Abstract

We investigate the effectiveness of capital controls using capital control indicators specific to several asset categories. The effectiveness of these policy instruments is analyzed along different angles. Specifically, we assess whether capital controls are effective in reducing the volume of capital flows, in reducing the probability of capital surges and flights, in strengthening financial stability, and in affecting the exchange rate. Our results point out three main conclusions. Capital controls are generally effective; the effectiveness of capital controls is differentiated for advanced and emerging economies; we find the largest effects on capital flows. We also show that capital controls are associated with a smaller probability of capital surges and flights, and, in emerging economies, with an undervalued exchange rate. We find some evidence that controls are associated with an improved financial stability, by reducing credit growth and FX currency loans: however, this evidence is not fully robust.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The goal of this work is a systematic analysis of the effectiveness of capital controls in reducing the volume and the volatility of capital flows, in strengthening financial stability, and in affecting the exchange rate.

The attitudes toward capital controls tend to swing between extreme positions, reflecting the changing implications of capital flows over the financial cycle. From a political economy perspective, the liberalization of capital flows is likely to be encouraged when the economy recovers after a crisis. As growth gains traction, capital inflows may become undesirably large, appreciating the domestic currency and fueling asset prices. If this process ends up with a sudden stop of capital flows and with a financial crisis, the consensus for capital controls usually increases.

Capital controls had been pervasive during the Bretton Woods era, and they were progressively dismantled since the late 70s. In the late 90s, the Asian crisis prompted an overhaul of the received wisdom: some scholars contributed to reopen the debate on the usefulness of capital controls (Rodrik 1998; Krugman 1999). The global financial crisis has fueled once again the debate, highlighting the risks associated with large and volatile flows: since 2007, many countries have been restricting their financial account, also endorsed by academics (Rey 2013; Blanchard 2017). A growing theoretical literature has emerged, focusing on the different motivations underlying capital controls. A first stream of this literature focuses on the role of capital controls in addressing pecuniary externalities, which arise for occasionally binding financial constraints (Korinek 2011; Korinek and Mendoza 2014; Devereux et al. 2018). A second stream of the literature focuses on the role of controls in affecting terms of trade (Costinot et al. 2014; Farhi and Werning 2014; Heathcote and Perri 2016). A third stream of research studies the interaction between capital controls and financial frictions (Unsal 2013; Kitano and Takaku 2017; Nispi Landi 2018a).

There is an intense dialogue among international institutions about the merits of capital controls. The IMF Institutional View states that capital flow management measures (CFMsFootnote 1) are part of the policy toolkit, and their use is appropriate under certain conditions, even if they should not substitute for warranted macroeconomic adjustment (IMF 2012). The IMF has argued that the use of CFMs after 2009 has been broadly in line with the Institutional View. A joint policy paper by the IMF, the FSB, and the BIS promotes an holistic approach on financial stability, encompassing capital flows management and macroprudential measures (IMF-FSB-BIS 2016). The only international body having jurisdiction on capital movements is the OECD, which has a different view: according to the OECD, CFMs are last resort policies, whose use should be strictly regulated.Footnote 2

Although the political debate considers CFMs as a single class of instruments, in this paper we focus only on capital controls, excluding currency based measures. We have data for a large sample of countries and over an extended period of time. We build the capital control indicators by elaborating the dataset by Fernández et al. (2016), which is based on the IMF’s Annual Report on the Exchange Arrangements and Exchange Restrictions (AREAER). This dataset has the clear advantage of reporting capital control indicators specific to several asset categories, distinguishing the restrictions on domestic investors from those on foreign investors. This allows us to look at the effects of capital controls on inflows and outflows separately. Following the classification of the Balance of Payments Manual (BPM6), in this paper capital flows refer to cross-border financial transactions recorded in the financial account: for each economy, inflows represent changes in the country’s gross external liabilities, and outflows relate to changes in the country’s gross external assets.Footnote 3 We consider as capital controls on inflows the restrictions on foreign investors and as capital controls on outflows the restrictions on domestic investors. The dataset covers twenty years of data for a large set of countries, including both emerging (EMEs, henceforth) and advanced economies (AEs, henceforth). This allows us to analyze potential heterogeneity in the effectiveness of capital controls.

Policy makers use capital controls to achieve several policy objectives. In a sample of 11 EMEs, (Pasricha 2017) finds that capital control policies respond to both macroprudential and mercantilist motivations: controls may be used to underpin financial stability and to preserve competitive advantage in trade. In a sample of 79 AEs and EMEs, (Fratzscher 2012) finds that capital controls are motivated by concern for the overheating of the domestic economy, in the form of high credit growth, rising inflation, and output volatility; he finds that capital controls are associated with significantly undervalued exchange rates; in addition, he shows that countries with shallow financial markets tend to use relatively more capital controls, presumably to protect their economies against the disruptive effects of large and volatile capital flows. Given the multitude of motivations for the use of capital controls, we look at the impact of controls on several variables: capital inflows, capital outflows, and their components; the probability of extreme events, such as capital surges and capital flights; domestic credit growth; the share of domestic loans denominated in foreign currency; exchange rate misalignments.

Capital controls are endogenous to capital flows and macroeconomic variables, and this undermines an analysis of the causal effect of these policy instruments. As noticed by the literature (e.g. by Ostry et al. 2012; Bruno et al. 2017), if countries tend to tighten controls when the volume of capital flows is high, the OLS estimates of regressing capital flows on capital controls should be upward biased. If the coefficient on capital controls is negative, reverse causality would make the result even more robust. Therefore, we believe that our estimates, whom we cautiously interpret as partial correlations, may anyway help to assess the effectiveness of capital controls.

Our results point out three conclusions. Capital controls are generally effective; the effectiveness of capital controls is differentiated for AEs and EMEs; capital controls mainly affect capital flows. Specifically, capital controls are associated with lower capital inflows both in AEs and EMEs. In EMEs, this is mostly driven by the ability of capital controls to condition FDI and portfolio investments. In AEs, the effect is mostly driven by the impact on other investments, a residual category that includes mainly banking flows. Moreover, we find some evidence that capital controls may affect also other variables. Capital controls on inflows are associated with a lower probability of a capital surge, and the result is mainly driven by AEs. Restrictions on outflows are associated with lower outflows (in AEs) and with a lower probability of a capital flight (both in AEs and EMEs). Our estimates suggest that capital controls on inflows are associated with undervalued exchange rates only in EMEs. The negative partial correlation between controls on other investment inflows and domestic credit growth suggests that capital controls are useful to mitigate financial stability concerns. We find that controls on capital inflows are associated with a reduced share of domestic loans denominated in foreign currency. However, these last two results are less robust, if we change the sample composition (credit growth), or the estimation method (FX loans).

