Abstract

Building on the observable trend toward increasing division of scientific labor in entrepreneurial ecosystems, we investigate the effects of different modes of implementation for external knowledge sourcing such as alliances and acquisitions. More specifically, by estimating a Poisson model based on 951 acquisitions by 209 companies from the biotechnology industry, the study analyzes two unique forms of external knowledge sourcing, namely alliances and acquisitions. In line with theoretical arguments, we find a saturating association of the exploration orientation of acquisitions with exploratory innovation output, while comprehensively controlling for prior exploratory and exploitative acquisitions and alliances, as well as other firm-level and acquisition-level determinants. We also find an inverted U-shaped association between the exploitation orientation of acquisitions and exploitative innovation output. These findings suggest that utilizing dissimilar knowledge sourced through acquisitions seems to have no inherent limitations; however, the inverted U-shaped relationship found for the exploitation orientation of acquisitions and exploitation innovation output indicates that utilizing similar knowledge has limitations and consequently an optimum level. We discuss the implications of this in the context of the knowledge spillover theory of entrepreneurship.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Innovation research reports an enduring and increasingly well-established trend of an increasing division of scientific labor in entrepreneurial ecosystems. This especially holds in the context of high-technology industries such as biotechnology (biotech) or pharmaceuticals (pharma). Biotech and pharma companies constantly build alliances or acquire other firms, especially startups, to increase their innovation output through external knowledge sourcing. Such external knowledge transfers and spillovers have been argued to positively influence innovation performance but at the same time, the question has been raised of whether this process has limits (Berchicci 2013; Hottenrott and Lopes-Bento 2016).

Sometimes, partners in different modes of implementation for external knowledge sourcing such as alliances, acquisitions, or joint ventures offer knowledge that is too similar or too different to generate innovation output (Orsi et al. 2015; Phelps 2010). Additionally, in contract-based modes, the duration of collaboration is limited, and contracts may be changed or terminated when effects on innovation performance stagnate. In contrast, equity-based modes such as acquisitions are less reversible and cannot easily be terminated. Research has shown that post-merger integration processes typically last for about 5 years and comprise actions from the identification of differences between acquirer and target firm through to the implementation of organizational change processes concerning both strategic and operational activities (Quah and Young 2005).

Equity arrangements like mergers and acquisitions are usually associated with a “controlling ownership” whereas contractual relationships like alliances are not (Yin and Shanley 2008). Accordingly, a merged entity can be beneficial for knowledge creation because compared with a mere contract-based relationship limitation like coordination or monitoring costs, the risk of knowledge disclosure and the threat of opportunistic behavior of the collaborative partners (Hottenrott and Lopes-Bento 2016) can be reduced. The literature provides a number of studies on the effect of knowledge recombination on innovation output in alliances (e.g., Rothaermel and Deeds 2004; Zhang 2016), whereas hardly any studies analyze whether the mechanisms found in contract-based relationships are also present in the case of acquisitions.

In collaborations, knowledge is recombined to generate innovation output (Wadhwa and Basu 2013). Dependent on whether unfamiliar or familiar resources are complemented, exploratory or exploitative knowledge transfers or spillovers occur. Accordingly, literature differentiates between exploratory and exploitative modes of knowledge spillover or transfer (e.g., Koza and Lewin 1998; Hill and Birkinshaw 2014). The distinction of exploration and exploitation in existing literature essentially goes back to March (1991) and Levinthal and March (1993). Exploration implies a preparedness to experiment with or engage in the search for new knowledge or information, whereas exploitation focuses on the refinement, standardization, or the enhancement of existing competencies or technologies (March 1991; Levinthal and March 1993; Lin et al. 2013). As noted above, various studies examine alliance-based relationships with respect to exploration or exploitation in the knowledge generation process (e.g., Rothaermel 2001b; Zhang 2016; Lavie and Rosenkopf 2006; Lin et al. 2007) whereas literature on equity arrangements is scarce.

Studies find equity-based arrangements for external knowledge sourcing have both positive (Ahuja and Katila 2001; Dushnitsky and Lenox 2005; Entezarkheir and Moshiri 2017; Mishra and Slotegraaf 2013) and negative (Hitt et al. 1991; Fernald et al. 2015; Van de Vrande et al. 2011) effects on innovation output. The literature also highlights different results concerning the relationship between the type of equity arrangement and the character of innovation output; for example, corporate venture capital investments are positively related to the generation of radical innovation (Van de Vrande et al. 2011), whereas joint ventures were found to have a limited effect on exploitative innovation output (Dunlap et al. 2015). Some studies show that mergers or acquisitions are positively related to radical or exploratory innovation output (Wubben et al. 2015; Wagner 2011).

In the post-merger integration phase, acquirer and target must overcome numerous challenges, such as cultural or organizational differences (Quah and Young 2005). In the case of generation of innovation output after acquisitions, this specifically concerns the combination of new or related knowledge. The literature refers to products (Stettner and Lavie 2014), patent classes (Karamanos 2012), patent citations (Chiu 2014), or the industry (Lavie and Rosenkopf 2006) to gauge differences or similarities among the knowledge bases between target and acquirer, or more generally, between collaborating partners. Nevertheless, literature also indicates contradictory assumptions about the relationship between the (dis-) similarity of knowledge transferred or spilled over between partners and innovation output (Wadhwa et al. 2016; Van de Vrande 2013). Furthermore, existing studies mainly focus on increases or reductions in innovation output but less frequently address the qualitative characteristics of such output.

Therefore, we contribute to the literature by analyzing same- and different-industry acquisitions and their impact on innovation output characteristics by addressing the following questions: When is a mode of knowledge transfer/spillover characterized as exploratory or exploitative? And is there a relationship between the characteristic of the mode of knowledge transfer/spillover and exploratory or exploitative innovation output? To anchor these research questions in the existing literature, we review prior research in the next section. Subsequently, we develop hypotheses and identify suitable data to test them. Finally, we present the results of the empirical analysis and discuss them and the implications for future research flowing from our study.

2 Literature review

Knowledge to fuel innovation may be sourced from inside an organization or from outside, as in the case of alliances and acquisitions (Stettner and Lavie 2014). Literature differentiates between predominantly exploratory or exploitative organizational modes of knowledge sourcing and transfer. Within an organization, research laboratories largely support the generation of exploratory knowledge (Hill and Birkinshaw 2014) whereas exploitative knowledge is often generated when existing knowledge is recombined in day-to-day business activities. In terms of external knowledge sourcing, some types of alliances such as R&D joint ventures can be categorized as largely aiming for the transfer of exploratory knowledge (Colombo et al. 2006); other alliance types, research contracts, licensing, or franchising instead largely focus on sourcing exploitative knowledge (Koza and Lewin 1998; Laursen et al. 2010).

When defining exploration and exploitation, the literature often specifies the parts of the value chain affected. Exploration in this respect mostly refers to research and development activities at the front end of the value chain (Zhang 2016; Rothaermel 2001a). In contrast, exploitation is linked more to marketing and sales activities at the customer end of the value chain (Lavie et al. 2011; Lin et al. 2009). Accordingly, research tends to assign exploration more to technological knowledge creation and exploitation to commercialization activities. Another definitional differentiation relates exploration to so-called upstream activities (e.g., R&D collaboration) and exploitation to downstream activities (e.g., collaboration with customers or suppliers) (Stettner and Lavie 2014; Yang et al. 2014). Yet, another stream of literature relates both exploration and exploitation to technical knowledge creation, and thus to the first part of the value chain (e.g., Nooteboom et al. 2007; Phelps 2010). The current research aligns with this last categorization method and uses a technological definition of both exploration and exploitation, based on whether new knowledge is created. The literature defines newness of knowledge in different dimensions; for example, knowledge that is “new to the world” (Blindenbach-Driessen and Van den Ende 2014), “new to the industry” (Gilsing et al. 2008), or “new to the firm” (Gilsing et al. 2008). In line with this and given our level of analysis is the acquisition by an individual firm, we define exploratory innovation output as being new to the acquirer. Consistent with this definition of newness at the firm level, we relate exploitative innovation output to the creation of knowledge that builds on existing knowledge, that is, knowledge that is not new to the firm.

