Abstract

The article provides a general overview for the landscapes of national nanotechnology development from 1991 to 2010. More than 230,000 unique patents are identified based on a composite search strategy in the Derwent innovation index database. According to the concordance between patent classification and industry technology, some main application areas are identified to compare the positions and specializations among the leading countries. By extracting the content of the “use” subfield in the abstracts and harvesting the keywords representing characteristics of life cycle, nanotechnology patents are grouped into four categories: nanomaterials, nanointermediates, nano-enabled products, and nanotools, which can be seen as four stages of nanotechnology’s value chain. These analyses enable us to identify the distributions of value chain and prolific research institutions among the leading countries. It is found that China is productive in nanomaterials and nanointermediates, rather than nano-enabled products and nanotools, which could be mainly explained by the fact that Chinese academia makes a main contribution to nanotechnology patenting. However, there is a big gap between university patenting and market demands, leading to a low rate of technology transfer or licensing.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Nanotechnology has been widely recognized as one of the most promising technologies of this century. Considering that it will become a common technology for almost all technology sectors and will deliver substantial economic benefits to the global economy, more than 60 countries have launched nanotechnology development strategies in their national agenda for science and technology development since 2000 (Roco 2005). Further, some leading countries have been making substantial sustained investments in this emerging field to develop and capture its commercial value. To some extent, the competence of countries achieved in nanotechnology can be used as a benchmark for a country’s scientific and technological competitiveness. This results in rapid growth rates of R&D expenditures, scientific publications and patent applications in nanotechnology. Considering the global distribution of these indicators, the United States, Japan, and main European countries like Germany, UK, and France, can be identified as key players in nanotechnology (Liu et al. 2009; OECD 2009).

More recently, China has emerged as one of the key global players in this field (Kostoff et al. 2008; Guan and Ma 2007; Zhou and Leydesdorff 2006; Youtie et al. 2008). Its scientific research and technological development in nanotechnology has attracted considerable attentions from scholars, senior managers, and policymakers all over the world. Nanotechnology in China has been identified as a main component and a priority mission area in its strategic policy plans for future developments in science and technology. It has been given a high level of investment and significant support from central and local governments (Bai 2005; Hassan 2005). Regarding the number of scientific publications in the international journals, China has outperformed Germany and Japan, following only the United States. Its development actually shows the world-class research results in some specific areas. However, the quality of Chinese publications seems to be still at a relatively low level. Thus, Chinese nanotechnology community has made remarkable progress in fundamental scientific research of nanotechnology. China is on the way of becoming a main contributor in this emerging field.

However, although a large body of studies has concentrated in the current state of China from the perspective of scientific results, little is known about its global competitive position in the development and commercialization of nanotechnology. In general, traditional methodology of assessing competitive strength of mature technologies and industries are based on these data, such as sales, profits, market share, and trade. But it seems to be not available for assessing competitiveness of this emerging technology, since nanotechnology is still largely in an early stage of development and related data have not been collected. Alternatively, patent data have been employed as a well acknowledged indicator to highlight the position and specialization of countries across nanotechnology sub-areas and application fields. Patent analyses offer some important insights for the understanding of current and future developments of nanotechnology. Most bibliographic analyses focus on the historical trends in nanotechnology patenting, the identification of major players, major patent applicants, the distribution of technological fields and application areas and the evaluation of international patenting strategies, but there are two notable exceptions. Lux Research, a nanotechnology research and advisory company, introduced the framework of nanotechnology value chain on the basis of the value added to track the performance of companies participating in the application and commercialization of nanotechnology and that of industry sectors impacted by nanotechnology (Lux Research 2004). In its framework, nanotechnology products can be classified into four stages: nanomaterials, nanointermediates, nano-enabled products, and nanotools. Alencar et al. (2007) indicated this taxonomy appropriate to evaluate the national position along this nanotechnology value chain without involving details specific to particular businesses.

