Abstract

This study investigates the effects of paying bribes on access to credit for small and medium enterprises (SMEs). Bribery is variously portrayed, in the literature, as greasing the wheel (helping) or sand in the wheel (impeding) applications for credit. Studies supporting both perspectives leave the issue unresolved, encouraging further analysis, using reliable data and robust analytic methods. An examination of The World Bank Enterprise Surveys of SME data for India, using an instrumental variable probit model, provides a more definitive answer. SME bribery is detrimental to accessing credit and more so for firms that have been in business for many years and operating on a small scale. Involvement of supply and demand side forces increases the need for multiple control variables. From a supply side perspective, high corruption increases difficulties for financial institutions to control borrower risk and recover loans. Accordingly, financial institutions reduce their lending to SMEs, which mostly belong to a high-risk category. Unlike large firms, SMEs paying bribes to grease the wheel are drawn to the informal sector, avoiding attention from officials. Where SMEs pay bribes in the formal sector, it is noticed and likely to increase the probability that other parties will also demand payments. The demand side argument regards bribes as tax, increasing loan costs to SMEs. Consequently, making significant bribes decreases SMEs’ profitability. Less profitable SMEs may not obtain access to credit. From a policy perspective, anti-corruption measures, in emerging and low-income economies, are vital for developing SMEs and stimulating significant welfare gains.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper examines how corruption influences external credit access for small- and medium-sized enterprises (SMEs)Footnote 1 in India. There is a growing body of literature concerning the implications of corruption and, in particular, the significance of bribery in the business world. An economic framework, adopting the ‘grease the wheel’ or the ‘sand in the wheel’ concept, considers whether corruption increases access to finance (by greasing the wheels) or reduces access through raising the cost to the borrower (through sand in the wheel).

The quality of the institutional environment may significantly impact the development of credit market in many regards (Galli et al. 2017). As an example, the enforcement of legal rights (La Porta et al. 1997; Galli et al. 2017) and the competitiveness of the bank market (Cavalluzzo et al. 2002) play a role in the credit market, thereby affecting SMEs’ access to external credit. Although corruption is universally recognised as an important dimension of the quality of institutions, scant literature reports the effects of corruption on SMEs’ credit access. The credit market, for SMEs, provides a fertile domain for plentiful corruption. There is stringent vetting of SMEs’ applications for credit, and financial institutions face potentially greater risks in serving SMEs, creating an environment where additional motivating forces might be utilised to purchase ‘obligingness’ from a credit supplier. Additionally, particular elements and structures of the SME/bank relationship, for example large amounts of casualness, obscure lines amongst business and SME proprietors, further increasing the potential risk of corruption.

Although making informal payments (e.g. bribes) is detrimental to all types of businesses, it poses a major problem for the development of SMEs (Gbetnkom 2012; Şeker and Yang 2014). When corruption is high, financial institutions will find it harder to control borrower risk and recover loans. Unlike large firms, where SMEs pay bribes, they are drawn to the informal sector to avoid being noticed by officials. When an SME pays bribes in securing credit, it is noticed and potentially increases the number of other parties who will demand payments. In that case, financial institutions reduce their lending to SMEs, which mostly belong to a high-risk category.

There are both supply and demand side forces involved. From the supply side perspective, bank employees extracting bribes increase the risk to the credit supplier, and consequently, the cost of lending to the SME portfolio increases. Corruption can bring greater ambiguity to banks’ claims and their enforcement actions against corrupt firms in the case of loan non-payment. Therefore, this reduced enforcement power against defaulting SMEs moderates banks’ passion to lend to bribing firms (Qi and Ongena 2018). The demand side argument regards bribes as a tax that increases the cost of loans to the borrowers (Fungáčová et al. 2015), i.e. the SME and, more specifically, the SME owner. As a consequence of the need to make significant bribes, SMEs’ profitability is decreased. If bribery leads to an erosion of the efficient allocation of resources, then these bribery costs are likely to lower the profits of the SMEs. Financial institutions, as they perceive SMEs as risky because of low profitability ventures, will respond from the supply side by denying them credit. Both these arguments tend to curb the availability of external credit, which in turn increases the level of credit constraints faced by the SMEs.

The full extent of bribery is unknown but a 2004 estimate placed it at US$1000 billion per annum, or 3% of the world’s gross domestic product (GDP), of which SMEs pay a large portion (UNIDO and UNODOC 2007). For SMEs, corruption may reduce access to resources and impose informal ‘fees’ for services, depriving them of advancement opportunities. There is likely to be distorted pricing and signals through the economy. Clarity on whether growth is stymied by credit constraints resulting from corruption is essential.

This paper contributes to extant knowledge in four important ways. First, to the best of our knowledge, our paper is the first investigation of credit constraints in SMEs from the perspective of corruption, using micro-data, which are country-specific, rich and recent. We extend the current literature by measuring corruption perception, using a dummy variable, and corruption intensity with a continuous variable of firm’s credit constraint. Previous research often measures bribery as a dummy variable and fails to capture adequately the intensity of bribery. Second, we investigate the firm characteristics and owner–manager’s interactions using bribery in credit access. Firm and owner–manager characteristics can influence the impact of bribery on firms’ credit access by easing or tightening indebtedness. Thus, this study provides significant insights into the impact of bribery on SMEs in emerging economies. Third, we use an objective measure of financial constraint, which is strongly correlated with macroeconomic indicators, rather than indirect proxies. Recent studies (Gorodnichenko and Schnitzer 2013; Hansen and Rand 2014; Wellalage and Locke 2016, 2017) use self-reported measures to capture credit constraints, but such self-reporting metrics are subject to potential measurement errors. Fourth, the micro-econometric robustness of our analysis is an advance, as we deal directly with the issue that a firm’s explanatory variables are frequently related endogenouslyFootnote 2 with dependent variables. Our use of an instrumental variable approach with a two-step probit model controls for endogeneity bias, which is a recurring econometric problem in credit constraint and corruption studies. When omitted variable(s) cannot be measured, the robust remedy for controlling endogeneity is an instrumental variable regression, which is the method we follow.

Our examination of the relationship between credit constraints and corruption uses firm-level data for 7153 SMEs in India. We apply a direct approach to measuring credit-constrained firms, using specific credit questions in the World Bank Enterprise Survey (World Bank Enterprise Surveys 2014). An instrumental probit model analysis finds SMEs paying bribes are on average 68.2% more likely to be credit constrained than their counterparts that do not pay bribes. Also, a bribe intensity variable is significantly positively related with credit constraints. Specifically, when bribe intensity increases 1%, the SME’s credit constraint increases 3.4%, when all other factors are constant. This result supports the ‘sand in the wheel’ concept.

Section 2 of this paper reviews relevant research in the literature and hypotheses development. Section 3 covers a discussion of data, variables, methods and procedures used in the empirical study. Section 4 contains the results. Section 5 explains the robustness tests and Section 6 concludes this paper.

2 Literature review

2.1 Indian SMEs and institutional environment

The International Monetary Fund (IMF) classifies India as part of the Emerging and Developing Asia Group and the World Bank categorises it as a lower middle-income nation. SMEs play a significant role in India’s economic development through innovation, diversification and employment generation. An estimated 29.8 million SMEs in India (Improving Access to Finance for Women-owned Businesses in India 2014) contribute 11.5% of GDP, 45% of industrial output and 40% of exports and employ nearly 69 million people (Asian Development Bank 2015).

Corruption and access to finance are the biggest barriers to growth and development for SMEs in India (Fungáčová et al. 2015; Honorati and Mengistae 2007; Kato and Sato 2015). Despite their enormous economic contribution and the likelihood they experience the impact of bribery and corruption more acutely than larger companies, there is surprisingly little research focusing on SMEs in India. With fewer resources at their disposal than larger enterprises, SMEs are particularly vulnerable to bribery, and proportionately, more of them may be affected.