Other streams of literature characterize different modes of implementation for external knowledge sourcing, spillover, or transfer as exploratory or exploitative according to their characteristics. Collaborative relationships with new partners are in this respect seen as indicative of exploration (Dittrich and Duysters 2007; Lavie and Rosenkopf 2006) and collaborations with recurrent partners as indicative of exploitation (Russo and Vurro 2010; Zhang 2016). Furthermore, collaborations with partners from different industries (Stettner and Lavie 2014) or with a focus on different technological fields (Belderbos et al. 2010; Cirillo et al. 2014; Gilsing et al. 2008) are also categorized as exploratory modes. Consequently, relationships with partners from similar or related industries (Lavie and Rosenkopf 2006; Russo and Vurro 2010) or partners with familiar technological knowledge bases (Nooteboom et al. 2007; Phelps 2010) are seen as representing exploitative modes of sourcing, spillover, or transfer.

In summary, the literature provides different ways in which to characterize modes of collaboration or their output as exploratory or exploitative, whereas there are only a few empirical studies that link the exploratory or exploitative innovation output of firms to equity-based knowledge sourcing or transfer from external partners (Schamberger et al. 2013). More specifically, we find studies investigating the relationship between exploration and/or exploitation in different collaborative modes on firm performance in general (Hill and Birkinshaw 2014; Nielsen and Gudergan 2012; Yamakawa et al. 2011) or innovation performance in particular (Rothaermel 2001a, b; Kim and Park 2013; Faems et al. 2005). We also find studies investigating factors like geographic ties, network configurations, or learning aspects as they affect exploratory or exploitative innovation output in different forms of collaboration (Ozer and Zhang 2015; Karamanos 2012; Wang and Hsu 2014). However, these studies mainly investigate non-equity-based relationships or do not differentiate between equity and contract-based relationships. Few existing studies on equity-based relationships refer to factors that influence exploratory (exploitative) activity or output (Phene et al. 2012; Lin 2014; Wagner 2011) or focus expressly on venture capital investments, rather than mergers or acquisitions in general (Titus et al. 2014; Wadhwa and Basu 2013).

Equity and non-equity-based alliances are characterized differently with respect to risk and structure and accordingly present different challenges concerning the transfer of knowledge (Delerue, 2004). Equity-based transactions follow rather hierarchical structures and are assumed to reduce the risk occasioned by opportunistic behavior (Das and Teng, 1996; Delerue, 2004). In line with those hierarchical structures, the transfer of knowledge is assumed to follow a determined line of communication. This assumption contrasts with the situation with non-equity alliances where the degree of control concerning the actions of the individual actors in a company, and even their commitment, can be rather low (Das and Teng, 1996). Consequently, the diversification of risk is greater in non-equity-based partnerships (Das and Teng, 1996). Following this argumentation, the knowledge transfer can be assumed to differ between non-equity-based and equity-based transactions. In non-equity-based transactions, there may be a lack of knowledge transferred because of the missing hierarchical structures that impose the transfer of knowledge. Furthermore, employees might hide potentially relevant knowledge because of a lack of commitment. The survival of the individual entities may not depend on the success of the contractual alliance. Compared with other equity arrangements, the success of mergers and acquisitions depends greatly on the commitment of the parties involved (Van de Vrande, 2013). Accordingly, a merged entity depends on the cooperation and knowledge transfer of employees from the previously independent entities. Such transfers are also fostered by the hierarchical structures that create an atmosphere of control in the post-merger phase. Furthermore, equity arrangements are investments where capabilities have to be formed over the long term. Accordingly, and in contrast to contract-based relationships, the long-term success of innovation depends on whether the knowledge transfer is based on a well-founded and sustainable basis. Van de Vrande (2013) therefore assumes integrated modes of operation like acquisitions are the most attractive form for technologically distant collaborative relationships.

Most studies in the literature explore the exploration–exploitation nexus exclusively from either an input or an output perspective; that is, they only determine knowledge sources or innovation outcomes to be exploration–or exploitation-oriented. Only very few studies examine the exploration–exploitation nexus from a combined input and output perspective, by considering what results from exploration–or exploitation-oriented modes of implementing external knowledge sourcing and transfer. One such is the study of Zhang et al. (2015) that scrutinizes the exploration of subsidiaries from multinational corporations and the novelty of innovation output, but however does not address equity-based modes. To fill this gap, our research specifically focuses on acquisitions as a frequent equity-based mode of external knowledge sourcing and transfer and examines the effect of exploration- versus exploitation-based external knowledge sourcing as an input on the type of innovation output (exploratory versus exploitative) subsequently generated in acquiring firms.

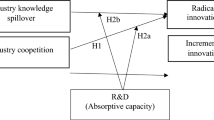

3 Hypothesis development

The current study develops its hypotheses based on the literature examining the impact of diverse or similar knowledge bases on performance (Miller 2006; Pianta and Meliciani 1996; Sampson 2007). Furthermore, we extend the conceptual basis by incorporating the absorptive capacity theory introduced by Cohen and Levinthal (1990) and its extension by Zahra and George (2002). According to Cohen and Levinthal (1990), absorptive capacity is the “ability to recognize the value of new information, assimilate it, and apply it to commercial ends.” Zahra and George (2002) differentiate between potential and realized capacity that covers the “acquisition and assimilation” of knowledge respectively the “transformation and exploitation.” Based on this theory, an organization has to have knowledge like basic skills or information on technological developments in order to utilize external knowledge (Cohen and Levinthal 1990). In a collaborative relationship, the partners screen each other to find a suitable counterpart. Zahra and George (2002) relate the identification of proper knowledge and the establishment of new relationships with the acquisition phase, which suggests prior knowledge is built prior to the relationships and thus a precondition for the generation of absorptive capacity is established. As an acquisition is a long-term partnership, the development of absorptive capacity can be assumed. In collaboration, the knowledge of the partners is combined to generate innovation output. Nesta and Saviotti (2005) find a positive relationship between the scope and the coherence of a knowledge base and innovation performance. Knowledge to be combined may be similar or dissimilar depending on the relatedness of the partners’ knowledge bases. In an acquisition, the knowledge bases of the acquirer and the acquisition target are combined. Accordingly, the acquirer’s knowledge base is expanded by that of the target (Ahuja and Katila 2001). This combined knowledge has to be interpreted and serves as basis for learning (Zahra and George 2002). Zahra and George (2002) define this as the “assimilation phase.”

Several studies identify a positive relationship between technological diversity and firm performance in general (Miller 2006; Suzuki and Kodama 2004), or innovation performance in particular (Kotabe and Swan 1995). This relationship also is supported in the case of acquisitions featuring complementary knowledge bases (Cassiman et al. 2005; Makri et al. 2010).

A combination of different knowledge bases may lead to newly recombined knowledge (Nooteboom et al. 2007). From the absorptive capacity theory view, organizations with internal research and development activities have an advantage in the absorption of external knowledge as the necessary capability is generated as a secondary product of the respective activity (Cohen and Levinthal 1990). Zahra and George (2002) find that according to prior research, there is a relationship between the absorptive capacity of an organization and its innovative output. In the transformation phase, knowledge is combined, and new opportunities are discovered (Zahra and George 2002). Afterwards, the identified opportunities are followed up, and new competencies are created in the exploitation phase (Zahra and George 2002).

