broadband internet promote knowledge spillovers from incumbent organizations to economic agents. These positive effects may be ascribed to increased interactions among incumbent organizations and economic agents which seem to be facilitated by these types of infrastructure. Thus, the extent to which knowledge promotes entrepreneurial activity across countries can be explained by taking into account these types of infrastructure.

Our study makes three important contributions to the KSTE literature. First, we propose an explanation for the seemingly inconclusive results that we observe in the KSTE literature by highlighting the role of infrastructure for knowledge spillover entrepreneurship. In fact, our findings suggest that countries with a more developed digital and physical infrastructure exhibit higher levels of knowledge spillover entrepreneurship than countries with a less developed infrastructure. We show that three types of infrastructure are particularly conducive to knowledge spillovers. These types of infrastructure allow the mobility of knowledge through increased interactions among incumbent organizations and economic agents, thereby encouraging knowledge diffusion. Second, our findings further imply not only that knowledge is a key driver of knowledge spillover entrepreneurship and should, therefore, be encouraged but also that infrastructure is an essential component of the knowledge spillover mechanism which should not be overlooked. Finally, we contribute to the scholarly conversation linking context-specific factors with entrepreneurial activity that has called for further research on the impact of infrastructure on entrepreneurship. As Audretsch et al., (2015, p. 226) rightfully note, “infrastructure may be one of the most overlooked influences of entrepreneurial activity.” We address this gap by highlighting the role of infrastructure for knowledge spillover entrepreneurship.

Next to contributing to the KSTE literature, our study has practical implications for policymakers that aim to increase knowledge spillover entrepreneurship within their country. Our findings suggest that knowledge spillover entrepreneurship can be encouraged by developing both the physical and the digital infrastructure of a country. Specifically, policymakers should invest in the railway infrastructure to enhance the connectivity of people and foster interactions between them. Next to investing in the expansion of the railway network, policymakers should also allocate funds to make rail use more attractive as well as to create spaces within trains that encourage interaction among passengers. The design of these spaces may be inspired by the concept of co-working spaces that already manage to successfully enable knowledge sharing (Bouncken et al., 2023). Likewise, policymakers can encourage knowledge spillover entrepreneurship by investing in fixed broadband infrastructure as well as by increasing the expansion of power grids. This enables economic agents to engage with a variety of market participants and to access and convey knowledge through various digital channels. In essence, our findings suggest that infrastructure should be an integral part of innovation policy instead of only being regarded as a means of transportation or information technology.

Although our study makes several important contributions to the KSTE literature, it is not without inherent limitations which, however, represent fruitful avenues for future research. While the chosen research method allows us to observe the impact of infrastructure on knowledge spillovers at the country level, it does not provide definite evidence for causal effects. To address the causality issues associated with OLS regressions, we use lagged independent variables. However, future research is still advised to investigate the relationships using panel estimations. Although our study provides interesting insights into the role of infrastructure for knowledge spillover entrepreneurship, we do not distinguish between different types of entrepreneurial firms. As research suggests that firm characteristics, e.g., firm size, partially determine the relevance of regional versus national types of infrastructure (Audretsch & Belitski, 2023), we advise future research to examine the role of different firm characteristics in knowledge spillovers encouraged through infrastructure. Furthermore, we decided to conduct our study on the country level, although the majority of KSTE studies examine the knowledge spillover mechanism on the regional level (Fotopoulos, 2022; Qian, 2018). While the country-level focus is rather unique to our study, we still believe that it would be interesting to investigate the impact of regional infrastructure in knowledge spillovers to get a more nuanced understanding of the mechanism. Therefore, we encourage scholars to investigate the role of infrastructure in knowledge spillovers on the regional level.

Notes

We use the natural logarithm of expenditures on R&D, expressed as a percent of GDP.

We use the natural logarithm of fixed broadband internet and mobile telephone subscriptions.

Empirical results can be found in Table 4.

References

Abiad, A., Furceri, D., Topalova, P., & Scotland, A. (2014). IMF survey: The time is right for an infrastructure push. International Monetary Fund: World Economic Outlook.

