Abstract

Grounding on the Knowledge Spillover Theory of Entrepreneurship, this paper advances research on innovative start-ups by studying whether and how university knowledge fosters the creation of these firms at the local level. First, we contend that geographical proximity shapes the impact of university knowledge on the creation of innovative start-ups in a geographical area. In other words, in this context, university knowledge spillovers are highly localized. Second, we argue that the availability in an area of individuals with open-minded attitudes (regional openness) lessens the localized nature of university knowledge spillovers, favouring the exploitation of geographically distant university knowledge for the creation of innovative start-ups. Results from estimations of zero-inflated negative binomial regressions on a sample of 1188 province–industry pairs confirm our conjectures.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Young Innovative Companies (YICs) are small young companies, intensively engaged in innovation activities. These firms have a superior ability in generating new knowledge or combining existing knowledge to develop radically new products and services with significant commercial applications (Veugelers 2008; Schneider and Veugelers 2010). Accordingly, scholars and policymakers concur that YICs can benefit greatly the productive system and ultimately the society as a whole (e.g. EC-DG ENTR 2009).

To date, contributions on YICs have mainly focused on their economic and innovative performance. In particular, empirical studies have shown that YICs outperform their competitors both in terms of sales related to innovative products (see again Schneider and Veugelers 2010) and firm’s growth (Czarnitzki and Delanote 2013). Conversely, we know comparatively less on the factors that drive the creation of these firms. This paper contributes to fill this gap by studying the role of university knowledge for the creation of YICs (i.e. the creation of innovative start-ups) at the local level. The central tenant of our work is that, given the nature of innovative start-ups, university knowledge positively affects their creation, but geographical distance shapes this effect (see Bonaccorsi et al. 2014 for a similar argument in case of local entrepreneurship in high-tech industries). Accordingly, we first discuss and empirically document that the creation of innovative start-ups in a geographical area depends on the availability of university knowledge in that area as the successful exploitation of this knowledge requires geographical proximity. In other words, we document that in this context, university knowledge spillovers are localized. Second, taking inspiration from recent contributions within the Knowledge Spillover Theory of Entrepreneurship (KSTE, Acs et al. 2009; Qian et al. 2013; Qian and Acs 2013), we argue that local factors may lessen the localized nature of university knowledge spillovers, thus favouring the exploitation of distant university knowledge for the creation of innovative start-ups. In particular, for sake of relevance, we focus on regional openness, as defined by the presence in the area of individuals with open-minded attitudes.

In addressing the aforementioned issues, this paper offers two main contributions. First, we replicate in the context of innovative start-ups a well-established result of the literature studying the effect of university knowledge on local entrepreneurship. Bonaccorsi et al. (2014) investigate how far university knowledge (as measured by graduates, publications and patents) goes to nurture the creation of new firms in knowledge-intensive industries. The authors find that the positive effect of university knowledge rapidly decays with distance. Similar evidence is in Audretsch and Lehmann (2005), Baptista and Mendonça (2010), Fritsch and Aamoucke (2013),Footnote 1 which analyse the impact of university knowledge on the creation of new firms in high-tech or knowledge-intensive industries. The value of our replication exercise stems from the fact that all these studies refer to the creation of new firms in specific industries, while our work analyses the creation of a specific category of firms. On the one side, high-tech and knowledge-intensive industries may include firms that do not have innovation at the core of their activity. On the other side, innovative start-ups (i.e. new firms that have innovation as their core mission and main source of competitive advantage) can potentially emerge in any industry, although their presence is likely more remarkable in knowledge-intensive and high-tech industries. Second, previous works that have researched the localized nature of university knowledge spillovers have not considered that territorial characteristics can reduce the importance of geographical proximity.

In the empirical part of the paper, we test our conjectures referring to the creation of innovative start-ups in Italy as defined by Decree Law 179/12. In an effort of stimulating innovative entrepreneurship, this law contains the requirements a new firm must fulfil to be labelled as an innovative start-up. Specifically, it must be young (less than 5 years old), small (less than 5 million € of turnover) and innovative, i.e. its mission must be the development, the production and commercialization of innovative products and services (see Sect. 3 for a further details). As such, the definition of Italian innovative start-up is consistent with the definition of YIC used in the literature (see Schneider and Veugelers 2010). In this context, we estimate zero-inflated negative binomial regressions whose dependent variable is the number of innovative start-ups operating in 12 industries (according to the NACE rev. 2 classification) and created in 99 Italian provinces (NUTS 3 levelFootnote 2) between 2011 and 2014. Therefore, the unit of analysis is the province–industry pair and our sample consists of 1188 observations (see Glaeser and Kerr (2009) and Ghani et al. (2013) for similar approaches). The main explanatory variables deal with the knowledge produced by universities within and outside a focal province (Bonaccorsi et al. 2014) and with regional openness as measured by open-minded attitudes of individuals residing in a province (Florida and Tinagli 2005).

The paper proceeds as follows. The next section provides the theoretical background of our study and develops the research hypotheses. Section 3 describes the econometric models used to test these hypotheses and the dependent and independent variables included in the models. In Sect. 4, we illustrate the results of the econometric analysis. Section 5 concludes the paper by summarizing its main results, acknowledging its limitations, and indicating directions for future research.

2 Theoretical background and research hypotheses

A well-established scholarly tradition acknowledges that universities are a major source of knowledge and technological opportunities (e.g. Cohen and Levinthal 1990; Klevorick et al. 1995), which, in turn, constitute a fundamental input for the development, production and commercialization of innovative products and services. Accordingly, it is reasonable to expect that university knowledge has a fundamental role in the creation of innovative start-ups, which have innovation as their core mission. In particular, we contend that the creation of innovative start-ups in a geographical area depends on the availability of knowledge that spills over from universities in that area. Our reasoning echoes contributions within the KSTE (Acs et al. 2009, 2013; Ghio et al. 2015), which have studied the creation of new firms in high-tech and knowledge-intensive industries (e.g. Acosta et al. 2011; Audretsch and Lehmann 2005; Audretsch et al. 2004; Bonaccorsi et al. 2013, 2014; Guerini and Rossi-Lamastra 2014). According to these works, knowledge-intensive entrepreneurship in an area is the response to the local availability of university knowledge, which established firms do not commercially exploit as their knowledge filter (Acs and Plummer 2005) limits their ability to leverage knowledge, which is too far from their existing skills and competences (Mueller 2006). Conversely, the knowledge filter does not affect prospective entrepreneurs, which can exploit available university knowledge through the creation of new firms.