We build upon several recent works that analyze the effectiveness of capital controls in cross-country studies.Footnote 4 The literature finds mixed results.Footnote 5 Some works report evidence of effectiveness in mitigating bond and banking inflows (Bruno et al. 2017), in dampening the proportion of FX loans in domestic bank lending (Ostry et al. 2012), in reducing domestic credit growth (Forbes et al. 2015). Beirne and Friedrich (2017) show that the effectiveness of CFMs depends on the structure of the banking sector. Some works argue that the effectiveness of capital controls is limited: Forbes et al. (2015) and Binici et al. (2010) find that controls are not effective in reducing capital inflows; Forbes and Warnock (2012) argue that controls are not associated with any type of extreme capital flow episodes. Other works show that controls targeting some specific flows shift foreign capital on other asset categories (Dell’Erba and Reinhardt 2015; Bruno et al. 2017).

In this paper, the key point of departure from most of the literature is the use of a capital control indicator specific to the variable on which effectiveness is evaluated. For instance, when the variable of interest is the volume of portfolio outflows, we use an indicator capturing restrictions only on portfolio outflows. The database by Fernández et al. (2016) is particularly suited for this purpose, given its wide coverage of capital control categories. In addition, the dataset allows us to focus on a broad range of policy objectives, rather than limiting the analysis only to one specific dimension.

The work is organized as follows. In Section 2, we describe the capital control indicators used in the empirical model, which is illustrated in Section 3. In Section 4, we show the results of our baseline specification. In Section 5 we perform a battery of robustness checks. Section 6 concludes.

2 Capital Control Indicators

2.1 Construction of the Indicators

Assessing the effectiveness of capital controls requires the use of appropriate measures. There exist two main categories of indicators: de jure indicators, which capture the existence of regulatory measures on capital movements; de facto indicators, which are based on economic variables. Given that the goal of this paper is to examine the effects of capital controls on some economic variables, the analysis is carried out using de-jure indicators.

De jure indicators usually draw on the AREAER database, which provides information on restrictions applied to specific transactions recorded in the Balance of Payments. These indicators typically have two main drawbacks. They are very broad measures of capital openness, because they do not capture restrictions on specific transactions. They fail to account for the intensity of capital controls. In this paper, we use the dataset released by Fernández et al. (2016) (FKR, henceforth), which solves the first problem, but it is not able to capture the intensity of capital controls. The dataset distinguishes restrictions across ten types of transactions, taking into account the residency of investors to whom restrictions are applied. We consider as inflows the changes in gross external liabilities of the country, and as outflows the changes in foreign assets held by domestic investors: controls on capital inflows refer to restrictions applied to foreign investors, controls on capital outflows refer to restrictions on domestic investors.Footnote 6

In this dataset, the restrictions include a large set of capital controls: authorizations, approval, permission, clearances, quantity restrictions, deposit requirements, and taxes.Footnote 7 The restrictions are differentiated on the basis of the investors’ residency. The main advantage of this dataset is the possibility to construct measures of capital controls targeted to specific flows. The dataset includes 100 countries (31 AEs and 69 EMEs),Footnote 8 over the period 1995-2015. In this section, we describe the indicators for the full set of countries. In the estimation sample described in the next section, we drop some countries with specific characteristics.

Using FKR allows us to construct indicators strictly related to the transactions recorded in the financial account of the Balance of Payments. FKR contains dummy variables along two main dimensions: the type of transaction and the residency status of investors. The dummies take the value of one if there is a restriction in place, and they are zero otherwise. We take advantage of granular information in FKR to construct specific indicators for the three broad types of transactions recorded in the financial account of the Balance of Payments: FDIs, portfolio and other investments. For each type of investment flow, for each country, in each year, we take the simple average of the dummy variables for capital inflows and outflows separately (Table A.1). We obtain six capital control indicators: three for inflows and three for outflows. For each country i and year t, capital control indicators are indicated with

where \(c=\left \{fdi,ptf,other\right \}\) denotes the asset category, and \(d=\left \{in,out\right \}\) denotes the direction, which refers to the residency status of investors (foreign and domestic, respectively).

The control index on FDIs (inflows and outflows) is the average of two dummy variables. The first dummy accounts for the presence of any kind of restrictions on transactions between entities with participation linkages. The second dummy refers to restrictions applied to the phase of the liquidation of the investment. The index for portfolio investments (inflows and outflows) is the average of the indicators referring to specific instruments (bonds, equities, money market instruments, and collective investments).Footnote 9 The index for the other investments (inflows and outflows) is computed as the average of three dummy variables: financial credit, commercial credit, and guarantees indices (Table A.1).Footnote 10

We also compute aggregate direction-specific indexes of controls on inflows and outflows, by taking the average of the three indicators computed above:

Finally, we compute an aggregate indicator of capital controls by taking the average of \(KK_{it}^{tot,in}\) and \(KK_{it}^{tot,out}\):

In the regression analysis, if one of the dummies underlying these aggregate indicators is missing, the indicator features a missing value. In the next section, where we illustrate some characteristics of the capital control indicator, we compute the aggregate indicators also for those observations with one or more missing dummies, in order to consider all countries in all periods.Footnote 11

2.2 Descriptive Evidence

With these indicators in hand, we illustrate some stylized facts about the use of capital controls. There is a strong heterogeneity across countries, in terms of the level of capital controls and in terms of the strategies adopted over the last two decades. Some countries (e.g. Russia, Chile, and Korea) stand out as having loosened capital controls, while other countries (e.g. Iceland and Argentina) have restricted their financial account. Some countries have not substantially modified their stance: China and India maintain a high level of capital controls, while most AEs are persistently open.

Countries tend to be more close to portfolio inflows compared to FDI and other inflows (Table 1, columns 1-3). With respect to outflows, FDI are relatively more open than portfolio and other investments. In general, we observe a generalized increase in the use of capital controls following the Global Financial Crisis, in particular for controls on FDI inflows and for controls on portfolio outflows.

