Abstract

Waste management is an essential tool for policymakers. We derive an efficient production function using a dual cost approach related to waste from the output. Since producers do not bear the cost of waste disposal, the demand for virgin material increases in the production process. Therefore, preserving exhaustible resources by imposing a tax on virgin materials and waste disposals is essential. This study compares the effect of tax on waste and the demand for virgin material. Our results suggest that (a) taxing waste or virgin material will induce recycling only for the polluting firms; (b) a tax on virgin material is highly effective for the polluting firms; however, the output will reduce; (c) a higher tax may lead cross-border trade of waste generated. We also focus on different markets, such as perfectly competitive markets and imperfectly competitive markets. We conclude as the number of firms increases under Cournot’s oligopolistic setup, the effect on the profitability becomes negligible. The findings of this study have greater implications for the environment and climate policies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A trade-off exists between economic development and negative externalities from production. Most wastes are generated from industrial activities that challenge sustainable ecosystems, which calls for mitigation policies. The idea of cradle to grave is important, as Germany experienced a circular resource flow. However, this idea is based on minimizing waste through multiple resource use that needs technological and resource policies support. This can be analysed using a neo-classical economics framework, including taxes and subsidies in the production process, as documented in Anderson and Spiegelman (1977), Dinan (1993), Rousso and Shah (1994) and Sigman (1995). Waste is a by-product of the production activities; however, considered a bad output. End of pipe techniques helps reduce waste. However, it may lead to an increase in the cost of production in the short run; hence waste, minimizing and utilizing waste using better technology are highly important (Hughes, 1978; Uimonen 1994). In this paper, we modify Hughes and Ulimonen’s arguments using a dual cost approach, augmenting Conrad (1997, 1999). As waste disposal and recycling are important for a better ecosystem, and many countries have targeted green growthFootnote 1, a theoretical approach is essential in this context. To explain waste in production, management, and reduction in waste, we focus on the following research questions.

-

1.

Under the setup of an efficient production function, how does tax influence the reduction and reuse of waste?

-

2.

How do output decisions and profitability in different markets behave?

To answer these questions, we construct a theoretical model that augments Conrad’s (1999) approach. Here the idea is to minimize waste and convert it into a helpful resource. We also investigate whether this is a ‘win–win’ situation for all or if there is a trade-off for the producers between implementing green policies and the firm’s outcome. The remainder of this paper is as follows. Section 2 discusses the literature review; Sect. 3 discusses the model and carries out a firm-level analysis; Sect. 4 introduces the model under a different market setup; and Sect. 5 concludes the paper.

2 Review of literature

Reducing waste through the polluter’s pay principle has drawn policymakers' attention in the 1960s (Medema, 2020). It is often criticized from the point of view of the Coasian bargain (Coase, 1960). However, the ease and feasible implementation has impeded the tax instrument from losing relevance (Kneese, 1956; Crocker, 1968). Lee (1975) concluded that a uniform tax might produce the least-cost abatement, but the effectiveness will vary across different markets, depending on market power. Under a perfectly competitive setup, a tax to control negative externality through waste reduction is considered the benchmarking rule (Conrad, 1993). In addition, subsidy on abatement is encouraged for an imperfectly competitive market. The ongoing belief of reducing waste only through taxing virgin material is opposed by Dinan (1993). He suggests a combination of waste taxation and incentives for reuse might help. Fullerton and Kinnaman (1995) argued that sometimes it is difficult to find the polluter, such as in the case of illicit burning. In such a situation, an optimal tax may produce an undesirable result. Hence, they have argued for favouring a deposit-refund system, i.e., tax on all output and refund on deposits. But the effectiveness of the tax depends on the elasticity of the polluter’s decision (Levinson 1999). Palmer and Walls (1997) estimated the effect of taxation on waste recycling on the U.S economy. The finding suggests that the tax can increase the use of secondary materials, but it may not lead to an optimal solution. They have also argued in favour of the deposit-refund system. However, this must be implemented carefully as a wrong tax policy can substantially negatively impact the environment (Turner et al., 1998).

Morris et al. (1998) have examined the effect of tax on the landfill on the waste reduction in the U.K. They suggest that increasing such a tax has produced an effective result in reducing landfills. This implies that one policy cannot be fitted for all. However, they have also pointed out that money raised from the tax is not spent efficiently to make a cheaper alternative to the landfill. Bruvoll (1998) argues that more use of virgin material will increase waste and pollution. He has also pointed out that biased price policies, such as indirect taxation, have increased the use of virgin material. He proposes a trade-off by increasing the tax on virgin material and reducing the tax on labour. Using a general equilibrium framework, he has shown that it has a net benefit. This will lead to lesser use of virgin material and a pollution reduction from waste and emissions. Conrad (1999) has conducted a comparative study of the outcome of a tax on virgin material versus a tax on waste to induce recycling, besides reducing the use of exhaustible resources. He has further estimated the impact on the outcome of employment, output and profitability.