However, starting from the seminal work of Jaffe (1989), many studies have documented the localized nature of university knowledge spillovers. Scholars have shown that the effects of university knowledge on local firms’ innovation activities and on local entrepreneurship decrease with the distance from the university generating this knowledge (e.g. Anselin et al. 1997, 2000; Audretsch and Feldman 1996; Fischer and Varga 2003; Acosta et al. 2011; Audretsch and Lehmann 2005; Bonaccorsi et al. 2013). This consistent evidence relates to the nature of university knowledge, which is hardly understandable by non-scientists (Antonelli 2011) as they do not possess the specialized languages of science, with its specific codes and meanings (Gardner 2004; Halliday and Martin 1993). University knowledge results from scientists’ race to achieve first a discovery or to solve first a complex scientific and technical problem (Stephan 2012). Consequently, it has high cognitive complexity and—despite scientists’ effort to codify it in scientific publications (Agrawal 2006)—it has a large tacit component. This makes university knowledge sticky (Pavitt 1991), i.e. difficult to transfer from scientists to non-scientists. Geographical proximity reduces these difficulties. First, it increases the probability that non-scientists (e.g. prospective entrepreneurs or firms) become aware of opportunities created by university knowledge simply by participating in workshops and conferences and coming across scientists during these events. Second, and more importantly, geographical proximity lowers the costs of face-to-face contacts, which are the best way for transferring tacit and complex knowledge (Desrochers 2001), while long-distance communication channels (e.g. email or telephone) prove to be inadequate to this end. Much of the creative thought and expertise of scientists is indeed not reproducible in words and its transfer benefits from visual and body language clues and from quick exchanges of requests and provisions of clarifications and feedbacks (Storper and Venables 2004). In particular, we contend that these clarifications and feedbacks are very important for prospective entrepreneurs intending to leverage university knowledge for creating innovative start-ups. Indeed, university knowledge is not immediately convertible in innovative products and services (Agrawal 2006; Bercovitz and Feldman 2006; Carlsson et al. 2009). To transform university knowledge into economic knowledge having a commercial value, prospective entrepreneurs must invest time and resources and internalize specific skills (Bercovitz and Feldman 2006). Third, scholars have noted that people living in the same geographical area share a common set of norms, conventions, values and expectations, which create geographical homophily, i.e. a preference for interacting with individuals of the same geographical area (Ruef et al. 2003). For instance, Italian provinces have historically had a strong territorial identity to the extent that residents in a province usually prefers to interact among each other instead of getting in contact with individuals residing in other provinces (see Alessandrini et al. 2009 for a similar argument). In turn, geographical homophily has been positively associated to the transfer of tacit knowledge within an area (Gertler 2003), thus enhancing the importance of geographical proximity for the exploitation of university knowledge by prospective entrepreneurs.

Basing on the above discussion, we formulate hypothesis H1.

H1

The exploitation of university knowledge for creation of innovative start-ups requires geographical proximity, i.e. in this context, university knowledge spillovers are highly localized.

Nevertheless, we maintain that the characteristics of a geographical area may favour the exploitation of distant university knowledge, thus reducing the localized nature of university knowledge spillovers. Specifically, for sake of relevance, we focus here on the effect of regional openness, as measured by the local presence in a geographical area of individuals with open-minded attitudes. According to the definition of Qian (2013, p. 2722), these individuals are willing to understand and respect ideas and behaviours differing or even conflicting with their own, for instance being tolerant towards minorities (e.g. homosexuals or immigrants, see Florida 2002a, b; Florida et al. 2008). Empirical studies have found that regional openness positively relates to the local concentration of talented individuals and high-tech firms and, more generally, with local development (see, e.g. Florida 2002a, b; Florida and Gates 2002; Florida et al. 2008; Mellander and Florida 2011; among others). We expand on this evidence and contend that regional openness favours the exploitation of knowledge from geographically distant universities for the creation of innovative start-ups. Open-minded individuals are extroverted and curious (McCrae 1987). Their presence breeds an informal and creative atmosphere (Stolarick and Florida 2006) and reduces communication barriers among individuals (Qian 2013), who are thus more prone to interact with people with different backgrounds (Spencer-Rodgers and McGovern 2002). In such a context, it is easier to exchange experiences and ideas and we expect that geographical proximity has less impact on the exploitation of university knowledge by prospective entrepreneurs. First, in a local environment with a dense web of personal interactions, prospective entrepreneurs likely have more face-to-face contacts, which facilitate the awareness about knowledge opportunities despite the challenges of geographical distance. This holds particularly true as individuals with open-minded attitudes are less sensitive to geographical homophily (Ruef et al. 2003) and this results in more fruitful interactions with individuals from distant geographical areas. Moreover, regional openness is positively associated to the attraction in a geographical area of talented individuals (Florida 2002a; Florida et al. 2008), including university researchers. Such incoming flows make more likely the occurrence of face-to-face contacts between academicians attracted in the geographical area and local prospective entrepreneurs, thus favouring knowledge spillovers from distant universities. According to these arguments, we conclude that prospective entrepreneurs in areas characterized by higher regional openness are better able in identifying and enacting entrepreneurial opportunities stemming from distant university knowledge. We therefore put forth hypothesis H2:

H2

Regional openness favours the exploitation of distant university knowledge for creation of innovative start-ups, thus reducing the localized nature of university knowledge spillovers.