Incidences of corruption and tax evasion in India regularly attract media attention and fuel debate. The problem of non-performing loans in Indian, especially public sector, banks is indicative of the issue. When a quota is established for the minimum percentage of loans made that must go to SMEs, and also to agriculture, it is likely SME owners will want to be in the quota and potentially to be willing to pay an entry fee to get in the door. Corruption, tax evasion and crimes have resulted in an estimated US$462 billion in gross illicit assets leaving India (Kar 2011). Further, Debroy and Bhandari (2011) consider public officials in India might be consuming 1.26% of the country’s GDP through corruption. According to the International Property Rights Index (IPRI) (2015),Footnote 3 India, with a score of 5.25/10, ranks 10th in Asia and Oceania and 62nd in the world. The IPRI index value is indicative of a complicated environment for both economic freedom and the efficient operation of markets.

2.2 Hypotheses development

Corruption is a major concern in emerging economies, because it influences growth and productivity (Mauro 1995; Méon and Weill 2010; Wei 2000). Since external credit is a driving force for growth (Levine et al. 2000), it is important to ascertain whether corruption affects economic development indirectly via external credit provision for firms. Theoretically, the effect of corruption on firms’ access to credit follows two strands: positive or negative. One line of thought in the literature argues that corruption is likely to have beneficial effects in emerging economies for firms suffering from restrictive private monopolies and government practices (Voskanyan 2000). Corruption is seen as beneficial in countries with poorly functioning institutions and defective bureaucracy (Wei 2000; Weill 2011). When accessing external finance, such as bank loans, corruption allows firms to overcome bureaucratic processes and unclear or complex regulations (Agrawal and Knoeber 2001; Khwaja and Mian 2005), exemplifying the grease the wheel concept.

The alternative view (Mauro 1995; Reinikka and Svensson 2005) espouses a sand in the wheel concept where corruption in lending contributes to a reduction in a firm’s bank debt due to increasing cost to borrowers. A bribe amounts to a tax on borrowers and constitutes an obstacle to credit (Fungáčová et al. 2015). The core of the debate between grease the wheel and sand in the wheel lies in the combination of corruption with low-quality governance. Poor definition and enforcement of property rights, in the emerging economies, permits corruption to grease the wheels of access to external finance for SMEs. Ineffective legal enforcement of contracts, weak regulations and difficulty in enforcing property rights encourage private entrepreneurs to rely on informal forms of security (Ahlstrom et al. 2000) while actively seeking alternative governance structures and contractual arrangements (Peng 2001). Consequently, informal ties and relational governance tend to fill the ‘institutional void’. Research by Nguyen and Van Dijk (2012), one of the limited number of country-specific studies that drills down to the firm level, examines corruption, growth and governance in private- versus state-owned firms in Vietnam. They observe corruption impacts private enterprise more adversely than state-owned businesses. SMEs collectively lack established lobby groups and political connections, and compared to large enterprises, they may become exposed to heavy bribe requests and extortion. Bribes reduce SMEs’ investment and impact on their long-term survival (Jovanovic 2002). Also, corruption favours a particular class of people and creates inequality in opportunities when accessing bank credit and other external sources of finance (Mo 2001). Corrupt lending processes are detrimental to the development of SMEs, as they restrict their long-term credit access that in turn culminates in restricting private sector activities and slow growth for SMEs. The restriction of opportunity and productivity leads to frustration and socio-political instability where there is an inadequate formal institutional infrastructure (Khanna and Palepu 1997).

In an efficient financial system, all capital should earn very similar risk-adjusted returns. Distortions in the intermediation system, such as corruption, rent seeking and lobbying, will bias the capital-allocation process (Khwaja and Mian 2005). SMEs choose to act opaquely to mitigate the risk of governmental expropriation or to lower the costs that they may face from predatory governments forcing them to pay bribes. This complicates how firms access external financing and makes it harder to write enforceable contracts with suppliers, because of moral hazards and adverse selection problems. When the risk of expropriation is high, firms in greater need of transparency allocate capital less efficiently and grow more slowly than those that function well at minimum levels of transparency (Durnev et al. 2009). At the country level, King and Levine (1993), Levine (1998) and Beck et al. (2000) show that differences in legal origins and efficiency explain differences in financial access. The certainty of the law and the opportunity to enforce legal rights in court impact upon bank lending decisions and, thus, on the SMEs’ access to credit. However, SMEs’ ability to access external credit is affected by the limited quantity and accuracy of information available (Berger and Frame 2007; Mason and Brown 2013), which impedes the assessment of their creditworthiness and access to credit (Moro et al. 2014; Petersen and Rajan 1997). When there is an environment with a weak law enforcement system or corrupt legal system, financial institutions will find it difficult to control borrower risk and recover the loan in the event of default. As a consequence, financial institutions will be more restrictive in lending ex ante, increasing credit constraints.

Although recent research using micro-level data emphasises the relationship between corruption and access to finance, the findings are inconclusive (Fungáčová et al. 2015; Kato and Sato 2015). This may be due to a causal relationship between corruption and access to finance. On one hand, in a highly corrupt environment, bribes act as a vehicle for access to limited resources, such as bank credit, and financial institutions may allocate funds for firms who are willing to pay bribes. On the other hand, corruption fosters credit constraints, especially for small firms. This is because in a corrupt lending process, bank officials choose firms who are willing to pay bribes instead of credible SMEs. This is burdensome for SMEs relying on limited financial resources. However, it has not been established whether the relationship is causal and, if it were to be so, what the driving factors might be. Does a lack of access to formal finance encourage entrepreneurs to pay bribes to gain access to the formal finance or does corruption prevent them from accessing formal finance? While keeping in mind the causality effect we hypothesise:

H1:There is a negative relationship between paying bribes and level of credit constraints faced.

Although corruption is pervasive, most studies measure bribery as a dummy variable, which may not sufficiently capture bribe intensity (Van Vu et al. 2017; Zhou and Peng 2012). Few studies measure bribery as a continuous variable, which may be due to a lack of availability of corruption data (Chen et al. 2013; Vu and Van Le 2016). Nevertheless, it appears that offering/paying higher bribes can have an effect on credit access, with consequent costs and benefits to the firm. As an example, Chen et al. (2013), adopting a country-level study of access to bank credit, observe a positive link between a proxy for the amount of bribes the firm provides and its smooth operations, and increased access to external credit. As only well-performing firms can afford to pay bribes, “good [commercial] principles are often complied with because they are compatible with the incentives of individual bankers through the grease the wheel mechanism” (Chen et al. 2013, p. 2544). This, of course, ignores the distribution of who receives the gains and the effective pricing of risk.

The common insight is that firms in emerging markets are more likely to pay bribes to bend or overcome regulatory constraints (Harstad and Svensson 2011). The average bribe, as a percentage of annual sales (bribe intensity), may be higher for SMEs when compared to larger firms. If all firms operate in the same institutional environment, then the extent of a bribe depends on the bargaining power of firms (Francisco and Pontara 2007). In a bargaining model where the size of the bribe depends upon negotiation between the firm and a bureaucrat, Svensson (2003) suggests the firm’s bribery amount depends on its “ability to pay.” Firms with high profits, or firms expecting high profits in the near future, have weak bargaining power to resist the demand for bribe payments. Lenders wishing to extract a bribe see profitable firms as capable of paying. Clarke and Xu (2004) find that firms with relatively higher profitability can afford to pay higher bribes to get things done. Where firms have high operating costs, Rand and Tarp (2012) find bribery amounts available to ease access to finance are significantly reduced.

A visibility argument proposed by Vu and Van Le (2016) suggests a firm’s visibility affects its bribe intensity. Small firms may need to pay less to the bureaucrat to bend the rules to get credit access because their visibility is low vis à vis their larger counterparts. Nevertheless, proponents of grease the wheel claim that high bribes lead to an efficient process for allocating credit, since the most efficient firms will be able to afford to pay the highest bribes (Lui 1985). On the other hand, sand in the wheel suggests high bribe payments can contribute to a reduction in a firm’s bank debt due to increasing the cost of the loan. In these cases, a bribe amounts to a tax on SME owners and constitutes an obstacle to credit (Fungáčová et al. 2015).

The issue of whether the size of bribes enhances credit access is primarily an empirical question. It is important to determine the direction of causality. While keeping in mind the causality effect we hypothesise:

H2:There is a negative relationship between the amount of bribe offered by SMEs and credit constraints.

2.3 Moderation effect of firm characteristics and owner–manager characteristics on bribes and credit constraints

In the absence of effective economic institutions, bribes may be channels to access credit for SMEs. However, the impact of bribery on a firm’s credit access may be driven by firm-specific characteristics and owner/manager characteristics. Therefore, the variation across firms in their credit access may be explained by (i) the variation across firms in bribery payments and (ii) firm-specific characteristics and owner/manager characteristics.

