Abstract

We study the bargaining power of investors and the contagion effects of investor-owned single family homes on nearby property values. By controlling for the characteristics of both buyers and sellers, we find that investors tend to have more bargaining power than owner-occupiers — they purchase at lower prices and sell at higher prices, all else equal. We identify two types of investors: Professional Investors (e.g., corporations and partnerships) and Individual Investors. We find differences in the behavior of these two types of investors. For example, Individual Investors tend to invest in homes similar in terms of unobserved quality to those purchased by owner-occupiers. The tendency to buy lower quality homes is primarily attributable to Professional Investors. We also find that Professional Investors have more bargaining power than Individual Investors. For the contagion analysis, we use a repeat sales methodology and find that increasing ownership by investors in a neighborhood is associated with a small positive effect on nearby property values.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

This paper provides new information about the role and effects of investors in the single family housing market. Historically, the single family housing market was dominated by owner –occupiers. The housing crisis of 2006–2012 saw a dramatic increase in investor involvement in the single family market. Less than 1 % of single family homes were purchased by investors in 2004 while more than 6 % were purchased by investors in 2012.Footnote 1

First, we explore several issues related to the buying and selling behavior of investors. In particular, we investigate whether investors tend to be better “bargainers” in negotiating transaction prices. We find that, after controlling for the major house characteristics (house size, lot size, number of bathrooms and bedrooms and age), investors tend to pay less as buyers and sell for more, ceteris paribus. We also find significant differences between the behavior of Professional Investors (e.g., corporations and partnerships) and Individual Investors. We find that the former tend to buy lower quality properties than either owner-occupiers or Individual Investors. Our results also show that the Professional Investors are better bargainers than both of the other groups. Second, we study the effect that changes in the number of nearby investor-owned properties have on local house prices. With respect to these contagion effects, we find that an increase in the number of nearby investor-owned properties has a small positive effect on local owner-occupied property values.

Better understanding the effects of investor activity has become increasingly important as their role has increased, especially as the U.S. grapples with how to restructure the housing finance system. Since World War II, owner-occupancy has generally been favored in the U.S. The sharp decline in national housing prices and the rapid increase in foreclosures following 2006 led to a resurgence of the debate about homeownership. Because investors historically played such a small role in the single family housing market, their increased role has only recently become the subject of serious investigation.

Our work extends the nascent literature in several ways. First, we use a combination of methods to identify “investors”.Footnote 2 Our methodology enables us to identify whether the investor participated in a transaction as the buyer, the seller or both. Significantly, we distinguish between investors that operate as corporations or partnerships (“Professional Investors”) and Individual Investors. Further, we have unique data that enables us to study investor activity for thirty years (1986–2016) in a major metropolitan market—Denver, CO. Finally, because of our unique and extensive data, we are better able to control for confounding variables.

For estimating the bargaining effects, we apply the methodology developed by Harding et al. (2003) and find that investors (especially Professional Investors) are better bargainers than owner occupiers.Footnote 3 This finding is subject to different interpretations or explanations. First, it could simply reflect the fact that investors are more experienced and skilled at evaluating homes and negotiating real estate transactions. Second, it could reflect the fact that investors (and especially those entities we designate as Professional Investors) have better access to a variety of financing options and are not as dependent on traditional mortgage lenders. The observed pricing difference could also mean that investors provide liquidity at times when there are few other buyers and additional supply when market supply conditions are tight. Finally, the observed bargaining advantage could be the result of investors being better at market timing—buying when prices are low and selling when prices are high. Most likely, the true explanation involves a combination of these effects.Footnote 4

We also study whether having nearby investor-owned properties has an effectFootnote 5 on local house prices by modifying the approach developed by Harding et al. (2009) to study the contagion effect of foreclosed properties on nearby non-distressed property values. Specifically, we study whether home value appreciation is adversely affected by an increase in the number of nearby investor-owned properties. The method entails controlling for observed and unobserved property characteristics by using a repeat sales specification, where the traditional dummy variables on the right hand side are augmented by controls for the change in the number of nearby distressed properties and nearby investor–owned properties. Our results confirm previous studiesFootnote 6 that find a negative contagion effect for distressed properties but, significantly, we also show a small, but statistically significant, positive effect from having an increase in the number of nearby properties that are investor-owned. This finding is counter to the conventional wisdom that investor-owned rental properties have an adverse effect on neighborhood property values but is consistent with the results of other recent studies (e.g., Allen et al. 2018, and Ganduri et al. 2019).

The remainder of this paper is organized as follows. The next section provides a literature review and discusses the empirical issues. The following section describes our methodology and data. The Results Section presents results and the final section summarizes our conclusions and discusses implications.

Literature Review and Empirical Issues

Literature

While rental of single family residences has long been a common practice, prior to the financial crisis, it was typically done by individual owners on a small scale – often because the household was moving temporarily or as a temporary substitute for selling while waiting for better market conditions. The “business” of buying single family detached homes in large numbers with the express purpose of generating rental income expanded significantly during and after the 2008 financial crisis (see Molloy and Zarutskie 2013; Ganduri et al. 2019). As a result, until recently, there has been limited research into the role and effect of such investors in the single family market.

Early studies of the effects of investor activity in housing markets include Haughwout et al. (2011), Fisher and Lambie-Hanson (2012), Schnure (2014) and Bracke (2015). Haughwout et al. (2011) document large increases in the share of purchases by real estate investors in markets that experienced large run-ups in home prices followed by sharp declines in prices (“boom/bust” markets). These authors define “real estate investors” as those who own more than one property based on first mortgage liens reported on their credit report. Fisher and Lambie-Hanson (2012) explore the differences between investors and owner-occupiers in Chelsea, MA - an urban area with a mixture of single family homes and multifamily properties. They find that investors have shorter holding periods, invest more after purchase and experience about the same foreclosure risk when compared to owner-occupiers. Schnure (2014) looks at the role that investors play in facilitating the shift to lower rates of homeownership in the economy after the financial crisis and concludes that by providing capital and management expertise, investors help mitigate housing disequilibrium. Bracke (2015) focuses on the purchase prices paid by investors relative to the prices paid by others. He studies the behavior of “buy-to-rent” investors in the UK housing market during 2013, and reports that those investors paid roughly 1 % less than other buyers for equivalent properties. Bracke (2015) does not control for the type of seller.

Shifting to more recent literature, Turnbull and van der Vlist (2017) estimate how much of the “rental discount”Footnote 7 is attributable to the bargaining ability of investors by imbedding bargaining related variables into a canonical search model. They find that investors (owners of rental properties) have a bargaining advantage when negotiating with owner-occupiers. This bargaining advantage implies that the “rental discount” is in fact larger than earlier estimates that did not control for bargaining effects. The Turnbull and van der Vlist (2017) specification differs from our model specification in that they use a set of buyer/seller (0,1) indicators to control for bargaining effects rather than the transformed measures of bargaining and demand effects developed by Harding et al. (2003). Turnbull and van der Vlist (2017) control for the omitted demand effect by using a matched control sample using a propensity score matching model to control for selection bias. We believe the Harding et al. (2003) specification provides better control for the demand effect (i.e., selection bias).

