Abstract

In this paper, we use three structural models to investigate a country’s credit risk by applying it to a sovereign balance sheet. The transformed-data maximum likelihood estimation method and the maximization–maximization algorithm are adopted for model calibration. The derived probability of default over time for four sample countries matched well with the events and economic conditions that occurred during the sample period. Our empirical analyses show that structural models can be used to determine with high accuracy whether the credit of a sovereign country is in a precarious situation. We then illustrate how the structural approach can be an effective tool to monitor the sovereign credit risk.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The ability of a sovereign country to repay its foreign debt has long been an important issue.Footnote 1 After the global financial crisis of 2008, concerns arose about countries defaulting because of over-stretched bailout attempts and other aggressive fiscal policies. For instance, the International Monetary Fund (IMF) warned that the debts these countries were accruing could put global financial stability at risk and prolong weakness in the credit markets.Footnote 2 If a borrowing country does not have enough foreign exchange (FX) reserves to make its payments on time, a financial crisis will occur. To survive the resulting turmoil, the country’s government must obtain loans from other countries or from international financial institutions such as the IMF.

For example, when Iceland encountered a bank default event, the government took over three “too-big-to-fail” private investment banks; however, it did not have enough funds to repay the banks’ debts. Furthermore, as foreign investors owned most of Iceland’s stocks, stock prices, as well as FX rates, depreciated rapidly (Benediktsdottir et al. 2011). In late 2008, the Icelandic government raised the interest rate and secured a loan from the IMF to rescue the country from default. Hungary, Mexico, and Poland also obtained funding support from the IMF. Some European countries like Greece face credit problems that are still evolving.

Sovereign credit risk has been studied extensively in the literature. Kalotychou and Staikouras (2006), Fuertes and Kalotychou (2006), and Frankel and Saravelos (2012) demonstrated that sovereign credit risk has a high correlation with external debt, gross domestic product (GDP), inflation, and FX reserves. Chesney and Morisset (1992), Claessens and Pennacchi (1996), Karmann and Maltritz (2003), Oshiro and Saruwatari (2005), Huschens et al. (2007), and Gray et al. (2007) used a structural model to predict default events. Duffie et al. (2003) applied a reduced-form approach to measure Russia’s default risk during the Asian financial crisis of the 1990 s. Arnold (2012), Li and Zinna (2013), and Acharya et al. (2014) investigated the relationship between the sovereign credit risk and credit risk of banks.

Since the credit default swap (CDS) market is one of the best ways to study the credit risk of an entity, we attempt to explore other useful market information and incorporate it into the structural model to obtain a consistent sovereign default risk prediction of the CDS price.Footnote 3 In this paper, we propose a modification of the sovereign balance sheet by Gray et al. (2007) and compare three default triggering models, namely, the Merton (1974), the exogenous default-boundary Brockman and Turtle (BT) (2003), and the endogenous default-boundary Leland and Toft (LT) (1996) models, to estimate the value of a country’s assets and construct the relationship between the sovereign balance sheet and the default risk. The unknown variables and parameters in the Merton model and BT model are estimated by the transformed-data maximum likelihood estimation (MLE) method proposed by Duan (1994, 2000), Duan et al. (2003, 2004); the variables in the LT model are estimated by the mixed maximization–maximization (MM) algorithm proposed by Forte (2011) and Forte and Lovreta (2012). Finally, we apply the Spearman’s rank correlation coefficient (Spearman’s ρ) and the receiver operating characteristic (ROC) test adopted by Engelmann et al. (2003) and Jessen and Lando (2015) to examine the model performance.

The rest of the paper is organized as follows. In Sect. 2, the relevant literature is reviewed. The sovereign balance sheet, the BT model and LT model, and the quantitative methods are described in Sect. 3. Section 4 presents our data. The empirical results are reported in Sect. 5, and in Sect. 6 we offer concluding remarks.

2 Literature review

Black and Scholes (1973) pioneered use of the option pricing model to assess the relationship between a bond price and the associated credit risk. Merton (1974) applied the basic accounting equation (Asset = Liability + Equity) to define bankruptcy as occurring when a firm’s asset value is lower than its liability. The probability of default (PD) of a corporate bond can be calculated using the Black–Scholes-Merton framework (BSM), which is referred to as the structural model in the literature. In contrast, other researchers, including Brenann and Schwartz (1980), Jarrow and Turnbull (1995), Duffee (1998), and Duffie and Singleton (1999), have developed the reduced-form model, which measures default by tracking the stochastic process of the corporate bond price or its yield.

Later researchers have tried to modify and relax the assumptions of the structural model in the BSM framework. For example, Black and Cox (1976) presented an explicit equilibrium model which assumes that a bond may default at any time before maturity if the asset price reaches an exogenous threshold. Considering the same asset process as Merton (1974) and Black and Cox (1976), Leland and Toft (1996) formulated the price of debt with maturity at a future time. Under their framework, a company’s optimal default barrier is determined by its optimal capital structure, which is an endogenous variable. Longstaff and Schwartz (1995) imported the stochastic riskless interest rate, shown in Vasicek (1977), and its correlation with asset price. Briys and de Varenne (1997) considered specific bankruptcy thresholds. Zhou (2001) further proposed that the asset value follows the normal jump diffusion process. Hui et al. (2003) extended the results of Longstaff and Schwartz (1995) and Briys and de Varenne (1997) by taking into account economic deterioration. Brockman and Turtle (2003) proposed a barrier-option framework for valuating corporate securities.

Focusing on credit risk at the national level, Chesney and Morisset (1992) considered a country’s willingness to pay for its external debt to be a random variable following a stochastic process. The default event occurs if the willingness to pay is less than the face value of the external debt at maturity. Claessens and Pennacchi (1996) assumed that a country’s default risk indicator follows a stochastic process. A default is defined as the value of its indicator falling below zero. Their empirical study demonstrated that the model can predict a credit event in a sovereign country with high accuracy.

In recent years, the issue of sovereign credit risk has gained increasing attention from financial economists. Duffie et al. (2003) studied the yield spread of Russia’s dollar-denominated debt during the Asian financial crisis using a reduced-form model. They found that the yield spread varied significantly over time. In addition, it was negatively correlated with Russia’s foreign currency reserves and oil prices. Karmann and Maltritz (2003) characterized the stochastic process of ability to pay, defined as the country’s FX reserves plus its potential capital imports. A default event is defined as occurring if the ability to pay is less than the total amount of the (net) repayment obligations at the maturity date. Oshiro and Saruwatari (2005) developed a model based on the BSM framework to quantify a country’s credit risk and deduced the sovereign asset value by sovereign bond price and the Morgan Stanley Capital International (MSCI) equity index.

Fuertes and Kalotychou (2006) used an early warning indicator to predict a sovereign default, which occurs when the jump-in arrears exceed a specific portion of the total external debt or when the rescheduled debt exceeds the decrease in total arrears. In their empirical study, they found that while complex models are better at describing the data, simple models outperform complex models in terms of forecasting accuracy. Huschens et al. (2007) constructed a model based on BSM to study the forecasting ability of a sovereign default event. They selected 19 countries in emerging markets to validate their model and obtained statistically significant results. Frankel and Saravelos (2012) investigated whether leading indicators can explain the financial crisis in 2008 and 2009. They found that FX reserves and past movements in the FX rate are the leading indicators to predict a crisis.

