Abstract

This paper examines the welfare implications of input price discrimination in a vertically-related market, which is composed of a monopolistic upstream market and a duopolistic downstream market. The downstream duopolists produce quality-differentiated products at different marginal costs. We show that the equilibrium input prices are closely related to the downstream quality gap and cost difference. When the monopolist simply charges a unit wholesale price for its input product, discriminatory pricing could be socially desirable even though the aggregate output remains unchanged. Nevertheless, if a two-part tariff is feasible, then banning price discrimination could increase the aggregate output and social welfare.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Price discrimination is a common business practice,Footnote 1 to which the literature has paid considerable attention with respect to its welfare implications in final goods markets.Footnote 2 Most antitrust concerns about price discrimination, nevertheless, relate to the pricing of input products (or intermediate goods), rather than of final goods.Footnote 3 Consequently, the recent literature has had an increased interest in input monopolists’ discriminatory pricing activities.Footnote 4

The purpose of this paper is to investigate the policy implications of third-degree price discrimination in input markets by employing a vertically-related market model. An important feature in the model is that an input monopolist sells a homogenous input product to a downstream industry that produces quality-differentiated products.

The consideration of quality differentiation herein is relevant, because it is commonly observed that firms often use the same input offered by a single supplier to produce quality-differentiated products. For example, many PC and laptop manufacturers, such as Asustek, Dell, Lenovo, Toshiba, etc., utilize the same Intel Core processors for their quality-differentiated products. To our best knowledge, the implications of quality differentiation have not been addressed in the extant literature on input price discrimination.

We consider two common contracts: linear and non-linear price contracts. In the linear pricing regime, discriminatory pricing by an upstream monopolist does not affect aggregate output, but does cause ambiguous welfare effects, depending on the sizes of the downstream quality gap and cost difference. Price discrimination can be socially desirable, because the resulting output reallocation is efficient. In other words, the socially more efficient downstream firm can sell relatively more output. Nevertheless, in the non-linear pricing regime a ban on price discrimination may lower wholesale prices for downstream firms, which reduces the wholesale markup and thus increases the aggregate output and social welfare.

The remainder of the paper is organized as follows: Sect. 2 reviews the related literature. Section 3 presents the model. Section 4 analyzes the regime of a linear price contract. Section 5 derives the results under the regime of a non-linear price contract. Section 6 concludes the paper.

2 Related Literature

A well-known result in the literature on wholesale price discrimination is that for homogeneous products, price discrimination can impair production efficiency by shifting outputs from efficient downstream firms to inefficient ones. This raises production costs and thus reduces social welfare; see, e.g., Katz (1987), DeGraba (1990), and Yoshida (2000).Footnote 5 In contrast to the above-mentioned literature, we develop a quality differentiation model in which the downstream firms differ not only in production cost, but also in product quality, and whereby the conventional misallocation effect may not arise. More specifically, if the cost difference is moderate, wholesale price discrimination favors the low-cost firm due to its quality disadvantage, thereby reducing production costs and enhancing social welfare.

Our welfare result is related to several papers. Inderst and Valletti (2009) consider demand-side substitutability and conclude that a discriminatory monopolist gives price discounts to efficient downstream firms, which is allocatively efficient. Arya and Mittendorf (2010) point out that the output allocation across markets (consumers) is efficient under price discrimination.Footnote 6 With endogenous entry, Herweg and Müller (2012) show that discriminatory pricing decreases unit wholesale prices and thus increases market output and social welfare.Footnote 7 In contrast, we analyze the quality gap and the cost difference in the downstream industry so as to identify the conditions under which wholesale price discrimination is socially desirable.

Inderst and Shaffer (2009) examine the effects of wholesale price discrimination for a two-part tariff—i.e., a unit wholesale price plus a fixed fee—and find that wholesale price discrimination is welfare improving, because downstream firms’ unit wholesale prices can thus be lower (as compared to uniform pricing).Footnote 8 As a distinction, we find that discriminatory two-part tariffs may be socially harmful.Footnote 9 The reason, which is in line with that of Herweg and Müller (2016), is that uniform pricing yields a lower unit wholesale price than does discriminatory pricing when the fixed fee is determined by the participation constraint of the low-cost firm. Specifically, in our model this is the case if the downstream cost difference is relatively small.

3 The Basic Model

We consider a vertically-related market that is composed of one upstream monopolistic market and one downstream duopolistic market. The upstream monopolist produces and sells a homogeneous input to the downstream market. The downstream duopolists, which are denoted as firms 1 and 2, use the input to produce quality-differentiated products and compete with each other for a population of consumers who differ in their willingness to pay for product quality.

Assume that the product quality levels of firms 1 and 2 are \(s_{1}\) and \(s_{2}\), respectively. Without loss of generality, we normalize \(s_{2}\) to be 1 and assume that \(s_{1} = s > 1\) throughout the paper. In other words, firm 1 is the high-quality firm and firm 2 is the low-quality firm, and their quality gap is given as \(s - 1 > 0\). Note that the quality gap means that consumers can enjoy an additional benefit from consuming firm 1’s product. Hence, if the price is the same, then consumers gain more surplus by purchasing the high-quality product. We assume throughout the paper that the firms’ quality levels are exogenously given (but in Sect. 4.3 we shall discuss the issue of endogenous quality choice).

A consumer’s willingness to pay for quality is parameterized by a valuation \(\theta\) that is uniformly distributed over the interval \([0,1]\). The utility of consumers when buying firm i’s product at price \(p_{i}\) is defined as follows: \(U = \theta s_{i} - p_{i}\), \(i = 1,2\).Footnote 10 We further assume that each consumer purchases at most one product and one unit of the product. Given the downstream firms’ product prices, each consumer maximizes utility by choosing either to buy one of the products or not to buy.

Consumers are partitioned by two marginal consumers, \(\theta_{12}\) and \(\theta_{20}\): Those with valuations in the range of \([\theta_{12} , \, 1]\) buy the high-quality product; those in \([\theta_{20} ,\theta_{12} )\) buy the low-quality one; and those in \([0,\theta_{20} )\) buy neither.Footnote 11 The two marginal consumers are respectively specified as \(\theta_{12} = (p_{1} - p_{2} )/(s - 1)\) and \(\theta_{20} = p_{2}\). Assume that the outputs of firms 1 and 2 are respectively \(q_{1}\) and \(q_{2}\). From \(q_{1} = 1- \theta_{12}\) and \(q_{2} = \theta_{12} - \theta_{20}\), the demand functions for the two qualities are then specified as follows:

To produce one unit of the product, assume that firms 1 and 2 need to buy one unit of the input from the upstream monopolist and respectively incur marginal costs \(c_{1}\) and \(c_{2}\). We further assume that the high-quality firm’s marginal cost is larger than that of the low-quality firm; i.e., \(c_{1} > c_{2}\), which can be justified by the fact that the production of high-quality goods often requires high-skilled workers; the high-quality firm thereby incurs high wage costs and marginal costs. To simplify the notation, we assume that \(c_{2} = 0\) and \(c_{1} = c\); thus, \(c\) also represents the downstream cost difference. For the sake of simplicity, the upstream monopolist’s cost is assumed to be zero.

