TMS has forged cooperative agreements with several carefully selected organizations that actively work to benefit the materials science community. In this occasional series, JOM will provide an update on the activities of these organizations. This installment, by the Center for Resource Recovery & Recycling (CR3), focuses on the importance of recycling of rare earths to mitigate the so-called Balance Problem. The CR3 is a research center established by Worcester Polytechnic Institute, Colorado School of Mines, and KU Leuven. Twenty-eight corporations and national laboratories along with support from the U.S. National Science Foundation’s Industry University Cooperative Research Center (I/UCRC) program are sponsors of the center.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

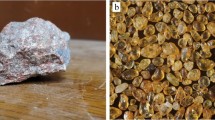

The rare earths or rare-earth elements (REEs) are found in nature as mixtures of the different elements in certain ratios, which can show variations depending on the type of ore or the geographical location of the deposit. Bastnäsite and monazite are rich in the light rare-earth elements (LREEs), whereas xenotime and Chinese ion-adsorption clays are rich in the heavy rare-earth elements (HREEs). The general trend in the natural abundance of the rare earths is that the elements become scarcer with increasing atomic number Z (abundances decrease over the lanthanide series; HREEs are much less abundant than LREEs). Moreover, elements with an even atomic number Z are more abundant than elements with an odd atomic number (Oddo–Harkins rule). For example, cerium (Z = 58) is more abundant than its neighbors lanthanum (Z = 57) and praseodymium (Z = 59). Cerium is the dominating rare earth in ores rich in LREEs, while yttrium is the main rare earth in ores rich in HREEs.

The balance between the demand by the economic markets and the natural abundance of the REEs in ores is a major problem for the market of these elements. This is the so-called Balance Problem (or Balancing Problem).1 The ideal situation is a perfect balance between the demand and supply of all REE elements. A balanced demand with respect to the supply of REEs corresponds to the minimum price for the individual REEs because the production costs are then shared by all REEs extracted from a given resource. Unfortunately, a market in balance is very difficult to achieve because of differences in demand due to technological evolutions in applications. The result is a sometimes very high demand of an REE that is a minor constituent in the ore (such as dysprosium), while the demand of the major constituent (such as yttrium) is relatively much lower. Increasing the overall REE production to meet the highest demand of any REE and to stockpile the other REEs with lower demand seems to be an obvious solution. This will increase the overall price of the REEs due to the extra costs for separating the REE mixtures and stockpiling. Adjusting the overall REE production to optimize the REE producer’s operational margins will create surpluses of some REEs and shortages of other REEs. Shortages of a minor constituent lead to dramatic price increases of this REE due to its (very) high price inelasticity. Preferentially, the REE market is driven by the demand for elements that are very abundant (cerium and lanthanum) since this will create fewer problems with stockpiling of the elements that are available in excess.

The balance problem implicates that the rare-earth industry has to find new applications for REEs that are available in excess or to search for substitutions for REEs that have limited availability and that are high in demand. A second option is that the REE producers diversify the types of rare-earth ores and also consider less common minerals such as loparite and eudialyte, which have different abundances of REEs with respect to bastnäsite, monazite, or xenotime. A third approach to mitigate the Balance Problem is to stimulate REE recycling. Although this has not yet been fully appreciated, it must be realized that recycling can indeed be very important if the REE market is driven by elements that are only minor constituents in the REE ores, as is the case currently.

At present, the LREE market is driven by the demand for neodymium for neodymium-iron-boron (NdFeB) magnets. For instance, about 25,000 tons of neodymium were required for the production of magnets in 2011. This means that sufficient quantities of REE ores had to be mined to produce at least 25,000 tons of neodymium. Because the natural abundance of neodymium is relatively low in the LREE ores, cerium, praseodymium, and samarium are produced in excess and have to be stockpiled. The lanthanum market is in balance, thanks to its use in nickel metal hydride batteries and optical glasses. Praseodymium can be used as an admixture in NdFeB magnets but not samarium. More samarium-cobalt magnets could be produced, but the high price of cobalt is an issue. To bring the LREE market into balance, new high-volume applications for samarium, praseodymium, and especially cerium are required.

The HREEs are produced in much smaller quantities than the LREEs. Currently, the HREE market is driven by the demand for dysprosium, which is used to increase the temperature resistance of NdFeB magnets. About 1600 tons of dysprosium were consumed in 2011. The supply equals the demand for europium, yttrium, and erbium. There is a shortage of terbium, but this problem can still be relieved by the use of stockpiles. Gadolinium, holmium, thulium, ytterbium, and lutetium are produced in excess and are stockpiled. New large-volume applications are needed for the heaviest rare earths (Ho-Lu). Currently, no large-scale separation of these elements is performed.

