Abstract

This study examines the effect of voluntary disclosure in annual reports on tax avoidance activities. The agency theory of tax avoidance suggests that tax sheltering is associated with important agency costs, underlining the importance of corporate governance mechanisms such as voluntary disclosure in shaping tax planning. Using a sample of 3448 firm-year observations of French listed firms over 2007–2013, the results show that voluntary disclosure is associated with lower tax avoidance activities, providing evidence that this disclosure can be seen as an effective monitoring tool that reduces the insiders’ likelihood to engage in rent extraction through tax avoidance activities. The results also indicate that the negative effect of voluntary disclosure on tax avoidance is significant only when family control is below 40%, suggesting that the disciplinary role of voluntary disclosure is limited to firms with relatively low family control levels. Overall, our findings are consistent with the agency theory of tax avoidance and highlight the important role of corporate disclosure in improving corporate governance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Tax avoidance activities have been subject of great interest for researchers, regulators, and practitioners alike, given the prominent role of taxation in the economy (Huseynov et al., 2017). In general, firms have plenty of opportunities to ‘legally’ reduce taxes, but firms tend to make anything that reduces their tax payments in a way to keep their cash reserves inside the firm (Dyreng et al., 2010). Recent anecdotal evidence suggests that tax avoidance practices are widespread worldwide and are even adopted by the most reputed companies such as Apple, Facebook, and Starbucks (Davis et al., 2016).

Although tax avoidance is generally suggestive of increased firms’ cash savings, it may considerably contribute to managers' private benefits since the observability of managerial actions by investors, and tax authorities is lower in more tax-aggressive firms (Desai & Dharmapala, 2009;Balakrishnan et al., 2019).Footnote 1 Generally speeking, there is a consensus in the literature that tax avoidance practices are complex and challenging to detect and monitor by third parties, particularly in opaque environments.Footnote 2 These practices are even more opaque for investors since they are obscured from tax authorities (Desai & Dharmapala, 2009). This raises an important question on how does corporate transparency shape tax avoidance activity. In this study, we investigate the effect of voluntary disclosure on the level of tax planning in French-listed firms.

The literature on tax avoidance poses that the decision to engage in tax avoidance activities depends on the benefits and costs of such activities (Kovermann & Velte, 2019). A number of studies suggest that tax avoidance is associated with efficiency purposes and tends to be firm value-enhancing when it is made for the sole purpose of reducing corporate tax obligations since it helps increase cash flows and after-tax income (Rego & Wilson, 2012; Austin & Wilson, 2017). For example, more intensive tax avoidance activities are shown to be related to higher firm value (Phillips, 2003), higher investments (Graham & Tucker, 2006), and higher acquisition quality (Blouin et al., 2020).

However, given that tax sheltering leads to an immediate increase in firms’ cash flows, managers could personally benefit from tax planning while reducing shareholders’ returns (Chen et al., 2010; Hanlon & Heitzman, 2010; McGuire et al., 2014; Khan et al., 2017). These wealth transfers from shareholders to managers typically provide a piece of evidence on the existence of agency problems associated with tax aggressiveness (Desai & Dharmapala, 2009; Blaylock, 2016). Many empirical studies support this view by showing that tax avoidance activity provides a favorable ground for managerial opportunism as reflected in managerial rent diversion (Lim, 2011), earnings and accruals persistence (Blaylock et al. 2012), earnings manipulations (Balakrishnan et al., 2019), earnings management (Desai & Dharmapala, 2009), related party transactions (Desai & Dharmapala, 2006), bad news hoarding activities (Kim et al., 2011), risky investment opportunities (Armstrong et al., 2015), investment inefficiency (Khurana et al., 2018), poor CSR activity and performance (Hoi et al., 2013; Lanis & Richardson, 2018), and insider trading profits (Chung et al., 2019).

Our study extends this line of research by using voluntary disclosure as a mechanism that may limit managerial opportunism over corporate policies. Indeed, a voluntary disclosure environment typically has a disciplinary role and is commonly associated with increased observability and monitoring of managerial actions (Jensen & Meckling, 1976). Thus, we argue that, if tax avoidance brings about agency problems, a strong voluntary disclosure policy is intended to have a disciplinary role leading to decreased tax avoidance activity.

Using a sample of 3448 firm-year observations of listed French firms, we examine the relationship between tax avoidance and voluntary disclosure over 2007–2013. Voluntary disclosure is measured using a unique dataset that is manually formed from the corporate annual reports of French firms as developed by Derouiche et al. (2016). This index consists of 72 items of content covering different information types: general information, corporate governance information, and financial information. Results show that when voluntary disclosure increases, tax avoidance decreases, meaning that the more voluntary disclosure a firm produces, the less likely they engage in tax avoidance activities. Thus, overall, voluntary disclosure appears an effective monitoring tool for minority shareholders that reduces the insiders’ likelihood of engaging in rent extraction through tax avoidance activities.

To provide additional insights into this evidence, we further examine the impact of voluntary disclosure on tax avoidance in family firms, especially as many large listed firms in France are controlled by families (Boubaker, 2007), and agency problems in family firms are typically higher compared to that in other firms (Anderson & Reeb, 2003). The results indicate that, in general, extensive family control does not have a key role in the relationship between voluntary disclosure and tax avoidance. However, below a relatively low level of control (40%), family firms may favor transparency and avoid opportunistic behavior to preserve shareholder wealth rather than private rents. This suggests that voluntary disclosure in family firms in which the controlling family does not have full control can be a tool for reducing tax avoidance activities. We conduct many robustness checks using alternative variable’s measurement and statistical techniques. We also address endogeneity concerns using a two-stage least squares (2SLS) approach.

