Abstract

We have investigated the quantization of the multi-player Stackelberg game by proposing an asymmetric quantum entanglement operation. Due to the informational asymmetry between the leaders and followers in the Stackelberg model, it is more natural to have differential quantum entanglement in a multi-player quantum Stackelberg game. It is found that the profit functions considered in the multi-player Stackelberg model display interesting and intriguing patterns as functions of quantum entanglement parameters. In particular, differential quantum entanglement could cause the leaders to lose the first-mover advantage inherent in the classical Stackelberg model. This surprising feature raises an important question: “To move first or not to move first?”

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Game theory is concerned with how rational individuals make decisions when they are mutually interdependent. This theory finds many applications in various branches of economics and areas such as the social sciences, biology and engineering [1,2,3]. With the recent interest in quantum computing and quantum information theory, there has been much effort in trying to recast classical game theory using quantum probability amplitudes, and hence study the effect of quantum superposition, interference and entanglement on the agents’ optimal strategies [4, 5]. The seminal work on quantum game theory by Meyer [6] studied a simple coin tossing game and showed how a player utilizing quantum superposition could win with certainty against a classical player. Since then, many interesting aspects on quantum games with discrete strategies have been studied theoretically. For example, a general protocol for “two-player-two-strategy” quantum games with entanglement was developed by Eisert et al. [7] using the well-known prisoners’ dilemma as an example, and this was extended to multi-player games by Benjamin and Hayden [8]. Besides the games with discrete strategies, Li et al. [9] also investigated the quantization of games with continuous strategic space. They gave a “minimal” quantum structure of Cournot duopoly and showed that the players can escape the frustrating dilemma-like situation, i.e. the unique Nash equilibrium is inferior to the Pareto optimal as in the prisoners’ dilemma, if the structure involves a maximally entangled state. The essence of their “minimal” extension of the classical Cournot duopoly into the quantum domain is that the strategic space is maintained unexpanded and only the initial state is extended to be an entangled state. This extension has the advantage that if the game of nonzero entanglement exhibits any features not seen in the classical game, these features can be completely attributed to the quantum entanglement.

Later, Lo and Kiang [10] generalized Li et al.’s [9] “minimal” quantization rules to both Cournot model and Bertrand model of oligopoly. Inspired by the generalized multimode SU(1,1) displacement operator introduced by Lo and Liu [11], they proposed a unitary entanglement operation of the form

where \(\beta _{ij}=2\gamma \left( 1/N-\delta _{ij}\right) \), and the operators \({\hat{a}}_{i}\) and \({\hat{a}}_{i}^{\dag }\) are the annihilation and creation operators of the ith field mode, respectively, satisfying the commutation relations: \(\big [ {\hat{a}}_{i},{\hat{a}}_{j}^{\dag } \big ] \) \(=\delta _{ij}\) and \(\big [ {\hat{a}}_{i},{\hat{a}}_{j}\big ] =0\). It should be noted that the entanglement operation \({\hat{J}}\left( \gamma \right) \) is symmetric with respect to the interchange of any pair of field modes, and that the matrix \({\varvec{\beta }}\) has been chosen such that in the limit of \(N\rightarrow \) \(\infty \) there is no entanglement in order to guarantee a perfectly competitive market. Following Li et al. [9], they assumed the starting state to be the tensor product of N single-mode vacuum states which are subsequently entangled via the unitary operation \({\hat{J}} ( \gamma ) \) described in Eq. (1). The resultant state \(|\psi _{i}\rangle \equiv {\hat{J}}( \gamma ) |\)vac\(\rangle _{1}\otimes |\) vac\(\rangle _{2}\otimes |\)vac\(\rangle _{3}\cdots \otimes |\)vac\(\rangle _{N}\) is a generalized multimode squeezed vacuum state introduced by Lo and Sollie [12]. Then, all the N firms execute their strategic moves via the unitary operations \(\big \{ {\hat{D}}_{i}( x_{i}) \equiv \exp \big \{ x_{i}\big ( {\hat{a}}_{i}^{\dag }-{\hat{a}}_{i}\big ) /\sqrt{2}\big \};\;i=1,2,3,\ldots ,N\big \} \), respectively. Having executed their moves, the firms forward their electromagnetic field modes to the final measurement, prior to which a disentanglement operation \({\hat{J}}( \gamma ) ^{\dag }\) is performed. Thus, the final state prior to the measurement is given by \(|\psi _{f}\rangle \equiv {\hat{J}}( \gamma ) ^{\dag } \big [ \prod _{i=1}^{N}{\hat{D}}_{i}( x_{i}) \big ] {\hat{J}}( \gamma ) |\)vac\(\rangle _{1}\otimes |\)vac\(\rangle _{2}\otimes |\)vac\( \rangle _{3}\cdots \otimes |\)vac\(\rangle _{N}\). The final measurement is made corresponding to the observables \(\{ {\hat{X}}_{i}\equiv ( {\hat{a}}_{i}^{\dag }+{\hat{a}}_{i}) /\sqrt{2};\;i=1,2,3,\ldots ,N\} \). It is obvious that without quantum entanglement, namely \(\gamma =0\), this quantum structure can be easily shown to yield a faithful representation of the classical game, and the final measurement gives the original classical results: \(q_{i}\equiv \langle \psi _{f}|{\hat{X}}_{i}|\psi _{f}\rangle =x_{i}\) for \(i=1\), 2, 3,..., N. On the other hand, for any case of nonzero quantum entanglement, it is straightforward to show that the final measurement yields the following respective quantities of the firms:

