Abstract

In this paper, we consider nonlinear dynamics with continuously distributed lags. A generalization of the logistic equation, its solution and economic models of logistic growth are proposed by taking into account continuously distributed lags. The logistic integro-differential equations are considered for exponential and gamma distributions of delay time. The integro-differential equations of the proposed model of logistic growth with distributed lag are represented by differential equations with derivatives of integer orders. The solution of the logistic integro-differential equations with exponentially distributed lag is obtained. Characteristic properties of nonlinear dynamics with continuously distributed lags are described. The main difference between dynamics with lag from standard dynamics without delay lies in the existence of a cutoff threshold of growth. We propose the principle of growth clipping by distributed lag, which states that the distributed lag can lead to the emergence of the cutoff threshold, below which growth is replaced by decline. For economy, this means that for production growth, the starting production should exceed a certain minimum (critical) value of production.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The logistic differential equations with integer and noninteger derivatives are simple nonlinear equations that find their applications for describing processes in the natural sciences and economics [1,2,3,4,5,6,7,8] including the processes with memory [9,10,11]. The changes of the exogenous variable (input, impact, force) do not lead to instant changes of endogenous variable (output, response to an impact). Between exposure and response, there often exists a finite time interval due to the finite speed of the processes. In economic models with continuous time, the final speed of process is taken into account as a time delay (lag) [12,13,14]. In the simplest form, this lag is considered in the form of fixed time delay. For example, the economic multiplier with fixed time lag is described by the equation \(Y(t )={m X}({t-\tau }),\) where \(\tau >0\) is the time constant that is called delay time (see equation 6 in [12, p. 25]), \(m>0\) is the multiplier coefficient and X(t) and Y(t) are exogenous and endogenous variables, respectively. The economic accelerator with fixed time lag is described by the equation \({Y}({t} )={a X}^{(1)}({{t}-\tau } ),\) where \(\tau >0\) is the delay time, \({a}>0\) is the multiplier coefficient (see equation 2 in [12, p. 62]) and \({X}^{(1)}(t)=\mathrm{d}X(t)/\mathrm{d}t\) is first-order derivative of the exogenous variable.

In general, the delay time is not a constant value and is often regarded as a random variable whose distribution is determined by some probability density function \({M}(\tau )\) on the positive semiaxis. Averaging the multiplier and accelerator equations with respect to the delay time, we obtain the multiplier and accelerator equations with continuously distributed lag.

Continuously distributed delay times in economy can be described by exponential and gamma distributions. Exponential distribution is the continuous analog of the geometric distribution. This distribution describes the time of receipt of the order for the enterprise, the waiting time for an insurance event, time between visits by shop, the service life of parts of complex products. Note that the main characteristic property of the exponential distribution is memoryless. The gamma distribution is often used to take into account waiting times in econometrics. The gamma distributions are applied to describe economic processes, in which there is a sharp increase in the average duration of time delays, including delays orders in queues and delays in payments.

In macroeconomics, the first time the continuously distributed lag was considered by William Phillips in 1954. Macroeconomic growth models, where exponentially distributed lags are taken into account in the form of ordinary differential equations, have been proposed in the Phillips articles [15, 16]. In the Phillips models, economic multiplier and accelerator are considered with a continuous (exponential) lag. To obtain Phillips model, in which the continuous change of delay time is represented, an exponentially distributed time lag is introduced by the assumption that “whenever the production flow is different from the flow of demand, the production flow will be changing in a direction which tends to eliminate the difference and at a rate proportional to the difference” (see [15], and [16, p. 135]).

An application of exponentially distributed lag in economics has been described by Allen in 1956 [12,13,14]. The linear differential equations with operators that describe continuously distributed lag are used in various economic models. For example, macroeconomic models based on economic accelerators and multipliers with exponentially distributed lags are in Section 1.9 of [12, pp. 23–29], Section 5.8 of [12, pp. 166–170] and [14, pp. 88–94]. The operators with continuously distributed lag have wide applications in describing various economic processes with lag. Recently, these operators with exponentially distributed lag were defined in works of Caputo and Fabrizio [17, 18], where they have been misinterpreted as fractional derivatives and integrals of noninteger orders [19,20,21]. It is well known that the finite speed of the process does not mean that there is memory in the process [9,10,11]. In addition, the exponential distribution has the key property of being memoryless.

Note that the continuously distributed lag in economic models with continuous time is considered only for linear differential equations. Nonlinear differential equations with a continuously distributed lag have not yet been investigated. Therefore, it is important to investigate the effects of accounting for the distributed lag in nonlinear models and to describe the features of their behavior. The most well-known nonlinear economic models are the model of growth in competitive environment and the logistic growth model (for example, see [4] and references therein).

This paper actually consists of two parts.

The first part of the paper describes the generalizations of the logistic differential equation, in which we take into account the exponentially and gamma-distributed lags, its solutions and some characteristic properties that are important for application. We propose a generalization of the logistic differential equations, where the continuously distributed lags are taken into account in integer-order derivative. A solution of the logistic integro-differential equation with exponentially distributed lag is suggested. Using the computer simulations, we describe properties of the nonlinear dynamics with continuously distributed lag for gamma distribution.

The second part is devoted to applications of the results, which are derived in the first part, to describe economic growth with exponentially and gamma-distributed lag. Using the investment accelerator with exponential lag, we generalize the nonlinear economic model of growth in competitive environment and the logistic growth model. In this part, we describe the distinctive features of logistic growth with distributed lag from the standard economic dynamics that does not take into account the distribution of the delay time.

2 Differential operator with continuously distributed lag

The translation operator [1, pp. 95–96] is defined by the equation

where \(\tau \in {\mathbb {R}}_+ \). Operator (1) maps a function X(t) on \({\mathbb {R}}\) to its translation \({X}({{t}-\tau })\) on the fixed value \(\tau \in {\mathbb {R}}_+ \) that is positive constant that characterizes the fixed time delay. In the general case, the delay time \(\tau \) is not a constant value. This parameter can be considered as a random variable, whose distribution is determined by some probability density function \({M}(\tau )\) on the positive semiaxis. The density \({M}(\tau )\) satisfies the conditions of nonnegativity and the normalization

Averaging Eq. (1) with respect to the delay time, we obtain the translation operator with continuously distributed lag [12, pp. 25–26] that is defined by the equation

Note that the translation operator (1) with fixed time lag is a particular case of (3), when density is described by the Dirac delta function. Operator (3) can be also called as the operator of the continuously distributed lag. Note that operator is actively used in mathematical economics to describe macroeconomic growth models with continuously distributed lag [12,13,14]. Using operator (3), we can define the derivatives of integer order with continuously distributed lag as a composition of the translation operator (3) with continuously distributed lag and the derivative of integer order \({X}^{\left( {{n}}\right) }\left( {t} \right) =\mathrm{d}^{{n}}{X}\left( {t} \right) /{\mathrm{d}t}^{{n}}\) by the equation

where \({M}\left( \tau \right) \) satisfies the nonnegativity and the normalization conditions (2).