Allen et al. (2018) examines how investors impact local housing prices. In their research, investors are defined as grantees that purchased two or more single- family dwellings or purchased one single family dwelling as an LLC, LP, etc. during the sample period. They find that the larger the investor – where size is measured by the number of purchases in a specified time frame - the greater the purchase discount for the investor. They report that large investors obtain a discount close to 14 %, while small investors obtain a discount of roughly 8 %. Allen et al. (2018) also report that an increase in the percentage of homes purchased by investors is associated with higher house prices in the census tract. Allen et al. (2018) focus solely on the nature of the buyer (i.e., investor or owner-occupier) and do not control for the type of seller. As discussed below, because our data identifies both buyer and seller, we are better able to control for the fact that investors tend to buy lower quality homes (the “demand” effect) and reduce the omitted variable bias associated with estimating purchase discounts.Footnote 8

Ganduri et al. (2019) find a positive “spillover” effect of investor-owned properties on nearby non-distressed properties. The authors attribute the positive effect to the fact that investors provided needed liquidity - especially in very distressed neighborhoods. The Ganduri et al. (2019) results are based on analysis of the Federal Housing Finance Agency “bulk sales” of distressed properties acquired by the government sponsored enterprises. It is unclear whether such results generalize to a gradual increase in investor-owned properties resulting from the acquisition by investors from owner-occupiers in the non-distressed market. In contrast, our results are based on secondary market sales of transactions and specifically exclude REO sales.

Hayunga and Munneke (2019) study the issue of whether real estate agents (a very specific, but easily observed type of investor) transact for their own accounts at prices different than when they represent a client. Traditional analyses using a binary indicator variable to control for agents as sellers for their own account have shown that agents sell their own properties at higher prices. Hayunga and Munneke (2019) extend this literature by using the bargaining framework of Harding et al. (2003) to control for unobserved differences in the characteristics of the home (the demand factor) while also analyzing the bargaining power of agents as both buyers and seller. In addition to studying the bargaining power of real estate agents, Hayunga and Munneke (2019) analyze the bargaining power of other market participants including a group they call “companies”. Their companies include home builders, financial institutions, limited partnerships and other “buy to rent” investors. They find that both agents and companies are stronger bargainers than individuals. That is, they buy at lower prices and sell at higher prices ceteris paribus. Their work comes closest to our approach to estimating the bargaining power of investors and their results are consistent with ours. Our work differs from theirs in the definition of investors, our focus on secondary market sales of existing homes and our exploration of possible contagion effects. We also have strong locational controls (tract-by-year fixed effects).

Other recent papers have studied various aspects of the role of investors. Hansz and Hayunga (2016) focus on the purchase price negotiated by investors (without controlling for the demand effect) and find that investors pay roughly 10 % less compared to individuals purchasing at the same time and that the discount is larger for larger investors. Mills et al. (2019), like Bracke (2015), focuses on large firms that purchase homes with the intention of creating a portfolio of rental properties and generating a stream of rental income (“buy-to-rent”), and contrast those investors with investors assumingly more focused on short term price appreciation (which might be called “flippers”). The authors document several differences between the behavior of large buy-to-rent firms, other corporate investors and individual investors that are relevant to our work. For example, they observe that locations with larger increases in buy-to-rent purchases experience greater price appreciation over the next two years. The authors conclude that buy-to-rent investors contribute positively to housing demand in those submarkets where they were most active and supported local housing market recovery. Finally, Smith and Liu (2018) examine institutional investors’ purchases (without controlling for the type of seller) of single family dwellings in Atlanta, GA in the period subsequent to the most recent housing crisis, and find that investors purchase for a discount in the range of approximately 6% to 11%.Footnote 9 They also find that owner-occupiers face greater liquidity constraints than institutional investors.

Empirical Issues

Identifying investors is a challenging empirical task and different authors have used different definitions. One common approach is to identify investors by comparing the property address against the address to which the local taxing authority sends a property tax bill. Fisher and Lambie-Hanson (2012) use this approach as one of their metrics for determining investor-ownership. The underlying rationale is that owner-occupiers will have their property tax bill sent to the property address, while investors will have the bill sent to their own address (which is assumed to be different from the property address). This approach is subject to at least two potential errors: First, to the extent that owner-occupiers choose to use a post office box for mail delivery, they will be misclassified as investors. Other legitimate owner-occupiers may choose to have their tax-related correspondence sent to a different address because they are temporarily away from the home (e.g., occupancy is delayed until the end of a school year) or some other convenience-related factor.Footnote 10 The second potential error is that investors may be classified as owner-occupiers if they own a 2–4 unit property and occupy one of the units. In such cases, the addresses will coincide.Footnote 11 When using this approach, it is likely that the first error type predominates: misclassifying owner-occupiers as investors and thus over-estimating the stock of investor-owned properties.

Another approach to identifying investors is to define “investors” by the number of properties they own or have financed (e.g., see Molloy and Zarutskie 2013) during a specified period. This definition could erroneously characterize highly mobile owner-occupiers as investors.Footnote 12 It is also difficult to implement without data that spans an extended period in order to correctly flag those investors who operate at a small scale in any given year (e.g., an investor who buys a property every 18 months to rehab and resell). Finally, investors can be identified based on name. For example, Mills et al. (2019) use a master list of “buy to rent” investorsFootnote 13 and compare the recorded buyer name to this list to identify buy-to-rent investors.Footnote 14

We use a combination approach to identify investors. First, we use the recorded name fields in the deed records for each transaction to identify “professional” investors. The public deed transfer records for Denver, Colorado report both the buyer and the seller names and addresses. Individual names can be distinguished from the names of corporations, partnerships, charitable organizations, political entities, banks and other agencies. We parse the names of the non-individuals to identify several major classes of investors including financial institutions, builders, corporations, partnerships, agencies, etc. As described below, we use a subset of these major classes (e.g., excluding federal and state agencies, builders and financial institutions) resulting in a group of investors we designate as “professional” buyers and sellers based on their names. This group of “Professional Investors” includes limited partnerships, corporations and others.Footnote 15 This distinction enables us to examine how the bargaining effects differ for professional vs. individual investors (defined below) – which is one of the key contributions of our work.

To flag individual investors, we use a combination of factors. First, we compare the seller’s reported address with the property address. If the two addresses differ, we flag the seller as an investor. The same approach cannot be used to flag investor buyers since it is to be expected that their current address will differ from that of the property they are purchasing. However, we draw upon the fact that we have all transactions for a given house to partially address this problem. Consider a home that sells at t0 and t1. If we have flagged a seller at t1 as an investor seller, we assume that when the same person (or persons) bought the home in the previous transaction, they were an investor buyer at t0. This procedure is likely to underestimate the number of investor buyers. For example, the procedure will not flag an investor buyer who purchases a property and does not sell the property during the sample period.Footnote 16 Further, we will incorrectly classify some individual buyers as investors if they originally occupy the property and subsequently move out and rent the property before selling. However, as noted below, we augment this imperfect identification of buyer investors by using the number of transactions for a given name.

In addition to using names and addresses to flag individual investor buyers and sellers, we search all transactions from 1986 through 2016 and identify individuals who are frequent buyers and sellers. We identify anyone who has bought more than five single family homes during that period as an investor buyer for all transactions. Similarly, if the same individual sells more than five homes in the period, we flag all their sales as investor seller transactions.

