Abstract

Using rich firm-level data of around 12,000 firms over 2004–2016, this study attempts to identify the factors responsible for the slowdown in gross investment and productivity in Indian manufacturing post-Global Financial Crisis. Our analysis reveals that the decline in investment is more pronounced for firms with higher productivity. Furthermore, we find evidence indicating a slowdown in the flow of capital and labor from less productive to more productive firms post-Global Financial Crisis. This indicates that a part of the fall in investment can be attributed to a decline in allocative efficiency, which is likely to have an impact on both aggregate productivity and income. Moreover, we probe into the causes behind the slowdown in the relationship between firm productivity, investment, capital and labor growth. We find that credit misallocation, financial constraints, age, and firm size played key roles in the investment slowdown. Finally, we present a counterfactual scenario by analyzing the extent of extra output and aggregate productivity that could be generated in the absence of misallocation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The level of aggregate productivity is an important driver of the standard of living in a country. Aggregate productivity is closely tied to efficient allocationFootnote 1 of resources in the economy. Allocative efficiency implies that more productive firms are either large or growing in size while less productive firms are either small or shrinking (Haltiwanger 2011). One way of achieving allocative efficiency is through the reallocation of factors of production towards more productive firms by means of the exit or decline in the market share of less efficient firms (Andrews and Hansell 2021). However, in the presence of market distortions and policy regulations that restrict the flow of resources towards productive firms, the pace of reallocation is likely to be slower, resulting in lower allocative efficiency (Banerjee and Duflo 2005). This explains the significant differences in efficiency of resource allocation between developed and developing countries. In fact, various studies have demonstrated the prevalence of significant misallocation of resources, i.e., variations in static marginal products of labor and capital, across firms within industries in developing economies on account of market inefficiencies and weak institutions.Footnote 2

In the context of an emerging economy, India, prior empirical evidence points to large productivity gains in the absence of misallocation (Hsieh and Klenow 2009). Notably, earlier studies have identified various factors associated with misallocation. For instance, misallocation of capital results from credit market distortions, whereby funds are directed towards less productive companies while more productive firms encounter credit restrictions that hinder their expansion, resulting in a slowdown in the pace of resource reallocation. Misallocation of credit may also lead to the prevalence of economically unviable zombie firms,Footnote 3 which can pose barriers to the entry and growth of other firms. In addition to variations in the degree of allocative efficiency among nations, the rate of reallocation in an economy can also shift over time, influenced by structural modifications or policy alterations. Furthermore, as posited by the Schumpeterian Cleansing Hypothesis,Footnote 4 changes in business dynamism, particularly during periods of economic downturn, can alter the pace of this reallocation. The Schumpeterian Cleansing Hypotheses emphasizes that economic downturns force inefficient firms off the market, thereby freeing resources that can be allocated to more efficient firms. However, in the context of developed economies, the evidence on whether recessions tend to induce increased efficiency has been mixed.

During 2003 to 2007, the Indian economy experienced an average growth rate of around 9% (Nagaraj 2013). Along with high economic growth, the investment rate in the manufacturing sector also increased during this period. However, post Global Financial Crisis (GFC), both economic growth and investment experienced slowdowns. Although economic growth recovered shortly, investment in the manufacturing sector continued to exhibit a downward trend until 2016 (Fig. 6 in Appendix A). Moreover, along with the slowdown in investment during the post-crisis period, growth in labor productivity in total manufacturing also reduced from 7 to 5.3%(Krishna et al., 2022, Chapter 12).Footnote 5 In our sample using Prowess database, we find that pre-GFC period (2003–2007), the average annual growth rate in labor productivity in the organized manufacturing sector was 14%, whereas post-GFC period, the average annual productivity growth declined to 8%.Footnote 6

Given that labor productivity is an important determinant of long-run standard of living, it is crucial to identify the factors behind the slowdown in labor productivity from a policy perspective. Notably, with lower investment, capital per worker is likely to grow more slowly, which in turn reduces the growth in output per worker, ultimately affecting productivity growth. Another possible reason for low aggregate labor productivity is decline in economic dynamism, which lowers the efficiency of resource allocation (Haltiwanger 2011). This implies that scarce labor and capital are likely to be employed in low productivity firms, lowering both labor productivity and the total factor productivity growth (TFPG). In fact, a primary motivation to carry out this study is our initial observation that the decline in investment post-GFC has specifically been larger among more productive firms.

As evident from Fig. 7 in Appendix A, post-GFC, the decline in investment rate was greater for more productive firms (firms belonging to the top two quartiles) compared to the less productive ones (firms belonging to the bottom two quartiles). This suggests that the slowdown in investment and capital accumulation has an allocative component. It also indicates that the factors restricting productive firms from investing may also affect the quality and quantity of aggregate investment. In this context, while prior studies based on the experiences of advanced countries have highlighted the effects of weak investment and declining dynamism on labor productivity separately, it must be noted that these two factors may also affect each other (Hambur and Andrews 2023). For example, if an economy experiences slow growth due to slow productivity growth as a result of lower investment, productive firms may not be incentivized to grow and maintain their market share, thus lowering the overall dynamism. At the same time, if the dynamism in the economy is slow due to frictions that prevent productive firms from expanding their capital and labor, it could lead to lower investment.

This study is further motivated by the observation that alongside slowdowns in investment and productivity growth in the Indian manufacturing following the GFC, there was a notable rise in the share of zombie firms in the total number of non-financial firms in the Indian economy (from around 1% in 2008–09 to around 11% in 2015–16).Footnote 7 According to the experiences of developed economies, like Japan (Caballero et al. 2008) and other OECD countries (McGowan et al. 2017), prevalence of zombie firms is associated with crowding out scarce resources, which creates barriers to entry and constrains the growth (capital, labor and investment) of more productive firms. This, in turn, is likely to slow down the process of resource reallocation towards more productive and efficient firms, affecting aggregate productivity. In this context, Chari et al. (2021) showed that the presence of zombie firms can be linked to the policy of credit forbearanceFootnote 8 adopted by the Reserve Bank of India (RBI) post-GFC, which resulted in credit misallocation.

Against this backdrop, the present study attempts to examine the dynamics of allocative efficiency in the Indian manufacturing sector for the period 2004–2016. In particular, we analyze the inter-firm dynamics pertaining to input (capital, labor) reallocation and link it to the extent and efficiency of the credit reallocation process. Broadly, this study tries to address the following questions:

-

1.

Is there any evidence of slower economic dynamism and reallocation of labor and capital in Indian manufacturing post-GFC? If so, can we link them to the slowdown in investment observed post-GFC?

-

2.

What are the possible factors behind this? Do the same factors drive both slower dynamism and weaker investment?

-

3.

In the case of a slowdown in the pace of reallocation, how large or small are its economic consequences?