3 Data and methodology

3.1 Econometric specification and dependent variables

We test the aforementioned research hypotheses through various models having the following general form:

The dependent variable \({\text{N}}\_{\text{START}}\_{\text{UPS}}_{i,j}\) is the number of innovative start-ups created in Italy in industry i and province j in the period 2011–2014. Specifically, at the end of 2012, the Italian Government approved the Decree Law 179/12, which provides specific measures aimed at promoting the creation and development of a particular category of firms, which the Law labelled as innovative start-ups. The Decree Law 179/12 defines an Italian innovative start-up as an independent firm, which complies with the following criteria. It (1) has less than 5 years old; (2) has a turnover of less than 5 million; (3) has the development, production and commercialization of innovative products and services as its business core mission. Moreover, the firm must meet (at least) one of the following additional requirements: R&D expenses/return ratio must be greater than 15 %, at least 1/3 of the total workforce must possess a PhD or must have worked for at least 3 years in a research institute and the firm must be the holder or the licensee of (at least) one patent. We extracted data on the population of Italian innovative start-ups from the dedicated website by InfoCamere (http://startup.registroimprese.it). From this website, we downloaded the complete list of Italian innovative start-ups and information on their geographical location, industry of operation (NACE rev. 2) and foundation year. The list is updated every week and, at the time of our extraction (On October 6th, 2014), the database provided information on 2685 innovative start-ups established starting from 2008.

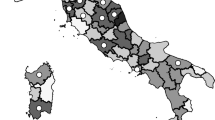

As aforementioned, when estimating Eq. (1) we limit the analysis to the start-ups created in the period 2011–2014. Furthermore, due to data constraints, we exclude from the analysis the start-ups created in the provinces of the Sardinia region.Footnote 3 Finally, to avoid that our results are driven by industries where the phenomenon is negligible, we consider only those industries (at the 2 digit level of the NACE rev. 2 classification) for which the number of start-ups created in the focal period (2011–2014) is higher than 40 (see Jofre-Monseny et al. 2011 for a similar approach). This selection process leads us to consider 1188 industry/province pairs (12 industries × 99 provinces), accounting for 1916 innovative start-ups operating in 12 industries. Table 1 reports the distribution of these 1916 start-ups by industry, foundation year and macro-regions. Quite interestingly, innovative start-ups do not necessarily operate in high-tech industries.Footnote 4 For instance, 51 and 49 innovative start-ups operate in the publishing activities and retail trade industries, respectively. Furthermore, Fig. 1 illustrates the geographic distribution of the number of Italian innovative start-ups in our sample per million inhabitants (as in 2011).

We resort to a zero-inflated negative binomial estimation technique for the estimation of Eq. (1) to deal with the count-nature of our dependent variable and with the presence of observations for which it assumes value zero (in 668 out of 1188 industry/province pairs the number of innovative start-ups is zero). A similar approach is for instance in Baptista and Mendonça (2010).

3.2 Main explanatory variables

The variable \({\text{LOCAL}}\_{\text{UNIKNOW}}_{i,j}\) refers to university knowledge from universities located in the province j that constitutes the knowledge base of innovative start-up’s industry i. In particular, we built \({\text{LOCAL}}\_{\text{UNIKNOW}}_{i,j}\) as the ratio between the average number (in the period 2009–2011) of full, associate and assistant professors (i.e. the academic staff) of the universities located in province j, specialized in the scientific fields that constitute the knowledge base of the industry i, and the population of the province j as in 2011.

More specifically, we extracted data on academic staff of Italian universities from the Italian Ministry of Education and Research (Ministero dell’Istruzione, dell’Università e della Ricerca, MIUR) database. We consider the average academic staff enrolled in the period 2009–2011 in the 80 Italian research-active universities. To this end, we refer to the definition reported in the EUMIDA database on European Higher Education Institutions that identifies a university as research-active if research is a constitutive part of institutional activities and it is organized with a durable perspective.Footnote 5 Data on academic staff are disaggregated according to the 14 macro-disciplinary areas defined by the MIUR, namely: (1) Mathematics and computer sciences; (2) Physics; (3) Chemistry; (4) Earth sciences; (5) Biology; (6) Medicine; (7) Agricultural and veterinary sciences; (8) Civil engineering and architecture; (9) Industrial and information engineering; (10) Philological-literary sciences, antiquities and arts; (11) History, philosophy, psychology and pedagogy; (12) Law; (13) Economics and statistics; (14) Political and social sciences. For each innovative start-up’s industry considered in this study, we associated the university disciplinary areas (according to the MIUR classification) that constitute the knowledge base for this industry, building on the findings of Schartinger et al. (2002).Footnote 6 For instance, for the manufacture of machinery and equipment (C26 according to the NACE rev. 2 classification) industry, we consider the academic staff active in the areas of Mathematics and computer sciences, Physics and Industrial and information engineering.

Similarly, the variable \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j}\) refers to university knowledge that constitutes the knowledge base of the innovative start-up’s industry i from universities located outside the focal province j. In line with studies on how university knowledge spillovers decays with distance (e.g. Anselin et al. 2000; Bonaccorsi et al. 2014; Fischer and Varga 2003; Howells 2002), we measure the effect of knowledge created by universities located outside the province j on the creation of innovative start-ups (in each industry i) in province j by using a spatially weighted measure:

where d j,k is the geographical distance between province j and province k, \({\text{LOCAL}}\_{\text{UNIKNOW}}_{i,k}\) refers to specialized university knowledge that constitutes the knowledge base for the industry i generated from universities located in province k, (with k ≠ j), and α is a distance decay parameter. We calculate distances by considering the centroid of each province (with 1 km as the unit of distance). Following Bonaccorsi et al. (2014), we determine the value of the decay parameter α empirically. More specifically, the parameter α is set to 2.5, which is the value that maximizes the log likelihood of the econometric model (see Table 6 in the “Appendix” for the estimations obtained with different values of α).

The variable \({\text{OPENNESS}} _{j}\) measures regional openness. Grounding on the works of Florida (Florida et al. 2008; Florida and Tinagli 2005), we build this variable as the average of three components (\({\text{School enrollment}}_{j} , {\text{Education}}_{j}\) and \({\text{Mixed families}}_{j}\)) which are calculated using data from the Italian National Statistical Office (ISTAT). Specifically, \({\text{School enrollment}}_{j}\) is the ratio between the number of foreign children enrolled in the primary schools of province j and the total number of children enrolled in the primary schools in that province. \({\text{Education}}_{j}\) is the percentage of foreign population with a university degree in province j. \({\text{Mixed families}}_{j}\) is the percentage of families of two or more people with at least one foreign individual among the components.Footnote 7 \({\text{OPENNESS}} _{j}\) accounts therefore for the presence in province j of individuals with open-minded attitudes as it measures the extent to which residents interact with foreigners (e.g. by establishing mixed families or being enrolled in the same schools) and in so doing (likely) develop openness and tolerance towards new experiences and minorities (e.g. immigrants, see Florida 2002a, b; Qian 2013).