Gray et al. (2007) proposed a framework for the sovereign balance sheet. The assets include FX reserves, net fiscal assets, and other public assets; the liabilities consist of guarantees, foreign-currency debt, local-currency debt, and base money. Foreign-currency debt can be considered the senior claim and local-currency debt plus base money the junior claim. The FX spot rate was used to translate the market value of the local-currency liabilities. Plank (2010) studied CDS contagion effects among 16 countries in Europe during the financial crisis. He also demonstrated a sovereign structural model driven by the sovereign’s repayment capacity (includes international reserves exports and imports) and total amount of external debt in six emerging countries. Galai and Wiener (2012) showed that the government or company should issue the debt denominated in foreign currency since the funding cost is cheaper if the statistical correlation of asset return and changes in exchange rate is positive.

In addition to the bond price and the sovereign balance sheet, the CDS price is also useful for estimating default risk. Blanco et al. (2004) and Hull et al. (2004) analyzed a large panel of corporate issuers from the United States and Europe and found that CDS prices can predict credit events. Chan-Lau and Kim (2004) tested the equilibrium relationships among CDS, bond, and equity prices in eight emerging countries. They found that the CDS and bond spreads were highly correlated, whereas the equity prices were not correlated with either variable. Carr and Wu (2007) constructed a joint valuation framework consisting of the bivariate diffusion of the currency return variance and sovereign default intensity. They showed that the sovereign CDS spread has a strong positive contemporaneous correlation with the implied volatility of currency options.

Many studies explored the relationship between the sovereign CDS prices and some other key factors that influence credit risk of sovereigns. Using data in different countries, Arnold (2012), Li and Zinna (2013), and Acharya et al. (2014) showed the sovereign risk and credit risk of banks are related. Ang and Longstaff (2013) used CDS of U.S. Treasury, some U.S. states, and major Euro countries to show the systemic sovereign credit risk is more related to financial market variables than macroeconomic conditions. Chen (2013) further used structural model to examine the results of Ang and Longstaff (2013). Hui and Fong (2015) found the cointegration and time varying conditional correlation between the prices of sovereign CDS and currency option markets in four developed countries.

An important issue in the BSM framework is how to estimate the asset value and its volatility because it cannot be observed directly in the market. There are three approaches (Duan et al. 2004). Jones et al. (1984) and Ronn and Verma (1986) applied Itô’s lemma to form simultaneous equations and solved for these two variables. Eom et al. (2004) used the market value of equity and total debt to imply the asset value. Duan (1994) and Duan (2000) derived the transformed-data MLE to estimate the unknown variables and parameters.

Although all three approaches have been widely used, Duan (1994, 2000), and Bruche (2007) argued that constant volatility in equity as assumed in the first approach is not reasonable. Wang and Li (2004) showed that Eom et al.’s (2004) approach is theoretically inconsistent with the boundary conditions of the option pricing model. Their Monte Carlo simulations also showed that this approach may lead to biased predictions.

Bruche (2007), Wang and Li (2004, 2008), and Duan et al. (2004) demonstrated by simulation methods that the transformed-data approach is best for estimating unknown variables and parameters, especially when using the BT model framework. Duan et al. (2004) showed that Vassalou and Xing’s (2004) method, which applied an iteration method to estimate the unknown variables and parameters, is an expectation maximization (EM) algorithm that provides a maximum likelihood estimator in an incomplete market. Duan and Fulop (2009) also proved via the particle filter method that equity prices were contaminated by trading noise.

Forte (2011) and Forte and Lovreta (2012) tested several parameter calibration methods under Leland and Toft’s (1996) framework. They showed that the mixed MM algorithm is the best numerical method for estimating the CDS price; it obtains the fewest CDS pricing errors when compared to other methods.

In the next section, we first describe the construction of an option model based on the sovereign balance sheet. We then use the transformed-data MLE and MM approaches to estimate all the unknown parameters.

3 Model setup and methodology

Many studies, including Kalotychou and Staikouras (2006), Fuertes and Kalotychou (2006), and Frankel and Saravelos (2012), have applied the ratio of external debt to GDP or FX reserves to measure a country’s financial condition. In contrast, we apply the structure of the sovereign balance sheet as shown by Gray et al. (2007) to define a credit event in a country. We further apply this framework to measure the sovereign credit risk of the countries in our sample.

3.1 Sovereign balance sheet

We first discuss the items in the balance sheet of a sovereign country by applying an argument similar to that of Gray et al. (2007). The assets include FX reserves, net fiscal assets, and other public assets, whereas the liabilities include external debt, guarantees, and money supply 1 (M1). The details are as follows:

-

FX Reserves: The net international reserves from the public sector, including foreign currency deposits, bonds, gold, special drawing rights (SDRs), and IMF reserve positions held by the central bank or monetary authority.

-

Net Fiscal Assets: Taxes and fiscal revenues with expenditures.

-

Other Public Assets: The equities and other assets of public enterprises.

-

External Debt: The debt held by nonresidents of the country. According to the World Bank, the gross external debt position includes the external debt from the general government, central banks, deposit-taking corporations (except the central bank), other sectors, and direct investment. In this study, we choose the first three items (i.e., general government, central bank, and deposit-taking corporation) to obtain the whole external debt of a sovereign. However, we also allow flexibility if the government provides the collateral for the other two parts of external debt.

-

Money Supply 1: M1 contains notes and coins in circulation, demand deposits, and items defined by each central bank.

-

Guarantees: The sovereign liability that protects the financial system.

The structure of the sovereign balance sheet is illustrated in Table 1. Note that the assets and liabilities are expressed in foreign currencies.

External debt is senior to other liabilities because FX reserves are required to repay the debt. If the FX reserves are insufficient, the country has no choice but to default. On the other hand, M1 and guarantees are junior claims and behave like equity of a sovereign. If foreign investors predict that the economy of a country is growing, they will buy its currency at the spot rate, defined as the amount of its currency per one unit of foreign currency, and invest in the stock market or high-yield bonds in that country. As a result, the domestic currency will appreciate in value, thereby increasing the asset value of the country. Meanwhile, if the government cannot redeem its external debt at the maturity date, a default occurs.Footnote 4 Because it is difficult for debt holders to “own” a sovereign country, the government should negotiate with a creditor (an international institution or the government of another country) to find a way to meet its debt obligations. Therefore, we can assume a critical barrier that exists in such a way that if the asset value is lower than this barrier, the government must reschedule its payments or refinance its capital before the debt reaches maturity.

We consider a country’s domestic currency to be “soft” currency. The total amount of the external debt must be repaid by an acceptable foreign currency. From the foreign creditor’s point of view, the total value of sovereign assets or liabilities is actually determined by the FX rate. Therefore, the foreign currency is used as a numéraire for the market price of all the items on the country’s balance sheet.