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30. https://doi.org/10.1007/s11187-008-9157-3

Acs, Z. J., Audretsch, D. B., Braunerhjelm, P., & Carlsson, B. (2012). Growth and entrepreneurship. Small Business Economics, 39(2), 289–300. https://doi.org/10.1007/s11187-010-9307-2

Acs, Z. J., Audretsch, D. B., & Lehmann, E. E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41(4), 757–774. https://doi.org/10.1007/s11187-013-9505-9

Acs, Z. J., Audretsch, D. B., Braunerhjelm, P., & Carlsson, B. (2004). The missing link: The knowledge filter and endogenous growth (discussion paper). Center for Business and Policy Studies. Stockholm

Anokhin, S., & Wincent, J. (2012). Start-up rates and innovation: A cross-country examination. Journal of International Business Studies, 43(1), 41–60. https://doi.org/10.1057/jibs.2011.47

Audretsch, D. B. (2007). Entrepreneurship capital and economic growth. Oxford Review of Economic Policy, 23(1), 63–78. https://doi.org/10.1093/oxrep/grm001

Audretsch, D. B., & Belitski, M. (2013). The missing pillar: The creativity theory of knowledge spillover entrepreneurship. Small Business Economics, 41(4), 819–836. https://doi.org/10.1007/s11187-013-9508-6

Audretsch, D. B., & Belitski, M. (2017). Entrepreneurial ecosystems in cities: Establishing the framework conditions. The Journal of Technology Transfer, 42(5), 1030–1051. https://doi.org/10.1007/s10961-016-9473-8

Audretsch, D. B., & Belitski, M. (2020). The role of R&D and knowledge spillovers in innovation and productivity. European Economic Review, 123, 103391. https://doi.org/10.1016/j.euroecorev.2020.103391

Audretsch, D. B., & Keilbach, M. (2008). Resolving the knowledge paradox: Knowledge-spillover entrepreneurship and economic growth. Research Policy, 37(10), 1697–1705. https://doi.org/10.1016/j.respol.2008.08.008

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy, 34(8), 1191–1202. https://doi.org/10.1016/j.respol.2005.03.012

Audretsch, D. B., & Vivarelli, M. (1996). Firms size and R&D spillovers: Evidence from Italy. Small Business Economics, 8(3), 249–258. https://doi.org/10.1007/BF00388651

Audretsch, D. B., Bönte, W., & Keilbach, M. (2008). Entrepreneurship capital and its impact on knowledge diffusion and economic performance. Journal of Business Venturing, 23(6), 687–698. https://doi.org/10.1016/j.jbusvent.2008.01.006

Audretsch, D. B., Heger, D., & Veith, T. (2015). Infrastructure and entrepreneurship. Small Business Economics, 44(2), 219–230. https://doi.org/10.1007/s11187-014-9600-6

Audretsch, D. B., Belitski, M., & Korosteleva, J. (2021a). Cultural diversity and knowledge in explaining entrepreneurship in European cities. Small Business Economics, 56(2), 593–611. https://doi.org/10.1007/s11187-019-00191-4

Audretsch, D. B., Lehmann, E. E., & Seitz, N. (2021b). Amenities, subcultures, and entrepreneurship. Small Business Economics, 56, 571–591.

Audretsch, D. B., & Belitski, M. (2023). Geography of knowledge collaboration and innovation in Schumpeterian firms. Regional Studies, 1–20. https://doi.org/10.1080/00343404.2023.2222137

Audretsch, D. B. (1995). Innovation and industry evolution. MIT press

Autio, E., Nambisan, S., Thomas, L. D., & Wright, M. (2018). Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 72–95.

Belitski, M., & Desai, S. (2016). What drives ICT clustering in European cities? The Journal of Technology Transfer, 41(3), 430–450. https://doi.org/10.1007/s10961-015-9422-y

Belitski, M., Korosteleva, J., & Piscitello, L. (2023). Digital affordances and entrepreneurial dynamics: New evidence from European regions. Technovation, 119, 102442.

Bennett, D. L. (2019). Infrastructure investments and entrepreneurial dynamism in the US. Journal of Business Venturing, 34(5), 105907. https://doi.org/10.1016/j.jbusvent.2018.10.005

Block, J., Sandner, P., & Spiegel, F. (2015). How do risk attitudes differ within the group of entrepreneurs? The role of motivation and procedural utility. Journal of Small Business Management, 53(1), 183–206. https://doi.org/10.1111/jsbm.12060

Boudreaux, C. J., & Nikolaev, B. (2019). Capital is not enough: Opportunity entrepreneurship and formal institutions. Small Business Economics, 53, 709–738.

Bouncken, R. B., Aslam, M. M., Gantert, T. M., & Kallmuenzer, A. (2023). New work design for knowledge creation and sustainability: An empirical study of coworking-spaces. Journal of Business Research, 154, 113337.