The results of this study indicate that, overall, the process of resource reallocation in Indian manufacturing is efficiency enhancing. However, post-GFC, the pace of reallocation of capital and labor from less to more productive firms declined. Sub-sample analysis conducted in this study reveals that slowdown in the pace of reallocation was significantly higher among older and larger firms, indicating that inefficient old and large firms were less likely to exit the market or shrink in size post-GFC. As pointed out by Decker et al. (2020), two potential factors might have played a role in explaining the slowdown in case of the United States: (i) the size of idiosyncratic TFP shocks has decreased over time, resulting in less within-industry dispersion in productivity, and (ii) business investment is less responsive to firm-level productivity of a given magnitude due to rising adjustment cost or frictions. Our findings provide evidence in support of the “responsiveness” hypotheses. Consistent with the process of reallocation of capital and labor, a similar pattern is observed with respect to the flow of credit from less to more productive firms. Furthermore, while the overall pace of credit reallocation is found to be efficiency enhancing, we identify a significant slowdown in the speed post-GFC. Moreover, these results hold true across various sub-samples, indicating the possibility that the dynamics of allocative efficiency in capital and labor may be closely related to firms’ access to debt finance.

Further, we undertook sub-sample analysis based on industry and firm heterogeneity in terms of dependence on external finance and credit constraints. Results show that firms in industries having greater dependence on external finance and credit-constrained firms experienced a greater slowdown in their speed of reallocation. This points to the likelihood of an increase in credit market distortions and financial constraints post-GFC, contributing to lower “responsiveness” of business investment to productivity shocks. Although various other factors could be responsible for the decline in capital and labor reallocation and the slowdown in investment and dynamism, we looked into one pertinent possibility whether firms investing more in intangibles and digital capital could lead to an apparent slowdown in investment and slower dynamism. Our results indicate absence of statistically significant effect of these factors Finally, we present a counterfactual scenario to analyze the extent of extra output and aggregate productivity that can be generated in the absence of misallocation. We find that in the absence of a slowdown in the relationship between productivity, capital and labor growth, the TFPG would have increased by 0.21% points by 2016.

This study contributes to the literature in a number of ways. It fits into the body of literature exploring the “cleansing effect” of recession that was initially proposed by Schumpeter. Existing evidence on whether recessions are generally efficiency enhancing is mixed. Some studies claim that the pace of reallocation increase during recession (Davis and Haltiwanger 1990; Hyun 2016; Ramey and Shapiro 1998) while others have reported a decrease in the pace of reallocation following economic downturns (Caballero and Hammour 1996; Barlevy 2003). Another set of studies demonstrated that the cleansing effect rather depends on the nature of an economic downturn. In the context of GFC, Foster et al. (2016) found that while a crisis is usually marked by stronger-than-usual productivity-enhancing reallocation, the pace of reallocation in the United States actually declined post-GFC. Similar results were reported by Mead and Roland (2020) in the context of the United Kingdom. In this context, the current study contributes to the above-mentioned strand of literature by providing evidence of input misallocation.

Additionally, this study fits into the literature exploring “shocks” vs. “responsiveness” hypothesis as an explanation for the slowdown in the pace of input reallocation (Decker et al. 2020; Berger and Vavra 2019). Furthermore, we explore the implications of slowdown in the relationship between productivity, capital growth and labor growth on TFPG and investment from the perspective of an emerging economy – India. In addition, we contribute to the tangential literature exploring the impact of credit market imperfections and financial frictions on misallocation in general (Midrigan and Xu 2014; Gopinath et al. 2017; Bau and Matray 2023). With respect to an economic downturn, such as the GFC, numerous studies have shown that the presence of financial frictions and credit market distortions lower the pace of efficiency-enhancing reallocation (Osotimehin and Pappada 2016; Sakai and Uesugi 2021; Barlevy 2003; Ouyang 2009). In the context of India, Chari et al. (2021) provided evidence of credit misallocation and zombie lending post-GFC, which they attributed to the policy of credit forbearance adopted by the RBI post-GFC (2008–2015). Therefore, the findings of this study related to credit market distortions is in line with previous findings. However, unlike Chari et al. (2021), who focused on the non-financial sector as a whole, this study concentrates only on the manufacturing sector since it is the major driver of capital formation in the Indian economy. Moreover, with regard to credit misallocation and its correlation with investment, productivity, capital and labor, our results are more general in the sense that they apply not only to zombie (distressed) firms vs. non-zombie (non-distressed) firms but also to firms across different productivity quartiles.

The remainder of this paper is structured as follows: The next section describes the data source. Section 3 discusses empirical framework, where we look into the relationship between productivity, capital and labor growth to understand the evolution of the process of allocative efficiency in Indian manufacturing over the study period. Section 4 discusses results obtained using the baseline model, followed by sub-sample analysis. Section 5 examines factors behind the slowdown in the pace of reallocation, investigating the role of credit market distortions, financial frictions and the role of intangibles and digital capital in causing the slowdown. In Section 6, counterfactual analysis is presented. Section 7 concludes.

2 Data source

This study uses the Prowess database – a firm-level dataset compiled by the Centre for Monitoring Indian Economy (CMIE) – which provides information on all publicly traded firms as well as a large number of private firms (both listed and unlisted) across various industries in the Indian economy. This dataset has an advantage over the Annual Survey of Industries (ASI) – another dataset that is widely used to study the Indian manufacturing sector. While ASI is constructed using repeated cross-sections of firms, Prowess is a firm-level panel dataset that allows the tracking of changes in capital, labor and other variables over time.Footnote 9 Moreover, it contains information drawn from the income statements and balance sheets of companies, which is particularly well-suited for the current study since it allows an examination of the role of credit market distortions in contributing to the slowdown in the pace of capital and labor reallocation. Furthermore, the companies included in the Prowess database account for more than 70% of all economic activity in the organized industrial sector of India and 75% of all corporate taxes collected by the Government of India (Bau and Matray 2023). For this study, we focus on the manufacturing sector firms belonging to the two-digit National Industrial Classification (NIC) during the period 2004–2016.

For our empirical analysis, we consider firm-level information on sales, capitalFootnote 10 (net fixed assets), wage bill, total assets, energy expenses (power and fuel), age, total debt and bank credit. As part of the data filtering procedure, only those firms reporting positive, non-missing values of sales, capital, wage bill, and total assets are considered for empirical analysis. We proceed with the data filtering process as follows. The initial sample consisted of 17,618 unique firms during the period 2004–2016. We drop firm-year observations with missing or negative values for sales, capital, wages, and total assets. Our final estimation sample comprised of an unbalanced panel of 83,955 firm year observations (from 12,642 firms) over 2004–2016, with an average of seven observations per firm. However, in our empirical analysis since we take lag of one period, total number observations further get reduced to 68,278 corresponding to 11,916 unique firms.Footnote 11 Subsequently, output and input variables are deflated using the wholesale price index (WPI) provided by the Central Statistics Office (CSO) to obtain the values in real terms. The descriptions of the variables and their descriptive statistics are presented in Table 1.

