Abstract

This research examines the effects of input price discrimination on allocation efficiency and social welfare. Instead of assuming constant marginal costs, we allow downstream firms to produce under increasing marginal costs. When downstream firms operate in separate markets, even though total output remains unchanged, consumer surplus and social welfare could be greater under discriminatory pricing than under uniform pricing. Moreover, the social desirability of input price discrimination can still hold true when downstream firms compete either in Cournot or Bertrand fashion.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Assuming constant-returns-to-scale technologies, the extant literature has demonstrated that input price discrimination impairs allocation efficiency and thus reduces social welfare. The main reason is that input monopolists charge lower unit prices to downstream firms with higher marginal costs under input price discrimination. This distorts output allocation by shifting outputs from low-cost firms toward high-cost firms and thus harms social welfare if total output remains unchanged.

We reexamine this allocative inefficiency of input price discrimination by allowing downstream firms to produce under diminishing-marginal-return technologies. In the model, downstream firms’ marginal costs no longer remain constant and are increasing with outputs.Footnote 1 Our model analyzes an input monopolist that decides the per-unit prices for the input via either discriminatory pricing or uniform pricing. Even though the two pricing regimes result in the same total output, their welfare ranking—surprisingly—is ambiguous.

If the downstream firms operate in two separate markets with identical demands, then due to cost asymmetry the downstream market prices differ when the input monopolist charges a uniform price. When moving from uniform pricing to discriminatory pricing, the resulting output reallocation between the markets could be efficient in terms of both consumption and production perspectives. As a result, consumer surplus as well as social welfare could be greater under discriminatory pricing than under uniform pricing.

Input price discrimination could still be welfare enhancing when downstream firms compete for the same group of consumers. For a market of homogeneous goods, where firms engage in Cournot competition, this social desirability could take place regardless of whether the firm that receives a price discount is producing at a lower or higher net marginal cost under discriminatory pricing. The reason is that discriminatory pricing may favor the downstream firm that produces under a relatively flat marginal cost curve. Similar welfare results arise when the downstream firms produce differentiated products and engage in Bertrand competition.

The rest of the paper proceeds as follows: Sect. 2 reviews the related literature. Section 3 presents the basic model where downstream firms operate in separate markets. Section 4 derives the equilibrium results and welfare comparisons. Section 5 explores the results for Cournot and Bertrand competition. Section 6 concludes.

2 Related Literature

Katz (1987), DeGraba (1990), and Yoshida (2000) point out that discriminatory input monopolists tend to charge higher prices in supplying inputs to more efficient downstream firms. If total output remains unchanged, then relative to uniform pricing, input price discrimination is allocatively inefficient by boosting downstream production costs.Footnote 2 In the current paper, instead of assuming constant marginal costs, we allow downstream firms’ marginal costs to be increasing with outputs and show that output reallocation by price discrimination could be efficient and hence welfare-enhancing.

Some papers find that discriminatory input monopolists can set the per-unit input price efficiently from the welfare point of view. Low-cost downstream firms may receive price discounts under price discrimination if there exists input substitution (Inderst & Valletti, 2009) and downstream firms manufacture quality-differentiated products (Chen, 2017). The reason is that low-cost firms could have more elastic demands for the input. Allowing for two-part tariffs, Inderst and Shaffer (2009) show that an input monopolist charges lower unit prices to a low-cost downstream firm, because doing so allows it to exploit—via fixed payments—more of the downstream profits.Footnote 3

Our welfare result is similar to the above-mentioned papers, but the intuition is quite different from theirs. We focus on convex costs and show that a downstream firm that receives a price discount may produce under a lower marginal cost. Discriminatory pricing could thus reduce production costs and therefore be welfare-enhancing. This paper complements the extant literature by identifying a novel factor for the allocation efficiency of input price discrimination.

The present welfare findings are also in line with some papers in the literature, which indicate that per-unit input price discrimination could enhance welfare in different contexts such as: the introduction of multiple markets (Arya & Mittendorf, 2010); the consideration of endogenous entry (Dertwinkel-Kalt et al., 2016; Herweg & Müller, 2012; Kao & Peng, 2012); the existence of downstream bargaining powers (O’Brien, 2014); and the use of sequential contracting (Kim & Sim, 2015).

3 The Basic Model

We consider a vertically-related market in which an input monopolist produces and sells a homogeneous input to two downstream manufacturers—firm 1 and firm 2—which process the input to produce a homogeneous final good under different cost functions. The downstream firms operate in separate markets with the same inverse demand function: \(p_{i} = {1} - q_{i}\), where \(p_{i}\) and \(q_{i}\) are respectively downstream firm i’s price and output, \(i = 1,2\). We restrict our attention to identical demand so as to identify the impacts of the downstream cost asymmetry.