Furthermore, Van de Vrande et al. (2011) find that the technological distance of alliance partners is associated with an increase in radical innovation. In line with this result, Phelps (2010) finds a positive association of technological diversity in alliances with exploratory innovation output. Zahra and George (2002) furthermore assume a positive influence of the diversity and complementarity of external knowledge and the ability of an organization to develop its potential absorptive capacity. Nooteboom et al. (2007) assume that people with different knowledge bases help and stimulate each other when they work together and especially in the case of equity-based relationships, a hierarchical communication structure should support such knowledge exchange. This positive relationship should hold as long as the difference between knowledge bases is not so large as to cause resistance in knowledge transfer (Empson 2001) or communication problems (Nooteboom et al. 2007), when opportunities for innovation will no longer be identified (Nooteboom et al. 2007). This last issue may be especially challenging in acquisitions where the structures for knowledge transfer are predetermined. Nooteboom et al. (2007) consequently assume a decreasing absorptive capacity for collaborative relationships where the partners have different knowledge bases. With regard to acquisitions, if the parties knowledge bases differ too much, integrating the knowledge can be too complex in the post-acquisition phase (Van de Vrande 2013). According to Van de Vrande (2013), monitoring costs associated with integration rise with complexity in general. Despite the risk of opportunistic behavior in equity-based partnerships being lower than in contractual relationships (Das and Teng 1996), that risk still exists and binds resources that are diverted from innovation. In scrutinizing corporate venture capital investments, Wadhwa et al. (2016) find an inverted U-shaped relationship between the diversity of investment portfolios and innovation performance. Van de Vrande (2013) consistently finds an inverted U-shaped relationship between the relative technological variance and innovation performance. Moreover, Sampson (2007) finds an inverted U-shaped relationship between technological diversity and innovation output in alliances. Finally, a study by Gilsing et al. (2008) identifies an inverted U-shaped relationship between technological distance and exploration. As exploratory acquisitions are acquisitions where diverse knowledge is combined, we assume exploratory acquisitions exert an increasing influence up to a certain degree of exploration orientation. The acquirer takes the opportunity to absorb new knowledge from the acquired entity and to use it for creating knowledge new to the organization. This may be seen as a consequence of a proper target selection process where the aim of acquisition is to gain additional knowledge. The approach permits previously unknown knowledge in particular to be used to enhance technology and product lines, and is in line with our definition of exploratory innovation output. When knowledge becomes too different, we assume exploratory innovation output declines in line with the literature. Given the focus of this research paper is on the post-acquisition phase, we suppose that the time frame is too short to handle aspects of knowledge that lead to innovation that are too different. Accordingly, we hypothesize:

H1: Exploration orientation of acquisitions has an inversely U-shaped or saturating association with exploratory innovation output.

The knowledge base of the acquisition target is new to the acquirer when it is different from its own knowledge base. In that case, the acquisition can be characterized as exploratory. The knowledge is familiar to the acquirer when the knowledge bases of both acquirer and acquisition target are similar or related. In this case, the acquisition can be characterized as exploitative (Stettner and Lavie 2014). Therefore, knowledge recombination in equity arrangements may refer to exploratory or exploitative input. In the post-acquisition phase, innovation output is created by the merged entity. The literature finds a negative effect of similar technologies and substitutes on innovation performance (Colombo and Rabbiosi 2014; Cassiman et al. 2005). Accordingly, too great similarity of knowledge bases seems to hinder innovation output. At the same time, too little similarity of knowledge may be an obstacle as is suggested by the inverted U-shaped relationship of the relatedness of knowledge with innovation performance found in extant research (Cloodt et al. 2006; Cefis et al. 2015). Nooteboom et al. (2007) assume that a certain degree of familiarity in knowledge bases fosters the mutual exchange of knowledge. Especially in acquisitions, familiarity is important for the transfer of tacit and uncodified knowledge as it creates an atmosphere of trust.

Whereas the authors state that a too great a degree of familiarity prevents innovation as absorptive capacity declines (Nooteboom et al. 2007), Datta and Roumani (2014) focused on the time required to release products and launch ideas after acquisition and found that related acquired knowledge reduces this time more than does unrelated knowledge.

In acquisitions, entities with similar knowledge bases build upon related foreknowledge when they start working together, which should facilitate communication between the entities. But organizations with similar knowledge bases may also tend toward more incremental innovation (Makri et al. 2010) as the knowledge bases of acquirer and target are too similar to push radical innovation. Accordingly, acquisitions based on related knowledge foster exploitation in the post-merger phase (Lin 2014). We assume that the acquisition of rather similar targets is intended to refine or improve products in line with the basic definitions of exploitative innovation. Orsi et al. (2015) find a positive effect for the technological similarity of the acquirer and acquisition target on the acquirer’s efficiency in using the acquired knowledge up to a certain level of similarity. Accordingly, innovation seems to be best supported if knowledge bases are not too similar. Prahbu et al. (2005) confirm this by finding that moderate levels of similarity relate to the highest innovation output from acquisitions. If knowledge bases are too similar, the knowledge bases cannot be extended, and the aim of the acquisition may be based on the extension of capacities but not on thoughts about the extension of the existing knowledge base. Following this, the innovation output is not increased when knowledge bases are too similar. In line with this, we hypothesize:

H2: Exploitation orientation of acquisitions has an inversely U-shaped or saturating association with exploitative innovation output.

4 Sample and data

We test our hypotheses using company data from the biotech industry. Research and development activities in this industry are often characterized by high costs, incalculable risks, and distant time horizons (Fernald et al. 2015). Accordingly, external knowledge sourcing is important for incumbents not only for product development but also for commercialization (Fernald et al. 2015). At the same time, the industry is characterized by a large number of entrants that typically lack the resources necessary to successfully commercialize new products on their own (Deeds and Hill 1996) but are often specialists in dedicated fields of research. Financially, startups and small firms in the biotech industry are often backed by venture capital (Lazonick and Tulum 2011). Therefore, trade sales are an important exit strategy option for investors, because, for example, initial public offerings are dependent on market conditions and are thus not always possible (Cooke 2007). These characteristics make the biotech industry a suitable context to test our hypotheses. To do so, we collected data from the Thomson SDC Mergers & Acquisitions database and identified the biotech companies included in our analysis based on Standard Industrial Classification (SIC) codes. SIC codes at the 4-digit level for the primary activities of organizations are commonly used in empirical research on biotech companies to map homogeneity or heterogeneity of activities (e.g., Hand 2007; George et al. 2001; Kim and Park 2013; Rothaermel and Thursby 2007). The first two digits of an SIC code specify the industrial sector and the last two the area of activity (United States Department of Labor 2017). For our analysis, we included companies with the following seven SIC codesFootnote 1: 2833 referring to “Medicinal chemicals and botanical products”; 2834 referring to “Pharmaceutical preparations”; 2835 referring to “In vitro and in vivo diagnostic substances”; 2836 referring to “Biological products, except diagnostic substances”; 5122 referring to “Drugs, drug proprietaries, and druggists’ sundries”; 8071 referring to “Medical laboratories”; and 8731 referring to “Commercial physical and biological research”. Our sample consists of acquiring companies that acquired rather small targets. We calculated the quotient between the deal value and the total assets of the acquirer in order to get an idea about the size relation of the deals. However, those data were available for only around half of the acquisitions reviewed. Available data show that in 95.24% of the acquisitions, this quotient is smaller than one. By implication, 4.76% of acquisitions would have a quotient between deal value and total assets of the acquirer that is greater or equal to one.

To measure knowledge flows, we linked acquisitions to patent data from the National Bureau of Economic Research (NBER) extended database, which contains US patent data from 1963 to 2006 (Hall et al. 2001; Bessen 2009). Finally, our data are complemented by alliance data from the Thomson SDC Joint Ventures & Alliances database to control the impact of prior exploratory or exploitative alliances. Combining these three data sources made it possible to include 951 acquisitions of 209 biotech companies in our analysis for the years from 1978 to 2001. Accordingly, we can capture a time horizon of 5 years after acquisition to account for post-acquisition knowledge creation with the NBER database.

5 Variables

Our dependent variables, exploratory (exploitative) innovation output, are based on the change in patent classes of the patents applied for by the acquiring company during the 5 years after acquisition, as compared with the patent pool of the 5 years before acquisition. Patent classes are a commonly used measure to map diversity of innovation activities in literature (e.g., Lerner 1994; Belderbos et al. 2010). We analyze our patent data based on the 4-digit level of the International Patent Classification System (IPC). If a patent applied for in the 5 years after acquisition is categorized in a different technology class than patents applied for in the 5 years before acquisition, that patent is classified as exploratory. When the focal patent is in the same technology class as patents applied for 5 years before acquisition, that patent is classified as an exploitative patent. We set the time horizon for comparison up to 5 years before the event in focus, the acquisition. This is an interval commonly used in the literature to categorize exploratory (exploitative) innovation output (e.g., Nooteboom et al. 2007; Karamanos 2012). We calculate the exploratory (exploitative) innovation output by summing the exploratory (exploitative) patents in the 5 years after acquisition.