We contribute to prior literature in many respects. First, as far as we know, this study is the first one to investigate the effect of voluntary disclosure in annual reports on tax avoidance activities. In the literature on tax avoidance, very few studies have tackled corporate disclosure, such as geographic earnings disclosure (Hope et al., 2013) and country-level disclosure requirements (Kerr, 2019). However, no prior work has investigated voluntary disclosure in annual reports. Second, analyzing the various categories of voluntary disclosure, that is, total disclosure, disclosure about corporate governance, and financial information related to tax avoidance, has not been studied before. Third, the agency theory of tax avoidance has been extensively addressed in environments in which agency problems lie between managers and shareholders. However, in a concentrated control environment, such as in France, the agency relationships are specific as there are dominant shareholders who mainly manage the firm and have considerable control over key corporate policies. Hence, agency problems may occur between controlling and minority shareholders, which may alter the disciplinary role of voluntary disclosure and offer new insights into tax planning.

The remainder of this paper is organized as follows. Section Related literature and hypotheses development reviews the literature and develops the research hypotheses. Section Voluntary disclosure in a concentrated control context describes the sample and data. Section Hypotheses developmentreports the results of descriptive statistics and univariate analysis. Section Voluntary disclosure and tax avoidancedescribes the results of the multivariate analysis, robustness checks, and endogeneity. Section 6 summarizes and concludes the paper.

2 Related literature and hypotheses development

This section outlines the literature on voluntary disclosure in a concentrated ownership context. It also develops the research hypotheses.

2.1 Voluntary disclosure in a concentrated control context

The agency theory suggests that the principal and the agent are expected to maximize their own utility, creating a divergence of their interests. Better monitoring of managerial actions could ensure that principals act in all shareholders' best interests, thus reducing agency conflicts (Jensen & Meckling, 1976). The traditional agency problems occurring between managers and shareholders will shift to those between dominant shareholders and minority shareholders if concentrated ownership increases to a level where the controlling shareholder gains effective control. In such instances, the controlling shareholder has little incentive to create firm value but a greater incentive to extract private rent (Claessens et al., 2000).

To mitigate these agency problems, firms may reinforce management monitoring exerted by minority shareholders, notably by acting in a way that reduces information asymmetry between insiders and outsiders in a voluntary disclosure environment (e.g., Verrecchia, 1983; Healy and Palepu 2001; Eng & Mak, 2003; Beatty et al., 2010). For example, Allegrini and Greco (2013) focus on voluntary disclosure of Italian listed firms, mostly characterized by concentrated ownership and high insider shareholders representation in the board of directors. The authors provide evidence that the presence of more diligent directors is associated with higher voluntary disclosures, and thus with greater transparency to outsiders and fewer risks of private benefits exploitation. Alternatively, controlling shareholders who are willing to entrench themselves may act in a way that increases corporate opacity by adopting a poor voluntary disclosure policy. Consistent with this view, Lee (2007) shows that firms in which controlling shareholders enjoy more control in excess of their equity holdings have lower voluntary disclosure. He explains that dominant shareholders having more opportunities and incentives for pursuing private benefits tend to reduce voluntary disclosure to camouflage their opportunistic behavior. Chen et al. (2008) find that greater agency conflicts between insiders and outside investors in family firms lead to higher discretion of the controlling family over corporate disclosures, leading to lower voluntary disclosure, in particular, that concerning short and long-run forecasts. Tinaikar (2014) examines voluntary compensation disclosure in dual-class share firms and finds that these firms are less transparent than their single-class counterparts, consistent with a private control benefits explanation in concentrated ownership settings.

From the information demand side, firms, particularly those with severe agency problems, could use voluntary disclosure to positively signal managers’ accountability to corporate stakeholders. Indeed, controlling shareholders could gain more from corporate transparency, notably through higher voluntary disclosure than from private rents. Many recent empirical studies support this claim. For example, Chung et al. (2015) find that comprehensive voluntary disclosure has a significant positive effect on the relation between firm value and excess executive compensation and that executive compensation and the interests of the shareholders are better aligned through a friendly board when it comes to information transparency. Derouiche et al. (2016) investigate how the geographic location of a firm is related to voluntary disclosure. They argue that as firms are further away from shareholders, monitoring effectiveness will be limited, and, therefore, managers are incentivized to disclose more information to increase firm value. Consistent with this argument, they find that voluntary disclosure in annual reports and monitoring are complements. Allaya et al. (2020) show that voluntary disclosure is viewed more positively by lenders in environments where the risk of wealth expropriation by dominant shareholders is higher. Dicko et al. (2020) find that voluntary disclosure, notably those covering environmental, social, and governance information, is higher in more politically connected firms, reputed to have higher agency costs, resulting in better financial performance.

2.2 Hypotheses development

2.2.1 Voluntary disclosure and tax avoidance

There is extensive literature documenting that corporate governance quality plays an important role in shaping tax avoidance practices.Footnote 3In particular, there is a growing body of evidence suggesting that outsiders see tax avoidance as an important source of agency costs, which makes the role of corporate governance even more prominent in tax-aggressive firms. In this respect, Lim (2011) finds that larger institutional ownership help reduce managerial rent diversion due to tax avoidance activity. Chung et al. (2019) find that insiders are less likely to take advantage of the opacity and complexity inherent to tax aggressiveness to consume private benefits when they are more effectively monitored, notably by institutional investors. Chan et al. (2016) provide evidence on the existence of tunneling-related tax avoidance and report that the extent of such tunneling decreases with the level of investor protection provided by a legal system. Chang et al. (2020) show that the likelihood that tax avoidance leads to expropriating minority shareholders through tunneling is reduced by implementing effective internal control systems. They explain that internal control mitigates the potentially high agency costs of tax-aggressive firms. Other studies explore the board of directors' disciplinary role and conclude that tax avoidance decreases with board effectiveness (Lanis & Richardson, 2018) and the financial expertise of audit committee members (Hsu et al., 2018).

Some other studies focus on the importance of corporate disclosure in deterring agency costs of tax avoidance. In this perspective, Hope et al. (2013) analyze tax avoidance regarding geographic earnings disclosure and find that firms that avoid disclosing geographic earnings have lower current effective tax rates than those that continue disclosing geographic earnings. This finding suggests that managers are more likely to use poor disclosure policy to hide their tax planning strategies. In a related vein, Balakrishnan et al. (2019) document that information problems of tax-aggressive firms can be mitigated by increasing tax-related disclosures as they are likely to expose and clarify managers’ motivation for tax strategies. In line with this idea, Kerr (2019) reports that better corporate governance and higher corporate disclosure requirements imply a higher ability to detect tax planning by outside third parties, i.e., investors, tax authorities, and public interest groups, thus making tax avoidance less likely to occur.