3 Empirical framework

To examine whether the relationship between productivity, labor, and capital changed post-GFC, we follow Hambur and Andrews (2023). It should be noted that Hambur and Andrews (2023) improved upon the approach proposed by Decker et al. (2020) by further extending it to include both capital and investment. In particular, Decker et al. (2020) drew on the idea that based on the initial size of a firm, more productive firms will have a higher growth than less productive ones in the presence of productivity-enhancing reallocation.

For a wide range of models with decreasing returns to scale revenue function (φ < 1) Footnote 12 due to diminishing returns to scale or imperfect competition:

where Revenuei,t, \({{TFP}}_{i,t}\), and \({E}_{i,t}\), represent total revenue, total factor productivity, and employment of firm i at time t, respectively, Decker et al. (2020) show that employment growth (\({g}_{i,t+1}^{E}\)) will be increasing in the level of productivity (\({{TFP}}_{i,t}\)), conditional on the initial firm size \({E}_{i,t}\)Footnote 13, which can be represented as:

Subsequently, adopting a first-order linear-log approximation yield:

where the lowercase variables tfp and e refer to the logarithm of productivity and employment. The coefficient \({\beta }_{1}\) captures the responsiveness of employment growth to productivity. It may be affected by a number of factors, including those affecting the adjustment cost of labor. Notably, the model proposed by Hambur and Andrews (2023), which accounts for capital and investment, can be expressed as follows:

where future growth (\({g}_{i,t+1}^{k}\)) in capital is a function of the log productivity (\({{tfp}}_{i,{t}}\)) of firm i at time t. In Eq. (4), the total factor productivity of each firm is calculated using the semi-parametric method following Ackerberg et al. (2015; ACF henceforth).Footnote 14 Fundamentally, ACF allows shocks to labor prices to be exogenous, serial correlated and unobservable, while also permitting the labor input to be dynamic along with unobservable adjustment costs (Van Beveren 2012). The ACF approach is an improvement on the widely-used measure of TFP proposed by Levinsohn and Petrin (LP) (2003). Note that for our empirical analysis, tfpi,t is expressed as a deviation from the industry average,Footnote 15 implying a comparison of the high and low productivity firms within the same industry. Vector Z refers to the control variables, which includes initial firm size (proxied by the log of total assets), log of firm age (number of years since incorporation) and firm sales growth. All controls are lagged by one year. Additionally, we include industry and time fixed effects, to account for any time and industry-specific unobserved factors.

Furthermore, in accordance with Davis et al. (1996) and Decker et al. (2020), capital stock growth is defined as the change in capital stock divided by the average capital stock at both (current and previous) periods:

where \({k}_{i,t}\) is the capital stock of firm i in period t.

Similarly, labor growth is defined as follows:

Notably, the coefficient of interest considered in the baseline model in Eq. (4) is \({\gamma }_{1}\). In particular, \({\gamma }_{1} > 0\) suggests that capital (labor) flows from less productive to more productive firms within the same industry, indicating that the process of capital reallocation is efficiency enhancing even after controlling for firm level heterogeneity, industry, and time fixed effects.Footnote 16

Since our aim is to analyze whether the slowdown in investment post-GFC is related to a slowdown in the efficiency of capital and labor reallocation, we extend the baseline model to also include an interaction term between GFC and productivity (\({gfc}* {{tfp}}_{i,t}\)), as follows:

Here, \({\gamma }_{2}\) measures the change in the speed of reallocation between less productive and more productive firms post-GFC, with \({\gamma }_{2}\)< 0 implying a weakening of the efficiency of capital and labor reallocation. We estimate both the baseline model and the above model (noted in Eq. (7)) using an interaction term by using pooled OLS.Footnote 17

4 Results

4.1 Capital and labor reallocation

Column 1 of Table 2 shows the results of the baseline estimation using Eq. (4). We find that TFP has a statistically significant positive coefficient, indicating that capital stock growth is higher for more productive firms compared to less productive firms. This finding suggests that, generally, capital tends to flow towards more efficient firms at the expense of less efficient firms within sectors, indicating that the process of capital reallocation is usually efficiency enhancing. Next, we estimate Eq. (7) to examine changes in the relationship between capital stock growth and productivity post-GFC. Column 2 of Table 2 displays the results, where the negative coefficient of the interaction term (\({gfc}* {{tfp}}_{i,t,}\)) suggests that the speed of reallocation slowed down post-GFC, highlighting that the relationship between capital stock growth and productivity slowed down post-GFC. Similarly, with regard to growth in labor stock, we find that although labor reallocation was generally efficiency enhancing (Column 3), the speed of reallocation reduced post-GFC (Column 4). In terms of magnitude, we find that pre-GFC, the difference in capital growth between a more productive firm (i.e. the firm with tfp one standard deviation above the industry mean) and a less productive firm (i.e. the firm with tfp one standard deviation below the industry mean) was around 10 percentage points. However, post-GFC, the difference fell by 2.3 percentage points, or by more than 1/3rd. Similarly, in the case of labor, we find that pre-GFC, a more productive firm’s growth was 9.2 percentage more than a less productive firm. However, this gap fell by 1.8 percentage points, or around less than one thirdFootnote 18. This indicates that the post-GFC period witnessed a greater decline in the efficiency of capital reallocation.Footnote 19

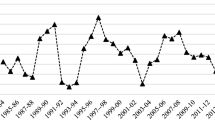

Furthermore, we also re-estimate the model in Column 2 of Table 2 but replacing the tfp variable with a dummy variable indicating the firms’ position (by quartile) in the productivity distribution at time t. This made the analysis more flexible and non-parametric, and may also lead to more robust estimates compared to the previous scenario that assumed a linear relationship (Hambur and Andrews 2023). The results presented in Fig. 1 show that the growth rate of capital stock is higher for more productive firms compared to less productive firms. However, over time, a narrowing of the gap in capital growth between the least productive firms and other firms is observed, particularly for the most productive quartile. This implies that firms were not only undertaking less investment but the investments they did undertake were also likely to be low yielding.

This finding hints at the possibility of an allocative dimension to the business investment slowdown, suggesting that the obstacles hindering economic dynamism impacted both expansion of capital and TFP. This further alludes to a possible misallocation of capital.

We observe a similar trend in the case of labor growth as well (Fig. 2). We notice that the gap in labor growth between the least productive firms and other firms narrowed over time, particularly for the most productive quartile. We observe that both pre and post GFC, the average labor growth by productivity quartile relative to the bottom quartile is lower than average capital growth.

4.2 Sub-sample analysis

To understand the heterogeneity of the sample firms, we examine the relationship between input growth (capital and labor) and productivity based on firm age. This set of analyses is necessary to identify whether slowdown in the pace of reallocation was more prominent for young or old firms. We define young firms as those operational for less than or equal to 5 years while old firms are those operating for more than 5 years following Decker et al. (2020).Footnote 20 Table 3 presents the results of the sub-sample analysis by age. We find that while there is no significant difference in the speed of reallocation post-GFC is observed in the sample of young firms, a significant slowdown in the speed of reallocation post-GFC is found in the case of older firms (Columns 2 and 4, respectively).Footnote 21 Overall, this finding suggests greater dynamism among younger firms, wherein they either survive or fail and exit.

