Abstract

This paper empirically investigates the risk factors of the property swap prices using 4 years of price data relative to the UK Investment Property Databank (IPD) Total Return All Property Swap. The implied forward rates are analyzed with a first difference model to determine its main components. Regarding the risk free rate, the traditional sport-forward relation does not hold for property derivatives. The impact of the risk free rate on forward rates appears as being complex and made of different effects; it varies according to time and maturities. Derivatives prices take into account the smoothing effect of the underlying index and REITs stocks are also relevant to explain these prices. The informational content of the swap is important. The impact of the REITs and of the smoothing decreases with maturities. The risk factor structure obtained is more complex than found in many other studies relative to commodities, securities or bonds. Possible reasons for this phenomenon are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Property derivatives provide access to a unique class of assetsFootnote 1 and allow for real estate trading in a liquid context for short-term horizons. They offer portfolio diversification at a low cost by taking a position on the overall market and not only on some properties. Specifically, property derivatives could improve diversification both domestically and internationally and facilitate arbitrage strategies across various markets. This is helpful for investors like medium portfolio managers for whom diversification is otherwise hardly within their reach. Tactically, they offer the opportunity to hedge and profit from a downturn in the property market. Furthermore, property derivatives may contribute to ease fluctuations in property prices since they convey information about the fundamental value of the underlying assets. This mechanism is more generally referred to as the price discovery function of the derivative market.

Banks, homeowners, and mutual funds also have considerable needs for property derivatives. Banks are exposed to real estate prices via credit mortgages and more generally, all the economy through securitization. Whereas Flavin and Yamashita (2002) explain that homeowners carry a too high amount of property risk to achieve optimal diversification, Syz et al. (2007) show that their risk exposure as their probability of default can be significantly decreased by adding property derivates to credit mortgages. Mutual funds are interested in property derivatives as they allow positive exposure to real estate prices, which can improve their diversification. Without derivatives they are reluctant to invest in real estate, a market which is less familiar and more complex than bonds or stocks. On the other hand, it is particularly interesting to remark that all listed companies are potentially more and more concerned by these financial products.Footnote 2 Property derivatives have the potential to become a dominant tool for providing solutions to such needs.

There are generally three forms of derivative transactions: futures/forwards, options, and swaps. In a broader sense, one could also add securitized products, housing loans and warranty agreements. They have been developed mainly in the UK and have appeared in the United States (US) in recent years. Although the UK market is today the most mature, it essentially remains an over the counter (OTC) market where the most liquid contract is the Total Return Swap (TRS) on Investment Property Databank Footnote 3 (IPD) indices. Since 2006, futures are listed on the Chicago Mercantile Exchange (CME)Footnote 4 and more recently on Eurex,Footnote 5 but the volumes stay lower. That said, the amount of data is now sufficient to investigate with IPD derivatives. To our knowledge, this paper represents the first attempt at an empirical investigation.

A 2006 survey of USA real estate investment managers and other likely participants in a derivatives market, conducted by the MIT Center for Real Estate, identified the lack of confidence in how the derivatives should be priced as one of the most important perceived barriers to the use of the derivatives. Such concerns are understandable because property derivatives products differ from traditional derivatives products, in that the underlying reference asset (the real estate index) cannot be traded in a cash or spot market. This complicates the pricing of property derivatives, as the basic Black-Scholes formula and the traditional futures-spot arbitrage do not hold. In these pricing methods, derivative prices do not depend on individual preferences, because any derivative is assumed to be perfectly replicable by an appropriate trading strategy in the underlying asset. In other words, it is based on a no-arbitrage argument and on the market completeness which do not allow market expectations and preferences to influence the price of the derivatives. Since that argument does not hold for property derivatives, different approaches need to be considered.

Theoretical researches explore these topics but they do not seem to be able to explain the observed price quotes. Moreover, no extant empirical research investigates the issues of property derivative prices. This paper aims to improve the knowledge about the factors that affect prices. We will consider risk free rate, level of smoothing for the underlying appraisal index, financial information embedded in the REITs stocks and some general economical elements. The study is realized for the time interval [2007; 2010]. Factors’ influence differs according to the period of observation and the forward maturities. The following section presents the IPD All property total return swaps, and then a literature review is developed. Section 4 introduces the transformation of the swaps quotes into the forward rates and it also presents the panel structure. Section 5 is devoted to the explanatory variables and to the various models that are considered. Section 6 discusses the empirical results, and Section 7 concludes.

Property Derivatives: The Case of ipd all Property Total Return Swaps

The Underlying Asset

Unlike the stock market, it is not possible for real estate derivatives to use one single physical asset as underlying. To do so, we use a real estate index as the primary asset to calculate the percentage change in property market prices in each consecutive period. The time intervals are chosen to be as short as possible and typically range from one month to a year. Two major types of property price indices are available: appraisal-based indices and transaction-based indices. Although transaction-based indices represent the market price better than appraisal-based indices, their constructions often suffer from a too small number of observed transactions. This point is particularly acute when it comes to write a derivative on this underlying index. Indeed, we need the index’s nominal level at each settlement date even if the market volume collapses. Otherwise, we would not be able to compute the payoff of the derivative.

There are a variety of appraisal-based indices from various providers. However, the IPD-indexes are well recognized among market practitioners and widely used for derivatives in Europe. Its equivalent on the US market would be the National Council of Real Estate Investment Fiduciaries (NCREIF). They provide three standardized measures of performance for each sector under consideration: total return, income return and capital return. All growth and index calculations are value weighted, meaning that “each property contributes to the result in proportion to its capital value and are compounded monthly to report industry standard time weighted measures for quarterly, biannual and longer periods” as defined by IPD. Considering the UK market, IPD has also developed a monthly all property total return index with coverage of 15 %Footnote 6 of the total professionally managed UK property investment market. This index is used as the monthly proxy of the annual IPD index.

The use of appraisal-based indices for property derivatives is not without consequence. They suffer from two major types of problems: noise and lag. Noise refers to random deviation between the index value and the actual market price. However, this problem should not be a real concern for indices with large market coverage. Lag gives index inertia and predictability. It causes the expected future returns of the index to differ from the equilibrium property market return expectations. The temporal lag in appraisal behavior is explained by the fact that appraisers use past transaction prices to make current estimates for property valuations. This “tyranny of past values” phenomenon also conducts the index to be a smoothed indicator, in the sense that it underestimates the true level of volatility. Noise and lag reduce the value of appraisal based indexes for targeted investment purpose and benchmarking; they could also constitute an obstacle to the growth of real estate derivative markets. Because the index is non-tradable and cannot be perfectly replicated, the classic arbitrage mechanisms does not necessarily apply. The differences between the index and the underlying property market it tracks must be accounted for in the equilibrium price of the derivatives.

The mismatch of real estate indices has been explored in various studies, e.g. Firstenberg et al. (1988); Quan and Quigley (1989, 1991) and Geltner (1991, 1993). Lag causes indices to have different risk characteristics than the average property tracked by indices; as indicated it implies a smoothing of the true market volatility and a dampening of apparent correlation with other financial assets. Usually a first-order autoregressive model is a reasonable model to evaluate appraisers' behaviors and capture smoothing phenomenon.

The Contract

Parties in a UK property return swap trade an annual IPD real estate total return index for an interest rate. Since 2006, there has been a shift towards a simplified annual contract with fixed interest rate. At the beginning of the contract, the purchaser of real estate risk agrees to pay a fixed price each year for the duration of the contract, usually between 1 and 5 years, based on a notional contract size (e.g., £10 m). In exchange, the buyer receives the annual total return of the relevant real estate index.

