Abstract

Consumers with bounded perception treat sufficiently similar goods as homogeneous. The effects of bounded perception on a vertically differentiated duopoly with sequential quality choice are examined. When quality entails fixed costs the market becomes more concentrated. When quality entails marginal costs, the second mover may profitably imitate the product of its rival, and the market is either more or less concentrated depending on how bounded perception is. When firms incur entry costs, neither firm may opt to produce when quality entails marginal costs, whereas at least one firm always produces when quality entails fixed costs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Can we always tell similar goods apart? The quality of a good is a nebulous attribute that is hard to assess at first glance; consequently, given this limitation to our perception, it is interesting to examine how it influences the selection of goods that we are presented with. This is done by looking at firms’ product design and the degree of concentration in a market in which consumers are bounded in their ability to distinguish between goods of different quality.

Intuitively, it is not clear whether bounded perception should help or hinder a given firm. On the one hand, it is more difficult for a firm to distinguish its product. On the other hand, it could produce a “knock off” good and ride on the success of its rival.

It is shown that both intuitions may be correct, depending on the cost structure: whether the cost of quality is fixed or marginal. A clear illustration is thus given of the importance of studying the interaction between individuals with decision-making limitations and other economic agents, as the results are non-straightforward and not necessarily robust to small changes in the surrounding arrangement.

The model used is a vertically differentiated duopoly, with the results of fixed and marginal costs of quality contrasted. With fixed costs, firms must distinguish themselves or fall into the Bertrand trap, which leads to greater market concentration. With marginal costs, one firm can “imitate” the other by producing a good of the same perceived quality but with lower marginal costs. The market may then be either more or less concentrated depending on how bounded consumer perception is.

Section 2 reviews some of the existing literature on perception. Section 3 formalizes bounded perception, and Sects. 4 and 5 examine its effect on a model of vertical differentiation with sequential quality choice with respectively fixed and marginal costs of quality. Section 6 presents an extension in which firms pay a cost to enter the market. Section 7 discusses the findings, Sect. 8 concludes.

2 Literature Review

Bounded perception is formalized using Rubinstein (1988)’s concept of a similarity relation, which specifies which elements of a set are sufficiently similar to be regarded as identical. Similarity relations are related to earlier work by Luce (1956) on semi-orders and are consistent with much psychophysical research on stimulus detection, particularly the Weber–Fechner law (Falmagne 2002).

Similarity relations have also been employed to explain anomalies in lottery choice (Aizpurua et al. 1993; Leland 1994; Buschena and Zilberman 1999) and intertemporal choice (Leland 2002).

The current article moves beyond these studies of individual choice to consider the impact of consumers with bounded perception when they interact with profit maximizing firms. It should thus be considered as a model of behavioural organization. Spiegler (2011) and Grubb (2015) provide overviews of this body of research, while Eliaz and Spiegler (2015) show some potential new directions it might take.

There are fewer articles studying the impact of similarity relations beyond individual choice, but Bachi (2014) uses a Rubinstein similarity relation in a duopoly market in which consumers randomize over firms when prices are sufficiently close together. Webb (2014) uses an identical behavioural mechanism to this article in a vertically differentiated market, but with simultaneous rather than sequential quality choice.

Kalayci and Potters (2011) investigate experimentally a market in which buyers find it difficult to distinguish between goods. Their experimental design represents goods’ value by a sum that is hard to compute accurately in the time that is allowed for decision making. They find that buyers make a significant number of “mistakes” by not purchasing the good offering the greater surplus.

The introduction of a psychological distortion of the way that individuals regard goods is related to recent research on attention and salience. Bordalo et al. (2012, 2013a, b, 2015) and Kőszegi and Szeidl (2013) examine how individuals’ attention is drawn towards attributes for which there is greater variation within the choice set and are overweighted in decision making.

There has also been some investigation of consumers’ perception in the marketing literature. (For example Chandon and Ordabayeva (2009) study how individuals’ assessment of a product’s volume can be influenced by packaging shape, and Kwortnik et al. (2006) examine the effects of labeling on consumer choice.) However, the studies in this field are mostly targeted at very specific effects with very specific product types.

That consumers are less informed about goods than firms means the situation is somewhat similar to markets with asymmetric information (Akerlof 1970). However, the key difference is the behaviour of consumers. They act as if fully informed, but with an inherent psychological limitation to their decision making, rather than being aware of the information asymmetry and taking it into account. There is no possibility to learn from past poor transactions, which is an essential feature of a market for lemons.

The information structure also differs in that consumers are perfectly informed about goods that are sufficiently dissimilar, but cannot distinguish at all between similar goods. Even if this structure were approximated by consumers who receive a noisy signal of quality, they do not update prior beliefs in the canonical way. In particular, consumers do not infer anything about the behaviour of firms given that they see two goods of apparently the same quality.

Thus firms face fundamentally different incentives than in a standard asymmetric information situation, and a typical unraveling result is not observed. To emphasize the difference, Baltzer (2012) examines asymmetric information in a market setting very similar to the one considered here, and does find unraveling, in contrast to the findings of this article.

The economic institution utilized is a vertically differentiated product market. Models of vertical differentiation are ideal settings in which to examine perceptual limitations, since firms’ profits depend heavily on their ability to distinguish their goods in the eyes of consumers.

Early development of the vertical differentiation framework was undertaken by Gabszewicz and Thisse (1979), Shaked and Sutton (1982), and Hung and Schmitt (1988). There now exists a profusion of theoretical models of vertical differentiation and many empirical applications.

A common behavioural approach when incorporating psychological insights into economics is followed: a standard economic model is taken and an extra parameter is added such that the original model is nested within the new. To do this, a baseline model is required, and the particular model used is most similar to Motta (1993) and Lutz (1997) in the case of 0 entry costs.

3 Bounded Perception and Consumer Behaviour

The notion of bounded perception of similar goods will now be formalized. A good c = (q, −p) has two attributes, quality q and price p, with \(Q=[0,\infty )\) the set of qualities and \(P=[0,\infty )\) the set of prices. The set of goods is then \(C=Q\times -P.\) \(\succsim_{u}\) is a preference relation on C that satisfies the standard assumptions. Let \(\sim_{s}\) be a Rubinstein similarity relation (Rubinstein 1988) on Q. If \(q\sim_{s}\,q^{\prime }\), then q and q′ are sufficiently similar that an individual regards them as identical. If \(q\nsim_{s}\,q^{\prime }\) then an individual regards them as dissimilar.

Together \(\succsim_{u}\) and \(\sim_{s}\) induce a decision preference relation \(\succsim_{d}\) on C in the following way:

-

(i)

If \(q\nsim_{s}\,q^{\prime }\) and \(c\succsim_{u}\,c^{\prime }\), then \(c\succsim _{d}\,c^{\prime }\).

-

(ii)

If \(q\sim _{s}\,q^{\prime }\) and \(p\le\, p^{\prime }\), then \(c\succsim _{d}\,c^{\prime }\).

Note that \(\succsim _{d}\) is complete, but not generally transitive. \(\succsim _{u}\) may be thought of as a “true” underlying preference relation and \(\succsim _{d}\) as the relation actually used by in individual in decision making, given the limitations captured by \(\sim _{s}\).

Functional forms are assumed for the various relations. Let \(\succsim _{u}\) be represented by the utility function u = α q−p, \(\alpha \in \mathbb {R}_{+}\) and let \(\sim _{s}\) be represented by the parameter \(\delta \in [1,\infty )\). δ is termed the perception threshold. Let q h , \(q_{\ell }\in Q\) be the qualities of two goods h and \(\ell\), with \(q_{h}\ge q_{\ell }>0\), then:

-

(i)

If \(\frac{q_{h}}{q_{\ell }}\ge \delta\), \(q_{h}\nsim _{s}q_{\ell }\).