SME ownership can moderate the bribe and credit access relationship. Female ownership, foreign ownership and government ownership may have a mediation effect on the bribes and credit constraints relationship. Bellucci et al. (2010) suggest the information from businesses owned by females is limited and less reliable in weak institutional environments due to information asymmetry. In this environment, an adverse selection problem works against loan applications from creditworthy female-owned SMEs. A bribe, in such instances, may act as a vehicle for obtaining access to external credit for the SME. From a financial institution’s perspective, to bend the rules for a creditworthy female-owned SME is more comfortable than allocating credit to a less creditworthy male-owned SME for the same size bribe (Wellalage and Locke 2016).

Foreign ownership may not influence access to credit in the same way as government ownership. A lax or undeveloped institutional framework that does not deter corruption is generally observed in public administration (Fungáčová et al. 2015). Consequently, government ownership may positively moderate the bribe and credit access relationship when compared to foreign ownership. Hence, having foreign ownership may weaken the relation between bribery and SMEs’ credit access.

Firm characteristics, such as firm size, firm age and firm level innovation, may also moderate the bribe and credit constraints relationship in SMEs. Additionally, we argue that large firms that have grown over the years have more political capital than young nascent firms; accordingly, firm size and age may moderate bribes and the credit access relationship. Additionally, large firms that have been around longer than the recently started firms are more likely to know the loop-holes and have learned to either avoid them or find an alternative way to deal with cumbersome situations.

Innovating SMEs experience greater difficulty accessing external finance than their large counterparts (Hutton and Lee 2012; Mason and Brown 2013; Mina et al. 2013), which is likely to be attributable to high levels of uncertainty, risk and extremely skewed profits (Scherer and Harhoff 2000). Additional opaqueness emerges where innovative firms intentionally maintain information asymmetries to avoid revealing information to competitors (Hall and Lerner 2010; Mancusi and Vezzulli 2010). According to the above arguments, we expect firm-level innovation may positively moderate the bribe and credit access relationship in SMEs.

3 Data, method and analysis

3.1 Data

Data drawn from the World Bank, 2014 Enterprise Surveys,Footnote 4 uses information from registered firms. The surveys include representative random samples of firms across the world, using the same core questionnaire and the same sampling method. The World Bank, 2014 Enterprise Surveys incorporate interviews with Indian business owners and top managers from 9281 small, medium and large enterprises from June 2013 through December 2014. After excluding large firms, there are 7800 SME observations. We also exclude private foreign individuals, company-owned or organisation-owned firms, government or state-owned firms and firm-owned firms.Footnote 5 These exclusions, following Chen et al. (2013), remove a problem where different ownership arrangements may impact the SME arrangements for access to credit. There are 7153 firm-level observations remaining.

The Enterprise Surveys collect both qualitative and quantitative information at the firm level. Details regarding each business include business location and business type, owner/manager demographics and characteristics (owner/manager gender, top manager experience), business financial information (net profit reinvestment proportion, total expenses) and information relating to firm accessibility to external financing sources. In addition, the survey provides responses to questions concerning security of property rights, reliability of legal systems and the level of corruption.

Dependent variable

Our dependent variable (Constraints) is derived from the following survey questions:

- (i)

At this time, does this establishment have an overdraft facilityFootnote 6?

- (ii)

At this time, does this establishment have a line of credit or loan from a financial institution?

From these two questions we calculate Constraints as value 1 if the firm does not have (i) an overdraft facility or (ii) a line of credit or loan from a financial institution: otherwise 0, following the taxonomy of Love and Martínez Pería (2014). However, this Constraints proxy has two limitations. First, some SMEs which do not need borrowings are coded as credit constrained. Second, SMEs may have overdraft facility or other borrowing facility, that is close to being fully utilised and the SMEs need more credit to run their operations smoothly, but are classified as not credit constrained. Nevertheless, this objective metric captures credit constrained firms in a non-subjective manner; thus, it increases the reliability of the Constraints variable. Given the limitation of the data, our objective proxy of credit Constraints is appropriate.Footnote 7

Independent variables

The main independent variables (Bribe_D and Bribe_Intensity) are derived from the following two survey questions:

- (i)

In your experience is it true that establishments are sometimes required to make gifts or informal payments to public officials to ‘get things done’ with regard to customs, taxes, licences, regulations, services, etc.?

- (ii)

On average, what percentage of total annual sales, or estimated total annual value, do establishments like this one pay in informal payments or gifts to public officials for this purpose?

In line with best practice in corruption studies, survey question (i) refers to ‘establishments like this’ to help elicit truthful responses (Billon and Gillanders 2016). However, this self-reported measure is subject to potential measurement errors, arising from business owners’ reticence in stating the correct value of bribes.

Our two metrics are:

- 1)

Bribe_D: captures paying a bribe or not, taking value 1 if the firm makes gifts or informal payments to public officials to ‘get things done’ with regard to customs, taxes, licences, regulations, services, etc.; otherwise 0.

- 2)

Bribe_Intensity: a continuous variable, indicating percentage of total annual sales forming informal payments or gifts to public officials. A calculation of the percentage of annual sales occurs where the firm provides only estimates of total annual value.

Control variables

In line with prior studies, we control for firm characteristics and firm ownership factors that may affect credit constraints. The firm characteristic variables are firm size, firm core activities, firm location, firm legal status, age, exporting ability and firm-level innovation.

Prior studies note that the firm size is an important determinant of firm credit constraints. The most frequently cited factor that exacerbates credit constraints of small firms is ‘opaqueness’ (Berger and Frame 2007; Berger and Udell 1998). Large firms with more tangible assets tend to have greater access to long-term debt (Burkart and Ellingsen 2004) compared to small firms with fewer assets to use as collateral. Similarly, young SMEs face greater difficulties in accessing external finance and incur higher costs, due largely to information asymmetry between the banks and the SMEs (Chakravarty and Xiang 2011). Using World Bank data, Chakravarty and Xiang (2011) report that older and larger firms enjoy easier access to external financing when compared to younger and smaller firms. Therefore, controlling for firm size and firm age is likely to be important to our study.

The legal form of a business can also affect the access to external finance and the capital structure decisions of SMEs (Yildirim et al. 2013). As an example, Coleman (2000) reports that incorporation is positively associated with greater use of bank financing compared to sole proprietorship. Moreover, engaging in international trade will make SMEs less vulnerable to fluctuations in domestic demand, improving the export-oriented firm’s financial stability and profitability (Yildirim et al. 2013). Therefore, export-oriented SMEs may have higher access to external financing compared to non-exporting SMEs. Hence, we include firm legal status and export status as control variables in this study.

Firms in the manufacturing industry face different environmental and economic conditions and, thus, tend to have unique variance of earnings and sales compared to other industries. Barbosa and Moraes (2004) argue that the relationship between industry classification and financial leverage is based on an assumption that industry classification is a proxy for business risk. Therefore, controlling for industry effect is important in our study. Also, firm-level innovation has a significant positive impact on external financing (Hall and Ziedonis 2001; Baum and Silverman 2004). We include firm-level innovation as a control variable.

Capital_City is a categorical variable. It is included in the model to capture the effect of the geographical location of firms. The literature suggests that firms located in capital cities vis à vis firms located in non-capital cities have easier access to markets for both inputs and outputs, reducing their marginal costs of production (Kumarasamy and Singh 2018). Availability of a superior infrastructure reduces costs and so increases capital city firms’ profitability (Elbadawi et al. 2001), leading to easier access to external finance.

In a weak institutional environment, the characteristics of a SME owner–manager play a significant role in accessing credit (N. Wellalage and Locke 2016). We control owner–manager characteristics in our analysis. Various studies show that gender of the owner–manager plays an important role in accessing credit (De Mel et al. 2009; Wellalage and Locke 2016). Prior results suggest discrimination against female entrepreneurs exists in African countries (Richardson et al. 2004; Cavalluzzo et al. 2002). Anecdotal evidence suggests various characteristics of female-owned businesses lead financial institutions to refuse credit to female-owned SMEs. These characteristics include things such as women’s entrepreneurship in smaller firms and riskier ventures (Coleman 2000), young firms (Riding and Swift 1990) and being home-based or operating in the informal sector (Dollar et al. 2005).