The input monopolist charges downstream firm i the unit input price \(w_{i}\), by either discriminatory pricing or uniform pricing. No arbitrage is assumed when the upstream monopolist charges discriminatory prices. The marginal cost for the upstream monopolist of producing the input is constant and is assumed to be zero for simplicity.

The downstream firms need to buy one unit of the input for manufacturing one unit of the final good. In addition, they incur costs when processing the input into the final good. The process cost is given in a quadratic-linear form: \(TC_{i} \, = \,\alpha_{i} q_{i} \, + \,{{\beta_{i} (q_{i} )^{2} } \mathord{\left/ {\vphantom {{\beta_{i} (q_{i} )^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\), where \(\alpha_{i} ,\,\beta_{i} > 0,\,\alpha_{i} < 1,\,i = 1,2.\) The downstream marginal cost, net of the input payment and denoted as \(c_{i}\), is derivable as: \(\alpha_{i} + \beta_{i} q_{i}\), which is increasing with outputs at the rate of \(\beta_{i}\).

A possible reason for the increasing net marginal cost is that firms produce under diminishing-marginal-return technology. Without loss of generality, we further assume throughout the paper that \(\alpha_{1} > \alpha_{2}\). In other words, the vertical intercept of firm 1’s net marginal cost curve is larger than firm 2’s, whereas the slope (increasing rate) of the former (\(\beta_{1}\)) is allowed to be either greater than, less than, or equal to that of the latter (\(\beta_{2}\)).

We derive our results by solving a two-stage game, in which the input monopolist first chooses per-unit input prices, and then each downstream firm chooses the monopoly outputs (prices) in each market.Footnote 4 We shall consider later the situations where the downstream firms compete for the same group of consumers. Moreover, it is assumed that the input monopolist always serves the two downstream firms and that \(\alpha_{1}\) is not too large, such that each downstream firm produces positive outputs under all circumstances.Footnote 5

4 Equilibrium Results and Comparisons

From the above model specifications, we note that downstream firms’ profits are:

The monopolist’s profit is:

Given the input prices, from (1) the profit-maximizing outputs are derivable as:

which are also the derived demands that the input monopolist faces. Next, from (3) the price elasticities of the derived demands (\(\varepsilon_{i}\)) are derivable as:

According to (4), the larger is the value of \(\alpha_{i}\), the more elastic is the downstream firm i’s demand for the input. The intuition is as follows: Other factors being equal, from (3) an increase in \(\alpha\) shifts the (linear) derived demand curve inward with an unchanged slope. There is a smaller quantity demanded at each input price level. Due to the decreased quantity base, an input price change causes a proportionally larger output change. As a result, the derived demand becomes more elastic as \(\alpha\) rises.

The price elasticity of input demand is not affected by \(\beta\) from (4). When \(\beta\) changes, from (3) a firm’s derived demand curve pivots around the fixed vertical intercept. Since the derived demand curve is linear, shifting the derived demand curve in such a way leads to the same price elasticity at any given input price level.

It is worth noting that the price elasticity of input demand is also related to the shapes of the product demand curve. The positive relation between the input price elasticity and \(\alpha\) obtained here can still hold true beyond the case of linear demands; nevertheless, the irrelevance of \(\beta\) to the input price elasticity is due to the linear demand setting.Footnote 6 The literature extensively discusses the impacts of demand conditions on the welfare effects of price discrimination,Footnote 7 but the discussion of cost effects is still lacking. We therefore restrict our attention on linear demands so as to focus on the impacts of cost factors. As we will see below, the different effects of the cost parameters—\(\alpha\) and \(\beta\)—on equilibrium discriminatory input prices are relevant in the welfare comparisons.

Under discriminatory pricing, the monopolist charges a personalized price to each downstream firm to maximize profit in (2), which yields:

where superscript d represents hereafter the equilibrium results under discriminatory pricing. Firm i’s input price is negatively related to \(\alpha_{i}\) under discriminatory pricing. Intuitively, from (4) a downstream firm with a higher \(\alpha\) value has a more elastic derived demand and thus will be charged a lower input price under discriminatory pricing.

Under uniform pricing, the monopolist charges a uniform input price to all downstream firms. With \(w_{i} = w\), from (2) we arrive at the equilibrium uniform price as follows:

where superscript u represents hereafter the equilibrium results under uniform pricing.