To assess whether regional openness favours the exploitation of university knowledge created outside the focal province for the creation of innovative start-ups, we interact \({\text{UNIKNOW}}\_{\text{EXT}}_{i,j}\) and \({\text{OPENNESS}}_{j}\).

3.3 Controls

Following the literature on new firm creation at the local level (see below), we control for a set of local characteristics, which may affect the creation of innovative start-ups at the local level. To construct these variables, we combined data from several sources, including Movimprese, ISTAT and OECD. First, we control for the presence of agglomeration economies by considering the strengths of customer–supplier relationships (Glaeser and Kerr 2009). Following Glaeser and Kerr (2009), we calculate the relative strength of input relationships as:

where \({\text{Input}}_{i \to k}\) is the share of industry i’s inputs that comes from industry k, with k \(\epsilon\) I (where I defines the industries according to the NACE rev. 2 classification) as reported in the Input–Output matrix (as in 2010) provided by ISTAT. The variable considers the aggregate absolute deviations between the industrial inputs required by industry i, from every industry k, and the province j’s actual industrial composition, in terms of share of employees (i.e. \(E_{k,j} /E_{j}\)). The variable \({\text{INPUT}}_{i,j}\) varies from −2 (i.e. no inputs available in the considered province) to 0 (i.e. all inputs are available in the considered province in precise proportions). The relative strength of output relationships is defined as:

where \({\text{Output}}_{i \to k}\) is the share of industry i’s outputs that go to industry k (with k \(\epsilon\) I) as reported in the Input–Output matrix. The first bracketed term proxies the concentration of industrial sales opportunities for industry i in the province j, by multiplying the share of output of industry i that goes to industry k with the share of industry k’s employment in the province j (i.e. \(E_{k,j} /E_{j}\)). By summing across industries, we measure the concentration of industrial sales opportunities for industry i in the province j. To normalize the metric, the second term in bracket is used, which measures the total potential industrial sales into the province. Accordingly, \({\text{OUTPUT}}_{i,j}\) varies from zero to one, with higher values indicating greater presence of sales opportunities.

Second, several academic contributions have shown that the local density of incumbent firms significantly affects new firm creation in a geographical area (e.g. Bonaccorsi et al. 2013; Plummer and Acs 2014). The variable \({\text{INCUMBENT}}_{i,j}\) controls for this aspect, by considering the number of firms registered in the industry i in the province j per inhabitants of the province. Moreover, we also consider the diversity of the local industrial system with the variable \({\text{IND}}\_{\text{DIVERSITY}}_{i,j}\). One of the most significant insights of seminal work of Jacobs (1969), recently echoed by Audretsch et al. (2010), is that the entrepreneurial activity benefits from higher degrees of diversity of the local industrial system. Following Gao (2004), we measure the industrial diversity of a province j as:

where s j,i is the share of firms in province j operating in the industry i, with i \(\epsilon\) I. The variable varies between zero and one, with higher values corresponding to higher levels of diversity.

Third, we account for the effect of technological spillovers by including the variable \({\text{TECH}}_{j}\), which is the number of patent applications per million inhabitants in the province j as in 2010. Patent activity is often used in the literature as a proxy for knowledge generated by incumbent firms or individuals and having a more immediate commercial value compared to university knowledge (Block et al. 2013; Qian et al. 2013).

Fourth, in line with Qian and Acs (2013), we measured the local availability of skilled human capital (\({\text{SKILLED}}_{j}\)) as the percentage of population within the province j with either a university master of science or PhD degree.

Fifth, we control for the size of the local labour market. Specifically, we measure the employment in the province–industry pair (\({\text{EMPLOYMENT}}_{i,j}\) ), through the logarithm of number of employees in the industry i in the province j (Glaeser and Kerr 2009). We also control for the fact that labour market is not confined into the boundaries of the province j, as individuals can move from other provinces in search of job opportunities. We therefore include the variable \({\text{EXT}}\_{\text{EMPLOYMENT}}_{i,j}\), which, mirroring the methodology used for the variable of external university knowledge, is calculated as:

where \({\text{EMPLOYMENT}}_{i,k}\) is the logarithm of number of employees in the industry i in the province k (with k ≠ j).

Lastly, we control for the population density (i.e. the number of inhabitants per km2; \({\text{DENSITY}}_{j}\) ) in the province as in 2011 (Bonaccorsi et al. 2014) and we include industry and regional (NUTS2) dummies. Table 2 reports a detailed description of all the dependent and independent variables, while Table 3 reports their summary statistics and the correlation matrix.

4 Results

The Vuong test (Vuong 1989; Cameron and Trivedi 2009) confirms the superior fitting performance of zero-inflated negative binomial technique compared to the standard negative binomial regression.Footnote 8 Therefore, Table 4 shows the results of the econometric estimates obtained by employing a zero-inflated negative binomial regression. In particular, column (I) shows the results when considering only the direct effects of the main explanatory variables included in the analysis, i.e. \({\text{LOCAL}}\_{\text{UNIKNOW}}_{i,j }\), \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j }\) and \({\text{OPENNESS}}_{j }\). Results in Column (II) include also the interaction term \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j } \times {\text{OPENNESS}}_{j }\). To easy the interpretation of the coefficients, in the reported estimates all the continuous variables have been standardized (mean 0 and standard deviation 1).

We first examine results in Column (I). Before analysing our main explanatory variables, we briefly discuss the evidence concerning control variables. As regards the impact of agglomeration economies, we do not find evidence that the relative strength of output relationships matters for the creation of innovative start-ups at the local level. Conversely, our findings highlight that the relative strength of input relationships among industries (\({\text{INPUT}}_{i,j}\)) affects the dependent variable. The coefficient of \({\text{INPUT}}_{i,j}\) is indeed positive and significant (p value <0.01). Furthermore, the presence in province j of incumbent firms operating in industry i negatively affects the creation of innovative start-ups in industry i and province j. Indeed, the coefficient of the variable \({\text{INCUMBENT}}_{i,j}\) is negative and significant (p value <0.01). Conversely, we find a remarkable effect of the diversity of the local industrial system on the creation of innovative start-ups in a geographical area, suggesting the importance of Jacobian externalities (Jacobs 1969) in this context. The variable \({\text{IND}}\_{\text{DIVERSITY}}_{j}\) has indeed a positive and significant coefficient (p value <0.01). As expected, technological spillovers influence the local creation of innovative start-ups (Qian and Acs 2013), with the variable \({\text{TECH}}_{j}\) having a positive and significant coefficient (p value <0.01). Quite surprisingly, the coefficient of \({\text{SKILLED}}_{j}\), accounting for the local availability of skilled human capital, is positive but not significant. Finally, the coefficients of population density (\({\text{DENSITY}}_{j}\)) and local number of employees (\({\text{EMPLOYMENT}}_{i,j} )\) are positive and statistically significant (p value <0.01).