Nofsinger and Wang (2011) argue the experience of the owner–manager plays a crucial role in overcoming some of the problems that hinder SME access to external finance, including information asymmetry and moral hazard. From the external finance providers’ perspective, experienced owner–managers are better performers than less-experienced owner–managers. It is rational to factor experience into the process of evaluating the creditworthiness of SMEs. Therefore, we control for owner-manager characteristics to obtain a better understanding of the relationship between bribes and credit constraints.

Table 1 provides the definition and measurement of variables included in the models.

3.2 Model

This study applies a discrete choice probit model for binary choice (yes: no) responses to the credit constraints question. In the binary probit model, credit constraint is shown as 1, while access to credit is 0. The probit model is:

where p is the outcome of the dummy (0–1) variable for the kth observation, Φ is the standard cumulative normal, Xk is the vector of explanatory variables for observation k and β is the vector of coefficients to be estimated. The probit coefficients are not directly interpretable, but marginal effects for continuous variables are available as:

where Xk is a vector of independent variables (k is the number of independent variables), β is the vector of estimated coefficients and ϕ is the normal density function. For dummy variables, the discrete change in probability when the dummy variable switches from 0 to 1 is calculated as Φ(X1β) − Φ(\(\overline{x\ }\ \beta\)), where X1 = X0 = Xk except that the ith elements of X1 and X0 are set to 1 and 0, respectively.

3.3 Analysis

Empirical findings in prior research show mixed results, which may, in part, be due endogeneity, arising from measurement errors, auto-correlated error terms, simultaneous causality and omitted variables. Improved econometric methods, over time, led studies using panel data as a solution for endogeneity, e.g. the analysis by Van Vu et al. (2017) of the relationship between corruption, types of corruption and financial performance in Vietnamese SMEs. Fixed-effect models and models in differences provide efficient solutions when the unobservable characteristics are time-invariant (Wooldridge 2015).

In our sample, the firm’s unobserved characteristics may be time-varying and firm-fixed effects are insufficient to eliminate spurious relationships between corruption and credit constraints. The instrumental variable (IV) method controls for possible endogeneity and a Smith and Blundell (1986) test provides a simple check for endogeneity in limited information contexts simultaneous with limited dependent variable models. This is appropriate for considering endogeneity between the credit constraint proxy and Bribe_D and Bribe_Intensity variables. The null hypothesis of the Smith and Blundell (1986) test specifies Bribe_D and Bribe_Intensity explanatory variables. The null hypothesis specifies all explanatory variables as being exogenous to the credit constraint proxy. To avoid the pernicious effects of weak instruments,Footnote 8 the explanatory power and the exclusion restrictions of the instruments are tested. The test rejects the null hypothesis that Bribe_D and Bribe_Intensity variables are exogenous at a 1% significance level.

Valid instrumental variables need to satisfy two conditions: (i) they are uncorrelated with error term (u), and (ii) they are moderately associated with the suspect endogenous variables, once the other independent variables are controlled. Since (u) is unobservable, the most common guideline for determining whether the selected instruments are relevant in the first stage equation is the F-test for joint significance. If the F-test exceeds the value 10, then the selected instrument is accepted as relevant.

In a judiciary system, fairness and how it could affect business is an instrument for Bribe_D (Judiciary). Fernandez and Kraay (2005) and Honorati and Mengistae (2007) link corruption as a proxy for the quality institutions supporting property rights, while Cull and Xu (2005) and Johnson et al. (2000) use the judiciary system as a proxy for the quality of property rights. Accordingly, consistent with the expectation that access to finance depends on the level of judiciary system fairness, we use Judiciary as a proxy for the Bribe_D. It has a value of 1 if the SME owner strongly disagrees or tends to disagree with the statement in the World Bank survey, “that the court system is fair, impartial and uncorrupted,” otherwise it takes a value 0. The F-test for instrument relevance for our instrument variable Judiciary is 21.54, enhancing confidence that the instrument is appropriate. Although given the constraints, the Judiciary proxy addresses the endogeneity problem in relation to error terms, and reverse causality is not fully ruled out.

Following Fisman and Svensson (2007), Qi and Ongena (2018) and Wellalage et al. (2018), this study uses locality-sector average of bribery (Local_Sec_Avg_Bribe) as an instrument for Bribe_Intensity. Following the Qi and Ongena (2018) technique for each individual SME, firm bribery is averaged across all other firms within the same locality and the same sector but excludes the firm itself. Local_Sec_Avg_Bribe is exogenous to the firm and is likely determined by (i) the business mode of the sector and (ii) the rent-seeking ability of the bureaucrats, which are exogenous to the firm. So, instrumenting Bribe_Intensity by Local_Sec_Avg_Bribe can minimise omitted unobservable errors that are correlated with bribe intensity at the firm, but not the locality-sector level. The F-statistic is distant from the rejection cut-off of 10 (F-test is 28.29), enhancing confidence that the instrument set is appropriate.

On the basis of the diagnostic test values, the proposed instruments are well-specified and the econometric findings are robust. It is suitable to infer that the instrumental variable probit model (i.e., IV probit) is appropriate.

4 Results

Table 2 provides a list of the variables included in the regression analysis and their respective descriptive statistics. We find that approximately 38% of Indian SMEs are credit constrained. This is consistent with Beck and Demirguc-Kunt (2006), who in their multi-country study, state that 39% of small firms and 36% of medium-sized firms report credit accessibility as a major constraint. A minimum (0) and maximum (1), combined with a median of 0 and mean of approximately .3792, for Constraints suggests significant variability and skewness of credit constraints in our sample. The variable Bribe_D has a mean (median) of .2357 (0), indicating that approximately 24% of SMEs make informal payments to get things done in India. Bribe_Intensity shows a mean (median) value of .0007 (0). This aligns with Vu and Van Le (2016), noting low mean values for paying bribes and bribe intensity variables in Vietnamese SMEs. A plausible reason for the low values of Bribe_D and Bribe_Intensity is that smaller firms are home-based and do not need any registration or other activities that require government or other third-party authorisation. Nevertheless, the number of observations for Bribe_D and Bribe_Intensity suggest that SME owners are reluctant to provide expropriation details concerning their businesses. Only 6% of SMEs are located in the state or union territory capitals of India,Footnote 9 and 77% of SMEs belong to the manufacturing industry.

Our sample consists of approximately 43% small firms and 57% medium-sized firms. Fifty-four percent of firms are sole proprietorships and only 13% of SMEs have female owners. The mean (median) value of the firm age is 19 (16) years. The results for the variable Manager_exp show that the mean (median) value of experience is approximately 13 (10) years. However, the values for manager experience range from less than 1 to 65 years. Approximately 10% of the sample firms export sales directly or indirectly. Foreign ownership and government ownership are rare in this sample. Specifically, only .6 and .11% of the sample firms have at least 1% foreign ownership and government ownership, respectively.

The Inno variable indicates almost 56% of the sample SMEs are innovators, as they had introduced new or significantly improved products or services or methods of manufacturing products in the previous triennium. The mean value of Personal_Loan indicates that approximately 15% of SMEs have outstanding personal loans as a source of funds for the firm. These descriptive characteristics provide additional dimensions and a potential for richer analysis when examining the relationship between credit constraints and corruption in India. The non-parametric distributions of the variables are important.

The variance inflation factor (VIF), checking for the multicollinearity for all explanatory and dependent variables, is 1.62, indicating that our results are not affected by a multicollinearity issue.Footnote 10 As a robustness test, the Spearman rank correlation matrixFootnote 11 is computed and it shows a significant correlation between credit constraints and bribe proxies,Footnote 12 supporting a claim that corruption interacts with firm credit constraints in SMEs.

Table 3, panel A, presents probit estimations of credit constraints and corruption relationship considering an existence of bribes (Bribe_D). Panel B provides probit estimations of credit constraints and corruption relationship, considering bribe intensity as a continuous variable (Bribe_Intensity). A Smith and Blundell (1986) test for exogeneity suggests correlation in the unobserved covariates that determine both the corruption variables (i.e. Bribe_D and Bribe_Intensity) and credit constraints, pointing to the advantages of using IV probit and IV probit marginal effects.