Given the model specifications, we shall conduct the analysis under two different price contract regimes: a linear price contract regime; and a non-linear price contract regime. In the former regime, the monopolist simply charges a unit wholesale price for the input sold, whereas it charges a unit wholesale price plus a fixed fee (i.e., a two-part tariff) in the latter. Under each price contract regime, the monopolist determines the input prices by either of two pricing policies: discriminatory pricing, and uniform pricing. We assume that there is no arbitrage when the upstream monopolist charges discriminatory prices.

The timing of the game is as follows: In the first-stage game, the upstream monopolist, in anticipation of the equilibrium in the second-stage game, determines the input prices via either discriminatory pricing or uniform pricing. In the second-stage game, given the input prices that are offered the downstream firms choose their prices a la Bertrand. The game is solved by backward induction. A Cournot competition model will be discussed in Sect. 4.2. In what follows we first investigate the equilibrium outcomes for the two-stage game under the linear pricing regime. Section 5 then conducts the analysis for the non-linear pricing regime.

Assume that the unit wholesale prices charged to firms 1 and 2 are respectively \(w_{1}\) and \(w_{2}\). The profit functions of firms 1 and 2 are then defined as follows:

The profit of the upstream monopolist is defined as:

The aggregate consumer surplus is defined as:

Social welfare is the summation of the aggregate consumer surplus and the profits of all firms, which is defined as follows:

In the second-stage game, firms 1 and 2 choose prices to maximize their individual profits in (2) and (3), respectively. By using the first-order conditions for profit maximization, the equilibrium prices are derived as follows:

By substituting (7) into (1), the downstream firms’ outputs are:

The downstream outputs in (8) are also the derived demands that the monopolist faces.Footnote 12 From (8), the corresponding marginal consumers, who will be used in the analysis for welfare effects later, are specified as:

We assume that Assumption 1 holds true throughout the paper as follows.

Assumption 1

(1) \(w_{i} > 0\). (2) \(q_{i} (w_{1} ,w_{2} ) > 0.\) (3) \(\Omega \text{ }(w_{1} ,w_{2} ) > \hbox{max} \{ \Omega_{1} ,\Omega_{2} \}\), where \(\Omega_{i}\) is the monopolist’s profit when serving only the downstream firm \(i\), \(i = 1,2\).

The conditions in Assumption 1, which are related to the parameter values \(s\) and \(c\), respectively ensure that in equilibrium: The unit wholesale prices are positive; the duopolistic firms are active and produce positive outputs; and the monopolist always finds it profitable to serve both downstream firms. Note that the specific parameter ranges, under which Assumption 1 is met, will vary for different scenarios (i.e., different competition and price contract forms).

4 Linear Price Contract

In the first-stage game, anticipating the derived demands in (8), the monopolist decides the optimal unit wholesale prices by either discriminatory pricing or uniform pricing.

Under discriminatory pricing, the monopolist chooses \(w_{1}\) and \(w_{2}\) to maximize its profit \(\, \Omega \text{ }\):

Substituting (8) into (10) and solving the first-order conditions for profit maximization yield:

where the superscript d stands for discriminatory pricing hereafter. We assume that \(c < {{2s(s - 1)} \mathord{\left/ {\vphantom {{2s(s - 1)} {(2s - 1)}}} \right. \kern-0pt} {(2s - 1)}}\) from Assumption 1.Footnote 13 Moreover, the second-order conditions are always satisfied: \({{\partial^{2} \Omega } \mathord{\left/ {\vphantom {{\partial^{2} \Omega } \partial }} \right. \kern-0pt} \partial }w_{1}^{2} = {{ - (4s - 2)} \mathord{\left/ {\vphantom {{ - (4s - 2)} {\left[ {(4s - 1)(s - 1)} \right] < 0}}} \right. \kern-0pt} {\left[ {(4s - 1)(s - 1)} \right] < 0}}\); and \({{\partial^{2} \Omega } \mathord{\left/ {\vphantom {{\partial^{2} \Omega } \partial }} \right. \kern-0pt} \partial }w_{2}^{2} = {{ - s(4s - 2)} \mathord{\left/ {\vphantom {{ - s(4s - 2)} {\left[ {(4s - 1)(s - 1)} \right] < 0}}} \right. \kern-0pt} {\left[ {(4s - 1)(s - 1)} \right] < 0}}\).

From (11), we obtain the following proposition:

Proposition 1

Assume that the upstream monopolist adopts a linear price contract. If \(c \ge ( < )s - 1\) , then \(w_{ 1}^{d} \le ( > )\text{ }w_{ 2}^{d}\) , such that either the high-quality firm or the low-quality firm can pay a relatively low wholesale price under discriminatory pricing.

The extant literature has already shown that a discriminatory monopolist charges a higher unit wholesale price to the downstream firm with lower marginal cost; see, e.g., Katz (1987), DeGraba (1990), and Yoshida (2000). The intuition is as follows: As pointed out by Valletti (2003, p. 974), the low-cost firm produces more output than does the high-cost firm. Hence, without changing the aggregate output, the input monopolist can increase profits by raising the unit wholesale price for the low-cost firm, while lowering that for the high-cost firm, because the increased profit gained from the inputs that are sold to the low-cost firm can compensate for the lower profit from the high-cost firm. This implies that the low-cost firm is a less elastic buyer of the input.

In our model, downstream firms differ not only in production cost, but also product quality. Similar to the cost advantage, other things being equal, the firm with high quality enjoys a competitive advantage and sells more output, and thereby is a less elastic input buyer. In sum, the higher is the quality level or the lower is the cost for a downstream firm, the more inelastic is its derived demand. If the quality gap is more significant than the cost difference, then firm 1’s input demand is less elastic than firm 2’s, and vice versa.

Inderst and Valletti (2009) show that when facing the threat from demand-side substitution, a discriminatory monopolist, given downstream participation constraints, tends to charge a lower unit wholesale price for a relatively efficient (low-cost) downstream firm. The reason is that the efficient downstream firm has more incentive to choose the alternative supply option, which forces the monopolist to offer it more price discounts. In our model, due to its quality disadvantage, the low-cost firm can receive a price discount under price discrimination even in the absence of the substitution threat.

If the monopolist adopts uniform pricing, then it sets the same unit wholesale price for the two downstream firms. With \(w_{1}\) and \(w_{2}\) equal to \(w\), the monopolist’s profit is specified as:

By solving the first-order conditions for profit maximization, we obtain the uniform wholesale price:

where the superscript u stands for uniform pricing hereafter. To ensure that Assumption 1 is met, we assume that \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} <\, c\,< \bar{c}\), where \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} = (s - 1)^{2} /3s\) and \(\bar{c} = [s(8s + 1)(s - 1)]/(8s^{2} - s - 1)\).Footnote 14 The second-order condition is always satisfied as \({{\partial^{2} \Omega } \mathord{\left/ {\vphantom {{\partial^{2} \Omega } \partial }} \right. \kern-0pt} \partial }w^{2} = {{ - (4s + 2)} \mathord{\left/ {\vphantom {{ - (4s + 2)} {(4s - 1) < 0}}} \right. \kern-0pt} {(4s - 1) < 0}}\).