For the operationalization of our independent variables, namely weighted exploration (exploitation) orientation of acquisitions, we compare the SIC codes of the acquirer and the acquisition target. When the SIC code of the acquirer is the same as that of the acquisition target, we take it to indicate an exploitation-oriented acquisition. When the SIC code of the acquiring company and the acquisition target differ, we interpret that as signaling an exploration-oriented acquisition. We use the primary SIC code as well as secondary SIC codes of the acquirer and target and look for accordance and differences. To account for their relative importance, accordance and differences in the primary SIC code are weighted doubly, whereas accordance or differences in the secondary SIC codes are weighted singly. For the weighted exploration orientation of acquisitions, we sum the weighted differences in the primary and secondary SIC codes between acquirer and target and divide them by the total number of SIC codes of the acquirer. For the weighted exploitation orientations of acquisition, we sum the weighted accordance in the primary and secondary SIC codes and divide them by the total number of SIC codes of the acquirer.

While definitionally acquisitions are somewhat closer to knowledge transfers, in our view, they represent at best imperfect transfers. This is due to the uncertainties of post-merger integration outcomes but also due to the bounded rationality of decision makers pre-acquisition, which Thaler (1994) referred to as the “winner’s curse” paradox (i.e., those companies willing to make the highest acquisition bid are most likely prone to sub-optimal information processing). Given these inherent uncertainties, acquisitions have at least some elements of knowledge spillovers. This matters particularly when these issues are related to different types of knowledge (e.g., exploratory vs. exploitative) and is consistent with the knowledge spillover theory of entrepreneurship that can help to explain heterogeneity in and development of capabilities due to acquisitions as a means to change the resource base of the firm (Agarwal et al. 2010). Therefore, acquisitions seem to be an important aspect of that theory and merit further study and analysis.

Alongside our independent variables, we added a number of control variables and time dummies to our model. We control for the home country difference between acquirer and target in order to account for internationalization effects and because a positive relationship between cross-border acquisitions and innovation performance has been found (McCarthy and Aalbers 2016). It has been suggested that this is because differences in home countries foster exploratory innovation output as knowledge bases are more different (Dunlap-Hinkler et al. 2010). Therefore, we construct a dummy variable that takes a zero value when acquirer and target are based in the same home country, and a value of one if acquirer and target have different home countries.

Because alliances can enhance the knowledge bases of cooperating partners (Steensma et al. 2012), we control for prior exploratory (exploitative) alliances in the 5 years preceding the acquisition and the year of the acquisition by comparing the SIC codes of alliance partners and the acquirer. In alliances, the cooperating partners obtain access to each other’s knowledge bases and can accumulate complementary knowledge (Jiang and Li 2009). Keil et al. (2008) suggest that learning in alliances might be expected or unexpected depending on the goal of the collaborative relationship. In so-called learning alliances, for example, knowledge is actively transferred, whereas in other forms of alliances, learning may be a by-product of collaboration (Keil et al. 2008). When the focus of the alliance fits the focus of the following acquisition, the prior alliance should strengthen the corresponding innovation output. Furthermore, prior studies have generally shown that alliances have a positive impact on innovation output (Fernald et al. 2015; Stuart 2000; Sampson 2007). Accordingly, we assume that when an acquirer has entered an alliance with a company that has the same primary SIC code (which is considered exploitative) and later acquires a target firm with the same SIC code as its own (exploitative acquisition), that action should support the exploitative character of innovation output later on. Conversely, when an acquirer enters an alliance with a company with a different primary SIC code (which is considered exploratory) and later acquires a target firm with a different SIC code than itself (exploratory acquisition), subsequent innovation output should be exploratory in character. We assume that an alliance has its greatest effect when it is in the same year as the acquisition and loses influence the more time has passed since it occurred. Accordingly, and in line with the depreciation rate of knowledge stock suggested by Hall (1990), we discount the impact of prior alliances based on the following weights relative to the year of the acquisition t: at t-1, 0.9; at t-2, 0.8; at t-3, 0.7; at t-4, 0.6; and at t-5, 0.5. Next, we calculate a prior alliance exploration (respectively: exploitation) ratio by summing all weighted exploratory (exploitative) alliances as defined above and dividing them by the total number of exploratory (exploitative) alliances.

Furthermore, we include a control variable for prior exploratory (exploitative) acquisitions in the 5 years before and within the year of the focal acquisition. To action that we compare the SIC codes of the acquirer and target firms. When the character of the acquisition is the same as the character of the focal acquisition, the prior acquisition should support the corresponding innovation output characteristics. Hence, when the acquirer purchases a target that has the same SIC code (exploitative) and the later focal acquisition is also an exploitative one, then this acquisition should support the exploitative characteristic of innovation output afterwards. In contrast, when the prior acquisition is characterized by the acquirer and target having different SIC codes (i.e., it is exploratory) and the focal acquisition also has an exploratory character, then this should support subsequent exploratory innovation output.

With regard to alliances, by analogy, we assume that a prior acquisition has the greatest effect on innovation output in the same year as the focal acquisition so that a prior acquisition loses influence the longer it is since the focal acquisition took place. Thus, we discount prior acquisitions with the following weights relative to the year of acquisition: at t-1, 0.9; at t-2, 0.8; at t-3, 0.7; at t-4, 0.6; at t-5, 0.5. Following that step, we calculate a prior acquisition exploration (exploitation) ratio by summing all weighted exploratory (exploitative) acquisitions and dividing them by the total number of exploratory (exploitative) acquisitions.

The innovation-related characteristics of a company’s ultimate parent influence the innovation output of the parent firm’s affiliates (Belderbos 2003). Therefore, we control for SIC code difference between the acquirer’s ultimate parent and the acquirer to account for different or similar knowledge bases that increase the absorptive capacity of the acquirer (Cohen and Levinthal 1990). We assume that different SIC codes foster the generation of exploratory innovation output after acquisition as the firm is used to combining different knowledge bases. While this increases absorptive capacity for exploratory innovation, having the same SIC increases absorptive capacity for exploitative innovation. Thus, we create a dummy variable that takes a value of one if the SIC code of the acquirer and its ultimate parent is different, and a value of zero otherwise.

Moreover, we control for the SIC code difference between the acquirer’s ultimate parent and the target. Since especially in knowledge-intensive sectors like the biotech industry, collaborative relationships play a considerable role in learning and technology development (Powell 1998). We therefore assume that the knowledge base of the ultimate parent enhances the knowledge base of the acquirer, and thus the absorptive capacity of the latter, in turn benefiting knowledge generation after acquisition. In this, the ultimate parent having a different SIC code from the target necessitates the recombination of different knowledge bases, and therefore fosters the creation of exploratory innovation output. Conversely, we anticipate a positive influence exerted by the acquirer’s ultimate parent and the acquisition target having the same SIC code according to exploitative innovation output. Therefore, we create a dummy variable that takes a zero value when SIC codes are the same and a value of one otherwise.

Finally, we control for the total sum of patents generated in the 5 years after acquisition to control for knowledge investments (which increase a firm’s absorptive capacity and hence its ability to receive knowledge generated by others) and size effects. Given the literature reveals contradictory results on the influence of acquisitions for the characteristics of the innovation output (Wubben et al. 2015; Dunlap et al. 2015), we assume that a general increase in the overall number of patents is positively associated with both exploratory and exploitative innovation output.

