Abstract

This article examines how the scientific specialization of universities impacts new firm creation across industries at the local level. In accordance with the Pavitt-Miozzo-Soete taxonomy, we consider eight industry categories, which reflect the characteristics of firms’ innovation patterns and, ultimately, the knowledge inputs that firms require. Using data on new firm creation in Italian provinces (i.e., at the NUTS3 level), we estimate negative binomial regression models separately for each industry category to relate new firm creation to the scientific specialization in basic sciences, applied sciences and engineering, and social sciences and humanities of neighboring universities. We find that universities specialized in applied sciences and engineering have a broad positive effect on new firm creation in a given province, this effect being especially strong in service industries. Conversely, the positive effect of university specialization in basic sciences is confined to new firm creation in science-based manufacturing industries, even if this effect is of large magnitude. Universities specialized in social sciences and humanities have no effect on new firm creation at the local level whatever industry category is considered.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Scholars have long debated on whether and how universities exert an influence on the productive system of the local context in which they are embedded. Studies on this theme have traditionally focused on the effects of university presence on R&D, innovation and growth of firms located in neighboring geographical areas (e.g., Jaffe 1989; Anselin et al. 2000; Fischer and Varga 2003). More recently, scholars have focused attention on the impact of universities on the creation of new firms at the local level (see Acosta et al. 2011 and Bonaccorsi et al. 2013a for recent surveys of this emerging literature).

New firm creation is indeed an effective mechanism to leverage the knowledge generated by universities. First, according to the knowledge spillover theory of entrepreneurship (e.g., Audretsch 1995; Acs et al. 2009), universities produce knowledge that creates new opportunities that can be exploited commercially. These opportunities are often discarded by incumbent firms, which are unable to recognize their potential value and are unwilling to implement new products or processes. Conversely, prospective entrepreneurs can penetrate the knowledge filter (Acs and Plummer 2005) and create new ventures out of university knowledge. Second, prospective entrepreneurs can rely on university knowledge for solving complex technological problems (e.g., Meyer-Krahmer and Schmoch 1998; Cohen et al. 2002). In turn, this facilitates the creation of new firms.

In order to benefit from university knowledge for new firm creation, prospective entrepreneurs require intense and frequent direct interactions with academic personnel (Storper and Venables 2004; Morgan 2004). As a corollary, geographical proximity to a university plays a potential role for new firm creation (Audretsch and Lehmann 2005). Accordingly, several empirical studies have documented the positive impact of different kinds of university knowledge—i.e., scientific publications, academic patents and knowledge embedded in university graduates—on new firm creation at the local level (Harhoff 1999; Woodward et al. 2006; Kirchhoff et al. 2007; Acosta et al. 2011; Piva et al. 2011; Bonaccorsi et al. 2013b). This article grounds on this literature and originally adds to it by offering a comprehensive answer to two interlinked research questions: (1) does the allegedly positive effect of university knowledge on new firm creation at the local level vary across industries, depending on the peculiarities of industry-specific innovation patterns? (2) Does this effect depend on the scientific specialization of universities?

Our main insight is that the diverse scientific specialization of universities has a different impact on new firm creation at the local level, depending on the knowledge inputs required by firms that operate in industries characterized by different innovation patterns and the strenght of the knowledge filter of incumbent firms in these industries. Knowledge spilling over from universities with diverse scientific specializations has indeed different value for the creation of new firms in different industries, in terms of both the new opportunities that this knowledge creates and of the solutions to complex problems that it provides. For instance, polytechnics generate technical knowledge, with quite immediate commercial applications, and train highly qualified technicians, such as engineers, architects and designers. Furthermore, new instruments and techniques developed within engineering departments can be directly used to improve production processes and to help solve complex technical problems. Hence, we expect a pervasive impact across industries of this type of knowledge on new firm creation at the local level. Conversely, biology, chemistry, physics and mathematics departments generate more basic, fundamental knowledge, whose practical applications are less direct and immediate, or limited to specific industries. Furthermore, the knowledge filter of incumbent firms likely depends on the technological environment typical of the industry in which incumbents operate. The smaller (or greater) propensity of incumbent firms to use new ideas derived from university knowledge, thereby leaving more (or less) room for new firm creation, is indeed related to the degree of uncertaintyFootnote 1 surrounding the further development and commercial exploitation of these new ideas. A greater uncertainty leads to greater inertia on the part of incumbent firms (Audretsch and Keilbach 2007). In turn, uncertainty differs across the scientific fields from which these new ideas originate. On the basis of the above considerations, it is reasonable to expect that universities having diverse scientific specializations nurture local entrepreneurship differently in diverse industries.

To answer the aforementioned research questions, we cluster new firms in eight industry categories on the basis of the characteristics of their innovation patterns—and, ultimately, of the knowledge inputs they require—according to a comprehensive taxonomy of both manufacturing and service economic activities obtained by combining the taxonomies proposed by Pavitt (1984) and by Miozzo and Soete (2001). With respect to university specialization, we distinguish among basic sciences, applied sciences and engineering, and social sciences and humanities (see Sect. 3 for a detailed description of the scientific fields).

Our work originally advances our comprehension of the relationship link between university knowledge and new firm creation at the local level, an issue that has both academic and policy relevance. Prior studies have shown that the impact of university knowledge on industrial R&D differs across industries and depends on the scientific field in which this knowledge is produced (Klevorick et al. 1995; Cohen et al. 2002). However, these findings have not been fully integrated within the research strand that studies the impact of university knowledge on new firm creation at the local level. The few studies that have considered the impact on new firm creation of the scientific field of university knowledge have focused on high-tech industries. Reasonably enough, these works have shown that university specialization in natural sciences and engineering fosters local high-tech entrepreneurship (Woodward et al. 2006; Abramovsky et al. 2007; Kirchhoff et al. 2007; Baptista and Mendonça 2010), while university specialization in social sciences has no effect (Audretsch et al. 2005; Audretsch and Lehmann 2005; for an exception relating to knowledge-intensive business services, see Baptista and Mendonça 2010). Nevertheless, these works have not investigated whether and how the impact of university specialization on new firm creation varies across industries. In so doing, our article depicts a comprehensive picture of the impact of university knowledge on local entrepreneurship across the entire productive system. Therefore, it offers interesting suggestions to policymakers who design policies in support of entrepreneurship.

In the empirical part of the article, we consider the Italian province (NUTS3 level) as a unit of analysis. Separately for each industry category in the Pavitt-Miozzo-Soete (PMS) taxonomy, we estimate negative binomial regression models where the dependent variable is the number of new firms created in each province/industry category. In order to assess the effect of university specialization, we examine whether universities specialized in basic sciences, applied sciences and engineering and social sciences and humanities influence new firm creation differently at the local level in the eight industry categories. For this purpose, we combine data from a number of rich information sources, including the EUMIDA database, containing data on Italian universities, and the MOVIMPRESE directory, from which we extracted the total population of new firms established in Italy during 2010 in each industry category.

Our results suggest that university specialization in basic sciences has a limited direct impact on new firm creation at the local level across the eight industry categories, its effect being confined to science-based manufacturing industries. Conversely, proximity to universities specialized in applied sciences and engineering has a broader positive impact on new firm creation, which spans across industry categories, and it is especially strong in service industries. Finally, university specialization in social sciences and humanities does not engender any significant positive effect on new firm creation in any of the eight industry categories of the PMS taxonomy.

The remainder of the article is organized as follows. The next section describes the PMS taxonomy and links the characteristic of the innovation patterns in the eight industry categories to the scientific specialization of universities. Section 3 illustrates the data, the variables used in descriptive analyses and econometric models, and the estimation method. Section 4 provides overall descriptions of the Italian university system and productive system. Then, it reports the results of the econometric estimates. Section 5 discusses these results and concludes the article.

