Abstract

The present study examines the nature of structural change and productivity dynamics in the organised manufacturing of India since economic liberalisation in the early 1990s. We find significant changes in Indian manufacturing as the specialisation pattern moved towards technology-intensive segments with considerable improvement in output, productivity, wages, and capital intensity. However, a corresponding growth in employment is not observed across many industries. The decomposition of labour productivity at the sectoral level reveals the overwhelming presence of within-sectoral technological change component of growth across different industries. However, the detailed plant-level data show evidence of positive structural change, in terms of static and dynamic shifts, among the medium technology-intensive sectors during the 2000s. The findings point out the need to have comprehensive and strategic policy interventions to address the structural rigidities and institutional bottlenecks in the manufacturing sector.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Historically, the development experiences of nations show a consistent positive correlation between the rate of growth of industrialisation and the pace of economic growth (Sabillon 2008). It is a stylised fact that changes in economic structure from traditional agrarian activities to modern manufacturing activities generate several economic benefits. For instance, the growth experiences of advanced economies reveal that the shift of economic resources towards manufacturing activities is associated with considerable structural change bonuses in terms of improved output per worker (labour productivity), technological change, learning effects, specialisation, and intersectoral linkages than any other productive sectors (see Szirmai 2013). Since manufacturing is characterised by high productivity and technological dynamism, the transition of economies from low-income to high-income requires the development of a well-functioning industrial base (see Weiss & Tribe 2016). Naturally, emerging developing countries have adopted various policy instruments to orientate towards a high-income growth path through industrialisation (Rijesh 2020).

Since the Second Five-Year Plan (FYP), the policymakers in India recognised the need to develop a strong industrial base. Despite creating a diversified manufacturing sector, the continued pursuit of inward orientation with blanket protective policies like industrial licensing, capacity caps, technology restrictions, tariffs, quota etc., created large economic inefficiencies (See Ahluwalia 1991; Kochhar et al. 2006; Panagariya 2008). The systematic economic reforms introduced in the early 1990s are aimed at correcting market distortions by creating a favourable environment for improving production efficiency and external competitiveness. In contrast to the earlier regime, the liberalisation initiatives endorse outward orientation and increased openness, which is expected to bring substantial economic gains through increased competition, technology upgradation, and economies of scale.

The industrial response to the reform process is well-documented. Several studies have examined the performance of the industries across various dimensions including output growth (Goldar 2018; Nagaraj 2017; Ahsan & Mitra 2016), productivity (Erumban et al. 2019; Rijesh 2016; Goldar 2014), employment (Papola 2012), etc. In general, the emerging consensus is that there was perceptible growth in the quality and variety of industrial goods, especially during the mid-2000s. However, this was not accompanied by a significant improvement in the relative size of the industrial sector in gross domestic product (GDP), which stagnated at around 14–15% (Nagaraj 2017).

The existing studies have reported significant changes in the composition of production and productivity since the reforms. However, only a few have studied the systematic link between the changes in the industrial structure and worker productivity. The studies that have examined these aspects, for example, Erumban et al., (2019); Ahsan and Mitra (2016); Cortuk and Singh (2011), are largely based on aggregate sectoral-level data covering a limited period. Given that structural transformation results from workers moving from low-productivity to higher value-added industries, there is a need to analyse heterogeneity at a more disaggregated level. The present study is an attempt to fill this gap in the literature. In particular, we aim to analyse the pattern of structural change in organised manufacturing and the contribution of resource reallocation across industries on aggregate manufacturing productivity since economic liberalisation.

The rest of the paper is organised as follows. Section 2 details the concept of structural change and growth. Section 3 provides a brief overview of the literature on structural change and productivity in the Indian manufacturing sector. Section 4 presents the descriptive evidence of the changing structure of manufacturing across different parameters during 1991–2016. Section 5 details the empirical results of the decomposition exercise of labour productivity to account for the incidence of structural change in manufacturing. Section 6 concludes.

2 Structural Change and Productivity

One of the distinctive features in the course of economic development is the changes in the relative pattern of the productive structure. The rate of economic growth is often accompanied by considerable changes in the composition of sectoral output, employment, organisation, and institutional dynamics. Accordingly, the changes in the relative weight of major components of an aggregate indicator of the economy, which we refer to as structural change, have been the central element of economic development (Ishikawa 1987). In a broader context, structural change signifies the movement of resources from agriculture into non-agricultural activities, followed by manufacturing industries and services. In economic history, the concept of structure denotes the relative significance of economic sectors in terms of production and factor content (Syrquin 1988). In this respect, the process of industrialisation is central to the process of structural change.Footnote 1