From (5) and (6) we can derive downstream firms’ equilibrium outputs under either pricing regime as:

The total output (\(Q = q_{1} + q_{2}\)) is the same under the two pricing regimes:

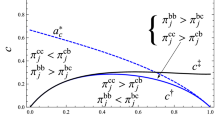

Before examining the welfare changes by moving from uniform pricing to discriminatory pricing, it is helpful to examine initially the resulting output changes. First, relative to uniform pricing, since \(w_{1}^{d} < w^{u} < w_{2}^{d}\) from (5) and (6), firm 1’s outputs rise and firm 2’s fall under discriminatory pricing: \(q_{1}^{d} > q_{1}^{u}\), \(q_{2}^{d} < q_{2}^{u}\), and \(q_{1}^{d} - q_{1}^{u} = - (q_{2}^{d} - q_{2}^{u} ) = \tfrac{\Delta \alpha }{{2(4 + \beta_{1} + \beta_{2} )}} \equiv \Delta q > 0\), where \(\Delta \alpha = \alpha_{1} - \alpha_{2} > 0\).

Second, under each pricing regime, the rankings between downstream firms’ outputs are summarized as follows:

Lemma 1

If \(\beta_{1} \ge \beta_{2}\), then \(q_{1}^{d} < q_{2}^{d}\) and \(q_{1}^{u} < q_{2}^{u}\). If \(\beta_{1} < \beta_{2}\), then \(q_{1}^{d} > q_{2}^{d}\) and \(q_{1}^{u} > q_{2}^{u}\) only when \(\Delta \alpha\) is sufficiently small.

Proof

See “Appendix”.□

If \(\beta_{1} \ge \beta_{2}\), then given any output level, firm 1’s net marginal cost is higher than firm 2’s, because of \(\Delta \alpha > 0\) by assumption. In this case, firm 1 is less efficient and thus produces less than firm 2 under either pricing regimes, such that \(q_{1}^{d} < q_{2}^{d}\) and \(q_{1}^{u} < q_{2}^{u}\). Nevertheless, if \(\beta_{1} < \beta_{2}\), then firm 1 could produce at lower net marginal costs than firm 2 under sufficiently larger output levels. Hence, in this situation, if \(\Delta \alpha\) is sufficiently small, then \(q_{1}^{d} > q_{2}^{d}\) and \(q_{1}^{u} > q_{2}^{u}\).

Let us now turn to examine the changes in consumer surplus and social welfare that is caused by discriminatory pricing. For separate markets, consumer surplus is defined as \(CS = \int_{{p_{1} }}^{1} {q(p)\,dp} + \int_{{p_{2} }}^{1} {q(p)\,dp}\), which can be specified as \(CS = {{[(q_{1} )^{2} + (q_{2} )^{2} ]} \mathord{\left/ {\vphantom {{[(q_{1} )^{2} + (q_{2} )^{2} ]} 2}} \right. \kern-\nulldelimiterspace} 2}\). The difference in consumer surplus between discriminatory pricing and uniform pricing is then derivable as:

the sign of which is ambiguous and is related to \(\alpha_{i}\) and \(\beta_{i}\) according to Lemma 1.

From (10) and Lemma 1, even though the total output remains unchanged, discriminatory pricing could enhance consumer surplus. The intuition is as follows: Due to cost asymmetry, the two market outputs as well as the market prices are not the same under uniform pricing. If \(\beta_{1} < \beta_{2}\) and \(\Delta \alpha\) is sufficiently small, then by Lemma 1, \(q_{1}^{u} > q_{2}^{u}\) and so \(p_{1}^{u} < p_{2}^{u}\). As the two demands are identical, when outputs shift from firm 2 (or market 2) to firm 1 (or market 1) under discriminatory pricing, the increased consumer surplus in market 1 outweighs the decreased consumer surplus in market 2, and thereby yields greater total consumer surplus.

Social welfare is the summation of consumer surplus and profits and can be further specified as: \(SW = \int_{0}^{{q_{1} }} {(p_{1} - c_{1} )\;dq} + \int_{0}^{{q_{2} }} {(p_{2} - c_{2} )\,dq}\). The welfare difference between discriminatory pricing and uniform pricing is then given by:

Recall that \(c_{i} = \alpha_{i} + \beta_{i} q_{i}\), which is firm i’s net marginal cost.