To our knowledge, only Turnbull and van der Vlist (2017) and our paper identify the nature of both the buyer and the seller.Footnote 17 As documented in Harding et al. (2003), when assets are traded in thin markets, the final price is the result of negotiations between the buyer and seller. If one party has more “bargaining power” than the other, the negotiated price will reflect the imbalance in negotiating skill and experience. For example, accepted wisdom is that buyers should look for a “motivated seller” (e.g., one who has already moved to take a new job and thus faces higher carrying costs) to get the best deal. It is inappropriate to estimate a discount attributable solely to a buyer characteristic such as being an investor without controlling for the characteristics of the other party to the negotiation. Further, without controlling for both the bargaining and demand effects of investors as discussed below, it is likely that the involvement of an investor is related to unobserved characteristics of the property which could bias the estimated purchase discount associated with bargaining power.Footnote 18

Methodology and Data

Methodology

Estimating the Bargaining Power of Investors

The Bargaining Model

We begin the discussion of estimating an investor bargaining effect by working with the basic log linear hedonic relationship in eq. (1).Footnote 20

In eq. (1) above, P represents the property price, C is a vector of characteristics, and s is the vector of shadow prices. The property is viewed as a bundle of value-generating attributes fully described by the vector of characteristics, C.

When a bundled-good trades in a deep, liquid market, the s values are revealed through trading of bundles that differ in attributes. Bargaining has no role in determining prices when both C and s are known to buyer and seller and neither buyer nor seller faces search costs associated with a failure to purchase or sell any particular bundle.Footnote 21 However, as a good becomes increasingly heterogeneous, it trades in increasingly thin markets. Consequently, the “prices” (s) of the attributes (C) become harder to ascertain, market participants gain a degree of market power, and search costs increase. All of these deviations from a perfect market create incentives for bargaining. Consider, as an example, a seller with the only four-bedroom house available for sale in a market where generally larger families are the potential buyers. This seller has a degree of monopoly power, which provides an incentive to attempt to negotiate a higher price than that given by eq. (1).

If relative bargaining power enters the hedonic model as a fixed shift in prices, then we can write, for each individual asset:

where Bi represents the impact of bargaining on the observed transaction price for house i. Negative values of Bi (lower prices) are realized when a strong buyer negotiates with a weak seller and vice versa.

Harding et al. (2003) (HRS) assume that Bi is a linear function of vectors of buyer and seller demographic characteristics, D, each with characteristic coefficients denoted by the corresponding vector b (dropping the subscript i to simplify notation):

Substituting (3) into (2) yields:

There is a significant omitted variable problem with using eq. (4) in practical applications. The vector C is known to buyer and seller but only partially observed by the analyst. Furthermore, the unobserved characteristics are likely to be correlated with the buyer and seller demographic characteristics. To demonstrate, partition the vector C into the observed characteristics, C1 and the unobserved characteristics C2. We expect that:

where s2 is the vector of shadow prices on C2, Dk is the same vector of individual descriptive characteristics as in eq. (3), and eD represents idiosyncratic differences in preferences across individuals. Comparing eqs. (4) and (5), it is clear that if C2 is omitted from (4) then the coefficients on Dk will yield biased measures of bargaining power: individual traits that affect bargaining outcomes also influence demand for unobserved attributes of the traded good. Substituting eq. (5) into eq. (4) gives:

where s1 is the vector of shadow prices for C1, and ε = eB + eD.

Equation (6) shows that if we simply include indicators for whether the buyer and seller are investors (e.g., Dsell = 0/1and Dbuy = 0/1), the estimated coefficients on the indicator variable will represent the sum of the bargaining effect and the demand effect.Footnote 22 For example, if an investor buyer tends to buy properties with well below average unobserved quality (dbuy < < 0), it will be hard to distinguish the sign of the bargaining effect (bbuy).

HRS use two assumptions to identify the separate bargaining and demand effects:

(i) Symmetric bargaining power: bsell = − bbuy

-

(ii)

Symmetric demand: dsell = dbuy.

Using these assumptions results in:

Equation (7) can be readily estimated using ordinary least squares by including the sums and differences of the buyer and seller characteristics. The estimated \( \hat{b} \) represents the bargaining effect while \( \hat{d} \) represents the demand effect. Even if one is only interested in the bargaining effect, it is important to control for omitted variable bias by including both transformations of Dbuy and Dsell in the model. In our analysis, the buyer and seller characteristic of interest is whether or not the participant is an investor.Footnote 23

The first assumption of symmetric bargaining power (i) can be thought of in terms of “experience”. An experienced investor should be above average in negotiating both as a buyer and seller. The contrary assumption would imply that an investor was above average at negotiating as a buyer, but not so as a seller (or vice versa). Given our limited set of observed property characteristics, the second assumption is somewhat more problematic. It seems likely that investors buy properties with below average unobserved characteristics (e.g., quality or condition), invest to improve the property’s unobserved characteristics and then sell the improved property. For example, Fisher and Lambie-Hanson (2012) report that investors spend more on improvements after purchase than do individual buyers. Since we do not observe the improvements made, it is possible that dbuy ≠ dsell. We explore the implications of that possibility below.

If we do not impose the demand symmetry assumption, (ii), we return to eq. (2), but explicitly show the observed and unobserved characteristics:

As before, we substitute for B, using assumption (i):

Next, we substitute expression (5) to control for the effect of the unobserved characteristics

Equation (10) cannot be estimated directly because (Dsell-Dbuy), Dsell and Dbuy are collinear. Consider, instead, if we estimate the following equation:

Let us consider E(\( \hat{K} \)) – where \( \hat{K} \) is the estimated coefficient that results from applying OLS to eq. (11). Some basic algebra provides that:

s2’C2 = (Dsell + Dbuy)[dsell[\( \frac{D^{sell}}{\left({D}^{sell}+{D}^{buy}\right)}\left]+{d}^{buy}\right[\frac{D^{buy}}{\left({D}^{sell}+{D}^{buy}\right)} \)]].

Therefore, E[\( \hat{K} \)] = E [dsell[\( \frac{D^{sell}}{\left({D}^{sell}+{D}^{buy}\right)}\left]+{d}^{buy}\right[\frac{D^{buy}}{\left({D}^{sell}+{D}^{buy}\right)} \)]].

First, note that if HRS assumption (ii) holds and dsell = dbuy, then\( E\left[\hat{K}\right]=d \), the demand effect for investors.

Consider four possible combinations for Dsell and Dbuy.

Dsell | Dbuy | (Dsell + Dbuy) | E[\( \hat{K\Big]} \) |

|---|---|---|---|

1 | 0 | 1 | dsell |

0 | 1 | 1 | dbuy |

0 | 0 | 0 | Base Case |

1 | 1 | 2 | ½dsell + ½dbuy |

The table shows that if we estimate eq. (11) when dbuy ≠ dsell, the expected value of the estimated coefficient (E[\( \hat{K} \)]) will be a weighted average of dsell and dbuy. The weights on those two values depend on the mix of investor sellers and buyers in the estimating sample. Although, this complicates the interpretation of the estimated demand coefficient, it does not affect the estimated bargaining effect. Since we are primarily interested in the estimated bargaining effect, the complex nature of the estimated demand coefficient is not a major issue.Footnote 24

Estimating the Contagion Effect of Investor-Owned Properties

Our approach to exploring the price impact of investor-owned properties on general housing values is motivated by Harding et al. (2009) (HRY) who use a repeat sales analysis to quantify the impact of nearby foreclosures on the prices of non-distressed properties. Using a repeat sales approach provides excellent control for unobserved property and location characteristics and thereby reduces the potential for omitted variable bias in estimating the effect on price of selected locational attributes such as distressed properties or investor-owned properties.Footnote 25 HRY consider the number of nearby distressed properties to be a locational characteristic for each non-distressed property transaction. Importantly, the changes in this particular characteristic are observable. For example, if there is a negative externality associated with having a nearby property in the process of foreclosure, then, ceteris paribus, a property with three nearby foreclosures should sell at a lower price than an identical house with only one. By using a repeat sales specification to assess the impact of nearby distressed properties, HRY are better able to justify the “ceteris paribus” assumption needed when comparing transactions that differ in terms of the number of nearby distressed properties but also may differ in terms of unchanging but unobserved property and location characteristics. Further, by simultaneously estimating the general change in local house prices, HRY effectively control for the overall change in house prices between the two sales dates. A negative externality from an increase in the number of nearby properties between the two sales should be reflected in below average house price appreciation, which is the dependent variable in a repeat sales specification.