The process of industrialisation, especially specialisation in manufacturing, is critical for economic growth as it provides greater scope for specialisation, technological learning, and product diversification than any other sector (UNCTAD 2016; Weiss & Tribe 2016). This is even more relevant for low-income countries where differences in productivity induce workers to shift from non-manufacturing to manufacturing, which creates structural change bonuses. This growth-enhancing process of structural change is evident from the recent historical experiences of China and East and South-East Asian Newly Industrialised Countries (NICs) (See McMillan & Rodrik 2011). Hence, a robust manufacturing sector is an essential element for successful growth and technological catch-up as it generates virtuous, cumulative linkages with the rest of the sectors enhances technological progress and offers the strongest potential for higher productivity gains (UNCTAD 2016).Footnote 2

The reallocation of economic resources among different sectors, i.e. structural change, is a prominent driving force of economic growth and productivity (see Lewis 1954; Kaldor 1966; Syrquin 1988). The economic literature argues that economic structure changes because of preferential differences in the income elasticity of demand, sectoral-specific productivity changes, user-producer spillovers, and differential propensities towards entrepreneurial discovery (see Pasinetti 1981; Peneder 2003; Dietrich 2012). On the demand side, the increase in income per capita changes the structure of demand as per the Engels Law, and the dissimilar income elasticities across sectors create readjustments in production and accelerate the speed of structural change. On the supply side, sectoral productivity growth differentials impact the rate of structural change.

The continued shift of factor inputs from lower (agriculture) to higher (manufacturing) productive sectors augment aggregate productivity and income per capita. This structural change bonus has been a major source of growth in developing countries (see Lewis 1954; Chenery et al. 1986; Timmer & Szirmai 2000; Szirmai 2013). Conventionally, most empirical studies have focussed on the movement of workers from agriculture to manufacturing and ignored the structural dynamics within the manufacturing sector (Timmer & Szirmai 2000). In the course of economic development, industries upgrade their activities from relatively low levels of productivity to higher productivity and, subsequently, incentivise workers to transfer towards more productive manufacturing activities rather than acquiring efficiency gains from the new and improved method of production within industries (see Fabricant 1942; Fagerberg 2000; Timmer & Szirmai 2000).

2.1 Accounting for Structural Change and Productivity: Shift-Share Approach

To examine the contribution of structural change on labour productivity growth, we use the conventional shift-share (S–S) decomposition framework first introduced by Fabricant (1942) and used extensively in the literature (see Syrquin 1988; Fagerberg 2000; Timmer & Szirmai 2000; McMillan & Rodrik 2011; Vu 2017). This conventional method proposes to decompose aggregate productivity growth into the effects of productivity growth within-sector (technological progress) and effects due to structural change. The S–S decomposition analysis of aggregate labour productivity of the Indian manufacturing sector over the period [0, T] is derived following Fagerberg (2000).

Let LP = labour productivity, O = output (value added), L = labour input. Then,

i = manufacturing industry (i = 1,…,n)

Labour productivity in the manufacturing industry i is defined as:

The share of manufacturing industry i in total employment is expressed as follows:

By substituting, Eqs. (2) and (3) into Eq. (1), we obtain:

Assuming \(\Delta \mathrm{LP}={\mathrm{LP}}_{1}-{\mathrm{LP}}_{0}, \Delta S= {S}_{1}-{S}_{0},\) we can derive the following decomposition identity in level form using Eq. (4):

In terms of growth rate, we can rewrite Eq. (5) as follows:

Equation (6) indicates that the changes in aggregate productivity growth can be decomposed into three effects, namely, static-shift effect, dynamic-shift effect, and within-shift effect. The first two effects represent structural change while the final effect signifies technological progress in the sector (Vu 2017).

The static industry effect is calculated as the sum of changes in worker allocation across industries during the final year and initial year, weighted by the labour productivity in the base year. The static effect is positive/negative when industries with higher productivity attract more/less labour force and thereby increase/decrease the share in total employment (Peneder 2003). The dynamic industry effect is the sum of the interaction between changes in labour productivity and changes in the worker share of industries. It is assumed that when industries increase their productivity and employment simultaneously, the combined effect generates a positive contribution to aggregate productivity growth (Peneder 2003).Footnote 3 The interaction effect reflects the scenario when increased worker reallocation is directed towards industries with higher growth in labour productivity.Footnote 4 The within-industry effect corresponds to changes in labour productivity weighted by the initial share of employment in the industry. This effect reflects that there is no structural change (allocation of workers across industries) and the entire productivity changes reflect pure technical change through learning by doing, capital intensity, increased efficiency, average hours of work, and technological advances (see Vu 2017).

3 Structural Change and Productivity in Indian Manufacturing: Brief Review

Several empirical studies have examined the changing nature of industrial structure and productivity since economic reforms are based on relatively simple measures of industrial composition. Papola (2012) finds that despite a stable share of industrial share in GDP, the manufacturing sector witnessed considerable structural change as the share of traditional industries declined vis-à-vis modern industries. Although there was an improvement in labour productivity, registered manufacturing witnessed an absolute decline in employment during 1997–2007. Nagaraj (2017) concurs with the relative stagnation of manufacturing but noted considerable product diversification and improved quality and variety of domestic production during 1991–2014. Goldar (2018), however, using double-deflation found a clear upward trend in the share of manufacturing in aggregate GVA during 2003–2011.