Next, we examine the relationship of productivity with capital and labor growth based on firm size. We define firms as small if they belong to the bottom quartile in terms of firm-size distribution, while large firms are considered as those belonging to the 2nd–4th quartiles. The results are presented in Table 4. For the sample of small firms (Columns 1 and 3), no significant change in the speed of reallocation is observed for both capital and labor post-GFC. However, in the case of large firms, we identify a significant slowdown in the pace of reallocation post-GFC (Columns 2 and 4).Footnote 22 This finding implies that the slowdown in economic dynamism was mainly witnessed by large firms, which suggests that large inefficient and incumbent firms were less likely to exit or shrink in size following the GFC.

5 Factors behind the slowdown in the pace of reallocation

As highlighted by Decker et al. (2020), there are two potential broad categories of explanations for the weakening of the relationship between productivity quartile and firm-level capital growth:

-

(i)

the size of idiosyncratic TFP shocks (across firms within industries) has decreased over time, resulting in less within-industry dispersion in TFP.

With smaller TFP shocks, the incentive for firms to invest reduces. Therefore, if the difference between the lowest quartile and the highest quartile of productivity has decreased over time, then, other things equal, we would expect to see a weakening of the relationship between quartile of the TFP distribution and firm-level capital growth.

To determine this possibility, we analyze the within-industry dispersion in tfp across different years (Fig. 3) below.

Fig. 3 We find that, on average, the TFP dispersion within industries increased modestly by 0.013 post-GFC. Based on the pattern of TFP dispersion, we would expect reallocation in manufacturing to remain the same or increase in the post-GFC period. However, the observed weakening in the relationship between productivity, capital and labor growth post-GFC, provides evidence against the “shock” hypothesis as a possible reason for decline in reallocation post-GFC. This finding is in line with Decker et al. (2020).

-

(ii)

business investment is less responsive to firm-level TFP shocks of a given magnitude.

This could happen when there are frictions that prevents productive firms from employing more capital and labor at the cost of less productive firms. While there can be many sources of such frictions, in particular, we consider the role of distortion in the credit market, and the role of financial frictions (Sections 5.1 and 5.2). Further, we also probe the issue of mismeasured or unmeasured investment (Section 5.3).

-

(a)

Distortion in the allocation of credit and role of financial frictions.

A potential explanation for the slower flow of capital to more productive firms can be the increasing difficulties encountered by firms in obtaining external funding, thereby increasing frictions in investing. This could, for example, explain the occurrence of declining credit supply or increasing financial frictions due to firms having less collateral or greater information asymmetry. A large number of studies have analyzed the impact of credit market imperfections and financial frictions on misallocation. For instance, Gopinath et al. (2017) found that a substantial part of the increased misallocation of capital in Mediterranean countries post-1999 can be attributed to financial frictions. Similarly, using plant-level data pertaining to the U.S manufacturing industry, Midrigan and Xu (2014) reported misallocation of capital arising from financial frictions to be one of the primary channels leading to a decline in TFP. In the context of Indian manufacturing, Bau and Matray (2023) showed that capital market liberalization during 1995–2015 resulted in increased access to finance, which led to a reduction in both capital and labor misallocation and an increase in TFP. Similarly, numerous studies have examined the effects of financing frictions and credit availability on firm investment and growth (Rajan and Zingales 1998).

-

(b)

Mismeasurement of investment due to unmeasured intangible capital or “digital capital”.

The study further investigates the possibility whether the apparent weakening of relationship between productivity and input growth especially for more productive ones may be due to those firms making greater investments in intangible assets and digital capital. Given the increasing significance of intangibles and digital capital in the economy, there may be a possibility that firms might have undertaken greater investment in intangibles and digital capital in place of investment in physical capital during the post-crisis period. Notably, such increased investments are more likely to have been undertaken by more productive firms rather than less productive ones. In such a scenario, since the measure of capital growth considered in this study does not capture intangible assets, it would be inappropriate to attribute the slowdown in investment in physical capital in more productive firms to a decline in allocative efficiency.

-

(a)

5.1 Distortions in the allocation of credit

Post-GFC, during 2008–2015, the RBI adopted a regulatory forbearance strategy that relaxed the norms for banks and financial institutions to restructure their assets. This strategy was implemented to help borrowers tide over temporary hardships caused by the GFC. However, what was supposed to be a short-term temporary measure continued for a much longer period of seven years. Taking advantage of the regulatory forbearance, banks started to restructure their loans even for unviable entities, which allowed the latter to hide the true asset quality in balance sheets. The inflated profits were then utilized by banks to pay increased dividends to shareholders, including the government in the case of public sector banks. As a result, banks became severely undercapitalized, which distorted their incentives and fostered risky lending practices, including lending to zombies (loss making, unviable firms). As a result of the distorted incentives, banks ended up misallocating credit, which in turn affected the quality of investment in the economy. By the time forbearance ended in 2015, restructuring had increased seven times while the number of non-performing assets (NPAs) had almost doubled compared to its pre-forbearance levels (Government of India 2021).Footnote 23

In this sub-section, we examine the relationship between credit reallocation and firm productivity following Li et al. (2023), Sakai and Uesugi (2021) and Herrera et al. (2011). Our objective is to examine the correlation in the patterns of the inputs and credit reallocation. The basic idea behind this approach is that, on controlling for various firm level characteristics, efficiency-enhancing credit reallocation should ensure a higher credit growth rate for more productive firms as compared to less productive firms. Following Davis and Haltiwanger (1992) and Herrera et al. (2011), we define the credit growth rate as the ratio of change in overall debt of firm f at time t−1 and t to the average overall debt of firm f between time t −1 and time t. More specifically, this can be formulated as:

Furthermore, since most of the debt is predominantly in the form of bank credit, we also include the growth rate in bank credit as our measure for the credit growth rate. Notably, the growth rate formula is similar to Eq. (8).Footnote 24

We then estimate a regression model that connects the growth rate of the debt variables to firm productivity. The following equation represents the baseline specification for credit growth:

where future growth (\({g}_{i,t+1}^{{debt}}\)) is a function of the current log productivity of firm i at time t. In this context, it should be noted that \({{tfp}}_{i,t}\) is expressed as a deviation from the industry average, which allows for comparisons between high and low productive firms within the same industry. Vector Z refers to the control variables, including initial firm size (proxied by the log of total assets lagged by one year), age (number of years since incorporation), previous period sales growth, industry and time fixed effects. We assume a one-period lag for these explanatory factors because firm productivity and other firms’ characteristics may be endogenously determined. In this context, the value of coefficient \({\alpha }_{1}\) is of particular interest. Notably, \({\alpha }_{1} > 0\) indicates the existence of efficiency-enhancing reallocation, i.e. credit flows from less efficient to more efficient firms. To determine the pace of reallocation of credit post-GFC from less efficient to more efficient firms, we add an interaction term \(({gfc}* {{tfp}}_{i,t})\) to the above equation, expressed as follows:

where GFC is a dummy representing the period from 2008 to 2016. If \({\alpha }_{2}\) is positive, it would mean that the pace of credit reallocation increased post-GFC, while a negative coefficient of \({\alpha }_{2}\) would mean that the pace of credit reallocation declined post-GFC. Notably, given that the previous literature already provides evidence of credit misallocation, we expect \({\alpha }_{2}\) to be negative.