The sign of \(\Delta SW\) in (11) is ambiguous as there is a welfare increase in market 1 and a welfare decrease in market 2. The reasons for the ambiguity are as follows. On the one hand, from Lemma 1 the market price (\(p_{i}\)) differs in the two markets under uniform pricing. The output that shifts from market 2 to market 1 because of price discrimination can enhance the consumption benefit if \(p_{1} > p_{2}\). On the other hand, since the net marginal cost—\(c_{i}\)—increases with outputs, the output reallocation may reduce the total cost if firm 2’s net marginal cost is increasing at a faster rate than firm 1’s.

To determine the welfare change, we further rearrange \(\Delta SW\) as:

From (10) and (12), we report the related welfare results in Proposition 1:

Proposition 1

With separate markets, if \(\beta_{1} \ge \beta_{2} ,\) then input price discrimination reduces consumer surplus and social welfare. If \(\beta_{1} < \beta_{2}\) and \(\Delta \alpha\) is sufficiently small, then consumer surplus and social welfare are greater under discriminatory pricing than under uniform pricing.

Proof

See “Appendix”.□

The results of Proposition 1 show that downstream costs are critical in determining the efficiency of the output reallocation that is caused by price discrimination. In sharp contrast to the literature, we show that even though the total output remains unchanged, by giving a price discount to the downstream firm whose net marginal cost is increasing at a slower rate, discriminatory pricing could reduce downstream costs and thus enhance welfare.

5 Downstream Competition

We now extend the basic model by considering downstream competition. We assume that firms compete either in Cournot fashion or in Bertrand competition. To derive Cournot results, following the basic model, we consider a market of homogeneous goods in Sect. 5.1, whereas we employ a differentiated product model to analyze Bertrand competition in Sect. 5.2.

5.1 Cournot Competition

Assume now that firms 1 and 2, which manufacture a homogeneous product, are competing for consumers under a linear demand curve: \(p = {1} - q_{1} - q_{2}\). We shall analyze here the two-stage game where the monopolist decides the unit input prices first, and then the downstream firms choose their outputs in Cournot fashion.

Given the input prices—\(w_{1}\) and \(w_{2}\)—routine calculations yield the Cournot outputs:

The outputs are the derived demands that the monopolist faces. Similar to the model with separate markets, from (13) firm i’s input demand becomes more elastic with larger \(\alpha_{i}\), but is not affected by \(\beta_{i}\).Footnote 8

The intuition for the elasticity relations in the Cournot game is the same as was previously mentioned: From (13), an increase in \(\alpha\) reduces a firm’s output and shifts inward its derived (linear) demand curve. The smaller output base then leads to a more elastic input demand. Beyond the case of linear demand curves, Valletti (2003) also shows that a downstream firm that produces under a larger per-unit cost—which is similar to a larger \(\alpha\) in our paper—has a more elastic derived demand for the input and will pay more for the input under price discrimination. However, similar to the model with separate markets, the irrelevance of \(\beta\) crucially rests on the setting of linear demand.Footnote 9

From the derived demands in (13), under the corresponding pricing regime, the monopolist charges the following input prices:

where \(w_{{1}}^{d} < w^{u} < w_{2}^{d}\). This is line with results from the existing literature: e.g., Katz (1987), DeGraba (1990), and Yoshida (2000), among many others. Assuming constant marginal costs, they show that discriminatory pricing—relative to uniform pricing—is less socially desirable, because less efficient firms (or high-cost firms), due to their input price advantage, can thus produce more.

Different from the above-mentioned literature, in the present paper firms’ marginal cost is no longer constant, and is increasing with outputs. Hence, relative to its rival, a downstream firm could produce at either a higher or a lower net marginal cost given an output level. As will be seen later, it turns out that the firm that receives a price discount does not necessarily produce at a higher net marginal cost. Thus, the traditional efficiency distortion by input price discrimination may not take place when firms produce at increasing marginal costs.

Substituting (14) into (13), we rearrange firms’ outputs under discriminatory pricing policy as:

and under uniform pricing the outputs are:

Under either pricing regime, the total output is the same and is given as:

According to (17), discriminatory pricing and uniform pricing lead to the same consumer surplus. Hence, their welfare ranking is decided by the resulting process cost change. Moreover, from (15) and (16), we can find that \(q_{1}^{d} > q_{1}^{u}\), \(q_{2}^{d} < q_{2}^{u}\), \(\Delta q = q_{1}^{d} - q_{1}^{u} = q_{2}^{u} - q_{2}^{d} = {{\Delta \alpha } \mathord{\left/ {\vphantom {{\Delta \alpha } {(4 + 2\beta_{1} + 2\beta_{2} )}}} \right. \kern-\nulldelimiterspace} {(4 + 2\beta_{1} + 2\beta_{2} )}} > 0\), and Lemma 1 also applies here. As previously noted, the total process costs may be lower under discriminatory pricing than under uniform pricing.