There exist a large number of empirical studies on the productivity dynamics of Indian manufacturing, especially since economic reforms.Footnote 5 The seminal study by Ahluwalia (1991) reported a turnaround in productivity trends since the initial liberalisation of the 1980s. However, several subsequent studies questioned her findings on account of methodology and variable construction (see Balakrishnan & Pushpangadan 1994). Overall, the consensus is that the productivity growth during the 1990s was not substantial (Rijesh 2016). In contrast, several studies during the post-2000 period find a considerable increase in productivity (see Bollard et al. 2013, and Rijesh 2016). Although studies have explored the nature of industrial composition and productivity, only a few have examined the link between structural change and productivity growth during the reform period.

Cortuk and Singh (2011) examined the link between structural change and growth from 1951 to 2007 at 1999–2000 prices data of GDP collected from the Reserve Bank of India (RBI) database. For computing structural change, the study uses two different indices computed annually, namely, (1) the Norm of Absolute Values (NAV)Footnote 6 and (2) the Modified Lilien Index (MLI). The Value-at-Risk (VAR) analysis of structural change and growth and structural break analysis revealed that 1988 is the period of a structural break in India. Post this period, the VAR analysis revealed the significant positive impact of structural change on growth. The Granger causality test using growth and MLI series indicate one-way Granger causality from structural change to growth from 1988 to 2007. Ahsan and Mitra (2016) observed that within-sector productivity growth has been significant for aggregate labour productivity growth based on McMillian and Rodrik's (2011) decomposition method. Overall, there is evidence of the movement of workers to sectors with high productivity during 1991–2004. They find that the structural change contributed less than a fourth of the overall labour productivity growth rate of 4%.

Erumban et al. (2019) examined the dynamics of structural change during 1981–2011 based on the 2015 version of the India KLEMS database. The study observed an impressive growth of labour productivity during 2003–2011 (7.5%) accompanied by a positive impact of structural change on aggregate labour productivity as workers moved from low-productivity to high-productivity industries. However, the movement of workers from less productive sectors to fast-growing sectors was not observed as there was a lack of employment generation in high-performing sectors. In general, 50–80% of aggregate productivity growth was contributed by within-industry productivity growth and the rest by structural change.

4 Performance of the Indian Organised Manufacturing Sector (1991–2016)

In this section, we provide a descriptive statistical account of the Indian organised manufacturing sector. The primary data of industrial production and performance parameters are collected from the Annual Survey of Industries (ASI), published annually by the Central Statistics Office (CSO), Government of India. The ASI is the principal source of registered manufacturing factories and consists of census and sample frames distributed across India. We collected the principal characteristics of industries from the published reports of ASI Volume 1 at the sectoral level. Since the National Industrial Classification (NIC) used to identify manufacturing activities has undergone significant changes during the study period, a correspondence series was prepared following the concordance scheme of Rijesh (2019). The detailed 3-digit level data are collected from the concordance series provided by EPWRFITS, an online database. The factory-level data at the unit level is procured from ASI National Data Archive and amassed at the 5-digit level for the period 2000 to 2007 (NIC-98/04) and 2008 to 2016 (NIC-08). For deflation, we use the disaggregated Wholesale Price Indices (WPI) from the Office of Economic Advisor and the Consumer Price Index (CPI) for industrial workers (Labour Bureau), Government of India.

A look at the share of aggregate manufacturing, including both organised and unorganised segments, in GDP indicates that the size has been relatively stable around 15–17% during 1990–91 to 2011–12 (See Fig. 1). This supports the widely held view of a virtually stagnant share of the manufacturing sector in aggregate GDP since liberalisation.Footnote 7 The continuing stagnancy of manufacturing indicates the inability of the industrial sector to have a dynamic impact on the economy. As evident from Fig. 1, more than 80% of industrial output is generated in the organised sector.

4.1 Industry Composition

The objective of this sub-section is to examine the nature of structural changes in manufacturing based on the compositional distribution of industries categorised at the broad classification of NIC. The detailed distribution of manufacturing sectors in terms of production, worker, capital, and wages across different technology-intensive classifications is given in Table 1. For brevity, the major trends across technology groups are summarised in Fig. 2. In terms of Gross Value Added (GVA), the size of manufacturing is dominated by the medium-to-high technology (MHT) segments for the entire period (41%). On the other hand, the medium-to-low technology (MLT) sector which had a 28% share in 1991, improved its share to 35% by 2016. In contrast, the share of Low Technology (LT) has declined from 31% to 24% during the same period. This declining trend is also visible across other parameters such as fixed capital, emoluments, and employment levels. Although the technology-intensive (both MHT & MLT) manufacturing occupied a larger portion of value added, the larger part of the workforce continued to be absorbed in the traditional LT. In the case of MHT, both the share of wages and employment witnessed a marginal improvement while the share of capital declined over time. Overall, it is evident that a decline (increase) in GVA is associated with a corresponding decline (increase) in wages and employment across sectors, except leather products and non-metallic mineral-producing sectors (For detail, see Rijesh 2020).