In the Cournot model the profits of the firms can then be evaluated as:

Solving for the Nash equilibrium yields the unique solution

for \(i=1,2,3,\ldots ,N\). The corresponding profits of the firms at this equilibrium are given by

As a result, a “minimal” quantum extension of the classical Cournot N-opoly is obtained.

Furthermore, Zhou et al. [13] extended the quantum Cournot duopoly to three firms with different pair-wise entanglement parameters. They found that the sum of the firms’ profit increases monotonically to a limit as the three entanglement parameters tend to infinity. Indeed, the sum of the three firms’ profit will attain the same asymptotic limit even if there are only two pair-wise entanglement parameters (that is, one of the entanglement parameter is zero), provided these two parameters tend to infinity. They also considered the case for an arbitrary number, N, of firms, but then restricted themselves in this case to a common entanglement parameter.Footnote 1 Such a situation had been discussed by Lo and Kiang [10], though a different form for the entanglement parameter was used.

In the Cournot oligopoly, the firms assume a symmetric role, and the presence of different pair-wise entanglement parameters seems artificial. In contrast, there is an inherent asymmetry in the Stackelberg duopoly, where there is a first mover and a follower. Unlike the Cournot duopoly in which both firms make their strategic moves at the same time and thus have to guess what the action of their opponents would be, the Stackelberg duopoly allows one of the firms to move first. Since the other firm can now observe its opponent’s move before making its own decision, the game can no longer be modelled as static. In such a dynamic game, there exists an interesting result: there is a clear advantage to moving first. This first-mover advantage in the Stackelberg duopoly is due to the fact that being able to make its strategic decision known, the first mover does not need to guess what the follower will do because the follower is assumed to behave optimally. We therefore believe that it is more natural to have differential entanglement in a multi-player quantum Stackelberg game than in a Cournot one. In this paper we study this scenario and, in particular, we examine how the differential entanglement affects the first-mover advantage. Our analysis indicates that for a small number of firms the leaders could lose the first-mover advantage and might experience a disadvantage instead. This surprising feature is certainly not expected in the classical game. The general scheme of this paper is as follows: in the next section the model of quantum Stackelberg oligopoly with differential pair-wise entanglement is proposed, and its solution is discussed in detail in Sect. 3. The last section concludes our findings.

2 Quantum Stackelberg oligopoly

In the Stackelberg model of oligopoly some of the firms, namely the leaders, are allowed to move first while the remaining firms, namely the followers, can observe the leaders’ moves before making their own choices. To find the solution to this oligopoly problem, the concept of subgame perfect equilibrium or backwards induction is needed [1,2,3]. This means we first solve for the followers: each of the followers reacts optimally to the moves of both the leaders and other followers, by making his/her own choice which maximizes his/her profits. Then, each of the leaders takes into account the optimal response of the followers and set his/her own move in such a way as to maximize his/her own profits against the followers and other leaders. That is, the leaders substitute the followers’ reaction functions into their own profit functions and then optimize their moves accordingly. An appropriate candidate of the entanglement operator used in quantizing the Stackelberg oligopoly is given by