For UK All Property trades, the relevant index is the IPD Annual All Property Index. As this index is published at the end of February of the following year, annual cash flow payment for swap trades are settled at beginning of March. Although swaps can be structured and tailored to suit the needs of an individual investor (as they are OTC instruments), we focus on the conventional form: the IPD Annual UK All Property Swap based with a fixed-rate.

Their prices quote the fixed-rate leg over calendar years, regardless of when the trade was actually executed. The price of the fixed-rate leg will change over the year, taking into account the performance of the IPD Monthly considered as a reliable estimator of the IPD annual.

However, a basis risk has to be mentioned. As indicated above, it is mainly the Property Unit Trusts that face a legal obligation of monthly appraisals. Consequently, it may happen that the properties used to calculate the monthly index are not perfectly representative of those used for the annual index and that they may follow a partially specific price dynamic. But we also must recognize that hedging users of the swaps are generally in a situation in which the properties they intend to hedge are not strictly mirrored by the underlying IPD index. In all the cases, motivation is not perfect replication but rather macro-hedging. Thus, we may consider that there is a replication (basis) risk premium included in the swap prices. From an informational and efficiency point of view, it also means that month by month the swaps improve their forecasts of the index using the best available information, which includes the monthly index, and also the quarterly index. At the end of the year, when the annual index is published, the informational set can be adjusted.

Time Period of Observation

The observation period ranges from 31/12/2006 to 31/12/2010. In that period the swap market appears as being active: the total outstanding notional is around 8 000 £m and the notional of trades executed each quarter is around 1 000 £m, with two peaks for Q1 2007 and Q1 2008 (cf. Figure 1). Two other points deserve to be noted regarding the interval of time. First, in that period the market was a pure OTC. Thereafter, it evolved and transactions are now registered on the Eurex platform. But even now we cannot consider that it is a pure and standardized market because most of the deals are negotiated OTC and then simply dropped on the Eurex. However, we may consider that this evolution decreased the counterparty risk and improved the transparency.

Second, the economic environment during that period is a very complicated one, with subprime crisis and its consequences on the banking system (it may explain the peaks we observe for Q1 2007 and Q1 2008). But this very uncertain environment could be regarded as a positive factor for the IPD swap market and for the present article because of the needs of hedging and reallocations during that difficult period (the spot index decreased approximately by 30 % from June 2007 to June 2009). We also have to note that the classical notion of risk-free rate could be interrogated in such a context. Before mid-2009 it stayed at a usual level and varied between 5 % and 1 %. But after that date it falls close to 0 %, thus we should understand this rate more as a return free risk, or maybe simply a reference rate. The study period will be divided in two in Section 6 in order to study how the drivers of the forward rates change between these two different sub-periods.

Literature Review

The Replication Issue

Contemporary financial pricing models are based on an arbitrage-free efficient market model where the price reflects the ability to create a self-financing arbitrage portfolio. Björk and Clapham (2002); Patel and Pereira (2007) who have extended the model of Buttimer et al. (1997) use the assumptions that the real estate index process can be treated as the price process of a traded asset with a certain associated dividend (income) process and in continuous time to assess property derivatives. They obtain the same results as in more traditional markets such as stock markets: the buyer of a swap has to pay the risk free rate in exchange for the real estate return, and any forwards follow the well known futures-spot parity theorem.

However these results do not explain the historical spread (fixed-rate minus LIBOR) for real estate total swaps which has been large, hundreds of basis points. Their assumptions are overly simplistic in the case of derivatives, where the underlying asset is a non-tradable asset, such as the UK IPD All Properties. The strength of the traditional arbitrage mechanisms operating on the market depends on the ease of buying and short selling a replicating portfolio. However, direct properties cannot be traded continuously and instantly at the prevailing spot in order to replicate the underlying index. As explained by Syz (2008), real estate transactions are charaterized by high transaction costs (the in and out cost is between 5 % and 7 %), slow transaction process, illiquidity, and the absence of short selling. This is a non-exhaustive list of the difficulty to replicate real estate index by trading direct property. Arbitrage traders will also face, e.g., the vacancy rate or the reinvestment of the intermediary cash flows.

In the case where the seller of the derivative has already a property portfolio, it will not perfectly replicate the IPD index. A perfect real estate diversification in the sense of Markowitz is unrealistic and necessarily uses a lot of capital that is not acceptable in self-financing traditional arbitrage strategies. Moreover, even if the property ownership has a truly diversified portfolio, the dynamic of the real estate index will not entirely match because of the noise and lag effects. Bertus et al. (2008) also show, using 23 years of data, that replicating real estate index with existing futures contracts would be largely ineffective for the U.S. as a whole: they find an R-square between 9 % and 20 % according to the index analyzed. Considering listed real estate vehicles, as Real Estate Investment Trusts (REITs), Lee et al. (2007) reveal an existing but limited connection with the Russell-NCREIF index. According to Glascock et al. (2000), REITs behave more like stocks after 1992 although equity REITs are cointegrated with private real estate during their entire sample period.

The use of an untradable underlying asset which is particularly difficult to replicate explains why market participants identified the lack of confidence in how the derivatives should be priced as one of the most important perceived barriers to the use of the derivatives.

Theoretical Arbitrage Considerations to Price Swaps and Forwards

Swaps are essentially just a series of forward contracts stitched together and agreed upon all at once up front; understanding forward prices is an appropriate approach to analyze the swap prices. Geltner and Fisher (2007) define the equilibrium forward prices as Eq. 1.

where,

- IPD(t, T) :

-

forward price agreed upon at time t to be paid a time T.

- E t [IPD T ] :

-

the expectation as of time t of the future index price (value) at time T

- IPD(π) t , T :

-

market equilibrium-required ex ante risk premium in the index total.

The term E t [IPD T ] allows forward prices to reflect any predictability or forecast relative to an appraisal-based index, here, the IPD index. At equilibrium, they should theoretically correct the lack of efficiency associated to their underlying assets. Moreover, this formula does not contradict the future spot parity theorem. Indeed, if the IPD index was tradable and efficient, Eq. 2 would be verified and then we should recover the well known relation.

where rf t , T is the risk free rate at date t for the maturity T.

Regarding the fixed rate of the swaps Geltner and Fisher (2007) defined a theoretical model conforms to the price implied by Eq. 1. They identify the existence of a feasibly trading window summarized in Eq. 3.

where,

- rf :

-

is the riskless interest rate.

- L :

-

consists on the difference between the index and the property equilibrium risk premia plus the momentum effect.

- α :

-

corresponds to the alpha expected by short parties from their covering portfolio (additional expected premium for a given strategy)

- B (b):

-

reflects the private expectation of the long (short) side to reflect his relatively bullish (bearish) outlook, we can assume that B (b) is positive (negative).

- FR :

-

represents fix rate of the swap.

Notice that the terms rf + L are common to both sides of the condition state in Eq. 3. Thus if both parties have neutral expectations about the market, and the short party expects no alpha from their covering property portfolio (B = b= α = 0), then the only feasible trading price, Eq 4, is a single point which includes the index lag effect, L.