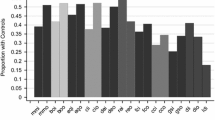

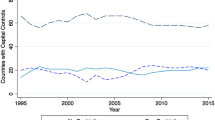

There is a strong difference in levels between AEs and EMEs (Figs. 1 and 2, Table 1 columns 4-9): AE tend to be more open to both inflows and outflows. We also observe a strong time-series correlation between EMEs and AEs controls: the liberalization trend has reversed around the Global Financial Crisis both for AEs and for EMEs. While EMEs on average increased the level of capital controls in a generalized manner, AEs raised restrictions in a selective way, mainly on FDI inflows.Footnote 12

Controls in AEs and EMEs (inflows) (cross-country means). Capital controls on inflows in AEs (left scale) and EMEs (right scale), average across countries. Source: Fernández et al. (2016) and our elaboration

Controls in AEs and EMEs (outflows) (cross-country means). Capital controls on outflows in AEs (left scale) and EMEs (right scale), average across countries. Source: (Fernández et al. 2016) and our elaboration

We also examine the use of capital controls in EMEs, by regions (Figs. 3 and 4).Footnote 13 South-Asian countries stand out as the most closed to income and outflows, while Latin-American countries are the most open. However, since 2006 Latin-American countries have been strongly tightening capital controls. European Central-Asian countries are the ones that have liberalized the most the financial account since 1995: the liberalization trend has been sligthly reverting after the Global Financial Crisis. In Sub-Saharan Africa, the level of capital controls is in line with the emerging-market average, although restrictions are quite stable over time.

Controls in EMEs by Region (inflows) (cross-country means). Capital controls on inflows in Emerging markets. Source: (Fernández et al. 2016) and our elaboration

Controls in EMEs by Region (outflows) (cross-country means). Capital controls on outflows in Emerging markets. Source: (Fernández et al. 2016) and our elaboration

With the aim to explore the relationship between capital controls and financial development, we plot the \(\overline {KK}_{i}^{tot}\) indices against the averages across time of the financial development index developed by Svirydzenka (2016) and released by the IMF (Fig. 5). We observe a negative relationship: countries with high capital controls tend to have less developed financial markets.

Capital controls and financial development. Capital controls are measured with \(\overline {KK}^{tot}_{i}\) (i.e the within-country mean of the aggregate indicator) (source: (Fernández et al. 2016) and our elaboration). Financial development is measured with the within-country mean of the index provided by Svirydzenka (2016) and released by the IMF. The black line represents the fitted values of a regression of capital controls on financial development

3 Data and Regression Model

3.1 Dependent Variables

The first goal of the work is to verify to what extent capital controls have an effect on the volume of capital flows. Forbes and Warnock (2012) argue that it is important to focus on gross flows instead of net flows, because the latter can mask dramatic changes in gross flows. Before the mid-1990s, researchers used to focus on net flows, which roughly mirrored gross inflows. More recently, the literature has stressed that gross inflows (driven by foreign investors) and gross outflows (driven by domestic investors) tend to move independently. This entails that the effects of capital controls need to be analyzed separately for inflows and outflows.

We consider four categories of gross capital inflows: FDIs, portfolio investments, other investments, and total inflows (the sum of the first three components). The same taxonomy is considered for gross capital outflows. The data come from the IMF Balance of Payments Statistics, and they are divided by GDP; gross inflows refer to the entry “net incurrence of liabilities”, and gross outflows refer to “net acquisition of financial assets”. If controls are effective, we expect that a tightening of capital controls on a given flow reduces that specific flow.

Our second goal is to analyze whether capital controls affect financial stability and exchange rates. An increase in capital controls should i) reduce the probability of capital surges and ii) capital flights;Footnote 14 iii) it should dampen domestic credit growth by curbing banks’ external borrowing; iv) it should decrease the share of bank loans denominated in foreign currency, by constraining the ability of domestic banks to tap international markets; v) it should depreciate the exchange rate by reducing the demand of domestic currency.Footnote 15 Accordingly, we take as dependent variables in separate regressions: i) capital surges and ii) capital flights; iii) the growth of domestic credit to the non-financial sector; iv) the fraction of domestic loans denominated in domestic currency; v) the exchange rate misalignments.

In our framework, capital surges (capital flights) occur when two conditions are jointly verified in a given year: the annual year-over-year increase of quarterly inflows (outflows) exceeds the five-year rolling mean by two standard deviations in at least one quarter during that year, as in Forbes and Warnock (2012); the annual change exceeds 2% of GDP. Given that we use annual data in our regression, we convert into annual data the information on capital surges and flights that is extracted from quarterly data; for example, if a capital surge occurs in the last quarter of year t and continues in the first quarter of year t + 1, our dependent variable will take value 1 both in t and t + 1. According to our definition, we identify capital surges and flights taking into account both the variability of flows (first condition) and their macroeconomic size (second condition). The respect of these conditions ensures that capital surges and flights are extreme episodes, from both a statistical and an economic standpoint (see Crystallin et al. 2015). In our sample, capital surges and flights occur in 6.8% and 6% of our observations respectively. If we use the definition of Forbes and Warnock, the occurrence of extreme episodes increases to 9.8% for surges and 9.9% for flights. The correlation between our measure of extreme episodes and the one adopted by Forbes and Warnock (2012) is strong (0.84 for surges, 0.78 for flights).

The database EQCHANGE, released by the CEPII, provides estimates of the exchange rate equilibrium levels for a large sample of economies (Couharde et al. 2018). Using the Behavioral Equilibrium Exchange Rate approach, they estimate three models assuming a long-run relationship between real exchange rates and their fundamentals (the level of productivity, net foreign assets, and terms of trade). Exchange rate misalignments are obtained as the deviations of the effective exchange rate from its equilibrium level. As a proxy of exchange rate misalignments, we use an indicator included in the CEPII dataset, namely the average of the estimates obtained through the three models.

3.2 Empirical Specification

Following the literature, our baseline specification is a panel regression model without country fixed effects, given that capital controls display little variation over time; as Ostry et al. (2012) point out, the inclusion of fixed effects would make difficult to identify the effect of capital controls on dependent variables. For each category of flows \(c=\left \{fdi,ptf,other\right \}\) and direction \(d=\left \{in,out\right \}\), we estimate the following regression model:

where \(Y_{it}^{c,d}\) denotes gross capital flows in percentage of GDP (for category c, direction d, in country i, at time t); \(KK_{it-1}^{c,d}\) is the correspondent capital control index: for instance, if the dependent variable is FDI outflows (\(Y_{it}^{fdi,out}\)), the capital control indicator used in the regression is \(KK_{it-1}^{fdi,out}\); Zit is a set of pull factors typically considered as important determinants of capital flows:Footnote 16 a measure of the real side of the business cycle (real GDP growth), a measure of the nominal side of the business cycle (the CPI inflation rate), an index of financial development,Footnote 17 the public debt/GDP ratio as a proxy for country risk, the nominal exchange rate depreciation, a measure of trade integration (the sum of imports and exports divided by GDP), and a short-term interest rate; 𝜗t denotes year fixed effects, to capture push factors of capital flows; 𝜖it is the error term.Footnote 18

The same model is estimated also for five other dependent variables: i) capital surges and ii) capital flights; iii) domestic credit growth; iv) the percentage of domestic loans denominated in foreign currency; v) the exchange rate misalignment. In these additional regressions, the capital control index is \(KK_{it-1}^{tot,in}\), except for the regression on capital flights, where we use \(KK_{it-1}^{tot,out}\). In regressions for capital surges and flights, we use a logistic model, since the regressands are dummy variables. In the regression for foreign currency loans, the sample starts in 2008, for limited availability of the dependent variable. In the regression for the exchange rate misalignment, we drop the exchange rate depreciation from the set of regressors, and we include the first-difference of the foreign reserves/GDP ratio. Moreover in this regression we also include a set of dummy variables that measure the flexibility of the exchange rate regime,Footnote 19 and we use contemporaneous values of all regressors but capital controls (given that the exchange rate is a fast-moving variable).