In terms of individual sectors, the largest output (GVA) share is by the chemical sector (18%) in 2016 (see Table 1). The chemical sector also accounted for the largest share in wages (14%). In the recent period, the highest contributor of GVA is from the MHT sectors (41%) followed by MLT (35%) and LT (24%) sectors. Although the relative share of technology categories has been stable over time, it is evident that the share of LT has declined from 31% to 24% while the share of MLT has increased from 28% to 35%. In the MHT group, the value added of chemicals, medical optics, and transport equipment has improved while the electrical & non-electrical machinery sectors have declined. As noted before, the declining GVA is associated with a corresponding fall in wages and employment levels in the respective industries under each technology category. In the case of MLT, except for non-metallic minerals and basic metals, the rest of the sectors increased their share of GVA from 1991 to 2016. For LT, a large number of sectors experienced a reduction in value added (6 out of 9) which is also visible in their declining share in wages and employment during this period.

In terms of wages, the largest contributing industries belong to the MHT sector (both chemical and transport equipment accounting for 14% share) in 2016. This is in contrast to the situation in the early 1990s, where textiles (an LT sector) accounted for the largest share (17%). Since liberalisation, the wage share of MHT sectors has expanded. Compared to LT, technology-intensive sectors have shown a marked improvement in the composition of wages. The relative number of workers employed in the traditional industries (share of LT sectors in total manufacturing employment) has also fallen over time. For instance, in 1991, the largest contributor to employment was in textiles (17%) which has declined to 11% by 2016. In the latest period, the food and beverage sector (13%), textiles (11%), and chemicals sectors (10%) provided the largest employment.

The industrial composition at the 3-digit level of disaggregation distributed across major technology classifications is given in Table 4 in the appendix. The pattern of industrial composition witnessed at the sectoral level is more apparent at the disaggregated level. For example, the largest contributors (top 10) of industrial GVA for the entire period are found to be concentrated among high technology-intensive industries like other chemicals (10%), basic chemicals (7%), office & computing machinery (4%), motor vehicles (3%), and special-purpose machinery (3%). However, only other chemicals, office accounting machinery, and special-purpose machinery contributed significantly to the total employment. Although high technology-intensive industries expanded considerably, this has been confined to a limited number of industries. For instance, out of 56 industries at the 3-digit level, only 13 technology-intensive industries increased their contribution to overall GVA. In that too, the major improvement was concentrated among a few industries like refined petroleum (13%), other chemicals (12%), and motor vehicles parts (4%). In contrast, a large number of industries reported a declining share of GVA from 1991 to 2016. In terms of employment, the low technology industries like spinning & weaving (12%), other food products (8%), tobacco (5%) etc. contributed a major share during the entire period of study (see Table 4 for further details).

4.2 Growth Profile

For a comprehensive assessment of the compositional shifts, it is important to examine the rate of expansion of industrial activities over time. Figure 3 shows the year-to-year growth of aggregate manufacturing GVA, wages, capital, and workers. In general, the trend across variables is largely cyclical. In the initial period of liberalisation, there is a noticeable declining trend among the key performance indicators. Post-2000, there is a marked revival that sustained up to 2008, which also marked the beginning of significant turmoil in the global financial market. Since 2008, the rate of expansion was relatively modest although there is some sign of recovery post-2012.

We fitted a semi-log model to capture the overall rate of expansion of selected variables. This is carried out using the time series data of production (both value added and gross output), fixed capital, wages, employment, and productivity derived at the 2-digit level of sectoral classification grouped across three technology-intensive classes. During the entire period, the rate of expansion of output, expressed in terms of value added, is around 9.0% per annum (see Fig. 4). In terms of the gross output indicator, the rate of growth is marginally higher at 9.4% (see Table 1 for detail).

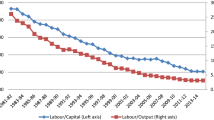

This increase in production, however, is not apparent across other indicators. For instance, the rate of growth of the number of total persons engaged, wages, and labour productivity is reported to be only 3.0%, 5.6% and 5.5% per annum, respectively. In contrast, there is a markedly higher rate of expansion of capital input (10.9%) which indicates increased capital formation and mechanisation of manufacturing activities post-liberalisation. Figure 4 further provides the overall growth rate of technology-intensive categories across these parameters. Comparatively, the high technology industries have outperformed other segments in terms of growth in output and productivity. It is striking to note that all parameters in low technology industries, except the capital, have been significantly low. As seen earlier, the higher rates of growth in the capital are evident across all segments of manufacturing industries.

4.2.1 Medium-to-High Technology Manufacturing Sectors

The performance of five high technology-intensive industries on selected parameters is given in Table 1. We can notice that the growth of GVA in medical optics (13.7%), transport equipment (10.9%), and non-electrical machinery (9.4%) were relatively higher than the aggregate manufacturing GVA (8.6%). The chemical sector, which accounted as the largest contributor of GVA (share of 1800%), has also registered an impressive growth of 7.3%. The output expansion has been accompanied by an improvement in the efficiency at which the worker is used in the production process across different industries. For example, the productivity growth of all technology-intensive industries is in the range of 7.1–7.6%, which is relatively higher than the all-India average of 5.5% rates of growth, except in chemicals.