Similar to the structural credit risk model of a firm that applies the stock price to infer the credit risk of the corporation, we use FX rate to measure the credit risk of a sovereign under the sovereign balance sheet. Furthermore, our assumptions are also consistent with the study in Hui and Fong (2015), which showed that the sovereign credit affects the FX rate in the long run.

Although the structure of a country’s balance sheet resembles that of a corporation’s, the payoff schedule for the contingent equity claim is different. Westphalen (2002) and Chan-Lau and Kim (2004) claimed that a sovereign country cannot surrender all its assets to its debt holders when a default occurs. Hence, to maintain its reputation and capital, the borrowing country must refinance by issuing new bonds or borrowing money from the World Bank, the IMF, or other lenders even though the interest rate will rise to a very high level.

Below, we construct three default models (Merton model, BT model, and LT model) to determine and compare whether funding is required. The Merton model is the original structure from Merton (1974); the BT model is from Brockman and Turtle (2003) and Duan et al. (2003). Finally, we follow the idea in Forte (2011) and Forte and Lovreta (2012) to construct the LT model.

3.2 The Merton and BT model for sovereign credit risk

Let V(t) denote the value of the country’s total assets in the domestic currency at time t and Q(t) denote the exchange rate between the domestic currency and the foreign currency under consideration. We assume that a representative country issues a single foreign-currency zero-coupon bond with a promised payoff K at maturity date T if the value of X(t) = V(t)/Q(t) is never less than the certain level H within 0 ≤ t ≤ T. We also set Y(t) = E(t)/Q(t). Therefore, the payoff of the external debt at time T is

and the value of the junior claim at time T is

In other words, from a foreign creditor’s point of view, the payoff of the junior claim is a vanilla call option on the value of the country’s assets. Furthermore, if there is a continuous barrier H that the asset value X(t) has to be higher than for all 0 ≤ t ≤ T to avoid refinancing, the junior claim seems like a down-and-out barrier call option on the value of the country’s assets. The payoffs of the senior and junior claims at time T are illustrated in Fig. 1.

As shown in Fig. 1, if the value of the assets in foreign currency is higher than K at maturity, i.e., X(T) ≥ K, the senior claim holders receive K and the junior claim holders receive X(T) − K. The value of the junior claim increases with X(T) if X(T) > K. The appreciation of the domestic currency increases the value of the country’s assets.

In our setup, we do not constrain the barrier H to be lower than or equal to a promised payoff K since we hope to detect the credit event as early as possible. Because the external debt usually does not increase very sharply, or the government perhaps needs to enhance its credit to protect all the external debt that is not recorded in the data, we hope the barrier H can get close to the asset value X(t) actively instead of waiting until X(t) is close to K, which can help the model detect the credit event of the sovereign early. As mentioned previously, the high barrier H can be seen as the government providing the collateral for the other two parts of the external debt, including other sectors, and direct investment.

We then follow the framework of Merton (1974) and Shreve (2004) to construct the model for measuring the sovereign risk. Let \({\text{W}}\left( {\text{t}} \right) = \left( {{\text{W}}_{ 1} (t),{\text{W}}_{ 2} (t)} \right)\) be a two-dimensional Brownian motion on a given space (Ω, ℱ(t), P), where the W1(t) is the Brownian motions of domestic currency and the W2(t) is the Brownian motions of foreign currency. They are independent. We assume that the process V(t) the asset value, V(t) in the domestic currency satisfies

where α and σ1 < 0 are, respectively, the instantaneous expected return and the standard deviation of the asset value, and δ is the instantaneous payout to investors of the asset value. The process of the exchange rate, Q(t), satisfies

where \(\gamma \in {\text{R,}}\;\sigma_{2} > 0,\) and \(\rho \in \left[ { - 1,1} \right]\) are constants. By the Lévy characterization theorem, the term

follows Brownian motion under the probability measure P. Hence, from the following proposition, we can find the value (in a foreign currency) of the country’s junior claim at time t for a sovereign and its default probability in the vanilla option framework.

Proposition 1

Assume that a representative country issues a single foreign-currency zero-coupon bond with a promised payoff K at maturity date T. Let r and r f be the domestic and foreign constant riskless interest rates, respectively, δ and δ f be the instantaneous domestic and foreign payout to investors of the asset value, respectively, and X(t) = x. The value of the junior claim in foreign currency at time t, Y(t) = y, in the pure option framework is

where N(·) is the standard normal cumulative distribution function,

and \(\sqrt {\sigma_{3} = \sigma (\sigma_{1}^{2} - 2\rho \sigma_{1} \sigma_{2} + \sigma_{2}^{2})}.\)

Furthermore, according to the Girsanov theorem, there exists a constant parameter μ = f(α, γ, σ 3) such that

under the empirical probability measure P f. The default probability between time t and time T is

Proof All procedures follow chapter 9 of Shreve (2004). The details are in “Appendix 1”.

Applying a similar idea from Brockman and Turtle (2003) and Duan et al. (2003), we have the following proposition to construct our BT model. The BT model combines the structure of a Merton model and a barrier, which is not only the threshold of the default point but also a measure of the country’s ability to survive before negotiating with its creditors and rescheduling its repayments.

Proposition 2

Assume the same notation as in Proposition 1. Let H be a continuous barrier, X(t) > H. The value of the junior claim in foreign currency at time t, Y(t) = y, in the barrier option framework is

where N(·) is the standard normal cumulative distribution function,

and \(\eta = \frac{{r^{f} - \delta^{f} }}{{\sigma_{3}^{2} }} + \frac{1}{2}.\)

The default probability between time t and time T is

Proof Consider the following two equations:

and

we can apply a procedure similar to that in Proposition 1 to obtain our results, which are shown in “Appendix 2”.

Under the BT model structure and applying put-call parity, we know the value of the external debt at time t is

where \({\text{C}}_{{{\text{down}} - {\text{and}} - {\text{in}}}} \left( {\text{t}} \right)\) and \({\text{P}}\left( {\text{t}} \right)\) are, respectively, a down-and-in call option and a put option under the same underlying asset \({\text{X}}\left( {\text{t}} \right)\) and strike price K. A high value of the down-and-in call option means that the bond holder may have the right to manage or sell the company if the underlying asset \({\text{X}}\left( {\text{t}} \right)\) touches the barrier H.

3.3 The LT model for sovereign credit risk

Applying the idea of Leland and Toft (1996) and Forte and Lovreta (2012), we assume a country issues a total of N external bonds with promised principal \({\text{p}}_{i}\) at each maturity date ti and constant coupon flow c i , \({\text{i}} \in \left\{ {1,2,{ \ldots },{\text{N}}} \right\}.\) The sum of all \({\text{p}}_{i}\) is the total nominal face value of external debt K, and the default barrier H means the fraction of K, \({\text{H}} = \beta {\text{K}},\;\beta \ge 0.\) As mentioned earlier, we do not set any upper limit for β. Assuming that the stochastic process of asset value is the same with Eq. (6), the value of each bond d i at time t is

where τ i = t i − t, ϕ is bankruptcy costs, and F t (x, τ i ) and G t (x, τ i ) are given in “Appendix 4”. Also, if \({\text{X(}}t) = x\) and \({\text{Y(}}t )= y,\) the total of external debt value is

and the equity value is

We set ϕ = 0 in Eq. (12) since the equity holder does not need to take any bankruptcy cost.