Columns 1 and 3 of Table 5 present the results of our baseline estimation using Eq. (9). We find that TFP maintains a statistically significant positive coefficient, indicating higher debt and bank credit growth for more productive firms compared to less productive ones. This finding suggests that the process of credit reallocation is generally efficiency enhancing. Subsequently, we employ Eq. (10) to identify changes in the relationship among debt, bank credit growth and productivity post-GFC. Columns 2 and 4 of Table 5 display the results of this analysis. The statistically significant negative coefficient for the interaction term (\({gfc}* {{tfp}}_{i,t}\)) suggests that the relationship between productivity, debt, and bank borrowing growth slowed down post-GFC, which means that the speed of credit reallocation decelerated post-GFC. In terms of magnitude, we find that pre-GFC, the difference in debt growth between a more productive firm and a less productive firms was around 9.6 percentage points. However, post-GFC, the difference fell by 2.5 percentage points. Similarly, for bank borrowing growth, we find that pre-GFC, a more productive firm had a growth which was 13.8 percentage more than a less productive firm. However, the gap fell by 2.6 percentage points. Overall, this set of results suggests that an increase in credit market frictions hindered the flow of credit to more productive firms at the expense of less productive firms. Notably, these results are consistent with the previous literature on zombie lending (Chapter 7, Economic Survey 2021; Chari et al. 2021). However, the results of this study are more comprehensive, since it is not confined to the experience of only zombie (distressed) firms.

We also analyze the relationship of debt and bank credit growth with productivity in terms of firm age and firm size, the results of which are reported in Appendix C under additional results (Tables 9 and 10). The findings show that while the slowdown in the pace of reallocation was significant for older and larger firms, no evidence of such a slowdown could be identified for the sample of young and small firms.

Furthermore, Eq. (10) is estimated by replacing the TFP variable with a dummy variable indicating the firms’ position (by quartile) in productivity distribution at time t. This is similar to the approach adopted in the case of capital and labor. Figure 4 below displays the results of this analysis, revealing that more productive firms achieved higher credit (debt) growth. However, post-GFC, the difference in credit (debt) growth between the least productive firms and other firms narrowed, particularly for the most productive quartile.

As shown in Fig. 5, a similar trend is observed in the case of bank borrowing. It is evident that the difference in the growth in bank borrowing between the least productive firms and other firms narrowed over time, especially for the most productive quartile. This hints at possible misallocation of credit post-GFC.

Overall, the above results pertaining to inter-firm dynamics in credit reallocation are largely similar to the inter-firm dynamics related to input (capital, labor) reallocation, suggesting a potential correlation between the two. This further indicates that the slowdown in capital and labor reallocation post-GFC may have occurred due to a slowdown in credit reallocation.

5.2 Role of financial friction

This study also compares the speed of reallocation across samples of credit-constrained and unconstrained firms, with the sample firms considered as credit-constrained if their debt-to-equity ratio was above the industry median in a particular year. The results, presented in Table 6, show that firms with higher financial constraints experienced greater slowdown.Footnote 25

Furthermore, we estimate the pace of reallocation across industries based on their dependence on external finance. We expect the slowdown to be larger for industries characterized by greater reliance on external finance if financial frictions and access to credit contributed to the slowdown in reallocation. The industry classification based on external financial dependence is presented in Table 11 of Appendix D. As expected, firms belonging to industries with high financial dependence exhibited greater slowdown in their pace of capital reallocation (Columns 1 and 2 of Table 7). This again points towards the possible role of access to finance in contributing to the slowdown.Footnote 26 However, we also found that the slowdown in the pace of labor reallocation was lower for industries with greater dependence on external finance (Columns 3 and 4). One possible explanation for this finding is the likelihood of labor substitution and lesser investment in physical capital (Spaliara 2009).

5.3 Intangible and digital capital

Here, we investigate the role of intangibles and digital capital by investigating the relationship between input growth (capital and labor) and productivity across sectors based on their use of technology.Footnote 27 In the case of more productive firms investing more in intangibles and digital capital, the slowdown in the relationship between input growth (capital and labor) and productivity during a post-crisis period can be expected to be greater in high-tech industries, since the firms in such industries have a greater incentive to invest in intangibles and digital capital. Table 8 shows the results obtained on analyzing the relationship between the growth rates of physical capital and productivity across industries based on technology intensity. It is observed that, post-GFC, the slowdown is quite significant in low-tech industries, while no evidence of a slowdown is noticed for high-tech industries. Similarly, on comparing medium low-tech and medium high-tech industries, a greater slowdown is estimated for the former. Therefore, based on the available evidence, we are unable to conclude whether the slowdown in the relationship between physical capital growth and productivity is partly driven by productive firms investing more in intangibles. This result is consistent with Decker et al. (2020), who found no significant correlation between capital growth and productivity in high-tech industries in the U.S. Notably, the slowdown was found to be significant in other sectors.

We also examine the relationship between growth in intangible capital and firm productivity However, no significant relationship between productivity and growth in intangibles could be observed in both cases, indicating that the slowdown in the relationship between physical capital growth and productivity is not driven by firms investing more in intangibles.Footnote 28

6 Counterfactual analysis

The results mentioned above highlight that the relationship between productivity and input growth has weakened post-GFC, implying a slowdown in the flow of resources from less productive to more productive firms. Such allocative inefficiency is likely to lower aggregate productivity. In this context, a pertinent question that emerges is related to the extent of this decline in productivity. To address this, the approach proposed by Decker et al. (2020) is adopted. The basic idea of this approach is to construct a counterfactual productivity index for capturing what would have happened had the relationship between productivity and input growth not weakened. In such a case, more productive firms would have become larger, which also means that aggregate productivity would have been higher. For the purpose of this analysis, we consider two different models: (i) a model in which responsiveness between input (capital and labor) growth and (lagged) productivity is allowed to vary through the inclusion of time trend interactions, and (ii) a model in which this relationship is kept constant at the level estimated at the beginning of the sample (where TFP*time interaction is set equal to zero). These models offer different predictions for capital and employment growth in time t+1, which can then be combined with the (initial) level of employment and capital for the firm in t to attain predicted inputs. After obtaining the predicted inputs, the aggregate input index is constructed.

Based on these predictions, we calculate the base year productivity (11) and two other indexes employing shares from the models with a trend (12) and without a trend (13).

After obtaining the productivity indexes, the estimated counterfactual productivity can be calculated as follows:

Our findings indicate that in the absence of a slowdown, the aggregate TFP would have increased by 0.21% points by 2016.