In Eq. 4, the meaning of price changes in the swap market at the equilibrium has only two components, a change in interest rates and a change in the index lag effect. However these theoretical results are not sufficient to explain the observed fix rate on the market; Eq. 1 which is the primary element of the swap prices has to be revisited. Lizieri et al. (2010), extend these research by introducing other frictions (partly quoted by, Geltner and Fisher (2007)) which conduct to define an arbitrage trading window around the equilibrium forward price mainly explained by the transaction cost (round trip costs around 7.7 %), the transaction time (search process could easily take 6 months) relative to the transaction on the direct properties and by the difficulty to short sell real estate. However, in this pricing consideration, the interest rates stay the most important component around which the window will be built. This ability to buy real estate to tradeoff property derivatives could be objectionable and could involve many problems; for example, the payment of the capital growth (do we have to sell a part of the building?), the management of vacancy risk and the minimum portfolio amount to get an optimal spatial and a sectorial diversification.

Market Pricing Within a no-Arbitrage Band

For all these reasons, prices defined by Eq. 1 are difficult to trade-off and can move away from their equilibrium. If there is no strength to assure this relation, price will only be a result of a mechanism of supply and demand. Syz (2008) conjectures that inside the arbitrage bands defined by the price of the underlying and of the market frictions, the expectations of market participants drive derivative prices. By defining LB as the lower bound and UB as the upper bound and ME as the market expected future spot price we might hypothesis that forward prices have the following dynamic:

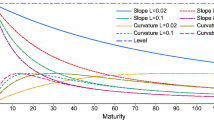

Figure 2 is a pure theoretical example representative of Eq. 5: the forward price of maturity T-t (i months for exemple), the red dotted curve, follows the market expectation (the light blue curve) but remained between the upper and the lower bound (the grey lines) themselves built around the unsmoothed appraisal based index (the green curve) which is a function of the appraisal based index (the blue curve).

Theoretical forward price dynamic over time. This figure is a theoretical example of Eq. 5 representative of the forward price dynamic. The forward price of maturity x months at date t, F(t,t + x), corresponds to the red dotted curve and follows the market expectation of the underlying index (the light blue curve) but remains within the upper and the lower bound (the grey lines). These bound are built around the unsmoothed index (the green curve) computed via the observed level of the appraisal-based index (the smooth blue curve) and result from market imperfections

In Eq. 5, only if prices are outside the fluctuation band, arbitrage can be achieved using physical properties or other vehicles. In case where many holders of physical properties want to hedge themselves by taking a short position via derivatives, the property spread can become negative. This analysis gels with the market practitionners point of view; the Investment Property Forum Footnote 7 (IPF) says “In the property derivatives market, underlying indices such as those published by IPD are not investable (or if an investor attempted to recreate an IPD index it would take a considerable length of time and cost). As a result, pricing is determined primarily by investor expectations of returns […] Investors should be aware that, in its short history, the derivatives market in the UK has been more accurate in forecasting market returns than most market commentators and forecasters!”.

At this point, the true issue is to know how big the fluctuation band is. Indeed, the bigger is the fluctuation band and more often prices will be driven by market expectations. Under the realistic assumption that short selling is impossible for direct properties, the lower bound will be potentially non-existing and then the band will be very significant and asymmetrical.Footnote 8 It is difficult to determine the exhaustive list of all the parameters susceptible to impact the superior border of the trading window. Moreover, for most of them, their precise impact is indeterminable: we can only assess their signs. The main parameters are the risk free rate, the transaction cost (round trip costs around 7.7 %), the basis risk,Footnote 9 and the liquidity risk (which could be associated to the basis risk). The basis risk will be mainly explained by the smoothing effect of the transaction based index, by the transaction time (search process could easily take 6 months for transactions on real estate) and by the low liquidity in real estate. The basis risk conducts to an imperfect hedge and then, as any risk, implies a higher spread (risk premium). We can also underline some important problems which should spread out the trading window by making the risk neutral portfolio more complex and then more expensive to implement. Indeed, most swaps are relative to the total return. The seller of the swap has to pay this return every year but earns the rents every month or every quarter: the seller has to invest again all the intermediary cash flow at the real estate yield. Moreover, the seller may have to sell a part of his property to pay the capital growth. In fact, if we are a seller able to create a real estate portfolio matching perfectly the IPD index (which seems impossible), it is still difficult to pay the real estate total return. In the case where the seller uses other vehicles to tradeoff derivative contracts, we can hypothesis that the fluctuation band will remain non negligeable because of a sharply rise of the risk basis.

The theoretical framework of the arbitrage theory is not verified for property derivatives. Syz (2008) claims that they must remain within an arbitrage band, but given the many imperfections in the real estate market we have reasons to believe that it is very broad and probably unbalanced.

Computing and Analyzing the IPD Forward Rates

As swaps are essentially a series of forward contracts pieced together and agreed upon up front, we will analyze these forwards rather that the swap directly. It would not be easy to conduct the same analysis on the swap directly. The strike variation of a forward is much more simple to interpret (there is only one cash flow) than the fixed quote of a swap relative to different maturities cash flows. This building-block approach allows isolating market phenomenon related to a given date – for instance, a specific year, for which there will be a lot of closed-end funds that will reach maturity, will have to liquidate their assets and to increase in such a way the supply. It is also interesting to study the market behavior for a given maturity – some elements in Drouhin and Simon (2014) suggest that the dynamics for maturities at less than 2 years are different than the dynamics with greater maturity.

For each month of our dataset, we will compute the implied IPD forwards from the IPD swap quotes using the methodology presented in Drouhin and Simon (2011). This article presents the formal link between the YYREIS (Year on Year Real Estate Indexed Swap), the ZCREIS (Zero Coupon Real Estate Indexed Swap) and a real estate indexed forward. The ZCREIS is a function of the forward. The YYREIS can be stripped in ZCREIS and consequently it can be decomposed in forwards too. For the pricing stage a problem occurs, namely the difficulty to reinvest the periodic cash flow at the correct real estate rate. Mathematically speaking, it produces a convexity problem. In Drouhin and Simon (2014), the magnitude of the error when ignoring this problem is estimated and discussed. It appears as a second-order problem, and the approximation is acceptable. On that basis, a recursive procedure is possible, and it allows for computing the forward rates from the IPD swap quotes.

This method was already employed in Drouhin and Simon (2014) with the same database. In this article a comparison was realized between the IPD index, the IPD index unsmoothed, a REITs index and the forward rates of different maturities. The first four moments for these series were compared, correlations and temporal auto-correlations were discussed, segmented behaviors for forwards were studied and causality issues between the series were considered. The results of this article are that the forwards have a very strong informational content, and they appear as very performant in terms of price discovery function. In Drouhin and Simon (2014) a comparative point of view was retained—that is, comparisons with various other real estate market indicators. The present article instead focuses on a factorial and intrinsic approach. What are the main drivers of the forward rates?

Swap and Forward Data for the Panel Approach

IPD Swaps

This data set is constituted by the quotes of the UK IPD all property total returns swaps Footnote 10 from the 31/12/2006 to the 31/12/2010. It is a daily database but numerous daily data are missing. Swaps in this database have a fixed interest rate. The maturities are all December and they go from December 2007 to December 2015. The maximum duration of a swap contract is 5 years. For more details about these quotes, the reader can refers to Appendix 2. The quotes attributed for each beginning of the month are relative to the 10th working day. It corresponds to the publication of the UK IPD monthly all property. If the IPD swaps quotes are not available on the 10th working day we will use the quotes just before. We do not use linear interpolation because this kind of approximation integrates information not available on the day required. We use the quotes of the IPD swaps the days when are published the index.

Using these quotes and the risk free rate for which the maturity are available on Datastream from 1 month to more than 5 years, we compute the IPD forward at each date using the methodology introduced by Drouhin and Simon (2011). In this way, we obtain the IPD forward quotes (the strike) for each month of our study period. IPD forward are on absolute level and comparable to the IPD spot. The IPD Monthly and the IPD Annual have been provided by the Investment Property Databank (IPD). Using these results we are able to construct the implied IPD forward curve up to maturity 5 years and this for all the dates between 31/12/2006 and 31/12/2010. The maturity 0 year corresponds to the IPD spot.