Since the early 2000s, several countries have started implementing tax policies to reduce waste.Footnote 2 The theoretical proposals were getting empirically validated.Footnote 3 Conrad (2000) has simulated a model for the German chemical industry to check the impact of tax on pollution control. The results indicate an increase in the use of materials and a failure to produce a double dividend. On the contrary, it is found that the Baumol-Oates suggestion of implementing a tax per ton of waste helped Denmark reduce their solid waste generation by 26 per cent from 1987 to 1998 (Andersen and Dengsoe, 2002). However, the behavioural change is less responsive to the industries. They have indicated a problem estimating a correct cost due to institutional problems. Hence, they concluded that some institutional dimensions should supplement the rational-choice assumption. Sahlin et al. (2007) have estimated the impact of the incineration tax on recycling for Sweden’s municipal solid waste. They found heterogeneous results across different sectors. Recycling depends on the level of taxation and types of tax imposed, along with a few other determinants, such as cooperation and information, and so forth. Soderholm (2011) has estimated the effect of taxing virgin material on recycling in the U.K, Sweden, and Denmark.

The empirical results indicate that the impact is not impressive despite having a higher demand for recycling. This is because producers have lesser incentives to recycle, so a second-best solution is preferred. It may be helpful for the non-point source of pollution and allocation of property rights. Zacho et al. (2018) conducted a municipal case study for waste recycling and reuse. They concluded that the reuse of waste has a huge potential for value creation. However, it depends on waste collection and the profitability of the recycled material. Their finding suggests that the economic value of cardboard is higher than plastic and wood. In addition, the current regulation is not sufficiently working as a stimulus. Weerdt et al. (2020) have examined the influence of incineration tax on recycling industrial plastic in Belgium. The findings suggest that lower pollution in the previous period and higher taxation will increase recycling. The impact of taxation will be more in the long run.

3 Production of waste as by-product

Let us assume the industrial process does not recycle waste automatically. Once the output is produced, the waste is discharged to the environment as a by-product. In a standard economic theory of production, output production depends on labour, capital, material, energy, and technology. In this model, we assume that technology helps reduce the waste generated from production.. However, we also use recycling as an independent activity. Hence, we can classify materials used in the production process as useful materials and unused materials in the production process.

Let us assume that output \((x)\) is produced from labour \((L)\) and gross material \((GM)\). Hence, we can write:

From gross material, net material \((M)\) and gross wastes \((GW)\) are produced. If \(\alpha\) unit of \(GW\) is produced from 1 unit of \(GM\) then, \((1 - \alpha )\) units of \(M\) will be produced from 1 unit of \(GM\).

Thus,

Now, the efficient production function \(f(.)\) can be derived from the production function \(F(.)\). Since the objective of the producer is to derive net material from the gross material, which has a marketable price, the efficient production function can be written as:

To recycle waste, efforts (e) are needed, i.e., \(\alpha = \alpha (e)\) where \(\alpha^{\prime}(e) < 0, \, \alpha^{\prime\prime}{\text{(e)}} > 0\) and effort will reduce waste production given the labour and gross material. The producers will pay for labour, gross material, and gross waste. Let us assume that the per-unit price of labour, gross material, and gross waste are \(PL, \, PGM, \, and \, PW\), respectively. So, the standard minimization problem becomes:

There are two types of waste, viz. new and old. The former is produced during the production process, and no transportation cost is required to recycle. The consumers produce the latter, which is difficult and costly to bring back to the firms and recycle. Consequently, only new scraps are considered in this regard for our analysis. Gross waste can either be used directly or indirectly for recycling or reused after the reprocessing.

Further, let us assume that \(\beta\) unit of raw waste \(\left( {RW} \right)\) is produced from 1 unit of gross waste. Thus, \(\beta\) can be termed the recycling intensity. Hence, we can write:

Gross waste has to be collected, sorted, and separated, and for that, labour is required. Thus, a per-unit cost is associated with recycling which has to be confronted with the cost of not recycling the gross waste and the opportunity cost forgone to produce the raw material from the gross material. If the per-unit cost is \(c\left( \beta \right)\) then, the total cost of transforming gross waste to raw waste will be \(c\left( \beta \right).RW = c\left( \beta \right).\beta .GW{\text{ and }}c^{\prime}(\beta ) > 0,c^{\prime\prime}(\beta ) \ge 0\). Here, it is assumed that the rise in the quantity of transformation positively affects the cost. In some other cases, such as water, mineral, etc., recycling is carried out multiple times; hence, the marginal cost of recycling increases when quality decreases. We consider a Leontief Production function for the transformation of raw waste into material waste \(\left( {MW} \right)\). Therefore, we can write as:

From (6) and (7), we get the leftover which is the final waste that cannot be used in the production process and disposed of in the environment. Hence, total waste is the sum of the difference between the gross and raw waste and the part of the raw waste that cannot be recycled. Therefore,

Finally, the objective function becomes:

The terms in the third brackets, in Eq. (9), is the price of net material \(\left( {\widetilde{PM}} \right)\) consisting of all components of waste externality given in the front of net material [from Eq. 7, we get \(LW = \left( {aw/al} \right)RW\)].

Thus, the cost function becomes: \(PL.L + P\tilde{M}.M\). Finally, recycled material need not be purchased for the gross material. It reduces the total cost by the value of net material recovered from recycling.

Thus, the objective function becomes:

We know \(MW = aw.RW = aw.\beta .\left( {\frac{\alpha }{1 - \alpha }} \right).M\). Hence, the cost minimization problem can be written as follows:

\(PM\): Effective user cost of material adjusted by the cost reduction due to regained material;\(P\tilde{M}\): Cost components from recycling whereas the term in the first bracket is the benefit, which is lesser, equal to one. It is the percentage of derived demand for pure material required only due to recovered material from recycling, i.e.

Since cost minimization is dual to the production function, the problem is stated from profit maximization under a perfectly competitive market. The profit maximization problem is stated as follows:

As per the assumption of the negative relationship between effort and productivity, we can write \(C_{e},C_{ee} > 0\). If products are to be designed better with less waste, more efforts are required; hence, productivity will decline. To regain the previous level of productivity, a firm may use additional labour with a higher wage, leading to an increase in output cost. Change in recycling intensity affects the cost function through changes in the effective user cost of material, adjusted by the cost reduction due to regained material. Still, the latter is not affected by recycling intensity, and thereby we can write \(C_{PM}.PM_{\beta} = 0\), which is followed by \(PM_{\beta} = 0\).

Taking the derivative of Eq. (11) with respect to \(\beta\):

The term in the first bracket in the first part of the equation \(\left( {12} \right)\) is denoted by \(S_{MW}\). From the cost–benefit analysis, we can say that the cost-raising effect of recycling should be equal to the marginal benefit of recycling. This condition is derived from a lower effective user cost due to more material recovered from gross waste.

Let us assume that: \(MW = aw.RW = aw.\beta .\frac{\alpha }{1 - \alpha }\). Hence, we can write the equation \(\left( {12} \right)\) as follows:

From this alternative form of Eq. (12), we can infer that the elasticity of material price with respect to recycling intensity is equal to the recovered material ratio.

Sigman (1995) proposes imposing a tax on virgin material to reduce waste. We re-develop Sigman’s argument. Reducing waste generation can be restricted in two ways: (i) by imposing a tax on waste and (ii) a tax on virgin material. Let us assume that the price of waste is equal to \(PW\); thus, a lesser volume will reduce the stock of virgin material. Let us further assume that \(\tau\) is the tax imposed upon the usage of virgin material. Therefore, the new price of the virgin material is \(PGM = PG\tilde{M} + \tau\).

To find out the effect of tax on waste and virgin material on recycling intensity, we differentiate Eq. (12) with respect to \(\beta \, \& \, PW\) and arrive at the following:

Similarly, if tax is imposed on virgin material, then:

Comparing \(\frac{{d\beta }}{{dPW}}\& \frac{{d\beta }}{{d\tau }} \), we get: \(\frac{d\beta }{{dPW}} < \frac{d\beta }{{d\tau }}\).

Therefore, we can conclude that an equal amount of tax on virgin material is more effective in increasing the recycling intensity (if the waste coefficient is more than 0.5). However, Dinan (1993) explains a mixed policy imposing a tax on both virgin material and waste disposal. The intention behind imposing a price on waste and virgin material is to enhance recycling to save the exhaustible resources used as virgin material in the production process. Hence, this resource-saving equation can be justified if:

Thus, we can write \(\alpha { > }\frac{1}{2}\). Hence, we conclude that:

Equation (14) implies that the tax on both waste and virgin material will increase the recycling intensity if the waste coefficient is greater than \(\left( \frac{1}{2} \right)\). This implies that if a rise in one additional unit of gross material will increase gross waste production by more than 0.50 units, then a tax can be implemented on that product to induce recycling. On the contrary, two alternative cases can also be presented, such as:

-

1.