-

(ii)

If \(\frac{q_{h}}{q_{\ell }}<\delta\), \(q_{h}\sim _{s}q_{\ell }\).

Furthermore, if \(q_{h}/q_{\ell }<\delta\) so that q h and \(q_{\ell }\) are regarded as similar, the individual is assumed to perceive both goods as having quality \(q^{\prime }=\lambda q_{h}+( 1-\lambda) q_{\ell }\), \(\lambda \in [ 0,1]\).

Thus, if two goods are dissimilar enough in quality that the ratio of the high to low quality exceeds the threshold, they are perceived as heterogeneous. On the other hand, if they are similar enough that the ratio of the high to low quality falls below the threshold, they are treated as homogeneous: When expressing a preference between the two, only price information is taken into account and not quality information.

That the perception threshold applies to the ratios of goods’ qualities means that as the absolute level of quality increases, so does the absolute difference in quality that is required for an individual to perceive them as heterogeneous. This is analogous to the classical Weber–Fechner law of psychology, which states that the smallest difference of intensity of some stimulus that an individual can detect (the just-noticeable difference, hereafter JND) is greater the greater the absolute level of the stimulus.Footnote 1

Note that there is a discontinuity in the perception of quality at the perception threshold δ: The consumer perceives quality perfectly when \(q_{h}/q_{\ell }=\delta\); yet if q h is reduced or \(q_{\ell }\) raised by even an infinitesimal amount, the goods are regarded as homogeneous.

The unrealistic nature of this discontinuity may be rationalized by considering it as a simplification of a “smoother”, probabilistic mechanism, in which there is some probability of perceiving the goods as homogeneous which becomes greater as qualities become more similar. This is again analogous to psychology, in which in modern research the JND is usually defined as the difference at which stimuli can be distinguished with a certain probability.

The magnitude of the ratio \(q_{h}/q_{\ell }\) may, given the assumptions made, be interpreted either as a physical or hedonic measure of how far apart the goods are. Thus \(q_{h}/q_{\ell }=2\) may be read as “h is of twice as good quality as \(\ell\), according to some objective measure” or as “the consumer gets twice as much pleasure from h as from \(\ell\)”. This property depends on the linearity of the utility function in q, and in general the interpretations do not coincide. The magnitude of the quality ratio is further discussed in Sect. 4.

A similarity ratio is not introduced for price, although it is plausible that consumers often act as if very similar prices are identical. Quality is generally a much harder to assess attribute than is price, and so the range of prices that are similar enough to be treated as the same is assumed to be negligible compared to the corresponding range of qualities.Footnote 2

There is hence a tension between a consumer’s bounded perception of goods’ quality and the ability to determine a precise willingness-to-pay (WTP) for them. This is resolved by the assumption that if \(q_{h}/q_{\ell }<\delta\), both goods h and \(\ell\) are perceived as having quality \(q^{\prime }=\lambda q_{h}+( 1-\lambda) q_{\ell }\), \(\lambda \in [ 0,1]\). The consumer’s WTP for both goods is then α q′, and although WTP is precisely defined, it is distorted by perceiving the goods as homogeneous, and consumers’ decisions whether to participate in the market are non-rational.

It should be noted that although this is a natural assumption, the only necessary restriction on consumer behaviour in Sect. 4 is that consumers never purchase the higher priced good when \(q_{h}/q_{\ell }<\delta\). The assumption will be revisited in Sect. 5.

4 Fixed Costs

Fixed costs of quality will be addressed first, with initially the baseline case of perfect perception derived, before moving on to bounded perception.

4.1 Baseline Case; δ = 1

Two identical firms produce a good with quality q ∈ Q which they sell at price p ∈ P. There is a fixed cost of quality c(q) = 0.5q 2 with all other costs 0. Consumers gain utility u = α q−p, \(\alpha \in \mathbb {R}_{+}\), from consuming a single unit of the good. They gain no utility from further units, and the payoff from not consuming is normalized to 0. There is a unit mass of consumers with α uniformly distributed between 0 and 1.

At the start of the game each firm is selected by nature to be the first mover with probability 1/2. Let firm 1 denote the first mover and firm 2 denote the second mover.Footnote 3 The timing of the market is as follows:-

- Period 1: :

-

Firm 1 chooses quality.

- Period 2: :

-

Firm 2 observes firm 1’s choice and chooses quality.

- Period 3: :

-

Both firms set prices simultaneously.

Let \(h\in \{ 1,2\}\), (\(\ell \in \{ 1,2\}\)) denote the firm that produces the high (low) quality good. Then the consumer with taste parameter \(\alpha ^{\prime }=( p_{h}-p_{\ell }) /( q_{h}-q_{\ell })\) is indifferent between purchasing from either firm, and the consumer with taste parameter \(\alpha ^{\prime \prime }=p_{\ell }/q_{\ell }\) is indifferent between the low-quality firm and not consuming. Demands for the high- and low-quality firms are thus respectively 1−α′ and α′−α″, implying profits of

From the first-order conditions, given in the appendix [Eq. (21)], it is found that equilibrium prices in period 3 are

Thus profits for given qualities are

The first- and second-order conditions are given in the Appendix (see Eq. (22).

Firm 1 takes advantage of its first-mover status to produce the high quality good, so \(\pi _{1}( q_{1},q_{2}) =\pi _{h}( q_{1},q_{2})\) and \(\pi _{2}=( q_{1},q_{2}) =\pi _{\ell }( q_{1},q_{2})\). Denote the constants that solve \(( \partial /\partial q_{2}) \pi _{2}( q_{1},q_{2}) =0\) simultaneously with \(( \partial /\partial q_{1}) \pi _{1}( q_{1},q_{2}^{BR}( q_{1}) ) =0\) as \(r_{1}\approx 0.245\) and \(r_{2}\approx 4.78\times 10^{-2}\).

The profits of each firm in equilibrium are \(\pi _{1}^{\ast}( q_{1},q_{2}) \approx 0.0245\) and \(\pi _{2}^{\ast}( q_{1},q_{2}) \approx 1.52\times 10^{-3}\). The share of total profit that accrues to the high-quality firm is σ 1 ≈ 0.942. Firm 1 uses its leader status to gain a greater share of the market than does firm 2.

Finally, consumer surplus is given by \(CS( q_{h},q_{\ell }) =\int _{\alpha ^{\prime }}^{1}( \alpha q_{h}-p_{h}) d\alpha +\int _{\alpha ^{\prime \prime }}^{\alpha ^{\prime }}( \alpha q_{\ell }-p_{\ell }) d\alpha\) which simplifies to

so that in equilibrium \(CS^{\ast}( q_{1},q_{2}) \approx 0.0421\).

4.2 Bounded Perception; δ > 1

Now let consumers have bounded perception: δ > 1. Suppose the firms choose qualities such that \(q_{h}/q_{\ell }<\delta\), so that consumers perceive them to be homogeneous. Bertrand competition in period 3 drives prices down to marginal cost (= 0), and so the firms will make a loss. This leads to a key result:

Lemma 1

With fixed costs of quality, qualities such that \(q_{h}/q_{\ell }<\delta\) are never observed in equilibrium.

All proofs are contained in the appendix. Note that this result does not depend on the assumption that when the quality ratio lies below the perception threshold, firms perceive both goods as having quality \(q^{\prime }=\lambda q_{h}+( 1-\lambda ) q_{\ell }\). The only necessary restriction on consumers’ behaviour given a quality ratio below the perception threshold is that they never purchase the higher priced good.