Implied IPD Forward Curves and Implied IPD Forward Rates

Because the swap maturities are relative to the 31 December of each year from 2007 to 2015, the maturities available for the implied IPD forwards are also relative to the 31 December of each year from 2007 to 2015. For each month t in the studied period [Dec 2006; Dec. 2010], using Drouhin and Simon (2011) methodology we are able to compute the forward price for the five following maturities available (the five next December months). For example, for t = October 31, 2007 we have the forwards of maturity 2, 14, 26, 38 and 50 months. And for t = Jun 31, 2007 we have the forwards of maturity 6, 18, 30, 42 and 54 months (respectively associated with the maturities DEC2007, DEC 2008, DEC 2009, DEC 2010 and DEC2011). Thus we are now able to compute our endogenous variable, the implied forward rates, where T corresponds to one of the five next December months:

Their analysis is very informative. For example, in 2008, the worse the crisis is and the higher the backwardationFootnote 11 becomes. Indeed, the 12 months IPD forward was 16 % below the IPD spot; at this date, the IPD forward becomes positive only for the maturity higher than 48 months. The stronger backwardation appears at the end of February 2009: the quote of the IPD forward of maturity 8 months was equal to −20.9 %. The forward rates seem reflect the economic context (contango or backward situation) and forecast the IPD index. For more details about the statistical characteristic of the real estate forward curve refer to Drouhin and Simon (2014).

Panel Structure

Summing up, the preparation process of the forward data is as follows. The IPD swaps in our database are quoted as a fixed rate over calendar year. Using these quotes, we compute the IPD forward curve for each date t, which reflects the forward prices for the different maturities available (the five next December months). As forwards are the primary elements of swaps, by identifying their risk factors we deduct those of the IPD swaps. Using these forwards we adopt a panel data approach in first difference where observations are repeated in the same cross section (typically the forward for different maturities) and observed for several time periods. We use a large cross section (maturities from 1 to 60 months) from 2007 to 2010, rather than a long panel such as a small cross section observed for many times periods. A major advantage of panel data is to increase confidence in estimation.

More precisely, each IPD forward, IPD(t,T) is associated with an “individual” according to its residual maturity. The residual maturity is defined as the number of months i between the date t and the fixed December maturity of the contract, T. Therefore, we have the individual 1 month residual maturity (i = 1), the individual 2 months residual maturity (i = 2) and so on until 60 (i = 60). For each individual, we will have 4 observations, one in 2007, one in 2008, one in 2009, and one in 2010. Using the subscript i, we can rewrite IPD(t,T) as IPD(t,i), i.e., as the IPD forward of residual maturity i months at date t. It is important to understand the distinction between the fixed maturity T, which is a date, a month, and the residual maturity i, which is a number of months between 1 and 60.

Figure 3 explains more precisely how the “individuals” 1 and 10 corresponding respectively to the forward of residual maturity 1 and 10 months are recorded. The first observation for the individual 10 is done in February 2007 (FEB 2007), 10 months before the expiration date of the IPD forward DEC 2007 (December 2007). The second observation is realized in February 2008 (FEB 2007), 10 months before the expiration date of the IPD forward DEC 2008 (December 2008). Thus, we get four observations for each of our forwards of residual maturity i; one for each year from 2007 to 2010.

Example for individuals 1 and 10 months. We observe across time from December 2006 (DEC 2006) to December 2008 (DEC 2008) the individual i (with i equal to one and ten) corresponding to the forward of residual maturity i-months. The residual maturity is defined as the difference in number of months between the quotation date of the contract t and its fixed maturity T. Every contract has a fixed December maturity T. Therefore, the first observation (Observation n = 1) of the individual i = 10, i.e., of the forward of residual maturity 10 months is in February 2007 (FEB 2007); the second in February 2008 (FEB 2008). The same for the individual i = 1

Forward Rates and First Difference Model

Each IPD forward of residual maturity i at date t, IPD(t, i), can be written as:

where c0 , i is a constant term, εt , i an error term, IPDt the observed IPD montly at the date t. x1 … xn are the unknown risk factors and c1 … cn the associated coefficients. According to the value of the exponential term compared to 1, it indicates if we are in a backwardation or a contango situation. It is possible to compute at date t what we define as the forward rate K ,t , i :

By dividing the left and the right hand sides by i/12, which corresponds to the maturity expressed in number of years, we obtain the monthly implied forward rate:

Finally, we compute the first-differences estimator. It measures the association between individual-specific one-period changes in regressors and individual-specific one-period changes in the dependent variable. The first differences estimator yields consistent estimates of cj in the fixed-effect model, though the coefficients of time-invariant regressors are not identified.

where dK t , i is the variation of the forward rate of residual maturity i between the month t and the previous forward rate of maturity i available, at t minus 12 months. By determining the variables that impact dK t , i , i.e., the xj , t in first difference for which the cj coefficients are significant, we will be able to isolate the risk factors relative to the IPD forwards and by extension to the IPD swaps. These risk factors are variables for which a change involves a change of the property derivatives.

Equations Specification and Exogenous Variables

Equations Specifications

In our study, and according to section 3 relative to the literature review, four main specifications with various risk factors are tested.

Basic Arbitrage Model

The first one, Eq. 10,Footnote 12 lays on the traditional theory of arbitrage or in other words on the ability to create a self financing portfolio of real estate to trade of property derivatives.

This mechanism should imply a forward rate equal to the risk free rate of the forward maturity considered. Therefore, the first variable included will be Rf t , i , the risk free rate at date t for the maturity i. However, some effects in the case where the traditional future-spot relation does not hold (see Section 3.2) or where the impact of the risk free rate as the key parameter of a self financing portfolio becomes negligible might potentially involve a negative relation. Its understanding lays on a potential difference of efficiency in the sense of Fama (1970) between real estate indices and property derivatives.

The value of an asset is equal to the sum of its cash-flows generated and discounted at appropriate rates. If real estate appraisals were valued accordingly, prices should be strongly related to the risk free rate. However, Hartzell et al. (1987) show that interest rates have surprisingly little impact on the cap rates because appraisers seem to place more faith in comparable sales than in their own discounted cash flow (DCF) analysis. In fact, they mainly use the capitalization appraisal method in which the capitalization rate is computed via the comparable one. The direct consequence is that new information (an increase/decrease of the interest rate in our case) is progressively and not instantaneously integrated in prices. Clayton et al. (2001) analyze how appraisers use the transaction price data available to them and show that appraisers, exploit 6.86 comparable sales in average, to estimate the overall capitalization rate (used in the capitalization appraisal method). Even if the number of comparables is relatively small, the consequences should be limited if the average number of months between the appraisal date and the comparable sales was not 13.68 months. It results in the use of outdated information. The maximum lag across time observed in their sample is higher than 25 months and rises up to 35 months. The out of date information used in appraisals explains that new information will take time to be reflected in prices and thus that real estate indices are not efficient in the weak sense of Fama (1970). Moreover, even if appraisers use current transaction prices, these prices would not include current information. Indeed, as real estate operations take time, the capitalization rate observed generally reflect a price defined few months before. Therefore negative (positive) variation of the interest rate could involves a positive (negative) variation of the IPD forward to reflect the current price information not included in the IPD index. Mathematically, this risk free rate influence corresponds to its effect on E t [IPD T ] in Eq. 2. We may possibly also discuss a potential ability difference between appraisers and market practitioners to incorporate to the appraisals/prices the information set relative to the dynamic of the risk free rate (strongly autocorrelated).