7 Conclusion

Investment growth is directly linked to aggregate productivity growth, such that a decline in the former is likely to have a negative implication on overall productivity. Moreover, a decline in allocative efficiency and economic dynamism can also lead to a decline in investment and overall productivity in the presence of frictions that prevent the best possible utilization of resources. Motivated by observations of a slowdown in the investment and labor productivity in Indian manufacturing post-GFC, this study employed firm-level panel data to investigate the allocative efficiency of capital and labor in the Indian manufacturing sector during 2004–2016.

Our findings offer evidence of not only an investment slowdown but also lower investment undertaken by more productive firms. This indicates that the slowdown in investment comprised an allocative component. Consistent with this finding, we find that there is a weakening in the relationship between productivity and input growth which implies a slowdown in the pace of efficiency-enhancing resource reallocation post-GFC. Furthermore, the sub-sample analysis conducted in this study revealed that the slowdown was more significant among old and large firms. With regard to the possible causes behind this slowdown, we examined the “shocks” vs. “responsiveness” hypotheses. While we did not find any evidence supporting the “shocks” hypothesis, we found the role of credit misallocation and financial constraints which might have weakened the relationship between productivity, capital, and labor growth thereby supporting the “responsiveness” hypotheses. Exploring further, we noticed a correlation in the inter-firm dynamics of both inputs and credit reallocation. Our results indicate that firms that were more reliant on external finance and more credit-constrained firms experienced greater slowdown in their speed of reallocation. Finally, a counterfactual exercise was conducted to find that in the absence of a slowdown in the relationship between productivity, capital and labor growth, the TFPG would have increased by 0.21% points by 2016.

Given that aggregate productivity is a major driver of the per capita income of an economy, identifying the factors behind any productivity slowdown is crucial from a policy perspective. Drawing on this context, the current study tries to link financial market frictions with the efficiency of resource allocation – an exercise that has valuable implications for aggregate productivity.

One limitation of this study is that it did not account for firm entry and exit, since the dataset used did not provide any related information on the same. Utilizing this information would definitely have enhanced our understanding of the inter-firm dynamics of resource reallocation and its impact on investment and productivity. We hope that future research will be able to address this issue in greater detail using more nuanced datasets.

Data availability

The database used is a proprietary database available from CMIE-Prowess. Following is the link to the website: (https://prowessiq.cmie.com/).

Notes

Efficient allocation (or allocative efficiency) implies that resources are utilized for their highest valued uses, which in turn contributes to higher overall productivity and an improved living standard.

For a review of the literature on the various sources contributing to misallocation, refer to Restuccia and Rogerson (2017).

Zombie firms typically refer to unproductive companies characterized by the inability to cover interest payments on their outstanding debts. Despite being loss-making and inefficient, these firms may continue to survive in the market, in many cases, due to backing from creditors or government support.

Schumpeter (1934) argued that recessions primarily serve the purpose of liquidation and reallocation of resources.

Reserve Bank of India - Reports (rbi.org.in)

Another study for the organized manufacturing in India using Annual Survey of Industries (ASI) data also reported a decline in average annual labor productivity growth from 9% pre-GFC period to 2% post-GFC (Rijesh 2023).

Refer to Pg. 57 of RBI Bulletin-February, 2022, for more details. (https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/BULLETINFEB20220AA3C61D698B4A76995677735F2AE71D.PDF).

Forbearance refers to the concessions or temporary relief granted by lenders to borrowers facing short-term financial hardship. This may include allowing borrowers to temporarily suspend or reduce their loan payments, extending the loan repayment period, or relaxing loan terms. Forbearance is usually offered to borrowers facing unexpected economic or legal circumstances or in the event of an economic downturn, such as a financial crisis.

Previously, Bau and Matrey (2023) employed this database to study the impact of foreign capital market liberalization on capital misallocation and aggregate productivity in the Indian manufacturing sector. Apart from Bau and Matrey (2023), the Prowess database has also been used in several other studies, including De Loecker et al. (2012), Topalova and Khandelwal (2011), Chari et al. (2021) and others.

We used net fixed assets and wage bill as proxy for capital stock and employment following Bau and Matrey (2023).

We also winsorized wages to sales ratio at 1 and 99 percentile value to avoid outliers.

One implication of this assumption is that reallocation will be efficiency enhancing as long as resources continue to flow from less productive to more productive firms till their marginal products are equalized (Decker et al. 2020). Note that in the approach proposed by Hsieh and Klenow (2009) as well, efficiency is maximized when marginal products are equalized across firms. However, the Hsieh and Klenow (2009) approach is based on a number of restrictive assumptions. If the assumptions do not hold, the measured misallocation may be overstated or understated.

Note that for both the state variables, the current period’s productivity realization \({{TFP}}_{i,t}\) and the initial firm size \({E}_{i,t}\), are known prior to making any growth decision. Additionally, the productivity realization is derived from a persistent AR (1) process.

Details of the TFP estimation are presented in Appendix B.

We compute \({{tfp}}_{i,{t}}\) deviation as tfpit – mean (\({{tfp}}_{i,{t}}\)), where tfpit refers to the log value of TFP at the firm level while mean (tfpit) refers to the mean value of tfpit at the two-digit (NIC) industry level.

Notably, this study primarily focuses on the intensive margin (degree/intensity to which a resource is utilized or applied) and does not consider firm entry and exit separately since the Prowess dataset is not particularly suited for the study of firm entry and exit (Topalova and Khandelwal 2011).

We use pooled OLS since our dependent variable is in growth form, which effectively removes any firm fixed effects.

Since we calculate tfp as a deviation from the industry–year mean, we can calculate the difference in capital and labor growth between a high productivity firm and a less productivity firm by multiplying the regression coefficients in column 2 and 4 by 2 SDs. Note that, in order to remove the variations in tfp dispersion over time, we fix the value of standard deviation (of 0.89) over the entire sample.

As a robustness check, we create a balanced panel by accounting for only those firms that persisted throughout the entire sample period from 2004–2016. Table 13 (Appendix E) presents the estimation results related to the regression conducted using Eqs. (4) and (7), whereas Table 14 (Appendix E) presents the estimation results obtained for the regression carried out using Eqs. (9) and (10). We find that the results for these estimations are qualitatively similar to the results obtained using an unbalanced panel. We also used an alternative measure of TFP using Levinsohn and Petrin (2003) approach. Results reported in Appendix E (Tables 15 and 16) remain qualitatively similar.

Note that, due to small number of observations in the sample of young firms, we follow Hambur and Andrews (2023) and removed lagged sales growth variable as a control to increase the sample size of young firms.

Following Paternoster et al. (1998), we use Z-test to examine whether the coefficients on the interaction term between the two groups (young and old) are statistically significant or not. The result shows that the coefficients are significantly different between “young” and “old” subsamples. The Z-statistic for the coefficients of the interaction term in column (2) of Table 3 is \(Z=(-0.026-0.010)/\sqrt{{(0.019)}^{2}+{(0.004)}^{2}}=-1.89\). The Z-statistic for the coefficients of the interaction term in column (4) of Table 3 is \(Z=(-0.025-0.006)/\sqrt{{(0.004)}^{2}+{(0.018)}^{2}}=-1.72\). It is statistically significant at the 10% level.