The following discussion of results consider the IV probit and IV probit marginal effect. The instrument variable of Bribe_D (i.e. Weak_Judiciary) is positively correlated with SMEs’ credit constraints and are significant at the 1% level. In particular, column III in panel A reports that a Bribe_D variable change from 0 to 1 (i.e. not paying bribes to paying bribes) increases the standardised IV probit index by 4.8 standard deviations. Further, considering the marginal effect, as shown in panel A column IV, paying bribes increases the probability of SMEs’ credit constraints by approximately 68.24%. The instrument variable of Bribe_Intensity (i.e. Sec-Avg-Bribe) is positively correlated with SMEs’ credit constraints and significant at the 1% level. Column VII in panel B reports a 1% increase in Bribe Intensity results in a 2.720 standard deviation increase in the predicted probit index. Further, the marginal effect, in column VIII, indicates that a 1% increase in Bribe_ Intensity leads to a 3.43% increase in credit constraints for SMEs paying a bribe vis à vis SMEs not paying bribes. Further, the IV coefficient of paying bribes (Bribe_D) is greater than the IV coefficient of proxy for the size of the bribe (Bribe_Intensity). This indicates that the impact of the existence of a bribe is higher than the bribe intensity for SMEs in credit-constrained conditions.

These findings fit with both the supply side and the demand side arguments concerning credit constraints. The supply side argument espoused by La Porta et al. (1997) claims that in the case of default, corruption reduces law enforcement by the courts in cases of borrowers defaulting. When corruption is high, financial institutions find it harder to control borrower risk and recover loans. Therefore, financial institutions reduce their lending to SMEs, which are mostly in a high-risk category. The demand side argument regards bribes acting as a tax that increases the cost of a loan to the borrower, that is, the SME and, more specifically, the SME owner. Also, if bribery leads to an erosion of the efficient allocation of resources, then these, as bribery costs, are likely to lower SME profits. Financial institutions, as they perceive SMEs as risky because of low profitability ventures, will deny them credit.

Our results reject both hypothesis 1 (H1:There is a negative relationship between paying bribes and level of credit constraints faced) and hypothesis 2 (H2:There is a negative relationship between the amount of bribe offered by SMEs and credit constraints). Corruption imposes an additional barrier for SMEs in India when accessing external finance, which is consistent with the sand in the wheel concept.

Table 3 presents a summary of the effect of interactive variables and control variables on credit constraints. Panels A and B indicate that the mean credit constraint for small firms (Small) is higher than for medium-sized firms. Panel A and panel B results align with Beck and Demirguc-Kunt (2006) and Schiffer and Weder (2001), who find that small firms face greater constraints than medium and large counterparts. It may be that in emerging markets moral hazard problems are so rampant that smaller firms cannot persuade external finance providers to finance them (Wellalage and Locke 2017). Further, greater opacity is associated with greater constraints on small firms. Although the interactive variable Bribe_D × Small indicates that bribe-paying small firms experience slightly less credit constraints than non-bribe-paying small firms, when measuring bribes as a continuous variable, the interactive variable Bribe Intensity × Small reveals that the credit constraints of the bribe-paying small firms is higher than for non-bribe-paying small firms. For firms, a bribe is an additional payment to government, analogous to a tax, suggesting these bribery costs are likely to lower profits of SMEs. Financial institutions, as they perceive small firms as risky because of low profitability ventures, will deny them credit.

Table 3 panels A and B indicate that the mean credit constraint for female-owned SMEs is lower than that for male-owned SMEs. This may be due to preferential treatment of female entrepreneurs in India’s micro-credit markets (Wellalage and Locke 2017) where female owners have greater access to external financing. The interactive variable Bribe_D × Female in panel A demonstrates that the mean credit constraint of bribe-paying female-owned SMEs is approximately 9% lower than for non-bribe-paying female-owned firms (Sum of coefficients of Bribe_D × Female β − .0826 and Female β − .0061).

The one possible reason is that mainly female-owned businesses are concentrated in industry sectors where firms are smaller in size and in which cash sales predominate (Wilson and Tagg 2010), in contrast to growth-oriented male-owned SMEs that reinvested their profit. In such a scenario, the female-owned businesses appear to have higher discretionary cash flow and balances. Lenders prefer to offer credit for higher profit margin SMEs when evaluating the borrowers’ riskiness. In this situation, bribes may work as greasing the wheels for high profit margin female-owned SMEs to eliminate bureaucratic red tape.

It is also noted that women typically try to access smaller amounts of funding because the so-called feminine occupations are less capital intensive (D’espallier et al. 2011). The perception of higher risk amongst loan officers causes them to prefer smaller-sized loans (Muravyev et al. 2009). The perception of risk increasing with the size of the loan may encourage approval of small loans. However, the higher administrative cost of approving multiple small loans will result in smaller returns to the lender. In this situation, bribes may work as greasing the wheels for high profit margin female-owned SMEs to eliminate bureaucratic red tape.

Panel A column IV indicates that innovative SMEs are less credit constrained than non-innovative SMEs, which is consistent with government intervention becoming a common practice to support innovative SMEs in India over recent years. It may be that innovation signals the quality of firm activities, embodying evidence that the firm is well-managed, leading to an increase in lenders’ confidence about the prospective borrower and easing access to credit. Additionally, innovation may suggest that the firm is associated with having clever people. Therefore, lending to people perceived as clever is less risky than lending to non-innovative firms. Hall and Ziedonis (2001), discussing the US semi-conductor industry, observe that patent rights have a significant positive impact in attracting venture capital funding. Baum and Silverman (2004) record similar evidence. This may be that a patent indicates future cash flows. Nevertheless, when innovative SMEs pay a bribe, they have a further reduction in credit constraints. The bribe increases the ease of access as it greases the wheel in obtaining external finance.

There is a location effect, with SMEs in a capital city facing higher credit constraints than SMEs in other locations. In particular, the marginal effect indicates that firms from a capital city face approximately 16.51% (panel A using Bribe_D variable) and 2.88% (panel B using Bribe_Intensity variable) higher credit constraints vis à vis SMEs from other locations. In high firm density settings, whereby financial institutions may be more sophisticated in filtering applications and deemed high risk, SMEs are not succeeding in obtaining external financing. On the other hand, most firms in metropolitan cities trying to expand to survive could be already highly geared.

There is an industry effect, with manufacturing firms facing more credit constraints than firms from other sectors. This is consistent with the view that indicates industry as a proxy of risk. Panel A shows the manufacturing industry firms are faced with 9.43% higher credit constraints than those in the non-manufacturing sectors. It is plausible the banks tend to show a bias towards certain industries (Rajan and Zingales 1998) and the manufacturing sector incurs higher up-front costs and has higher fixed costs, greater operating leverage and generally higher financial leverage, which may make for a higher risk profile.

A statistically significant negative correlation exists between top managers’ experience and credit constraints (panel A lntop_exp coefficient is − .0356 and panel B lntop_exp coefficient is − .0186). This is similar to the results from a South Asian SMEs study by Wellalage and Locke (2017). We find greater manager experience assists in reducing SME credit constraints.

Exporting SMEs are less credit constrained than non-exporting SMEs. Panel A reports that export firms are approximately 11.47% less credit constrained than non-exporters (see panel A), when measuring the existence of bribes as a dummy variable. Further, panel B shows exporters are 21.20% less credit constrained than non-exporting SMEs, when measuring bribes as a continuous variable. Firms that are more productive are more likely to export and earn higher profits (Manova 2012) and financial institutions are more favourably disposed to offering credit to export firms. Also, government incentives to build an export economy strengthen that the signalling position of exporting SMEs is important.

Sole proprietors are more likely to face higher credit constraints than non-sole proprietor and SME proprietors. Panel A shows that sole proprietors are approximately 10.89% more credit constrained than their multi-owner SME counterparts when measuring existence of bribes as a dummy variable. Panel B reports that sole proprietors are approximately 1.20% more credit constrained than their multi-owner counterparts when measuring bribe as a continuous variable. Further, our study indicates that when SME owners have outstanding personal loans used in their businesses, they face fewer credit constraints than those without outstanding personal loans. When bribes are measured as a dummy variable, the marginal effects indicate that SMEs with personal loans face approximately 19.18% lower credit constraint (panel A column III) and 4.07% lower credit constraint compared to SMEs without personal loans in the business enterprise. The line between business and personal lives of SME owners is often blurred. Therefore, SME owners having outstanding personal loans can indicate their creditworthiness, which could positively affect credit access.