Let us now turn attention to the main explanatory variables. In line with H1, we find that the coefficient of \({\text{LOCAL}}\_{\text{UNIKNOW}}_{i,j }\) is positive and statistically significant (p value <0.05). The average marginal effect (ME) and the average semi-elasticity (SE) of \({\text{LOCAL}}\_{\text{UNIKNOW}}_{i,j }\) on the number of innovative start-ups are 0.21 and 13 %, respectively.Footnote 9 Hence, one standard deviation increase of \({\text{LOCAL}}\_{\text{UNIKNOW}}_{i,j }\) in the focal province leads to a 0.21 increase in the number of innovative start-ups in each industry/province. This corresponds to a 13 % increase in the number of innovative start-ups in percentage terms. Conversely, the effect of university knowledge created outside the focal province (\({\text{EXT}}\_{\text{UNIKNOW}}_{i,j }\)) is not significant. These results suggest that, in line with H1, the exploitation of university knowledge for the creation of innovative start-ups requires geographical proximity and university knowledge spillovers are highly localized in this context. Finally, the coefficient of \({\text{OPENNESS}}_{j }\) is positive and (weakly) significant (p value <0.10): the presence of individuals with open-minded attitudes in an area seems to influence the creation of innovative start-ups in that area. Despite the low significance of the coefficient, this result is in line with studies showing that a higher level of regional openness is associated with a higher presence of high-tech start-ups (Florida and Gates 2002; Florida et al. 2008).

Column (II) reports the results when introducing the interaction term between external university knowledge and regional openness (\({\text{EXT}}\_{\text{UNIKNOW}}_{i,j } \times {\text{OPENNESS}}_{j }\)). With respect to results shown in Column (I), the effects of other explanatory variables remain substantially unchanged. The average ME and SE of \({\text{LOCAL}}\_{\text{UNIKNOW}}_{i,j }\) are 0.19 and 11 %, respectively (p value <0.05). Again, these findings support hypothesis H1. The effect of \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j }\) is still non-significant, while the coefficient of the interaction term \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j } \times {\text{OPENNESS}}_{j }\) is positive and statistically significant (p value <0.05). Given the nonlinear specification of the zero-inflated negative binomial model, looking at the estimated coefficient of the \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j } \times {\text{OPENNESS}}_{j }\) is not enough to determine both the magnitude and the statistical significance of the interactive effect. To ascertain whether \({\text{OPENNESS}}_{j }\) positively moderates the effect of external university knowledge on the creation of innovative start-ups, we therefore report the average ME and SE of \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j }\) as \({\text{OPENNESS}}_{j }\) varies (the solid lines in Figs. 2 and 3 respectively). We consider increasing values of (the standardized value of) \({\text{OPENNESS}}_{j }\), from −1.87 (the minimum value of its distribution in the sample) to 1.85 (its maximum value). We estimated the 95 % confidence intervals (the dashed lines) by the delta method.

As Fig. 2 shows, the ME of \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j }\) on the creation of innovative start-ups in the focal province j increases as \({\text{OPENNESS}}_{j }\) increases. When \({\text{OPENNESS}}_{j }\) is set at its mean value (i.e. its standardized value is zero), one standard deviation increase of \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j }\) leads to a non-significant increase in the number of innovative start-ups in the focal province j. However, when \({\text{OPENNESS}}_{j }\) is set at one standard deviation above its mean (i.e. its standardized value equals 1), the increase in the number of innovative start-ups in the focal province j becomes statistically significant (at least at the 5 % level). Specifically, in this latter case one standard deviation increase of \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j }\) leads to an average 0.19 increase in the number of innovative start-ups. The corresponding figure is 0.42 when (the standardized value of) \({\text{OPENNESS}}_{j }\) is 1.85 (i.e. its maximum value).

In order to assess the effect \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j }\) as \({\text{OPENNESS}}_{j }\) varies in percentage terms, Fig. 3 reports average SEs. The percentage increase in the number of innovative start-ups due to a one standard deviation increase of \({\text{EXT}}\_{\text{UNIKNOW}}_{i,j }\) switches from 11 % when (the standardized value of) \({\text{OPENNESS}}_{j }\) is 1, to 20 % when (the standardized value of) \({\text{OPENNESS}}_{j }\) reaches its maximum value (1.85). These results provide support to our hypothesis H2. External university knowledge has an effect on the creation of innovative start-ups in a province only when the regional openness is high.

5 Conclusions

In this work, we have built on the KSTE framework to discuss and empirically investigate the role of university knowledge in fostering the creation of innovative start-ups at the local level. In accordance with recent contributions (e.g. Audretsch and Lehmann 2005; Acosta et al. 2011; Laursen et al. 2011; Bonaccorsi et al. 2014), our results highlight that knowledge generated by universities located in a geographical area has a strong impact on the creation of innovative start-ups in that area. However, this positive effect vanishes when considering knowledge generated by distant universities. In other words, the exploitation of university knowledge by prospective entrepreneurs for the creation of innovative start-ups requires geographical proximity pointing to the fact that university knowledge spillovers are highly localized. However, the presence in the area of individuals with open-minded attitudes reduces the importance of geographical proximity as it favours interpersonal interactions and weakens geographical homophily, thus facilitating the exploitation of distant knowledge.

