Abstract

Combining both bibliometrics and citation network analysis, this research evaluates the global development of micro-electro mechanical systems (MEMS) research based on the Derwent Innovations Index database. We found that worldwide, the growth trajectory of MEMS patents demonstrates an approximate S shape, with United States, Japan, China, and Korea leading the global MEMS race. Evidenced by Derwent class codes, the technology structure of global MEMS patents remains steady over time. Yet there does exist a national competitiveness component among the top country players. The latecomer China has become the second most prolific country filing MEMS patents, but its patent quality still lags behind the global average.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Micro-electro mechanical systems, or MEMS, have been increasingly identified as one of the most promising technologies for the twenty-first century (Choudhary and Kaur 2015; Ko 2007). By integrating nanostructured materials and nanoparticle-based structures with micromachining technology, MEMS are now increasingly visible in various aspects of the national economy and social development, ranging from automotive and medical to electronic, communication, and defense applications (Kaur et al. 2013; Girshick 2008; Roco 2005). With their great potential to revolutionize the industry and upgrade various products, MEMS are eliciting global scientific efforts and governmental funding. Over the last three decades, global government investment in this area has increased dramatically (Bathrinarayanan and Tamizhchelvan 2013). For instance, the Japanese government has initiated diverse programs to foster innovation in this domain. In 1990, Japan initiated a 10-year program in micromachine technology worth 250 million USD (Lee 1997; Allen 2003). The Japan MEMS Enhancement Consortium in 2009 alone invested over 80 million USD to spur MEMS research and development. China has likewise invested heavily in MEMS. The 863 Plan alone earmarked 8.8 million CNY for MEMS research (Sun et al. 2002; Lux Research 2009). According to the Yole Development Report (2014), MEMS business reached 12 billion USD at the end of 2013, and it is projected that global investment in this promising area will be above 20 billion USD by 2020.

In spite of its promising applications and bright future, few empirical studies have examined the development of MEMS. This study provides evidence of the promise of MEMS by collecting and analyzing thousands of MEMS patents from 1990–2013. The paper begins with a brief description of our method and data. This is followed by bibliometric analysis of the MEMS patents. Typical patent indicators are adopted to compare, monitor, and analyze research activities at global, country, and institutional levels. Next, we explore the citation networks of MEMS patents using Gephi software. We conclude by highlighting findings and research limitations.

Method and data

Since Seidel first described the patent citation system for the patent office (Seidel 1949), patent analysis has been accepted as an effective tool for capturing research development and innovation. A growing number of studies have used bibliometrics or patentometrics, as initiated by Narin (1994), to capture worldwide trends of patenting activities and innovation drivers, especially for emerging and promising technologies. We only name a few notable studies here.

For example, based on the analysis of front-page references of nano patents, Meyer (2000a) found that citation linkage can be seen as a proxy indicator of the multifaceted interplay between science and technology. In their empirical study of nanotechnology inventions filed in 15 patenting offices, Dang et al. (2010) profiled the development trends of this emerging field at the country level. Focusing on carbon nanotube field emission display, Chang et al. (2010) applied patent analysis to monitor the status quo and dynamics of this emerging technology domain. A recent study conducted by Milanez et al. (2014) applied logistic curves to analyze nano-related patent data using a dataset from Derwent Innovations Index. Meanwhile, with the advancement of computer science and software development, an increasing number of publications have used visualization software, including Google Earth (Hu et al. 2012), science overlay maps (Tang and Shapira 2011a), Ucinet (Tang and Shapira 2011b), and the like.

Following practices established in previous research (Wang and Guan 2012; Milanez et al. 2014; Ma and Porter 2015), the patent dataset we chose is from Derwent Innovations Index (hereinafter DII), a simplified version of the patent database Derwent World Patents Index.Footnote 1 Possessing a well-known advantage of covering patent bibliographic information from more than 40 worldwide patenting authorities, DII has indexed millions of patents filed back to 1963 (Milanez et al. 2014). More importantly, additional information such as rewritten patent titles, abstracts, and Derwent classifications assigned by technical specialists are available to enable more meaningful analysis than the original legal documents (Ma and Porter 2015).