Various scholars have made significant efforts to collect and analyze nanotechnology patents, but seldom mentioned the situation of China. It may be due to two reasons. One is that their works drew from a single patent office database, e.g., the United States Patent and Trademark Office (USPTO), or European Patent Office (EPO), to harvest patent data within nanotechnology, but Chinese applicants tend to file patents with their national patent office rather than with foreign patent offices. Chinese performance in international nanotechnology patenting is weak relative to its research strength (Kostoff et al. 2008). Shapira and Wang (2009) also reported China’s relatively weaknesses in commercialization and international patenting of the research. If Chinese domestic patents are brought into, China’s current state and development is unclear. Considering the increasing role of China’s technology market, it is necessary to provide an answer on this issue. The other is that although the number of patents acquired by Chinese applicants has surged in the past few years, most of them come from universities and public research institutions (PRIs). The number of indigenous companies actively engaging in nanotechnology R&D and commercialization is still relatively small due to their limited technological capabilities of indigenous companies and a lack of incentives.

The purpose of this article is to evaluate competitive advantage of China from more comprehensive perspective and to compare it with the leading players across application fields and along nanotechnology value chain, respectively. The study exploits a database of nanotechnology patents from the Derwent innovation index (DII), because it is the most comprehensive database covering the data of the main leading patent-issuing authorities. By the content analyses of the “use” subfield in the abstracts, nanotechnology patents are grouped into four categories: nanomaterials, nanointermediates, nano-enabled products, and nanotools, which can be seen as four life cycle stages of nanotechnology’s value chain. These analyses enable us to identify the distributions of value chain and productive research institutions among the leading countries.

The remainder of this article is organized as follows. In the next section, we summarize the methods of identifying nanotechnology patents and the framework of nanotechnology value chain. Section “Results” discusses the present situation of nanotechnology from various perspectives by examining historical trends and market share by country, by institution sector (such as company, university, and PRI), and by the applications of industry technology concerned. Then, a picture of nanotechnology along nanotechnology value chain by country is portrayed. Finally, we will draw our conclusions on China’s position in the development and commercialization of nanotechnology.

Methods and data

Search strategy

Previous to the analysis of patent landscapes, it is crucial to define the search strategy and select suitable databases. Since nanotechnology is an emerging and rapidly evolving field with the multidisciplinary nature, it is difficult to delineate its boundaries and harvest the relevant publications and patents of the field. Different bibliometric search strategies of querying keywords and prominent terms in titles, abstracts, and patent claims, are found to collect publications and patents of nanotechnology, including simple term search for the prefix “nano,” complex, and evolutionary lexical queries, citation analysis, bootstrapping techniques, the use of core journal sets based on Bradford’s law and hybrid lexical-citation methods (Braun et al. 1997; Glänzel and Meyer 2003; Schummer 2004; Leydesdorff and Zhou 2007; Mogoutov and Kahane 2007; Zitt and Bassecoulard 2006). There seems to be no agreements having been made on search approaches of nanotechnology in the above-mentioned studies. For conveniences of retrieving and identifying nanotechnology publications and patents, we employ the search strategy suggested by Porter et al. (2008). Porter et al. (2008) reviewed a variety of search efforts and provides a two-staged modularized Boolean search strategy. There are three advantages of this search approach. First, it is combined with nanotechnology expert panel review. Second, it has strong ability to search large-scale and multiple databases to retrieve relevant research articles, patents applications and awards, and other type data. Third, it incorporates most of search keywords appeared in earlier studies and traces the emergence of new terms. Thus, this search strategy could be a good choice of defining nanotechnology.

Whereas numerous studies conduct searches accessing only one single patent database, e.g., the database of USPTO or the one of EPO, fewer ones make use of databases containing data from several national and international patent offices, like the chemical abstracts (CA) database or the DII database (Liu et al. 2009; OECD 2007). These choices of selecting one patent office database may underestimate the performance of some emerging countries or institutions. As a matter of fact, a high share of Chinese nanotechnology patents was only applied at the Sino Intellectual Patent Office (SIPO). Our study exploits a database of nanotechnology patents from the DII database, since this data source avoids some of the country biases. DII is the most comprehensive database covering the data of the main leading patent-issuing authorities including USPTO, Japan Patent Office (JPO), EPO, World Intellectual Property Organization (WIPO), SIPO, and so on. Further, it provides the descriptive titles and concise abstracts rewritten by subject experts linking to full-text primary patent records from a range of full patent sources, which can be retrieved easily and exactly. More importantly, it has the use information of most patents in the field of abstracts.