All variables are winsorized at the 2% to dampen the impact of outliers, except those variables taking values in the unit interval (such as capital controls). Standard errors are clustered at the country level and are robust to heteroskedasticity. As in Beirne and Friedrich (2017), we exclude small countries, oil exporters, and countries from Sub-Saharan Africa (except South Africa): the initial sample of 100 countries, for which the capital control index is available, is reduced to 65 countries (37 EMEs and 28 AEs). The sample period is 1996-2015, dictated by the availability of the capital control indexFootnote 20 and the financial development indicator.Footnote 21 Table 2 reports the summary statistics of the regression sample.

Endogeneity issues, in particular reverse causality, are a possible concern in regressions testing the effectiveness of capital controls. In order to address endogeneity concerns, capital controls indicators enter the model with a one-year lag. We also note that if countries tend to tighten capital restrictions when the volume of capital flows is high, when credit excessively grows, and when the exchange rate is overvalued, the OLS estimates of our regressions should be upward biased; if the coefficient on capital controls is negative, reverse causality would make the result even more robust. This observation has led many authors to employ an OLS regression when testing the effectiveness of capital controls, thus downplaying the endogeneity issue (Ostry et al. 2012; Bruno et al. 2017). We do not claim that the identification is clean and we cautiously interpret our estimates as partial correlation. Nevertheless, we are confident that our results help to assess the effectiveness of capital controls.

4 Baseline Specification

In this section we describe the results of the baseline regression. In particular, we are interested in the estimated coefficients of capital controls. In Table 3 column 1, we report the marginal effect of one-standard-deviation increase in the capital control indicator on each dependent variables. In the OLS regression, the marginal effect is given by the estimated coefficient times the standard deviation of the indicator. This does not hold for the Logit estimation, which is not linear. The standard deviations of the capital control indicators lie between 0.3-0.35, so the effects of a standard-deviation increase is quite comparable among asset classes. The same holds for controls on capital outflows (their standard deviation lies between 0.3-0.4). In Table 3 column 2, we divide the one-standard-deviation marginal effect in column 1 by the mean of the dependent variable, in order to evaluate the economic relevance of the effect.

The first set of regressions shows that capital controls are associated with lower capital flows, suggesting that these policy tools are quite effective for all types of investments (Table 4). According to the point estimate, a one-standard-deviation increase in \(KK_{it}^{c,in}\) (with c = fdi,ptf,other) coincides with a reduction in FDI, portfolio, and other inflows in percent of GDP by 0.66, 0.45, and 0.58 percentage points respectively. These numbers are economically relevant: FDI, portfolio, and other inflows decrease by 15%, 19%, and 20% of their respective means, though the p-value of \(KK_{it}^{other,in}\) is 0.14. A one-standard-deviation rise in the aggregate indicator KKtot,in is associated to lower total capital inflows in percent of GDP by 2.15 percentage points (corresponding to 22% of average total inflows). The signs of the other coefficients are reasonable in most cases, though not always significant; we find that capital flows are positively associated with a higher degree of trade openness, financial development, GDP growth, and interest rates; higher public debt and exchange rate depreciation are associated with lower capital inflows; the inflation rate is positively associated with higher other inflows.

Our second set of regressions suggests that restrictions on portfolio and other investments lead to reduction in capital outflows (Table 5). A one-standard-deviation increase in the indicators is associated with lower portfolio and other outflows in percent of GDP by 0.79 and 0.96 percentage points respectively (around 32% and 41% of their means respectively). The coefficient on FDI controls is indistinguishable from zero, though the sign of the point estimate is negative. Considering total outflows, a one-standard-deviation rise in the aggregate indicator is associated with a reduction of outflows around 2 percentage points (around 25% of capital outflows mean). Regressors have all the expected sign, except for the interest rate, whose positive sign is more difficult to interpret.

These findings suggest that capital controls reduce the volume of gross capital flows. Another related question is whether capital controls decrease the probability of capital surges and capital flights. We test this hypothesis in our third set of regressions. The estimated coefficients on KKtot,in and KKtot,out are negative and statistically significant, in the logistic regressions on surges and flights respectively (Tables 6 and 7, first column). A one-standard-deviation increase in the indicators is associated with a reduction in the probability of surges and flight by 4% and 3% percentage points respectively. This is a big effect, given that the sample mean of surges and flights is 6% and 5% respectively. Our results differ from those obtained by Forbes and Warnock (2012), who do not find a significant effect of capital controls on extreme episodes. The main reason is our different definition of extreme episodes. Our definition of surges and flights is stricter: we also require that the annual change in capital flows exceeds 2% of GDP, in order to focus only on surges and flights that have a sizable macroeconomic impact. When we use the same methodology of Forbes and Warnock, the coefficients of capital controls are no longer significant. This suggests that capital controls are effective in reducing the probability of extreme episodes only when changes in capital flows are important from a macroeconomic perspective.

Excessive capital inflows may fuel credit booms which, in turn, may undermine financial stability. Capital controls may help to mitigate the expansion of domestic credit. Consistently with this hypothesis, when the dependent variable is domestic credit growth, we find a significant coefficient only when we use the control on other inflows, which include bank loans (Table 8, first column): a one-standard-deviation increase in controls on other inflows coincides with a fall in credit growth by 1.23 percentage points, corresponding to 12% of credit growth mean in the full sample.

Tighter capital controls may reduce the ability of domestic banks to tap international markets, hence they may reduce the amount of foreign currency loans within the economy. Capital controls may also reduce the ability of domestic agents to borrow directly from foreign banks. Our results are consistent with these hypotheses. We find that capital controls are associated with a lower percentage of foreign currency loans (Table 9, first column): the sign on KKtot,in is negative and statistically significant at the 1% level. The same holds for all categories of inflows controls. Specifically, a one-standard-deviation increase in KKtot,in is associated with a reduction in foreign currency loans by about 14 percentage points, around 43% of the sample mean.