Recall that \(TC_{i} = \alpha_{i} q_{i} + {{\beta_{i} (q_{i} )^{2} } \mathord{\left/ {\vphantom {{\beta_{i} (q_{i} )^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\). We can then rearrange the cost difference as:

where each term in the bracket represents the difference in net marginal cost between firms 1 and 2 under either pricing regime and is ambiguous in sign. Since \(q_{1}^{d} > q_{1}^{u}\) and \(q_{2}^{d} < q_{2}^{u}\), \(\Delta \alpha + \beta_{1} q_{1}^{d} - \beta_{2} q_{2}^{d}\) is larger than \(\Delta \alpha + \beta_{1} q_{1}^{u} - \beta_{2} q_{2}^{u}\). As a result, if \(\Delta \alpha + \beta_{1} q_{1}^{d} - \beta_{2} q_{2}^{d} < 0\),Footnote 10 then \(\Delta \alpha + \beta_{1} q_{1}^{u} - \beta_{2} q_{2}^{u} < 0\): In equilibrium firm 1’s net marginal cost is lower than firm 2’s under either pricing regime. Hence, \(\Delta TC < 0\): Total production cost is lower under discriminatory pricing than under uniform pricing.

Note that \(\Delta \alpha + \beta_{1} q_{1}^{d} - \beta_{2} q_{2}^{d} < 0\) is a sufficient condition, but not a necessary one, for the cost-reducing result (\(\Delta TC < 0\)). For instance, if \(\Delta \alpha + \beta_{1} q_{1}^{d} - \beta_{2} q_{2}^{d} > 0\) and \(\Delta \alpha + \beta_{1} q_{1}^{d} - \beta_{2} q_{2}^{d} < 0\), then \(TC < 0\) can still hold true under some parameter combinations. This implies that even though discriminatory pricing favors the downstream firm that is producing at a higher net marginal cost, it can still reduce production costs and thus is welfare-enhancing relative to uniform pricing.

From (18), we specify the conditions for the welfare changes in Proposition 2:

Proposition 2

Assume that the downstream firms produce a homogeneous good and play Cournot competition. If \(\beta_{1} < \beta_{2}\) and \(\Delta \alpha\) is sufficiently small, then social welfare is greater under discriminatory pricing than under uniform pricing; otherwise, the welfare ranking reverses.

Proof

See “Appendix”.□

From Proposition 2, if \(\beta_{1} \ge \beta_{2}\), then firm 1 is less efficient than firm 2 as its net marginal cost curve is always above firm 2’s. Hence, the resulting welfare is in line with the existing literature, whereby discriminatory pricing leads to allocation distortion and thus is welfare-reducing. The welfare ranking may reverse, nevertheless, when \(\beta_{1} < \beta_{2}\), where firm 1’s net marginal cost is increasing less than firm 2’s. This is because, due to increasing marginal costs, the output reallocation from firm 2 to firm 1 by price discrimination could lead to a lower total production cost.

5.2 Bertrand Competition

We now consider a differentiated product model. Assume that there is a representative consumer whose utility function is given by: \(U = q_{1} + q_{2} - (q_{1}^{2} + 2\gamma q_{1} q_{2} + q_{2}^{2} )/2\), where \(q_{1}\) and \(q_{2}\) are respectively the outputs of firms 1 and 2, and \(0 < \gamma < 1\) is the degree of substitution for the two downstream firms’ products.Footnote 11 Given the downstream prices, solving the utility-maximization problem yields the demand system as: \(q_{i} = \frac{1}{{1 - \gamma^{2} }}[1 - \gamma - p_{i} + \gamma p_{j} ]\,,\,\,i,j = 1,2,\,\,i \ne j.\)

We place the detailed calculations for the related equilibrium results and proofs under Bertrand competition in the “Appendix”. From the demand system, the equilibrium input prices under either pricing regime are derivable as:

The previous intuition for equilibrium discriminatory input prices also applies here. This result is also in line with that obtained by Chen (2017), who assumes that downstream firms produce quality-differentiated products and shows that a downstream firm’s input price decreases when its net marginal cost increases under price discrimination. We derive the same result for horizontally-differentiated products. Furthermore, from (19), we have the same result as was previously demonstrated: Since \(w_{1}^{d} < w^{u} < w_{2}^{d}\), when the monopolist moves from uniform pricing to discriminatory pricing, firm 1’s outputs rise and firm 2’s outputs fall.