Our work offers two main contributions to extant literature. First, it illustrates theoretically and confirms empirically the effect of localized university knowledge spillovers in fostering the creation of innovative start-ups. In so doing, it extends to these firms the overarching idea of KSTE that entrepreneurship is a powerful mechanism for transferring university knowledge to the productive system (Audretsch and Lehmann 2005; Ghio et al. 2015; Mueller 2006). More specifically, we have replicated in the context of innovative start-ups consolidated results on the localized nature of university knowledge spillovers, which scholars have obtained studying new firms creation in knowledge-intensive and high-tech industries (Fritsch and Aamoucke 2013; Acosta et al. 2011). In discussing the mechanisms through which knowledge from proximate universities stimulates entrepreneurship in a geographical area, these studies have implicitly assumed that start-ups in knowledge-intensive and high-tech industries have innovation as their core mission (e.g. Fritsch and Aamoucke 2013). However, this is not always the case and innovative firms can potentially arise in any industry. Focusing our work on innovative start-ups, we have reaffirmed that firms must meet criteria well beyond the industry of operation to be labelled as innovative.

Second, the paper adds to emerging conversations on whether and how the characteristics of an area shape the exploitation of knowledge spillovers by prospective entrepreneurs in that area. Plummer and Acs (2014) have studied the negative role of local competition on the exploitation of locally available knowledge for new firm creation. More in line with the theme of this paper, Qian and Acs (2013) and Qian et al. (2013) have put forth the concept of entrepreneurial absorptive capacity (EAC), which brings the notion of absorptive capacity (Cohen and Levinthal 1990) in the entrepreneurship field. The authors have defined EAC as the ability of individuals in an area to recognize, value and commercialize knowledge available in that area through the creation of start-ups. They have measured EAC by the local presence of graduated individuals (as proxy of the local endowment of business and scientific skills) finding that it positively moderates the exploitation of local knowledge embodied in industrial patents for the creation of high-tech start-ups. Showing that the open-minded attitudes of residents favour the conversion of distant university knowledge into local entrepreneurship, we highlight regional openness as another possible dimension of the EAC. Indeed, regional openness breeds a creative and cosmopolitan atmosphere that favours interpersonal contacts and reduce geographical homophily, thus making individuals able to identify, assimilate, transform and commercialize (Zahra and George 2002) valuable knowledge located beyond the “comfort zone” of province boundaries.

As any other, this work has limitations, which open interesting avenues for future research. First, we move from the premise that universities spread across territories new knowledge and technological opportunities and that these opportunities are a fundamental input for the development of innovations, thus fostering local innovative entrepreneurship. However, we have not directly assessed the degree to which the knowledge produced by a given university enters into the creation of innovative start-ups. In other words, we cannot directly gauge whether and how innovative start-ups use university knowledge for the development of their new products and services. For instance, do these products and services result from the combination (Schoenmakers and Duysters 2010) of pieces of university knowledge with pieces of knowledge from other sources? Do prospective entrepreneurs identify pieces of university knowledge, which are closer to commercialization and build their start-ups on them? Further studies should try to provide answers to these questions also taking advantages of qualitative research methods. Second, we focus here on the moderating effect of regional openness on the exploitation of distant university knowledge. Despite the relevance of this dimension, we encourage research on other territorial characteristics, which may affect the exploitation of university knowledge spillovers for the creation of innovative start-ups. For instance, scholars may consider variables like the local endowment of infrastructures (Piva et al. 2011), the local availability of industrial knowledge (Guerini and Rossi-Lamastra 2014) or the local presence of technological incubators (Colombo and Delmastro 2002).

A third set of limitations relate to data unavailability. Specifically, we have computed regional openness by aggregating individual-level data on residents’ open-minded attitudes towards foreign people. In so doing, we have not accounted for individuals’ tolerance and open-mindedness towards homosexual individuals (Florida 2002b; Florida et al. 2008; Qian 2013). Anyway, several studies have documented the high correlation between the local presence of individuals with open-minded attitudes towards homosexual individuals and the local presence of foreign people (see, e.g. Florida 2002a; Florida and Tinagli 2005). Moreover, our data on innovative start-ups refer just to the Italian case and thus country-level characteristics may bias our results by influencing the ways in which prospective entrepreneurs leverage university knowledge spillovers for new firm creation. For instance, due to its history and cultural heritage, Italy has a particularly strong geographical homophily, which likely boosts the importance of geographical proximity for the exploitation of university knowledge spillovers. Thus, the question is: Does this hold true for other countries? We welcome studies that will answer such a question by replicating our analysis using databases on other countries. In addition, given the novelty of the observed phenomenon (Law no. 221/2012 implementing the Decree 179/2012 became effective only December 2012 19th), data on Italian innovative start-ups prevent us of performing time-varying analyses. Repeating our analyses using panel data will allow investigating whether time-varying effects are at work.

Despite the aforementioned limitations, our work offers interesting indications to policymakers. Stimulating innovative entrepreneurship ranks as a top priority in the current economic debate, and it is especially important in countries like Italy, where the economic growth is struggling to recover and the unemployment rates are very high.Footnote 10 Indeed, new firms can be important sources of new job creation and economic development (Audretsch 1995). In particular, the second pillar of the Entrepreneurship 2020 Action Plan promoted by the European Commission highlights that EU Member States should support entrepreneurship by “creating the right business environment” which helps people in leveraging their creativity and innovative capacities.Footnote 11 Universities can significantly contribute to create this business environment by spreading knowledge and technological opportunities across territories. However, to unleash universities’ potential, policymakers should design initiatives that promote the interactions between scientists and prospective entrepreneurs. For instance, policymakers may favour the mobility of scientists, who enter new regions by bringing with them their personal endowment of university knowledge. According to our results, this incoming flow of distant university knowledge can benefit local entrepreneurship, especially in areas where regional openness creates a dense web of interpersonal interactions and reduces the constraints of geographical homophily. In this latter regard, it is worth noting that public campaigns intended to develop openness and tolerance towards minorities may have the unintended side effect of stimulating new firm creation, especially in areas with a limited endowment of local knowledge. Indeed, these campaigns breed open-minded attitudes, which, according to our results, are conducive to the search and recognition of entrepreneurial opportunities outsides regional boundaries.

Notes

The authors include in their analysis German firms in: (1) high-technology manufacturing industries, devoting more than 8.5 % of their input to R&D; (2) technologically advanced manufacturing industries (R&D intensity between 3.5 and 8.5 %); and (3) technology-oriented services, covering only some selected service industries related to innovation and new technologies.