We use Z-test to examine whether the coefficients on the interaction term between the two groups (small and large) are statistically significant or not. The result showed that the coefficients are significantly different between “small” and “large” subsamples. The Z-statistic for the coefficients of the interaction term in column (2) of Table 4 is \(Z=(-0.028-(-0.002))/\sqrt{{(0.010)}^{2}+{(0.005)}^{2}}=-2.36\). It is statistically significant at the 5% level. The Z-statistic for the coefficients of the interaction term in column (4) of Table 4 is \(Z=(-0.019-(-0.001))/\sqrt{{(0.005)}^{2}+{(0.006)}^{2}}=-2.57\). It is statistically significant at the 1% level.

\({g}_{i,t}^{{Bank\; credit}}=\frac{{{Bank\; credit}}_{i,t}-{{Bank\; credit}}_{i,t-1}}{0.5({{Bank\; credit}}_{i,t}+{{Bank\; credit}}_{i,t-1})}\)

We use the Z-test to examine whether the coefficients on the interaction term between the two groups (unconstrained and constrained) are statistically significant or not. However, we fail to find statistically significant differences between them.

We use Z-test to examine whether the coefficients on the interaction term between the two groups (low dependence and high dependence) are statistically significant or not. However, we fail to find statistically significant differences between the “low dependence” and “high dependence” subsamples.

The classification of industries is based on the OECD (2011) classification, according to which industries can be classified into four categories based on their use of technology: 1) Low-tech industry, 2) Medium low-tech industry, 3) Medium high-tech industry and 4) High-tech industry. The industry classification based on technology intensity is shown in Table 12 in Appendix D.

Results are available upon request.

References

Ackerberg DA, Caves K, Frazer G (2015) Identification Properties of Recent Production Function Estimators. Econometrica 83(6):2411–2451

Andrews D, Hansell D (2021) Productivity‐Enhancing Labor Reallocation in Australia. Econ Rec 97(317):157–169

Berger D, Vavra J (2019) Shocks Versus Responsiveness: What Drives Time-Varying Dispersion? J Political Econ, 127(5):2104–2142

Barlevy G (2003) Credit Market Frictions and the Allocation of Resources over the Business Cycle. J Monetary Econ 50(8):1795–1818

Bau N, Matray A (2023) Misallocation and Capital Market Integration: Evidence from India. Econometrica 91(1):67–106

Banerjee AV, Duflo E (2005) Growth Theory Through the Lens of Development Economics. In: Aghion P, Durlauf S (eds.) Handbook of Economic Growth. Elsevier, Amsterdam

Caballero RJ, Hammour ML (1996) On the Timing and Efficiency of Creative Destruction. Q J Econ 111(3):805–852

Caballero R, Hoshi T, Kashyap A (2008) Zombie Lending and Depressed Restructuring in Japan. Am Econ Rev 98(5):1943–77

Chari A, Jain L, Kulkarni N (2021) The Unholy Trinity: Regulatory Forbearance, Stressed Banks and Zombie Firms. Working Paper 28435. National Bureau of Economic Research, https://doi.org/10.3386/w28435

Davis S, Haltiwanger, Schuh S (1996) Job Creation and Destruction. The MIT Press, Cambridge

Davis SJ, Haltiwanger J (1992) Gross Job Creation, Gross Job Destruction, and Employment Reallocation. Q J Econ 107(3):819–863

Davis S, Haltiwanger J (1990) Gross Job Creation and Destruction: Microeconomic Evidence and Macroeconomic Implications Gross Job Creation and Destruction: Microeconomic Evidence and Macroeconomic Implications. In NBER Macroeconomics Annual, 5, MIT Press, p 123–186

Decker RA, Haltiwanger J, Jarmin RS, Miranda J (2020) Changing Business Dynamism and Productivity: Shocks versus Responsiveness. Am Econ Rev 110(12):3952–3990

De Loecker J, Goldberg PK, Khandelwal AK, Pavcnik N (2016) Prices, Markups, and Trade Reform. Econometrica 84(2):445–510

Foster L, Grim C, Haltiwanger J (2016) Reallocation in the Great Recession: Cleansing or Not? J Labor Econ 34(S1):S293–S331

Government of India (2021) Economic Survey 2020-21, Volume 1, Chapter 7, Ministry of Finance. https://www.indiabudget.gov.in/budget2021-22/economicsurvey/index.php

Gopinath G, Kalemli-Özcan Ş, Karabarbounis L, Villegas-Sanchez C (2017) Capital Allocation and Productivity in South Europe. Q J Econ 132(4):1915–1967

Haltiwanger J (2011) Firm Dynamics and Productivity. Growth Eur Invest Bank Pap 16(1):116–136

Hambur J, Andrews D (2023) Doing Less, with Less: Capital Misallocation, Investment and the Productivity Slowdown in Australia. RBA Research Discussion Papers 2023-03. Reserve Bank of Australia https://doi.org/10.47688/rdp2023-03

Herrera AM, Kolar M, Minetti R (2011) Credit Reallocation. J Monetary Econ 58(6-8):551–563

Hsieh C-T, Klenow P (2009) Misallocation and Manufacturing TFP in China and India. Q J Econ 124(4):1403–1448

Hyun J (2016) Job Reallocation, Financial Crises, And Policy Reforms: Evidence from Korea. Contemp Econ Policy 34(4):729–745

Krishna KL, Goldar B, Das DK, Aggarwal SC, Erumban AA, Das PC (2022) India Productivity Report. Centre for Development Economics, Delhi School of Economics. https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/INDIAPRODUCTIVITYREPORT26D0A735C8B4411FBD4513A11532FA51.PDF

Levinsohn J, Petrin A (2003) Estimating Production Functions Using Inputs to Control for Unobservables. Rev Econ Stud 70(2):317–341

Li X, Ge X, Chen Z (2023) The Characteristics Analysis of Credit Reallocation in China’s Corporate Sector: From the Volatility, Spatiality, Cyclicality and Efficiency Approach. Financ Res Lett 55(Part B):103930

McGowan MA, Andrews D, Millot V (2017) The Walking Dead? Zombie Firms and Productivity Performance in OECD Countries. https://doi.org/10.1787/18151973

Midrigan V, Xu DY (2014) Finance and Misallocation: Evidence from Plant-Level Data. Am Econ Rev 104(2):422–458

Mead, Roland I (2020) Has the Financial Crisis Undermined Credit Reallocation in the United Kingdom? CEP Industrial Strategy Paper No CEPIS08, LSE Centre for Economic Performance https://doi.org/10.17863/CAM.64185

Nagaraj R (2013) India’s Dream Run, 2003-08: Understanding the Boom and Its Aftermath. Econ Political Wkly 48(20):39–51

OECD (2011) ISIC REV. 3 Technology Intensity Definition: Classification of Manufacturing Industries into Categories Based on R and D Intensities. OECD, Paris