To examine the robustness of the welfare changes of this output reallocation, for notation simplicity, we hereafter assume that the vertical intercept and slope of firm 2’s net marginal cost curve are normalized to be 0 and 1, respectively: \(\alpha_{2} = 0\), and \(\beta_{2} = 1\). We find that if \(\beta_{1} < 1\) and \(\alpha_{1}\) (or \(\Delta \alpha\)) are sufficiently small, then discriminatory pricing is more socially desirable than uniform pricing. Hence, although the specific conditions vary with the degree of substitution (\(\gamma\)), the previous results qualitatively remain under Bertrand competition.

6 Conclusions

This paper has examined the effects on allocation efficiency of input price discrimination by relaxing the assumption of constant marginal costs. We assume that downstream firms’ marginal costs are increasing with outputs and that their increasing rates could differ. The equilibrium outcomes between discriminatory pricing and uniform pricing are compared for models with separate markets and with downstream competition.

We find that relative to uniform pricing, even though the market output remains unchanged, allowing input price discrimination could reduce production costs and hence enhance social welfare. The reason is that discriminatory pricing may favor the downstream firm whose net marginal cost is increasing at a slower rate. Consumer surplus could also be greater under price discrimination. In contrast to the existing literature on input price discrimination, this social desirability could remain even if the downstream firm that receives a price discount is producing at a higher net marginal cost under price discrimination.

Notes

Diminishing-marginal-return technologies are a common feature of firms’ production processes (e.g. Varian, 1992). Empirical studies also show that decreasing-returns-to-scale production technology prevails in many industries. Bardhan (1973) shows in India firm-level data that the production of rice exhibits decreasing returns to scale. The same result is found by Basu and Fernald (1997), who use aggregate data to estimate production of 34 manufacturing industries in the U.S.

The change in total output is also critical to the welfare effects of input price discrimination. Yoshida (2000) further shows that input price discrimination—when yielding higher outputs—will harm social welfare. DeGraba (1990) considers cost-reducing R&D investments of downstream firms and finds that input price discrimination reduces downstream investments and thus market output, and thereby reduces social welfare.

We restrict our attention on linear pricing, rather than non-linear pricing, which has also been examined in the literature; e.g., Herweg and Müller (2014). In the model with separate markets, if the input monopolist charges two-part tariffs, then it will set the per-unit prices at zero in order to eliminate double marginalization; this allows it to extract all of the possible downstream rents via fixed payments. As a result, both discriminatory pricing and uniform pricing lead to the same equilibrium prices and outputs and of course are indifferent from a welfare point of view.

With separated markets, the condition \(\alpha_{1} { < }\tfrac{{({2} + \beta_{1} )(1 + \alpha_{2} ) + 2 + \beta_{2} }}{{6 + 2\beta_{1} + \beta_{2} }}\) is required for this purpose.

The demonstration of the effects on input price elasticity of the two cost parameters under non-linear demands is available upon request to the author.

Firm i’s price elasticity of input demand is \(\varepsilon_{i} = - \tfrac{{\partial q_{i} }}{{\partial w_{i} }}\tfrac{{w_{i} }}{{q_{i} }} = \tfrac{{({2} + \beta_{j} )w_{i} }}{{1 + \alpha_{j} + \beta_{j} + w_{j} - (2 + \beta_{j} )(\alpha_{i} + w_{i} )}}\). Hence, firm i’s input demand is more elastic for larger \(\alpha_{i}\) and is unaffected by the value of \(\beta_{i}\).

For Cournot competition, the demonstration of the cost effects on input price elasticity under non-linear demands is available upon request to the author.

The signs of the two terms are detailed in the Proof of Proposition 2 in the “Appendix”.

When \(\gamma\) rises, the two products become more substitutable. In the extreme, the two goods are homogeneous if \(\gamma = {1}\), whereas they are independent if \(\gamma = {0}\).

References

Arya, A., & Mittendorf, B. (2010). Input price discrimination when buyers operate in multiple markets. Journal of Industrial Economics, 58(4), 846–867.

Bardhan, P. K. (1973). Size, productivity and returns to scale: An analysis of farm level data in Indian agriculture. Journal of Political Economy, 81(6), 1370–1386.

Basu, S., & Fernald, J. G. (1997). Returns to scale in U.S. production: Estimates and implications. Journal of Political Economy, 105(2), 249–283.