The Nomenclature of territorial units for statistics (NUTS) classification is a hierarchical system for partitioning the European economic territory into sub-territories (regions, counties, and so on). The current NUTS classification lists 97 regions at NUTS-1, 270 regions at NUTS-2 and 1294 regions at NUTS-3 level. Further information is available at: http://epp.eurostat.ec.europa.eu/portal/page/portal/nuts_nomenclature/introduction.

In 2011, the Italian Government re-organized the four provinces of the Sardinia region into eight new provinces. However, in several cases the statistical sources of data that we use in the present study provide information on the Sardinia region by referring to the old classification based on four provinces. Because of these data constraints, we have therefore excluded the provinces of Sardinia from our analysis.

For the list of high-tech industries as defined by Eurostat see http://ec.europa.eu/eurostat/statistics-explained/index.php/Glossary:High-tech.

The following criteria define research-active universities: (1) the existence of institutionally recognized research units; (2) the existence of an official research mandate; (3) the presence of regular PhD programs; (4) the inclusion of research in the strategic planning; and (5) the regular provision of funds for research activities from public agencies as well as from private institutions. For further information, see http://ec.europa.eu/research/era/docs/en/eumida-final-report.pdf.

Before computing the average, we standardize the value of each component in line with Florida and Tinagli (2005).

Our findings are, however, robust to other estimation techniques. Specifically, results do not change when using negative binomial, Poisson and Tobit models (in the Tobit model, the dependent variable is the logarithm of one plus the number of innovative start-ups in the province/industry pair and the left-censoring limit is zero).

The average ME is the average increase in the number of innovative start-ups in the province/industry due to a one standard deviation increase in the variable of interest (\({\text{LOCAL}}\_{\text{UNIKNOW}}_{i,j }\)), while the average SE is the average percentage increase of the dependent variable due to the same variation of \({\text{LOCAL}}\_{\text{UNIKNOW}}_{i,j }\).

At the end of 2014, the Italian unemployment rate among individuals who are less than 25 years old was 42.7, while the corresponding figure in Europe was 21.9. Data available in the Eurostat website: http://ec.europa.eu/eurostat/web/lfs/data/database.

See http://ec.europa.eu/enterprise/policies/sme/entrepreneurship-2020/index_en.htm for further details.

References

Acosta, M., Coronado, D., & Flores, E. (2011). University spillovers and new business location in high-technology sectors: Spanish evidence. Small Business Economics, 36(3), 365–376.

Acs, Z. J., Audretsch, D. B., & Lehmann, E. E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41(4), 757–774.

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30.

Acs, Z. J., & Plummer, L. A. (2005). Penetrating the “knowledge filter’’ in regional economies. The Annals of Regional Science, 39(3), 439–456.

Agrawal, A. (2006). Engaging the inventor: Exploring licensing strategies for university inventions and the role of latent knowledge. Strategic Management Journal, 27(1), 63–79.

Alessandrini, P., Presbitero, A. F., & Zazzaro, A. (2009). Banks, distances and firms’ financing constraints. Review of Finance, 13(2), 261–307.

Anselin, L., Varga, A., & Acs, Z. J. (1997). Local geographic spillovers between university research and high technology innovations. Journal of Urban Economics, 42(3), 422–448.

Anselin, L., Varga, A., & Acs, Z. J. (2000). Geographic and sectoral characteristics of academic knowledge externalities. Papers in Regional Science, 79(4), 435–443.

Antonelli, C. (2011). Handbook on the economic complexity of technological change. Cheltenham: Edward Elgar.

Audretsch, D. B. (1995). Innovation and industry evolution. Cambridge, MA: MIT Press.

Audretsch, D., Dohse, D., & Niebuhr, A. (2010). Cultural diversity and entrepreneurship: A regional analysis for Germany. The Annals of Regional Science, 45(1), 55–85.

Audretsch, D. B., & Feldman, M. P. (1996). R&D spillovers and the geography of innovation and production. The American Economic Review, 96(3), 630–640.

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy, 34(8), 1191–1202.

Audretsch, D., Lehmann, E. E., & Warning, S. (2004). University spillovers: Does the kind of science matter? Industry and Innovation, 11(3), 193–206.

Baptista, R., & Mendonça, J. (2010). Proximity to knowledge sources and the location of knowledge-based start-ups. The Annals of Regional Science, 45(1), 5–29.

Bercovitz, J., & Feldman, M. (2006). Entrepreneurial universities and technology transfer: A conceptual framework for understanding knowledge-based economic development. The Journal of Technology Transfer, 31(1), 175–188.

Block, J. H., Thurik, R., & Zhou, H. (2013). What turns knowledge into innovative products? The role of entrepreneurship and knowledge spillovers. Journal of Evolutionary Economics, 23(4), 693–718.

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi-Lamastra, C. (2013). University specialization and new firm creation across industries. Small Business Economics, 41(4), 837–863.

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi-Lamastra, C. (2014). The impact of local and external university knowledge on the creation of knowledge-intensive firms: Evidence from the Italian case. Small Business Economics, 43(2), 261–287.

Cameron, A. C., & Trivedi, P. K. (2009). Microeconometrics using Stata (Vol. 5). College Station, TX: Stata Press.

Carlsson, B., Acs, Z. J., Audretsch, D. B., & Braunerhjelm, P. (2009). Knowledge creation, entrepreneurship, and economic growth: A historical review. Industrial and Corporate Change, 18(6), 1193–1229.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: a new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Colombo, M. G., & Delmastro, M. (2002). How effective are technology incubators? Evidence from Italy. Research Policy, 31(7), 1103–1122.

Czarnitzki, D., & Delanote, J. (2013). Young Innovative Companies: the new high-growth firms? Industrial and Corporate Change, 22(5), 1315–1340.

Desrochers, P. (2001). Geographical proximity and the transmission of tacit knowledge. The Review of Austrian Economics, 14(1), 25–46.

EC-DG ENTR. (2009). European competitiveness report 2008. European Commission: Luxemburg.

Fischer, M. M., & Varga, A. (2003). Spatial knowledge spillovers and university research: evidence from Austria. The Annals of Regional Science, 37(2), 303–322.

Florida, R. (2002a). Bohemia and economic geography. Journal of Economic Geography, 2(1), 55–71.

Florida, R. (2002b). The rise of the creative class: And how its transforming work, leisure, community and everyday life. New York: Basic Books.