Because the idea of asset process and the barrier setup in both the BT model and the LT model are the same, we know the default probability π LT between time t and T is the same as π BT in Eq. (9). Alternatively, under the definition of ϕ and β, we know the recovery rate of all external debt is \(\left( {1 - \phi } \right)\beta\) if the default event is announced.

3.4 Transformed-data MLE method

We follow the procedure of Duan et al. (2003, 2004), and Wang and Choi (2009) to estimate all the unknown parameters and variables in our three models. We assume that no trading noise exists between the unobservable asset value and its contingent claim.

Assume the values of the junior claims and FX rates observed at each time point of n equal intervals during a year. In other words, the value of Y(t) is observable at time \({\text{t}} \in \left\{ {0,{\text{h}},2{\text{h}}, \ldots ,{\text{nh}}} \right\},\) with \({\text{h}} = 1/{\text{n}}\) year. In this case, \({\text{X}}\left( 0 \right) = {\text{x}}\) and \({\text{Y}}\left( 0 \right) = {\text{y}} .\) Under the Merton model framework, the log-likelihood functions of the asset and junior claims are

According to Duan et al. (2004) and Forte and Lovreta (2012), since they both use the same stochastic process of asset value and barrier setup, the log-likelihood function of the junior claims is

The derivation of Eq. (15) is provided in “Appendix 3”. The transformation term \(\left| {\partial {\text{Y}}/\partial {\text{X}}} \right|\) for the BT model is also shown in “Appendix 3”, and for the LT model it is shown in “Appendix 4”. For the Merton model and the BT model, we use the following iteration procedure to estimate all the unknown variables and parameters:

-

1.

Assign the initial values to μ, σ3 and H in Eq. (5) or Eq. (8) to evaluate the implied asset value \(\widehat{\text{X}}\left( {\text{t}} \right)\) under Merton model or BT model consideration.

-

2.

To derive the MLE of μ, σ3 (and H), apply the log-likelihood function of Eqs. (14) or (15).

-

3.

Calculate and compare the absolute errors between the initial values in the first step and the results from MLE in the second step. If the error is less than the convergence criterion, the procedure ends here. Otherwise, go back to Step 1 and replace the values of the parameters with those derived in Step 2.

-

4.

Use the converged \(\widehat{\sigma }_{3}\) (and \(\widehat{\text{H}}\)) in Step 3 to calculate the implied asset value \(\widehat{\text{X}}\left( {\text{t}} \right)\) and its default probability \(\pi_{\text{Merton}}\) (or \(\pi_{\text{BT}}\)).Footnote 5

In the LT model, Forte and Lovreta (2012) created the MM algorithm, which sets the β as fixed in Eq. (15) and estimates μ and σ 3 only at the first and second step, and then compared the error criterion at the third step. After that, since every equity holder aims to own the maximum partition of asset value, β should satisfy

Therefore, we adjust the β such that Eq. (16) is satisfied at the fourth step. Finally, we calculate the default probability \(\pi_{\text{LT}}\) at the fifth step. For details of the algorithm, refer to Forte and Lovreta (2012).

3.5 The model CDS spread

The trading volume of the CDS is larger than that for any other credit derivatives market. This instrument provides a way for investors to hedge or speculate on credit risk. Since the CDS market price is the most important benchmark, we follow the method in Plank (2010) to derive model-implied CDS prices under our three models and compare the correlation with respect to the CDS market price.

Assume that the default occurs only at each coupon payment date, two times per year (semiannual). We denote each payment date as t i , \({\text{i}} \in \left\{ {0,1,{ \ldots },N - 1} \right\}.\) t N is the maturity date of the CDS. Let s be the CDS spread, which is the percentage of the notional amount to be paid per year. The risk-free rate is \({\text{r}}^{\text{f}}\), and the recovery rate is (1 − ϕ)β. Assume that the notional principal is $1. The total expected payment then becomes

where π(t i ) means the default probability between time 0 and t i on any specific model. Similarly, the expected present value of loss given default from the credit buyer is

Considering the no-arbitrage environment, Eqs. (17) and (18) should be equal; hence, we have

Following Plank (2010), since the range of the emerging market recovery rate is between 20 and 30 %, we assume (1 − ϕ)β equals 25 %. Therefore, we set ϕ = 1 − 25 %/β when we estimate CDS spread s.

4 Data

According to Bartram et al. (2007), important financial and economic events that occurred after 1994 affected sovereign credit risk. Therefore, we apply several important economic events in our sample period to support this point of view.

We use US dollars as a numéraire in our empirical studies. Our sample comprises four countries: Iceland, Korea (South Korea), Russia, and South Africa. The data we used include long-term and short-term external debt, money supply 1, risk-free interest rates, instantaneous paid-out rates of assets, FX rates, CDS prices, and coupon rate. Details are as follows:

-

External Debt: Information about external debt is taken primarily from the Joint External Debt Hub (JEDH)Footnote 6 on the IMF website, then checked or supplemented with data from the central bank website of each sampled country.Footnote 7 In the Merton model and the BT model, we follow Vassalou and Xing (2004) and Bharath and Shumway (2008) where the strike price of the sovereign debt equals the short-term debt plus one-half of the long-term debt. In the LT model, we follow Forte (2011) and Forte and Lovreta (2012), who set the debt structure of a sovereign as short-term debt, maturing in 1 year, and nine parts of long-term debt with equal face value, maturing in 2–10 year, respectively.

-

M1: Monthly data of this item are from Datastream. We use these data to represent the amount of a sovereign’s junior claims.

-

Risk-Free Interest Rates: We also follow the idea of Forte (2011) and Forte and Lovreta (2012) and apply the swap rate as the risk-free interest rate. In the BT model, we use the 1-year US dollar (USD) swap rate to represent the instantaneous short rate. In the LT model, we use the 1–10 year swap rate to represent the risk-free rate in each tenor so as to discount the coupon of the bond when we calculate the market value of external debt. All the swap rate data are from Datastream.

-

Instantaneous Paid-Out Rate: According to Eq. (19) in “Appendix 1”, under our balance sheet structure, we apply the 1-year constant maturity treasury (CMT) rate, obtained from the US Board of Governors of the Federal Reserve System (Fed), as the USD instantaneous pay-out rate. The coupon of the treasury is the interest expense of the US government.

-

FX Rates: The daily data for FX rates are from Datastream.

-

CDS Price: Since the 5-year CDS market is the more liquid than other tenors, we adopt the 5-year CDS data from Bloomberg in our sample.

-

Coupon: We assume the coupon rate is equal to the 10-year or longer tenor par bond with the USD as the issue currency for each sovereign. The historical issuance information is from Bloomberg.

The sample period of all data items is shown in Table 2. The linear interpolation method is used to convert the quarterly external debt and monthly junior claim amounts to daily amounts. We assume 252 trading days per year. We also follow Forte and Lovreta (2012) to take the average on our 1-year daily base coupon, paid-out rate, and external debt, respectively, and then forecast the PD and CDS prices from the 1–5 year base on the three models. We finally compare the 5-year model CDS and market CDS prices to validate our model performance since the market CDS in this tenor is more liquid. Because the data for external debt are usually from a late-season announcement, we apply the previous quarter of external debt data when we estimate.