Despite substantial increases in output and productivity, it is striking to note that there was hardly any equivalent increase in employment and wages. The moderate rise in wages does indicate the inability of the sector to reap the benefit of increased productivity over time. The expansion of value added seems to be largely based on the growth of capital relative to the worker. For instance, the expansion of capital in all industries has been substantially higher than that of total persons engaged in production. The rate of employment growth is strikingly poor, especially in the case of machinery products which has grown around 2% per annum. The increased capital accumulation, however, has been able to improve the efficiency of workers across industries. This increased capital deepening explains the substantial rise in productivity across different industrial sectors.

4.2.2 Medium-to-Low Technology Manufacturing Sector

Compared to aggregate manufacturing, three industries, namely rubber & plastics (10.5%), fabricated metal products (9.0%), and refined petroleum products (8.9%), in this segment witnessed significant GVA growth (see Table 1). As noted earlier, the expansion of value added is less than that of gross output which indicates the increasing use of material inputs. We can see the prevalence of capital-intensive mode of production across MLT industries as the rates of growth in the capital are relatively higher than labour inputs. This retells the pattern observed in the MHT sector discussed earlier. The productive efficiency of labour, however, was found to have increased moderately (in the range of 4.1–5.7%).

In contrast, we find a marked improvement in the rate of growth of industrial wages relative to other technology groups. The rate of increase in worker wages across all MLT industries, which is in the range of 6–8%, is higher than aggregate manufacturing (5.6%), except for basic metals (see Table 1). One notable sector that has increased its presence in the recent period is refined petroleum manufacturing, which has performed better in terms of GVA, wages, and labour productivity.

4.2.3 Low Technology Manufacturing Sector

The performance of LT industries is comparatively lower than the high technology-intensive sectors (see Table 1). Out of the nine industries, only three industries, namely apparel, leather, and furniture & recycling, witnessed a higher rate of growth in GVA compared to aggregate manufacturing. Strikingly, all traditionally labour-intensive industries have witnessed a considerable capital deepening over time. In six industries (namely, food & beverages, tobacco, textiles, wood, paper, and print & publishing), the growth of workers is less than 3% per annum. This poor performance is further reflected in the slow expansion of industrial wages across LT. The productivity improvement is largely propelled by a highly capital-intensive mode of production. Being a labour-surplus economy, this pattern of growth trajectory clearly shows the inadequacy of the LT sector to emerge as the leading sector to absorb the wide pool of productive (surplus) workers across manufacturing activities.

The descriptive analysis clearly shows that the expansion of manufacturing industries since liberalisation is largely dominated by the growth of capital-intensive modes of production. The absorption of productive workers across different segments, especially towards less innovation-based production activities, has been absent. Although there is growth in labour productivity, a corresponding rise in wages is not visible across sectors.

5 Structural Change and Productivity Growth: Decomposition Analysis

The focus of this section is to discuss the impact of structural change on the productivity growth of Indian manufacturing using the shift-share decomposition framework outlined in Section 2.1. The descriptive analysis in this section is carried out at finer levels of disaggregation of the 3-digit and 5-digit levels of industrial classification.

As evident from Fig. 5, the growth of productivity has been largely cyclical. During the initial period of economic liberalisation, the largest spike in growth rates was witnessed in the low technology sector. However, since the beginning of the 2000s, the productivity of the LT sector decelerated considerably. During this period, the MLT witnessed some improvement, though, post-2008 the rate of growth has been negative for several years. The growth rates of MHT industries, although fluctuating, were relatively stable throughout. Overall, the labour productivity in aggregate manufacturing is around 6% per annum during 1991–2016 (see Fig. 6). The average growth of productivity across technology-intensive industries (both MHT and MLT) is relatively higher than LT sector during this period.

To explore productivity dynamics, we segregated the entire period into three sub-periods, namely (1) 1991–2000, (2) 2001–2007 and (3) 2008–2016. The first period corresponds to the initial decade of economic liberalisation. The second period represents the second wave of economic reforms. The final period represents the financial crisis aftermath. The average growth rate of productivity across manufacturing during these periods is given in Fig. 6. In the case of LT, there is a clear deterioration in trend growth rates during the selected three periods. The highest improvement in productivity in these traditional industries is witnessed during the first period (6%). Since then there is a marked decline which is noticeably evident in the post-global crisis period.