It should be noted that each record in DII means a basic patent defined as a unique invention, enabling a global view of all equivalent patents referred to this particular invention in a patent family structure. A patent family is a group of published patent documents relating to the same invention and patented in different countries by way of the priority or priorities of a particular patent document. We treat the invention described in each record as unit of analysis. Applying the search strategy in DII, we harvest more than 230,000 records in the time frame of 1991–2010.

The focus of this article has been put on the analysis of China compared to its main competitors, i.e., the USA, Japan, Germany, France, Britain, and Korea. Country of residence of the inventor particularly the first-named inventor is frequently used to count patents to measure inventive performance in the country level. However, it is difficult to identify patent origin in DII because nationality of inventor is not yet provided. Country of residence of the applicant may be an alternative choice, since patent counts by applicant concentrate on patent ownership. Though the information is not available yet via DII, we could harvest it from other channels. To solve this, we extracted all the institutions with 20 or more patents within the field of nanotechnology during the period of 1991–2010 and collected geographical area of each applicant from its official website or other business portal websites. It also has an advantage of incorporating change and variation of assignee names. Then, we used the locations of their headquarters to identify their nationalities.

Nanotechnology value chain

According to a recent report from Lux Research, nanotechnology is viewed as a value chain going from nanomaterials to nanointermediates to nano-enabled products, and all supported by nanotools. A basic scheme of the value chain for nanotechnology-based products can be illustrated as follows. Upstream, nanomaterials are raw materials which have unique size-dependent properties stemming from their nanometric scale dimensions and have been minimally processed, e.g., carbon nanotubes, quantum dots, nanoparticles, and dendrimers. During the second value chain stage, these nanomaterials are incorporated into nanointermediates acquiring value added during processing by being functionalized. Coatings, nanocatalysts, superconducting wires, and optical components improved with nanomaterials are good examples. Nanointermediates are then incorporated in the third value chain stage to make nano-enabled final products available in the market ranging from airplanes to cells phones to medical diagnostics. Equipment used to visualize, manipulate, and model matter at the nanoscale, e.g., scanning probe microscopes, is needed during all three stages. Based on this value chain ontology, Lux Research gathered actual and estimated sales data for companies supplying each of these products and made forecasts that the sales of products incorporating emerging nanotechnology will rise to $2.6 trillion in 2014. Although the notion of nanotechnology value chain proposed by Lux Research has been broadly used by academics, government officials, policy makers, and other trend watchers, it does not provide technical details of this framework.

Under the framework of nanotechnology value chain, Alencar et al. (2007) developed a similar taxonomy to place nanotechnology patents in three stages of its value chain not including nanotools by digging the content of patent documents. They extracted the proposed patent uses from the abstract field of patents by text mining and then employed lexical analysis to figure out the most frequent and significant terms within a selected IPC subclass. These terms together with the description of a selected IPC subclass were used to judge which of the three stages best reflects them. Finally the value chain stage for each leading use of nanotechnology patents grouped by their IPC subclasses was given in a representative table. This taxonomy is appropriate to estimate the national position along this nanotechnology value chain without involving details specific to particular businesses.

On the basis of these works, we perform our value chain metrics for classifying nanotechnology patents into four categories: nanomaterials, nanointermediates, nano-enabled products, and nanotools. In the first step, we collect the keywords or products representing the features of four stages from the related reports or presentations of Lux Research. During the second step, we apply text mining and lexical analysis, i.e., the same procedures as Alencar et al. (2007) suggested, in order to collect the most frequent terms of the leading IPC subclass. At last, we undertake the search strategy by merging these words gained in former steps to classify nanotechnology patents into four stages of the value chain. DII includes descriptive abstracts written by subject specialists. The abstract may include categories such as novelty, detailed description, use, advantage, and others depending on the selected patent. We extract the information of the “use” subfield in the abstracts. Then, we apply keywords strategy on the “use” subfield to assign a nanotechnology patent in four categories. For example, if the use field of a patent contains the words listed in Table 1, such as carbon nanotubes, quantum dots, nanoparticles, and so on, this patent then belongs to the first stage of value chain, nanomaterials.

Results

First of all, we will present a historical trend for nanotechnology patenting over the period of 1991–2010, based on date of entry into the database. Following this general overview, we will present major results regarding the patent landscapes of China and its main competitors in nanotechnology. Analyzing major applicants in each country emphasizes the main differences in nanotechnology patenting between the respective countries. Moreover, we point out the core areas of each country within the broad field of nanotechnology. Finally, we pay attention to the positions of value chain of national nanotechnology development.