2 The PMS industry taxonomy, university scientific specialization and creation of new firms

As mentioned above, the present study moves from the premise that universities with different scientific specializations nurture territories with diverse knowledge inputs. Contingent on the strenght of incumbent firms’ knowledge filter, these knowledge inputs can be leveraged by prospective entrepreneurs to create new firms in different industry categories, which are characterized by different innovation patterns. Thus, we build on previous works that have emphasized that industries differ in their patterns of innovation and relate them to the research stream that has addressed the impact of the scientific specialization of universities on the productive system.

Focusing attention on manufacturing industries, the seminal contribution by Pavitt (1984) proposes a taxonomy that defines four industry categories with common characteristics in terms of sources, nature and directions of innovation: science-based (SB), supplier-dominated (SD), scale-intensive (SI) and specialized-supplier (SS) industries.

The SB industry category includes electronics (inclusive of telecommunication equipment), computers and pharmaceutical industries. Firms in this group are the most R&D intensive ones. The development of radically new products that meet customers’ latent needs and allegedly create new industry segments is a fundamental source of competitive advantage for firms in SB industries. The innovation pattern of these firms builds on their ability to explore and take advantage of the technological opportunities generated by advancements in scientific knowledge. Klevorick et al. (1995) highlight that basic scientific fields (like biology for pharmaceutical firms or physics for semiconductor firms) have crucially driven technological progress in SB industries. Hence, in these industries university knowledge in both basic sciences and applied sciences and engineering is a fundamental source of new ideas for innovative products. The further development and commercial exploitation of these new ideas is surrounded by great uncertainty (in the sense of Knight 1921). Because of this uncertainty, incumbent firms suffering from organizational inertia are slow in recognizing the business opportunities associated with these innovations, especially the most radical ones. Due to the knowledge filter of incumbent firms, university knowledge in the above-mentioned fields fuels new firm creation. In accordance with this argument, most academic startups, i.e., new firms created by academic personnel with the aim of exploiting knowledge generated by university research, fall in this industry category (Rothaermel et al. 2007). Furthermore, the novelty of the products developed by newly created SB firms implies that these firms are often obliged to develop internal capabilities to master process innovations alike and to solve complex technical problems. For this purpose, the knowledge inputs of local universities in basic sciences and in applied sciences and engineering are again of paramount importance. In sum, in the SB industry category we expect a positive impact of university specialization in both basic sciences and applied sciences and engineering on new firm creation at the local level.

Conversely, SD industries include firms operating in traditional industries (e.g., textiles, leather goods, furniture). These firms generally produce goods that are simple from a technological viewpoint, while their in-house R&D and engineering capabilities tend to be weak or absent. Innovations are mainly directed to process innovations aimed at reducing costs. These innovations mainly come from suppliers, being embodied in the capital equipment and intermediate inputs. Accordingly, we expect the impact of universities on new firm creation at the local level to be weak, independently of university scientific specialization.

Firms in SI industries produce consumer durables (e.g., food, chemicals and motor vehicles) and processed raw materials (e.g., metal manufacturing, glass and cement). Their production activities generally involve mastering complex systems, and economies of scale are a crucial source of competitive advantage. SI firms produce a high proportion of their own process technologies and need to nurture internally the technological skills necessary for this innovation activity. Therefore, geographical proximity to universities specialized in applied sciences and engineering makes it easier for new firms in these industries to hire well-trained scientists and engineers and access knowledge that solves the complex technical problems arising in scaling up production processes, and so this favors the creation of new firms.

Finally, the SS industry category includes equipment-building and mechanical engineering industries. The innovative activity of SS firms relates primarily to product innovations that are used by other industries as capital inputs. The competitive success of these firms depends mainly on the development of the distinctive capability to continuously improve product design and assure product reliability, and on firms’ ability to respond sensitively and quickly to users’ changing needs. Accordingly, as indicated by the seminal work by Von Hippel (1976), users are a crucial source of knowledge inputs for the innovative activity of SS firms. Neighboring universities may favor the creation of new SS firms to the extent that they offer them knowledge inputs in applied sciences and engineering that help solve the new technical problems raised by users. Nonetheless, as collaborations with users are compelling for SS firms, geographical proximity to users is more important to new firms in this industry category than the geographical proximity to universities specialized in applied sciences and engineering.

Let us now consider service industries. In the original formulation, the Pavitt taxonomy classifies service industries within the SD industry category. Nevertheless, other studies have suggested that there is heterogeneity in the patterns of innovation in services. Tidd et al. (2001) propose a revised Pavitt taxonomy adding a fifth category, that of information-intensive firms. Evangelista (2000) classifies service industries in four categories: technology users, science and technology based, interactive and IT based, and technical consultancy. De Jong and Marsili (2006) propose a taxonomy for small and micro firms in both manufacturing and services, classifying firms into four categories that resemble Pavitt's taxonomy. Following more recent studies (e.g., Dewick et al. 2004; Castellacci 2008; Castaldi 2009; Capasso et al. 2011; Forsman 2011), in this article we combine the Pavitt taxonomy of manufacturing industries with the taxonomy of services put forth by Miozzo and Soete (2001). Specifically, these authors distinguish among four different groups of service industries: knowledge-intensive business services (KIBS),Footnote 2 supplier-dominated services (SDS), physical network services (PNS) and information network services (INS).

The KIBS category includes software, R&D services, engineering and consultancy firms. KIBS industries are to some extent similar to the SB category in manufacturing industries in that (1) they produce their own innovations, (2) they rely heavily on R&D activities, and (3) their innovation patterns are in a close relation with the scientific advances achieved by universities (see, e.g., Castellacci 2008). Accordingly, we expect that in this industry category, university specialization in both basic sciences and applied sciences and engineering engenders a positive effect on new firm creation at the local level for reasons similar to those illustrated in the discussion on SB industries.

SDS industries are just the opposite of KIBS. The SDS category includes hotels, restaurants, rental services and personal services firms. Similarly to SD manufacturing firms, SDS firms mainly rely for their innovation activity on the purchase of capital goods produced in manufacturing sectors or on the adoption of information technology, while the knowledge inputs generated by universities play a minor role. Therefore, it is reasonable to expect that their innovation pattern is similar to that of SD manufacturing industries. Accordingly, we predict a negligible impact of neighboring universities on new firm creation in this industry category, whatever university scientific specialization.

In PNS industries we find firms operating in transport, energy, water, waste management, travel, wholesale trade and distribution services. The ability to design and manage large-scale physical networks (e.g., energy and water transportation and distribution networks, gas and oil pipelines, logistics networks) is a crucial source of competitive advantage for PNS firms. These firms need to develop internal R&D and engineering capabilities oriented to process innovation. Knowledge provided by universities is an essential input to solve the related technical problems. Accordingly, as for the SI industry category, the local availability of well-trained scientists and engineers and the high-quality technical knowledge produced by engineering and applied sciences university departments are expected to positively affect new firm creation. Indeed, accessing these essential knowledge inputs at distance would be very complex and costly for new firms.

Finally, the INS industry category includes communication, financial intermediation and insurance services. These activities depend on large information networks and heavily rely on efficient information management. Patterns of innovation in this industry category are similar to those in the SI and PNS categories in that economies of scale are a key source of competitive advantage. However, the advent of new paradigms in computer and information network technologies in the 1980s and 1990s have determined radical technological and organizational changes among INS firms, leading to the externalization of information-based innovations and the simplification of internal technological tasks.Footnote 3 Therefore, engineering skills have become less important for these firms. Accordingly, the positive impact on new firm creation of the specialization of local universities in applied sciences and engineering is expected to be weaker than in the SI and PNS industry categories.