The picture that emerges from the above developments is that corporate disclosure is an important tool to battle tax avoidance strategies owing to its effectiveness in mitigating increased agency costs of tax-aggressive firms. To the extent that voluntary disclosure is an important aspect of corporate governance, thus acting as a disciplinary mechanism, we expect that firms providing higher voluntary disclosure levels engage in less tax avoidance. We thus formulate our first hypothesis as follows.

Hypothesis 1

There is a negative association between voluntary disclosure and tax avoidance

2.2.2 Voluntary Disclosure, Family Firms, and Tax Avoidance

The likelihood of corporate insiders, i.e., managers and controlling shareholders, to use lower disclosures for tax sheltering may depend on the degree of agency problems occurring between insiders and outsiders. The control power of the principal shareholder is amongst the more important driving force for these problems. Many studies underline the prominent role of controlling families in firm management. The dominant view that emerges from these studies is that the controlling family is very keen to reduce agency problems given its long investment horizon in the firm and underdiversified equity holdings (e.g., Anderson & Reeb, 2003; Chen et al., 2008). The behavioral agency model suggests that family firms are more willing to preserve socioemotional wealth, which makes them reticent to engage in practices involving the loss of such wealth (Chrisman & Patel, 2012). In support of this view, Anderson and Reeb (2003) document that family firms outperform their non-family counterparts, suggesting that family ownership is a strong organizational structure that preserves shareholder wealth. Boubaker et al. (2015) report that the value that investors attribute to cash holdings is higher in family firms compared to other firms.

However, controlling families at the helm of businesses raises the minority shareholders’ concerns about potential rent-seeking, which may be masked inter alia by tax planning strategies (Chen et al., 2010). Investment in tax reduction is also shown to be associated with the firm’s higher riskiness because such investments could be readily reversed by tax authorities leading to higher tax payments in the future (Dhaliwal et al., 2017; Guenther et al., 2017). This implies that insiders would avoid risky tax reduction strategies since they will bear a large part of such risk (Kubick et al., 2014; Moore et al., 2017). Moreover, tax avoidance involves reputational and litigation costs that increase controlling families’ fear about family wealth (Chen et al., 2008). Based on this view, Brune et al. (2019) report that tax avoidance is less likely in family firms, particularly those managed by founders reputed to be more attached to their firm because these businesses are typically socio-emotional wealth loss-averse. In a similar vein, Steijvers and Niskanen (2014) find that private family firms have lower tax avoidance levels than non-family firms and that the presence of strong corporate governance structures (e.g., independent board of directors) makes family firms even less tax aggressive.

A likely implication is that the provision of higher voluntary disclosure by family-controlled firms is a good signal to outsiders since this would make managerial practices, particularly those concerning tax planning, more transparent and more aligned to the shareholders’ interests. Therefore, the negative effect of voluntary disclosure on tax avoidance is expected to be more pronounced in family firms than in other firms. We thus formulate our second hypothesis as the following.

Hypothesis 2

The (negative) effect of voluntary disclosure on tax avoidance is more pronounced in family firms than in non-family firms.

3 Sample and data

3.1 Sample selection

The sample covers French listed firms on Euronext over the period 2007–2013. The utilities and financial companies are excluded from our analysis because of their specific disclosure requirement. We also discard observations having missing values. We are left with a sample of 3448 firm-year observations. Financial data are extracted from the Thomson Reuters Eikon database. To obtain voluntary disclosure indices, we construct a unique dataset that is manually gathered from French firms' annual reports.

The study period starts in 2007, which is the first year that publicly listed firms in Europe, including in France, are required to produce in their annual report a corporate governance statement (Directive, 2006/46/EC), which represents an important aspect of a firm’s voluntary disclosure policy. We end the analysis in 2013 because of the potential substantial changes in tax practices of French firms subsequently to the implementation in 2014 of the OECD’s Action Plan on Base Erosion and Profit Shifting report (BEPS) (OECD, 2013). The OECD/G20 BEPS aimed at joining international efforts to address base erosion, profit shifting, and tax evasion concerns. It entails 15 actions that mainly consist of the creation of a global platform for a Country by Country Reporting (CbCR) as well as the implementation of stricter and more harmonized rules that limit the deductibility of interest payments and provisions so that to prevent tax treaties abuse (Fuest et al., 2019).Footnote 4 Furthermore, the year 2014 had seen many new measures against tax fraud in France such as “Cazeneuve Guidelines #2″ inviting taxpayers owning undisclosed foreign assets to regularize their tax status against a decrease of penalties as well as the reinforcement of transfer pricing documentation that includes rulings rewarded to related parties by foreign tax authorities.Footnote 5 Moreover, starting from 2014, the scope of voluntary disclosure could be substantially shaped by the creation in 2013 of the Haut Comité de gouvernement d'entreprise (High Corporate Governance Committee), which is required to monitor the implementation of the Afep-Medef Code (i.e., the French corporate governance best practices code) including voluntary disclosure practices of French-listed firms.”

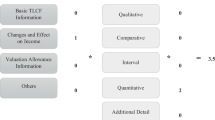

3.2 Construction of voluntary disclosure index

Voluntary disclosure involves additional information that exceeds the mandatory requirements on the disclosure of financial statements. To measure the level of voluntary disclosure, we use a self-constructed scoring index based on a checklist of 72 possible items in annual reports (see the Appendix). These items are composed of three relevant information categories: general information, corporate governance information, and financial information. Information on corporation governance includes 46 items such as ownership, director, and manager information. Financial information includes 18 items such as dividend policy, sales forecast, and other financial data. For each item of the checklist, the value of 1 is added to the score if this item is disclosed, and 0 if it is not disclosed. An item is not considered in calculating the score if it is not applicable for a given firm. To obtain the voluntary disclosure index, the following score is calculated:

where SCOREj is the total score awarded to firm j, and max(SCOREj) is the maximum possible score for firm j.