6 Model and estimation

In our model, the level of analysis is the individual acquisition. We test our hypotheses based on the following two equations:

with (see also Table 1):

- NEXIPt/t + 5:

-

Exploitative innovation output at time t to t + 5

- NEXRPt/t + 5:

-

Exploratory innovation output at time t to t + 5

- EIA2t:

-

Squared weighted exploitation orientation of acquisitions at time t

- EIAt:

-

Weighted exploitation orientation of acquisitions at time t

- ERA2t:

-

Squared weighted exploration orientation of acquisitions at time t

- ERAt:

-

Weighted exploration orientation of acquisitions at time t

- SPt/t + 5:

-

Total sum of patents generated at time t to t + 5

- HCD:

-

Home country difference between acquirer and target

- SAA:

-

SIC code difference between acquirer’s ultimate parent and acquirer

- SAT:

-

SIC code difference between acquirer’s ultimate parent and target

- FERAt/t−5:

-

Ratio of further exploratory acquisitions at time t to t − 5.

- FEIAt/t−5:

-

Ratio of further exploitative acquisitions at time t to t − 5

- FEIALt/t−5:

-

Ratio of further exploitative alliances at time t to t − 5

- FERALt/t−5:

-

Ratio of further exploratory alliances at time t to t − 5

- ε:

-

Error term

Table 1 shows the descriptive statistics and correlations of our variables. Since one variable is the complement to the other, a perfect negative correlation between the weighted exploration orientation of acquisitions and the weighted exploitation orientation of acquisition exists. For the estimations, this correlation is however not problematic because we use the variables in separate models.

To conduct the estimation, we use a Poisson model because it is appropriate for dependent count variables and can sufficiently address aspects of the variable distribution in our case (Greene 1994). Given the evidence for overdispersion, based on the Vuong test, we report results for the zero-inflated variant of the Poisson model.

7 Results

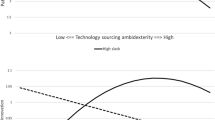

Results from the zero-inflated Poisson model estimations are shown in Tables 2, 3, 4, and 5. Hypothesis 1 predicts that exploration orientation of acquisitions has an inversely U-shaped or saturating association with exploratory innovation output. Model 1 in Table 4 shows the baseline estimations concerning this hypothesis. Model 3 shows the full specification with the linear and the quadratic term. The linear term here is positive and significant and the quadratic term is negative and significant. Accordingly, and as proposed in our hypothesis H1, an inverted U-shaped or saturating influence of exploratory acquisitions on the exploratory innovation output is therefore found in the data. We conducted further tests as proposed by Lind and Mehlum (2010) to test for the existence of an inverted U-shape and present the results in Table 6. We calculated the slope at the lower and upper bound by applying the following equation: slopelow/up = β1 + 2β2Xlow/up. The slope at the lower bound is positive but not significant (SLB = 0.41). The slope at the upper bound is also positive and not significant (SUB = 0.21). The extreme point is at Xext = − (β1/2β2) = 2.09 and thus lies out of the data range. In summary, we cannot support the assumption of an inverted U-shaped influence but a saturating effect.

Model 1 also shows the influence of control variables on the exploratory innovation output. We find positive and significant influences of the total sum of patents and the home country difference on exploratory innovation output that are consistent with our expectations. Furthermore, we find significant and positive relationships of the ratio of further exploratory acquisitions and the ratio of further exploratory alliances on exploratory innovation output in line with our assumptions. Furthermore, the ratio of further exploitative alliances and the ratio of further exploitative acquisitions both also have a positive and significant influence on exploratory innovation output. Finally, whereas the SIC code difference between the acquirer’s ultimate parent and target is significantly negatively associated with exploratory innovation output, the SIC code difference between the acquirer’s ultimate parent and acquirer is significantly positively associated with exploratory innovation output.

Turning to hypothesis 2 proposing that exploitation orientation of acquisitions has an inversely U-shaped or saturating association with exploitative innovation output, model 1 in Table 2 provides the baseline estimations. The results for the full specification in model 3 reveal the significance of the linear and the quadratic parameters with the signs as expected. Given the sign of the linear term is positive and the sign of the quadratic term is negative, the hypothesized inversely U-shaped or saturating relationship between the exploitation orientation of acquisitions and exploitative innovation output is confirmed in the data.

To test for the existence of a U-shape, we again conduct the tests proposed by Lind and Mehlum (2010) and report the results in Table 6. The slope at the lower bound is increasing and significant (SLB = 0.85***), while that at the upper bound is negative at a significant level (SUB = − 1.53***). The extreme point is positioned at 0.36 and thus is within the data range. We also verified the result using the Fieller interval. In summary, we can support our assumption of the existence of an inverted U-shape of the weighted exploitation orientation of acquisitions on exploitative innovation output.

Regarding the control variables, we find significant positive effects of the total sum of patents, the SIC code difference between acquirer’s ultimate parent and acquirer, the ratio of further exploitative acquisitions, the home country difference, and the ratio of further exploratory alliances on exploitative innovation output and thus can confirm our assumptions. As well, we find a negative and significant influence of the SIC code difference between the acquirer’s ultimate parent and target, the ratio of further exploratory acquisitions, and the ratio of further exploitative alliances on exploitative innovation output.

In order to counter the assumption that the change in exploratory/exploitative innovation output is attributable to a general change in the innovation output, we analyze the distribution of the variables exploratory innovation output, exploitative innovation output, and their means by year of acquisition. The absolute 5-year explorative innovation output by year of the acquisition is illustrated by Fig. 1. Reflecting the number of acquisitions per year, we find large mean values for explorative innovation output for acquisition years with only low absolute patent output, but find low mean values for explorative innovation output in acquisition years where the absolute patent output is relatively large. For exploitative innovation output, this effect is not apparent as this output generally is much reduced compared with the explorative innovation output.Footnote 2

8 Sensitivity analysis

We assume that prior exploratory and exploitative alliances have their greatest influence in the year of the main acquisition and thus follow an ascending weighting as described for the variable prior exploratory (exploitative) alliances (basic model). However, argumentation in the literature also points to there being learning effects from prior relationships. Consequently, some authors assume that the relationship has to be established for some time before the alliance works (Saxton 1997; Kale et al. 2001; Lui 2009). Furthermore, the literature states that previous collaboration experience causes a rise in innovation output from external linkages (Love et al. 2014). Aware of that argumentation, we conducted sensitivity analysis with different weighting schemes. The results for the sensitivity models (S-models) are shown in Tables 7 and 8 for the dependent variable exploitative innovation output and Tables 9 and 10 for the dependent variable exploratory innovation output. To prevent endogeneity, we exclude the year of the main acquisition from the weighting in sensitivity model 1 (S-model 1). Sensitivity model 2 follows the argumentation that it takes time until the collaboration works and thus follows a descending weighting (S-model 2), that means the contrary weighting scheme compared with the basic model. This weighting is also used for sensitivity analysis without considering the year of the main acquisition (S-model 3). Finally, both lines of reasoning, that is, the descending and the ascending weighting are combined as a centered weighting in sensitivity model 4 (at t-1, 0.2; at t-2, 0.6; at t-3, 1; at t-4, 0.6; at t-5, 0.2). As illustrated in Tables 7, 8, 9, and 10, the results for the main effects remain constant for all four sensitivity models in comparison with the basic model. The learning effects from prior relationships seem to be only marginal.

We integrate further sensitivity analysis to test the influence of exploitative (explorative) acquisition on the explorative (exploitative) innovation output. As both independent variables are perfectly correlated, we are not able to integrate the reverse variable as a control variable. Results presented in Table 11 show that both the linear and the quadratic term of exploitative acquisitions have a negative effect on explorative innovation output. However, explorative acquisitions show an inverted U-shaped influence on exploitative innovation output.

9 Conclusions and discussion

The current study analyzes the relationship between exploitative (exploratory) acquisitions and exploitative (exploratory) innovation output, where acquisitions are understood as one important form of opportunity-seeking behavior in the context of the knowledge spillover theory of entrepreneurship (Agarwal et al. 2010). While controlling for other important forms of such behavior, for example, in terms of alliances (which also proxy for ecosystem and network conditions as sources for interorganizational flows and spillovers of knowledge), we find support for two hypotheses derived in this context for the exploitative input–output relationship.

More specifically, we find support for our first hypothesis by establishing a saturating relationship of exploratory acquisitions and exploratory innovation output. Extant research points to a declining influence of too diverse knowledge on innovation output generation (Wadhwa et al. 2016; Van de Vrande 2013), which is confirmed by our findings. In our independent variable, we analyze acquisitions where acquirer firms have at least seven different SIC codes whereas their acquired targets are characterized by 109 different SIC codes. Accordingly, the range of combined knowledge in acquisition is very broad which contributes to extend extant literature in terms of the scope of applicability.