The main characteristics of the innovation patterns of firms in the eight industry categories and our predictions relating to the impact of the scientific specialization of universities on new firm creation at the local level are synthesized in Table 1.

3 Data and methods

3.1 Data

We collected data on the population of new firms established in Italy in 2010 (22,761 firms) from the MOVIMPRESE (Union of the Italian Chambers of Commerce) database. Data on new firms were then aggregated according to the PMS taxonomy.Footnote 4 Data on Italian universities were extracted from the EUMIDA database. The database was developed under a European Commission tender, and it is based on official statistics produced by the National Statistical Authorities in all 27 EU countries plus Norway and Switzerland (for details, see EUMIDA 2010). The EUMIDA project consisted of two data collection processes: Data Collection 1 included all higher education institutions that are active in graduate and postgraduate education (i.e., universities), but also in vocational training (2,457 institutions in total). Out of them, 1,364 are defined as research active institutions, implying that research is considered by the institution as a constitutive part of institutional activities and it is organized with a durable perspective. Criteria for inclusion were the following: the existence of institutionally recognized research units; the existence of an official research mandate; the presence of regular PhD programs; the consideration of research in the strategic objectives and plans; and the regular funding for research projects either from public agencies or from private companies. Research active institutions include all universities, but also non-PhD granting institutions and college-like institutions that devote resources to research, particularly in dual higher education systems in Central and Northern Europe. Research active institutions were the object of Data Collection 2, for which a larger set of variables were collected. These variables include the disaggregation of the academic staff in six academic disciplines (as in 2008), namely: agriculture, engineering (i.e., architecture, civil engineering, industrial engineering and information engineeringFootnote 5), humanities (i.e., arts, history, linguistics, philosophy and psychology), medical sciences, natural sciences (i.e., biology, chemistry, earth sciences, mathematics and physics) and social sciences (i.e., economics, law and political sciences). We extracted from the EUMIDA database information on the location of all Italian research active universities and, for each university, on the size of the academic staff in the different academic disciplines. As will be explained in greater detail in Sect. 3.2, academic disciplines are used to define the scientific specialization—in basic sciences, applied sciences and engineering, and social sciences and humanities—of each Italian university.

Our final data set consists of 80 research active universities and 22,761 new firms established in Italy during 2010. We classified data into geographical units (Italian provinces, equivalent to NUTS3 level) according to the location of new firms and universities. In particular, in 51 out of the 103 provinces considered in this study, there is at least one research active university.

In addition, we considered an array of characteristics of Italian provinces. To this aim, we relied on multiple sources of data. From the MOVIMPRESE database we extracted the number of incumbent firms in each Italian province as in 2009. As for new firms, data on incumbent firms were aggregated according to the PMS taxonomy alike. Furthermore, we used the Italian National Institute of Statistics (ISTAT) and the Istituto TagliacarneFootnote 6 databases to extract data on economic context, demographics and the infrastructural endowment of Italian provinces as in 2009. Finally, we downloaded the list of Italian science parks and business incubators as in 2009 from the website of the Association of Italian Science and Technology Parks (APSTI). A detailed description of the variables used in this study is reported in the next section.

3.2 Variables and estimation method

The aim of this article is to assess the impact of university specialization on new firm creation at the local level in different industry categories. Accordingly, the dependent variable, Newfirm i,j , is the number of new firms established during 2010 in the province i and in the industry category j, with j ∈ Λ = {SB, SD, SI, SS, KIBS, SDS, PNS, INS}.

Variables dealing with university specialization are calculated according to the following three steps procedure. First, we used the disaggregation of the academic staff by academic discipline (i.e., engineering, humanities, medical sciences, natural sciences and social sciences)Footnote 7 reported in the EUMIDA database to compute a Balassa Index (BI u,d ) for each university u and academic discipline d (Balassa 1965). BI u,d values range between zero and infinity with neutral value at 1. Values higher than 1 mean that that the university u is more specialized in the academic discipline d than the average Italian university and vice versa when values are lower than 1. Specifically:

where staff u,d is the number of full professors, associate professors and assistant professors enrolled in the university u and specialized in the academic discipline d (engineering, humanities, medical sciences, natural sciences and social sciences).

Second, we constructed three university specialization variables using the Italian provinces as the unit of analysis and distinguishing between universities specialized in basic sciences (UNI_BAS i ), applied sciences and engineering (UNI_APP i ), and social sciences and humanities (UNI_SSH i ). Specifically, UNI_BAS i is a dummy variable that equals 1 if in the province i there is at least one university whose academic staff is specialized in natural sciences (i.e., in the province i there is at least one university with a Balassa Index in natural sciences >1). Similarly, UNI_APP i is a dummy that equals 1 if in the province i there is at least one university with a Balassa Index that is >1 in engineering or in medical sciences and UNI_SSH i equals 1 if in the province i there is at least one university with a Balassa Index >1 in humanities or social sciences.

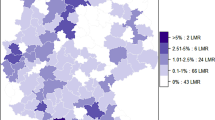

Third, university knowledge does not exert effects only within the border of the province in which the university is located, but cross-border effects might be at work. Indeed, new firm creation in a province might be affected by specialized knowledge developed by universities located in neighboring provinces (Woodward et al. 2006; Bonaccorsi et al. 2013b). Therefore, starting from the three university specialization variables defined above, we considered the effect engendered by universities located in neighboring provinces through the spatial weighted variables UNI_BAS w i , UNI_APP w i and UNI_SSH w i . These variables were constructed using the distance between every possible pair of Italian provinces as a weight (for a similar approach, see Fischer and Varga 2003).Footnote 8 Specifically:

where x ∈ Ω = (UNI_BAS i , UNI_APP i , UNI_SSH i ) and d i,k is the Euclidean distance (km) from the centroid of the province i to the centroid of the province k, with d i,i = 1. According to Eq. (2), the variables UNI_BAS w i , UNI_APP w i and UNI_SSH w i measure the geographical proximity to provinces in which there are universities specialized in basic sciences, applied sciences and engineering, and social sciences and humanities, respectively.

As our dependent variable Newfirm i,j —i.e., the number of new firms in province i in industry category j—is a count variable, we evaluated the impact of university specialization on new firm creation at the local level by estimating a negative binomial regression model (for a similar approach, see Audretsch and Lehmann 2005) separately for each industry category in the PMS taxonomy.Footnote 9 We opted for the negative binomial regression model instead of the Poisson regression model as our dependent variable is characterized by over-dispersion (Greene 2003; Hilbe 2007).Footnote 10 We resorted to the following specification:

The vector Z i,j includes several control variables to account for other factors affecting new firm creation at the local level. First, knowledge spillovers do not originate only because of university presence. According to the knowledge spillover theory of entrepreneurship, also incumbent firms are a significant source of knowledge inputs for new firms. The density of incumbent firms in a geographical area has been shown to significantly affect new firm creation at the local level (e.g., Baptista and Swann 1999; Acs and Plummer 2005). Therefore, we included the number of incumbent firms in the industry category j per thousand inhabitants in the province i (Firms_pop i,j ). Furthermore, knowledge spillovers may originate from firms in industries other than the focal industry in which new firms operate (Jacobs 1969). The higher is the industrial diversity the more valuable are the knowledge spillovers from other industries for new firm creation in province i (Feldman and Audretsch 1999). Industrial diversity is inversely captured by the Herfindahl-Hirschman Index (HHI i ) of the shares of incumbent firms operating in each industry out of the total incumbent firms located in province i (Kerr and Glaeser 2009). Following the arguments above, we predict a positive coefficient for variable Firms_pop i,j and a negative coefficient for variable HHI i .