3.3 Dependent variable

Our dependent variable, TaxAvoidance, is measured as the difference between pretax income and cash taxes paid, divided by pretax income, which is an inverse indicator of cash effective tax rate.Footnote 6 Thus, the higher the cash effective tax rate, the more taxes a firm pays, which means lower tax avoidance levels.

3.4 Model specification

Following the extant literature on tax avoidance, including Chen et al. (2010), we test our first hypothesis by developing the following tax avoidance model:

where VD is the voluntary disclosure index. Size is the natural logarithm of the market value. Leverage is the ratio of long-term debt to total assets. MB is the ratio of market value to common equity. PretaxIncome is the ratio of pretax income to total assets. PPE is the ratio of property, plant & equipment to total assets. RD is the ratio of R&D to total assets. EqInc is the ratio of pretax income to common equity. Intangible is the ratio of Intangibles to total assets. Ownership is the voting rights of the largest shareholder. All financial variables are winsorized at the 1% and 99% levels.

Our primary focus is the coefficient β1 estimating the effect of voluntary disclosure on tax avoidance. This coefficient is expected to be negative, consistent with our first hypothesis predicting a negative association between voluntary disclosure and tax avoidance.

To test the second hypothesis, we introduce an interaction term between family firms and voluntary disclosure index and obtain the following model specification:

where Family is a dummy variable taking the value one if the largest shareholder is a family and 0 otherwise.

Our main focus is the coefficient β11 estimating the effect of voluntary disclosure on cash effective tax rate in family firms. This coefficient is expected to be negative, consistent with our second hypothesis that the negative association between voluntary disclosure and tax avoidance is more pronounced in family firms than in other firms.

We opt for the OLS models in our main analysis due to the specificities of our variable of interest, i.e., voluntary disclosure, which is sticky over time as evidenced by the relevant literature on corporate disclosure (e.g., Brown & Tucker, 2011; Nelson & Pritchard, 2016; Dyer et al., 2017).Footnote 7 In fact, one major limitation of fixed effects models is the lack of assessment of the effects of variables featuring little within-group variation (Gujarati, 2004). Because fixed effects models rely on within-group variations, we need repeated observations for each group, and a reasonable amount of variation of the key variable within each group, which does not seem to hold for voluntary disclosure variables. Indeed, regressing voluntary disclosure on its lagged value—while controlling for year—and industry-fixed effects—yields a coefficient of the lagged voluntary disclosure of 0.97, which is quite close to one. This implies that voluntary disclosure is persistent over time and that, accordingly, firm-fixed-effects regressions may fail to fully detect relationships in the data.

3.5 Control variables

Following Hope et al. (2013), we use two sets of control variables. The first set of variables captures tax planning incentives and opportunities, whereas the second set captures differences in book and tax reporting that may affect the tax avoidance activities. The first set includes the following variables:

Size, which is the natural logarithm of the market value of equity and proxies for firm size. Larger firms are more likely to face higher tax payments and, thus, lower tax avoidance.

Leverage is the leverage ratio. It is included because if a firm is highly leveraged, it does not need to engage in tax avoidance activities as highly leveraged firms already benefit from a tax shield due to debt financing.

MB is the market-to-book ratio and proxies for firm growth. It is included as a control because if a company grows, it will have to pay more taxes as the benefits will grow accordingly, leading to lower tax avoidance.

PI is pretax income scaled by lagged total assets. It measures the profitability of a firm. It is suggested that more profitable firms are more willing to engage more in tax planning activities because profitable firms have higher effective tax rates.

The second set of control variables includes the following:

PPE is included because a firm with more tangible assets is expected to have larger tax and financial reporting differences because of the treatment of depreciation expense.

RD and Intangible are included to consider the divergence in the treatment of intangible assets in book and tax reporting.

EqInc is equity income and is included to control the divergence in the treatment of consolidated earnings obtained using the equity method.

Ownership is the percentage of voting rights of the largest shareholder in the firm. This variable controls for the control power of the largest shareholder over the tax avoidance activities.

YearDummies are included to capture changes on the macro-economic level, such as tax law changes that differ across years and may influence the firm's tax avoidance decisions.

IndustryDummies are included because some industries may not have incentives to engage in tax avoidance activities due, for instance, to stricter regulations.

4 Descriptive statistics and univariate analysis

Table 1 presents the descriptive statistics of the variables used in this study. The results show an average Tax avoidance of 91.86% and a median of 100%, ranging from a minimum of 48.18% to a maximum of 100%. The standard deviation for Tax avoidance is 0.1604. Concerning voluntary disclosure variables, results report that the overall voluntary disclosure index has a mean (median) of 0.4282 (0.4516) and a standard deviation of 0.1945. This indicates that an average (a median) firm reports about 43% (45%) of the maximum amount of voluntary disclosure conveyed by the sampled firms. The financial voluntary disclosure index has a mean of 0.3095 and a median of 0.3333 with a standard deviation of 0.1652, whereas the corporate governance information index has a mean (median) of 0.4231 (0.4130) with a standard deviation of 0.2312. This suggests that French firms are more likely to disclose their corporate governance system, which is qualitative information, than about their financial characteristics, which is quantitative information.

Table 2 presents the correlation analysis between tax avoidance and the various measures of voluntary disclosure and control variables. The results show a strong negative correlation (at the 1% confidence level) between TaxAvoidance and the three voluntary disclosure indices, i.e., TotVD, GovVD, and FinVD, which provides preliminary evidence on the negative impact of voluntary disclosure on tax avoidance. Furthermore, TaxAvoidance is significantly negatively correlated with most control variables—e.g., firm size, leverage, growth, pretax income, property plant and equipment, intangibles, equity income, and ownership– and highly positively correlated with research and development.

The correlation coefficients reported in Table 2 are all below 0.3, which denotes the less likelihood of multicollinearity problem between explanatory variables. To reinforce this, we estimate variance inflation factors (VIF) for Eq. (2) in the last column of Table 2. The results show that VIF values for all the independent variables are well below 10 with an average of 1.58 (close to 1) and the highest value of 2.63, below the rule-of-thumb critical value of 10 (Gujarati, 2004). This confirms that multicollinearity is not a problem for this specification.