Chen, C.-S. (2017). Price discrimination in input markets and quality differentiation. Review of Industrial Organization, 50(3), 367–388.

DeGraba, P. (1990). Input market price discrimination and the choice of technology. American Economic Review, 80(5), 1246–1253.

Dertwinkel-Kalt, M., Haucap, J., & Wey, C. (2016). Procompetitive dual Pricing. European Journal of Law and Economics, 41(3), 537–557.

Herweg, F., & Müller, D. (2012). Price discrimination in input markets: Downstream entry and efficiency. Journal of Economics and Management Strategy, 21(3), 773–799.

Herweg, F., & Müller, D. (2014). Price discrimination in input markets: Quantity discounts and private information. Economic Journal, 124(577), 776–804.

Herweg, F., & Müller, D. (2016). Discriminatory nonlinear pricing, fixed costs, and welfare in intermediate-goods markets. International Journal of Industrial Organization, 46, 107–136.

Inderst, R., & Shaffer, G. (2009). Market power, price discrimination, and allocative efficiency in intermediate-goods markets. RAND Journal of Economics, 40(4), 658–672.

Inderst, R., & Valletti, T. (2009). Price discrimination in input markets. RAND Journal of Economics, 40(1), 1–19.

Kao, K.-F., & Peng, C.-H. (2012). Production efficiency, input price discrimination, and social welfare. Asia-Pacific Journal of Accounting and Economics, 19(2), 227–237.

Katz, M. L. (1987). The welfare effects of third-degree price discrimination in intermediate good markets. American Economic Review, 77(1), 154–167.

Kim, H., & Sim, S. (2015). Price discrimination and sequential contracting in monopolistic input markets. Economics Letters, 128, 39–42.

O’Brien, D. P. (2014). The welfare effects of third-degree price discrimination in intermediate good markets: The case of bargaining. RAND Journal of Economics, 45(1), 92–115.

Schmalensee, R. (1981). Output and welfare implications of monopolistic third-degree price discrimination. American Economic Review, 71(1), 242–247.

Valletti, T. (2003). Input price discrimination with downstream Cournot competitors. International Journal of Industrial Organization, 21, 969–988.

Varian, H. R. (1985). Price discrimination and social welfare. American Economic Review, 75(4), 870–875.

Varian, H. R. (1992). Microeconomic analysis. Norton.

Yoshida, Y. (2000). Third-degree price discrimination in input markets: Output and welfare. American Economic Review, 90(1), 240–246.

Acknowledgements

The author is very thankful to Lawrence J. White (Editor) and two anonymous referees for their insightful comments and suggestions. The financial support from the Ministry of Science and Technology of Taiwan (MOST 106-2410-H-031-009-MY2) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Lemma 1

From (7) and (8), comparing firms’ outputs under either pricing regime yields:

where \(\Delta \alpha = \alpha_{1} - \alpha_{2} > 0\). If \(\beta_{1} \ge \beta_{2}\), then \(q_{1}^{d} - q_{2}^{d} < 0\) and \(q_{1}^{u} - q_{2}^{u} < 0\). If \(\beta_{1} < \beta_{2}\), then the two output differences could be positive if \(\Delta \alpha\) is sufficiently small. □

1.2 Proof of Proposition 1

By substituting equilibrium outputs (7) and (8) into (10) and (12) under either pricing regime, we specify the comparisons of consumer surplus and social welfare between discriminatory pricing and uniform pricing as:

If \(\beta_{1} \ge \beta_{2}\), then the signs of \(\Delta CS\) and \(\Delta SW\) are negative. If \(\beta_{1} < \beta_{2}\), and \(\Delta \alpha\) is sufficiently small, then the two signs are positive.□

1.3 Proof of Proposition 2

The two terms \(\Delta \alpha + \beta_{1} q_{1}^{d} - \beta_{2} q_{2}^{d}\) and \(\Delta \alpha + \beta_{1} q_{1}^{u} - \beta_{2} q_{2}^{u}\) can be rearranged, respectively, as:

which are positive if \(\beta_{1} \ge \beta_{2}\); they are negative if \(\beta_{1} < \beta_{2}\) and \(\Delta \alpha\) is sufficiently small.