Concerning our second hypothesis, exploitative acquisitions are found to have an inverted U-shaped relationship with exploitative innovation output. The finding is in line with those that suggest too similar knowledge diminishes the generation of innovation output (Orsi et al. 2015). Nevertheless, exploitative acquisitions may still foster incremental output that does not lead to patents. This finding could concern knowledge that is characterized by a too low inventive step to merit patenting, or knowledge that the company did not want to pursue patent applications for because of costs, or uncertainty over whether the patent would be granted.

As mentioned above, extant literature finds differing relationships between equity-based arrangements and innovation output as compared with non-equity arrangements (e.g., Ahuja and Katila 2001; Hitt et al. 1991). Furthermore, the question of whether mergers and acquisitions generally lead to more exploratory or more exploitative innovation output is equivocal (e.g., Wubben et al. 2015; Van de Vrande et al. 2011). In conclusion, our study clarifies if and under which conditions acquisitions as an important form of external knowledge sourcing benefit exploratory or exploitative innovation output which can explain contradictory results found across past work and shows that the exploratory or exploitative character of an acquisition has a significant association with the character of corresponding innovation output. We also analyzed learning effects in our sensitivity analysis. We do not find significant changes in the main effects when applying different weighting to other relationships of the acquirer. Consequently, we can show that further relationships like explorative (exploitative) acquisitions and alliances influence the character of the innovation output; however, the learning effects do not seem to depend on the time the relationship was established in the pre-acquisition phase. We find spillover effects, but they do not change the main effect regardless of whether the collaborative partnership was established 5 years before the acquisition or in the year of the main acquisition. We additionally analyzed the effect of explorative (exploitative) acquisitions on exploitative (explorative) innovation output. We find that exploitative acquisitions counteract explorative innovation output. However, explorative acquisitions have a positive effect on exploitative innovation output up to a certain point.

Those acquisitions are not only an important tool in the market for products but also in the market for ideas and for the financial market. A trade sale is an important exit strategy, especially for investors in young entrepreneurial firms that have a scientific background (Colombo et al. 2010). We hope the results from this study can be applied to support investors in choosing a suitable acquirer.

In the market for ideas, small and young firms in particular can profit from cooperation with an established organization (Gans and Stern 2003). The incumbent may offer an opportunity to commercialize products arising from ideas and technologies (Gans and Stern 2003), and accordingly, an acquisition might not only be an exit strategy in the financial market but also offer the opportunity to compete in the market for ideas.

Furthermore, our study contributes to the literature on knowledge spillover entrepreneurship by analyzing the complementary effects of knowledge flows by means of acquisition while controlling for the effect of other modes of implementation for external knowledge sourcing, such as alliances. The current research therefore extends the knowledge spillover theory of entrepreneurship, by focusing on and allowing for acquisitions of new ventures by existing firms, with an additional mechanism beyond the possibility of existing firms creating new ventures that is highlighted in Agarwal et al. (2007).

Our findings in this respect help to clarify the current picture by showing how firms that opt to not exploit knowledge internally can in principle use a market-based mechanism such as acquisitions to enable knowledge cycling through spillovers or transfers. The finding is linked to the question of how spillovers can bring about win–win situations in a wider ecosystem, where alliances have an additional role of enabling network and ecosystem embeddedness.

While the current research employs comprehensive and novel variables accounting for parallel mechanisms of knowledge transfer and spillover to understand the whole exploratory (exploitative) input–output relationship of innovation and acquisitions, and in so doing also makes important methodological contributions to the field (for example, in terms of novel weighting schemes for prior alliances and acquisitions), some limitations and areas for future research must be acknowledged. First, data limitations meant it was impossible to comprehensively control for size and age among the focal firms. Information on total assets loses about one-third of our observations and therefore any inference on this basis must be considered far less representative and reliable. Furthermore, we find a strong correlation in the data between total assets and the sum of patents as used in our estimations. More direct re-testing of age and size effects with better data would certainly be worthwhile in future research.

Second, an extension of the analysis to performance effects would be desirable, since it has been argued that knowledge spillovers ultimately relate to firm growth (Agarwal et al. 2010). Such an extension would facilitate further analysis relating to how changes to a firm’s resource base and its capabilities through the mechanism of acquisitions (while controlling for other mechanisms for interorganizational knowledge flows and spillovers, such as alliances or joint ventures) ultimately affect firm heterogeneity at an economic outcome level. To sum up, our study, by looking at the effects of exploratory versus exploratory acquisitions on corresponding innovation outputs contributes to the knowledge spillover theory of entrepreneurship by highlighting additional channels for knowledge spillovers. It also therefore offers an empirical contribution by analyzing new data and by developing and applying comprehensive new measures that enable better control of other relevant factors when testing our hypotheses, as detailed above. In doing so, the study should ultimately foster a better understanding of how boundaries for different types of knowledge are transcended by several actors dividing scientific labor in a specific entrepreneurial ecosystem, and also in part address geographical and other distances in the context of knowledge sourcing strategies.

Notes

Descriptions of the SIC codes are taken from the "Standard Industrial Classification (SIC) System Search" website of the United States Department of Labor.

Figures showing these descriptive illustrations of the variables are available from the authors on request.

References

Agarwal, R., Audretsch, D., & Sarkar, M. B. (2007). The process of creative construction: knowledge spillovers, entrepreneurship, and economic growth. Strategic Entrepreneurship Journal, 1(3–4), 263–286.

Agarwal, R., Audretsch, D., & Sarkar, M. B. (2010). Knowledge spillovers and strategic entrepreneurship. Strategic Entrepreneurship Journal, 4(4), 271–283.

Ahuja, G., & Katila, R. (2001). Technological acquisitions and the innovation performance of acquiring firms: a longitudinal study. Strategic Management Journal, 22(3), 197–220.

Belderbos, R. (2003). Entry mode, organizational learning, and R&D in foreign affiliates: evidence from Japanese firms. Strategic Management Journal, 24(3), 235–259.

Belderbos, R., Faems, D., Leten, B., & Van Looy, B. (2010). Technological activities and their impact on the financial performance of the firm: exploitation and exploration within and between firms. Journal of Product Innovation Management, 27(6), 869–882.

Berchicci, L. (2013). Towards an open R&D system: internal R&D investment, external knowledge acquisition and innovative performance. Research Policy, 42(1), 117–127.

Bessen, J. (2009). NBER PDP project user documentation: matching patent data to Compustat firms. https://sites.google.com/site/patentdataproject/Home/downloads.

Blindenbach-Driessen, F., & Van den Ende, J. (2014). The locus of innovation: the effect of a separate innovation unit on exploration, exploitation, and ambidexterity in manufacturing and service firms. Journal of Product Innovation Management, 31(5), 1089–1105.

Cassiman, B., Colobo, M. G., Garrone, P., & Veugelers, R. (2005). The impact of M&A on the R&D process: an empirical analysis of the role of technological – and market-relatedness. Research Policy, 34(2), 195–220.

Cefis, E., Marsili, O., & Rigamonti, D. (2015). Industry relatedness and post-acquisition innovative performance: the moderating effects of acquirer’s capabilities and target size. Academy of Management Annual Meeting Proceedings, 1(1), 1–7.

Chiu, Y.-C. (2014). Balancing exploration and exploitation in supply chain portfolios. IEEE Transactions on Engineering Management, 61(1), 18–27.

Cirillo, B., Brusoni, S., & Valentini, G. (2014). The rejuvenation of inventors through corporate spinouts. Organization Science, 25(6), 1764–1784.

Cloodt, M., Hagedoorn, J., & Van Kranenburg, H. (2006). Mergers and acquisitions: their effect on the innovative performance of companies in high-tech industries. Research Policy, 35(5), 642–654.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: a new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Colombo, M. G., Grilli, L., & Piva, E. (2006). In search of complementary assets: the determinants of alliance formation of high-tech start-ups. Research Policy, 35(8), 1166–1199.