For the reason stated above and in subsection 3.2, we do not exactly know if the risk free rate has a negative or a positive impact on the forward prices. The end result should depend of the relative size of each contrary influence on the forward prices. The first effect is relative to the difference (Eq. 11) between the observed forward price logarithm and the “true” price of the IPD index in logarithm (defined in Eq. 2) explained by the risk free rate.

The second effect is relative to the difference (Eq. 12) between the IPD spot logarithm (the observed one) and the “true” price of the IPD index in logarithm (priced by the market thanks to the implied forward price) explained by the risk free rate.

In the case where effect 1 is higher than effect 2, we should observe a positive impact of the risk free rate on the forward prices. On the contrary, if effect 2 is higher than effect 1 we should observe a negative impact of the risk free rate on the forward prices. A significant positive or negative value in Eq. 12 would be very informative for the market and would contribute to the well known price discovery function of future market. In this condition, IPD forward would be a better predictor (the information set included in prices is broader) of the future IPD index than the IPD index himself. However, if this was verified we should thought that other informative indicators could be significant for property derivative prices because there are not or are differently integrated to the underlying.

Basic Arbitrage Model with lag Effect

As stated in Section 3, Lizieri et al. (2010) explain that a gap between the theoretical quotes (the risk free rate) and the observed ones could be explained by the predictability of the appraisal based index strongly autocorrelated (see Eq. 13). If the smoothing effect was not taken into account by forward prices then, ceteris paribus, prices would differ from their equilibrium values and thus offer abnormal returns. To investigate this possibility, we use the variable “ AR t , i ” (Auto Regressive) which is equal to the forecast of the IPD log return between the quotation date, date t, and the contract maturity (i month after the date t) using an AR(1) model. In the literature it is commonly considered that appraisal based indexes follow an AR(1) process. One may refer to Langenbach (2009) or Marcato and Key (2007) for a more general discussion about the choice of the model and the issue of the temporal variations of the smoothing effect. Adding this variable to the risk free rate, we define Eq. 13, the second specification.

where ε i , t is an error term. According to the literature, we expect a positive sign for the AR variable in first difference. The higher the forecast return is, the higher the forward rate should be (see Geltner and Fisher (2007)). This amounts to try to explain a potential positive or negative difference in Eq. 12 by the predictability of the index.

Adding Mean_premium

In a third specification, we explore the occurrence of disseminated information in forward prices relative to Real Estate Investment Trust (REIT) market. As REITs are tradable on the stock market, their prices result from an observable mechanism of supply and demand which efficiently incorporates more information than appraisal based index. Consequences are notably a high degree of liquidity and a low autocorrelation of the returns (see Drouhin and Simon (2014)). On this intuition we thought about an adapted manner to integrate the potential supplement of information included in REITs relatively to the appraisal-based index. We retain a variable relative to the premium/discount on their assets. This variable is computed using balance sheets and the unadjusted prices of the 8 main REITs in UK market. Its relevance is particularly strong due to the requirement for REITs to use IFRS standard and then reassess (at fair value) their own assets using real estate appraisers. The corollary of this method is that any premium denotes an assessment of the equity at its market value higher than its book value (in fair value) and therefore that market practitioner point of views are different than the appraiser ones. This difference might partly explain why it is so difficult to establish a link between real estate index and REITs. However it could also be explained by a divergence in term of price dynamic between direct properties and REITs often associated to the stock market (Mull and Soenen (1997); Clayton and MacKinnon (2001) and Benjamin et al. (2001)). The difference of real estate pricing or/and of information set between appraisers and market practitioners should be reflected in IPD forwards contracts based on appraisal index but traded by market practitioners.

The premium variable could be considered as a way to reflect the impact of market practitioner expectations in excess of the appraiser ones (the IPD index). If there was no difference, forward prices would not be explained by our premium variable and at the contrary if there is one, we expect a positive sign related to it, in first differences. Indeed, if the forward rate reflects the market expectations, the higher they are and the higher the forward rate should be to avoid abnormal returns (relative to the predictability of the IPD index). Adding the Mean_premium variable (corresponding to the premium/discount observed) to the specification 2 we get the specification 3 below where ε i , t is an error term.

Adding Macroeconomic Variables

In a fourth specification we include macroeconomic variables to analyze their impact on the forward price. One time again, their impacts should reflect different pricing considerations between appraisers and market practitioners and especially a response time to a change in the information set potentially shorter for market practitioners. The variables are Eco_1, Eco_5 and CPI in first difference. Eco_1 and Eco_5 are dummy variables based on the unemployment rate and on the GDP growth. If the economic context is positive, Eco_1 is equal to 1 and 0 otherwise. On the contrary, if the economic context is bad, Eco_5 is equal to 1 and 0 otherwise. We expect a positive sign for Eco_1 and a negative one for Eco_5. Indeed, if the forward rate reflects the market expectations and if market practitioners have a lower response time, a good (a bad) economic context should imply a higher (a lower) forward rate. Concerning the CPI which is the monthly year on year (YOY) inflation rate we expect in first difference a positive coefficient. Indeed, real estate is generally considered as strongly correlated to inflation and then, the higher the inflation rate is the higher the real estate expectation should be. More details will be given to these three variables in the next section relative to the presentation of the data. They control also in our regressions for the economic context. It let us develop a more general framework than the one including only dummy variables equal to 1 if the forward year was 2007 (for example) and 0 otherwise. The fourth specification is defined as:

Link Between Exogenous Variables and Theoretical Elements

The theoretical relation (3) relative to the forward rates is an inequality. It suggests that the various elements of the lower and the upper boundaries could impact the forward rates. The first component is the risk-free rate, which is included directly in our model. In paragraphs 3.2 and 3.3 we discussed how the lag effect could impact the derivatives prices, which mainly depends on the appraisers’ behaviour. We use the variable AR as a proxy of L; it is a time-varying measure of the lag power. In the theoretical inequality the interval [−b, B] represents the possible range of the expected premiums for the real estate market. We use the variables CPI, Eco_1 and Eco_5 as proxies. At last, the variable Mean_premium is used as an approximation of α. It is a measure of the additional return investors are expecting when they invest in the REITs. In other words, it indicates the difference between market consensus (represented by the appraisers) and expectations for specific strategies implemented by agents who try to beat the market (the REITs).

Exogenous Variables and Descriptive Statistics

The risk free rate, R fi , t variable, is associated to the rate relative to the UK Government Liabilities of maturities i. These rates are collected for i equal to 1 to 60 months in Datastream. The forecast variable, AR t , i represents the forecast of the IPD return (in logarithm) at date t for the maturity i using the historical IPD monthly log return and an AR(1) process (different for each date t).Footnote 13

The mean premium of the REIT (variable Mean_premium) is computed using the balance sheets and the unadjusted prices of Big Yellow Group Plc, British land company Plc, Derwent London Plc, Great Portland Estates Plc, Hammerson Plc, Land Securities Group Plc, SEGRO Plc and Shaftesbury Plc. Data relative to the balance sheet come from SNL data and the unadjusted price from Datastream. Using these data we compute the variable Mean_premium corresponding to the market-to-book-value minus one.Footnote 14

The variables Eco_1 and Eco_5 are dummy variables representative of the economic context. If the economic context is considered as good (relatively to the period) Eco_1 is equal to 1 and 0 otherwise. On the contrary if the economic context is considered as bad (relatively to the period) Eco_5 is equal to 1 and 0 otherwise. We decide to use these variables to avoid multicolinearity in our econometric analysis. Indeed, the different macroeconomic variables, strongly relate to each other. These variables are based on the unemployment rate and on the growth of the GDP. Eco_1 is equal to 1 when the unemployment rate is below its first quintile and the economic growth is higher than its fourth quintile and 0 otherwise. Eco_5 is equal to 1 when the unemployment rate is above its fourth quintile and the economic growth is lower than its first quintile and 0 otherwise. The construction of these two variables creates a reference class for our econometric models in which the economic context is neither good nor bad.