We retrieved MEMS patent documents from DII by using the following modularized Boolean terms. The regex expressions of “$” and“*” match [0,1] and [0, ∞) occurrences of characters respectively to allow alternative forms and variations of MEMS technology.

Data extraction was completed on February 14, 2015.

TS = (“MEMS$” OR “Micro-Electro-Mechanical System*” OR “Nano/Micro-Electro-Mechanical System* OR “Microelectro Mechanical System*” OR “Microelectromechanical System*” OR “Micromachine*” OR “Micro-machine*” OR Microsystem OR “Micro-systems” or “Micro-system”).

The original search returned 27,152 hits. The full bibliographic information of DII patent families was downloaded and exported to VantagePoint for further analysis. The bibliographic information includes title, patent number, inventor, assignee name, unique DII identification number, citing patent information, abstract, international patent classifications (IPCs), Derwent class code, and so on. After downloading the information, we conducted several rounds of cleaning and consolidation on the bibliographical information, including but not limited to removing duplicates, standardizing organization names, and so on. For the detailed procedure, please refer to Tang et al. (2013) and Youtie et al. (2011).Footnote 2

Since the patents prior to 1990 are rather sparse, we only include patents filed in the period of 1990–2013 for analysis. The final data analyzed comprised 26,745 unique MEMS patent records. The dataset constructing and consolidating process is illustrated in Fig. 1.

Analysis

Global trends

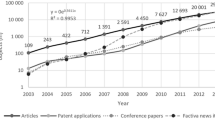

DII shows that the first MEMS patent indexed was filed by Stanford Research Institute (#US3453478 A) in 1966. For the next two decades, patenting activities in the MEMS field remained inactive. Globally, only 161 MEMS patents are indexed in Derwent Innovations Index from 1963 to 1989. The situation started to change in 1990 when MEMS patents started to grow. Over the examined period (1990–2013), the number of MEMS patents increased from 40 records in 1990 to 2266 in 2013, a more than 50-fold increase. Over the last ten years, the annual patent applications in the MEMS domain have consistently been above 2500 each year except the year of 2013.Footnote 3 This growth trajectory demonstrates an interesting trend of approximate S shape, thus we further categorize it into three stages of 8 years.

As depicted in Fig. 2, MEMS patents rose linearly in the first eight-year period (1990–1997). Then, they increased exponentially from 1998 to 2004, when many countries started MEMS research and development (R&D) projects (Ma 2015). Then, MEMS patents reached maturity and somehow remained relatively steady until leveling off in 2013.

As shown in Table 1, USPTO leads with 16,050 patents, followed by JPO (9833), WIPO (6494), and SIPO (5948). TETRAD patents, i.e., the same patent document filed in the four patent-issuing offices of USPTO, JPO, WIPO, and SIPO, account for 90 % of the global MEMS patents over the examined period. This finding supports the TETRAD patents claim of Glanzel et al. (2008) that patents filed at these four patenting offices should be taken into consideration for global patent analysis.

Figure 3 depicts the annual trends of patents filed in the top five patenting offices to provide further understanding of the dynamics of MEMS development. As shown, USPTO has taken the lead through our examined 24-year period, but its comparative advantage was not that apparent until 2000. SIPO started to take off in 2008, when it first surpassed EPO in terms of MEMS patents volume. One tangible reason is that after China joined the World Trade Organization (WTO), some global technology giants built their “patent thickets” in this largest developing country (Murray and Stern 2007); the other reason is that more research organizations in China became more active in filing patents to protect MEMS inventions.

Country level

Our MEMS patent database reveals that 95 countries have claimed their innovations in the form of MEMS patents. DII does not have geographical information for patent inventors. Assuming most patents are first filed in the country where their R&D activities were performed, we use the first filing at a patent office, that is, the priority date and priority country, as the applicant country and patenting year to assess country competitiveness in MEMS research (Milanez et al. 2014).