for \(\beta _{ij}=2\gamma ( 1/N-\delta _{ij}) \) and \(\alpha _{ij}=2\lambda ( 1/M-\delta _{ij}) \). The operators \({\hat{a}} _{i} \) and \({\hat{a}}_{i}^{\dag }\) represent the annihilation and creation operators of the followers, while the operators \({\hat{b}}_{i}\) and \({\hat{b}} _{i}^{\dag }\) are associated with the leaders. These operators satisfy the commutation relations: \(\big [ {\hat{a}}_{i},{\hat{a}}_{j}^{\dag }\big ] =\big [ {\hat{b}}_{i},{\hat{b}}_{j}^{\dag }\big ] =\delta _{ij}\) and \(\big [ {\hat{a}} _{i},{\hat{a}}_{j}\big ] =\big [ {\hat{b}}_{i},{\hat{b}}_{j}\big ] =\big [ \hat{a }_{i},{\hat{b}}_{j}\big ] =\big [ \hat{a}_{i},\hat{b}_{j}^{\dag }\big ] =0\). Unlike the entanglement operator used in the Cournot model, this operator takes into account the inherent asymmetry in the Stackelberg model. Furthermore, for \(M=N=1\) and \(\gamma =\lambda =0\), this model is reduced to the quantum Stackelberg duopoly model studied by Lo and Kiang [14].

For simplicity, in the following we shall concentrate on two special cases, namely the case of a single leader with N followers and the case of a single follower with M leaders, in order to demonstrate the effect of quantum entanglement on the outcomes of the Stackelberg oligopoly. It is obvious that the former case is obtained by setting \(M=1\) and \(\lambda =0\), while requiring \(N=1\) and \(\gamma =0\) yields the latter case.

2.1 Special case of a single leader with N followers

In the special case of a single leader with N followers, there can be one entanglement parameter among the fellow followers, and a different one between the first mover and the followers. Thus, the entanglement operator becomes

Our subsequent analysis begins with introducing the initial state \(|\psi _{i}\rangle \) of the system, which is the tensor product of \(( N+1) \) single-mode vacuum states subjected to the entanglement operation given in Eq. (7). The leader’s strategic move is executed via the unitary operation \(\hat{D}( x_{0}) \equiv \exp \{ x_{0}( \hat{b}^{\dag }-\hat{b}) /\sqrt{2}\} \), while the followers’ are represented by the unitary operations \(\{ \hat{D} _{i}( x_{i}) \equiv \exp \{ x_{i}( \hat{a}_{i}^{\dag }- \hat{a}_{i}) /\sqrt{2}\};\;i=1,2,3,\ldots ,N\} \). Having executed their moves, the final state after the disentanglement operation is given by \(|\psi _{f}\rangle \equiv \hat{J}( \gamma ,\xi ) ^{\dag } \big [ \prod _{i=1}^{N}\hat{D}_{i}( x_{i}) \,\hat{D}( x_{0}) \big ] \hat{J}( \gamma ,\xi ) |\psi _{i}\rangle \). Then, the final measurement gives the quantities of products produced by the firms:

Here, the subscript 0 refers to the single leader. As a result, the profits of the leader and the followers are given by

In accordance with the backwards induction analysis, the followers know the leader’s strategic move \(x_{0}\), and thus, they choose their moves \( \left\{ x_{i}\right\} \) by optimizing their profits with respect to this \( x_{0}\):

Since all followers are identical, they will all arrive at the same optimal value \(x^{*}\), and hence, the above equation can be simplified to yield

where

Their identical profit \(u^{*}\) is then given by

Next, we substitute the optimal value \(x^{*}\) into the profit or utility function of the leader given in Eq. (9). Optimizing it with respect to \(x_{0}\) , one obtains

and

It is not difficult to show that both \(x_{0}^{*}\) and \(u_{0}^{*}\) are nonnegative definite. In terms of the optimal value \(x_{0}^{*}\) given in Eq. (14), we could also determine the optimal values \(x^{*}\) in Eq. (11) and \(u^{*}\) in Eq. (13). For \(\gamma =\xi =0\), it is apparent that the above results are reduced to the well-known results of the classical Stackelberg oligopoly model, namely [1,2,3]

which explicitly demonstrates the first-mover advantage in the model for \( \Delta u^{*}>0\).