Table 1 summarizes the main information relative to the origin of the data and Table 2 provides some general statistics.

We have 4 years of data and then 48 occurrences on a monthly basis (from January 2007 until December 2010). These 48 months represent a total of 240 forward prices (48 months × 5 maturities) or 180 observations (240–5 × 12) in first difference with a maturity between 1 and 60 months. To provide general statistic as the average or the standard deviation and because we have only 4 observations for each forward maturity we used constant forward maturity contract of 1, 3 and 5 years.Footnote 15 Furthermore, because we have as many forecast variables (AR) as maturities (60), we made the choice to provide general statistic only for the 1 and 5 years forecast variables (AR t,12 and AR t,60 ).

One interesting thing to note is the a priori negative relation between the forward rate contract maturities and the standard deviation. Indeed, this meets the well known Samuelson effect observed for forward contracts with other underlying assets (see Lautier and Raynaud (2011)). Minimum and maximum values are explained by the IPD process, strongly autocorrelated (the AR(1) coefficient can rise to 0.8) associated to a highly volatile real estate market on our study period.

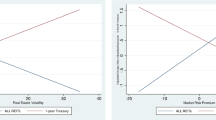

We examine scatterplots of dk (Fig. 4), the endogenous variable, and each of the linear exogenous variables to look for any abnormal data in our sample. The data relative to id 122 seems to be very particular. Therefore, to understand the general dynamic of the forward curve we decide after further investigations to delete this observation relative to a 6 months maturity forward rate. This observation could bias the parameters. Observations id 182 and 181 seem also slightly different from the other observations. For this reason we do the regressions of the empirical results section with and without them. However, as the results are not different regardless we keep them in the sample or we remove them, we make the choice to keep these two occurrences. Graphically, we observe a positive relation between dk and dAR , dk and dmean_premium and dk and dUnemployment. At the contrary, we observe a negative relation between dk and dRf_i, dk and dGDP and dk and dCPI. For details about the correlation of the variables used in our analysis, the reader can refer to Appendix 1.

Scatter plots of the data. Figure 4 represents the scatter plots of dK, the endogenous variable (the implied forward rates) in first difference, and each of the exogenous variables in first difference as well (except the dummy variables). This amount to represent the changes in the implied forward rates of maturity i months (with i equal to one to 60) with the changes in the exogenous on the same periods

Empirical Results

In this section we estimate the four equations presented in the previous section. In order to deepen our results, they are assessed on the full sample and also on different time periods. Furthermore, as the forward do not exhibit exactly the same pattern according to the maturities we also analyze their fluctuations for different groups of forward maturities.

Analysis of the Traditional Future-Spot Relationship

In Table 3 we estimate the first specification, Eq. 10, relative to the impact of the risk free rate on the implied forward rates. The estimations are realized in regression 1 on all the maturities together and, in the regression 2 to 5, we are running the model on different maturities independently.

The relation between the variation of the implied forward rate and the variation of the risk free rate is negative and significant at the 5 % (regression 1 and 2) and 10 % (regression 3, 4 and 5) level of confidence whatever the maturity considered.Footnote 16 All results show that the traditional relation presented in financial textbooks does not hold for property derivatives. There is no positive and significant relation between the strike of the forwards and the risk free rate observed for the different maturities.

But, this conclusion is probably a little hasty; we cannot reject such mechanism without more evidence. Indeed, we have potentially a superposition of effects with a negative end result as described in subsection 5.1.1. However, this is an argument in favor of Eq. 1, i.e., of forward prices as a more efficient real estate vehicle in the sense of Fama (1970) (the information set included in prices is broader). They are potentially restoring to interest rate its legitimate place in real estate prices; Hartzell et al. (1987) show that interest rates have surprisingly little impact on appraisal-based index because appraisers have more faith in prices. This negative relation could also come from different perceptions of the impact of the interest rate changes between appraisers and market practitioners. It is important to remark that this negative effect becomes lower when the forward maturity increases. This could be justified by an increase of the positive effect or a decrease of the negative one, or both. On the one hand, if the negative relation is explained by an integration of current information into price, it is legitimate to think that this information has a decreasing impact when the maturity increases. On the other hand, Lizieri et al. (2010) explain that tradeoffs are easier for the longest maturities (notably because of the transaction cost) and then justify the fact that the positive effect would increase with maturity. Regarding the R-squared of Table 3, they range from around 7 % to 10 %.

To ensure the negative relation between the implied forward rate and the risk-free rate observed in our sample, in Table 4, we reassessed the same specification for different sub-periods. Indeed, the RESET test in Table 3 is not satisfying, and the levels of confidence, though acceptable, are not very high. Moreover, as mentioned in section 2.3, the time-period is neither common nor uniform. This raises the issue of the stability of the relation across time. Even if our sample lays on a relatively short period of study we have enough data to divide our sample into two sub-samples. We have a first sample defined as the first differences from 01/31/2008 to the 06/31/2009 and a second one defined from 07/31/2009 to the 12/31/2010.

The results of Table 4 are more significant than in Table 3. The relation between the implied forward rate and the risk-free rate is always negative and significant at the 1 % level of confidence, globally and by maturities. The RESET test is better (except for the longest maturities of the second period) and the R2 also improves. We can also note that the coefficient of the risk-free rate seems to be decreasing in these two heterogeneous time-intervals. These results display a likely high interest for property derivatives as an informative indicator thanks to the well known price discovery function of future market. As the spot market is suffering from a severe lack of information, we are now going to study if the derivatives market is more efficient in the sense that it would integrate more information.

Informational Content of the Property Derivatives

Table 5 exhibits different specifications of eqs. 13, 14 and 15 which integrate an IPD forecast (based on its autocorrelated process), the mean discount or premium observed on the UK REIT market, the economic context and the inflation rate.

As for the Specification 1, the relation between the variation of the forward curve (dk) and the variation of the interest rate is negative and significant at the 1 % level of confidence. The AR variable reflecting the predictable returns of the underlying using an AR(1) process is always positive and significant at the 1 % level of confidence. This is conforming to what we expected in Section 3.2; forward prices do integrate the smoothed effect of the appraisal-based index and thus avoid abnormal returns. Lizieri et al. (2010) explain that a gap between the theoretical quotes (the risk free rate) and the observed quotes could be explained by the predictability of the appraisal based index strongly autocorrelated. For this reason, property derivatives could constitute an interesting unsmoothed indicator of real estate prices. As the ones of Edelstein and Quan (2006); Hansz and Diaz (2001) and Barkham and Geltner (1995) for example, the forward prices could be an alternative methodology to unsmooth appraisal based indices.