By lemma 1, it must be that (for any observed δ) \(q_{2}\le q_{1}/\delta\). If \({{\mathrm{argmax}}}_{q_{2}}\pi _{2}( q_{1},q_{2}) \le q_{1}/\delta\), this must be a best response. If, however, \({{\mathrm{argmax}}}_{q_{2}}\pi _{2}( q_{1},q_{2}) >q_{1}/\delta\), then firm 2, given that \(\pi _{2}( q_{1},q_{2})\) is single-peaked, will choose the highest quality such that consumers still perceive the goods as heterogeneous. In summary, firm 2’s best response function is

For small δ then, the outcome is as in the baseline; yet from lemma 1, for sufficiently high δ the outcome is changed. Denote the point at which the baseline outcome no longer holds as δ′ f .

Let \(\delta >\delta _{f}^{\prime }\) so that \(q_{2}^{BR}( q_{1}) =q_{1}/\delta\). Substituting into \(\pi _{1}( q_{1},q_{2})\) and taking the first-order condition allows each firm’s equilibrium quality to be determined as

Further substitution reveals each firm’s profit to be

\(\delta _{f}^{\prime }\) is then found by equating the upper and lower components of \(\pi _{1}^{\ast}(q_{1},q_{2})\), with \(\delta _{f}^{\prime }\approx 4.941\).

Firm 1’s share of the total profit is

and consumer surplus is

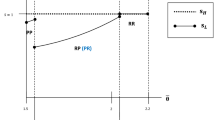

These expressions are illustrated in Fig. 1.

The derivatives of each firm’s total profit, firm 1’s profit share and consumer surplus are

From these expressions it is concluded that

Proposition 1

-

(i)

Firm 1’s profit is weakly increasing in δ and weakly greater than in the baseline case.

-

(ii)

Firm 2’s profit is weakly decreasing in δ and weakly lower than in the baseline case.

-

(iii)

Firm 1’s share of the total profit is weakly increasing in δ and weakly greater than in the baseline case.

-

(iv)

Consumer surplus is weakly decreasing in δ and weakly lower than in the baseline case.

Bounded perception affects the market only when \(\delta >\delta _{f}^{\prime }\approx 4.941\). However, this number is not general, but instead is determined by the qualities that firms produce in the baseline case. Firm 1 chooses a quality that is almost 5 times higher than firm 2’s, and its costs are almost 25 times as great.

A smaller value of \(\delta _{f}^{\prime }\) would result if, for example, q is regarded as excess quality over some minimum feasible level. A more concentrated mass of consumers who demand medium quality, rather than a flat uniform distribution, or a marginal cost of production (independent of quality) would also lead to firms that produce qualities that are closer together in the baseline.

The minimum perception threshold is hence a direct result of the stylized assumptions made for tractability’s sake in the baseline model, rather than a property of the bounded perception mechanism itself. This allows it to be reconciled with analogous psychological results on just-noticeable differences in stimuli, which typically take small values.Footnote 4

5 Marginal Costs of Quality

Suppose now that each firm instead incurs marginal costs of quality with the functional form c(q) = 0.5D q 2 where D is demand. Fixed costs are 0. The results will be contrasted with the previous section, demonstrating that the effects of bounded perception in a market are highly dependent on its cost structure. The baseline case of perfect perception is again derived first, before moving on to bounded perception.

5.1 Baseline Case; δ = 1

Demands for the high- and low-quality firm are unchanged from the previous section, and so profits are

From the first-order conditions [Eq. (23)], equilibrium prices are

and profits for given qualities are

To ensure non-negative demand for the high-quality good, the restriction \(q_{\ell }\le q_{h}\le 2-0.5q_{\ell }\) is imposed.Footnote 5 First-order conditions are given in the Appendix [Eqs. (24) and (25)]. Although the profit functions are not concave, it is possible to show that

Lemma 2

\(\pi _{h}( q_{h},q_{\ell })\) and \(\pi _{\ell }( q_{h},q_{\ell })\) have unique local maxima in the range \(0\le q_{\ell }\le q_{h}\), \(q_{\ell }\le q_{h}\le 2-0.5q_{\ell }\).

Firm 1 again takes advantage of its first-mover status to produce the high-quality good, so \(\pi _{1}( q_{1},q_{2}) =\pi _{h}( q_{1},q_{2})\) and \(\pi _{2}( q_{1},q_{2}) =\pi _{\ell } ( q_{1},q_{2})\). In the appendix it is shown that firm 1 chooses \(q_{1}^{\ast}=s_{1}\approx 0.611\) and firm 2 chooses \(q_{2}^{\ast}=s_{2}\approx 0.309\). The profits of each firm in equilibrium are then \(\pi _{1}^{\ast}( q_{1},q_{2}) \approx 0.0377\) and \(\pi _{2}^{\ast}( q_{1},q_{2}) \approx 0.0166\) and the proportion of total profit going to the incumbent is σ 1 ≈ 0.694.

Rearranging \(CS( q_{h},q_{\ell }) =\int _{\alpha ^{\prime }}^{1}( \alpha q_{h}-p_{h}) d\alpha +\int _{\alpha ^{\prime \prime }}^{\alpha ^{\prime }}( \alpha q_{\ell }-p_{\ell }) d\alpha\) gives

so that consumer surplus is \(CS^{\ast}( q_{1},q_{2}) \approx 0.0908\).

5.2 Bounded Perception; δ > 1

Suppose consumers have bounded perception. With fixed costs, firm 2 was constrained to choose a quality that consumers perceived as distinct (lemma 1). This is not the case with marginal costs.

If firms choose qualities such that \(q_{h}/q_{\ell }<\delta\), consumers regard the goods as homogeneous and hence purchase whichever is cheaper (if any). However, the marginal costs are not identical: The low-quality firm enjoys a cost advantage. It is a standard result that in period 3, Bertrand-Nash equilibrium prices are

with the lower-quality/cost firm capturing the entire market.

Firm 2, as the second mover always has the option of choosing a quality such that q 2 < q 1 and q 1/q 2 < δ and capturing the whole market. Taking such action is referred to as firm 2 imitating firm 1. The ability of firm 2 to imitate means that lemma 1 does not hold when costs of quality are marginal.

If firm 2 imitates firm 1, then firm 1 captures none of the market. Thus firm 1 is constrained not to choose a quality such that firm 2’s best response is imitation.

The demand for firm 2’s good when it imitates is \(D_{2}=1-p_{2}/q^{\prime }\), where \(q^{\prime }=\lambda q_{h}+( 1-\lambda) q_{\ell }\) is the quality that consumers perceive firm 2’s (and firm 1’s) good to be. So far the only necessary assumption about consumers when \(q_{h}/q_{\ell }<\delta\) has been that they never purchase the higher priced good. Now however, another simplifying assumption is made to give clarity to the analysis.

As was stated previously, the main focus of this article is the contrast between the cases of fixed and marginal costs of quality. The contrast is largely driven by firm 2’s ability to imitate firm 1 when quality entails marginal costs, and its profit from imitation is increasing in λ. Therefore, to emphasize the contrast between the two cases and to greatly simplify the analysis, it is assumed that λ = 1. This implies that when \(\frac{q_{h}}{q_{\ell }}<\delta\) consumers perceive both goods as being of quality q′ = q h . All conclusions are qualitatively unchanged under the oppositely extreme assumption of λ = 0.

If it imitates, firm 2 minimizes its cost by choosing the lowest quality such that consumers are unable to distinguish it from firm 1’s good. However, this is undefined, as firm 2 can choose q 2 arbitrarily close to q 1/δ. Assume that there is some minimum technologically feasible difference in quality ε. Firm 2 will then maximize its profit, conditional on imitating, by choosing q 2 = q 1/δ + ε.

As ε becomes very close to 0, q 2 is approximately q 1/δ, but with consumers still unable to perceive the difference between q 1 and q 2. Thus in the following section, when it is stated that firm 2 imitates by choosing q 2 = q 1/δ, it should be read as an approximation of choosing q 2 = q 1/δ + ε with ε very close to 0.

Conditional on imitating firm 1, firm 2’s profit is

Note that this becomes 0 as δ approaches 1, so for sufficiently low δ the market outcome is unchanged from the baseline case. Let the point at which the baseline outcome no longer obtains be \(\delta _{m}^{\prime }\).