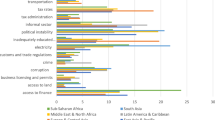

Figure 1 presents the marginal effect plots for the interaction term with bribery (Bribe_D).Footnote 13 These plots demonstrate important differences between SMEs paying and not paying bribes.

Figure 1a plots the relationship between firm size (small firm or not) and firm-level credit constraints. Small-sized firms face higher credit constraints than medium-sized firms regardless of whether or not they pay bribes. Figure 1 shows that as firm size decreases from medium to small, credit constraints increase. Small firms paying bribes are less credit constrained than small firms not paying bribes. However, within the medium-sized firm category, those firms paying bribes are slightly more credit constrained than those not paying bribes.

Figure 1b plots the relationship between the owner’s gender and firm-level credit constraints. Male-owned SMEs are more highly credit constrained than female-owned SMEs, whether or not they pay bribes. Paying bribes has significantly greater impact on female-owned SMEs’ level of credit constraints than on male-owned SMEs. When female-owned SMEs pay bribes, they have lower credit constraints compared to female-owned SMEs that not pay bribes.

Figure 1c plots the relationship between firm-level innovation and firm-level credit constraints. Regardless of paying bribes or not, innovative SMEs have less credit constraints than non-innovative firms, and innovative SMEs paying bribes are less credit constrained than innovative SMEs not paying bribes.

Figure 1d plots the relationship between foreign ownership (at least 1% foreign ownership) and firm-level credit constraints, showing that non-foreign-owned firms are always more highly credit constrained than SMEs with some foreign ownership. When non-foreign-owned firms pay bribes, they are slightly less credit constrained than non-foreign firms not paying bribes. However, when foreign-owned SMEs pay bribes, they are more credit constrained than foreign-owned SMEs not paying bribes.

Figure 1e plots the relationship between government ownership (at least 1% government ownership) and firm-level credit constraints. It shows that regardless of government ownership, bribe-paying firms face slightly more credit constraints than non-bribe-paying firms.

Figure 1f plots the relationship between firm age (age as a continuous variable) and firm-level credit constraints. For newer firms, there is virtually no relationship between credit constraint and bribes. As firm age increases, those SMEs paying bribes face considerably lower credit constraints.

The expected moderating influence expected, from the discussion of control variables in Section 2.3 above, is not strong. As reflected in Table 3 many of the variables are statistically significant but not all have negative signs. Robustness checking is necessary.

5 Robustness

To assess the robustness of our findings, two tests were performed.Footnote 14 First, we checked whether our results hold when different proxies for credit constraints are used. Credit constraints can occur due to difficulties in accessing external credit or high costs associated with external credit.

- (i)

Following Gorodnichenko and Schnitzer (2013), we re-analysed our study sample using costs of external finance as proxy for credit constraints.

The World Bank Enterprises Surveys measure the cost of external financing on a scale ranging from 1 (“No obstacle”) to 4 (“Very Severe obstacle”). We found that results are substantially the same as for the main dependent variable (Constraints), so overall interpretation of the results does not alter.

- (ii)

Following Wellalage et al. (2018), we re-analysed our study sample using difficulties in accessing external finance as proxy for credit constraints.

This study develops a Constraints variable as follows: when an SME (1) applies for and is denied credit (applicant), or (2) does not apply for credit because application procedures are too complex, or collateral requirements are too high/does not have guarantor or the size of loan and maturity is insufficient or interest rate is too high (non-applicant) (Table 4).

In a second set of robustness testing, we re-estimated the regression results using logit and IV logit regression techniques. Although coefficients changed slightly, the overall interpretation of the results are similar to the baseline results.

6 Conclusion

This paper explores the relationship between corruption and access to credit for SMEs in India. Micro-econometric modelling provides a robust framework of analysis as it recognises and minimises the endogeneity of corruption in credit constraints and reverses causality issues. The sand in the wheel concept aligns with the evidence indicating that paying bribes and bribe intensity increase credit constraints for SMEs when endogeneity is controlled, using instrumental variables.

We ascertain that approximately 38% of Indian SMEs are credit constrained. However, only approximately 24% of SMEs make informal payments to get things done in India. Our results reject our hypotheses that ‘there is a negative correlation between bribes and level of credit constraints faced’ and that ‘the amount of bribe offered by SMEs is negatively correlated with the level of credit constraints with which they are confronted.’ Specifically, our findings from our Indian SMEs’ firm-level data indicate that:

SMEs paying bribes are, on average, 68.2% more likely to be credit constrained than their counterparts that do not pay bribes.

Bribe intensity increases the probability of SMEs’ credit constraints by approximately 3.4%.

The impact of the existence of a bribe is higher than the bribe intensity for SMEs (in credit constraints).

Overall, we find that corruption imposes an additional barrier for SMEs in India when accessing external finance and endorses the sand in the wheel concept. We also find that to access credit, it is advantageous for the SME to be innovative, with experienced managers, who have taken a personal loan.

SMEs may not always be able to avoid paying bribes or other unofficial payments, because refusing to engage in corrupt practices jeopardises the survival of the enterprise. In general, bribe payments avoid ideological discrimination for SMEs and indicate that bribes become a tax on SME borrowers and so are obstacles to gaining credit. We recommend bribe payments be analysed in ways that provide for useful policy implications. Extending this research to other countries in South Asia that are recipients of funding from the World Bank, Asian Development Bank and other agencies will be particularly helpful and important for policy making in those countries.

Our analysis suggests enhanced SME access to finance relies mainly on the development of the governance mechanisms such as those that provide a strengthened legal environment. For an SME choosing to operate in the formal sector, consistency with controls at national, state/territory and local levels may result in lengthy postponements that add to costs. Such expenses may be relatively higher than those borne by large enterprises. As an example, the introduction of GST in India by the central Government from 1 July 2017, to replace multiple State and local taxes and charges, may serve to reduce red tape: it may also promote the informal economy as SMEs prefer to stay under the radar.

In such scenarios, SMEs may employ less savoury commercial expediencies to accelerate progress and reduce the cost of delays. Hence, a fundamental issue to address is the enactment of regulations that strengthen property rights and foster improvements in the development of SMEs in India. Policymakers, through improving the quality of the judiciary and implementing policies that lead to reduction in corruption levels, are likely to achieve the largest gains in national productivity. Our research indicates that anti-corruption measures are vital for the development of SMEs in India.

The delimitation between legitimate and degenerate practice is not simple to characterise, and SMEs generally may not have the ability to recognise or delineate the subtleties and nuances of appropriateness in transactions. For example, giving endowments, keeping in mind the end goal is to maintain great business connections, is a common practice and permitted, while offerings to influence choice are entirely taboo. There are numerous hazy areas, and the mix of customary practice, varying between regions, makes for a murky picture. Acceptance that it is not clear-cut as to what are legitimate and what are illicit practices points to the need for a clearly articulated set of principles and more development of public officials.

Further, our results indicate that the implementation of successful anti-corruption programmes will produce beneficial outcomes. Agency costs are high, from the perspective of national development, where officials rent-seek through their office. Monitoring costs are high when there is a substantial cash economy and laundering rents is a simple matter of course. Bonding options require a civil service salary which is recognised as reasonable, and this in many emerging and low-income economies may only be achievable with fewer civil servants.

Our study has limitations, some of which may be fruitful avenues for future research. The possibility of extending the research to other countries is important for policy making in countries that are recipients of SME development funding from funding agencies. The time period for this analysis relates to 2013–2014 for 7153 SMEs. However, this 1-year slice of data offers the opportunity only for cross-sectional analysis of the latest available data. The analysis and findings suggest potential advice for policymakers based on the extant situation. Future research may be able to use time-series data, should it become available, allowing analyses of bribery impact on credit access for SMEs during pre-crisis and post-crisis periods, and could shed light on changes if any, in credit access behaviours.