Second, as a measure of the size of the regional demand, we used the population density (Density i ), measured as the ratio between the population and the area in square meters of the province. We expect to find higher creation of new firms in provinces with higher population density. Moreover, we included the variable Dist_Capital i , that measures the distance (in km) of the province i from the administrative capital of the region at NUTS2 level (see Baptista and Mendonça 2010, for a similar approach).

Third, individual characteristics do have an impact on the probability to start a new firm. Accordingly, we included the percentage of the population between 20 and 39 years old out of the total population in the province i (Pop_20_39 i ) as we expect that individuals in this age class have a higher propensity to entrepreneurship (Kerr and Glaeser 2009). In addition, unemployed individuals may be more likely to start their own venture as their opportunity costs of self-employment are low (see Carree et al. 2008 for a discussion on this issue). To control for this effect, we included the variable Unemployment i , measured as the percentage of unemployed individuals out of the total workforce in the province i. Fourth, some geographical areas have more hostile natural environments for firms producing certain goods and services (e.g., mountain areas are inadequate for ship building or for transporting very heavy products). Accordingly, we posit that new firm creation at the local level is affected by the cost disadvantages engendered by natural environments (Ellison and Glaeser 1999). As a proxy of these cost disadvantages, we included the percentage of the population living in mountain areas out of the total population in the province i (Pop_moun i ).

Fifth, we controlled for the presence of economic infrastructures in the province i, by including an index of economic infrastructure development (Index_infra i ), in line with the view that an efficient infrastructure stimulates entrepreneurship, especially in services (Piva et al. 2011).

Sixth, we included a dummy variable indicating if in the province i there is at least one business incubator (BI i ). Indeed, business incubators assist nascent firms in developing their business and provide them support services (Colombo and Delmastro 2002).Footnote 11

Finally, to take into account the presence of a North-South divide with respect to new firm creation (e.g., Bonaccorsi et al. 2013a), we added dummy variables at NUTS1 level (i.e., Italian macro-areas). We report in Table 2 the detailed description of variables used in our study and in Table 3 their summary statistics.

4 Results

4.1 The Italian university system

The Italian university system is one of the oldest in the world. The University of Bologna claims to be the first university in Europe, together with Paris. By the early 1600s, Italy had a fairly well-developed university system.Footnote 12 According to the tradition, the most important disciplines were humanities (Studia Humanitatis), philosophy (logic, natural philosophy, theology and moral philosophy), medicine, mathematics and law. The ancient model of universities spanning basic sciences, applied sciences, humanities and law, survived over centuries. Then, established universities included new technical disciplines (engineering) and social sciences (economics, business, political science) within their scope. In addition, the increasing social demand for vocational training and professional education that Italy experienced after the Second World War and in the 1970s has been channeled into the university system (Kyvik 2004). The dominant model that has emerged from these historical tendencies is thus one of a Generalist University, covering a large span of disciplines with teaching and research. Specialized universities by discipline (e.g., technical universities, medical universities) are indeed very rare (Bonaccorsi and Daraio 2007).

The legacy of this historical tradition is still visible in the data on scientific specialization of universities we consider in this article (i.e., in basic sciences, applied sciences and engineering and social sciences and humanities). Specifically, it turns out that only 4, 10 and 18 Italian universities (out of 80) are specialized exclusively in basic sciences, applied science and engineering and social sciences and humanities, respectively. As to the other 48 universities, they are specialized in more than one scientific field, or, in very rare cases (2 out of 80), they have no particular scientific specialization.

The four universities specialized exclusively in basic sciences (i.e., Parma, Perugia, Cagliari and Trieste) are located in peripheral areas. Universities specialized exclusively in applied sciences and engineering include the four polytechnics (Milan, Torino, Bari and Ancona) and some young universities such as Campus Biomedico in Rome and Università Mediterranea in Reggio Calabria. Universities specialized exclusively in social sciences and humanities include some private business schools (e.g., Bocconi and LUISS) and universities for foreign students (Siena and Perugia). Finally, universities specialized in more than one scientific field tend to be old and established (e.g., Bologna, Padova, Pisa), with some examples of younger institutions (e.g., Roma Tor Vergata, Modena).

4.2 The Italian productive system according to the PMS taxonomy

Table 4 reports the distribution of incumbent firms as in 2009 (in the first two columns) and new firms created in 2010 (in the third and fourth columns) in all the eight industry categories of the PMS taxonomy. The last column also shows the entry rate, i.e., the ratio between the number of new firms and the number of incumbent firms.

The sum of incumbent firms in services (INS, PNS, SDS and KIBS industry categories) accounts for 77.95 % of the total number of incumbent firms in all the industry categories. Furthermore, the percentage of new firms in services out of the total number of new firms in all the industry categories is 83.15 %. Considering that the percentage of exits in services out of the total number of exits is 79.17 %, these figures argue in favor of the increasing importance of services in the Italian economy. This is hardly surprising: the increasing weight of services over the overall economic activities a mainstream tendency of developed economies. Services are playing an increasingly important role in most OECD countries (see, e.g., Pilat et al. 2006. See also Drejer 2004 and Miles 2005 for evidence in the UK and US, respectively).

Figures in Table 4 clearly highlight that SDS is the largest industry category in the Italian economy, accounting for 39.78 % of the total number of incumbent firms in all industries and for 38.30 % of the total number of new firms. Conversely, the SB industry category is the smallest one (0.72 and 0.51 % considering incumbent and new firms, respectively), confirming the low specialization of the Italian economy in high-tech manufacturing. However, a different pattern emerges when looking at high-tech services, i.e., the KIBS industry category. The percentage of KIBS incumbent firms out of the total number of incumbent firms in all industries is 11.85 %. In addition, among the eight industry categories, the KIBS category exhibits the highest entry rate (2.97 %). The percentage of new firms in the KIBS category with respect to the total number of new firms is indeed 20.41 %. Furthermore, the percentage of exits in the KIBS category with respect to the total number of exits in all industries is 13.98 %. Overall, this descriptive evidence suggests that high-tech services are becoming increasingly important in the Italian economy. Finally, it is worth noting that in service industries entry rates are generally higher than in manufacturing. The only exception in manufacturing is the SS industry category, which exhibits a quite high entry rate (2.12 %). This is probably related to the fact that in the SS industries barriers to entry are quite low, while they are rather high in the SI, INS and PNS industries. Following the discussion in Sect. 2, in the SI and PNS industry categories the cost advantages of large incumbent firms that have already achieved economies of scale may prevent new firm creation.Footnote 13 The presence of high barriers to entry in the INS industry category is to be traced back to the fact that this category includes regulated industries such as telecommunications and financial services. Conversely, the low entry rate in the SD industry category may be driven by the adverse economic conditions that characterized Italy in 2010, which have negatively affected consumers’ demand.Footnote 14

4.3 Results of the econometric estimates

The results of the econometric estimates of Eq. (3) for the eight industry categories of the PMS taxonomy are reported in Table 5. Panel A of Table 5 shows the econometric estimates of manufacturing industries, while panel B concerns services.

Results for control variables are in line with the literature. We find evidence on knowledge spillovers coming from local incumbent firms operating in the same industry category. The coefficients for Firms_pop i,j are positive and significant in all industry categories. Conversely, the role of industrial diversity in determining new firm creation is much more limited, being confined to the SD industry category. The coefficient of the variable measuring population density (Density i ) is positive and significant in manufacturing industries (with the exception of the SB industry category) and in the SDS industry category. Dist_Capital i has a negative and significant coefficient only in the SD and PNS industry categories. The share of population between 20 and 39 years old in the province (Pop_20_39 i ) has a positive and significant impact on new firm creation in all industry categories, while the coefficient of Pop_moun i is negative and significant in most industry categories (with the exception of the SB, SD and INS industry categories). Quite surprisingly, the presence of business incubators (BI i ) is not associated with a significantly higher number of new firms in the SB industry category. Conversely, entrepreneurship in SB industries is higher in provinces with high unemployment rates. In these provinces, the number of incumbent firms in the SB industry category possibly is low. Accordingly, the opportunity costs of self-employment are low, and skilled people are more likely to start their own venture with respect to provinces in which skilled workers can be easily hired by SB incumbent firms. Finally, as expected, Index_infra i is positive and significant for the PNS and INS industries, suggesting that the availability of infrastructures is relevant for network industries.