Overview of trends in nanotechnology patents

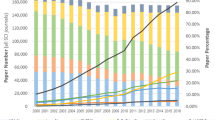

In Fig. 1, the historical trend in nanotechnology patenting is depicted, whereas we analyze this trend for patents acquired by the leading organizations of selected countries. These leading organizations whose total number of patent granted are larger than 20 are found to be most active in patenting nanotechnology. From 1991 to 2010, total numbers of nanotechnology patent is more than 230,000 and more than half is acquired by these organizations. These organizations are identified as our sample for further investigation.

We studied two distinct phases in the history of nanotechnology. From 1991 to 2000, nanotechnology research was just beginning around the world and most countries did not have many patents. For the period of 2001–2010, it accounts for 84% of patents. Since the US launched the first national nanotechnology initiative in 2000, the potential of nanotechnology has been recognized in more and more countries. A strong increase in the number of patents can be identified at the beginning of the 2000s, rising from about 6,858 patents in 2000 to more than 25,000 in 2010. The average annual growth rate for this period amounts to 20%. Considering the historical trends in nanotechnology patenting of these countries, the rapid growth rate of Chinese and Korean patents is especially remarkable. Not surprisingly, China has become the technological leaders in nanotechnology and moved into the first place in 2009, rising from only 76 patents in 2000 to 4,016 in 2009 and representing the annual growth rate of 70%. For the market share of global patents of nanotechnology, the US was second to Japan regarding the number of patents, followed by China, Korea, and some European countries. This result seems to be different from other works showing that the US always makes the dominant position in nanotechnology. As noted above, the treatment of patent families and the calculation of patents by only the leading organizations in our analyses may result in different counts. Another argument could be that since the JPO patents do not contain assignee country information, most studies did not draw on the JPO database when calculating the distributions of assignee country.

We also analyze to what extent internationality matters in the respective patenting strategies of these countries, as shown in Table 2. All applicants have a regional advantage of showing their competitiveness, filing the largest number of patents in their home country. Specially, the Asian countries show an extremely high percentage of nanotechnology patents at their home patent offices. On the other hand, to manufacture or sell products in a foreign country, it is necessary to obtain a patent right in that country. Filing applications to a foreign patent office may reflect the applicant’s strong intention to develop, manufacture and sell goods in that country. USPTO is widely recognized as the most important and largest technology market in the world and therefore relevant for any internationally oriented company. It is found that applicants from the US and European countries succeed in pursuing international patenting strategy, not only actively filing at the triad patent offices but also having more PCT (patent cooperation treaty) applications. For the US and European countries, they show their competitiveness in the worldwide market. Furthermore, applicants from the USA file slightly more patents in Europe than in Japan, while applicants from Japan apply for many more patents in the USA than in Europe. And Korea applicants file many more patents in the USA than in Europe. Although the type of patent office targeted is different, we find that the distribution of patents acquired by Chinese organizations is highly skewed, with more than 98% of all patents applied for at the SIPO and only 4.6% for at the USPTO. Unlike China, Japan, and Korea have a considerable proportion of USPTO applications. In China, the average number of patents applied for at the WIPO, JPO or other patent offices still remains very low. In short, there is a lack of internationality in Chinese nanotechnology patenting activity.

Institutional sector analysis of nanotechnology patents

The emergence and development of nanotechnology have been characterized by knowledge generation and transfer within and among universities, public research institutions (PRIs, including hospitals and non-profit organizations), and corporations. The identification of institutional sectors of patents relies on information about the assignee name of patents, enabling a distinction between companies, universities, and PRIs. Figure 2 presents the shares of nanotechnology patents by these institutional sectors. Significant variations are detected in the institutional sectors of nanotechnology by country. In those developed countries, company is the main performer in industrial applications of nanotechnology. At one extreme, in the case of Japan, more than 90% of these nanotechnology patents are assigned to company compared with 80% in Germany and 70% in the US. In contrast, university produced most of the nanotechnology patents in China. During the period of 1991–2010, university accounted for close to 80% of patent grants, while industry only accounted for 8%. The rest were granted to PRIs. In the case of France public research organizations and laboratories play an especially important role in patenting activity, accounting for nearly 40% of these patents.