Table 2 lists the top 10 countries or regions leading the MEMS race ranked by the numbers of priority patents filed in each country. We easily observe two distinct groups: the United States, Japan, China, and Korea are the top four countries, with more than 2000 MEMS patent families each; and the rest of the top 10 countries, with MEMS patents between 100 and 1000 each. In total, the top four possess over 87 % of the global inventions in this field. The US alone holds about 45 % of the global share with 12,104 MEMS patents, which is about 1.68 times of the runner-up, Japan. The fifth most prolific country, Germany, leads the European Union with 844 MEMS patents. The top five countries’ patenting development over three eight-year periods is depicted in Fig. 4. Three Asian tigers, Japan, China, and Korea, are demonstrating rapidly rising development trajectories.

Our data indicate that since 2013, China has become the second largest country for MEMS patent applications, despite its notorious weak intellectual protection. The number of Chinese patents grew from a negligible global share of 0.5 % in the first period to 16 % in the third period, third in the world to America and Japan. One reason could be due to China’s large market, which also could be a good indicator of Chinese MEMS advancement, and the second reason is the catalyst effect of its joining WTO. Another factor could be China’s evaluation and incentive system, which highly values SCI publications and patents as discussed by Tang et al. (2015). A further examination supports this speculation. Our data show that the key players of MEMS applicants are Chinese elite universities and the Chinese Academy of Sciences. In sharp contrast, less than 50 % of MEMS patents filed in China are granted to business firms. This statistic is lower than the global average of MEMS patents (78.6 %) granted to commercial firms.

In addition to the quantity indicator of patent family counts, family size and triad patentsFootnote 4 are two typical measures for patent analysis on patent quality (Meyer Meyer 2000a, b; Lee et al. 2007). As shown in Table 2, our data reveal that 2751 out of 26,745 (10.3 %) MEMS patent families are triad patents. The United States leads with 1545 triad patents, i.e., 56 % of the world total. Notably, although the number of MEMS patents filed in Korea is less than one-third that of Japan, its triad patents number is higher than that of Japan. Strikingly, mainland China and Taiwan, which rank third and eighth in terms of the total counts of MEMS patents, respectively, have the smallest share of triad patents. This suggests that in terms of patent quality and economic value, both countries/regions’ MEMS patents pale in comparison to their international counterparts. It may also indicate that so far these two countries/regions have not paid enough attention to open up global market.

The message conveyed by the triad patent indicator is further verified by the size of patent families, assuming that the additional cost of protection in different countries is worthwhile (OECD 2009). As shown in Table 2, the family size of patents in mainland China and Taiwan are 1.4 and 1.74, which are far lower than the global average of 2.08. The larger family size of MEMS patents in Canada, France, and Korea indicated their patents’ higher economic values.

Institutional level

Using thesauri, we further categorize assignees into the following types: individual, research institute, university, and enterprises. Enterprises are the major players of MEMS patenting activities. In our MEMS patent dataset, over three-fourths (i.e., 21,034) of patents were assigned to commercial firms. This is followed by individuals (about 24.6 %), universities (11.1 %), and research institutes (6.4 %). One interesting observation is that among individual assignees, 64.8 % of them co-assign with firms. This suggests that it is a quite common phenomenon that individuals partner with enterprises for MEMS inventions.

Table 3 lists the top 20 prolific institutions based on the assignee field. All top 20 MEMS institutions are headquartered in developed countries, with eight in the US and seven in Japan. Enterprises take the lion’s share. Only one research institute, Commissariat Energie Atomique, and one university, the California University system, are listed. When measured by filed MEMS patents, Japanese electronic industries stand out. Nikon Corp and Canon filed the most MEMS patents. Eight US research institutions and enterprises entered the top 20. Not one institute from mainland China or Taiwan entered into the top 20.