For \(\delta >\delta _{m}^{\prime }\), firm 2 wishes to imitate firm 1 rather than produce a lower, distinct quality. Firm 1 must avoid this. If it raises its quality, this simply increases firm 2’s incentive to imitate. If it reduces its quality, firm 2 finds it less attractive to imitate and more attractive to produce a high quality good.

The threat of being imitated leads firm 1 to cede the advantage of producing the high quality good to its rival.

In the appendix, it is shown that when quality entails marginal costs the qualities that the firms produce are

where \(\delta _{m}^{\prime }\approx 1.073\), \(\delta _{m}^{\prime \prime }\approx 1.106\), \(\delta _{m}^{\prime \prime \prime }\approx 2.339\) and \(\tilde{s}_{1}\approx 0.555\), \(\tilde{s}_{2}\approx 0.906\). \(\mu ( \delta)\) is defined by the ratio \(( q_{2}^{\ast}/q_{1}^{\ast}) | _{\delta _{m}^{\prime }<\delta \le \delta _{m}^{\prime \prime }}\) and is given by the unique root of Eq. (26) taking a value >1. A(δ), B(δ), and C(δ) are functions of δ given by Eq. (27).

For \(\delta _{m}^{\prime }\), the threat of imitation causes firm 1 to allow firm 2 to become the high-quality firm;Footnote 6 and for \(\delta _{m}^{\prime }<\delta <\delta _{m}^{\prime \prime }\), firm 2 strictly prefers to be the high-quality firm rather than imitate. When the threshold exceeds \(\delta _{m}^{\prime \prime }\), however, it prefers to imitate even firm 1’s low quality. In response, firm 1 must lower its quality still further until firm 2 (weakly) prefers to enter as the high-quality firm rather than imitate.Footnote 7

For \(\delta _{m}^{\prime \prime }<\delta \le \delta _{m}^{\prime \prime \prime }\), the equilibrium ratio of high to low quality, \(\mu (\delta )\), is above the perception threshold. However, for \(\delta >\delta _{m}^{\prime \prime \prime }\), \(\mu (\delta )\) lies below the threshold. Hence firm 2, if it enters as the high-quality firm, must choose a quality that is higher than it would ideally like in order to distinguish itself.Footnote 8

Substitution then gives firms’ profits as

Firm 1’s share of total profit is

Finally, consumer surplus is given by

These expressions are shown in Fig. 1.

Derivatives of profits and of firm 1’s share of total profit are not explicitly given for reasons of brevity. However, regarding comparative statics it is possible to state that

Proposition 2

-

(i)

Firm 1’s profit is weakly lower than in the baseline case.

-

(ii)

Firm 2’s profit is weakly greater than in the baseline case for δ ≲ 7.547 and lower than in the baseline case for δ ≳ 7.547.

-

(iii)

Firm 1’s share of the total profit is weakly decreasing in δ for \(\delta <\delta _{m}^{\prime \prime \prime }\) and increasing in δ for \(\delta >\delta _{m}^{\prime \prime \prime }\). For δ ≲ 9.453 it is lower than in the baseline case, and for δ ≳ 9.453 it is greater than in the baseline case.

-

(iv)

Consumer surplus is weakly decreasing in δ for \(\delta >\delta _{m}^{\prime }\). For δ ≲ 1.667 it is greater than in the baseline case, and for δ ≳ 1.667 it is lower than in the baseline case.

The contrasting conclusions of propositions 1 and 2 are summarized in Table 1.

6 Entry Costs and Market Existence

So far is has been assumed that there were no costs that are associated with entering the market. To analyze the impact of relaxing this assumption, suppose that firms must now pay an entry cost in order to produce. Let \(E\in [0,\bar{E})\) represent the fixed cost of entry, which is identical for both firms, with the upper limit of this cost \(\bar{E}\) equal to the monopoly profit, which hence ensures that the market is viable.Footnote 9

The timing of the game is also altered to reflect the fact that firms must decide whether or not to enter the market, At the start, firm 1 decides whether to be the first to enter the market. If it declines, the opportunity to be the first to enter passes to firm 2. If firm 2 declines, it reverts to firm 1, and so the firms alternate in having the opportunity to enter the market first until one does so.

If firm \(i\in \{1,2\}\) enters the market, it incurs an entry cost E and chooses a quality that is observed by firm \(j\ne i\). Firm j decides whether or not to enter the market also. If it does so, it incurs entry cost E and chooses its quality. Finally there follows a single price-setting period in which either only firm i or both firms i and j are active.

The introduction of an entry cost allows for the possibility that the first mover deters entry by the second mover, and it is hence possible to analyze the effect of bounded perception on the number of firms that are observed in the market at a given entry cost. However, the results closely resemble those that were already obtained with regard to market concentration with 0 entry cost, so there is little insight to be gained. Instead, we examine whether firms ever reach the production stage.

Given that there is a single period in which firms can earn revenue, for a firm to wish to enter the market it must earn enough in that period to cover its entry cost. Thus there is a possibility that in equilibrium firms alternate between refusing to be the first to enter the market, and hence production never takes place. This is referred to as no market existence.

Proposition 3

-

(i)

When the costs of quality are fixed, a market always exists for any entry cost \(E\in [0,\bar{E})\).

-

(ii)

When the costs of quality are marginal, there exist entry costs for which market entry does not occur.

The reduction in the profit of the first mover caused by the ability of the second mover to imitate can be so great that neither firm wishes to create the market by being the first mover.

7 Discussion

A key insight that is garnered from Sects. 4 and 5 is that bounded perception has very different results depending on the cost structure, as is summarized in Table 1. Consumer behaviour for given qualities and prices is fully determined, and so they are not strategic players in the market: It is a game between firms only, as is common in studies of behavioural industrial organization. Thus the disparate results in the two sections are due to the differing abilities of each firm to exploit bounded perception.

The key difference is whether, when consumers perceive goods as homogeneous, firms are identical when competing in prices, or whether one firm has an advantage in marginal cost. Bertrand competition between identical firms leads to a loss for both, but with differing marginal costs, the low cost firm makes a profit.

Thus when quality entails fixed costs, firm 1 as the first mover finds bounded perception to be an advantage. It picks its quality knowing that firm 2 must position itself so that consumers perceive the goods as distinct, as otherwise it makes a loss. When quality entails marginal costs, the low quality/cost firm may make a profit from choosing a good that is perceived as identical to its rival’s. This grants an advantage to firm 2 as the second mover, since it can always choose to be the low-quality firm.

It is also important to note that even when the direction of the comparative statics is the same in both cases, the underlying causes are very different. When quality entails fixed costs, firm 1 exploits bounded perception to increase its market share. When quality entails marginal costs, firm 1 has to ensure that firm 2 does not imitate, which it does by choosing a quality that is so low that imitation is not worthwhile. Even when \(\delta >\delta _{m}^{\prime \prime \prime }\) and its market share increases with δ, it is capturing a greater share of a market whose overall value is less.

If we turn to consumer surplus: Consumer surplus is decreasing in the perception threshold in both cases with the exception of a jump at \(\delta _{m}^{\prime }\) when quality entails marginal costs. It is also lower than in the baseline with the exception of \(\delta _{m}^{\prime }<\delta \lesssim 1.667\) when quality entails marginal costs. Hence for the most part consumers are harmed by perceptual limitations.

When quality entails fixed costs, a higher perception threshold benefits firm 1, and its increased power in the market reduces consumer welfare. When quality entails marginal costs, on the other hand, with a sufficiently high threshold consumers are harmed by the under-provision of quality by the incumbent in its effort not to be imitated. In both cases, firms’ equilibrium qualities are also further apart, implying less intense competition in prices and lower consumer welfare.