Notes

The Enterprise Surveys undertaken by the World Bank in 2014 (www.enterprisesurveys.org) categorise Indian firms having up to 99 employees as SMEs, and that is the definition used in this study. Firms with 5 to 19 employees are categorised as small firms, and those with 20 to 99 employees are defined as medium-sized.

An endogeneity problem occurs when an explanatory variable is correlated with the error term (Wooldridge 2002). Endogeneity can arise from the following sources: unobservable heterogeneity, simultaneity, omitted variable biases and reverse causality.

The IPRI is an annual comparative study that aims to quantify the strength of property rights—both physical and intellectual—and to rank countries accordingly. The IPRI scores and ranks each country based on ten factors reflecting the state of its legal and political environment, physical property rights and intellectual property rights. The higher the score of IPRI, the higher the strength of property rights. Finland received the highest score of 8.3/10.

The World Bank’s Enterprise Surveys offer an expansive array of economic data on 130,000 firms in 135 countries. The World Bank Enterprise Survey website provides details as to how the surveys are conducted (http://www.enterprisesurveys.org). An Enterprise survey is a firm-level survey of a representative sample of an economy’s private sector. The surveys cover a broad range of business environment topics including access to finance, corruption, infrastructure, crime, competition and performance measures.

Creating a dichotomous variable for private foreign individuals, company- or organisation-owned firms, government or state-owned firms and other firm-owned firms groups (denoted as group 1) and other firms (denoted as group 2), we check the credit accessibility differences using ANOVA, which confirms that different ownership forms do not exhibit the same impact on credit accessibility. Hence, we have excluded group 1.

Overdraft facility is a short-term credit agreement with the bank. This facilitates an account holder to use or withdraw more than they have in their account, without exceeding a specified maximum amount. An overdraft facility can be offered on a secured (assets are pledged as security) or unsecured (no assets are pledged as security) basis.

In Section 5—Robustness, we used alternative proxies of credit constraints and report the robustness of results.

The smaller the correlation between the instrument and the endogenous variable, the larger the standard errors of the instrumental variable estimator will be. Furthermore, low correlation between the instrument and the endogenous variable can drive towards asymptotic-biased estimators (Wooldridge 2002).

India consists of 29 states and 7 union territories. The National Capital Territory of Delhi is the administrative capital territory of India and Mumbai is the financial, commercial and entertainment capital of India.

Gujarati and Porter (2003) suggest that there is no evidence of multicollinearity if the VIF (variance inflation factor) value is below the critical level of 10.

If both variables are dichotomous, Pearson correlation = Spearman correlation = Kendall’s tau. Most of our model variables are dichotomous.

The results are not reported to save space but are available from the authors upon request.

Due to the low number of observations, some interactions variables with Bribe_Intensity are dropped. Therefore, we only have plots for the interaction terms of the variables with Bribe_D.

Second robustness test results are not reported in order to save space and are available from the authors upon request.

References

Agrawal, A., & Knoeber, C. R. (2001). Do some outside directors play a political role? The Journal of Law and Economics, 44(1), 179–198. https://doi.org/10.1086/320271.

Ahlstrom, D., Bruton, G. D., & Lui, S. S. (2000). Navigating China’s changing economy: strategies for private firms. Business Horizons, 43(1), 5–5. https://doi.org/10.1016/S0007-6813(00)87382-6.

Asian Development Bank. (2015). Report and recommendation of the President to the Board of Directors. Project Number: 49207-001.

Barbosa, E. G., & Moraes, C. D. C. (2004). Determinants of the firm’s capital structure: the case of the very small enterprises. Economics Working Paper Archive at WUSTL, Finance, 302001.

Baum, J. A., & Silverman, B. S. (2004). Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. Journal of Business Venturing, 19(3), 411–436. https://doi.org/10.1016/S0883-9026(03)00038-7.

Beck, T., & Demirguc-Kunt, A. (2006). Small and medium-size enterprises: access to finance as a growth constraint. Journal of Banking & Finance, 30(11), 2931–2943. https://doi.org/10.1016/j.jbankfin.2006.05.009.

Beck, T., Levine, R., & Loayza, N. (2000). Finance and the sources of growth. Journal of Financial Economics, 58(1–2), 261–300. https://doi.org/10.1016/S0304-405X(00)00072-6.

Bellucci, A., Borisov, A., & Zazzaro, A. (2010). Does gender matter in bank–firm relationships? Evidence from small business lending. Journal of Banking & Finance, 34(12), 2968–2984.

Berger, A. N., & Frame, W. S. (2007). Small business credit scoring and credit availability. Journal of Small Business Management, 45(1), 5–22. https://doi.org/10.1111/j.1540-627X.2007.00195.x.

Berger, A. N., & Udell, G. F. (1998). The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance, 22(6–8), 613–673.

Billon, S., & Gillanders, R. (2016). State ownership and corruption. International Tax and Public Finance, 23(6), 1074–1092. https://doi.org/10.1007/s10797-015-9390-z.

Burkart, M., & Ellingsen, T. (2004). In-kind finance: a theory of trade credit. American Economic Review, 94(3), 569–590.

Cavalluzzo, K. S., Cavalluzzo, L. C., & Wolken, J. D. (2002). Competition, small business financing, and discrimination: evidence from a new survey. The Journal of Business, 75(4), 641–679. https://doi.org/10.1086/341638.

Chakravarty, S., & Xiang, M. (2011). Determinants of profit reinvestment by small businesses in emerging economies. Financial Management, 40(3), 553–590.

Chen, Y., Liu, M., & Su, J. (2013). Greasing the wheels of bank lending: evidence from private firms in China. Journal of Banking & Finance, 37(7), 2533–2545. https://doi.org/10.1016/j.jbankfin.2013.02.002.

Clarke, G. R., & Xu, L. C. (2004). Privatization, competition, and corruption: how characteristics of bribe takers and payers affect bribes to utilities. Journal of Public Economics, 88(9–10), 2067–2097. https://doi.org/10.1016/j.jpubeco.2003.07.002.

Coleman, S. (2000). Access to capital and terms of credit: a comparison of men- and women-owned small businesses. Journal of Small Business Management, 38(3), 37–52.

Cull, R., & Xu, L. C. (2005). Institutions, ownership, and finance: the determinants of profit reinvestment among Chinese firms. Journal of Financial Economics, 77(1), 117–146. https://doi.org/10.1016/j.jfineco.2004.05.010.

D’espallier, B., Guérin, I., & Mersland, R. (2011). Women and repayment in microfinance: a global analysis. World Development, 39(5), 758–772.

De Mel, S., McKenzie, D., & Woodruff, C. (2009). Are women more credit constrained? Experimental evidence on gender and microenterprise returns. American Economic Journal: Applied Economics, 1(3), 1–32. https://doi.org/10.1257/app.1.3.1.

Debroy, B., & Bhandari, L. (2011). Corruption in India – The DNA and the RNA. New Delhi: Konark Publishers Pvt. Ltd.

Dollar, D., Hallward-Driemeier, M., & Mengistae, T. (2005). Investment climate and firm performance in developing economies. Economic Development and Cultural Change, 54(1), 1–31. https://doi.org/10.1086/431262.

Durnev, A., Errunza, V., & Molchanov, A. (2009). Property rights protection, corporate transparency, and growth. Journal of International Business Studies, 40(9), 1533–1562. https://doi.org/10.1057/jibs.2009.58.

Elbadawi, I., Mengistae, T., & Zeufack, A. (2001). Geography, supplier access, foreign market potential, and manufacturing exports in Africa: an analysis of firm level data. The CSAE and UNIDO conference, 2001. Oxford.

Fernandez, A. M., & Kraay, A. (2005). Property rights institutions, contracting institutions, and growth in South Asia: macro and micro evidence. The World Bank. Background paper prepared for the SAARC Business Leaders’ Conclave: South Asia Regional Integration and Growth, New Delhi, November, 17–18.

Fisman, R., & Svensson, J. (2007). Are corruption and taxation really harmful to growth? Firm level evidence. Journal of Development Economics, 83(1), 63–75. https://doi.org/10.1016/j.jdeveco.2005.09.009.

Francisco, M., & Pontara, N. (2007). Does corruption impact on firm’s ability to conduct business in Mauritania? Policy Research working paper ; no. WPS 4439. http://documents.worldbank.org/curated/en/972721468051561393/Does-corruption-impact-on-firms-ability-to-conduct-business-in-Mauritania-evidence-from-investment-climate-survey-data. Accessed 16 Mar 2018.