Colombo, M., Mustar, P., & Wright, M. (2010). Dynamics of science-based entrepreneurship. The Journal of Technology Transfer, 35(1), 1–15.

Colombo, M. G., & Rabbiosi, L. (2014). Technological similarity, post-acquisition R&D reorganization, and innovation performance in horizontal acquisitions. Research Policy, 43(6), 1039–1054.

Cooke, P. (2007). Growth cultures: the global bioeconomy and its bioregions. Abingdon and New York: Routledge.

Das, T. K., & Teng, B.-S. (1996). Risk types and inter-firm alliance structures. Journal of Management Studies, 33(6), 827–843.

Datta, P., & Roumani, Y. (2014). Knowledge-acquisitions and post-acquisition innovation performance: a comparative hazards model. European Journal of Information Systems, 24(2), 202–226.

Deeds, D. L., & Hill, C. W. L. (1996). Strategic alliances and the rate of new product development: an empirical study of entrepreneurial biotechnology firms. Journal of Business Venturing, 11(1), 41–55.

Delerue, H. (2004). Relational risks perceptions in European biotechnology alliances: the effect of contextual factors. European Management Journal, 22(5), 546–556.

Dittrich, K., & Duysters, G. (2007). Networking as a means to strategy change: the case of open innovation in mobile telephony. Journal of Product Innovation Management, 24(6), 510–521.

Dunlap, D., Mc Donough, E. F., III, Mudambi, R., & Swift, T. (2015). Making up is hard to do: Knowledge acquisition strategies and the nature of new product innovation. Journal of Product Innovation Management, 33(4), 472–491.

Dunlap-Hinkler, D., Kotabe, M., & Mudambi, R. (2010). A story of breakthrough versus incremental innovation: corporate entrepreneurship in the global pharmaceutical industry. Strategic Entrepreneurship Journal, 4(2), 106–127.

Dushnitsky, G., & Lenox, M. J. (2005). When do incumbents learn from entrepreneurial ventures? Corporate venture capital and investing firm innovation rates. Research Policy, 34(5), 615–639.

Empson, L. (2001). Fear of exploitation and fear of contamination: impediments to knowledge transfer in mergers between professional service firms. Human Relations, 54(7), 839–862.

Entezarkheir, M., & Moshiri, S. (2017). Mergers and innovation: Evidence from a panel of US firms. Economics of Innovation and New Technology, 1–22.

Faems, D., Van Looy, B., & Debackere, K. (2005). Interorganizational collaboration and innovation: toward a portfolio approach. Journal of Product Innovation Management, 22(3), 238–250.

Fernald, K., Pennings, E., & Claassen, E. (2015). Biotechnology commercialization strategies: risk and return in interfirm cooperation. Journal of Product Innovation Management, 32(6), 971–996.

Gans, J. S., & Stern, S. (2003). The product market and the market for “ideas”: commercialization strategies for technology entrepreneurs. Research Policy, 32(2), 333–350.

George, G., Zahra, S. A., Wheatley, K. K., & Khan, R. (2001). The effects of alliance portfolio characteristics and absorptive capacity on performance: a study of biotechnology firms. The Journal of High Technology Management Research, 12(2), 205–226.

Gilsing, V., Nooteboom, B., Vanhaverbeke, W., Duysters, G., & Van den Oord, A. (2008). Network embeddedness and the exploration of novel technologies: technological distance, betweenness centrality and density. Research Policy, 37(10), 1717–1731.

Greene, W.H. (1994). Accounting for excess zeros and sample selection in Poisson and negative binomial regression models. NYU Stern School of business/Department of Economics 94–10.

Hall, B. H. (1990). The impact of corporate restructuring on industrial research and development. Brookings Papers on Economic Activity, 3, 85–135.

Hall, B.H., Jaffe, A.B., & Trajtenberg, M. (2001). The NBER patent citations data file: lessons, insights and methodological tools. NBER working Paper 8498.

Hand, J. R. M. (2007). Determinants of the round-to-round returns to pre-IPO venture capital investments in U.S. biotechnology companies. Journal of Business Venturing, 22(1), 1–28.

Hill, S. A., & Birkinshaw, J. (2014). Ambidexterity and survival in corporate venture units. Journal of Management, 40(7), 1899–1931.

Hitt, M. A., Hoskisson, R. E., Ireland, R. D., & Harrison, J. S. (1991). Effects of acquisitions on R&D inputs and outputs. Academy of Management Journal, 34(3), 693–706.

Hottenrott, H., & Lopes-Bento, C. (2016). R&D partnerships and innovation performance: can there be too much of a good thing. Journal of Product Innovation Management, 33(6), 773–794.

Jiang, X., & Li, Y. (2009). An empirical investigation of knowledge management and innovative performance: the case of alliances. Research Policy, 38(2), 358–368.

Kale, P., Dyer, J., & Singh, H. (2001). Value creation and success in strategic alliances: alliancing skills and the role of alliance structure and systems. European Management Journal, 19(5), 463–471.

Karamanos, A. G. (2012). Leveraging micro- and macro-structures of embeddedness in alliance networks for exploratory innovation in biotechnology. R&D Management, 42(1), 71–89.

Keil, T., Maula, M., Schildt, H., & Zhara, S. A. (2008). The effect of governance modes and relatedness of external business development activities on innovative performance. Strategic Management Journal, 29(8), 895–907.

Kim, C., & Park, J.-H. (2013). Exploratory search for a high-impact innovation: the role of technological status in the global pharmaceutical industry. R&D Management, 43(4), 394–406.

Kotabe, M., & Swan, K. S. (1995). The role of strategic alliances in high-technology new product development. Strategic Management Journal, 16(8), 621–636.

Koza, M. P., & Lewin, A. Y. (1998). The co-evolution of strategic alliances. Organization Science, 9(3), 255–264.

Laursen, K., Leone, M. I., & Torrisi, S. (2010). Technological exploration through licensing: new insights from the licensee’s point of view. Industrial and Corporate Change, 19(3), 871–897.

Lavie, D., Kang, J., & Rosenkopf, L. (2011). Balance within and across domains: the performance implications of exploration and exploitation in alliances. Organization Science, 22(6), 1517–1538.

Lavie, D., & Rosenkopf, L. (2006). Balancing exploration and exploitation in alliance formation. Academy of Management Journal, 49(4), 797–818.

Lazonick, W., & Tulum, Ö. (2011). US biopharmaceutical finance and the sustainability of the biotech business model. Research Policy, 40(9), 1170–1187.

Lerner, J. (1994). The importance of patent scope: an empirical analysis. RAND Journal of Economics, 25(2), 319–333.

Levinthal, D. A., & March, J. G. (1993). The myopia of learning. Strategic Management Journal, 14(Winter), 95–112.

Lin, H.-E., Mc Donough, E. F., III, Lin, S.-J., & Lin, C. Y.-Y. (2013). Managing the exploitation/exploration paradox: the role of a learning capability and innovation ambidexterity. Journal of Product Innovation Management, 30(2), 262–278.

Lin, L.-H. (2014). Exploration and exploitation in mergers and acquisitions: an empirical study of the electronics industry in Taiwan. International Journal of Organizational Analysis, 22(1), 30–47.

Lin, Z., Yang, H., & Demirkan, I. (2007). The performance consequences of ambidexterity in strategic alliance formations: empirical investigation and computational theorizing. Management Science, 53(10), 1645–1658.

Lin, Z. J., Peng, M. W., Yang, H., & Sun, S. L. (2009). How do networks and learning drive M&As? An institutional comparison between China and the United States. Strategic Management Journal, 30(10), 1113–1132.

Lind, J. T., & Mehlum, H. (2010). With or without U? The appropriate test for a U-shaped relationship. Oxford Bulletin of Economics and Statistics, 72(1), 109–118.

Love, J. H., Roper, S., & Vahter, P. (2014). Learning from openness: the dynamics of breadth in external innovation linkages. Strategic Management Journal, 35(11), 1703–1716.

Lui, S. S. (2009). The roles of competence trust, formal contract, and time horizon in interorganizational learning. Organization Studies, 30(4), 333–353.