The repeat sales approachFootnote 26 begins with the standard log-linear hedonic house price specification – repeated here as eq. (12) for convenience.

The repeat sales model provides a way to estimate house price trends without observing the full vector of house characteristics. Under the assumption that both the vector of characteristics and the vector of attribute prices is constant between two observed transactions, the inner product (s’C) differences out when one models the rate of price appreciation between two sales instead of the price at time t. For instance, we rewrite (12) asFootnote 27:

whereCiincludes all (observed and unobserved) property characteristics related to the price of an individual property. The error term,\( {\eta}_t^i \), is assumed to be independent and identically distributed and captures pure random shocks. The second sale occurs at time t + τ. Differencing eqs. (13) for the two time periods, and assuming C and s are time-invariant, leads to:

The terms γt and γt + τ are readily estimated using a set of indicator variables showing both the original sale date and the second sale date.

HRY extended eq. (14) by adding an additional characteristic that is observed to change between sales: Nit -- the number of distressed properties near property i at time t. In our analysis, we add a second additional changing locational characteristic: the number of nearby investor-owned properties, Mit. The resulting model for the appreciation between two sales dates becomes:

With this specification, the impact of nearby foreclosures and investor-owned properties can be estimated using the OLS estimates of the parameters a and b. The definition of Nit and Mit is discussed in the Data Section.

Data

We use public records associated with real property transfers and tax assessment files from the City of Denver, Colorado. The current map of Denver is shown in Fig. 1.Footnote 28 It is important to note that our data is drawn exclusively from properties located within the city limits of Denver. As a result, our sample is likely to include older and more densely distributed housing units than would a sample drawn from the full metropolitan area, including suburbs.Footnote 29

We combine assessor records describing property characteristics with records describing deed transfers associated with Denver properties between 1986 and 2016.Footnote 30 Using the property address, we geocode each property and assign each property to its associated census tract. The full file includes 593,378 transaction records encompassing all property types and all deed transfer instrument types. We restrict our attention to transactions for single family residential properties (excluding 2–4 unit structures) where the transfer had been executed using a warranty deed. This reduces the sample to a total of 251,376 transactions. Because a single property can transact several times, the number of distinct underlying single family properties is approximately 100,000.

We utilize the raw data for several different purposes. First, we focus on estimating hedonic models for the negotiated sale price using the property characteristics as right hand side variables as well as the bargaining and demand variables. To create the bargaining factor (Dsell - Dbuy) and demand factor (Dsell + Dbuy) that we use in eq. (11), we identify each seller and buyer and determine whether each is an investor. The procedure we use to identify investors and non-investors is discussed in the section titled “Empirical Issues”.

Next, to conduct the contagion analysis by estimating eq. (15), we create a repeat sales sample. The repeat sales approach requires us to exclude all properties that transact only once. We also filter out repeat sales that have very short holding periods (i.e., flips) and those where the overall annual rate of price appreciation suggests significant unobserved changes in the property or data errors. The full description of the creation of this data set is provided in the section titled “Estimating Contagion Effects (below)” along with a comparison of the excluded homes relative to those that have repeat sales.

Results

Estimating Bargaining Power

The objective of this section is to estimate the bargaining power of investors as reflected in single family transaction prices in Denver, Colorado during the period from 1986 through 2016. We use the bargaining specification of Harding et al. (2003) described in eq. (11) above (repeated here for convenience):

We define Dsell to be an indicator variable that takes on the value of 1 if the seller in a given transaction is identified as an investor and zero otherwise. Dbuy is defined analogously. Thus (Dsell - Dbuy) takes on a value of 1 if an investor sells to a non-investor, −1 if a non-investor sells to an investor buyer and zero if both buyer and seller are investors or non-investors. A positive coefficient on this term suggests that investors sell at higher prices and buy at lower prices than non-investors. If the term is zero, the buyer and seller are deemed equal in this attribute and thus equal in bargaining power. The term (Dsell + Dbuy) controls for the demand effect and the correlation between unobserved attributes and the demographic characteristics in D. The demand factor takes on values of 0, 1, or 2 depending on the number of investors involved in the transaction.

As described in the data section, we begin with 251,376 single family residential transactions occurring between 1986 and 2017 executed via a warranty deed with reported characteristics. To make sure that we have a sufficient number of transactions in each calendar year, we restrict the sample to the years from 1986 through 2016. This eliminates eight hundred and thirty-six transactions (.32% of the total). The year 1986 has the smallest number of transactions in the resulting data set—3270. To eliminate non-arm’s length transactions, we exclude all transactions with reported prices less than or equal to $100. To minimize outlier effects, we filter out transactions with prices or assessed values greater than one million dollars. These filters eliminate approximately fifty-seven thousand transactions. We then filter for complete and reasonable information on the property characteristics such as lot size, number of bathrooms, bedrooms, house size, etc. For estimating the base bargaining effects, we chose to eliminate transactions on new and very old homes (greater than 100 years old).Footnote 31 We eliminate new home sales (defined as being sold in the year built or the year after the year built) because these transactions are almost always between a home builder and an individual and the purchaser is generally buying the right to at least partially customize the home interior and may receive certain guarantees from the builder/seller that do not apply to secondary market sales of homes. We choose to focus on secondary market transactions as more clearly reflecting the relative bargaining power of the parties to the transaction. These filters reduce the sample to approximately 163,000 transactions.

Finally, we filter out all transactions where the previous transaction for that property uses a sheriff’s deed, a deed in lieu of foreclosure or a public trustee deed because these are likely REO sales.Footnote 32 For similar reasons, we also eliminate all transactions where the seller is a mortgage company, bank, savings and loan association, the Federal Housing Administration, a Government Sponsored Enterprise (GSE) or similar entity. These REO type transactions likely entail special circumstances or distressed properties where normal bargaining and pricing do not take place. These final filters reduce our sample to 126,351 single family warranty deed transactions between the years of 1986 and 2016 where buyer and seller could freely negotiate terms on a normal property.Footnote 33

Table 1 provides summary statistics for the full sample (first two columns) as well as three subsamples. In the full sample, a transaction is flagged as involving an investor if a transacting party meets the criteria to be defined as either a professional investor or an individual investor - the broadest definition of investor. The top rows of the table summarize the major house characteristics. The lower portion provides information about the parties to the transactions. The three subsamples correspond to the different definitions of investors that we discussed above and reveal differences in the type of property in which the specified investor type invests. The two columns labelled Individual Investors are based on just those transactions where an individual investor was involved in the transaction as either a buyer or seller (or both). The columns labelled Professional Investors report statistics for just those transactions where a professional investor was involved as either a buyer or seller (or both). Note that if a transaction involves both an Individual Investor (e.g., as a buyer) and a Professional Investor (e.g., as a seller), it will be included in both subsamples so the sum of the observations in the subsamples exceeds the total number of transactions. Finally, the last two columns of the table describe the properties in transactions that do not involve an investor as either a buyer or a seller. These transactions have owner-occupiers as both buyer and seller.