Fungáčová, Z., Kochanova, A., & Weill, L. (2015). Does money buy credit? Firm-level evidence on bribery and bank debt. World Development, 68, 308–322. https://doi.org/10.1016/j.worlddev.2014.12.009.

Galli, E., Mascia, D. V., & Rossi, S. P. S. (2017). Does corruption affect access to bank credit for micro and small business? Evidence from European MSMES? ADBI Working Paper Series, 23. https://www.adb.org/sites/default/files/publication/327581/adbi-wp756.pdf.Accessed 8 Apr 2018.

Gbetnkom, D. (2012). Corruption and small and medium-sized enterprise growth in Cameroon.

Gorodnichenko, Y., & Schnitzer, M. (2013). Financial constraints and innovation: why poor countries don’t catch up. Journal of the European Economic Association, 11(5), 1115–1152. https://doi.org/10.1111/jeea.12033.

Gujarati, D., & Porter, D. (2003). Basic econometrics (5th Edition, Vol. 363). New York, NY: McGrawHill.

Hall, B. H., & Lerner, J. (2010). The financing of R&D and innovation. Handbook of the Economics of Innovation, 1, 609–639.

Hall, B. H., & Ziedonis, R. H. (2001). The patent paradox revisited: an empirical study of patenting in the US semiconductor industry, 1979–1995. RAND Journal of Economics, 32(1), 101–128. http://www.jstor.org/stable/2696400. Accessed 13 Oct 2017.

Hansen, H., & Rand, J. (2014). The myth of female credit discrimination in African manufacturing. Journal of Development Studies, 50(1), 81–96. https://doi.org/10.1080/00220388.2013.849337.

Harstad, B., & Svensson, J. (2011). Bribes, lobbying, and development. American Political Science Review, 105(1), 46–63. https://doi.org/10.1017/S0003055410000523.

Honorati, M., & Mengistae, T. (2007). Corruption, the business environment, and small business growth in India. Policy Research Working Paper; no. WPS 4338, 4338, 31. http://documents.worldbank.org/curated/en/171081468034785505/pdf/wps4338.pdf. Accessed 16 Mar 2018.

Hutton, W., & Lee, N. (2012). The city and the cities: ownership, finance and the geography of recovery. Cambridge Journal of Regions, Economy and Society, 5(3), 325–337. https://doi.org/10.1093/cjres/rss018.

Improving Access to Finance for Women-owned Businesses in India. (2014). Micro, small, and medium enterprise finance, 48. https://www.ifc.org/wps/wcm/connect/a17915804336f2c29b1dff384c61d9f7/Womenownedbusiness1.pdf?MOD=AJPERES. Accessed 9 Nov 2016.

International Property Rights Index. (2015). 7. https://s3.amazonaws.com/ipri2018/2015_es.pdf. Accessed 7 Jan 2016.

Johnson, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2000). Tunneling. American Economic Review, 90(2), 22–27. https://doi.org/10.1257/aer.90.2.22.

Jovanovic, M. (2002). European economic integration: limits and prospects. New York: Taylor & Francis.

Kar, D. (2011). The drivers and dynamics of illicit financial flows from India: 1948-2008. Economic and Political Weekly, XLVI(15). https://doi.org/10.2139/ssrn.2333086.

Kato, A., & Sato, T. (2015). Greasing the wheels? The effect of corruption in regulated manufacturing sectors of India. Canadian Journal of Development Studies/Revue canadienne d'études du développement, 36(4), 459–483. https://doi.org/10.1080/02255189.2015.1026312.

Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4), 41–48.

Khwaja, A. I., & Mian, A. (2005). Do lenders favor politically connected firms? Rent provision in an emerging financial market. The Quarterly Journal of Economics, 120(4), 1371–1411. https://doi.org/10.1162/003355305775097524.

King, R. G., & Levine, R. (1993). Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics, 108(3), 717–737. https://doi.org/10.2307/2118406.

Kumarasamy, D., & Singh, P. (2018). Access to finance, financial development and firm ability to export: experience from Asia–Pacific countries. Asian Economic Journal, 32(1), 15–38.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (1997). Legal determinants of external finance. Journal of Finance, 52(3), 1131–1150. https://doi.org/10.2307/2329518.

Levine, R. (1998). The legal environment, banks, and long-run economic growth. Journal of Money, Credit and Banking, 30(3), 596–613. https://doi.org/10.2307/2601259.

Levine, R., Loayza, N., & Beck, T. (2000). Financial intermediation and growth: causality and causes. Journal of Monetary Economics, 46(1), 31–77. https://doi.org/10.1016/S0304-3932(00)00017-9.

Love, I., & Martínez Pería, M. S. (2014). How bank competition affects firms’ access to finance. The World Bank Economic Review, 29(3), 413–448. https://doi.org/10.1093/wber/lhu003.

Lui, F. T. (1985). An equilibrium queuing model of bribery. Journal of Political Economy, 93(4), 760–781.

Mancusi, M. L., & Vezzulli, A. (2010). R&D, innovation and liquidity constraints. In CONCORD 2010 conference, Sevilla (pp. 3–4).

Manova, K. (2012). Credit constraints, heterogeneous firms, and international trade. Review of Economic Studies, 80(2), 711–744. https://doi.org/10.1093/restud/rds036.

Mason, C., & Brown, R. (2013). Creating good public policy to support high-growth firms. Small Business Economics, 40(2), 211–225. https://doi.org/10.1007/s11187-011-9369-9.

Mauro, P. (1995). Corruption and growth. The Quarterly Journal of Economics, 110(3), 681–712. https://doi.org/10.2307/2946696.

Méon, P.-G., & Weill, L. (2010). Is corruption an efficient grease? World Development, 38(3), 244–259. https://doi.org/10.1016/j.worlddev.2009.06.004.

Mina, A., Lahr, H., & Hughes, A. (2013). The demand and supply of external finance for innovative firms. Industrial and Corporate Change, 22(4), 869–901. https://doi.org/10.1093/icc/dtt020.

Mo, P. H. (2001). Corruption and economic growth. Journal of Comparative Economics, 29(1), 66–79. https://doi.org/10.1006/jcec.2000.1703.

Moro, A., Fink, M., & Kautonen, T. (2014). How do banks assess entrepreneurial competence? The role of voluntary information disclosure. International Small Business Journal, 32(5), 525–544. https://doi.org/10.1177/0266242612458444.

Muravyev, A., Talavera, O., & Schäfer, D. (2009). Entrepreneurs’ gender and financial constraints: evidence from international data. Journal of Comparative Economics, 37(2), 270–286. https://doi.org/10.1016/j.jce.2008.12.001.

Nguyen, T. T., & Van Dijk, M. A. (2012). Corruption, growth, and governance: private vs. state-owned firms in Vietnam. Journal of Banking & Finance, 36(11), 2935–2948. https://doi.org/10.1016/j.jbankfin.2012.03.027.

Nofsinger, J. R., & Wang, W. (2011). Determinants of start-up firm external financing worldwide. Journal of Banking & Finance, 35(9), 2282–2294.

Peng, M. W. (2001). How entrepreneurs create wealth in transition economies. The Academy of Management Executive, 15(1), 95–108. https://doi.org/10.5465/AME.2001.4251397.

Petersen, M. A., & Rajan, R. G. (1997). Trade credit: theories and evidence. The Review of Financial Studies, 10(3), 661–691. https://doi.org/10.1093/rfs/10.3.661.

Qi, S., & Ongena, S. (2018). Will money talk? Firm bribery and credit access. Financial Management, forthcoming, 40, https://doi.org/10.1111/fima.12218.

Rajan, R. G., & Zingales, L. (1998). Financial dependence and growth. The American Economic Review, 88(3), 559–586.

Rand, J., & Tarp, F. (2012). Firm-level corruption in Vietnam. Economic Development and Cultural Change, 60(3), 571–595.

Reinikka, R., & Svensson, J. (2005). Fighting corruption to improve schooling: evidence from a newspaper campaign in Uganda. Journal of the European Economic Association, 3(2–3), 259–267. https://doi.org/10.1162/jeea.2005.3.2-3.259.