We turn attention now to the role of university specialization. First, in all estimates, we observe that in accordance with our predictions the scientific specialization in social sciences and humanities (UNI_SSH w i ) is not significant at conventional confidence levels.Footnote 15 Furthermore, university specialization in basic sciences influences new firm creation at the local level only in SB industries. The coefficient of UNI_BAS w i [i.e., β 1 according to Eq. (3)] is positive and significant at 5 %. To evaluate the magnitude of this effect, we calculated the incidence rate ratio (IRR) of β 1, i.e., exp(β 1).Footnote 16 The IRR of β 1 for the SB industry category is 1.896, meaning that a one unit increase in UNI_BAS w i is associated with an 89.6 % increase in the number of new SB firms in the province i. It is worth noting that a one unit increase in UNI_BAS w i corresponds to the difference between a province in which there is at least one university specialized in basic sciences and a province without universities specialized in this domain (holding constant the other characteristics of the focal province and the effect of universities located in other provinces). These results are consistent with the view that the basic scientific knowledge produced by local universities is a fundamental input of the innovation activity of new SB firms. Conversely, for other industry categories we did not find any significant impact of university specialization in basic sciences. Quite surprisingly, the coefficient of UNI_APP w i is not significant in the SB and SI industry categories. However, university specialization in applied sciences and engineering engenders a positive effect on new firm creation at the local level in all service industries, with the exception of INS industries, where the coefficient of UNI_APP w i is positive but it is not significant. The coefficient of UNI_APP w i is positive and significant at 5 % in the KIBS and SDS industry categories and at 1 % in the PNS industry category. The corresponding IRRs associated with the β 2 coefficient are 1.338, 1.331 and 1.389 in the KIBS, SDS and PNS industry categories, respectively. Hence, the presence of universities specialized in applied sciences and engineering in the province i results in a 33.8, 33.1 and 38.9 % increase (ceteris paribus) in the number of new firms in the KIBS, SDS and PNS industry categories, respectively. Finally, we do not detect any significant effect of university specialization in the SI, SS, SD and INS industry categories. The fact that the effect of university specialization in applied sciences and engineering is not significant in the SI industry category is rather surprising. Firms in this category usually need technical skills in order to scale up productive processes. Nevertheless, geographical proximity to a university seems not to be the main mechanism through which new firms in this industry category access technical knowledge. A possible reason lies in the fact that the localization choice of these firms is more sensitive to proximity to production inputs, like cheap labor, or to the local availability of public support measures, than to the characteristics of the local university system.

4.4 Robustness checks

To further validate our findings, we run three robustness checks whose results are reported in the Appendix. First, we re-run negative binomial regression models in each industry category by including three additional university variables. Specifically, UNI_Staff w i is a measure of university size, and it is defined as the number of full, associate and assistant professors; UNI_Patents w i is the ratio between the number of academic patents and the number of full, associate and assistant professors; and UNI_Third w i is the ratio between third party funding and government core funding. These variables have been spatially weighted according to expression (2). As shown in Table 9 of the Appendix, results on university specialization are qualitatively similar to those reported in Table 5, although statistical significance is somewhat weaker.

Second, one may argue that observing new firm creation at one point in time (i.e., in 2010) may bias our results. Therefore, we estimated the negative binomial regression models using as dependent variable the sum of the new firms created in 2009, 2010 and 2011 in each industry category. As shown in Table 10 of the Appendix, results are largely unchanged for the SB, PNS and KIBS industry categories. However, the specialization in applied sciences and engineering has a positive impact significant at the conventional confidence levels also in the SS and INS industry categories, while its impact on SDS is negligible.

Finally, we controlled whether our results are affected by spatial autocorrelation. To this aim, we run Moran I tests to check spatial autocorrelation of the post-estimation residuals of the negative binomial regression models presented in Table 5. These tests reject the null hypothesis of absence of spatial autocorrelation in the residuals only in the SD and PNS industry categories (at the 1 and 10 % significance level, respectively). Therefore, we run spatial autoregressive models (SAR), which include a spatially weighted measure of the dependent variable among the regressors to account for the possible spatial autocorrelation in the dependent variable. Ideally, we should have run SAR for count data based on a Poisson distribution as proposed by Lambert et al. (2010). However, at present there are no routines in STATA (the econometric software used in this study) to estimate these models. For this reason, we run SAR models estimated via maximum likelihood for each industry category using as dependent variable the inverse hyperbolic sine transformation of the number of new firms, defined as log[Newfirm i,j + (Newfirm 2 i,j + 1)1/2]. This transformation can be interpreted as a logarithmic transformation, but it is appropriate when the dependent variable assumes, as in our case, value zero for some observations (Burbidge et al. 1988). Results are shown in Table 11 in the Appendix and confirm the findings reported in Table 5.Footnote 17

5 Discussion and conclusions

In this article, we have discussed and offered detailed empirical evidence on how new firm creation at the local level across the eight industry categories of the PMS taxonomy depends on the scientific specialization of neighboring universities. Results suggest that university specialization in applied sciences and engineering has a positive effect of nonnegligible magnitude on local entrepreneurship in services. Conversely, university specialization in social sciences and humanities does not engender any significant effect on new firm creation in any industry category. Furthermore, university specialization in basic sciences matters only for SB industries, this effect being of very large magnitude.

The contribution of the present article to extant literature is twofold. First, our results complement the evidence provided in the Yale (Klevorick et al. 1995) and the Carnegie Mellon (Cohen et al. 2002) surveys on the impact of public research (i.e., research from universities and governmental R&D laboratories) on industrial R&D in manufacturing industries. This evidence suggests that public knowledge in basic sciences is fundamental for industrial R&D in a few selected industries (e.g., biology and chemistry in pharmaceuticals, physics and mathematics in semiconductors and aerospace, Cohen et al. 2002, p. 11). In most industries, respondents in the Yale and Carnegie Mellon surveys consider public research in engineering and applied sciences (notably, material sciences and computer sciences) to contribute more importantly to industrial R&D than research in the basic sciences. We add to this debate by shifting the locus of inquiring from the impact of public knowledge in diverse scientific fields on industrial R&D to its impact on the creation of new firms. Such a choice is undoubtedly of both academic and practical relevance as startups are generally regarded as the major beneficiaries of knowledge produced by universities and governmental R&D laboratories. Moreover, the aforementioned studies have examined the impact of university specialization only in manufacturing industries. Conversely, our work extends the boundaries of the analysis to include service industries, thus contributing to the literature that studies entrepreneurship and innovation in services (Tether 2003, 2005; Tether and Tajar 2008; for a recent review see Miles 2012). Our findings document the positive impact of university knowledge in engineering and applied sciences for local entrepreneurship in services. This impact is not limited to the KIBS industry category. University knowledge is important also in the PNS industry category where the ability to design and manage large-scale physical networks is a source of competitive advantage.