The table shows that the average home size was 1318 square feet of finished living area above ground and 419 square feet in finished basement space. The average transacting home had 2.67 bedrooms and 2.11 bathrooms. The average home age is 54 years, even after excluding homes greater than 100 years old. Recall however, that we exclude all new home sales. The average price for the sample period is $234,593. Looking first to the Non-Investor subsample (columns 7 and 8), we see that homes involved in transactions between owner-occupiers are slightly bigger than the full sample average, have somewhat larger lots and are slightly younger. The average transaction price is $10,000 higher than the full sample average. Individual Investors (columns 3 and 4) are involved in transactions for smaller homes, smaller lotsFootnote 34 and properties with fewer bedrooms and bathrooms. The average sale price is $50,000 less than the average for transactions between Non-Investors. The characteristics of the homes that involve Professional Investors fall between those involving Individual Investors and those involving just owner-occupiers, but the average transaction price is the highest of the three subsamples.

Turning to the lower portion of the table, we confirm that we are excluding all transactions identified as likely REO sales and sales by financial institutions and government related entities. Below those items we first see a breakdown of investor involvement. Looking first at the full sample, the table reports that 28% of the full sample involve an investor seller and 13% involve an investor buyer. A portion of the difference in seller vs. buyer activity is due to the difficulty involved in using the address fields to flag individual investor buyers. However, excluding REO sales and financial institution sales also contributes to the difference. To the extent that investors tend to buy REO properties (either in auctions or individually) or are more comfortable buying from financial institutions and government agencies than are owner-occupiers, their participation in non-REO transactions are expected to be skewed toward the seller role. Despite the imbalance, we have roughly 16,000 transactions involving investor buyers – a number that is sufficient to estimate their effect on negotiated prices.

The next four rows of the table provide summary data describing the transactions. For example, in the full sample, we see that 9.82% of the transactions involve investors as both buyer and seller. (For the full sample, an “investor” is defined to include both Individual Investors and Professional Investors). The next three rows show that 68.75% of the transactions involve non-investors (owner-occupiers) as both buyer and seller, 18.37% of the transactions entail the sale of a property by an investor to a non-investor, and 3.05% entail a sale from an individual to an investor. The last two rows summarize the two bargaining power variables used in eq. (11). The positive “bargaining difference”, (Dsell - Dbuy), reflects the excess of investor sellers over investor buyers. The average “demand factor” (Dsell + Dbuy) of .41 reflects the fact that 21% (18.4% + 3.05%) of the transactions involve a single investor as either a buyer or seller (creating a demand factor equal to 1) and an additional 10% of the transactions involve investors as both buyer and seller (with a demand factor value of 2). As can be expected by the definitions of the subsamples, the breakdown for the subsample labelled Non-Investors shows that 100% of the transactions in the subsample involve non-investors as both buyer and seller. The different breakdowns of seller/buyer roles for Individual Investors and Professional Investors is partly attributable to the fact that the definition of Professional Investors is not affected by the role (i.e., buyer/seller) the entity plays, whereas for Individual Investors, we expect an underestimate of investor buyers for the portion identified based on address fields. This likely contributes to the higher percentage of investors buying from non-investors (31.45%) for the Professional Investors compared with Individual Investors buying from non-investors (6.50%). The data also provide evidence that Professional Investors are much less likely to resell to another Professional Investor than is the case for Individual Investors (6.86% vs. 32.00%).Footnote 35

Table 2 provides the results of estimating eq. (11) (without the log transformation of the dependent price variable)Footnote 36 using the different definitions of what constitutes an “investor”. In estimating eq. (11), the vector C of property characteristics includes the above ground finished living area, lot size, finished basement size, number of bathrooms and bedrooms and categorical variables describing the age of the property. In addition, to control for location and time effects, we include in each model a full set of census tract by year fixed effects. The estimated coefficients for the fixed effects are suppressed. We report estimates for the full sample period (1986–2016) and a shorter period restricted to the run-up before the housing crisis and the years that follow the crisis (2003–2016). The table reports all estimated parameters except for the fixed effects. The rightmost two columns (“All Investors”) report the most comprehensive results using the broadest definition of an investor— the one that includes both Individual Investors and Professional Investors. The top rows of the table provide the estimated coefficients for the property characteristics. The estimated coefficients are reasonable estimates of the associated shadow prices, consistent with previous literature (e.g., approximately $40,000 for a quarter acre lot and a price/square foot around $100).Footnote 37 In general, the full sample models and the restricted sample models provide similar results.Footnote 38

The last two rows of results in Table 2 report the coefficients on the bargaining and demand factors in eq. (11). Looking first at the results for all investors (the rightmost two columns), the estimated bargaining coefficient, b, on (Dsell - Dbuy) is positive and highly significant. The positive bargaining estimate implies that ceteris paribus, investors sell for higher prices and buy at lower prices when negotiating with a non-investor. This favorable bargaining result could be attributable to greater liquidity, greater experience, more specialized expertise or better market timing.Footnote 39 The estimated coefficient on the demand factor, (Dsell + Dbuy), is negative and significant. Under the assumption of demand symmetry (ii), the negative sign indicates that investors tend to be active in a lower valued segment of the housing market (after controlling for observed characteristics). There is a suggestion of this in Table 1 where we see investors buying and selling somewhat smaller and older homes. However, the model for the estimated demand coefficient controls for all observed housing characteristics and so the estimated demand effect is strictly attributable to unobserved characteristics (e.g., lower quality or poorer condition) or locational differences at a finer level than the census tract. Even if demand symmetry does not hold, the significant negative coefficient strongly suggests that investors are operating in a segment of the market characterized by lower-valued unobserved characteristics such as quality and condition because the weighted average of dbuy and dsell is negative.Footnote 40

The other two pairs of columns reflect the results of defining investors to be just those individuals flagged as investors (either by address or frequency of trading) or to those Professional Investors identified by name.Footnote 41 These two restricted models provide some insight into possible differences in the operating practices of Individual Investors and Professional Investors. We first note that the estimates for the attribute prices are quite similar. However, the estimated bargaining related coefficients are quite different. The positive bargaining effect and negative demand effect are larger in magnitude for the Professional Investors than they are for the combined definition of investor. At the same time, the bargaining estimate for Individual Investors is a small negative number and is only marginally significant in the post 2003 sample. The estimated demand coefficient is negative and significant for both types of investors but is markedly smaller in magnitude for Individual Investors than for Professional Investors.

Taken as a whole, the bargaining results suggest that most of the pricing-related bargaining power of investors reflected in the “All Investors” results is attributable to the Professional Investors. We find little evidence that Individual Investors pay markedly lower prices or sell at higher prices than do owner-occupiers. Under the assumption of demand symmetry, both types of investors tend to operate in a lower valued market segment (due to unobserved property and location characteristics) – but the differential is much stronger for the Professional Investors.