From (11) and (13), the uniform price (\(w^{u}\)) is a weighted mean of the two discriminatory prices: \(w_{1}^{d}\) and \(w_{2}^{d}\). We present this result in the following lemma:

Lemma 1

The uniform wholesale price is bounded by the two discriminatory prices, such that \(w^{u} = \alpha w_{1}^{d} + (1 - \alpha )w_{2}^{d}\) and \(\alpha = 1/(2s + 1) < 1\).

Lemma 1 shows a common result in the extant literature: When compared with uniform pricing, discriminatory pricing harms one of the downstream duopolists while benefitting the other. Note that \(w_{2}^{d}\) is constant and not affected by both quality and cost levels \(s\) and \(c\). If \(w_{1}^{d} > w_{2}^{d}\), then an increase in the quality gap \(s\) causes \(w^{u}\) to move away from \(w_{2}^{d}\) as \(w_{1}^{d}\) increases, but an increase in the cost difference \(c\) shifts \(w^{u}\) toward \(w_{2}^{d}\) as \(w_{1}^{d}\) decreases. The reason is that the aggregate derived demand is less elastic than the low-quality demand in this case. Moreover, the increase in the quality level \(s\) (the cost difference level \(c\)) decreases (increases) the price elasticity of the aggregate demand and thus \(w^{u}\) increases (decreases). On the other hand, the opposite arises for \(w_{1}^{d} < w_{2}^{d}\).

4.1 Output and Welfare Comparisons

From the equilibrium results, in order to meet Assumption 1, given a quality level the cost difference cannot be too large or too small. Since \(\bar{c} < 2s(s - 1)/(2s - 1)\), in this section we consider the specified parameter range of \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < \bar{c}\), under which Assumption 1 is met for both uniform pricing and discriminatory pricing.

The social welfare function defined in (6) can be rewritten as follows:

The first term on the RHS in (14) represents social welfare from the consumption of the high-quality product, whereas the second term represents that of the low-quality product.

When comparing the welfare levels between the two pricing policies, we refer to the welfare difference due to the diverse values of \(\theta_{12}\) and \(\theta_{20}\) as the output reallocation effect and the aggregate output effect, respectively. More specifically, the former effect emerges, because in equilibrium the consumers between \(\theta_{12}^{d}\) and \(\theta_{12}^{u}\) buy different qualities under each pricing policy. The latter effect arises as consumers between \(\theta_{20}^{d}\) and \(\theta_{20}^{u}\) buy the low-quality product under one of the pricing policies, but buy neither product under the other price policy. In other words, one of the pricing policies accommodates more consumers (or larger aggregate output).

It is worth noting that when moving from uniform pricing to discriminatory pricing, in contrast to the extant literature, the output reallocation effect is determined not only by cost changes, but also by changes in consumed quality. For instance, if the aggregate output is fixed, an increase in the high-quality output (or a decrease in the low-quality output) means that both the aggregate production cost and the consumption of the high-quality product increase. The former change is socially harmful, whereas the latter is socially beneficial. Hence, due to the increased consumption of the high-quality product, the resulting output reallocation effect may be positive in terms of social welfare even though the cost becomes larger.

Before analyzing the welfare effects, it is useful to first compare firms’ outputs under the two pricing policies. By substituting the wholesale prices in (11) and (13) into (9) and rearranging, the marginal consumers under the two pricing policies are derivable as follows:

From the comparison between (15) and (16), the result in (17), and by the fact that \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < s - 1 < \bar{c}\), we establish the following proposition:

Proposition 2

Assume that the upstream monopolist adopts a linear price contract. The aggregate output is the same under both discriminatory and uniform pricing. If \(c > ( < )s - 1\) , then \(\theta_{ 1 2}^{d} < ( > )\text{ }\theta_{ 1 2}^{u}\) such that relative to uniform pricing, the high-quality output is larger (smaller) and the low-quality output is smaller (larger) under discriminatory pricing.

The same-aggregate-output result is not surprising as it is well-known under a linear demand setting.Footnote 15 On the other hand, from Proposition 1 and Lemma 1, if \(c > s - 1\), then firm 1 pays a lower discriminatory wholesale price than does firm 2; thus, the former produces more and the latter produces less under discriminatory pricing than under uniform pricing, and vice versa.

We now examine the welfare effects by using the welfare difference between discriminatory pricing and uniform pricing, which is defined as: \(\Delta SW \equiv SW^{d} - SW^{u}\). Note that from Proposition 2, the welfare effect of price discrimination is determined only by the output reallocation effect, because the aggregate output is the same under either pricing policy.

If \(c > s - 1\), then from Proposition 2, \(\theta_{12}^{d} < \theta_{12}^{u}\), and the welfare difference \(\Delta SW = \int_{{\theta_{12}^{d} }}^{{\theta_{12}^{u} }} {\left[ {\theta (s - 1) - c} \right]\text{ }} d\theta\) is negative as \(\theta (s - 1) - c < 0,\text{ }\quad \forall \;\theta \in \left[ {\theta_{12}^{d} ,\theta_{12}^{u} } \right]\). On the other hand, if \(c < s - 1\), then we have \(\theta_{12}^{d} > \theta_{12}^{u}\), and the welfare difference is \(\Delta SW = \int_{{\theta_{12}^{u} }}^{{\theta_{12}^{d} }} {\left[ {c - \theta (s - 1)} \right]\text{ }} d\theta\), which has an ambiguous sign. By substituting (15) and (16) into the welfare difference and rearranging, we obtain:

From (18), there is a critical value \(c^{ * } = (20s^{3} - 15s^{2} - 9s + 4)/(20s^{2} + 9s - 2)\) such that \(\Delta SW > 0\) if \(c > c^{ * }\); otherwise, \(\Delta SW \le 0\).

From the above discussions and by the fact that \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c^{ * } < s - 1 < \bar{c}\), we can establish the following proposition:

Proposition 3

Assume that the upstream monopolist adopts a linear price contract. Even though the aggregate output remains unchanged, discriminatory pricing is more socially desirable than is uniform pricing if and only if \(c \in (c^{ * } ,\text{ }s - 1)\).

The intuition is as follows: In the case of \(c < s - 1\), the high-quality firm has a wholesale price disadvantage and produces less under discriminatory pricing. If the high-quality cost is relatively low, then an increase in the high-quality output is socially desirable. Under such a circumstance, the price discrimination that reduces the high-quality output leads to an inefficient output reallocation. If the high-quality product becomes costly such that \(c > c^{ * }\), then the decreased high-quality output is socially efficient. When the cost rises further and exceeds \(s - 1\), price discrimination turns to favor the high-quality firm. In this case, the increased high-quality output is socially inefficient, because the high-quality cost is too large.