A caveat to these results is that they hold strictly in a comparative statics setting. Analysis of consumer welfare when consumers do not precisely perceive the quality of goods may be problematic if it is unclear whether welfare should depend on a good’s perceived or objective quality. This problem is avoided only due to consumers’ always being able to perceive goods perfectly in equilibrium.

The perceived quality of goods is context-dependent: If we consider the change in welfare for a consumer who shifts from one equilibrium to another, it is necessary to take into consideration the new goods as being viewed in context with the old. Otherwise paradoxes arise, such as an individual’s being measured as better off when provided with good i rather than j, despite her regarding i and j as perfectly homogeneous.

Allowing for positive costs of firm entry (so long as they are below the baseline maximum) reveals another contrast between the two cases. Firm 1 unsurprisingly always enters the market when quality entails fixed costs. When quality entails marginal costs, however, there are circumstances in which the prospect of being imitated causes it not to enter.

The stark result of no market existing allows for a welfare result that is robust to the concerns discussed above. The definitive conclusion is that consumers are left worse off than in the standard case, as they are never presented with the chance to purchase. Such a result justifies patents and intellectual property regulations that are designed to prevent first-mover firms from being imitated. However, this result applies only when quality entails marginal costs, as restricting entry reduces welfare when quality entails fixed costs.

For any of the conclusions that have been presented to have relevance, it is necessary for consumers’ perceptual limitations to be severe enough. Thus it is important to consider whether any empirical evidence exists that perception influences a market.

Supporting experimental evidence is found in the aforementioned Kalayci and Potters (2011). However, experimental asset markets often choose stylized parameters for reasons of tractability and closeness to theory, so the external validity of the result should not be taken at face value.

If we compare the market concentration results to the baseline, there is no qualitative difference that could not be observed by altering the parameters of the market. Thus empirical observation of bounded perception may involve a comparison of two markets with similar cost and demand structures yet demonstrably different consumer ability to compare goods. Another prediction is that, since the perception threshold is defined with respect to the ratio of goods’ qualities, at the high-end of a market there should be a greater degree of product differentiation.

A further possibility is to exploit changes in consumer perception over time. Progressive restrictions on advertising and the recently introduced plain packaging law in Australia have made it much more difficult to distinguish between high and low quality cigarettes. If we assume that the cigarette market is best characterized by quality that entails marginal costs and a high δ (exceeding \(\delta _{m}^{\prime \prime \prime }\)), the prediction is that the interventions led to a more concentrated market. This has indeed been observed (Clarke and Prentice 2012).

Although it has no direct bearing on the specific conclusions of this article, some evidence that perception is empirically relevant is that it is easy to observe real-world firms that take actions that are intended to influence consumer perception. These actions may try to help perception: For example, by adopting a clear colour scheme to make quality discernible at a glance; or the actions may try to hinder perception: For example important nutritional information is often placed on the back of food packaging.

Although perception is treated exogenously in the current framework, firms have clear and conflicting incentives to influence perception. The threshold δ may be thought of as the frame in which consumers see goods. It should thus be possible in future research to analyze how firms compete over the frame in which consumers see their goods in a similar way to Spiegler (2014).

Aside from the specific conclusions with regard to entry into a vertically differentiated market, conclusions can also be drawn about the impact of individual choice limitations in a market. Consumers are identical in both Sects. 4 and 5, and firms differ only in whether the cost of producing a given quality is per-unit or independent of demand.

The interaction between consumers’ decision-making limitations and firms’ behaviour is vastly different in both cases, however, with the same limitations leading to a natural monopoly for the first mover in one case and in the other case to a market that is so unprofitable that no firm ever enters. This highlights the importance of considering decision making limitations not only in the context of individual choice, but also in the context of the consequences for interactions with other actors.

8 Conclusion

The impact on individuals’ decision making when their perception is imperfect is a growing area of study in the field of economics. Here, the impact beyond that on the individual is considered. It has been demonstrated that the interactions between perceptual limitations and the cost structure of firms is a complex one, with disparate effects on market outcomes.

There is also potential for extending the simple framework that has been presented here. For example, the perception threshold is entirely exogenous, yet it is plausible that consumers’ perception may improve with experience. Another fruitful avenue may be to relax the assumption of a homogeneous threshold, and allow those with a strong taste for quality to be better at detecting quality differences.

That consumers are not perfect in their perception of the world is of consequence, and should not be neglected when analyzing market structure.

Notes

In fact it is equivalent to a common formulation of the “law”, Δ I/I = K, where I is the intensity of some stimulus, Δ I is the JND and K is a constant. If δ = K−1, this is exactly the formulation employed here.

For a treatment of consumers with a similarity relation for prices in a market, see Bachi (2014).

The first mover is decided by nature, but it could also be that firm 1 is able to move first due to being endowed with some innovation ability that firm 2 lacks. In this case it could be that firm 2’s cost of quality is higher, due to its lack of innovation ability, or lower due to learning from observing firm 1 to be more efficient; but this does not qualitatively affect the results.

The ratio ΔI/I, where I is stimulus intensity and ΔI is the JND is termed the Weber fraction, and is equivalent to δ−1. This has been estimated to be, for example, 0.079 for brightness, 0.048 for loudness and 0.02 for heaviness (Techtsoonian 1971).

Note that such a restriction also applies when quality entails fixed costs; however, it is trivially non-binding.

i.e. its quality solves \(\max _{q_{\ell }}\pi _{\ell }( q_{h}^{BR} ( q_{\ell }) ,q_{1})\).

i.e. its quality solves \(\pi _{h}(q_{h}^{BR}(q_{1}),q_{1}) =\pi _{I}(q_{1})\).

i.e. firm 1’s quality solves \(\pi _{h}(\delta q_{1},q_{1})=\pi _{I}(q_{1})\).

References

Aizpurua, J., Ishiishi, T., Nieto, J., & Uriarte, J. (1993). Similarity and preferences in the space of simple lotteries. Journal of Risk and Uncertainty, 6, 289–297.

Akerlof, G. (1970). The market for “lemons”: Quality uncertainty and the market mechanism. Quarterly Journal of Economics, 84(3), 488–500.

Bachi, B. (2014). Competition with price similarities. (Unpublished manuscript)

Baltzer, K. (2012). Standards vs. labels with imperfect competition and asymmetric information. Economics Letters, 114(1), 61–63.

Bordalo, P., Gennaioli, N., & Shleifer, A. (2012). Salience theory of choice under risk. The Quarterly Journal of Economics, 127(3), 1243–1285.

Bordalo, P., Gennaioli, N., & Shleifer, A. (2013a). Salience and asset prices. American Economic Review Papers and Proceedings, 103(3), 623–628.

Bordalo, P., Gennaioli, N., & Shleifer, A. (2013b). Salience and consumer choice. Journal of Political Economy, 121(5), 803–843.

Bordalo, P., Gennaioli, N., & Shleifer, A. (2015). Competition for attention. Review of Economic Studies. (Forthcoming)

Buschena, D., & Zilberman, D. (1999). Testing the effects of similarity on risky choice: Implications for violations of expected utility. Theory and Decision, 46(3), 253–280.

Chandon, P., & Ordabayeva, N. (2009). Supersize in one dimension, downsize in three dimensions: Effects of spatial dimensionality on size perceptions and preferences. Journal of Marketing Research, 46, 739–753.

Clarke, H., & Prentice, D. (2012). Will plain packaging reduce cigarette consumption? Economic Papers: A Journal of Applied Economics and Policy, 31(3), 303–317.

Eliaz, K., & Spiegler, R. (2015). Beyond “Ellison’s matrix”: New directions in behavioral industrial organization. Review of Industrial Organization, 47(3), 259–272.

Falmagne, J. C. (2002). Elements of psychophysical theory. Oxford: Oxford University Press.