Technology area analysis by DII classification system

The interdisciplinary nature of MEMS is reflected in different Derwent class codes. In the DII database, patents are classified into 21 technology subject areas of 3 general areas: chemical (Sections A–M), engineering (P–Q), and electrical and electronic engineering (S–X). The patent classification analysis of our dataset indicates that the Semiconductor Materials and Processes subdomain has the largest share of MEMS patents (40 %), followed by Electromechanical Transducers and Small Machines (34 %); Discrete Devices (30 %); Electro-(in)organic, chemical features of electrical devices (27 %), and Engineering Instrumentation, recording equipment, general testing methods (14 %). Since one patent record can belong to multiple technological domains and thus have different international patent classification (IPC) codes and Derwent class codes, the sum of percentage shared in any situation will be greater than 100 % (Milanez et al. 2014).

The top five Derwent class codes of MEMS patents in each of the three eight-year periods are shown in Table 4. Two interesting observations emerge. First, the structure of MEMS patents over the last 24 years remains rather steady: the four categories of U12 (Discrete Devices), U11 (Semiconductor Materials and Processes), L03 (Electro-(in)organic, chemical features of electrical devices), and V06 (Electromechanical Transducers and Small Machines) consistently dominate all three periods. Second, MEMS patents in Discrete Devices (U12) ranked first in the first two periods, with a share of over 40 %, but in the third period less than 20 % of MEMS patents are filed in this subfield. To illustrate the comparative strength of MEMS subdomains, if any, across different national systems, Table 5 lists the dominant Derwent class codes of the top five countries leading in MEMS patents. All but China have the largest share of MEMS patents in the subfield of Semiconductor Materials and Processes. This is particularly true for Japan and Korea. China’s innovation strength in MEMS, however, is comparatively decentralized, with a bit more emphasis on V06 (Electromechanical Transducers and Small Machines).

Citation network visualization

We use the software Gephi 0.8.2, an open-source software program, to visualize the association structure of the MEMS patents based on their citation network. Cited patent family is taken as the source node, and citing patent family is treated as the destination node. The citation matrix of the MEMS patents is constructed by using a SQL server. We identified 11,076 out of 26,745 (41.4 %) unique nodes (i.e., MEMS patent families) and 40,104 edges (citation relation).

The three snapshots in Fig. 5 show the knowledge flow within the MEMS domain over the last 24 years. Among the 11,076 nodes embedded in the citation network, 7265 (65.5 %) of nodes are cited at least once by other MEMS patents. Also, 654 clusters, or communities, which are colored differently, are identified by the embedded algorithm of Gephi. The “ForceAltas 2” layout is adopted to visualize the panorama of the network. The nearer the nodes are to each other, the more similar the patents are. For a detailed description of the layout selection and graph layout algorithm, please refer to Bastian et al. (2009) and Jacomy et al. (2014). The node sizes are proportional to the out-degree of each node (i.e., the times cited by other MEMS patent families). To better display the citation network, we divide the 24-year study period into three successive eight-year periods: 1990–1997, 1998–2005, and 2006–2013.

In the first period, 298 nodes with 167 edges appear in the citation network. The five most cited patent families of two communities (four colored in brown and one in pastel green) are evidenced by the large node sizes emerging in this period. Further investigation reveals that three out of four patent families from the brown-colored community are owned by Texas Instruments Inc. And the patent family of the pastel green community belongs to Rockwell International Corp. Both companies are headquartered in the United States and have been pioneers in this domain and contributed significantly to the advancement of MEMS innovation.

The citation network in the second period becomes much denser with a rapid increase of nodes (3752) and edges (7274). Associations among MEMS patents appear more frequently within and across communities, as evidenced by the growing edges connecting nodes both inter- and intra-community. In addition to the growth of the two dominant communities of the first period, more important patent families from other communities emerge in the second period. This demonstrates the flourish and division of MEMS research development.

The increase in nodes (7026) and edges (11437) continues into the third period. We also observe an increase in interactions among nodes. However, the citation network in this period demonstrates a different picture than the previous two. In this period, the citation network becomes more dispersed, with limited influential nodes except the nodes from the traditional brown community. The dispersion of the network further demonstrates the differentiation and diffusion of the R&D of MEMS.