5 Empirical results

We first study whether any critical events or key factors may have caused a country to have a high market CDS price during a specific time period. We then compare the PD and CDS for the four countries that are estimated by three structural models. Finally, we conduct statistical tests to examine the performance of the structural models.

5.1 Financial and economic events during the sample period

Figure 2 shows the 5-year CDS price of the four sample countries and the hurdle price, which we set at 300 basis points (bps). If the CDS price of a sovereign is higher than the hurdle price, we expect the credit rating of the sovereign to be deteriorated. Comparing CDS prices and the hurdle price, three important financial market events are included in our sample period.

The first event began in 2007 and was the result of the sub-prime mortgage crisis. During the recession, the stock markets worldwide began to fall, and the USD became the strongest currency. International capital flowed from most of the countries to the US so as to avoid exchange losses. From 2009, the Fed announced three successive quantitative easings (QEs), which is also known as large-scale asset purchases, including mortgage-backed securities (MBS), from private financial institutions. The aim of this action was to provide liquidity in the market and stimulate bank lending. The global financial market began to recover after the second half of 2009.

The next global credit event during our sample period was the European sovereign debt crisis. This crisis event started in Greece at the end of 2009 and spread to other euro countries, including Ireland, Portugal, Spain, and Italy, among others, between 2011 and 2012. After financial support from the European Financial Stability Facility (EFSF), the European Central Bank (ECB), or the IMF, financial stability in all euro countries has improved and interest rates have fallen. In May 2014, only Greece and Cyprus needed financial help from third parties.

Before the end of the sample period, the European Union (EU) and United States imposed economic sanctions against Russia in March 2014 because of the conflict between Russia and Ukraine. Furthermore, collapsing oil prices and the decreased USD to RUB rate in the 2014Q4 also led to a drop in Russia’s FX reserves. Thus, in Fig. 2, we see that the CDS price of Russia went higher than the hurdle price after December 2014. We believe that this event also increased the credit risk of Russia.

The fluctuations of FX rates are illustrated in Fig. 3, and the equity value under our sovereign balance sheet framework for four countries is shown in Fig. 4. The FX rates of all countries are devalued and the equity values are also decreasing during the global financial crisis from 2008Q4 to 2009Q1. However, the European sovereign debt crisis seems not to have direct influence in our sample countries. The ZAR began to depreciate in 2011 because of the long-term strike, and the RUB seriously depreciated in 2014Q4 after economic sanctions were imposed and the price of crude oil fell 40 %.

In Fig. 4, the increasing equity values doubled in structural models of both Iceland and Russia from the end of 2005 to the end of 2007. However, the equity values also decreased for around one-third in the second half of 2008. From the balance sheet setup and the option theory, one should expect that both countries will have high model CDS prices during the crisis.Footnote 8 Similar situation also appeared for Russia in the fourth quarter of 2014.Footnote 9

On the other hand, in the upper right panel of Fig. 4, the equity value of Korea is steadily increasing after the end of 2008. It appears that the Korean economy did not suffer from the global financial crisis. Park and Oh (2005) indicated that the government implemented a number of financial reforms, including the creation of Financial Supervisory Service and adoption of new inflation targeting after 1997 Asian financial crisis. As a result, the credit rating of Korea continuous to improve and its sovereign CDS price is the lowest among the four countries after December 2007.Footnote 10

In contrast, due to the lengthy labor strike and severe electricity shortfall in recent years, the GDP growth of South Africa is slow and the budget deficit is increasing. Therefore, some of rating companies downgraded the rating of South Africa during these years.Footnote 11 In Fig. 4, the equity value of South Africa does decrease after the second half of 2011. However, the decreasing magnitude of equity value is not very huge, which implies the model CDS will not soar substantially as well, and the market CDS is also relatively stable from 2011 to 2014.

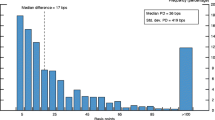

According to the hurdle price of market CDSs, we divide our sample period into two groups by country. If the country’s market CDS at a sample day is equal to or higher than 300 bps, we define that day as a default day and as being in the default group. Otherwise, the day is a non-default day and in the non-default group. We report the number of default versus non-default days of each country in Table 3. The number of default days in Iceland was greater than that in the other three countries since the Icelandic economy was more vulnerable than the others during the global recession in 2008. Furthermore, Iceland was also affected by the European sovereign debt crisis from 2011 to 2012 since international trade between Iceland and euro countries was frequent. The main samples of the default group for other countries were from the global recession in 2008 and 2009. Russia also had some days from 2014Q4 after the plunge of the crude oil price.

5.2 Estimates Using US Dollar as Numeraire

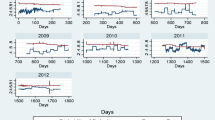

Figures 5, 6, 7, and 8 present the estimates of the μ, σ 3, PD, and CDS for all models. It is apparent that the trend of V is increasing if and only if μ > 0. If the μ is becoming negative, \(\sigma_{3}\) is becoming higher, or the asset price V is close to the model barrier, the probability of default (PD) of the country is close to 1 and the model CDS is also becoming higher, meaning that the country may need financial support from other countries or institutions.

The bottom panel of Figs. 5, 6, 7, and 8 shows the comparisons of CDS prices from the model versus the market CDS prices. The left axis is the measure of market CDS, and the right axis is the measure of model CDS. All CDS prices by the BT model are highest since the model is extremely sensitive when the asset value is close to the default barrier, and the Merton model is the lowest in our sample period since the model does not contain any barrier and the asset value is also much higher than the promised payoff K. Although the absolute difference between market CDS and model CDS seems large for all models and sample countries, we will demonstrate that our structural model can capture the trend and peak times of market CDS, namely, the capability of identifying high sovereign credit risk on the verge of the crisis.

As shown in Fig. 5, Iceland had negative μ in all the models during 2008H2 to 2010H1 (sub-prime mortgage crisis) and 2011H2 to 2012H1 (European sovereign debt crisis) because the equity value in Fig. 4 shows downside trends in these two periods. All models for Iceland exhibit high PDs and high model CDSs during the global financial crisis period, which is consistent with the collapse of equity value shown in Fig. 4. After 2010, since the external debt is decreased, the model CDSs begin to flat. All model CDSs are relatively flat in 2012 except for the BT model with its high implied default barrier.

As seen in Fig. 6, Korea also follows the trend of equity value in Fig. 4 in which the drift term μ is negative during the mortgage crisis and close to zero during the European sovereign debt crisis. The BT model is also more sensitive than the other two models in 2012.

After economic sanctions and the oil price collapse, foreign investors fled and caused large capital outflow from Russia and RUB depreciated sharply in 2014Q4. Figure 7 shows that all three models have high PDs and model CDSs in the last several days of sample period in 2014, especially when the Central Bank of Russia raised its interest rate from 10.5 to 17 % on 2014/12/16. In addition to 2014Q4, all models also have high PDs and model CDSs during the global financial crisis period, and the BT model also has higher PD in 2012.