Let us consider a simple probability density function of the exponential distribution, the probability density function is

where \(\lambda >0\) is the rate parameter that is also called the speed of response [12, p. 27]. For function (5), the normalization condition (2) holds (see equation 8 of [12, p. 26]). As an alternative parameter to the speed of response for the exponential lag, we can consider the time constant \({T}=1/\lambda \). For exponentially distributed lag, the parameter T is the average delay time [12, p. 27].

Exponential distribution describes the time between events in a Poisson point process, i.e., a process in which events occur continuously and independently at a constant average rate. It is the continuous analog of the geometric distribution [12,13,14]. The exponential distribution has the main property of being memoryless. The memoryless means that the distribution of “waiting time” to a certain event does not depend on how much time has passed. If the probability of an event on a small time interval is very small and does not depend on the onset of other events, then the time intervals between the event sequences are distributed according to an exponential distribution.

Using operator (4) with density (5), we can define the integer-order differential operator with exponentially distributed lag

where \(\lambda >0\) is the rate parameter of exponential distribution and \({X}^{\left( {n} \right) }\left( {t} \right) \) is the derivative of the integer order \({n}\in \mathbb {N}\). Differential operators for other types of probability distributions of lag can be defined analogously.

The operators with exponentially distributed lag, which are integer-order derivatives with lag, have been described in [12,13,14] (for example, see Section 1.9 of [12, pp. 23–29], Section 5.8 of [12, pp. 166–170] and [14, pp. 88–94]). Recently, these operators with exponentially distributed lag were defined in works of Caputo and Fabrizio [17, 18], where it has been misinterpreted as a derivative of a fractional order [19,20,21]. We can state that the derivative of integer order with exponentially distributed lag coincides with the Caputo–Fabrizio operator of the order \(\alpha ={n}-1+\lambda /\left( {\lambda +1} \right) .\) Note that the memoryless property of the exponential distribution allows us to state that differential operator (6) cannot be used to describe processes with memory.

The logistic differential equation without lags has the form

where the constant \({r}>0\) defines the growth rate. Equation (7) is the logistics differential equation that is also called the Verhulst equation [1]. The solution of logistic Eq. (7) is described by so-called logistic function.

Using operator (6), we can generalize the logistic integro-differential equation by taking into account the exponentially distributed lag in the form

where \(\lambda \) is the speed of response. Note that Eq. (8) is naturally obtained in the economic model with continuous time by taking into account the standard investment accelerator with an exponentially distributed lag used in economics [12,13,14]. In this paper, we will also consider the logistic equation with the gamma-distributed lag. The following sections will discuss solutions and their properties of this equation, and then the application of this equation to the economy will be described.

3 Logistic equation with exponentially distributed lag

Let us formulate and prove theorem about equation of logistic growth with the exponentially distributed lag.

Theorem 1

The logistic equation with the exponentially distributed lag

can be represented as the differential equation

where r is the investment coefficient and \(\lambda \) is the speed of response, and it has the solution in the form

where C is a constant.

Proof

Let us define the auxiliary variable \(\xi \left( {t} \right) \) by the equation

that is \(\xi \left( {t} \right) =\left( {\mathbf{D}_{\mathbf{T}+}^{{\varvec{\lambda }},1} {X}} \right) \left( {t} \right) .\) The differentiation of Eq. (12) gives

Using Eq. (12), Eq. (13) can be represented in the form

Then, Eq. (9) can be represented as the system of differential equation

Substituting the variable \(\xi \left( {t} \right) \) from the first equation of system (14) into the second equation, we obtain the differential equation

Then, Eq. (16) takes the form

Let us obtain solution of Eq. (16) that is rewritten in the form

Using the variable

Eq. (18) takes the form

that can be rewritten in the form

Using the separation of variables and the table integral

we obtain the solution

Equation (23) can be written in the form

As a result, the solution of the logistic equation with exponentially distributed lags has form (11).

This is the end of the proof. \(\square \)

4 Features of logistic growth with distributed lag

Let us consider the logistic differential equation with exponentially distributed lags in the form

The stationary (equilibrium) states (\({X}^{\left( 1 \right) }\left( {t} \right) =0)\) are defined by the expression \({X}\left( {t} \right) =0\) and \({X}\left( {t} \right) =1\). The logistic equation demonstrates the evolution to these equilibrium (or steady) states.

If the process, which is described by Eq. (25), is initially at steady state \({X}\left( 0 \right) =0\), then it remains in this state for an infinitely long time and change of state cannot be realized. For this reason, there should be certain initial pushes, which will transfer the process to another steady state. This can be achieved by fluctuations and random external influence (random force).

For economic application, we will consider the initial conditions \({X}\left( 0 \right) \in \left[ {0,1} \right] \).

It should be emphasized that in contrast to processes without distributed lags, the process can return to the stationary state \({X}\left( {t} \right) =0\) if in the initial values \({X}\left( 0 \right) \in \left( {0,1} \right) \) satisfies the condition

and growth in the opposite sign of inequality. This means that there is a critical value \({X}_\mathrm{cr} \) of the initial value \({X}\left( 0 \right) \) of the variable \({X}\left( {t} \right) \) defined by the expression

where \({T}=1/\lambda \) is the average time of delay.

In the presence of the exponentially distributed lag, the behavior of \({X}\left( {t} \right) \) differs from the case of absence of a lag. In general case, there is no growth of the function \({X}\left( {t} \right) \) at the slightest and infinitely small deviation from the equilibrium value \({X}\left( {t} \right) =0\). For example, for some values of \({X}\left( 0 \right) \), the dynamics of further values \({X}\left( {t} \right) \) may show a decline instead of growth. As a result, the behavior of \({X}\left( {t} \right) \) demonstrates the decline if the inequality \(0<X\left( 0 \right) <{X}_\mathrm{cr} \) is satisfied. We have the growth of \({X}\left( {t} \right) \) if the condition \({X}_\mathrm{cr}<X\left( 0 \right) <1\) is satisfied.

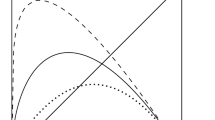

To illustrate this behavior of \({X}\left( {t} \right) \), we give Figs. 1, 2 and 3.