Conclusion and discussion

This study uses a uniquely constructed MEMS patents dataset to understand the technological innovation prospects in this promising domain. This research has some limitations. To begin with, the utilities and caveats of using patents and patent citations for technological innovation have been well articulated by former studies (for example, Meyer 2000b; Narin 1994). Secondly, due to the limits of its scope, this study examines the association among MEMS patents based only on patent co-citation. Further study on the co-patenting network will yield significant research management and policy implications for industrial competitiveness. Finally, the Gephi visualization is built upon the MEMS patents dataset we constructed. In other words, citations from non-MEMS patents are not reflected in Fig. 5. It would be interesting for future research to examine the impact of highly cited MEMS patents outside MEMS to see the “enabling” feature of the MEMS research family.

In spite of its limitations, several interesting findings from this study are worth noting. We find that associated with the expanding global market and technology advancement of MEMS, an increasing number of MEMS patents are being filed around the globe. The network spatialization drawn upon the MEMS citation network also highlights the field dynamics of the MEMS domain. Our research also demonstrates that globally MEMS innovations are concentrated in the United States, European countries, and the emerging economies in Asia. We observe the profiles of Japan, US, China, Korea, and Germany emphasize notable differences in concentration niches in MEMS innovation. This study also adds to the growing body of evidence that China is becoming a global leader in scientific publishing and innovation research. Yet in sharp contrast to its research performance evidenced by MEMS publications, China’s patent quality in the MEMS domain is still in its early stages. After years of intense internal debates among Chinese elites, “indigenous innovation” (zi zhu chuang xin) emerged as the favored national development strategy. Under the flag of indigenous innovation, the Chinese government has spent enormous and escalating amounts of money in some strategic technology domains. As is reflected by the significant performance disparity between scientific articles and patent quality, it is clear that there is still a long way to go for the Chinese government to facilitate the knowledge transfer between science and technology borders.

Notes

Please note the raw records extracted from DII are patent family, i.e., a group of related inventions on the same technical subject filed in different countries (Martínez 2010; Grupp and Mogee 2004). Globally it is becoming increasingly common for a single invention to be filed with multiple patent authorities for which legal protection is sought.

The patent data indexed in DII for 2013 are incomplete due to collection lag; thus, we see a bit of a downward slope for that year.

Triad patents refer to a set of patent applications related to the same invention filed at the three traditionally most prestigious patenting offices: JPO, EPO, and USPTO.

References

Allen, M. G. (2003). Microsystems Technologies in Japan. Microsystems Research in Japan, 37

Bastian M, Heymann S, Jacomy M (2009) Gephi: an open source software for exploring and manipulating networks. International AAAI Conference on Weblogs and Social Media, San Jose, CA

Bathrinarayanan A, Tamizhchelvan M (2013) MEMS output in scopus database: a bibliometric analysis. J Adv Libr Inf Sci 2(2):100–104

Chang PL, Wu CC, Leu HJ (2010) Using patent analyses to monitor the technological trends in an emerging field of technology: a case of carbon nanotube field emission display. Scientometrics 82(1):5–19

Choudhary N, Kaur D (2015) Vibration damping materials and their applications in nano/micro-electro-mechanical systems: a review. J Nanosci Nanotechnol 15(3):1907–1924

Dang Y, Zhang Y, Fan L, Chen H, Roco MC (2010) Trends in worldwide nanotechnology patent applications: 1991 to 2008. J Nanopart Res 12(3):687–706

Girshick SL (2008) Aerosol processing for nanomanufacturing. J Nanopart Res 10(6):935–945

Glanzel W, Debackere K, Meyer M (2008) ‘‘Triad’’ or ‘‘Tetrad’’? On global changes in a dynamic world. Scientometrics 74(1):59–76

Grupp H, Mogee ME (2004) Indicators for national science and technology policy: how robust are composite indicators? Res Policy 33(9):1373–1384

Hu GY, Carley S, Tang L (2012) Visualizing nanotechnology research in canada: evidence from publication activities, 1990–2009. J Technol Transfer 35(4):550–562