Figure 8 is the estimation results for South Africa. Due to the slow economic growth and depreciation of ZAR with respect to the USD after 2011H2, the μ of all models are negative, and PD and CDS derived by the BT model are also high after that time period. The LT model also reacts to the market slightly.

5.3 Model performance

To compare the performance of the three models based on our sovereign balance sheet, we follow Jessen and Lando (2015) using ROC,Footnote 12 the Mann–Whitney U-test, and Spearman’s ρ to test whether our model CDS prices can reflect the information regarding sovereign risk. Since Spearman’s ρ is a measure of rank correlation, a high Spearman’s ρ implies high area under the curve (AUC).

We first use Spearman’s ρ rank correlation test to examine whether the rank of our model CDS over time is consistent with the rank of market CDS for each country. Table 4 shows that the Merton model has the highest ρ for Korea, the BT model has the highest ρ for Iceland, and the LT model has the highest ρ for Russia and South Africa, indicating that our structural approach can assign similar rank of sovereign risk to that of the market CDS. However, the Spearman’s ρ of LT model and BT model for Iceland and Korea are lower than 50 %. Thus, we cannot find one single model that provides the most consistent rank with market CDS than the other two models for the four countries in our study.

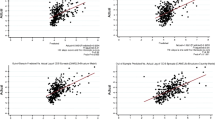

We further follow the result of Table 3 and test whether our model can assign distinguishable scores for two groups: the default group versus the non-default group. Following Engelmann et al. (2003), we define the hit rate and false alarm rate, as shown in Table 5. The hit rate of a certain cutoff level C, \({\text{HR}}\left( {\text{C}} \right),\) is the percentage of total default days that the model CDS is equal to or higher than C, and the false alarm rate of a certain cutoff level C, \({\text{FAR}}\left( {\text{C}} \right),\) is the percentage of total non-default days on which the model CDS is equal to or higher than C. Given a sequence of \(\left\{ {{\text{C}}_{1} , \cdots ,{\text{C}}_{\text{n}} } \right\},\), we will have \(\left( {{\text{FAR}}\left( {{\text{C}}_{\text{i}} } \right),{\text{HR}}\left( {{\text{C}}_{\text{i}} } \right)} \right)_{{{\text{i}} = 1,{ \ldots }{\text{n}}}}\) based on different countries and models. We plot all points of FAR versus HR and connect them to obtain different ROC curves in Fig. 9.

Since the curves in Fig. 9 are away from the diagonal line, all the models have the significant ability to assign model CDS in the default and non-default day groups. We further calculate AUC, shown in Table 6, to examine which model performs better for each sample country. The results of AUC show that the LT model has the highest AUC for Korea (0.9978), South Africa (0.8967), and Russia (0.9999), and the Merton model performs best for Iceland (0.8520). Since all AUCs are higher than 78 %, all three models have ability to predict sovereign risk. Furthermore, the results of AUC of all three models for South Africa and Korea are higher than 0.99, showing that structural approach can capture credit risk well in these two countries. In contrast, AUCs for Iceland are relatively low and ranging from 0.7868 to 0.8520, because of the unusual balance sheet of Iceland.

We also apply the Mann–Whitney U-test to examine whether the AUCs differ for each country, as shown in Table 7. From Engelmann et al. (2003) and Jessen and Lando (2015), our hypothesis is \(H_{0} : AUC_{1} = AUC_{2}\) for any two of our three models. The test statistic is

where σ 21 and σ 22 are the variance of two AUCs, and σ 212 is the correlation between them. If one model has the largest AUC value for a country and the differences for the other two models in the U-test are significant, that model best suited to the given country.

Obviously, the model CDS prices among three models differ for Iceland and Russia since the p-values of differences between any two model CDS prices are significant. For Korea, the LT model is significantly better than the Merton model at 5 % level and with the BT model at 1 % level, but there is no statistical difference between the Merton and BT models. Finally, the only significant different AUCs for South Africa is between the Merton and LT models at 5 % level, which means the AUC of the BT model does not differ much from the AUCs of the Merton and the LT models.

In summary, based on the results of the Spearman’s ρ rank correlation test and the AUC test, the LT model is the best model for Russia and South Africa since the LT model performs best in both tests. For Korea, the Merton model has the highest correlation rank with market CDS while the LT model has the best result under the AUC test. The result for Iceland is mixed, since the BT model has the best rank correlation with the market CDS while the AUC is a little lower than in the Merton model. Since Iceland has the very unusually large banking sector to GDP, it may need very specific assumption in order to model its credit risk. Therefore, the LT model with endogenous default boundary can be considered as the best among the three structural models in explaining sovereign risk.

6 Conclusion

In this study, we applied the sovereign balance sheet structure and employed three structural models (Merton, BT, and LT models) to measure the sovereign credit risk. The transformed-data MLE approach and MM algorithm were used to calibrate the unknown parameters and variables. The derived default probabilities over time for our sample countries match most of the important financial or economic events that occurred during the test periods. Although Spearman’s ρ test showed that there is no single model can have the most consistent rank with market CDS in all four sample countries, the ROC and AUC tests illustrate that our structural approach can differentiate whether the credit of a sovereign country is in an precarious situation. The Mann–Whitney U-test also supports the results of ROC and AUC that the LT model is the best model for Korea, Russia and South Africa, and the Merton model is best for Iceland. Since Iceland has the very unusually large banking sector to GDP and may need special assumptions in order to model its credit risk, the LT model with endogenous default boundary can be a better structural model among the three chosen models in explaining sovereign risk.

We provide a theoretical background to show why the CDS increases in most countries simultaneously with exchange rate depreciation and decreases in foreign capital. Although there is still room to improve sovereign CDS pricing using structural approach, the changes of the equity value and the implied default probability can be an effective tool for monitoring credit quality of a country. This in turn can help policy maker for deciding the monetary policy such as the appropriate the level of external debt, money supply or exchange rate. However, we shall note that countries in which the foreign exchange rate is relatively fixed (e.g. China) or those cannot control monetary policy (e.g. Eurozone) may not consistent with our model framework. Credit risk of countries like Greece needs to be further explored in the future study.

Notes

For example, Park and Oh (2005) showed that Korea was hit by Asian financial crisis in 1997 because of the high level of short-term external debt with respect to GDP and large inflows of foreign capital staying in financial system instead of physical investment.

Global Financial Stability Report, IMF, April 13, 2010.

Although some studies such as Jenkins et al. (2014) found evidence of both underreaction and overreaction to previously accounting information during financial crisis period (from July, 2007 to June, 2009 in their study), suggesting that the CDS market is less efficient during crisis periods and is more efficient during periods of relative economic stability, we follow prevailing literature, such as Pan and Singleton (2008) and Hui and Fong (2015), to use CDS price to represent the credit risk of a sovereign in our study.

We assume international investors will withdraw their capital and the FX rate will depreciate if the FX reserves cannot repay the external debt at the maturity date. This assumption is consistent with Aizenman et al. (2015) who showed that the FX rate will depreciate with respect to US dollar in emerging market if the FX reserves are not enough to the level of its model prediction.