If \(0 > \frac{d\beta }{{dPW}}\) , i.e., if \(\alpha < 0.5\) then, an increase in the price of waste disposal will have a negative impact on recycling. Hence, imposing a tax on either waste or virgin material will be a boomerang for waste reduction. Hence, if the waste coefficient is less than \(\left( \frac{1}{2} \right)\), i.e., the rise in gross waste is less than 0.50 units due to an additional unit increase in the gross material. Therefore, imposing a tax on virgin material and increasing the cost of waste would adversely affect the recycling intensity. This case can be linked with setting up factories abroad and engaging in trade activities. It can happen because increasing recycling intensity might be costlier than paying the tax and polluting for the non-polluting firms as they have realized the efficient scale of production.

-

2.

If \(\frac{d\beta }{{dPW}} = 0\), i.e., if \(\alpha = 0.5\) then, imposing a tax on virgin material or increasing the price of the waste would be futile because recycling intensity becomes independent. Hence, we can write \(\alpha = \frac{1}{2}\). So, if the waste coefficient is exactly \(\left( \frac{1}{2} \right)\) then, imposing a tax on virgin material or increasing the price of waste disposal will not affect recycling intensity.

We have followed a similar framework to Conrad (1999). We agree with his conclusion that the waste coefficient plays a major role in inducing recycling through taxation. Recently, Weerdt et al. (2020) have a similar empirical finding for Belgium’s plastic industry. However, Conrad’s (1999) suggestion was to impose a tax to increase the recycling, but we find a particular threshold where this solution is feasible. In addition, we have two additional zones where recycling will be perfectly inelastic to tax, or it will have a negative impact, i.e., the firm will prefer to pay and pollute as recycling is costlier to tax. The latter case may be influenced by other factors, such as the firm has realized the economies of scale, the issue of profitability or changing output decision, and so forth.

Similar calculations can be carried out assuming \(GW = 2\alpha .GM\). It can be presented that imposing a tax would be better than pricing the waste disposal if the waste coefficient is greater than 0.25. The related argument on the waste-coefficient is presented in Table 1. Hence, the threshold level change based on the multiplier of the waste coefficient. The higher the multiplier, the lower the waste coefficient threshold to induce recycling through taxation.

The profit-maximizing condition of the producer changes with the change in output. Thus, if output changes, then the profit maximization condition of the producers will be:

On the other hand, with a change in effort, the condition will be:

This implies the level of effort is optimal if the marginal input savings in the cost of net material justifies exactly the increase in the cost of production from the loss in productivity of the labourers. Using Shepherd’s Lemma, we write \(C_{PM} = M\).

Now, a change in the effort will change the price of materials. By taking differentiation of equation \(\left( {11} \right)\) with respect to e, we arrive at the following:

In addition, if we take the differentiation of the equation \(\left( 9 \right)\) with respect to e then we arrive at:

Since effort reduces gross waste, \(P\tilde{M}_{e}\) it is negative. Since \(\alpha^{\prime}\) is negative, terms inside the bracket must be positive. Hence, the total effect of the second, third and fourth term should outweigh the effect of the first term. In Eq. (17), the first term implies a reduction of cost from gross material to net material due to higher effort; the second term implies a reduction in recycling costs due to less gross waste; the third term denotes a reduction in labour due to production in net material from recycled waste, and the fourth term represents a reduction in fees for waste disposal due to rise in recycling.

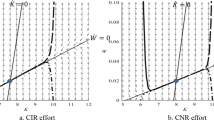

3.1 Comparative static analysis

Let us now look at the comparative static analysis for production as a waste that is a by-product of the production system. The change in the price of virgin material, in turn, affects the production, effort, recycling and waste. Let us assume that the new price of the virgin material is \(PGM = PG\tilde{M} + \tau\). To find out its effect on the factors stated above, we need to take the total differentiation of Eqs. (15), i.e., \(\left( {\pi_{x} = 0} \right)\) and (16), i.e., \(\left( {\pi_{e} = 0} \right)\) and thereby, we get Eqs. (18) and (19):

To make the analysis simple, the production function is considered homothetic, i.e., \(\pi_{xe} = \pi_{ex} = 0\). To find out the elasticity of output with respect to the higher fee on the waste, we need to take the total differentiation of Eq. (15), and we get:

Due to homothetic production function, \(dPGM = dPL = 0\), which implies:

The last term of the RHS is the ratio of two different elasticities. The elasticity given in the numerator is the elasticity of material with respect to output, and the elasticity in the denominator is the elasticity of marginal cost with respect to output. Both are positive. The other terms on the right-hand side of the above equation are positive. The first component is the ratio between total payment to gross waste and revenue from the output. The second component is the reciprocal of the recovered material ratio. Similarly, we can derive the effect of:

If the first term of Eq. (21) is higher than the first term of Eq. (20), output reduction will be more for taxing virgin material. Since gross material is divided into gross waste and net material, we can say that the gross material-output ratio is higher than the former. However, in both cases, taxes will negatively impact output growth. The above condition holds if the amount of tax levied upon virgin material equals the price charged on waste disposal. However, if the volume of these two is different, we need to verify whether this holds true or not. If \(\frac{d\ln x}{{d\ln PW}}\) = \(\frac{d\ln x}{{d\ln \tau }}\) then, the volume of waste time the price charged on it is equal to the volume of gross material times the tax imposed upon virgin material because all other terms in the equation are the same. Hence, we can write \(PW\left( {1 - \beta .aw} \right)\alpha .GM = \tau .GM\) or \(\tau = PW\left( {1 - \beta .aw} \right)\alpha .GM\). Thus, if the tax value is exactly equal to this equation, then the impact would be the same for both. In fact, if \(\tau < PW\left( {1 - \beta .aw} \right)\alpha .GM\) then, the tax on waste will reduce the output by more. If \(\tau > PW\left( {1 - \beta .aw} \right)\alpha .GM\); only then, the impact of taxation on output growth would be worse than imposing fees on waste.

A higher gap between tax on waste or virgin material can also increase the comparative advantage of one country over the other. Thus, waste can be a trade source depending on the volume of tax on virgin material and waste disposal. Firms that find it difficult to produce within a certain standard with strict regulations in a developed nation may be incentivised to shift their production to underdeveloped countries or developing economies. Theories such as pollution haven hypothesis, UNCTAD’s revealed comparative advantage, Double Tax Avoidance Act etc., can play a major role in this regard.

Proposition-1

Taxing waste disposal or virgin material affects not only recycling and output but affect the effort. To derive \(\frac{de}{{dPW}}{\text{ and }}\frac{de}{{d\tau }}\), we need to start from the equation \(\left( {19} \right)\) besides keeping the earlier assumption as it is, i.e., the production function is homothetic and hence, \(\pi_{ex} = 0,dPL = 0,d\tau = 0\). Hence, we can write:

Here \(\pi_{ee}\) negative due to the concavity assumption of profit on effort and output. \(\varepsilon .,_{e} = \varepsilon_{M,e} + \frac{1}{1 - \alpha }.\varepsilon_{ \alpha ,e} + \varepsilon_{M,PM}.\varepsilon_{PM,e}\) is the compound elasticity. For \(\frac{de}{{dPW}} > 0{, }\varepsilon_{\text{.,e < 0}}\) since the values of all elasticity are negative for the material saving condition, it implies \(\left| {\varepsilon_{M,e} + \frac{1}{1 - \alpha }.\varepsilon_{\alpha ,e}} \right| > \left| {\varepsilon_{M,PM}.\varepsilon_{PM,e}} \right|\). If this condition were altered, then the price of waste would negatively impact the effort, which once again opens the scope of international trade. Similarly, we can derive:

Hence, \(\frac{de}{{d\tau }} > \frac{de}{{dPW}}\) holds true if \(\left| {\varepsilon_{M,e} + \frac{1}{1 - \alpha }.\varepsilon_{\alpha ,e}} \right| > \left| {\varepsilon_{M,PM}.\varepsilon_{PM,e}} \right|\) given gross material is greater than waste. If the case is altered, then the imposition of tax may prone the producers to produce abroad.

Proposition-2

To determine the effect of the price of waste elasticity on waste disposal, we take the total differentiation of Eq. (8). After making some adjustments, we get the following:

Hence, we can write:

Here, we develop an advanced result attempted by Conrad (1999). The above equation gives an ambiguous result. The first two terms of the RHS produce an ambiguous sign, and the third term is negative. The fourth term provides the demand with effect on M, as PW increases the price of net material, i.e., PM. Hence, the product is negative because the elasticity is negative. We can conclude from Eq. (20) that the third term is also negative. A change in the price of waste disposal will only have a negative impact on the production of waste in the following cases:

-

1.

If the first term is negative (that holds true if \(\left| {\varepsilon_{M,e} + \frac{1}{1 - \alpha }.\varepsilon_{\alpha ,e}} \right| > \left| {\varepsilon_{M,PM}.\varepsilon_{PM,e}} \right|\)) and \(\alpha \ge \frac{1}{2}\) then the second term is either zero or negative, if the second term is negative, the value has to be lower than the sum of the other three terms.