Table 3 lists the top 40 assignees by their names, i.e., the names of companies, universities, and research institutes that own the patents. In general, the top 40 assignee institutions are from Japan, the United States, China, and Korea. As expected the list is dominated by multinational enterprises (MNEs) based in Japan and the United States such as Canon, Fuji, NEC, Matsushita, Sony, IBM, and GE. All of these, including two Korean companies, Samsung and LG, are major players in the electronics industry in which top–down approaches to nanoscale engineering have been used already for some time. Nonetheless, universities or PRIs, such as California University and Chinese Academy of Sciences, also show up on the list along with a biotechnology company named Genentech. Besides Chinese Academy of Sciences, three universities in China also make the list, namely Tsinghua University, Zhejiang University, and Shanghai Jiaotong University. None of Chinese company is found in this table.

Trends in nanotechnology patent applications by application fields

Nanotechnology is considered to be an emerging general purpose technology, exhibiting a widening variety of uses in a widening number of application areas and industries. In order to capture its development and application across countries and show how technological competence is transferred into economic performance, it is crucial to translate technical patent classification into economic sectors. For these purposes, a concordance that maps the rather technical patent classification into industrial classification will be needed. In our analysis, patents have been classified into five areas and 35 fields according to Schmoch’s work (Schmoch 2008). He distinguished 35 technologies based on the international patent classification (IPC) and grouped them into five industry areas (see Appendix for the detail classification of industry technology). A patent application is usually assigned to several IPC codes, the first of which is used as the main classification at many patent offices to represent the most substantial aspect of the patent. We employed the main classification to distribute each patent into multiple fields of industry technology.

The distribution of nanotechnology patents across more industry-oriented areas by country is illustrated in Fig. 3. Of all nanotechnology patents identified for this overview the largest share is classified to the area of chemistry. Electrical patents also constitute a noteworthy share followed by instruments. This figure also indicates that no country appears particularly active in the application areas of mechanical engineering and other fields, where nanotechnology may have fewer effects. Hence, these two areas can be excluded from the analysis which follows. The largest number of nanotechnology patents originating from China is also in chemistry, but has a higher share. While most countries are involved in clear similar patterns, Korea stand out with a higher share of patents in the field of electrical engineer. By breaking down these areas into 35 application fields, we can find that macromolecular chemistry (including polymers), optics, pharmaceuticals, semiconductors, surface technology and materials and metallurgy could be seen as the most important application fields, accounting for the largest share of nanotechnology patents in the world technology market. Further, pharmaceuticals and biotechnology represent areas in which nanotechnology is contributing to diversification in new fields. Among 35 technology fields, micro-structural and nanotechnology, materials and metallurgy, semiconductors, surface technology and coating, digital communication have witnessed the higher growth rates.

Next, we discuss the position and specialization pattern of countries across the technology fields in which nanotechnology is finding its applications. The “revealed technological advantage” (RTA) index provides interesting insights as one basis for this issue. The RTA index is defined as the ratio of the share of patenting of a country in a particular application field, and the corresponding share for patenting globally. For the sake of clarity, the RTA indexes of China and its main competitors are illustrated in Fig. 4 only for the application fields with the top six largest share globally. It is clear that China appears more specialized only in the field of materials and metallurgy, compared with Korea and European countries. Both France and Britain are similarly specialized across the application fields of pharmaceuticals, while the United States and Germany appears well-proportioned. Especially, Korea distinguishes itself from other countries with the highest specialization in semiconductors, while being less specialized in the other application fields. Japan appears more specialized in macromolecular chemistry and polymers, and optics, compared to the United States, China, and European countries. It is also interesting to note that China represent relatively more specialized in the application field of materials, chemical engineering, and digital communication.

Positions of nanotechnology value chain

From the perspective of nanotechnology value chain, all nanotechnology patents have been categorized into four stages to show its development and compare the position and specialization pattern of countries again. Figure 5 shows the distribution and trend of nanotechnology patents along four stages of nanotechnology value chain. Of all nanotechnology patents identified for these overviews the largest share is classified to the stage of nanointermediates all the time, followed by nano-enabled product and nanomaterial, while nanotools only have a small share and its share (estimated at 2% in 2008) has stayed relatively constant. Though the market share of nanointermediates has decreased recently, its dominant role does not appear to have changed significantly over the time concerned. Thus, it reflects the infant stage of nanotechnology commercialization. However, nano-enabled products also constitute a noteworthy share followed by nanomaterials. During the period 1991–2010, patents in the stage of nano-enabled products had strong growth, with the annualized growth rate surpassing 40%.