The variable relative to the premium/discount observed on the asset of the UK REITs (dMean_premium) has a positive and highly significant impact on the implied forward rates. It reflects the impact of market practitioner’s expectations in excess of the appraiser ones (the IPD index). If there was no discordance, forward prices would not be explained by our premium variable. However, as the impact is significant we should think that market information, not lagged as the one included in the appraisal-based index, is incorporated in forward prices and thus that derivative prices are more efficient than their underlying asset itself. Market practitioners potentially respond quicker to a change in the information set than appraisers. Forward prices reflect the market expectations relative to appraiser expectations, the higher they are and the higher prices should be to avoid abnormal returns (see Eq. 1).

The economic variables, Eco_1 and Eco_5, which should be associated to the economic context, are not, except for the Eco_5 variable in regressions (3) and (4), significant at the five percent level of confidence. However, all their signs conform to what we expect; positive for the Eco_1 variable and negative for the Eco_5. No conclusion can be drawn from the CPI variable which is not significant.

Contrary to Table 3 and Table 4 where the maximum observed R-squared was equal to 22.7 % (all maturities), the one of Table 5 rises up to 71.6 %. Therefore, we are explaining around 70 % of the implied forward rate fluctuations using Eq. 15. The only inclusion of the AR variable on the full sample increased the R-squared of 54.4 % (from 8.2 % to 62.6 %).

Segmentation Results and Robustness Checks

Segmentation by Maturities

To extend the consistency of the results whatever the maturity considered, we complete our investigation; all the equations of Table 5 are reassessed for different maturities in Table 6. The risk free rate is always negative and significant, except for the maturities lower than 24 months. The variable AR and the mean premium variable are always positive and significant, whatever the maturities. Considering the Eco_1 and Eco_5 variables, they have a sign constantly conform to what we expected but their impact is not always significant.

It is interesting to note that the values of the AR and Mean_premium coefficients are a strictly decreasing function of the maturity. This makes sense for AR because this variable is related to the predictable part of the IPD returns and obviously, this part should be a decreasing function of the maturity. The appeal of adding the smoothing variable AR is clear for all maturities. Indeed, when we consider the model with only one variable, the risk-free rate, the R2 is low (Table 4). But when the variable AR is included (Table 6), the R2 highly increases. This feature is valid for the maturities taken as a whole, as previously mentioned, but also separately.

On the other hand, when the maturities become longer, the economic variable Eco_1 seems to improve its explaining power. These elements suggest that the drivers for the shortest maturities (less than 24 months) might be different from those for the longer maturities.

Segmentation by Maturities and Periods

The results of the previous section could be interrogated because of the bad RESET test of Table 6. We had already faced the same kind of problem with Table 3 and solved it by dividing the time interval in two (Table 4). The economic environment was indeed very different between these two sub-periods. Thus, here also, it seemed relevant to split the period in two. However, with such a double segmentation (by maturities and by periods), the sample size became small. Consequently, we had to make a compromise on the number of explaining variables. We chose to retain only the risk-free rate, AR and Mean_premium. The inclusion of the other three variables would make the results unstable and difficult to interpret.

The results of Table 7 indicate that the coefficients for the three variables are as expected: significant, negative for the risk-free rate, and positive for AR and Mean_premium. The RESET test is acceptable. This specification issue is consistent with the fact that the explaining power of the factors seems to vary across time. The first period corresponds to a very difficult economic context under unusual circumstances. The coefficients for AR and Mean_premium are smaller and this period seems to be rate-driven. On the contrary, for the second period, the coefficient of AR is multiplied by two. This suggests that the degree of smoothing would evolve according to the market conditions. The influence of Mean_premium is also reinforced. It is interesting to note that for AR and Mean_premium, the coefficients are always a strictly decreasing function of maturity, on both sub-periods.

Controlling for Volume and Others Tests

Figure 1 indicates that the volume of trades executed each quarter can present variations and even shocks. Consequently, we also estimated the model introducing the volume series (in level and in first difference). We found that the estimated coefficients stay constant; our results are robust to the liquidity issue. First difference estimators are consistent even if the true model is the one with fixed effects. Several other tests of consistency have also been conducted (omitted variable, multicollinearity, impact of outlier). All these tests let us think that our results are not biased.

Conclusion

This paper investigates on property derivatives and more especially on the IPD All Property Total Return Swaps using a 4 years database in the UK market. By stripping these IPD swaps into their primary components, the forwards, we examine their price dynamics using a panel model with clustering.

Regarding the risk free rate, the traditional sport-forward relation does not hold for property derivatives. We find a negative and significant impact on the implied forward rates. This impact appears as being made of different effects and it varies according time and maturities. With a longer series it could be interesting for future researches to deepen this puzzle of the link between risk free and forward rates.

The predictability of the IPD index, measured by the variable AR, is a significant factor; it means that the derivatives prices take into account the smoothing imperfection of the underlying index. Information embedded in the REITs stocks is also significant for the forwards. The informational content of the swap is important and the explaining power of the model is good. The main drivers appear as being first the smoothing effect, then, at the same magnitude, the premium on the REITs and the risk free rate. The explanatory power of the model varies according to the period of time. The impact of the REITs and the smoothing effect decreases with maturities, and for longer maturities general economic variables would become more relevant.

Property derivatives can be quite revealing and interesting as an indicator of what is happening in the property market, more rapidly and precisely than is revealed by contemporary returns to the index itself. Even though the index on which the swap is based is lagged, the change in the swap price can reflect contemporaneous changes in the underlying property market without a lag. By integrating a broader information set, forwards prices are potentially a more accurate estimator of real estate prices than their own underlying index. This mechanism known as the price discovery function of forward contracts is particularly relevant for real estate where the market is suffering from a severe lack of transparency. These results are consistent with the market practitioner intuitions and to the theory developed by Geltner and Fisher (2007) and Lizieri et al. (2010). If property derivatives could be particularly useful for hedging or real estate exposure, an increase of the trading volume of the future contract could also lead to disseminate information in the cash property market.

Notes

Indeed, under International Accounting Reporting Standards (IFRS), corporate properties must be impaired when they are carried at less than their recoverable amount under the International Accounting Standard (IAS) 36. Furthermore, IAS 36 enables firms to reevaluate properties when the recoverable amount increases, i.e., when real estate prices rise. The use of fair value grows the possibility that properties may influence account settlement. Therefore the desire to avoid real estate risk while retaining ownership of strategic assets should expand in the future.

The Investment Property Databank Ltd. was created in the UK in 1985 and was meant to measure and analyze properties by compiling data from leading property investors. Concerning the UK indices, data have been published for the first time in 1985 but reach back to 1981.

Only a few institutional investors such as the Property Unit Trusts (PUTs) face a legal obligation of monthly appraisals.

For a forward price lower than the fair value, we need to sell the underlying asset short in order to hedge the derivative and then to tradeoff derivative using direct properties. Therefore, for any spread under the fair value, there is no financial strength to push up the spread and then achieve an equilibrium price (we should probably observe an asymmetrical fluctuation band around the Unsmoothed index).

The basis risk in finance is the risk associated with imperfect hedging. It could arise because of the difference between the asset whose price is to be hedged and the asset underlying the derivatives or because of a mismatch between the expiration date of the contracts and the actual selling date of the asset.

This data set has been provided by the hedge fund Iceberg Alternative Investment.

Backwardation (contango) refers to the market condition wherein the price of a forward of futures contract is trading below (above) the present spot price.

From a mathematical point of view, there is no constant in the reference equation (9). However, we preferred to keep it for equations (10), (13), (14) and (15), in case of an unanticipated trend on the market (for instance, a variation in the transaction costs). In all cases, the estimated constant is insignificant or small.