Jacomy M, Venturini T, Heymann S, Bastian M (2014) ForceAtlas2, a continuous graph layout algorithm for handy network visualization designed for the Gephi software. PLoS ONE 9(6):e98679. doi:10.1371/journal.pone.0098679

Kaur N, Choudhary N, Goyal RN, Viladkar S, Matai I, Gopinath P et al (2013) Magnetron sputtered Cu3 N/NiTiCu shape memory thin film heterostructures for MEMS applications. J Nanopart Res 15(3):1–16

Ko WH (2007) Trends and frontiers of MEMS. Sens Actuators A 136(1):62–67

Lee J (1997) Overview and perspectives on Japanese manufacturing strategies and production practices in machinery industry. J Manuf Sci Eng 119(4B):726–731

Lee YG, Lee JD, Song YI, Lee SJ (2007) An in-depth empirical analysis of patent citation counts using zero-inflated count data model: The case of KIST. Scientometrics 70(1):27–39

Lux Research (2009) The recession’s ripple effect on nanotech. State of the market report. Lux Research Inc, New York

Ma YD (2015) MEMS research collaboration in Shanghai. Thesis. (in Chinese)

Ma J, Porter AL (2015) Analyzing patent topical information to identify technology pathways and potential opportunities. Scientometrics 102(1):811–827

Martínez C (2010) Patent families: when do different definitions really matter? Scientometrics 86(1):39–63

Meyer M (2000a) Does science push technology? patens citing scientific literature? Res Policy 29:409–434

Meyer M (2000b) What is special about patent citations? Differences between scientific and patent citations. Scientometrics 49(1):93–123

Milanez DH, Lopes de Faria LI, do Amaral RM, Leiva DR, Rodrigues Gregolin JA (2014) Patents in nanotechnology: an analysis using macro-indicators and forecasting curves. Scientometrics 101(2):1097–1112

Murray F, Stern S (2007) Do formal Intellectual property rights hinder the free flow of scientific knowledge? J Econ Behav Organ 63(4):648–687

Narin F (1994) Patent bibliometrics. Scientometrics 30(1):147–155

OECD (2009) OECD patent statistics manual. doi 10.1787/9789264056442-en. Accessed 28 Jan 2013

Roco MC (2005) International perspective on government nanotechnology funding in 2005. J Nanopart Res 7(6):707–712

Seidel AH (1949) Citation system for patent office. J Patent Office Soc 31:554–567

Sun L, Zhou Z, Gong Z (2002) The research development of MEMS and National strategies. Roberts Technol Appl 1:2–4

Tang L, Hu GY (2013) Tracing the footprint of knowledge spillover: evidence from U.S.-China Collaboration in Nanotechnology. J Am Soc Inf Sci Technol 66(9):1923–1932

Tang L, Shapira P (2011a) China-US scientific collaboration in nanotechnology: patterns and dynamics. Scientometrics 88(1):1–16

Tang L, Shapira P (2011b) Regional development and interregional collaboration in the growth of nanotechnology research in China. Scientometrics 86(2):299–315

Tang L, Shapira P, Youtie J (2015) Is there a clubbing effect underlying Chinese research citation increases? J Assoc Inf Sci Technol 66(9):1923–1932

Wang G, Guan J (2012) Value chain of nanotechnology: a comparative study of some major players. J Nanopart Res 14(2):702–715

Yole Développement (2014) Status of the MEMS industry report. The electronic version is available at http://www.yole.fr/MEMS-Market-MIS.aspx#.VeKbc31q_R0

Youtie J, Porter A, Shapira P, Tang L, Benn T (2011) The use of environmental health and safety research in nanotechnology research. J Nanosci Nanotechnol 11(1):158–166

Acknowledgments

We acknowledge support from the National Natural Science Foundation of China (#71273030) and Shanghai Soft Science Key Project (#14692102900). The findings and observations contained in this paper are those of the authors and do not necessarily reflect the views of the funding agencies.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hu, G., Liu, W. Nano/micro-electro mechanical systems: a patent view. J Nanopart Res 17, 465 (2015). https://doi.org/10.1007/s11051-015-3273-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11051-015-3273-1