Second, in the spirit of the call of the present special issue, the article advances the knowledge spillover theory of entrepreneurship (Audretsch 1995; Audretsch and Lehmann 2005; Audretsch and Keilbach 2007; Acs et al. 2009). Prior works examining how university knowledge spills over across territories to nurture local entrepreneurship have focused on the impact of university knowledge on new firm creation in high-tech industries (Woodward et al. 2006; Abramovsky et al. 2007; Kirchhoff et al. 2007; Baptista and Mendonça 2010; Bonaccorsi et al. 2013b). Our results on new firm creation in the SB and KIBS industry categories mimic those of the aforementioned studies. Thus, the present article offers further support to the idea that university knowledge is a source of innovative opportunities that, being neglected by incumbent firms, foster local entrepreneurship in high-tech industries. More importantly, the article offers novel nuances to the knowledge spillover theory of entrepreneurship by relating the impact of the scientific specialization of universities on new firm creation to the specificities of the innovation patterns in the eight industry categories of the PMS taxonomy. Indeed, the positive impact of university specialization in applied sciences and engineering on local entrepreneurship in the PNS and SDS industry categories suggests that universities not only provide prospective entrepreneurs with innovative opportunities to be exploited commercially, but also help them to solve the technical problems they encounter while creating their ventures out of entrepreneurial opportunities that are not necessarily generated by universities (but, e.g., by incumbent firms). These findings are consistent with the view that innovation is not a linear process, in which basic research directly leads to industrial R&D, which, in turn, leads to development, production and marketing. Prominent scholars (e.g., Kline and Rosenberg 1986; Von Hippel 1988; Nelson 1990; Rosenberg 1992) have suggested more complex models of innovation, involving feedback, loops and non-sequential interactions. As a further addition to the knowledge spillover theory of entrepreneurship, it is worth mentioning that we consider here a fine-grained classification of the scientific specialization of universities. Recent works used instead a more general aggregation of scientific fields, by grouping natural and engineering sciences (e.g., Audretsch and Lehmann 2005; Baptista and Mendonça 2010. For an exception, see Abramovsky et al. 2007). Our results indicate that this distinction is important as the effect of university specialization in basic and applied sciences is quite diverse.

We are aware that the article has some limitations, which leave room for further inquiry. First, although it provides a comprehensive analysis of all industries in the economy, it is limited to the Italian case. Extending the analysis to other countries might help us understand if results are driven by specificities of the Italian productive and university system. In particular, we do not detect any significant impact of universities specialized in basic and applied sciences on new firm creation in most manufacturing industries. This evidence is rather puzzling and might be driven by the low propensity to innovate across the Italian manufacturing system. Second, this study analyzes the impact of university specialization on new firm creation. It would be interesting to investigate whether new firms benefit from specialized university knowledge after foundation. For instance, do new firms located in the neighborhood of universities specialized in basic or applied sciences grow faster? Do they have better chances of surviving? Third, our data refer to 2010, when Italy was still in the middle of a severe recession initiated in 2008. Accordingly, the effect of university specialization on new firm creation might be weakened by the fact that, in that year, the global crisis slowed down the entrepreneurial dynamics. However, also an opposite effects might be at work as during recession times high unemployment rates reduce the opportunity costs of starting a new venture (e.g., Thurik et al. 2008). Furthermore, while incumbent firms tend to reduce their R&D investments in a crisis, and so knowledge spillovers from incumbent firms are lower, university spillovers are less dependent on economic cycles. Following this line of reasoning, during recession times one may observe an increase in the probability of starting a new venture based on university spillovers. Hence, it would be interesting to repeat this exercise in a booming period in order to check how our results are affected by the economic cycle. Finally, because of data availability, the unit of analysis is the Italian province. A finer unit of analysis would allow better evaluating the spatial range of the effect of university specialization on local entrepreneurship.

Despite the aforementioned limitations, our results have interesting policy implications. First, our findings reinforce the view that universities do have an impact on new firm creation at the local level. Specifically, the article shows that the impact of university knowledge on local entrepreneurship is not limited to high-tech industries and spans the whole productive system. Therefore, our work offers useful insights for the design of national and regional policies to support local entrepreneurship across industries, this being a major determinant of growth for countries and regions (e.g., Fritsch 1997; Audretsch and Keilbach 2004, 2005; Mueller 2006; Carree and Thurik 2008; Carree et al. 2012). For instance, policymakers who intend to foster science-based entrepreneurship should provide support to basic research. Indeed, confirming the earlier literature and in the spirit of the knowledge spillover theory of entrepreneurship, we have found that basic university research generates strong positive externalities for the SB industry category. Conversely, support to applied science and engineering is likely to be beneficial for local entrepreneurship in service industries.

Second, our findings challenge the conventional wisdom in public policies for innovation and innovative entrepreneurship (Larédo and Mustar 2001; Llerena and Matt 2005; Nauwelaers and Wintjes 2008). These policies have by and large assumed manufacturing industries, and notably SB industries, as the conceptual reference point and the main target. They have been aimed to foster the commercial exploitation of scientific knowledge generated by universities, e.g., through the support to the creation of academic startups and incubators. Our findings are thus somewhat puzzling for policymakers, since they show that the most widespread effect of university knowledge on new firm creation is to be found in services, not in manufacturing. Service industries account for about 80 % of the Italian economy. By comparison, SB firms account for <1 % of the Italian economy. Accordingly, our findings raise the question of how new firm creation in services could be facilitated and supported by strengthening the link between the knowledge created by universities specialized in engineering and applied science and prospective service entrepreneurs. Developing this issue here is out of the scope of this article, but we believe that it will be worth of further exploration if we want public policies in support of entrepreneurship to be really effective.

Notes

Following Knight’s (1921) distinction between uncertainty and risk, Alvarez and Barney (2005) argue that while under risk a probability distribution of the values of economic variables can be calculated, no such calculation is possible under uncertainty. Confronted with uncertainty, incumbent firms then suffer from organizational inertia, leaving room for newly created firms to capture the entrepreneurial opportunities generated out of innovative ideas.

For sake of clarity, Miozzo and Soete (2001) identify the industry category “science-based and specialized suppliers.” To avoid confusion with the industry categories SB and SS in the manufacturing industries, here we prefer to use the terminology used by Castellacci (2008) and Castaldi (2009), which refers to the KIBS category.

Rao (2001) highlights how the emergence of the stand-alone software industry contributed greatly to undermining the in-house R&D activity of telecommunication service firms (see also Miozzo and Ramirez 2003). Similarly, the financial industry experienced a significant rise in information system outsourcing in the early 1990s (see, e.g., Altinkemer et al. 1994; Palvia 1995).

Information engineering includes computer sciences.

Since we do not consider agriculture in the industry taxonomy, we did not take into account the academic staff that is specialized in agricultural sciences.

Data on the latitude and longitude of each province were extracted from ISTAT databases to calculate distances among provinces. Then, we calculated, by means of a GIS program, the Euclidean distance (in km) between the centroids of each province.

In the estimation of the negative binomial regression model for each industry category, we also cluster data at the NUTS2 level. This approach should account for possible spatial autocorrelation in our data (for a similar approach, see Baptista and Mendonça 2010). In Sect. 4.2, we provide an additional check to evaluate whether our results are biased because of spatial autocorrelation. In particular, the results of the spatial autoregressive model that we run on a transformation of our dependent variable are very close to those of the negative binomial regression model.

To evaluate the appropriateness of the negative binomial regression model against the Poisson model, we performed a likelihood ratio test, under the null hypothesis that the over-dispersion coefficient is zero. Furthermore, as the dependent variable assumes value zero in some industry categories in some provinces, we also report the Vuong test to evaluate the appropriateness of the negative binomial model against the zero inflated negative binomial model. Results of the tests are reported at the bottom of Table 5 (see Sect. 4.3) and confirm the appropriateness of the negative binomial regression model.