Fratzscher (2012) and Pasricha (2017) point out that capital controls may be associated with mercantilist purposes. We estimate a regression in which the dependent variable is an indicator of exchange rate misalignment, and the regressor of interest is KKtot,in. Our findings suggest that capital controls on inflows significantly affect the level of exchange rate misalignment (Table 10, first column): a one-standard-deviation increase in KKtot,in is associated with a reduction (depreciation) in the effective exchange rate by 7 percentage points with respect to the equilibrium level. This is a large effect, given that the mean of the exchange-rate misalignment is − 0.08.

5 Robustness Analysis

In this section, we test the robustness of our results along several dimensions. First, we explore whether our findings are driven by a specific sub-sample of countries. Second, we use two different approaches to compute the aggregate indicators. Third, we employ both a GMM and a TSLS estimation method. Fourth, we include some macroprudential indicators in the baseline regression.

5.1 Countries Sub-samples

In the empirical literature on the effectiveness of capital controls, results are mixed and hinge on several factors. The robustness of our results to the sample composition is a crucial aspect of our analysis, given that we do not include country fixed effects in the model. The reason is the little variation in our variable of interest within individual countries, since many economies do not vary the level of capital controls. As noticed by Eichengreen and Rose (2014), capital controls are persistent: once imposed they tend to stay in place for long periods, and once removed they are rarely restored. Aware of this problem, we put our estimation through some robustness checks in which we split the sample or exclude some countries. In this way, we can verify whether the results of the baseline regressions can be generalized, or if they are driven by some specific economies. Specifically, we run regressions separately for AEs and EMEs. We carry out another check by excluding from the sample those countries that have a constantly high level of capital controls (“persistently closed” countries): as Klein (2012) points out, it is important to distinguish between long-standing and episodic capital controls, because they respond to distinct policy objectives, and the effects on financial variables tend to be different.Footnote 22 Given that some countries do not vary capital controls, we also carry out regressions considering only those countries that feature a minimum of variability in the time series. We label these countries as “active”. Non-active countries are more open: the average \(KK_{it}^{tot}\) is 0.32 for active countries and 0.11 for non-active countries. Footnote 23 Tables with the estimated coefficients are reported in the next pages (Tables 6-10) and in the Online Appendix (Tables A.2-A.9).

As regards the effect of capital controls on aggregate inflows, our robustness analysis confirms the result of the baseline regression. The coefficient on KKtot,in is always negative and significant (Table A.2). The coefficient is much higher for AEs (Table A.2, column 3), given that these countries on average receive larger capital flows. When we exclude persistently closed economies or we consider only active countries, the coefficient on capital controls is always negative and significant (Table A.2, column 4 and 5).

We repeat the same exercise for FDI, portfolio and other inflows. With regard to FDIs, the results of the baseline regression are generally confirmed (Table A.3, column 3). The effect of capital controls on portfolio investments is always of the expected sign, but strongly significant only for EMEs (Table A.4, column 2). For other investments, the coefficient on capital controls is significant only for AEs (Table A.5, column 3). To sum up, these results suggest that the effects of capital controls on specific investment types tend to be differentiated: controls on FDIs reduce inflows across-the-board, those on portfolio investments are effective only for EMEs, those on other investments mainly affect inflows in AEs. In the last two cases, the results of the baseline regression become not significant when we exclude persistently closed economies.

The effects of capital controls on capital outflows are more evident for AEs, mainly driven by portfolio and other investments (tables A.8-A.9, column 3). For EMEs, our findings suggest that controls on outflows are effective for FDI and portfolio flows, but not for other investments and for the aggregate indicator (tables from A.7 to A.9, column 2). By excluding persistently closed economies or by considering only active countries, results slightly change: in particular, controls on FDI outflows become more significant.

The baseline regressions indicate that higher capital controls on inflows are associated with a lower probability of surges. This finding is confirmed for AEs (Table 6, column 3), while the effect is not significant for EMEs (Table 6, column 2). The effect is also significant when we restrict the sample to active countries, and when we exclude persistently closed economies (Table 6, column 4 and 5). Controls on outflows are associated with a lower incidence of capital flights; this finding holds for both AEs and EMEs (Table 7, columns 2 and 3). The coefficient loses significance when we exclude persistently closed economies (Table 7, column 4).

As regards curbing domestic credit growth, we find a significant effect of capital controls on other investments for AEs, but not for EMEs (Table 8, columns 2 and 3). We do not find significant effects when we exclude persistently closed economies (Table 8, columns 4 and 5). This last finding is not the result of slower credit dynamics in closed economies: credit growth in persistently closed economies (13.9% on average) is higher on average than credit growth in other countries (9.8% on average). Our analysis does not support the use of episodic capital controls to dampen credit expansion, because the association with credit growth is not significant when we drop countries with long-standing capital controls. Using a different dataset on a smaller sample, (Klein 2012) finds that the significant association between long-standing capital controls and credit growth disappears when controlling for per-capita income. By contrast, our results are confirmed also when we include per-capita income in the regression, suggesting that our estimates are not biased by this omitted variable. To sum up, the results of the robustness analysis are not univocal: our findings suggest that the effects of capital controls on domestic credit, though robust for some group of countries, are not systematic.

The robustness analysis indicates that capital controls are unambiguously associated with a lower fraction of loans denominated in foreign currency in all groups of countries (Table 9). This finding confirms that capital controls may help to reduce the currency mismatch of the economy, by limiting the volume of liabilities denominated in foreign currency.

Finally, the baseline regressions indicate that capital controls are associated with undervalued exchange rates. This outcome is confirmed for EMEs, but not for AEs (Table 10, columns 2 and 3). Our findings support the argument of several authors that there may be also mercantilist purposes behind the use of capital controls by some EMEs. The effect is robust also when we exclude persistently closed economies and when we consider only active countries (Table 10, columns 4 and 5).

5.2 Alternative Indicators

The aggregate indicator for controls on inflows is based on a simple average of the indicators for controls on FDI, portfolio and other inflows. The same holds for the aggregate indicator for capital controls on outflows. The relevance of individual types of capital inflows and outflows varies across countries and over time: we refine the aggregate indicators by using a weighted average (as opposed to a simple average) based on liabilities and asset stocks. Specifically, the new indicators read:

where \(L_{it}^{c}\) is the share of liability c over total liabilities in country i and year t, with \(c=\left \{fdi,ptf,other\right \}\); similarly, \(A_{it}^{c}\) is the share of asset c over total assets in country i and year t. We replicate all the baseline regressions that involve the aggregate indicators by using the refined indices. In Table A.10 column 2, we report the coefficients of the refined index in each regression: results barely change.