5 Empirical results

This section provides a multivariate analysis of the effect of voluntary disclosure on tax avoidance and the role of family firms in this effect. It also presents robustness checks.

5.1 Effect of voluntary disclosure on tax avoidance

Table 3 reports the results of OLS regressions of Eq. (2) testing the relation between voluntary disclosure and tax avoidance.

In column (1), we explore the effect of the total voluntary disclosure index. The findings show a strong negative relation between total voluntary disclosure and cash effective tax rate with a negative coefficient, which is significant at the 1% confidence level. This suggests that voluntary disclosure negatively affects tax avoidance, meaning that firms with higher voluntary disclosure tend to engage in less tax avoidance activities.

A similar result is found in columns (2) and (3). The coefficient of the financial information disclosure index is negative and significant at the 1% confidence level. The coefficient of governance information disclosure index is also negative and significant at the 5% confidence level. This suggests that firms with higher voluntary disclosure on corporate governance and financial aspects engage in less tax avoidance activities.

Overall, our findings are consistent with our first hypothesis predicting that voluntary disclosure reduces tax avoidance, thereby reinforcing the view that corporate disclosure plays an effective disciplinary role.

Table 3 shows that most of their coefficients exhibit the expected sign except for Intangible and PPE when analyzing the control variables. The variables Size, Leverage, MB, PI, EqIncome, and Ownership have all a negative and significant relationship with the tax avoidance ratio for the three levels of information disclosure. PPE and RD are positively and significantly associated with tax avoidance at the 10% level.

The R-squared is nearly the same for the regressions with total voluntary disclosure, governance information, and financial information with respectively 25.42%, 25.27%, and 25.43%. This suggests that the model fits to explain the variation in voluntary disclosure for all categories.

5.2 Family firms and the effect of voluntary disclosure on tax avoidance

Table 4 reports the results of testing the role of family control in the relationship between voluntary disclosure and tax avoidance. In Panel A, columns 1–3 show the results of Eq. (3), whereas in Panel B, columns 4–6 show the results of this equation under the condition that ownership of the largest shareholder is less than 40%. The family firm variable Family is a dummy taking the value one if the largest shareholder is a family and 0 otherwise.

The results in columns 1–2 of Panel A show that the coefficient of the interaction term TotVD*Family, which measures the effect of voluntary disclosure on tax avoidance in family firms, is negative but statistically not significant. This means that, overall, family firms are unlikely to have a significant role in the effect of voluntary disclosure on tax avoidance. The same result can be found in Column 3 for the interaction term of financial information index and family firms. Column 2 shows the results of the effect of family firms on the relation between governance information disclosure and tax avoidance. The coefficient of the interaction term is negative and statistically significant at the 10% level. This suggests that the negative effect of voluntary disclosure on tax avoidance is more pronounced when the firm is family-controlled, but this holds only for voluntary disclosure related to governance information. Thus, overall, we do not find significant evidence that the effect of voluntary disclosure on tax avoidance is more pronounced when firms are owned by families.

In columns 4–6 of Panel B, we rerun our regression by considering the effect of voluntary disclosure on tax avoidance in family firms in which the controlling family holds no more than 40% of the controlling stake. The results from column 4 show that the coefficient of the interaction term TotVD*Family is negative and statistically significant at the 10% level, suggesting that family firms that hold a relatively small control stake (i.e., below 40%) deepen this negative effect of total voluntary disclosure on tax avoidance. The same holds for governance information (column 5) but not for financial information (column 6), where the coefficient is of the interaction term is negative but statistically not significant.

These results indicate that voluntary disclosure in family firms in which the controlling family does not have full control can be a tool for reducing tax avoidance activities. This suggests that, in general, a large family control does not have a key role in strengthening the relationship between voluntary disclosure and tax avoidance. However, below a relatively low level of control, family firms may favor transparency and avoid opportunistic behavior to preserve shareholder wealth rather than private rents. Thus, overall, voluntary disclosure can be seen as an effective monitoring tool for minority shareholders, thus reducing the insiders’ likelihood to engage in rent extraction through tax avoidance activities. In family firms, this disciplinary role of voluntary disclosure may, however, be limited to those with relatively low family control levels. Alternatively, as controlling shareholders can influence corporate disclosure policies, they can avoid using voluntary disclosure to camouflage tax avoidance activities—so there is no significant relationship between voluntary disclosure and tax avoidance—when they want to extract private rent at high levels of control.Footnote 8

5.3 Robustness checks and endogeneity

5.3.1 Robustness to alternative tax avoidance measurement

To check the robustness of our results, we use an alternative measurement of our dependent variable. Thus, we measure tax avoidance as the difference between pretax income and the sum of deferred taxes plus current taxes, divided by pretax income, which is an inverse indicator of the effective tax rate (Hope et al., 2013). The corresponding results are presented in Table 5. They show that for the three indices of the voluntary disclosure indices, the coefficient estimate remains negative and statistically significant, which provides further evidence on the view that voluntary disclosure tends to refrain from tax avoidance activities and may thus act as a monitoring device for outsiders.

5.3.2 Robustness to alternative statistical techniques

We check whether the estimation method drives our results using alternative econometric techniques. The results are in Table 6. Columns 1–3 use fixed effects estimations, while columns 4–6 employ random effects regressions. We find that the three voluntary disclosure variables' coefficients remain negative and statistically significant, consistent with our main results. Columns 7–9 report the OLS regressions results with standard errors clustered at the firm level that minimizes serial correlations of the error term. The results corroborate our finding that more voluntary disclosure prevails in less tax-aggressive firms. Columns 10–12 re-estimate our baseline model using the Fama–MacBeth approach that estimates cross-sectional regressions separately for each year. The results suggest that our main findings remain qualitatively unchanged.