In a model with eq. (11) using natural log transforms for price and size characteristics, when focusing on the bargaining effects for “All Investors”, the bargaining effect is estimated to be in the range of 10% to 13%.Footnote 42 Again, the positive sign indicates bargaining power: i.e., selling at higher prices and buying at lower prices. The estimated demand effect for “All Investors” is in the range of −7% to −10%. The negative sign suggests that investors are working in a lower value segment of the market, after controlling for the known characteristics and census tract by year fixed effects. Reviewing the models using narrower definitions of investors, we find the estimated bargaining effect is essentially zero for Individual Investors and the estimated demand effect is on the order of −3% to −4%. In contrast, for Professional Investors, we observe an estimated bargaining effect of roughly 16% and a demand effect of −13%. These differences tell essentially the same story discussed above based on the regressions without log transforms.

To facilitate comparison of the various model results, Table 3 presents the twenty-four estimated bargaining and demand coefficients from the six models presented in Table 2 and six similar models in using a log transform of the dependent variable (identified in Table 3 as models 1–4). In addition, Table 3 presents the results of three robustness checks. Recall that in Models 1–4, we exclude all transactions deemed to be likely REO sales and sales by financial institutions. In the first robustness check (Model 5), we include both categories of transactions.Footnote 43 Many of these added transactions are the sales of recently foreclosed or distressed properties by a financial institution to an owner-occupier or investor. In Model 5 with the expanded sample, we include indicator variables identifying likely REO sales and sales by financial institutions as well as the full set of characteristics, fixed effects, and bargaining and demand related variables used in Models 1–4. For the robustness checks beginning with Model 5, we report only the bargaining and demand results for the full time period (1986–2016) without log transforms so the best comparison is with Model 1. The results are quite similar. The largest differences arise with the Professional Investors where we see a somewhat smaller bargaining effect and demand effect. This is likely because the REO sales and financial institution sales generally entail a motivated “professional” investor as seller and because such sellers have less bargaining power in those types of transactions.Footnote 44

The second robustness check (Model 6) includes new home sales transactions but excludes REO sales and financial institution sales. In estimating Model 6, the sellers of new homes are categorized as Professional Investors. Because we include the full time period and use nominal sales prices, the best comparison is with Model 1. As with Model 5, the Model 6 results for Individual Investors are essentially unchanged. The results for Professional Investors reflect larger bargaining and demand effects—but the signs are the same. We believe these results support the reasoning that led to the exclusion of new home sales in the first place. Negotiations for such sales are different than the back and forth negotiations typical in secondary market sales. Furthermore, buyers likely are willing to pay a premium for a house with features and finishes they have personally selected. We expect these tendencies would bias upward the estimated bargaining power of the builder. In Model 6, the results for the specification that pools all investor types are more affected by the inclusion of new homes than the similar bargaining and demand estimates in Model 5 which is consistent with the fact that there are more new home sales than there are REO and financial institution sales.

Finally, we report the bargaining effects estimated using real prices (expressed in 2016 dollars) as Model 7. Because dollar denominated coefficients in a model of real prices are not directly comparable to those of Model 1, we use the specification with log transforms and the best comparison is with Model 2. The results from Model 7 are nearly identical to those reported for Model 2.

In summary, our results lead us to four major conclusions:

-

1.

Investors have significant “bargaining power” – they sell for higher prices and buy at lower prices, ceteris paribus.

-

2.

Investors tend to transact properties with lower market values after controlling for observed property characteristics as well as location by year fixed effects.

-

3.

Individual Investors seem to behave differently from Professional Investors in that they have less bargaining power and deal with properties with unobserved characteristic values closer to the market average.

-

4.

The above results are not driven by our choices to exclude REO sales and new home sales.

Estimating Contagion Effects

Although there is a significant literature on distressed property contagion, there is relatively limited research on investor-owned property or rental property contagion. This type of contagion is the primary focus of the contagion aspect of our research, but we include the REO contagion effect as a control in our analysis because previous literature has shown its significance and to leave it out of the model would likely generate an omitted variable bias.

As described in the Methodology Section, we use a repeat sales approach to estimate the “contagion effect” of having nearby investor-owned properties when a property sells. We believe using a repeat sales approach is the best way to control for unobserved property and location characteristics. To the extent that the number of nearby investor-owned properties is correlated with unobserved property or location characteristics, a hedonic model which adds a measure of investor activity to the right hand side variables will generate biased estimates of the contagion effect.

The repeat sales approach is costly in that it discards transactions from homes that sell only once during the observation period. We are fortunate to have both a long sample period (1986–2016) and a large number of transactions. Nevertheless, we are sensitive to the potential criticism that the excluded transactions are fundamentally different than the repeat transactions. In our full sample, we have transactions from 99,817 different single family properties. 31,347 of those homes have only a single transaction.Footnote 45 We further filter out transaction pairs that have short holding periods, transaction prices less than $5000 or more than $1,000,000 or unusually low or high average annual holding period returns.Footnote 46 The resulting repeat sales sample includes 52,136 homes and 92,753 repeat sales pairs. Table 4 reports the frequency of repeat sales for this sample of homes. For example, 27,027 have exactly two transactions and thus provide a single repeat sales transaction; 14,603 homes have three transactions and thus provide two repeat sales observations. The maximum number of repeat sales observations from a single home over thirty years is nine.

Table 5 compares the property characteristics for the full sample of 99,817 homes to the 52,136 homes with at least one repeat sale and the 47,681 homes excluded either because they have only a single transaction or because of other characteristics of the sales. The repeat sales sample includes smaller and older homes with fewer bedrooms and bathrooms. The differences tend to be numerically small (< 100 square feet in finished area, < 700 square feet of lot size and approximately four years in age on a base of 47 yearsFootnote 47), but given the sample size, all (except the number of bathrooms) are statistically significant. In our opinion, the benefit of controlling for unobserved property and location differences outweighs these relatively small attribute differences.

Table 6 provides a different perspective on the data and the role of the different types of investors. In the repeat sales specification, the dependent variable is the log of the ratio of prices (ln(P1/P0)) and is reported to be 0.3337 for the full sample. This corresponds to an average change in price from first to second sale of 54.9%.Footnote 48 Using the time between sales as the holding period (measured in years), the total price appreciationFootnote 49 can be expressed as an annual rate of price appreciation – assuming annual compounding.Footnote 50 For example, looking at the full sample, given the roughly six year average holding period, the average annual rate of price appreciation per year (with annual compounding) is 7.73%..Footnote 51

Table 6 provides a breakdown of the full sample into repeat sales pairs where the original buyer is an Individual Investor, a Professional Investor or an owner occupier (non-investor). This breakdown enables us to look at the question of whether investors earn a higher rate of return from price appreciation than do owner-occupiers. Based on the bargaining results that show investors pay less when purchasing and sell for more when selling, we expect that the rate of return from price appreciation should be greater.Footnote 52 The numbers in Table 6 are consistent with this prediction: On average, Professional Investors earn an annual rate of return from price appreciation (exclusive of payments for maintenance and improvements) of 12.42% compared with 7.20% for owner-occupiers. Individual Investors earn an intermediate rate of return from price appreciation of 9.86%. Professional Investors hold the property for a markedly shorter time than owner–occupiers (3.4 years vs. 6.1 years). Again, Individual Investors have an intermediate holding period of 5.1 years.