Our baseline aggregate indicators may suffer from another shortcoming. The three asset classes do not contain the same number of restrictions: two dummies for FDI, eight for portfolio, and three for other investments. The averaging method to compute the aggregate indicators might lead to an unequal treatment across asset classes: a change in one of the two restrictions for FDI flows would affect the aggregate measure of capital controls much stronger than a corresponding change in one of the eight restrictions of portfolio flows. We test the robustness of our results by using indicators that do not suffer from this issue. In this robustness exercise, we compute the asset-class specific indicators by using two dummies for every asset class; we still compute the refined aggregate indicators as simple means of the three asset-class specific indicators. The capital control indicator for FDI flows already consists of two dummies. We use two different strategies to pick the two dummies for portfolio and other inflows and outflows. In the first strategy, we pick the restrictions that are more used on average. These restrictions coincide with those having the highest standard deviations.Footnote 24 In Table A.10 column 3, we report the coefficient of interest in the regressions involving the aggregate indicators: results are in line with the baseline regressions. Results are robust also in the regressions that do not involve the aggregate indicators. In the second strategy, we pick those restrictions that the theoretical literature has often used to model capital controls.Footnote 25 Results are in line with the baseline estimates (Table A.10 column 4): the coefficient on the aggregate indicator on total inflows is still significant but it is lower.

5.3 Endogeneity

In order to mitigate the endogeneity of capital controls, in the baseline regression we have used the first lag of the capital control indicators. As a robustness exercise, we consider two additional strategies.

As a first step, we apply an IV-TSLS approach. The instruments should be correlated with capital controls and they should be exogenous to our dependent variables. We use the instruments proposed by Ostry et al. (2012): a binary variable equal to 1 if in year t − 1 country i is member of the European Union (EU), and equal to 0 otherwise; a binary variable equal to 1 if in year t-1 there is a bilateral investment treaty (BIT) between country i and the United States, and equal to 0 otherwise. As argued by Ostry et al. (2012), both variables should be negatively correlated with capital controls, given that EU memberships and BITs constrain the use of financial account restrictions. In addition, EU memberships and BITs are unlikely to be related to capital flows or to the dependent variables that we use in the baseline regressions. Results are shown in Tables A.15-A.18. Compared to the baseline regression, the coefficients of interests are in general much larger, but they are estimated with less precision. Only the regression with FX Loans features a marginal effect of capital controls lower than the baseline estimate.Footnote 26 However, in most regressions the F-statistic of the joint significance of the two instruments is lower than 10, meaning that the instruments are weak (Staiger and Stock 1997). Moreover, the coefficient of BIT is negative and significant only in the regression for other inflows.

As a second step, we use the dynamic system GMM estimation developed by Arellano and Bover (1995) and Blundell and Bond (1998). The system GMM uses the lagged levels of the series as instruments for the endogenous variables in equations in first differences, and the use of lagged differences of the dependent variable as instruments for equations in levels. Following (Bruno et al. 2017), in order to reduce the number of instruments, we keep as independent variables only GDP growth, inflation rate, depreciation rate, and the policy rate, using only one lag. For the same reason, we exclude time fixed effects and we add the VIX, as a proxy for push factors. Results are in Tables A.19-A.22. We also report the p-values for the tests of serial correlation of the residuals: residuals should have no one-order serial correlation (we need a low p-value in the AR(1) test), but they should feature second-order serial correlation (we need a relatively high p-value in the AR(2) test). The GMM estimation shows that capital controls are very effective in reducing capital inflows and capital outflows: the estimated coefficients are much bigger than the OLS counterparts. Similarly, we find a larger impact of capital controls on surges and flights episodes, though the coefficients are imprecisely estimated. With regard to the other dependent variables, estimates are not fully reliable: the AR(1) test fails for the credit growth regression; the AR(2) test fails for the FX loans regression; in the regression for exchange rate misalignment, the coefficient of the lagged dependent variable is higher than one, making the model unstable.

5.4 Macroprudential Policy

In the baseline regression, we control for the short-term interest rate, in order to rule out that capital controls may absorb the effects of monetary policy. However, capital controls may also absorb the effects of other policies, such as macroprudential measures. Specifically, macroprudential instruments related to foreign currency exposure may be deployed jointly with capital controls. In order to control for macroprudential measures, we use the database provided by Alam et al. (2019). The database consists in seventeen macroprudential indicators, at the monthly frequency. Each macroprudential indicator takes value 1 if the country has tightened the macroprudential instrument, -1 if the country has loosened it, and 0 otherwise. We include two macroprudential indicators in our regression: 1) Limits on foreign currency lending, and rules or recommendations on FC loans (FX Macropru 1). 2) Limits on net or gross open foreign exchange positions, limits on FX exposures and FX funding, and currency mismatch regulations (FX Macropru 2). Given that we use yearly data, we transform the monthly indicators into yearly indicators by taking the sum over months. Results are in Tables A.11-A.14, in the Online Appendix. The coefficients of capital controls in the capital flow regressions remain significant for most asset classes, but they are slightly lower. For the other dependent variables, the coefficients of interest are bigger. Interestingly, tighter macroprudential instruments are associated with a reduction in the dependent variables in most regressions. Specifically, the effect of FX Macropru 1 is statistically significant for most capital inflows and outflows. A tightening in FX Macropru 2 significantly reduces capital surges.Footnote 27

6 Conclusions

This paper analyzes the effectiveness of capital controls along several dimensions. If policy makers introduce capital controls, they should expect a substantial reduction in capital inflows and outflows: our estimates suggest that these variables are those affected the most by capital controls. Controls on other inflows and outflows seem more effective for AEs. Controls on portfolio inflows seem more effective for EMEs. In addition, we find that capital controls may affect also other variables. Our findings are consistent with the view that capital controls are useful tools to reduce the probability of extreme capital-flow episodes. In EMEs, we show that controls are associated with a more undervalued exchange rate. We find some evidence that these restrictions are able to reduce credit growth and the share of foreign currency-loans: however, this evidence is not fully robust.

The results should be weighed against the unintended consequences of the use of capital controls for mercantilist purposes. The association between capital controls and exchange rate misalignments that we document in this paper, chimes with OECD warnings about the risks related to a widespread use of capital controls.Footnote 28 While capital controls used for exchange rate targeting are potentially beneficial in the short term at the country level, they may lead to negative outcomes from a collective perspective, vanishing the benefits associated with global financial markets.Footnote 29 The multitude of policy objectives related to capital controls and the risk of a non-cooperative approach by individual countries call for a strengthened coordination at international level, through the role played by multilateral organizations. “Countering the risk that process of [trade and] financial integration may go into reverse, requires, above all, political leadership and international coordination. But co-operation can also greatly benefit from a clear and globally recognized framework” (Visco 2016).Footnote 30

We believe that the effectiveness of capital controls should be further analyzed, in at least two dimensions. First, capital controls may potentially affect variables that are strongly related each other; moreover, their effect is likely to last for some periods. These considerations could support the use of vector autoregression which, however, require observations at least at the quarterly frequency.Footnote 31 Second, an important step further would be to develop an indicator able to capture the change in the intensity of capital controls. We leave these issues to future research.