Brucks, M. S., & Levav, J. (2022). Virtual communication curbs creative idea generation. Nature, 605(7908), 108–112. https://doi.org/10.1038/s41586-022-04643-y

Bruhn, M., Demirguc-Kunt, A., & Singer, D. (2023). Competition and firm recovery post-COVID-19. Small Business Economics, 1–32. https://doi.org/10.1007/s11187-023-00750-w

Caiazza, R., Belitski, M., & Audretsch, D. B. (2020). From latent to emergent entrepreneurship: The knowledge spillover construction circle. The Journal of Technology Transfer, 45, 694–704. https://doi.org/10.1007/s10961-019-09719-y

Chandra, A., & Thompson, E. (2000). Does public infrastructure affect economic activity?: Evidence from the rural interstate highway system. Regional Science and Urban Economics, 30(4), 457–490. https://doi.org/10.1016/S0166-0462(00)00040-5

Chowdhury, F., Audretsch, D. B., & Belitski, M. (2019). Institutions and entrepreneurship quality. Entrepreneurship Theory and Practice, 43(1), 51–81. https://doi.org/10.1177/1042258718780431

Davidsson, P. (2015). Entrepreneurial opportunities and the entrepreneurship nexus: A re-conceptualization. Journal of Business Venturing, 30(5), 674–695. https://doi.org/10.1016/j.jbusvent.2015.01.002

De Clercq, D., Hessels, J., & Van Stel, A. (2008). Knowledge spillovers and new ventures’ export orientation. Small Business Economics, 31(3), 283–303. https://doi.org/10.1007/s11187-008-9132-z

Driven, Driven. (2021). European Small businesses find a digital safety net during Covid-19. Connected Commerce: Report.

Ejermo, O., Kander, A., & Henning, M. S. (2011). The R&D-growth paradox arises in fast-growing sectors. Research Policy, 40(5), 664–672. https://doi.org/10.1016/j.respol.2011.03.004

Enkel, E., Gassmann, O., & Chesbrough, H. (2009). Open R&D and open innovation: Exploring the phenomenon. R&D Management, 39(4), 311–316. https://doi.org/10.1111/j.1467-9310.2009.00570.x

Feldman, M. P. (2014). The character of innovative places: Entrepreneurial strategy, economic development, and prosperity. Small Business Economics, 43, 9–20.

Fotopoulos, G. (2022). knowledge spillovers, entrepreneurial ecosystems and the geography of high growth firms. Entrepreneurship Theory and Practice. https://doi.org/10.1177/10422587221111732

Ghio, N., Guerini, M., Lehmann, E. E., & Rossi-Lamastra, C. (2015). The emergence of the knowledge spillover theory of entrepreneurship. Small Business Economics, 44(1), 1–18. https://doi.org/10.1007/s11187-014-9588-y

Global Entrepreneurship Monitor (2023). Global entrepreneurship monitor data. Definitions. Retrieved from https://www.gemconsortium.org/wiki/1154. Accessed 06 Jan 2023.

González-Pernía, J. L., Jung, A., & Peña, I. (2015). Innovation-driven entrepreneurship in developing economies. Entrepreneurship & Regional Development, 27(9–10), 555–573. https://doi.org/10.1080/08985626.2015.1075602

Goswami, K., Mitchell, J. R., & Bhagavatula, S. (2018). Accelerator expertise: Understanding the intermediary role of accelerators in the development of the Bangalore entrepreneurial ecosystem. Strategic Entrepreneurship Journal, 12(1), 117–150.

Guerrero, M., & Urbano, D. (2014). Academics’ start-up intentions and knowledge filters: An individual perspective of the knowledge spillover theory of entrepreneurship. Small Business Economics, 43(1), 57–74. https://doi.org/10.1007/s11187-013-9526-4

Heger, D., Veith, T., & Rinawi, M. (2011). The effect of broadband infrastructure on entrepreneurial activities: The case of Germany. ZEW-Centre for European Economic Research Discussion Paper, (11–081). Available at SSRN: https://ssrn.com/abstract=1992957 or https://doi.org/10.2139/ssrn.1992957. Accessed 01 Jan 2023.