Japan and the United States are the global leaders in nanotechnology, occupying the dominating positions across all the stages (see Fig. 6). Japan has the largest share of these patents grouping into the nanointermediated stage, and does so in nano-enabled products and nanotools, while the United States has a 49% share of all nanomaterial patents. The remaining countries individually account for less than 28% of these patents. China appears to apply nanotechnology mainly in the stage of nanomaterials, but only accounts for an 11% share.

We also employ the RTA index to provide noteworthy insights for the position and specialization pattern of China and its main competitors across four stages along nanotechnology value chain. It is clear that China, the United States and European countries are similarly specialized in the stage of nanomaterials, while Japan appears less specialized. China seems relatively more specialized in nanointermediates compared to US and European countries. However, considering the lower market share in this stage, its technological competence in nanointermediates may be sensitive. Japan shows a higher level in three other stages except nanomaterials, signifying the breadth of its national nanotechnology base, especially in nano-enabled products and nanotools. Korea also appears to lean relatively more on applications in nanointermediates and nanotools (Fig. 7).

Conclusions

The potential implications of nanotechnology, coupled with the substantial sustained investments, have raised concerns and interest in China’s competitive position among other competing countries in this field. Publication and patent data have been employed for a long time as indicators of scientific and technological strength, providing insight into the current position and serving as bellwethers of future competitiveness. Their role as such these indicators is still on the rise. Considering that a large number of studies have shown China’s leading role in nanotechnology publications, we employ patent data for identifying China’s position and specialization among its main competitors in technological development and applications in this emerging field.

Nanotechnology patents are analyzed from various perspectives by examining historical trends and market share by country, by institution sector (such as company, university, and PRI), and by the applications of industry technology concerned, respectively. The principal results of the analysis are as follows. It is also widely believed that the United States and Japan appear to be the overall global leader in nanotechnology. Although other studies collecting data only from one single patent database reported that China’s progress was less impressive in patenting than in publishing, we draw on a more comprehensive database to argue that China has been becoming the largest producers of nanotechnology patents since 2009 and also leading in specific areas of nanotechnology, such as materials, chemical engineering, and digital communication.

By mining the content of the “use” subfield in the abstracts and harvesting keywords representing value chain from existing literatures, nanotechnology patents are grouped into four categories: nanomaterials, nanointermediates, nano-enabled products, and nanotools, used as four life cycle stages of nanotechnology’s value chain. Our findings show that nanointermediates has its dominant role, while nano-enabled products constitute a noteworthy share and show the rise trend in the future. It reflects that nanotechnology development appears to concentrate in the second stage of the value chain, nanointermediates. More and more companies have participated in the process of transforming nanotechnology into final products. China is productive in nanomaterials and nanointermediates, rather than nano-enabled products and nanotools. RTA values of four stages reflect that China has relatively specialized in the stage of nanomaterials, facing with competition from the United States and European countries, while Japan appear specialized in nano-enabled products and nanotools. But the United States and Japan have controlled the majority of all the four stages, while China’s market share is relatively small.

Reasons for this may originate from two significant differences, existing in regard to the distribution of institution sectors in nanotechnology patenting and international patenting strategies between China and its main competitors. First, unlike other developed countries, where industry is the main performer in industrial applications of nanotechnology, university and research institutes in China produced most of nanotechnology. During the period of 1991–2010, universities in China accounted for close to 80% of its patent grants, while industry only accounted for 8%. Our another study showed that the annual growth rate of university patents in this emerging field exceeded the average annual growth rate and one fifth of the worldwide nanotechnology patents in 2008 were acquired by universities (Guan and Wang 2010). Although universities are an important source of knowledge in nanotechnology and have become more actively engaged in ideas of patenting, industrial capability of transferring scientific results into technological applications is more important. But Chinese companies lack competence in undertaking research and development in nanotechnology. We only see that Hongfujin precision has built a joint research center with Tsinghua University, representing that China is short of cooperation between university and industry. Second, international strategy of China’s patenting activity in nanotechnology is absent. Although the type of patent office targeted is different, we found that the distribution of patents acquired by these universities was highly skewed, with 98% in SIPO and only 4.6% in USPTO. Researchers from these universities may have the language advantage and also have a lower cost in patenting with SIPO, but the quality and economic value may be lower than with others. It is apparent that more comprehensive research is necessary to get a clearer and deeper picture of nanotechnology in China.