5.3.3 Endogeneity issues

In our previous analysis, we document that voluntary disclosure has an effect on tax avoidance activity, but the choice of disclosure policy could, in turn, be influenced by tax planning strategies causing endogeneity concerns. Indeed, more tax-aggressive firms are more willing to limit their exposure to the market scrutiny (Kerr, 2019), notably by decreasing their voluntary disclosure. To test endogeneity, we use a 2SLS approach.

In the first stage regressions, we identify instruments by investigating the determinents of voluntary disclosure. Thus, and following prior disclosure literature (e.g., Dhaliwal et al., 2011; Allaya et al., 2020, amog others), we specify our first stage model as following:

where Volatility is earnings volatility, measured as as the standard deviation of earnings over the previous five years; Litigation is litigation risk, which is a dummy variable that equals 1 if the firm belongs to a high litigation industry (SIC codes 2833–2836, 3570–3577, 3600–3674, 5200–5961, 7370–7374, 8731–8734), and 0 otherwise. The other variables are described above.

Firm size (Size) is included in the disclosure model since larger firms are expected to have greater voluntary disclosure because of potentially high contracting costs of large firms. The model also includes profitability (EqInc) to account for the likelihood of more profitable firms to communicate all types of voluntary disclosure. Moreover, we control for earnings volatility (Volatility) to reflect that firms with high exposure to legal action owing to their volatile results are more forthcoming in their voluntary disclosure. Lastly, litigation risk (Litigation) is included to incorporate the fact that firms' exposure to litigation risk gives them an incentive to have a good voluntary disclosure policy in a manner that mitigates such risk.

In the second-stage regressions, we consider Eq. (2) having tax avoidance as dependent variable and replace the voluntary disclosure’ variables with their fitted values from the first-stage regressions specified in Eq. (4).

Results of the 2SLS estimation are reported in Table 7. Columns 4, 5 and 6 show the results of the first-stage regressions, using TotVD, GovVD and FinVD, respectively, as dependent variables. We find evidence of the relevance of our instruments given that all five explanatory variables of the disclosure model have statistically significant coefficients with the predicted sign. Moreover, our model does not seem to suffer from a weak-instrument problem since the first-stage F-statistics are greater than the critical value of 10.83 which applies to models including five instruments (Stock & Yogo, 2005). Further, the Sargan test of of overidentifying restrictions is not statistically significant (i.e., p-Values greater than 10%), meaning that instruments used are valid.

In columns 1 − 3, we estimate the second stage regressions and find that fitted values of the three voluntary disclosure variables have a strongly negative coefficient, thus corroborating our main finding of lower tax avoidance in firms with higher voluntary disclosure. In addition, the coefficients of control variables are, overall, statistically significant and have similar signs as those found in the main analysis.

6 Conclusion

Based on the agency theory of tax avoidance, this study examines the effect of voluntary disclosure on tax sheltering of French firms. France is an interesting laboratory as a concentrated control setting where agency conflicts are no longer between managers and shareholders but between controlling and minority shareholders. The disciplinary role of voluntary disclosure in such contexts may be shaped by insiders’ likelihood to extract private rents through tax planning and to mask their opportunistic behavior by voluntarily disseminating less information to the public.

Using a sample of 3448 firm-year observations over 2007–2013, we first examine the effect of voluntary disclosure on tax avoidance of French listed firms, and then the role that family firms play in this effect. Results suggest that engaging in tax avoidance activities decreases when the firm discloses more voluntary information, which means that voluntary disclosure can serve as an effective monitoring tool for investors. We also find that this effect is only significantly magnified in family firms where the controlling family holds less than 40% of ownership equity. This suggests that, below a relatively low level of control, family firms may favor transparency and avoid opportunistic behavior to preserve shareholder wealth rather than private rents. Thus, overall, voluntary disclosure can be seen as an effective monitoring tool for minority shareholders, thus reducing insiders’ likelihood to engage in rent extraction through tax avoidance activities. In family firms, this disciplinary role of voluntary disclosure may, however, be limited to those with relatively low family control levels. Our study has relevant implications for both academics and practitioners. It allows a better understanding of tax planning drivers in France by offering additional insights into tax avoidance depending on corporate governance quality. This paper also provides empirical evidence that corporate disclosure is a valuable disciplinary device of firms’ practices and economically important for the public in France, which can be extended to most European countries.

Notes

The agency view of corporate tax avoidance provides a primary channel through which voluntary disclosure can affect tax avoidance. Despite the existence of an alternative value creation view for tax avoidance, the literature underscores that its potential benefits are typically offset by the increased opportunities for managers to pursue self-serving actions through tax planning, particularly in poorly-governed firms. In this respect, Desai and Dharmapala (2009, pp. 537 and 538) argue that: “the simple view of corporate tax avoidance as a transfer of resources from the state to shareholders is incomplete given the agency problems characterizing shareholder-manager relations” and that “corporate tax avoidance not only entails distinct costs, but these costs may outweigh the benefits to shareholders, given the opportunities for a diversion that these vehicles provide”.

The complexity of tax avoidance stems from the fact that such activity involves the subdivision of the firm into many different business activities (e.g., income qualifying for treaty-based withholding taxes and activity qualifying for the domestic manufacturers’ deduction), a variety of tax-documents (e.g., transfer pricing documentation, signed intercompany agreements; and exemption certificates), and, sometimes, the simultaneous use of local and foreign tax jurisdictions (i.e., tax-motivated transfer pricing and cost-sharing agreements). Balakrishnan et al. (2019) provide other examples of tax planning strategies that increase corporate opacity such as the creation of entities for multi-state tax planning (e.g., captive real estate investment trusts [REITs] and intangible holding companies), net operating loss monetization, and capital loss utilization.

Kovermann and Velte (2019) provide a succinct overview of this literature that largely underscores the importance of agency costs associated with tax avoidance activities.

In France, the 2014 Finance Bill introduced a new anti-hybrid financing measure limiting the deductibility of interests accrued to related party lenders, which represents France’s first concrete step to give effect to the BEPS project (Deloitte & tax@hand 2014).

Art. 223 B quinquies of the French Tax Code.