Florida, R., & Gates, G. (2002). Technology and tolerance. Diversity and high-tech growth. Brookings Review, 20(1), 32–36.

Florida, R., Mellander, C., & Stolarick, K. (2008). Inside the black box of regional development—human capital, the creative class and tolerance. Journal of Economic Geography, 8(5), 615–649.

Florida, R., & Tinagli, I. (2005). L’Italia nell’era creativa. Creativity Groupe Europe.

Fritsch, M., & Aamoucke, R. (2013). Regional public research, higher education, and innovative start-ups: An empirical investigation. Small Business Economics, 4(4), 865–885.

Gao, T. (2004). Regional industrial growth: evidence from Chinese industries. Regional Science and Urban Economics, 34(1), 101–124.

Gardner, M. (2004). Scientific language. Language Institute Journal, 2, 13–32.

Gertler, M. S. (2003). Tacit knowledge and the economic geography of context, or the undefinable tacitness of being (there). Journal of Economic Geography, 3(1), 75–99.

Ghani, E., Kerr, W. R., & O’connell, S. (2013). Spatial determinants of entrepreneurship in India. Regional Studies, 48(6), 1071–1089.

Ghio, N., Guerini, M., Lehmann, E. E., & Rossi-Lamastra, C. (2015). The emergence of the knowledge spillover theory of entrepreneurship. Small Business Economics, 44(1), 1–18.

Glaeser, E. L., & Kerr, W. R. (2009). Local industrial conditions and entrepreneurship: How much of the spatial distribution can we explain? Journal of Economics & Management Strategy, 18(3), 623–663.

Guerini, M., & Rossi-Lamastra, C. (2014). How university and industry knowledge interact to determine local entrepreneurship. Applied Economics Letters, 21(8), 513–516.

Halliday, M. A. K., & Martin, J. R. (1993). Writing science: Literacy and discursive power. London: Falmer.

Howells, J. R. (2002). Tacit knowledge, innovation and economic geography. Urban Studies, 39(5–6), 871–884.

Jacobs, J. (1969). The economy of cities. New York: Random House.

Jaffe, A. (1989). Real effects of academic research. American Economic Review, 79(5), 957–970.

Jofre-Monseny, J., Marín-López, R., & Viladecans-Marsal, E. (2011). The mechanisms of agglomeration: Evidence from the effect of inter-industry relations on the location of new firms. Journal of Urban Economics, 70(2), 61–74.

Klevorick, A. K., Levin, R. C., Nelson, R. R., & Winter, S. G. (1995). On the sources and significance of interindustry differences in technological opportunities. Research Policy, 24(2), 185–205.

Laursen, K., Reichstein, T., & Salter, A. (2011). Exploring the effect of geographical proximity and university quality on university–industry collaboration in the United Kingdom. Regional Studies, 45(4), 507–523.

McCrae, R. R. (1987). Creativity, divergent thinking, and openness to experience. Journal of Personality and Social Psychology, 52(6), 1258.

Mellander, C., & Florida, R. (2011). Creativity, talent, and regional wages in Sweden. The Annals of Regional Science, 46(3), 637–660.

Mueller, P. (2006). Exploring the knowledge filter: How entrepreneurship and university–industry relationships drive economic growth. Research Policy, 35(10), 1499–1508.

Pavitt, K. (1991). What makes basic research economically useful? Research Policy, 20(2), 109–119.

Piva, E., Grilli, L., & Rossi-Lamastra, C. (2011). The creation of high-tech entrepreneurial ventures at the local level: the role of local competences and communication infrastructures. Industry and Innovation, 18(6), 563–580.

Plummer, L. A., & Acs, Z. J. (2014). Localized competition in the knowledge spillover theory of entrepreneurship. Journal of Business Venturing, 29(1), 121–136.

Qian, H. (2013). Diversity versus tolerance: The social drivers of innovation and entrepreneurship in US cities. Urban Studies, 50(13), 2718–2735.

Qian, H., & Acs, Z. J. (2013). An absorptive capacity theory of knowledge spillover entrepreneurship. Small Business Economics, 40(2), 185–197.

Qian, H., Acs, Z. J., & Stought, R. R. (2013). Regional systems of entrepreneurship: the nexus of human capital, knowledge and new firm formation. Journal of Economic Geography, 13(4), 559–587.

Ruef, M., Aldrich, H. E., & Carter, N. M. (2003). The structure of founding teams: Homophily, strong ties, and isolation among US entrepreneurs. American Sociological Review, 68(2), 195–222.

Schartinger, D., Rammer, C., Fischer, M. M., & Fröhlich, J. (2002). Knowledge interactions between universities and industry in Austria: Sectoral patterns and determinants. Research Policy, 31(3), 303–328.

Schneider, C., & Veugelers, R. (2010). On young highly innovative companies: Why they matter and how (not) to policy support them. Industrial and Corporate Change, 19(4), 969–1007.

Schoenmakers, W., & Duysters, G. (2010). The technological origins of radical inventions. Research Policy, 39(8), 1051–1059.

Spencer-Rodgers, J., & McGovern, T. (2002). Attitudes toward the culturally different: The role of intercultural communication barriers, affective responses, consensual stereotypes, and perceived threat. International Journal of Intercultural Relations, 26(6), 609–631.

Stephan, P. E. (2012). How economics shapes science. Cambridge, MA: Harvard University Press.

Stolarick, K., & Florida, R. (2006). Creativity, connections and innovation: A study of linkages in the Montréal Region. Environment and Planning A, 38(10), 1799–1817.

Storper, M., & Venables, A. J. (2004). Buzz: face-to-face contact and the urban economy. Journal of Economic Geography, 4(4), 351–370.

Veugelers, R. (2008). The role of SMEs in innovation in the EU: A case for policy intervention? Review of Business and Economics, 53(3), 239–262.

Vuong, Q. H. (1989). Likelihood ratio tests for model selection and non-nested hypotheses. Econometrica: Journal of the Econometric Society, 57(2), 307–333.

Zahra, S. A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185–203.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ghio, N., Guerini, M. & Rossi-Lamastra, C. University knowledge and the creation of innovative start-ups: an analysis of the Italian case. Small Bus Econ 47, 293–311 (2016). https://doi.org/10.1007/s11187-016-9720-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-016-9720-2