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (25) with \({r}=0.5\), \(\lambda =0.2\) and \({X}\left( 0 \right) =0.29\)

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (25) with \({r}=0.5\), \(\lambda =0.2\) and \({X}\left( 0 \right) =0.31\)

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (25) with \({r}=1\), \(\lambda =2\) and \({X}\left( 0 \right) =0.0001\)

For Figs. 1 and 2, we consider parameters \({r}=0.5\), \(\lambda =0.2\) that lead to the critical value \({X}_\mathrm{cr} =0.3\). Figure 1 illustrates the decline since \({X}\left( 0 \right) =0.29<{X}_\mathrm{cr} \). Figure 2 illustrates the growth since \({X}\left( 0 \right) =0.31>{X}_\mathrm{cr} \). For Fig. 3, we consider parameters \({r}=1\), \(\lambda =2\) that lead to the critical value \({X}_\mathrm{cr} <0\) and we have the growth for small initial values of the output \({Y}\left( 0 \right) =0.0001\).

Figures 2 and 3 demonstrate the shape similar to the classical logistic curve, with ’turning point’ (i.e., the growth in the first phase of development and slowing growth while approaching the upper equilibrium).

5 Logistic equation with exponentially distributed lag and second-order derivative

The logistic equation with the exponentially distributed lag, where the derivative has the second order (\({n}=2)\), has the form

Equation (28) can be represented as the differential equation of second order

This statement is proved similarly to the proof of Theorem 1. For \({n}=2\), Eq. (29) has the form of the Lienard equation often used in the theory of oscillations and dynamical systems.

The computer simulation of the behavior of X(t) is given in Figs. 4, 5 and 6, where we can see the damping oscillations.

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (29) with \({r}=1\), \(\lambda =10\) and \({X}\left( 0 \right) =0.1, \quad { X}^{\left( 1 \right) }\left( {t} \right) =0.1\)

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (29) with \({r}=1\), \(\lambda =2\) and \({X}\left( 0 \right) =0.1, \, { X}^{\left( 1 \right) }\left( {t} \right) =0.1\)

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (29) with \({r}=0.2\), \(\lambda =10\) and \({X}\left( 0 \right) =0.1, \,{ X}^{\left( 1 \right) }\left( {t} \right) =0.1\)

In Figs. 4, 5 and 6, we use the initial conditions \({X}\left( 0 \right) =0.1, \, { X}^{\left( 1 \right) }\left( 0 \right) =0.1\). We use the following parameters in Fig. 4 with \({r}=1\), \(\lambda =10\); in Fig. 5 with \({r}=1\), \(\lambda =2\); and in Fig. 6 with \({r}=0.2\), \(\lambda =10\). Comparison of Figs. 4 and 5 shows that if the average time of delay \({T}=1/\lambda \) increases (from 0.1 to 0.5), then oscillations near the upper equilibrium position decrease. Comparison of Figs. 4 and 6 shows that if the growth rate decreases (from 1 to 0.2), then damping of the oscillation amplitude decreases.

We see that in this case, which is described by Eq. (29), we have the damping oscillation that tends to the upper steady state \({X}\left( {t} \right) =1\). Note that the clipping of growth by distributed lag and the effect of the return to the lower equilibrium value by continuously distributed lag are absent.

6 Logistic equation with gamma-distributed lag

For the gamma distribution, the probability density function is

where \({a}>0\) is the coefficient of shape and \(\lambda >0\) is the rate, where \(\theta =1/\lambda \) is scale coefficient. The gamma distributions are used to describe complex economic processes, where appears a sharp increase in the average duration of various delays (delay orders in queues, delays in payments, etc.), as well as an increase in the likelihood of risk events or insurance events. These interpretations are very close to the continuously distributed time lag. The special case of the gamma distribution when the shape parameter is integer number (\({a}={m}\in \mathbb {N})\) is also called the Erlang distribution. If \({a}=1\), the gamma density function takes the form of the exponential density function.

Using the gamma distribution, we can define the integer-order differential operator with gamma-distributed lags

Since the exponential distribution is a special case of gamma distribution for \(a=1\), we have \(\left( {\mathbf{D}_{\mathbf{T}+}^{{\varvec{\lambda }},\mathbf{n}} {X}} \right) \left( {t} \right) =\left( {\mathbf{D}_{\mathbf{T}+}^{{\varvec{\lambda }},1,\mathbf{n}} {X}} \right) \left( {t} \right) .\)

Let us give and prove a statement that allows us to represent nonlinear integro-differential equations with the Erlang distribution of lag by a system of differential equations.

Theorem 2

The nonlinear integro-differential equation

with the Erlang distribution of lag can be represented as the system of the differential equation

where \({k}=0,1,\ldots ,\left( {{m}-1} \right) ,\) where \({m}\in \mathbb {N}\) is the shape parameter of the gamma distribution.

Proof

Using the binomial expansion, the weighting function (30) can be written in the form

This allows us to represent the density function of the Erlang distribution as the sum

where

for \({k}=0,1,\ldots ,\left( {{n}-1} \right) \). Then we get

Let us define the auxiliary variables

The differentiation of the variable \({Y}_{{k}} \left( {t} \right) \) gives

Equality (39) can be written in the form

where \({k}=0,1,\ldots ,\left( {{m}-1} \right) \), and

Substituting (42) and (43) into (41), we obtain the second equation of system (33).

This is the end of the proof. \(\square \)

Let us consider the case, when the shape parameter is equal to two, i.e., \({m}=2\). Then, the density of the gamma-distributed lag has the form

and

Then, using Theorem 2, the nonlinear integro-differential equation

can be represented as the system of the differential equation

For \({t}>0\), the elimination of the auxiliary variables \({Y}_0 \left( {t} \right) \) and \({Y}_1 \left( {t} \right) \) from system (47) gives

The logistic equation is defined by the function

As a result, we prove the following statement.

Theorem 3

The logistic equation with lag, which is distributed by gamma distribution with shape parameter \({a}=2\), has the form

and it can be represented as the differential equation

Let us consider the special cases of the first-order and second-order derivatives in Eqs. (50) and (51).

For \({n}=1\), Eq. (76) takes the form

We have the growth if \(1-2{ X}\left( 0 \right) <0\) and decline if \(1-2{ X}\left( 0 \right) >0\). For n=1, the critical value \({X}_\mathrm{cr} \) of the initial value \({X}\left( 0 \right) \) of the variable \({X}\left( {t} \right) \) is defined by the expression \({X}_\mathrm{cr} =0.5\). Note that the critical value does not depend on the parameters of r and \(\lambda \).