For the sake of synthesis, the correlation matrix is reported in the Appendix (Table A3). We also performed a variance inflation factor (VIF) analysis, which suggests that multicollinearity is not a problem in our estimates. Indeed, in all industry categories the mean VIF is below the 5 threshold, while the maximum VIF is below the threshold of 10 (Belsley et al. 1980).

Both Bologna and Paris claimed the honor of being the first university in Europe; each began in the second half of the twelfth century. The universities of Padua, Naples, Siena, Rome, and Perugia followed between 1222 and 1308. After a pause, a second wave occurred between 1343 and 1445, with the establishment of Pisa, Florence, Pavia, Ferrara, Turin and Catania. After another century-long pause, a third wave of late Renaissance foundations created the universities of Macerata, Salerno, Messina and Parma between 1540 and 1601 (Grendler 2002; p. 1). See also De Ridder-Symoens (1992) and Rashdall (2010 ).

For a discussion on the mechanisms through which large incumbent firms create barriers to entry, see, Caves and Porter (1977).

The percentage of new firms in the SD category with respect to the total number of new firms is indeed 5.38 %, while the percentage of exits in the SD category with respect to the total number of exits in all industries is 8.96 %.

As a robustness check, we run additional regressions by distinguishing the university specialization in basic, applied and social sciences (i.e., we excluded humanities). Results are similar to those reported in Table 5, confirming that the effect of universities specialized in social sciences on new firm creation at the local level is not significant. Results are available from the authors upon request.

The IRR is the ratio at which the dependent variable increases (or decreases) for a one unit increase in the explanatory variable, while holding all other variables in the model constant.

We also estimated spatial error models (SEM) in the eight industry categories using the same dependent variables. SEM models take into account spatial autocorrelation by including in the error term an additional component that is spatially dependent. Results are qualitatively similar to those obtained through the SAR models and are available from the authors upon request.

References

Abramovsky, L., Harrison, R., & Simpson, H. (2007). University research and the location of business R&D. The Economic Journal, 117(519), C114–C141.

Acosta, M., Coronado, D., & Flores, E. (2011). University spillovers and new business location in high-technology sectors: Spanish evidence. Small Business Economics, 36(3), 365–376.

Acs, Z., Audretsch, D. B., Braunerjhelm, P., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30.

Acs, Z., & Plummer, L. A. (2005). Penetrating the ‘Knowledge Filter’ in regional economies. Annals of Regional Science, 39(3), 439–456.

Altinkemer, K., Chaturvedi, A., & Gulati, R. (1994). Information systems outsourcing: Issues and evidence. International Journal of Information Management, 14(4), 252–268.

Alvarez, S. A., & Barney, J. B. (2005). How do entrepreneurs organize firms under conditions of uncertainty? Journal of Management, 31(5), 776–793.

Anselin, L., Varga, A., & Acs, Z. (2000). Geographic and sectoral characteristics of academic knowledge externalities. Papers in Regional Sciences, 79(4), 435–443.

Audretsch, D. B. (1995). Innovation and industry evolution. Cambridge: MIT Press.

Audretsch, D. B., & Keilbach, M. (2004). Entrepreneurship capital and economic performance. Regional Studies, 38(8), 949–959.

Audretsch, D. B., & Keilbach, M. (2005). Entrepreneurship capital and regional growth. Annals of Regional Science, 39(3), 457–469.

Audretsch, D. B., & Keilbach, M. (2007). The theory of knowledge spillover entrepreneurship. Journal of Management Studies, 44(7), 1242–1254.

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy, 34(8), 1191–1202.

Audretsch, D. B., Lehmann, E. E., & Warning, S. (2005). University spillovers and new firm location. Research Policy, 34(7), 1113–1122.

Balassa, B. (1965). Trade liberalisation and “Revealed” comparative advantage. The Manchester School, 33(2), 99–123.

Baptista, R., & Mendonça, J. (2010). Proximity to knowledge sources and the location of knowledge-based start-ups. Annals of Regional Studies, 45(1), 5–29.

Baptista, R., & Swann, P. (1999). A comparison of clustering dynamics in the US and UK computer industries. Journal of Evolutionary Economics, 9(3), 373–399.

Belsley, D. A., Kuh, E., & Welsch, R. E. (1980). Regression diagnostics: Identifying influential data and sources of collinearity. New York: Wiley.

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi Lamastra, C. (2013a). How universities contribute to the creation of knowledge intensive firms: Detailed evidence on the Italian case. Available at http://ssrn.com/abstract=2051473. Accessed February 6, 2012.

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi Lamastra, C. (2013b). The impact of local and external university knowledge on the creation of knowledge-intensive firms: Evidence from the Italian case. Available at http://ssrn.com/abstract=2316145. Accessed August 30, 2013.

Bonaccorsi, A., & Daraio, C. (2007). University autonomy and structural constraints in the Italian system. In A. Bonaccorsi & C. Daraio (Eds.), Universities and strategic knowledge creation. Specialization and performance in Europe (pp. 241–271). Cheltenham: Edward Elgar.

Burbidge, J. B., Magee, L., & Robb, A. L. (1988). Alternative transformations to handle extreme values of the dependent variable. Journal of the American Statistical Association, 83(401), 123–127.

Capasso, M., Cefis, E., & Frenken, K. (2011). Spatial differentiation in industrial dynamics a core-periphery analysis based on the Pavitt–Miozzo–Soete taxonomy. Available at http://ideas.repec.org/p/dgr/tuecis/wpaper1101.html. Accessed February 6, 2012.

Carree, M. A., Della Malva, A., & Santarelli, E. (2012). The contribution of universities to growth: Empirical evidence for Italy. The Journal of Technology Transfer. doi:10.1007/s10961-012-9282-7.

Carree, M. A., Santarelli, E., & Verheul, I. (2008). Firm entry and exit in Italian provinces and the relationship with unemployment. International Entrepreneurship and Management Journal, 4(2), 171–186.

Carree, M. A., & Thurik, A. R. (2008). The lag structure of the impact of business ownership on economic performance in OECD countries. Small Business Economics, 30(1), 101–110.

Castaldi, C. (2009). The relative weight of manufacturing and services in Europe: An innovation perspective. Technological Forecasting and Social Change, 76(6), 709–722.

Castellacci, F. (2008). Technological paradigms, regimes and trajectories: Manufacturing and service industries in a new taxonomy of sectoral patterns of innovation. Research Policy, 37(6–7), 978–994.

Caves, R. E., & Porter, M. E. (1977). From entry barriers to mobility barriers: Conjectural decisions and contrived deterrence to new competition. The Quarterly Journal of Economics, 91(2), 241–262.

Cohen, W. M., Nelson, R. R., & Walsh, J. P. (2002). Links and impacts: The influence of public research on industrial R&D. Management Science, 48(1), 1–23.

Colombo, M. G., & Delmastro, M. (2002). How effective are technology incubators? Evidence from Italy. Research Policy, 31(7), 1103–1122.

De Jong, J., & Marsili, O. (2006). The fruitflies of innovations: A taxonomy of innovative small firms. Research Policy, 35(2), 213–229.

De Ridder-Symoens, H. (1992). A history of the university in Europe. Cambridge: Cambridge University Press.

Dewick, P., Green, K., & Miozzo, M. (2004). Technological change, industry structure and the environment. Futures, 36(3), 267–293.

Drejer, I. (2004). Identifying innovation in surveys of services: A Schumpeterian perspective. Research Policy, 33(3), 551–562.

Ellison, G., & Glaeser, E. L. (1999). The geographic concentration of industry: Does natural advantage explain agglomeration? The American Economic Review, 89(2), 311–316.

EUMIDA. (2010). Feasibility study for creating a European University data collection [Contract No. RTD/C/C4/2009/0233402].