The REE market is a rapidly changing market, and new applications could bring the REE market further out of balance. Although the current REE market is driven by the demand for neodymium and dysprosium, this could rapidly change, as shown by the historical evolutions in the REE market. Neodymium has not always been the most critical element on the REE market. As long as the rare earths were used as mixtures (e.g., as mischmetal), the Balance Problem was not very relevant. In the 1960s and the early 1970s, europium was the most critical REE because it has a low natural abundance and it was high in demand for the production of the red phosphors for color television screens. In fact, the Mountain Pass mine in California was at that time mainly operated for the production of europium. The low concentration of europium in bastnäsite meant that large excesses of the LREEs were produced and these needed to be stockpiled. To obtain 1 ton of Eu2O3 from bastnäsite, one had to excavate an amount of REE ores that contained 300 tons of La2O3, 450 tons of CeO2, 38 tons of Pr6O11, 118 tons of Nd2O3, 7.3 tons of Sm2O3, 1.4 tons of Gd2O3, and 0.9 tons of Y2O3.2 In the 1970s and 1980s, samarium was the most critical REE because of its use in samarium-cobalt permanent magnets. At a certain time, there was a real shortage of samarium and prices were skyrocketing. Before 1985, there were no industrial applications for dysprosium, and neodymium metal was not produced on an industrial scale. At that time, no one could have foreseen that 25 years later, dysprosium and neodymium would be high in demand. One can predict that there will be further changes in the REE markets in the future. As mentioned, gadolinium is currently produced in excess. Small-volume applications such as magnetic resonance imaging contrast agents cannot consume the world supply of gadolinium. However, commercialization of magnetic refrigerators (based on the magnetocaloric effect) could lead to a demand for gadolinium because several kilograms of gadolinium are required for a single magnetic refrigerator.

Due to the increasing supply risk of REEs (cf. Chinese market dominance), there is currently a strong interest in the recycling of these elements from end-of-life consumer goods.3 The main waste streams that are under consideration are REE permanent magnets, nickel metal hydride batteries, and lamp phosphors. However, one must realize that recycling of REEs is also relevant for mitigating the Balance Problem. Recycling of NdFeB magnets to recover neodymium and dysprosium implies that less primary REE ores have to be mined to ensure the global supply of neodymium and dysprosium. Less mining of REE ores means less overproduction of cerium and samarium. For this reason, also mining companies such as Molycorp (Mountain Pass mine) are developing recycling schemes for NdFeB magnets. Recycling of europium, terbium, and yttrium from lamp phosphors also helps to keep the REE market into balance. At KU Leuven, the influence of REE recycling on the Balance Problem is being studied in an interdisciplinary research project, which is carried out within the framework of the Sustainable Inorganic Materials Management (SIM2) research program and the Research Platform for the Advanced Recycling and Reuse of Rare Earths (RARE3).4 RARE3 targets breakthrough recycling processes based on non-aqueous technology for two main applications of rare earths: permanent magnets and lamp phosphors. By recycling the REEs from phosphors and magnets, one specifically targets the five most critical rare earths: neodymium, europium, terbium, dysprosium, and yttrium. This work is part of a more general objective to create fully integrated, closed-loop recycling flow sheets for rare-earth magnets and phosphors. Concurrently, a consequential life cycle analysis is carried out for the recycling of rare earths in magnets and lamp phosphors. More information on the RARE3 project can be found on the project’s website: http://www.kuleuven.rare3.eu/.

Furthermore, KU Leuven, in association with their CR3 partners, Worcester Polytechnic Institute (WPI) and Colorado School of Mines (CSM), is developing cost-effective technologies based primarily on hydrometallurgy and on ionic liquids to recover HREE from lamp phosphor dust and Nd from waste NdFeB magnets. The work at CSM has shown that Eu and Y can be removed with high recovery rates, and further recovery of La, Ce, and Tb can be affected in a two-stage process if desired. WPI working with Joel Clark at the Massachusetts Institute of Technology (MIT) are developing methodologies to assess criticality of materials.

In conclusion, the availability of REEs is determined not only by the production volumes of REE ores but also by the natural abundance of individual REEs. It is a continuous challenge to match the supply and demand of all REEs. The current market is driven by the demand for neodymium and dysprosium, but the situation could rapidly change by the introduction of new REE applications on the market. The REE research community is stimulated to actively search for new applications that could consume stockpiled REEs. So far, the Balance Problem has mainly been considered from the viewpoint of REE ores. However, a stronger emphasis on recycling of rare earths will definitively have an influence on the Balance Problem. Although these effects have not been systematically analyzed yet and obviously the impact of the time delay before REE containing products become available for recycling needs to be considered in relation to the shifting demand for specific rare earth metals, it is still believed that recycling of REEs, especially of neodymium and dysprosium from NdFeB magnets, may be highly instrumental to alleviate the REE market intrinsic unbalance.

References

P. Falconnet, J. Less-Common Met. 111, 9 (1985).

P. Falconnet (Paper presented at the Workshop on Basic and Applied Aspects of Rare Earths, Venice, 1989), p. 27.

K. Binnemans, P.T. Jones, B. Blanpain, T. Van Gerven, Y. Yang, A. Walton, and M. Buchert, J. Clean. Prod., in press. doi:10.1016/j.jclepro.2012.12.037.

P.T. Jones, T. Van Gerven, K. Van Acker, D. Geysen, K. Binnemans, J. Fransaer, B. Blanpain, B. Mishra, and D. Apelian, JOM 63 (12), 14 (2011).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Binnemans, K., Jones, P.T., Van Acker, K. et al. Rare-Earth Economics: The Balance Problem. JOM 65, 846–848 (2013). https://doi.org/10.1007/s11837-013-0639-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11837-013-0639-7