-

2.

If the first term is negative and the second term is positive.

-

3.

The first term is positive, and the second term is positive, but the sum of the second, third and fourth terms is stronger than the first one.

-

4.

The first term is positive, and the second term is negative or zero, but the sum of the last two terms on the right-hand side must outweigh the effect of the sum of the first two terms.

The second and the third cases are the special cases that Conrad (1999) has discussed. However, unless the waste coefficient is greater than 0.50 or \(\varepsilon .,_{e} < 0\) it is difficult to calculate the exact impact of Eq. (24), as in the other cases, there would always be a bias towards trade. Hence, other factors will also affect this equation. Our generalised conclusion supports the empirical findings of having the different impacts of the tax on waste reduction across various sectors (Sahlin et al., 2007; Zacho et al., 2018).

The same estimation can be done for tax on virgin material, and if Eq. (14), (20) and (23) holds true, given \(\tau = PW{\text{ and }}\frac{\partial PM}{{\partial \tau }} > \frac{\partial PM}{{\partial PW}}\) only then, taxing virgin material would be more effective in reducing waste, given \(\alpha > \frac{1}{2}{\text{ and }}\varepsilon .,_{e} < 0\). Finally, from the assumption of the Leontief Production Function of material waste, we get \(MW = aw.RW = aw.\beta .\frac{\alpha \left( e \right)}{{1 - \alpha \left( e \right)}}.M\)

By taking total differentiation, we can calculate the impact of the price of waste on the production of material waste, which is shown in the following equation:***

Since the first two terms, once again, can either be positive or negative, depending upon the strength of the terms on the right-hand side, material waste will respond to the change in the price of waste disposal.

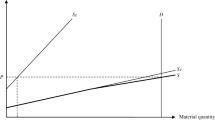

Proposition 3

Labourers often violate the environmental regulations in the industrialized nation when their jobs are at stake. Thus, environmental regulation on labour demand for policymakers is important. The total demand for labour depends on marginal cost since this is a cost minimization problem. However, the price of labour affects the cost here, but the price of virgin material affects the cost. If \(\frac{M - MW}{M}\) decreases the price of virgin material the firm should substitute material for labour. Due to use in a material, less labour demand is reduced by \(\left( \frac{MW}{W} \right)LW\) where, \(LW = \left( {\frac{aw}{{al}}} \right)RW\). Hence,

Taking the total differentiation of the above equation, we get:

The following conclusions can be derived from the above analysis.

-

1.

A lower output will negatively influence labour demand.

-

2.

The more expensive the substitute of material, the more the demand for labour will be.

-

3.

A higher effort will reduce material price, and there will be a reduction in the substitution effect between \(L{\text{ for }}M\).

-

4.

A decline in output will reduce the labour in the recycling division.

-

5.

If the material becomes expensive, less can be recycled, thereby leading to a negative impact.

-

6.

Waste awareness negatively influences labour demand since there is less material to be recycled.

-

7.

Raising the degree of recycling will positively impact the demand for labour.

4 Productions, waste recycling, and waste disposal in different market scenarios

4.1 The perfectly competitive market

The effect of taxing waste or virgin material will change the recycling decision and the firm’s outcome. In this section, we discuss its impact in a perfectly competitive market. Aluminium, iron, steel, pulp etc., can exemplify this regard. It is assumed that there are n number of firms in the industry, and each produces x unit of output. Hence, the total production from industrial production is \(X = nx\), and the per-unit price of selling is p; it is further assumed that the market is in long-run equilibrium. Hence, neither any firm will exit nor enter the market, and zero-profit conditions characterize market equilibrium. We know that:

As the main interest is to find out its impact on output and effort, we set \(\pi_{x} = 0,\pi_{e} = 0\), and the following equations are derived:

The main purpose is to determine the effect of resource and waste taxation on the industry’s output, firm’s output, and effort.

We take the total differentiation of the above three equations to represent them in terms of cost-share and elasticity. Taking total differentiation of the above three equations, we get the following equations:

To have an efficient scale of output, we require \(de\) added terms should be zero in equation number (32). Hence, this equation can be re-written as \(p^{\prime}dnx - C_{xx}dx - M_{x}PM_{PW}dPW = 0\).

Proposition 4

The impact on output can be represented by the expression of elasticity and cost-share.