Gabszewicz, J., & Thisse, J. F. (1979). Price competition, quality and income disparities. Journal of Economic Theory, 20, 340–359.

Grubb, M. (2015). Behavioral consumers in industrial organization: An overview. Review of Industrial Organization, 47(3), 247–258.

Hung, N., & Schmitt, N. (1988). Quality competition and threat of entry in duopoly. Economics Letters, 27, 287–292.

Kalayci, K., & Potters, J. (2011). Buyer confusion and market prices. International Journal of Industrial Organization, 29(1), 14–22.

Kőszegi, B., & Szeidl, A. (2013). A model of focusing in economic choice. The Quarterly Journal of Economics, 128(1), 53–104.

Kwortnik, R., Creyer, E., & Ross, W. (2006). Usage-based versus measure-based unit pricing: Is there a better index of value? Journal of Consumer Policy, 29(1), 37–66.

Leland, J. (1994). Generalized similarity judgements: An alternative explanation for choice anomalies. Journal of Risk and Uncertainty, 9, 151–172.

Leland, J. (2002). Similarity judgments and anomalies in intertemporal choice. Economic Enquiry, 40(4), 574–581.

Luce, R. (1956). Semiorders and a theory of utility discrimination. Econometrica, 24(2), 178–191.

Lutz, S. (1997). Vertical product differentiation and entry deterrence. Journal of Economics, 65(1), 79–102.

Motta, M. (1993). Endogenous quality choice: Price vs. quantity competition. The Journal of Industrial Economics, 14(2), 113–131.

Rubinstein, A. (1988). Similarity and decision making under risk (is there a utility theory resolution to the Allais paradox?). Journal of Economic Theory, 46, 145–153.

Shaked, A., & Sutton, J. (1982). Relaxing price competition through product differentiation. Review of Economic Studies, 49(1), 3–13.

Spiegler, R. (2011). Bounded rationality and industrial organization. Oxford: Oxford University Press.

Spiegler, R. (2014). Competitive framing. American Economic Journal: Microeconomics, 6(3), 35–58.

Techtsoonian, R. (1971). On the exponents in Stevens’ law and the constant in Ekman’s law. Psychological Review, 78(1), 71–80.

Webb, E. (2014). Perception and quality choice in vertically differentiated markets. University of Copenhagen, Discussion Papers No.14-07.

Acknowledgments

I would like to thank Alexander Sebald, Peter Norman Sørensen, Dan Nguyen, Lawrence J. White and two anonymous referees, as well as seminar participants at the University of Copenhagen, the 9th Nordic Conference on Behavioural and Experimental Economics (2014) and the 2013 Danish Graduate Program in Economics workshop for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Appendix

Appendix

1.1 Fixed Costs of Quality

The first-order conditions of Eq. (1) are

from which it is easy to see that the second-order conditions are negative.

The first- and second-order conditions of Eq. (3) are

1.1.1 Proof of Lemma 1

If \(q_{h}/q_{\ell }<\delta\), Bertrand competition with effectively homogeneous goods and identical marginal costs of 0 for each firm occurs. Firms earn no revenue and make a loss for any \(q_{h},q_{\ell }>0\). Then as each firm can make 0 profit from selecting 0 quality, \(q_{h}/q_{\ell }<\delta\) cannot be an equilibrium. Any q h > 0 is perceivably different from \(q_{\ell }=0\), so that q h = 0 is not a best response to \(q_{\ell }=0\). For any q h > 0 it is possible to find some \(0<q_{\ell }\le q_{h}/\delta\) that is strictly positive and perceivably different to q h . From the first-order condition of \(\pi _{\ell }( q_{h},q_{\ell })\), \(( \partial /\partial q_{\ell }) \pi _{\ell }( q_{h},q_{\ell }) | _{q_{\ell }=0}>0\), so \(q_{\ell }=0\) is not a best response to any q h = 0 \(\square\).

1.1.2 Proof of Proposition 1

-

(i)

Substituting, for example, δ = 5 into Eq. (7a), \(( \partial /\partial \delta) \pi _{1}^{\ast}( q_{1},q_{2}) | _{\delta =5}\approx 0.014\), and\(( \partial /\partial \delta ) \pi _{1}^{\ast}( q_{1},q_{2}) | _{\delta >\delta _{f}^{\prime }}=0\) has no solutions for δ > 1.

-

(ii)

Substituting, for example, δ = 5 into Eq. (7b), \(( \partial /\partial \delta ) \pi _{2}^{\ast}( q_{1},q_{2}) | _{\delta =5}\approx -1.29\times 10^{-5}\) and \(( \partial /\partial \delta ) \pi _{2}^{\ast}( q_{1},q_{2}) | _{\delta >\delta _{f}^{\prime }}=0\) has a single solution that satisfies δ > 1, \(\delta =0.125( 25+193^{1/2}) \approx 4.86<\delta _{f}^{\prime }\).

-

(iii)

Substituting, for example, δ = 5 into Eq. (8), \(( \partial /\partial \delta ) \sigma _{1}| _{\delta =5}\approx 0.0103\) and \(( \partial /\partial \delta ) \sigma _{1}| _{\delta >\delta _{f}^{\prime }}=0\) has a single solution for δ > 1, \(\delta =2<\delta _{f}^{\prime }\). \(\square\)

-

(iv)

Substituting, for example, δ = 5 into Eq. (10d), \(( \partial /\partial \delta ) CS^{\ast}( q_{1},q_{2}) | _{\delta =5}\approx -1.23\times 10^{-3}\) and \(( \partial /\partial \delta ) CS^{\ast}( q_{1},q_{2}) | _{\delta >\delta _{f}^{\prime }}=0\) has a single solution that satisfies δ > 1, at \(\delta =( 37+3( 241) ^{1/2}) /40\approx 2.089<\delta _{f}^{\prime }\).

1.2 Marginal Costs of Quality

The first-order conditions of Eq. (12) are

from which it is easy to see that the second-order conditions are negative.

1.2.1 Proof of Lemma 2

The first-order condition of \(\pi _{h}( q_{h},q_{\ell })\) is

so there are at most five stationary points, two of which are q h = 0 and \(q_{h}=2-0.5q_{\ell }\). The polynomial in the rightmost bracket of the numerator has discriminant \(\varDelta =-71964q_{\ell }^{6}+415008q_{\ell }^{5}-627392q_{\ell }^{4} +121856q_{\ell }^{3}-94208q_{\ell }^{2}\). \(\varDelta \ge 0\) if \(q_{\ell }=8/3\), \(q_{\ell }\approx 3.005\), both of which lie outside the range, or \(q_{\ell }=0\), in which case the roots of the polynomial are \(q_{h}=2/3\) and \(q_{h}=2\). Thus \(\varDelta <0\) for \(q_{\ell }<q_{h}<2-\frac{1}{2}q_{\ell }\), and there is a unique maximum of \(\pi _{h}( q_{h},q_{\ell })\) in this range.