To illustrate the behavior of \({X}\left( {t} \right) \), we give the computer simulation of the dynamics of \({X}\left( {t} \right) \) in Figs. 7 and 8. For Figs. 7 and 8, we consider parameters \({r}=1\) and \(\lambda =5\). Figure 7 illustrates the decline since \({X}\left( 0 \right) =0.45<{X}_\mathrm{cr} \). Figure 8 illustrates the growth since \({X}\left( 0 \right) =0.55>{X}_\mathrm{cr} \).

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (53) with \({r}=1\), \(\lambda =5\) and \({X}\left( 0 \right) =0.45,{ X}^{\left( 1 \right) }\left( {t} \right) =0.1\)

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (53) with \({r}=1\), \(\lambda =5\) and \({X}\left( 0 \right) =0.55,{ X}^{\left( 1 \right) }\left( {t} \right) =0.1\)

For \({n}=2\), Eq. (52) takes the form

For the region \({X}\left( 0 \right) \in \left[ {0,1} \right] \), we have the decline in the case

and we get the growth if

As a result, we have the critical value \({X}_\mathrm{cr} \) of the variable \({X}\left( {t} \right) \) is defined by the expression

In addition, in this case, the growth of \({X}\left( {t} \right) \) can be accompanied by damped oscillations near the upper equilibrium state \({X}\left( {t} \right) =1\).

The computer simulation of the behavior of \({X}\left( {t} \right) \) is given in Figs. 9, 10, 11 and 12.

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (54) with \({r}=0.6\), \(\lambda =0.6\) and \({X}\left( 0 \right) =0.19,{ X}^{\left( 1 \right) }\left( {t} \right) =0.1\)

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (54) with \({r}=0.6\), \(\lambda =0.6\) and \({X}\left( 0 \right) =0.21{ X}^{\left( 1 \right) }\left( {t} \right) =0.1\)

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (54) with \({r}=0.6\), \(\lambda =1\) and \({X}\left( 0 \right) =0.2\) and \({ X}^{\left( 1 \right) }\left( {t} \right) =0.1\)

Plot of the function \({X}\left( {t} \right) \) that is described by Eq. (54) with \({r}=0.6\), \(\lambda =3\) and\({ X}\left( 0 \right) =0.2\) and \({ X}^{\left( 1 \right) }\left( {t} \right) =0.1\)

For Figs. 9 and 10, we consider parameters \({r}=0.6\), \(\lambda =0.6\) and \({ X}^{\left( 1 \right) }\left( {t} \right) =0.1\). In this case, the critical value is equal to \({X}_\mathrm{cr} =0.2\). Figure 9 illustrates the decline since \({X}\left( 0 \right) =0.19<{X}_\mathrm{cr} \). Figure 10 illustrates the growth since \({X}\left( 0 \right) =0.21>{X}_\mathrm{cr} \). For Figs. 9 and 10, we use the initial conditions \({X}\left( 0 \right) =0.2\) and \({ X}^{\left( 1 \right) }\left( {t} \right) =0.1\). For Figs. 11 and 12, we use the initial conditions \({X}\left( 0 \right) =0.2\) and \({X}^{\left( 1 \right) }\left( {t} \right) =0.1\). Figure 11 illustrates the growth with damped oscillations for \({r}=0.6\), \(\lambda =1\). Figure 12 illustrates the growth with damped oscillations for \({r}=0.6\), \(\lambda =3\). From Figs. 11 and 12, we see as the rate parameter of the gamma-distributed lag increases, then the oscillations increase.

Note that Fig. 10 demonstrates the shape similar to the classical logistic curve, with ’turning point’ (i.e., growth in the first phase of development and slowing growth while approaching the upper equilibrium state). The shape of Fig. 10 has some differences. These differences lie in a faster initial growth, which are hard to see in Fig. 10. In order to show this, we give the initial stage of growth in Fig. 13. The slowing growth while approaching the upper equilibrium state can be seen in Fig. 10.

Plot of initial growth of \({X}\left( {t} \right) \) for the parameters of Fig. 10, i.e., with \({r}=0.6\), \(\lambda =0.6\) and \({X}\left( 0 \right) =0.21{ X}^{\left( 1 \right) }\left( {t} \right) =~0.1\)

Moreover, the similar shapes (with ’turning point’) have all figures with growth (nonstandard logistic curves). The main differences between nonstandard logistic curves and the standard curve are the following three features: (1) a possibility of a decline instead of growth for small initial values; (2) a possibility of faster initial growth; and (3) a possibility of oscillations around the upper equilibrium state. The ’turning point’ is defined by the existence of a moment in time \(t_{\mathrm{turning}} >0\), in which the function \({ X}^{\left( 2 \right) }\left( t \right) \) changes the sign, i.e., \({ X}^{\left( 2 \right) }\left( {t_{\mathrm{turning}} } \right) =0\), \({ X}^{\left( 2 \right) }\left( {t_{\mathrm{turning}} } \right) >0\) for \(t<t_{\mathrm{turning}} \), \({ X}^{\left( 2 \right) }\left( {t_{\mathrm{turning}} } \right) <0\) for \(t>t_{\mathrm{turning}} \). The ’turning points’ exist for all figures for which \(X\left( 0 \right) >{X}_\mathrm{cr} \).

7 Application in economics: logistic growth with distributed lag

First, let us consider the economic model of growth in a competitive environment and the logistic growth model without lag in order to fix the designation and have references. Then, we will describe logistic growth models with exponentially and gamma-distributed lags. For the analysis of these models, we will use the results obtained for the logistic integro-differential equation with distributed lag.

7.1 Logistic growth model without lag

The standard economic model of growth in a competitive environment and the logistic growth models use the concepts of economic accelerator and multiplier.

The accelerator equation without lag has the form

where \({Y}\left( {t} \right) \) is the output, i.e., the volume of production that was produced and sold at the time t, and the function \({I}\left( {t} \right) \) is net investments, i.e. the investments to expand production (the difference between the total investment and amortization costs), where \({v}>0\) is the accelerator coefficient (the investment coefficient).