The lower portion of Table 6 describes the locational variables Nit and Mit that are included in the estimation of eq. (15) (repeated here for convenience):

The table reports that in the full sample, the average number of REO properties is approximately 1 unit within a circle of 0.2 km (roughly 1/8th mile) at the original purchase and 1.63 at the time of resale. To provide perspective, there are an average of 88 single family residences in the same circumference and so the percentage of nearby properties that are in distress is about 1.1% at t0 and 1.9% at t1. The number of nearby investor-owned properties is significantly larger—approximately 13 properties (15%) at both t0 and t1.Footnote 53 As shown in eq. (15), the change in these counts is included in the repeat sales regression. The last two rows of Table 6 report these average changes—a small increase in nearby distressed properties and a small decrease in investor-owned properties.Footnote 54

There are differences in the counts of distressed properties and investor-owned properties when we sort by the type of original purchaser. Of note, Professional Investors buy properties with a substantially larger number of investor-owned properties in the immediate vicinity (21 vs 13) and a larger number of distressed properties (1.29 vs 1.05). This suggests that investors tend to cluster their purchases in areas with above average numbers of distressed properties and where other investors are active. Also of interest is that the number of distressed properties declines (compared with an overall average increase) on average during the shorter holding period of these investors and the number of nearby investor-owned properties falls sharply during the holding period. This suggests investors are buying in neighborhoods that improve during the holding period. Owner-occupier buyers tend to buy properties in neighborhoods characterized by near average numbers of distressed properties and investor-owned properties. As before, Individual Investors fall between these two subgroups.

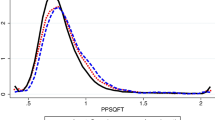

Figure 2 plots our estimated Denver price index from 1987 (the first year with Case-Shiller data) through 2016. The figure compares our estimated price index with the Denver indices published by the Federal Housing Finance Authority (FHFA) and S&P CoreLogic Case-Shiller. It is important to note that the two published indices are for the full Denver metropolitan area whereas our data is restricted to the City of Denver. Further, the FHFA and Case Shiller indices include transactions for condominiums and 2–4 unit structures as well as the detached single family homes that comprise our index. Also, of interest, the FHFA indexFootnote 55 is based on loans purchased by the GSEs (both purchase money loans and refinance loans where appraised value is used in lieu of the sale price). These loans are restricted in size because the GSEs are required to focus on low to moderate income purchasers. The S&P CoreLogic Case-Shiller index is based solely on reported sales transactions.Footnote 56 For these reasons, our index does not exactly mirror the published indices.

We plot two variations of our index: one that estimates just the price index without controls for changes in the number nearby distressed and investor-owned properties (i.e. excludes the two rightmost terms of eq. (15)) and one that includes those controls. The figure shows that both of our price indices exhibit the same general pattern over time as do the other price indicesFootnote 57 – namely a long gradual ramp up of prices from the 1990s to the early 2000s followed by a relatively modest (compared with other MSAs such as Miami, Phoenix or Las Vegas) decline in the late 2000s. The major difference is that our index reflects a more rapid recovery post 2010 than do the other indices. Overall, we believe the figure supports the belief that our repeat sales sample is generally representative of the local house price movements.

Table 7 presents the estimated coefficients on the change in nearby distressed properties (REO Effect) and the coefficient of the change in the number of nearby investor-owned properties (Investor Effect). The table also reports the average annual rate of house price appreciation from 1987 through 2016 as a summary of the plotted indices in Fig. 2. The table reports the results from four different model specifications. Models 1 and 2 exclude all repeat sales transactions where the sale at time 0 is deemed to be an REO sale (as was the case in the bargaining analysis). Models 3 and 4 include those 4483 extra REO related transactions. For each pair of model specifications, we estimate eq. (15) with and without the controls for nearby REO properties and nearby investor-owned properties. We first observe that the estimated REO Effect shows a negative contagion effect of approximately −1.3% in both Models 2 and 4. This order of magnitude is consistent with other credible published estimates.Footnote 58 The estimated effect from nearby investor-owned properties is approximately +.5% -- opposite in sign and roughly 40% of the magnitude of the REO Effect. It is unlikely that the favorable correlation between the number of nearby investor-owned properties and price is causal in the sense that people are willing to pay more for a property because there are nearby investor-owned properties. Rather, it seems likely that the relationship is related to the ability of investors to pick properties and locations that are more likely to outperform the overall market. Recall from the discussion above, that investors seem to pick properties located in neighborhoods where the number of distressed properties was declining rather than increasing. Also, it is important to keep in mind that we do not control for post purchase investment by either investors or owner-occupiers. If investors buy lower quality properties, it is likely that these investors spend more on maintenance and improvements. Li (2017) finds that investment in property improvements is also “contagious” in that if one owner in a neighborhood invests in property renovations and improvements, the likelihood that other nearby property owners will also invest in improvements increases. This mechanism likely helps explain the positive price effect reported in Table 7.

It is important to remember that our data is drawn from within the city limits of Denver where investor activity was not unusual. Consequently, our results may not be generalizable to suburban and rural areas – especially if there is a significant change in the level of investor activity in those areas. For example, if a neighborhood transitions from exclusively owner-occupied homes to one with a substantial number of rental properties, there might be an initial negative reaction on the part of potential buyers. Such a transition might be viewed as an additional risk. On the other hand, a neighborhood that moves from roughly 12% rental to 15% rental would likely be viewed as “stable” and as posing less uncertainty. Rosenthal (2018) shows that gradual transition from owner occupancy to rental is a natural part of the filtering process. Because our data is restricted to the City of Denver (with an average rental mix of 12–15%), preferences regarding changes in the neighborhood mix of ownership type are likely different than they would be if we were to study a new suburb which was undergoing a sharp increase in investor activity.

Discussion & Conclusions

In this paper, we focus on the role played by investors in the single family residential market of Denver, Colorado during the period from 1986 to 2016. We study two distinct aspects of investor activity. First, we study the question of whether investors are better bargainers when buying and selling single family residences. Second, we analyze the potential contagion effect of changes in the number of nearby investor-owned properties on the value of homes in the same neighborhood.

Because previous researchers have suggested that investors buy properties at a discount, we estimate the bargaining power of investors relative to owner-occupiers. To control for the potential bias of estimates that do not control for the possibility that investor choices of properties are endogenous, we apply the bargaining framework developed by Harding et al. (2003). We find that investors are strong bargainers relative to owner occupiers. Controlling for observed house characteristics as well as year by census tract fixed effects, investors pay less when acting as a buyer and sell for more when acting as a seller. Interestingly, we find that there is a significant difference between Professional Investors (corporations and partnerships) and smaller Individual Investors. The bargaining advantage of Professional Investors is far greater than that of Individual Investors – roughly 16% for Professional Investors compared with near zero for Individual Investors. We also find evidence that investors operate in a lower valued segment of the market—even after controlling for observed characteristics and year by census tract fixed effects. This finding suggests that investors are more likely to purchase lower quality, poorly maintained properties and that estimates of “investor discount” that do not control for this fact are likely biased.