\(\pi _{\ell }( q_{h},q_{\ell })\) is continuous in the range \(0\le q_{\ell }\le q_{h}\), is 0 at \(q_{\ell }=0\) and \(q_{\ell }=q_{h}\) and is positive for some \(q_{\ell }\) within the range. Thus if there is a single stationary point in the interior of the range, it is a maximum. The first-order condition of \(\pi _{\ell }( q_{h},q_{\ell })\) is

which shows that there are at most four stationary points, one of which is \(q_{\ell }=2q_{h}\). The polynomial in the rightmost bracket of the numerator has discriminant \(\varDelta =15633q_{h}^{6}-4380q_{h}^{5}+28900q_{h}^{4}-21952q_{h}^{3}\). \(\varDelta \ge 0\) if either \(q_{h}=0\), which implies no \(q_{\ell }\) such that \(0<q_{\ell }<q_{h}\), or if \(q_{h}=2/3\), in which case the sole root of the first-order condition is \(q_{\ell }=1/3\). Otherwise \(\varDelta <0\), and there is a single root of the polynomial, and there is a unique maximum of \(\pi _{2\ell }( q_{h},q_{\ell })\) for \(0<q_{\ell }<q_{h}\). \(\square\)

1.2.2 Derivation of \(q_{h}^{\ast}\), \(q_{\ell }^{\ast}\)

Let δ = 1. Denote the constants that solve \((\partial /\partial q_{\ell })\pi _{\ell }(q_{h},q_{\ell })=0\) simultaneously with \(( \partial /\partial q_{h}) \pi _{h}( q_{h},q_{\ell }^{BR}( q_{h}) ) =0\) as \(k_{h}\approx 0.567\) and \(k_{\ell }\approx 0.289\). \(k_{\ell }\) is a best response by firm 2 to q 1 = k h given that it is constrained to produce \(q_{2}\le q_{1}\); i.e., \(q_{1}=k_{h}\), \(q_{2}=k_{\ell }\) is an equilibrium only if firm 2 does not wish to deviate to produce some \(q_{2}\ge q_{1}\). \(\pi _{\ell }( q_{h},q_{\ell }) | _{( q_{h}, q_{\ell })=( k_{h},k_{\ell }) }\approx 0.0151\), whereas choosing, for example, \(q_{2}=0.9\) gives profit \(\pi _{h}( q_{h},q_{\ell }) | _{( q_{h}, q_{\ell })=( 0.9,k_{h}) }\approx 0.0195\), so this is not an equilibrium.

As by lemma 2, \(( \partial /\partial q_{h}) \pi _{h}( q_{h},q_{\ell }^{BR}( q_{h}) ) <0\) for \(q_{h}>k_{h}\), firm 1 chooses the lowest q 1 such that firm 2 wishes to produce q 2 < q 1 rather than deviating to a high quality. Denote the constants that solve \(( \partial /\partial q_{h}) \pi _{h}( q_{h},q_{1}) =0\), \(( \partial /\partial q_{\ell }) \pi _{\ell }( q_{1},q_{\ell }) =0\) and \(\pi _{h}( q_{h},q_{1}) =\pi _{\ell }(q_{1},q_{\ell })\) simultaneously as \(s_{2h}\approx 0.939\), \(s_{1}\approx 0.612\), and \(s_{2}\approx 0.309\). For δ = 1, equilibrium qualities are then \(q_{1}^{\ast}=s_{1}\approx 0.612\), \(q_{2}^{\ast}=s_{2}\approx 0.309\).

Define \(\delta _{m}^{\prime }\approx 1.071\) as the point at which firm 2’s profit from imitating q 1 = s 1 is equal to its profit in the baseline case. Let \(\delta >\delta _{m}^{\prime }\). Firm 1 chooses q 1 < s 1 so that firm 2 prefers to enter as the high-quality firm rather than imitate. Denote the constants that solve \(( \partial /\partial q_{h}) \pi _{h}( q_{h},q_{\ell }) =0\) simultaneously with \(( \partial /\partial q_{\ell }) \pi _{\ell }( q_{h}^{BR}( q_{\ell }) , q_{\ell }) =0\) as \(\tilde{s}_{2}\approx 0.906\) and \(\tilde{s}_{1}\approx 0.555\). This represents an equilibrium until \(\delta\) is sufficiently large that firm 2 makes a greater profit from imitating \(\tilde{s}_{1}\) than producing \(\tilde{s}_{2}\). Define \(\delta _{m}^{\prime \prime }\approx 1.106\) as the solution to \(\pi _{h}( q_{h},q_{\ell }) | _{( q_{h},q_{\ell })=( \tilde{s}_{h}, \tilde{s}_{\ell }) }= \pi _{I}( q_{1}) | _{q_{1}=\tilde{s}_{h}}.\)

Let \(\delta >\delta _{m}^{\prime \prime }\). Denote by q 2h the quality that firm 2 chooses conditional on producing such that q 2 > q 1 and by q 2I the quality that firm 2 chooses conditional on imitating. As by lemma 2, \(( \partial /\partial q_{\ell }) \pi _{\ell }( q_{h}^{BR}( q_{\ell }) , q_{\ell }) <0\) for \(q_{\ell }<\tilde{s}_{1}\), firm 1 chooses the highest q 1 such that firm 2 prefers to produce a high, distinct quality rather than imitating; i.e., such that \(\pi _{I}(q_{1})=\max _{q_{2h}}\pi _{h} (q_{2h},q_{1})\).

Suppose δ is sufficiently small that \({{\mathrm{argmax}}}_{q_{2h}}\pi _{h}( q_{2h},q_{1}) \ge \delta q_{1}\). Let \(\mu =q_{2h}/q_{1}\) and substitute \(q_{2h}=\mu q_{1}\) into the first-order condition of \(\pi _{h}( q_{2h},q_{1})\). After rearrangement this gives \(q_{1}=4( \mu ^{2}-3\mu +2) /( 24\mu ^{3}-22\mu ^{2} +5\mu +2)\). Substituting this expression and \(q_{2h}=\mu q_{1}\) into \(\pi _{I}( q_{1}) =\pi _{h}( q_{2h},q_{1})\) results in

Although no analytical solutions exist, numerical approximations are possible to find to solutions for given values of δ. Define \(\mu ( \delta )\) as the unique root of this equation that takes a value that is greater than 1, from which Eq. (17) in the range \(\delta _{m}^{\prime \prime }<\delta \le \delta _{m}^{\prime \prime \prime }\) follows.

Define \(\delta _{m}^{\prime \prime \prime }\) as the solution to \(\mu ( \delta ) =\delta\), with \(\delta _{m}^{\prime \prime \prime }\approx 2.339\). Let \(\delta >\delta _{m}^{\prime \prime \prime }\). \({{\mathrm{Argmax\, }}}_{q_{2h}}\pi _{h}( q_{2h},q_{1}) <\delta q_{1}\), so firm 2’s best response conditional on choosing \(q_{2}>q_{1}\) is \(\delta q_{1}\). Substituting \(q_{2h}=\delta q_{1}\) into \(\pi _{I}( q_{1}) =\pi _{h}( q_{2h},q_{1})\) and rearranging yields \(q_{1}=( -B( \delta ) -( B^{2}( \delta ) -4A( \delta ) C( \delta ) ) ^{1/2}) / ( 2A( \delta) )\), with

which completes the derivation of Eq. (17).

1.2.3 Proof of Proposition 2

-

(i)

For \(\delta _{m}^{\prime }<\delta \le \delta _{m}^{\prime \prime }\), \(\pi _{1}^{\ast}( q_{1},q_{2}) \approx 0.0259< \pi _{1}^{\ast}( q_{1},q_{2}) | _{\delta =1}\approx 0.0377\). Let \(\delta _{m}^{\prime \prime }<\delta \le \delta _{m}^{\prime \prime \prime }\). As \(( \partial /\partial \delta ) \pi _{I}( q_{1}) >0\) and \(( \partial /\partial \delta ) \pi _{2}^{\ast}( q_{1},q_{2}) =0\), it must be that \(( \partial /\partial \delta ) q_{1}^{\ast}<0\), which implies by lemma 2 that firm 1’s profit is decreasing in \(\delta\) and as \(\lim _{\delta \rightarrow \delta _{m}^{\prime \prime +}}\pi _{1}^{\ast}( q_{1},q_{2}) \approx 0.0259\), it is lower than in the baseline. Let \(\delta >\delta _{m}^{\prime \prime \prime }\). The only solution to \(( \partial /\partial \delta ) \pi _{1}^{\ast}( q_{1},q_{2}) =0\) in the range \(\delta >\delta _{m}^{\prime \prime \prime }\) is \(\delta \approx 5.240\), and as \(\pi _{1}^{\ast}( q_{1},q_{2}) | _{\delta \approx 5.240}\approx 0.315< \pi _{1}^{\ast}( q_{1},q_{2}) | _{\delta =1}\approx 0.0377\), firm 1’s profit is lower than in the baseline.