4.2 Downstream Cournot Competition

We now consider Cournot competition so as to examine the robustness of the previous results under Bertrand competition. Assume that the downstream firms engage in Cournot competition in the second stage of the two-stage game, and they now face the inverse demand functions: \(p_{1} = s - sq_{1} - q_{2}\) and \(p_{2} = 1 - q_{1} - q_{2}\).Footnote 16

From standard calculations, the downstream equilibrium outputs in the second-stage game are:

The corresponding marginal consumers are then:

In the first-stage game, by using the derived demand in (19), the monopolist decides the unit wholesale prices. Proceeding as previously, under discriminatory pricing the optimal wholesale prices are the same as those in (11), whereas the equilibrium wholesale price under uniform pricing is \(w^{u} = (3s - c - 1)/4s\). Similarly, the uniform wholesale price is a weighted mean of the discriminatory wholesale prices, \(w^{u} = \alpha w_{1}^{d} + (1 - \alpha )w_{2}^{d}\), where \(\alpha = {1 \mathord{\left/ {\vphantom {1 {2s}}} \right. \kern-0pt} {2s}} < 1\).

Here the upper and lower bounds of the cost difference are redefined as: \(\bar{c} = 3s - 1 - (4s^{2} - s)^{1/2}\) and \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} = [2s - 1 - (4s - 1)^{1/2} ]/2\).Footnote 17 Substituting the equilibrium wholesale prices into (20) yields:

From (21), Proposition 2 also holds true here that the aggregate output is the same under the two pricing policies; and if \(c > ( < )\text{ }s - 1\), then \(\theta_{12}^{d} < ( > )\theta_{12}^{u}\).

With regard to welfare effects, similarly if \(c > s - 1\), then the welfare difference between discriminatory pricing and uniform pricing is negative. On the other hand, if \(c < s - 1\), then the welfare difference is:

From (22), there is a critical value \(c^{*} = (20s^{3} - 19s^{2} - 2s + 1)/(20s^{2} + 5s - 1)\) such that the welfare difference is positive if \(c > c^{ * }\). Since the condition \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c^{ * } < s - 1 < \bar{c}\) is met, the qualitative result proposed by Proposition 3 still holds true under Cournot competition.

4.3 Endogenous Quality Choice

In our model product quality is exogenously given. While endogenizing quality is beyond the scope of this paper, it is worth discussing price discrimination’s effects on the downstream firms’ quality-improvement incentives and the resulting degree of quality differentiation. To this end, we incorporate the downstream firms’ quality choices into our previous analysis and assume that these quality choices are prior to the decisions of the wholesale prices and the retail prices. For simplicity, we also assume that there are no marginal costs for quality improvement activities and that the downstream firms for the time being have the same marginal cost.

In the stylized specification, from Proposition 1, since a high-quality downstream firm will be discriminated against, wholesale price discrimination reduces downstream firms’ efforts to enhance quality. The intuition is similar to DeGraba (1990), who points out that wholesale price discrimination reduces the downstream efforts in cost-reducing R&D investment. Furthermore, this implies that wholesale price discrimination weakens the advantage of being a high-quality firm. Hence, the equilibrium quality differentiation between firms is also smaller under discriminatory pricing than under uniform pricing.

5 Non-linear Price Contract

We now consider the scenario where two-part tariffs are feasible. The upstream monopolist offers each downstream firm a take-or-leave-it price contract, which specifies a unit wholesale price and a fixed fee. In the following analysis, we exclusively refer to “price discrimination” to the situation whereby the monopolist charges a two-part tariff that has different terms for the two different downstream firms.Footnote 18 Thus, under discriminatory pricing, the monopolist offers each firm \(i\) a price contract (\(w_{i}\),\(F_{i}\)), where \(w_{i} \ge 0\) and \(F_{i} \ge 0\) are respectively the unit wholesale price and the fixed-fee payment, \(i = 1,2.\) Thus, the fixed fees that are charged to the two downstream firms can be different, as can be the unit price. Under uniform pricing, following Inderst and Shaffer (2009), the monopolist offers both downstream firms the same price contract \((w,F)\)—i.e., the same fixed fee and the same unit price.

In this section, downstream firm i’s profit is redefined as \(\pi_{i} (w_{1} ,w_{2} ) - F_{i} ,\text{ }i = 1,2,\) and \(\pi_{i} (w_{1} ,w_{2} )\) is hereafter the profit gross of fixed fees. The monopolist’s profit is redefined as \(\Omega \text{ }(w_{1} ,w_{2} ) = \text{ }\sum\nolimits_{i = 1}^{2} {\left( {w_{i} q_{i} (w_{1} ,w_{2} ) + F_{i} } \right)}\). Consumer surplus and social welfare are the same as those defined in (5) and (6).

Herweg and Müller (2016) show that if non-linear wholesale prices are feasible, then uniform pricing is more socially desirable than price discrimination. In their model, a monopolist sells its intermediate good to Cournot duopolists, which differ in both marginal and fixed costs. In contrast with their model, in the following we also analyze Cournot competition, but shed light on how the quality and cost differences between downstream firms can generate similar results. Note that our qualitative results still hold true regardless of whether the downstream duopolists play Bertrand or Cournot competition.Footnote 19

The game proceeds as follows: The monopolist first decides the unit wholesale prices and fixed fees by either uniform pricing (i.e., the same fixed fee and the same unit price is charged to the two downstream firms) or discriminatory pricing (i.e., different fixed fees and different unit prices may be charged to the downstream firms), and then the downstream duopolists choose their outputs in Cournot fashion. Note that since fixed fees have no effect on downstream firms’ outputs, the equilibrium outputs and marginal consumers under Cournot competition defined in Eqs. (19) and (20) apply here.

Before solving the two-stage game, it is useful to first consider a hypothetical benchmark whereby the upstream and downstream markets are integrated by the monopolist that can now produce the two qualities.Footnote 20 We assume hereafter that \(c < s - 1\) such that both qualities will be offered.Footnote 21 By using the demand functions in (1), the integrated monopolist decides prices \(p_{1}\) and \(p_{2}\) to maximize its profit: \(\Omega \text{ }(p_{1} ,p_{2} ) = \text{ }p_{1} q_{1} + p_{2} q_{2}\).

It is worth noting that the integrated monopolist will find the set of retail prices that maximizes overall industry profits. This vertical integration overcomes the double marginalization problem, and it also internalizes any spillover/externality effects from competition between the two products. From the first-order conditions for profit maximization, the optimal prices are: \(p_{1} = {{(s + c)} \mathord{\left/ {\vphantom {{(s + c)} 2}} \right. \kern-0pt} 2}\) and \(p_{2} = {1 \mathord{\left/ {\vphantom {1 2}} \right. \kern-0pt} 2}\),Footnote 22 which yields the marginal consumers as follows:

Let us now move back to the non-integrated markets. Under discriminatory pricing (i.e., different fixed fees and different unit prices to the two downstream firms), the monopolist solves the profit maximization problem:

where \(\pi_{i} (w_{1} ,w_{2} ) - F_{i} \ge 0\) is the participation constraint for downstream firm i.