We next investigate whether there is a negative spillover effect associated with an increase in the number of investor-owned properties in a neighborhood. To control for unobserved property characteristics, we use a repeat sales framework where we measure the change in the number of foreclosed properties and investor-owned properties between the two sales. Our results confirm previous findings of a significant negative externality associated with nearby foreclosed properties but also show that increased investor ownership in a neighborhood is associated with a small positive effect on nearby house prices. While it may seem counter-intuitive that increased ownership by investors who buy at a discount to market value is associated with a positive effect on nearby prices, we believe the explanation lies in the combination of the investors’ greater skill, experience and liquidity. It seems likely that investors (especially Professional Investors) have the skill and liquidity to select properties and neighborhoods ripe for improving values and have the liquidity to improve the purchased properties. As Li (2017) shows, these property improvements increase the likelihood that nearby homeowners will also invest in their properties.Footnote 59

In summary, our analysis demonstrates that investors negotiate favorable prices on lower quality homes and eventually sell the property at a relatively higher price. When acting as sellers, investors can be more “patient” and wait for the neighborhood to improve and for the proverbial “motivated” buyer than an owner-occupier who must move to take a new job or obtain a larger home for a larger family. Our results show that investor activity in a market may be stabilizing and beneficial—supplying liquidity in downturns and supply in upturns. It appears that in Denver, investor purchase activity absorbed excess supply while their sales provided additional stock of housing when demand for owner-occupied housing improved. In other words, greater investor activity helped smooth the Denver housing cycle.

Future work in this area is needed to better explore the role of maintenance and improvements made by investors after purchase. Our research was limited because we do not have data on such expenditures. Other research should be directed at determining whether the role played by investors in a market differs with the magnitude and phase of the market cycle. For example, our results are based on a market that did not experience an extreme “boom/bust” market. Under those conditions, we found investors played a stabilizing role. That role could be different in cities with markets that underwent more severe disruption. Further, it may be that the bargaining power of investors varies systematically over an economic cycle.

Our results provide valuable insights for future policy discussions about the extent of government support for homeownership. In particular, our evidence that investor activity can be favorable suggests that Federal housing policy should not overly favor homeownership.

Change history

03 July 2020

A Correction to this paper has been published: https://doi.org/10.1007/s11146-020-09780-7

Notes

Molloy and Zarutskie (2013) discusses the potential benefits and risks of investor involvement. On the positive side, the authors observe that investors deploy capital for the purchase and renovation of homes that might otherwise remain under-maintained and/or vacant. However, they also discuss a risk that investors could overestimate rental demand or underestimate the cost to renovate creating a local risk of increased vacancy.

Previous studies have variously defined investor-owned properties as those where the tax bill is sent to an address different from the property address or as properties owned by entities that have purchased multiple properties, or used a list corporate names that have declared themselves in the business of operating single family rental properties. We use a combination of all three methods.

The bargaining framework can only be used when it is possible to identify the nature of both buyers and sellers.

A less favorable explanation is that the positive pricing advantage results from investors taking advantage of distressed homeowners facing foreclosure and/or pressure to move and therefore buy for prices below market value. However, this does not explain the price advantage observed for investor sales.

The literature on the benefits of homeownership (See Coulson and Li 2013 for a summary) has contributed to a negative perception of renters and investors. The conventional explanation for this perception has been that renters under-invest in maintenance activities because they do not participate in the investment benefit and further may not stay long enough to enjoy the full consumption benefit. Further some have argued that investors are more likely to default because of lower default costs. See Henderson and Ioannides (1983), Wolfson (1985), Williams (1993), Ioannides and Rosenthal (1994), O’Sullivan (1996), and Haughwout et al. (2010).

See Frame (2010) for a review of related foreclosure contagion literature. Other recent foreclosure contagion papers include Li (2017). A relevant contribution of Li (2017) is the finding of a “contagion” type of effect for local capital investments. For example, Li (2017) finds than nearby homeowners are more likely to invest in major maintenance projects when they observe nearby owners investing in their property.

The term “rental discount” in Turnbull and van der Vlist (2017) and others refers to the common observation that rental properties generally sell at a discount to observationally equivalent owner-occupied properties.

To the extent that investors tend to deal with lower quality properties (as measured by characteristics not included in the regression model), if the “demand” effect is not controlled for in the model, the estimated bargaining discount is likely to be biased. Further, it is important to control for the characteristics of both the buyer and seller. For example, if investors are intrinsically better bargainers and an investor buyer negotiates with an owner-occupier seller, we expect to observe a larger negotiated “discount” than if an investor buyer negotiates with a similarly skilled investor seller.

As described by Cohen et al. (2012), Atlanta experienced a much larger run up in prices, as well as a much steeper “bust”, than Denver.

Another issue with using the tax authority mailing address is the common practice of mortgage lenders escrowing property tax payments. In most cases where taxes are escrowed, the tax bill is sent to the lending institution where the address will differ from the property address.

The discussion of potential errors associated with identifying investors by differences in address fields is intended to be generally descriptive and not any specific article. By restricting our attention to single family properties, we avoid the second error.

In addition, it is likely that at least one of the multiple purchases by an individual investor is for the purpose of occupancy. Thus, some owner-occupier purchases will be classified as investor purchases.

Mills et al. (2019) obtain their “master list” based on entities that “appear frequently in media reports on buy-to-rent activity or that follow a business model that is known to be the same as the rest of the buy-to-rent investors…”

We used the Mills et al. (2019) list of names but found that those firms accounted for a very small fraction of the Denver, CO transactions during our study period.

The most common terms that identify professional investors are “LLC”, “LLP” and “INC”. A complete list of the terms used to identify professional investors is available from the authors upon request.

This error type is mitigated in our data by the fact that we exclude new home sales so that almost all our transactions are a second or higher sale transaction for the property.

As noted before, Turnbull and van der Vlist (2017) use a set of indicator variables to capture the possible permutations of buyer and seller.

Ideally, one would control for other buyer and seller characteristics. For example, one could envision measuring the experience, education and liquidity of the buyer and seller. Unfortunately, our data do not enable us to use anything more than the identification of the buyer/seller as an investor or not.

The description of the bargaining model presented here is based on the more detailed development in Harding et al. (2003).

With deep, liquid markets, both buyer and seller can costlessly find an alternative property.

The situation is even more complex if one simply includes an indicator denoting the status of only the buyer or seller, as several previous authors have done. For example, if one tries to estimate an “investor discount” by including an indicator for the buyer being an investor without controlling for the seller characteristic, unless the buyer and seller variables are uncorrelated, the estimated coefficient will not be an efficient estimator of the sum of the effects.

We consider different definitions of investors: Professional Investors, Individual Investors and both definitions combined. As discussed in the Results Section, when estimating our bargaining models, we control for location and time using tract by year fixed effects.

Based on our own analysis and other published work, we have a strong prior that dbuy < 0. If investors make larger investments in improvements and upgrades (to unobserved characteristics) than do owner-occupiers, then dsell > dbuy -- and possibly positive if investors sell properties with more valuable unobserved characteristics than do owner-occupiers.

One exception is that the repeat sales model cannot control for the age of the property. As discussed in the Data section, the average age of homes in our sample is 54 years. It is possible that older homes require more maintenance than newer homes. Since we are unable to observe the maintenance expenditures associated with the homes in our sample, a correlation between age of the property and unobserved maintenance expenditures could reduce the precision of our contagion estimates. Nevertheless, we believe the repeat sales approach provides the best possible control for unobserved characteristics.

The modification incorporates the assumption that prices of all homes rise and fall due to overall market forces. The current level of market forces is represented by γt .