Notes

We refer to CFMs as those policy tools including both capital controls and currency-based measures. When we refer to capital controls, we mean only those restrictions to the financial account that discriminate between residents and non-residents.

The OECD jurisdiction on capital movements is restricted to the countries that have subscribed the “OECD Code of Liberalization of Capital Movements.”

Gross capital inflows represent the difference between investment and disinvestment in domestic assets by non-residents. Gross outflows are the difference between investment and disinvestment in foreign assets by residents.

For country-case studies, the volume edited by Edwards (2009) includes an excellent analysis of the experience of several EMEs during ’90s and early 2000s. See Vithessonthi and Tongurai (2013) and Chamon and Garcia (2016) for more recent case-studies of the effectiveness of capital controls, in Thailand and Brazil respectively.

Magud et al. (2018) provides a thorough survey of the literature. They conclude that capital control effectiveness is quite limited.

As regards portfolio flows, the FKR dataset distinguishes also between restrictions on purchases by residents (or non-residents) from restrictions on sales by residents (or non-residents). This distinction would allow to look at the impact of capital controls on gross sales of domestic financial instruments to foreign residents and gross purchases of foreign financial instruments by domestic residents; however, this analysis is not feasible, because the Balance of Payments database provides data only on net purchases by foreigners of domestic financial instruments and net sales by domestic investors of foreign financial instruments (see also Footnote 3).

The index does not consider requirements related to reporting, registration, and notification procedures. Restrictions on specific economic sectors or countries and restrictions for political or national security reasons are also excluded.

We use the IMF World Economic Outlook classification in order to distinguish between advanced economies (AEs) and emerging markets and developing countries (EMEs). According to the IMF criterion, each country falls into one of these two categories.

The indicators on bonds, equities, money market instruments, and collective investments inflows (outflows) are obtained as the average of the specific restrictions on purchases and sales by non-residents (residents). We associate restrictions on non-residents (residents) to inflows (outflows). The reader can refer to Schindler (2009) for the relationship between the direction of flows and the residency status of investors.

In the Balance of Payments, the item “Other Investments” includes banking flows, trade credit, other accounts receivable or payable, and insurance and guarantee schemes.

Missing dummies are a problem mostly for Sub-Saharan countries, which are excluded from the regression analysis.

These findings are broadly confirmed when we use the same sample employed for the econometric analysis, in which we exclude small countries, oil exporters and countries from Sub-Saharan Africa (see Section 3.2).

We use the World Bank criterion to classify EMEs in different regions. EAP: East Asia & Pacific. SA: South Asia. SSA: Sub-Saharan Africa. MEN: Middle East & North Africa. ECA: Europe & Central Asia. LAC: Latin America & Caribbean.

Capital controls may also affect the other two categories of extreme events related to capital flows, i.e. stops and retrenchments (see Forbes and Warnock 2012). As we are interested in assessing capital controls as tools to deal with large and volatile capital flows, we choose to focus on capital surges and flights, which are related to excessive increasing inflows and outflows respectively. By contrast, in order to prevent stop and retrenchment episodes, capital controls should avoid that inflows and outflows fall too much below their average.

Data on domestic credit are obtained from the Global Financial Development Database (Čihák et al. 2013). Data on the currency denomination of bank loans come from the World Bank.

Data on control variables are obtained from the WEO, except for financial development (Svirydzenka 2016) and the policy rate (Datastream).

The dummy variables are provided by Ilzetzki et al. (2019), who classify countries in six categories according to the flexibility of the exchange rate.

The indicator starts in 1995 but it enters the regression with a one-year lag. The indicator for portfolio flows starts in 1997.

The financial development indicator ends in 2014 and enters the regression with a one-year lag.

Let \(\bar {KK}_{i}^{tot}\) be the mean of \(KK_{it}^{tot}\) for country i. A country is persistently closed if i) the aggregate indicator \(KK_{it}^{tot}\) is in the fourth quartile of the cross-section distribution of \(\bar {KK}_{i}^{tot}\) in at least 75% of the yearly observations; ii) the aggregate indicator \(KK_{it}^{tot}\) is never below the median of the cross-section distribution of \(\bar {KK}_{i}^{tot}\). The list of persistently closed countries is in the Online Appendix.

A country is active if the standard deviation of the aggregate indicator \(KK_{it}^{tot}\) is above the 25th percentile. The list of non-active countries is in the Online Appendix. “Active” countries are all the other countries.

For portfolio inflows we include: “collective investments, sale or issue locally by nonresidents”; “bonds, sale or issue locally by nonresidents”. For other inflows, among the three restrictions we exclude “Guarantees, sureties and financial backup facilities inflow restrictions”. For portfolio outflows we include: “bonds, purchase abroad by residents”; “money market instruments, purchase abroad by residents”. For other outflows, among the three restrictions we exclude “Commercial credits outflow restrictions”.

For portfolio inflows we include: “bonds, purchase locally by nonresidents”; “equity, purchase locally by nonresidents”. For other inflows and outflows we exclude commercial credits. For portfolio outflows we include: “bonds, purchase abroad by residents”; “equity, purchase abroad by residents”.

Notice that in the baseline regression for capital surges and flights, the estimated coefficient of capital controls is lower than the baseline estimates (obtained with a Logit estimation), but the marginal effect of capital controls is larger.

Alam et al. (2019) also provide an aggregate indicator of macroprudential policy, given by the sum of all the single indicators. The coefficient of capital controls barely change if we include the aggregate indicator in the regression. Results are available upon request.

See for example (OECD 2017), “Open and Orderly Capital Movements - Interventions from the 2016 OECD High-Level Seminar.”

See Nispi Landi (2018b) for an analysis of the international spillover effects arising from capital controls.

Intervention by Ignazio Visco, Governor of the Bank of Italy to the “OECD High-Level Seminar Open and Orderly Capital Movements”.

Pasricha et al. (2018) make some steps in this direction.