By substituting \(F_{i} = \pi_{i} (w_{1} ,w_{2} )\) into the objective function in (24), it turns out that the discriminatory monopolist can choose \(w_{1}\) and \(w_{2}\) so as to replicate the (maximum) profit level of the integrated monopoly case. Hence, by utilizing the corresponding marginal consumers that are delineated in (23) for the hypothetical benchmark and those that are presented in (20) for the non-integrated case, the optimal unit wholesale prices are derivable as:

and the fixed fees are: \(F_{i}^{d} = \pi_{i}^{d} \left( {w_{1}^{d} ,w_{2}^{d} } \right).\)

By comparing the two discriminatory prices in (25), we obtain the following proposition:

Proposition 4

Assume that the monopolist adopts a non-negative two-part tariff. If \(c > ( < )(s - 1)/2\) , then \(w_{ 1}^{d} > ( < )\text{ }w_{ 2}^{d}\), such that either the high-quality firm or the low-quality firm can pay a lower unit wholesale price under discriminatory pricing.

Under discriminatory pricing, to gain the integrated monopoly profit, the monopolist finds the set of unit wholesale prices that eliminates the spillover effects of competition between the two downstream firms. Positive wholesale markups are thus established to keep retail prices sufficiently high—i.e., to make the downstream market less competitive. In addition, unit price discounts are given to the “right” downstream firm. As a result, the high-quality firm may pay a relatively high unit wholesale price due to its high marginal cost.

Under uniform pricing (i.e., the same unit price and the same fixed fee are charged to the two downstream firms), the monopolist now chooses the same contract (\(w,F\)) for both downstream firms and solves the maximization problem:

Note that the downstream firms’ profit ranking is ambiguous given a uniform \(w\) and \(F\).Footnote 23 Hence, according to the possible binding participation constraints, the solution to the maximization problem exhibits three possible regimes.

From Assumption 1, we hereafter assume that \(s < 1.97\) and \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < \bar{c}\), where \(\bar{c} = {{\left\{ {16s^{2} - 9s - 1 - 2\left[ {s(8s + 1)(2s - 1)} \right]^{1/2} } \right\}} \mathord{\left/ {\vphantom {{\left\{ {16s^{2} - 9s - 1 - 2\left[ {s(8s + 1)(2s - 1)} \right]^{1/2} } \right\}} {\left( {16s + 1} \right)}}} \right. \kern-0pt} {\left( {16s + 1} \right)}}\) and \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} = {{\left\{ { - 3s(s + 1) + (2s + 1)\left[ {2s(3s - 1)} \right]^{1/2} } \right\}} \mathord{\left/ {\vphantom {{\left\{ { - 3s(s + 1) + (2s + 1)\left[ {2s(3s - 1)} \right]^{1/2} } \right\}} {\left( {3s + 2} \right)}}} \right. \kern-0pt} {\left( {3s + 2} \right)}}\).Footnote 24 We can then report the solution to (26) by Lemma 2 Footnote 25:

Lemma 2

Assume that \(s < 1.97\) and \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < \bar{c}\) . The optimal unit wholesale price and fixed fee under uniform pricing are:

where \(c^{\prime} = \frac{{12s^{3} - 47s^{2} + 20s - 1 + 8(3s - 1)s^{3/2} }}{{36s^{2} - 21s + 1}}\text{ }\) and \(c^{\prime\prime} = \frac{{64s^{4} - 60s^{3} + 15s^{2} - 4s + 1 - 16(2s - 1)s^{5/2} }}{{64s^{3} - 20s^{2} + 5s - 1}}.\)

Proof See the “Appendix 1”.

Under uniform pricing, the monopolist cannot extract the overall profit from the downstream firm that has a non-binding participation constraint; i.e., the double marginalization problem vis-à-vis the downstream firm is not resolved. This implies that the spillover effect of downstream competition, as compared with discriminatory pricing, is less crucial to determining the unit wholesale price. Here, the form of the fixed fee is crucial, which can be either the low-cost firm’s gross-of-fixed-fee profit or the gross-of-fixed-fee profit of the high-cost firm, depending upon the cost difference levels.

By substituting the unit wholesale prices in (27) into (20) and rearranging, the equilibrium marginal consumers under uniform pricing are then derivable as follows:

From the preceding results, we are now ready to examine the welfare difference between discriminatory pricing and uniform pricing. As \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} > 0\) and \(\bar{c} < s - 1\), we thus assume that \(s < 1.97\) and \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < \bar{c}\) for both pricing policies. By substituting the corresponding marginal consumers in (23) and (28) into (14), we obtain the welfare levels under either pricing policy. The welfare comparison yields Proposition 5:

Proposition 5

Assume that the monopolist adopts a non-negative two-part tariff. If \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < c^{\prime}\) , then banning price discrimination in input markets—i.e., insisting that the same fixed fee and the same unit price be charged to the two downstream firms—is welfare improving.

Proof See the “Appendix 2”.

The intuition is as follows: A discriminatory monopolist charges sufficiently high wholesale prices so as to eliminate the spillover effects from downstream competition. Under uniform pricing, nevertheless, the incentive to eliminate the spillover effects is not that strong. If the cost difference is sufficiently small, then for larger fixed-fee revenues the monopolist charges a unit wholesale price that is even lower than those under discriminatory pricing. The lower wholesale price then increases both downstream firms’ outputs and thus makes uniform pricing socially desirable.

The result in Proposition 5 is quite different from Inderst and Shaffer (2009), who show that if a two-part tariff is allowed, then downstream firms’ wholesale prices are always higher under uniform pricing than under discriminatory pricing, which makes the latter more socially desirable than the former. In contrast, we show that the wholesale prices are lower under the former than under the latter if \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < c^{\prime}\), thereby reversing the welfare ranking.

The reverse welfare ranking is in line with that of Herweg and Müller (2016). In their model the monopolist also charges a lower wholesale price under uniform pricing if the low-marginal-cost firm’s participation constraint is binding. This is the case, because the low-cost firm incurs substantial fixed costs. By contrast, in our model the low-cost firm’s participation constraint is binding due to its quality disadvantage. Specifically, this is the case when the cost difference is relatively small (i.e., \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < c^{\prime}\)).

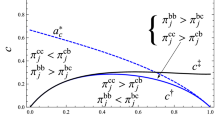

We further elaborate the above intuition through a numerical example with a specified value of the quality gap—\(s = 1.6\)—whereby the equilibrium wholesale prices and the marginal consumers between the two pricing policies can be presented in Figs. 1 and 2. Here, the horizontal axis stands for the cost difference, and the equilibrium outcomes under discriminatory pricing (uniform pricing) are shown by the solid lines (dotted lines).Footnote 26

Figure 1 shows the unit wholesale prices of (25) and (27) in the relevant cost range. Under discriminatory pricing, as the cost difference is so large here, Proposition 4 shows that \(w_{1}^{d} > w_{ 2}^{d}\). The price divergence also expands with the increase in the cost difference.

Three cases on the other hand need to be discussed under uniform pricing: First, if \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < c^{\prime}\), then the low-cost firm’s participation condition is binding, and the monopolist’s fixed-fee revenue is \(2\pi_{2}^{u}\). As a rise in the unit wholesale price causes a significant fall in firm 2’s gross-of-fixed-fee profit, the monopolist has an incentive to decrease the wholesale price for larger fixed-fee revenues.Footnote 27 Such incentive makes the uniform unit wholesale price lower than the two discriminatory prices.