Olley SG, Pakes A (1996) The Dynamics of Productivity in the Telecommunications Equipment Industry. Econometrica 64:1263–1297

Osotimehin S, Pappadà F (2016) Credit Frictions and the Cleansing Effect of Recessions. Econ J 127(602):1153–1187

Ouyang M (2009) The Scarring Effect of Recessions. J Monetary Econ 56(2):184–199

Paternoster R, Brame R, Mazerolle P, Piquero A (1998) Using the Correct Statistical Test for the Equality of regression Coefficients. Criminology 36(4):859–866

Ramey V, Shapiro M (1998) Costly Capital Reallocation and the Effects of Government Spending. Carnegie Rochester Conf Ser Public Policy 48(1):145–194

Rajan R, Zingales L (1998) Financial Development and Growth. Am Econ Rev 88(3):559–586

Restuccia D, Rogerson R (2017) The Causes and Costs of Misallocation. J Econ Perspect 31(3):151–174

Rijesh R (2023) Economic Liberalisation, Structural Change and Productivity Growth in Indian Organised Manufacturing Sector, 1991–2016. Indian J Labor Econ 66(1):131–154

Sakai K, Uesugi I (2021) Credit Reallocation, Firm Size, and Productivity. Tokyo, Japan, RIETI. https://www.rieti.go.jp/jp/publications/dp/19e004.pdf

Schumpeter Joseph A (1934) “Depressions”. In: Douglass Brown (ed.) The Economics of the Recovery Program. Whittlesey House, McGraw-Hill Book Co, New York and London, p 22–37

Spaliara ME (2009) Do Financial Factors Affect the Capital–Labor Ratio? Evidence from UK Firm-Level Data. J Bank Financ 33(10):1932–1947

Topalova P, Khandelwal A (2011) Trade Liberalization and Firm Productivity: The Case of India. Rev Econ Stat 93(3):995–1009

Van Beveren I (2012) Total Factor Productivity Estimation: A Practical Review. J Econ Surv 26(1):98–128

Acknowledgements

We thank the journal editor (Professor Christopher Parmeter) and anonymous reviewers for useful comments and suggestions. We also thank the participants of the 18th East Asian Economic Association (EAEA) Conference, Delhi Winter School 2023, Institute for Studies in Industrial Development (ISID) National Conference 2023 for valuable feedback and thoughtful advice. We are also grateful to Yuko Nikaido, Abhishek Kumar, Sushanta Mallik, Suma Athreye, Ketan Reddy, Chandrakanti Behera, and Jayati Chatterjee for their comments and suggestions.

Author information

Authors and Affiliations

Contributions

Both 1 and 2, wrote the main manuscript text, carried out the empirical analysis, prepared figures, and reviewed the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Appendix B

Firm-level production function estimation

First Stage

TFP estimation process begins with implementing the conventional Cobb-Douglas (C-D) production function in its logarithmic form. Considering the logarithm of a C-D production function, the estimation equation for firm i at time t is represented as:

where yit, stands for output, \({w}_{{it}}\) stands for variable input (labor and intermediate inputs), \({s}_{{it}}\) stands for state variable (capital), \({\varepsilon }_{{it}}\) stand for normally distributed idiosyncratic pure random variable, whereas \({\omega }_{{it}}\) represents the unobserved productivity shock (observable only to a firm manager but not unobservable to an econometrician) likely to be correlated with the firm input choices. \({\omega }_{{it}}\) is assumed to follow exogenous first-order Markov process:

where \({\mu }_{{it}}\) is random term uncorrelated with either the state or the free variables.

In the above equation, the subscript i, t denotes firm i, and time t. Using OLS to estimate the above production function will lead to biased estimates of \({\beta }_{l}\), and \({\beta }_{k}\) due to the assumption of strict exogeneity between error term and the independent variables. However, in reality, firms make their input choices based on the level of productivity. Therefore, not including the unobserved productivity variable into the regression equation will lead to endogeneity arising from simultaneity bias (Olley and Pakes (OP) 1996). In order to correct for the endogeneity, Levinsohn and Petrin (LP) (2003), suggested using the intermediate input such as materials, energy, fuel to proxy for the unobserved productivity. Under the control function approach suggested by Levinsohn and Petrin (LP) (2003), demand function for the proxy variable can be written as: \({{m}}_{{it}}=f(\,{K}_{{it}},\,{\omega }_{{it}})\). Under the assumption of scalar unobservable and strictly monotonicity, the demand function for the proxy variable is invertible in \({\omega }_{{it}}\) i.e., \({\omega }_{{it}}\)=\({f}^{-1}\left({m}_{{it}},\,{K}_{{it}}\right)=h\left({m}_{{it}},\,{K}_{{it}}\right)\). Plugging the inverse demand function for the proxy variable into the production function (15) we obtain:

where \({\varnothing }_{{it}}\left({m}_{{it}},\,{K}_{{it}}\right)\) is defined as: \({\varnothing }_{{it}}\left({m}_{{it}},\,{K}_{{it}}\right)={\beta }_{k}{s}_{{it}}+h\left({m}_{{it}},\,{K}_{{it}}\right)\). Note that this solves the endogeneity problem since unobserved \({\omega }_{{it}}\) can now be observed. Estimation of Eq. (18) yields to obtain a consistent estimate of \(\hat{{\beta }_{w}}\). Additionally, we also obtain estimates of the composite function, \(\hat{{\varnothing }_{{it}}}\).

Second Stage

Using the estimated coefficient from the first stage, and making use of the moment conditions, the coefficient of the capital variable can be obtained by estimating the following equation:

Note that in order to estimate the labor and capital variables, both Olley and Pakes (OP) (1996) and Levinsohn and Petrin (LP) (2003) use Generalized Method of moments (GMM) or Non-Linear Least Square (NLLS).

Once consistent estimates of both labor and capital variables are obtained, the productivity variable is obtained as a residual as follows:

One of the criticisms of the Olley and Pakes (OP) (1996) and Levinsohn and Petrin (LP) (2003) model, as put forward by Ackerberg et al. (2015) is that both assume that there is no adjustment cost to labor variable. However, in presence of unobservable adjustment cost (for example, hiring and firing cost, or long-term contracts) to the labor variable, there will be multicollinearity and identification issues with the labor variable. In such a case, the labor should actually be considered as a state variable and enter as an argument in demand function for proxy along with unobserved productivity as follows: \({m}_{{it}}=f(\,{K}_{{it}},\,{\omega }_{{it}},\,{l}_{{it}})\). As a result, under the Ackerberg et al. (2015) methodology, the labor coefficient along with other input coefficients are identified in the second stage by applying either GMM or NLLS.

Appendix C (Additional results)

Appendix D

Appendix E

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Basu, S., Sasidharan, S. Productivity, investment slowdown, and misallocation: evidence from Indian manufacturing. J Prod Anal (2024). https://doi.org/10.1007/s11123-024-00730-6

Accepted:

Published:

DOI: https://doi.org/10.1007/s11123-024-00730-6