References

Alam Z, Alter MA, Eiseman J, Gelos MR, Kang MH, Narita MM, Nier E, Wang N (2019) Digging Deeper–Evidence on the Effects of Macroprudential Policies from a New Database. IMF Working Paper (19/66)

Arellano M, Bover O (1995) Another look at the Instrumental Variable Estimation of Error-Components Models. J Econ 68(1):29–51

Beirne J, Friedrich C (2017) Macroprudential policies, capital flows, and the structure of the banking sector. J Int Money Financ 75:47–68

Binici M, Hutchison M, Schindler M (2010) Controlling capital? legal restrictions and the asset composition of international financial flows. J Int Money Financ 29(4):666–684

Blanchard O (2017) Currency wars, coordination, and capital controls. Int J Central Banking 13(2):283–308

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Bruno V, Shim I, Shin HS (2017) Comparative assessment of macroprudential policies. J Financ Stab 28:183–202

Bush G (2019) Financial development and the effects of capital controls. Open Econ Rev 30(3):559–592

Chamon M, Garcia M (2016) Capita Controls in brazil: Effective. J Int Money Financ 61:163–187

Čihák M, Demirgüċ-Kunt A, Feyen E, Levine R (2013) Financial development in 205 economies, 1960 to 2010. Financial Perspectives 1(2):17

Costinot A, Lorenzoni G, Werning I (2014) A Theory of Capital Controls as Dynamic Terms-of-Trade Manipulation. J Polit Econ 122(1):77–128

Couharde C, Delatte AL, Grekou C, Mignon V, Morvillier F (2018) EQCHANGE : A world database on actual and equilibrium effective exchange rates. Int Econ 56:206–230

Crystallin M, Efremidze L, Kim S, Nugroho W, Sula O, Willett T (2015) How Common Are Capital Flows Surges? How They Are Measured Matters-a Lot. Open Econ Rev 26(4):663–682

Dell’Erba S, Reinhardt D (2015) FDI, Debt and Capital Controls. J Int Money Financ 58:29–50

Devereux MB, Young ER, Yu C (2018) A New Dilemma: Capital Controls and Monetary Policy in Sudden Stop Economies. Journal of Monetary Economics

Edwards S (2009) Capital Controls and Capital Flows in Emerging Economies: Policies, Practices, and Consequences. University of Chicago Press for the NBER

Eichengreen B, Rose A (2014) Capital Controls in the 21st Century. J Int Money Financ 48:1–16

Farhi E, Werning I (2014) Dilemma not trilemma? Capital controls and exchange rates with volatile capital flows. IMF Economic Review 62(4):569–605

Fernández A., Klein MW, Rebucci A, Schindler M, Uribe M (2016) Capital control measures: a new dataset. IMF Economic Review 64(3):548–574

Forbes K, Fratzscher M, Straub R (2015) Capital-flow Management measures: What Are They Good for?. J Int Econ 96:S76–S97

Forbes KJ, Warnock FE (2012) Capital flow waves: surges, stops, flight, and retrenchment. J Int Econ 88(2):235–251

Fratzscher M (2012) Capital controls and foreign exchange policy. J Econ Chilena (The Chilean Economy) 15(2):66–98

Heathcote J, Perri F (2016) On the desirability of capital controls. IMF Econ Rev 64(1):75–102

Ilzetzki E, Reinhart CM, Rogoff KS (2019) Exchange Arrangements Entering the 21st Century: Which Anchor Will Hold? Quarterly Journal of Economics, Forthcoming

IMF (2012) The Liberalization and Management of Capital Flows: An Institutional View

IMF-FSB-BIS (2016) Elements of Effective Macroprudential Policies: Lessons from International Experience

Kitano S, Takaku K (2017) Capital controls and financial frictions in a small open economy. Open Econ Rev 28(4):761–793

Klein MW (2012) Capital controls: gates versus walls. Brook Pap Econ Act 317–350

Korinek A (2011) The new economics of prudential capital controls: a research agenda. IMF Economic Review 59(3):523–561

Korinek A, Mendoza EG (2014) From Sudden Stops to Fisherian Deflation:, Quantitative Theory and Policy. 6:299–332

Kose MA, Prasad E, Rogoff K, Wei S-J (2009) Financial globalization: a reappraisal. IMF Staff papers 56(1):8–62

Krugman P (1999) Depression economics returns. Foreign Affairs 78(1):56–74

Magud NE, Reinhart CM, Rogoff KS (2018) Capital controls: myth and reality. Ann Econ Financ 19(1):1–47

Nispi Landi V (2018a) Capital controls, Macroprudential Measures and Monetary Policy Interactions in an Emerging Economy. Bank of Italy Working paper No.1154

Nispi Landi V (2018b) Capital controls spillovers. Bank of Italy Working paper No.1184

OECD (2017) Open and Orderly Capital Movements: Interventions from the 2016 OECD High-Level Seminar

Ostry JD, Ghosh AR, Chamon M, Qureshi MS (2012) Tools for managing Financial-Stability risks from capital inflows. J Int Econ 88(2):407–421

Pasricha G (2017) Policy rules for capital controls. BIS Working Paper No.670

Pasricha GK, Falagiarda M, Bijsterbosch M, Aizenman J (2018) Domestic and multilateral effects of capital controls in emerging markets. J Int Econ 115:48–58

Rey H (2013) Dilemma not trilemma: the Global Cycle and Monetary Policy Independence. Federal Reserve Bank of Kansas City, Economic Policy Symposium

Rodrik D (1998) Who needs capital-account convertibility. Essays in International Finance, 55–65

Schindler M (2009) Measuring financial integration: a new data set. IMF Staff Pap 56(1):222–238

Staiger D, Stock JH (1997) Instrumental variables regression with weak instruments. Econometrica 65(3):557–586

Svirydzenka K (2016) Introducing a New Broad-Based Index of Financial Development. IMF Working Paper (16/5)

Unsal DF (2013) Capital flows and financial stability: monetary policy and macroprudential responses. Int J Central Banking 9(1):233’–285

Visco I (2016) Open and orderly capital movements: interventions from the 2016 OECD High-Level seminar, Chapter 1.3

Vithessonthi C, Tongurai J (2013) Unremunerated reserve requirements, exchange rate volatility, and firm value. J Int Financ Markets Inst Money 23:358–378

Acknowledgments

We are especially grateful to the Editor and two anonymous referees. We also thank Pietro Catte, Riccardo Cristadoro, Francesco Paternò and seminar participants of REI internal workshop and Villa Mondragone International Economic Seminar. All remaining errors are ours.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The views expressed in this paper are our own and do not necessarily reflect those of the Bank of Italy.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Nispi Landi, V., Schiavone, A. The Effectiveness of Capital Controls. Open Econ Rev 32, 183–211 (2021). https://doi.org/10.1007/s11079-020-09591-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-020-09591-6