In many other studies, tax avoidance is measured using the current effective tax rate (current tax expense to pretax income ratio). In our main analysis, we opt for cash effective tax rates rather than current effective tax rates to encounter some limitations. Indeed, tax expense includes current tax expense and deferred tax expense which means that if a firm accelerates deductions and deferring income for tax purposes, this diminishes current taxes but increases deferred taxes. This will not be captured in the current effective tax rate as it includes both current tax expense and deferred tax expense. Moreover, tax expenses can be overstated compared to taxes paid when firms have stock option deductions because when employees exercise their stock option rights, which is not considered in tax expenses (Dyreng et al., 2010).

Our results remain qualitatively the same when we use fixed effects estimations (Table 6, Columns 1–3).

A finding of greater tax aggressiveness in family firms is consistent with family owners valuing the tax savings and rent extraction more than the associated costs: price discount, IRS penalty, and reputation damage.

References

Allaya, M., Derouiche, I., & Muessig, A. (2020). Voluntary disclosure, ownership structure, and corporate debt maturity: A study of French listed firms. Forthcoming, International Review of Financial Analysis.

Allegrini, M., & Greco, G. (2013). Corporate boards, audit committees and voluntary disclosure: evidence from Italian Listed Companies. Journal of Management & Governance, 17(1), 187–216.

Anderson, R. C., & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. The Journal of Finance, 58(3), 1301–1328.

Armstrong, C. S., Blouin, J. L., Jagolinzer, A. D., & Larcker, D. F. (2015). Corporate governance, incentives, and tax avoidance. Journal of Accounting and Economics, 60(1), 1–17.

Austin, C. R., & Wilson, R. J. (2017). An examination of reputational costs and tax avoidance: Evidence from firms with valuable consumer brands. The Journal of the American Taxation Association, 39(1), 67–93.

Balakrishnan, K., Blouin, J. L., & Guay, W. R. (2019). Tax aggressiveness and corporate transparency. The Accounting Review, 94(1), 45–69.

Beatty, A., Liao, S., & Weber, J. (2010). Financial reporting quality, private information, monitoring, and the lease-versus-buy decision. The Accounting Review, 85(4), 1215–1238.

Blaylock, B. S. (2016). Is tax avoidance associated with economically significant rent extraction among US firms? Contemporary Accounting Research, 33(3), 1013–1043.

Blaylock, B., Shevlin, T., & Wilson, R. J. (2012). Tax avoidance, large positive temporary book-tax differences, and earnings persistence. The Accounting Review, 87(1), 91–120.

Blouin, J. L., Fich, E. M., Rice, E. M., & Tran, A. L. (2020). Corporate tax cuts, merger activity, and shareholder wealth. Journal of Accounting and Economics, 101315.

Boubaker, S. (2007). Ownership-control discrepancy and firm value: Evidence from france. Multinational Finance Journal, 11(3/4), 211.

Boubaker, S., Derouiche, I., & Hassen, M. (2015). Family control and the value of cash holdings. Journal of Applied Business Research (JABR), 31(2), 647–660.

Brown, S., & Tucker, J. (2011). Large-sample evidence of firms’ year-over-year MD&A modifications. Journal of Accounting Research, 49, 309–346.

Brune, A., Thomsen, M., & Watrin, C. (2019). Family firm heterogeneity and tax avoidance: The role of the founder. Family Business Review, 32(3), 296–317.

Chan, K. H., Mo, P. L. L., & Tang, T. (2016). Tax avoidance and tunneling: Empirical analysis from an agency perspective. Journal of International Accounting Research, 15(3), 49–66.

Chang, H., Dai, X., He, Y., & Wang, M. (2020). How internal control protects shareholders' welfare: evidence from tax avoidance in China. Forthcoming, Journal of International Accounting Research.

Chen, S., Chen, X. I. A., & Cheng, Q. (2008). Do family firms provide more or less voluntary disclosure? Journal of Accounting Research, 46(3), 499–536.

Chen, S., Chen, X., Cheng, Q., & Shevlin, T. (2010). Are family firms more tax aggressive than non-family firms? Journal of Financial Economics, 95(1), 41–61.

Chrisman, J. J., & Patel, P. C. (2012). Variations in R&D investments of family and nonfamily firms: Behavioral agency and myopic loss aversion perspectives. Academy of Management Journal, 55(4), 976–997.

Chung, H., Judge, W. Q., & Li, Y. H. (2015). Voluntary disclosure, excess executive compensation, and firm value. Journal of Corporate Finance, 32, 64–90.

Chung, S. G., Goh, B. W., Lee, J., & Shevlin, T. (2019). Corporate tax aggressiveness and insider trading. Contemporary Accounting Research, 36(1), 230–258.

Claessens, S., Djankov, S., & Lang, L. H. (2000). The separation of ownership and control in East Asian corporations. Journal of Financial Economics, 58(1–2), 81–112.

Davis, A. K., Guenther, D. A., Krull, L. K., & Williams, B. M. (2016). Do socially responsible firms pay more taxes? The Accounting Review, 91(1), 47–68.

Deloitte & Tax@hand (2014). Draft comments on anti-hybrid rule. https://www.taxathand.com/article/1238/France/2014/Draft-comments-on-anti-hybrid-rule. Accessed 17 April 2014.

Derouiche, I., Jaafar, K., & Zemzem, A. (2016). Firm geographic location and voluntary disclosure. Journal of Multinational Financial Management, 37, 29–47.

Desai, M. A., & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics, 79(1), 145–179.

Desai, M. A., & Dharmapala, D. (2009). Corporate tax avoidance and firm value. The Review of Economics and Statistics, 91(3), 537–546.

Dhaliwal, D. S., Lee, H. S., Pincus, M., & Steele, L. B. (2017). Taxable income and firm risk. The Journal of the American Taxation Association, 39(1), 1–24.

Dhaliwal, D. S., Li, O. Z., Tsang, A., & Yang, Y. G. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. The Accounting Review, 86, 59–100.

Dicko, S., Khemakhem, H., & Zogning, F. (2020). Political connections and voluntary disclosure: the case of Canadian listed companies. Journal of Management and Governance, 24(2), 481–506.