Second, if \(c^{\prime} < c < c^{\prime\prime}\), then the unit wholesale price is increasing and may be lower than or be between the two discriminatory prices. In this case the wholesale price is determined by the profit equalization: \(\pi_{1}^{{}} (w) = \pi_{2}^{{}} (w)\). Suppose that the equalization occurs initially at a certain cost level. Other things being equal, if the cost difference enlarges, then \(\pi_{1}^{{}} (w)\) decreases and \(\pi_{2}^{{}} (w)\) increases; thus, a profit divergence arises. Since a rise in the unit wholesale price leads to a greater profit reduction for firm 2 than for firm 1, the unit wholesale price must then increase so as to eliminate the divergence; thus, the unit wholesale price is increasing in this range.

Third, if \(c^{\prime\prime} < c < \bar{c}\), then firm 1’s participation condition is binding, and the fixed fee is \(\pi_{1}^{u}\). The cost difference now is very large such that \(\pi_{1}^{u}\) is quite low, which makes the fixed-fee revenue (\(2\pi_{1}^{u}\)) less relevant to the upstream profit. The monopolist therefore tends to raise the unit wholesale price so as to extract more of firm 2’s rents. The price-raising incentive becomes even stronger when the cost difference expands, which yields an increasing unit wholesale price in this case.

We now turn to examine the equilibrium marginal consumers in (23) and (28) in Fig. 2. It shows that the high-quality output is larger under uniform pricing than under discriminatory pricing, because firm 1 always pays a lower unit wholesale price under the former versus under the latter from Fig. 1. On the other hand, the output rankings of the low-quality product and the aggregate output are ambiguous. If firm 2’s participation constraint is binding (or \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < c^{\prime}\)), then both the low-quality output and the aggregate output are larger under uniform pricing than under discriminatory pricing.Footnote 28 The larger outputs explain the welfare result in Proposition 5.

6 Concluding Remarks

This paper has set up a quality-differentiated model to examine the welfare effects of price discrimination in input markets. In contrast to the extant literature, in the regime of a linear price contract input we find that allowing price discrimination may enhance social welfare even though the total output remains unchanged. This result is robust to whether the downstream duopolists compete in either Bertrand or Cournot fashion. Moreover, when a two-part tariff is allowed, banning price discrimination in input markets could be socially desirable.

Some remarks with respect to our results are warranted: For linear pricing, it is well-known in the literature on price discrimination in final goods markets that the change in aggregate output as a result of price discrimination is a key criterion for determining welfare implications. In general, if allowing price discrimination does not cause the aggregate output to rise, then it is welfare harming. Nevertheless, we show that allowing price discrimination in input markets enhances social welfare, even though the aggregate output remains unchanged. This implies that the output criterion toward price discrimination on final goods may not apply to price discrimination in input markets.

The practice of price discrimination is, on the other hand, usually thought to be an aspect of monopoly power. If a simple two-part tariff is feasible, then allowing this form of price discrimination is welfare desirable, because the monopolistic markup can thus be eliminated. In contrast, by considering the possibility of differing—i.e., discriminating—two-part tariff pricing structures in input markets, we find that an upstream monopolist may charge higher unit wholesale prices to the downstream firms under a discriminatory two-part tariff pricing arrangement versus that under uniform two-part tariff pricing. Hence, even if two-part tariffs are feasible, permitting differing (and thus discriminatory) two-part tariff schemes for wholesale prices may harm social welfare.

Notes

For example, both the Robinson-Patman Act of 1936 in the United States and the Article 102(c) of the Treaty on the Functioning of the European Union (TFEU) conditionally prohibit price discrimination in input markets. See Schwartz (1986) for the legal issues of the Robinson-Patman Act and Geradin and Petit (2006) for comprehensive discussions of price discrimination under TFEU competition law.

See also Valletti (2003) for an analysis of a general demand model under a Cournot oligopoly.

Chen et al. (2011) consider both firm-specific heterogeneity and market-specific heterogeneity in their model and find that permitting input price discrimination is allocatively efficient in terms of the output distribution among consumers.

The low-wholesale-price result also arises when downstream firms have bargaining powers—e.g., O’Brien (2014)—or when the monopolist adopts sequential contracting (e.g., Kim and Sim 2015). Two papers are also related to the model of Herweg and Müller (2012): Dertwinkel-Kalt et al. (2016) complement the analysis of Herweg and Müller (2012) and gain the same conclusion that price discrimination in input markets is pro-competitive; they also examine pro-competitive price discrimination in a dynamic setting in which downstream firms choose their cost-reduction innovations. Kao and Peng (2012) allow the downstream market structure to be endogenously determined and find a similar welfare result to Herweg and Müller (2012).

Arya and Mittendorf (2010) also consider a two-part tariff and present the same welfare result.

With information asymmetry, Herweg and Müller (2014) also conclude that non-linear price discrimination is welfare harming if it does not increase expected aggregate output.

The marginal consumer \(\theta_{12}\) is indifferent between buying either product, whereas the marginal consumer \(\theta_{20}\) is indifferent between buying the low-quality product and not buying.

As compared to Inderst and Valletti’s (2009) demand functions that differ only in vertical intercepts, in our quality differentiation model the derived demands of the downstream firms differ in both the intercept and the slope. Hence, our specification of vertical differentiation allows for various derived demands for inputs.

The condition is derived from Assumption 1 (2). Given the condition, Assumption 1 (1) is met as \(s - c > 0\). On the other hand, the discriminatory monopolist’s profit is: \(\Omega \left( {w_{1}^{d} ,w_{2}^{d} } \right) = \left[ {(2s - 1)c^{2} - (4s^{2} - 4s)c + 2s^{3} - s^{2} - s} \right]/[4(4s - 1)(s - 1)].\) It also shows that Assumption 1 (3) is met as \(\Omega \left( {w_{1}^{d} ,w_{2}^{d} } \right) > \hbox{max} \{ \Omega_{1} ,\Omega_{2} \}\), where \(\Omega_{1} = (s - c)^{2} /(8s)\) and \(\Omega_{2} = {1 \mathord{\left/ {\vphantom {1 8}} \right. \kern-0pt} 8}\).

The upper and lower bounds are calculated from Assumption 1 (2). If \(c < \bar{c}\) (\(c > \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c}\)), then \(q_{1} (w_{u} ) > 0\) (\(q_{2} (w_{u} ) > 0\)). On the other hand, the monopolist’s profit is: \(\Omega (w^{u} ) = \left( {3s - c} \right)^{2} /\left[ {4(4s - 1)(2s + 1)} \right].\) Furthermore, if \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < \bar{c}\), then Assumption 1 (3) is met as \(\Omega (w^{u} ) > \hbox{max} \{ \Omega_{1} ,\Omega_{2} \}\), where \(\Omega_{1} = (s - c)^{2} /8s\) and \(\Omega_{2} = 1/8\).

This result follows directly from the symmetric cross-price effects in the system of the derived demand functions. See also Layson (1998) for a detailed demonstration.

The inverse demand functions are derived by solving \(p_{1}\) and \(p_{2}\) in (1).