Makri, M., Hitt, M. A., & Lane, P. J. (2010). Complementary technologies, knowledge relatedness, and invention outcomes in high technology mergers and acquisitions. Strategic Management Journal, 31(6), 602–628.

March, J. G. (1991). Exploration and exploitation in organizational learning. Organization Science, 2, 71–87.

Mc Carthy, K. J., & Aalbers, H. L. (2016). Technological acquisitions: the impact of geography on post-acquisition innovative performance. Research Policy, 45(9), 1818–1832.

Miller, D. J. (2006). Technological diversity, related diversification, and firm performance. Strategic Management Journal, 27(7), 601–619.

Mishra, S., & Slotegraaf, R. J. (2013). Building an innovation base: exploring the role of acquisition behavior. The Journal of the Academy of Marketing Science, 41(6), 705–721.

Nesta, L., & Saviotti, P. P. (2005). Coherence of the knowledge base and the firm’s innovative performance: evidence from the U.S. pharmaceutical industry. The Journal of Industrial Economics, 53(1), 123–142.

Nielsen, B. B., & Gudergan, S. (2012). Exploration and exploitation fit and performance in international strategic alliance. International Business Review, 21(4), 558–574.

Nooteboom, B., Van Haverbeke, W., Duysters, G., Gilsing, V., & Van den Oord, A. (2007). Optimal cognitive distance and absorptive capacity. Research Policy, 36(7), 1016–1034.

Orsi, L., Ganzaroli, A., De Noni, I., & Marelli, F. (2015). Knowledge utilisation drivers in technological M&As. Technology Analysis & Strategic Management, 27(8), 877–894.

Ozer, M., & Zhang, W. (2015). The effects of geographic and network ties on exploitative and exploratory product innovation. Strategic Management Journal, 36(7), 1105–1114.

Phelps, C. C. (2010). A longitudinal study of the influence of alliance network structure and composition on firm exploratory innovation. Academy of Management Journal, 53(4), 890–913.

Phene, A., Tallman, S., & Almeida, P. (2012). When do acquisitions facilitate technological exploration and exploitation? Journal of Management, 38(3), 753–783.

Pianta, M., & Meliciani, V. (1996). Technological specialization and economic performance in OECD countries. Technology Analysis & Strategic Management, 8(2), 157–174.

Powell, W. W. (1998). Learning from collaboration: knowledge and networks in the biotechnology and pharmaceutical industries. California Management Review, 40(3), 228–240.

Prabhu, J. C., Chandy, R. K., & Ellis, M. E. (2005). The impact of acquisition on innovation: poison pill, placebo or tonic? Journal of Marketing, 69(1), 114–130.

Quah, P., & Young, S. (2005). Post-acquisition management: a phases approach for cross-border M&As. European Management Journal, 23(1), 65–75.

Rothaermel, F. T. (2001a). Incumbent’s advantage through exploitating complementary assets via interfirm cooperation. Strategic Management Journal, 22(6/7), 687–699.

Rothaermel, F. T. (2001b). Complementary assets, strategic alliances, and the incumbent's advantage: an empirical study of industry and firm effects in the biopharmaceutical industry. Research Policy, 30(8), 1235–1251.

Rothaermel, F. T., & Deeds, D. L. (2004). Exploration and exploitation alliances in biotechnology: a system of new product development. Strategic Management Journal, 25(3), 201–221.

Rothaermel, F. T., & Thursby, M. (2007). The nanotech versus the biotech revolution: sources of productivity in incumbent firm research. Research Policy, 36(6), 832–849.

Russo, A., & Vurro, C. (2010). Cross-boundary ambidexterity: balancing exploration and exploitation in the fuel cell industry. European Management Review, 7(1), 30–45.

Sampson, R. C. (2007). R&D alliances and firm performance: the impact of technological diversity and alliance organization on innovation. Academy of Management Journal, 50(2), 364–386.

Saxton, T. (1997). The effects of partner and relationship characteristics on alliance outcomes. Academy of Management Journal, 40 (2), Special research forum on alliances and networks, 443–461.

Schamberger, D. K., Cleven, N. J., & Brettel, M. (2013). Performance effects of exploratory and exploitative innovation strategies and the moderating role of external innovation partners. Industry and Innovation, 20(4), 336–356.

Steensma, H. K., Howard, M., Lyles, M., & Dhanaraj, C. (2012). The compensatory relationship between technological relatedness, social interaction, and knowledge flow between firms. Strategic Entrepreneurship Journal, 6(4), 291–306.

Stettner, U., & Lavie, D. (2014). Ambidexterity under scrutiny: exploration and exploitation via internal organization, alliances, and acquisitions. Strategic Management Journal, 35(13), 1903–1929.

Stuart, T. E. (2000). Interorganizational alliances and the performance of firms: a study of growth and innovation rates in a high-technology industry. Strategic Management Journal, 21(8), 791–811.

Suzuki, J., & Kodama, F. (2004). Technological diversity of persistent innovators in Japan: two case studies of large Japanese firms. Research Policy, 33(3), 531–549.

Thaler, R. H. (1994). The winner’s curse: paradoxes and anomalies of economic life. Princeton: Princeton University Press.

Titus, V., House, J. M., & Covin, J. G. (2014). The influence of exploration on external corporate venturing activity. Journal of Management, 43(5), 1609–1630.

United States Department of Labor (2017). Standard Industrial Classification (SIC) System Search. https://www.osha.gov/pls/imis/sicsearch.html. Accessed 24 July 2017.

Van de Vrande, V. (2013). Balancing your technology-sourcing portfolio: how sourcing mode diversity enhances innovative performance. Strategic Management Journal, 34(5), 610–621.

Van de Vrande, V., Vanhaverbeke, W., & Duysters, G. (2011). Technology in-sourcing and the creation of pioneering technologies. Journal of Product Innovation Management, 28(6), 974–987.

Wadhwa, A., & Basu, S. (2013). Exploration and resource commitments in unequal partnerships: an examination of corporate venture capital investments. Journal of Product Innovation Management, 30(5), 916–936.

Wadhwa, A., Phelps, C., & Kotha, S. (2016). Corporate venture capital portfolios and firm innovation. Journal of Business Venturing, 31(1), 95–112.

Wagner, M. (2011). To explore or to exploit? An empirical investigation of acquisition by large incumbents. Research Policy, 40(9), 1217–1225.

Wang, C.-H., & Hsu, L.-C. (2014). Building exploration and exploitation in the high-tech industry: the role of relationship learning. Technological Forecasting and Social Change, 81, 331–340.

Wubben, E. F. M., Batterink, M., Kolympiris, C., Kemp, R. G. M., & Omta, O. S. W. F. (2015). Profiting from external knowledge: the impact of different external knowledge acquisition strategies on innovation performance. International Journal of Technology Management, 69(2), 139–165.

Yamakawa, Y., Yang, H., & Lin, Z. (2011). Exploration versus exploitation in alliance portfolio: performance implications of organizational, strategic, and environmental fit. Research Policy, 40(2), 287–296.

Yang, H., Zheng, Y., & Zhao, X. (2014). Exploration or exploitation? Small firms’ alliance strategies with large firms. Strategic Management Journal, 35(l), 146–157.

Yin, X., & Shanley, M. (2008). Industry determinants of the “merger versus alliance” decision. Academy of Management Review, 33(2), 473–491.

Zahra, S. A., & George, G. (2002). Absorptive capacity: a review, reconceptualization, and extension. Academy of Management Review, 27(2), 185–203.

Zhang, F., Jiang, G., & Cantwell, J. A. (2015). Subsidiary exploration and the innovative performance of large multinational corporations. International Business Review, 24(2), 224–234.

Zhang, J. (2016). Facilitating exploration alliances in multiple dimensions: the influence of firm technological knowledge breadth. R&D Management, 46(S1), 159–173.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Lange, S., Wagner, M. The influence of exploratory versus exploitative acquisitions on innovation output in the biotechnology industry. Small Bus Econ 56, 659–680 (2021). https://doi.org/10.1007/s11187-019-00194-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-019-00194-1