References

Alencar MSM, Porter AL, Antunes AMS (2007) Nanopatenting patterns in relation to product life cycle. Technol Forecast Soc Change 74(9):1661–1680

Bai CL (2005) Ascent of nanoscience in China. Science 309(5731):61–63

Braun T, Schubert A, Zsindely S (1997) Nanoscience and nanotechnology on the balance. Scientometrics 38(2):321–325

Glänzel W, Meyer M (2003) Patents cited in the scientific literature: an exploratory study of ‘reverse’ citation relations in the triple helix. Scientometrics 58(2):415–428

Guan J, Ma N (2007) China’s emerging presence in nanoscience and nanotechnology: a comparative bibliometric study of several nanoscience ‘giants’. Res Policy 36(6):880–886

Guan J, Wang G (2010) A comparative study of research performance in nanotechnology for China’s inventor–authors and their non-inventing peers. Scientometrics 84:331–343

Hassan M (2005) Small things and big changes in the developing world. Science 309(5731):65–66

Kostoff RN, Barth RB, Lau CGY (2008) Quality vs. quantity of publications in nanotechnology field from the People’s Republic of China. Chin Sci Bull 53(8):1272–1280

Leydesdorff L, Zhou P (2007) Nanotechnology as a field of science: its delineation in terms of journals and patents. Scientometrics 70(3):693–713

Liu X, Zhang P, Li X, Chen H, Dang Y, Larson C, Roco MC, Wang X (2009) Trends for nanotechnology development in China, Russia, and India. J Nanopart Res 11(8):1854–1866

Lux Research (2004) Sizing nanotechnology’s value chain. Lux Research. http://www.luxresearchinc.com. Accessed 6 Nov 2009

Mogoutov A, Kahane B (2007) Data search strategy for science and technology emergence: a scalable and evolutionary query for nanotechnology tracking. Res Policy 36(6):893–903

OECD (2009) Nanotechnology—an overview based on indicators and statistics. OECD Science, Technology and Industry Working Papers, Paris

Porter AL, Youtie J, Shapira P, Schoeneck DJ (2008) Refining search terms for nanotechnology. J Nanopart Res 10(5):715–728

Roco MC (2005) International perspective on government nanotechnology funding in 2005. J Nanopart Res 7(6):707–712

Schmoch U (2008) Concept of a technology classification for country comparisons. Final report to the World Intellectual Property Organisation (WIPO), WIPO. http://www.wipo.int/export/sites/www/ipstats/en/statistics/patents/pdf/wipo_ipc_technology.pdf. Accessed 5 May 2010

Schummer J (2004) Multidisciplinarity, interdisciplinarity, and patterns of research collaboration in nanoscience and nanotechnology. Scientometrics 59(3):425–465

Shapira P, Wang J (2009) From lab to market? Strategies and issues in the commercialization of nanotechnology in China. Asian Bus Manage 8(4):461–489

Youtie J, Shapira P, Porter AL (2008) Nanotechnology publications and citations by leading countries and blocs. J Nanopart Res 10(6):981–986

Zhou P, Leydesdorff L (2006) The emergence of China as a leading nation in science. Res Policy 35(1):83–104

Zitt M, Bassecoulard E (2006) Delineating complex scientific fields by an hybrid lexical-citation method: an application to nanosciences. Inf Process Manage 42(6):1513–1531

Acknowledgments

This research is funded by the National Natural Science Foundation of China (Project no. 70773006) and the National Social Science Foundation of China (Project no.10zd&014). The authors wish to thank the anonymous reviewers for their valuable comments and suggestions that have led to the improvement of this article.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Wang, G., Guan, J. Value chain of nanotechnology: a comparative study of some major players. J Nanopart Res 14, 702 (2012). https://doi.org/10.1007/s11051-011-0702-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11051-011-0702-7