We compute this variable with a moving sample window of 6 years prior each month t. Using this window and an AR(1) process, we forecast the IPD log return for every of the 60 months following the month t. One time these forecasts computed for the month t, we sum the first i monthly forecasts to obtain the predictable IPD log return between the month t and the month t + i. We also tried to evaluate an ARMA(p,q) process at each month t to compute our forecast, but the results were not significantly different on our risk factor analysis.

The mean premium variable is computed using the following relation

$$ \mathrm{Mean}\_{\mathrm{premium}}_{\mathrm{t}}=\frac{1}{8}\sum_{\mathrm{j}=1}^8\frac{{\mathrm{EquityAtMarketValue}}_{\mathrm{j},\mathrm{t}}}{{\mathrm{RealEstateAssets}}_{\mathrm{j},\mathrm{t}}+{\mathrm{OtherNonCurrentAssets}}_{\mathrm{j},\mathrm{t}}+{\mathrm{TotalCurrentAssets}}_{\mathrm{j},\mathrm{t}}-{\mathrm{TotalLiabilities}}_{\mathrm{j},\mathrm{t}}}-1, $$where EquityAtMarket value j , t , RealEstateAssets j , t, TotalCurrentAssets j , t , TotalLiabilities j , t and OtherNonCurrentAsset j , t are respectively the equity at market value, the real estate assets, the total current assets, the total liabilities and the other non-current asset of the REIT j at date t. As the book value of the real estate assets are available only on a quarterly or biannual basis we realize an update of the these assets using the IPD real estate return between t and the previous balance sheet available (date of the previous balance sheet statement, t-x). This assumption, lays on the supposition that the REITs considered are perfectly diversified and without leveraged investment in joint venture.

We rearranged the data to obtain time series with constant maturity forward. Using linear approximation we compute the IPD forward of maturity i-months for each month t of our dataset.

There is one observation missing in the regression 2 because of the dropped data id 122. However, the inclusion of this forward rate does not change the results.

References

Barkham, R., & Geltner, D. (1995). Price discovery in American and British property markets. Journal of Real Estate Economics, 23, 21–44.

Benjamin, J., Sirmans, S., & Zietz, E. (2001). Returns and risk on real estate and other investments: more evidence. Journa of Real Estate Portfolio Management, 7, 183–214.

Bertus, M., Hollans, H., & Swidler, S. (2008). Hedging house price risk with CME futures contracts: the case of Las Vegas residential real estate. The Journal of Real Estate Finance and Economics, 37, 265–279.

Björk, T., & Clapham, E. (2002). On the pricing of real estate index linked swaps. Journal of Housing Economics, 11, 418–432.

Buttimer, R. J., Kau, J. B., & Slawson, C. V. (1997). A model for pricing securities dependent upon a real estate index. Journal of Housing Economics, 6, 16–s30.

Clayton, J., & MacKinnon, G. (2001). The time-varying nature of the link between REIT, real estate and financial asset returns. Journal of Real Estate Porfolio Management, 7, 43–54.

Clayton, J., Geltner, D., & Hamilton, S. W. (2001). Smoothing in commercial property valuations: evidence from individual appraisals. Real Estate Economics, 29, 337–360.

Clayton, J., Giliberto, M. S., Gordon, J. N., Hudson-Wilson, S., Fabozzi, F. J., & Liang, Y. (2009). Real estate’s evolution as an asset class. The Journal of Portfolio Management, 35, 10–22.

Drouhin, Pierre-Arnaud, Arnaud Simon, 2011, Stripping of real estate-indexed swaps and forward term structure: interest and computational method, Working paper, available on ssrn.com

Drouhin, P.-A., & Simon, A. (2014). Are property derivatives a leading indicator of the real estate market? Journal of European Real Estate Research, 7, 158–180.

Edelstein, R. H., & Quan, D. C. (2006). How does appraisal smoothing bias real estate returns measurement? The Journal of Real Estate Finance and Economics, 32, 41–60.

Fama, E. F. (1970). Efficient capital markets: a review of theory and empirical work. The Journal of Finance, 25, 383–417.

Firstenberg, P. M., Ross, S. A., & Zisler, R. C. (1988). Real estate: the whole story. The Journal of Portfolio Management, 14, 22–34.

Flavin, M., & Yamashita, T. (2002). Owner-occupied housing and the composition of the household portfolio. American Economic Review, 92, 345–362.

Geltner, D. (1991). Smoothing in appraisal-based returns. The Journal of Real Estate Finance and Economics, 4, 327–345.

Geltner, D. (1993). Temporal aggregation in real estate return indices. Real Estate Economics, 21, 141–166.

Geltner, D., & Fisher, J. D. (2007). Pricing and index considerations in commercial real estate derivatives. The Journal of Portfolio Management, 33, 99–118.

Glascock, John, L., & Lu, C. (2000). Further evidence on the integration of REIT, bond, and stock returns. The Journal of Real Estate Finance and Economics, 20, 177–194.

Hansz, J. A., & Diaz III, J. (2001). Valuation bias in commercial appraisal: a transaction price feedback experiment. Real Estate Economics, 29, 553–565.

Hartzell, D., Hekman, J. S., & Miles, M. E. (1987). Real estate returns and inflation. Real Estate Economics, 15, 617–637.

Ibbotson, R. G., & Siegel, L. B. (1984). Real estate returns: a comparison with other investments. Real Estate Economics, 12, 219–242.

Langenbach, M. (2009). Systematic and unsystematic risk in European office markets. Deriving models for performance and risk measurement in real estate. Thesis, Paris-Dauphine University.

Lautier, D., & Raynaud, F. (2011). Statistical properties of derivatives: a journey in term structures. Physica A: Statistical Mechanics and its Applications, 390, 2009–2019.

Lee, M.-L., Lee, M.-T., Kevin, C. H., & Chiang (2007). Real estate risk exposure of equity real estate investment trusts. The Journal of Real Estate Finance and Economics, 36, 165–181.

Lizieri, C., Marcato, G., Ogden, P., & Baum, A. (2010). Pricing inefficiencies in private real estate markets using total return swaps. The Journal of Real Estate Finance and Economics, 45, 774–803.

Marcato, Gianluca, and Tony Key, (2007) Smoothing and implications for asset allocation choices. Journal of Portfolio Management, 33, Special Issue 2007, 85–98.

Mull, S. R., & Soenen, L. A. (1997). U.S. REITs as an asset class in international investment portfolios. Financial Analysts Journal, 53, 55–61.

Patel, K., & Pereira, R. (2007). Pricing property index linked swaps with counterparty default risk. The Journal of Real Estate Finance and Economics, 36, 5–21.

Quan, D. C., & Quigley, J. M. (1989). Inferring an investment return series for real estate from observations on sales. Real Estate Economics, 17, 218–230.

Quan, D. C., & Quigley, J. M. (1991). Price formation and the appraisal function in real estate markets. The Journal of Real Estate Finance and Economics, 4, 127–146.

Syz, Juerg M., 2008, Property Derivatives: Pricing, Hedging and Applications. Chichester: John Wiley and Sons.

Syz, J. M., Vanini, P., & Salvi, M. (2007). Property derivatives and index-linked mortgages. The Journal of Real Estate Finance and Economics, 36, 23–35.

Author information

Authors and Affiliations

Corresponding author

Appendixes

Appendixes

Appendix 1

Appendix 2

Rights and permissions

About this article

Cite this article

Drouhin, PA., Simon, A. & Essafi, Y. Forward Curve Risk Factors Analysis in the UK Real Estate Market. J Real Estate Finan Econ 53, 494–526 (2016). https://doi.org/10.1007/s11146-015-9534-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-015-9534-z