Evangelista, R. (2000). Sectoral patterns of technological change in services. Economics of Innovation and New Technology, 9(3), 183–222.

Feldman, M. P., & Audretsch, D. B. (1999). Innovation in cities: Science-based diversity, specialization and localized competition. European Economic Review, 43(2), 409–429.

Fischer, M. M., & Varga, A. (2003). Spatial knowledge spillovers and university research: Evidence from Austria. Annals of Regional Studies, 37(2), 303–322.

Forsman, H. (2011). Innovation capacity and innovation development in small enterprises. A comparison between the manufacturing and service sectors. Research Policy, 40(5), 739–750.

Fritsch, M. (1997). New firms and regional employment change. Small Business Economics, 9(5), 437–448.

Greene, W. H. (2003). Econometric analysis. New York: Prentice Hall.

Grendler, P. F. (2002). The universities of the Italian Renaissance. Baltimore: The Johns Hopkins University Press.

Harhoff, D. (1999). Firm formation and regional spillovers—Evidence from Germany. Economics of Innovation and New Technology, 8(1–2), 27–55.

Hilbe, J. (2007). Negative binomial regression. Cambridge: Cambridge University Press.

Jacobs, J. (1969). The economy of cities. New York: Random House.

Jaffe, A. (1989). Real effects of academic research. American Economic Review, 79(5), 957–970.

Kerr, W. R., & Glaeser, E. L. (2009). Local industrial conditions and entrepreneurship: How much of the spatial distribution can we explain? Journal of Economics and Management Strategy, 18(3), 623–663.

Kirchhoff, B. A., Newbert, S. L., Hasan, I., & Armington, C. (2007). The influence of university R&D expenditures on new business formations and employment growth. Entrepreneurship: Theory and Practice, 31(4), 543–559.

Klevorick, A. K., Levin, R. C., Nelson, R. R., & Winter, S. G. (1995). On the sources and significance of inter-industry differences in technological opportunities. Research Policy, 24(2), 185–205.

Kline, S. J., & Rosenberg, N. (1986). An overview of innovation. In R. Landau & N. Rosenberg (Eds.), The positive sum strategy (pp. 275–305). Washington: National Academy Press.

Knight, F. H. (1921). Risk uncertainty and profit. Boston: Houghton Mifflin Company.

Kyvik, S. (2004). Structural changes in higher education systems in Western Europe. Higher education in Europe, 29(3), 393–409.

Lambert, D. M., Brown, J. P., & Florax, R. J. (2010). A two-step estimator for a spatial lag model of counts: Theory, small sample performance and an application. Regional Science and Urban Economics, 40(4), 241–252.

Larédo, P., & Mustar, P. (2001). Research and innovation policies in the new global economy. Cheltenham: Edward Elgar.

Llerena, P., & Matt, M. (2005). Innovation policy in a knowledge-based economy. Berlin: Springer.

Meyer-Krahmer, F., & Schmoch, U. (1998). Science-based technologies: University–industry interactions in four fields. Research Policy, 27(8), 835–851.

Miles, I. (2005). Innovation in services. In J. Fagerberg, D. Mowery, & R. Nelson (Eds.), The oxford handbook of innovation (pp. 433–457). Oxford: Oxford University Press.

Miles, I. (2012). Introduction to service innovation. In L. A. Macaulay, I. Miles, J. Wilby, L. Zhao, Y. L. Tan, & B. Theodoulidis (Eds.), Case studies in service innovation (pp. 1–15). New York: Springer.

Miozzo, M., & Ramirez, M. (2003). Services innovation and the transformation of work: The case of UK telecommunications. New Technology, Work and Employment, 18(1), 62–79.

Miozzo, M., & Soete, L. (2001). Internationalization of services: A technological perspective. Technological Forecasting and Social Change, 67(2–3), 159–185.

Morgan, K. (2004). The exaggerated death of geography: Learning, proximity and territorial innovation systems. Journal of Economic Geography, 4(1), 3–21.

Mueller, P. (2006). Exploring the knowledge filter: How entrepreneurship and university-industry relationships drive economic growth. Research Policy, 35(10), 1499–1508.

Nauwelaers, C., & Wintjes, R. (2008). Innovation policy in Europe. Measurement and strategy. Cheltenham: Edward Elgar.

Nelson, R. R. (1990). Capitalism as an engine of progress. Research Policy, 19(3), 193–214.

Palvia, P. C. (1995). A dialectic view of information systems outsourcing: Pros and cons. Information and Management, 29(5), 265–275.

Pavitt, K. (1984). Sectoral patterns of technical change: Towards a taxonomy and a theory. Research Policy, 13(6), 343–373.

Pilat, D., Cimper, A., Olsen, K., & Webb, C. (2006). The changing nature of manufacturing in OECD economies. STI Working paper 2006/9. OECD, Paris, 2006. Available at http://dx.doi.org/10.1787/308452426871. Accessed February 6, 2012.

Piva, E., Grilli, L., & Rossi Lamastra, C. (2011). The creation of high-tech entrepreneurial ventures at the local level: The role of local competences and communication infrastructures. Industry and Innovation, 18(6), 563–580.

Rao, P. M. (2001). Structural change and innovation in U.S. telecommunications. Economics of Innovation and New Technology, 10(2–3), 169–198.

Rashdall, H. (2010). The universities of Europe in the middle ages. Cambridge: Cambridge University Press (original edition 1895).

Rosenberg, N. (1992). Scientific instrumentation and university research. Research Policy, 21(4), 381–390.

Rothaermel, F. T., Agung, S. D., & Jiang, L. (2007). University entrepreneurship: A taxonomy of the literature. Industrial and Corporate Change, 16(4), 691–791.

Storper, M., & Venables, A. (2004). Buzz: Face-to-face contact and the urban economy. Journal of Economic Geography, 4(4), 351–370.

Tether, B. S. (2003). The sources and aims of innovation in services: Variety between and within sectors. Economics of Innovation and New Technology, 12(6), 481–505.

Tether, B. S. (2005). Do services innovate (differently)? Insights from the European innobarometer survey. Industry and Innovation, 12(2), 153–184.

Tether, B. S., & Tajar, A. (2008). Beyond industry–university links: Sourcing knowledge for innovation from consultants, private research organisations and the public science-base. Research Policy, 37(6–7), 1079–1095.

Thurik, A. R., Carree, M. A., Van Stel, A., & Audretsch, D. B. (2008). Does self-employment reduce unemployment? Journal of Business Venturing, 23(6), 673–686.

Tidd, J., Bessant, J., & Pavitt, K. (2001). Managing innovation: Integrating technological, market and organisational change. Chichester: Wiley.

Von Hippel, E. (1976). The dominant role of users in the scientific instrument innovation process. Research Policy, 5(3), 212–239.

Von Hippel, E. (1988). The sources of innovation. New York: Oxford University Press.

Woodward, D., Figueiredo, O., & Guimaraes, P. (2006). Beyond the Silicon Valley: University R&D and high technology location. Journal of Urban Economics, 60(1), 15–32.

Acknowledgments

The financial support of Regione Toscana Project LILIT: I Living Labs per l’Industria Toscana (PAR FAS REGIONE TOSCANA Linea di Azione 1.1.a.3) is kindly acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

Andrea Bonaccorsi is on leave from DESTEC, University of Pisa.

Appendix

Appendix

1.1 Industry categories

1.2 Correlation matrix

See Table 8.

1.3 Robustness checks

Rights and permissions

About this article

Cite this article

Bonaccorsi, A., Colombo, M.G., Guerini, M. et al. University specialization and new firm creation across industries. Small Bus Econ 41, 837–863 (2013). https://doi.org/10.1007/s11187-013-9509-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-013-9509-5