By substituting the above two terms into (18) and rearranging it, we derive the cost difference as:

where \(\psi = 2(2 + \beta_{1} + \beta_{2} )(3 + 2\beta_{1} + 2\beta_{2} + \beta_{1} \beta_{2} ) > 0\), \(\phi = 24 + 21\beta_{1} + 17\beta_{2} + 4\beta_{1}^{2} + 2\beta_{2}^{2} + 10\beta_{1} \beta_{2} + \beta_{1} \beta_{2}^{2} + \beta_{1}^{2} \beta_{2} > 0\), and \(\theta = 2(2 + \beta_{1} + \beta_{1} )(1 - \alpha_{1} )(\beta_{1} - \beta_{2} )\). Note that \(\theta < 0\) if \(\beta_{1} < \beta_{2}\) and otherwise \(\theta \ge 0\). Hence, if \(\beta_{1} < \beta_{2}\), then the sign of \(\Delta TC\) is negative when \(\Delta \alpha\) is sufficiently small. Under such circumstances, discriminatory pricing is cost-reducing and thus more socially desirable than uniform pricing.□

1.4 Results under Bertrand competition

From the first-order conditions for profit maximization, the reaction functions under Bertrand competition are \(p_{i} (p_{j} ) = \frac{{(1 - \gamma )[1 - \gamma^{2} + \beta_{i} + (1 + \gamma )(\alpha_{i} + w_{i} )]}}{{2 - 2\gamma^{2} + \beta_{i} }} + \frac{{\gamma (1 - \gamma^{2} + \beta_{i} )}}{{2 - 2\gamma^{2} + \beta_{i} }}p_{j} ,i \ne j,i,j = 1,2\), whereby the equilibrium prices are derivable as follows:

where \(A = (4 - \gamma^{2} )(1 - \gamma^{2} ) + (2 - \gamma^{2} )(\beta_{1} + \beta_{2} ) + \beta_{1} \beta_{2} > 0\).

The derived demands on input are then given as:

From these demands, the input monopolist chooses input prices for profit maximization. The equilibrium input prices under corresponding pricing regimes are presented in (19), whereby the equilibrium outputs under either pricing regime are then derivable as:

where \(\theta^{\prime} = (2 - \gamma^{2} + \beta_{j} )(6 - 3\gamma^{2} - 2\gamma + 2\beta_{i} + \beta_{j} ) - \gamma^{2} > 0\), and \(\theta^{\prime\prime} = (2 + \gamma - \gamma^{2} + \beta_{i} )(2 + \gamma - \gamma^{2} + \beta_{j} ) - 4\gamma^{2} > 0\).

To simplify notations, we assume hereafter that \(\alpha_{2} = 0\) and \(\beta_{2} = 1\). Substituting the above equilibrium outputs into the cost difference defined in (18) and rearranging yields:

The sign of \(\Delta TC\) depends on the sign of the term \([\Psi \alpha_{1} - \Gamma (1 - \beta_{1} )]\), which is always positive if \(\beta_{1} \ge 1\). Nevertheless, it is ambiguous if \(\beta_{1} < 1\). In this case, when \(\alpha_{1}\) approximates to 0, the term \([\Psi \alpha_{1} - \Gamma (1 - \beta_{1} )]\) becomes negative. Moreover, the value of the term is increasing with \(\alpha_{1}\). As a result, given \(\beta_{1} < 1\), if \(\alpha_{1}\) is sufficiently small, then the term is negative, and thus discriminatory pricing leads to a lower production cost relative to uniform pricing.

With differentiated products, social welfare is defined as \(W \equiv U - TC_{1} - TC_{2}\), whereby the welfare difference, \(\Delta W \equiv W^{d} - W^{u}\), is then derivable as:

The sign of \(\Delta W\) depends on the sign of the term \([ - \Psi^{\prime}\alpha_{1} + \Gamma (1 - \beta_{1} )]\), which is negative if \(\beta_{1} \ge 1\), but is ambiguous if \(\beta_{1} < 1\). If \(\beta_{1} < 1\), then when \(\alpha_{1}\) is close to zero, the sign of \([ - \Psi^{\prime}\alpha_{1} + \Gamma^{\prime}(1 - \beta_{1} )]\) becomes positive. Moreover, the value of \([ - \Psi^{\prime}\alpha_{1} + \Gamma^{\prime}(1 - \beta_{1} )]\) is decreasing with \(\alpha_{1}\). As a result, if \(\beta_{1} < 1\) and \(\alpha_{1}\) is not too large, then the term could be positive, whereby discriminatory pricing is more socially desirable than is uniform pricing under Bertrand competition.

Rights and permissions

About this article

Cite this article

Chen, CS. Input Price Discrimination and Allocation Efficiency. Rev Ind Organ 60, 93–107 (2022). https://doi.org/10.1007/s11151-021-09830-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-021-09830-1