Directive 2006/46/EC of the European Parliament and of the Council of 14 June 2006 amending Council Directives 78/660/EEC on the annual accounts of certain types of compa-nies, 83/349/EEC on consolidated accounts, 86/635/EEC on the annual accounts and consolidated account of banks and other financial institutions and 91/674/EEC on the annual accounts and consolidated accounts of insurance undertakings, Official Journal of the European Union, L 224/1, 16.8.2006.

Dyer, T., Lang, M., & Stice-Lawrence, L. (2017). The evolution of 10-K textual disclosure: Evidence from Latent Dirichlet Allocation. Journal of Accounting and Economics, 64(2–3), 221–245.

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2010). The effects of executives on corporate tax avoidance. The Accounting Review, 85(4), 1163–1189.

Eng, L. L., & Mak, Y. T. (2003). Corporate governance and voluntary disclosure. Journal of Accounting and Public Policy, 22(4), 325–345.

Fuest, C., Parenti, M., & Toubal, F. (2019). International corporate taxation: What reforms? What impact? Notes Du Conseil D’analyse Économique, 6, 1–12.

Graham, J. R., & Tucker, A. L. (2006). Tax shelters and corporate debt policy. Journal of Financial Economics, 81(3), 563–594.

Guenther, D. A., Matsunaga, S. R., & Williams, B. M. (2017). Is tax avoidance related to firm risk? The Accounting Review, 92(1), 115–136.

Gujarati, D. (2004). Basic econometrics (4th ed.). McGraw-Hill Publishers.

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2–3), 127–178.

Healy, P. M., & Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31, 405–440.

Hoi, C. K., Wu, Q., & Zhang, H. (2013). Is corporate social responsibility (CSR) associated with tax avoidance? Evidence from irresponsible CSR activities. The Accounting Review, 88(6), 2025–2059.

Hope, O. K., Ma, M. S., & Thomas, W. B. (2013). Tax avoidance and geographic earnings disclosure. Journal of Accounting and Economics, 56(2–3), 170–189.

Hsu, P. H., Moore, J. A., & Neubaum, D. O. (2018). Tax avoidance, financial experts on the audit committee, and business strategy. Journal of Business Finance & Accounting, 45(9–10), 1293–1321.

Huseynov, F., Sardarli, S., & Zhang, W. (2017). Does index addition affect corporate tax avoidance? Journal of Corporate Finance, 43(C), 241–259.

Jensen, M., & Meckling, W. (1976). Theory of the firm: Management behavior, agency costs and capital structure. Journal of Financial Economics, 3(4), 305–360.

Kerr, J. N. (2019). Transparency, information shocks, and tax avoidance. Contemporary Accounting Research, 36(2), 1146–1183.

Khan, M., Srinivasan, S., & Tan, L. (2017). Institutional ownership and corporate tax avoidance: New evidence. The Accounting Review, 92(2), 101–122.

Khurana, I. K., Moser, W. J., & Raman, K. K. (2018). Tax avoidance, managerial ability, and investment efficiency. Abacus, 54(4), 547–575.

Kim, J. B., Li, Y., & Zhang, L. (2011). Corporate tax avoidance and stock price crash risk: Firm-level analysis. Journal of Financial Economics, 100(3), 639–662.

Kovermann, J., & Velte, P. (2019). The impact of corporate governance on corporate tax avoidance—A literature review. Journal of International Accounting, Auditing and Taxation, 36, 100270.

Kubick, T. R., G. B. Lockhart, and J. R. Robinson. 2014. Does inside debt moderate corporate tax avoidance? Working paper, The University of Kansas, Clemson University, and Texas A&M University.

Lanis, R., & Richardson, G. (2018). Outside directors, corporate social responsibility performance, and corporate tax aggressiveness: An empirical analysis. Journal of Accounting, Auditing & Finance, 33(2), 228–251.

Lee, K. W. (2007). Corporate voluntary disclosure and the separation of cash flow rights from control rights. Review of Quantitative Finance and Accounting, 28(4), 393–416.

Lim, Y. (2011). Tax avoidance, cost of debt and shareholder activism: Evidence from Korea. Journal of Banking & Finance, 35(2), 456–470.

McGuire, S. T., Wang, D., & Wilson, R. J. (2014). Dual class ownership and tax avoidance. The Accounting Review, 89(4), 1487–1516.

Moore, J. A., Suh, S., & Werner, E. M. (2017). Dual entrenchment and tax management: Classified boards and family firms. Journal of Business Research, 79, 161–172.

Nelson, K. K., & Pritchard, A. C. (2016). Carrot or stick? The shift from voluntary to mandatory disclosure of risk factors. Journal of Empirical Legal Studies, 13(2), 266–297.

OECD. (2013). Action plan on base erosion and profit shifting. OECD Publishing.

Phillips, J. D. (2003). Corporate tax-planning effectiveness: The role of compensation-based incentives. The Accounting Review, 78(3), 847–874.

Rego, S. O., & Wilson, R. (2012). Equity risk incentives and corporate tax aggressiveness. Journal of Accounting Research, 50(3), 775–810.

Steijvers, T., & Niskanen, M. (2014). Tax aggressiveness in private family firms: An agency perspective. Journal of Family Business Strategy, 5(4), 347–357.

Stock, J. H., & Yogo, M. (2005). Testing for weak instruments in linear IV regression. In D. W. K. Andrews, & J. H. Stock (Eds.). Chapter 5 in identification and inference in econometric models: Essays in honor of Thomas J. Rothenberg.

Tinaikar, S. (2014). Voluntary disclosure and ownership structure: an analysis of dual class firms. Journal of Management & Governance, 18(2), 373–417.

Verrecchia, R. E. (1983). Discretionary disclosure. Journal of Accounting and Economics, 5, 179–194.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Boubaker, S., Derouiche, I. & Nguyen, H. Voluntary disclosure, tax avoidance and family firms. J Manag Gov 26, 129–158 (2022). https://doi.org/10.1007/s10997-021-09601-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10997-021-09601-w