A two-part tariff itself is a form of block tariff, whereby the monopolist can implement second-degree price discrimination. Hence, in the regime of non-linear pricing, when we refer to the term price discrimination (or discriminatory pricing), it is not clear whether this means second-degree or third-degree price discrimination. To avoid confusion, in our paper the term “price discrimination” exclusively refers to third-degree price discrimination.

The proofs for the Bertrand results are available upon request.

We thank an anonymous referee for suggesting this.

Siebert (2015) demonstrates that if the marginal cost is zero, then a monopolist will not sell both the high-quality and low-quality product, but rather only the former due to the cannibalization effect. We assume that the high-quality product is more costly to produce than the low-quality one; i.e., \(c > 0\). Due to the cost advantage, the integrated monopolist always offers the low-quality product. However, if c is sufficiently large such that \(c > s - 1\), then the monopolist will not offer the costly high-quality product in order to avoid cannibalizing the demand for the low-quality (low-cost) product. Hence, we assume here that \(c < s - 1\).

The second-order conditions are always satisfied as \({{\partial \Omega } \mathord{\left/ {\vphantom {{\partial \Omega } {\partial p_{1} }}} \right. \kern-0pt} {\partial p_{1} }} = {{ - 2} \mathord{\left/ {\vphantom {{ - 2} {(s - 1)}}} \right. \kern-0pt} {(s - 1)}} < 0\) and \({{\partial \Omega } \mathord{\left/ {\vphantom {{\partial \Omega } {\partial p_{2} }}} \right. \kern-0pt} {\partial p_{2} }} = {{ - 2s} \mathord{\left/ {\vphantom {{ - 2s} {(s - 1)}}} \right. \kern-0pt} {(s - 1)}} < 0\).

Given a specific contract (\(w,F\)), the high-quality firm’s profit is lower than the low-quality firm’s profit when the cost difference is sufficiently large, and vice versa.

If the value of \(s\) is sufficiently large, then the uniform unit wholesale price may be negative in some of the three regimes. In order to encompass more realistic results, we therefore assume that \(s < 1.97\). Please refer to the proof of Lemma 2 in the “Appendix 1” section for the detailed calculations of the threshold quality gap and the upper and lower bounds for the cost difference.

Note in Lemma 2 that the ranking of the threshold levels of cost difference, \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c^{\prime} < c^{\prime\prime} < \bar{c}\), always holds true if \(s < 1.97\).

In the figures, the values of the relevant cost differences are: \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} \approx 0. 3 1 8 5\), \(\bar{c} \approx 0. 4 3 6 8\), \(c^{\prime} \approx 0. 3 5 8 6\), and \(c^{\prime\prime} \approx 0. 4 2 5 3\).

This incentive becomes even stronger when the cost difference increases, thereby making the unit wholesale price move downward as shown in the figure.

It also worth noting from Fig. 2 that if \(c > c^{\prime}\), then for cost differences close to \(c^{\prime}\) the aggregate output is still relatively large under uniform pricing. This implies that within the cost range \(c^{\prime} < c < c^{\prime\prime}\) in the figure, there exists a threshold cost difference below which the previous welfare conclusion applies. As the intuition for this result is the same as previously noted, instead of providing a formal proof with tedious calculations, we merely present this possibility through the numerical example of Fig. 2.

References

Arya, A., & Mittendorf, B. (2010). Input price discrimination when buyers operate in multiple markets. Journal of Industrial Economics, 58(4), 846–867.

Chen, C.-S., & Hwang, H. (2014). Spatial price discrimination in input markets with an endogenous market boundary. Review of Industrial Organization, 45(2), 139–152.

Chen, C.-S., Hwang, H., & Peng, C.-H. (2011). Welfare, output allocation and price discrimination in input markets. Academia Economic Papers, 39(4), 535–560.

Choi, C. J., & Shin, H. S. (1992). A comment on a model of vertical product differentiation. The Journal of Industrial Economics, 40(2), 229–231.

Coloma, G. (2003). Price discrimination and price dispersion in the Argentine gasoline market. International Journal of the Economics of Business, 10(2), 169–178.

DeGraba, P. (1990). Input market price discrimination and the choice of technology. American Economic Review, 80(5), 1246–1253.

Dertwinkel-Kalt, M., Haucap, J., & Wey, C. (2016). Procompetitive dual pricing. European Journal of Law and Economics, 41(3), 537–557.

Geradin, D., & Petit, N. (2006). Price discrimination under EC competition law: Another antitrust doctrine in search of limiting principles? Journal of Competition Law and Economics, 2(3), 479–531.

Herweg, F., & Müller, D. (2012). Price discrimination in input markets: Downstream entry and efficiency. Journal of Economics & Management Strategy, 21(3), 773–799.

Herweg, F., & Müller, D. (2014). Price discrimination in input markets: Quantity discounts and private information. Economic Journal, 124(577), 776–804.

Herweg, F., & Müller, D. (2016). Discriminatory nonlinear pricing, fixed costs, and welfare in intermediate-goods markets. International Journal of Industrial Organization, 46, 107–136.

Inderst, R., & Shaffer, G. (2009). Market power, price discrimination, and allocative efficiency in intermediate-goods markets. RAND Journal of Economics, 40(4), 658–672.

Inderst, R., & Valletti, T. (2009). Price discrimination in input markets. RAND Journal of Economics, 40(1), 1–19.

Kao, K.-F., & Peng, C.-H. (2012). Production efficiency, input price discrimination, and social welfare. Asia-Pacific Journal of Accounting & Economics, 19(2), 227–237.

Katz, M. L. (1987). The welfare effects of third-degree price discrimination in intermediate good markets. American Economic Review, 77(1), 154–167.

Kim, H., & Sim, S. (2015). Price discrimination and sequential contracting in monopolistic input markets. Economics Letters, 128, 39–42.

Layson, S. K. (1998). Third-degree price discrimination with interdependent demand. Journal of Industrial Economics, 46(4), 511–524.

Motta, M. (1993). Endogenous quality choice: Price versus quantity competition. Journal of Industrial Economics, 41(2), 113–131.

O’Brien, D. P. (2014). The welfare effects of third-degree price discrimination in intermediate good markets: the case of bargaining. RAND Journal of Economics, 45(1), 92–115.

Robinson, J. (1933). The economics of imperfect competition. London: Macmillan.

Schmalensee, R. (1981). Output and welfare implications of monopolistic third-degree price discrimination. American Economic Review, 71(1), 242–247.

Schwartz, M. (1986). The perverse effects of the Robinson-Patman Act. Antitrust Bulletin, 31(3), 733–757.

Siebert, R. (2015). Entering new markets in the presence of competition: Price discrimination versus cannibalization. Journal of Economics & Management Strategy, 24(2), 369–389.

Valletti, T. (2003). Input price discrimination with downstream Cournot competitors. International Journal of Industrial Organization, 21, 969–988.

Varian, H. R. (1985). Price discrimination and social welfare. American Economic Review, 75(4), 870–875.

Villas-Boas, S. B. (2009). An empirical investigation of the welfare effects of banning wholesale price discrimination. RAND Journal of Economics, 40(1), 20–46.