The accelerator equation without lag has the form

where \({Z}\left( {t} \right) \) is the income and m is the net investment rate (\(0<m<1)\) that describes the share of income that goes to the net investment. In the model of growth in a competitive environment, the income is described by equation

where \({P}\left( {t} \right) ={P}\left( {{Y}\left( {t} \right) } \right) \) is the price of the released product \({Y}\left( {t} \right) \). Substitution of expression (60) in (59) and then the result in Eq. (58) gives the model equation

which describes the growth in a competitive environment without lag and memory. In the logistic model, the price is a linear function of the output

where \({p}_0 \) is a price that does not depend on the volume of production and \({p}_1 \) is the margin price. Substitution of (62) in (61) gives the equation

that is equation of the logistic growth model without lag and memory. If \({p}_0 \ne 0\) and \({p}_1 \ne 0\), we can use the variable \({X}\left( {t} \right) \), which is defined by the equation

The equation of logistic growth (63) is the logistic differential equation (7), where the constant \({r}={p}_0 {m}/{v}\) defines the growth rate. The solution of Eq. (63) has the form

Note that the characteristic feature of logistic growth without delays is the increase of the output \({Y}\left( {t} \right) \) even at the slightest and infinitely small deviation from the zero value of the output \({Y}\left( 0 \right) =0\). Equation (9) means that volume of production (output) \({Y}\left( {t} \right) \), which was produced and sold at the time t, will grow at any start of production (\({Y}\left( 0 \right) >0)\).

7.2 Logistic growth model with distributed lag

The standard economic models that are described by Eqs. (61) and (63) assume an instantaneous change in some variables when other variables change. This means these models do not take into account the memory effect and the time delay (lag) effect. The economic models of logistic growth with memory have been proposed in [4]. In general, economic processes have a finite speed, and the change of the economic variable does not lead to instant changes of other variables that depend on it. Therefore, it is important to describe logistic growth with lag.

In the simplest case of lagging with fixed durations, the linear accelerator equation has the form

where \(\tau >0\) is delay time that characterizes the fixed time lag.

In general, the delay time is not a constant value and it is often regarded as a random variable, distribution of which can be described by a probability density function \({M}\left( \tau \right) \) on the positive semiaxis that satisfies the normalization condition

In economics, \({M}\left( \tau \right) \) is usually called the weighting function (see [3, pp. 25–26]).

Let us consider averaging the accelerator equation (65) over random variable \(\tau >0\) that is continuously distributed with the density \({M}\left( \tau \right) \) in the form

Using the normalization condition (66), we get

which is described in [12, pp. 25–27] (see also [12, p. 72]) as a continuous analog of the discretely distributed lag. As we obtain the equation of investment accelerator with continuously distributed lag. In economic models with continuous time, the exponential distribution of the lag is usually considered [12,13,14]. The continuously distributed lags are described in Section 1.9 of [12, pp. 23–29] and Section 5.8 of [12, pp. 166–170] for exponential weighting function. The existence of the time delay (lag) is connected with the fact that the economic processes take place with a finite speed, and the change of the economic factor (input) does not lead to instant changes of indicator (output) that depends on it. Equation (69) means that \({I}\left( {t} \right) \) depends on the rate of output \({Y}^{\left( 1 \right) }\left( \tau \right) \) for all past time (\(\tau \le {t})\). The normalization condition (67) means that the economic process, which is described by accelerator equation (68), passes through all states without any losses.

The fixed time delay (66) is a particular case of (68), in which we can use \({M}\left( t \right) =\delta \left( {{t}-{T }} \right) \) with delay time \({T}>0\). The discretely distributed lag [12, pp. 25–27] is a special case of the (68), when \({M}\left( \tau \right) =\mathop \sum _{{n}=0}^\infty {M}_{{n}} \left( {T} \right) \,\delta \left( {\tau -{n T}} \right) \), where \(\delta \left( {t} \right) \) is the Dirac delta function and \({T}>0\) is the constant parameter of the fixed time delay (the length of delay).

Using the change of variable (\({t}-\tau \rightarrow \tau )\), Eq. (68) can be rewritten in the form

Integral equation (70) describes economic (investment) accelerator with the continuously distributed lag [12,13,14], which distribution is described by the weighting function \({M}\left( \tau \right) \) that satisfies the normalization condition (67).

7.3 Logistic growth model with exponentially and gamma-distributed lags

An important case of continuous lag is the exponentially distributed lag, which is described by the density function (5). In economics, the exponentially distributed lag is considered as continuous version of the geometric lag that is based on geometric sequence (progression) in models with discrete time [12,13,14]. The exponential distribution has the following economic interpretation. Let us consider a market for goods on which the purchase is made from time to time. Under certain assumptions, the time between two consecutive purchases of the same goods will be a random variable with an exponential distribution. The average waiting time for a new purchase is \(1/\lambda \). The parameter \(\lambda \) can then be interpreted as the average number of new purchases per unit of time.

Using differential operator (6) with the exponential distribution of lag (5), the equation of accelerator with the exponential lag has the form

If we explicitly write out the operator (6), then accelerator equation (72) will have the form

Integral equations (71), (72) describe investment accelerator with the exponentially distributed lag [12,13,14] with the speed response \(\lambda =1/{T}\). Note that the memoryless property of the exponential distribution leads to the fact that accelerator (71), (72) cannot be used to describe logistic growth with memory. To take into account the memory [9,10,11] in logistic growth model, we can use fractional derivatives of noninteger orders [4].

Using the accelerator with the exponentially distributed lag (71) in the model of growth in a competitive environment instead of the accelerator without lag (58), we obtain the new growth model.

Substitution of expression (60) in (59) and then the result in Eq. (71) gives the equation of the growth model in the form

Let us consider the case, when the price is a linear function of output \({Y}\left( {t} \right) \) that is described by Eq. (62) with \({p}_0 \ne 0\) and \({p}_1 \ne 0\). In this case, Eq. (72) has the form

Equation (74) describes the economic models of logistic growth with the exponentially distributed lag. Changing the variable \({Y}\left( {t} \right) =\left( {{p}_0 /{p}_1 } \right) { X}\left( {t} \right) ,\) we get the logistic equation (9) with the exponentially distributed lag where \({r}\,{=}\,{m p}_0 /{v}\), and \({X}\left( {t} \right) {=}\left( {{p}_1 /{p}_0 } \right) { Y}\left( {t} \right) .\)

The exponentially distributed lag is actively used in macroeconomic models with distributed lag in the framework of the continuous-time approaches [12, p. 26]. In standard macroeconomic models, the differential equations of exponentially distributed lag are used instead of equations with integro-differential operators. For example, the economic accelerator with the exponential lag (72) is usually considered [12, p. 63] in the form

Equation (75) is called the differential equations of the exponential lag [12, p. 27]. This equation is actively used in various macroeconomic models. For example, differential equation (75) is used in the Phillips model of multiplier–accelerator that takes into account the exponentially distributed lag (for details, see [12, pp. 72–74]).