-

(ii)

For \(\delta _{m}^{\prime }<\delta \le \delta _{m}^{\prime \prime }\), \(\pi _{2}^{\ast}( q_{1},q_{2}) \approx 0.0204> \pi _{2}^{\ast}( q_{1},q_{2}) | _{\delta =1}\approx 0.0166\). Let \(\delta _{m}^{\prime \prime }<\delta <\delta _{m}^{\prime \prime \prime }\). It was shown above that \(( \partial /\partial \delta ) q_{1}^{\ast}<0\), and as \(( \partial /\partial q_{\ell }) \pi _{h}( q_{h},q_{\ell }) <0\) for \(0\le q_{\ell }\le q_{h}\le 2-\frac{1}{2}q_{\ell }\) it follows that firm 2’s profit is increasing in \(\delta\). As \(\lim _{\delta \rightarrow \delta _{m}^{\prime \prime +}}\pi ( q_{1},q_{2}) \approx 0.0204\), its profit is greater than in the baseline. Let \(\delta >\delta _{m}^{\prime \prime \prime }\). The equation \(\pi _{2}^{\ast}( q_{1},q_{2}) | _{\delta >\delta _{m}^{\prime \prime \prime }}= \pi _{2}^{\ast}( q_{1},q_{2}) | _{\delta =1}\) has a unique solution at \(\delta \approx 7.547\).

-

(iii)

For \(\delta _{m}^{\prime }<\delta \le \delta _{m}^{\prime \prime }\), \(\sigma _{1}\approx 0.560< \sigma _{1}| _{\delta =1}\approx 0.694\). Let \(\delta _{m}^{\prime \prime }<\delta \le \delta _{m}^{\prime \prime \prime }\). It is shown above that \(( \partial /\partial \delta ) \pi _{1}^{\ast}( q_{1},q_{2}) <0\) and \(( \partial /\partial \delta ) \pi _{2}^{\ast}( q_{1},q_{2}) >0\), from which it follows that \(( \partial /\partial \delta ) \sigma _{1}<0\). Let \(\delta >\delta _{m}^{\prime \prime \prime }\). It was shown above that for \(\delta _{m}^{\prime \prime \prime }<\delta \lesssim 5.250\), \(( \partial /\partial \delta ) \pi _{1}^{\ast}( q_{1},q_{2}) >0\) and \(( \partial /\partial \delta ) \pi _{2}^{\ast}( q_{1},q_{2}) <0\), which together imply \(( \partial /\partial \delta ) \sigma _{1}>0\). As \(( \partial /\partial \delta ) \sigma _{1}| _{\delta >\delta _{m}^{\prime \prime \prime }}=0\) has no solutions for \(\delta >\delta _{m}^{\prime \prime \prime }\), it must be that \(( \partial /\partial \delta ) \sigma _{1}>0\) for \(\delta \gtrsim 5.240\). The equation \(\sigma _{1}| _{\delta >\delta ^{\prime \prime \prime }}= \sigma _{1}| _{\delta =1}\) has the unique solution \(\delta \approx 9.453\).

-

(iv)

\(CS^{\ast}( q_{1},q_{2}) | _{\delta _{m}^{\prime }<\delta \le \delta _{m}^{\prime \prime }}\approx 0.106\) which is greater than the baseline surplus of \(CS^{\ast}( q_{1},q_{2}) | _{\delta =1}\approx 0.0908\). From Eq. (20), \(( \partial /\partial \mu ( \delta ) ) CS^{\ast}( q_{1},q_{2}) | _{\delta _{m}^{\prime \prime }<\delta \le \delta _{m}^{\prime \prime \prime }}=0\) reduces to

$$\begin{aligned} 9216\mu ^{9}\left( \delta \right)&-31616\mu ^{8}\left( \delta \right) +51632\mu ^{7}\left( \delta \right) -59920\mu ^{6}\left( \delta \right) 49483\mu ^{5}\left( \delta \right) -27613\mu ^{4}\left( \delta \right)\\&+10868\mu ^{3}\left( \delta \right) -2936\mu ^{2}\left( \delta \right) +416\mu \left( \delta \right) -16=0. \end{aligned}$$(28)which has the unique solution satisfying \(\mu ( \delta ) >1\) of \(\mu ( \delta ) \approx 1.358\). Substituting this value into Eq. (26) shows that this occurs at \(\delta \approx 1.0277<\delta _{m}^{\prime \prime }\). Since, for example, \(( \partial /\partial \delta ) CS^{\ast}( q_{1},q_{2}) | _{\delta =2}\approx -0.0225\), \(( \partial /\partial \delta ) CS^{\ast}( q_{1},q_{2}) | _{\delta _{m}^{\prime \prime }<\delta \le \delta _{m}^{\prime \prime \prime }}<0\). Numerically, \(( \partial /\partial \delta ) CS^{\ast}( q_{1},q_{2}) | _{\delta >\delta _{m}^{\prime \prime \prime }}=0\) has no solutions for \(\delta >1\) and as, for example, \(( \partial /\partial \delta ) CS^{\ast}( q_{1},q_{2}) | _{\delta =5}=-8.77\times 10^{-3}\), \(( \partial /\partial \delta ) CS^{\ast}( q_{1},q_{2}) | _{\delta >\delta _{m}^{\prime \prime \prime }}<0\). Numerically, \(CS^{\ast}( q_{1},q_{2}) | _{\delta >\delta ^{\prime }}= CS^{\ast}( q_{1},q_{2}) | _{\delta =1}\) has the solution \(\delta \approx 1.667\).\(\square\)

1.3 Entry Costs and Market Existence

1.3.1 Proof of Proposition 3

-

(i)

From proposition 1, firm 2’s profit given that it enters is weakly decreasing in δ so that the range of entry costs at which firm 1 deters entry is weakly increasing in δ. Also from proposition 1, firm 1’s profit given that firm 2 enters is weakly increasing in δ, which implies that for any \(E\in [0,\overline{E})\) firm 1’s profit is weakly greater with δ > 1 than in the baseline. Thus as the market always exists in the baseline, it always exists with δ > 1.

-

(ii)

With entry costs, firm 1 can potentially deter firm 2 from entering. Such an action is possible if firm 2’s maximin profit is negative. By construction, for \(\delta>\delta _{m}^{\prime \prime }\), firm 2’s maximin profit is \(\pi _{2}^{\ast}( q_{1},q_{2})\), so firm 1 is unable to deter entry for \(E<\pi _{2}^{\ast}( q_{1},q_{2})\). Firm 1 chooses not to enter the market if \(E>\pi _{1}^{\ast}( q_{1},q_{2})\), so for any \(\delta\) such that \(\pi _{2}^{\ast}( q_{1},q_{2}) >\pi _{1}^{\ast}( q_{1},q_{2})\) there exists a range \(\pi _{2}^{\ast}( q_{1},q_{2})>E>\pi _{1}^{\ast}( q_{1},q_{2})\) such that no market exists. It is hence sufficient to find some \(\delta\) for which \(\pi _{2}^{\ast}( q_{1},q_{2}) >\pi _{1}^{\ast}( q_{1},q_{2})\), and \(\pi _{2}^{\ast}( q_{1},q_{2}) | _{\delta =3}\approx 0.0375\) and \(\pi _{1}^{\ast}( q_{1},q_{2}) | _{\delta =3}\approx 0.0272\).\(\square\)

Rights and permissions

About this article

Cite this article

Webb, E.J.D. If It’s All the Same to You: Blurred Consumer Perception and Market Structure. Rev Ind Organ 50, 1–25 (2017). https://doi.org/10.1007/s11151-016-9512-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-016-9512-5