The detailed 3-digit level analysis revealed that only 15 out of 56 industries reported a higher labour productivity growth rate relative to the aggregate manufacturing sector during the reference period (see Table 4 in the appendix). The MLT sector performed comparatively better, especially during the second period, growing at a rate of 13.0% per annum. However, post-2008, the rate of productivity growth declined sharply to − 0.8%. Only two industry groups, namely rubber products (code 251) and glass products (code 261), reported a higher productivity growth rate than the aggregate manufacturing sector. For MHT, the overall performance across periods is highly remarkable. During the three periods, the rate of productivity growth was markedly higher than overall manufacturing and for the entire period, 16 industries witnessed significant improvement (see Table 4 in the appendix). This indicates that overall productivity growth is largely driven by technology-intensive industries (see Rijesh 2020). Finally, the period 2001–07 marked notable productivity improvement across manufacturing groups (see Fig. 6).

The discussion so far has explored the changing composition of output and productivity under different industrial groups and technological parameters. Economic restructuring since economic reforms is expected to bring significant structural changes and productive efficiency. As previously stated, one common method to gauge these changes is the decomposition of productivity (labour) into three effects, namely: (a) the contribution of labour productivity within each sector/industry (within-growth effects), (b) the productivity effect from worker reallocation due to the differences in productivity levels between industries/sectors at the initial period (static-shift effects), and (c) the productivity effects from labour relocation due to differences in productivity growth rates between industries/sectors over time (dynamic-shift effects). The combined effects of static and dynamic shift effects equal the total effects of employment reallocation in manufacturing (see Foster-McGregor & Verspagen 2016).

The within-effects is positive (negative) when the weighted growth in labour productivity in an industry is positive (negative). The static shift is positive (negative) when a worker reallocates (shifts) from relatively less (more) productive industries to more (less) productive industries. The dynamic effect is positive (negative) when workers move towards industries that also experience positive (negative) productivity growth. In Fig. 7, we provide the result of the decomposition of aggregate manufacturing productivity into its three components.

At the aggregate level, it is evident that within-growth effects, rather than pure structural change effects, have contributed to productivity growth. Except for a few years, the within effects or technological progress is largely positive, which is expected as usually labour productivity in most industries tends to grow over time. In contrast, the structural change effects (both static-shift and dynamic-shift effects) are not substantial to productivity growth. Relatively, the static-structural effect seems to have higher prominence than dynamic structural effects as the latter is largely negative throughout the study. It is striking to note that structural change components did not have much impact during the fast-growing period of 2000–2007.

Based on 3-digit level ASI data, we decomposed productivity across technology groups during 1991–2016, 1991–2000, 2001–2007 and 2008–2016 (see Table 2). For the entire period, the overwhelming part of productivity is accounted by within effects, which is visible across technology (see Fig. 8). In the case of LT, the structural components were found to be negative throughout. The only segment where the reallocation of the worker from low-productive activities to high-productive activities seems to be prominent is the MLT sector. For MHT, there is marginal evidence of increased productivity along with a rise in employment.

The period-wise breakup reveals that the within-growth effect has been positive throughout technology industry groups and sub-periods. For LT, the 1990s marked a significant structural change effect on productivity as the static effect and dynamic effect remained positive. However, the subsequent period witnessed structural burden phenomena as the expansion in productivity was not accompanied by employment generation. The negative sign implies that industries with higher productivity could not attract workers or the fast-growing industries failed to maintain their level of employment.

In the case of MLT, the evidence of structural bonus is prominent as the static-shift effect is found positive during all three sub-periods. This is noticeable during 2000–2007 when both components of structural change are positive, which suggests that worker reallocation across productive sectors has been an important source of aggregate MLT productivity growth. For MHT, we do not observe any substantial improvement in worker reallocation towards more productive activities or growing productive industries. Incidentally, the structural change effect is found to be positive during the period of the global financial crisis (2008–2016). Overall, consistent with the results reported in the existing literature, the structural components appear to be largely dominated by the within-productivity growth effects.

Finally, we also carry out the decomposition analysis using the factory/unit level data of ASI, aggregated at the 5-digit level. For brevity, the decomposition of unit-level industries is reported across 19 major industrial sectors. Because of data complexity, the analysis is restricted to two periods, i.e. 2000–2007 and 2008–2016 (see Table 3). The analysis further substantiates our earlier findings of an overwhelming effect of within-growth effects. However, in contrast to our aggregate analysis, we do find evidence of structural change effects among technology-intensive industries. For example, during the 2000–2007 period, 7 out of 19 industries recorded positive static and dynamic shifts. All technology-intensive sectors witnessed a positive dynamic shift suggesting that workers shifted towards high-productivity industries and the fast-growing industries were able to maintain a higher share of employment. However, this was not sustained post-2008 as static and dynamic effects reported negative values for several industries. As noted earlier, the major contribution continues to be stemmed from within-industry across technology groups. Overall, the following three industry groups, namely apparel, print & publishing, refined petroleum, and rubber & plastic, reported positive structural change effects on aggregate productivity during 2000–2016.