2.2 Special case of a single follower with M leaders

In the special case of a single follower with M leaders, the entanglement operator is given by

and the initial state \(|\psi _{i}\rangle \) of the system is the tensor product of \(( M+1) \) single-mode vacuum states subjected to the entanglement operation given in Eq. (17). The strategic moves of the follower and leaders are executed via the unitary operations: \(\hat{D}( x_{0}) \equiv \exp \{ x_{0}( \hat{a}^{\dag }-\hat{a}) / \sqrt{2}\} \) and \(\{ \hat{D}_{i}( x_{i}) \equiv \exp \{ x_{i}( \hat{b}_{i}^{\dag }-\hat{b}_{i}) /\sqrt{2}\} ;\;i=1,2,3,\ldots ,M\} \), respectively. After executing their moves and the disentanglement operation, the final state is given by \(|\psi _{f}\rangle \equiv \hat{J}( \lambda ,\xi ) ^{\dag }\big [ \prod _{i=1}^{N}\hat{D}_{i}( x_{i}) \,\hat{D}( x_{0}) \big ] \hat{J}( \lambda ,\xi ) |\psi _{i}\rangle \). The final measurement generates the quantities of products produced by the firms:

The corresponding profits are then given by

It should be noted that in this special case the subscript 0 refers to the single follower instead.

To perform the backwards induction analysis, we first solve the equation

for the optimal move \(x_{0}^{*}\) of the follower and obtain

The function \(H\left( \xi \right) \) is defined by

Then, by substituting this optimal value \(x_{0}^{*}\) into the profit function of the leaders given in Eq. (19) and optimizing it with respect to \( x_{i}\), the optimal move and profit of each leader are determined as follows:

where

Here, the derivations have made use of the fact that all leaders are identical and they will all arrive at the same optimal value of \(x^{*}\). Accordingly, the corresponding optimal move and profit of the follower are given by

It should be noted that, unlike the case of a single leader with N followers, the leaders’ optimal moves and profits in this case are no longer nonnegative definite. For \(\lambda =\xi =0\), the well-known results of the classical Stackelberg oligopoly model are recovered, namely [1,2,3]

which clearly indicate the first-mover advantage in the model for \(\Delta u^{*}>0\)

a The leader’s profit \(u_{0}^{*}\) (in units of the classical value) is plotted versus the entanglement parameter \(\gamma \) for different values of the entanglement parameter \(\xi \) in the case of one leader with two followers, i.e. \(N=2\), b the profit of each follower \(u^{*}\) (in units of the classical value) is plotted versus \( \gamma \) for different values of \(\xi \) in the same case, and c the profit difference \(\Delta u^{*}\equiv u_{0}^{*}-u^{*}\) (in units of the classical value) is plotted versus \(\gamma \) for different values of \(\xi \) in the same case. It should be noted that \(\xi \) must be less than 0.46561 in order to have nonnegative values of \(x^{*}\)

3 Illustrative numerical results

In Fig. 1 the profits of each follower \(u^{*}\) and the leader \( u_{0}^{*}\) of the special case of a single leader with two followers (i.e. \(N=2\)) are plotted versus the entanglement parameter \(\gamma \) (between the two followers) for different values of the entanglement parameter \(\xi \) (between each follower and the leader). Our analysis indicates that if \(\xi \) is less than 0.46561, then \(x^{*}\) is non-negative for all values of \(\gamma \). Of course, nonnegative values of \( x^{*}\) can also be found for other values of \(\xi \) provided that \( \gamma \) is chosen appropriately. As shown in the figure, for \(\gamma \lessapprox -\,2\) the leader’s profit \(u_{0}^{*}\) (in units of the classical value) is infinitesimal. Then, it starts to increase rapidly with the entanglement parameter \(\gamma \) and saturates around \(\gamma =1\) for the given values of the entanglement parameter \(\xi \). The profit of each follower \(u^{*}\) (in units of the classical value) also exhibits similar behaviour. In addition, tuning the parameter \(\xi \) enables us to enhance or suppress their profits against the classical values.

Moreover, the difference between the leader’s profit and the profit of each follower \(\Delta u^{*}\equiv u_{0}^{*}-u^{*}\) (in units of the classical value) is plotted against \(\gamma \) for different values of \(\xi \). It is apparent that the leader’s profit is always more than the followers’ for the given values of \(\xi \). In other words, the leader always has an advantage over the followers. However, significant first-mover advantage occurs only for \(\gamma \gtrapprox 1\). In Fig. 2 we examine how the number of followers affects the aforementioned first-mover advantage. The results indicate that the same pattern of the first-mover advantage also exists for \( N=5\), 10 and 30, as well as that the sole effect of increasing the number of followers is simply the enhancement of the first-mover advantage. In all these cases the parameter \(\xi \) plays the role of fine-tuning the first-mover advantage only. Besides, it should be noted that in each of these three cases the value of \(\xi \) is capped by an upper bound to ensure the nonnegative definiteness of \(x^{*}\) for all values of \(\gamma \).