Wauthy, X. (1996). Quality choice in models of vertical differentiation. Journal of Industrial Economics, 44(3), 345–353.

Yoshida, Y. (2000). Third-degree price discrimination in input markets: Output and welfare. American Economic Review, 90(1), 240–246.

Acknowledgments

The author is very grateful to Lawrence J. White (the Editor) and two anonymous referees for very helpful comments. The financial support from the National Science Council of Taiwan (NSC 102-2410-H-034-065) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proof of Lemma 2

When solving the unit wholesale price under uniform pricing, we need to check the monopolist’s incentive for serving both downstream firms and the participation constraint for each downstream firm. If the monopolist serves only firm 1 or firm 2, then its profits are respectively:

Given a unit wholesale price, downstream firms’ profits gross of fixed fees are:

Note that Eqs. (29) and (30) are used to derive the relevant parameter ranges for the equilibrium uniform wholesale prices.

We shall derive the optimal uniform wholesale price in three regimes: First, if firm 2’s participation constraint is binding, then the monopolist solves:

From the first-order condition for profit maximization, the optimal wholesale price is:

The second-order condition is satisfied as: \(\partial^{2} \Omega /\partial w^{2} = - 4(3s - 1)/(4s - 1)^{2} < 0.\) The optimal fixed fee is \(F = \pi_{2} (w)\).

By substituting (32) into (31) and rearranging, the monopolist profit is specified as follows:

To ensure that the monopolist will serve both downstream firms—i.e., the profit in (33) is larger than that in (29)—the cost disadvantage must be larger than the threshold level:

Substituting (32) into (30) and rearranging yield:

From (35), to ensure that firm 1’s participation constraint is satisfied (i.e., \(\pi_{1} - \pi_{2} > 0\)), the cost difference must be smaller than the threshold level:

A comparison of (34) and (36) shows that \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c^{\prime}\). Hence, if \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < c^{\prime}\), then (32) is the optimal unit wholesale price under uniform pricing. Note that in this case the uniform wholesale price may turn to be negative under some parameter combinations. The equilibrium wholesale price is positive only if: \(c < \tilde{c} = {{(4s^{2} - 3s + 1)} \mathord{\left/ {\vphantom {{(4s^{2} - 3s + 1)} {(12s - 5)}}} \right. \kern-0pt} {(12s - 5)}}\). However, if \(s > \tilde{s} \approx 1.97\), then \(\tilde{c} < c^{\prime}\) and (32) is negative for \(\tilde{c} < c < c^{\prime}\). Hence, to ensure that the equilibrium wholesale price is always positive, we further assume that \(s < 1.97\).

Second, if firm 1’s participation constraint is binding, then the monopolist’s objective function is: \(\Omega \text{ }(w) = \text{ }w\left( {q_{1} (w) + q_{2} (w)} \right) + 2\pi_{ 1} (w ).\) Proceeding as previously, we can respectively solve for the unit wholesale price, the monopolist’s profit, and the downstream firms’ profits as follows:

The fixed fee is \(\pi_{ 1} (w )\). The second-order condition satisfies: \({{\partial^{2} \Omega } \mathord{\left/ {\vphantom {{\partial^{2} \Omega } {\partial w^{2} }}} \right. \kern-0pt} {\partial w^{2} }} = {{ - 8s(2s - 1)} \mathord{\left/ {\vphantom {{ - 8s(2s - 1)} {(4s - 1)^{2} }}} \right. \kern-0pt} {(4s - 1)^{2} }} < 0.\)

From (29) and (38), the monopolist serves both downstream firms only if:

On the other hand, from (39), firm 2’s participation constraint is satisfied (i.e., \(\pi_{2} - \pi_{1} > 0\)) only if:

As \(c^{\prime\prime} < \bar{c}\), we thus conclude that given a quality level, if \(c^{\prime\prime} < c < \bar{c}\), then (37) is the optimal unit wholesale price.

Note that if \(c^{\prime} < c < c^{\prime\prime}\), then neither (32) nor (37) meet all of the downstream participation constraints. Under such circumstances, the equilibrium unit wholesale price is determined by the profit-equalization condition: \(\pi_{1} (w ) { = }\pi_{2} (w )\). By substituting the profits in (30) into the condition and solving for w, we obtain:

The optimal fixed fee is \(F = \pi_{1} (w ) { = }\pi_{2} (w )\). The monopolist’s profit is: \(\, \Omega \text{ } = {{\left[ {(s - c - 1)(\varPsi - \varUpsilon )} \right]} \mathord{\left/ {\vphantom {{\left[ {(s - c - 1)(\varPsi - \varUpsilon )} \right]} {\left[ {(s - 1)(4s - 1)} \right]}}} \right. \kern-0pt} {\left[ {(s - 1)(4s - 1)} \right]}}^{2}\), where \(\varPsi = - 4s^{3} + (6 + 16c)s^{2} - (2 + 9c)s + c\), and \(\varUpsilon = \left[ {4s^{3} - (7 + 12c)s^{2} + (4 + 5c)s - c - 1} \right]s^{1/2}\). Given \(s < 1.97\), in the cost range the uniform wholesale price is positive, and the monopolist’s profit \(\Omega \text{ }\) is larger than \(\, \Omega_{1}\) and \(\, \Omega_{2}\) in (29).

By summarizing the results in (32), (37), and (40), we obtain Lemma 2.

Appendix 2: Proof of Proposition 5

By substituting the corresponding marginal consumers from (23) and (28) into the social welfare function in (14), we can calculate the equilibrium welfare under either pricing policy as follows:

where \(\alpha = - 36s^{2} + 111s - 31\), \(\beta = 24s^{3} - 154s^{2} + 144s - 30\), and \(\gamma = - 4s^{4} + 87s^{3} - 37s^{2} + s + 1\).

The welfare difference (\(\Delta SW = \text{ }SW^{d} - SW^{u}\)) is then specified as follows:

where \(\tilde{\alpha } = 36s^{3} - 39s^{2} + 70s - 19\), \(\tilde{\beta } = - 2(s - 1)(3s + 1)(4s^{2} + 9s - 3)\), and \(\tilde{\gamma } = (s - 1)^{2} (4s^{3} + 25s^{2} - 10s + 1)\).

Letting \(\Delta SW\) equal zero and solving for the threshold levels of cost difference, we obtain:

This shows that the welfare difference is negative for \(\tilde{c}^{ - } < c < \tilde{c}^{ + }\); otherwise, it is positive. If \(s < 1.97\), then the cost ranking \(\tilde{c}^{ - } < \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c^{\prime} < \tilde{c}^{ + }\) always holds true. Hence, if \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{c} < c < c^{\prime}\), then \(\Delta SW < 0\), which completes the proof of Proposition 5.

Rights and permissions

About this article

Cite this article

Chen, CS. Price Discrimination in Input Markets and Quality Differentiation. Rev Ind Organ 50, 367–388 (2017). https://doi.org/10.1007/s11151-016-9537-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-016-9537-9

Keywords

- Input price discrimination

- Wholesale price discrimination

- Quality differentiation

- Two-part tariffs

- Social welfare