The use of the representation by differential equations of integer order (75) instead of the integro-differential operator (72) is caused by the fact that there are considerable difficulties in handling the integrals in (72). The differential equations of economic models, as a rule, are easier to handle in comparison with the integro-differential equations.

Using representation (75) of Eq. (71), the nonlinear integro-differential equation (73) can be represented as the system of the differential equation

Substituting the variable \({I}\left( {t} \right) \) from the first equation of system (76) into the second equation, we obtain the differential equation

where \({P}_{{Y}}^{\left( 1 \right) } \left( {{Y}\left( {t} \right) } \right) \) is the partial derivative of the function \({P}\left( {Y} \right) \) with respect to the variable Y and \(\lambda \) is the speed of response. As a result, Eq. (77) takes the form

If we assume that the price is a linear function of output \({Y}\left( {t} \right) \) that is described by Eq. (62), then

where \({p}_0 \) is the price, which is independent of the output, and \({p}_1 \) is the margin price.

As a result, we obtain the equation

Using \({Y}\left( {t} \right) {=}\left( {{p}_0 /{p}_1 } \right) { X}\left( {t} \right) \) and \({r}\,{=}\,{mp}_0 /{v}\), we get Eq. (10). The stationary (equilibrium) states (\({X}^{\left( 1 \right) }\left( {t} \right) =0)\) are defined by the expression \({X}\left( {t} \right) =0\) and \({X}\left( {t} \right) =1,\) which corresponds to the values of the output \({Y}\left( {t} \right) =0\) and \({Y}\left( 0 \right) ={p}_0 /{p}_1 \). The economic processes demonstrate the evolution to these equilibrium (or steady) states.

If we will use the n-order derivative in the logistic equation with exponentially distributed lag instead of the first-order derivative, then we have the equation

For \({n}=2\) Eq. (82) can be represented by Eq. (25), where \({Y}\left( {t} \right) =\left( {{p}_0 /{p}_1 } \right) { X}\left( {t} \right) \) and \({r}={mp}_0 /{v}\).

If we will consider the gamma distribution of lag with shape parameter \({a}=2\), then equation of the economic model of logistic growth with lag has the form

For \({a}=2\) and \({n}=2\), Eq. (82) can be represented by Eq. (52), where \({Y}\left( {t} \right) =\left( {{p}_0 /{p}_1 } \right) { X}\left( {t} \right) \) and \({r}={mp}_0 /{v}\).

Using the results, which are obtained for logistic integro-differential equation with exponentially distributed lag, we can consider properties of the economic model of logistic growth with exponentially distributed lag, which is described by Eq. (80), where \({Y}\left( {t} \right) \) describes the volume of production (output), which was produced and sold at the time t. The logistic growth of output \({Y}\left( {t} \right) \) with the exponentially distributed lag differs from the case of the absence of lag. For some values of the initial output \({Y}\left( 0 \right) \), the dynamics of further output may show a decline instead of growth in the presence of the distributed lag. The economic behavior of the output \({Y}\left( {t} \right) \) demonstrates the decline if the following inequality is satisfied

and we have the growth of the output \({Y}\left( {t} \right) \) if the condition is satisfied

where we consider \({Y}\left( 0 \right) \in \left[ {0,{p}_0 /{p}_1 } \right] ,\) and \({r = m p}_0 /{v}\).

It should be emphasized that in contrast to processes without distributed lags, the economic process can return to the lower stationary state \({Y}\left( {t} \right) =0\) if the initial value \({Y}\left( 0 \right) \) is less than a certain critical value \({Y}_\mathrm{cr} \), which is determined by the expression

where \({T}=1/\lambda \) is the average time of delay. Parameter (83) defines the critical value of the initial output for the economic model of logistic growth with exponentially distributed lag.

For exponentially distributed lag with the integer-order derivatives of the orders \({n}\ge 2\), the critical values \({Y}_{\mathrm{cr},n} \) with \({n}\ge 2\) are absent. In this case \({n}=2\), we have the damping oscillation that tends to the upper steady state \({Y}\left( {t} \right) ={p}_0 /{p}_1 \).

For gamma-distributed lag shape parameter \({a}=2\) and the order of derivative \({n}=2\), the critical value \({Y}_{\mathrm{cr},a,n} \) with \({a},{n}\in \mathbb {N}\) of the initial \({Y}\left( {t} \right) \) is defined by the expression

For \(n=1\), the critical value of gamma distribution with \(a=2\) is defined by the expression \({Y}_{\mathrm{cr},1,2} ={p}_0 /\left( {2{p}_1 } \right) \). Note that the critical value does not depend on the model parameters of m, v and the rate parameter \(\lambda \) (or the scale coefficient \(\theta =1/\lambda )\) of the gamma distribution (30). For \(a=1\), the gamma distribution takes the form of the exponential distribution. Therefore, the critical values of gamma distribution coincide with the values of exponential distribution, i.e., \({Y}_{\mathrm{cr},1,n} ={Y}_{\mathrm{cr},n}\). The existence of the critical values \({Y}_{\mathrm{cr},a,n} \) for noninteger shape parameter \({a}>0\) is an open question.

Using the economic interpretation of \({Y}\left( {t} \right) \) as the output, we will consider \({Y}\left( {t} \right) >0\) and the initial condition \({Y}\left( 0 \right) \in \left[ {0,{p}_0 /{p}_1 } \right] \). The dynamics of output demonstrates a growth if the condition \({Y}\left( 0 \right) >{Y}_{\mathrm{cr},a,n} \) holds. If this inequality holds, then the economic processes demonstrate the evolution to the upper equilibrium (or steady) state \({Y}\left( {t} \right) ={p}_0 /{p}_1 \). If the inequality \({Y}\left( 0 \right) <{Y}_{\mathrm{cr},a,n} \) holds, then the economic processes demonstrate the decline in the form of the evolution to the lower equilibrium state \({Y}\left( {t} \right) =0\).

Note that the characteristic feature of standard logistic growth model without delays is violated. Distributed lag leads to the fact that volume of the production (output) \({Y}\left( {t}\right) \), which was produced and sold at the time \({t}>0\), can grow or fall, depending on the size of the initial production (\({Y}\left( 0 \right) >{Y}_{\mathrm{cr},a,n}\) or \({Y}\left( 0 \right) <{Y}_{\mathrm{cr},a,n}\)).

As a result, we can formulate the principle, which states that the distributed lag leads to the emergence of the cutoff threshold, below which growth is followed by decline.