We know,

Hence, re-arranging equation number (34):

This is the price elasticity of demand weighted by the cost share of waste disposal. If the cost of waste is much more important, then the industry’s output will shrink, and prices will rise. If the price of elasticity is high, then the responsiveness of output to a waste fee is considerable. Similarly, the responsiveness of the industry’s output to tax on virgin material can be derived:

Thus, here also, with an equal amount of tax on virgin material and the price of waste, we can say that effect of taxation is stronger as gross material is higher than the waste. If the amount of the taxes is different, then the threshold point becomes one of the important determinants to evaluate the effectiveness.

Proposition 5

In the long run, the firms' output is unaffected by the price charged on waste disposal or tax on virgin material. Since there is \(n\) number of firms and \(X = nx\) we can write:

The percentage change in the number of firms equals the percentage change in total demand. Similarly, the total elasticity of waste disposal can also be decomposed into:

A higher price on waste reduces waste production, and it decreases through the exit of the firm. Similarly, the responsiveness of effort to the price of waste for firm-level analysis, the same expression can be derived here. Still, the assumption of homothetic production function is not required since the production scale is assumed to be efficient.

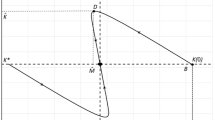

4.2 The imperfectly competitive market

Let us assume that the market is oligopolistic, and there are n number of symmetric firms; both decide to recycle the waste to avoid the cost of waste management. There will be no entry or exit after the imposition of resource-related taxes. The Cournot Nash equilibrium can be written as:

where the profit is:

Taking total differentiation of Eq. (38), we get:

Hence, the output is negatively affected by the rise in the price of waste disposal. Thus, the change in profit is:

In the case of monopoly, the term in the bracket equals zero. The monopolist will charge a higher price in such a manner so that cost of recycling is covered. Hence, the profit decreases by \(S_{MW}.W.dPW\). If \(\frac{dx}{{dPW}}\) term in Eq. (42) is replaced by the value of Eq. (41), then with the constant returns to scale, i.e., \(\left( {C_{xx} = 0} \right)\) it becomes:

The consumer has to bear the higher cost share of material waste to net material and producers less. However, the burden for the producer is more if he is a monopolist than an oligopolist. This is reduced for the oligopolies as the term in the bracket in equation no. (42) is negative. The first term is positive; the price has to go up with the reduction in output levels. Similarly, the impact on profit from imposing a tax on virgin materials can also be found.

Suppose several firms in the long run-in oligopoly rise and tend towards infinity. In that case, the tax on output approaches the long-run equilibrium effect, and the effect on profit becomes negligible.

5 Conclusion and future scope for research

The standard neoclassical framework does not consider the by-product of constructing a production possibility frontier. This is generally assumed with the free disposal of waste. Over the days, the disposal sites are becoming scarce, and the people residing near those sites have to bear the cost. In addition to that, it hampers the aesthetic value also. Hence, waste management has become an important aspect. Recycling, reuse, and disposal should be included in the production function of a firm-level analysis where waste is a by-product and will not allow the production to be on the frontier of the transformation function. It is assumed that by charging the price of waste disposal or tax on virgin material, the frequent and reckless waste disposal can be controlled to reduce the use of virgin material besides recycling more. This is to promote a material-saving approach. However, the value of the waste coefficient plays an important role in determining this, which opens the room for trade. Though an equal amount of tax on virgin material has proved to be more effective under some conditions, the alternative is also possible if those conditions are not met. Even with unequal taxation and price level, a threshold determines the change in the effectiveness of these instruments. Contrary to this, there is a trade-off between growth and recycling intensity for these two instruments determined by the compound elasticity.

The paper contributes by showing how a similar form of tax would have different effects on waste reduction. This is determined by the waste coefficient, which is heterogeneous across all the firms. Factors like economies of scale, technological advancement, quality of materials, etc., are responsible for the same. This will have a different influence on determining output, waste, labour demand, etc. It will help guide policies in developing nations without proper regulations or a concrete database to prescribe specific policies. Since the entire argument is now confined to “Net-Zero” emission, this model can be extended for designing country-specific energy tax to confine the surface temperature increase by 1.5 to 2 degrees Celsius by 2100. Countries like IndiaFootnote 4 have a substantial energy database but lack a strong regulatory policy for emission reduction.Footnote 5 Implementing such a tax in specific sectors might be helpful to check the effect during the buffer period. The short-term goal of 2030 will help check the long-term commitment of 2070. Otherwise, a wrong policy measure may pose a considerable cost burden to the future generation.

Notes

India is considered as a special case from the time of Paris agreement (2015) as it is the third highest global emitter but eligible to receive funds from the developed countries for environmental expenditure.

Performance, Achievement, and Trade (PAT) scheme is implemented in a few industries but its effectiveness is still in question.