6 Concluding Remarks

The purpose of the present study was to examine the magnitude of structural change in the organised manufacturing sector of India since liberalisation. Since structural change involves the reallocation of productive resources across manufacturing, the continual shift of factor inputs from lower to higher productivity activities is expected to raise aggregate industrial productivity. To study structural change and productivity, we use the shift-share decomposition methodology using the manufacturing data from 1991 to 2016 at a broad level (2-digit) as well as the disaggregated level (3-digit and 5-digit levels). The 5-digit level analysis was based on ASI unit-level data for the period 2000–2007 and 2008–2016.

The descriptive statistics revealed that since economic reforms, the share of technology-intensive sectors such as chemicals, refined petroleum, metals and machinery value-added and wages have expanded relative to tradition-low technology sectors like food, beverages, wood, paper etc. They also reported better growth in output, wages, capital and productivity than traditional sectors. Notably, the MLT industries like refined petroleum, rubber & plastic, metal products, electrical equipment registered higher employment growth. However, the LT sectors continue to contribute significantly to overall employment (around 54% in 2016). In all industries, the output growth was accompanied by a significant increase in capital input use. On average, labour productivity increased by around 6% per annum which was relatively higher among the technology-intensive industries. In contrast, there was a large deceleration of productivity in many LT industries.

The significant changes in the composition of production, particularly from the traditional sectors in the initial reform period to the gradual dominance of medium-technology industries, suggest the reallocation of workers across industries. The decomposition exercise indicates that a large part of productivity gains is explained by within-growth component. The structural change components, although positive, are not substantial in magnitude. In the case of technology, the structural change factors were negative for several industries belonging to the LT sectors, especially post-2000. During this period, there was some evidence of workers moving towards higher technology industries. This was substantiated by the findings based on unit-level, which reported evidence of a static and dynamic shift of workers towards highly productive industries, especially belonging to the MLT sector during 2000–2007. The positive structural change effects, although considerably less than the within-shift effects, indicate that the reallocation process has positively contributed to aggregate industrial productivity.

The evidence of the presence of an intrasectoral component on productivity is consistent with the existing literature (see Erumban et al. 2019; McMillan & Rodrik 2011; Peneder 2003; Fagerberg 2000, Timmer & Szirmai 2000). However, in contrast to Erumban et al. (2019) we do find evidence of intersectoral or between-effect components operating at a highly disaggregated level. The positive role of structural change, although relatively modest in magnitude, is indicative of the potential gains to be exploited through industrialisation. To facilitate pro-growth resource allocation, policy efforts should be directed towards improving factor market rigidities, human capital development, rationalising informality and easing supply-side bottlenecks in the Indian manufacturing sector.

Notes

The static-effect indicates whether workers are shifting towards industries with above-average productivity. The dynamic-effects captures whether labour productivity is higher in industries that expand their employment share (see Foster-McGregor & Verspagen, 2016).

In case the interaction term is negative, this indicates that industries with higher productivity growth cannot maintain their level of employment. This can result in falling share of employment in faster productive industries which indicates the presence structural burden of structural change on aggregate labour productivity as envisaged by Baumol (Peneder 2003).

For a comprehensive literature survey, see Goldar (2014).

NAV measures aggregate shifts in sectoral shares and it is calculated as the one-half of the sum of the absolute value of sectoral share differences between the initial and final years. The MLI is the standard deviation of the sectoral growth rates of employment from initial and final period (see Dietrich 2012 for further details).

It has to be noted that the above conclusion is based on data at current prices. A recent article by Goldar (2018) noted significant improvement in the share of manufacturing in aggregate GVA when double-deflated GVA is used. For instance, the manufacturing share is reported to have increased from 10 percent in 1980–81 to 22% in 2011–12 (see Goldar 2018).

References

Ahluwalia, I.J. 1991. Productivity and Growth in Indian Manufacturing. Delhi: Oxford University Press.

Ahsan Reshad N. and Devashish Mitra (2016). Can the Whole Actually Be Greater Than the Sum of Its Parts? Lessons from India’s Growing Economy and Its Evolving Structure in Mc Millan, M., Rodrik, D., & Sepúlveda, C. (Eds). Structural Change, Fundamentals, and Growth: A Framework and Case Studies. International Food Policy Research Institute, Washington, DC.

Balakrishnan, P., and K. Pushpangadan. 1994. Total Factor Productivity Growth in Manufacturing Industry: A Fresh Look. Economic and Political Weekly 29 (31): 2028–2035.

Bollard, Albert, Peter J. Klenow, and Gunjan Sharma. 2013. ’India’s Mysterious Manufacturing Miracle. Review of Economic Dynamics 16 (1): 59–85.

Chenery, H., S. Robinson, and M. Syrquin. 1986. Industrialisation and Growth: A Comparative Study. World Bank: Oxford University Press.

Cortuk, O., and N. Singh. 2011. Structural Change and Growth in India. Economics Letters 110 (3): 178–181.

Dietrich, A. 2012. Does Growth Cause Structural change, or is it the Other Way Around? A Dynamic Panel Data Analysis for Seven OECD Countries. Empirical Economics 43 (3): 915–944.

Erumban, A.A., D.K. Das, S. Aggarwal, and P.C. Das. 2019. Structural Change and Economic Growth in India. Structural Change and Economic Dynamics 51: 186–202.