Principle of growth clipping by distributed lag. In the logistic growth model, the effect of exponentially and gamma-distributed lags can lead to the appearance of a cutoff threshold, below which growth is replaced by a decline. If the condition \(Y\left( 0 \right) >Y_{\mathrm{cr},a,n}\) with \(a,n\in \mathbb {N}\) holds, then we have the growth to the upper equilibrium state \(Y\left( t \right) =p_0 /p_1 \). If the inequality \(0<Y\left( 0 \right) <Y_{\mathrm{cr},a,n}\) holds, then we have the decline to the lower equilibrium state \(Y\left( t \right) =0\).

This principle states that for production growth, the starting production should exceed a certain minimum (critical) value of production. An initial value of the output \({Y}\left( 0 \right) >0\) can transfer the economic process to upper steady state \({Y}\left( {t} \right) ={p}_0 /{p}_1 \) only if the initial values \({Y}\left( 0 \right) \) are greater than the critical value \({Y}_\mathrm{cr} \), i.e., \({Y}\left( 0 \right) >{Y}_{\mathrm{cr},a,n} \) . Note that the growth clipping by exponentially distributed lag is absent for \(\lambda \ge {r}\) since \({Y}_{{c},1,1} \le 0\) for this relationship of parameters. The clipping of growth by gamma-distributed lag with shape \(a=2\) is also absent for \(\lambda ^{2}\ge {r}\) since \({Y}_{{c},2,2} \le 0\) for this relationship of parameters. For economic processes without delay, described by the standard logistic equations (7), such effect of the return to the lower equilibrium value by continuously distributed lag is absent.

8 Conclusion

In this paper, we consider a generalization of the logistic differential equation by taking into account continuously distributed lag. We describe dynamics of processes, in which the distribution of lag is described by the gamma and exponential distributions.

The macroeconomic models with continuously distributed lag, which is described by linear differential equations, are actively considered in mathematical economy [12,13,14]. In this paper, we describe nonlinear differential equations with continuously distributed lag. We demonstrate that the logistic growth of output with the distributed lag differs from the case of the absence of lag. One of the most important differences is the fact that for some values of the initial output, the dynamics of further values of the output may show a decline instead of growth. We formulate the principle of growth clipping by distributed lag, which states that the lag can lead to the emergence of the cutoff threshold, below which growth is replaced by decline. In economy, this means that for production growth, the starting production should exceed a certain minimum (critical) value of production.

Let us note possible generalizations of the proposed description. In economic growth model, it is important to take into account distributed lag in the processes with power-law fading memory. To describe the power-law memory, we can use the fractional derivatives and integral [10, 11, 22]. The continuously distributed lag can be taken into different economic models with power-law memory including the Harrod–Domar model [10, 23], the intersectoral macroeconomic models [24], the natural growth model [25], the growth model with constant pace [26] and the economic models with time-dependent parameters [27].

For economic models, it is interesting to understand whether the growth clipping disappears, when we take into account the effects of fading memory. To take into account the memory in the logistic growth model, we can consider a generalization of the logistic equations with distributed lag by the replacement of the integer-order nth derivative in Theorem 2 to fractional derivative [28,29,30,31,32,33,34]. Since exact solutions to the fractional logistic equation have not yet been found [7, 8], the study of the problem is possible only by computer simulation of fractional logistic equations with continuously distributed lag.

We assume that the proposed models with power-law memory and continuously distributed lag can be used for economic growth modeling of some real economic processes. Economic processes with memory in European countries were modeled in [35,36,37,38,39,40,41]. We assume that analogous modeling can be realized for these processes by taking into account the continuously distributed lag. The simulation of these processes can be constructed by a generalization of the methods described in the works written by the groups of scientists Tejado et al. [35,36,37,38,39,40] and the group of Luo et al. [41]. To take into account the distributed lag for described processes, it is possible to replace the kernel of fractional derivatives by the (exponential or gamma) weighting functions. The models with power-law memory and continuously distributed lag, which have been suggested in this paper, can give more correct economic growth modeling by taking into account nonlinearity and time delay in a generalization of methods applied in the works [35,36,37,38,39,40,41].

References

Verhulst, P.F.: Mathematical researches into the law of population growth increase. Nouveaux Mémoires de l’Académie Royale des Sciences et Belles-Lettres de Bruxelles. 18, 1–42 (1845). (in French)

Kwasnicki, W.: Logistic growth of the global economy and competitiveness of nations. Technol. Forecast. Soc. Change 80(1), 50–76 (2013)

Girdzijauskas, S., Streimikiene, D., Mialik, A.: Economic growth, capitalism and unknown economic paradoxes. Sustainability 4, 2818–2837 (2012)

Tarasova, V.V., Tarasov, V.E.: Logistic map with memory from economic model. Chaos Solitons Fractals 95, 84–91 (2017). https://doi.org/10.1016/j.chaos.2016.12.012. (arXiv:1712.09092)

Fick, E., Fick, M., Hausmann, G.: Logistic equation with memory. Phys. Rev. A 44(4), 2469–2473 (1991)

El-Sayed, A.M.A., El-Mesiry, A.E.M., El-Saka, H.A.A.: On the fractional-order logistic equation. Appl. Math. Lett. 20(7), 817–823 (2007)

West, B.J.: Exact solution to fractional logistic equation. Phys. A Stat. Mech. Appl. 429, 103–108 (2015)

Area, I., Losada, J., Nieto, J.J.: A note on the fractional logistic equation. Phys. A Stat. Mech. Appl. 444(C), 182–187 (2016)

Tarasov, V.E., Tarasova, V.V.: Accelerator and multiplier for macroeconomic processes with memory. IRA Int. J. Manag. Soc. Sci. 9(3), 86–125 (2017). https://doi.org/10.21013/jmss.v9.v3.p1

Tarasova, V.V., Tarasov, V.E.: Concept of dynamic memory in economics. Commun. Nonlinear Sci. Numer. Simul. 55, 127–145 (2018). https://doi.org/10.1016/j.cnsns.2017.06.032. (arXiv:1712.09088)

Tarasov, V.E., Tarasova, V.V.: Criterion of existence of power-law memory for economic processes. Entropy 20(6), (2018) Article ID 414. 24 p. https://doi.org/10.3390/e20060414

Allen, R.G.D.: Mathematical Economics, 2nd edn. Macmillan, London (1960). (First Edition 1956) 812 p. ISBN: 978-1-349-81547-0. https://doi.org/10.1007/978-1-349-81547-0

Allen, R.G.D.: Mathematical Economics. Andesite Press, p. 568 (2015). ISBN: 978-1297569906

Allen, R.G.D.: Macro-economic Theory, A Mathematical Treatment, p. 420. Macmillan, London (1968)

Phillips, A.W.: Stabilisation policy in a closed economy. Econ. J. 64(254), 290–323 (1954). https://doi.org/10.2307/2226835