References

Andersen, M.S., Dengsoe, N.: Economic instruments in environmental protection in Denmark Economic instruments in environmental protection in Denmark, 2000. J. Mater. Cycles Waste Manage. 4(1), 23–28 (2002)

Anderson, R.C., Spiegelman, R.D.: Tax policy and secondary material use. J. Environ. Econ. Manag. 4(1), 68–82 (1977)

Bruvoll, A.: Taxing virgin materials: an approach to waste problems. Resour. Conserv. Recycl. 22(1–2), 15–29 (1998)

Coase, R.H.: The journal of LAW c. J. Law Econ. 3, 1–44 (1960)

Conrad, K.: Taxes and subsidies for pollution-intensive industries as trade policy. J. Environ. Econ. Manage. 25(2), 121–135 (1993)

Conrad, K. (1997). A theory of production with waste and recycling. Discussion Papers/Institut für Volkswirtschaftslehre und Statistik, 550.

Conrad, K.: Resource and waste taxation in the theory of the firm with recycling activities. Environ. Resource Econ. 14(2), 217–242 (1999)

Conrad, K.: An econometric model of production with endogenous improvement in energy efficiency, 1970–1995. Appl. Econ. 32(9), 1153–1160 (2000)

Crocker, T.D.: Some economics of air pollution control. Nat. Resour. J. 8(2), 236–258 (1968)

De Weerdt, L., Sasao, T., Compernolle, T., Van Passel, S., De Jaeger, S.: The effect of waste incineration taxation on industrial plastic waste generation: a panel analysis. Resour. Conserv. Recycl. 157, 104717 (2020)

Dinan, T.M.: Economic efficiency effects of alternative policies for reducing waste disposal. J. Environ. Econ. Manage. 25(3), 242–256 (1993)

Fullerton, D., Kinnaman, T.C.: Garbage, recycling, and illicit burning or dumping. J. Environ. Econ. Manage. 29(1), 78–91 (1995)

Hughes, J.P.: Factor demand in the multi-product firm. South. Econ. J. 45, 494–501 (1978)

Kneese, A.V.: An Industry Study Approach to the Problem of Exclusive Dealing. Indiana University, Bloomington (1956)

Lee, D.R.: Efficiency of pollution taxation and market structure. J. Environ. Econ. Manage. 2(1), 69–72 (1975)

Levinson, A.: NIMBY taxes matter: the case of state hazardous waste disposal taxes. J. Public Econ. 74(1), 31–51 (1999)

Medema, S.G.: “Exceptional and unimportant”? externalities, competitive equilibrium, and the myth of a pigovian tradition. Hist. Political Econ. 52(1), 135–170 (2020)

Morris, J.R., Phillips, P.S., Read, A.D.: The UK Landfill Tax: an analysis of its contribution to sustainable waste management. Resour. Conserv. Recycl. 23(4), 259–270 (1998)

Palmer, K., Walls, M.: Optimal policies for solid waste disposal taxes, subsidies, and standards. J. Public Econ. 65(2), 193–205 (1997)

Rousso, A.S., Shah, S.P.: Packaging taxes and recycling incentives: the German green dot program. Natl. Tax J. 47(3), 689–701 (1994)

Sahlin, J., Ekvall, T., Bisaillon, M., Sundberg, J.: Introduction of a waste incineration tax: effects on the Swedish waste flows. Resour. Conserv. Recycl. 51(4), 827–846 (2007)

Sigman, H.A.: A comparison of public policies for lead recycling. The RAND J. Econ. 26, 452–478 (1995)

Soderholm, P.: Taxing virgin natural resources: Lessons from aggregates taxation in Europe. Resour. Conserv. Recycl. 55(11), 911–922 (2011)

Turner, R.K., Salmons, R., Powell, J., Craighill, A.: Green taxes, waste management and political economy. J. Environ. Manage. 53(2), 121–136 (1998)

Uimonen, S.: Emission taxes vs financial subsidies in pollution control. J. Econ. 60(3), 281–297 (1994)

Zacho, K.O., Mosgaard, M., Riisgaard, H.: Capturing uncaptured values—a Danish case study on municipal preparation for reuse and recycling of waste. Resour. Conserv. Recycl. 136, 297–305 (2018)

Funding

There is no funding support for this research. This research is carried out as an academic research output between authors of this manuscript.

Author information

Authors and Affiliations

Contributions

Both authors contributed to the study conception and design. Both authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interests

The authors have no relevant financial or non-financial interests to disclose

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Sahu, S.K., Bagchi, P. Waste from production: an analysis at the firm level. Qual Quant 57, 2641–2656 (2023). https://doi.org/10.1007/s11135-022-01482-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-022-01482-x