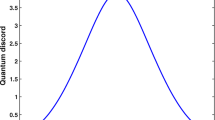

In Fig. 3 the profits of each leader \(u^{*}\) and the follower \( u_{0}^{*}\) of the special case of a single follower with two leaders (i.e. \(M=2\)) are plotted versus the entanglement parameter \(\lambda \) (between the two leaders) for different values of the entanglement parameter \(\xi \) (between each leader and the follower). In order to ensure the values of \(x_{0}^{*}\), \(u_{0}^{*}\) and \(u^{*}\) to be nonnegative definite for all values of \(\lambda \), we must require \(-\,1.24645<\xi <0\). Other values of \(\xi \) can also be allowed if \(\lambda \) is chosen appropriately. For \(\lambda \lessapprox -\,2\) the profits of the follower \( u_{0}^{*}\) (in units of the classical value) and each leader \(u^{*}\) (in units of the classical value) are very small. Then, they start to grow rapidly with the entanglement parameter \(\lambda \) and come to a plateau around \(\lambda =1\) for the given values of the entanglement parameter \(\xi \) . By varying the parameter \(\xi \), we are able to monitor the profits against the classical values, too. Likewise, it is found that the first-mover advantage is essentially zero for \(\lambda <-\,3\) and then it begins to rise rapidly. After hitting the maximum near the classical value at \(\lambda \approx -\,1\), the first-mover advantage starts to diminish, and an unexpected loss of the first-mover advantage appears at \(\lambda \approx 0 \) (except for \(\xi =0\)). The loss deteriorates with the entanglement parameter \(\lambda \) until it levels off at \(\lambda \approx 2\). This feature is certainly not expected in the classical model of Stackelberg oligopoly. In Fig. 4 the loss of the first-mover advantage is further examined for \(M=5\), 10 and 30. The same pattern of the loss exists for \( M=5\), 10 and 30, too; increasing the number of leaders simply results in aggravation of the loss. Furthermore, in all these cases the parameter \(\xi \) plays the role of fine-tuning the first-mover advantage only, and its value is confined within a specific range.

The profit difference \(\Delta u^{*}\equiv u_{0}^{*}-u^{*}\) (in units of the classical value) is plotted against \(\gamma \) for different values of \(\xi \) in the case of a 5 followers (i.e. \( N=5)\), b 10 followers (i.e. \(N=10\)), and c 30 followers (i.e. \(N=30\)). It should be noted that in each of these three cases the value of \( \xi \) is capped by an upper bound, namely \(\xi =0.48467\), 0.49202 and 0.49726 for \(N=5\), 10 and 30, respectively

a The follower’s profit \(u_{0}^{*}\) (in units of the classical value) is plotted versus the entanglement parameter \(\lambda \) for different values of the entanglement parameter \(\xi \) in the case of one follower with two leaders, i.e. \(M=2\), b the profit of each leader \( u^{*}\) (in units of the classical value) is plotted versus \(\lambda \) for different values of \(\xi \) in the same case, and c the profit difference \(\Delta u^{*}\equiv u^{*}-u_{0}^{*}\) (in units of the classical value) is plotted versus \(\lambda \) for different values of \(\xi \) in the same case. It should be noted that \(\xi \) must be confined within the specific range \(\left[ -\,1.24645,0\right] \) in order to ensure the values of \( x_{0}^{*}\), \(u_{0}^{*}\) and \(u^{*}\) to be nonnegative definite

The profit difference \(\Delta u^{*}\equiv u^{*}-u_{0}^{*}\) (in units of the classical value) is plotted against \( \gamma \) for different values of \(\xi \) in the case of a 5 leaders (i.e. \(M=5)\), b 10 leaders (i.e. \(M=10\)), and c 30 leaders (i.e. \(M=30\)). It should be noted that in each of these three cases the value of \(\xi \) is confined within a specific range, namely \(\left[ -\,1.07602,0\right] \), \(\left[ -\,1.03549,0\right] \) and \(\left[ -\,1.01134,0 \right] \) for \(M=5\), 10 and 30, respectively