Phillips, A.W.H.: Collected Works in Contemporary Perspective. In: Leeson, R. (ed.). Cambridge University Press, Cambridge, p. 515 (2000). ISBN: 9780521571357

Caputo, M., Fabrizio, M.: A new definition of fractional derivative without singular kernel. Prog. Fract. Differ. Appl. 1(2), 73–85 (2015). https://doi.org/10.12785/pfda/010201

Caputo, M., Fabrizio, M.: Applications of new time and spatial fractional derivatives with exponential kernels. Prog. Fract. Differ. Appl. 2(1), 1–11 (2016). https://doi.org/10.18576/pfda/020101

Ortigueira, M.D., Tenreiro, Machado J.: A critical analysis of the Caputo–Fabrizio operator. Commun. Nonlinear Sci. Numer. Simul. 59, 608–611 (2018). https://doi.org/10.1016/j.cnsns.2017.12.001

Tarasov, V.E.: No nonlocality. No fractional derivative. Commun. Nonlinear Sci. Numer. Simul. 62, 157–163 (2018). https://doi.org/10.1016/j.cnsns.2018.02.019. (arXiv:1803.00750)

Tarasov, V.E.: Caputo-Fabrizio operator in terms of integer derivatives: memory or distributed lag? Comput. Appl. Math. 38, 113 (2019). https://doi.org/10.1007/s40314-019-0883-8

Tarasova, V.V., Tarasov, V.E.: Economic interpretation of fractional derivatives. Prog. Fract. Differ. Appl. 3(1), 1–7 (2017). https://doi.org/10.18576/pfda/030101

Tarasov, V.E., Tarasova, V.V.: Macroeconomic models with long dynamic memory: fractional calculus approach. Appl. Math. Comput. 338, 466–486 (2018). https://doi.org/10.1016/j.amc.2018.06.018

Tarasova, V.V., Tarasov, V.E.: Dynamic intersectoral models with power-law memory. Commun. Nonlinear Sci. Numer. Simul. 54, 100–117 (2018). https://doi.org/10.1016/j.cnsns.2017.05.015

Tarasova, V.V., Tarasov, V.E.: Fractional dynamics of natural growth and memory effect in economics. Eur. Res. 12(23), 30–37 (2016). https://doi.org/10.20861/2410-2873-2016-23-004

Tarasova, V.V., Tarasov, V.E.: Economic growth model with constant pace and dynamic memory. Probl. Mod. Sci. Educ. 2(84), 40–45 (2017). https://doi.org/10.20861/2304-2338-2017-84-001

Tarasov, V.E., Tarasova, V.V.: Time-dependent fractional dynamics with memory in quantum and economic physics. Ann. Phys. 383, 579–599 (2017). https://doi.org/10.1016/j.aop.2017.05.017

Samko, S.G., Kilbas, A.A., Marichev, O.I.: Fractional Integrals and Derivatives Theory and Applications, p. 1006. Gordon and Breach, New York (1993)

Kiryakova, V.: Generalized Fractional Calculus and Applications. Longman and J. Wiley, New York, p. 360 (1994). ISBN 9780582219779

Podlubny, I.: Fractional Differential Equations, p. 340. Academic Press, San Diego (1998)

Kilbas, A.A., Srivastava, H.M., Trujillo, J.J.: Theory and Applications of Fractional Differential Equations, p. 540. Elsevier, Amsterdam (2006)

Diethelm, K.: The Analysis of Fractional Differential Equations: An Application-Oriented Exposition Using Differential Operators of Caputo Type. Springer, Berlin, p. 247 (2010). https://doi.org/10.1007/978-3-642-14574-2

Tarasov, V.E., Tarasova, S.S.: Fractional and integer derivatives with continuously distributed lag. Commun. Nonlinear Sci. Numer. Simul. 70, 125–169 (2019). https://doi.org/10.1016/j.cnsns.2018.10.014

Tarasov, V.E., Tarasova, V.V.: Phillips model with exponentially distributed lag and power-law memory. Comput. Appl. Math. (2018). Accepted 2018.09.24

Tejado, I., Valerio, D., Valerio, N.: Fractional calculus in economic growth modelling. The Spanish case. In: Moreira, A.P., Matos, A., Veiga, G. (eds.) CONTROLO’2014—Proceedings of the 11th Portuguese Conference on Automatic Control. Volume 321 of the Series Lecture Notes in Electrical Engineering. Springer, pp. 449–458 (2015) https://doi.org/10.1007/978-3-319-10380-8_43

Tejado, I., Valerio, D., Valerio, N.: Fractional calculus in economic growth modeling. The Portuguese case. In: Conference: International Conference on Fractional Differentiation and its Applications (FDA’14) (2014). https://doi.org/10.1109/ICFDA.2014.6967427

Tejado, I., Valerio, D., Perez, E., Valerio, N.: Fractional calculus in economic growth modelling: the Spanish and Portuguese cases. Int. J. Dyn. Control 5(1), 208–222 (2015). https://doi.org/10.1007/s40435-015-0219-5

Tejado, I., Valerio, D., Perez, E., Valerio, N.: Fractional calculus in economic growth modelling: the economies of France and Italy. In: Spasic, D.T., Grahovac, N., Zigic, M., Rapaic, M., Atanackovic, T.M. (eds.) Proceedings of International Conference on Fractional Differentiation and its Applications. Novi Sad, Serbia, July 18–20. Novi Sad, pp. 113–123 (2016)

Tejado, I., Perez, E., Valerio, D.: Fractional calculus in economic growth modelling of the group of seven. SSRN Electron. J. (2018). https://doi.org/10.2139/ssrn.3271391

Tejado, I., Perez, E., Valerio, D.: Economic growth in the European Union modelled with fractional derivatives: first results. Bull. Pol. Acad. Sci. Tech. Sci. 66(4), 455–465 (2018). https://doi.org/10.24425/124262

Luo, D., Wang, J.R., Feckan, M.: Applying fractional calculus to analyze economic growth modelling. J. Appl. Math. Stat. Inform. 14(1), 25–36 (2018). https://doi.org/10.2478/jamsi-2018-0003

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interests regarding the publication of this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tarasov, V.E., Tarasova, V.V. Logistic equation with continuously distributed lag and application in economics. Nonlinear Dyn 97, 1313–1328 (2019). https://doi.org/10.1007/s11071-019-05050-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11071-019-05050-1

Keywords

- Logistic equation

- Translation operator

- Distributed lag

- Memory

- Integro-differential operator

- Probability distribution

- Exponential distribution

- Gamma distribution