We recognize that it is difficult to pin down the default barrier H when the barrier is low relative to the asset value, that is, the default probability is low (Lee et al. 2009). This is because when the default probability is low, the low barrier estimate can vary across a wide range since it does not affect the likelihood function and equity pricing results. Fortunately, as Lee et al. (2009) indicated, the bias of low-barrier cases scarcely affects the default probabilities of the sample countries, which is the main focus of our study.

The database was constructed by the Bank for International Settlements (BIS), the International Monetary Fund (IMF), the Organization for Economic Cooperation and Development (OECD), and the World Bank (WB).

Since Icelandic government only took over the domestic deposit of three investment banks in 2008, the other parts were go into receivership and liquidated. Most part of foreign deposit was moved from “Deposit-taking Corporations” to “DMBs Undergoing Winding-up Proceedings”, which belongs to other sectors in World Bank Database, since 2008Q4. Therefore, we do not contain this part into our sample when it was moved.

According to Moody’s report, the credit rating of Iceland dropped from Aaa in Mar., 2008 to Baa3 in 2014.

According to Moody’s report, the credit rating of Russia dropped from Baa1 in Oct., 2014 to Ba1 in Feb., 2015.

According to Moody’s report, the credit rating of Korea improved from Ba1 in 1998 to Aa3 in 2014.

According to Moody’s report, the credit rating of South Africa dropped from A3 in July, 2009 to Baa2 in Nov., 2014.

References

Acharya V, Drechsler I, Schnabl P (2014) A pyrrhic victory? Bank bailouts and sovereign credit risk. J Financ 69:2689–2739

Aizenman J, Cheung YW, Ito H (2015) International reserves before and after the global crisis: is there no end to hoarding? J Int Money Financ 52:102–126

Ang A, Longstaff FA (2013) Systemic sovereign credit risk: lessons from the U.S. and Europe. J Monetary Econ 60:493–510

Arnold IJM (2012) Sovereign debt exposures and banking risks in the current EU financial crisis. J Policy Model 34:906–920

Bartram SM, Brown GW, Hund JE (2007) Estimating systemic risk in the international financial system. J Financ Econ 86:835–869

Benediktsdottir S, Danielsson J, Zoega G (2011) Lessons from a collapse of a financial system. Econ Policy 26:183–235

Bharath ST, Shumway T (2008) Forecasting default with the Merton distance to default model. Rev Financ Stud 21:1339–1369

Black F, Cox JC (1976) Valuing corporate securities: some effects of bond indenture provisions. J Financ 31:351–367

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81:637–659

Blanco S, Brennan R, Marsh IW (2004) An empirical analysis of the dynamic relationship between investment grade bonds and credit default swaps. Working paper. Bank of England

Brenann M, Schwartz E (1980) Analyzing convertible bonds. J Financ Quant Anal 15:907–929

Briys E, de Varenne F (1997) Valuing risky fixed rate debt: an extension. J Financ Quant Anal 32:239–248

Brockman P, Turtle H (2003) A barrier option framework for corporate security valuation. J Financ Econ 67:511–529

Bruche M (2007) Estimating structural bond pricing models via simulated maximum likelihood. Working paper. London School of Economics

Carr P, Wu L (2007) Theory and evidence on the dynamic interactions between sovereign credit default swaps and currency options’. J Bank Financ 31:2383–2403

Chan-Lau JA, Kim YS (2004) Equity prices, credit default swaps, and bond spreads in emerging markets. Working paper. International Monetary Fund

Chen H (2013) Comment on “Systemic sovereign credit risk: lessons from the U.S. and Europe” by Ang and Longstaff. J Monetary Econ 60:511–516

Chesney M, Morisset J (1992) Measuring the risk of default in six highly indebted countries. Working paper. The World Bank

Claessens S, Pennacchi G (1996) Estimating the likelihood of Mexican default from the market prices of Brady bonds. J Financ Quant Anal 31:109–126

Duan JC (1994) Maximum likelihood estimation using pricing data of the derivative contract. Math Financ 4:155–167

Duan JC (2000) Correction: maximum likelihood estimation using pricing data of the derivative contract. Math Financ 10:461–462

Duan JC, Fulop A (2009) Estimating the structural credit risk model when equity prices are contaminated by trading noises. J Econometrics 150:288–296

Duan JC, Gauthier G, Simonato JG, Zaanoun S (2003) Estimating Merton’s model by maximum likelihood with survivorship consideration. Working paper. University of Toronto

Duan JC, Gauthier G, Simonato JG (2004) On the equivalence of the KMV and maximum likelihood methods for structural credit risk models. Working paper. University of Toronto

Duffee G (1998) The relation between treasury yields and corporate bond yield spreads. J Financ 53:2225–2242

Duffie D, Singleton K (1999) Modelling term structures of defaultable bonds’. Rev Financ Stud 12:687–720

Duffie D, Pedersen LH, Singleton K (2003) Modeling sovereign yield spreads: a case study of Russian debt. J Financ 58:119–159

Engelmann B, Hayden E, Tasche D (2003) Measuring the discriminative power of rating systems. Working paper. Deutsche Bundesbank

Eom YH, Helwege J, Huang JZ (2004) Structural models of corporate bond pricing: an empirical analysis. Rev Financ Stud 17:499–544

Forte S (2011) Calibrating structural models: a new methodology based on stock and credit default swap data. Quant Financ 11:1745–1759

Forte S, Lovreta L (2012) Endogenizing exogenous default barrier models: the MM algorithm. J Bank Financ 36:1639–1652

Frankel J, Saravelos G (2012) Can leading indicators assess country vulnerability? Evidence from the 2008–2009 global financial crisis. J Int Econ 87:216–231

Fuertes A, Kalotychou E (2006) Early warning systems for sovereign debt crises: the role of heterogeneity’. Comput Stat Data Anal 51:1420–1441

Galai D, Wiener Z (2012) Credit risk spreads in local and foreign currencies. J Money Credit Bank 44:883–901

Gray DF, Merton R, Bodie Z (2007) Contingent claims approach to measuring and managing sovereign credit risk. J Investment Manag 5:1–24

Hui CH, Fong TPW (2015) Price cointegration between sovereign CDS and currency option markets in the financial crises of 2007–2013. Int Rev Econ Financ. doi:10.1016/j.iref.2015.02.011

Hui CH, Lo CF, Tsang SW (2003) Pricing corporate bonds with dynamic default barriers. J Risk 5:17–37

Hull JC, Predescu M, White A (2004) The relationship between credit default swap spreads, bond yields, and credit rating announcements. J Bank Financ 28:2789–2811

Huschens S, Karmann A, Maltritz D, Vogl K (2007) Country default probabilities: assessing and backtesting. J Risk Model Validat 1:3–26

Jarrow R, Turnbull S (1995) Pricing derivatives on financial securities subject to credit risk. J Financ 50:53–86

Jenkins NT, Kimbrough MD, Wang J (2014) The extent of informational efficiency in the credit default swap market: evidence from post-earnings announcement returns. Rev Quant Financ Account. doi:10.1007/s11156-014-0484-y