Fabricant, S. 1942. Employment in Manufacturing, 1899–1939. New York: National Bureau of Economic Research.

Fagerberg, J. 2000. Technological Progress, Structural Change and Productivity Growth: A Comparative Study. Structural Change and Economic Dynamics 11: 393–411.

Foster–McGregorVerspagen, N. B. 2016. The Role of Structural Change in the Economic Development of Asian Economies. Asian Development Review 33 (2): 74–93.

Goldar, B (2014). Productivity in Indian Manufacturing in the Post-Reform Period: A Review of Studies, in Vinish Kathuria, S. N. Rajesh Raj and Kunal Sen (Eds.), Productivity in Indian Manufacturing: Measurement, Methods and Analysis, Routledge, New Delhi.

Goldar, B. 2018. Source of Growth and Structural Changes in the Indian Economy Since 1980, in D.K Das (Eds) Productivity Dynamics in Emerging and Industrialized Countries, Routledge, South Asian Edition.

Ishikawa, S. 1987. Structural Change ‘An Entry of the New Palgrave. A Dictionary of Economics.

Kaldor, N. 1966. Causes of the Slow Rate of Economic Growth of the United Kingdom. London: Cambridge University Press.

Kochhar, K., U. Kumar, R. Rajan, A. Subramanian, and T. Ioannis. 2006. India’s Pattern of Development: What Happened, What Follows? Journal of Monetary Economics 53 (5): 981–1019.

Lewis, A. 1954. Economic Development with Unlimited Supplies of Labour. The Manchester School of Economic and Social Studies 22: 139–191.

McMillan, M.S., Rodrik, D. 2011. Globalization, Structural Change and Productivity Growth. NBER Working Paper No. 17143. National Bureau of Economic Research, Cambridge M.A.

Nagaraj, R. 2017. Economic Reforms and Manufacturing Sector Growth. Economic and Political Weekly 52 (2): 61–68.

Panagariya, A. 2008. India: The Emerging Giant. Oxford University Press.

Papola T.S. 2012. Structural Changes in the Indian Economy: Emerging Patterns and Implications, ISID Working Paper 2012/02, June 2012.

Pasinetti, L. 1981. Structural Change and Economic Growth. A Theoretical Essay on the Dynamics of the Wealth of Nations. Cambridge: Cambridge University Press.

Peneder, M. 2003. Industrial Structure and Aggregate Growth. Structural Change and Economic Dynamics 14 (4): 427–448.

Rijesh, R. 2016. Productivity Growth in Organised Manufacturing Sector in India: Evidence from Technology Intensive Classification of Industries. Artha Vijnana 58 (2): 121–148.

Rijesh, R. 2019. International Trade and Productivity Growth in Indian Industry: Evidence from the Organized Manufacturing Sector. Journal of South Asian Development 14 (1): 1–39.

Rijesh, R. 2020. ‘Liberalisation, Structural Change and Productivity Growth in Indian Organised Manufacturing Sector’, ISID Working Paper, WP225, May 2020.

Sabillon, C. 2008. On the Causes of Economic Growth: The Lessons of History, Algora Publishing.

Syrquin, M. 1988. Patterns of Structural Change. In: Chenery, H., Srinivasan, T.N. (Eds.), Handbook of Development Economics. North-Holland, Amsterdam.

Szirmai, A. 2013. 'Manufacturing and Economic Development', in Szirmai, A., W. Naudé and L. Alcorta (Eds), Pathways to Industrialisation in the 21st Century, New Challenges and Emerging Paradigms, Oxford, Oxford University Press.

Timmer, M., and A. Szirmai. 2000. Productivity Growth in Asia Manufacturing: The Structural Bonus Hypothesis Examined. Structural Change and Economic Dynamics 11: 371–392.

UNCTAD. 2016. Trade and Development Report 2016-Structural Transformation for Inclusive and Sustained Growth. United Nations: United Geneva.

Vu, K.M. 2017. Structural Change and Economic Growth: Empirical Evidence and Policy Insights from Asian Economies. Structural Change and Economic Dynamics 41: 64–77.

Weiss, J and M. Tribe 2016. Routledge Handbook of Industry and Development. Routledge, Taylor & Francis Group: New York.

Acknowledgements

This paper is a revised and updated version of the ISID working paper No 225. We acknowledge the generous financial support and assistance by the Indian Council of Social Science Research (ICSSR). I am thankful to the anonymous referee for his useful and constructive comments and suggestions. The usual disclaimer applies.

Funding

This study is a part of the research project sponsored by the ICSSR, New Delhi, India.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares no potential conflicts of interest concerning the research, authorship, and/or publication of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Table 4.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rijesh, R. Economic Liberalisation, Structural Change and Productivity Growth in Indian Organised Manufacturing Sector, 1991–2016. Ind. J. Labour Econ. 66, 131–154 (2023). https://doi.org/10.1007/s41027-023-00430-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41027-023-00430-z