Hovhannisyan, N., & Keller, W. (2015). International business travel: An engine of innovation? Journal of Economic Growth, 20, 75–104. https://doi.org/10.1007/s10887-014-9107-7

Iftikhar, M. N., Justice, J. B., & Audretsch, D. B. (2022). The knowledge spillover theory of entrepreneurship: An Asian perspective. Small Business Economics, 1–26. https://doi.org/10.1007/s11187-021-00577-3

Kirschning, R., & Mrożewski, M. (2023). The role of entrepreneurial absorptive capacity for knowledge spillover entrepreneurship. Small Business Economics, 60(1), 105–120. https://doi.org/10.1007/s11187-022-00639-0

Koellinger, P. (2008). Why are some entrepreneurs more innovative than others? Small Business Economics, 31(1), 21–37. https://doi.org/10.1007/s11187-008-9107-0

Mrożewski, M., & Kratzer, J. (2017). Entrepreneurship and country-level innovation: Investigating the role of entrepreneurial opportunities. The Journal of Technology Transfer, 42(5), 1125–1142. https://doi.org/10.1007/s10961-016-9479-2

Nundy, S., Ghosh, A., Mesloub, A., Albaqawy, G. A., & Alnaim, M. M. (2021). Impact of COVID-19 pandemic on socio-economic, energy-environment and transport sector globally and sustainable development goal (SDG). Journal of Cleaner Production, 312, 127705.

Qian, H. (2017). Skills and knowledge-based entrepreneurship: Evidence from US cities. Regional Studies, 51(10), 1469–1482. https://doi.org/10.1080/00343404.2016.1213383

Qian, H. (2018). Knowledge-based regional economic development: A synthetic review of knowledge spillovers, entrepreneurship, and entrepreneurial ecosystems. Economic Development Quarterly, 32(2), 163–176. https://doi.org/10.1177/0891242418760981

Qian, H., & Acs, Z. J. (2013). An absorptive capacity theory of knowledge spillover entrepreneurship. Small Business Economics, 40(2), 185–197. https://doi.org/10.1007/s11187-011-9368-x

Schwab, K., & Sala-i-Martín, X. (2015). The global competitiveness report 2014–2015: Full data edition. World Economic Forum. Available at: https://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2014-15.pdf. Accessed 04 Jan 2023.

Stam, E. (2014). The Dutch entrepreneurial ecosystem. Available at SSRN 2473475. https://ssrn.com/abstract=2473475 or https://doi.org/10.2139/ssrn.2473475. Accessed 27 Dec 2022.

Thompson, T. A., Purdy, J. M., & Ventresca, M. J. (2018). How entrepreneurial ecosystems take form: Evidence from social impact initiatives in Seattle. Strategic Entrepreneurship Journal, 12(1), 96–116.

Tsvetkova, A., & Partridge, M. (2021). Knowledge-based service economy and firm entry: An alternative to the knowledge spillover theory of entrepreneurship. Small Business Economics, 56(2), 637–657. https://doi.org/10.1007/s11187-019-00193-2

UNESCO Institute for Statistics. (2023). UIS Statistics. https://data.uis.unesco.org/#. Accessed 01 May 2023.

Valliere, D., & Peterson, R. (2009). Entrepreneurship and economic growth: Evidence from emerging and developed countries. Entrepreneurship & Regional Development, 21(5–6), 459–480. https://doi.org/10.1080/08985620802332723

Von Briel, F., Davidsson, P., & Recker, J. (2018). Digital technologies as external enablers of new venture creation in the IT hardware sector. Entrepreneurship Theory and Practice, 42(1), 47–69. https://doi.org/10.1177/104225871773277

Welter, F., Baker, T., Audretsch, D. B., & Gartner, W. B. (2017). Everyday entrepreneurship—A call for entrepreneurship research to embrace entrepreneurial diversity. Entrepreneurship Theory and Practice, 41(3), 311–321. https://doi.org/10.1111/etap.12258

Welter, F., Baker, T., & Wirsching, K. (2019). Three waves and counting: The rising tide of contextualization in entrepreneurship research. Small Business Economics, 52(2), 319–330. https://doi.org/10.1007/s11187-018-0094-5

Woolley, J. L. (2014). The creation and configuration of infrastructure for entrepreneurship in emerging domains of activity. Entrepreneurship Theory and Practice, 38(4), 1042–2587. https://doi.org/10.1111/etap.12017

World Bank. (2022). Research and development expenditure (% of GDP). Retrieved from https://data.worldbank.org/indicator/GB.XPD.RSDV.GD.ZS

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kirschning, R., Mrożewski, M. Revisiting the knowledge spillover paradox: the impact of infrastructure. Small Bus Econ 63, 1–20 (2024). https://doi.org/10.1007/s11187-023-00833-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-023-00833-8

Keywords

- Knowledge spillover theory of entrepreneurship

- Digital infrastructure

- Physical infrastructure

- Country-level entrepreneurship