Jessen C, Lando D (2015) Robustness of distance-to-default. J Bank Financ 50:493–505

Jones EP, Mason S, Rosenfeld E (1984) Contingent claims analysis of corporate capital structures: an empirical investigation. J Financ 39:611–627

Kalotychou E, Staikouras SK (2006) An empirical investigation of the loan concentration risk in Latin America. Journal of Multinational Financial Management 16:363–384

Karmann A, Maltritz D (2003) Sovereign risk in a structural approach: evaluating sovereign ability-to-pay and probability of default. Working paper. Dresden University of Technology

Lee HH, Lee CF, Chen RR (2009) Empirical studies of structural credit risk models and the application in default prediction: review and new evidence. Int J Inf Technol Decis Mak 8:629–675

Leland HE, Toft KB (1996) Optimal capital structure, endogenous bankruptcy, and the term structure of credit spreads. J Financ 51:987–1019

Li J, Zinna G (2013) On bank credit risk: systemic or bank specific? Evidence for the United States and United Kingdom. J Financ Quant Anal 49:1403–1442

Longstaff FA, Schwartz ES (1995) A simple approach to valuing risky fixed and floating rate debt. J Financ 50:789–819

Merton RC (1974) On the pricing of corporate debt: the risk structure of interest rates. J Financ 28:449–470

Oshiro N, Saruwatari Y (2005) Quantification of sovereign risk: using the information in equity market prices. Emerg Mark Rev 6:346–362

Pan J, Singleton KJ (2008) Default and recovery implicit in the term structure of sovereign CDS spreads. J Financ 63:2345–2384

Park D, Oh J (2005) Korea’s post-crisis monetary policy reforms. Rev Pacific Basin Financ Market Policies 8:707–731

Plank TJ (2010) Essays in sovereign credit risk. University of Pennsylvania

Ronn EI, Verma AK (1986) Pricing risk-adjusted deposit insurance: an option-based model. J Financ 41:871–895

Shreve SE (2004) Stochastic calculus for finance vol 2: Continuous-time models. Springer, New York

Vasicek O (1977) An equilibrium characterization of the term structure. J Financ Econ 5:177–188

Vassalou M, Xing Y (2004) Default risk in equity returns. J Financ 59:831–868

Wang HY, Choi TW (2009) Estimating default barriers from market information. Quant Financ 9:187–196

Wang HY, Li KL (2004) On bias of testing Merton’s model. Working paper. The Chinese University of Hong Kong

Wang HY, Li KL (2008) Structural models of corporate bond pricing with maximum likelihood estimation. J Empir Financ 15:751–777

Westphalen M (2002) Valuation of sovereign debt with strategic defaulting and rescheduling. Working paper. University of Lausanne and Fame

Zhou C (2001) The term structure of credit spreads with jump risk. J Bank Financ 25:2015–2040

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proof of proposition 1

Following the assumption in Eqs. (3) and (4), let r and \({\text{r}}^{\text{f}}\) be, respectively, the domestic and foreign constant riskless interest rate. Under the domestic risk-neutral probability measure \(\widetilde{\text{P}}\), we have

where \(\varTheta_{1}\) and \(\varTheta_{2}\) satisfy

We now let

The risk-neutral measure associated with the numéraire \({\text{M}}^{\text{f}} \left( {\text{t}} \right){\text{Q}}\left( {\text{t}} \right)\) is given by

Given

Under the foreign risk-neutral measure \(\widetilde{\text{P}}^{f}\), we have

which is Eq. (6) in the proposition, where

That is, \(\widetilde{\text{W}}_{3}^{\text{f}}\) is a Brownian motion under the risk-neutral probability measure \(\widetilde{\text{P}}^{f}\). Therefore, the payoff of the junior claim in foreign currency, \({\text{y}} = {\text{E}}\left( {\text{t}} \right)/{\text{Q}}\left( {\text{t}} \right)\), in the vanilla European option framework is

where \({\text{x}} = {\text{V}}\left( {\text{t}} \right)/{\text{Q}}\left( {\text{t}} \right),N( \cdot )\) is the standard normal cumulative distribution function, and

On the other hand, according to the Radon-Nikodym theorem, there also exists an almost surely positive random variable Z, such that \({\text{E}}^{{\widetilde{\text{P}}^{f} }} \left[ {\text{Z}} \right] = 1{\text{Z}}\) and

where Pf and \(\widetilde{\text{P}}^{f}\) are the empirical probability measure and the risk-neutral probability measure, respectively. According to the Girsanov theorem, there exists a constant parameter \(\mu = {\text{f}}\left( {\alpha ,\gamma ,\sigma_{3} } \right),\) such that

where \({\text{W}}_{3}^{\text{f}} \left( {\text{t}} \right),\;0 \le {\text{t}} \le {\text{T}},\) is a Brownian motion under the empirical probability measure Pf. Hence, under Pf, the process of \({\text{V}}\left( {\text{t}} \right)/{\text{Q}}\left( {\text{t}} \right)\) is

The PD of the external debt becomes

Appendix 2: Proof of proposition 2

Under the BT model structure, the payoff of the junior claim in foreign currency is

where \({\text{x}} = {\text{V}}\left( {\text{t}} \right)/{\text{Q}}\left( {\text{t}} \right),{\text{N(}} \cdot )\) is the standard normal cumulative distribution function,

and

The PD of the external debt becomes

Appendix 3: Proof of log-likelihood function of the junior claim

Under the BT model framework, the process of X(s) will stop at barrier H when \({\text{X}}\left( {\text{s}} \right) = {\text{H,}}\;{\text{t}} \le {\text{s}} \le {\text{T}}.\) The density function of X(s) should be

where

From Eqs. (2) and (19), the density function of \({\text{Y}}\left( {\text{s}} \right) = {\text{E}}\left( {\text{s}} \right)/{\text{Q}}\left( {\text{s}} \right)\) becomes

where \(\partial {\text{Y}}\left( {\text{s}} \right)/\partial {\text{X}}\left( {\text{s}} \right)\) is the delta of the down-out-call barrier option,

where

Applying Eq. (21) and under the consideration of survivorship, the log-likelihood function of the junior claims in the foreign currency is

where

Appendix 4: Functions in the LT model

As shown in Forte (2011) and Forte and Lovreta (2012), the expressions for \({\text{F}}_{\text{t}} \left( {{\text{x}},\tau_{\text{i}} } \right)\) and \({\text{G}}_{\text{t}} \left( {{\text{x}},\tau_{\text{i}} } \right)\) are

where

Also, for any time \({\text{s}} \in \left\{ {0,{\text{h}},2{\text{h}}, \ldots ,{\text{nh}}} \right\},\) the transformation term is given by

where

and \({\text{f}}( \cdot )\) is the standard normal pdf,

Rights and permissions

About this article

Cite this article

Lee, HH., Shih, K. & Wang, K. Measuring sovereign credit risk using a structural model approach. Rev Quant Finan Acc 47, 1097–1128 (2016). https://doi.org/10.1007/s11156-015-0532-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-015-0532-2