4 Conclusion

We have investigated the quantization of the multi-player Stackelberg game by proposing an asymmetric quantum entanglement operation given in Eq. (7). This quantization scheme is different from the one introduced in the quantization of the Cournot and Bertrand oligopolies where a symmetric quantum entanglement operation given in Eq. (1) is used instead. We believe that due to the informational asymmetry between the leaders and followers in the Stackelberg model, it is more natural to have differential quantum entanglement in a quantum Stackelberg oligopoly. For simplicity, two special cases of the multi-player Stackelberg model, namely the case of a single leader with N followers as well as the case of a single follower with M leaders, have been examined in detail to demonstrate the effect of quantum entanglement on the outcomes of the Stackelberg oligopoly. Our analysis indicates that in the former case the quantum entanglement simply monitors the first-mover advantage against the classical value, whereas in the latter case an unexpected loss in the first-mover advantage could be caused by the quantum entanglement. This surprising feature is certainly not expected in the classical Stackelberg model and raises an important question: “To move first or not to move first ?”. Furthermore, we believe that the general case of M leaders with N followers may contain more complex patterns of the players’ profits and a thorough investigation is desirable.

As a final remark, it should be noted that using a different quantization scheme Iqbal and Toor [15] also performed an analysis of the quantum Stackelberg duopoly. Their study indicates that the backward induction outcome in the quantum form of Stackelberg duopoly becomes the same as the classical equilibrium of Cournot duopoly. That is, the classical first-mover advantage is avoided by quantization. On the other hand, using the minimal quantization rule, Lo and Kiang [14] has found that while positive entanglement enhances the first-mover advantage beyond the classical limit, the advantage is dramatically suppressed by negative entanglement, leading to its disappearance asymptotically. Hence, despite that both quantization schemes predict suppression of the first-mover advantage, the two schemes show significant differences, too.

Notes

The two approaches of course should give the same profit result if in the first one sets all the entanglement parameters to be the same, and in the second one sets \(N=3\). However, the two in their paper did not agree. The result they obtained by setting all the parameters equal in the first approach actually became independent of the entanglement parameter. This can be corrected if the limit of the three parameters approaching to the same value is taken properly.

References

Bierman, H.S., Fernandez, L.: Game Theory with Economic Applications, 2nd edn. Addison-Wesley, Boston (1998)

Gravelle, H., Rees, R.: Macroeconomics, 2nd edn. Longman, London (1992)

Romp, G.: Game Theory: Introduction and Applications. Oxford University Press, New York (1997)

Khan, F.S., Solmeyer, N., Balu, R., Humble, T.S.: Quantum games: a review of the history, current state, and interpretation. Quantum Inf. Process. 17, 309 (2018)

Alonso-Sanz, R.: Quantum Game Simulation. Springer, Basel (2019)

Meyer, D.A.: Quantum strategies. Phys. Rev. Lett. 82, 1052 (1999)

Eisert, J., Wilkens, M., Lewenstein, M.: Quantum games and quantum strategies. Phys. Rev. Lett. 83, 3077 (1999)

Benjamin, S.C., Hayden, P.M.: Multiplayer quantum games. Phys. Rev. A 64(3), 030301 (2001)

Li, H., Du, J., Massar, S.: Continuous-variable quantum games. Phys. Lett. A 306, 73 (2002)

Lo, C.F., Kiang, D.: Quantum oligopoly. Europhys. Lett. 64(5), 592 (2003)

Lo, C.F., Liu, K.L.: Multimode bosonic realization of the \(su\left(1,1\right) \) Lie algebra. Phys. Rev. A 48(4), 3362 (1993)

Lo, C.F., Sollie, R.: Generalized multimode squeezed states. Phys. Rev. A 47(1), 733 (1993)

Zhou, J., Ma, L., Li, Y.: Multiplayer quantum games with continuous-variable strategies. Phys. Lett. A 339, 10 (2005)

Lo, C.F., Kiang, D.: Quantum stackelberg duopoly. Phys. Lett. A 318, 333 (2003)

Iqbal, A., Toor, A.H.: Backwards-induction outcome in a quantum game. Phys. Rev. A 65, 052328 (2002)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Lo, C.F., Kiang, D. To move first or not to move first?. Quantum Inf Process 18, 335 (2019). https://doi.org/10.1007/s11128-019-2452-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11128-019-2452-x